Exhibit 99.1

Investor Presentation January 13, 2015 to Acquire Majority Equity Interest in ZAIS Group Parent, LLC, the sole member of HF2 Financial Management Inc.

HF2 F INANCIAL M ANAGEMENT I NC . Safe Harbor The following slide show was furnished to the Securities and Exchange Commission (“SEC”) as part of a Current Report on Form 8 - K filed by HF 2 Financial Management Inc . (“HF 2 ”) with the SEC on January 13 , 2015 . HF 2 will be holding presentations for certain of its stockholders, as well as other persons who might be interested in purchasing HF 2 securities, regarding its acquisition of a majority of the membership interests in ZAIS Group Parent, LLC (“ZGP”), the parent and sole member of ZAIS Group, LLC (“ZAIS” or “ZAIS Group”, and together with ZGP, the “Company”) pursuant to an Investment Agreement with ZGP as described in the Form 8 - K (and exhibits thereto) filed by HF 2 on September 17 , 2014 . This presentation and Form 8 - K are being distributed from time to time to attendees of this presentation . HF 2 and its directors and officers and EarlyBirdCapital, Inc . (“EBC”) and Sandler O’Neill & Partners, L . P . (“SOP”), the underwriters of HF 2 ’s initial public offering, may be deemed participants in the solicitation of proxies to HF 2 ’s stockholders with respect to the proposed transaction . A list of the names of HF 2 ’s directors and officers and a description of their interests in HF 2 is contained in HF 2 ’s Annual Report on Form 10 - K, which was filed with the SEC on March 31 , 2014 , and will also be contained in the definitive proxy statement for the proposed transaction when available . EBC’s and SOP’s interests in HF 2 is contained in HF 2 ’s Annual Report on Form 10 - K, which was filed with the SEC on March 31 , 2014 , and the Merger and Acquisition Agreement by and among HF 2 , EBC and SOP, which is an exhibit to such report, and will also be contained in the definitive proxy statement for the proposed transaction when available . Information about the Company and its officers and directors will also be included in the definitive proxy statement for the proposed transaction . HF 2 has filed a preliminary proxy statement on Schedule 14 A with the SEC on October 31 , 2014 and intends to file with the SEC a definitive proxy statement on Schedule 14 A in connection with the stockholder vote on the proposed transaction . STOCKHOLDERS OF HF 2 AND OTHER INTERESTED PERSONS ARE ADVISED TO READ THE COMPANY’S PRELIMINARY PROXY STATEMENT AND, WHEN AVAILABLE, HF 2 ’S DEFINITIVE PROXY STATEMENT IN CONNECTION WITH THE SOLICITATION OF PROXIES FOR THE SPECIAL MEETING TO APPROVE THE PROPOSED TRANSACTION BECAUSE THIS PROXY STATEMENT WILL CONTAIN IMPORTANT INFORMATION . The definitive proxy statement will be mailed to stockholders as of a record date to be established for voting on the proposed transaction . Stockholders will also be able to obtain a copy of the preliminary proxy statement and definitive proxy statement once available, and other relevant documents, without charge, at the SEC’s Internet site http : //www . sec . gov or by contacting HF 2 ’s secretary at HF 2 Financial Management Inc . , 999 18 th Street, Suite 3000 , Denver, Colorado 80202 . As a result of the review by the SEC of the proxy statement, HF 2 may be required to make changes to its description of the Company or other financial or statistical information contained in the proxy statement . None of the information in this investor presentation constitutes either an offer or solicitation to buy or sell any of ZAIS’s products or services, nor is any such information a recommendation for any of ZAIS’s products or services .

HF2 F INANCIAL M ANAGEMENT I NC . Forward - Looking Statements This investor presentation, and other statements that HF 2 may make, contains forward - looking statements within the meaning of the Private Securities Litigation Reform Act, including, for example, statements about ( 1 ) the ability to complete and the benefits of the transaction with the Company ; and ( 2 ) HF 2 ’s and the Company’s future financial or business performance, strategies, growth initiatives and expectations . Forward - looking statements are typically identified by words or phrases such as “trend,” “potential,” “opportunity,” “pipeline,” “believe,” “comfortable,” “expect,” “anticipate,” “current,” “intention,” “estimate,” “position,” “assume,” “outlook,” “continue,” “remain,” “maintain,” “sustain,” “seek,” “achieve,” and similar expressions, or future or conditional verbs such as “will,” “would,” “should,” “could,” “may” and similar expressions . HF 2 cautions that forward - looking statements are subject to numerous assumptions, risks and uncertainties, which change over time . Forward - looking statements speak only as of the date they are made, and HF 2 assumes no duty to and does not undertake to update forward - looking statements . Actual results could differ materially from those anticipated in forward - looking statements and future results could differ materially from historical performance . In addition to factors previously disclosed in HF 2 ’s filings with the SEC, the following factors, among others, could cause actual results to differ materially from forward - looking statements or historical performance : ( 1 ) the inability of HF 2 to consummate the transaction with the Company and realize the benefits of such transaction, which may be affected by, among other things, competition, the ability of the combined company to grow and manage growth profitably, and retain its management and key employees ; ( 2 ) the occurrence of any event, change or other circumstances that could give rise to the termination of the definitive agreement between HF 2 and the Company for the business combination ; ( 3 ) the outcome of any legal proceedings that may be instituted against HF 2 , the Company or others following announcement of the proposed transaction ; ( 4 ) the inability to meet Nasdaq’s listing standards and to continue to be listed on the NASDAQ Stock Market ; ( 5 ) the risk that the proposed transaction disrupts current plans and operations of the Company as a result of the announcement and consummation of the transactions described herein ; ( 6 ) costs related to the proposed transaction ; ( 7 ) changes in political, economic or industry conditions, the interest rate environment or financial and capital markets, which could result in changes in demand for products or services or in the value of assets under management ; ( 8 ) the relative and absolute investment performance of advised or sponsored investment products ; ( 9 ) the impact of capital improvement projects ; ( 10 ) the impact of future acquisitions or divestitures ; ( 11 ) the unfavorable resolution of legal proceedings ; ( 12 ) the extent and timing of any share repurchases ; ( 13 ) the impact, extent and timing of technological changes and the adequacy of intellectual property protection ; ( 14 ) the impact of legislative and regulatory actions and reforms and regulatory, supervisory or enforcement actions of government agencies relating to HF 2 ; ( 15 ) terrorist activities and international hostilities, which may adversely affect the general economy, financial and capital markets, specific industries, and HF 2 ; ( 16 ) the ability to attract and retain highly talented professionals ; and ( 17 ) the impact of changes to tax legislation and, generally, the tax position of HF 2 . HF 2 ’s filings with the SEC, accessible on the SEC’s website at http : //www . sec . gov, discuss, and HF 2 ’s definitive proxy statement in connection with the stockholder vote on the proposed transaction will discuss, these factors in more detail and identify additional factors that can affect forward - looking statements .

HF2 F INANCIAL M ANAGEMENT I NC . Introduction to HF2 1 HF2 F INANCIAL M ANAGEMENT I NC . ▪ ~$175 million available for business combination ▪ Listed on NASDAQ (“HTWO”) ▪ No dilutive warrants or options ▪ Launched by principals of Berkshire Capital Securities LLC ▪ Leading M&A advisory boutique focused exclusively on the financial services industry ▪ Sponsor of an earlier successful SPAC, Highbury Financial Inc. (“HBRF”) HF 2 is a special purpose acquisition company with a focus on companies operating in the financial services industry

HF2 F INANCIAL M ANAGEMENT I NC . Comprehensive Search Process with Focused Criteria Management integrity, character and ethics Proven investment skill Shared goals, values and alignment of interests Team and/or successors committed for long term Ability and desire to operate a public company Operating leverage from fixed cost base Substantial growth potential ZAIS Group 2 ▪ Conducted 16 - month search process beginning after IPO in March 2013 ▪ Identified over 800 potential targets and sources of potential targets initially ▪ Engaged in over 100 detailed conversations regarding a potential transaction ▪ Delivered over 50 preliminary indications of interest Exhaustive Search for Ideal Target

HF2 F INANCIAL M ANAGEMENT I NC . Introduction to ZAIS Group 3 (1) As of September 30, 2014. AUM primarily is comprised of ( i ) cash plus aggregate principal balance of investments with respect to certain non - mark - to - market structured vehicles; (ii) cash plus market value of investments with respect to certain structured vehicles; (iii) total assets for mark - to - market funds and separately managed acco unts; and (iv) uncalled capital commitments, if any, for funds that are not in liquidation. AUM also includes assets in the warehouse phase for new structured credit vehicles and does not treat leverage and other operating liabilities as a reduction of AUM. ▪ Outstanding team ▪ Strong reputation with institutional investors ▪ Distinguished investment track record across multiple market cycles since 1997 ▪ Robust and scalable platform ▪ Specifically identified growth initiatives ▪ Experience managing public REIT ZAIS is a dynamic investment management firm with approximately $ 4 . 7 billion ( 1 ) of AUM focused on specialized credit investments

HF2 F INANCIAL M ANAGEMENT I NC . Attractive Investment Opportunity 4 (1) As of June 30, 2014. (2) Please see page 15 for a calculation of this initial valuation multiple and Exhibit E for an explanation of Adjusted EBITDA as well as the reconciliation to Total Comprehensive Income (Loss). Long Term Alignment ▪ No liquidity for current owners of ZAIS at closing; entire equity stake retained ▪ Upward adjustments to current owners’ retained equity based on stock price performance ▪ Significant equity allocations to key employees with long - term vesting provisions ▪ Restrictive covenants for all employee equity owners ▪ Drive growth of existing, high quality products ▪ Expand current sales, marketing and distribution efforts ▪ Accelerate new products and strategies in development ▪ Capitalize on current and future market dislocations Multiple Avenues for Growth ▪ Attractive initial valuation at 4.4x LTM Adjusted EBITDA (1,2) ▪ Significant cash available to fuel strategic growth initiatives ▪ Regular quarterly dividends expected to be paid from distributable earnings after closing ▪ Incremental special dividends possible depending on size and timing of performance fees Compelling Investment Opportunity Today

