UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-22747

ALPS SERIES TRUST

(Exact name of registrant as specified in charter)

1290 Broadway, Suite 1000, Denver, Colorado 80203

(Address of principal executive offices) (Zip code)

Camilla Nwokonko, Secretary

ALPS Series Trust

1290 Broadway, Suite 1000

Denver, CO 80203

(Name and address of agent for service)

(303) 623-2577

(Registrant’s telephone number, including area code)

| Date of fiscal year end: | September 30 |

| | |

| Date of reporting period: | October 1, 2023 – September 30, 2024 |

| Item 1. | Reports to Stockholders. |

Beacon Accelerated Return Strategy Fund

Annual Shareholder Report | September 30, 2024

This annual shareholder report contains important information about Beacon Accelerated Return Strategy Fund - I Class for the period of October 1, 2023 to September 30, 2024.

You can find additional information about the Fund at https://www.beacontrust.com/services/investment-management/beacon-funds. You can also request this information by contacting us at 1-844-894-9222.

What were the Fund's Cost for the last year?

(based on a hypothetical $10,000 investment)

| CLASS NAME | COST OF A $10,000 INVESTMENT | COST PAID AS A PERCENTAGE OF A $10,000 INVESTMENT |

|---|

| Beacon Accelerated Return Strategy Fund - I | $141 | 1.28% |

How did the Fund perform last year?

The Beacon Accelerated Return Strategy Fund - I returned 20.42% for the 12 months ended September 30, 2024. This is in contrast to the CBOE S&P 500 BuyWrite Index, which had a 18.31% return for the same time period.

The returns sought to be generated by the Fund are derived from two distinct return elements, i.e. returns from Directional/Enhanced market movements and returns from Income (or option premium). Each return driver plays a crucial, and sometimes complementary role in the overall performance of the strategy.

Over the last year, the Directional/Enhanced component added value due to the increase in the S&P 500, and the Income component detracted from value since the premium collected from selling out of the money call options was less than the losses from the exercised options.

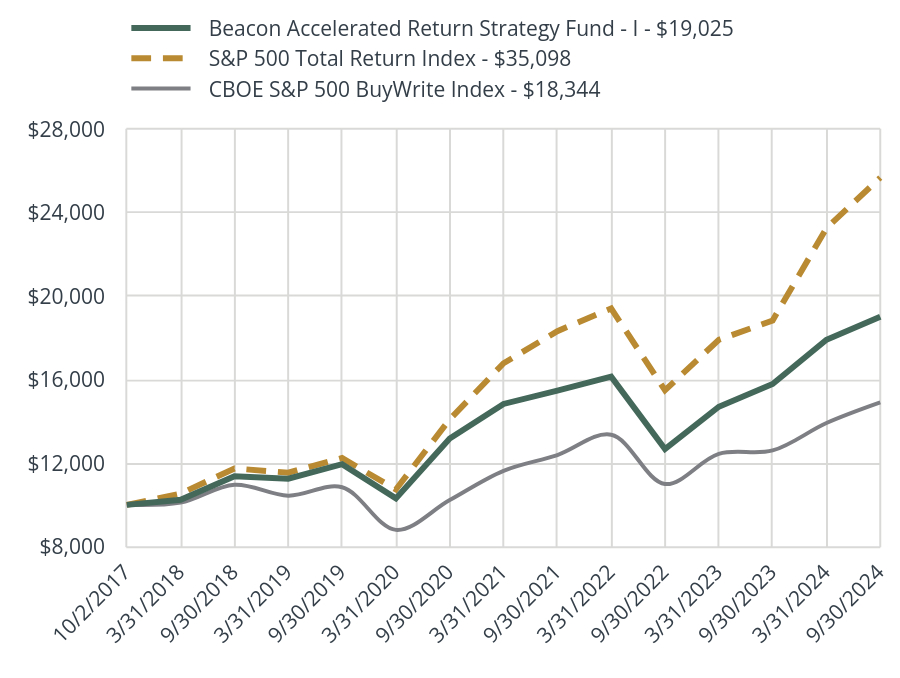

How did the Fund perform since inception?

Total Return Based on $10,000 Investment

| Beacon Accelerated Return Strategy Fund - I - $19,025 | S&P 500 Total Return Index - $35,098 | CBOE S&P 500 BuyWrite Index - $18,344 |

|---|

| 10/2/2017 | $10,000.00 | $10,000.00 | $10,000.00 |

| 3/31/2018 | $10,243.42 | $10,542.64 | $10,108.88 |

| 9/30/2018 | $11,370.39 | $11,745.49 | $10,965.39 |

| 3/31/2019 | $11,254.70 | $11,543.82 | $10,441.48 |

| 9/30/2019 | $11,949.29 | $12,245.13 | $10,843.96 |

| 3/31/2020 | $10,310.53 | $10,738.30 | $8,799.38 |

| 9/30/2020 | $13,182.74 | $14,100.17 | $10,230.23 |

| 3/31/2021 | $14,841.63 | $16,789.51 | $11,632.69 |

| 9/30/2021 | $15,478.84 | $18,330.91 | $12,389.07 |

| 3/31/2022 | $16,146.55 | $19,416.37 | $13,363.35 |

| 9/30/2022 | $12,672.40 | $15,494.73 | $11,000.36 |

| 3/31/2023 | $14,707.26 | $17,915.78 | $12,447.06 |

| 9/30/2023 | $15,799.14 | $18,844.28 | $12,609.14 |

| 3/31/2024 | $17,916.72 | $23,269.24 | $13,927.23 |

| 9/30/2024 | $19,025.14 | $25,694.46 | $14,917.28 |

Average Annual Total Retuns

| Class I | 1 Year | 5 Year | Since Inception |

|---|

| Beacon Accelerated Return Strategy Fund - Class I | 20.42% | 9.75% | 9.63% |

| S&P 500 Total Return Index | 36.35% | 15.98% | 14.44% |

| CBOE S&P 500 BuyWrite Index | 18.31% | 6.59% | 5.88% |

- Total Net Assets$86,392,330

- # of Portfolio Holdings51

- Portfolio Turnover Rate (Class I)-%

- Advisory Fees Paid$900,367

The Fund’s past performance is not a good predictor of the Fund’s future performance. The "Average Annual Total Returns" table and graph presented above do not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares.

Call 1-844-894-9222 for current month-end performance.

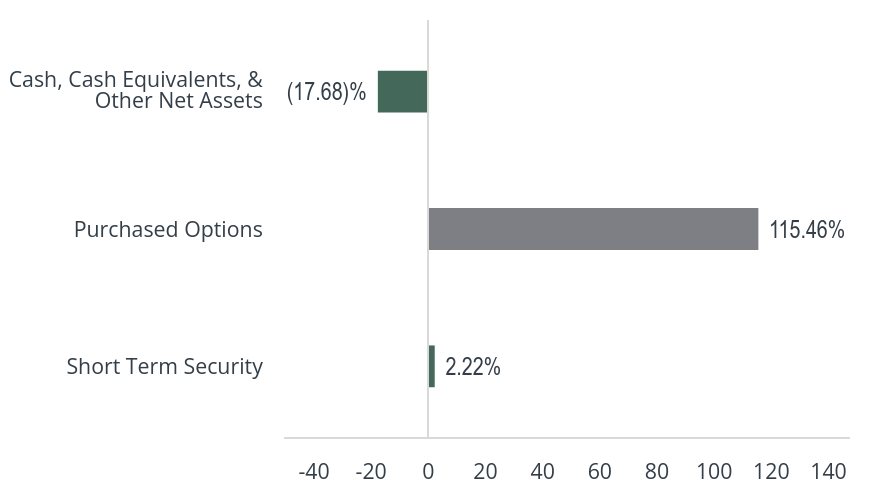

What did the Fund invest in?

| Top 10 | % |

|---|

| Call XSP October 0.01 10/14/2024 | 11.34% |

| Call XSP November 0.01 11/14/2024 | 10.67% |

| Call XSP December 0.01 12/13/2024 | 10.66% |

| Call XSP January 0.01 01/14/2025 | 10.33% |

| Call XSP Febuary 0.01 02/14/2025 | 9.32% |

| Call XSP May 0.01 05/14/2025 | 8.31% |

| Call XSP JUNE 0.01 06/13/2025 | 8.31% |

| Call XSP JULY 0.01 07/14/2025 | 8.30% |

| Call XSP March 0.01 03/14/2025 | 7.99% |

| Call XSP April 0.01 04/14/2025 | 7.98% |

| Total % of Top 10 Holdings | 93.21% |

| Value | Value |

|---|

| Short Term Security | 2.22% |

| Purchased Options | 115.46% |

| Cash, Cash Equivalents, & Other Net Assets | (17.68)% |

| Value | Value |

|---|

| United States | 117.68% |

There have been no material Fund changes during the reporting period.

Changes in and Disagreements with Accountants

There have been no changes in or disagreements with the Fund's independent accounting firm during the reporting period.

Availability of Additional Information

Additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, can be found by visitinghttps://www.beacontrust.com/services/investment-management/beacon-funds.

If you have consented to receive a single annual or semi-annual shareholder report at a shared address you may revoke this consent by calling the Transfer Agent 1-973-206-7100.

Distributor, ALPS Distributors, Inc.

Phone: 1-844-894-9222

Email: mutualfunds@beacontrust.com

Beacon Accelerated Return Strategy Fund - Class I

Annual Shareholder Report | September 30, 2024

Beacon Planned Return Strategy Fund

Annual Shareholder Report | September 30, 2024

This annual shareholder report contains important information about Beacon Planned Return Strategy Fund - I Class for the period of October 1, 2023 to September 30, 2024.

You can find additional information about the Fund at https://www.beacontrust.com/services/investment-management/beacon-funds. You can also request this information by contacting us at 1-844-894-9222.

What were the Fund's Cost for the last year?

(based on a hypothetical $10,000 investment)

| CLASS NAME | COST OF A $10,000 INVESTMENT | COST PAID AS A PERCENTAGE OF A $10,000 INVESTMENT |

|---|

| Beacon Planned Return Strategy Fund - I | $129 | 1.20% |

How did the Fund perform last year?

The Beacon Planned Return Strategy Fund - I returned 14.70% for the 12 months ended September 30, 2024. This is in contrast to the CBOE S&P 500 BuyWrite Index, which had a 18.31% return for the same time period.

The returns sought to be generated by the Fund are derived from three distinct return elements, i.e., returns from Directional/Enhanced market movements, returns from Income (or option premium) and returns from the Hedge that creates constant “downside protection”. Each return driver plays a crucial and sometimes complementary role in the overall performance of the strategy.

Over the last year, the Directional/Enhanced component added value due to the increase in the S&P 500, the Income component detracted from value since selling the out of the money call options lost more than the gains received from selling put options, and the Hedge component detracted from value due to the rise in the S&P 500.

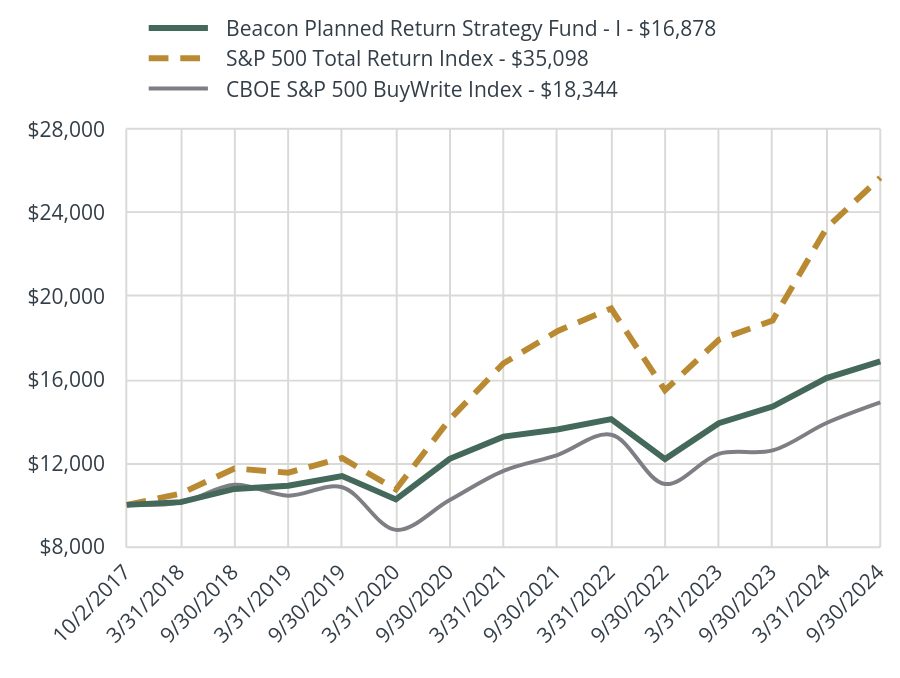

How did the Fund perform since inception?

Total Return Based on $10,000 Investment

| Beacon Planned Return Strategy Fund - I - $16,878 | S&P 500 Total Return Index - $35,098 | CBOE S&P 500 BuyWrite Index - $18,344 |

|---|

| 10/2/2017 | $10,000.00 | $10,000.00 | $10,000.00 |

| 3/31/2018 | $10,132.44 | $10,542.64 | $10,108.88 |

| 9/30/2018 | $10,764.46 | $11,745.49 | $10,965.39 |

| 3/31/2019 | $10,916.92 | $11,543.82 | $10,441.48 |

| 9/30/2019 | $11,385.88 | $12,245.13 | $10,843.96 |

| 3/31/2020 | $10,263.80 | $10,738.30 | $8,799.38 |

| 9/30/2020 | $12,207.17 | $14,100.17 | $10,230.23 |

| 3/31/2021 | $13,272.12 | $16,789.51 | $11,632.69 |

| 9/30/2021 | $13,614.63 | $18,330.91 | $12,389.07 |

| 3/31/2022 | $14,113.47 | $19,416.37 | $13,363.35 |

| 9/30/2022 | $12,197.17 | $15,494.73 | $11,000.36 |

| 3/31/2023 | $13,917.65 | $17,915.78 | $12,447.06 |

| 9/30/2023 | $14,714.94 | $18,844.28 | $12,609.14 |

| 3/31/2024 | $16,078.38 | $23,269.24 | $13,927.23 |

| 9/30/2024 | $16,877.86 | $25,694.46 | $14,917.28 |

Average Annual Total Retuns

| Class I | 1 Year | 5 Year | Since Inception |

|---|

| Beacon Planned Return Strategy Fund - Class I | 14.70% | 8.19% | 7.77% |

| S&P 500 Total Return Index | 36.35% | 15.98% | 14.44% |

| CBOE S&P 500 BuyWrite Index | 18.31% | 6.59% | 5.88% |

- Total Net Assets$384,241,502

- # of Portfolio Holdings97

- Portfolio Turnover Rate (Class I)-%

- Advisory Fees Paid$3,685,434

The Fund’s past performance is not a good predictor of the Fund’s future performance. The "Average Annual Total Returns" table and graph presented above do not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares.

Call 1-844-894-9222 for current month-end performance.

What did the Fund invest in?

| Top 10 | % |

|---|

| Call XSP October 56.75 10/14/2024 | 9.60% |

| Call XSP November 58.75 11/14/2024 | 9.43% |

| Call XSP AUGUST 72.00 08/14/2025 | 8.53% |

| Call XSP September 73.42 09/12/2025 | 8.36% |

| Call XSP July 73.55 07/14/2025 | 8.30% |

| Call XSP June 70.80 06/13/2025 | 7.50% |

| Call XSP Febuary 65.20 02/14/2025 | 7.32% |

| Call XSP April 67.30 04/14/2025 | 7.29% |

| Call XSP May 69.00 05/14/2025 | 7.20% |

| Call XSP March 67.18 03/14/2025 | 7.16% |

| Total % of Top 10 Holdings | 80.69% |

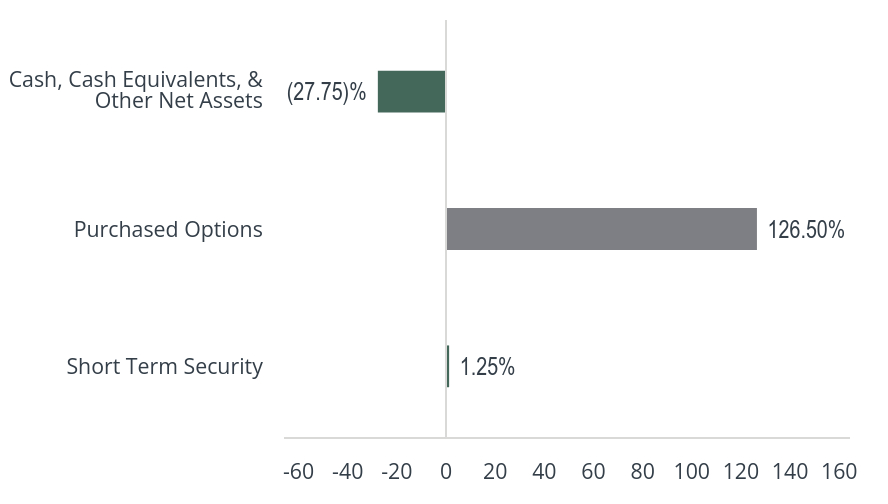

| Value | Value |

|---|

| Short Term Security | 1.25% |

| Purchased Options | 126.50% |

| Cash, Cash Equivalents, & Other Net Assets | (27.75)% |

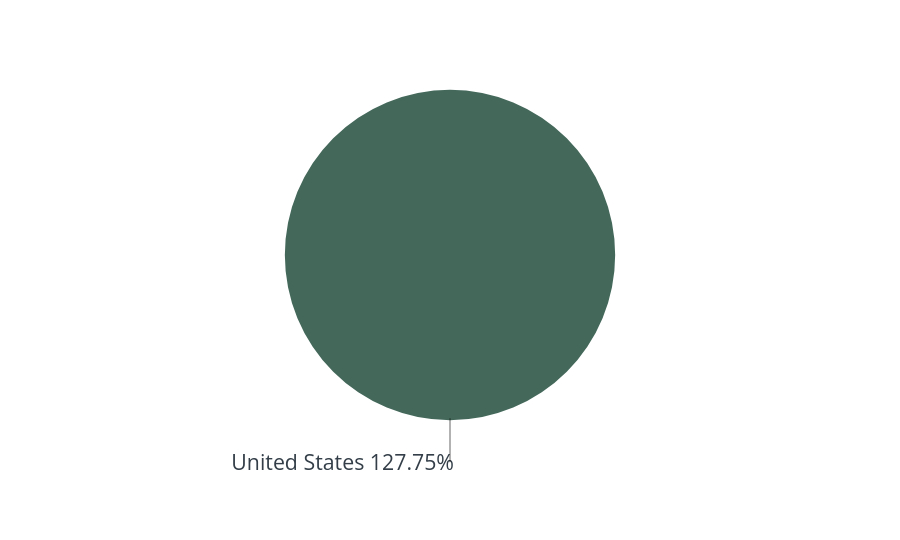

| Value | Value |

|---|

| United States | 127.75% |

There have been no material Fund changes during the reporting period.

Changes in and Disagreements with Accountants

There have been no changes in or disagreements with the Fund's independent accounting firm during the reporting period.

