UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number811-22819

ETFis Series Trust I

(Exact name of registrant as specified in charter)

1540 Broadway, 16th Floor

New York, NY 10036

(Address of principal executive offices) (Zip code)

ETFis Series Trust I

c/o Corporation Service Company

2711 Centerville Road, Suite 400

Wilmington, DE 19808

(Name and address of agent for service)

Registrant’s telephone number, including area code:(212) 593-4383

Date of fiscal year end:October 31

Date of reporting period:October 31, 2019

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

The Report to Shareholders is attached herewith.

INFRACAP REIT PREFERRED ETF

VIRTUS GLOVISTA EMERGING MARKETS ETF

VIRTUS INFRACAP U.S. PREFERRED STOCK ETF

VIRTUS LIFESCI BIOTECH CLINICAL TRIALS ETF

VIRTUS LIFESCI BIOTECH PRODUCTS ETF

VIRTUS NEWFLEET MULTI-SECTOR BOND ETF

VIRTUS PRIVATE CREDIT STRATEGY ETF

VIRTUS REAL ASSET INCOME ETF

VIRTUS WMC GLOBAL FACTOR OPPORTUNITIES ETF

INFRACAP MLP ETF

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of each Fund’s shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

You may elect at any time to receive not only shareholder reports but also other communications such as prospectuses from the Fund electronically, or you alternatively may elect to receive all future shareholder reports in paper free of charge. Please contact your financial intermediary to make your request and to determine whether an election made with the financial intermediary will apply to all funds in which you own shares through that intermediary.

ANNUAL REPORT

October 31, 2019

| | | Page (s)

|

| | | 1 |

| | | 2 |

| | | 26 |

| | | 29 |

InfraCap REIT Preferred ETF

| | | |

Virtus Glovista Emerging Markets ETF

| | | |

Virtus InfraCap U.S. Preferred Stock ETF

| | | |

Virtus LifeSci Biotech Clinical Trials ETF

| | | |

Virtus LifeSci Biotech Products ETF

| | | |

Virtus Newfleet Multi-Sector Bond ETF

| | | |

Virtus Private Credit Strategy ETF

| | | |

Virtus Real Asset Income ETF

| | | |

Virtus WMC Global Factor Opportunities ETF

| | | |

| | | 30 |

| | | 58 |

| | | 60 |

| | | 62 |

| | | 67 |

| | | 68 |

| | | 77 |

InfraCap MLP ETF

| | | |

| | | 88 |

| | | 92 |

| | | 93 |

| | | 94 |

| | | 95 |

| | | 96 |

| | | 97 |

| | | 105 |

| | | 108 |

| | | 110 |

Shareholder Letter (unaudited)

October 31, 2019

Dear Fellow ETFis Funds Shareholder:

I am pleased to present this annual report for ETFis Series Trust I, which reviews the performance of the following funds within the Trust, including two recent additions, for the twelve months ended October 31, 2019:

• | | InfraCap REIT Preferred ETF (PFFR) |

• | | Virtus Glovista Emerging Markets ETF (EMEM) |

• | | Virtus InfraCap U.S. Preferred Stock ETF (PFFA) |

• | | Virtus LifeSci Biotech Clinical Trials ETF (BBC) |

• | | Virtus LifeSci Biotech Products ETF (BBP) |

• | | Virtus Newfleet Multi-Sector Bond ETF (NFLT) |

• | | Virtus Private Credit Strategy ETF (VPC) - Launched on February 7, 2019, this fund seeks investment results that correspond with the price and yield performance of the Indxx Private Credit Index. |

• | | Virtus Real Asset Income ETF (VRAI) - Launched on February 7, 2019, this fund seeks investment results that correspond with the price and yield performance of the Indxx Real Asset Income Index. |

• | | Virtus WMC Global Factor Opportunities ETF (VGFO) |

• | | InfraCap MLP ETF (AMZA) |

The report provides financial statements and portfolio information for the above funds. For the funds with a performance history of more than six months, the report also provides commentary from the portfolio manager on how the fund performed relative to the markets in which it invests.

On behalf of Virtus ETF Advisers LLC (the “Adviser”) and our fund Sub-Advisers, thank you for your investment. If you have questions, please contact your financial adviser, or call 1-888-383-0553. We invite you to visit our website, www.virtusetfs.com, to learn more about the funds.

Sincerely,

William Smalley

President

ETFis Series Trust I

This material must be accompanied or preceded by the prospectus.

1

Management’s Discussion of Fund Performance (unaudited)

October 31, 2019

InfraCap REIT Preferred ETF Management’s Discussion of Operations

Overview

The InfraCap REIT Preferred ETF (the “Fund”) seeks to track the investment results of an index composed of preferred shares listed on U.S. Exchanges and issued by Real Estate Investment Trusts, as represented by the Indxx REIT Preferred Stock Index (the “Index”). The Fund invests in a representative sample of securities included in the Index that collectively has a profile similar to the Index. Due to the use of representative sampling, the Fund may or may not own all of the securities that are included in the Index.

Update

In the fiscal year ended October 31, 2019, the Fund’s market value total return (NYSE price change plus dividends) was 14.31%. The total return on Net Asset Value (NAV) was 13.78%. The Fund’s benchmark index, the Indxx REIT Preferred Stock Index, earned a total return of 15.02% during this period.

Preferred shares are fixed income securities, and prices are influenced by changes in long-term interest rates. During the fiscal year, the yield on the 30-year U.S. Treasury bond fell 122 basis points, from 3.39% to 2.17%. Yields on preferred shares fell in response, with prices rising accordingly. While preferred stock performed well, common stocks and Real Estate Investment Trusts exhibited greater potential for total returns.

Top performing preferred stocks for the fiscal year included Washington Prime Group 7½% Cumulative Preferred Series H, Summit Hotel Properties Cumulative Prf. Registered Series E, and City Office REIT Inc., 6.625% Cumulative Pfd. Registered Series A.

Washington Prime Group is a Real Estate Investment Trust with retail properties located in the Midwest. Investors may have found Washington’s preferred issues to be more compelling and stable than the company’s common shares.

Summit Hotel Properties, Inc. is a Real Estate Investment Trust that owns hotels throughout the U.S. The company’s common stock and preferred issues performed well during the period as investors viewed Summit’s October announcement of a significant acquisition favorably.

City Office REIT Inc. is a Real Estate Investment Trust that owns office properties in the Southern and Western U.S. City’s common stock and investor outlook improved during the year which was highlighted during the company’s capital raising roadshow completed in early October 2019.

Detractors from relative performance included Ashford Hospitality Trust Inc. 7.375% Pref Series G, Pebblebrook Hotel Trust 6.3% Cumulative Pfd. Registered Shares Series F and Colony Capital 8.75% Cumulative Prf. Shares Series E.

Pebblebrook Hotel Trust is a hotel operator that, while it has made progress selling non-core assets and deleveraging its balance sheet, is still challenged by its acquisition of LaSalle Hotel Properties.

Ashford Hospitality Trust, Inc. is a Real Estate Investment Trust that invests in full service hotel properties. Shares of Ashford’s common and preferred issues were under pressure during the period as management addressed concerns of a slowdown in business travel and increased employee costs.

Colony Capital is a diversified Real Estate Investment Trust. The company’s common and preferred shares underperformed similar issuers when some analysts questioned the complexity of the company’s balance sheet during the period.