HF2 F INANCIAL M ANAGEMENT I NC . The ZAIS Platform 5 ▪ Headquartered in Red Bank, New Jersey, with operations in London and Shanghai ▪ Experience managing assets and risk across multiple market cycles ▪ Track record of opportunistically capitalizing on market trends and dislocations ▪ Comprehensive internal controls to support high quality compliance and risk management ▪ Robust and scalable infrastructure with experience operating a public company Platform ▪ CIO and portfolio managers active in all marketing efforts ▪ ZAIS has built long - term relationships with a global investor base ▪ Focus on large institutional investors, including insurance companies, public and corporate pension funds, banks, foundations and endowments ▪ Dedicated 9 - person client relations team (1) Marketing & Client Relations Team ▪ Founded in 1997 by Christian Zugel, former senior executive at J.P. Morgan ▪ Over 120 employees, including over 50 investment professionals (1) ▪ Senior team members have, on average, over 20 years of industry experience (2) (1) As of September 30, 2014. (2) Senior team members include Investment Committee and Management Committee members. ▪ Deep credit expertise across a wide range of investments ▪ Mortgages: Agencies, RMBS, CMBS, residential whole loans ▪ Corporate debt: CLOs, single name credit, leveraged loans, synthetics Investment Expertise Disciplined investing in specialized credit to consistently capture liquidity / complexity premiums over base yields

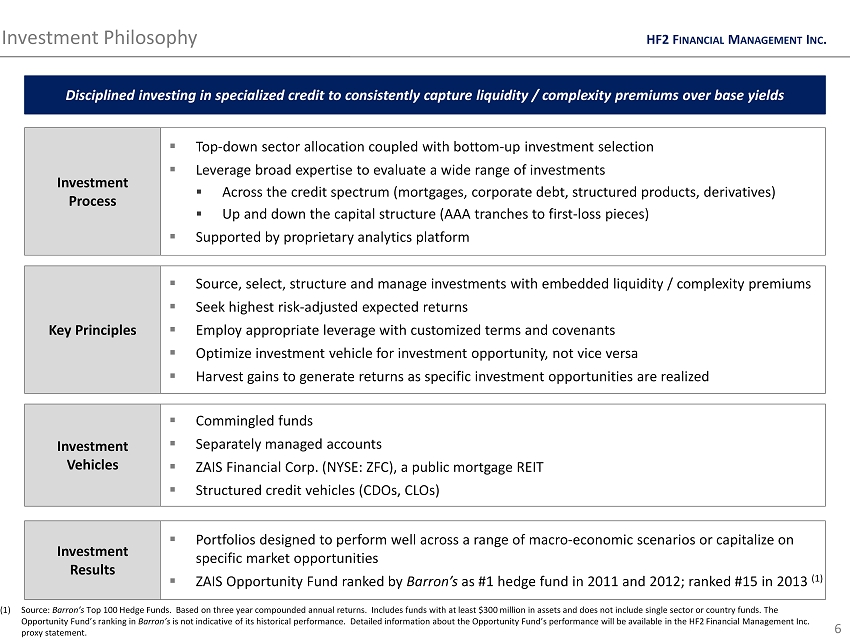

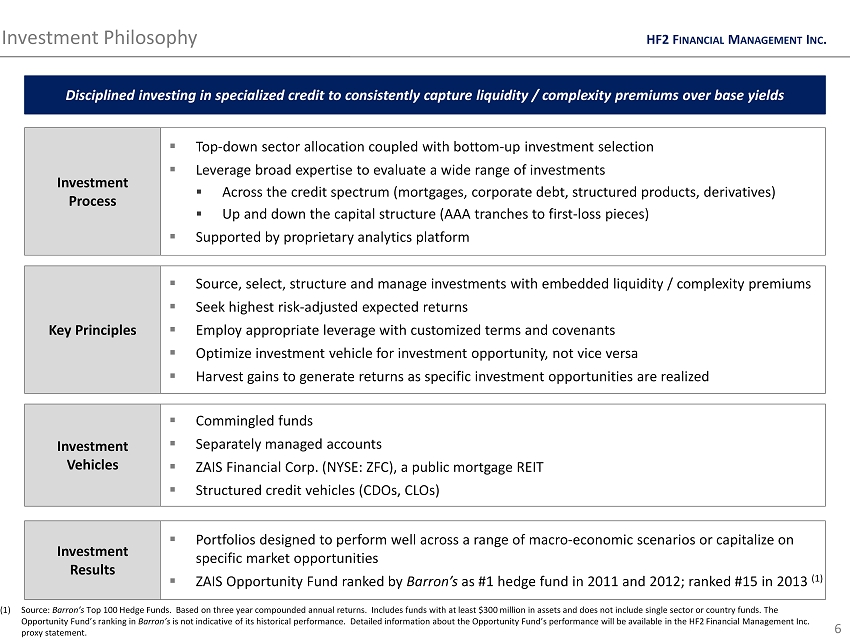

HF2 F INANCIAL M ANAGEMENT I NC . Investment Philosophy 6 ▪ Portfolios designed to perform well across a range of macro - economic scenarios or capitalize on specific market opportunities ▪ ZAIS Opportunity Fund ranked by Barron’s as #1 hedge fund in 2011 and 2012; ranked #15 in 2013 (1) Investment Results Investment Process ▪ Top - down sector allocation coupled with bottom - up investment selection ▪ Leverage broad expertise to evaluate a wide range of investments ▪ Across the credit spectrum (mortgages, corporate debt, structured products, derivatives) ▪ Up and down the capital structure (AAA tranches to first - loss pieces) ▪ Supported by proprietary analytics platform (1) Source: Barron’s Top 100 Hedge Funds. Based on three year compounded annual returns. Includes funds with at least $300 million in assets and do es not include single sector or country funds. The Opportunity Fund’s ranking in Barron’s is not indicative of its historical performance. Detailed information about the Opportunity Fund’s performance will be avail ab le in the HF2 Financial Management Inc. proxy statement. Disciplined investing in specialized credit to consistently capture liquidity / complexity premiums over base yields ▪ Commingled funds ▪ Separately managed accounts ▪ ZAIS Financial Corp. (NYSE: ZFC), a public mortgage REIT ▪ Structured credit vehicles (CDOs, CLOs) Investment Vehicles ▪ Source, select, structure and manage investments with embedded liquidity / complexity premiums ▪ Seek highest risk - adjusted expected returns ▪ Employ appropriate leverage with customized terms and covenants ▪ Optimize investment vehicle for investment opportunity, not vice versa ▪ Harvest gains to generate returns as specific investment opportunities are realized Key Principles

HF2 F INANCIAL M ANAGEMENT I NC . Annualized Total Returns Leading Investment Performance 7 Annual Total Returns Growth of a Dollar ZAIS Specialized Credit Composite (1) Please refer to following page for corresponding notes. ZAIS Specialized Credit Composite (1) J.P. Morgan Domestic High Yield Index + / - 1-Year 10.26% 7.63% 2.63% 3-Year 14.61% 11.32% 3.29% 5-Year 19.52% 11.10% 8.42% 7-Year 4.69% 8.99% -4.30% Since Inception (2) 14.71% 9.40% 5.31% ZAIS Specialized Credit Composite (1) J.P. Morgan Domestic High Yield Index + / - 2014 YTD (3) 6.84% 3.74% 3.10% 2013 9.79% 8.24% 1.55% 2012 26.72% 15.39% 11.33% 2011 10.50% 6.96% 3.54% 2010 36.70% 14.73% 21.97% 0 1 2 3 4 5 $6 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 ZAIS Specialized Credit Composite JPM HY S&P 500

HF2 F INANCIAL M ANAGEMENT I NC . Notes: ZAIS Specialized Credit Composite 8 (1) The ZAIS Specialized Credit Composite (“ZAIS Composite” or “Composite”) includes 29 separately managed accounts, funds of one an d commingled funds that are managed for a broad range of specialized credit mandates, varying in size. The ZAIS Composite inc lud es accounts that are managed similarly to, and have similar targeted assets as, the mix of assets envisioned for recent broad structured cre dit mandates, including an active mandate managed for an institutional client. For potential broad structured credit mandates, ZAIS would opportunistically invest in non - agency RMBS, CLO mezzanine tranches, CLO equity tranches and, selectively, CMBS. As such, ZAIS excluded from the Composite those ZAIS managed funds and accounts that currently invest in other assets (e.g., senior CLO tranches, residential whole lo ans , agency interest only securities), structured product vehicles managed by ZAIS, ZFC REIT, and funds and managed accounts where ZAIS assumed management of the vehicles from prior managers. Since monthly performance information was not required for Matrix I and Matrix II funds, ZAIS did not include these funds in the ZAIS Composite (Matrix I net IRR was 11.87 %; Matrix II - A net IRR was 17.64 %; Matrix II - B net IRR was 6.13%). The ZAIS Composite is calculated by asset weighting the individual monthly returns of each component using the aggre gat ed beginning - of - period capital balances and external cash flows as if the composite were one portfolio. The Composite’s Year - to - Da te net returns are considered time - weighted since they are the cumulative result of compounding all monthly net return results. The ZAIS Composite return results : (i ) are not a guarantee, prediction, or indicator of future returns; future investors could make a lesser profit or could incur substantial losses; (ii) are net of accrued management fees, incentive fees/allocations, if any, and foreign currency translation gains and losses; (iii) are based on capital activity for both fee paying and non - fee paying investors; (iv) reflect a mix of active and liquidated vehicles; (v) reflect the reinvestment of dividends, interest and earnings; (vi) treat client directed intra - month cash flows, if any, in separately managed accounts as if inflows occurred at the start of the month and outflows at the end of the month for purposes of calculating mo nth ly returns; ( vii) treat redemption or withdrawal charges of redeeming or withdrawing investors that were retained in the fund for the benefit of remaining investors as profit to the remaining investors (this increase in capital for remaining investors are not treated as pr ofits under U.S. generally accepted accounting principles (“GAAP”)); and (viii) treat capital activity during July 2006 to November 2006 in one vehicle as if all the activity occurred in the month of November 2006 because the vehicle was ramping up during that time period. A structured product industry standard performance benchmark does not exist. As a result, there is no exact data point against which ZAIS can com par e its performance. ZAIS does, however, closely monitor several sources of data to assess its performance relative to indices compo sed of relevant, if not identical, assets, including the J.P. Morgan Domestic High Yield Index (the “JPM HY”), ABX, PrimeX, CMBX and various proprietary dealer constructed indices. These indices each contain strengths and weaknesses. ZAIS has benchmarked the ZAIS Composite against the JPM HY mainly because of the relevance of the asset class and the fact that the index has been in existence for a period predating the ince pti on of the Composite. Over shorter holding periods, tracking error relative to the proposed benchmark could be quite significant . (2) From February 2002 to September 2014 . (3) As of September 30 , 2014.

