UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22819

ETFis Series Trust I

(Exact name of registrant as specified in charter)

1540 Broadway, 16th Floor

New York, NY 10036

(Address of principal executive offices) (Zip code)

ETFis Series Trust I

c/o Corporation Service Company

2711 Centerville Road, Suite 400

Wilmington, DE 19808

(Name and address of agent for service)

Registrant’s telephone number, including area code: (212) 593-4383

Date of fiscal year end: October 31

Date of reporting period: October 31, 2017

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

The Report to Shareholders is attached herewith.

ETFis Series Trust I

INFRACAP REIT PREFERRED ETF

ISECTORS® POST-MPT GROWTH ETF

VIRTUS CUMBERLAND MUNICIPAL BOND ETF

VIRTUS LIFESCI BIOTECH CLINICAL TRIALS ETF (FORMERLY KNOWN AS:

BIOSHARES BIOTECHNOLOGY CLINICAL TRIALS FUND)

VIRTUS LIFESCI BIOTECH PRODUCTS ETF (FORMERLY KNOWN AS:

BIOSHARES BIOTECHNOLOGY PRODUCTS FUND)

VIRTUS NEWFLEET MULTI-SECTOR UNCONSTRAINED BOND ETF

VIRTUS WMC GLOBAL FACTOR OPPORTUNITIES ETF

INFRACAP MLP ETF

ANNUAL REPORT

October 31, 2017

| | | | Page (s)

|

| | | | | 3 | |

| | | | | 4 | |

InfraCap REIT Preferred ETF

| | | | | | |

iSectors® Post-MPT Growth ETF

| | | | | | |

Virtus Cumberland Municipal Bond ETF

| | | | | | |

Virtus LifeSci Biotech Clinical Trials ETF (Formerly known as: BioShares Biotechnology Clinical Trials Fund)

| | | | | | |

Virtus LifeSci Biotech Products ETF (Formerly known as: BioShares Biotechnology Products Fund)

| | | | | | |

Virtus Newfleet Multi-Sector Unconstrained Bond ETF

| | | | | | |

Virtus WMC Global Factor Opportunities ETF

| | | | | | |

| | | | | 22 | |

| | | | | 25 | |

| | | | | 26 | |

| | | | | 47 | |

| | | | | 49 | |

| | | | | 51 | |

| | | | | 55 | |

| | | | | 62 | |

InfraCap MLP ETF

| | | | | | |

| | | | | 71 | |

| | | | | 78 | |

| | | | | 79 | |

| | | | | 80 | |

| | | | | 81 | |

| | | | | 82 | |

| | | | | 83 | |

| | | | | 90 | |

| | | | | 92 | |

| | | | | 97 | |

| | | | | 99 | |

2

Shareholder Letter (unaudited)

October 31, 2017

Dear Fellow ETFis Funds Shareholder:

I am pleased to present this annual report for ETFis Series Trust I, which reviews the performance of the following funds within the Trust, including three recent additions, for the twelve months ended October 31, 2017:

• | | InfraCap REIT Preferred ETF (PFFR) — Launched on February 7, 2017, this fund seeks investment results that correspond, before fees and expenses, to the price and yield performance of the Indxx REIT Preferred Stock Index. |

• | | iSectors® Post-MPT Growth ETF (PMPT) |

• | | Virtus Cumberland Municipal Bond ETF (CUMB) — Launched on January 17, 2017, this fund seeks to provide a competitive level of current income exempt from federal income tax, while preserving capital. |

• | | Virtus LifeSci Biotech Clinical Trials ETF (BBC) |

• | | Virtus LifeSci Biotech Products ETF (BBP) |

• | | Virtus Newfleet Multi-Sector Unconstrained Bond ETF (NFLT) |

• | | Virtus WMC Global Factor Opportunities ETF (VGFO) — Launched on October 10, 2017, this fund seeks to outperform the MSCI ACWI® Index with lower downside risk over a complete market cycle, utilizing Wellington Management Company’s proprietary rules-based investment process. |

• | | InfraCap MLP ETF (AMZA) |

The report provides financial statements and portfolio information for the above funds. For the funds with a performance history of more than six months, the report also provides commentary from the portfolio manager on how the fund performed relative to the markets in which it invests.

On behalf of Virtus ETF Advisers LLC (the “Adviser”) and our fund Sub-Advisers, thank you for your investment. If you have questions, please contact your financial adviser, or call 1-888-383-0553. We invite you to visit our website, www.virtusetfs.com, to learn more about the funds.

Sincerely,

William Smalley

President

ETFis Series Trust I

This material must be accompanied or preceded by the prospectus.

3

Management’s Discussion of Fund Performance (unaudited)

October 31, 2017

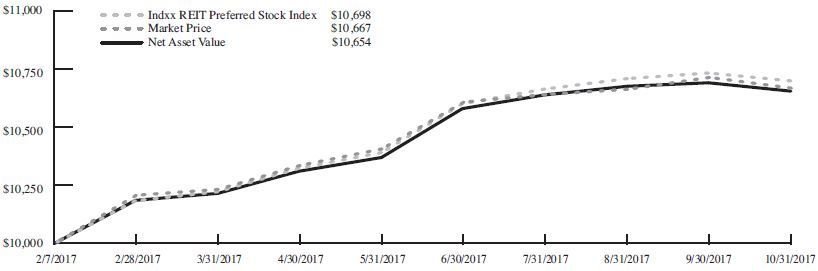

InfraCap REIT Preferred ETF

Management’s Discussion of Operations

Overview

The InfraCap REIT Preferred ETF (the “Fund”) launched on February 7, 2017 under the ticker symbol, PFFR. The Fund seeks investment results that correspond, before fees and expenses, to the price and yield performance of the Indxx REIT Preferred Stock Index. As such, the Fund will typically hold positions exclusively in Preferred Securities, listed on U.S. Exchanges and issued by Real Estate Investment Trusts (REITs).

Update

Owing to the February launch of the Fund, the fiscal year ended October 31, 2017 included less than 9 months of operations. During that time, the Fund paid its first three dividend distributions and delivered a 6.54% total return, net of fees.

Preferred Securities generally performed well during the period covered in this report. While the Federal Reserve (the “Fed”) raised its target for short term interest rates, investors seemed to take those moves in stride. Many interest rate sensitive investments, including preferred securities issued by REITs, saw limited impact from the Fed.

The leading contributors to the Fund’s performance were PS Business Parks Inc Preferred W, National Retail Properties Inc Preferred F and Public Storage Preferred E while exposure to Colony NorthStar Inc. Preferred E, Pennsylvania Real Estate Investment Trust Preferred C and PennyMac Mortgage Investment Trust Preferred Series A hurt relative performance.

Performance as of 10/31/2017

| | | Cumulative Total Return |

| | | Fund

Net Asset Value | | Fund

Market Price | | Indxx REIT

Preferred

Stock Index1 |

Since Inception2 | | 6.54% | | 6.67% | | 6.98% |

1 | | The Indxx REIT Preferred Stock Index is a market cap weighted index designed to provide diversified exposure to high yielding liquid preferred securities issued by Real Estate Investment Trusts listed in the U.S. The index is calculated on a total return basis. The index is unmanaged, its returns do not reflect any fees, expenses, or sales charges, and is not available for direct investment. |

Performance data quoted represents past performance and past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance data may be higher or lower than actual data quoted. Returns do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. For the most current month-end performance data please visit www.virtusetfs.com or call toll free (800) 243-4361. Market price returns are based on the mid-point of the highest bid and lowest offer for Fund shares as of the scheduled close of regular trading on the New York Stock Exchange Arca (“NYSE”), ordinarily 4:00 p.m. Eastern time, on each day during which the NYSE is open for trading, and do not represent the returns an investor would receive if shares were traded at other times.

Exchange Traded Funds: The value of an ETF may be more volatile than the underlying portfolio of securities the ETF is designed to track. The costs of owning the ETF may exceed the cost of investing directly in the underlying securities.

Market Price/NAV: Shares of ETFs often trade at a discount to their net asset value, which may increase investors’ risk of loss. At the time of sale, an investor’s shares may have a market price that is above or below the Fund’s NAV.

Preferred Stocks: Preferred stocks may decline in price, fail to pay dividends, or be illiquid.

Real Estate Investments: The Fund may be negatively affected by factors specific to the real estate market, including interest rates, leverage, property, and management.

Industry/Sector Concentration: A fund that focuses its investments in a particular industry or sector will be more sensitive to conditions that affect that industry or sector than a non-concentrated fund.

Passive Strategy/Index Risk: A passive investment strategy seeking to track the performance of the Underlying Index may result in the fund holding securities regardless of market conditions or their current or projected performance. This could cause the Fund’s returns to be lower than if the Fund employed an active strategy.

4

Management’s Discussion of Fund Performance (unaudited) (continued)

October 31, 2017

InfraCap REIT Preferred ETF (continued)

Correlation to Index: The performance of the Fund and its index may vary somewhat due to factors such as Fund flows, transaction costs, and timing differences associated with additions to and deletions from its index.

