As filed with the Securities and Exchange Commission on July 31, 2017.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22761

Stone Ridge Trust

(Exact name of registrant as specified in charter)

510 Madison Avenue, 21st Floor

New York, NY 10022

(Address of principal executive offices) (Zip code)

Stone Ridge Asset Management LLC

510 Madison Avenue, 21st Floor

New York, NY 10022

(Name and address of agent for service)

(855) 609-3680

Registrant’s telephone number, including area code

Date of fiscal year end: May 31, 2017

Date of reporting period: May 31, 2017

Item 1. Reports to Stockholders.

Annual Report

May 31, 2017

Elements U.S. Portfolio

Elements U.S. Small Cap Portfolio

Elements International Portfolio

Elements International Small Cap Portfolio

Table of Contents

|

| PERFORMANCE DATA (Unaudited) |

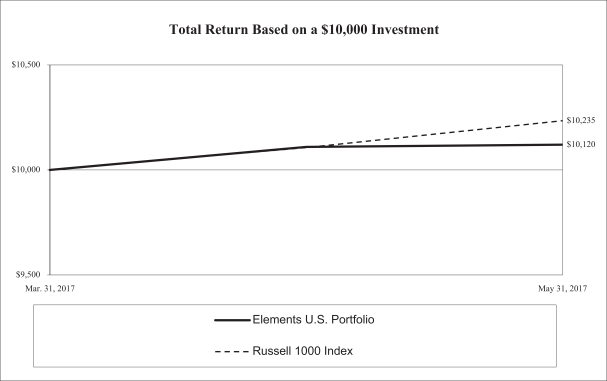

This chart assumes an initial gross investment of $10,000 made on April 3, 2017 (commencement of operations). Returns shown reflect the reinvestment of all dividends, and are net of fees and expenses, and reflect voluntary waivers and reimbursement of all of the Portfolio’s fees and expenses by Stone Ridge Asset Management (“Stone Ridge”). Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. In the absence of fee waivers and reimbursements, which may be discontinued at any time, returns for the Portfolio would have been lower. Past performance is not predictive of future performance. Investment return and principal value will fluctuate, so that your shares, when redeemed, may be worth more or less than the original cost.

The Russell 1000 Index is an unmanaged index that measures the performance of the stocks of the large-capitalization segment of the U.S. equity universe. Index figures do not reflect any deduction of fees, taxes or expenses, and are not available for investment. Returns shown for the index include reinvestment of all dividends.

| | | | |

| TOTAL RETURNS (FOR PERIOD ENDED MAY 31, 2017)(1) | |

| | | Since

Inception

(4/3/17) | |

Elements U.S. Portfolio | | | 1.20% | |

Russell 1000 Index | | | 2.35% | |

| (1) | Portfolio return is less than one year so return is not annualized. |

| | | | | | | | | | | | | | | | |

| | Elements Portfolios | | | | | | Annual Report | | | | | | May 31, 2017 | | |

| | | | | | | | | | |

2

| | | | |

| ELEMENTS U.S. SMALL CAP PORTFOLIO | | | | |

|

| PERFORMANCE DATA (Unaudited) |

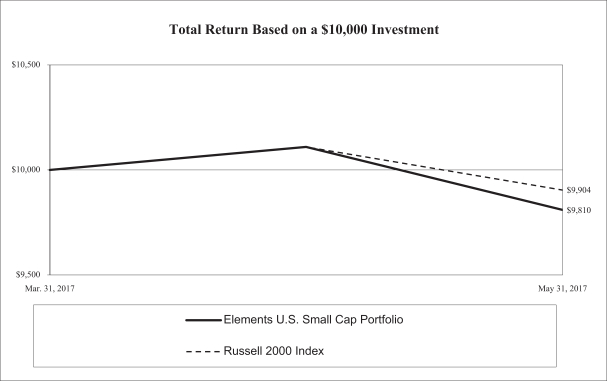

This chart assumes an initial gross investment of $10,000 made on April 3, 2017 (commencement of operations). Returns shown reflect the reinvestment of all dividends, and are net of fees and expenses, and reflect voluntary waivers and reimbursement of all of the Portfolio’s fees and expenses by Stone Ridge. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. In the absence of fee waivers and reimbursements, which may be discontinued at any time, returns for the Portfolio would have been lower. Past performance is not predictive of future performance. Investment return and principal value will fluctuate, so that your shares, when redeemed, may be worth more or less than the original cost.

The Russell 2000 Index is an unmanaged index that measures the performance of the small-capitalization segment of the U.S. equity universe. Index figures do not reflect any deduction of fees, taxes or expenses, and are not available for investment. Returns shown for the index include reinvestment of all dividends.

| | | | |

| TOTAL RETURNS (FOR PERIOD ENDED MAY 31, 2017)(1) | |

| | | Since

Inception

(4/3/17) | |

Elements U.S. Small Cap Portfolio | | | (1.90)% | |

Russell 2000 Index | | | (0.96)% | |

| (1) | Portfolio return is less than one year so return is not annualized. |

| | | | | | | | | | | | | | | | |

| | Elements Portfolios | | | | | | Annual Report | | | | | | May 31, 2017 | | |

| | | | | | | | | | |

3

| | | | |

| ELEMENTS INTERNATIONAL PORTFOLIO | | | | |

|

| PERFORMANCE DATA (Unaudited) |

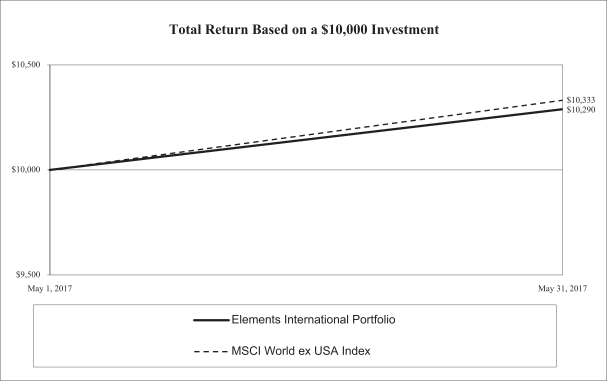

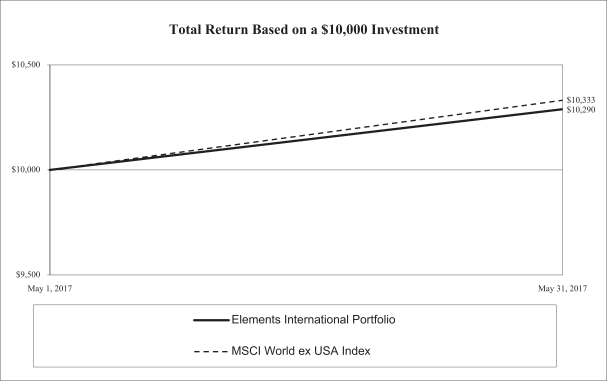

This chart assumes an initial gross investment of $10,000 made on May 1, 2017 (commencement of operations). Returns shown reflect the reinvestment of all dividends, and are net of fees and expenses, and reflect voluntary waivers and reimbursement of all of the Portfolio’s fees and expenses by Stone Ridge. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. In the absence of fee waivers and reimbursements, which may be discontinued at any time, returns for the Portfolio would have been lower. Past performance is not predictive of future performance. Investment return and principal value will fluctuate, so that your shares, when redeemed, may be worth more or less than the original cost.

The MSCI World ex USA Index is a free-float adjusted index which captures large- and mid-cap representation across 22 of 23 developed market countries, as determined by MSCI, excluding the United States. Index figures do not reflect any deduction of fees, taxes or expenses, and are not available for investment. Returns shown for the index include reinvestment of all dividends net of withholding tax.

| | | | |

| TOTAL RETURNS (FOR PERIOD ENDED MAY 31, 2017)(1) | | | |

| | | Since

Inception

(5/1/17) | |

Elements International Portfolio | | | 2.90% | |

MSCI World ex USA Index | | | 3.33% | |

| (1) | Portfolio return is less than one year so return is not annualized. |

| | | | | | | | | | | | | | | | |

| | Elements Portfolios | | | | | | Annual Report | | | | | | May 31, 2017 | | |

| | | | | | | | | | |

4

| | | | |

| ELEMENTS INTERNATIONAL SMALL CAP PORTFOLIO | | | | |

|

| PERFORMANCE DATA (Unaudited) |

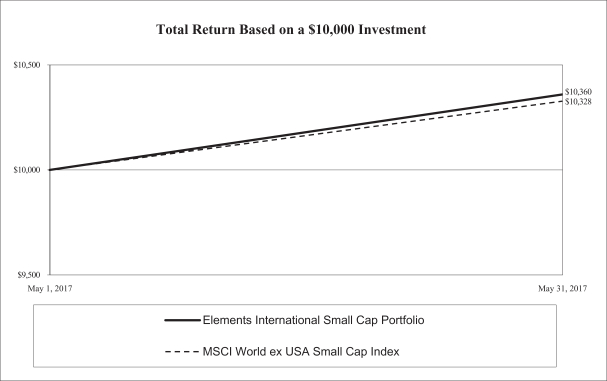

This chart assumes an initial gross investment of $10,000 made on May 1, 2017 (commencement of operations). Returns shown reflect the reinvestment of all dividends, and are net of fees and expenses, and reflect voluntary waivers and reimbursement of all of the Portfolio’s fees and expenses by Stone Ridge. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. In the absence of fee waivers and reimbursements, which may be discontinued at any time, returns for the Portfolio would have been lower. Past performance is not predictive of future performance. Investment return and principal value will fluctuate, so that your shares, when redeemed, may be worth more or less than the original cost.

The MSCI World ex USA Small Cap Index is a free-float adjusted index which captures small-cap representation across 22 or 23 developed market countries, as determined by MSCI, excluding the United States. Index figures do not reflect any deduction of fees, taxes or expenses, and are not available for investment. Returns shown for the index include reinvestment of all dividends net of withholding tax.

| | | | |

| TOTAL RETURNS (FOR PERIOD ENDED MAY 31, 2017)(1) | | | |

| | | Since

Inception

(5/1/17) | |

Elements International Small Cap Portfolio | | | 3.60% | |

MSCI World ex USA Small Cap Index | | | 3.28% | |

| (1) | Portfolio return is less than one year so return is not annualized. |

| | | | | | | | | | | | | | | | |

| | Elements Portfolios | | | | | | Annual Report | | | | | | May 31, 2017 | | |

| | | | | | | | | | |

5

| | |

| Management’s Discussion of Fund Performance | | |

The Elements U.S. Portfolio seeks to capture the equity risk premium by investing in a broad and diverse group of securities or derivatives on U.S. companies, with a focus on intuitive risk factors such as size, value, momentum, and quality that the Adviser believes may contribute to a positive equity risk premium. For the period since the Portfolio’s launch date on April 3, 2017 through May 31, 2017, the Portfolio’s total returns were 1.20%. Periods of positive performance for the Portfolio, such as the most recently completed fiscal year, correspond to periods when the equity risk premium and factors emphasized are positive for U.S. companies. There can be no assurance that the equity risk premium will be positive for the Portfolio’s investments at any time or on average and over time.

The Elements U.S. Small Cap Portfolio seeks to capture the equity risk premium by investing in a broad and diverse group of securities or derivatives on U.S. small capitalization companies, with a focus on intuitive risk factors such as size, value, momentum, and quality that the Adviser believes may contribute to a positive equity risk premium. For the period since the Portfolio’s launch date on April 3, 2017 through May 31, 2017, the Portfolio’s total returns were -1.90%. Periods of negative performance for the Portfolio, such as the most recently completed fiscal year, correspond to periods when the equity risk premium and factors emphasized are negative for U.S. small capitalization companies. There can be no assurance that the equity risk premium will be positive for the Portfolio’s investments at any time or on average and over time.