HF2 F INANCIAL M ANAGEMENT I NC . High Yield Corporates Growth of Investment Platform with Broad Credit Expertise (1) 9 (1) Reference year indicates timing of initial hires dedicated to or inception of the stated expertise. Opportunistic investing across market environments while expanding investment expertise 1997 Experienced Founder & CIO Investment Analytics Platform CDO Mezzanine Investments Credit Derivatives CLO Investments Synthetic CDOs RMBS Non - Agency RMBS Residential Mortgage Whole Loans CMBS Commercial Real Estate Leveraged Finance CMBS Commercial Real Estate Leveraged Finance Residential Mortgage Whole Loans Non - Agency RMBS RMBS Synthetic CDOs CLO Investments Credit Derivatives CDO Mezzanine Investments Investment Analytics Platform Experienced Founder & CIO High Yield Corporates 2013 - 2014 2012 2008 2006 2002 - 2003 1999

HF2 F INANCIAL M ANAGEMENT I NC . Deep Investment Team with Broad Expertise (1) 10 Christian Zugel Founder & Chief Investment Officer EXPANSIVE COVERAGE OF SPECIALIZED CREDIT UNIVERSE Mortgages Portfolio Management & Asset Allocation Michael Szymanski President Corporate Debt Agencies / Credit Trading Strategies Residential CLOs Single Name Credit Synthetics Leveraged Finance Commercial Denise Crowley Jeff Mudrick David Stehnacs Cara Roche William Connors Kenneth Harmonay Issam Samiri Vincent Ingato Glenn Boyd Team Members: US: 4 Team Members: US: 12 Team Members: US: 3 SH: 9 Team Members: US: 2 SH: 2 Team Members: UK: 1 SH : 4 Team Members: US: 6 SH : 1 Team Members: US: 3 SH : 2 Brian Hargrave Rick Nicklas (1) As of September 30, 2014 .

HF2 F INANCIAL M ANAGEMENT I NC . 52% 30% 18% Corporate Mortgage Multi-Strategy 45% 29% 17% 4% 2% 3% Insurance Company Corporate Pension Public Pension Bank Fund of Funds Other Diversified Base of Assets Under Management 11 (1) As of September 30, 2014 . Percentages are approximate and subject to change. (2) This graph is based on a denominator of approximately $3 billion which includes various funds and vehicles. The graph excludes no n f ee - paying assets, investments in ZAIS Financial Corp., a publicly traded mortgage REIT that completed its initial public offering in 2013, and some structured vehicles in which ZAIS does not know th e i dentity or type of investor, as this information is only available for related ownership interests that are traded in secondary markets. Accordingly, the above investor breakdown does not reflect all cli ent s of and investors in vehicles managed by ZAIS. AUM by Strategy (1) AUM by Investor Type (1,2) AUM by Vehicle Type (1) 48% 21% 15% 15% 1% Managed Account / Fund of One Structured Vehicle Master Fund Public REIT Other

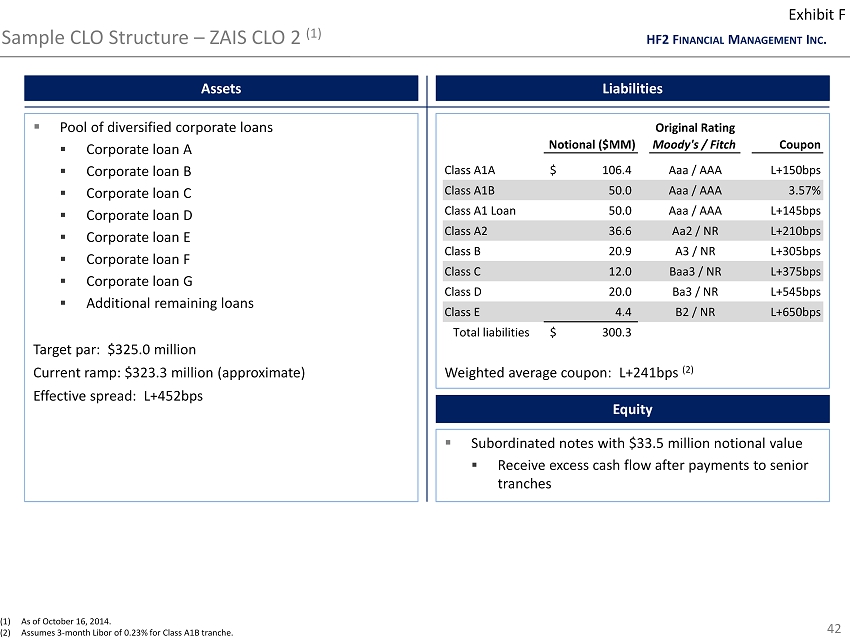

HF2 F INANCIAL M ANAGEMENT I NC . Multiple Pathways to Grow Existing Business 12 Outstanding Team Significant Experience Combined with Proprietary Analytics Proven Track Record Robust Infrastructure Enhance Sales and Marketing Efforts Expand into Additional Distribution Channels Broad Specialized Credit Mandate ▪ Outstanding investment performance record ▪ Opportunistic capital allocation across structured and other illiquid credit investments Separately Managed Accounts / Customized Solutions ▪ Significant capacity ▪ Expand customized investment accounts ▪ Develop broader institutional investor base Leveraged Finance / Corporate CLOs ▪ Purchase and securitize pools of diversified, high quality corporate loans ▪ Use regular new issuances to grow asset base ▪ 2 CLOs priced and closed in 2014 and 1 in the warehouse phase

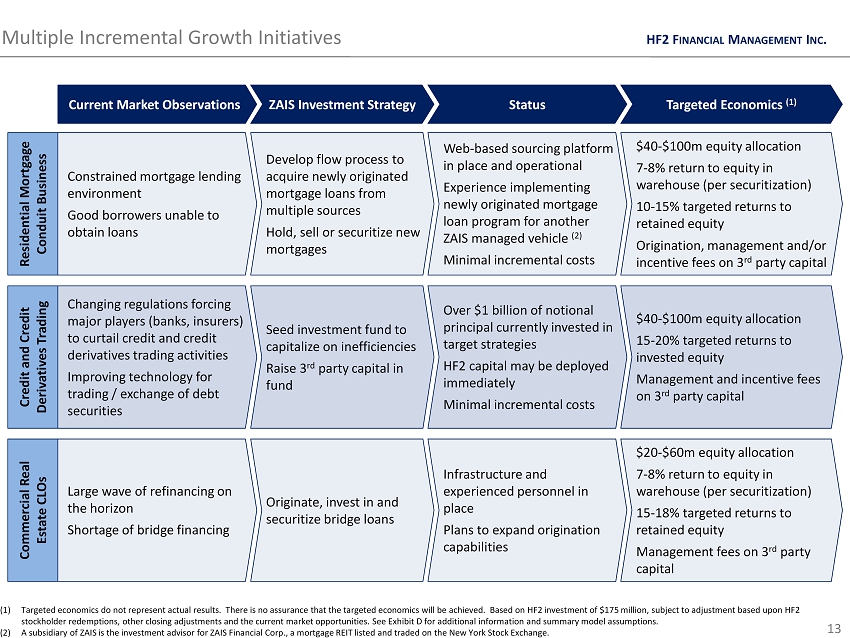

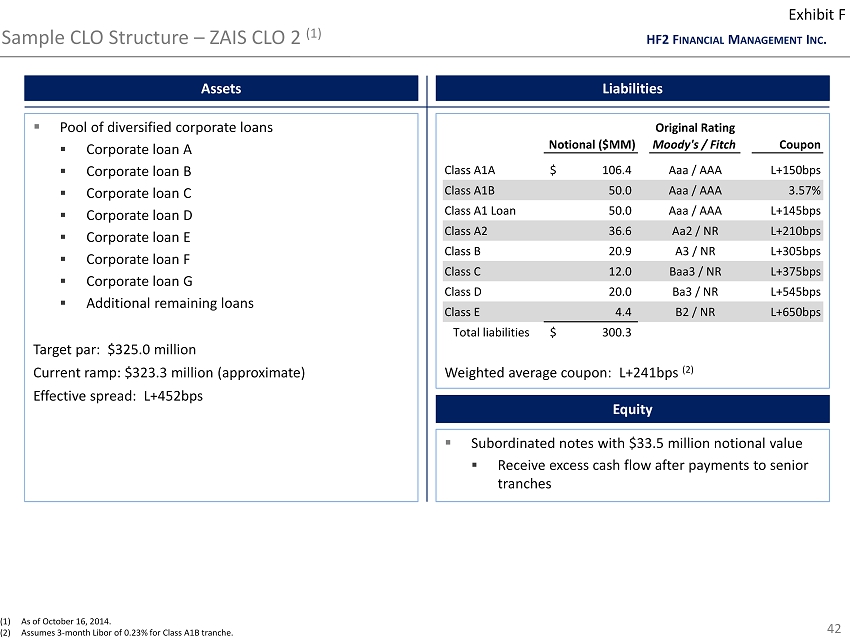

HF2 F INANCIAL M ANAGEMENT I NC . Credit and Credit Derivatives Trading Seed investment fund to capitalize on inefficiencies Raise 3 rd party capital in fund Changing regulations forcing major players (banks, insurers) to curtail credit and credit derivatives trading activities Improving technology for trading / exchange of debt securities Over $1 billion of notional principal currently invested in target strategies HF2 capital may be deployed immediately Minimal incremental costs $40 - $100m equity allocation 15 - 20% targeted returns to invested equity Management and incentive fees on 3 rd party capital Multiple Incremental Growth Initiatives 13 (1) Targeted economics do not represent actual results. There is no assurance that the targeted economics will be achieved. Based on HF2 investment of $175 million, subject to adjustment based upon HF2 stockholder redemptions, other closing adjustments and the current market opportunities. See Exhibit D for additional informa tio n and summary model assumptions. (2) A subsidiary of ZAIS is the investment advisor for ZAIS Financial Corp., a mortgage REIT listed and traded on the New York Stock Exchange . Residential Mortgage Conduit Business Develop flow process to acquire newly originated mortgage loans from multiple sources Hold, sell or securitize new mortgages Constrained mortgage lending environment Good borrowers unable to obtain loans Web - based sourcing platform in place and operational Experience implementing newly originated mortgage loan program for another ZAIS managed vehicle (2) Minimal incremental costs $40 - $100m equity allocation 7 - 8% return to equity in warehouse (per securitization) 10 - 15% targeted returns to retained equity Origination, management and/or incentive fees on 3 rd party capital Current Market Observations ZAIS Investment Strategy Originate, invest in and securitize bridge loans Large wave of refinancing on the horizon Shortage of bridge financing Infrastructure and experienced personnel in place Plans to expand origination capabilities $20 - $60m equity allocation 7 - 8% return to equity in warehouse (per securitization) 15 - 18% targeted returns to retained equity Management fees on 3 rd party capital Commercial Real Estate CLOs Status Targeted Economics (1)