Availability of Additional Information

Additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, can be found by visitinghttps://www.beacontrust.com/services/investment-management/beacon-funds.

If you have consented to receive a single annual or semi-annual shareholder report at a shared address you may revoke this consent by calling the Transfer Agent 1-973-206-7100.

Distributor, ALPS Distributors, Inc.

Phone: 1-844-894-9222

Email: mutualfunds@beacontrust.com

Beacon Planned Return Strategy Fund - Class I

Annual Shareholder Report | September 30, 2024

ANNUAL SHAREHOLDER REPORT | September 30, 2024

This annual shareholder report contains important information about Brigade High Income Fund - Founders Class for the period of October 1, 2023 to September 30, 2024.

You can find additional information about the Fund at https://www.brigadefunds.com/resources. You can also request this information by contacting us at 212.745.9700.

WHAT WERE THE FUND'S COST FOR THE LAST YEAR?

(based on a hypothetical $10,000 investment)

| CLASS NAME | COST OF A $10,000 INVESTMENT | COST PAID AS A PERCENTAGE OF A $10,000 INVESTMENT |

|---|

| Brigade High Income Fund - Founders | $56 | 0.52% |

HOW DID THE FUND PERFORM LAST YEAR?

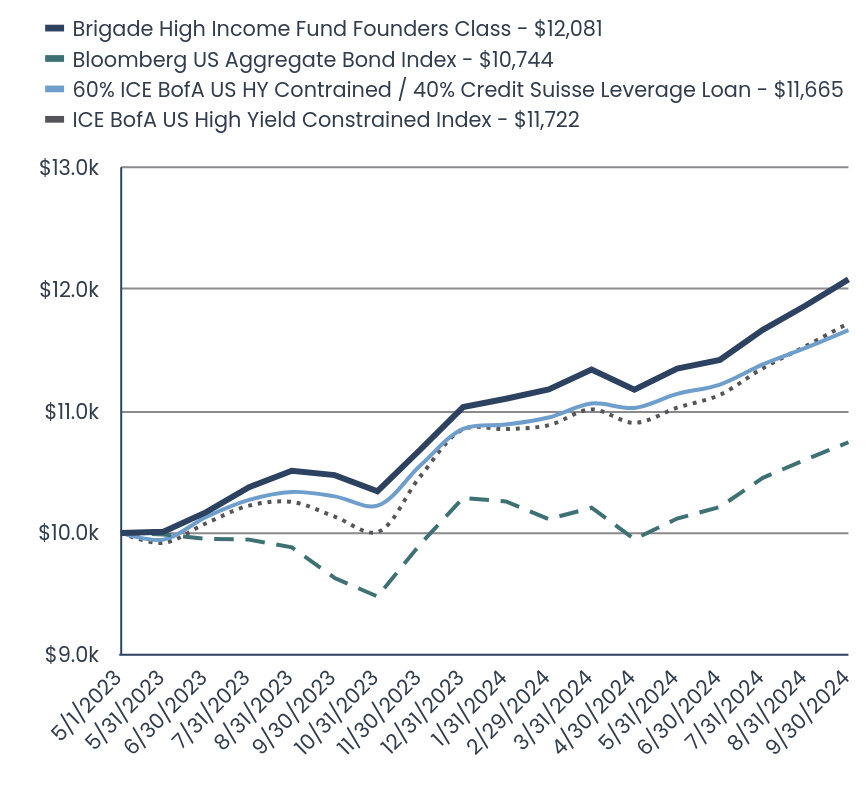

The Founder’s Share Class for the Fund returned +15.34% (net) for the one-year ending September 30, 2024, outperforming the 60% ICE BofA US HY Constrained / 40% Credit Suisse Leveraged Loan Index (+13.26%) while slightly underperforming the ICE BofA US High Yield Constrained Index (+15.67%).

The key driver to Fund performance over the one-year period were positions in high yield bonds, specifically within the Healthcare, Telecom, Energy and Financials industries. Healthcare and Telecom were among the most disperse sectors that have begun to see catalysts play out.

Bank loans was also a positive contributor to Fund performance. Similar to high yield bonds, drivers were diverse across sectors with Healthcare, Technology, Energy and Gaming the top contributors over the one-year period.

We continue to actively monitor macroeconomic developments and their effect on leveraged finance markets and remain confident in our current positioning as well as the opportunity set that we expect to become available to us in the coming months.

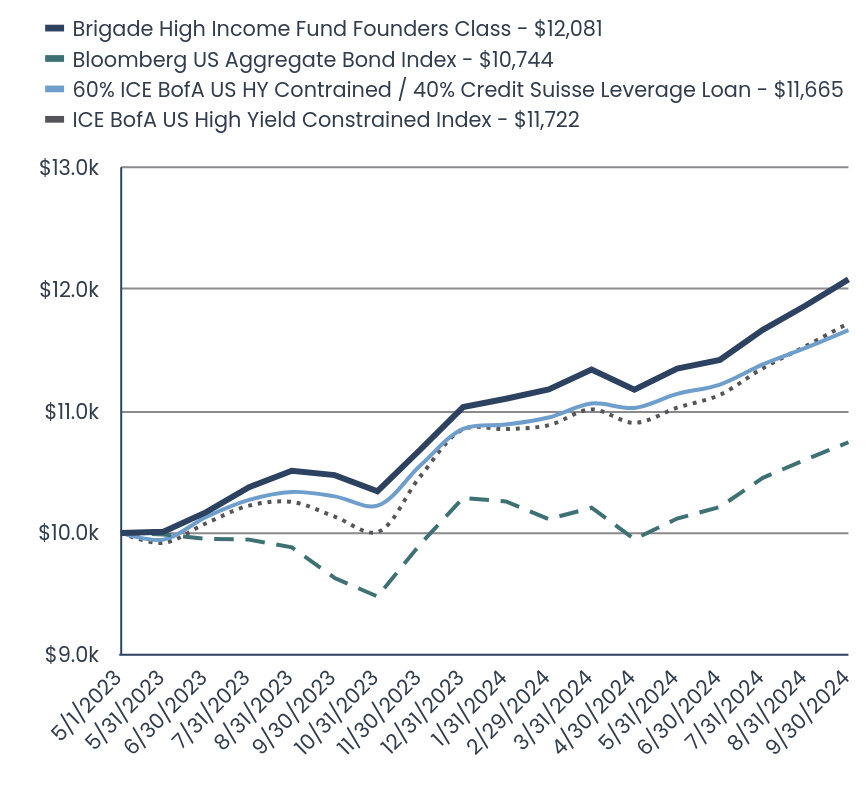

HOW DID THE FUND PERFORM SINCE INCEPTION?

TOTAL RETURN BASED ON $10,000 INVESTMENT

| Brigade High Income Fund Founders Class - $12,081 | Bloomberg US Aggregate Bond Index - $10,744 | 60% ICE BofA US HY Contrained / 40% Credit Suisse Leverage Loan - $11,665 | ICE BofA US High Yield Constrained Index - $11,722 |

|---|

| 5/1/2023 | $10,000.00 | $10,000.00 | $10,000.00 | $10,000.00 |

| 5/31/2023 | $10,010.00 | $9,987.39 | $9,944.92 | $9,918.28 |

| 6/30/2023 | $10,170.00 | $9,951.75 | $10,131.01 | $10,079.65 |

| 7/31/2023 | $10,375.31 | $9,944.85 | $10,270.63 | $10,223.73 |

| 8/31/2023 | $10,510.72 | $9,881.34 | $10,336.42 | $10,254.15 |

| 9/30/2023 | $10,474.48 | $9,630.21 | $10,299.81 | $10,133.66 |

| 10/31/2023 | $10,342.50 | $9,478.24 | $10,223.94 | $10,007.14 |

| 11/30/2023 | $10,683.74 | $9,907.46 | $10,552.73 | $10,463.95 |

| 12/31/2023 | $11,032.83 | $10,286.71 | $10,854.29 | $10,850.10 |

| 1/31/2024 | $11,101.21 | $10,258.45 | $10,889.52 | $10,852.19 |

| 2/29/2024 | $11,177.43 | $10,113.52 | $10,947.63 | $10,884.32 |

| 3/31/2024 | $11,341.18 | $10,206.92 | $11,062.27 | $11,013.97 |

| 4/30/2024 | $11,174.69 | $9,949.09 | $11,025.90 | $10,903.84 |

| 5/31/2024 | $11,348.61 | $10,117.76 | $11,141.06 | $11,027.57 |

| 6/30/2024 | $11,420.66 | $10,213.58 | $11,217.73 | $11,134.01 |

| 7/31/2024 | $11,666.50 | $10,452.15 | $11,382.75 | $11,352.50 |

| 8/31/2024 | $11,866.52 | $10,602.31 | $11,518.45 | $11,533.08 |

| 9/30/2024 | $12,081.16 | $10,744.29 | $11,665.22 | $11,721.54 |

AVERAGE ANNUAL TOTAL RETURNS

| Founders | 1 Year | Since Inception |

|---|

| Brigade High Income Fund - Founders (Incep. May 1, 2023) | 15.34% | 14.28% |

| Bloomberg US Aggregate Bond Index | 11.57% | 5.20% |

| 60% ICE BofA US HY Contrained / 40% Credit Suisse Leverage Loan | 13.26% | 11.49% |

| ICE BofA US High Yield Constrained Index | 15.67% | 11.87% |

- Total Net Assets$580,476,781

- # of Portfolio Holdings248

- Portfolio Turnover Rate49%

- Advisory Fees Paid$1,686,711

The Fund’s past performance is not a good predictor of the Fund’s future performance. The "Average Annual Total Return" table and graph presented above do not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares. Call 212.745.9700 for current month-end performance.

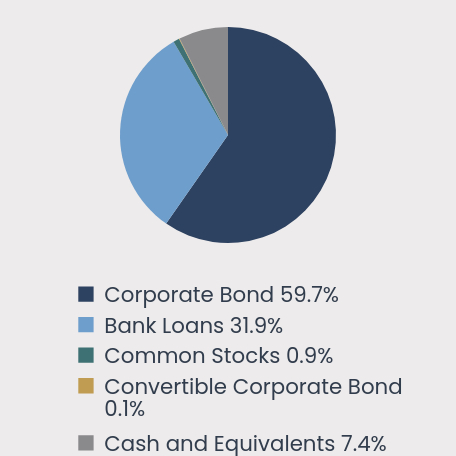

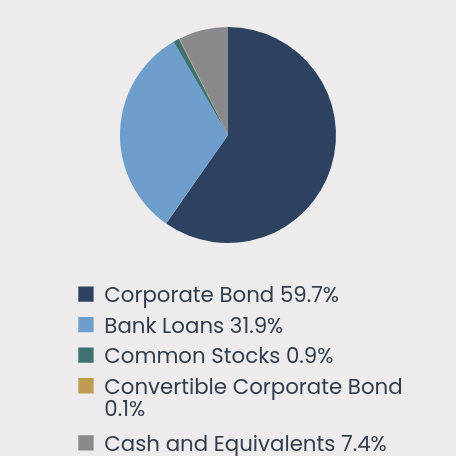

WHAT DID THE FUND INVEST IN?

ASSET CLASS WEIGHTINGS

(as a % of Net Assets)

| Value | Value |

|---|

| Corporate Bond | 59.7% |

| Bank Loans | 31.9% |

| Common Stocks | 0.9% |

| Convertible Corporate Bond | 0.1% |

| Cash and Equivalents | 7.4% |

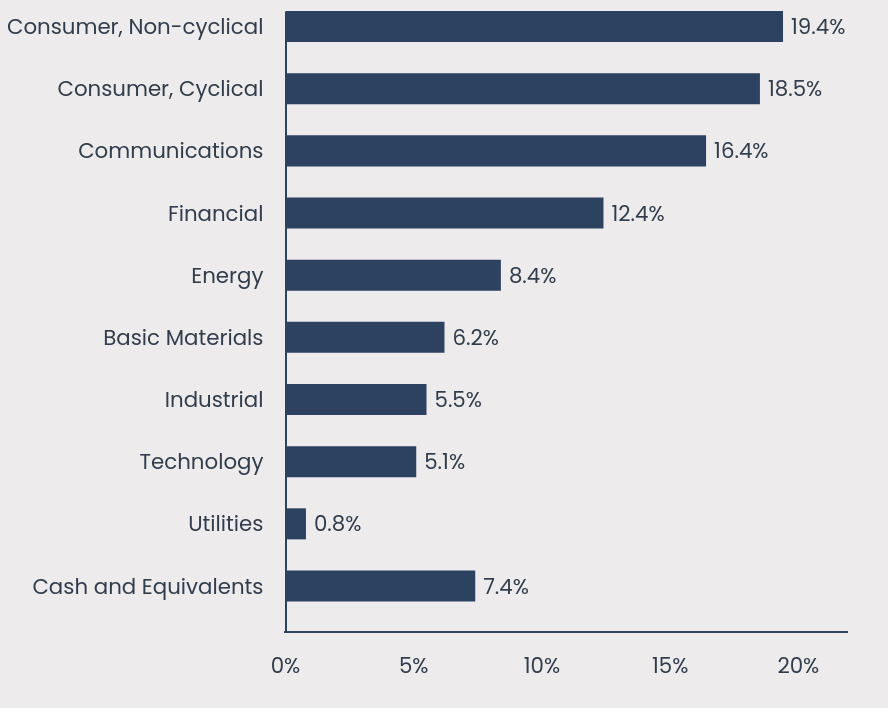

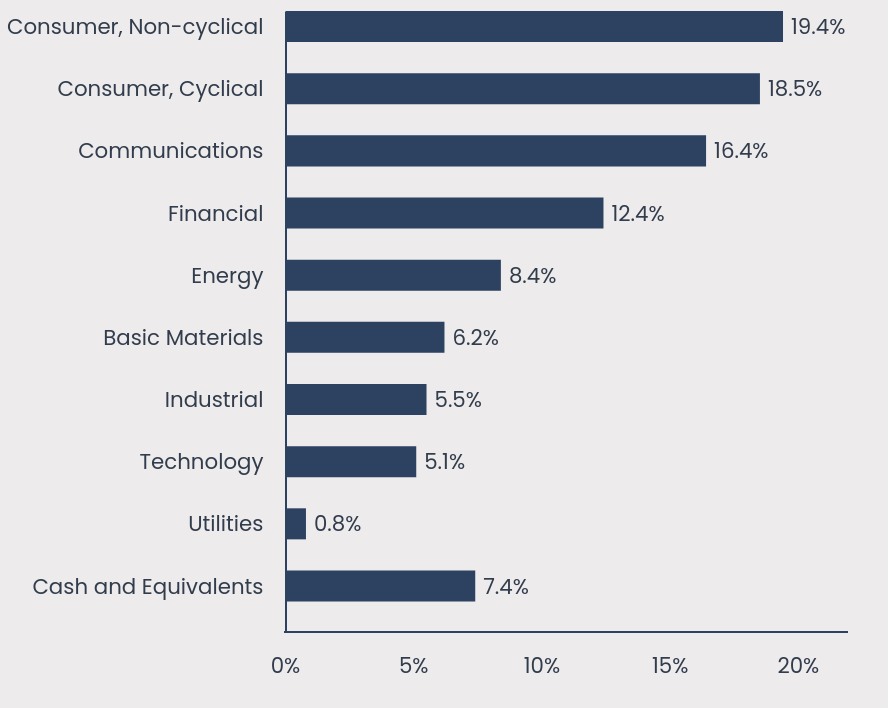

SECTOR WEIGHTINGS

(as a % of Net Assets)

| Value | Value |

|---|

| Cash and Equivalents | 7.4% |

| Utilities | 0.8% |

| Technology | 5.1% |

| Industrial | 5.5% |

| Basic Materials | 6.2% |

| Energy | 8.4% |

| Financial | 12.4% |

| Communications | 16.4% |

| Consumer, Cyclical | 18.5% |

| Consumer, Non-cyclical | 19.4% |

TOP TEN HOLDINGS

(as a % of Net Assets)

| Top 10 | Top 10 |

|---|

| Tenet Healthcare Corp. 06/15/2028 4.625% | 1.2% |

| TransDigm, Inc. 12/01/2031 7.125% | 1.2% |

| Team Health Holdings, Inc. 03/02/2027 3M SOFR + 5.25% | 1.2% |

| Radiology Partners, Inc. 01/31/2029 7.775% | 1.1% |

| Avaya Inc. 08/01/2028 1M SOFR + 7.50% | 1.0% |

| Syniverse Holdings LLC 05/13/2027 3M SOFR + 7.00% | 0.9% |

| Warhorse Gaming, LLC 06/15/2028 1M SOFR + 9.25% | 0.9% |

| Envision Healthcare Operating, INC. TL 1L 12/30/2027 1M SOFR + 8.25% | 0.9% |

| Carestream Health, Inc. 09/30/2027 3M SOFR + 7.50% | 0.9% |

| Team Health Holdings, Inc. 06/30/2028 13.50% | 0.9% |

| Total % of Top 10 Holdings | 10.1% |

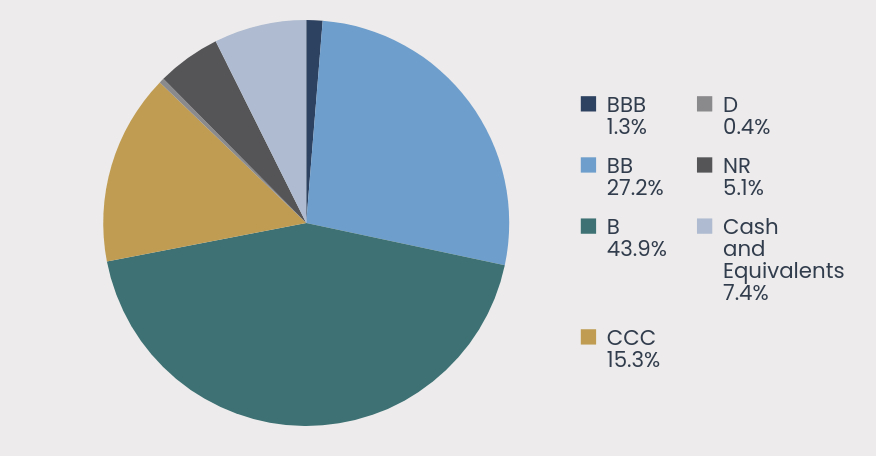

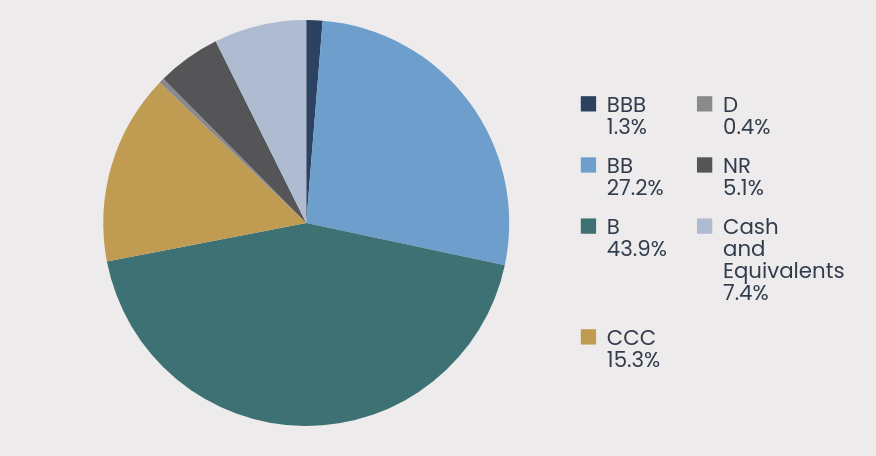

CREDIT QUALITY ALLOCATION

(as a % of Net Assets)

| Value | Value |

|---|

| BBB | 1.3% |

| BB | 27.2% |

| B | 43.9% |

| CCC | 15.3% |

| D | 0.4% |

| NR | 5.1% |

| Cash and Equivalents | 7.4% |

There have been no material Fund changes during the reporting period.