The Elements International Portfolio seeks to capture the equity risk premium by investing in a broad and diverse group of securities or derivatives on companies associated with countries with developed markets, with a focus on intuitive risk factors such as size, value, momentum, and quality that the Adviser believes may contribute to a positive equity risk premium. For the period since the Portfolio’s launch date on May 1, 2017 through May 31, 2017, the Portfolio’s total returns were 2.90%. Periods of positive performance for the Portfolio, such as the most recently completed fiscal year, correspond to periods when the equity risk premium, factors emphasized, and relevant currencies performances versus the U.S. dollar are positive for developed markets companies. There can be no assurance that the equity risk premium will be positive for the Portfolio’s investments at any time or on average and over time.

The Elements International Small Cap Portfolio seeks to capture the equity risk premium by investing in a broad and diverse group of securities or derivatives on small capitalization companies associated with countries with developed markets, with a focus on intuitive risk factors such as size, value, momentum, and quality that the Adviser believes may contribute to a positive equity risk premium. For the period since the Portfolio’s launch date on May 1, 2017 through May 31, 2017, the Portfolio’s total returns were 3.60%. Periods of positive performance for the Portfolio, such as the most recently completed fiscal year, correspond to periods when the equity risk premium, factors emphasized, and relevant currencies performances versus the U.S. dollar are positive for small capitalization developed markets companies. There can be no assurance that the equity risk premium will be positive for the Portfolio’s investments at any time or on average and over time.

Disclaimers

Past performance is no guarantee of future results.

Opinions expressed are subject to change at any time, are not guaranteed and should not be considered investment advice.

Investors should carefully consider the risks and investment objectives of the Elements U.S. Portfolio, Elements U.S. Small Cap Portfolio, Elements International Portfolio and Elements International Small Cap Portfolio (collectively, the “Portfolios”), as an investment in a Portfolio may not be appropriate for all investors and the Portfolios are not designed to be a complete investment program. There can be no assurance that a Portfolio will achieve its investment objective. An investment in the Portfolios involves a high degree of risk. It is possible that

| | | | | | | | | | | | | | | | |

| | Elements Portfolios | | | | | | Annual Report | | | | | | May 31, 2017 | | |

| | | | | | | | | | |

6

| | |

| Management’s Discussion of Fund Performance | | |

investing in a Portfolio may result in a loss of some or all of the amount invested. Before making an investment/allocation decision, investors should (i) consider the suitability of this investment with respect to an investor’s or a client’s investment objectives and individual situation and (ii) consider factors such as an investor’s or a client’s net worth, income, age and risk tolerance. Investment should be avoided where an investor/client has a short-term investing horizon and/or cannot bear the loss of some or all of the investment. Before investing in a Portfolio, an investor should read the discussion of the risks of investing in the Portfolio in the prospectus.

Mutual fund investing in funds involves risks. Principal loss is possible.

Economic, political, and issuer-specific events will cause the value of securities, and the Portfolios that own them, to rise or fall. Because the value of your investment in a Portfolio will fluctuate, you may lose money, even over the long term. Securities of smaller companies are often less liquid than those of larger companies. This could make it difficult to sell a smaller company security at a desired time or price. In general, smaller companies are also more vulnerable than larger companies to adverse business or economic developments, and they may have more limited resources. As a result, prices of smaller company securities may fluctuate more than those of larger companies. Foreign securities prices may decline or fluctuate because of economic or political actions of foreign governments and/or less regulated or liquid securities markets and may give rise to foreign currency risk. In addition to smaller company risk, securities of companies that exhibit other factors such as value, momentum or quality may be riskier than securities of companies that do not exhibit those factors, and may perform differently from the market as a whole. If a Portfolio uses derivatives, the Portfolio will be directly exposed to the risks of that derivative, including the risk that the counterparty to the derivative is unable or unwilling to perform its obligations. Derivatives are subject to a number of additional risks including risks associated with the potential illiquidity of the derivative, changes in interest rates, market movements, and the possibility of improper valuation. Changes in the value of a derivative may not correlate perfectly with the underlying asset, and a Portfolio could lose more than the amount invested in a derivative. Securities lending and similar transactions involve the risk that the counterparty may fail to return the securities in a timely manner or at all and that the value of collateral securing a securities loan or similar transaction falls.

The Portfolios intends to qualify for treatment as a “regulated investment company” (a “RIC”) under the Internal Revenue Code of 1986, as amended (the “Code”). In order to qualify for such treatment, each Portfolio must derive at least 90% of its gross income each taxable year from qualifying income, meet certain asset diversification tests at the end of each fiscal quarter, and distribute at least 90% of its investment company taxable income for each taxable year. A Portfolio’s investment strategy will potentially be limited by its intention to qualify for treatment as a RIC. The tax treatment of certain of the Portfolios’ investments under one or more of the qualification or distribution tests applicable to RICs is not certain. An adverse determination or future guidance by the IRS might affect a Portfolio’s ability to qualify for such treatment.

If, in any year, a Portfolio were to fail to qualify as a RIC under the Code for any reason, and were not able to cure such failure, the Portfolio would be subject to tax on its taxable income at corporate rates, and all distributions from earnings and profits, including any distributions of net tax-exempt income and net long-term capital gains, would be taxable to shareholders as ordinary income.

The Portfolios are classified as non-diversified under the 1940 Act. Accordingly, a Portfolio may invest a greater portion of its assets in the securities of a single issuer than if it were a “diversified” fund. To the extent that a Portfolio invests a higher percentage of its assets in the securities of a single issuer, the Portfolio is subject to a higher degree of risk associated with and developments affecting that issuer than a fund that invests more widely. The Portfolios are newly organized open-end management investment companies with no history of operations and are designed for long-term investors and not as a short-term trading vehicle.

Must be preceded or accompanied by a current prospectus.

The Portfolios are distributed by Quasar Distributors, LLC.

| | | | | | | | | | | | | | | | |

| | Elements Portfolios | | | | | | Annual Report | | | | | | May 31, 2017 | | |

| | | | | | | | | | |

7

| | | | |

| ALLOCATION OF PORTFOLIO HOLDINGS AT MAY 31, 2017 (Unaudited) | | | | |

| | | | | | | | |

ELEMENTS U.S. PORTFOLIO

PORTFOLIO ALLOCATION BY SECTOR | |

| | |

| Information Technology | | | $124,655,767 | | | | 20.2% | |

| | |

| Consumer Discretionary | | | 119,761,402 | | | | 19.4% | |

| | |

| Industrials | | | 85,131,396 | | | | 13.8% | |

| | |

| Financials | | | 74,499,172 | | | | 12.1% | |

| | |

| Consumer Staples | | | 66,458,559 | | | | 10.8% | |

| | |

| Health Care | | | 53,494,966 | | | | 8.7% | |

| | |

| Materials | | | 25,865,843 | | | | 4.2% | |

| | |

| Energy | | | 9,497,035 | | | | 1.6% | |

| | |

| Telecommunication Services | | | 7,317,078 | | | | 1.2% | |

| | |

| Utilities | | | 2,626,158 | | | | 0.4% | |

| | |

| Real Estate | | | 908,987 | | | | 0.2% | |

| | |

| Other(1) | | | 45,859,216 | | | | 7.4% | |

| | | $616,075,579 | | | | | |

| | | | | | | | |

ELEMENTS INTERNATIONAL PORTFOLIO

PORTFOLIO ALLOCATION BY SECTOR | |

| | |

| Industrials | | | $58,176,189 | | | | 15.5% | |

| | |

| Consumer Discretionary | | | 45,872,125 | | | | 12.2% | |

| | |

| Financials | | | 38,935,111 | | | | 10.4% | |

| | |

| Consumer Staples | | | 36,357,529 | | | | 9.7% | |

| | |

| Materials | | | 30,164,787 | | | | 8.1% | |

| | |

| Information Technology | | | 18,010,919 | | | | 4.8% | |

| | |

| Health Care | | | 11,581,559 | | | | 3.1% | |

| | |

| Telecommunication Services | | | 11,079,316 | | | | 3.0% | |

| | |

| Energy | | | 8,066,536 | | | | 2.2% | |

| | |

| Utilities | | | 7,528,529 | | | | 2.0% | |

| | |

| Other(2) | | | 108,589,649 | | | | 29.0% | |

| | | $374,362,249 | | | | | |

| (1) | Cash, cash equivalents, U.S. Government notes, short-term investments and other assets less liabilities. |

| (2) | Cash, cash equivalents, short-term investments and other assets less liabilities. |

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC.

| | | | | | | | |

ELEMENTS U.S. SMALL CAP PORTFOLIO

PORTFOLIO ALLOCATION BY SECTOR | |

| | |

| Consumer Discretionary | | | $95,815,474 | | | | 22.6% | |

| | |

| Industrials | | | 90,759,491 | | | | 21.4% | |

| | |

| Information Technology | | | 70,599,003 | | | | 16.7% | |

| | |

| Financials | | | 60,467,501 | | | | 14.3% | |

| | |

| Consumer Staples | | | 25,314,846 | | | | 6.0% | |

| | |

| Health Care | | | 23,189,539 | | | | 5.5% | |

| | |

| Materials | | | 16,153,793 | | | | 3.8% | |

| | |

| Energy | | | 7,654,420 | | | | 1.8% | |

| | |

| Utilities | | | 2,514,476 | | | | 0.6% | |

| | |

| Real Estate | | | 2,451,904 | | | | 0.6% | |

| | |

| Telecommunication Services | | | 1,701,346 | | | | 0.4% | |

| | |

| Other(1) | | | 26,491,496 | | | | 6.3% | |

| | | $423,113,289 | | | | | |

| | | | | | | | |

ELEMENTS INTERNATIONAL SMALL CAP PORTFOLIO

PORTFOLIO ALLOCATION BY SECTOR | |

| | |

| Industrials | | | $26,376,787 | | | | 20.1% | |

| | |

| Consumer Discretionary | | | 21,544,491 | | | | 16.4% | |

| | |

| Materials | | | 10,956,206 | | | | 8.4% | |

| | |

| Consumer Staples | | | 9,694,955 | | | | 7.4% | |

| | |

| Information Technology | | | 9,103,824 | | | | 6.9% | |

| | |

| Health Care | | | 3,677,086 | | | | 2.8% | |

| | |

| Financials | | | 3,666,552 | | | | 2.8% | |

| | |

| Energy | | | 2,378,142 | | | | 1.8% | |

| | |

| Telecommunication Services | | | 1,045,548 | | | | 0.8% | |

| | |

| Utilities | | | 966,545 | | | | 0.7% | |

| | |

| Other(2) | | | 41,854,224 | | | | 31.9% | |

| | | $131,264,360 | | | | | |

| | | | |

| | The accompanying Notes to the Financial Statements are an integral part of these Financial Statements. | | |

