Sound Point Floating Rate Income Fund

NOTES TO THE FINANCIAL STATEMENTS

February 28, 2013

(Unaudited)

1. Organization

Sound Point Floating Rate Income Fund (the “Fund”) was organized as a business trust under the laws of the Commonwealth of Delaware on October 24, 2012, and commenced operations on December 1, 2012. The Fund is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as a non-diversified, closed-end management investment.

Sound Point Capital Management, L.P. (the “Adviser”) is a registered investment adviser under the Investment Advisers Act of 1940, as amended, and serves as investment adviser to the Fund. The Fund operates as an interval fund under Rule 23c-3 of the 1940 Act and, as such, offers to repurchase between 5% and 25% of its outstanding Shares at their net asset value as of or prior to the end of each fiscal quarter.

The Fund’s investment objective is to provide consistently strong risk-adjusted returns. The Fund intends to achieve its objective by identifying fundamentally attractive floating rate loans or variable-rate investments, which pay interest at variable-rates and are determined periodically, on the basis of a floating base lending rate, such as the London Interbank Offered Rate (“LIBOR”) with or without a floor plus a fixed spread (“Floating Rate Loans”) and other investments, including senior secured and unsecured bonds, and by creating a portfolio with an optimal blend of these assets.

2. Significant Accounting Policies

The following is a summary of significant accounting policies followed consistently by the Fund in the preparation of its financial statements in conformity with accounting principles generally accepted in the United States of America (“U.S. GAAP”).

A. Valuation of Investments

The Fund’s investments in fixed income securities are generally valued using the prices provided directly by independent third party services or provided directly from one or more broker dealers or market makers, each in accordance with the valuation policies and procedures approved by the Fund’s Board of Trustees (the “Board”).

The pricing services may use valuation models or matrix pricing, which consider yield or prices with respect to comparable loan quotations from loan dealers or by reference to other securities that are considered comparable in such characteristics as credit rating, interest rates and maturity date, to determine the current value.

The Fund’s investments in bank loans are normally valued at the mid between the bid and ask obtained from dealers in loans by an independent pricing service in accordance with the Fund’s valuation policies and procedures approved by the Board.

In certain cases authorized pricing service vendors may not provide prices for a security held by the Fund, or the price provided by such pricing service vendor is deemed unreliable by the Adviser. In such cases, the Fund may use market maker quotations provided by an established market maker for that security (i.e., broker quotes) to value the security if the Adviser has experience obtaining quotations from the market maker and the Adviser determines that quotations obtained from the market maker in the past have generally been reliable (or, if the Adviser has no such experience with respect to a market maker, it determines based on other information available to it that quotations to be obtained by it from the market maker are reasonably likely to be reliable). In any such case, the Adviser will review any market quotations so obtained in light of other information in its possession for their general reliability.

Bank loans in which the Fund may invest have similar risks to lower-rated fixed income securities. Changes in the financial condition of the borrower or economic conditions or other circumstances may reduce the capacity of the borrower to make principal and interest payments on such instruments and may lead to defaults. Senior secured bank loans are supported by collateral; however, the value of the collateral may be insufficient to cover the amount owed to the Fund. By relying on a third party to administer a loan, the Fund is subject to the risk that the third party will fail to perform its obligations. The loans in which the Fund will invest are largely floating rate instruments; therefore, the interest rate risk generally is lower than for fixed-rate debt obligations. However, an increase in interest rates may adversely affect the borrower’s financial condition. Due to the unique and customized nature of loan agreements evidencing loans and the private syndication thereof, loans are not as easily purchased or sold as publicly traded securities. Although the range of investors in loans has broadened in recent years, there can be no assurance that future levels of supply and demand in loan trading will provide the degree of liquidity which currently exists in the market. In addition, the terms of the loans may restrict their transferability without borrower consent. These factors may have an adverse effect on the market price and the Fund’s ability to dispose of particular portfolio investments. A less liquid secondary market also may make it more difficult for the Fund to obtain valuations of the loans in its portfolio.