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS

There have been no changes in or disagreements with the Fund's independent accounting firm during the reporting period.

BRIGADE HIGH INCOME FUND - FOUNDERS CLASS

ANNUAL SHAREHOLDER REPORT | September 30, 2024

Distributor, ALPS Distributors, Inc.

Additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, can be found by visiting https://www.brigadefunds.com.

If you have consented to receive a single annual or semi-annual shareholder report at a shared address you may revoke this consent by calling the Transfer Agent 212.745.9700.

INSTITUTIONAL CLASS: BHIIX

ANNUAL SHAREHOLDER REPORT | September 30, 2024

This annual shareholder report contains important information about Brigade High Income Fund - Institutional Class for the period of October 1, 2023 to September 30, 2024.

You can find additional information about the Fund at https://www.brigadefunds.com/resources. You can also request this information by contacting us at 212.745.9700.

WHAT WERE THE FUND'S COST FOR THE LAST YEAR?

(based on a hypothetical $10,000 investment)

| CLASS NAME | COST OF A $10,000 INVESTMENT | COST PAID AS A PERCENTAGE OF A $10,000 INVESTMENT |

|---|

| Brigade High Income Fund - Institutional | $74 | 0.69% |

HOW DID THE FUND PERFORM LAST YEAR?

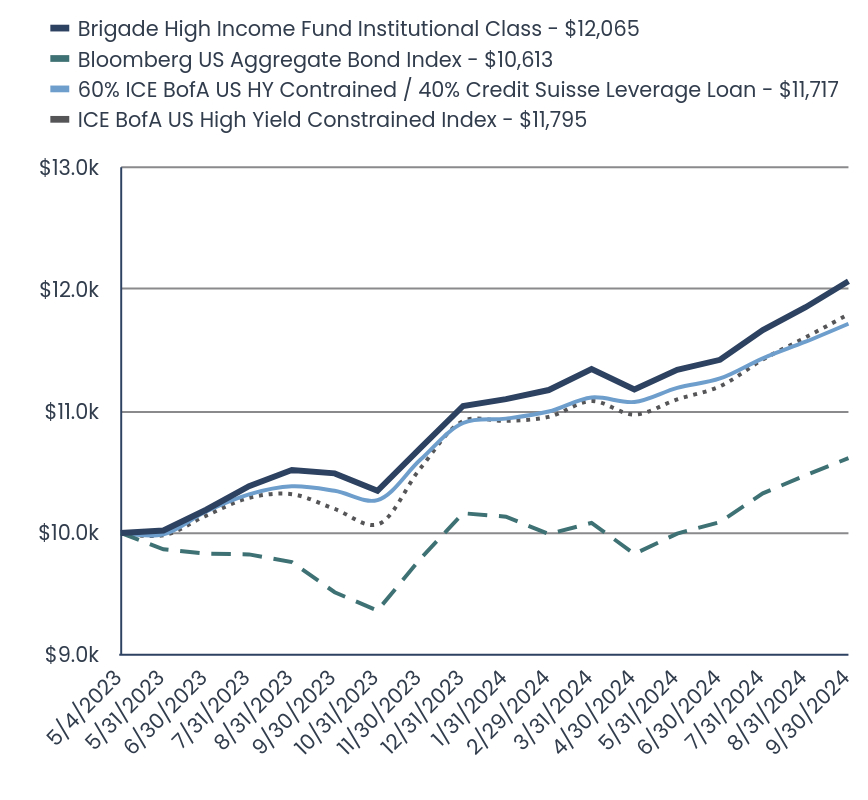

The Institutional’s Share Class for the Fund returned +15.14% (net) for the one-year ending September 30, 2024, outperforming the 60% ICE BofA US HY Constrained / 40% Credit Suisse Leveraged Loan Index (+13.26%) while slightly underperforming the ICE BofA US High Yield Constrained Index (+15.67%).

The key driver to Fund performance over the one-year period was positions in high yield bonds, specifically within the Healthcare, Telecom, Energy and Financials industries. Healthcare and Telecom were among the most disperse sectors that have begun to see catalysts play out.

Bank loans was also a positive contributor to Fund performance. Similar to high yield bonds, drivers were diverse across sectors with Healthcare, Technology, Energy and Gaming the top contributors over the one-year period.

We continue to actively monitor macroeconomic developments and their effect on leveraged finance markets and remain confident in our current positioning as well as the opportunity set that we expect to become available to us in the coming months.

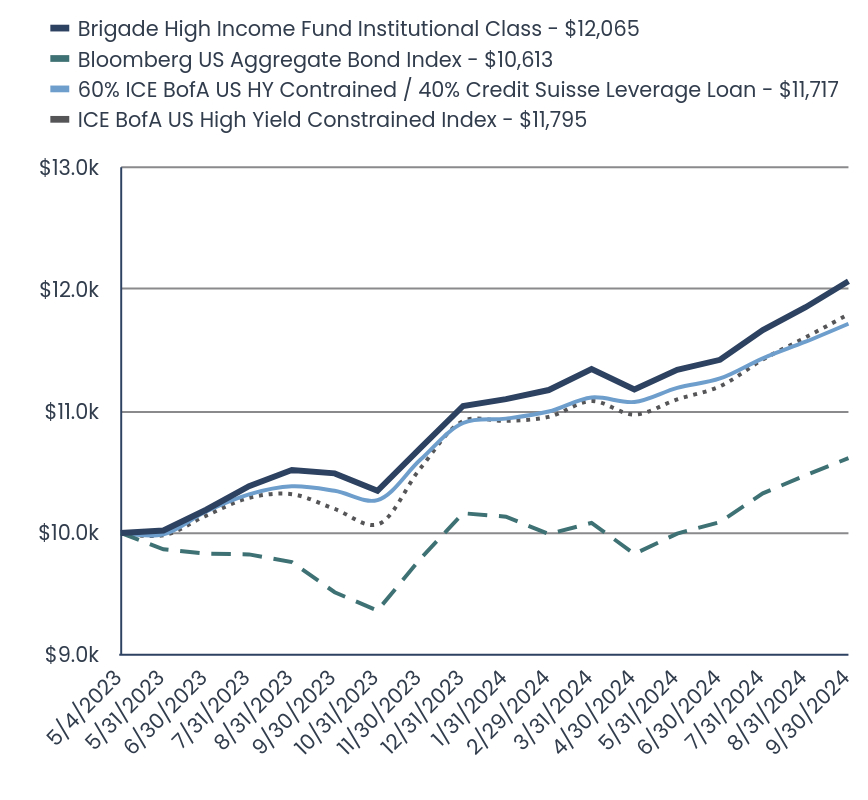

HOW DID THE FUND PERFORM SINCE INCEPTION?

TOTAL RETURN BASED ON $10,000 INVESTMENT

| Brigade High Income Fund Institutional Class - $12,065 | Bloomberg US Aggregate Bond Index - $10,613 | 60% ICE BofA US HY Contrained / 40% Credit Suisse Leverage Loan - $11,717 | ICE BofA US High Yield Constrained Index - $11,795 |

|---|

| 5/4/2023 | $10,000.00 | $10,000.00 | $10,000.00 | $10,000.00 |

| 5/31/2023 | $10,020.04 | $9,865.77 | $9,989.10 | $9,980.02 |

| 6/30/2023 | $10,190.38 | $9,830.56 | $10,176.02 | $10,142.40 |

| 7/31/2023 | $10,383.19 | $9,823.75 | $10,316.26 | $10,287.37 |

| 8/31/2023 | $10,516.63 | $9,761.00 | $10,382.35 | $10,317.98 |

| 9/30/2023 | $10,488.63 | $9,512.94 | $10,345.57 | $10,196.74 |

| 10/31/2023 | $10,345.54 | $9,362.82 | $10,269.36 | $10,069.43 |

| 11/30/2023 | $10,695.59 | $9,786.81 | $10,599.61 | $10,529.09 |

| 12/31/2023 | $11,042.25 | $10,161.45 | $10,902.51 | $10,917.65 |

| 1/31/2024 | $11,098.26 | $10,133.53 | $10,937.90 | $10,919.74 |

| 2/29/2024 | $11,172.73 | $9,990.36 | $10,996.27 | $10,952.07 |

| 3/31/2024 | $11,345.67 | $10,082.63 | $11,111.42 | $11,082.53 |

| 4/30/2024 | $11,177.41 | $9,827.93 | $11,074.89 | $10,971.72 |

| 5/31/2024 | $11,338.94 | $9,994.55 | $11,190.55 | $11,096.22 |

| 6/30/2024 | $11,420.95 | $10,089.21 | $11,267.57 | $11,203.32 |

| 7/31/2024 | $11,665.41 | $10,324.87 | $11,433.32 | $11,423.17 |

| 8/31/2024 | $11,852.53 | $10,473.20 | $11,569.62 | $11,604.87 |

| 9/30/2024 | $12,065.48 | $10,613.45 | $11,717.05 | $11,794.51 |

AVERAGE ANNUAL TOTAL RETURNS

| Institutional | 1 Year | Since Inception |

|---|

| Brigade High Income Fund - Institutional (Incep. May 4, 2023) | 15.14% | 14.34% |

| Bloomberg US Aggregate Bond Index | 11.57% | 4.32% |

| 60% ICE BofA US HY Contrained / 40% Credit Suisse Leverage Loan | 13.26% | 11.91% |

| ICE BofA US High Yield Constrained Index | 15.67% | 12.43% |

- Total Net Assets$580,476,781

- # of Portfolio Holdings248

- Portfolio Turnover Rate49%

- Advisory Fees Paid$1,686,711

The Fund’s past performance is not a good predictor of the Fund’s future performance. The "Average Annual Total Return" table and graph presented above do not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares. Call 212.745.9700 for current month-end performance.

WHAT DID THE FUND INVEST IN?

ASSET CLASS WEIGHTINGS

(as a % of Net Assets)

| Value | Value |

|---|

| Corporate Bond | 59.7% |

| Bank Loans | 31.9% |

| Common Stocks | 0.9% |

| Convertible Corporate Bond | 0.1% |

| Cash and Equivalents | 7.4% |

SECTOR WEIGHTINGS

(as a % of Net Assets)

| Value | Value |

|---|

| Cash and Equivalents | 7.4% |

| Utilities | 0.8% |

| Technology | 5.1% |

| Industrial | 5.5% |

| Basic Materials | 6.2% |

| Energy | 8.4% |

| Financial | 12.4% |

| Communications | 16.4% |

| Consumer, Cyclical | 18.5% |

| Consumer, Non-cyclical | 19.4% |

TOP TEN HOLDINGS

(as a % of Net Assets)

| Top 10 | Top 10 |

|---|

| Tenet Healthcare Corp. 06/15/2028 4.625% | 1.2% |

| TransDigm, Inc. 12/01/2031 7.125% | 1.2% |

| Team Health Holdings, Inc. 03/02/2027 3M SOFR + 5.25% | 1.2% |

| Radiology Partners, Inc. 01/31/2029 7.775% | 1.1% |

| Avaya Inc. 08/01/2028 1M SOFR + 7.50% | 1.0% |

| Syniverse Holdings LLC 05/13/2027 3M SOFR + 7.00% | 0.9% |

| Warhorse Gaming, LLC 06/15/2028 1M SOFR + 9.25% | 0.9% |

| Envision Healthcare Operating, INC. TL 1L 12/30/2027 1M SOFR + 8.25% | 0.9% |

| Carestream Health, Inc. 09/30/2027 3M SOFR + 7.50% | 0.9% |

| Team Health Holdings, Inc. 06/30/2028 13.50% | 0.9% |

| Total % of Top 10 Holdings | 10.1% |

CREDIT QUALITY ALLOCATION

(as a % of Net Assets)

| Value | Value |

|---|

| BBB | 1.3% |

| BB | 27.2% |

| B | 43.9% |

| CCC | 15.3% |

| D | 0.4% |

| NR | 5.1% |

| Cash and Equivalents | 7.4% |

There have been no material Fund changes during the reporting period.

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS

There have been no changes in or disagreements with the Fund's independent accounting firm during the reporting period.

BRIGADE HIGH INCOME FUND - INSTITUTIONAL CLASS

ANNUAL SHAREHOLDER REPORT | September 30, 2024

Distributor, ALPS Distributors, Inc.

Additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, can be found by visiting https://www.brigadefunds.com.

If you have consented to receive a single annual or semi-annual shareholder report at a shared address you may revoke this consent by calling the Transfer Agent 212.745.9700.

Carret Kansas Tax-Exempt Bond Fund

ANNUAL SHAREHOLDER REPORT | September 30, 2024

This annual shareholder report contains important information about Carret Kansas Tax-Exempt Bond Fund - A for the period of October 1, 2023 to September 30, 2024.

You can find additional information about the Fund at https://www.carret.com/carret-kansas-tax-exempt-bond-fund. You can also request this information by contacting us at 888.266.8787.

WHAT WERE THE FUND'S COST FOR THE LAST YEAR?

(based on a hypothetical $10,000 investment)

| CLASS NAME | COST OF A $10,000 INVESTMENT | COST PAID AS A PERCENTAGE OF A $10,000 INVESTMENT |

|---|

| Carret Kansas Tax-Exempt Bond Fund - A | $76 | 0.73% |

HOW DID THE FUND PERFORM LAST YEAR?

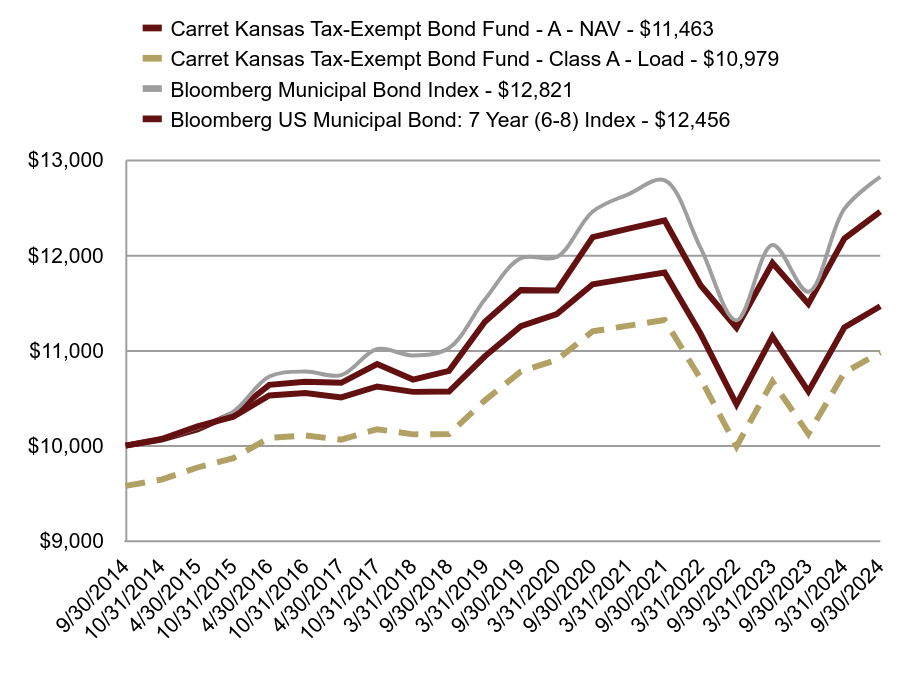

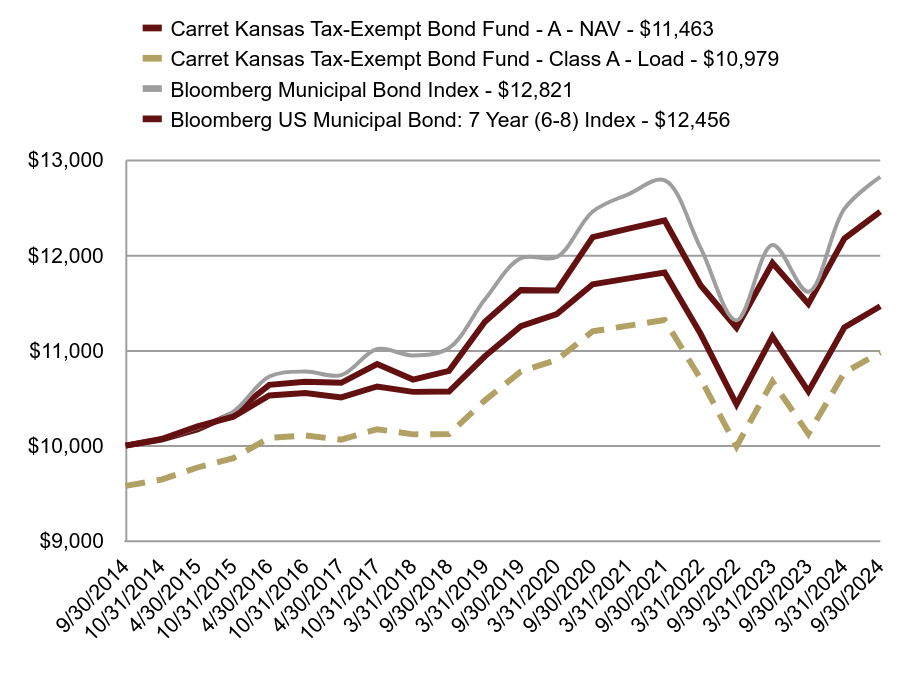

For the year ended September 30, 2024, the Carret Kansas Tax-Exempt Bond Fund returned 8.5% versus a return of 8.4% for the Bloomberg US Municipal Bond: 7 Year Index. The performance of the Fund was driven by the overall decline in interest rates during Fiscal Year 2024. The broad uncertainty of the macro and micro economies added a notable degree of volatility to the municipal bond landscape. The Fund’s high-quality focus, premium coupon bias, and intermediate-duration structure provided a cushion against market volatility.

HOW DID THE FUND PERFORM LAST 10 YEARS?

