|

Exhibit 99.2

|

SECURITY DATA & ANALYTICS

Company Overview

AUGUST 18, 2015 CONFIDENTIAL AND PROPRIETARY

Disclaimers

This presentation includes forward-looking statements. All statements contained in this presentation other than statements of historical facts, including statements regarding future results of operations and the financial position of Rapid7, Inc. (“Rapid7,” “we,” “us” or “our”) our business strategy and plans and our objectives for future operations, are forward-looking statements. The words “anticipate,” believe,” “continue,” “estimate,” “expect,” “intend,” “may,” “will” and similar expressions are intended to identify forward-looking statements. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our financial condition, results of operations, business strategy, short-term and long-term business operations and objectives, and financial needs. These forward-looking statements are subject to a number of risks and uncertainties, including, without limitation, those set forth in the “Risk Factors” section of our prospectus filed pursuant to Rule 424(b)(4) under the Securities Act of 1933, as amended, on July 17, 2015. Moreover, we operate in a very competitive and rapidly changing environment. New risks emerge from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. In light of these risks, uncertainties and assumptions, the future events and trends discussed in this presentation may not occur and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance, achievements or events and circumstances reflected in the forward-looking statements will occur. We are under no duty to update any of these forward-looking statements after the date of this presentation to conform these statements to actual results or revised expectations, except as required by law. You should, therefore, not rely on these forward-looking statements as representing our views as of any date subsequent to the date of this presentation. Moreover, except as required by law, neither we nor any other person assumes responsibility for the accuracy and completeness of the forward-looking statements contained in this presentation.

This presentation also contains estimates and other statistical data made by independent parties and by us relating to market size and growth and other data about our industry. This data involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. Neither we nor any other person makes any representation as to the accuracy or completeness of such data or undertakes any obligation to update such data after the date of this presentation. In addition, projections, assumptions and estimates of our future performance and the future performance of the markets in which we operate are necessarily subject to a high degree of uncertainty and risk.

Confidential and Proprietary 2

Delivering Security Data & Analytics

that revolutionize the practice of cyber security

Differentiated Security Analytics 35% $35m

Technology Platform Now Strategic Imperative revenue CAGR quarterly billings

See End Notes for additional information and definitions Confidential and Proprietary 3

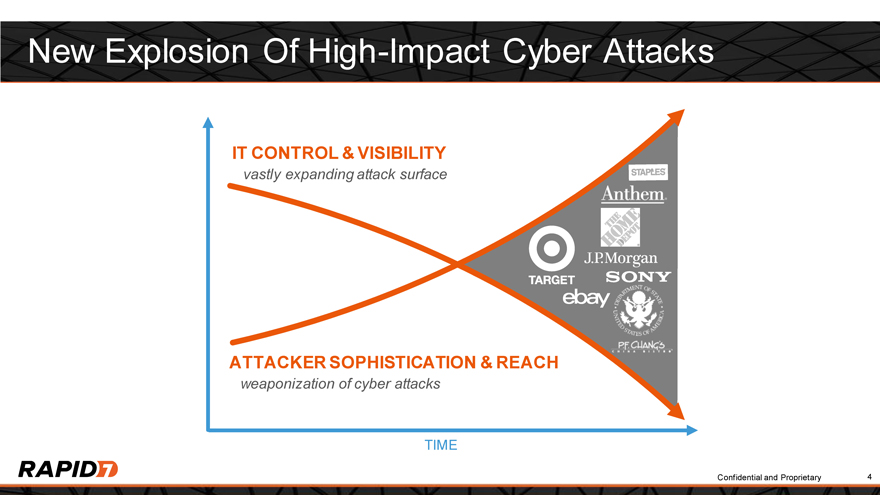

New Explosion Of High-Impact Cyber Attacks

IT CONTROL & VISIBILITY

vastly expanding attack surface

ATTACKER SOPHISTICATION & REACH

weaponization of cyber attacks

TIME

Confidential and Proprietary 4

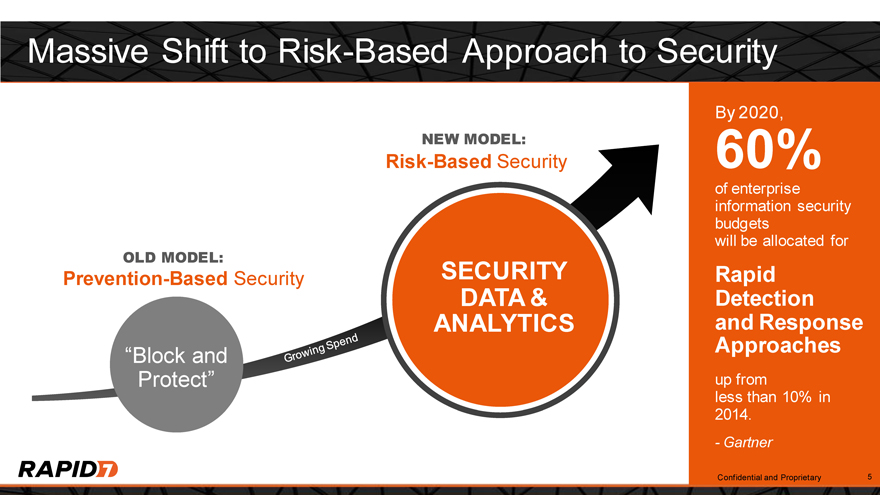

Massive Shift to Risk-Based Approach to Security

NEW MODEL:

Risk-Based Security

OLD MODEL: SECURITY

Prevention-Based Security

DATA & ANALYTICS

“Block and Protect”

Growing Spend

By 2020,

60%

of enterprise information security budgets will be allocated for

Rapid Detection and Response Approaches

up from less than 10% in 2014.