| | | | | | | | | | | | | | | | |

| | Elements Portfolios | | | | | | Annual Report | | | | | | May 31, 2017 | | |

| | | | | | | | | | |

8

| | |

| Schedule of Investments | | as of May 31, 2017 |

| | | | | | | | |

| | | SHARES | | | FAIR

VALUE | |

COMMON STOCKS - 92.4% | | | | | | | | |

| | | | | | | | |

| Automobiles & Components - 1.5% | |

BorgWarner, Inc. | | | 16,554 | | | $ | 703,711 | |

Delphi Automotive PLC (a) | | | 7,264 | | | | 639,014 | |

Ford Motor Co. | | | 154,459 | | | | 1,717,584 | |

Gentex Corp. | | | 73,881 | | | | 1,402,261 | |

Goodyear Tire & Rubber Co. | | | 13,075 | | | | 421,277 | |

Harley-Davidson, Inc. | | | 548 | | | | 29,049 | |

Lear Corp. | | | 7,039 | | | | 1,049,093 | |

Thor Industries, Inc. | | | 17,515 | | | | 1,585,633 | |

Visteon Corp. (b) | | | 13,869 | | | | 1,390,922 | |

| | | | | | | | |

| | | | | | | 8,938,544 | |

| | | | | | | | |

| Banks - 0.9% | |

Associated Banc-Corp. | | | 53,446 | | | | 1,274,687 | |

Bank of Hawaii Corp. | | | 5,263 | | | | 409,093 | |

BankUnited, Inc. | | | 1,147 | | | | 38,035 | |

Citizens Financial Group, Inc. | | | 4,043 | | | | 137,866 | |

Commerce Bancshares, Inc. | | | 3,339 | | | | 178,737 | |

Cullen/Frost Bankers, Inc. | | | 362 | | | | 33,181 | |

East West Bancorp, Inc. | | | 17,964 | | | | 983,170 | |

Fifth Third Bancorp | | | 1,206 | | | | 28,630 | |

First Hawaiian, Inc. | | | 6,194 | | | | 170,707 | |

First Horizon National Corp. | | | 3,123 | | | | 52,904 | |

Huntington Bancshares, Inc. | | | 8,475 | | | | 106,276 | |

New York Community Bancorp, Inc. | | | 595 | | | | 7,687 | |

Popular, Inc. (a) | | | 20,762 | | | | 772,346 | |

Regions Financial Corp. | | | 52,986 | | | | 733,326 | |

Signature Bank (b) | | | 296 | | | | 42,334 | |

TCF Financial Corp. | | | 23,441 | | | | 353,021 | |

TFS Financial Corp. | | | 1,061 | | | | 16,573 | |

Western Alliance Bancorp (b) | | | 480 | | | | 21,946 | |

| | | | | | | | |

| | | | | | | 5,360,519 | |

| | | | | | | | |

| Capital Goods - 10.2% | |

3M Co. | | | 3,818 | | | | 780,666 | |

Acuity Brands, Inc. | | | 3,003 | | | | 489,219 | |

AECOM Technology Corp. (b) | | | 24,618 | | | | 790,484 | |

AGCO Corp. | | | 13,130 | | | | 840,714 | |

Air Lease Corp. | | | 5,408 | | | | 199,663 | |

Allegion PLC (a) | | | 4,018 | | | | 315,935 | |

Allison Transmission Holdings, Inc. | | | 5,847 | | | | 226,396 | |

AMETEK, Inc. | | | 13,652 | | | | 833,045 | |

AO Smith Corp. | | | 25,958 | | | | 1,424,316 | |

Arconic, Inc. | | | 8,397 | | | | 230,666 | |

Armstrong World Industries, Inc. (b) | | | 6,029 | | | | 251,108 | |

Boeing Co. | | | 15,574 | | | | 2,922,150 | |

BWX Technologies, Inc. | | | 5,756 | | | | 279,742 | |

Carlisle Cos, Inc. | | | 13,255 | | | | 1,343,129 | |

Caterpillar, Inc. | | | 947 | | | | 99,842 | |

Chicago Bridge & Iron Co. (a) | | | 21,129 | | | | 399,761 | |

Colfax Corp. (b) | | | 12,393 | | | | 502,660 | |

Crane Co. | | | 16,409 | | | | 1,273,010 | |

Cummins, Inc. | | | 7,566 | | | | 1,193,158 | |

Danaher Corp. | | | 8,959 | | | | 760,978 | |

Donaldson Co, Inc. | | | 28,196 | | | | 1,352,280 | |

Dover Corp. | | | 3,457 | | | | 285,375 | |

Eaton Corp. PLC (a) | | | 13,455 | | | | 1,041,148 | |

Emerson Electric Co. | | | 22,356 | | | | 1,321,687 | |

| | | | | | | | |

| | | SHARES | | | FAIR

VALUE | |

| Capital Goods - 10.2% (continued) | |

Fastenal Co. | | | 790 | | | $ | 34,104 | |

Flowserve Corp. | | | 2,388 | | | | 115,818 | |

Fluor Corp. | | | 25,102 | | | | 1,126,076 | |

Fortive Corp. | | | 8,540 | | | | 533,323 | |

Fortune Brands Home & Security, Inc. | | | 23,882 | | | | 1,506,954 | |

General Dynamics Corp. | | | 1,820 | | | | 369,915 | |

Graco, Inc. | | | 5,714 | | | | 627,797 | |

HD Supply Holdings, Inc. (b) | | | 25,796 | | | | 1,040,869 | |

HEICO Corp. | | | 22,794 | | | | 1,691,543 | |

HEICO Corp. - Class A | | | 22,765 | | | | 1,426,227 | |

Hexcel Corp. | | | 11,935 | | | | 613,817 | |

Honeywell International, Inc. | | | 2,562 | | | | 340,720 | |

Hubbell, Inc. | | | 10,959 | | | | 1,270,258 | |

Huntington Ingalls Industries, Inc. | | | 5,880 | | | | 1,151,363 | |

IDEX Corp. | | | 5,197 | | | | 563,719 | |

Illinois Tool Works, Inc. | | | 200 | | | | 28,244 | |

Ingersoll-Rand PLC (a) | | | 11,077 | | | | 992,499 | |

ITT, Inc. | | | 31,913 | | | | 1,213,013 | |

Jacobs Engineering Group, Inc. | | | 38,628 | | | | 2,024,880 | |

L3 Technologies, Inc. | | | 5,711 | | | | 962,818 | |

Lennox International, Inc. | | | 7,008 | | | | 1,241,117 | |

Lincoln Electric Holdings, Inc. | | | 11,514 | | | | 1,029,121 | |

Lockheed Martin Corp. | | | 3,304 | | | | 928,854 | |

Masco Corp. | | | 10,369 | | | | 386,245 | |

Middleby Corp. (b) | | | 1,134 | | | | 145,560 | |

MSC Industrial Direct Co, Inc. | | | 15,693 | | | | 1,317,270 | |

Nordson Corp. | | | 2,917 | | | | 338,022 | |

Northrop Grumman Corp. | | | 1,275 | | | | 330,506 | |

Orbital ATK, Inc. | | | 67 | | | | 6,811 | |

Oshkosh Corp. | | | 23,165 | | | | 1,462,175 | |

Owens Corning | | | 7,648 | | | | 477,235 | |

Parker-Hannifin Corp. | | | 5,153 | | | | 811,443 | |

Pentair PLC (a) | | | 11,715 | | | | 775,767 | |

Quanta Services, Inc. (b) | | | 22,342 | | | | 685,006 | |

Raytheon Co. | | | 8,703 | | | | 1,427,379 | |

Regal Beloit Corp. | | | 17,850 | | | | 1,413,720 | |

Rockwell Automation, Inc. | | | 2,228 | | | | 353,628 | |

Rockwell Collins, Inc. | | | 4,254 | | | | 463,899 | |

Snap-on, Inc. | | | 4,657 | | | | 752,851 | |

Spirit AeroSystems Holdings, Inc. | | | 29,551 | | | | 1,610,234 | |

Stanley Black & Decker, Inc. | | | 5,238 | | | | 720,958 | |

Terex Corp. | | | 85 | | | | 2,786 | |

Textron, Inc. | | | 21,208 | | | | 1,013,742 | |

Timken Co. | | | 18,321 | | | | 845,514 | |

Toro Co. | | | 15,747 | | | | 1,078,512 | |

Trinity Industries, Inc. | | | 6,000 | | | | 153,120 | |

United Technologies Corp. | | | 1,711 | | | | 207,510 | |

USG Corp. (b) | | | 17,294 | | | | 491,841 | |

Valmont Industries, Inc. | | | 7,403 | | | | 1,083,799 | |

WABCO Holdings, Inc. (b) | | | 3,382 | | | | 411,995 | |

Wabtec Corp. | | | 1,303 | | | | 106,520 | |

Watsco, Inc. | | | 8,723 | | | | 1,230,990 | |

WESCO International, Inc. (b) | | | 21,391 | | | | 1,308,060 | |

WW Grainger, Inc. | | | 5,728 | | | | 986,820 | |

Xylem, Inc. | | | 7,731 | | | | 403,094 | |

| | | | | | | | |

| | | | | | | 62,793,193 | |

| | | | | | | | |

| | | | |

| | The accompanying Notes to the Financial Statements are an integral part of these Financial Statements. | | (Continued) |