TOTAL RETURN BASED ON $10,000 INVESTMENT

| Carret Kansas Tax-Exempt Bond Fund - A - NAV - $11,463 | Carret Kansas Tax-Exempt Bond Fund - Class A - Load - $10,979 | Bloomberg Municipal Bond Index - $12,821 | Bloomberg US Municipal Bond: 7 Year (6-8) Index - $12,456 |

|---|

| 9/30/2014 | $10,000.00 | $9,577.59 | $10,000.00 | $10,000.00 |

| 10/31/2014 | $10,069.24 | $9,643.90 | $10,068.55 | $10,064.46 |

| 4/30/2015 | $10,201.49 | $9,770.57 | $10,185.83 | $10,168.86 |

| 10/31/2015 | $10,304.35 | $9,869.08 | $10,357.26 | $10,337.47 |

| 4/30/2016 | $10,526.71 | $10,082.05 | $10,725.04 | $10,637.70 |

| 10/31/2016 | $10,552.30 | $10,106.56 | $10,777.57 | $10,671.52 |

| 4/30/2017 | $10,506.17 | $10,062.37 | $10,740.49 | $10,659.51 |

| 10/31/2017 | $10,620.96 | $10,172.32 | $11,013.84 | $10,855.82 |

| 3/31/2018 | $10,564.61 | $10,118.35 | $10,946.62 | $10,694.07 |

| 9/30/2018 | $10,567.25 | $10,120.87 | $11,025.32 | $10,785.48 |

| 3/31/2019 | $10,937.71 | $10,475.69 | $11,536.08 | $11,299.41 |

| 9/30/2019 | $11,254.44 | $10,779.04 | $11,968.05 | $11,634.19 |

| 3/31/2020 | $11,380.38 | $10,899.65 | $11,980.09 | $11,628.31 |

| 9/30/2020 | $11,694.44 | $11,200.45 | $12,457.76 | $12,190.03 |

| 3/31/2021 | $11,756.32 | $11,259.72 | $12,639.99 | $12,278.75 |

| 9/30/2021 | $11,816.89 | $11,317.72 | $12,785.15 | $12,363.55 |

| 3/31/2022 | $11,173.91 | $10,701.91 | $12,075.09 | $11,683.21 |

| 9/30/2022 | $10,432.48 | $9,991.80 | $11,314.78 | $11,237.65 |

| 3/31/2023 | $11,144.19 | $10,673.44 | $12,106.29 | $11,917.75 |

| 9/30/2023 | $10,569.79 | $10,123.30 | $11,616.19 | $11,488.13 |

| 3/31/2024 | $11,240.80 | $10,765.97 | $12,484.78 | $12,173.12 |

| 9/30/2024 | $11,463.49 | $10,979.26 | $12,820.99 | $12,455.95 |

AVERAGE ANNUAL TOTAL RETURNS

| Class A | 1 Year | 5 Year | 10 Year |

|---|

| Carret Kansas Tax-Exempt Bond Fund - Class A - NAV | 8.46% | 0.37% | 1.38% |

Carret Kansas Tax-Exempt Bond Fund - Class A - LoadFootnote Reference* | 3.81% | -0.50% | 0.94% |

| Bloomberg Municipal Bond Index | 10.37% | 1.39% | 2.52% |

| Bloomberg US Municipal Bond: 7 Year (6-8) Index | 8.41% | 1.38% | 2.22% |

- Total Net Assets$122,987,531

- # of Portfolio Holdings166

- Portfolio Turnover Rate10%

- Advisory Fees Paid$143,877

The Fund’s past performance is not a good predictor of the Fund’s future performance. The "Average Annual Total Returns" table and graph presented above do not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares.

Call 888.266.8787 for current month-end performance.

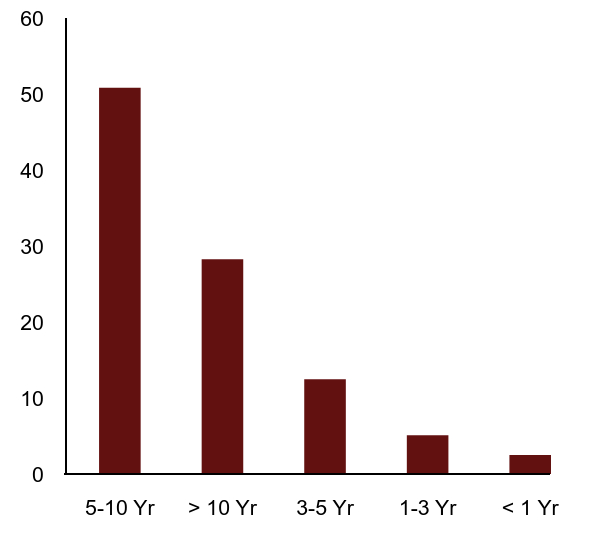

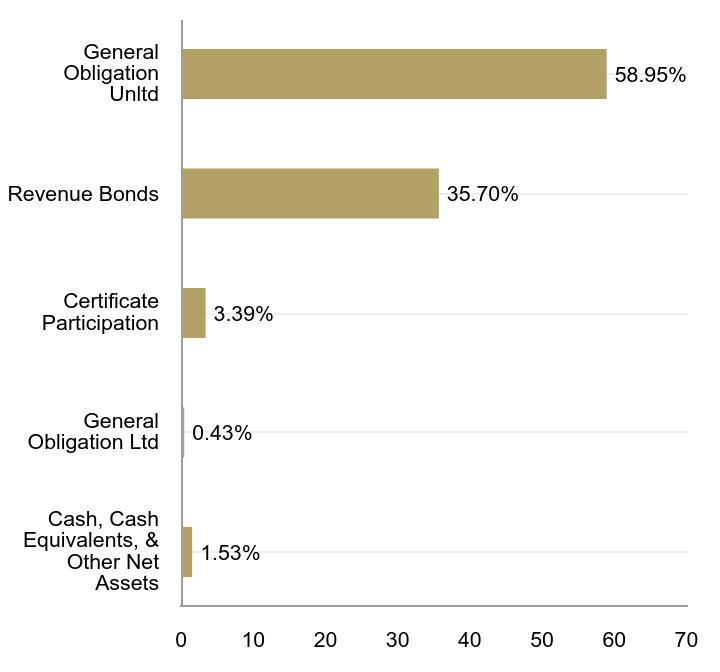

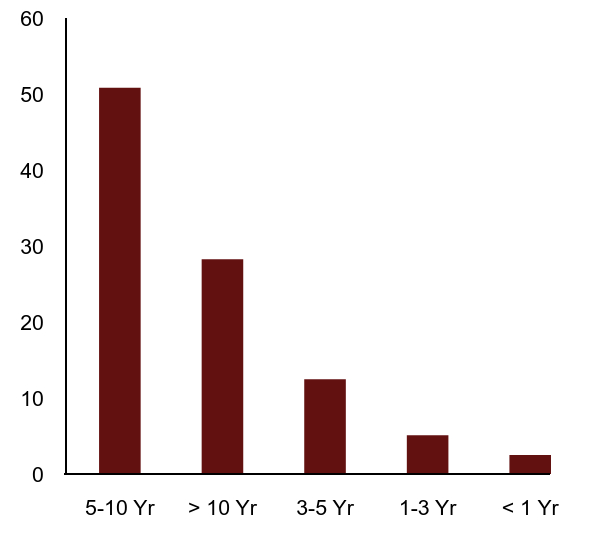

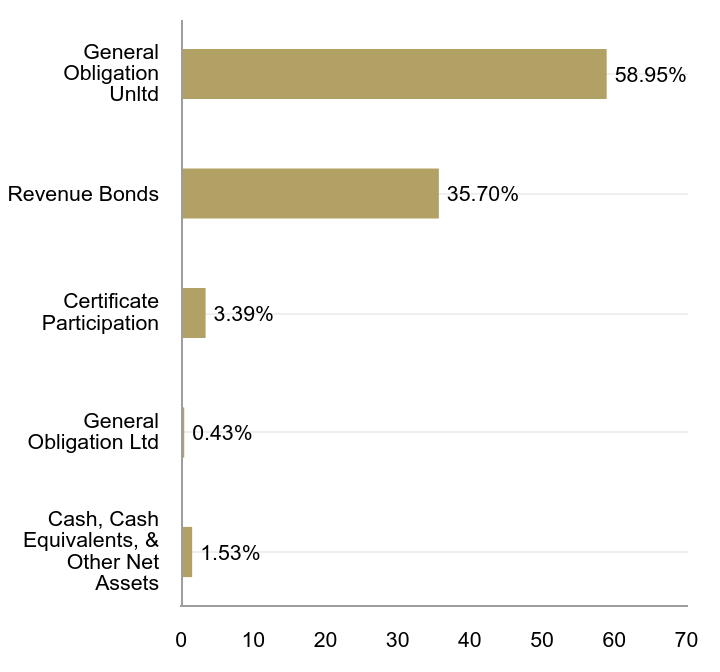

WHAT DID THE FUND INVEST IN?

| Value | Value |

|---|

| 5-10 Yr | 50.9% |

| > 10 Yr | 28.3% |

| 3-5 Yr | 12.5% |

| 1-3 Yr | 5.1% |

| < 1 Yr | 2.5% |

| Value | Value |

|---|

| Cash, Cash Equivalents, & Other Net Assets | 1.53% |

| General Obligation Ltd | 0.43% |

| Certificate Participation | 3.39% |

| Revenue Bonds | 35.70% |

| General Obligation Unltd | 58.95% |

| Top 10 | % |

|---|

| Allen County Unified School District No 257 09/01/2043 3.00% | 1.73% |

| State of Kansas Department of Transportation 09/01/2031 5.00% | 1.72% |

| State of Kansas Department of Transportation 09/01/2034 5.00% | 1.71% |

| Johnson & Miami Counties Unified School District No 230 Spring Hills 09/01/2030 5.00% | 1.68% |

| Kansas Development Finance Authority 05/01/2042 5.00% | 1.38% |

| State of Kansas Department of Transportation 09/01/2028 5.00% | 1.30% |

| Johnson County Unified School District No 229 Blue Valley 10/01/2040 4.00% | 1.27% |

| City of Lenexa KS 09/01/2033 3.00% | 1.27% |

| County of Johnson KS 09/01/2035 4.00% | 1.26% |

| Douglas County Unified School District No 497 Lawrence 09/01/2031 4.00% | 1.25% |

| Total % of Top 10 Holdings | 14.57% |

There have been no material Fund changes during the reporting period.

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS

There have been no changes in or disagreements with the Fund's independent accounting firm during the reporting period.

Additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, can be found by visiting https://www.carret.com/carret-kansas-tax-exempt-bond-fund.

Distributor, ALPS Distributors, Inc.

Phone: 888.266.8787

Email: info@carret.com

If you have consented to receive a single annual or semi-annual shareholder report at a shared address you may revoke this consent by calling the Transfer Agent 888.266.8787.

CARRET KANSAS TAX-EXEMPT BOND FUND - CLASS A

ANNUAL SHAREHOLDER REPORT | September 30, 2024

Carret Kansas Tax-Exempt Bond Fund

ANNUAL SHAREHOLDER REPORT | September 30, 2024

This annual shareholder report contains important information about Carret Kansas Tax-Exempt Bond Fund - I for the period of October 1, 2023 to September 30, 2024.

You can find additional information about the Fund at https://www.carret.com/carret-kansas-tax-exempt-bond-fund. You can also request this information by contacting us at 888.266.8787.

WHAT WERE THE FUND'S COST FOR THE LAST YEAR?

(based on a hypothetical $10,000 investment)

| CLASS NAME | COST OF A $10,000 INVESTMENT | COST PAID AS A PERCENTAGE OF A $10,000 INVESTMENT |

|---|

| Carret Kansas Tax-Exempt Bond Fund - I | $50 | 0.48% |

HOW DID THE FUND PERFORM LAST YEAR?

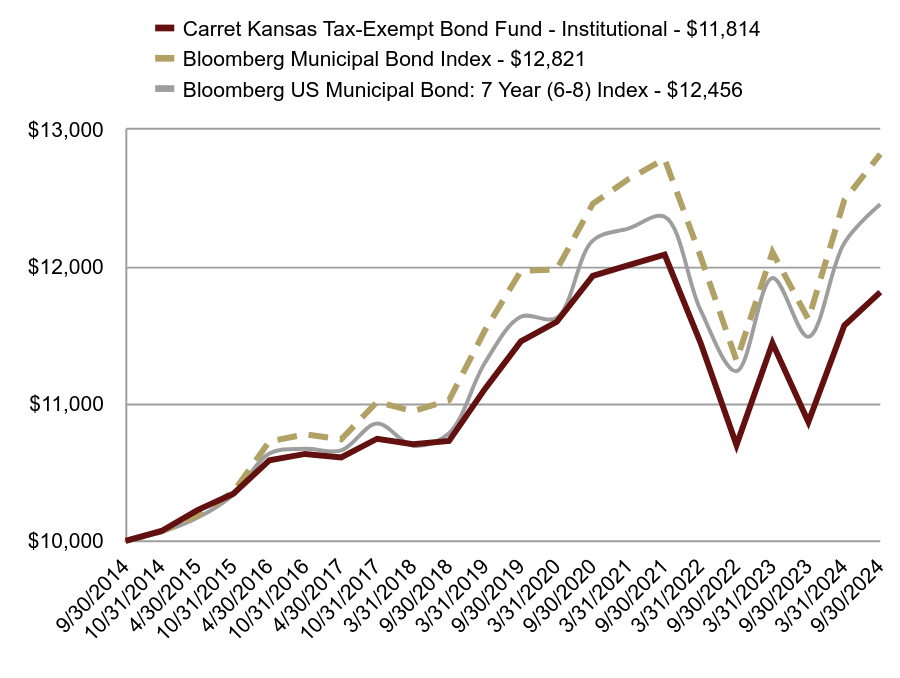

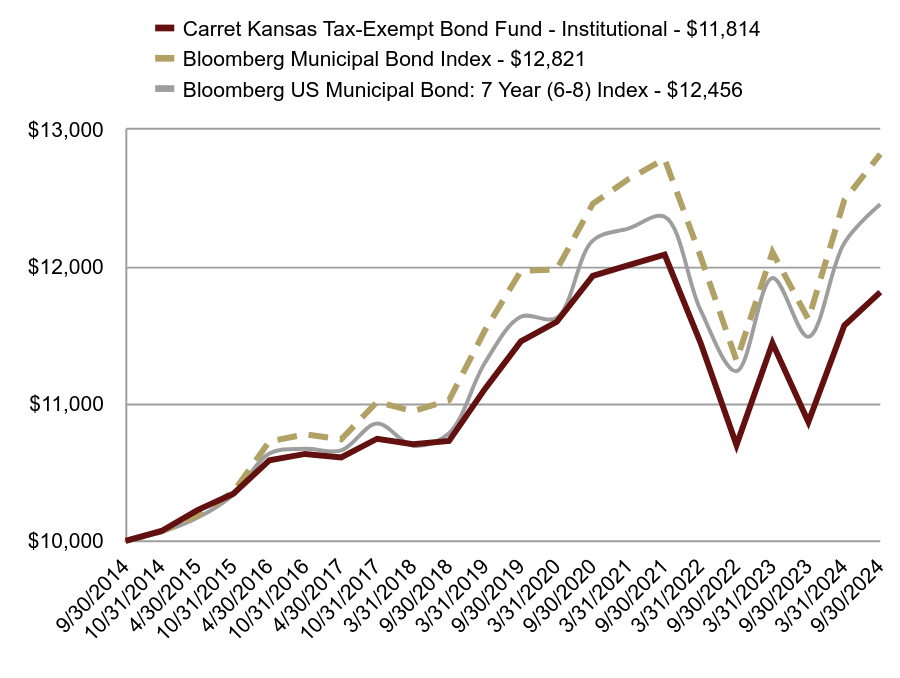

For the year ended September 30, 2024, the Carret Kansas Tax-Exempt Bond Fund returned 8.7% versus a return of 8.4% for the Bloomberg US Municipal Bond: 7 Year Index. The performance of the Fund was driven by the overall decline in interest rates during Fiscal Year 2024. The broad uncertainty of the macro and micro economies added a notable degree of volatility to the municipal bond landscape. The Fund’s high-quality focus, premium coupon bias, and intermediate-duration structure provided a cushion against market volatility.

HOW DID THE FUND PERFORM LAST 10 YEARS?

TOTAL RETURN BASED ON $10,000 INVESTMENT

| Carret Kansas Tax-Exempt Bond Fund - Institutional - $11,814 | Bloomberg Municipal Bond Index - $12,821 | Bloomberg US Municipal Bond: 7 Year (6-8) Index - $12,456 |

|---|

| 9/30/2014 | $10,000.00 | $10,000.00 | $10,000.00 |

| 10/31/2014 | $10,072.56 | $10,068.55 | $10,064.46 |

| 4/30/2015 | $10,224.56 | $10,185.83 | $10,168.86 |

| 10/31/2015 | $10,344.23 | $10,357.26 | $10,337.47 |

| 4/30/2016 | $10,587.69 | $10,725.04 | $10,637.70 |

| 10/31/2016 | $10,634.21 | $10,777.57 | $10,671.52 |

| 4/30/2017 | $10,608.17 | $10,740.49 | $10,659.51 |

| 10/31/2017 | $10,745.14 | $11,013.84 | $10,855.82 |

| 3/31/2018 | $10,705.39 | $10,946.62 | $10,694.07 |

| 9/30/2018 | $10,728.66 | $11,025.32 | $10,785.48 |

| 3/31/2019 | $11,108.35 | $11,536.08 | $11,299.41 |

| 9/30/2019 | $11,455.29 | $11,968.05 | $11,634.19 |

| 3/31/2020 | $11,597.89 | $11,980.09 | $11,628.31 |

| 9/30/2020 | $11,932.85 | $12,457.76 | $12,190.03 |

| 3/31/2021 | $12,010.96 | $12,639.99 | $12,278.75 |

| 9/30/2021 | $12,087.96 | $12,785.15 | $12,363.55 |

| 3/31/2022 | $11,444.55 | $12,075.09 | $11,683.21 |

| 9/30/2022 | $10,698.61 | $11,314.78 | $11,237.65 |

| 3/31/2023 | $11,442.69 | $12,106.29 | $11,917.75 |

| 9/30/2023 | $10,866.59 | $11,616.19 | $11,488.13 |

| 3/31/2024 | $11,570.50 | $12,484.78 | $12,173.12 |

| 9/30/2024 | $11,814.48 | $12,820.99 | $12,455.95 |

AVERAGE ANNUAL TOTAL RETURNS

| Institutional | 1 Year | 5 Year | 10 Year |

|---|

| Carret Kansas Tax-Exempt Bond Fund - Institutional | 8.72% | 0.62% | 1.68% |

| Bloomberg Municipal Bond Index | 10.37% | 1.39% | 2.52% |

| Bloomberg US Municipal Bond: 7 Year (6-8) Index | 8.41% | 1.38% | 2.22% |

- Total Net Assets$122,987,531

- # of Portfolio Holdings166

- Portfolio Turnover Rate10%

- Advisory Fees Paid$143,877

The Fund’s past performance is not a good predictor of the Fund’s future performance. The "Average Annual Total Returns" table and graph presented above do not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares.

Call 888.266.8787 for current month-end performance.