Fair value is defined as the price that the Fund would receive upon selling an investment in a timely transaction to an independent buyer in the principal or most advantageous market of the investment. A three-tier hierarchy is utilized to maximize the use of observable market data and minimize the use of unobservable inputs and to establish classification of fair value measurements for disclosure purposes. Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk. For example, market participants would consider the risk inherent in a particular valuation technique used to measure fair value, such as a pricing model, and/or the risk inherent in the inputs to the valuation technique. Inputs may be observable or unobservable. Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability and are developed based on market data obtained from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability and are developed based on the best information available in the circumstances. The three-tier hierarchy of inputs is summarized in the three broad levels listed below.

Level 1 - Valuations based on unadjusted quoted prices in active markets for identical assets or liabilities that the Fund has the ability to access. Valuation adjustments are not applied to Level 1 investments. Since valuations are based on quoted prices that are readily and regularly available in an active market, valuation of these investments does not entail a significant degree of judgment.

Level 2 - Valuations based on quoted prices in markets that are not active or for which all significant inputs are observable, either directly or indirectly.

Level 3 - Valuations based on inputs that are unobservable and significant to the overall fair value measurement.

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised is determining fair value is greatest for instruments categorized in level 3.

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

The following is a summary of the inputs used as of February 28, 2013 in valuing the Fund’s investments:

| | | | | | | | | | | | | |

| Description | | | Level 1 | | | Level 2 | | | Level 3 | | | Total Investments | |

Assets: Fixed Income: | | | | | | | | | | | | |

| Bank Loans (a) | | $ | - | | | $ | 11,728,427 | | | $ | - | | | $ | 11,728,427 | |

| Other: | | | | | | | | | | | | | | | | |

| Short-Term Investments (b) | | | 6,430,941 | | | | - | | | | - | | | | 6,430,941 | |

| Total Assets | | $ | 6,430,941 | | | $ | 11,728,427 | | | $ | - | | | $ | 18,159,358 | |

| | | | | | | | | | | | | | | | | |

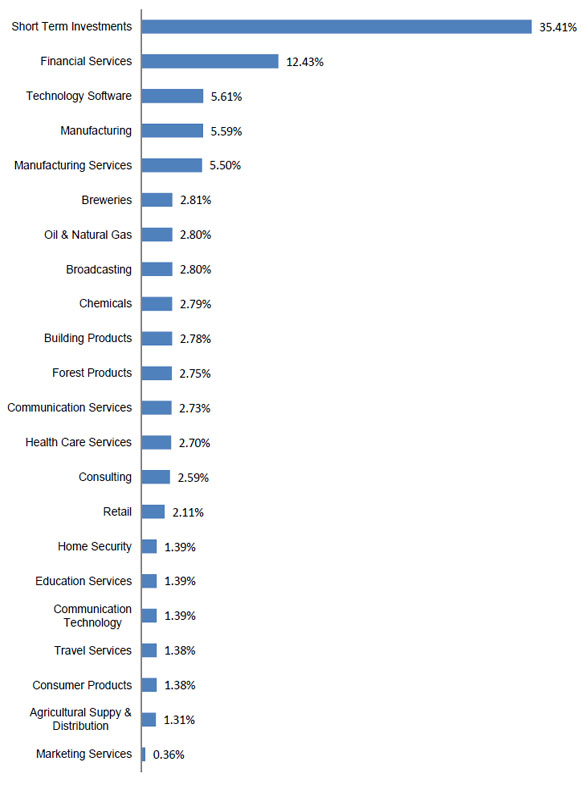

| (a) | All other industry classifications are identified in the Schedule of Investments. |

| (b) | Short-term investment is a sweep investment for cash balances in the Fund at February 28, 2013. |

B. Cash and Cash Equivalents

Cash and cash equivalents includes highly liquid investments with original maturities of three months or less from the date of purchase.

C. Investment Transactions, Related Investment Income and Expenses

Investment transactions are accounted for on a trade date basis. Interest income is recorded on the accrual basis, including the amortization of premiums and accretion of discounts on bank loans held using the yield-to-maturity method.

Realized gains and losses on investment transactions and unrealized appreciation and depreciation of investments are reported for financial statement and Federal income tax purposes on the identified cost method.

Expenses are recorded on the accrual basis as incurred.

D. Use of Estimates

The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

E. Federal Income Taxation

The Fund has elected to be taxed as a Regulated Investment Company (“RIC”) under the U.S. Internal Revenue Code of 1986, as amended, and intends to maintain this qualification and to distribute substantially all of its net taxable income to its shareholders.