- Gartner

Confidential and Proprietary 5

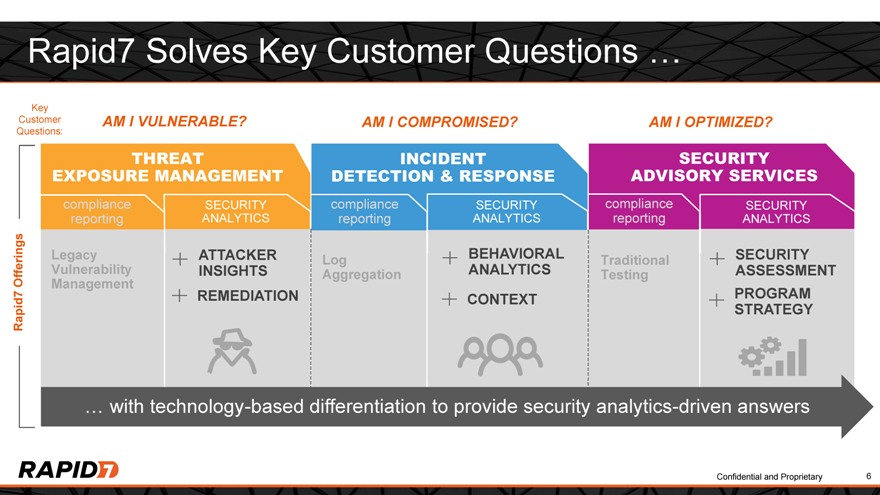

Rapid7 Solves Key Customer Questions …

Key

Customer AM I VULNERABLE? AM I COMPROMISED? AM I OPTIMIZED?

Questions:

THREAT INCIDENT SECURITY

EXPOSURE MANAGEMENT DETECTION & RESPONSE ADVISORY SERVICES

compliance SECURITY compliance SECURITY compliance SECURITY

reporting ANALYTICS reporting ANALYTICS reporting ANALYTICS

Legacy ATTACKER Log BEHAVIORAL Traditional SECURITY

Offerings Vulnerability INSIGHTS Aggregation ANALYTICS Testing ASSESSMENT

Management

REMEDIATION CONTEXT PROGRAM

Rapid7 STRATEGY

… with technology-based differentiation to provide security analytics-driven answers

Confidential and Proprietary 6

Technology Platform & Products

Confidential and Proprietary 7

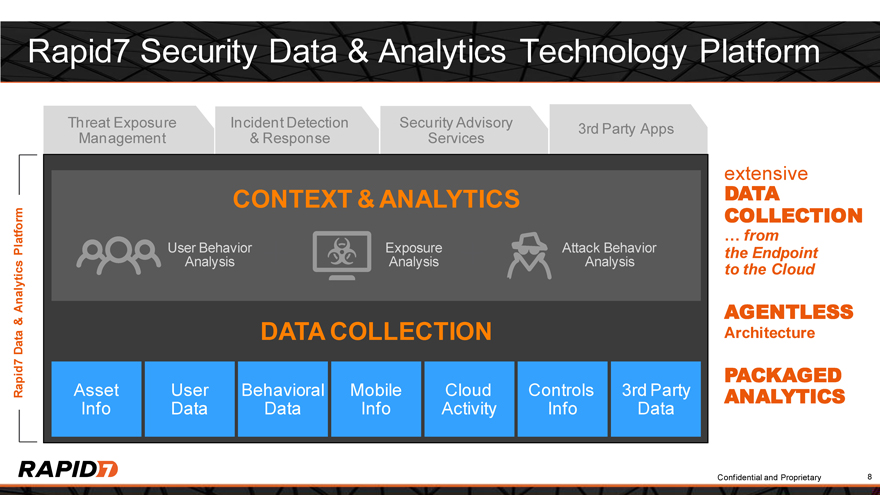

Rapid7 Security Data & Analytics Technology Platform

Threat Exposure Incident Detection Security Advisory 3rd Party Apps

Management & Response Services

CONTEXT & ANALYTICS

User Behavior Exposure Attack Behavior

Analysis Analysis Analysis

DATA COLLECTION

Asset User Behavioral Mobile Cloud Controls 3rd Party

Info Data Data Info Activity Info Data

Rapid7 Data & Analytics Platform

extensive

DATA COLLECTION

… from the Endpoint to the Cloud

AGENTLESS

Architecture

PACKAGED ANALYTICS

Confidential and Proprietary 8

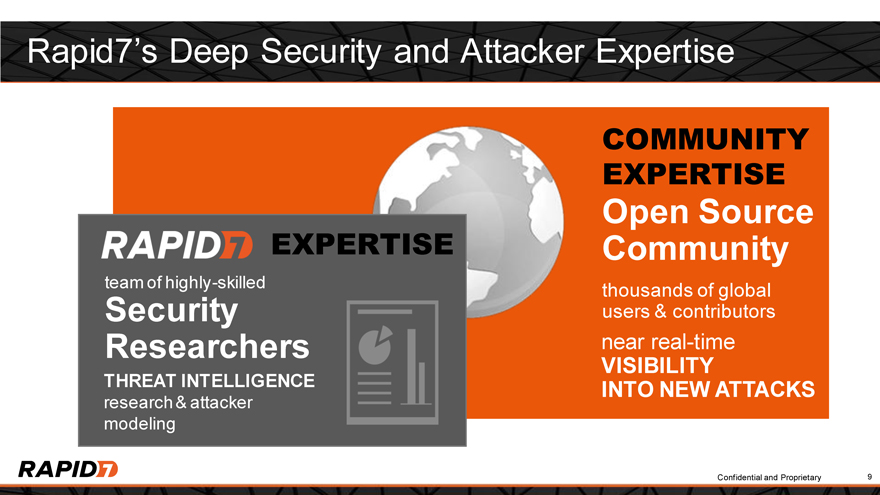

Rapid7’s Deep Security and Attacker Expertise

EXPERTISE

team of highly-skilled

Security Researchers

THREAT INTELLIGENCE research & attacker modeling

COMMUNITY EXPERTISE

Open Source Community

thousands of global users & contributors

near real-time

VISIBILITY

INTO NEW ATTACKS

Confidential and Proprietary 9

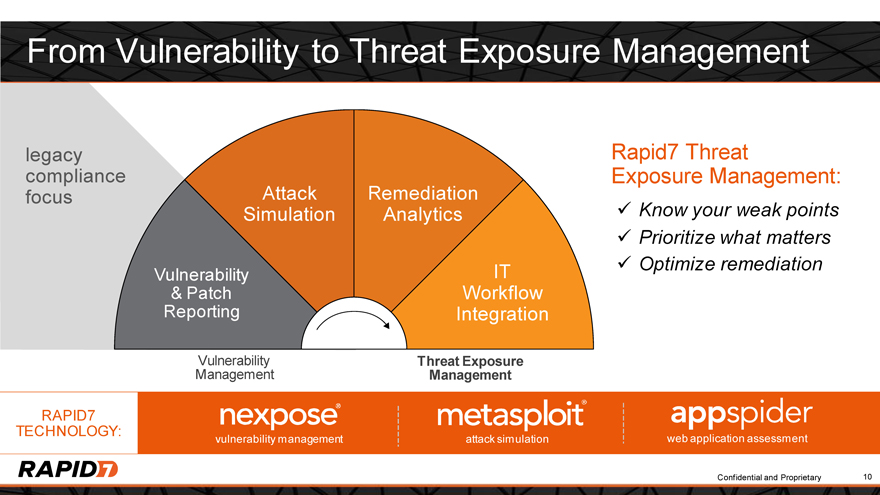

From Vulnerability to Threat Exposure Management

legacy compliance focus

Attack Remediation Simulation Analytics

Vulnerability IT

& Patch Workflow Reporting Integration

Vulnerability Threat Exposure

Management Management

Rapid7 Threat

Exposure Management:

Know your weak points Prioritize what matters Optimize remediation

RAPID7 TECHNOLOGY:

vulnerability management attack simulation web application assessment

Confidential and Proprietary 10

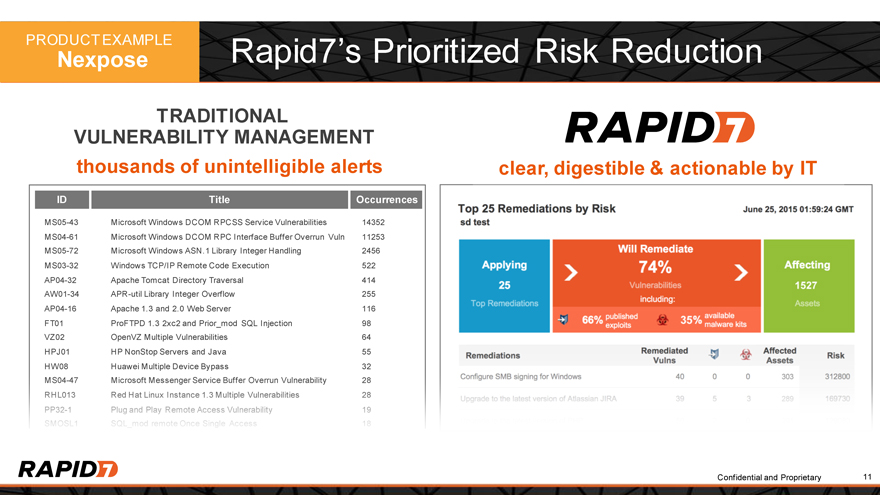

PRODUCT Nexpose EXAMPLE Rapid7’s Prioritized Risk Reduction

TRADITIONAL

VULNERABILITY MANAGEMENT

thousands of unintelligible alerts

ID Title Occurrences

MS05-43 Microsoft Windows DCOM RPCSS Service Vulnerabilities 14352

MS04-61 Microsoft Windows DCOM RPC Interface Buffer Overrun Vuln 11253

MS05-72 Microsoft Windows ASN.1 Library Integer Handling 2456

MS03-32 Windows TCP/IP Remote Code Execution 522

AP04-32 Apache Tomcat Directory Traversal 414

AW01-34 APR-util Library Integer Overflow 255

AP04-16 Apache 1.3 and 2.0 Web Server 116

FT01 ProFTPD 1.3 2xc2 and Prior_mod SQL Injection 98

VZ02 OpenVZ Multiple Vulnerabilities 64

HPJ01 HP NonStop Servers and Java 55

HW08 Huawei Multiple Device Bypass 32

MS04-47 Microsoft Messenger Service Buffer Overrun Vulnerability 28

RHL013 Red Hat Linux Instance 1.3 Multiple Vulnerabilities 28

PP32-1 Plug and Play Remote Access Vulnerability 19

SMOSL1 SQL_mod remote Once Single Access 18

Top 25 Remediations by Risk sd test June 25, 2015 01:59:24 GMT

Applying 25 Top Remediations Will Remediate 74% Vulnerabilities including:

66% published exploits 35% available malware kits

Affecting 1527 Assets

Remediations Remediated Vulns Affected Assets Risk

Configure SMB Signing for Windows 40 0 0 303 312800

Upgrade to the latest version of Atlassian JIRA 39 5 3 289 169730

clear, digestible & actionable by IT

Confidential and Proprietary 11

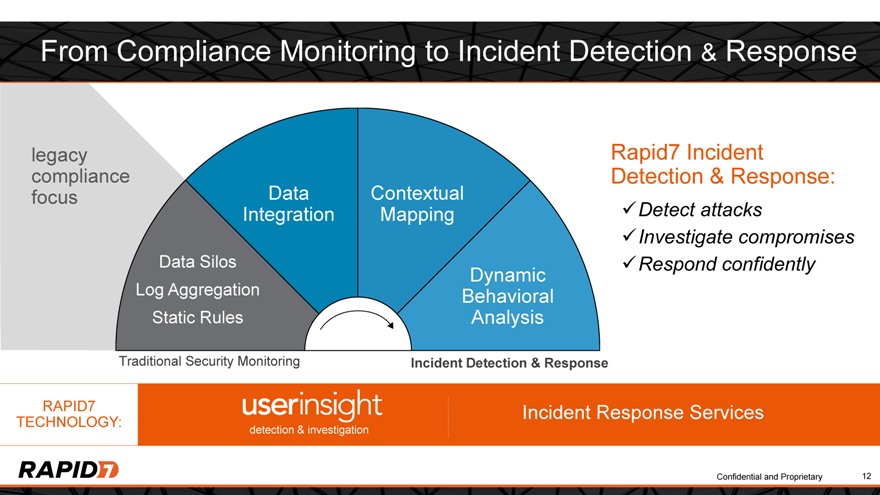

From Compliance Monitoring to Incident Detection & Response

legacy compliance

focus

Data

Integration

Contextual Mapping

Dynamic Behavioral Analysis

Data Silos Log Aggregation Static Rules

Traditional Security Monitoring Incident Detection & Response

RAPID7 Incident Response Services

TECHNOLOGY: detection & investigation

Confidential and Proprietary 12

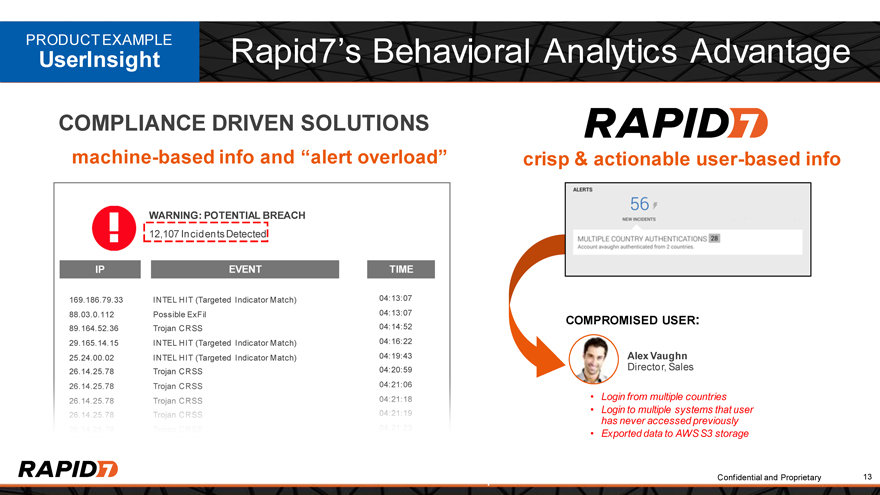

PRODUCT EXAMPLE Rapid7’s Behavioral Analytics Advantage

UserInsight

COMPLIANCE DRIVEN SOLUTIONS

machine-based info and “alert overload”

WARNING: POTENTIAL BREACH

12,107 Incidents Detected

IP EVENT TIME

169.186.79.33 INTEL HIT (Targeted Indicator Match) 04:13:07

88.03.0.112 Possible ExFil 04:13:07

89.164.52.36 Trojan CRSS 04:14:52

29.165.14.15 INTEL HIT (Targeted Indicator Match) 04:16:22

25.24.00.02 INTEL HIT (Targeted Indicator Match) 04:19:43

26.14.25.78 Trojan CRSS 04:20:59

26.14.25.78 Trojan CRSS 04:21:06

26.14.25.78 Trojan CRSS 04:21:18

26.14.25.78 Trojan CRSS 04:21:19

26.14.25.78 Trojan CRSS 04:21:23

crisp & actionable user-based info

COMPROMISED USER:

Alex Vaughn

Director, Sales

Login from multiple countries

Login to multiple systems that user has never accessed previously

Exported data to AWS S3 storage

Confidential and Proprietary 13

Synergy & Leverage From Partner Ecosystem

Rapid7 has

more50 than

Platform Integrations with Partners

DATA

COLLABORATION

PARTNERS

Two-way data sharing ‘Single pane of glass’ Enhanced platform value

DATA WORKFLOW

PARTNERS

IT security integration Streamlines correction Improves IT efficiencies

DATA

INGESTION

PARTNERS

Enhances analytics

Enables detection

Simplifies

investigations

Confidential and Proprietary 14

Market & Customers

Confidential and Proprietary 15

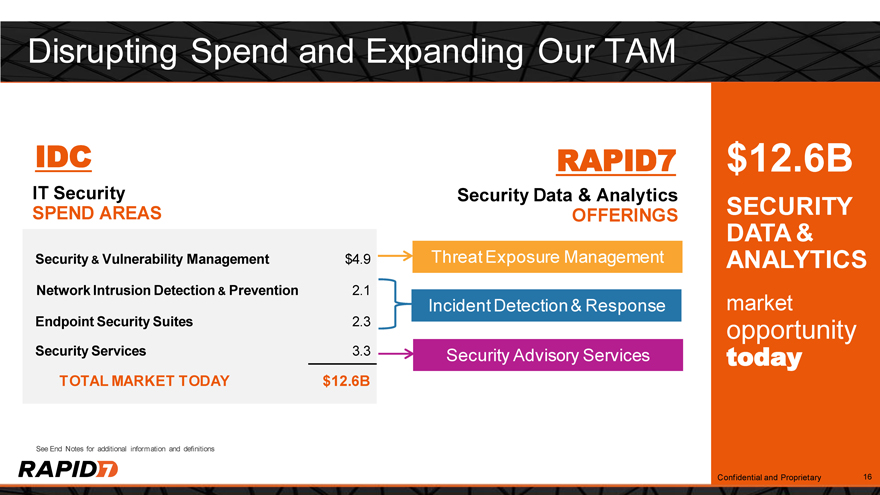

Disrupting Spend and Expanding Our TAM

IDC

IT Security

SPEND AREAS

Security & Vulnerability Management $4.9

Network Intrusion Detection & Prevention 2.1

Endpoint Security Suites 2.3

Security Services 3.3

TOTAL MARKET TODAY $12.6B

See End Notes for additional information and definitions

RAPID7

Security Data & Analytics

OFFERINGS

Threat Exposure Management

Incident Detection & Response

Security Advisory Services

$12.6B

SECURITY

DATA &

ANALYTICS

market

opportunity

today

Confidential and Proprietary 16

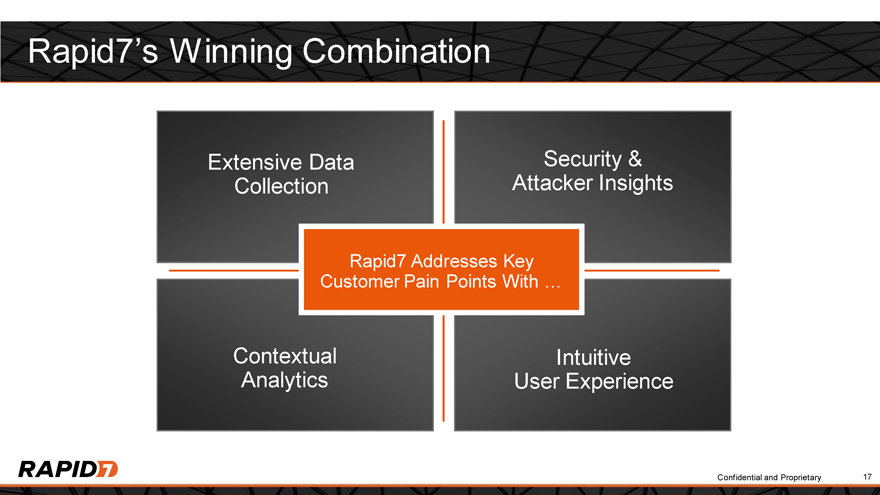

Rapid7’s Winning Combination

Extensive Data Security & Collection Attacker Insights

Rapid7 Addresses Key Customer Pain Points With …

Contextual Intuitive Analytics User Experience

Confidential and Proprietary 17

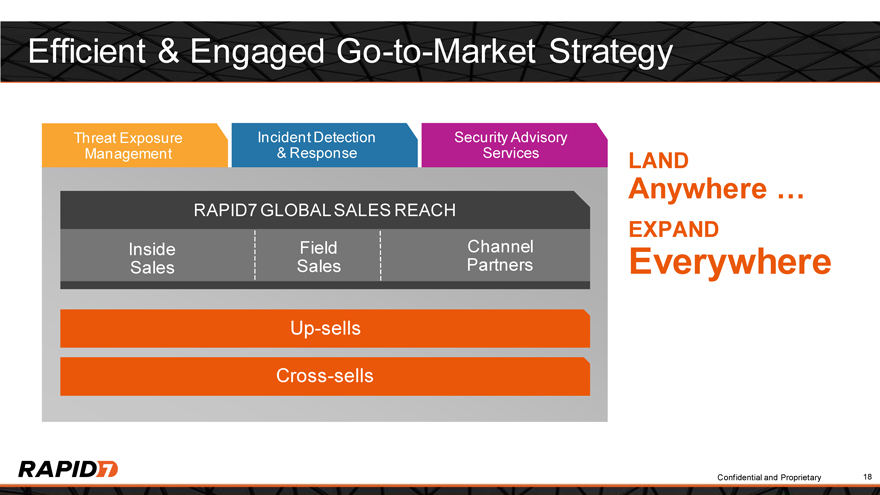

Efficient & Engaged Go-to-Market Strategy

Threat Exposure Incident Detection Security Advisory Management & Response Services

RAPID7 GLOBAL SALES REACH

Inside Field Channel Sales Sales Partners

Up-sells

Cross-sells

Anywhere LAND …

EXPAND

Everywhere

Confidential and Proprietary 18

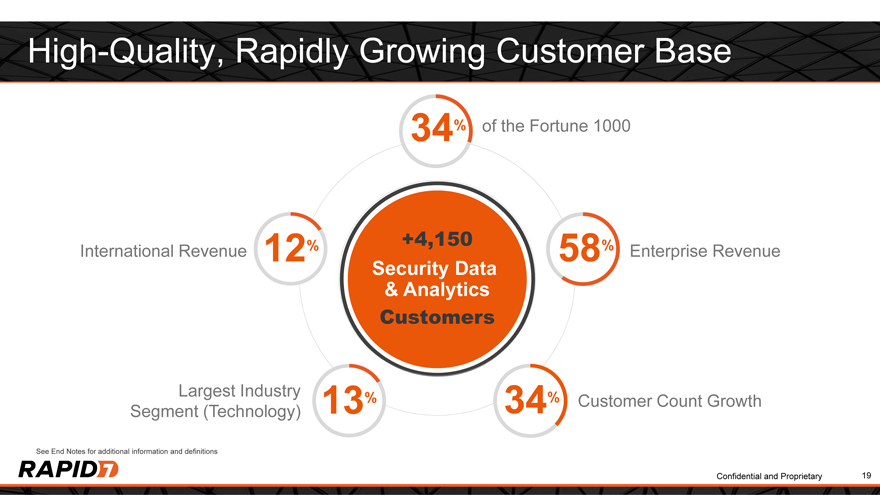

High-Quality, Rapidly Growing Customer Base

34% of the Fortune 1000

% +4,150 %

International Revenue 12 58 Enterprise Revenue

Security Data

& Analytics

Customers

Largest Industry % %

13 34 Customer Count Growth Segment (Technology)

See End Notes for additional information and definitions

Confidential and Proprietary 19

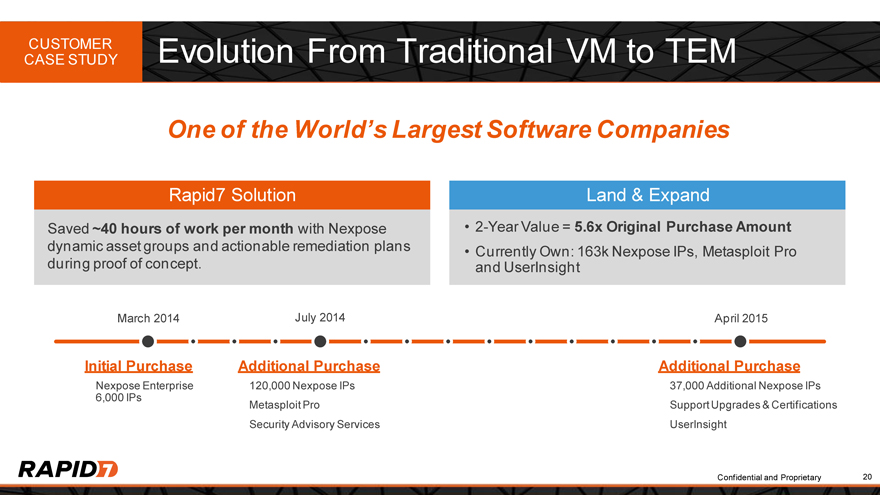

CUSTOMER Evolution From Traditional VM to TEM

CASE STUDY

One of the World’s Largest Software Companies

Rapid7 Solution

Saved ~40 hours of work per month with Nexpose dynamic asset groups and actionable remediation plans during proof of concept.

March 2014 July 2014

Land & Expand

2-Year Value = 5.6x Original Purchase Amount

Currently Own: 163k Nexpose IPs, Metasploit Pro and UserInsight

April 2015

Initial Purchase Additional Purchase

Nexpose Enterprise 120,000 Nexpose IPs 6,000 IPs Metasploit Pro Security Advisory Services