WHAT DID THE FUND INVEST IN?

| Value | Value |

|---|

| 5-10 Yr | 50.9% |

| > 10 Yr | 28.3% |

| 3-5 Yr | 12.5% |

| 1-3 Yr | 5.1% |

| < 1 Yr | 2.5% |

| Value | Value |

|---|

| Cash, Cash Equivalents, & Other Net Assets | 1.53% |

| General Obligation Ltd | 0.43% |

| Certificate Participation | 3.39% |

| Revenue Bonds | 35.70% |

| General Obligation Unltd | 58.95% |

| Top 10 | % |

|---|

| Allen County Unified School District No 257 09/01/2043 3.00% | 1.73% |

| State of Kansas Department of Transportation 09/01/2031 5.00% | 1.72% |

| State of Kansas Department of Transportation 09/01/2034 5.00% | 1.71% |

| Johnson & Miami Counties Unified School District No 230 Spring Hills 09/01/2030 5.00% | 1.68% |

| Kansas Development Finance Authority 05/01/2042 5.00% | 1.38% |

| State of Kansas Department of Transportation 09/01/2028 5.00% | 1.30% |

| Johnson County Unified School District No 229 Blue Valley 10/01/2040 4.00% | 1.27% |

| City of Lenexa KS 09/01/2033 3.00% | 1.27% |

| County of Johnson KS 09/01/2035 4.00% | 1.26% |

| Douglas County Unified School District No 497 Lawrence 09/01/2031 4.00% | 1.25% |

| Total % of Top 10 Holdings | 14.57% |

There have been no material Fund changes during the reporting period.

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS

There have been no changes in or disagreements with the Fund's independent accounting firm during the reporting period.

Additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, can be found by visiting https://www.carret.com/carret-kansas-tax-exempt-bond-fund.

Distributor, ALPS Distributors, Inc.

Phone: 888.266.8787

Email: info@carret.com

If you have consented to receive a single annual or semi-annual shareholder report at a shared address you may revoke this consent by calling the Transfer Agent 888.266.8787.

CARRET KANSAS TAX-EXEMPT BOND FUND - INSTITUTIONAL

ANNUAL SHAREHOLDER REPORT | September 30, 2024

0001558107ast:C000159698Member2024-09-30

Annual Shareholder Report - September 30, 2024

This annual shareholder report contains important information about Clarkston Founders Fund - Founders Class for the period of October 1, 2023 to September 30, 2024.

You can find additional information about the Fund at https://www.clarkstonfunds.com/literature/clarkston-founders-fund. You can also request this information by contacting us at 844.680.6562.

WHAT WERE THE FUND'S COSTS FOR THE LAST YEAR?

(based on a hypothetical $10,000 investment)

| CLASS NAME | COST OF A $10,000 INVESTMENT | COST PAID AS A PERCENTAGE OF A $10,000 INVESTMENT |

|---|

| Clarkston Founders Fund - Founders Class | $86 | 0.80% |

HOW DID THE FUND PERFORM LAST YEAR?

During the fiscal year ended September 30, 2024, the Fund’s Founders Class earned a return of 16.16% compared to 29.33% for the Russell Midcap® Index and 35.19% for the Russell® 3000 Index.

Three largest contributors to the Fund’s performance for the period:

US Foods Holding Corp. (USFD), one of America’s largest food distribution companies, serving approximately 250,000 restaurants and foodservice operators across the country

Post Holdings, Inc. (POST), a group of consumer packaged goods businesses that operate in a manner similar to a private equity firm

Stericycle, Inc. (SRCL), a company that provides regulated waste and compliance services in the United States, Europe, and internationally

Three largest detractors from the Fund’s performance for the period:

Altice USA, Inc. (ATUS), a provider of broadband communications and video services in the United States, Canada, Puerto Rico, and the Virgin Islands offering broadband, video, telephony, and mobile services to residential and business customers

Warner Bros. Discovery, Inc. (WBD), a media and entertainment company that operates worldwide.

Dollar General Corporation (DG), a discount retailer that provides consumable products, seasonal products, and apparel in the southern, southwestern, midwestern, and eastern United States

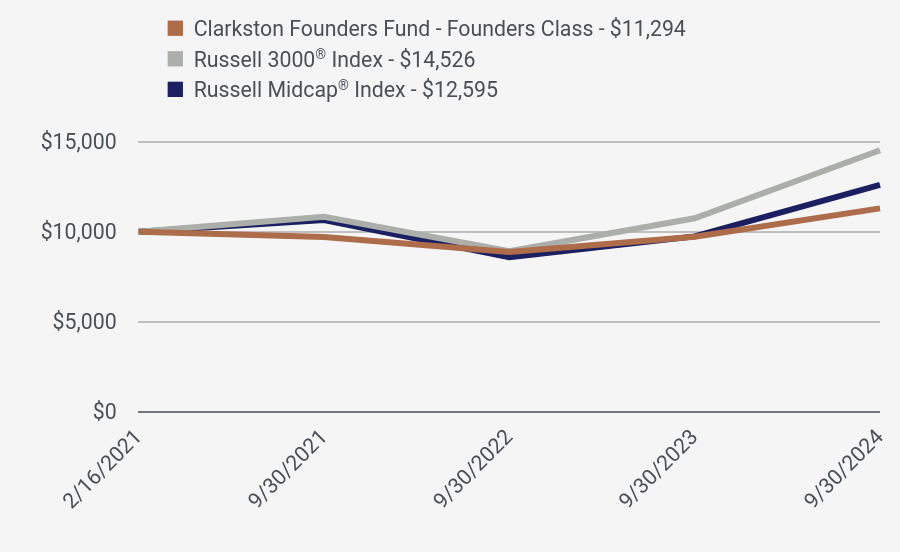

HOW DID THE FUND PERFORM SINCE INCEPTION?

TOTAL RETURN BASED ON $10,000 INVESTMENT

| Clarkston Founders Fund - Founders Class - $11,294 | Russell 3000® Index - $14,526 | Russell Midcap® Index - $12,595 |

|---|

| 2/16/2021 | $10,000.00 | $10,000.00 | $10,000.01 |

| 9/30/2021 | $9,709.86 | $10,828.58 | $10,650.09 |

| 9/30/2022 | $8,871.31 | $8,919.79 | $8,584.62 |

| 9/30/2023 | $9,723.29 | $10,744.89 | $9,738.90 |

| 9/30/2024 | $11,294.20 | $14,526.40 | $12,595.16 |

AVERAGE ANNUAL TOTAL RETURNS

| Founders | 1 Year | Since Inception |

|---|

| Clarkston Founders Fund - Founders Class (Incept. February 16, 2021) | 16.16% | 3.42% |

Russell 3000® Index | 35.19% | 10.87% |

Russell Midcap® Index | 29.33% | 6.58% |

The Fund’s past performance is not a good predictor of the Fund’s future performance. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares. Call 844.680.6562 for current month-end performance.

- Total Net Assets$774,895,467

- # of Portfolio Holdings (excluding cash)21

- Portfolio Turnover Rate17%

- Advisory Fees Paid$5,035,060

There have been no material Fund changes during the reporting period.

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS

There have been no changes in or disagreements with the Fund's independent accounting firm during the reporting period.

AVAILABILITY OF ADDITIONAL INFORMATION

Additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, can be found by visiting https://www.clarkstonfunds.com/literature/clarkston-founders-fund.

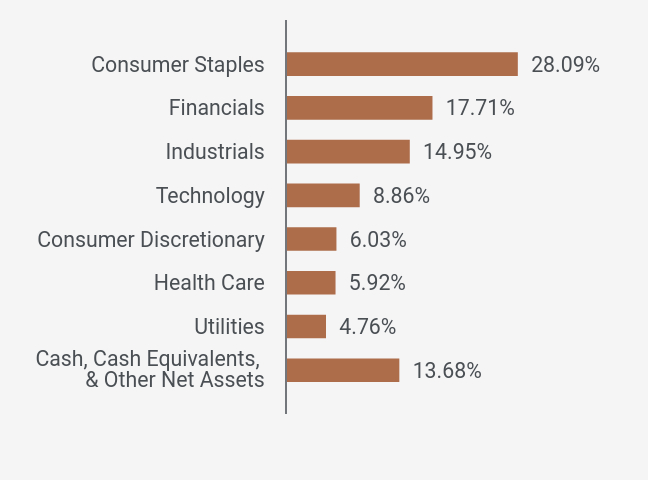

SECTOR WEIGHTINGS (as a % of Net Assets)

| Value | Value |

|---|

| Cash, Cash Equivalents, & Other Net Assets | 13.68% |

| Utilities | 4.76% |

| Health Care | 5.92% |

| Consumer Discretionary | 6.03% |

| Technology | 8.86% |

| Industrials | 14.95% |

| Financials | 17.71% |

| Consumer Staples | 28.09% |

If you have consented to receive a single annual or semi-annual shareholder report at a shared address you may revoke this consent by calling the Transfer Agent 844.680.6562.

FTSE Russell (“Russell”) is the source and owner of the trademarks, service marks and copyrights related to the Russell Indexes. Russell® is a trademark of Frank Russell Company. Neither Russell nor its licensors accept any liability for any errors or omissions in the Russell Indexes and/or Russell ratings or underlying data and no party may rely on any Russell Indexes and/or Russell ratings and/or underlying data contained in this communication. No further distribution of Russell Data is permitted without Russell’s express written consent. Russell does not promote, sponsor or endorse the content of this communication. You cannot invest directly in an index.

TOP TEN HOLDINGS (as a % of Net Assets)

| Top 10 | % |

|---|

| Clarivate PLC | 8.86% |

| Post Holdings, Inc. | 7.92% |

| US Foods Holding Corp. | 6.63% |

| Affiliated Managers Group, Inc. | 5.53% |

| GFL Environmental Inc. | 4.94% |

| Stericycle, Inc. | 4.76% |

| Molson Coors Beverage Co. | 4.38% |

| FedEx Corp. | 4.31% |

| Avantor, Inc. | 3.99% |

| Anheuser-Busch InBev SA/NV | 3.98% |

| Total % of Top 10 Holdings | 55.30% |

Clarkston Founders Fund - Founders Class : CFMDX

Annual Shareholder Report - September 30, 2024

Distributor, ALPS Distributors, Inc.

Institutional Class: CIMDX

Annual Shareholder Report - September 30, 2024

This annual shareholder report contains important information about Clarkston Founders Fund - Institutional Class for the period of October 1, 2023 to September 30, 2024.

You can find additional information about the Fund at https://www.clarkstonfunds.com/literature/clarkston-founders-fund. You can also request this information by contacting us at 844.680.6562.

WHAT WERE THE FUND'S COSTS FOR THE LAST YEAR?

(based on a hypothetical $10,000 investment)

| CLASS NAME | COST OF A $10,000 INVESTMENT | COST PAID AS A PERCENTAGE OF A $10,000 INVESTMENT |

|---|

| Clarkston Founders Fund - Institutional Class | $96 | 0.89% |

HOW DID THE FUND PERFORM LAST YEAR?

During the fiscal year ended September 30, 2024, the Fund’s Institutional Class earned a return of 16.00% compared to 29.33% for the Russell Midcap® Index and 35.19% for the Russell® 3000 Index.

Three largest contributors to the Fund’s performance for the period:

US Foods Holding Corp. (USFD), one of America’s largest food distribution companies, serving approximately 250,000 restaurants and foodservice operators across the country

Post Holdings, Inc. (POST), a group of consumer packaged goods businesses that operate in a manner similar to a private equity firm

Stericycle, Inc. (SRCL), a company that provides regulated waste and compliance services in the United States, Europe, and internationally

Three largest detractors from the Fund’s performance for the period:

Altice USA, Inc. (ATUS), a provider of broadband communications and video services in the United States, Canada, Puerto Rico, and the Virgin Islands offering broadband, video, telephony, and mobile services to residential and business customers

Warner Bros. Discovery, Inc. (WBD), a media and entertainment company that operates worldwide

Dollar General Corporation (DG), a discount retailer that provides consumable products, seasonal products, and apparel in the southern, southwestern, midwestern, and eastern United States

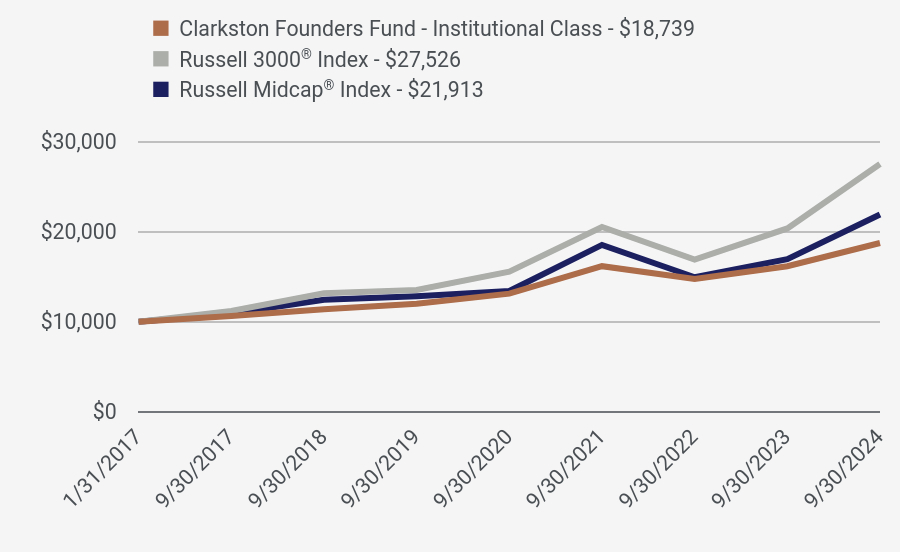

HOW DID THE FUND PERFORM SINCE INCEPTION?

TOTAL RETURN BASED ON $10,000 INVESTMENT

| Clarkston Founders Fund - Institutional Class - $18,739 | Russell 3000® Index - $27,526 | Russell Midcap® Index - $21,913 |

|---|

| 1/31/2017 | $10,000.00 | $10,000.00 | $10,000.00 |

| 9/30/2017 | $10,640.00 | $11,180.72 | $10,910.60 |

| 9/30/2018 | $11,385.78 | $13,146.27 | $12,435.94 |

| 9/30/2019 | $11,990.90 | $13,529.83 | $12,832.06 |

| 9/30/2020 | $13,110.31 | $15,559.49 | $13,416.23 |

| 9/30/2021 | $16,165.93 | $20,519.14 | $18,528.86 |

| 9/30/2022 | $14,753.59 | $16,902.16 | $14,935.38 |

| 9/30/2023 | $16,154.61 | $20,360.55 | $16,943.58 |

| 9/30/2024 | $18,738.58 | $27,526.15 | $21,912.85 |

AVERAGE ANNUAL TOTAL RETURNS

| Institutional | 1 Year | 5 Year | Since Inception |

|---|

| Clarkston Founders Fund - Institutional Class (Incept. January 31, 2017) | 16.00% | 9.34% | 8.54% |

Russell 3000® Index | 35.19% | 15.26% | 14.13% |

Russell Midcap® Index | 29.33% | 11.30% | 10.78% |

The Fund’s past performance is not a good predictor of the Fund’s future performance. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares. Call 844.680.6562 for current month-end performance.

- Total Net Assets$774,895,467

- # of Portfolio Holdings (excluding cash)21

- Portfolio Turnover Rate17%

- Advisory Fees Paid$5,035,060

There have been no material Fund changes during the reporting period.

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS

There have been no changes in or disagreements with the Fund's independent accounting firm during the reporting period.

AVAILABILITY OF ADDITIONAL INFORMATION

Additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, can be found by visiting https://www.clarkstonfunds.com/literature/clarkston-founders-fund.

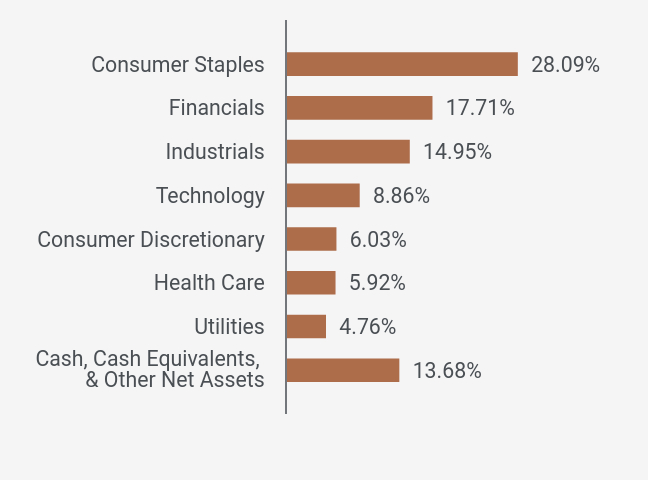

SECTOR WEIGHTINGS (as a % of Net Assets)

| Value | Value |

|---|

| Cash, Cash Equivalents, & Other Net Assets | 13.68% |

| Utilities | 4.76% |

| Health Care | 5.92% |

| Consumer Discretionary | 6.03% |

| Technology | 8.86% |

| Industrials | 14.95% |

| Financials | 17.71% |

| Consumer Staples | 28.09% |

If you have consented to receive a single annual or semi-annual shareholder report at a shared address you may revoke this consent by calling the Transfer Agent 844.680.6562.

FTSE Russell (“Russell”) is the source and owner of the trademarks, service marks and copyrights related to the Russell Indexes. Russell® is a trademark of Frank Russell Company. Neither Russell nor its licensors accept any liability for any errors or omissions in the Russell Indexes and/or Russell ratings or underlying data and no party may rely on any Russell Indexes and/or Russell ratings and/or underlying data contained in this communication. No further distribution of Russell Data is permitted without Russell’s express written consent. Russell does not promote, sponsor or endorse the content of this communication. You cannot invest directly in an index.

TOP TEN HOLDINGS (as a % of Net Assets)

| Top 10 | % |

|---|

| Clarivate PLC | 8.86% |

| Post Holdings, Inc. | 7.92% |

| US Foods Holding Corp. | 6.63% |

| Affiliated Managers Group, Inc. | 5.53% |

| GFL Environmental Inc. | 4.94% |

| Stericycle, Inc. | 4.76% |

| Molson Coors Beverage Co. | 4.38% |

| FedEx Corp. | 4.31% |

| Avantor, Inc. | 3.99% |

| Anheuser-Busch InBev SA/NV | 3.98% |

| Total % of Top 10 Holdings | 55.30% |

Clarkston Founders Fund - Institutional Class : CIMDX

Annual Shareholder Report - September 30, 2024

Distributor, ALPS Distributors, Inc.

Institutional Class: CILGX

Annual Shareholder Report - September 30, 2024

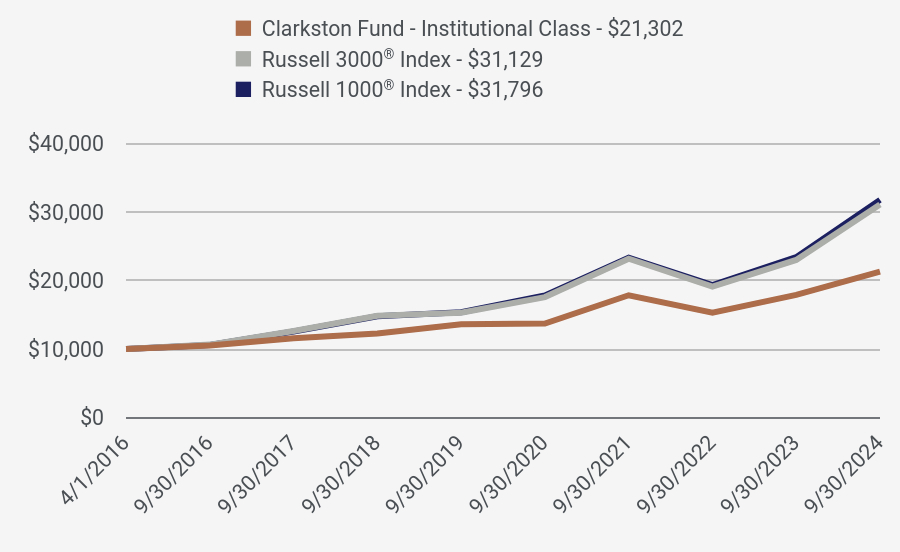

This annual shareholder report contains important information about Clarkston Fund Institutional Class for the period of October 1, 2023 to September 30, 2024.