F. Dividends and Distributions

Dividends to shareholders are recorded on the ex-dividend date. The character of dividends to shareholders made during the year may differ from their ultimate characterization for federal income tax purposes. The Fund will distribute substantially all of its net investment income and all of its capital gains to shareholders semi-annually. The character of distributions made during the year from net investment income or net realized gains might differ from the characterization for federal income tax purposes due to differences in the recognition of income and expense items for financial statement and tax purposes. When appropriate, reclassifications between net asset accounts are made for such differences that are permanent in nature. The reclassifications have no effect on net assets or net asset value per share.

G. Counterparty Risk

The Fund helps manage counterparty credit risk by entering into agreements only with counterparties the Adviser believes have the financial resources to honor their obligations. The Adviser monitors the financial stability of the Fund’s counterparties.

H. Recent Accounting Pronouncement

In January 2013, the Financial Accounting Standards Board issued Accounting Standards Update No. 2013-01 “Clarifying the Scope of Disclosures about Offsetting Assets and Liabilities” (“ASU 2013-01”) which amended Accounting Standards Codification Subtopic 210-20, Balance Sheet Offsetting. ASU 2013-01 clarified the scope of ASU No. 2011-11 “Disclosures about Offsetting Assets and Liabilities” (“ASU 2011-11”). ASU 2011-11 requires an entity to disclose both gross and net information related to offsetting and related arrangements enabling users of the financial statements to understand the effect of those arrangements on the entity’s financial position. The objective of this disclosure is to facilitate comparison between those entities that prepare their financial statements on the basic of U.S. GAAP and those entities that prepare their financial statements on the basis of International Financial Reporting Standards. ASU 2013-01 clarifies the scope of ASU 2011-11 as applying to derivatives accounted for in accordance with Topic 815, Derivatives and Hedging, including bifurcated embedded derivatives, repurchase agreements and reverse repurchase agreements, and securities borrowing and securities lending transactions that are offset either in accordance with other requirements of U.S. GAAP or subject to an enforceable master netting arrangement or similar agreement. The guidance in ASU 2013-01 and ASU 2011-11 is effective for interim and annual periods beginning on or after January 1, 2013. Adoption of ASU 2011-11 will have no effect on the Fund’s net assets. At this time, management is evaluating any impact ASU 2013-01 and ASU 2011-11 may have on the Fund’s financial statements.

In December 2011, the Financial Accounting Standard Board issued Accounting Standards Update No. 2011-11 “Disclosures about Offsetting Assets and Liabilities” (“ASU 2011-11”) requiring disclosures of both gross and net information related to offsetting and related arrangement enabling users of the financial statement to understand the effect of those arrangements on the entity’s financial position. The objective of this disclosure is to facilitate comparison between those entities that prepare the financial statements on the basis of U.S. GAAP and those entities that prepare their financial statements on the basis of International Financial Reporting Standards. ASU 2011-11 is effective for public entities for interim and annual periods beginning on or after January 1, 2013. Adoption of ASU 2011-11 will have no effect on the Fund’s net assets. At this time, management is evaluating the impact ASU 2011-11 may have on the Fund’s financial statement disclosures.

3. Agreements

The Fund has entered into an Investment Advisory Agreement with Sound Point Capital Management, L.P. Under the terms of the agreement, the Fund pays the Adviser a fee equal to an annual rate of 1.25 percent of the Fund’s month-end net asset, including assets attributable to the Adviser (or its affiliates) and before giving effect to any repurchases of Share by the Fund. The fee is paid monthly in advance.

Pursuant to the Expense limitation agreement with respect to the Fund, until at least December 31, 2013, the Adviser has agreed to waive fees and/or pay Fund expenses to the extent necessary to prevent the operating expenses of the Fund (excluding interest expense, brokerage commissions, transfer agency fees and expenses, offering costs, litigation, indemnification, shareholder meeting costs, licensing fees and other trading expenses, taxes and extraordinary expenses) from exceeding 0.35 percent of average daily net assets per year (the “Expense Cap”). Expenses borne by the Adviser due to the Expense Cap are subject to reimbursement by the Fund up to three years from the date the fee or expense was incurred, but no reimbursement payment will be made by the Fund if it would result in the Fund exceeding the Expense Cap.