EXPOSURE BY SECTOR (%) as of 10/31/19

| | | |

Mortgage REITs | | | | | 30.19 | |

Property REITs | | | | | 69.81 | |

Diversified | | | | | 21.02 | |

Storage | | | | | 11.22 | |

Office Property | | | | | 6.30 | |

Shopping Centers | | | | | 10.80 | |

Health Care | | | | | 2.22 | |

Residential | | | | | 7.54 | |

Hotels | | | | | 6.83 | |

Industrial | | | | | 2.18 | |

Data Centers | | | | | 0.75 | |

Farmlands | | | | | 0.94 | |

Total | | | | | 100.00 | |

2

Management’s Discussion of Fund Performance (unaudited) (continued)

October 31, 2019

InfraCap REIT Preferred ETF (continued)

TOP 10 HOLDINGS (%) as of 10/31/19

| | | |

Annaly Capital Management, Inc., Series F | | | | | 4.2 | |

Annaly Capital Management, Inc., Series D | | | | | 2.6 | |

Annaly Capital Management, Inc., Series G | | | | | 2.5 | |

National Retail Properties, Inc., Series F | | | | | 2.3 | |

Arch Capital Group Ltd., Series F | | | | | 2.2 | |

Senior Housing Properties Trust | | | | | 2.2 | |

AGNC Investment Corp., Series C | | | | | 2.2 | |

Monmouth Real Estate Investment Corp., Series C | | | | | 2.2 | |

Vornado Realty Trust, Series M | | | | | 2.2 | |

Colony Capital, Inc., Series I | | | | | 2.1 | |

EXPOSURE BY RATING (%) as of 10/31/19

| | | |

A- | | | | | 10.0 | % |

BBB+ | | | | | 2.8 | % |

BBB | | | | | 12.0 | % |

BBB- | | | | | 9.3 | % |

BB+ | | | | | 5.5 | % |

BB | | | | | 1.9 | % |

B | | | | | 0.6 | % |

B- | | | | | 0.8 | % |

NR | | | | | 57.1 | % |

Credit quality ratings on underlying securities of the Fund are received from S&P, Moody’s, and Fitch and converted to the equivalent S&P major rating category. This breakdown is provided by Infrastructure Capital Advisors and takes the median rating of the three agencies when all three agencies rate a security, the lower of the two ratings if only two agencies rate a security, and one rating if that is all that is provided. Unrated securities do not necessarily indicate low quality. Below investment-grade is represented by a rating of BB and below. Ratings and portfolio credit quality may change over time.

The preceding information is the opinion of the investment adviser and sub-adviser. Any such opinions are subject to change at any time based upon market or other conditions and should not be relied upon as investment advice. Statements of fact are from sources considered reliable, but the investment adviser and sub-adviser make no representation or warranty as to their completeness or accuracy. Past performance is no guarantee of future results, and there is no guarantee that market forecasts will be realized.

Performance as of 10/31/2019

| | | | Average Annual Total Return

|

| | | | Fund

Net Asset Value

| | Fund

Market Price

| | Index REIT

Preferred

Stock Index1

|

1 Year | | | | | 13.78 | % | | | 14.31 | % | | | 15.02 | % |

Since Inception2 | | | | | 6.28 | % | | | 6.46 | % | | | 7.22 | % |

| 1 | | The Indxx REIT Preferred Stock Index is a market cap weighted index designed to provide diversified exposure to high yielding liquid preferred securities issued by Real Estate Investment Trusts listed in the U.S. The index is calculated on a total return basis. The index is unmanaged, its returns do not reflect any fees, expenses, or sales charges, and is not available for direct investment. |

Performance data quoted represents past performance and past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance data may be higher or lower than actual data quoted. Returns do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. For the most current month-end performance data please visit www.virtusetfs.com or call toll free (800) 243-4361. Market price returns are based on the mid-point of the highest bid and lowest offer for Fund shares as of the scheduled close of regular trading on the New York Stock Exchange Arca (“NYSE”), ordinarily 4:00 p.m. Eastern time, on each day during which the NYSE is open for trading, and do not represent the returns an investor would receive if shares were traded at other times.

Exchange Traded Funds: The value of an ETF may be more volatile than the underlying portfolio of securities the ETF is designed to track. The costs of owning the ETF may exceed the cost of investing directly in the underlying securities.

3

Management’s Discussion of Fund Performance (unaudited) (continued)

October 31, 2019

InfraCap REIT Preferred ETF (continued)

Market Price/NAV: Shares of ETFs often trade at a discount to their net asset value, which may increase investors’ risk of loss. At the time of sale, an investor’s shares may have a market price that is above or below the Fund’s NAV.

Preferred Stocks: Preferred stocks may decline in price, fail to pay dividends, or be illiquid.

Real Estate Investments: The Fund may be negatively affected by factors specific to the real estate market, including interest rates, leverage, property, and management.

Industry/Sector Concentration: A fund that focuses its investments in a particular industry or sector will be more sensitive to conditions that affect that industry or sector than a non-concentrated fund.

Passive Strategy/Index Risk: A passive investment strategy seeking to track the performance of the Underlying Index may result in the fund holding securities regardless of market conditions or their current or projected performance. This could cause the Fund’s returns to be lower than if the Fund employed an active strategy.

Correlation to Index: The performance of the Fund and its index may vary somewhat due to factors such as Fund flows, transaction costs, and timing differences associated with additions to and deletions from its index.

Market Volatility: Securities in the Fund may go up or down in response to the prospects of individual companies and general economic conditions. Price changes may be short or long term.

No Guarantee: There is no guarantee that the Fund will meet its objective.

Non-Diversified: The Fund is non-diversified and may be more susceptible to factors negatively impacting its holdings to the extent that each security represents a larger portion of the Fund’s assets.

Prospectus: For additional information on risks, please see the Fund’s prospectus. The Fund may not be suitable for all investors.

Value of a $10,000 Investment Since Inception at Net Asset Value

The chart above represents historical performance of a hypothetical investment of $10,000 over the life of the Fund, assuming reinvestment of distributions. Past performance does not guarantee future results.

4

Management’s Discussion of Fund Performance (unaudited) (continued)

October 31, 2019

Virtus Glovista Emerging Markets ETF

The Virtus Glovista Emerging Market ETF (the “Fund”) (NYSE: EMEM) is an ETF that seeks to provide passive diversified exposure to stocks in “most favored” Emerging Market countries as identified by a proprietary quantitative methodology. The Fund passively replicates the Solactive Most Favored Nations Emerging Market Index (the “Index”). In the fiscal year ending October 31, 2019, the Index returned 11.18% whereas the Fund’s NAV returned 9.77%.

Emerging Market Equities have underperformed the S&P 500 and International Developed Market Equities during the fiscal year ending October 31, 2019. The performance of equity indices during the first ten months of the fiscal year was mainly driven by two US centered policy developments: (1) a marked dovish turn by the US Federal Reserve, and; (2) the Trump administration’s on-going engagement with China on trade dispute and its resultant impact on global growth and supply chains.

It is important to note the effect of currency movements on the Fund’s performance. In general, if the value of the U.S. dollar goes up compared with foreign currencies then investments traded in that foreign currency will go down in value. For the fiscal year ending October 31, 2019, the U.S. dollar continued a steady rise relative to most currencies relevant to the Fund thereby creating headwinds for most emerging markets and negatively impacting the Fund’s performance.

For the fiscal year ending October 31, 2019, key holdings that contributed to the Fund’s performance included Taiwan Semiconductor Manufacturing Co., Gazprom and Franklin FTSE India ETF. Conversely, SACI Falabella, Empresas COPEC and Sociedad Quimica y Minera de Chile were notable detractors from the Fund’s returns.

At fiscal year end the portfolio was invested in 16 different countries, in line with the Index.

The preceding information is the opinion of the investment adviser and sub-adviser. Any such opinions are subject to change at any time based upon market or other conditions and should not be relied upon as investment advice. Statements of fact are from sources considered reliable, but the investment adviser and sub-adviser make no representation or warranty as to their completeness or accuracy. Past performance is no guarantee of future results, and there is no guarantee that market forecasts will be realized.

Performance as of 10/31/2019

| | | | Average Annual Total Return

|

| | | | Fund

Net Asset Value

| | Fund

Market Price

| | Solactive Most Favored

Nations Emerging

Markets Index (net)1

|

1 Year | | | | | 9.77 | % | | | 8.39 | % | | | 11.18 | % |

Since Inception2 | | | | | (2.63 | )% | | | (3.07 | )% | | | (1.80 | )% |

| 1 | | The Solactive Most Favored Nations Emerging Markets Index (net) is an index of stocks from most favored countries selected from a universe of large liquid Emerging Market countries (currently fifteen). The index is designed to provide diversified exposure to stocks within large liquid countries in Emerging Markets while avoiding exposure to the stocks within weakest countries based on Glovista’s proprietary quantitative methodology. The index is calculated on a total return basis with net dividends reinvested. The index is unmanaged, its returns do not reflect any fees, expenses, or sales charges, and is not available for direct investment. |

Performance data quoted represents past performance and past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance data may be higher or lower than actual data quoted. Returns do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. For the most current month-end performance data please visit www.virtusetfs.com or call toll free (800) 243-4361. Market price returns are based on the mid-point of the highest bid and lowest offer for Fund shares as of the scheduled close of regular trading on the New York Stock Exchange Arca (“NYSE”), ordinarily 4:00 p.m. Eastern time, on each day during which the NYSE is open for trading, and do not represent the returns an investor would receive if shares were traded at other times.