HF2 F INANCIAL M ANAGEMENT I NC . ▪ ZAIS team will assume leadership of the combined company ▪ New slate of public company directors will be nominated ▪ Continuation of NASDAQ listing is anticipated ▪ Super - voting Class B Common Stock will be controlled by Christian Zugel, ZAIS’s founder Post - Closing Operation Transaction Outline 14 (1) Indirectly through ZAIS Group Parent, LLC. Assumes no HF2 stockholder redemptions and no other closing adjustments. ▪ Approximately 73% ownership in ZAIS held following closing (1) ▪ 100% of HF2 capital retained to drive strategic growth initiatives ▪ Alignment of interests with current owners and key employees of ZAIS HF2 ▪ Current owners’ retained equity interests (“Units”) exchangeable into 7,000,000 public shares (approximately 22% ownership) ▪ Two - year lockup with annual liquidity limits thereafter ▪ Additional Units exchangeable into up to 2,800,000 public shares available based on growth in stockholder value Current ZAIS Owners ▪ Initial Units exchangeable into 1,600,000 public shares (approximately 5% ownership) ▪ Two - year cliff vesting / lockup with annual liquidity limits thereafter ▪ Additional Units exchangeable into up to 5,200,000 public shares available based on growth in stockholder value Key Employees ▪ Approval of HF2 stockholders and U.K. Financial Conduct Authority required ▪ HF2 stockholders may redeem public shares for $10.50 per share ▪ ZAIS may terminate the transaction if HF2 delivers less than $100 million ▪ Closing anticipated in February 2015 Timing and Approvals

HF2 F INANCIAL M ANAGEMENT I NC . Financial Metrics (1) Assumes no HF2 stockholder redemptions and no other closing adjustments . Includes 7.0 million Class A Units to be held by current ZAIS owners and 1.6 million Class B Units to be held by ZAIS empl oye es following closing, which will be exchangeable into Class A Common Stock in the future, subject to certain limitations. (2) The actual price per share of HF2 Class A common stock may differ. (3) These financials include unaudited, Non - GAAP performance measures that ZAIS management uses to evaluate its operating performanc e and exclude revenue and expenses of investment vehicles required to be consolidated in accordance with GAAP. Please refer to Exhibit E for the reconciliation from GAAP to these Non - GAAP perfor mance measures and the explanations for the Non - GAAP adjustments. 15 All figures in millions, except per share amounts or as noted otherwise ▪ Historically, ZAIS has managed its business on a modified cash basis for accounting and management purposes ▪ On a modified cash basis, ZAIS has been profitable in every year since its inception, earning on average $36.4 million over the past 10 years, including a high of $107.8 million in 2007 and a low of $2.9 million in 2009 ▪ ZAIS received incentive and performance distributions or fees in every year from 2006 through 2014 ▪ Incentive compensation expense varies annually in proportion to realized incentive income Summary ZGP Financials (3) Valuation Shares outstanding at closing (1) 32.2 32.2 32.2 Illustrative price per share (2) 10.50$ 11.25$ 12.00$ Total equity value 338$ 362$ 386$ Less: estimated HF2 cash 175 175 175 Implied enterprise value 163$ 187$ 211$ LTM Adjusted EBITDA as of 6/30/14 (3) 42.1$ 42.1$ 42.1$ Implied EV / LTM Adjusted EBITDA 3.9x 4.4x 5.0x 9 Months LTM as Year Ended December 31, 6ME June 30, Ended 9/30/14 of 6/30/14 2013 2012 Management fee income 23.4$ 33.5$ 36.8$ 37.3$ Incentive income 52.5 71.7 38.0 127.6 Other revenues 0.5 1.0 1.4 1.4 Total revenues 76.4 106.2 76.2 166.3 Fixed expenses (23.0) (33.0) (34.6) (38.1) Variable expenses (29.1) (30.7) (27.8) (63.4) Total operating expenses (52.1) (63.7) (62.4) (101.5) Other income (expense) 0.6 (0.4) (0.4) (1.1) Adjusted EBITDA 24.9$ 42.1$ 13.4$ 63.7$

HF2 F INANCIAL M ANAGEMENT I NC . Ownership Structure (1) Assumes no HF2 stockholder redemptions and no other closing adjustments. (2) Up to 1,600,000 Units to be issued to key employees following closing, which are subject to a two - year cliff vesting period. Un vested Units do not participate in distributions and will be cancelled upon employees’ termination for any reason before the end of the vesting period. (3) Assumes issuance of 8,000,000 additional Units (maximum issuable) based on Total Value per HF2 Share. (4) Equal to the sum of (i) the average closing price during the 20 trading day period ending on any measurement date and (ii) th e c umulative dividends paid between the closing and the beginning of such 20 trading day period. (5) Measured from previous tranche. Tranche 1 assumes $10.50 per share for basis of calculation . (6) Assumes price per share is equal to Total Value per HF2 Share. Actual price per share would be equal to Total Value per HF2 Sha re at each tranche less the cumulative dividends paid between the closing and the point at which the corresponding tranche is achieved. 16 All figures in millions, except per share amounts or as noted otherwise Ownership (1) Structure for Post - Closing Contingent Issuances After Post-Closing At Closing Contingent Issuances # % # % Current HF2 shareholders 23.6 73.3% 23.6 58.7% Current ZAIS owners 7.0 21.7% 9.8 (3) 24.4% ZAIS employees 1.6 (2) 5.0% 6.8 (3) 16.9% Total 32.2 100.0% 40.2 100.0% Contingent Total % Increase Additional Units as Additional Value per HF2 in Individual % of Increase in Total Units Share Hurdle (4) HF2 Share Value (5) Shareholder Value (6) Tranche 1 2.0 12.50$ 19% 28% Tranche 2 2.0 15.00$ 20% 26% Tranche 3 2.0 18.00$ 20% 25% Tranche 4 2.0 21.50$ 19% 24%

HF2 F INANCIAL M ANAGEMENT I NC . Highlights of the Acquisition 17 ZAIS Group Right Partner ▪ High quality asset management firm ▪ Outstanding management team ▪ Strong institutional reputation ▪ Proven investment skill ▪ Robust and scalable platform ▪ Experience operating a public company Right Time ▪ Attractive upfront valuation for public stockholders ▪ Large, growing asset class ▪ Suite of high - quality investment products in place today ▪ Multiple identified growth initiatives Right Structure ▪ HF2 capital retained by ZAIS to fuel strategic growth initiatives ▪ Long - term commitment from management and employees ▪ Material equity incentives for management and employees ▪ Alignment of interests with public stockholders

Exhibits CONFIDENTIAL

HF2 F INANCIAL M ANAGEMENT I NC . ZAIS Team 19 Exhibit A Michael Szymanski President (6 Years at ZAIS) Christian Zugel Founder & Chief Investment Officer (17 Years at ZAIS) Mr . Zugel serves as Managing Member, Chief Investment Officer of ZAIS, and is also Chairman of ZAIS’s Management Committee . Mr . Zugel also serves as Chairman of the Board of ZAIS Financial Corp . Prior to founding ZAIS in 1997 , Mr . Zugel was a senior executive with J . P . Morgan Securities Inc . , where he led J . P . Morgan’s entry into many new trading initiatives . At J . P . Morgan, Mr . Zugel also served on the Asia Pacific management-wide and firm-wide market risk committees . Mr . Zugel received a Masters in Economics from the University of Mannheim, Germany . Mr . Szymanski serves as President at ZAIS . He is also a member of ZAIS’s Management Committee and serves as Chief Executive Officer, President and Director of ZAIS Financial Corp . Before joining ZAIS in September of 2009 , Mr . Szymanski was Chief Executive Officer of XE Capital Management, LLC, an investment management firm specializing in structured products, from 2003 to 2008 . Before that, Mr . Szymanski was Chief Financial Officer of Zurich Capital Markets, a subsidiary of Zurich Financial Group, from 2000 to 2002 . Mr . Szymanski was also a Vice President in the Bank and Insurance Strategies Group of Lehman Brothers from 1997 to 2000 , providing capital markets structuring and advisory services to financial institutions and corporations . Mr . Szymanski also spent nine years at Ernst & Young LLP advising financial services clients, leaving as a Senior Manager in the Capital Markets / M&A Advisory Group in New York . Mr . Szymanski is a CPA and received a B . A . in Business Administration with a concentration in Accountancy from the University of Notre Dame and an M . B . A . with a concentration in Finance from New York University’s Stern School of Business . Mr . Szymanski serves on the Board of Directors of the National Stock Exchange as Chairman of the Audit Committee .

HF2 F INANCIAL M ANAGEMENT I NC . ZAIS Team (1) 20 Exhibit A (1) As of September 30, 2014 . Years of Industry Years at Name Title Experience ZAIS Prior Experience Glenn Boyd Portfolio Manager 16 4 Barclays; Paine Webber / UBS; Credit Suisse Don Choe Chief Technology Officer 24 5 Barclays; Lehman Brothers William Connors Portfolio Manager 22 2 Battleground Capital Management; Ore Hill Partners; W.R. Huff Denise Crowley Portfolio Manager 19 17 J.P. Morgan Marc Galligan Chief Risk Officer 37 6 Bear Stearns; First National Bank of Boston; Chase Manhattan Bank Brian Hargrave Portfolio Manager 15 5 Lehman Brothers Kenneth Harmonay Research 26 2 Battleground Capital Management; W.R. Huff Vincent Ingato Portfolio Manager 32 1 CVC; Apidos Capital; Fuji Bank; Mizuho Financial Group; Wells Fargo Paul McDade Chief Financial Officer 28 5 XE Capital Management; Zurich Capital Markets; J.P. Morgan; Reliance Group; PwC Jeffrey Mudrick Portfolio Manager 21 2 G2 Investment Group; Citigroup; Lehman Brothers; Federated Rick Nicklas Portfolio Manager 25 6 Lehman Brothers; Donaldson, Lufkin & Jenrette Ann O’Dowd Chief Administrative Officer 20 14 Drexel, Burnham, Lambert Inc.; Salomon Brothers; PricewaterhouseCoopers Cara Roche Portfolio Manager 10 10 Started career with ZAIS Mark Russo Assistant General Counsel 10 7 Thacher Proffitt & Wood Issam Samiri Portfolio Manager 10 4 Crédit Agricole CIB; Lehman Brothers; Calyon Julian Schickel Managing Director 11 4 Glencore International; Lehman Brothers Karen Shapiro Chief Compliance Officer 31 1 Millennium Management LLC; Prudential; Fried Frank; SEC Staff David Stehnacs Portfolio Manager 13 13 Started career with ZAIS Howard Steinberg General Counsel 44 3 McDermott, Will & Emery; Prudential; Reliance Group; Dewey Ballantine

HF2 F INANCIAL M ANAGEMENT I NC . Robust Corporate Infrastructure (1) 21 Christian Zugel Founder & Chief Investment Officer Technology & Analytics Don Choe Chief Technology Officer Client Relations Jennifer Lakefield Steven Tholen Julian Schickel (2) Managing Directors Global Risk Management & Middle Office Marc Galligan Chief Risk Officer Finance, Accounting & Human Resources Paul McDade Chief Financial Officer Portfolio Management Team Members: US : 30 UK : 1 SH: 18 Team Members: US : 14 SH: 11 Team Members: US: 7 UK : 2 Team Members: US: 7 UK: 1 Team Members: US: 14 UK : 1 SH: 2 Team Members: US: 7 UK: 1 SH: 8 Michael Szymanski President Legal & Compliance Mark Russo Assistant General Counsel Karen Shapiro Chief Compliance Officer Howard Steinberg General Counsel Exhibit A (1) As of September 30, 2014. (2) Employed by ZAIS Group (UK) Limited.