| | | | | | | | | | | | | | | | |

| | Elements Portfolios | | | | | | Annual Report | | | | | | May 31, 2017 | | |

| | | | | | | | | | |

9

| | |

| Schedule of Investments | | as of May 31, 2017 |

| | | | | | | | |

| | | SHARES | | | FAIR

VALUE | |

| Commercial & Professional Services - 1.7% | |

Cintas Corp. | | | 5,512 | | | $ | 693,851 | |

Clean Harbors, Inc. (b) | | | 289 | | | | 16,881 | |

Copart, Inc. (b) | | | 13,489 | | | | 420,722 | |

Covanta Holding Corp. | | | 1,340 | | | | 19,765 | |

Dun & Bradstreet Corp. | | | 9,426 | | | | 986,996 | |

KAR Auction Services, Inc. | | | 7,610 | | | | 331,568 | |

LSC Communications, Inc. | | | 36,885 | | | | 784,544 | |

ManpowerGroup, Inc. | | | 18,039 | | | | 1,837,633 | |

Nielsen Holdings PLC (a) | | | 21,828 | | | | 839,941 | |

Pitney Bowes, Inc. | | | 56,393 | | | | 838,564 | |

Republic Services, Inc. | | | 15,440 | | | | 982,138 | |

Robert Half International, Inc. | | | 18,515 | | | | 860,762 | |

Rollins, Inc. | | | 6,457 | | | | 278,103 | |

RR Donnelley & Sons Co. | | | 100,242 | | | | 1,194,885 | |

Stericycle, Inc. (b) | | | 4,484 | | | | 366,657 | |

Verisk Analytics, Inc. (b) | | | 3,174 | | | | 256,745 | |

Waste Management, Inc. | | | 96 | | | | 6,999 | |

| | | | | | | | |

| | | | | | | 10,716,754 | |

| | | | | | | | |

| Consumer Durables & Apparel - 4.3% | |

Brunswick Corp. | | | 18,211 | | | | 1,006,340 | |

CalAtlantic Group, Inc. | | | 8,484 | | | | 305,763 | |

Carter’s, Inc. | | | 18,628 | | | | 1,530,477 | |

Coach, Inc. | | | 24,545 | | | | 1,134,224 | |

DR Horton, Inc. | | | 15,001 | | | | 490,383 | |

Garmin Ltd. (a) | | | 17,307 | | | | 900,656 | |

Hanesbrands, Inc. | | | 31,750 | | | | 655,638 | |

Hasbro, Inc. | | | 7,792 | | | | 820,186 | |

Kate Spade & Co. (b) | | | 51,405 | | | | 946,880 | |

Leggett & Platt, Inc. | | | 13,984 | | | | 727,448 | |

Lennar Corp. - A | | | 4,821 | | | | 247,366 | |

Lennar Corp. - B SHS | | | 1,482 | | | | 63,622 | |

Lululemon Athletica, Inc. (b) | | | 8,553 | | | | 412,853 | |

Mattel, Inc. | | | 22,418 | | | | 513,596 | |

Michael Kors Holdings Ltd. (a)(b) | | | 43,946 | | | | 1,458,128 | |

Mohawk Industries, Inc. (b) | | | 2,761 | | | | 660,707 | |

NIKE, Inc. | | | 49,993 | | | | 2,649,129 | |

NVR, Inc. (b) | | | 654 | | | | 1,492,677 | |

PulteGroup, Inc. | | | 10,390 | | | | 235,541 | |

PVH Corp. | | | 11,221 | | | | 1,188,865 | |

Ralph Lauren Corp. | | | 28,160 | | | | 1,909,248 | |

Skechers U.S.A., Inc. (b) | | | 71,494 | | | | 1,824,527 | |

Tempur Sealy International, Inc. (b) | | | 765 | | | | 35,527 | |

Toll Brothers, Inc. | | | 662 | | | | 24,434 | |

Tupperware Brands Corp. | | | 13,101 | | | | 942,093 | |

Under Armour, Inc. - Class A (b) | | | 4,825 | | | | 92,447 | |

Under Armour, Inc. - Class C (b) | | | 79,194 | | | | 1,412,029 | |

VF Corp. | | | 22,561 | | | | 1,213,782 | |

Vista Outdoor, Inc. (b) | | | 55,849 | | | | 1,171,712 | |

Whirlpool Corp. | | | 1,585 | | | | 294,081 | |

| | | | | | | | |

| | | | | | | 26,360,359 | |

| | | | | | | | |

| Consumer Services - 1.8% | |

Aramark | | | 18,008 | | | | 670,978 | |

Brinker International, Inc. | | | 37,339 | | | | 1,464,809 | |

Carnival Corp. (a) | | | 6,011 | | | | 385,125 | |

Chipotle Mexican Grill, Inc. (b) | | | 1,330 | | | | 634,876 | |

Choice Hotels International, Inc. | | | 7,781 | | | | 505,376 | |

| | | | | | | | |

| | | SHARES | | | FAIR

VALUE | |

| Consumer Services - 1.8% (continued) | |

Darden Restaurants, Inc. | | | 11,701 | | | $ | 1,040,570 | |

Domino’s Pizza, Inc. | | | 79 | | | | 16,726 | |

Extended Stay America, Inc. | | | 13,702 | | | | 249,376 | |

Graham Holdings Co. | | | 1,977 | | | | 1,183,828 | |

H&R Block, Inc. | | | 6,936 | | | | 184,081 | |

Hilton Grand Vacations, Inc. (b) | | | 5,387 | | | | 192,693 | |

Hilton Worldwide Holdings, Inc. | | | 500 | | | | 33,235 | |

Hyatt Hotels Corp. (b) | | | 29,023 | | | | 1,674,627 | |

International Game Technology PLC (a) | | | 28,169 | | | | 500,000 | |

McDonald’s Corp. | | | 123 | | | | 18,559 | |

Panera Bread Co. (b) | | | 1,337 | | | | 420,473 | |

Service Corp International | | | 12,241 | | | | 390,243 | |

ServiceMaster Global Holdings, Inc. (b) | | | 2,748 | | | | 103,874 | |

Six Flags Entertainment Corp. | | | 141 | | | | 8,514 | |

Starbucks Corp. | | | 1,287 | | | | 81,866 | |

Wendy’s Co. | | | 2,699 | | | | 43,643 | |

Wyndham Worldwide Corp. | | | 2,004 | | | | 202,384 | |

Yum China Holdings, Inc. (b) | | | 17,917 | | | | 688,192 | |

Yum! Brands, Inc. | | | 2,414 | | | | 175,353 | |

| | | | | | | | |

| | | | | | | 10,869,401 | |

| | | | | | | | |

| Diversified Financials - 3.1% | |

Affiliated Managers Group, Inc. | | | 1,312 | | | | 201,851 | |

Ally Financial, Inc. | | | 23,371 | | | | 433,298 | |

American Express Co. | | | 11,640 | | | | 895,582 | |

Ameriprise Financial, Inc. | | | 4,898 | | | | 591,629 | |

Artisan Partners Asset Management, Inc. | | | 37,392 | | | | 1,058,194 | |

Bank of America Corp. | | | 165,844 | | | | 3,716,564 | |

Capital One Financial Corp. | | | 2,195 | | | | 168,839 | |

Citigroup, Inc. | | | 6,415 | | | | 388,364 | |

Discover Financial Services | | | 3,800 | | | | 223,060 | |

Donnelley Financial Solutions, Inc. (b) | | | 13,626 | | | | 310,400 | |

E*TRADE Financial Corp. (b) | | | 20,075 | | | | 694,796 | |

Eaton Vance Corp. | | | 3,786 | | | | 176,314 | |

Federated Investors, Inc. | | | 54,391 | | | | 1,444,625 | |

FNF Group | | | 37,056 | | | | 1,578,956 | |

Franklin Resources, Inc. | | | 40,626 | | | | 1,697,761 | |

JPMorgan Chase & Co. | | | 8,219 | | | | 675,191 | |

Lazard Ltd. (a) | | | 463 | | | | 20,604 | |

Legg Mason, Inc. | | | 1,065 | | | | 39,267 | |

Leucadia National Corp. | | | 33,354 | | | | 813,504 | |

LPL Financial Holdings, Inc. | | | 190 | | | | 7,397 | |

MarketAxess Holdings, Inc. | | | 1,614 | | | | 307,596 | |

Morningstar, Inc. | | | 6,395 | | | | 467,986 | |

MSCI, Inc. | | | 899 | | | | 91,455 | |

Navient Corp. | | | 1,122 | | | | 16,190 | |

OneMain Holdings, Inc. (b) | | | 13,781 | | | | 310,899 | |

Raymond James Financial, Inc. | | | 100 | | | | 7,227 | |

S&P Global, Inc. | | | 406 | | | | 57,981 | |

SEI Investments Co. | | | 10,214 | | | | 511,619 | |

Synchrony Financial | | | 26,800 | | | | 719,580 | |

Thomson Reuters Corp. (a) | | | 37,644 | | | | 1,643,537 | |

Voya Financial, Inc. | | | 2,493 | | | | 85,211 | |

| | | | | | | | |

| | | | | | | 19,355,477 | |

| | | | | | | | |

| Energy - 1.5% | |

Baker Hughes, Inc. | | | 14,040 | | | | 774,306 | |

Cheniere Energy, Inc. (b) | | | 65 | | | | 3,167 | |

| | | | |

| | The accompanying Notes to the Financial Statements are an integral part of these Financial Statements. | | (Continued) |