Market Volatility: Securities in the Fund may go up or down in response to the prospects of individual companies and general economic conditions. Price changes may be short or long term.

No Guarantee: There is no guarantee that the Fund will meet its objective.

Non-Diversified: The Fund is non-diversified and may be more susceptible to factors negatively impacting its holdings to the extent that each security represents a larger portion of the Fund’s assets.

Prospectus: For additional information on risks, please see the Fund’s prospectus. The Fund may not be suitable for all investors.

Value of a $10,000 Investment Since Inception at Net Asset Value

The chart above represents historical performance of a hypothetical investment of $10,000 over the life of the Fund, assuming reinvestment of distributions. Past performance does not guarantee future results.

5

Management’s Discussion of Fund Performance (unaudited) (continued)

October 31, 2017

iSectors® Post-MPT Growth ETF

This discussion of operations relates to the fiscal year ending October 31, 2017. During this period, the net asset value of iSectors® Post-MPT Growth ETF (“PMPT” or the “Fund”) rose from $23.34 to $26.95. During the same period, the S&P 500® Index, the Fund’s benchmark index, increased 23.63% on a total return basis.

The fiscal year began right before the election. The resultant sweep of the US government by Republicans led to a strong rally in equities. PMPT began the fiscal year in a defensive posture by holding significant positions in bonds, energy and utility stocks. This led to Fund underperformance relative to its benchmark through the first half of 2017. By July, the strategy had increased its allocation to the financial and technology sectors while decreasing defensive holdings. The combination of increasing short-term interest rates, accelerating technology spending, and the prospect for tax reform was favorable to the overweighted sectors. Thus, PMPT outperformed its benchmark in the July to October period.

PMPT tends to perform better when equity markets are flat or dropping in price. However, it was difficult for the quantitative model behind PMPT’s strategy to consistently identify positive performing allocations during the strongly positive fiscal year 2017, which led to underperformance relative to PMPT’s benchmark.

Performance as of 10/31/2017

| | | | Average Annual Total Return

|

| | | | Fund

Net Asset Value

| | Fund

Market Price

| | S&P 500® Index1

|

| 1 Year | | | | | 16.20 | % | | | 16.06 | % | | | 23.63 | % |

Since Inception2 | | | | | 7.35 | % | | | 7.34 | % | | | 17.19 | % |

1 | | The S&P 500® Index is a free-float market capitalization-weighted index of 500 of the largest U.S. companies. The index is calculated on a total return basis with dividends reinvested. The index is unmanaged, its returns do not reflect any fees, expenses, or sales charges, and is not available for direct investment. |

Performance data quoted represents past performance and past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance data may be higher or lower than actual data quoted. Returns do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. For the most current month-end performance data please visit www.virtusetfs.com or call toll free (800) 243-4361. Market price returns are based on the mid-point of the highest bid and lowest offer for Fund shares as of the scheduled close of regular trading on the NASDAQ Stock Exchange (“NASDAQ”), ordinarily 4:00 p.m. Eastern time, on each day during which the NASDAQ is open for trading, and do not represent the returns an investor would receive if shares were traded at other times.

Exchange Traded Funds: The value of an ETF may be more volatile than the underlying portfolio of securities the ETF is designed to track. The costs of owning the ETF may exceed the cost of investing directly in the underlying securities.

Market Price/NAV: Shares of ETFs often trade at a discount to their net asset value, which may increase investors’ risk of loss. At the time of sale, an investor’s shares may have a market price that is above or below the Fund’s NAV.

Portfolio Turnover: The Fund’s principal investments strategies will result in a consistently high portfolio turnover rate. A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account.

Allocation: The Fund’s exposure to different asset classes may not be optimal for market conditions at a given time. Asset allocation does not guarantee a profit or protect against a loss in declining markets.

No Guarantee: There is no guarantee that the Fund will meet its objective.

Prospectus: For additional information on risks, please see the Fund’s prospectus. The Fund may not be suitable for all investors.

6

Management’s Discussion of Fund Performance (unaudited) (continued)

October 31, 2017

iSectors® Post-MPT Growth ETF (continued)

Value of a $10,000 Investment Since Inception at Net Asset Value

The chart above represents historical performance of a hypothetical investment of $10,000 over the life of the Fund, assuming reinvestment of distributions. Past performance does not guarantee future results.

7

Management’s Discussion of Fund Performance (unaudited) (continued)

October 31, 2017

Virtus Cumberland Municipal Bond ETF

The Virtus Cumberland Municipal Bond ETF (“CUMB” or the “Fund”) had a total return of 3.92% for the reporting period, while the Bloomberg Barclays Municipal Bond Index, the Fund’s benchmark index, posted a total return of 3.53%.

Buying longer term maturity municipal bonds during the initial months of the Fund’s operations was an important factor that helped performance. There was a notable sell-off in bonds in November and December 2016, prior to the Fund’s launch. While there had been some recovery by early January, there was still a good deal of value in the municipal bond market, particularly for longer term bonds, which had been most affected during the sell-off. The Fund’s purchases included bonds issued in the wake of the sell-off as well as some trading below par that had been issued in mid-2016.

At the start of 2017, the AAA-rated bonds’ tax free yield curve was, from a historical perspective, relatively cheap compared to US Treasuries at every point along the yield curve. As the Fed clarified its intentions to raise short term interest rates, short term municipal bond yields began correcting first, followed by intermediate term municipal bond yields and now we believe longer term municipal bond yields are correcting.

Going forward we expect any tax law changes to reduce the supply of tax free bonds at the margin. This is because of the House proposals to end Private Activity bonds as well as both the House and Senate plans to end advance refunding bonds. In addition, we believe any changes (in both plans) which end the deduction for state and local taxes will raise the demand for in state bonds in high state income tax states like California, New York, New Jersey, Connecticut and Massachusetts.

Performance as of 10/31/2017

| | Cumulative Total Return

|

| | Fund

Net Asset Value

| | Fund

Market Price

| | Bloomberg Barclays

Municipal Bond Index1

|

Since Inception2 | | | 3.92% | | | | 3.62% | | | | 3.53% | |

1 | | The Bloomberg Barclays Municipal Bond Index is a market capitalization-weighted index that measures the long-term tax-exempt bond market. The index is calculated on a total return basis. The index is unmanaged, its returns do not reflect any fees, expenses, or sales charges, and is not available for direct investment. |

Performance data quoted represents past performance and past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance data may be higher or lower than actual data quoted. Returns do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. For the most current month-end performance data please visit www.virtusetfs.com or call toll free (800) 243-4361. Market price returns are based on the mid-point of the highest bid and lowest offer for Fund shares as of the scheduled close of regular trading on the New York Stock Exchange Arca (“NYSE”), ordinarily 4:00 p.m. Eastern time, on each day during which the NYSE is open for trading, and do not represent the returns an investor would receive if shares were traded at other times.

Exchange Traded Funds: The value of an ETF may be more volatile than the underlying portfolio of securities the ETF is designed to track. The costs of owning the ETF may exceed the cost of investing directly in the underlying securities.

Market Price/NAV: Shares of ETFs often trade at a discount to their net asset value, which may increase investors’ risk of loss. At the time of sale, an investor’s shares may have a market price that is above or below the Fund’s NAV.

Credit & Interest: Debt securities are subject to various risks, the most prominent of which are credit and interest rate risk. The issuer of a debt security may fail to make interest and/or principal payments. Values of debt securities may rise or fall in response to changes in interest rates, and this risk may be enhanced with longer-term maturities.

Municipal Market: Events negatively impacting a municipal security, or the municipal bond market in general, may cause the Fund to decrease in value.

State & AMT Tax: A portion of income may be subject to some state and/or local taxes and, for certain investors, a portion may be subject to the federal alternative minimum tax.

Tax Liability Risk: Noncompliant conduct by a municipal bond issuer, or adverse interpretations, could cause interest from a security to become taxable, subjecting shareholders to increased tax liability.

8

Management’s Discussion of Fund Performance (unaudited) (continued)

October 31, 2017

Virtus Cumberland Municipal Bond ETF (continued)

Non-Diversified: The Fund is non-diversified and may be more susceptible to factors negatively impacting its holdings to the extent that each security represents a larger portion of the Fund’s assets.

No Guarantee: There is no guarantee that the Fund will meet its objective.

Prospectus: For additional information on risks, please see the Fund’s prospectus. The Fund may not be suitable for all investors.

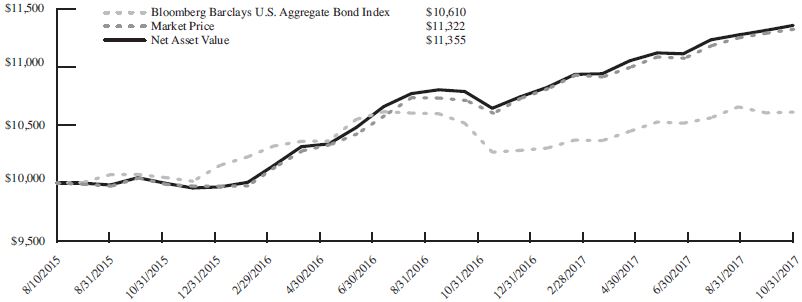

Value of a $10,000 Investment Since Inception at Net Asset Value

The chart above represents historical performance of a hypothetical investment of $10,000 over the life of the Fund, assuming reinvestment of distributions. Past performance does not guarantee future results.