HF2 F INANCIAL M ANAGEMENT I NC . Dynamic Investment Process 22 Disciplined top down sector allocation coupled with differentiated bottom up security / investment selection B O T T O M U P Credit Security Selection Commercial Portfolio Managers select securities and investments and manage exposure with analyst support, and risk and asset management oversight Residential CLOs Single Name Credit Synthetics Leveraged Finance Mortgages Corporate Debt Agencies / Credit Trading Strategies T O P D O W N Proprietary Analytics Platform Robust Infrastructure Macro Views / Investment Themes Investment Committee ▪ Investment strategy ▪ Thesis development ▪ Sector focus ▪ Allocations Exhibit B

HF2 F INANCIAL M ANAGEMENT I NC . Example of Proprietary Analytics (1) 23 Exhibit B (1) As of September 25, 2014 . ▪ ZAIS’s Efficient Frontier model provides real - time visibility into risk / return dynamics ▪ Underpins decisions regarding sector focus and allocations across the credit markets ▪ Highlights attractive investment opportunities within sectors and asset pools ▪ Illustrates investment opportunities and changes in market conditions for clients Prime Subprime High $ Px Alt A POA Subprime Low $ Px Senior AA A BBB 1.0 BB 1.0 BBB 2.0 BB 2.0 Equity 1.0 Equity 2.0 Agy CMBS A Agy CMBS BBB N - Agy CMBS AA N - Agy CMBS A N - Agy CMBS BBB - CMBX.1.A CMBX.4.AJ CMBX.4.AM CDX HY 0 1 2 3 4 5 6 7 8 0 1 2 3 4 5 6 7 8 3Y annualized TRR Relative Return Volatility

HF2 F INANCIAL M ANAGEMENT I NC . ZAIS Investment Strategy Observation Timeframe Product Flexible and Opportunistic Investment Platform (1) 24 (1) The selected examples included here do not include all funds and accounts managed by ZAIS. These examples are provided to illustrate ZAIS’s recognition of and execution on selected opportunistic investment strategies across different sectors and with different investment vehicles. While these examples reflect successful trading, not all trades are successful and profitable. (2) Gains on RMBS short positions exceeded losses suffered in subordinate positions in synthetic CLOs. Proven track record of investing across the credit spectrum through a variety of vehicles to capitalize on opportunities Please refer to Exhibit C for further details regarding investment products and corresponding performance statistics Create CDOs; issue term financing and purchase quality, diversified credits Major losses incurred by investors using short - term financing to buy long - term assets 1998 – 2007 ZING Series (CDOs ) Short consumer credit assets given overlending Long corporate credit exposure Residential mortgage securitizations priced aggressively Homeowners beginning to miss mortgage payments 2006 – 2007 RMBS Short Overlay Strategy (2) Buy and hold quality RMBS and whole loans Attractive assets available at significant discounts after deep sell - off in market 2007 – 2008 Matrix VI - Series SerVertis Purchase advisory contracts at nominal price; earn management fees ; manage assets through recovery to recoup value for investors Opportunity to purchase management contracts for several funds from distressed seller 2009 Zephyr Recovery Funds Leverage analytics to outperform through security selection Launch new initiatives Low credit yields Tight credit spreads Improving economy 2010 – Today Separately Managed Accounts Leveraged Finance / Corporate CLOs Exhibit B