You can find additional information about the Fund at https://www.clarkstonfunds.com/literature/clarkston-fund. You can also request this information by contacting us at 844.680.6562.

WHAT WERE THE FUND'S COSTS FOR THE LAST YEAR?

(based on a hypothetical $10,000 investment)

| CLASS NAME | COST OF A $10,000 INVESTMENT | COST PAID AS A PERCENTAGE OF A $10,000 INVESTMENT |

|---|

| Clarkston Fund - Institutional Class | $70 | 0.64% |

HOW DID THE FUND PERFORM LAST YEAR?

During the fiscal year ended September 30, 2024, the Fund earned a return of 18.94% compared to 35.68% for the Russell 1000® Index and 35.19% for the Russell® 3000 Index.

Three largest contributors to the Fund’s performance for the period:

US Foods Holding Corp. (USFD), one of America’s largest food distribution companies, serving approximately 250,000 restaurants and foodservice operators across the country

American Express Company (AXP), an integrated payments company offering credit card, charge card, banking, and other payment and financing products; network services; expense management products and services; and travel and lifestyle services

Affiliated Managers Group (AMG), a strategic investor and partner to a wide variety of independent investment management firms for over 30 years

Three largest detractors from the Fund’s performance for the period:

Lamb Weston Holdings, Inc. (LW), a company that engages in the production, distribution, and marketing of frozen potato products in the United States, Canada, Mexico, and internationally

Altice USA, Inc. (ATUS), a provider of broadband communications and video services in the United States, Canada, Puerto Rico, and the Virgin Islands offering broadband, video, telephony, and mobile services to residential and business customers

Warner Bros. Discovery, Inc. (WBD), a media and entertainment company that operates worldwide

HOW DID THE FUND PERFORM SINCE INCEPTION?

TOTAL RETURN BASED ON $10,000 INVESTMENT

| Clarkston Fund - Institutional Class - $21,302 | Russell 3000® Index - $31,129 | Russell 1000® Index - $31,796 |

|---|

| 4/1/2016 | $10,000.00 | $10,000.00 | $10,000.00 |

| 9/30/2016 | $10,520.00 | $10,651.67 | $10,602.18 |

| 9/30/2017 | $11,585.22 | $12,644.23 | $12,567.64 |

| 9/30/2018 | $12,279.68 | $14,867.07 | $14,800.27 |

| 9/30/2019 | $13,620.34 | $15,300.84 | $15,373.47 |

| 9/30/2020 | $13,731.26 | $17,596.17 | $17,835.24 |

| 9/30/2021 | $17,862.05 | $23,205.03 | $23,357.69 |

| 9/30/2022 | $15,301.96 | $19,114.60 | $19,336.60 |

| 9/30/2023 | $17,909.66 | $23,025.67 | $23,434.74 |

| 9/30/2024 | $21,301.83 | $31,129.23 | $31,796.21 |

AVERAGE ANNUAL TOTAL RETURNS

| Institutional | 1 Year | 5 Year | Since Inception |

|---|

| Clarkston Fund - Institutional Class (Incept. April 1, 2016) | 18.94% | 9.36% | 9.31% |

Russell 3000® Index | 35.19% | 15.26% | 14.30% |

Russell 1000® Index | 35.68% | 15.64% | 14.58% |

The Fund’s past performance is not a good predictor of the Fund’s future performance. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares. Call 844.680.6562 for current month-end performance.

- Total Net Assets$167,886,810

- # of Portfolio Holdings (excluding cash)24

- Portfolio Turnover Rate23%

- Advisory Fees Paid$590,276

There have been no material Fund changes during the reporting period.

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS

There have been no changes in or disagreements with the Fund's independent accounting firm during the reporting period.

AVAILABILITY OF ADDITIONAL INFORMATION

Additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, can be found by visiting https://www.clarkstonfunds.com/literature/clarkston-fund.

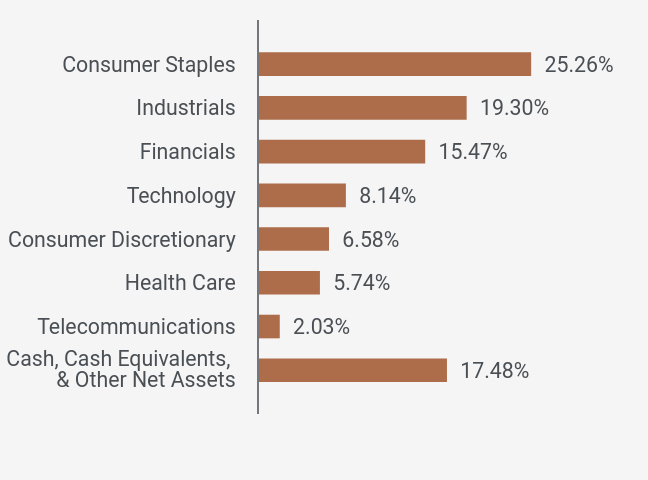

SECTOR WEIGHTINGS (as a % of Net Assets)

| Value | Value |

|---|

| Cash, Cash Equivalents, & Other Net Assets | 17.48% |

| Telecommunications | 2.03% |

| Health Care | 5.74% |

| Consumer Discretionary | 6.58% |

| Technology | 8.14% |

| Financials | 15.47% |

| Industrials | 19.30% |

| Consumer Staples | 25.26% |

If you have consented to receive a single annual or semi-annual shareholder report at a shared address you may revoke this consent by calling the Transfer Agent 844.680.6562.

FTSE Russell (“Russell”) is the source and owner of the trademarks, service marks and copyrights related to the Russell Indexes. Russell® is a trademark of Frank Russell Company. Neither Russell nor its licensors accept any liability for any errors or omissions in the Russell Indexes and/or Russell ratings or underlying data and no party may rely on any Russell Indexes and/or Russell ratings and/or underlying data contained in this communication. No further distribution of Russell Data is permitted without Russell’s express written consent. Russell does not promote, sponsor or endorse the content of this communication. You cannot invest directly in an index.

TOP TEN HOLDINGS (as a % of Net Assets)

| Top 10 | % |

|---|

| Clarivate PLC | 8.14% |

| US Foods Holding Corp. | 6.23% |

| Post Holdings, Inc. | 5.17% |

| Affiliated Managers Group, Inc. | 4.98% |

| FedEx Corp. | 4.81% |

| Anheuser-Busch InBev SA/NV | 4.34% |

| CH Robinson Worldwide, Inc. | 3.94% |

| Molson Coors Beverage Co. | 3.94% |

| Avantor, Inc. | 3.62% |

| Lamb Weston Holdings, Inc. | 3.39% |

| Total % of Top 10 Holdings | 48.56% |

Clarkston Fund - Institutional Class : CILGX

Annual Shareholder Report - September 30, 2024

Distributor, ALPS Distributors, Inc.

Annual Shareholder Report - September 30, 2024

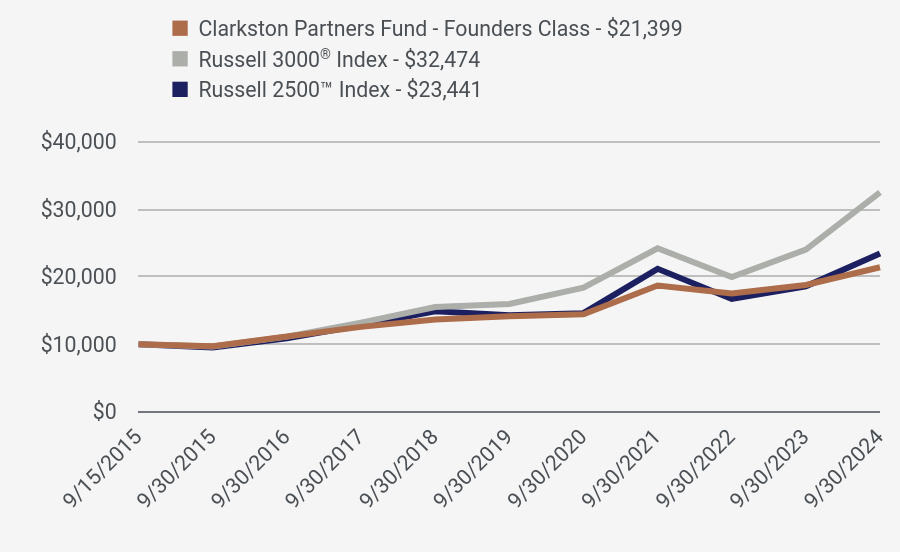

This annual shareholder report contains important information about Clarkston Partners Fund - Founders Class for the period of October 1, 2023 to September 30, 2024.

You can find additional information about the Fund at https://www.clarkstonfunds.com/literature/clarkston-partners-fund. You can also request this information by contacting us at 844.680.6562.

WHAT WERE THE FUND'S COSTS FOR THE LAST YEAR?

(based on a hypothetical $10,000 investment)

| CLASS NAME | COST OF A $10,000 INVESTMENT | COST PAID AS A PERCENTAGE OF A $10,000 INVESTMENT |

|---|

| Clarkston Partners Fund - Founders Class | $91 | 0.85% |

HOW DID THE FUND PERFORM LAST YEAR?

During the fiscal year ended September 30, 2024, the Fund’s Founders Class earned a return of 13.97% compared to 26.17% for the Russell 2500TMIndex and 35.19% for the Russell® 3000 Index.

Three largest contributors to the Fund’s performance for the period:

US Foods Holding Corp. (USFD), one of America’s largest food distribution companies, serving approximately 250,000 restaurants and foodservice operators across the country

Post Holdings, Inc. (POST), a group of consumer packaged goods businesses that operate in a manner similar to a private equity firm

Affiliated Managers Group, Inc. (AMG), a strategic investor and partner to a wide variety of independent investment management firms for over 30 years

Three largest detractors from the Fund’s performance for the period:

Leslie’s, Inc. (LESL), the largest direct-to-consumer brand in the U.S. pool and spa care industry

Hillenbrand, Inc. (HI), global industrial company that provides highly engineered processing equipment and services to customers around the world

Cable One, Inc. (CABO), a leading broadband communications provider to more than 1 million residential and business customers across 24 states

HOW DID THE FUND PERFORM SINCE INCEPTION?

TOTAL RETURN BASED ON $10,000 INVESTMENT

| Clarkston Partners Fund - Founders Class - $21,399 | Russell 3000® Index - $32,474 | Russell 2500™ Index - $23,441 |

|---|

| 9/15/2015 | $10,000.00 | $10,000.00 | $10,000.00 |

| 9/30/2015 | $9,700.00 | $9,665.53 | $9,498.31 |

| 9/30/2016 | $11,128.51 | $11,111.89 | $10,869.43 |

| 9/30/2017 | $12,559.25 | $13,190.54 | $12,803.44 |

| 9/30/2018 | $13,652.11 | $15,509.42 | $14,876.68 |

| 9/30/2019 | $14,127.99 | $15,961.93 | $14,275.04 |

| 9/30/2020 | $14,435.32 | $18,356.44 | $14,591.80 |

| 9/30/2021 | $18,689.92 | $24,207.63 | $21,162.24 |

| 9/30/2022 | $17,509.66 | $19,940.47 | $16,695.43 |

| 9/30/2023 | $18,775.22 | $24,020.53 | $18,579.37 |

| 9/30/2024 | $21,398.74 | $32,474.21 | $23,440.98 |

AVERAGE ANNUAL TOTAL RETURNS

| Founders | 1 Year | 5 Year | Since Inception |

|---|

| Clarkston Partners Fund - Founders Class (Incept. September 15, 2015) | 13.97% | 8.66% | 8.78% |

Russell 3000® Index | 35.19% | 15.26% | 13.91% |

| Russell 2500™ Index | 26.17% | 10.43% | 9.88% |

The Fund’s past performance is not a good predictor of the Fund’s future performance. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares. Call 844.680.6562 for current month-end performance.

- Total Net Assets$1,181,212,973

- # of Portfolio Holdings (excluding cash)21

- Portfolio Turnover Rate22%

- Advisory Fees Paid$9,880,128

There have been no material Fund changes during the reporting period.

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS

There have been no changes in or disagreements with the Fund's independent accounting firm during the reporting period.

AVAILABILITY OF ADDITIONAL INFORMATION

Additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, can be found by visiting https://www.clarkstonfunds.com/literature/clarkston-partners-fund.

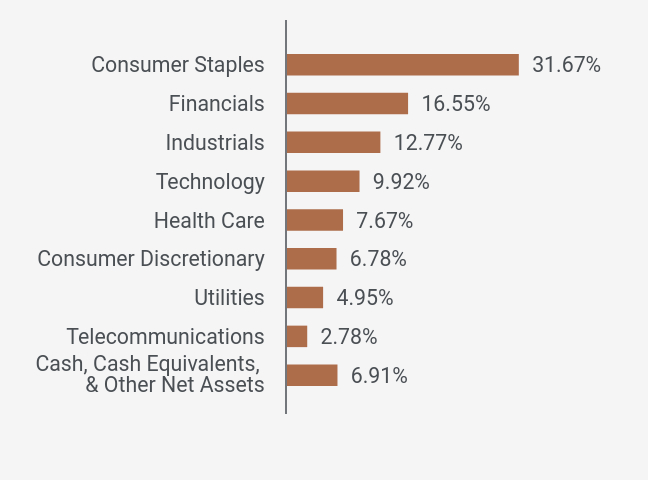

SECTOR WEIGHTINGS (as a % of Net Assets)

| Value | Value |

|---|

| Cash, Cash Equivalents, & Other Net Assets | 6.91% |

| Telecommunications | 2.78% |

| Utilities | 4.95% |

| Consumer Discretionary | 6.78% |

| Health Care | 7.67% |

| Technology | 9.92% |

| Industrials | 12.77% |

| Financials | 16.55% |

| Consumer Staples | 31.67% |

If you have consented to receive a single annual or semi-annual shareholder report at a shared address you may revoke this consent by calling the Transfer Agent 844.680.6562.

FTSE Russell (“Russell”) is the source and owner of the trademarks, service marks and copyrights related to the Russell Indexes. Russell® is a trademark of Frank Russell Company. Neither Russell nor its licensors accept any liability for any errors or omissions in the Russell Indexes and/or Russell ratings or underlying data and no party may rely on any Russell Indexes and/or Russell ratings and/or underlying data contained in this communication. No further distribution of Russell Data is permitted without Russell’s express written consent. Russell does not promote, sponsor or endorse the content of this communication. You cannot invest directly in an index.

TOP TEN HOLDINGS (as a % of Net Assets)

| Top 10 | % |

|---|

| Clarivate PLC | 9.92% |

| Post Holdings, Inc. | 8.25% |

| US Foods Holding Corp. | 7.18% |

| Affiliated Managers Group, Inc. | 6.88% |

| GFL Environmental Inc. | 5.54% |

| LPL Financial Holdings Inc. | 5.22% |

| Stericycle, Inc. | 4.95% |

| Molson Coors Beverage Co. | 4.75% |

| John Wiley & Sons, Inc. | 4.53% |

| CH Robinson Worldwide, Inc. | 4.32% |

| Total % of Top 10 Holdings | 61.54% |

Clarkston Partners Fund - Founders Class : CFSMX

Annual Shareholder Report - September 30, 2024

Distributor, ALPS Distributors, Inc.

Institutional Class: CISMX

Annual Shareholder Report - September 30, 2024

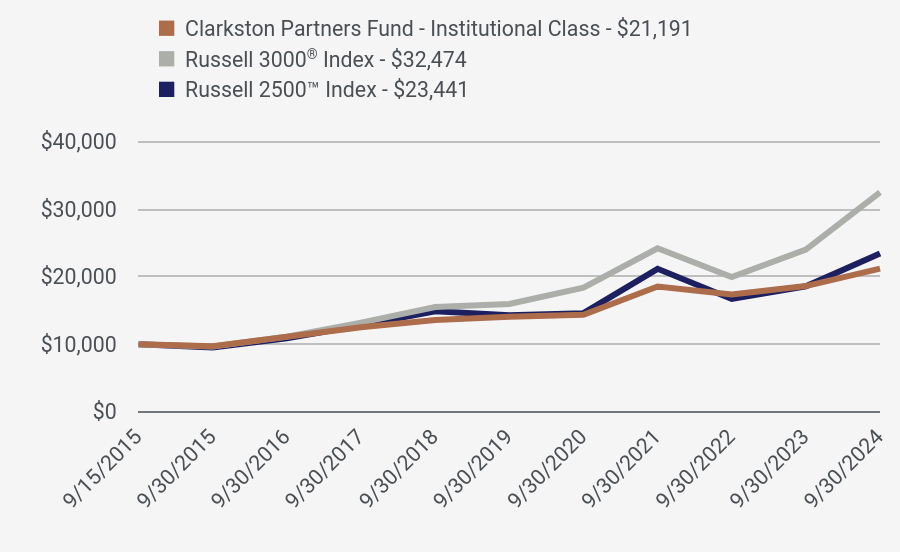

This annual shareholder report contains important information about Clarkston Partners Fund - Institutional Class for the period of October 1, 2023 to September 30, 2024.

You can find additional information about the Fund at https://www.clarkstonfunds.com/literature/clarkston-partners-fund. You can also request this information by contacting us at 844.680.6562.

WHAT WERE THE FUND'S COSTS FOR THE LAST YEAR?

(based on a hypothetical $10,000 investment)

| CLASS NAME | COST OF A $10,000 INVESTMENT | COST PAID AS A PERCENTAGE OF A $10,000 INVESTMENT |

|---|

| Clarkston Partners Fund - Institutional Class | $99 | 0.93% |

HOW DID THE FUND PERFORM LAST YEAR?

During the fiscal year ended September 30, 2024, the Fund’s Institutional Class earned a return of 13.88% compared to 26.17% for the Russell 2500TM Index and 35.19% for the Russell® 3000 Index.

Three largest contributors to the Fund’s performance for the period:

US Foods Holding Corp. (USFD), one of America’s largest food distribution companies, serving approximately 250,000 restaurants and foodservice operators across the country

Post Holdings, Inc. (POST), a group of consumer packaged goods businesses that operate in a manner similar to a private equity firm

Affiliated Managers Group, Inc. (AMG), a strategic investor and partner to a wide variety of independent investment management firms for over 30 years

Three largest detractors from the Fund’s performance for the period:

Leslie’s, Inc. (LESL), the largest direct-to-consumer brand in the U.S. pool and spa care industry

Hillenbrand, Inc. (HI), global industrial company that provides highly engineered processing equipment and services to customers around the world

Cable One, Inc. (CABO), a leading broadband communications provider to more than 1 million residential and business customers across 24 states

HOW DID THE FUND PERFORM SINCE INCEPTION?