Exchange Traded Funds: The value of an ETF may be more volatile than the underlying portfolio of securities the ETF is designed to track. The costs of owning the ETF may exceed the cost of investing directly in the underlying securities.

Market Price/NAV: Shares of ETFs often trade at a discount to their net asset value, which may increase investors’ risk of loss. At the time of sale, an investor’s shares may have a market price that is above or below the Fund’s NAV.

Industry/Sector Concentration: A fund that focuses its investments in a particular industry or sector will be more sensitive to conditions that affect that industry or sector than a non-concentrated fund.

5

Management’s Discussion of Fund Performance (unaudited) (continued)

October 31, 2019

Virtus Glovista Emerging Markets ETF (continued)

Equity Securities: The market price of equity securities may be adversely affected by financial market, industry, or issuer-specific events. Focus on a particular style or on small or medium-sized companies may enhance that risk.

Foreign & Emerging Markets: Investing internationally, especially in emerging markets, involves additional risks such as currency, political, accounting, economic, and market risk.

Passive Strategy/Index Risk: A passive investment strategy seeking to track the performance of the Underlying Index may result in the fund holding securities regardless of market conditions or their current or projected performance. This could cause the Fund’s returns to be lower than if the Fund employed an active strategy.

Non-Diversified: The Fund is non-diversified and may be more susceptible to factors negatively impacting its holdings to the extent that each security represents a larger portion of the Fund’s assets.

No Guarantee: There is no guarantee that the Fund will meet its objective.

Prospectus: For additional information on risks, please see the Fund’s prospectus. The Fund may not be suitable for all investors.

Value of a $10,000 Investment Since Inception at Net Asset Value

The chart above represents historical performance of a hypothetical investment of $10,000 over the life of the Fund, assuming reinvestment of distributions. Past performance does not guarantee future results.

6

Management’s Discussion of Fund Performance (unaudited) (continued)

October 31, 2019

Virtus InfraCap U.S. Preferred Stock ETF

Management’s Discussion of Operations

Overview

Virtus InfraCap U.S. Preferred Stock ETF (the “Fund”) seeks current income and, secondarily, capital appreciation through an actively-managed portfolio of high quality, U.S. preferred stocks. Callable preferred securities exhibiting a low or negative yield to call are generally excluded from the portfolio. The Fund utilizes options strategies and modest leverage to enhance income and total return.

Update

The fiscal year ended October 31, 2019 was characterized by extraordinary volatility in interest rates. The Federal Reserve began the period with a rate hike in December 2018 and ended it with three consecutive rate cuts. Rates on 10-year and 30-year U.S. Treasury bonds plunged to historic lows and then rebounded modestly. The yield curve began the period with a modest upward slope, inverted briefly (depending on the measure), and then resumed a modest upward curve by year end.

In the twelve months ending October 31, 2019, the Fund’s market value total return (NYSE price change plus dividends) was 18.97%. The total return on Net Asset Value (NAV) was 18.37%. The Fund’s benchmark index, the S&P U.S. Preferred Stock Index, earned a total return of 11.61% during this period.

Top performing preferred stocks for the fiscal year included Washington Prime Group 7½% Cumulative Preferred Series H, National General Holdings Corp. Deposit Shares Non-Cumulative Prf. Series B, and National General Holdings Corp. 7 ½% Deposit Shares Series C.

Washington Prime Group is a Real Estate Investment Trust with retail properties located in the Midwest, and National General Holdings Corporation provides personal and commercial insurance services to its customers. Investors may have found both issuers’ preferred shares to be more compelling and stable than their respective companies’ common shares.

Detractors from relative performance included Ashford Hospitality Trust Inc. 7.375% Pref Series G, Energy Transfer Operating LP, Cumulative Prf. Units Series D and Colony Capital 8.75% Cumulative Prf. Shares Series E.

Ashford Hospitality Trust Inc. is a Real Estate Investment Trust that invests in full service hotel properties. Shares of Ashford’s common and preferred issues were under pressure during the period as management addressed concerns of a slowdown in business travel and increased employee costs.

Energy Transfer Partners is a provider of midstream energy services. The company was under pressure during the period as was most of the energy sector.

Colony Capital is a diversified Real Estate Investment Trust. The company’s common and preferred shares underperformed similar issuers when some analysts questioned the complexity of the company’s balance sheet during the period.

The Fund’s portfolio composition emphasizes issuers that own long-lived assets that generate free cash flow. Preferred stocks issued by real estate investment trusts (REITs) and energy companies (primarily pipelines) comprised about 46% and 18.5% of the Fund’s total assets, respectively, at fiscal year-end. This compares to weightings of approximately 11% and 3% in the benchmark index. The Fund was underweight financial companies relative to the benchmark index (16% vs. 67% of total assets) but overweight mortgage REITs (24% vs. 4% of total assets). The Fund’s manager believes the high level of liquidity in the mortgage-backed securities market presents a more moderate risk profile than that of traditional bank issuers.

Approximately 37% of total assets were fixed-to-floating rate preferred stocks at fiscal year-end. This compares to almost 27% for the benchmark index. These securities have a fixed rate coupon at issue but become a floating rate security after a specified period of time, typically five or ten years after issuance. This structure provides investors with some protection from a rising rate environment while offering a higher current yield than that which is available on securities with coupon rates that float currently.

Dividend Payments

In the fiscal year ended October 31, 2019 the Fund made monthly dividend payments in the amount of $0.19 per share ($2.28 per year). The Fund plans to continue paying monthly dividends but dividends are not guaranteed.

The Fund’s dividend policy will be reviewed on an annual basis with the expectation that the announced dividend rate can be sustained for a period of 12 — 24 months. The Fund’s dividend is expected to be covered by its investment company taxable income (which includes ordinary income and short-term capital gains less expenses). For the purpose of calculating income available for distribution, some cash payments from REITs or MLPs treated as Return of Capital for tax or GAAP purposes may be included. Expenses include an 80 basis point advisory fee, leverage costs and other miscellaneous fees.

7

Management’s Discussion of Fund Performance (unaudited) (continued)

October 31, 2019

Virtus InfraCap U.S. Preferred Stock ETF (continued)

The Fund seeks to maintain relatively stable monthly distributions although the amount of income earned by the Fund varies from period-to-period. To achieve this objective, the Fund may from time-to-time distribute less than the full amount of income earned during a specific period, withholding some income for distribution in future periods. Consequently, the amount of income distributed in any one period may be more or less than the actual amount of income earned in that period.

The Fund’s current indicated yield based on its closing price on the New York Stock Exchange on October 31, 2019 ($26.57) was 8.58%. The Fund’s current indicated yield based on its Net Asset Value (NAV) per share ($26.43) was 8.62%.

Use of Leverage

As described in the Fund’s prospectus, the Fund may use modest leverage to help achieve its current income objective. The leverage ratio is expected to be maintained in a range of 10-35% of total assets over the long term. As of October 31, 2019, borrowing amounted to 17.4% of net asset value.

The Fund’s cost of borrowing fell during the fiscal year, and borrowed funds continued to generate an attractive positive spread. The Fund borrows at a 120 basis point premium to the 3-month LIBOR rate. The 3-month LIBOR rate fell to 1.90% at October 31, 2019 from 2.56% at October 31, 2018, and spreads ended the fiscal year modestly wider.

Use of Options

As described in the prospectus, the Fund utilizes options strategies to seek to boost the amount of income available to distribute to shareholders. The primary activity is covered call writing. The activity is focused on a small number of common stocks and ETFs owned by the Fund. The option strategy as implemented by the Fund’s manager was a net benefit to the Fund’s performance.