9

Management’s Discussion of Fund Performance (unaudited) (continued)

October 31, 2017

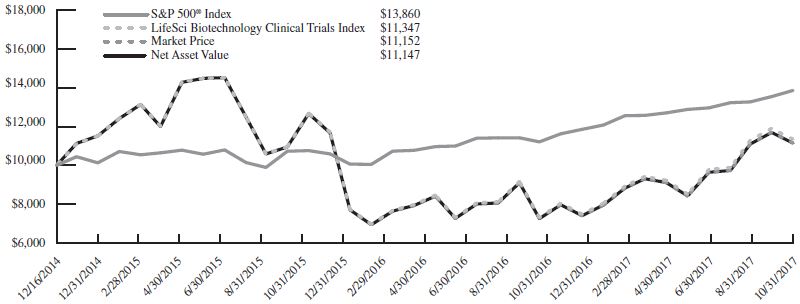

Virtus LifeSci Biotech Clinical Trials ETF

For the fiscal year ended October 31, 2017, the S&P 500® Index, Virtus LifeSci Biotech Clinical Trials ETF’s (“BBC” or the “Fund”) broad market benchmark index, was up 23.63% compared to a 55.26% total return for the LifeSci Biotechnology Clinical Trials Index, the index the Fund seeks to track. The biotechnology industry has benefited from strong drug discovery, compelling valuations after a poor performance last year and positive advancement in gene therapy over the fiscal year.

BBC NAV was up 53.66% for the fiscal year. There were no distributions made to shareholders.

The Fund performed well in a particularly strong market environment due to its significant exposure to biomedical technologies in the gene editing space. Another positive contribution to performance was exposure to therapeutics including drugs that target against tumor metabolism and immunity for treatment of cancer. Lastly our exposure to companies involved in immunology, as well as strong drug pipelines and promising clinical trials data, contributed to performance during the period.

As opposed to last year, the political climate in 2017, while volatile, did contribute to a more business friendly outlook for biotechnology companies.

Positions that contributed to significant positive performance during the fiscal year include MyoKardia, Inc., BeiGene Ltd., Dynavax Technologies Corp., and Sangamo Therapeutics, Inc. Positions that detracted from performance during the fiscal year include Versartis, Inc., Axovant Sciences Ltd., Advaxis, Inc., and Lexicon Pharmaceuticals, Inc.

On August 14, 2017, shareholders of the Fund approved an amended and restated investment advisory agreement with the Adviser. Effective upon shareholder approval of the amended and restated investment advisory agreement, the Adviser assumed responsibility for the day-to-day management of the Fund’s portfolio, and LifeSci Index Partners, LLC ceased serving as the Fund’s sub-adviser, but continues to serve as the index provider to the Fund’s underlying index.

Performance as of 10/31/2017

| | Average Annual Total Return

|

| | Fund

Net Asset Value

| | Fund

Market Price

| | LifeSci Biotechnology

Clinical Trials Index1

| | S&P 500® Index2

|

1 Year | | 53.66 | % | | 53.26 | % | | 55.26 | % | | 23.63 | % |

Since Inception3 | | 3.85 | % | | 3.86 | % | | 4.49 | % | | 12.01 | % |

1 | | The LifeSci Biotechnology Clinical Trials Index is designed to track the performance of U.S. listed biotechnology stocks with a lead drug in the clinical trial stage of development, typically a Phase 1, Phase 2 or Phase 3 trial, but prior to receiving marketing approval. The index is unmanaged, its returns do not reflect any fees, expenses, or sales charges, and is not available for direct investment. |

2 | | The S&P 500® Index is a free-float market capitalization-weighted index of 500 of the largest U.S. companies. The index is calculated on a total return basis with dividends reinvested. The index is unmanaged, its returns do not reflect any fees, expenses, or sales charges, and is not available for direct investment. |

Performance data quoted represents past performance and past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance data may be higher or lower than actual data quoted. Returns do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. For the most current month-end performance data please visit www.virtusetfs.com or call toll free (800) 243-4361. Market price returns are based on the mid-point of the highest bid and lowest offer for Fund shares as of the scheduled close of regular trading on the New York Stock Exchange Arca (“NYSE”), ordinarily 4:00 p.m. Eastern time, on each day during which the NYSE is open for trading, and do not represent the returns an investor would receive if shares were traded at other times.

Exchange Traded Funds: The value of an ETF may be more volatile than the underlying portfolio of securities the ETF is designed to track. The costs of owning the ETF may exceed the cost of investing directly in the underlying securities.

10

Management’s Discussion of Fund Performance (unaudited) (continued)

October 31, 2017

Virtus LifeSci Biotech Clinical Trials ETF (continued)

Biotechnology Sector Risk: The Fund’s assets will be concentrated in investments in the securities of issuers engaged primarily in the biotechnology industry. Companies within the biotechnology sector spend heavily on research and development, which may not necessarily lead to commercially successful products in the near or long term. In order to fund operations, these companies may require financing from the capital markets, which may not always be available on satisfactory terms or at all. The biotechnology sector is also subject to significant governmental regulation, and the need for governmental approvals, including, without limitation, FDA approval. The securities of biotechnology companies, especially those of smaller or newer companies, tend to be more volatile than those of companies with larger capitalizations or markets generally.

Industry/Sector Concentration: A fund that focuses its investments in a particular industry or sector will be more sensitive to conditions that affect that industry or sector than a non-concentrated fund.

Market Price/NAV: Shares of ETFs often trade at a discount to their net asset value, which may increase investors’ risk of loss. At the time of sale, an investor’s shares may have a market price that is above or below the Fund’s NAV.

Correlation to Index: The performance of the Fund and its index may vary somewhat due to factors such as Fund flows, transaction costs, and timing differences associated with additions to and deletions from its index.

Non-Diversified: The Fund is non-diversified and may be more susceptible to factors negatively impacting its holdings to the extent that each security represents a larger portion of the Fund’s assets.

No Guarantee: There is no guarantee that the Fund will meet its objective.

Prospectus: For additional information on risks, please see the Fund’s prospectus. The Fund may not be suitable for all investors

Value of a $10,000 Investment Since Inception at Net Asset Value

The chart above represents historical performance of a hypothetical investment of $10,000 over the life of the Fund, assuming reinvestment of distributions. Past performance does not guarantee future results.

11

Management’s Discussion of Fund Performance (unaudited) (continued)

October 31, 2017

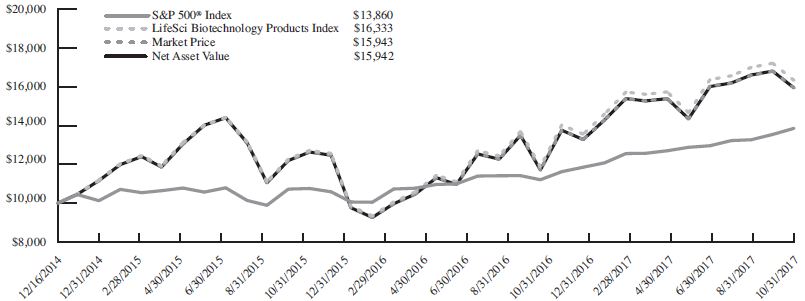

Virtus LifeSci Biotech Products ETF

For the fiscal year ended October 31, 2017, the S&P 500® Index, Virtus LifeSci Biotech Products ETF’s (“BBP” or the “Fund”) broad market benchmark index, was up 23.63% compared to an increase of 37.58% for the LifeSci Biotechnology Products Index, the index the Fund seeks to track.

BBP NAV was up 36.08% for the fiscal year. There were no distributions made to shareholders.

The Fund enjoyed positive performance for the period overall, as perceptions regarding U.S. healthcare reform turned positive for the industry. Other factors contributing to strong performance include increased appetite for M&A activity within the sector, as well as partnership announcements and positive sales and profit momentum among portfolio companies. Factors that detracted from performance include competition from generic competitive products, decreased earnings, and doubts about market adoption of new products.

Positions that contributed to performance during the fiscal year include Clovis Oncology, Inc., Exelixis, Inc., Ionis Pharmaceuticals, Inc., Enanta Pharmaceuticals, Inc., and Halozyme Therapeutics, Inc. Positions that detracted from performance during the fiscal year include Intercept Pharmaceuticals, Inc., Synergy Pharmaceuticals, Inc., and Radius Health, Inc.

On August 14, 2017, shareholders of the Fund approved an amended and restated investment advisory agreement with the Adviser. Effective upon shareholder approval of the amended and restated investment advisory agreement, the Adviser assumed responsibility for the day-to-day management of the Fund’s portfolio, and LifeSci Index Partners, LLC ceased serving as the Fund’s sub-adviser, but continues to serve as the index provider to the Fund’s underlying index.