TOTAL RETURN BASED ON $10,000 INVESTMENT

| Clarkston Partners Fund - Institutional Class - $21,191 | Russell 3000® Index - $32,474 | Russell 2500™ Index - $23,441 |

|---|

| 9/15/2015 | $10,000.00 | $10,000.00 | $10,000.00 |

| 9/30/2015 | $9,700.00 | $9,665.53 | $9,498.31 |

| 9/30/2016 | $11,103.21 | $11,111.89 | $10,869.43 |

| 9/30/2017 | $12,518.44 | $13,190.54 | $12,803.44 |

| 9/30/2018 | $13,584.55 | $15,509.42 | $14,876.68 |

| 9/30/2019 | $14,052.89 | $15,961.93 | $14,275.04 |

| 9/30/2020 | $14,343.09 | $18,356.44 | $14,591.80 |

| 9/30/2021 | $18,549.31 | $24,207.63 | $21,162.24 |

| 9/30/2022 | $17,364.47 | $19,940.47 | $16,695.43 |

| 9/30/2023 | $18,607.92 | $24,020.53 | $18,579.37 |

| 9/30/2024 | $21,191.26 | $32,474.21 | $23,440.98 |

AVERAGE ANNUAL TOTAL RETURNS

| Institutional | 1 Year | 5 Year | Since Inception |

|---|

| Clarkston Partners Fund - Institutional Class (Incept. September 15, 2015) | 13.88% | 8.56% | 8.66% |

Russell 3000® Index | 35.19% | 15.26% | 13.91% |

| Russell 2500™ Index | 26.17% | 10.43% | 9.88% |

The Fund’s past performance is not a good predictor of the Fund’s future performance. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares. Call 844.680.6562 for current month-end performance.

- Total Net Assets$1,181,212,973

- # of Portfolio Holdings (excluding cash)21

- Portfolio Turnover Rate22%

- Advisory Fees Paid$9,880,128

There have been no material Fund changes during the reporting period.

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS

There have been no changes in or disagreements with the Fund's independent accounting firm during the reporting period.

AVAILABILITY OF ADDITIONAL INFORMATION

Additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, can be found by visiting https://www.clarkstonfunds.com/literature/clarkston-partners-fund.

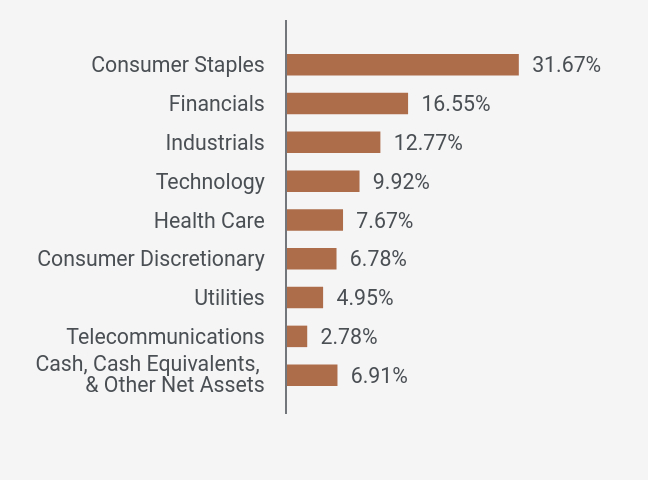

SECTOR WEIGHTINGS (as a % of Net Assets)

| Value | Value |

|---|

| Cash, Cash Equivalents, & Other Net Assets | 6.91% |

| Telecommunications | 2.78% |

| Utilities | 4.95% |

| Consumer Discretionary | 6.78% |

| Health Care | 7.67% |

| Technology | 9.92% |

| Industrials | 12.77% |

| Financials | 16.55% |

| Consumer Staples | 31.67% |

If you have consented to receive a single annual or semi-annual shareholder report at a shared address you may revoke this consent by calling the Transfer Agent 844.680.6562.

FTSE Russell (“Russell”) is the source and owner of the trademarks, service marks and copyrights related to the Russell Indexes. Russell® is a trademark of Frank Russell Company. Neither Russell nor its licensors accept any liability for any errors or omissions in the Russell Indexes and/or Russell ratings or underlying data and no party may rely on any Russell Indexes and/or Russell ratings and/or underlying data contained in this communication. No further distribution of Russell Data is permitted without Russell’s express written consent. Russell does not promote, sponsor or endorse the content of this communication. You cannot invest directly in an index.

TOP TEN HOLDINGS (as a % of Net Assets)

| Top 10 | % |

|---|

| Clarivate PLC | 9.92% |

| Post Holdings, Inc. | 8.25% |

| US Foods Holding Corp. | 7.18% |

| Affiliated Managers Group, Inc. | 6.88% |

| GFL Environmental Inc. | 5.54% |

| LPL Financial Holdings Inc. | 5.22% |

| Stericycle, Inc. | 4.95% |

| Molson Coors Beverage Co. | 4.75% |

| John Wiley & Sons, Inc. | 4.53% |

| CH Robinson Worldwide, Inc. | 4.32% |

| Total % of Top 10 Holdings | 61.54% |

Clarkston Partners Fund - Institutional Class : CISMX

Annual Shareholder Report - September 30, 2024

Distributor, ALPS Distributors, Inc.

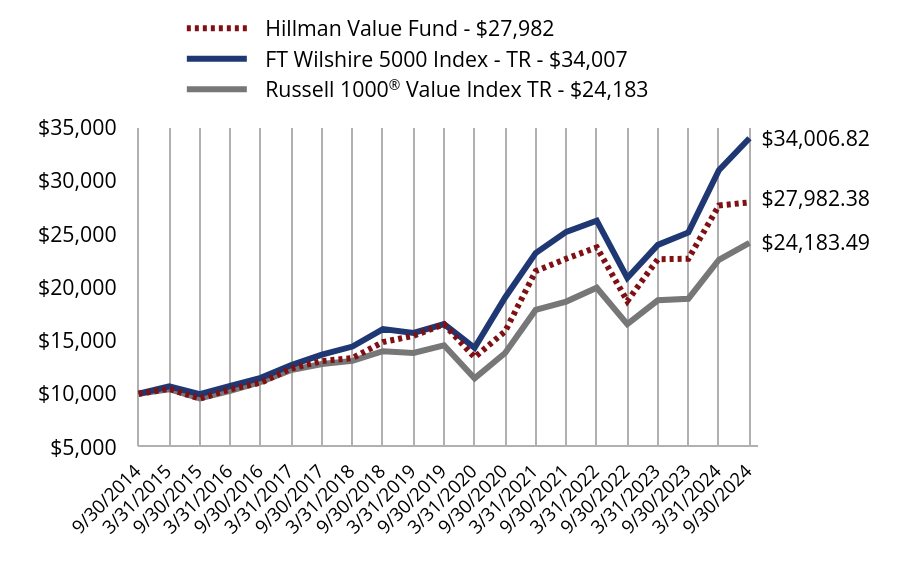

ANNUAL SHAREHOLDER REPORT - September 30, 2024

This annual shareholder report contains important information about Hillman Value Fund for the period of October 1, 2023 to September 30, 2024.

You can find additional information about the Fund at https://hcmfunds.com/resources. You can also request this information by contacting us at 1-855-400-5944.

This report describes changes to the Fund that occurred during the September 30, 2024 annual reporting period.

What were the Fund’s cost for the last year?

(based on a hypothetical $10,000 investment)

| FUND NAME | COST OF A $10,000 INVESTMENT | COST PAID AS A PERCENTAGE OF A $10,000 INVESTMENT |

|---|

| Hillman Value Fund | $106 | 0.95% |

How has the Fund performed last 10 years?

TOTAL RETURN BASED ON $10,000 INVESTMENT

| Hillman Value Fund - $27,982 | FT Wilshire 5000 Index - TR - $34,007 | Russell 1000® Value Index TR - $24,183 |

|---|

| 9/30/2014 | $10,000.00 | $10,000.00 | $10,000.00 |

| 3/31/2015 | $10,463.65 | $10,695.82 | $10,422.23 |

| 9/30/2015 | $9,538.33 | $9,965.91 | $9,557.63 |

| 3/31/2016 | $10,414.56 | $10,724.02 | $10,261.64 |

| 9/30/2016 | $11,034.76 | $11,495.06 | $11,105.49 |

| 3/31/2017 | $12,371.27 | $12,692.76 | $12,234.24 |

| 9/30/2017 | $13,065.76 | $13,670.66 | $12,784.94 |

| 3/31/2018 | $13,352.97 | $14,433.47 | $13,084.25 |

| 9/30/2018 | $14,855.70 | $16,076.63 | $13,993.12 |

| 3/31/2019 | $15,441.16 | $15,715.80 | $13,826.72 |

| 9/30/2019 | $16,532.17 | $16,543.25 | $14,552.94 |

| 3/31/2020 | $13,420.29 | $14,311.24 | $11,452.89 |

| 9/30/2020 | $15,859.78 | $19,047.95 | $13,821.68 |

| 3/31/2021 | $21,518.27 | $23,218.15 | $17,876.53 |

| 9/30/2021 | $22,685.40 | $25,210.39 | $18,660.91 |

| 3/31/2022 | $23,757.17 | $26,258.82 | $19,962.50 |

| 9/30/2022 | $18,703.53 | $20,881.52 | $16,540.48 |

| 3/31/2023 | $22,637.92 | $23,988.01 | $18,782.01 |

| 9/30/2023 | $22,686.64 | $25,157.50 | $18,928.63 |

| 3/31/2024 | $27,689.42 | $31,007.29 | $22,588.76 |

| 9/30/2024 | $27,982.38 | $34,006.82 | $24,183.49 |

How did the Fund perform last year?

For the year ended September 30, 2024, the Hillman Value Fund returned 23.34% versus a return of 27.76% for the Russell 1000 Value Total Return Index. The Fund benefitted from strong performance in the Information Technology, Communication Services, and Financials Sectors, while investments in the Industrials and Health Care Sectors weighed on performance. The premiums generated from option writing nominally benefitted performance. The long-term pursuit of outperformance requires variability around the index, which necessarily includes periods of underperformance. It is our view that investment in enterprises which we believe possess sustainable competitive advantages, coupled with adherence to our fundamentally sound valuation discipline, should work well over the long term.

AVERAGE ANNUAL TOTAL RETURNS

| Fund | 1 Year | 5 Year | 10 Year |

|---|

| Hillman Value Fund | 23.34% | 11.10% | 10.84% |

| FT Wilshire 5000 Index - TR | 35.18% | 15.50% | 13.02% |

Russell 1000® Value Index TR | 27.76% | 10.69% | 9.23% |

- Total Net Assets$229,141,646

- # of Portfolio Holdings39

- Portfolio Turnover Rate35%

- Advisory Fees Paid$1,517,153

The Fund’s past performance is not a good predictor of the Fund’s future performance. The "Average Annual Total Return" table and graph presented above do not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares.

Call 1-855-400-5994 for current month-end performance.

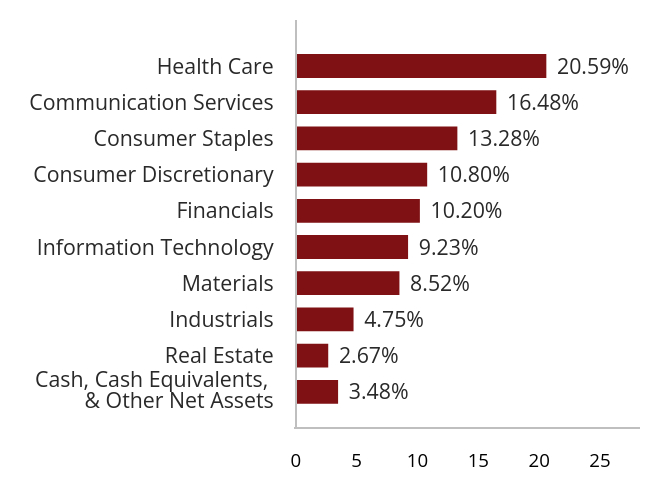

What did the Fund invest in?

| Value | Value |

|---|

| Cash, Cash Equivalents, & Other Net Assets | 3.48% |

| Real Estate | 2.67% |

| Industrials | 4.75% |

| Materials | 8.52% |

| Information Technology | 9.23% |

| Financials | 10.20% |

| Consumer Discretionary | 10.80% |

| Consumer Staples | 13.28% |

| Communication Services | 16.48% |

| Health Care | 20.59% |

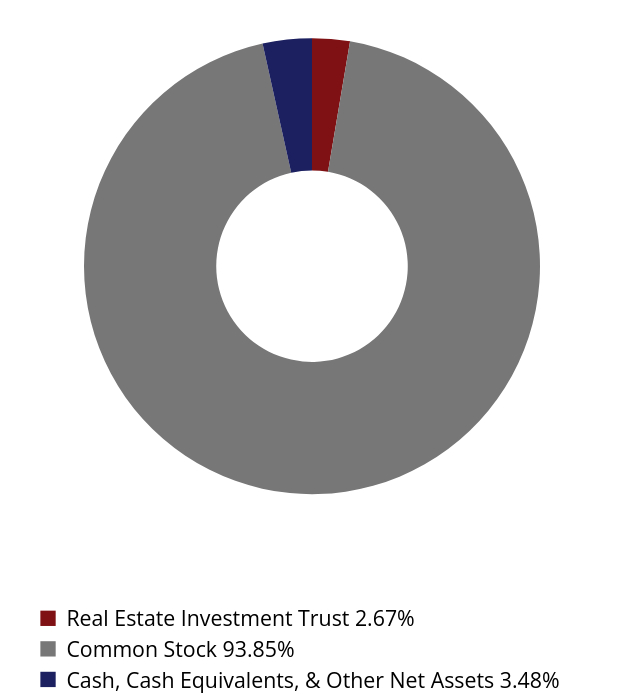

| Value | Value |

|---|

| Real Estate Investment Trust | 2.67% |

| Common Stock | 93.85% |

| Cash, Cash Equivalents, & Other Net Assets | 3.48% |

| Top 10 | % |

|---|

| Bristol-Myers Squibb Co. | 3.48% |

| US Bancorp | 3.11% |

| AT&T, Inc. | 2.98% |

| DuPont de Nemours, Inc. | 2.95% |

| Campbell Soup Co. | 2.94% |

| NIKE, Inc. | 2.91% |

| Warner Bros Discovery, Inc. | 2.91% |

| International Flavors & Fragrances, Inc. | 2.88% |

| Pfizer, Inc. | 2.79% |

| Walt Disney Co. | 2.73% |

| Total % of Top 10 Holdings | 29.68% |

This is a summary of certain changes to the Fund since February 1, 2024. For more complete information, you may review the Fund’s prospectus, dated February 1, 2024, at https://hcmfunds.com/resources or upon request at 1-855-400-5944 or info@hillmancapital.com.

Effective February 1, 2024, the Fund's management fee was reduced to 0.70%. Prior to February 1, 2024, the management fee was 0.85%.

Changes in and Disagreements with Accountants

There have been no changes in or disagreements with the Fund's independent accounting firm during the reporting period.

Availability of Additional Information

Additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information, can be found by visiting https://hcmfunds.com/resources.

If you have consented to receive a single annual or semi-annual shareholder report at a shared address you may revoke this consent by calling the Transfer Agent at 1-855-400-5944.

Hillman Value Fund — HCMAX

ANNUAL SHAREHOLDER REPORT - September 30, 2024

Distributor, ALPS Distributors, Inc.

SEVEN CANYONS STRATEGIC GLOBAL FUND

Annual Shareholder Report - September 30, 2024

This annual shareholder report contains important information about Seven Canyons Strategic Global Fund - Investor for the period of October 1, 2023 to September 30, 2024.

You can find additional information about the Fund at https://sevencanyonsadvisors.com/investor-reports. You can also request this information by contacting us at

833-722-6966.

This report describes changes to the Fund that occurred during the September 30, 2024 annual reporting period.

WHAT WERE THE FUND’S COST FOR LAST YEAR?

(based on a hypothetical $10,000 investment)

| CLASS NAME | COST OF A $10,000 INVESTMENT | COST PAID AS A PERCENTAGE OF A $10,000 INVESTMENT |

|---|

| Seven Canyons Strategic Global Fund - Investor | $154 | 1.40% |

HOW DID THE FUND PERFORM LAST YEAR?

The Seven Canyons Strategic Global Fund - Investor Fund returned 19.45% for the 12 months ended September 30, 2024. This is in contrast to the S&P 500 Total Return Index, which had a 36.35% return for the same time period. Please see below tables for additional indexes.

The Fund slightly underperformed the benchmark during the year. The main cause of underperformance came from the Fund's underweight in US stocks – 51% of the benchmark weight is in US assets, compared to only 14% of the fund portfolio. The Fund's US stock picks actually outperformed the benchmark’s, but the Fund's general underweight in this strong geography led to a large disparity in the Fund’s relative performance to the bench. At fiscal year end, we believe current valuations in US markets are extremely elevated relative to similar companies in international markets, which led the decision for the Fund to remain underweight in US stocks.

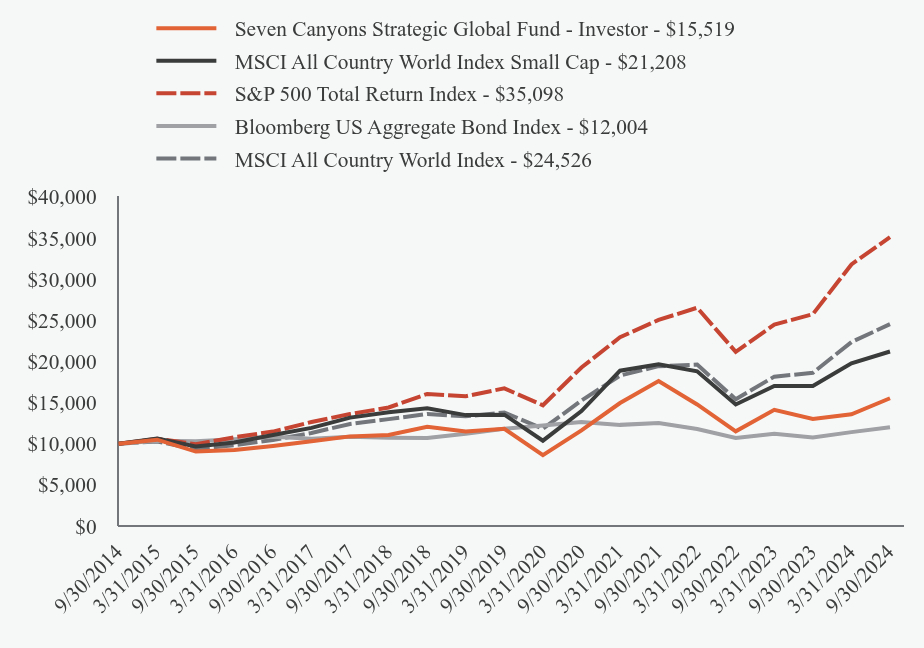

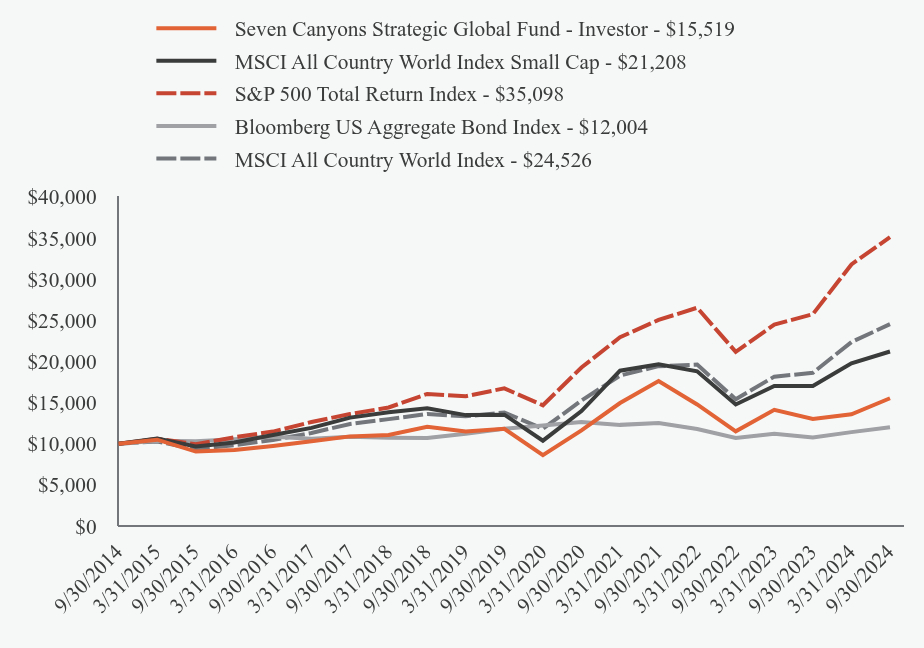

HOW DID THE FUND PERFORM LAST 10 YEARS?