Outlook

The Fund’s manager believes the preferred stock asset class is inefficiently priced and offers active managers the opportunity to add to benchmark returns. Over the years, special emphasis will be placed on maximizing the Fund’s yield-to-call. The Fund’s manager believes that avoiding issues that are callable and trading at prices above the call price will help achieve that result. Many preferred stock investors, especially passive funds, ignore the risk of owning issues with a negative yield-to-call.

After collapsing to historic lows, long-term Treasury rates are starting to lift, as confidence in global economic growth builds. The Fund’s manager believes wide interest rate spreads over long-duration U.S. Treasury bonds offer substantial protection from rate rises. The correlation between Treasury bond price moves and price swings in preferred stocks is likely to be moderated by the wide spreads.

The Fund’s manager believes that rates for long-duration fixed income securities are likely capped at a low level by investor demand for yield. Long-term U.S. interest rates remain very attractive to global investors and the Fund’s manager believes U.S. inflation indicators suggest a hands-off approach by the Federal Reserve is likely. In a relatively stable interest rate environment, the Fund’s manager believes preferred stock investors should earn attractive risk-adjusted returns.

The preceding information is the opinion of the investment adviser and sub-adviser. Any such opinions are subject to change at any time based upon market or other conditions and should not be relied upon as investment advice. Statements of fact are from sources considered reliable, but the investment adviser and sub-adviser make no representation or warranty as to their completeness or accuracy. Past performance is no guarantee of future results, and there is no guarantee that market forecasts will be realized.

Performance as of 10/31/2019

| | | | Average Annual Total Return

|

| | | | Fund

Net Asset Value

| | Fund

Market Price

| | S&P U.S.

Preferred Stock

Index1

|

1 Year | | | | | 18.37 | % | | | 18.97 | % | | | 11.61 | % |

Since Inception2 | | | | | 13.00 | % | | | 13.37 | % | | | 8.15 | % |

| 1 | | The S&P U.S. Preferred Stock Index measures performance of the U.S. preferred stock market. Preferred stocks pay dividends at a specified rate and receive preference over common stocks in terms of dividend payments and liquidation of assets. The index is calculated on a total return basis with dividend reinvested. The index is unmanaged, its returns do not reflect any fees, expenses, or sales charges, and is not available for direct investment. |

8

Management’s Discussion of Fund Performance (unaudited) (continued)

October 31, 2019

Virtus InfraCap U.S. Preferred Stock ETF (continued)

Performance data quoted represents past performance and past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance data may be higher or lower than actual data quoted. Returns do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. For the most current month-end performance data please visit www.virtusetfs.com or call toll free (800) 243-4361. Market price returns are based on the mid-point of the highest bid and lowest offer for Fund shares as of the scheduled close of regular trading on the New York Stock Exchange Arca (“NYSE”), ordinarily 4:00 p.m. Eastern time, on each day during which the NYSE is open for trading, and do not represent the returns an investor would receive if shares were traded at other times.

Exchange Traded Funds: The value of an ETF may be more volatile than the underlying portfolio of securities the ETF is designed to track. The costs of owning the ETF may exceed the cost of investing directly in the underlying securities.

Market Price/NAV: Shares of ETFs often trade at a discount to their net asset value, which may increase investors’ risk of loss. At the time of sale, an investor’s shares may have a market price that is above or below the Fund’s NAV.

Preferred Stocks: Preferred stocks may decline in price, fail to pay dividends, or be illiquid.

Leverage: When a fund leverages its portfolio, the value of its shares may be more volatile and all other risks may be compounded.

Derivatives: Investments in derivatives such as futures, options, forwards, and swaps may increase volatility or cause a loss greater than the principal investment.

Sector Focus: To the extent the Fund has significant exposure to one or more sectors, this may make the Fund particularly susceptible to adverse economic, political or regulatory occurrences and changes affecting companies in those sectors.

Non-Diversified: The Fund is non-diversified and may be more susceptible to factors negatively impacting its holdings to the extent that each security represents a larger portion of the Fund’s assets.

No Guarantee: There is no guarantee that the Fund will meet its objective.

Prospectus: For additional information on risks, please see the Fund’s prospectus. The Fund may not be suitable for all investors.

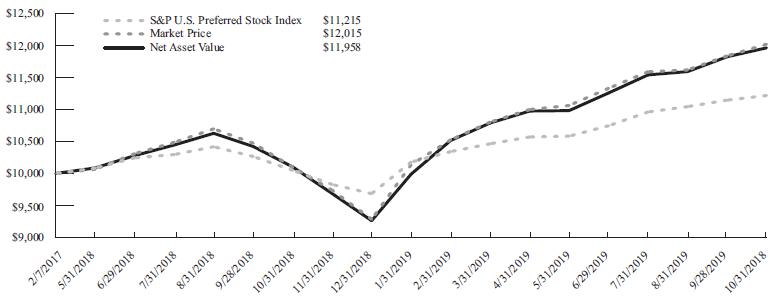

Value of a $10,000 Investment Since Inception at Net Asset Value

The chart above represents historical performance of a hypothetical investment of $10,000 over the life of the Fund, assuming reinvestment of distributions. Past performance does not guarantee future results.

9

Management’s Discussion of Fund Performance (unaudited) (continued)

October 31, 2019

Virtus LifeSci Biotech Clinical Trials ETF

The Virtus LifeSci Biotech Clinical Trials ETF (the “Fund”) seeks to track the LifeSci Biotechnology Clinical Trials Index (the “Index”), which provides passive exposure to U.S.-listed biotechnology stocks with a lead drug in the clinical trial stage of development.

For the fiscal year ended October 31, 2019, the Fund returned -1.67%, compared with the Index return of -1.25%.

Top performing stocks for the fiscal year included Allakos, Inc., which is involved in the development of therapeutic antibodies. The company’s shares doubled after it successfully completed its Phase 2 study for its eosinophil and mast cell antibody. Other positive contributors included Karyopharm Therapeutics, which focuses on the research and development of medicines to treat cancers, and Alder Biopharmaceuticals which is being acquired for $18 per share in cash by Danish Company Lundbeck LLC. The Fund sold its stock in Alder during the fiscal year. Iovance Biotherapuetics, which is involved in the development and commercialization of cancer immunotherapy products, also benefited relative performance. Rounding out the top contributors for the fiscal year were ArQule Inc., which focuses on the research and development of therapeutics to treat cancers and rare diseases, and Amyris Inc., an industrial biotechnology company.

Detractors from relative performance included Akebia Therapeutics, which engages in the development and commercialization of therapeutics for patients with kidney disease. Savara, Inc., a specialty pharmaceutical company involved in the development of serious respiratory diseases, detracted from relative returns. Novavax Inc., which develops vaccines to prevent viral infections, was a poor contributor to performance. The Fund sold its stock in both Savara, Inc. and Novavax Inc. during the fiscal year. Other negative contributors during the period were Adverum Biotechnologies, Inc., a clinical stage company that develops gene therapies for ophthalmic diseases, and KalVista Pharmaceuticals Inc., which produces small molecule protease inhibitors for hereditary angioedema (HAE) and diabetic macular edema (DME).

The preceding information is the opinion of the investment adviser. Any such opinions are subject to change at any time based upon market or other conditions and should not be relied upon as investment advice. Statements of fact are from sources considered reliable, but the investment adviser makes no representation or warranty as to their completeness or accuracy. Past performance is no guarantee of future results, and there is no guarantee that market forecasts will be realized.

Performance as of 10/31/2019

| | | | Average Annual Total Return

|

| | | | Fund

Net Asset Value

| | Fund

Market Price

| | LifeSci Biotechnology

Clinical Trials Index1

| | S&P 500®Index2

|

1 Year | | | | | (1.67 | )% | | | (1.75 | )% | | | (1.25 | )% | | | 14.33 | % |

Since Inception3 | | | | | 1.47 | % | | | 1.45 | % | | | 1.98 | % | | | 11.51 | % |

| 1 | | The LifeSci Biotechnology Clinical Trials Index is designed to track the performance of U.S.-listed biotechnology stocks with a lead drug in the clinical trial stage of development, typically a Phase 1, Phase 2 or Phase 3 trial, but prior to receiving marketing approval. The index is unmanaged, its returns do not reflect any fees, expenses, or sales charges, and is not available for direct investment. |

| 2 | | The S&P 500®Index is a free-float market capitalization-weighted index of 500 of the largest U.S. companies. The index is calculated on a total return basis with dividends reinvested. The index is unmanaged, its returns do not reflect any fees, expenses, or sales charges, and is not available for direct investment. |

Performance data quoted represents past performance and past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance data may be higher or lower than actual data quoted. Returns do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. For the most current month-end performance data please visit www.virtusetfs.com or call toll free (800) 243-4361. Market price returns are based on the mid-point of the highest bid and lowest offer for Fund shares as of the scheduled close of regular trading on the New York Stock Exchange Arca (“NYSE”), ordinarily 4:00 p.m. Eastern time, on each day during which the NYSE is open for trading, and do not represent the returns an investor would receive if shares were traded at other times.