| | | | | | | | | | | | | | | | |

| | Elements Portfolios | | | | | | Annual Report | | | | | | May 31, 2017 | | |

| | | | | | | | | | |

10

| | |

| Schedule of Investments | | as of May 31, 2017 |

| | | | | | | | |

| | | SHARES | | | FAIR

VALUE | |

| Energy - 1.5% (continued) | |

Dril-Quip, Inc. (b) | | | 25,116 | | | $ | 1,245,754 | |

Ensco PLC (a) | | | 443 | | | | 2,764 | |

Gulfport Energy Corp. (b) | | | 3,949 | | | | 56,668 | |

HollyFrontier Corp. | | | 12,298 | | | | 293,922 | |

Kinder Morgan, Inc. | | | 16,781 | | | | 314,812 | |

Kosmos Energy Ltd. (a)(b) | | | 1,310 | | | | 7,860 | |

Marathon Oil Corp. | | | 2,587 | | | | 33,683 | |

Marathon Petroleum Corp. | | | 12,386 | | | | 644,567 | |

Noble Corp PLC (a) | | | 267,453 | | | | 1,083,185 | |

Oceaneering International, Inc. | | | 31,687 | | | | 772,529 | |

PBF Energy, Inc. | | | 26,475 | | | | 511,497 | |

Rowan Cos. PLC (a)(b) | | | 33,331 | | | | 401,305 | |

Superior Energy Services, Inc. (b) | | | 3,242 | | | | 33,619 | |

Transocean Ltd. (a)(b) | | | 4,286 | | | | 38,960 | |

Valero Energy Corp. | | | 20,093 | | | | 1,235,117 | |

Williams Cos., Inc. | | | 21,042 | | | | 601,801 | |

World Fuel Services Corp. | | | 40,790 | | | | 1,441,519 | |

| | | | | | | | |

| | | | | | | 9,497,035 | |

| | | | | | | | |

| Food & Staples Retailing - 5.7% | | | | | | |

Casey’s General Stores, Inc. | | | 6,067 | | | | 706,138 | |

Costco Wholesale Corp. | | | 20,488 | | | | 3,696,650 | |

CVS Health Corp. | | | 50,879 | | | | 3,909,033 | |

Kroger Co. | | | 79,146 | | | | 2,356,968 | |

Rite Aid Corp. (b) | | | 157,634 | | | | 537,532 | |

Sprouts Farmers Market, Inc. (b) | | | 50,574 | | | | 1,211,753 | |

Sysco Corp. | | | 24,727 | | | | 1,349,105 | |

US Foods Holding Corp. (b) | | | 75,960 | | | | 2,275,762 | |

Walgreens Boots Alliance, Inc. | | | 47,732 | | | | 3,867,247 | |

Wal-Mart Stores, Inc. | | | 161,293 | | | | 12,677,630 | |

Whole Foods Market, Inc. | | | 73,085 | | | | 2,557,244 | |

| | | | | | | | |

| | | | | | | 35,145,062 | |

| | | | | | | | |

| Food, Beverage & Tobacco - 4.1% | |

Archer-Daniels-Midland Co. | | | 26,830 | | | | 1,115,591 | |

Blue Buffalo Pet Products, Inc. (b) | | | 300 | | | | 7,047 | |

Brown-Forman Corp. - Class - A | | | 4,168 | | | | 221,071 | |

Brown-Forman Corp. - Class - B | | | 15,489 | | | | 804,653 | |

Bunge Ltd. (a) | | | 19,677 | | | | 1,573,570 | |

Campbell Soup Co. | | | 28,963 | | | | 1,669,717 | |

Coca-Cola Co. | | | 30,770 | | | | 1,399,112 | |

Conagra Brands, Inc. | | | 29,761 | | | | 1,146,989 | |

Dr Pepper Snapple Group, Inc. | | | 2,984 | | | | 276,945 | |

Flowers Foods, Inc. | | | 90,558 | | | | 1,673,512 | |

General Mills, Inc. | | | 19,493 | | | | 1,106,033 | |

Hain Celestial Group, Inc. (b) | | | 32,539 | | | | 1,136,587 | |

Hershey Co. | | | 11,913 | | | | 1,373,211 | |

Hormel Foods Corp. | | | 46,569 | | | | 1,566,115 | |

Ingredion, Inc. | | | 14,308 | | | | 1,632,400 | |

JM Smucker Co. | | | 6,436 | | | | 822,843 | |

Kellogg Co. | | | 16,816 | | | | 1,204,025 | |

McCormick & Co, Inc. | | | 7,771 | | | | 809,350 | |

Mead Johnson Nutrition Co. | | | 12,528 | | | | 1,120,254 | |

Mondelez International, Inc. | | | 2,188 | | | | 101,939 | |

Monster Beverage Corp. (b) | | | 200 | | | | 10,112 | |

PepsiCo., Inc. | | | 1,422 | | | | 166,189 | |

Pilgrim’s Pride Corp. (b) | | | 20,167 | | | | 469,286 | |

Pinnacle Foods, Inc. | | | 12,496 | | | | 778,626 | |

| | | | | | | | |

| | | SHARES | | | FAIR

VALUE | |

| Food, Beverage & Tobacco - 4.1% (continued) | |

Post Holdings, Inc. (b) | | | 2,301 | | | $ | 184,862 | |

Reynolds American, Inc. | | | 18,632 | | | | 1,253,002 | |

TreeHouse Foods, Inc. (b) | | | 4,932 | | | | 380,652 | |

Tyson Foods, Inc. | | | 23,456 | | | | 1,344,967 | |

| | | | | | | | |

| | | | | | | 25,348,660 | |

| | | | | | | | |

| Health Care Equipment & Services - 5.9% | |

Acadia Healthcare Co., Inc. (b) | | | 578 | | | | 23,894 | |

Aetna, Inc. | | | 11,384 | | | | 1,649,086 | |

Align Technology, Inc. (b) | | | 1,254 | | | | 182,081 | |

Allscripts Healthcare Solutions, Inc. (b) | | | 56,847 | | | | 648,624 | |

AmerisourceBergen Corp. | | | 14,127 | | | | 1,296,435 | |

Anthem, Inc. | | | 16,330 | | | | 2,977,775 | |

Baxter International, Inc. | | | 10,580 | | | | 627,500 | |

C.R. Bard, Inc. | | | 1,404 | | | | 431,632 | |

Cardinal Health, Inc. | | | 15,779 | | | | 1,172,222 | |

Centene Corp. (b) | | | 11,192 | | | | 812,875 | |

Cerner Corp. (b) | | | 2,601 | | | | 169,975 | |

Cigna Corp. | | | 17,927 | | | | 2,890,370 | |

Cooper Cos., Inc. | | | 243 | | | | 53,156 | |

DaVita HealthCare Partners, Inc. (b) | | | 13,406 | | | | 888,282 | |

Dentsply Sirona, Inc. | | | 4,224 | | | | 268,308 | |

DexCom, Inc. (b) | | | 1,289 | | | | 86,157 | |

Edwards Lifesciences Corp. (b) | | | 3,360 | | | | 386,635 | |

Envision Healthcare Corp. (b) | | | 347 | | | | 18,950 | |

Express Scripts Holding Co. (b) | | | 27,208 | | | | 1,625,678 | |

HCA Healthcare, Inc. (b) | | | 672 | | | | 55,044 | |

Henry Schein, Inc. (b) | | | 8,558 | | | | 1,574,415 | |

Hill-Rom Holdings, Inc. | | | 11,717 | | | | 906,427 | |

Hologic, Inc. (b) | | | 7,452 | | | | 322,746 | |

Humana, Inc. | | | 10,494 | | | | 2,437,336 | |

IDEXX Laboratories, Inc. (b) | | | 2,381 | | | | 400,937 | |

Inovalon Holdings, Inc. (b) | | | 2,118 | | | | 28,805 | |

Laboratory Corp. of America Holdings (b) | | | 5,393 | | | | 749,627 | |

LifePoint Health, Inc. (b) | | | 1,461 | | | | 88,829 | |

MEDNAX, Inc. (b) | | | 16,677 | | | | 905,561 | |

Patterson Cos., Inc. | | | 17,143 | | | | 757,035 | |

Premier, Inc. (b) | | | 18,082 | | | | 624,191 | |

Quest Diagnostics, Inc. | | | 8,326 | | | | 905,619 | |

ResMed, Inc. | | | 1,075 | | | | 76,432 | |

UnitedHealth Group, Inc. | | | 29,240 | | | | 5,122,263 | |

Universal Health Services, Inc. | | | 3,275 | | | | 372,236 | |

Varex Imaging Corp. (b) | | | 39,391 | | | | 1,353,081 | |

Varian Medical Systems, Inc. (b) | | | 3,226 | | | | 319,439 | |

VCA, Inc. (b) | | | 2,745 | | | | 252,897 | |

WellCare Health Plans, Inc. (b) | | | 13,110 | | | | 2,252,298 | |

West Pharmaceutical Services, Inc. | | | 7,790 | | | | 755,786 | |

| | | | | | | | |

| | | | | | | 36,470,639 | |

| | | | | | | | |

| Household & Personal Products - 1.0% | |

Church & Dwight Co, Inc. | | | 26,257 | | | | 1,356,437 | |

Clorox Co. | | | 4,832 | | | | 655,847 | |

Colgate-Palmolive Co. | | | 9,211 | | | | 703,352 | |

Edgewell Personal Care Co. (b) | | | 10,020 | | | | 732,863 | |

Energizer Holdings, Inc. | | | 5,088 | | | | 272,717 | |

Estee Lauder Cos., Inc. | | | 8,459 | | | | 796,330 | |

Herbalife Ltd. (a)(b) | | | 5,259 | | | | 377,491 | |

Kimberly-Clark Corp. | | | 573 | | | | 74,335 | |

| | | | |

| | The accompanying Notes to the Financial Statements are an integral part of these Financial Statements. | | (Continued) |

| | | | | | | | | | | | | | | | |

| | Elements Portfolios | | | | | | Annual Report | | | | | | May 31, 2017 | | |

| | | | | | | | | | |

11

| | |

| Schedule of Investments | | as of May 31, 2017 |

| | | | | | | | |

| | | SHARES | | | FAIR

VALUE | |

| Household & Personal Products - 1.0% (continued) | |

Nu Skin Enterprises, Inc. | | | 17,163 | | | $ | 941,905 | |

Procter & Gamble Co. | | | 608 | | | | 53,559 | |

| | | | | | | | |

| | | | | | | 5,964,836 | |

| | | | | | | | |

| Insurance - 7.9% | | | | | | |

Aflac, Inc. | | | 10,815 | | | | 815,235 | |

Allstate Corp. | | | 13,871 | | | | 1,197,622 | |

American Financial Group, Inc. | | | 18,059 | | | | 1,803,191 | |

American National Insurance Co. | | | 3,866 | | | | 454,371 | |

AmTrust Financial Services, Inc. | | | 42,736 | | | | 561,551 | |

Arthur J Gallagher & Co. | | | 4,125 | | | | 234,011 | |

Assurant, Inc. | | | 8,087 | | | | 792,364 | |

Athene Holding Ltd. (a)(b) | | | 4,664 | | | | 229,842 | |

Berkshire Hathaway, Inc. (b) | | | 77,970 | | | | 12,886,882 | |

Brown & Brown, Inc. | | | 26,510 | | | | 1,151,329 | |

Cincinnati Financial Corp. | | | 19,937 | | | | 1,397,185 | |

CNA Financial Corp. | | | 33,445 | | | | 1,525,092 | |

Erie Indemnity Co. | | | 2,333 | | | | 274,757 | |

First American Financial Corp. | | | 40,114 | | | | 1,745,761 | |

Hanover Insurance Group, Inc. | | | 19,787 | | | | 1,650,038 | |

Hartford Financial Services Group, Inc. | | | 6,348 | | | | 313,528 | |

Lincoln National Corp. | | | 461 | | | | 29,956 | |

Loews Corp. | | | 24,330 | | | | 1,147,403 | |

Marsh & McLennan Cos, Inc. | | | 23,819 | | | | 1,847,402 | |

Mercury General Corp. | | | 9,997 | | | | 559,832 | |

MetLife, Inc. | | | 20,556 | | | | 1,039,928 | |

Old Republic International Corp. | | | 61,011 | | | | 1,206,798 | |

Principal Financial Group, Inc. | | | 14,049 | | | | 883,823 | |

ProAssurance Corp. | | | 20,238 | | | | 1,205,173 | |

Progressive Corp. | | | 53,327 | | | | 2,262,665 | |

Prudential Financial, Inc. | | | 6,797 | | | | 712,665 | |

Reinsurance Group of America, Inc. | | | 12,624 | | | | 1,571,814 | |

RenaissanceRe Holdings Ltd. (a) | | | 7,790 | | | | 1,112,879 | |

Torchmark Corp. | | | 23,706 | | | | 1,789,803 | |

Travelers Cos., Inc. | | | 13,446 | | | | 1,678,733 | |

Unum Group | | | 11,009 | | | | 495,185 | |

Validus Holdings Ltd. (a) | | | 35,712 | | | | 1,907,021 | |

WR Berkley Corp. | | | 31,146 | | | | 2,148,762 | |

| | | | | | | | |

| | | | | | | 48,632,601 | |

| | | | | | | | |

| Materials - 4.2% | | | | | | |

Air Products & Chemicals, Inc. | | | 160 | | | | 23,050 | |

Albemarle Corp. | | | 1,901 | | | | 215,954 | |

AptarGroup, Inc. | | | 12,801 | | | | 1,088,213 | |

Ashland Global Holdings, Inc. | | | 400 | | | | 26,616 | |

Avery Dennison Corp. | | | 19,097 | | | | 1,609,113 | |

Axalta Coating Systems Ltd. (a)(b) | | | 18,847 | | | | 589,911 | |

Bemis Co, Inc. | | | 29,156 | | | | 1,301,524 | |

Berry Global Group, Inc. (b) | | | 2,408 | | | | 139,640 | |

Cabot Corp. | | | 10,911 | | | | 569,881 | |

Celanese Corp. | | | 426 | | | | 36,870 | |

Crown Holdings, Inc. (b) | | | 11,982 | | | | 691,841 | |

Domtar Corp. | | | 26,333 | | | | 957,994 | |

Eagle Materials, Inc. | | | 1,584 | | | | 149,371 | |

Eastman Chemical Co. | | | 980 | | | | 78,508 | |

FMC Corp. | | | 7,010 | | | | 528,344 | |

Freeport-McMoRan, Inc. (b) | | | 38,402 | | | | 441,239 | |

Graphic Packaging Holding Co. | | | 32,271 | | | | 435,981 | |

| | | | | | | | |

| | | SHARES | | | FAIR

VALUE | |

| Materials - 4.2% (continued) | | | | | | |

Huntsman Corp. | | | 10,467 | | | $ | 250,161 | |

International Flavors & Fragrances, Inc. | | | 100 | | | | 13,789 | |

International Paper Co. | | | 1,018 | | | | 53,832 | |

LyondellBasell Industries NV (a) | | | 7,632 | | | | 614,529 | |

Monsanto Co. | | | 16,738 | | | | 1,965,376 | |

Mosaic Co. | | | 25,550 | | | | 578,196 | |

NewMarket Corp. | | | 403 | | | | 187,536 | |

Newmont Mining Corp. | | | 52,717 | | | | 1,800,285 | |

Nucor Corp. | | | 14,640 | | | | 850,584 | |

Owens-Illinois, Inc. (b) | | | 6,898 | | | | 155,688 | |

Packaging Corp of America | | | 1,363 | | | | 139,244 | |

Platform Specialty Products Corp. (b) | | | 12,835 | | | | 160,181 | |

Praxair, Inc. | | | 4,201 | | | | 555,750 | |

Reliance Steel & Aluminum Co. | | | 15,486 | | | | 1,129,704 | |

Royal Gold, Inc. | | | 138 | | | | 11,098 | |

RPM International, Inc. | | | 23,177 | | | | 1,256,889 | |

Scotts Miracle-Gro Co. | | | 5,153 | | | | 446,301 | |

Sealed Air Corp. | | | 20,631 | | | | 916,429 | |

Sherwin-Williams Co. | | | 1,506 | | | | 499,646 | |

Silgan Holdings, Inc. | | | 29,338 | | | | 933,242 | |

Sonoco Products Co. | | | 28,858 | | | | 1,463,389 | |

Steel Dynamics, Inc. | | | 14,746 | | | | 501,216 | |

United States Steel Corp. | | | 427 | | | | 8,903 | |

Valspar Corp. | | | 15,228 | | | | 1,720,612 | |

Westlake Chemical Corp. | | | 731 | | | | 44,927 | |

WestRock Co. | | | 13,159 | | | | 716,113 | |

WR Grace & Co. | | | 114 | | | | 8,173 | |

| | | | | | | | |

| | | | | | | 25,865,843 | |

| | | | | | | | |

| Media - 3.8% | | | | | | |

AMC Networks, Inc. (b) | | | 16,505 | | | | 874,435 | |

Cable One, Inc. | | | 275 | | | | 197,615 | |

CBS Corp. | | | 573 | | | | 35,016 | |

Cinemark Holdings, Inc. | | | 648 | | | | 25,641 | |

Clear Channel Outdoor Holdings, Inc. | | | 62,901 | | | | 242,169 | |

Discovery Communications, Inc. - A (b) | | | 65,885 | | | | 1,745,952 | |

Discovery Communications, Inc. - C (b) | | | 55,155 | | | | 1,424,654 | |

DISH Network Corp. (b) | | | 11,496 | | | | 733,100 | |

Interpublic Group of Cos., Inc. | | | 21,666 | | | | 540,133 | |

John Wiley & Sons, Inc. | | | 31,796 | | | | 1,612,057 | |

Liberty Broadband Corp. - Class A (b) | | | 294 | | | | 25,946 | |

Liberty Media Corp. - Liberty SiriusXM - A (b) | | | 44,609 | | | | 1,858,857 | |