U.S. Bancorp Fund Services, LLC serves as the Fund’s administrator. The Fund pays the administrator a monthly fee computed at an annual rate of 0.09 percent of the first $100,000,000 of the Fund's average net assets, 0.07 percent on the next $200,000,000 of the Fund’s average net assets and 0.04 percent on the balance of the Fund's average net assets.

U.S. Bancorp Fund Services, LLC serves as the Fund's transfer agent, dividend paying agent, and agent for the automatic dividend reinvestment plan.

U.S. Bank, N.A. serves as the Fund's custodian. The Fund pays the custodian a monthly fee computed at an annual rate of 0.03 percent of the Fund’s average daily market value, plus portfolio transaction fees.

4. Income Taxes

The Fund intends to comply with the requirements under Subchapter M of the Internal Revenue Code (“Code”) in order to qualify as a regulated investment company (“RIC”). If so qualified, the Fund will not be subject to federal income tax to the extent it distributes all of its taxable income and net capital gains to its shareholders.

As of February 28, 2013, the Fund did not have any tax position that did not meet the “more-likely-than-not” threshold of being sustained by the applicable tax authority. Generally, tax returns are open for examination by tax authorities for a period of three years from the date such returns were filed.

5. Investment Transactions

For the period from December 1, 2012 through February 28, 2013 the Fund purchased (at cost) and sold securities in the amount of $23,732,732 and $12,376,212 (excluding short term debt securities), respectively.

6. Common Stock

The Fund operates as an “interval fund” under Rule 23c-3 of the 1940 Act and, as such, provides a limited degree of liquidity to Shareholders. The Fund will offer to repurchase not less than 5% of its outstanding Shares on a quarterly basis. This is a fundamental policy that cannot be changed without Shareholder approval.

The Fund is permitted to issue an unlimited number of shares. Par value of all shares is $0.01. The Fund had 1,344,033 shares outstanding at February 28, 2013. During the period ended February 28, 2013, the Fund issued 1,344,033 shares and did not have any redemptions.

7. Subsequent Events

The Fund has performed an evaluation of subsequent events through April 26, 2013, the date the financial statements were issued, and has determined that no additional items require recognition or disclosure.

Sound Point Floating Rate Income Fund

ADDITIONAL INFORMATION

February 28, 2013

(Unaudited)

Form N-Q

The Fund will file its complete schedule of portfolio holdings for the first and third quarters of each fiscal year with the SEC on Form N-Q. The Fund’s Form N-Q will be available without charge by visiting the SEC’s Web site at www.sec.gov and may be reviewed and copied at the SEC’s Public Reference Room in Washington D.C. You may obtain information on the operation of the Public Reference Room by calling (800) SEC-0330.

Proxy Voting

The Fund will file its proxy voting records annually as of June 30 with the SEC on Form N-PX. The Fund’s Form N-PX will be available without charge by visiting the SEC’s Web site at www.sec.gov and may be reviewed and copied at the SEC’s Public Reference Room in Washington D.C. You may obtain information on the operation of the Public Reference Room by calling (800) SEC-0330.

Board of Directors

The Prospectus includes additional information about the Fund’s Trustees and Officers and is available upon request without charge by calling the Company collect at (212) 895-2260 or by visiting the SEC’s Web site at www.sec.gov.

Forward-Looking Statements

This report contains "forward-looking statements,'' which are based on current management expectations. Actual future results, however, may prove to be different from expectations. You can identify forward-looking statements by words such as "may'', "will'', "believe'', "attempt'', "seem'', "think'', "ought'', "try'' and other similar terms. The Fund cannot promise future returns. Management’s opinions are a reflection of its best judgment at the time this report is compiled, and it disclaims any obligation to update or alter forward-looking statements as a result of new information, future events, or otherwise.

Sound Point Floating Rate Income Fund

BOARD APPROVAL OF INVESTMENT ADVISORY AGREEMENT

(Unaudited)

Consideration and Approval of Investment Advisory Agreement

At a meeting held in person on November 2, 2012, the Fund’s Board of Trustees (the “Board”), including a majority of the Trustees who are not “interested persons” of the Fund or Sound Point Capital Management, LP (“Sound Point”) as defined in the Investment Company Act of 1940, as amended (the “Independent Trustees”), unanimously approved an investment advisory agreement between the Fund and Sound Point (the “Investment Advisory Agreement”).