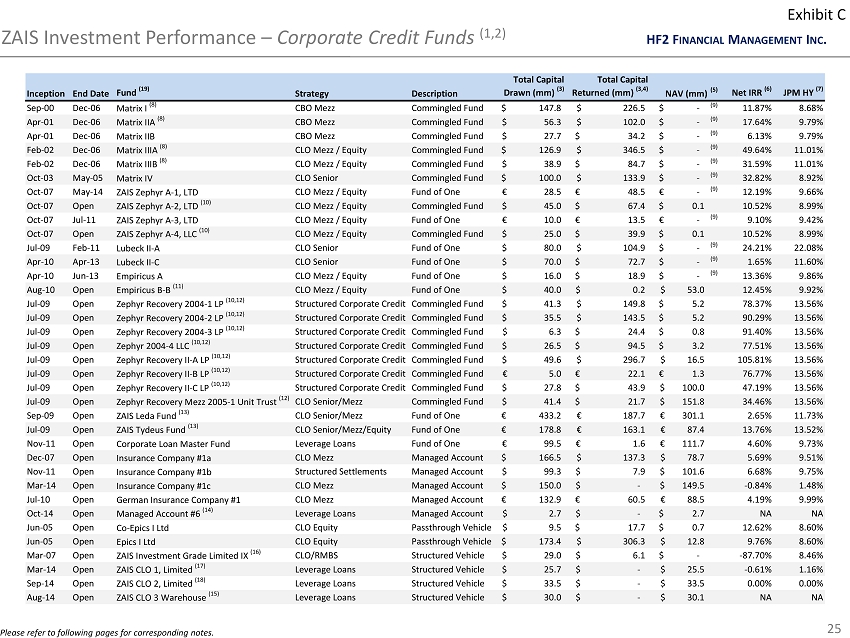

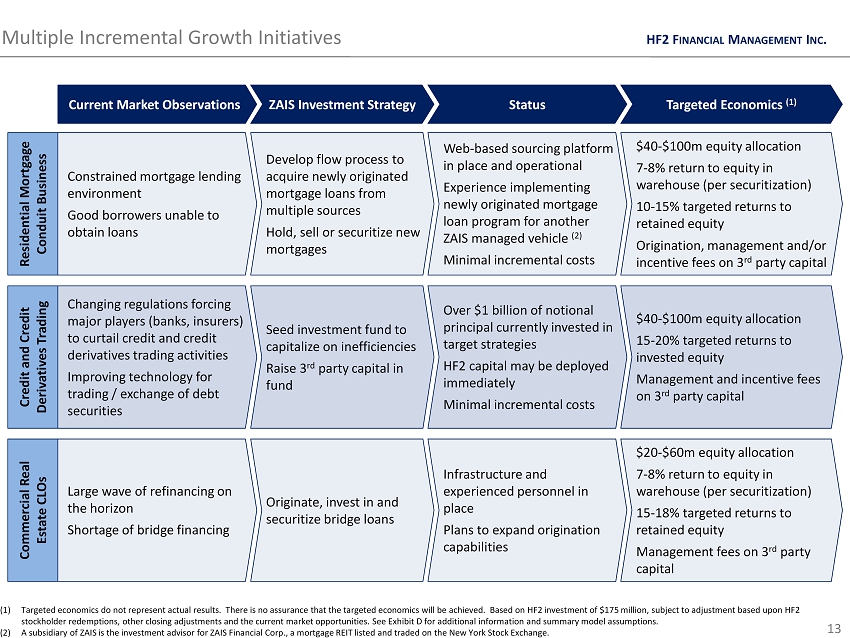

HF2 F INANCIAL M ANAGEMENT I NC . ZAIS Investment Performance – Corporate Credit Funds (1,2) 25 Exhibit C Please refer to following pages for corresponding notes. Total Capital Total Capital Inception End Date Fund (19) Strategy Description Drawn (mm) (3) Returned (mm) (3,4) NAV (mm) (5) Net IRR (6) JPM HY (7) Sep-00 Dec-06 Matrix I (8) CBO Mezz Commingled Fund 147.8$ 226.5$ -$ (9) 11.87% 8.68% Apr-01 Dec-06 Matrix IIA (8) CBO Mezz Commingled Fund 56.3$ 102.0$ -$ (9) 17.64% 9.79% Apr-01 Dec-06 Matrix IIB CBO Mezz Commingled Fund 27.7$ 34.2$ -$ (9) 6.13% 9.79% Feb-02 Dec-06 Matrix IIIA (8) CLO Mezz / Equity Commingled Fund 126.9$ 346.5$ -$ (9) 49.64% 11.01% Feb-02 Dec-06 Matrix IIIB (8) CLO Mezz / Equity Commingled Fund 38.9$ 84.7$ -$ (9) 31.59% 11.01% Oct-03 May-05 Matrix IV CLO Senior Commingled Fund 100.0$ 133.9$ -$ (9) 32.82% 8.92% Oct-07 May-14 ZAIS Zephyr A-1, LTD CLO Mezz / Equity Fund of One 28.5€ 48.5€ -€ (9) 12.19% 9.66% Oct-07 Open ZAIS Zephyr A-2, LTD (10) CLO Mezz / Equity Commingled Fund 45.0$ 67.4$ 0.1$ 10.52% 8.99% Oct-07 Jul-11 ZAIS Zephyr A-3, LTD CLO Mezz / Equity Fund of One 10.0€ 13.5€ -€ (9) 9.10% 9.42% Oct-07 Open ZAIS Zephyr A-4, LLC (10) CLO Mezz / Equity Commingled Fund 25.0$ 39.9$ 0.1$ 10.52% 8.99% Jul-09 Feb-11 Lubeck II-A CLO Senior Fund of One 80.0$ 104.9$ -$ (9) 24.21% 22.08% Apr-10 Apr-13 Lubeck II-C CLO Senior Fund of One 70.0$ 72.7$ -$ (9) 1.65% 11.60% Apr-10 Jun-13 Empiricus A CLO Mezz / Equity Fund of One 16.0$ 18.9$ -$ (9) 13.36% 9.86% Aug-10 Open Empiricus B-B (11) CLO Mezz / Equity Fund of One 40.0$ 0.2$ 53.0$ 12.45% 9.92% Jul-09 Open Zephyr Recovery 2004-1 LP (10,12) Structured Corporate Credit Commingled Fund 41.3$ 149.8$ 5.2$ 78.37% 13.56% Jul-09 Open Zephyr Recovery 2004-2 LP (10,12) Structured Corporate Credit Commingled Fund 35.5$ 143.5$ 5.2$ 90.29% 13.56% Jul-09 Open Zephyr Recovery 2004-3 LP (10,12) Structured Corporate Credit Commingled Fund 6.3$ 24.4$ 0.8$ 91.40% 13.56% Jul-09 Open Zephyr 2004-4 LLC (10,12) Structured Corporate Credit Commingled Fund 26.5$ 94.5$ 3.2$ 77.51% 13.56% Jul-09 Open Zephyr Recovery II-A LP (10,12) Structured Corporate Credit Commingled Fund 49.6$ 296.7$ 16.5$ 105.81% 13.56% Jul-09 Open Zephyr Recovery II-B LP (10,12) Structured Corporate Credit Commingled Fund 5.0€ 22.1€ 1.3€ 76.77% 13.56% Jul-09 Open Zephyr Recovery II-C LP (10,12) Structured Corporate Credit Commingled Fund 27.8$ 43.9$ 100.0$ 47.19% 13.56% Jul-09 Open Zephyr Recovery Mezz 2005-1 Unit Trust (12) CLO Senior/Mezz Commingled Fund 41.4$ 21.7$ 151.8$ 34.46% 13.56% Sep-09 Open ZAIS Leda Fund (13) CLO Senior/Mezz Fund of One 433.2€ 187.7€ 301.1€ 2.65% 11.73% Jul-09 Open ZAIS Tydeus Fund (13) CLO Senior/Mezz/Equity Fund of One 178.8€ 163.1€ 87.4€ 13.76% 13.52% Nov-11 Open Corporate Loan Master Fund Leverage Loans Fund of One 99.5€ 1.6€ 111.7€ 4.60% 9.73% Dec-07 Open Insurance Company #1a CLO Mezz Managed Account 166.5$ 137.3$ 78.7$ 5.69% 9.51% Nov-11 Open Insurance Company #1b Structured Settlements Managed Account 99.3$ 7.9$ 101.6$ 6.68% 9.75% Mar-14 Open Insurance Company #1c CLO Mezz Managed Account 150.0$ -$ 149.5$ -0.84% 1.48% Jul-10 Open German Insurance Company #1 CLO Mezz Managed Account 132.9€ 60.5€ 88.5€ 4.19% 9.99% Oct-14 Open Managed Account #6 (14) Leverage Loans Managed Account 2.7$ -$ 2.7$ NA NA Jun-05 Open Co-Epics I Ltd CLO Equity Passthrough Vehicle 9.5$ 17.7$ 0.7$ 12.62% 8.60% Jun-05 Open Epics I Ltd CLO Equity Passthrough Vehicle 173.4$ 306.3$ 12.8$ 9.76% 8.60% Mar-07 Open ZAIS Investment Grade Limited IX (16) CLO/RMBS Structured Vehicle 29.0$ 6.1$ -$ -87.70% 8.46% Mar-14 Open ZAIS CLO 1, Limited (17) Leverage Loans Structured Vehicle 25.7$ -$ 25.5$ -0.61% 1.16% Sep-14 Open ZAIS CLO 2, Limited (18) Leverage Loans Structured Vehicle 33.5$ -$ 33.5$ 0.00% 0.00% Aug-14 Open ZAIS CLO 3 Warehouse (15) Leverage Loans Structured Vehicle 30.0$ -$ 30.1$ NA NA

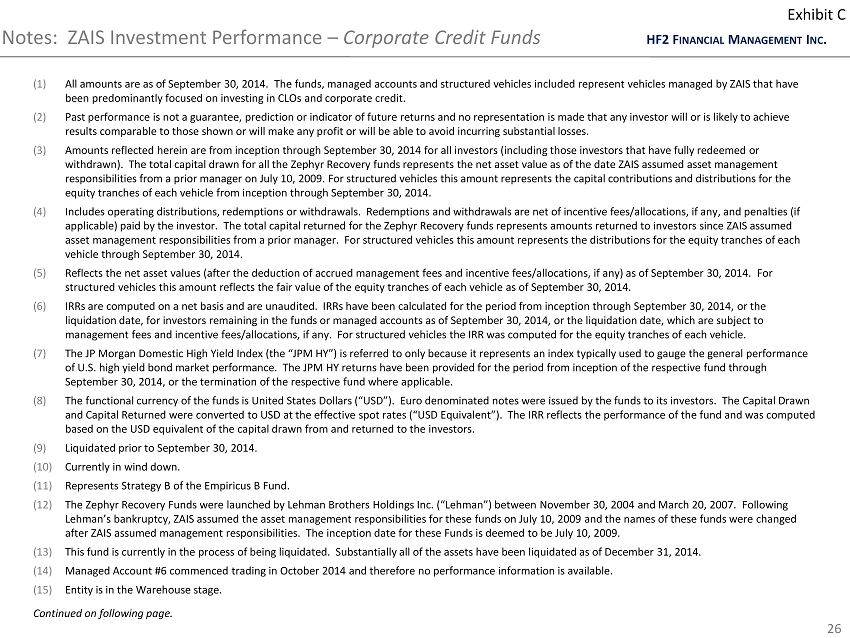

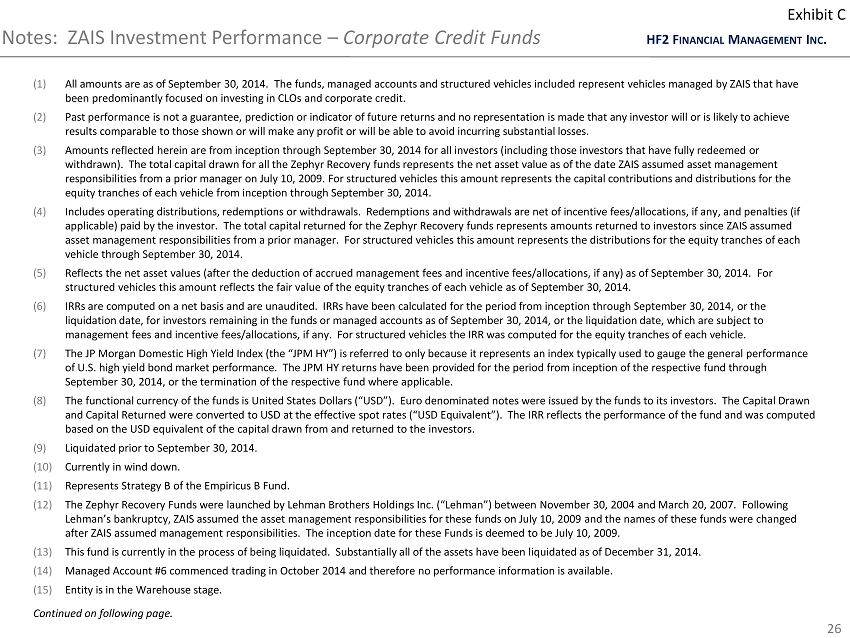

HF2 F INANCIAL M ANAGEMENT I NC . Notes: ZAIS Investment Performance – Corporate Credit Funds 26 Exhibit C (1) All amounts are as of September 30, 2014. The funds, managed accounts and structured vehicles included represent vehicles manage d b y ZAIS that have been predominantly focused on investing in CLOs and corporate credit . (2) Past performance is not a guarantee, prediction or indicator of future returns and no representation is made that any investor wil l o r is likely to achieve results comparable to those shown or will make any profit or will be able to avoid incurring substantial losses . (3) Amounts reflected herein are from inception through September 30, 2014 for all investors (including those investors that have fully r ede emed or withdrawn). The total capital drawn for all the Zephyr Recovery funds represents the net asset value as of the date ZAIS ass ume d asset management responsibilities from a prior manager on July 10, 2009. For structured vehicles this amount represents the capital contributi ons and distributions for the equity tranches of each vehicle from inception through September 30, 2014 . (4) Includes operating distributions, redemptions or withdrawals. Redemptions and withdrawals are net of incentive fees/allocations, if a ny, and penalties (if applicable) paid by the investor. The total capital returned for the Zephyr Recovery funds represents amounts returned to in ves tors since ZAIS assumed asset management responsibilities from a prior manager. For structured vehicles this amount represents the distributions for th e equity tranches of each vehicle through September 30, 2014 . (5) Reflects the net asset values (after the deduction of accrued management fees and incentive fees/allocations, if any) as of September 30, 2014. For structured vehicles this amount reflects the fair value of the equity tranches of each vehicle as of September 30, 2014 . (6) IRRs are computed on a net basis and are unaudited. IRRs have been calculated for the period from inception through September 30, 20 14, or the liquidation date, for investors remaining in the funds or managed accounts as of September 30, 2014, or the liquidation date, wh ich are subject to management fees and incentive fees/allocations, if any. For structured vehicles the IRR was computed for the equity tranches of each vehicle . (7) The JP Morgan Domestic High Yield Index (the “JPM HY”) is referred to only because it represents an index typically used to gauge th e general performance of U.S. high yield bond market performance. The JPM HY returns have been provided for the period from inception of the respe cti ve fund through September 30, 2014, or the termination of the respective fund where applicable . (8) The functional currency of the funds is United States Dollars (“USD”). Euro denominated notes were issued by the funds to its in ves tors. The Capital Drawn and Capital Returned were converted to USD at the effective spot rates (“USD Equivalent”). The IRR reflects the performance of the fund and was computed based on the USD equivalent of the capital drawn from and returned to the investors . (9) Liquidated prior to September 30, 2014 . (10) Currently in wind down . (11) Represents Strategy B of the Empiricus B Fund . (12) The Zephyr Recovery Funds were launched by Lehman Brothers Holdings Inc. (“Lehman”) between November 30, 2004 and March 20, 2007. F ollowing Lehman’s bankruptcy, ZAIS assumed the asset management responsibilities for these funds on July 10, 2009 and the names of the se funds were changed after ZAIS assumed management responsibilities. The inception date for these Funds is deemed to be July 10, 2009 . (13) This fund is currently in the process of being liquidated. Substantially all of the assets have been liquidated as of December 31, 2014. (14) Managed Account #6 commenced trading in October 2014 and therefore no performance information is available . (15) Entity is in the Warehouse stage . Continued on following page.