Performance as of 10/31/2017

| | Average Annual Total Return

|

| | Fund

Net Asset Value

| | Fund

Market Price

| | LifeSci Biotechnology

Products Index1

| | S&P 500® Index2

|

1 Year | | | 36.08 | % | | | 36.05 | % | | | 37.58 | % | | | 23.63 | % |

Since Inception3 | | | 17.60 | % | | | 17.60 | % | | | 18.59 | % | | | 12.01 | % |

1 | | The LifeSci Biotechnology Products Index is designed to track the performance of U.S. listed biotechnology stocks with at least one drug therapy approved by the U.S. Food and Drug Administration for marketing. The index is unmanaged, its returns do not reflect any fees, expenses, or sales charges, and is not available for direct investment. |

2 | | The S&P 500® Index is a free-float market capitalization-weighted index of 500 of the largest U.S. companies. The index is calculated on a total return basis with dividends reinvested. The index is unmanaged, its returns do not reflect any fees, expenses, or sales charges, and is not available for direct investment. |

Performance data quoted represents past performance and past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance data may be higher or lower than actual data quoted. Returns do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. For the most current month-end performance data please visit www.virtusetfs.com or call toll free (800) 243-4361. Market price returns are based on the mid-point of the highest bid and lowest offer for Fund shares as of the scheduled close of regular trading on the New York Stock Exchange Arca (“NYSE”), ordinarily 4:00 p.m. Eastern time, on each day during which the NYSE is open for trading, and do not represent the returns an investor would receive if shares were traded at other times.

Exchange Traded Funds: The value of an ETF may be more volatile than the underlying portfolio of securities the ETF is designed to track. The costs of owning the ETF may exceed the cost of investing directly in the underlying securities.

Biotechnology Sector Risk: The Fund’s assets will be concentrated in investments in the securities of issuers engaged primarily in the biotechnology industry. Companies within the biotechnology sector spend heavily on research and development, which may not necessarily lead to commercially successful products in the near or long term. In order to fund operations, these companies may require financing from the capital markets, which may not always be available on satisfactory terms or at all. The biotechnology sector is also subject to significant governmental regulation, and the need for governmental approvals, including, without limitation, FDA approval. The securities of biotechnology companies, especially those of smaller or newer companies, tend to be more volatile than those of companies with larger capitalizations or markets generally.

Industry/Sector Concentration: A fund that focuses its investments in a particular industry or sector will be more sensitive to conditions that affect that industry or sector than a non-concentrated fund.

12

Management’s Discussion of Fund Performance (unaudited) (continued)

October 31, 2017

Virtus LifeSci Biotech Products ETF (continued)

Market Price/NAV: Shares of ETFs often trade at a discount to their net asset value, which may increase investors’ risk of loss. At the time of sale, an investor’s shares may have a market price that is above or below the Fund’s NAV.

Correlation to Index: The performance of the Fund and its index may vary somewhat due to factors such as Fund flows, transaction costs, and timing differences associated with additions to and deletions from its index.

Non-Diversified: The Fund is non-diversified and may be more susceptible to factors negatively impacting its holdings to the extent that each security represents a larger portion of the Fund’s assets.

No Guarantee: There is no guarantee that the Fund will meet its objective.

Prospectus: For additional information on risks, please see the Fund’s prospectus. The Fund may not be suitable for all investors.

Value of a $10,000 Investment Since Inception at Net Asset Value

The chart above represents historical performance of a hypothetical investment of $10,000 over the life of the Fund, assuming reinvestment of distributions. Past performance does not guarantee future results.

13

Management’s Discussion of Fund Performance (unaudited) (continued)

October 31, 2017

Virtus Newfleet Multi-Sector Unconstrained Bond ETF

For the fiscal year ended October 31, 2017, the Virtus Newfleet Multi-Sector Unconstrained Bond ETF (“NFLT” or the “Fund”) had a total return of 5.26% versus a return of 0.90% for the Bloomberg Barclays U.S. Aggregate Bond Index, the Fund’s benchmark index.

Most spread sectors outperformed U.S. Treasuries during the fiscal year ended October 31, 2017.

The global growth outlook remained favorable and the search for yield persisted through the end of the fiscal year. Within most fixed income sectors, longer duration and lower quality assets were key drivers of performance.

The positive tone of the market that continued after the surprise outcome of the U.S. presidential election faced numerous challenges over the fiscal year.

Geopolitical tensions with North Korea, continued gridlock in Washington, moderate volatility in oil prices, and major weather events such as Hurricane Harvey caused periods of weakness within spread sectors.

However, these weak periods were short-lived as investors bought into any meaningful dip in prices, quickly pushing prices higher.

As anticipated, the Federal Reserve (the “Fed”) raised its target rate by 25 basis points on three separate occasions during the fiscal year to a range of 1.00% to 1.25%.

During the fiscal year, yields increased across the curve, but more so among shorter maturities, which caused the front end of the curve to steepen and the long end of the curve to flatten.

The underperformance of U.S. Treasuries relative to most fixed income spread sectors was the key driver of NFLT’s outperformance for the fiscal year.

Among fixed income sectors the Fund’s allocations to corporate high yield, and emerging markets high yield, and as well as issue selection within corporate high quality securities were the largest positive contributors to performance for the fiscal year.

During the fiscal year, NFLT’s allocation to agency mortgage-backed securities detracted from performance, however the Fund’s underweight versus the benchmark was beneficial. Also, issue selection within the bank loan allocation detracted from performance during the period as a handful of credit-specific events impacted performance.

Performance as of 10/31/2017

| | Average Annual Total Return

|

| | Fund

Net Asset Value

| | Fund

Market Price

| | Bloomberg Barclays

U.S. Aggregate

Bond Index1

|

1 Year | | 5.26% | | 5.72% | | 0.90% |

Since Inception2 | | 5.87% | | 5.73% | | 2.69% |

1 | | The Bloomberg Barclays U.S. Aggregate Bond Index measures the U.S. investment grade fixed rate bond market. The index is calculated on a total return basis. The index is unmanaged, its returns do not reflect any fees, expenses, or sales charges, and is not available for direct investment. |

Performance data quoted represents past performance and past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance data may be higher or lower than actual data quoted. Returns do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. For the most current month-end performance data please visit www.virtusetfs.com or call toll free (800) 243-4361. Market price returns are based on the mid-point of the highest bid and lowest offer for Fund shares as of the scheduled close of regular trading on the New York Stock Exchange Arca (“NYSE”), ordinarily 4:00 p.m. Eastern time, on each day during which the NYSE is open for trading, and do not represent the returns an investor would receive if shares were traded at other times.

Credit & Interest: Debt securities are subject to various risks, the most prominent of which are credit and interest rate risk. The issuer of a debt security may fail to make interest and/or principal payments. Values of debt securities may rise or fall in response to changes in interest rates, and this risk may be enhanced with longer-term maturities.

14

Management’s Discussion of Fund Performance (unaudited) (continued)

October 31, 2017

Virtus Newfleet Multi-Sector Unconstrained Bond ETF (continued)

High Yield-High Risk Fixed Income Securities: There is a greater level of credit risk and price volatility involved with high yield securities than investment grade securities.

Foreign & Emerging Markets: Investing internationally, especially in emerging markets, involves additional risks such as currency, political, accounting, economic, and market risk.

Bank Loans: Loans may be unsecured or not fully collateralized, may be subject to restrictions on resale and/or trade infrequently on the secondary market. Loans can carry significant credit and call risk, can be difficult to value and have longer settlement times than other investments, which can make loans relatively illiquid at times.

ABS/MBS: Changes in interest rates can cause both extension and prepayment risks for asset- and mortgage-backed securities. These securities are also subject to risks associated with the repayment of underlying collateral.

Market Price/NAV: Shares of ETFs often trade at a discount to their net asset value, which may increase investors’ risk of loss. At the time of sale, an investor’s shares may have a market price that is above or below the Fund’s NAV.

Prospectus: For additional information on risks, please see the Fund’s prospectus. The Fund may not be suitable for all investors.

Value of a $10,000 Investment Since Inception at Net Asset Value

The chart above represents historical performance of a hypothetical investment of $10,000 over the life of the Fund, assuming reinvestment of distributions. Past performance does not guarantee future results.

15

Management’s Discussion of Fund Performance (unaudited) (continued)

October 31, 2017

Virtus WMC Global Factor Opportunities ETF

Performance as of 10/31/2017

| | | | Cumulative Total Return

|

| | | | Fund

Net Asset Value

| | Fund

Market Price

| | MSCI AC

World Index (net)1

|

Since Inception2 | | | | | 0.38 | % | | | 0.84 | % | | | 0.78 | % |

1 | | The MSCI AC World Index (net) is a free float-adjusted market capitalization-weighted index that measures equity performance of developed and emerging markets. The index is calculated on a total return basis with net dividends reinvested. The index is unmanaged, its returns do not reflect any fees, expenses, or sales charges, and is not available for direct investment. |

Performance data quoted represents past performance and past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance data may be higher or lower than actual data quoted. Returns do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. For the most current month-end performance data please visit www.virtusetfs.com or call toll free (800) 243-4361. Market price returns are based on the mid-point of the highest bid and lowest offer for Fund shares as of the scheduled close of regular trading on the New York Stock Exchange Arca (“NYSE”), ordinarily 4:00 p.m. Eastern time, on each day during which the NYSE is open for trading, and do not represent the returns an investor would receive if shares were traded at other times.