Liberty Media Corp. - Liberty SiriusXM - B (b) | | | 14,026 | | | | 584,463 | |

Lions Gate Entertainment Corp. - A (a)(b) | | | 3,363 | | | | 91,137 | |

Lions Gate Entertainment Corp. - B (a)(b) | | | 2,369 | | | | 59,912 | |

Live Nation Entertainment, Inc. (b) | | | 30,757 | | | | 1,060,809 | |

Madison Square Garden Co. (b) | | | 3,317 | | | | 648,175 | |

News Corp. - Class A | | | 154,794 | | | | 2,071,144 | |

News Corp. - Class B | | | 66,839 | | | | 915,694 | |

Omnicom Group, Inc. | | | 3,980 | | | | 333,206 | |

Regal Entertainment Group | | | 24 | | | | 499 | |

Scripps Networks Interactive, Inc. | | | 24,110 | | | | 1,596,564 | |

TEGNA, Inc. | | | 46,566 | | | | 1,105,477 | |

Time Warner, Inc. | | | 3,623 | | | | 360,452 | |

Tribune Media Co. | | | 5,553 | | | | 212,125 | |

Twenty-First Century Fox, Inc. - A | | | 70,826 | | | | 1,920,801 | |

| | | | |

| | The accompanying Notes to the Financial Statements are an integral part of these Financial Statements. | | (Continued) |

| | | | | | | | | | | | | | | | |

| | Elements Portfolios | | | | | | Annual Report | | | | | | May 31, 2017 | | |

| | | | | | | | | | |

12

| | |

| Schedule of Investments | | as of May 31, 2017 |

| | | | | | | | |

| | | SHARES | | | FAIR

VALUE | |

| Media - 3.8% (continued) | | | | | | |

Twenty-First Century Fox, Inc. - B | | | 56,485 | | | $ | 1,519,447 | |

Viacom, Inc. - Class A | | | 6,013 | | | | 230,899 | |

Viacom, Inc. - Class B | | | 6,531 | | | | 227,213 | |

Walt Disney Co. | | | 11,624 | | | | 1,254,695 | |

| | | | | | | | |

| | | | | | | 23,508,287 | |

| | | | | | | | |

| Pharmaceuticals, Biotechnology & Life Sciences - 2.8% | |

Bio-Rad Laboratories, Inc. (b) | | | 1,945 | | | | 434,669 | |

Bio-Techne Corp. | | | 150 | | | | 16,812 | |

Bristol-Myers Squibb Co. | | | 35,449 | | | | 1,912,474 | |

Bruker Corp. | | | 31,774 | | | | 864,571 | |

Charles River Laboratories International, Inc. (b) | | | 2,077 | | | | 191,188 | |

Eli Lilly & Co. | | | 21,160 | | | | 1,683,701 | |

Endo International PLC (a)(b) | | | 41,460 | | | | 546,443 | |

Johnson & Johnson | | | 15,577 | | | | 1,997,750 | |

Mallinckrodt PLC (a)(b) | | | 81 | | | | 3,494 | |

Merck & Co., Inc. | | | 9,575 | | | | 623,428 | |

Mettler-Toledo International, Inc. (b) | | | 161 | | | | 93,832 | |

Mylan NV (a)(b) | | | 11,881 | | | | 463,121 | |

Patheon NV (a)(b) | | | 599 | | | | 20,791 | |

PerkinElmer, Inc. | | | 13,865 | | | | 874,327 | |

Perrigo Co. PLC (a) | | | 11,213 | | | | 816,867 | |

Pfizer, Inc. | | | 153,143 | | | | 5,000,119 | |

QIAGEN N.V. (a) | | | 16,417 | | | | 550,955 | |

Quintiles IMS Holdings, Inc. (b) | | | 1,021 | | | | 88,255 | |

VWR Corp. (b) | | | 16,566 | | | | 547,672 | |

Waters Corp. (b) | | | 1,636 | | | | 293,858 | |

| | | | | | | | |

| | | | | | | 17,024,327 | |

| | | | | | | | |

| Real Estate - 0.2% | | | | | | |

Jones Lang LaSalle, Inc. | | | 54 | | | | 6,236 | |

Realogy Holdings Corp. | | | 29,842 | | | | 908,987 | |

| | | | | | | | |

| | | | | | | 915,223 | |

| | | | | | | | |

| Retailing - 8.1% | | | | | | |

Advance Auto Parts, Inc. | | | 5,211 | | | | 696,346 | |

Amazon.com, Inc. (b) | | | 1,930 | | | | 1,919,617 | |

AutoNation, Inc. (b) | | | 9,095 | | | | 359,434 | |

AutoZone, Inc. (b) | | | 952 | | | | 576,836 | |

Bed Bath & Beyond, Inc. | | | 55,161 | | | | 1,898,090 | |

Best Buy Co., Inc. | | | 41,476 | | | | 2,463,260 | |

Burlington Stores, Inc. (b) | | | 11,619 | | | | 1,136,919 | |

Cabela’s, Inc. (b) | | | 6,991 | | | | 369,334 | |

CST Brands, Inc. | | | 300 | | | | 14,499 | |

Dick’s Sporting Goods, Inc. | | | 32,214 | | | | 1,324,962 | |

Dillard’s, Inc. | | | 3,667 | | | | 188,777 | |

Dollar General Corp. | | | 19,221 | | | | 1,410,629 | |

Dollar Tree, Inc. (b) | | | 15,937 | | | | 1,238,305 | |

Expedia, Inc. | | | 5,502 | | | | 791,077 | |

Foot Locker, Inc. | | | 22,528 | | | | 1,338,388 | |

GameStop Corp. | | | 35,085 | | | | 776,782 | |

Gap, Inc. | | | 88,295 | | | | 1,986,637 | |

Genuine Parts Co. | | | 10,233 | | | | 947,780 | |

Groupon, Inc. (b) | | | 391,197 | | | | 1,177,503 | |

Home Depot, Inc. | | | 1,768 | | | | 271,406 | |

Kohl’s Corp. | | | 35,842 | | | | 1,377,408 | |

| | | | | | | | |

| | | SHARES | | | FAIR

VALUE | |

| Retailing - 8.1% (continued) | | | | | | |

L Brands, Inc. | | | 13,152 | | | $ | 678,643 | |

Liberty Expedia Holdings, Inc. (b) | | | 9,442 | | | | 492,589 | |

Liberty Interactive Corp Q-A (b) | | | 81,391 | | | | 1,909,433 | |

LKQ Corp. (b) | | | 38,800 | | | | 1,221,812 | |

Lowe’s Cos., Inc. | | | 20,093 | | | | 1,582,726 | |

Macy’s, Inc. | | | 73,246 | | | | 1,721,281 | |

Michaels Cos, Inc. (b) | | | 83,723 | | | | 1,618,366 | |

Murphy USA, Inc. (b) | | | 17,825 | | | | 1,212,635 | |

Nordstrom, Inc. | | | 18,610 | | | | 777,898 | |

O’Reilly Automotive, Inc. (b) | | | 1,182 | | | | 286,139 | |

Penske Automotive Group, Inc. | | | 14,774 | | | | 625,679 | |

Pool Corp. | | | 8,892 | | | | 1,059,304 | |

Ross Stores, Inc. | | | 26,880 | | | | 1,718,170 | |

Sally Beauty Holdings, Inc. (b) | | | 74,598 | | | | 1,344,256 | |

Signet Jewelers Ltd. (a) | | | 21,235 | | | | 1,021,403 | |

Staples, Inc. | | | 285,984 | | | | 2,596,735 | |

Target Corp. | | | 42,894 | | | | 2,365,604 | |

Tiffany & Co. | | | 11,297 | | | | 982,387 | |

TJX Cos, Inc. | | | 22,686 | | | | 1,706,214 | |

Tractor Supply Co. | | | 25,681 | | | | 1,416,307 | |

TripAdvisor, Inc. (b) | | | 8,175 | | | | 314,819 | |

Urban Outfitters, Inc. (b) | | | 46,780 | | | | 882,739 | |

Williams-Sonoma, Inc. | | | 5,871 | | | | 285,683 | |

| | | | | | | | |

| | | | | | | 50,084,811 | |

| | | | | | | | |

| Semiconductors & Semiconductor Equipment - 2.4% | |

Applied Materials, Inc. | | | 59,458 | | | | 2,727,933 | |

Cree, Inc. (b) | | | 52,930 | | | | 1,262,116 | |

First Solar, Inc. (b) | | | 9,799 | | | | 377,360 | |

Intel Corp. | | | 85,332 | | | | 3,081,339 | |

KLA-Tencor Corp. | | | 9,331 | | | | 970,424 | |

Lam Research Corp. | | | 2,358 | | | | 365,891 | |

Marvell Technology Group Ltd. (a) | | | 73,440 | | | | 1,266,106 | |

Maxim Integrated Products, Inc. | | | 2,535 | | | | 121,173 | |

NVIDIA Corp. | | | 9,346 | | | | 1,349,095 | |

ON Semiconductor Corp. (b) | | | 44,942 | | | | 695,702 | |

QUALCOMM, Inc. | | | 1,848 | | | | 105,835 | |

Skyworks Solutions, Inc. | | | 5,480 | | | | 583,236 | |

Teradyne, Inc. | | | 13,619 | | | | 484,155 | |

Texas Instruments, Inc. | | | 7,762 | | | | 640,287 | |

Xilinx, Inc. | | | 9,275 | | | | 618,735 | |

| | | | | | | | |

| | | | | | | 14,649,387 | |

| | | | | | | | |

| Software & Services - 9.9% | | | | | | |

Accenture PLC-CL A (a) | | | 17,064 | | | | 2,123,956 | |

Activision Blizzard, Inc. | | | 1,603 | | | | 93,904 | |

Akamai Technologies, Inc. (b) | | | 4,258 | | | | 200,765 | |

Alliance Data Systems Corp. | | | 74 | | | | 17,844 | |

Alphabet, Inc. - Class A (b) | | | 10,860 | | | | 10,719,797 | |

Alphabet, Inc. - Class C (b) | | | 9,850 | | | | 9,503,871 | |

Amdocs Ltd. (a) | | | 30,373 | | | | 1,967,563 | |

ANSYS, Inc. (b) | | | 7,680 | | | | 970,214 | |

Atlassian Corp PLC (a)(b) | | | 6,801 | | | | 243,204 | |

Automatic Data Processing, Inc. | | | 1,305 | | | | 133,593 | |

Black Knight Financial Services, Inc. (b) | | | 11,914 | | | | 474,773 | |

Booz Allen Hamilton Holding Corp. | | | 29,500 | | | | 1,163,480 | |

Broadridge Financial Solutions, Inc. | | | 11,257 | | | | 854,294 | |

CA, Inc. | | | 28,354 | | | | 900,807 | |

| | | | |

| | The accompanying Notes to the Financial Statements are an integral part of these Financial Statements. | | (Continued) |