Additional Purchase

37,000 Additional Nexpose IPs Support Upgrades & Certifications UserInsight

Confidential and Proprietary 20

Multiple Drivers of Growth

1 2

5 3 4

1. Drive Analytics & Upgrade Enterprise

2. Continue to Grow Mid-market

3. Cross-sell Incident Detection & Response

with Increasing Customer Economics

4. Continue International Expansion

5. Serve as the Hub for Cyber Security

Confidential and Proprietary 21

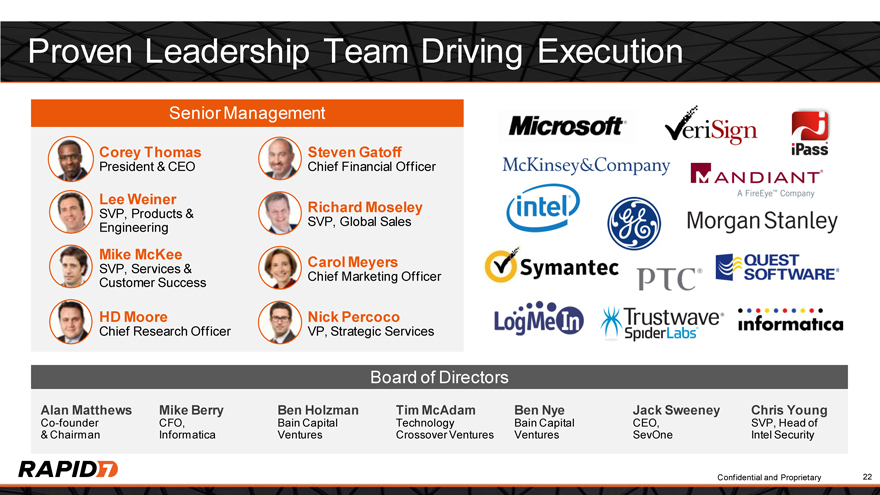

Proven Leadership Team Driving Execution

Senior Management

Corey Thomas

President & CEO

Lee Weiner

SVP, Products & Engineering

Mike McKee

SVP, Services & Customer Success

HD Moore

Chief Research Officer

Steven Gatoff

Chief Financial Officer

Richard Moseley

SVP, Global Sales

Carol Meyers

Chief Marketing Officer

Nick Percoco

VP, Strategic Services

Board of Directors

Alan Matthews Mike Berry Ben Holzman Tim McAdam Ben Nye Jack Sweeney Chris Young

Co-founder CFO, Bain Capital Technology Bain Capital CEO, SVP, Head of

& Chairman Informatica Ventures Crossover Ventures Ventures SevOne Intel Security

Confidential and Proprietary 22

Financial Overview

Confidential and Proprietary 23

Q2 2015 Financial Highlights

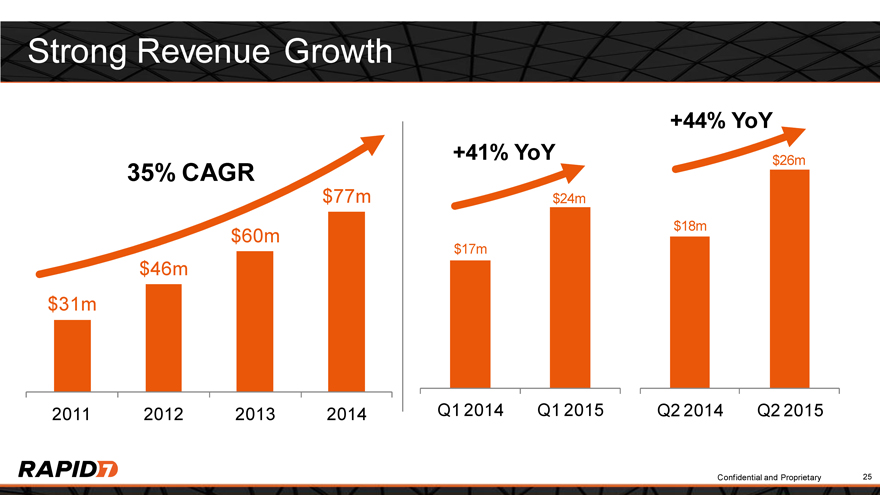

1 Strong Revenue Growth of 44% YoY

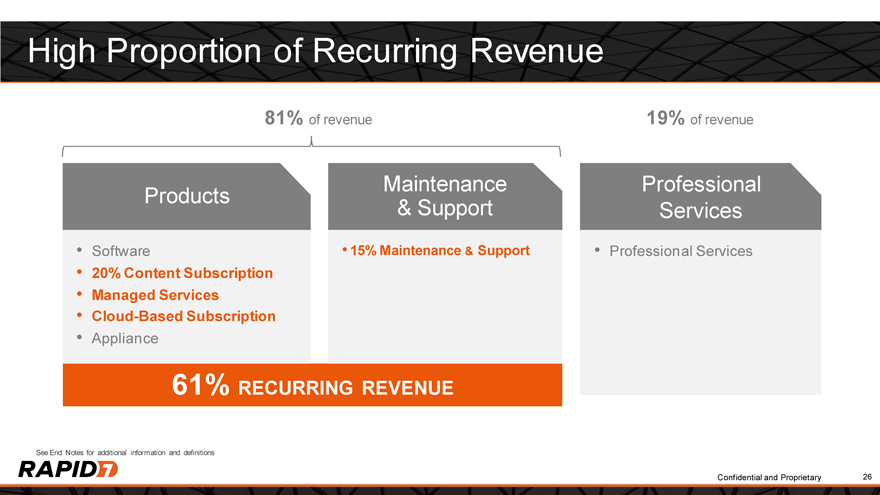

2 High-Visibility Recurring & Ratable Revenue model with 61% Recurring Revenue and 83% of Q2 Revenue on Balance Sheet as of April 1, 2015