To assist the Board in its consideration of the proposed Investment Advisory Agreement, the Board received in advance of their meeting certain materials and information regarding the services expected to be provided to the Fund by Sound Point under the Investment Advisory Agreement. In their deliberations, the Independent Trustees had the opportunity to meet privately without representatives of Sound Point present. In considering the approval of the Investment Advisory Agreement, the Trustees evaluated a number of considerations that they believed, in light of their own business judgment, to be relevant. They based their decision on the considerations discussed below, among others, although they did not identify any consideration or particular information that was controlling of their decision, and each Trustee may have attributed different weights to the various factors.

The Board considered the nature, extent and quality of the services anticipated to be provided by Sound Point to the Fund. As part of this review, the Board examined the nature, extent and quality of services provided to the other funds and accounts managed by Sound Point, as well as the quality of Sound Point’s professional management team. The Board found that Sound Point has the capabilities, resources, and personnel necessary to advise the Fund.

The Board considered the advisory fee and estimated total annual operating expenses of the Fund. The Board reviewed the advisory fee proposed to be paid by the Fund and compared it with the advisory fees being paid by comparable funds and the fees paid by the other funds and accounts managed by Sound Point. The Board determined that the Fund’s proposed advisory fee was reasonable in light of the services expected to be provided. The Board also considered the gross and net annual operating expenses of the Fund and the total annual operating expenses of comparable funds. It was noted that Sound Point, pursuant to the terms of the Expense Limitation Agreement with the Fund, would waive advisory fees and/or pay expenses of the Fund to the extent necessary to ensure that the Fund’s “Other Expenses” (with certain exclusions) do not exceed 0.35% through at least December 31, 2013. The Board concluded that total expenses of the Fund were reasonable in light of the services expected to be provided.

The Board Members considered economies of scale with respect to the management of the Fund, and concluded that the Fund’s fee structure reflected economies of scale to date but noted that they will have the opportunity to periodically reexamine whether the Fund has achieved economies of scale. The Board also considered information about the cost of providing advisory services to the Fund and the profitability of Sound Point in providing advisory services for the Fund. In addition, the Board also considered any other benefits derived by Sound Point from its relationships with the Fund.

After consideration of the factors described above, as well as other factors, the Board, including all of the Independent Trustees, concluded that the approval of the Investment Advisory Agreement is in the best interests of the Fund and its shareholders and voted to approve the Investment Advisory Agreement.

Sound Point Floating Rate Income Fund

PRIVACY NOTICE

The Fund collects and maintains nonpublic personal information about Shareholders as follows:

| · | Information we receive in subscription agreements, investor questionnaires and other forms which Shareholders complete and submit to us, such as names, addresses, phone numbers, social security numbers, and employment, asset, income and other household information; |

| · | Information we receive and maintain relating to the net asset value of a Shareholder’s shares, such as profit and loss allocations and capital withdrawals and additions; |

| · | Information about your investment in and other transactions with us and our affiliates, including information we receive and maintain relating to new issue and other securities transactions with and through the Fund and its affiliates; and |

| · | Information we receive about a Shareholder from the Shareholder’s purchaser representative, financial advisor, investment consultant or other financial institution with whom the Fund has a relationship and/or whom the Shareholder may have authorized to provide such information to the Fund. |

The Fund does not disclose any nonpublic personal information about its Shareholders or former Shareholders except as may be required or permitted by law. The Fund may disclose information about a Shareholder to its affiliates (including the Fund’s Board and/or Administrator or Investment Manager and the Fund’s employees or agents with a need to know such information to enable the Fund to provide statements, information and services to its Shareholders), and to the following types of third parties:

| · | Financial service providers such as the Fund’s prime broker who assists the Fund as part of the ordinary course of servicing your investments in the Fund; |

| · | Legal representatives of the Fund, such as our counsel, accountants and auditors; |

| · | Cergain non-affiliated parties who perform marketing services for the Fund or with whom we have entered into joint marketing agreements; and |

| · | Persons acting in a fiduciary or representative capacity on behalf of an individual Shareholder, such as an IRA custodian or Trustee of a grantor trust. |

On all occasions when it is necessary for us to share your personal information with nonaffiliated companies, we will require that such information only be used for the limited purpose for which it is shared and will advise these companies not to further share your information with others except to fulfill that limited purpose.