| | | | | | | | | | | | | | | | |

| | Elements Portfolios | | | | | | Annual Report | | | | | | May 31, 2017 | | |

| | | | | | | | | | |

13

| | |

| Schedule of Investments | | as of May 31, 2017 |

| | | | | | | | |

| | | SHARES | | | FAIR

VALUE | |

| Software & Services - 9.9% (continued) | | | | | | |

Cadence Design Systems, Inc. (b) | | | 25,278 | | | $ | 888,269 | |

CDK Global, Inc. | | | 6,891 | | | | 423,521 | |

Citrix Systems, Inc. (b) | | | 2,673 | | | | 220,629 | |

Cognizant Technology Solutions Corp. | | | 2,054 | | | | 137,433 | |

CommerceHub, Inc. - Series - A (b) | | | 6,494 | | | | 110,528 | |

CommerceHub, Inc. - Series - C (b) | | | 17,829 | | | | 306,302 | |

CoreLogic, Inc. (b) | | | 15,839 | | | | 685,829 | |

CSRA, Inc. | | | 23,662 | | | | 713,646 | |

Dell Technologies, Inc. - Class - V (b) | | | 14,359 | | | | 996,371 | |

DST Systems, Inc. | | | 2,809 | | | | 339,383 | |

eBay, Inc. (b) | | | 4,422 | | | | 151,675 | |

Euronet Worldwide, Inc. (b) | | | 5,474 | | | | 477,497 | |

Facebook, Inc. (b) | | | 6,237 | | | | 944,656 | |

FactSet Research Systems, Inc. | | | 3,519 | | | | 583,063 | |

Fidelity National Information Services, Inc. | | | 4,377 | | | | 375,853 | |

FireEye, Inc. (b) | | | 3,740 | | | | 56,063 | |

First Data Corp. (b) | | | 59,457 | | | | 1,018,498 | |

Fiserv, Inc. (b) | | | 4,137 | | | | 518,283 | |

Fortinet, Inc. (b) | | | 5,866 | | | | 230,768 | |

Gartner, Inc. (b) | | | 4,781 | | | | 571,808 | |

Genpact Ltd. (a) | | | 58,765 | | | | 1,605,460 | |

GoDaddy, Inc. (b) | | | 307 | | | | 12,630 | |

Guidewire Software, Inc. (b) | | | 2,003 | | | | 133,039 | |

IAC InterActive Corp. (b) | | | 11,551 | | | | 1,228,333 | |

International Business Machines Corp. | | | 25,362 | | | | 3,871,002 | |

Intuit, Inc. | | | 3,247 | | | | 456,658 | |

Jack Henry & Associates, Inc. | | | 2,964 | | | | 314,806 | |

Leidos Holdings, Inc. | | | 5,890 | | | | 327,248 | |

Manhattan Associates, Inc. (b) | | | 6,725 | | | | 314,999 | |

MasterCard, Inc. | | | 12,943 | | | | 1,590,436 | |

Match Group, Inc. (b) | | | 51,471 | | | | 1,002,655 | |

Nuance Communications, Inc. (b) | | | 899 | | | | 16,641 | |

Nutanix, Inc. (b) | | | 23,273 | | | | 434,042 | |

PayPal Holdings, Inc. (b) | | | 8,115 | | | | 423,684 | |

PTC, Inc. (b) | | | 1,469 | | | | 84,585 | |

Red Hat, Inc. (b) | | | 153 | | | | 13,704 | |

Sabre Corp. | | | 14,289 | | | | 320,502 | |

SS&C Technologies Holdings, Inc. | | | 6,519 | | | | 244,984 | |

Symantec Corp. | | | 2,374 | | | | 71,956 | |

Synopsys, Inc. (b) | | | 20,674 | | | | 1,547,862 | |

Tableau Software, Inc. (b) | | | 5,469 | | | | 339,133 | |

Teradata Corp. (b) | | | 61,257 | | | | 1,669,866 | |

Total System Services, Inc. | | | 11,077 | | | | 659,635 | |

Twitter, Inc. (b) | | | 18,732 | | | | 343,170 | |

Tyler Technologies, Inc. (b) | | | 592 | | | | 101,161 | |

Vantiv, Inc. (b) | | | 4,855 | | | | 304,506 | |

VeriFone Systems, Inc. (b) | | | 34,561 | | | | 632,121 | |

Visa, Inc. | | | 900 | | | | 85,707 | |

VMware, Inc. (b) | | | 26,726 | | | | 2,596,431 | |

Western Union Co. | | | 16,397 | | | | 311,871 | |

Yelp, Inc. (b) | | | 7,695 | | | | 214,844 | |

Zynga, Inc. (b) | | | 245,105 | | | | 862,770 | |

| | | | | | | | |

| | | | | | | 61,254,581 | |

| | | | | | | | |

| Technology Hardware & Equipment - 7.9% | |

Amphenol Corp. | | | 9,234 | | | | 688,857 | |

Apple, Inc. | | | 120,971 | | | | 18,479,530 | |

ARRIS International PLC (a)(b) | | | 32,351 | | | | 907,122 | |

| | | | | | | | |

| | | SHARES | | | FAIR

VALUE | |

| Technology Hardware & Equipment - 7.9% (continued) | |

Arrow Electronics, Inc. (b) | | | 12,654 | | | $ | 956,516 | |

Avnet, Inc. | | | 22,659 | | | | 831,132 | |

Brocade Communications Systems, Inc. | | | 54,083 | | | | 683,068 | |

CDW Corp. | | | 21,813 | | | | 1,312,706 | |

Cisco Systems, Inc. | | | 88,522 | | | | 2,791,099 | |

CommScope Holding Co, Inc. (b) | | | 26,298 | | | | 972,763 | |

Corning, Inc. | | | 64,121 | | | | 1,865,921 | |

Dolby Laboratories, Inc. | | | 37,413 | | | | 1,885,241 | |

EchoStar Corp. (b) | | | 6,418 | | | | 378,983 | |

F5 Networks, Inc. (b) | | | 7,955 | | | | 1,019,274 | |

Fitbit, Inc. (b) | | | 102,438 | | | | 535,751 | |

FLIR Systems, Inc. | | | 21,197 | | | | 803,154 | |

Harris Corp. | | | 4,550 | | | | 510,328 | |

HP, Inc. | | | 99,621 | | | | 1,868,890 | |

IPG Photonics Corp. (b) | | | 107 | | | | 14,877 | |

Jabil Circuit, Inc. | | | 42,744 | | | | 1,278,901 | |

Juniper Networks, Inc. | | | 63,964 | | | | 1,876,064 | |

Keysight Technologies, Inc. (b) | | | 25,402 | | | | 981,533 | |

Motorola Solutions, Inc. | | | 6,142 | | | | 513,287 | |

National Instruments Corp. | | | 29,229 | | | | 1,115,086 | |

NCR Corp. (b) | | | 28,902 | | | | 1,113,594 | |

NetApp, Inc. | | | 33,657 | | | | 1,362,772 | |

Trimble, Inc. (b) | | | 21,965 | | | | 791,619 | |

Western Digital Corp. | | | 526 | | | | 47,372 | |

Xerox Corp. | | | 391,261 | | | | 2,766,215 | |

Zebra Technologies Corp. (b) | | | 3,835 | | | | 400,144 | |

| | | | | | | | |

| | | | | | | 48,751,799 | |

| | | | | | | | |

| Telecommunication Services - 1.2% | |

AT&T, Inc. | | | 94,841 | | | | 3,654,224 | |

CenturyLink, Inc. | | | 8,402 | | | | 209,630 | |

Frontier Communications Corp. | | | 535,711 | | | | 701,781 | |

Telephone & Data Systems, Inc. | | | 32,639 | | | | 931,191 | |

T-Mobile US, Inc. (b) | | | 10,406 | | | | 701,572 | |

United States Cellular Corp. (b) | | | 27,995 | | | | 1,118,680 | |

| | | | | | | | |

| | | | | | | 7,317,078 | |

| | | | | | | | |

| Transportation - 1.9% | |

Alaska Air Group, Inc. | | | 1,777 | | | | 154,688 | |

Avis Budget Group, Inc. (b) | | | 305 | | | | 6,981 | |

CH Robinson Worldwide, Inc. | | | 10,479 | | | | 702,198 | |

Copa Holdings (a) | | | 3,157 | | | | 356,867 | |

Delta Air Lines, Inc. | | | 20,215 | | | | 993,163 | |

Expeditors International of Washington, Inc. | | | 27,533 | | | | 1,469,712 | |

Genesee & Wyoming, Inc. (b) | | | 522 | | | | 34,191 | |

J.B. Hunt Transport Services, Inc. | | | 11,650 | | | | 994,677 | |

JetBlue Airways Corp. (b) | | | 71,011 | | | | 1,592,067 | |

Kirby Corp. (b) | | | 4,510 | | | | 298,787 | |

Landstar System, Inc. | | | 23,551 | | | | 1,967,686 | |

Old Dominion Freight Line, Inc. | | | 6,884 | | | | 614,879 | |

Southwest Airlines Co. | | | 31,284 | | | | 1,879,856 | |

United Continental Holdings, Inc. (b) | | | 6,975 | | | | 555,698 | |

| | | | | | | | |

| | | | | | | 11,621,450 | |

| | | | | | | | |

| Utilities - 0.4% | |

Aqua America, Inc. | | | 2,743 | | | | 89,669 | |

Atmos Energy Corp. | | | 1,737 | | | | 144,709 | |

| | | | |

| | The accompanying Notes to the Financial Statements are an integral part of these Financial Statements. | | (Continued) |

| | | | | | | | | | | | | | | | |

| | Elements Portfolios | | | | | | Annual Report | | | | | | May 31, 2017 | | |

| | | | | | | | | | |

14

| | |

| Schedule of Investments | | as of May 31, 2017 |

| | | | | | | | |

| | | SHARES | | | FAIR

VALUE | |

| Utilities - 0.4% (continued) | |

Avangrid, Inc. | | | 2,553 | | | $ | 115,983 | |

Calpine Corp. (b) | | | 25,000 | | | | 321,250 | |

Eversource Energy | | | 556 | | | | 34,511 | |

MDU Resources Group, Inc. | | | 13,929 | | | | 379,287 | |

National Fuel Gas Co. | | | 528 | | | | 29,969 | |

NiSource, Inc. | | | 2,692 | | | | 70,180 | |

NRG Energy, Inc. | | | 23,554 | | | | 378,277 | |

OGE Energy Corp. | | | 469 | | | | 16,710 | |

ONEOK, Inc. | | | 3,027 | | | | 150,381 | |

PG&E Corp. | | | 2,450 | | | | 167,531 | |

Pinnacle West Capital Corp. | | | 530 | | | | 46,826 | |

UGI Corp. | | | 2,960 | | | | 151,493 | |

Vectren Corp. | | | 1,461 | | | | 89,618 | |

WEC Energy Group, Inc. | | | 136 | | | | 8,535 | |

Westar Energy, Inc. | | | 2,964 | | | | 156,944 | |

Xcel Energy, Inc. | | | 5,725 | | | | 274,285 | |

| | | | | | | | |

| | | | | | | 2,626,158 | |

| | | | | | | | |

TOTAL COMMON STOCKS

(Cost $561,148,185) | | | | | | | 569,072,024 | |

| | | | | | | | |

| | | | | | | | |

REAL ESTATE INVESTMENT TRUSTS - 0.2% | |

| | | | | | | | |

| Diversified Financials - 0.1% | |

Chimera Investment Corp. | | | 1,489 | | | | 27,695 | |

Starwood Property Trust, Inc. | | | 11,981 | | | | 263,822 | |

Two Harbors Investment Corp. | | | 15,022 | | | | 149,920 | |

| | | | | | | | |

| | | | | | | 441,437 | |

| | | | | | | | |

| Real Estate - 0.1% | |

Annaly Capital Management, Inc. | | | 58,673 | | | | 702,902 | |

| | | | | | | | |

| | | | | | | | |

TOTAL REAL ESTATE INVESTMENT TRUSTS

(Cost $1,113,822) | | | | 1,144,339 | |

| | | | | | | | |

| | |

| | | PRINCIPAL

AMOUNT | | | FAIR

VALUE | |

U.S. GOVERNMENT NOTES - 0.8% | | | | | | | | |

| | | | | | | | |

| U.S. Government Notes - 0.8% | |

United States Treasury Floating Rate Note - 0.899%, 07/31/2017 (c) | | $ | 5,001,000 | | | | 5,002,090 | |

| | | | | | | | |

TOTAL U.S. GOVERNMENT NOTES

(Cost $5,002,016) | | | | | | | 5,002,090 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | |

| | | SHARES | | | FAIR

VALUE | |

SHORT-TERM INVESTMENTS - 11.3% | | | | | | | | |

| | | | | | | | |

| Money Market Funds - 6.4% | |

Fidelity Institutional Money Market Funds - Government Portfolio - Institutional Class - 0.64% (d) | | | 7,913,264 | | | $ | 7,913,264 | |

First American Government Obligations Fund - Class Z - 0.65% (d) | | | 7,913,263 | | | | 7,913,263 | |