Exchange Traded Funds: The value of an ETF may be more volatile than the underlying portfolio of securities the ETF is designed to track. The costs of owning the ETF may exceed the cost of investing directly in the underlying securities.

Market Price/NAV: Shares of ETFs often trade at a discount to their net asset value, which may increase investors’ risk of loss. At the time of sale, an investor’s shares may have a market price that is above or below the fund’s NAV.

Equity Securities: The market price of equity securities may be adversely affected by financial market, industry, or issuer-specific events. Focus on a particular style or on small or medium-sized companies may enhance that risk.

Foreign & Emerging Markets: Investing internationally, especially in emerging markets, involves additional risks such as currency, political, accounting, economic, and market risk.

Geographic Concentration: Events negatively affecting the fiscal stability of a state, country, or region will cause the value of the Fund’s shares to decrease. Because the Fund concentrates its assets in a state, country, or region, the Fund is more vulnerable to those areas’ financial, economic, or other political developments.

Equity REITs: The Fund may be negatively affected by factors specific to the real estate market, including interest rates, leverage, property, and management.

Derivatives: Investments in derivatives such as futures, options, forwards, and swaps may increase volatility or cause a loss greater than the principal investment.

Prospectus: For additional information on risks, please see the Fund’s prospectus.

For the fiscal period ended October 31, 2017, the Fund did not have six months of performance and therefore graph lines are not presented.

16

Management’s Discussion of Fund Performance (unaudited) (continued)

October 31, 2017

InfraCap MLP ETF

Management’s Discussion of Operations

Overview

InfraCap MLP ETF (“the Fund”) seeks to provide a high level of current income, a growing income stream, and long-term capital appreciation. The Fund is an actively-managed portfolio of high quality, midstream energy master limited partnerships (MLPs) and related general partners. The Fund also utilizes options strategies and modest leverage to enhance income and total return.

The Fund focuses on the midstream MLP sector because most of these companies have a long-term history of relatively stable and growing cash distributions. These companies are typically involved in the production, gathering, transportation, storage, and processing of oil, natural gas, natural gas liquids and refined products.

Update

During the fiscal year ended on October 31, 2017, the Fund had a net loss, but it outperformed its benchmark, the Alerian MLP Infrastructure Index. The total return for the fund was negative 3.44%, while the fund’s benchmark reported a loss of 5.25%.

During the fiscal year, the net asset value (“NAV”) of the Fund fell from $10.63 to $8.37. A portion of the decline in NAV is attributable to the distribution of some net capital in the dividend payout. A further discussion of this topic is included in the Dividend Payments section below.

While 2017 was a year of improving fundamentals in the energy sector, the stocks underperformed the broader market by a substantial margin. Signs of recovery were largely ignored by investors.

In the midstream MLP sector, corporate actions caused investor confusion about distribution growth rates, and stock valuations fell to deeply depressed levels. Renewed volatility in crude oil prices added to uncertainty. Facing a high cost of capital in public markets, companies re-evaluated capital spending priorities and distribution policies, leading in some cases to a reset of per share payment rates.

The Fund was relatively overweight Energy Transfer Partners during the year and that was a drag on performance.

The Fund’s use of both leverage and options strategies worked to investors’ benefit during the year. Leverage adds to volatility and adds to losses in a down year. However, the weak market condition was an ideal environment for generating option premium income, and this activity reduced the Fund’s loss dramatically.

The Fund maintained its quarterly dividend rate of $0.52 per share during the year, and the total payout to investors was $2.08 per share. As noted, a portion of the payment was net capital.

Shares outstanding increased to 60,300,004 from 11,250,004.

Dividend Payments

The dividend rate is determined on a quarterly basis, and the rate may be adjusted during the year. An important consideration in determining the level of dividend payments is the estimated amount of distributable cash flow (“DCF”). DCF is investment income less expenses. Investment income includes cash distributions from master limited partnerships, dividends received from stocks, and net realized gains (losses) from written and purchased options contracts. Expenses include advisory fees, other miscellaneous fees and leverage costs.

The Supplemental Financial Data table includes the calculation of DCF and should be reviewed as part of this discussion. It should be noted that this calculation differs from the Statement of Operations because of the following factors: 1) GAAP does not include MLP distributions in investment income because these distributions are typically treated as return of capital; and 2) GAAP does not include net realized gains (losses) on written and purchased options contracts as investment income but reports them separately as realized and unrealized gains (losses).

The Supplemental Financial Data table also includes a calculation of the dividend coverage ratio. It indicates the portion of the dividend that was covered by cash income and option premium income. In 2015, the dividend was fully covered, but in 2016 and 2017, it was not fully covered. In those years, the Fund paid out a portion of net capital to cover the shortfall.

Rapid growth in the Fund’s assets and shares outstanding had a negative impact on the Fund’s ability to cover the dividend during this period. When shares are issued just prior to dividend payments, new investors get 100% of the dividend while the portfolio does not hold the related income-earning securities for 100% of the period leading up to the dividend declaration. In 2017, the Fund sought to anticipate this effect by more aggressively writing option premium under the assumption new shares would be issued. This activity only partially offset the impact of new share issuance, and the coverage ratio remained below 1:1.

17

Management’s Discussion of Fund Performance (unaudited) (continued)

October 31, 2017

InfraCap MLP ETF (continued)

The distribution of net capital to meet the targeted dividend rate has exacerbated the decline in the Fund net asset value related to the sector’s poor stock performance. In an environment of positive stock returns, net asset value per share may be sustained despite the distribution of net capital.

Use of Leverage

The Fund’s use of leverage is consistent with the limits set forth in the Investment Company Act of 1940 which states that the ratio of debt to net assets should not exceed 50%. The leverage ratio is impacted by increases and decreases in the market value of the Fund’s investments, the use of debt to finance the purchase of new securities, and/or the sale of investments where proceeds are used to pay down debt.

The Fund’s policy is to maintain the leverage ratio in a range of 10-35% over the long term. Additional leverage may be used when attractive investment opportunities arise but such leverage would be reduced over time. This leverage policy is consistent with the Fund’s investment objective to provide investors with a high level of current income. Total leverage represented 20.9% of net assets at year-end which was in the middle of the long-term target range.

The cost of borrowing rose during the year, but cash income from midstream MLP securities still generates a substantial positive spread. The Fund borrows at a 120 basis point premium to the 3-month LIBOR rate. During the fiscal year, the benchmark rate rose 49 basis points.

Use of Options

The Fund writes call and put premium on securities and ETFs to generate additional income for distribution to investors. It may also do it for hedging purposes. The primary activity is writing “covered” calls on positions held by the Fund.

The Fund strategies for writing covered calls are designed to minimize the impact of having stock called away during periods of rising stock prices. A risk management model is maintained to monitor the Fund’s positions relative to a designated target, and offsetting action is likely to occur in the event stock is called away. The use of leverage in a portfolio that writes covered calls helps minimize the risk of being left out of a market move higher.

Outlook

We are optimistic about the potential for attractive total returns in the midstream MLP sector in the coming years. The energy industry is one of boom and bust cycles, and it is currently in the trough of the latest.

Midstream companies typically weather these cycles well and emerge financially strong and growing. The most recent boom saw midstream companies lose some financial discipline, and balance sheets became too levered and distribution coverage ratios fell too low. These excesses are being corrected now, and a new base for distribution growth is being put in place.

The United States is emerging as the global leader in crude oil and natural gas production, and we expect the companies that serve that market to prosper. We look for solid growth in oil and gas production in the coming years.

We are encouraged by the valuation disparity between the private market for midstream assets and the valuations of companies in the public markets. Private buyers are willing to pay much higher prices for these assets than the prices these assets trade at on the stock exchanges. Public market discounts are often arbitraged away when private buyers begin to bid for public companies. We expect to see an increased level of M&A activity over the next couple years. This activity may be a catalyst for a general lift in the prices of midstream MLP stocks.

18

Management’s Discussion of Fund Performance (unaudited) (continued)

October 31, 2017

InfraCap MLP ETF (continued)

Performance as of 10/31/2017

| | Average Annual Total Return

|

| | Fund

Net Asset Value

| | Fund

Market Price

| | Alerian MLP

Infrastructure Index1

| | S&P 500® Index2

|

1 Year | | | (3.44 | )% | | | (3.55 | )% | | | (5.25 | )% | | | 23.63 | % |

Since Inception3 | | | (17.08 | )% | | | (17.12 | )% | | | (12.90 | )% | | | 11.81 | % |

1 | | The Alerian MLP Infrastructure Index is a composite of energy infrastructure Master Limited Partnerships (MLPs), whose constituents earn the majority of their cash flow from the transportation, storage, and processing of energy commodities. The index is calculated using a float-adjusted, capitalization-weighted methodology on a total-return basis. The index is unmanaged, its returns do not reflect any fees, expenses, or sales charges, and is not available for direct investment. |

2 | | The S&P 500® Index is a free-float market capitalization-weighted index of 500 of the largest U.S. companies. The index is calculated on a total return basis with dividends reinvested. The index is unmanaged, its returns do not reflect any fees, expenses, or sales charges, and is not available for direct investment. |

Performance data quoted represents past performance and past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance data may be higher or lower than actual data quoted. Returns do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. For the most current month-end performance data please visit www.virtusetfs.com or call toll free (800) 243-4361. Market price returns are based on the mid-point of the highest bid and lowest offer for Fund shares as of the scheduled close of regular trading on the New York Stock Exchange Arca (“NYSE”), ordinarily 4:00 p.m. Eastern time, on each day during which the NYSE is open for trading, and do not represent the returns an investor would receive if shares were traded at other times.