The Fund takes its responsibility to protect the privacy and confidentiality of Shareholder information very seriously. We maintain appropriate physical, electronic and procedural safeguards to guard Shareholder’s nonpublic personal information. We provide Shareholders with a Privacy Notice as part of their subscription materials and annually after that. If the Fund changes its privacy policies to permit it or its affiliates to share additional information the Fund has about you or to permit disclosures to additional types of parties, you will be notified in advance, and, if required by law, you will be given the opportunity to opt out of such additional disclosure and to direct us not to share your information with such parties.

Item 2. Code of Ethics.

Not applicable for semi-annual reports.

Item 3. Audit Committee Financial Expert.

Not applicable for semi-annual reports.

Item 4. Principal Accountant Fees and Services.

Not applicable for semi-annual reports.

Item 5. Audit Committee of Listed Registrants.

Not applicable to registrants who are not listed issuers (as defined in Rule 10A-3 under the Securities Exchange Act of 1934).

Item 6. Investments.

(a) Schedule of Investments is included as part of the report to shareholders filed under Item 1 of this form.

(b) Not applicable.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable for semi-annual reports.

Item 8. Portfolio Managers of Closed-End Management Investment Companies.

Not applicable for semi-annual reports.

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

| Period | (a) Total Number of Shares (or Units) Purchased | (b) Average Price Paid per Share (or Unit) | (c) Total Number of Shares (or Units) Purchased as Part of Publicly Announced Plans or Programs | (d) Maximum Number (or Approximate Dollar Value) of Shares (or Units) that May Yet Be Purchased Under the Plans or Programs |

Month #1 12/01/12-12/31/12 | 0 | 0 | 0 | 0 |

Month #2 1/01/13-1/31/13 | 0 | 0 | 0 | 0 |

Month #3 2/01/13-2/28/13* | 0 | 0 | 0 | 0 |

Month #4 | 0 | 0 | 0 | 0 |

Month #5 | 0 | 0 | 0 | 0 |

Month #6 | 0 | 0 | 0 | 0 |

Total | 0 | 0 | 0 | 0 |

*The Fund issued a Repurchase Offer on January 25, 2013. The Repurchase Offer enabled up 5% of the Fund’s outstanding shares to be redeemed by Shareholders. The Repurchased shares were paid out at the February 28, 2013 net asset value per share.

Item 10. Submission of Matters to a Vote of Security Holders.

Not applicable.

Item 11. Controls and Procedures.

| (a) | The Registrant’s President and Treasurer have reviewed the Registrant's disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act of 1940 (the “Act”)) as of a date within 90 days of the filing of this report, as required by Rule 30a-3(b) under the Act and Rules 13a-15(b) or 15d-15(b) under the Securities Exchange Act of 1934. Based on their review, such officers have concluded that the disclosure controls and procedures are effective in ensuring that information required to be disclosed in this report is appropriately recorded, processed, summarized and reported and made known to them by others within the Registrant and by the Registrant’s service provider. |

| (b) | There were no changes in the Registrant's internal control over financial reporting (as defined in Rule 30a-3(d) under the Act) that occurred during the second fiscal quarter of the period covered by this report that has materially affected, or is reasonably likely to materially affect, the Registrant's internal control over financial reporting. |

Item 12. Exhibits.

(1) Any code of ethics or amendment thereto, that is the subject of the disclosure required by Item 2, to the extent that the registrant intends to satisfy Item 2 requirements through filing an exhibit. Not applicable.

(2) A separate certification for each principal executive and principal financial officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. Filed herewith.

Certifications pursuant to Section 906 of the Sarbanes Oxley Act of 2002. Not applicable.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

(Registrant) Sound Point Floating Rate Income Fund

By (Signature and Title) /s/ Stephen J. Ketchum

Stephen J. Ketchum, President

Date May 8, 2013

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

By (Signature and Title) /s/ Stephen J. Ketchum

Stephen J. Ketchum, President

Date May 8, 2013

By (Signature and Title) /s/ Kevin Gerlitz

Kevin Gerlitz Treasurer

Date May 8, 2013