Exchange Traded Funds: The value of an ETF may be more volatile than the underlying portfolio of securities the ETF is designed to track. The costs of owning the ETF may exceed the cost of investing directly in the underlying securities.

Market Price/NAV: Shares of ETFs often trade at a discount to their net asset value, which may increase investors’ risk of loss. At the time of sale, an investor’s shares may have a market price that is above or below the Fund’s NAV.

10

Management’s Discussion of Fund Performance (unaudited) (continued)

October 31, 2019

Virtus LifeSci Biotech Clinical Trials ETF (continued)

Biotechnology Industry Risk: The Fund’s assets will be concentrated in investments in the securities of issuers engaged primarily in the biotechnology industry. Companies within the biotechnology industry spend heavily on research and development, which may not necessarily lead to commercially successful products in the near or long term. In order to fund operations, these companies may require financing from the capital markets, which may not always be available on satisfactory terms or at all. The biotechnology industry is also subject to significant governmental regulation, and the need for governmental approvals, including, without limitation, FDA approval. The securities of biotechnology companies, especially those of smaller or newer companies, tend to be more volatile than those of companies with larger capitalizations or markets generally.

Industry/Sector Concentration: A fund that focuses its investments in a particular industry or sector will be more sensitive to conditions that affect that industry or sector than a non-concentrated fund.

Correlation to Index: The performance of the Fund and its index may vary somewhat due to factors such as Fund flows, transaction costs, and timing differences associated with additions to and deletions from its index.

No Guarantee: There is no guarantee that the Fund will meet its objective.

Prospectus: For additional information on risks, please see the Fund’s prospectus. The Fund may not be suitable for all investors.

Value of a $10,000 Investment Since Inception at Net Asset Value

The chart above represents historical performance of a hypothetical investment of $10,000 over the life of the Fund, assuming reinvestment of distributions. Past performance does not guarantee future results.

11

Management’s Discussion of Fund Performance (unaudited) (continued)

October 31, 2019

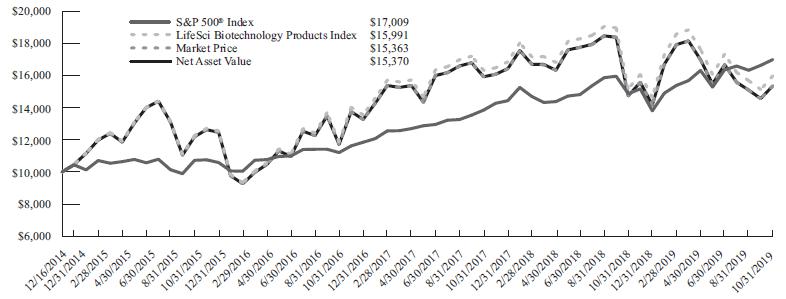

Virtus LifeSci Biotech Products ETF

The Virtus LifeSci Biotech Products ETF (the “Fund”) seeks to track the LifeSci Biotechnology Products Index (the “Index”), which provides passive exposure to U.S.-listed biotechnology stocks with at least one drug therapy approved by the U.S. Food & Drug Administration (“FDA”) for marketing.

For the fiscal year ended October 31, 2019, the Fund returned 4.22%, compared with the Index return of 5.32%.

The biggest driver of return for the Fund during the fiscal year was mergers & acquisitions (M&A) activity, particularly among firms in the oncology space. The top contributors to performance included Array BioPharma Inc., which was acquired by Pfizer during the fiscal year, and ACADIA Pharmaceuticals, which addresses central nervous system disorders. The Fund sold its stock in Array during the fiscal year. Other leading performers were Seattle Genetics, which develops antibody drugs for lymphoma, and The Medicines Co., which is a biopharmaceutical company focused on combatting atherosclerosis and cardiovascular disease.

Detractors from relative performance included Sarepta Therapeutics, which is involved in the development of ribonucleic acid, gene therapy, and gene editing. Clovis Oncology, which develops medicines to treat cancer and diagnostics tools to enhance development, also performed poorly during the fiscal year. Intercept Pharmaceuticals, Inc., which is involved in nonalcoholic steatohepatitis (NASH) therapies which treat chronic liver diseases, detracted from performance.

The preceding information is the opinion of the investment adviser. Any such opinions are subject to change at any time based upon market or other conditions and should not be relied upon as investment advice. Statements of fact are from sources considered reliable, but the investment adviser makes no representation or warranty as to their completeness or accuracy. Past performance is no guarantee of future results, and there is no guarantee that market forecasts will be realized.

Performance as of 10/31/2019

| | | | Average Annual Total Return

|

| | | | Fund

Net Asset Value

| | Fund

Market Price

| | LifeSci Biotechnology

Products Index1

| | S&P 500®Index2

|

1 Year | | | | | 4.22 | % | | | 4.21 | % | | | 5.32 | % | | | 14.33 | % |

Since Inception3 | | | | | 9.21 | % | | | 9.20 | % | | | 10.10 | % | | | 11.51 | % |

| 1 | | The LifeSci Biotechnology Products Index is designed to track the performance of U.S.-listed biotechnology stocks with at least one drug therapy approved by the FDA for marketing. The index is unmanaged, its returns do not reflect any fees, expenses, or sales charges, and is not available for direct investment. |

| 2 | | The S&P 500®Index is a free-float market capitalization-weighted index of 500 of the largest U.S. companies. The index is calculated on a total return basis with dividends reinvested. The index is unmanaged, its returns do not reflect any fees, expenses, or sales charges, and is not available for direct investment. |

Performance data quoted represents past performance and past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance data may be higher or lower than actual data quoted. Returns do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. For the most current month-end performance data please visit www.virtusetfs.com or call toll free (800) 243-4361. Market price returns are based on the mid-point of the highest bid and lowest offer for Fund shares as of the scheduled close of regular trading on the New York Stock Exchange Arca (“NYSE”), ordinarily 4:00 p.m. Eastern time, on each day during which the NYSE is open for trading, and do not represent the returns an investor would receive if shares were traded at other times.

Exchange Traded Funds: The value of an ETF may be more volatile than the underlying portfolio of securities the ETF is designed to track. The costs of owning the ETF may exceed the cost of investing directly in the underlying securities.

Market Price/NAV: Shares of ETFs often trade at a discount to their net asset value, which may increase investors’ risk of loss. At the time of sale, an investor’s shares may have a market price that is above or below the Fund’s NAV.

12

Management’s Discussion of Fund Performance (unaudited) (continued)

October 31, 2019

Virtus LifeSci Biotech Products ETF (continued)

Biotechnology Industry Risk: The Fund’s assets will be concentrated in investments in the securities of issuers engaged primarily in the biotechnology industry. Companies within the biotechnology industry spend heavily on research and development, which may not necessarily lead to commercially successful products in the near or long term. In order to fund operations, these companies may require financing from the capital markets, which may not always be available on satisfactory terms or at all. The biotechnology industry is also subject to significant governmental regulation, and the need for governmental approvals, including, without limitation, FDA approval. The securities of biotechnology companies, especially those of smaller or newer companies, tend to be more volatile than those of companies with larger capitalizations or markets generally.

Industry/Sector Concentration: A fund that focuses its investments in a particular industry or sector will be more sensitive to conditions that affect that industry or sector than a non-concentrated fund.

Correlation to Index: The performance of the Fund and its index may vary somewhat due to factors such as Fund flows, transaction costs, and timing differences associated with additions to and deletions from its index.

No Guarantee: There is no guarantee that the Fund will meet its objective.