TOTAL RETURN BASED ON $10,000 INVESTMENT

| Seven Canyons Strategic Global Fund - Investor - $15,519 | MSCI All Country World Index Small Cap - $21,208 | S&P 500 Total Return Index - $35,098 | Bloomberg US Aggregate Bond Index - $12,004 | MSCI All Country World Index - $24,526 |

|---|

| 9/30/2014 | $10,000.00 | $10,000.00 | $10,000.00 | $10,000.00 | $10,000.00 |

| 3/31/2015 | $10,488.12 | $10,621.56 | $10,593.00 | $10,342.99 | $10,272.87 |

| 9/30/2015 | $9,046.27 | $9,671.71 | $9,938.54 | $10,294.08 | $9,334.43 |

| 3/31/2016 | $9,231.89 | $10,143.17 | $10,781.85 | $10,545.74 | $9,827.24 |

| 9/30/2016 | $9,714.02 | $11,045.76 | $11,472.09 | $10,828.61 | $10,450.58 |

| 3/31/2017 | $10,296.40 | $11,918.05 | $12,633.34 | $10,592.20 | $11,305.41 |

| 9/30/2017 | $10,888.79 | $13,169.35 | $13,606.99 | $10,836.47 | $12,399.40 |

| 3/31/2018 | $11,063.13 | $13,833.37 | $14,400.98 | $10,719.63 | $12,983.85 |

| 9/30/2018 | $12,045.66 | $14,311.24 | $16,044.04 | $10,704.69 | $13,611.40 |

| 3/31/2019 | $11,489.86 | $13,474.05 | $15,768.56 | $11,199.93 | $13,321.57 |

| 9/30/2019 | $11,803.49 | $13,531.33 | $16,726.54 | $11,806.86 | $13,799.15 |

| 3/31/2020 | $8,611.92 | $10,366.25 | $14,668.25 | $12,200.51 | $11,822.21 |

| 9/30/2020 | $11,614.43 | $13,967.18 | $19,260.47 | $12,631.53 | $15,240.21 |

| 3/31/2021 | $14,938.53 | $18,868.13 | $22,934.04 | $12,287.16 | $18,277.12 |

| 9/30/2021 | $17,614.25 | $19,638.17 | $25,039.55 | $12,518.46 | $19,421.46 |

| 3/31/2022 | $14,771.73 | $18,802.37 | $26,522.27 | $11,776.98 | $19,607.46 |

| 9/30/2022 | $11,507.93 | $14,767.59 | $21,165.40 | $10,690.82 | $15,409.06 |

| 3/31/2023 | $14,121.62 | $17,003.09 | $24,472.49 | $11,213.64 | $18,149.10 |

| 9/30/2023 | $12,992.48 | $17,018.64 | $25,740.81 | $10,759.71 | $18,614.54 |

| 3/31/2024 | $13,577.81 | $19,776.18 | $31,785.18 | $11,404.06 | $22,350.79 |

| 9/30/2024 | $15,519.37 | $21,207.95 | $35,097.98 | $12,004.45 | $24,525.71 |

AVERAGE ANNUAL TOTAL RETURNS

| Investor | 1 Year | 5 Year | 10 Year |

|---|

| Seven Canyons Strategic Global Fund - Investor | 19.45% | 5.63% | 4.49% |

| MSCI All Country World Index Small Cap | 24.62% | 9.40% | 7.81% |

| S&P 500 Total Return Index | 36.35% | 15.98% | 13.38% |

| Bloomberg US Aggregate Bond Index | 11.57% | 0.33% | 1.84% |

| MSCI All Country World Index | 31.76% | 12.19% | 9.39% |

- Total Net Assets$14,230,052

- # of Portfolio Holdings61

- Portfolio Turnover Rate88%

- Advisory Fees Paid$5,379

The Fund’s past performance is not a good predictor of the Fund’s future performance. The "Average Annual Total Returns" table and graph presented above do not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares.

Call 833-722-6966 for current month-end performance.

WHAT DID THE FUND INVEST IN?

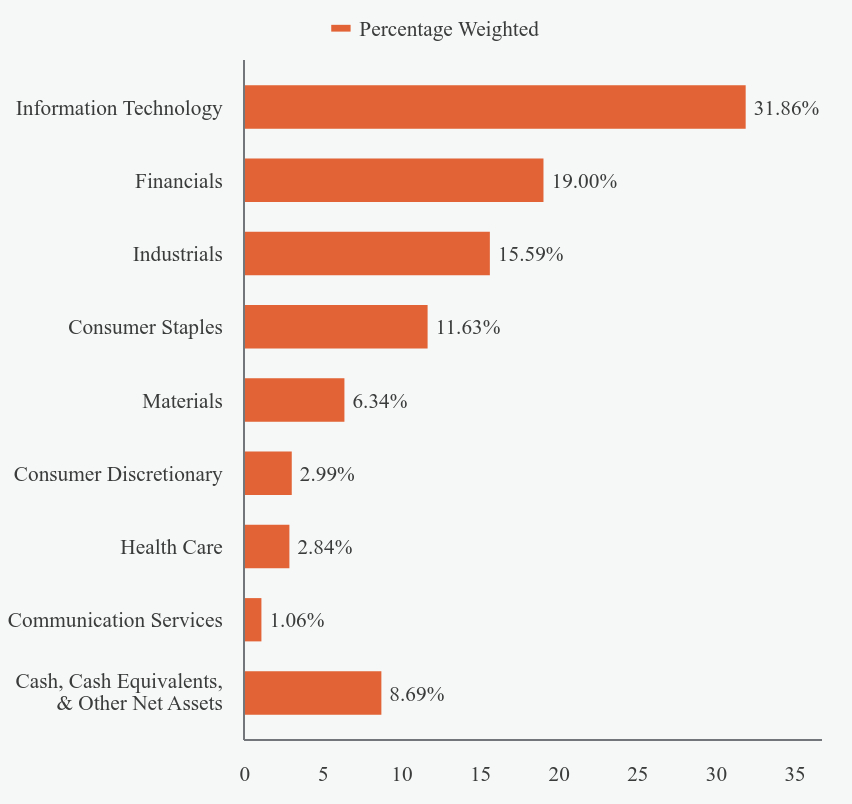

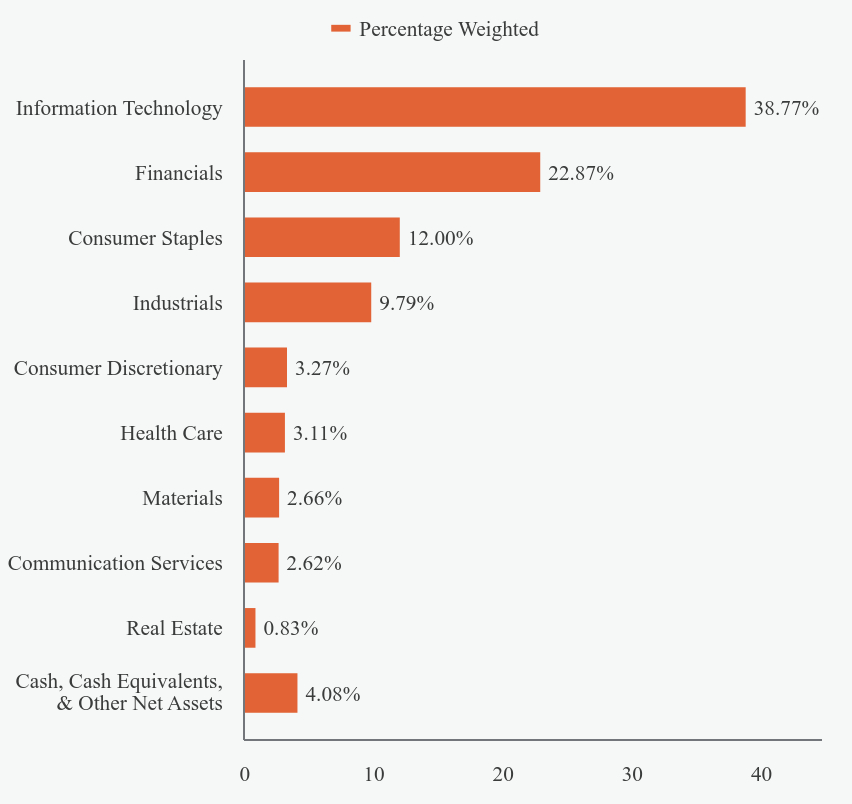

SECTOR WEIGHTINGS (as a % of Net Assets)

| Value | Value |

|---|

| Cash, Cash Equivalents, & Other Net Assets | 8.69% |

| Communication Services | 1.06% |

| Health Care | 2.84% |

| Consumer Discretionary | 2.99% |

| Materials | 6.34% |

| Consumer Staples | 11.63% |

| Industrials | 15.59% |

| Financials | 19.00% |

| Information Technology | 31.86% |

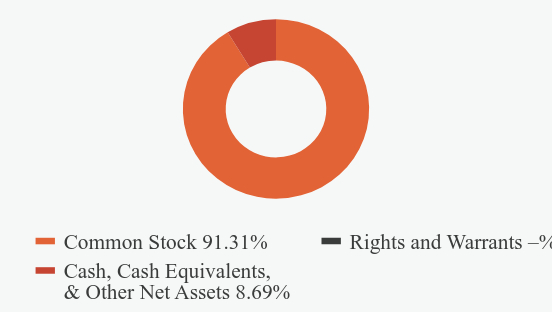

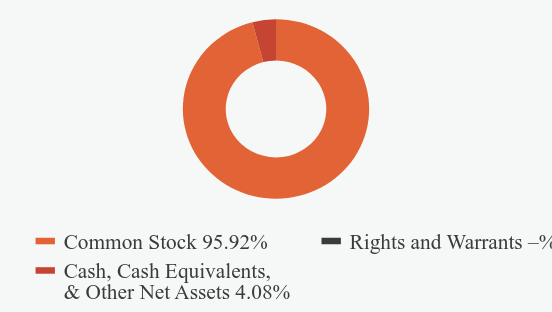

ASSET WEIGHTINGS

(as a % of Net Assets)

| Value | Value |

|---|

| Common Stock | 91.31% |

| Rights and Warrants | -% |

| Cash, Cash Equivalents, & Other Net Assets | 8.69% |

TOP TEN HOLDINGS

(as a % of Net Assets)

| Top 10 | % |

|---|

| State Street Institutional US Government Money Market Fund, Investor Class | 6.67% |

| flatexDEGIRO AG | 6.32% |

| JDC Group AG | 4.47% |

| ReposiTrack, Inc. | 4.23% |

| Elixirr International PLC | 4.13% |

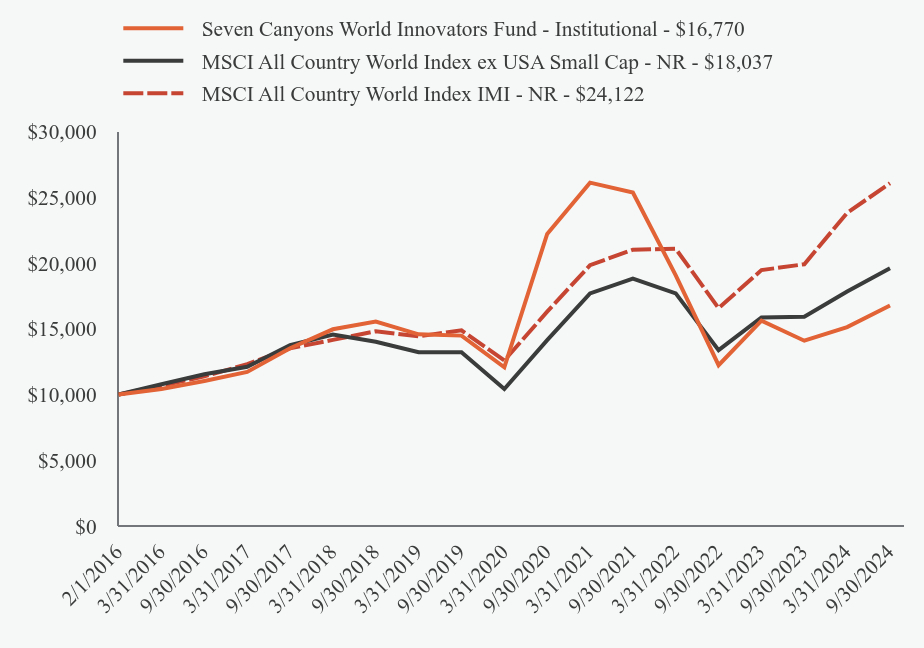

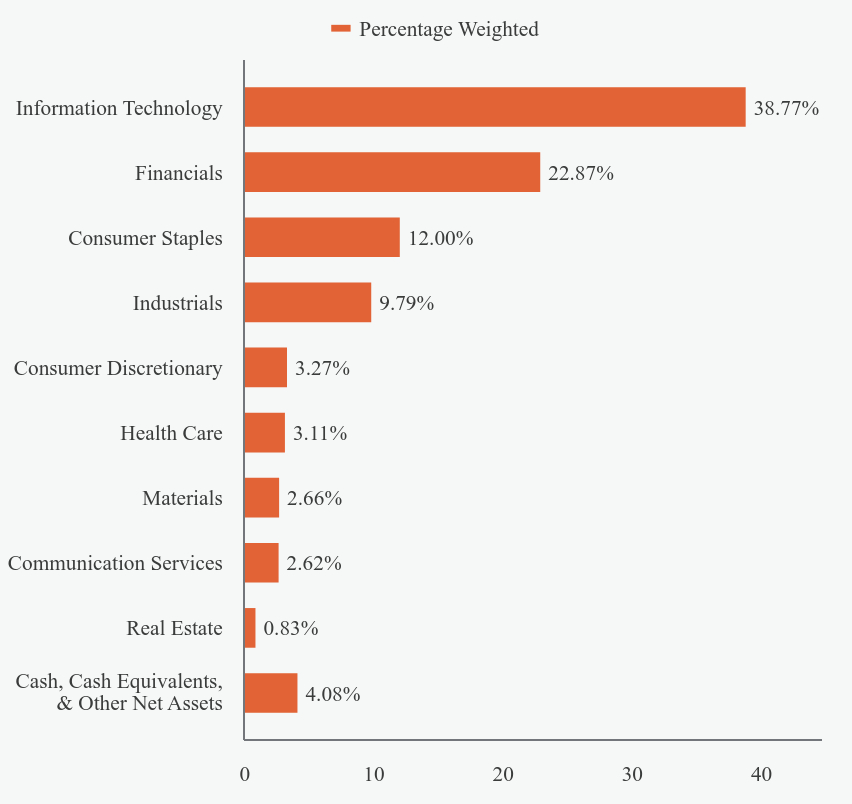

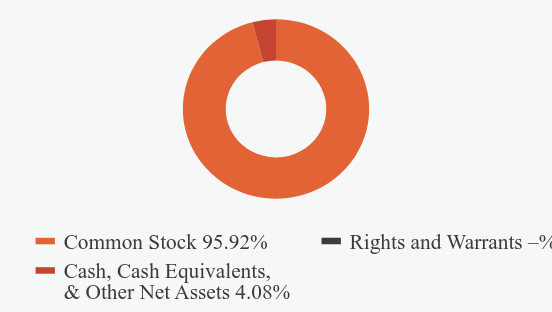

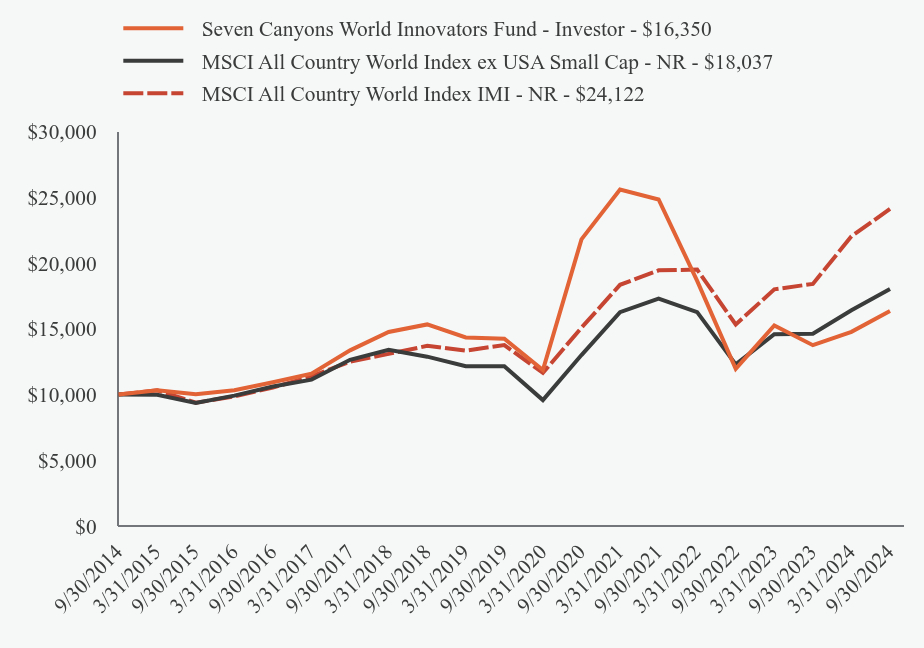

| Blackline Safety Corp. | 3.98% |