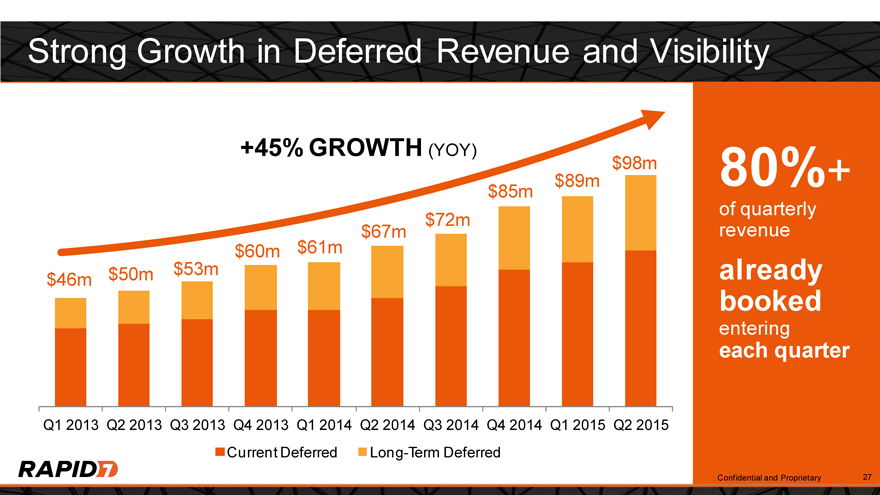

3 Strong continued Deferred Revenue Growth of 45% YoY

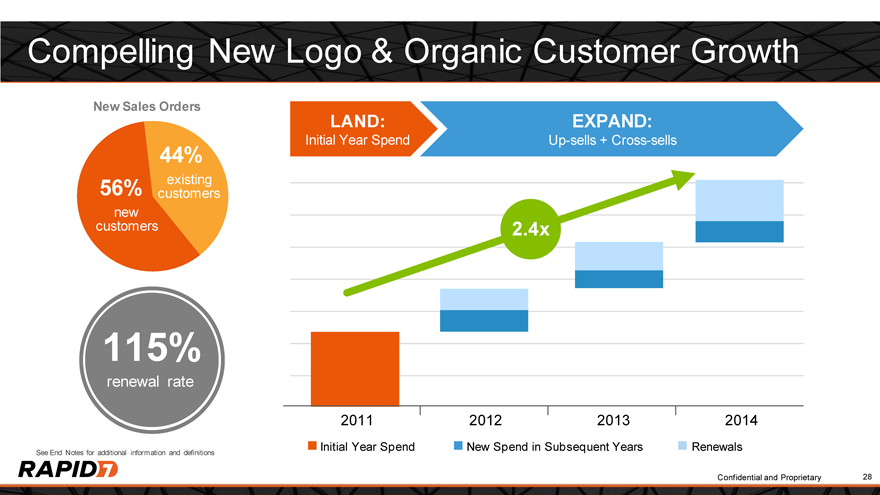

4 Solid Renewal Rate of 115% driving Attractive Customer Economics

5 Increasing Operating Efficiencies with material improvements in OpEx expense-to-revenue measures

See End Notes for additional information and definitions

Confidential and Proprietary 24

Strong Revenue Growth

35% CAGR

$77m $60m $46m $31m

2011 2012 2013 2014

+44% YoY +41% YoY $26m

$24m $18m $17m

Q1 2014 Q1 2015 Q2 2014 Q2 2015

Confidential and Proprietary 25

High Proportion of Recurring Revenue

81% of revenue

Products

Software

20% Content Subscription Managed Services Cloud-Based Subscription

Appliance

Maintenance

& Support

15% Maintenance & Support

19% of revenue

Professional Services

Professional Services

61% RECURRING REVENUE

See End Notes for additional information and definitions

Confidential and Proprietary 26

Strong Growth in Deferred Revenue and Visibility

+45% GROWTH (YOY)

$98m

$85m $89m

$67m $72m

$60m $61m

$46m $50m $53m

Q1 2013 Q2 2013 Q3 2013 Q4 2013 Q1 2014 Q2 2014 Q3 2014 Q4 2014 Q1 2015 Q2 2015

Current Deferred Long-Term Deferred

80%+

of quarterly revenue

already booked

entering quarter

each

Confidential and Proprietary 27

Compelling New Logo & Organic Customer Growth

New Sales Orders

44%

56% existing customers new customers

115%

renewal rate

See End Notes for additional information and definitions

LAND: EXPAND:

Initial Year Spend Up-sells + Cross-sells

2.4x

2011 2012 2013 2014

Initial Year Spend New Spend in Subsequent Years Renewals

Confidential and Proprietary 28

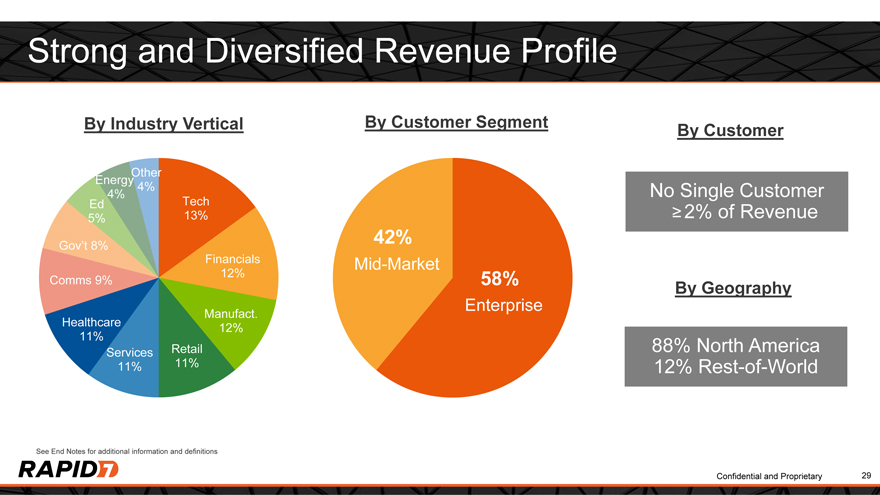

Strong and Diversified Revenue Profile

By Industry Vertical

Other Energy 4% 4%

Ed Tech

5% 13% Gov’t 8%

Financials 12% Comms 9%

Manufact. Healthcare 12% 11% Service Retail 11% 11%

See End Notes for additional information and definitions

By Customer Segment

42%

Mid-Market

58%

Enterprise

By Customer

No Single Customer e 2% of Revenue

By Geography

88% North America 12% Rest-of-World

Confidential and Proprietary 29

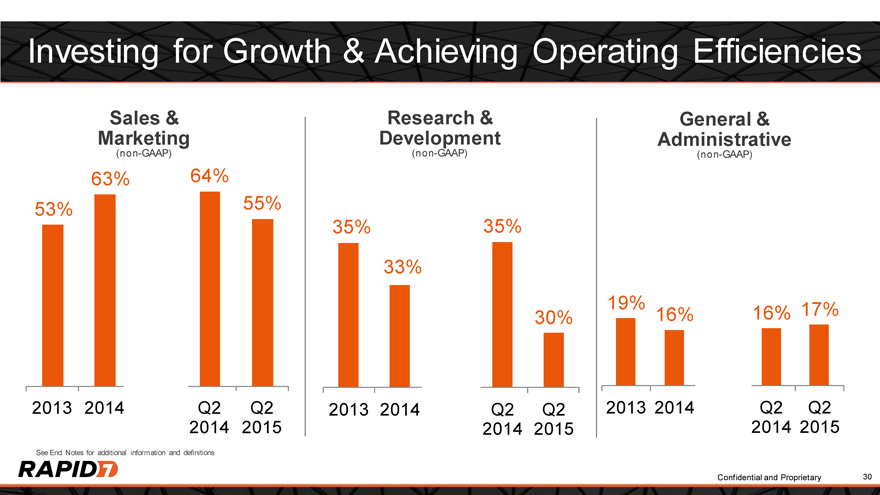

Investing for Growth & Achieving Operating Efficiencies

Marketing Sales &

(non-GAAP)