Interest Rate Risk: As yield-based investments, MLPs carry interest rate risk and may underperform in rising interest rate environments. Additionally, when investors have heightened fears about the economy, the risk spread between MLPs and competing investment options can widen, which may have an adverse effect on the stock price of MLPs. Rising interest rates may increase the potential cost of MLPs financing projects or cost of operations, and may affect the demand for MLP investments, either of which may result in lower performance by or distributions from the Fund’s MLP investments.

Exchange Traded Funds: The value of an ETF may be more volatile than the underlying portfolio of securities the ETF is designed to track. The costs of owning the ETF may exceed the cost of investing directly in the underlying securities.

Industry/Sector Concentration: A fund that focuses its investments in a particular industry or sector will be more sensitive to conditions that affect that industry or sector than a non-concentrated fund.

Short Sales: The Fund may engage in short sales, and may experience a loss if the price of a borrowed security increases before the date on which the Fund replaces the security.

Leverage: When a fund leverages its portfolio, the value of its shares may be more volatile and all other risks may be compounded.

Derivatives: Investments in derivatives such as futures, options, forwards, and swaps may increase volatility or cause a loss greater than the principal investment.

MLPs: Investments in Master Limited Partnerships may be adversely impacted by tax law changes, regulation, or factors affecting underlying assets.

Market Price/NAV: Shares of ETFs often trade at a discount to their net asset value, which may increase investors’ risk of loss. At the time of sale, an investor’s shares may have a market price that is above or below the Fund’s NAV.

Prospectus: For additional information on risks, please see the Fund’s prospectus. The Fund may not be suitable for all investors.

19

Management’s Discussion of Fund Performance (unaudited) (continued)

October 31, 2017

InfraCap MLP ETF (continued)

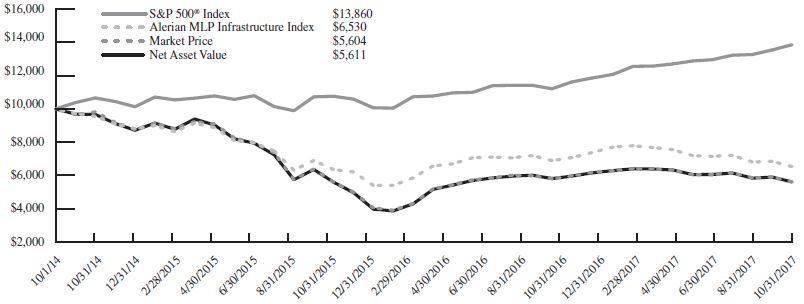

Value of a $10,000 Investment Since Inception at Net Asset Value

The chart above represents historical performance of a hypothetical investment of $10,000 over the life of the Fund, assuming reinvestment of distributions. Past performance does not guarantee future results.

20

Management’s Discussion of Fund Performance (unaudited) (continued)

October 31, 2017

Supplemental Financial Data

The information presented below regarding Distributable Cash Flow is supplemental non-GAAP financial information, which is meaningful to understanding the operating performance of the Fund. Distributable Cash Flow is the functional equivalent of EBITDA for non-investment companies. Management believes it is an important supplemental measure of performance. This information is supplemental, is not inclusive of required financial disclosures (such as Total Expense Ratio), and should be read in conjunction with our full financial statements.

| | | | Year ended

Oct 31,

2017

| | Year ended

Oct 31,

2016

| | Year ended

Oct 31,

2015

|

Investment Income

| | | | | | | | | | | | | | |

Distributions from master limited partnerships | | | | $ | 28,081,000 | | | $ | 4,391,084 | | | $ | 912,154 | |

Dividends | | | | | 764,352 | | | | 354,815 | | | | 100,421 | |

Net realized gain (loss) from written and purchased option contracts | | | | | 24,504,456 | | | | 3,057,069 | | | | 725,192 | |

Total Investment Income | | | | | 53,349,808 | | | | 7,802,968 | | | | 1,737,767 | |

Operating Expenses

| | | | | | | | | | | | | | |

Advisory Fees | | | | | 3,225,917 | | | | 515,252 | | | | 118,905 | |

Franchise Tax Expense | | | | | 5,088 | | | | — | | | | 613 | |

Total | | | | | 3,231,005 | | | | 515,252 | | | | 119,518 | |

Distributable cash flow before leverage costs | | | | | 50,118,803 | | | | 7,287,716 | | | | 1,618,249 | |

Interest expense | | | | | 3,203,804 | | | | 339,703 | | | | 25,361 | |

Distributable Cash Flow | | | | $ | 46,914,999 | | | $ | 6,948,013 | | | $ | 1,592,888 | |

Distributions to Shareholders | | | | $ | 78,416,009 | | | $ | 11,752,009 | | | $ | 1,506,258 | |

Dividend Coverage Ratio | | | | | 60 | % | | | 60 | % | | | 106 | % |

| | | | Qtr ended

Oct 31,

2017

| | Qtr ended

Jul 31,

2017

| | Qtr ended

Apr 30,

2017

| | Qtr ended

Jan 31,

2017

|

Investment Income

| | | | | | | | | | | | | | | | | | |

Distributions from master limited partnerships | | | | $ | 10,342,293 | | | $ | 8,433,993 | | | $ | 6,014,312 | | | $ | 3,290,402 | |

Dividends | | | | | 172,876 | | | | 242,137 | | | | 280,470 | | | | 68,869 | |

Net realized gain (loss) from written and purchased option contracts | | | | | 10,353,232 | | | | 8,028,119 | | | | 3,936,174 | | | | 2,186,931 | |

Total Investment Income | | | | | 20,868,401 | | | | 16,704,249 | | | | 10,230,956 | | | | 5,546,202 | |

Operating Expenses

| | | | | | | | | | | | | | | | | | |

Advisory Fees | | | | | 1,168,535 | | | | 997,524 | | | | 684,341 | | | | 375,517 | |

Franchise Tax Expense | | | | | 5,088 | | | | — | | | | — | | | | — | |

Total | | | | | 1,173,623 | | | | 997,524 | | | | 684,341 | | | | 375,517 | |

Distributable cash flow before leverage costs | | | | | 19,694,778 | | | | 15,706,725 | | | | 9,546,615 | | | | 5,170,685 | |

Interest expense | | | | | 1,323,923 | | | | 1,031,261 | | | | 510,535 | | | | 338,085 | |

Distributable Cash Flow | | | | $ | 18,370,855 | | | $ | 14,675,464 | | | $ | 9,036,080 | | | $ | 4,832,600 | |

Distributions to Shareholders | | | | $ | 29,744,003 | | | $ | 23,868,002 | | | $ | 16,224,002 | | | $ | 8,580,002 | |

Dividend Coverage Ratio | | | | | 62 | % | | | 61 | % | | | 56 | % | | | 56 | % |

21

Portfolio Composition

October 31, 2017 (unaudited)

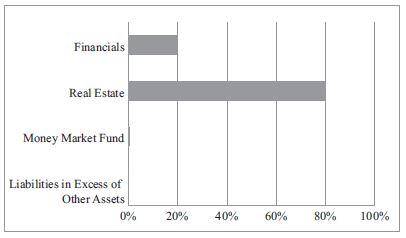

Asset Allocation as of 10/31/2017 (based on net assets)

InfraCap REIT Preferred ETF

| | | |

| Financials | | 19.3 | % |

| Real Estate | | 80.1 | % |

| Money Market Fund | | 0.6 | % |

| Liabilities in Excess of Other Assets | | (0.0 | )%* |

| Total | | 100 | % |

| | | | |

* | | Amount rounds to less than 0.05%. |

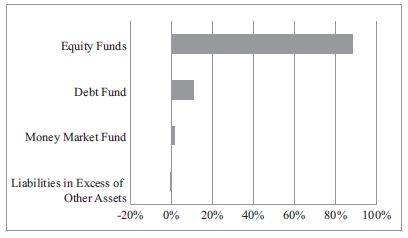

iSectors® Post-MPT Growth ETF

| | | |

| Equity Funds | | 88.1 | % |

| Debt Fund | | 10.9 | % |

| Money Market Fund | | 1.4 | % |

| Liabilities in Excess of Other Assets | | (0.4 | )% |

| Total | | 100 | % |

| | | | |

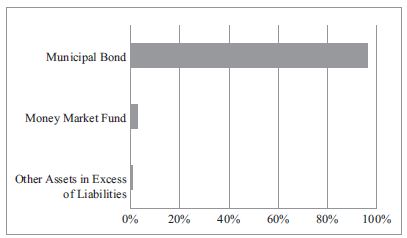

Virtus Cumberland Municipal Bond ETF

| | | |

| Municipal Bonds | | 96.2 | % |

| Money Market Fund | | 3.0 | % |

| Other Assets in Excess of Liabilities | | 0.8 | % |

| Total | | 100 | % |

| | | | |

22

Portfolio Composition (continued)