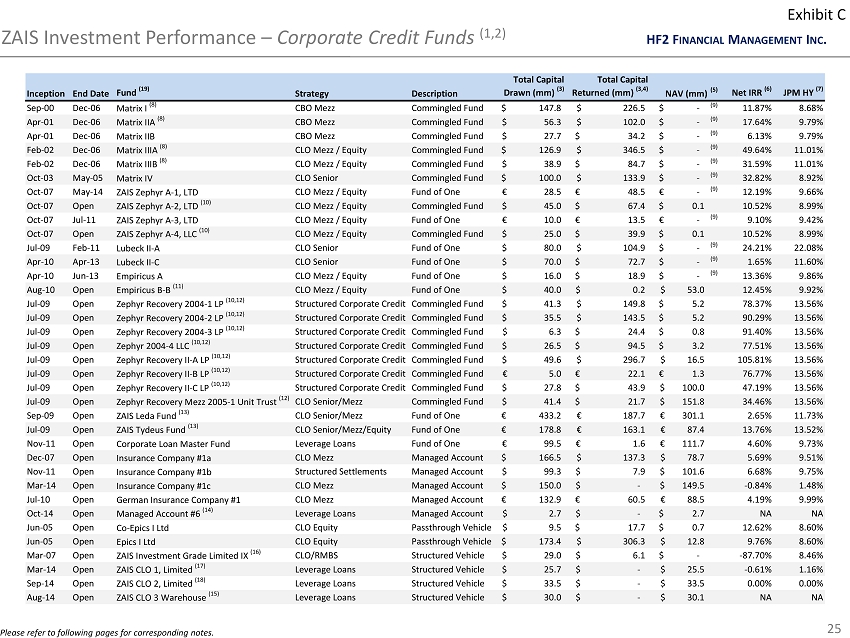

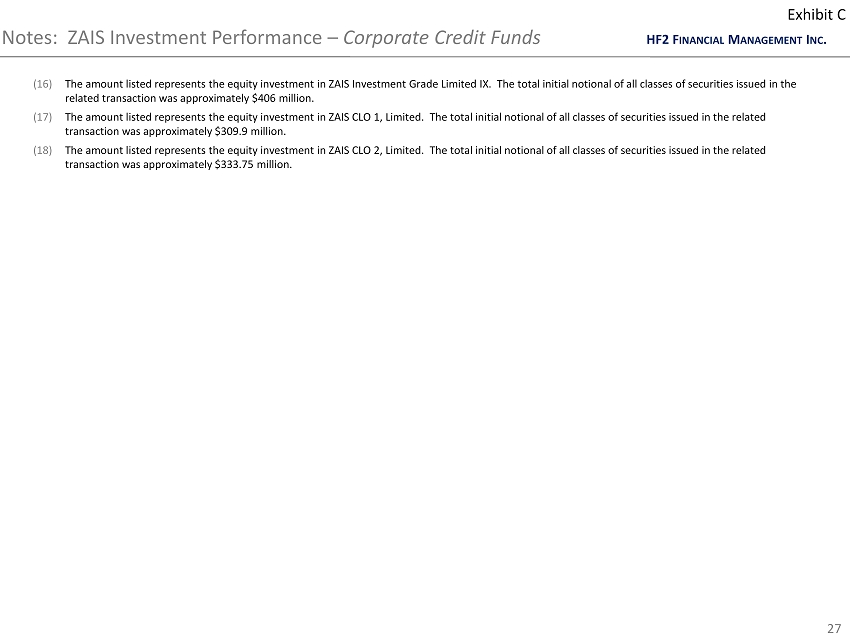

HF2 F INANCIAL M ANAGEMENT I NC . Notes: ZAIS Investment Performance – Corporate Credit Funds 27 Exhibit C (16) The amount listed represents the equity investment in ZAIS Investment Grade Limited IX. The total initial notional of all classe s o f securities issued in the related transaction was approximately $406 million . (17) The amount listed represents the equity investment in ZAIS CLO 1, Limited. The total initial notional of all classes of securiti es issued in the related transaction was approximately $309.9 million . (18) The amount listed represents the equity investment in ZAIS CLO 2, Limited. The total initial notional of all classes of securiti es issued in the related transaction was approximately $333.75 million .

HF2 F INANCIAL M ANAGEMENT I NC . ZAIS Investment Performance – Mortgage Related Strategies (1,2) 28 Exhibit C Please refer to following pages for corresponding notes. Total Capital Total Capital ABX. HE (13) InceptionEnd Date Fund (19) Strategy Description Drawn (mm) (3) Returned (mm) (3,4) NAV (mm) (5) Net IRR (6) 06-1 AAA 07-1 AAA M A T R I X V F U N D S Jul-06 Dec-12 Matrix V-C RMBS / CLO / ABS CDOs / ShortsFund of One 182.5$ 308.1$ -$ (7) 15.63% -0.46% NA Nov-06 Dec-12 Matrix V-A RMBS / CLO / ABS CDOs Commingled Fund 143.6$ 120.3$ -$ (7) -5.10% -0.48% NA Nov-06 Dec-12 Matrix V-B RMBS / CLO / ABS CDOs Commingled Fund 103.0$ 86.5$ -$ (7) -5.63% -0.48% NA D I S T R E S S E D N O N - A G E N C Y R M B S F O C U S E D F U N D S & R E L A T E D A C C O U N T S Sep-07 Dec-12 Matrix VI-C RMBS Fund of One 276.7$ 329.0$ -$ (7) 6.45% -0.16% -10.63% Jan-08 Dec-12 Matrix VI-A RMBS Commingled Fund 232.7$ 312.8$ -$ (7) 9.87% 0.42% -6.87% Jan-08 Dec-12 Matrix VI-B RMBS Commingled Fund 111.2$ 145.9$ -$ (7) 13.51% 0.42% -6.87% Jan-08 Sep-10 Matrix VI-D RMBS Fund of One 75.0$ 87.9$ -$ (7) 8.75% -3.25% -17.28% Jan-08 Dec-12 Matrix VI-F RMBS Fund of One (15) 108.9$ 144.6$ -$ (7) 8.45% 0.42% -6.87% Mar-08 Sep-10 ZAIS CL RMBS Fund of One (15) 116.9$ 132.4$ -$ (7) 7.64% -0.96% -8.51% Apr-08 Dec-12 Matrix VI-I RMBS Fund of One 75.1$ 106.6$ -$ (7) 10.63% 0.53% -4.64% May-09 Nov-12 Managed Account #2 RMBS Managed Account 25.0$ 38.4$ -$ (7) 19.08% 8.96% 17.44% Sep-09 Feb-11 Managed Account #4 RMBS Managed Account 50.0$ 61.5$ -$ (7) 20.75% 10.39% 31.98% Mar-10 Jun-12 Managed Account #1 RMBS Managed Account 19.5$ 23.1$ -$ (7) 9.36% 2.01% -0.63% Mar-12 Dec-13 ZAIS Mortgage Securities RMBS Fund of One (15) 172.2$ 211.0$ -$ (7) 17.24% 4.04% 23.38% Sep-06 Mar-10 Scepticus I RMBS Short Fund of One 58.9$ 554.1$ -$ (7) 754.71% NA NA Sep-06 Dec-08 Scepticus II RMBS Short Managed Account 8.4$ 114.7$ -$ (7) 1,129.42% NA NA Dec-06 Jan-09 Scepticus III RMBS Short Managed Account 12.0$ 115.2$ -$ (7) 1,116.59% NA NA Mar-07 Jun-08 Hartshorne CDO I, Ltd (8,16) RMBS Structured Vehicle 50.0$ 9.7$ -$ (7) -96.94% -6.37% -42.24% Aug-02 Open Galleria CDO V, Ltd (17) RMBS Structured Vehicle 12.0$ 1.8$ -$ -87.11% NA NA Jun-09 Open Managed Account #3 RMBS Managed Account 40.0$ 15.0$ 46.3$ 16.71% 6.88% 22.16% Apr-12 Open 2012 Managed Account (14) RMBS With Overlay Managed Account 71.3$ 48.0$ 40.2$ 12.19% 4.15% 32.88% Jul-12 Open INARI Fund RMBS With Overlay Fund of One 300.0$ -$ 356.9$ 9.35% 3.09% 28.49% May-13 Open Managed Account #5 RMBS With Overlay Managed Account 125.0$ -$ 133.7$ 4.93% -0.09% 19.94% R E S I D E N T I A L W H O L E L O A N S A N D C O M M E R C I A L R E A L E S T A T E Jan-09 Open ZAIS Value Added Real Estate Fund I, LP (9) Commercial Real Estate Non-fee Paying Investors 21.7$ 3.7$ 12.3$ -6.13% NA NA Aug-08 Open SerVertis Master Fund I LP (10,11) Residential Whole Loans Commingled Fund 726.9$ 1,029.2$ 1.1$ 8.42% 1.59% 12.09% Jul-11 Open ZAIS Financial Corp. Residential Whole Loans Public REIT 212.0$ (18) 65.4$ (18) 196.7$ 23.45% (12) 2.97% 31.29%