Prospectus: For additional information on risks, please see the Fund’s prospectus. The Fund may not be suitable for all investors.

Value of a $10,000 Investment Since Inception at Net Asset Value

The chart above represents historical performance of a hypothetical investment of $10,000 over the life of the Fund, assuming reinvestment of distributions. Past performance does not guarantee future results.

13

Management’s Discussion of Fund Performance (unaudited) (continued)

October 31, 2019

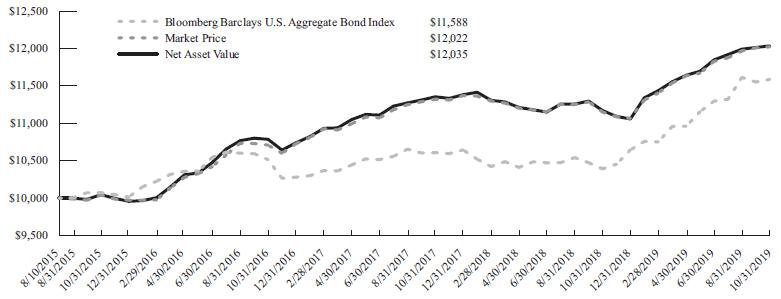

Virtus Newfleet Multi-Sector Bond ETF

The Virtus Newfleet Multi-Sector Bond ETF (the “Fund”) seeks to provide a high level of current income and, secondarily, capital appreciation.

How did the markets perform during the Fund’s fiscal year ended October 31, 2019?

The 12-month period included multiple challenges, including bouts of elevated volatility. The final quarter of 2018 witnessed a meaningful mispricing of risk assets. This was especially pronounced in December 2018. Fixed income investors, like all market participants, continued to wrestle with volatility brought on by geopolitical developments, trade rhetoric, mixed global economic signals, and central banks’ attempts to normalize monetary policy via policy rate increases and balance sheet adjustments. U.S. economic data stayed on a positive trend, which contrasted with other global economies. During this time, U.S. Treasuries performed well while spread sector performance was mixed. Sectors within the securitized products universe, such as asset-backed securities and residential mortgage-backed securities, generally outperformed, whereas corporate and emerging markets-related sectors lagged. Within most spread sectors, assets with short and intermediate duration and those with higher credit ratings outperformed on a total return basis. The high yield sector was the largest underperformer during the fourth quarter of 2018.

The year 2019 began in stark contrast to how 2018 ended. While many of the same concerns loomed, major global central banks, including the Federal Reserve (the Fed) and the European Central Bank (ECB), reacted to slowing economic activity and tame inflation by pivoting their tone and policy toward easing. This significant development, combined with improved valuations, led investors to favor risk assets. Most spread sectors outperformed through October 2019, led by investment grade corporates, corporate high yield, and emerging markets. Within spread sectors, the asset classes that were hardest hit in late 2018 outperformed during the first 10 months of 2019. Given the change in U.S. interest rates, longer duration within most asset classes outperformed on a total return basis. Securitized sectors, while still positive, lagged other sectors.

At its December 2018 meeting, the Fed raised its target range to 2.25% to 2.50%, up from 2.00% to 2.25%. The Fed, indicating a pivot toward easing of monetary policy early in 2019, signaled that rates are likely on hold for the balance of 2019. The Fed also announced changes to the management of its balance sheet. However, in early June 2019 the Chairman of the Fed indicated they are monitoring the impact of the tariff issues on the U.S. economic outlook, which was interpreted by the market that the Fed had opened the door to the rate cut discussion. The Fed subsequently lowered its target rate at the July, September, and October 2019 meetings to a range of 1.50-1.75%. The Fed continued through the end of the fiscal year to reinforce its view that current policy is appropriate and that it will continue to act to support the economic expansion.

The Treasury yield curve continued to twist and shift broadly flatter and lower during the 12 months ended October 31, 2019, and some segments of the U.S. yield curve remained inverted.

What factors affected the Fund’s performance during its fiscal year?

The outperformance of most spread sectors relative to U.S. Treasuries and agency mortgage-backed securities was the key driver of the Fund’s performance for the fiscal year ended October 31, 2019. Among fixed income sectors, the Fund’s allocations to and issue selection within the corporate high quality, yankee high quality, and emerging markets high yield sectors had a positive impact on performance for the fiscal year.

The Fund’s overall shorter duration relative to the benchmark hurt performance from a total return perspective. During the fiscal year, the Fund’s allocations to high yield bank loans and corporate high yield were the largest detractors from relative performance. Asset-backed and non-agency residential mortgage-backed securities in which the Fund invested also underperformed, given the shorter duration of these sectors during a period when rates were declining, thus detracting from the Fund’s performance.

The preceding information is the opinion of the investment adviser and sub-adviser. Any such opinions are subject to change at any time based upon market or other conditions and should not be relied upon as investment advice. Statements of fact are from sources considered reliable, but the investment adviser and sub-adviser make no representation or warranty as to their completeness or accuracy. Past performance is no guarantee of future results, and there is no guarantee that market forecasts will be realized.

Performance as of 10/31/2019

| | | | Average Annual Total Return

| |

| | | | Fund

Net Asset Value

| | Fund

Market Price

| | Bloomberg Barclays

U.S. Aggregate

Bond Index1

|

1 Year | | | | | 7.74 | % | | | 7.82 | % | | | 11.51 | % |

Since Inception2 | | | | | 4.48 | % | | | 4.45 | % | | | 3.55 | % |

| 1 | | The Bloomberg Barclays U.S. Aggregate Bond Index measures the U.S. investment grade fixed rate bond market. The index is calculated on a total return basis. The index is unmanaged, its returns do not reflect any fees, expenses, or sales charges, and is not available for direct investment. |

14

Management’s Discussion of Fund Performance (unaudited) (continued)

October 31, 2019

Virtus Newfleet Multi-Sector Bond ETF (continued)

Performance data quoted represents past performance and past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance data may be higher or lower than actual data quoted. Returns do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. For the most current month-end performance data please visitwww.virtusetfs.comor call toll free (800) 243-4361. Market price returns are based on the mid-point of the highest bid and lowest offer for Fund shares as of the scheduled close of regular trading on the New York Stock Exchange Arca (“NYSE”), ordinarily 4:00 p.m. Eastern time, on each day during which the NYSE is open for trading, and do not represent the returns an investor would receive if shares were traded at other times.

Credit & Interest: Debt securities are subject to various risks, the most prominent of which are credit and interest rate risk. The issuer of a debt security may fail to make interest and/or principal payments. Values of debt securities may rise or fall in response to changes in interest rates, and this risk may be enhanced with longer-term maturities.

High Yield-High Risk Fixed Income Securities: There is a greater level of credit risk and price volatility involved with high yield securities than investment grade securities.

Foreign & Emerging Markets: Investing internationally, especially in emerging markets, involves additional risks such as currency, political, accounting, economic, and market risk.

Bank Loans: Loans may be unsecured or not fully collateralized, may be subject to restrictions on resale and/or trade infrequently on the secondary market. Loans can carry significant credit and call risk, can be difficult to value and have longer settlement times than other investments, which can make loans relatively illiquid at times.

ABS/MBS: Changes in interest rates can cause both extension and prepayment risks for asset- and mortgage-backed securities. These securities are also subject to risks associated with the repayment of underlying collateral.

Market Price/NAV: Shares of ETFs often trade at a discount to their net asset value, which may increase investors’ risk of loss. At the time of sale, an investor’s shares may have a market price that is above or below the Fund’s NAV.

Prospectus: For additional information on risks, please see the Fund’s prospectus. The Fund may not be suitable for all investors.

Value of a $10,000 Investment Since Inception at Net Asset Value

The chart above represents historical performance of a hypothetical investment of $10,000 over the life of the Fund, assuming reinvestment of distributions. Past performance does not guarantee future results.