October 31, 2017 (unaudited)

Asset Allocation as of 10/31/2017 (based on net assets)

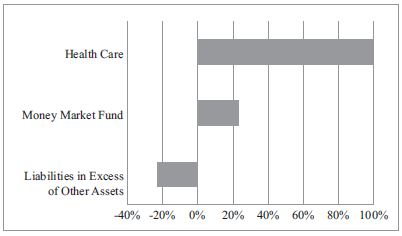

Virtus LifeSci Biotech Clinical Trials ETF

| | | |

| Healthcare | | 99.4 | % |

| Money Market Fund | | 23.3 | % |

| Liabilities in Excess of Other Assets | | (22.7 | )% |

| Total | | 100 | % |

| | | | |

Virtus LifeSci Biotech Products ETF

| | | |

| Healthcare | | 99.5 | % |

| Money Market Fund | | 20.6 | % |

| Liabilities in Excess of Other Assets | | (20.1 | )% |

| Total | | 100 | % |

| | | | |

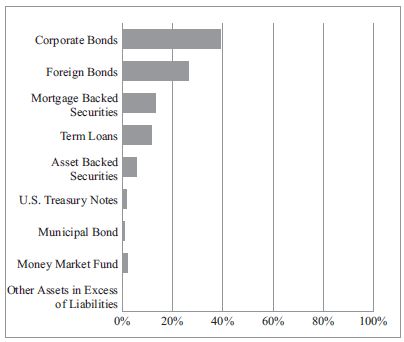

Virtus Newfleet Multi-Sector Unconstrained Bond ETF

|

| Corporate Bonds | | 39.2 | % |

| Foreign Bonds | | 26.2 | % |

| Mortgage Backed Securities | | 13.1 | % |

| Term Loans | | 11.5 | % |

| Asset Backed Securities | | 5.6 | % |

| U.S. Treasury Notes | | 1.5 | % |

| Municipal Bond | | 1.0 | % |

| Money Market Fund | | 1.9 | % |

| Other Assets in Excess of Liabilities | | 0.0 | %* |

| Total | | 100 | % |

* Amount rounds to less than 0.05%.

23

Portfolio Composition (continued)

October 31, 2017 (unaudited)

Asset Allocation as of 10/31/2017 (based on net assets)

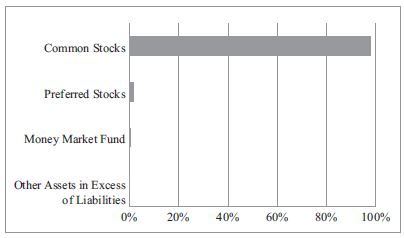

Virtus WMC Global Factor Opportunities ETF

| | | |

| Common Stocks | | 97.9 | % |

| Preferred Stocks | | 1.5 | % |

| Money Market Fund | | 0.6 | % |

| Other Assets in Excess of Liabilities | | 0.0 | %* |

| Total | | 100 | % |

| | | | |

* | | Amount rounds to less than 0.05%. |

InfraCap MLP ETF

| | | |

| Energy | | 126.3 | % |

| Debt Fund | | 0.1 | % |

| Purchased Options | | 0.1 | % |

| Commodity Funds | | (10.0 | )% |

| Exchange Traded Notes | | (1.4 | )% |

| Written Options | | (1.8 | )% |

| Liabilities in Excess of Other Assets | | (13.3 | )% |

| Total | | 100 | % |

| | | | |

24

Shareholder Expense Examples (unaudited)

As a shareholder of a Fund, you incur ongoing costs, including advisory fees and other fund expenses, if any. The following example is intended to help you understand your ongoing costs (in dollars and cents) of investing in a Fund and to compare these costs with the ongoing costs of investing in other funds. The examples are based on an investment of $1,000 invested at the beginning of the period and held throughout the entire period (May 1, 2017 to October 31, 2017), except as noted in footnotes below.

Actual expenses

The first line under each Fund in the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line for your Fund under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical example for comparison purposes

The second line under each Fund in the table provides information about hypothetical account values and hypothetical expenses based on each Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not each Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in each Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as brokerage commissions paid on purchases and sales of Fund shares. Therefore, the second line under each Fund in the table is useful in comparing ongoing Fund costs only and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | Beginning

Account

Value

05/01/17

| | Ending

Account

Value

10/31/17

| | Annualized

Expense Ratios(2)

| | Expenses Paid

During the

Period

|

InfraCap REIT Preferred ETF

| | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,033.40 | | | | 0.45 | % | | $ | 2.31(3) |

Hypothetical(1) | | $ | 1,000.00 | | | $ | 1,022.94 | | | | 0.45 | % | | $ | 2.29(4) |

iSectors® Post-MPT Growth ETF

| | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,092.50 | | | | 0.75 | % | | $ | 3.96(3) | |

Hypothetical(1) | | $ | 1,000.00 | | | $ | 1,021.42 | | | | 0.75 | % | | $ | 3.82(4) | |

Virtus Cumberland Municipal Bond ETF

| | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,027.10 | | | | 0.59 | % | | $ | 3.01(3) | |

Hypothetical(1) | | $ | 1,000.00 | | | $ | 1,022.23 | | | | 0.59 | % | | $ | 3.01(4) | |

Virtus LifeSci Biotech Clinical Trials ETF

| | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,223.10 | | | | 0.82 | % | | $ | 4.59(3) | |

Hypothetical(1) | | $ | 1,000.00 | | | $ | 1,021.07 | | | | 0.82 | % | | $ | 4.18(4) | |

Virtus LifeSci Biotech Products ETF

| | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,035.80 | | | | 0.82 | % | | $ | 4.21(3) | |

Hypothetical(1) | | $ | 1,000.00 | | | $ | 1,021.07 | | | | 0.82 | % | | $ | 4.18(4) | |

Virtus Newfleet Multi-Sector Unconstrained Bond ETF

| | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,027.50 | | | | 0.80 | % | | $ | 4.09(3) | |

Hypothetical(1) | | $ | 1,000.00 | | | $ | 1,021.17 | | | | 0.80 | % | | $ | 4.08(4) | |

Virtus WMC Global Factor Opportunities ETF

| | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,003.80 | | | | 0.49 | % | | $ | 0.27(5) | |

Hypothetical(1) | | $ | 1,000.00 | | | $ | 1,022.74 | | | | 0.49 | % | | $ | 2.50(4) | |

InfraCap MLP ETF

| | | | | | | | | | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 887.10 | | | | 0.95 | % | | $ | 4.52(3) | |

Hypothetical(1) | | $ | 1,000.00 | | | $ | 1,020.42 | | | | 0.95 | % | | $ | 4.84(4) | |

1 | | Assuming 5% return before expenses. |

2 | | Annualized expense ratios reflect expenses net of, interest expense, waived fees or reimbursed expenses, if applicable. |

3 | | Expenses are calculated using each Fund’s annualized expense ratio, multiplied by the average account value for the period, multiplied by 184/365 (to reflect the six-month period). |

4 | | Hypothetical expenses are calculated using the Fund’s annualized expense ratio, multiplied by the average account value for the period, multiplied by 184/365 (to reflect the six-month period). |

5 | | Actual expenses are calculated using the Fund’s annualized expense ratio, multiplied by the average account value for the period, multiplied by 20/365 (to reflect the period October 10, 2017 to October 31, 2017). |

25

Schedule of Investments — InfraCap REIT Preferred ETF

October 31, 2017

Security Description

| | | | Shares

| | Value

|

PREFERRED STOCKS — 99.4%

| | | | | | | | | | |

| |

Financials — 19.3%

| | | | | | | | | | |

AGNC Investment Corp., Series B, 7.75% | | | | | 11,330 | | | $ | 296,846 | |

ARMOUR Residential REIT, Inc., Series B, 7.88% | | | | | 9,205 | | | | 230,861 | |

Capstead Mortgage Corp., Series E, 7.50% | | | | | 13,970 | | | | 350,368 | |

Chimera Investment Corp., Series A, 8.00% | | | | | 9,388 | | | | 243,619 | |

Chimera Investment Corp., Series B, 8.00% | | | | | 19,423 | | | | 502,084 | |

CYS Investments, Inc., Series B, 7.50% | | | | | 12,949 | | | | 320,747 | |

Invesco Mortgage Capital, Inc., Series A, 7.75% | | | | | 9,064 | | | | 228,050 | |

Invesco Mortgage Capital, Inc.,

Series B, 7.75% | | | | | 10,035 | | | | 264,623 | |

MFA Financial, Inc., Series B, 7.50% | | | | | 12,949 | | | | 331,494 | |

New York Mortgage Trust, Inc., Series C, 7.88% | | | | | 5,827 | | | | 144,510 | |