First American Treasury Obligations Fund - Class Z - 0.64% (d) | | | 7,913,263 | | | | 7,913,263 | |

Morgan Stanley Institutional Liquidity Funds - Government Portfolio - Institutional Class - 0.67% (d) | | | 7,913,263 | | | | 7,913,263 | |

Short-Term Investments Trust - Treasury Portfolio - Institutional Class - 0.65% (d) | | | 7,913,263 | | | | 7,913,263 | |

| | | | | | | | |

| | | | | | | 39,566,316 | |

| | | | | | | | |

| | |

| | | PRINCIPAL

AMOUNT | | | FAIR

VALUE | |

| | | | | | | | |

| U.S. Treasury Bills - 4.9% | | | | | | |

0.729%, 06/29/2017 (e) | | $ | 1,000 | | | | 999 | |

0.800%, 07/13/2017 (e) | | | 10,000,000 | | | | 9,990,638 | |

0.862%, 08/03/2017 (e) | | | 20,000,000 | | | | 19,968,380 | |

| | | | | | | | |

| | | | | | | 29,960,017 | |

| | | | | | | | |

TOTAL SHORT-TERM INVESTMENTS

(Cost $69,528,028) | | | | | | | 69,526,333 | |

| | | | | | | | |

TOTAL INVESTMENTS

(Cost $636,792,051) - 104.7% | | | | | | | 644,744,786 | |

| | | | | | | | |

LIABILITIES IN EXCESS OF OTHER ASSETS - (4.7)% | | | | | | | (28,669,207) | |

| | | | | | | | |

TOTAL NET ASSETS - 100.0% | | | | | | $ | 616,075,579 | |

| | | | | | | | |

Percentages are stated as a percent of net assets.

| PLC - | Public Limited Company |

| (a) | Foreign issued security. Total foreign securities are $30,668,179, which represents 5.0% of net assets. |

| (b) | Non-income producing security. |

| (c) | Variable rate security. This rate is listed as of May 31, 2017. |

| (d) | Rate shown is the 7-day effective yield. |

| (e) | Rate shown is the effective yield based on purchase price. The calculation assumes the security is held to maturity. |

Open Futures Contracts

| | | | | | | | | | | | |

| DESCRIPTION | | NUMBER OF

CONTRACTS

PURCHASED | | | NOTIONAL

VALUE | | | UNREALIZED

DEPRECIATION | |

FUTURES CONTRACTS PURCHASED | | | | | | | | | | | | |

S&P 500 E-Mini Index, June 2017 Settlement | | | 360 | | | $ | 43,399,800 | | | $ | (15,577) | |

| | | | | | | | | | | | |

TOTAL FUTURES CONTRACTS PURCHASED | | | | | | $ | 43,399,800 | | | $ | (15,577) | |

| | | | | | | | | | | | |

| | | | |

| | The accompanying Notes to the Financial Statements are an integral part of these Financial Statements. | | |

| | | | | | | | | | | | | | | | |

| | Elements Portfolios | | | | | | Annual Report | | | | | | May 31, 2017 | | |

| | | | | | | | | | |

15

| | |

| Schedule of Investments | | as of May 31, 2017 |

| | | | |

| ELEMENTS U.S. SMALL CAP PORTFOLIO | | | | |

| | | | | | | | |

| | | SHARES | | | FAIR

VALUE | |

COMMON STOCKS - 93.4% | | | | | | | | |

| | | | | | | | |

| Automobiles & Components - 1.5% | | | | | | |

American Axle & Manufacturing Holdings, Inc. (a) | | | 10,273 | | | $ | 155,225 | |

Cooper Tire & Rubber Co. | | | 15,649 | | | | 563,364 | |

Cooper-Standard Holdings, Inc. (a) | | | 4,316 | | | | 466,171 | |

Dana Holding Corp. | | | 14,477 | | | | 305,754 | |

Dorman Products, Inc. (a) | | | 6,082 | | | | 507,239 | |

Fox Factory Holding Corp. (a) | | | 9,985 | | | | 328,007 | |

Gentherm, Inc. (a) | | | 230 | | | | 8,671 | |

Horizon Global Corp. (a) | | | 6,128 | | | | 90,143 | |

LCI Industries | | | 9,326 | | | | 830,014 | |

Modine Manufacturing Co. (a) | | | 3,234 | | | | 49,157 | |

Spartan Motors, Inc. | | | 67,059 | | | | 576,707 | |

Standard Motor Products, Inc. | | | 15,765 | | | | 767,125 | |

Stoneridge, Inc. (a) | | | 33,835 | | | | 523,089 | |

Strattec Security Corp. | | | 8,094 | | | | 287,742 | |

Superior Industries International, Inc. | | | 17,535 | | | | 341,933 | |

Tenneco, Inc. | | | 2,981 | | | | 169,470 | |

Tower International, Inc. | | | 7,226 | | | | 167,643 | |

Unique Fabricating, Inc. | | | 4,029 | | | | 37,429 | |

| | | | | | | | |

| | | | | | | 6,174,883 | |

| | | | | | | | |

| Banks - 7.1% | | | | | | |

Access National Corp. | | | 1,524 | | | | 42,657 | |

ACNB Corp. | | | 243 | | | | 6,865 | |

American National Bankshares, Inc. | | | 4,460 | | | | 155,431 | |

Ames National Corp. | | | 1,113 | | | | 33,000 | |

Arrow Financial Corp. | | | 4,204 | | | | 133,057 | |

Astoria Financial Corp. | | | 14,681 | | | | 271,892 | |

Atlantic Capital Bancshares, Inc. (a) | | | 6,276 | | | | 116,420 | |

BancFirst Corp. | | | 130 | | | | 12,278 | |

Banco Latinoamericano de Comercio Exterior, S.A. (b) | | | 10,087 | | | | 272,349 | |

Bank Mutual Corp. | | | 22,080 | | | | 195,408 | |

Bank of Marin Bancorp | | | 3,232 | | | | 193,758 | |

BankFinancial Corp. | | | 18,404 | | | | 270,171 | |

Bankwell Financial Group, Inc. | | | 128 | | | | 3,972 | |

Bear State Financial, Inc. | | | 9,733 | | | | 85,066 | |

Beneficial Bancorp, Inc. | | | 5,219 | | | | 76,458 | |

Berkshire Hills Bancorp, Inc. | | | 6,709 | | | | 240,518 | |

Blue Hills Bancorp, Inc. | | | 1,000 | | | | 18,000 | |

Boston Private Financial Holdings, Inc. | | | 11,064 | | | | 160,428 | |

Brookline Bancorp, Inc. | | | 14,027 | | | | 193,573 | |

Bryn Mawr Bank Corp. | | | 5,558 | | | | 227,044 | |

C&F Financial Corp. | | | 1,253 | | | | 60,332 | |

California First National Bancorp | | | 3,516 | | | | 60,299 | |

Camden National Corp. | | | 1,757 | | | | 70,631 | |

Capital City Bank Group, Inc. | | | 17,183 | | | | 322,353 | |

Cathay General Bancorp | | | 10,838 | | | | 384,749 | |

CenterState Banks, Inc. | | | 6,157 | | | | 148,014 | |

Central Pacific Financial Corp. | | | 13,047 | | | | 394,672 | |

Central Valley Community Bancorp | | | 9,999 | | | | 208,779 | |

Century Bancorp, Inc. - Class A | | | 696 | | | | 41,586 | |

Charter Financial Corp. | | | 8,817 | | | | 157,824 | |

Chemung Financial Corp. | | | 4,790 | | | | 180,008 | |

Citizens & Northern Corp. | | | 12,345 | | | | 275,170 | |

City Holding Co. | | | 330 | | | | 20,820 | |

| | | | | | | | |

| | | SHARES | | | FAIR

VALUE | |

| Banks - 7.1% (continued) | | | | | | |

CNB Financial Corp. | | | 2,423 | | | $ | 50,810 | |

CoBiz Financial, Inc. | | | 13,401 | | | | 210,932 | |

Codorus Valley Bancorp, Inc. | | | 891 | | | | 22,988 | |

Columbia Banking System, Inc. | | | 3,211 | | | | 117,876 | |

Community Bank System, Inc. | | | 12 | | | | 645 | |

Community Trust Bancorp, Inc. | | | 11,402 | | | | 473,183 | |

County Bancorp, Inc. | | | 1,562 | | | | 38,675 | |

Customers Bancorp, Inc. (a) | | | 11,100 | | | | 310,245 | |

Enterprise Bancorp, Inc. | | | 2,930 | | | | 87,900 | |

Enterprise Financial Services Corp. | | | 1,820 | | | | 72,982 | |

ESSA Bancorp, Inc. | | | 750 | | | | 10,913 | |

Essent Group Ltd. (a)(b) | | | 24,825 | | | | 900,403 | |

EverBank Financial Corp. | | | 11,371 | | | | 221,166 | |

F.N.B. Corp. | | | 14,867 | | | | 196,244 | |

Farmers Capital Bank Corp. | | | 4,873 | | | | 186,149 | |

Farmers National Banc Corp. | | | 14,028 | | | | 190,079 | |

Federal Agricultural Mortgage Corp. - Class C | | | 2,183 | | | | 132,290 | |

Fidelity Southern Corp. | | | 1,663 | | | | 35,572 | |

Financial Institutions, Inc. | | | 2,495 | | | | 76,472 | |

First Bancorp, Inc. | | | 2,954 | | | | 74,234 | |

First Bancorp Puerto Rico (a)(b) | | | 43,907 | | | | 227,877 | |

First Bancorp NC | | | 5,706 | | | | 158,399 | |

First Busey Corp. | | | 14,295 | | | | 405,835 | |

First Business Financial Services, Inc. | | | 9,448 | | | | 215,887 | |

First Citizens BancShares, Inc. - Class A | | | 837 | | | | 277,382 | |

First Commonwealth Financial Corp. | | | 42,726 | | | | 524,675 | |

First Community Bancshares, Inc. | | | 7,366 | | | | 187,833 | |

First Connecticut Bancorp, Inc. | | | 5,455 | | | | 136,648 | |

First Defiance Financial Corp. | | | 87 | | | | 4,533 | |

First Financial Bancorp | | | 13,599 | | | | 340,655 | |

First Financial Bankshares, Inc. | | | 507 | | | | 19,393 | |

First Financial Corp. | | | 1,646 | | | | 74,975 | |

First Financial Northwest, Inc. | | | 5,789 | | | | 92,740 | |

First Internet Bancorp | | | 1,495 | | | | 38,571 | |

First Interstate BancSystem, Inc. - Class A | | | 25,500 | | | | 889,946 | |

First Merchants Corp. | | | 6,860 | | | | 272,273 | |

First NBC Bank Holding Co. (a) | | | 45,404 | | | | 1,862 | |

Flagstar Bancorp, Inc. (a) | | | 485 | | | | 14,012 | |

Flushing Financial Corp. | | | 2,696 | | | | 74,895 | |

Fulton Financial Corp. | | | 38,426 | | | | 672,455 | |

German American Bancorp, Inc. | | | 803 | | | | 24,933 | |

Glacier Bancorp, Inc. | | | 10,859 | | | | 350,311 | |

Great Southern Bancorp, Inc. | | | 1,679 | | | | 82,187 | |

Great Western Bancorp, Inc. | | | 1,371 | | | | 51,906 | |

Green Bancorp, Inc. (a) | | | 6,364 | | | | 121,234 | |

Hanmi Financial Corp. | | | 1,088 | | | | 28,941 | |

Heartland Financial USA, Inc. | | | 8,647 | | | | 387,818 | |

Heritage Commerce Corp. | | | 46,723 | | | | 628,892 | |

Heritage Financial Corp. | | | 3,368 | | | | 80,327 | |

Home Bancorp, Inc. | | | 1,002 | | | | 34,870 | |

Home BancShares, Inc. | | | 1,628 | | | | 38,111 | |

HomeStreet, Inc. (a) | | | 9,085 | | | | 243,478 | |