15

Management’s Discussion of Fund Performance (unaudited) (continued)

October 31, 2019

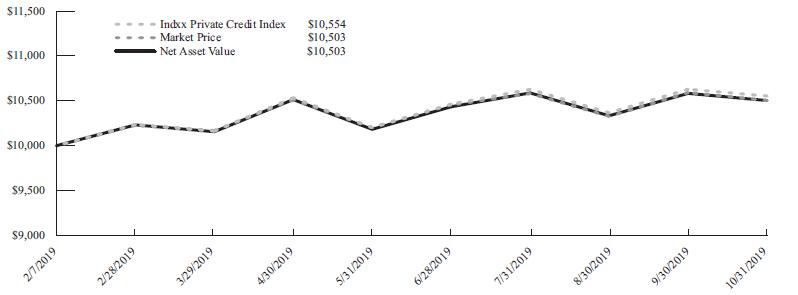

Virtus Private Credit Strategy ETF

The Virtus Private Credit Strategy ETF (the “Fund”) strives to deliver an alternative source of yield to traditional fixed income by focusing on the private credit market, particularly companies involved in lending to non-investment grade, small- to mid-sized U.S. companies.

The Fund seeks to track the Indxx Private Credit Index (the “Index”), which provides passive exposure to U.S.-listed instruments that emphasize private credit, including business development companies (“BDCs”) and closed-end funds (“CEFs”).

For the fiscal period from the Fund’s inception on February 7, 2019, through October 31, 2019, the Fund returned 5.03%, compared with the Index return of 5.54%. The Fund paid a distribution of $1.38 to shareholders during the period.

The best performing groups for the Fund during the fiscal period were BDCs that are involved in debt and equity financing to lower middle-market companies. These included Main Street Capital Corporation and Gladstone Investment Corp. TriplePoint Venture Growth BDC, which focuses on providing financing to companies at the venture growth stage (typically technology, life sciences, and higher growth industries), was another top contributor.

Detractors from relative performance included BDCs primarily involved in both loans and equity investments to middle market companies. These included Blackrock Capital Investment Corp. and Investcorp Credit Management. MCC Capital Partners was another BDC that detracted from performance due to a long merger period with Sierra Income Corp. The Fund sold its stock in MCC Capital Partners during the fiscal year.

The preceding information is the opinion of the investment adviser. Any such opinions are subject to change at any time based upon market or other conditions and should not be relied upon as investment advice. Statements of fact are from sources considered reliable, but the investment adviser makes no representation or warranty as to their completeness or accuracy. Past performance is no guarantee of future results, and there is no guarantee that market forecasts will be realized.

Performance as of 10/31/2019

| | | | Cumulative Total Return

|

| | | | Fund

Net Asset Value

| | Fund

Market Price

| | Index Private

Credit Index1

|

Since Inception2 | | | | | 5.03 | % | | | 5.03 | % | | | 5.54 | % |

| 1 | | The Indxx Private Credit Index is an index of listed BDCs and CEFs with a private credit focus. The Index is designed to serve as a broad-based benchmark for long-only investments in private credit. The Index is unmanaged, its returns do not reflect any fees, expenses, or sales charges, and is not available for direct investment. |

Performance data quoted represents past performance and past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance data may be higher or lower than actual data quoted. Returns do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. For the most current month-end performance data please visit www.virtusetfs.com or call toll free (800) 243-4361. Market price returns are based on the mid-point of the highest bid and lowest offer for Fund shares as of the scheduled close of regular trading on the New York Stock Exchange Arca (“NYSE”), ordinarily 4:00 p.m. Eastern time, on each day during which the NYSE is open for trading, and do not represent the returns an investor would receive if shares were traded at other times.

Exchange Traded Funds: The value of an ETF may be more volatile than the underlying portfolio of securities the ETF is designed to track. The costs of owning the ETF may exceed the cost of investing directly in the underlying securities.

Market Price/NAV: Shares of ETFs often trade at a discount to their net asset value, which may increase investors’ risk of loss. At the time of sale, an investor’s shares may have a market price that is above or below the Fund’s NAV.

Private Credit Funds: Private credit funds that invest in closed-end funds and business development companies bear the risk of these underlying assets, including liquidity, industry, currency, valuation and credit risks.

Equity Securities: The market price of equity securities may be adversely affected by financial market, industry, or issuer-specific events. Focus on a particular style or on small or medium-sized companies may enhance that risk.

Non-Diversified: The Fund is non-diversified and may be more susceptible to factors negatively impacting its holdings to the extent that each security represents a larger portion of the Fund’s assets.

16

Management’s Discussion of Fund Performance (unaudited) (continued)

October 31, 2019

Virtus Private Credit Strategy ETF (continued)

Credit & Interest: Debt securities are subject to various risks, the most prominent of which are credit and interest rate risk. The issuer of a debt security may fail to make interest and/or principal payments. Values of debt securities may rise or fall in response to changes in interest rates, and this risk may be enhanced with longer-term maturities.

High Yield-High Risk Fixed Income Securities: There is a greater level of credit risk and price volatility involved with high yield securities than investment grade securities.

Fund of Funds: Because the fund can invest in other funds, it indirectly bears its proportionate share of the operating expenses and management fees of the underlying fund(s).

Passive Strategy/Index Risk: A passive investment strategy seeking to track the performance of the Underlying Index may result in the fund holding securities regardless of market conditions or their current or projected performance. This could cause the Fund’s returns to be lower than if the Fund employed an active strategy.

Correlation to Index: The performance of the Fund and its index may vary somewhat due to factors such as Fund flows, transaction costs, and timing differences associated with additions to and deletions from its index.

Closed-End Funds: Closed-end funds may trade at a discount from their net asset values, which may affect whether the fund will realize gains or losses. They may also employ leverage, which may increase volatility.

Prospectus: For additional information on risks, please see the Fund’s prospectus. The Fund may not be suitable for all investors.

Value of a $10,000 Investment Since Inception at Net Asset Value

The chart above represents historical performance of a hypothetical investment of $10,000 over the life of the Fund, assuming reinvestment of distributions. Past performance does not guarantee future results.

17

Management’s Discussion of Fund Performance (unaudited) (continued)

October 31, 2019

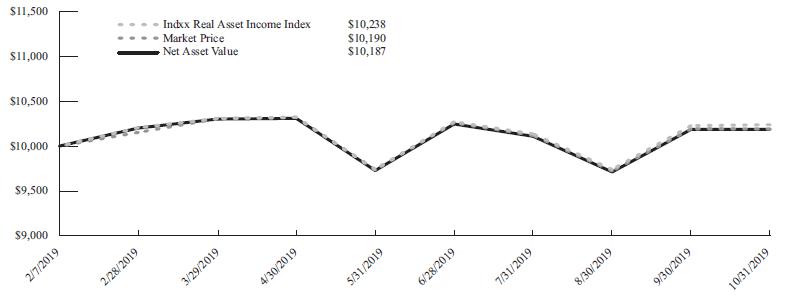

Virtus Real Asset Income ETF

The Virtus Real Asset Income ETF (the “Fund”) aims to provide passive exposure to high income-producing real asset securities. The Fund seeks to track the Indxx Real Asset Income Index (the “Index”), which is comprised of U.S.-listed securities with a history of dividend growth across three real asset categories:

• | | real estate, including real estate development and real estate investment trusts (“REITs”); |

• | | natural resources, including oil, metals, farmland, and forestry companies; and |

• | | infrastructure, including utilities, telecoms, and master limited partnerships (“MLPs”). |

For the fiscal period from the Fund’s inception on February 7, 2019, through October 31, 2019, the Fund returned 1.87%, compared with the Index return of 2.38%. The Fund paid a distribution of $0.53 to shareholders during the period.

The best performing groups for the Fund during the fiscal period included REITs, electric utilities, and oil & gas pipelines. Top stocks included Community Healthcare Trust, which engages in the acquisition of real estate properties that are leased to hospitals and healthcare systems. Reliance Steel & Aluminum Co., the largest metals distributor in North America, was another leading contributor, due to its strong free cash flow and organic growth. Air Products and Chemicals, Inc., a specialty chemical company that manufactures and distributes atmospheric gases, also contributed to the Fund’s relative returns.

Detractors from relative performance included RPC, Inc., which faced pressure in its fracturing business and reduced its dividend. Telecom Argentina, which sold off in sympathy with Argentina and the telecom sector, detracted from returns. Another negative contributor was Sociedad Quimica y Minera de Chile S.A., which engages in the production and distribution of fertilizers, potassium nitrate, iodine, and lithium chemicals.