PennyMac Mortgage Investment Trust, Series A, 8.13% | | | | | 7,446 | | | | 188,831 | |

Resource Capital Corp., 8.25% | | | | | 8,975 | | | | 220,516 | |

Resource Capital Corp., 8.63% | | | | | 7,769 | | | | 195,623 | |

Wells Fargo Real Estate Investment Corp., Series A, 6.38% | | | | | 17,805 | | | | 471,832 | |

Total Financials | | | | | | | | | 3,990,004 | |

| | | | | | | | | | | |

Real Estate — 80.1%

| | | | | | | | | | |

American Homes 4 Rent, Series C, 5.50%(1) | | | | | 12,301 | | | | 348,979 | |

American Homes 4 Rent, Series D, 6.50% | | | | | 17,400 | | | | 467,016 | |

American Homes 4 Rent, Series E, 6.35% | | | | | 14,891 | | | | 393,271 | |

Ashford Hospitality Trust, Inc., Series F, 7.38% | | | | | 7,769 | | | | 196,556 | |

Ashford Hospitality Trust, Inc., Series G, 7.38% | | | | | 10,035 | | | | 250,373 | |

CBL & Associates Properties, Inc., Series D, 7.38% | | | | | 29,378 | | | | 725,049 | |

CBL & Associates Properties, Inc., Series E, 6.63% | | | | | 11,168 | | | | 277,456 | |

City Office REIT, Inc., Series A, 6.63% | | | | | 7,372 | | | | 188,281 | |

Colony NorthStar, Inc., Series E, 8.75% | | | | | 14,568 | | | | 393,336 | |

Colony NorthStar, Inc., Series H, 7.13% | | | | | 18,946 | | | | 485,965 | |

Digital Realty Trust, Inc., Series C, 6.63%* | | | | | 26,060 | | | | 724,729 | |

Digital Realty Trust, Inc., Series G, 5.88% | | | | | 16,186 | | | | 413,067 | |

Digital Realty Trust, Inc., Series I, 6.35% | | | | | 16,186 | | | | 441,069 | |

GGP, Inc., Series A, 6.38% | | | | | 16,186 | | | | 408,697 | |

Hersha Hospitality Trust, Series D, 6.50% | | | | | 12,463 | | | | 320,922 | |

Hersha Hospitality Trust, Series E, 6.50% | | | | | 6,474 | | | | 163,792 | |

Kimco Realty Corp., Series J, 5.50% | | | | | 14,768 | | | | 370,972 | |

Kimco Realty Corp., Series K, 5.63% | | | | | 11,489 | | | | 290,212 | |

LaSalle Hotel Properties, Series J, 6.30% | | | | | 9,712 | | | | 250,472 | |

Monmouth Real Estate Investment Corp., Series C, 6.13% | | | | | 13,596 | | | | 342,483 | |

National Retail Properties, Inc., Series E, 5.70% | | | | | 18,614 | | | | 485,639 | |

National Retail Properties, Inc., Series F, 5.20% | | | | | 22,337 | | | | 560,882 | |

| |

Security Description

| | | | Shares

| | Value

|

PREFERRED STOCKS (continued)

| | | | | | | | | | |

| | | | | | | | | | | |

Real Estate (continued)

| | | | | | | | | | |

Pebblebrook Hotel Trust, Series C, 6.50% | | | | | 8,093 | | | $ | 205,562 | |

Pebblebrook Hotel Trust, Series D, 6.38% | | | | | 8,093 | | | | 209,406 | |

Pennsylvania Real Estate Investment Trust, Series B, 7.38% | | | | | 5,584 | | | | 142,560 | |

Pennsylvania Real Estate Investment Trust, Series C, 7.20% | | | | | 9,712 | | | | 255,426 | |

PS Business Parks, Inc., Series U, 5.75% | | | | | 14,891 | | | | 375,700 | |

PS Business Parks, Inc., Series W, 5.20% | | | | | 12,285 | | | | 310,811 | |

Public Storage, Series A, 5.88% | | | | | 6,141 | | | | 164,456 | |

Public Storage, Series B, 5.40% | | | | | 9,697 | | | | 250,571 | |

Public Storage, Series C, 5.13% | | | | | 6,465 | | | | 164,664 | |

Public Storage, Series D, 4.95% | | | | | 10,505 | | | | 263,360 | |

Public Storage, Series E, 4.90% | | | | | 11,313 | | | | 282,259 | |

Public Storage, Series V, 5.38% | | | | | 16,000 | | | | 403,520 | |

Public Storage, Series W, 5.20% | | | | | 14,545 | | | | 367,843 | |

Public Storage, Series X, 5.20% | | | | | 7,273 | | | | 185,025 | |

Retail Properties of America, Inc., Series A, 7.00% | | | | | 8,741 | | | | 221,322 | |

Rexford Industrial Realty, Inc., Series A, 5.88% | | | | | 5,827 | | | | 147,423 | |

Sunstone Hotel Investors, Inc., Series E, 6.95% | | | | | 7,446 | | | | 197,691 | |

VEREIT, Inc., Series F, 6.70% | | | | | 69,332 | | | | 1,772,819 | |

Vornado Realty Trust, Series L, 5.40% | | | | | 19,423 | | | | 491,402 | |

Washington Prime Group, Inc., Series H, 7.50% | | | | | 6,474 | | | | 163,210 | |

Welltower, Inc., Series I, 6.50% | | | | | 23,268 | | | | 1,427,026 | |

Total Real Estate | | | | | | | | | 16,501,274 | |

Total Preferred Stocks

| | | | | | | | | | |

(Cost $20,409,028) | | | | | | | | | 20,491,278 | |

| | | | | | | | | | | |

MONEY MARKET FUND — 0.6%

| | | | | | | | | | |

JP Morgan 100% U.S. Treasury Securities Money Market Fund, 0.88%(2)

| | | | | | | | | | |

(Cost $124,535) | | | | | 124,535 | | | | 124,535 | |

| | | | | | | | | | | |

TOTAL INVESTMENTS — 100.0%

| | | | | | | | | | |

(Cost $20,533,563) | | | | | | | | | 20,615,813 | |

Liabilities in Excess of Other Assets — 0.0%(3) | | | | | | | | | (6,470 | ) |

Net Assets — 100.0% | | | | | | | | $ | 20,609,343 | |

* | | Non-income producing security. |

(1) | | Represents step coupon security. Rate shown reflects the rate in effect as of October 31, 2017. |

(2) | | The rate shown reflects the seven-day yield as of October 31, 2017. |

(3) | | Amount rounds to less than 0.05% |

The following table summarizes valuation of the Fund’s investments under the fair value hierarchy levels as of October 31, 2017:

| | | | Level 1

| | Level 2

| | Level 3

| | Total

|

Asset Valuation Inputs

| | | | | | | | | | | | | | | | | | |

| Investments | | | | | | | | | | | | | | | | | | |

| Preferred Stocks | | | | $ | 20,491,278 | | | $ | — | | | $ | — | | | $ | 20,491,278 | |

| Money Market Fund | | | | | 124,535 | | | | — | | | | — | | | | 124,535 | |

| Total Investments | | | | $ | 20,615,813 | | | $ | — | | | $ | — | | | $ | 20,615,813 | |

For significant movements between levels within the fair value hierarchy, the Fund adopted a policy of recognizing transfers at the end of the fiscal year. There were no significant transfers between levels during the year ended October 31, 2017.

A reconciliation of assets in which Level 3 inputs are used in determining fair value is presented when there are significant Level 3 investments at the end of the reporting period. There were no Level 3 securities as of October 31, 2017.

The accompanying notes are an integral part of these financial statements.

26

Schedule of Investments — iSectors® Post-MPT Growth ETF

October 31, 2017

Security Description

| | | | Shares

| | Value

|

Exchange Traded Funds — 99.0%

| | | | | | | | | | |

| | | | | | | | | | | |

Equity Funds — 88.1%

| | | | | | | | | | |

Direxion Daily Financial Bull 3X Shares* | | | | | 25,453 | | | $ | 1,536,089 | |

Fidelity MSCI Information

Technology Index ETF | | | | | 74,917 | | | | 3,715,134 | |

ProShares Ultra Utilities | | | | | 26,200 | | | | 1,340,916 | |

Vanguard Energy ETF | | | | | 19,999 | | | | 1,851,507 | |

Vanguard REIT ETF | | | | | 9,311 | | | | 765,364 | |

Vanguard Utilities ETF | | | | | 21,870 | | | | 2,653,925 | |

Total Equity Funds | | | | | | | | | 11,862,935 | |

| | | | | | | | | | | |

Debt Fund — 10.9%

| | | | | | | | | | |

iShares 20+ Year Treasury Bond ETF | | | | | 11,789 | | | | 1,467,259 | |

| | | | | | | | | | | |

Total Exchange Traded Funds

| | | | | | | | | | |

(Cost $12,391,685) | | | | | | | | | 13,330,194 | |

| | | | | | | | | | | |