63% 64% 53% 55%

2013 2014 Q2 Q2 2014 2015

See End Notes for additional information and definitions

Development Research &

(non-GAAP)

35% 35% 33%

30%

2013 2014 Q2 Q2 2014 2015

Administrative General &

(non-GAAP)

19% 17% 16% 16%

2013 2014 Q2 Q2 2014 2015

Confidential and Proprietary 30

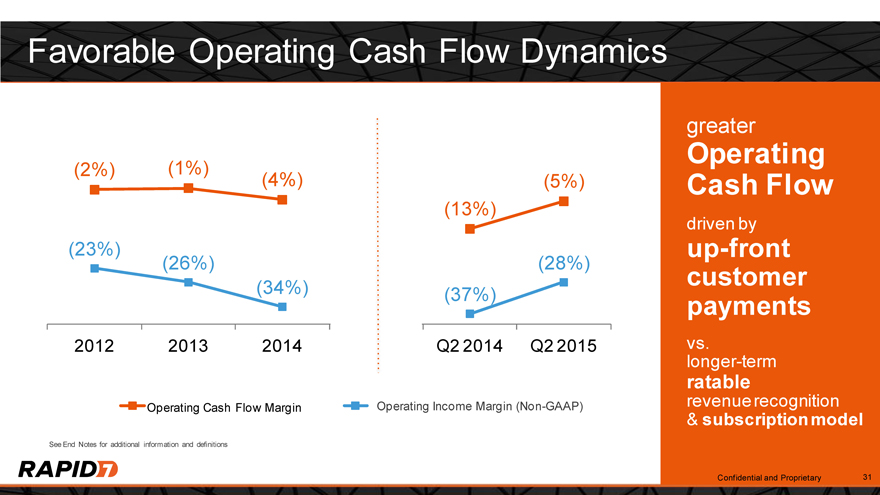

Favorable Operating Cash Flow Dynamics

(2%) (1%) (4%) (5%)

(13%)

(23%)

(26%) (28%)

(34%) (37%)

2012 2013 2014 Q2 2014 Q2 2015

Operating Cash Flow Margin Operating Income Margin (Non-GAAP)

See End Notes for additional information and definitions

greater Operating Cash Flow

up-front driven by customer payments

vs. longer-term ratable revenue recognition

& subscription model

Confidential and Proprietary 31

Investment Highlights

Disruptive

Security Data & Analytics Platform

Pioneering

IT Shift to Risk-Based Security

Strong

Recurring Revenue Growth & Visibility

Attractive

Customer Economics & Diverse Base

Compelling

And Growing Cyber Security Market

Confidential and Proprietary 32

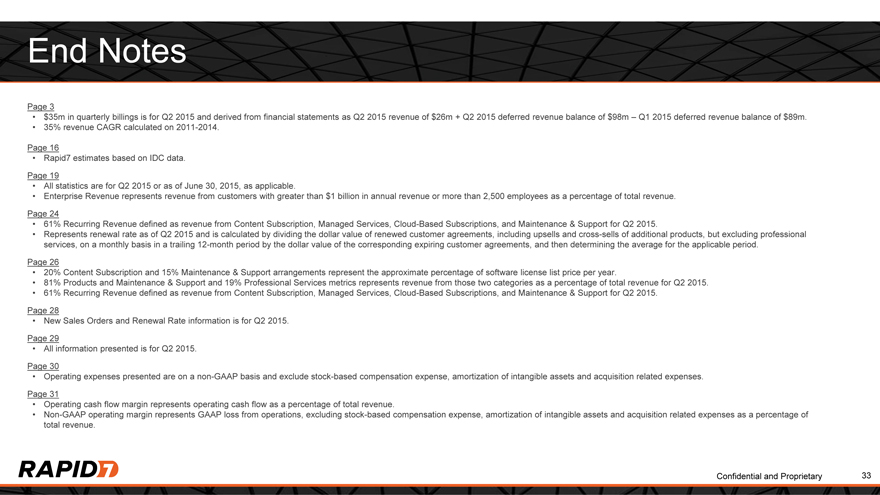

End Notes

Page 3

$35m in quarterly billings is for Q2 2015 and derived from financial statements as Q2 2015 revenue of $26m + Q2 2015 deferred revenue balance of $98m – Q1 2015 deferred revenue balance of $89m.

35% revenue CAGR calculated on 2011-2014.

Page 16

Rapid7 estimates based on IDC data.

Page 19

All statistics are for Q2 2015 or as of June 30, 2015, as applicable.

Enterprise Revenue represents revenue from customers with greater than $1 billion in annual revenue or more than 2,500 employees as a percentage of total revenue.

Page 24

61% Recurring Revenue defined as revenue from Content Subscription, Managed Services, Cloud-Based Subscriptions, and Maintenance & Support for Q2 2015.

Represents renewal rate as of Q2 2015 and is calculated by dividing the dollar value of renewed customer agreements, including upsells and cross-sells of additional products, but excluding professional services, on a monthly basis in a trailing 12-month period by the dollar value of the corresponding expiring customer agreements, and then determining the average for the applicable period.

Page 26

20% Content Subscription and 15% Maintenance & Support arrangements represent the approximate percentage of software license list price per year.

81% Products and Maintenance & Support and 19% Professional Services metrics represents revenue from those two categories as a percentage of total revenue for Q2 2015.

61% Recurring Revenue defined as revenue from Content Subscription, Managed Services, Cloud-Based Subscriptions, and Maintenance & Support for Q2 2015.

Page 28

New Sales Orders and Renewal Rate information is for Q2 2015.

Page 29

All information presented is for Q2 2015.

Page 30

Operating expenses presented are on a non-GAAP basis and exclude stock-based compensation expense, amortization of intangible assets and acquisition related expenses.

Page 31

Operating cash flow margin represents operating cash flow as a percentage of total revenue.

Non-GAAP operating margin represents GAAP loss from operations, excluding stock-based compensation expense, amortization of intangible assets and acquisition related expenses as a percentage of total revenue.

Confidential and Proprietary 33

Rapid7, Inc.

100 Summer Street Boston, MA 02110

Confidential and Proprietary