The preceding information is the opinion of the investment adviser. Any such opinions are subject to change at any time based upon market or other conditions and should not be relied upon as investment advice. Statements of fact are from sources considered reliable, but the investment adviser makes no representation or warranty as to their completeness or accuracy. Past performance is no guarantee of future results, and there is no guarantee that market forecasts will be realized.

Performance as of 10/31/2019

| | | | Cumulative Total Return

|

| | | | Fund

Net Asset Value

| | Fund

Market Price

| | Index Real Asset

Income Index1

|

Since Inception2 | | | | | 1.87 | % | | | 1.90 | % | | | 2.38 | % |

| 1 | | The Indxx Real Asset Income Index tracks the performance of US-listed securities in the Real Asset space (Real Estate, Natural Resources and Infrastructure) emphasizing dividend growth. The Index is unmanaged, its returns do not reflect any fees, expenses, or sales charges, and is not available for direct investment. |

Performance data quoted represents past performance and past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance data may be higher or lower than actual data quoted. Returns do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. For the most current month-end performance data please visit www.virtusetfs.com or call toll free (800) 243-4361. Market price returns are based on the mid-point of the highest bid and lowest offer for Fund shares as of the scheduled close of regular trading on the New York Stock Exchange Arca (“NYSE”), ordinarily 4:00 p.m. Eastern time, on each day during which the NYSE is open for trading, and do not represent the returns an investor would receive if shares were traded at other times.

Exchange Traded Funds: The value of an ETF may be more volatile than the underlying portfolio of securities the ETF is designed to track. The costs of owning the ETF may exceed the cost of investing directly in the underlying securities.

Market Price/NAV: Shares of ETFs often trade at a discount to their net asset value, which may increase investors’ risk of loss. At the time of sale, an investor’s shares may have a market price that is above or below the Fund’s NAV.

Equity Securities: The market price of equity securities may be adversely affected by financial market, industry, or issuer-specific events. Focus on a particular style or on small or medium-sized companies may enhance that risk.

18

Management’s Discussion of Fund Performance (unaudited) (continued)

October 31, 2019

Virtus Real Asset Income ETF (continued)

Equity REITs: The Fund may be negatively affected by factors specific to the real estate market, including interest rates, leverage, property, and management.

Non-Diversified: The Fund is non-diversified and may be more susceptible to factors negatively impacting its holdings to the extent that each security represents a larger portion of the Fund’s assets.

Infrastructure: A fund that focuses its investments in infrastructure-related companies will be more sensitive to conditions affecting their business or operations.

MLPs: Investments in Master Limited Partnerships may be adversely impacted by tax law changes, regulation, or factors affecting underlying assets.

Passive Strategy/Index Risk: A passive investment strategy seeking to track the performance of the Underlying Index may result in the fund holding securities regardless of market conditions or their current or projected performance. This could cause the Fund’s returns to be lower than if the Fund employed an active strategy.

Correlation to Index: The performance of the Fund and its index may vary somewhat due to factors such as Fund flows, transaction costs, and timing differences associated with additions to and deletions from its index.

Prospectus: For additional information on risks, please see the Fund’s prospectus. The Fund may not be suitable for all investors.

Value of a $10,000 Investment Since Inception at Net Asset Value

The chart above represents historical performance of a hypothetical investment of $10,000 over the life of the Fund, assuming reinvestment of distributions. Past performance does not guarantee future results.

19

Management’s Discussion of Fund Performance (unaudited) (continued)

October 31, 2019

Virtus WMC Global Factor Opportunities ETF

The Virtus WMC Global Factor Opportunities ETF (the “Fund”) (NYSE: VGFO) is an actively managed ETF that employs a dynamic, global multi-factor strategy that combines a quantitative investment approach with active management. Wellington Management’s proprietary value1, momentum2, and quality3 factors are used to drive stock selection generally within four distinct world regions—the U.S., Japan, Europe, and Emerging Markets—to create a diversified portfolio which seeks to adapt to changes in the risk environment.

Global equities rose over the trailing twelve-month period ended October 31, 2019, as measured by the MSCI All Country World Index. While U.S. equities led global markets during the period, Europe, Japan, and Emerging Market equities all posted positive gains. Across developed markets, a risk-off sentiment dominated as risk-aversion factors such as low volatility and expressions of quality outperformed other factor classes. Factor behavior was more varied in Emerging Markets, where trend-following factors such as momentum and growth led markets alongside expressions of quality. This occurred as investors grappled with ongoing macro uncertainties including slowing global growth and ongoing trade disputes between the United States and its trading partners.

During the fiscal year ended October 31, 2019, the Fund’s NAV increased by 11.32%, underperforming its benchmark, the MSCI All Country World Index (Net), which rose by 12.59%. Each of the four regions underperformed their respective benchmarks, however positioning in the United States was the most significant detractor.

Across each of the four regions, the portfolio’s exposure to value names detracted. While this exposure was a headwind across the portfolio, the types of companies that the value factor selected differed by geography. In the United States, for example, the factor allocated to underperforming Consumer Discretionary stocks including Macy’s and Kohl’s, which detracted most. The Fund sold its stock in Macy’s during the fiscal year. In Emerging Markets, the value factor’s Energy exposure was a headwind as it was both overweight the sector and owned underperforming names such as China Petroleum & Chemical Corp. which also detracted from the Fund’s relative performance.

The preceding information is the opinion of the investment adviser and sub-adviser. Any such opinions are subject to change at any time based upon market or other conditions and should not be relied upon as investment advice. Statements of fact are from sources considered reliable, but the investment adviser and sub-adviser make no representation or warranty as to their completeness or accuracy. Past performance is no guarantee of future results, and there is no guarantee that market forecasts will be realized.

| 1 | | Value factor is defined as one that captures the extent to which a stock is priced inexpensively in the market. |

| 2 | | Momentum factor is defined as one that captures sustained relative performance. |

| 3 | | Quality factor is defined as one based on low volatility. |

Performance as of 10/31/2019

| | | | Average Annual Total Return

|

| | | | Fund

Net Asset Value

| | Fund

Market Price

| | MSCI All Country

World Index (net)1

|

1 Year | | | | | 10.60 | % | | | 10.75 | % | | | 12.59 | % |

Since Inception2 | | | | | 5.16 | % | | | 5.33 | % | | | 6.06 | % |

| 1 | | The MSCI All Country World Index (net) is a free float-adjusted market capitalization-weighted index that measures equity performance of developed and emerging markets. The index is calculated on a total return basis with net dividends reinvested. The index is unmanaged, its returns do not reflect any fees, expenses, or sales charges, and is not available for direct investment. |

Performance data quoted represents past performance and past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance data may be higher or lower than actual data quoted. Returns do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. For the most current month-end performance data please visit www.virtusetfs.com or call toll free (800) 243-4361. Market price returns are based on the mid-point of the highest bid and lowest offer for Fund shares as of the scheduled close of regular trading on the New York Stock Exchange Arca (“NYSE”), ordinarily 4:00 p.m. Eastern time, on each day during which the NYSE is open for trading, and do not represent the returns an investor would receive if shares were traded at other times.

Exchange Traded Funds: The value of an ETF may be more volatile than the underlying portfolio of securities the ETF is designed to track. The costs of owning the ETF may exceed the cost of investing directly in the underlying securities.

Market Price/NAV: Shares of ETFs often trade at a discount to their net asset value, which may increase investors’ risk of loss. At the time of sale, an investor’s shares may have a market price that is above or below the Fund’s NAV.

20

Management’s Discussion of Fund Performance (unaudited) (continued)

October 31, 2019

Virtus WMC Global Factor Opportunities ETF (continued)

Equity Securities: The market price of equity securities may be adversely affected by financial market, industry, or issuer-specific events. Focus on a particular style or on small or medium-sized companies may enhance that risk.

Foreign & Emerging Markets: Investing internationally, especially in emerging markets, involves additional risks such as currency, political, accounting, economic, and market risk.

Geographic Concentration: Events negatively affecting the fiscal stability of a state, country, or region will cause the value of the Fund’s shares to decrease. Because the Fund concentrates its assets in a state, country, or region, the Fund is more vulnerable to those areas’ financial, economic, or other political developments.

Equity REITs: The Fund may be negatively affected by factors specific to the real estate market, including interest rates, leverage, property, and management.