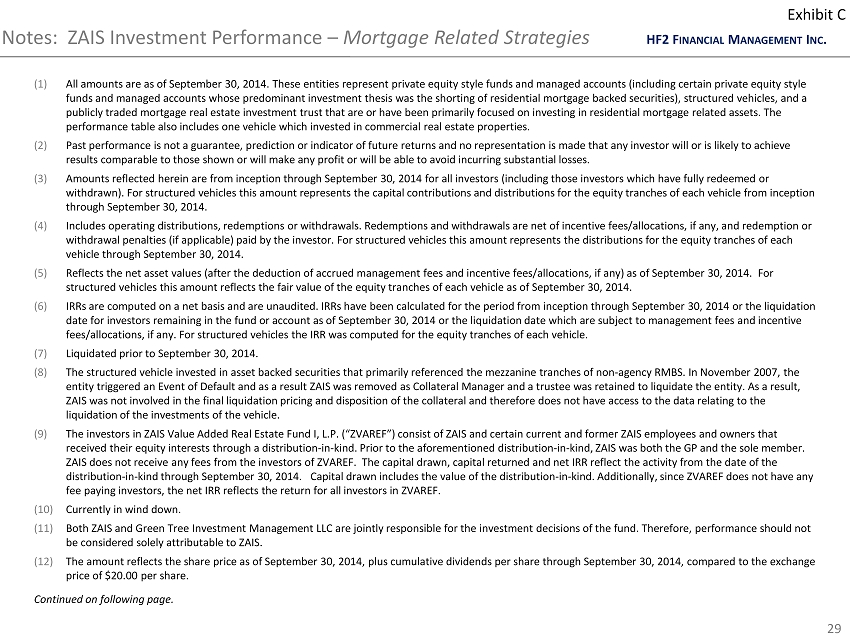

HF2 F INANCIAL M ANAGEMENT I NC . Notes: ZAIS Investment Performance – Mortgage Related Strategies 29 Exhibit C (1) All amounts are as of September 30, 2014. These entities represent private equity style funds and managed accounts (including ce rtain private equity style funds and managed accounts whose predominant investment thesis was the shorting of residential mortgage backed securities), s tru ctured vehicles, and a publicly traded mortgage real estate investment trust that are or have been primarily focused on investing in residential mor tga ge related assets. The performance table also includes one vehicle which invested in commercial real estate properties . (2) Past performance is not a guarantee, prediction or indicator of future returns and no representation is made that any investo r w ill or is likely to achieve results comparable to those shown or will make any profit or will be able to avoid incurring substantial losses . (3) Amounts reflected herein are from inception through September 30, 2014 for all investors (including those investors which hav e f ully redeemed or withdrawn). For structured vehicles this amount represents the capital contributions and distributions for the equity tranche s o f each vehicle from inception through September 30, 2014 . (4) Includes operating distributions, redemptions or withdrawals. Redemptions and withdrawals are net of incentive fees/allocatio ns, if any, and redemption or withdrawal penalties (if applicable) paid by the investor. For structured vehicles this amount represents the distributions f or the equity tranches of each vehicle through September 30, 2014 . (5) Reflects the net asset values (after the deduction of accrued management fees and incentive fees/allocations, if any) as of S ept ember 30, 2014. For structured vehicles this amount reflects the fair value of the equity tranches of each vehicle as of September 30, 2014 . (6) IRRs are computed on a net basis and are unaudited. IRRs have been calculated for the period from inception through September 30 , 2014 or the liquidation date for investors remaining in the fund or account as of September 30, 2014 or the liquidation date which are subject to man age ment fees and incentive fees/allocations, if any. For structured vehicles the IRR was computed for the equity tranches of each vehicle . (7) Liquidated prior to September 30, 2014 . (8) The structured vehicle invested in asset backed securities that primarily referenced the mezzanine tranches of non - agency RMBS. In November 2007, the entity triggered an Event of Default and as a result ZAIS was removed as Collateral Manager and a trustee was retained to liq uid ate the entity. As a result, ZAIS was not involved in the final liquidation pricing and disposition of the collateral and therefore does not have access t o t he data relating to the liquidation of the investments of the vehicle . (9) The investors in ZAIS Value Added Real Estate Fund I, L.P. (“ZVAREF”) consist of ZAIS and certain current and former ZAIS emp loy ees and owners that received their equity interests through a distribution - in - kind. Prior to the aforementioned distribution - in - kind, ZAIS was both the GP and the sole member. ZAIS does not receive any fees from the investors of ZVAREF. The capital drawn, capital returned and net IRR reflect the act ivi ty from the date of the distribution - in - kind through September 30, 2014. Capital drawn includes the value of the distribution - in - kind. Additionally, s ince ZVAREF does not have any fee paying investors, the net IRR reflects the return for all investors in ZVAREF. (10) Currently in wind down . (11) Both ZAIS and Green Tree Investment Management LLC are jointly responsible for the investment decisions of the fund. Therefor e, performance should not be considered solely attributable to ZAIS . (12) The amount reflects the share price as of September 30, 2014, plus cumulative dividends per share through September 30, 2014, co mpared to the exchange price of $20.00 per share . Continued on following page .

HF2 F INANCIAL M ANAGEMENT I NC . Notes: ZAIS Investment Performance – Mortgage Related Strategies 30 Exhibit C (13) The ABX.HE.06 - 1 AAA Index and ABX.HE. 07 - 1 AAA (the “ABX index”) is referred to only because it represents an index typically us ed to gauge the general performance of US subprime residential mortgage backed securities. The use of this index is not meant to be indicative of the as set composition or volatility of the portfolio of securities held by the funds, which may or may not have included securities which comprise the ABX Index, an d which may hold considerably fewer than the number of different securities that make up the ABX Index. As such, an investment in the fund sho uld be considered riskier than an investment in the ABX Index. The ABX Index returns have been calculated for the period from inception of the respective fu nd through September 30, 2014 or the termination of the respective fund where applicable. The ABX Index returns exclude the coupon payment and any app lic able principal losses payable . (14) This managed account is currently in the process of being liquidated. Substantially all of the assets have been liquidated a s o f December 31, 2014. (15) These funds were established for specific managers and contained various investors for whom the manager maintained discretion ary control . (16) The amount listed represents the equity investment in Hartshorne CDO I, Ltd. The total initial notional of all classes of securi tie s issued in the related transaction was approximately $1 billion . (17) The amount listed represents the equity investment in Galleria CDO V, Ltd. The total initial notional of all classes of securiti es issued in the related transaction was approximately $300 million . (18) Capital drawn includes the initial exchange offer, subsequent issuances of common stock and operating partnership units during the pr iva te phase and gross proceeds raised in the initial public offering. Capital returned includes redemptions of stock during the private phase and d ivi dends and distributions paid to investors during the private phase and subsequent to the initial public offering.

HF2 F INANCIAL M ANAGEMENT I NC . ZAIS Investment Performance – Multi - Strategy Funds and Accounts (1,2) 31 Exhibit C (1) All amounts are as of September 30, 2014. These funds and managed accounts represent private equity style funds, hedge funds and ma naged accounts that invest in a combination of corporate debt instruments, such as CLOs, leveraged loans and high yield bonds, as well as re sid ential and commercial mortgage related strategies. In addition, some funds invest in various derivative based instruments including, but not limite d t o swaps, interest only securities, inverse interest only securities and swaptions . (2) Past performance is not a guarantee, prediction or indicator of future returns and no representation is made that any investor wil l o r is likely to achieve results comparable to those shown or will make any profit or will be able to avoid incurring substantial losses . (3) Amounts reflected herein are from inception through September 30, 2014 for all investors (including those investors which have fully red eemed or withdrawn ). (4) Includes operating distributions, redemptions or withdrawals. Redemptions and withdrawals are net of incentive fees/allocations, if an y, and redemption or withdrawal penalties (if applicable) paid by the investor. (5) Reflects the net asset values (after the deduction of accrued management fees and incentive fees/allocations, if any) as of September 30, 2014 . (6) IRRs are computed on a net basis and are unaudited. For existing funds and managed accounts, IRRs have been calculated for the per iod from inception through September 30, 2014 for investors remaining in the fund or account as of September 30, 2014 which are subject to manag eme nt fees and incentive fees/allocations, if any. (7) The JP Morgan Domestic High Yield Index (the “JPM HY”) is referred to only because it represents an index typically used to gauge th e general performance of U.S. high yield bond market performance. The JPM HY returns have been provided for the period from inception of the respe cti ve fund through September 30, 2014, or the termination of the respective fund where applicable . (8) Net IRR assumes a $1 investment at inception and assumes no contributions or withdrawals during the investment period for a singl e i nvestor in ZAIS Opportunity Domestic Feeder Fund, LP ("Opportunity Fund Domestic Feeder") Series A Interests that is subject to advisory fees an d incentive allocation. Net IRR would differ for an investment in Opportunity Fund Domestic Feeder Series B, ZAIS Opportunity Fund, Ltd. Series A and Of fshore Feeder Series B, as a result of timing of capital transactions, differences in fund expenses and lower or no management fees. Effective April 1 , 2 012, management fee rates were reduced from 1.50% to 1.25% for Series A and from 1.00% to 0.75% for Series B. Effective January 1, 2013, incentive fee or allocation rates were reduced from 25% to 20% for Series A and from 20% to 15% for Series B. The Opportunity Fund Domestic Feeder's returns for Ja nua ry 2009 and February 2011 have been adjusted to account for an increase of capital resulting from redemption penalties retained in the fund for th e b enefit of the remaining investors . Continued on following page. Total Capital Total Capital Inception End Date Fund Strategy Description Drawn (mm) (3) Returned (mm) (3,4) NAV (mm) (5) Net IRR (6) JPM HY (7) Oct-03 Open Opportunity Fund CLO/RMBS/CMBS Commingled Fund NA NA NA 15.70% (8) 8.85% Oct-13 Open ZAIS Atlas Master Fund, LP RMBS / CLO / CMBS Commingled Fund NA NA NA 3.73% (9) 7.65% Mar-12 Open Pension Fund CLO / RMBS / CMBS Managed Account 169.0$ -$ 183.6$ 8.67% (10) 8.65% Apr-14 Open Insurance Company #2 RMBS / CLO Managed Account 72.9$ -$ 73.5$ 2.86% -0.47%

HF2 F INANCIAL M ANAGEMENT I NC . Notes: ZAIS Investment Performance – Multi - Strategy Funds and Accounts 32 Exhibit C (9) Net IRR assumes a $1 investment at inception and assumes no contributions or withdrawals during the investment period for a s ing le investor in ZAIS Atlas Fund, LP ("Atlas Domestic Feeder") Sub - Class A - 1 Interests that is subject to full advisory fees and incentive allocation. This net IRR result is based on pro forma returns based on what the highest fee paying Sub - Class A - 1 of Atlas Domestic Feeder would have returned if actual investme nts had been made in that Sub - Class . These pro forma results do not reflect an actual investment in the full fee paying Sub - Class which was not offered to investors until April 1, 2014 because the Master Feeder fund structure was in its start - up phase and Sub - Class A - 3, a reduced fee paying Sub - Class for the Founder’s shares, of the Atlas Domestic Feeder and ZAIS Atlas Offshore Ltd. was offered to investors. Net IRR would differ for an investment in Atlas Dom estic Feeder Sub - Class A - 2 and A - 3, as well as ZAIS Atlas Fund, Ltd. Sub - Class A - 1 and A - 3, as a result of timing of capital transactions, differences in f und expenses and lower or no management fees. (10) The returns for this vehicle do not take into account a fee rebate for the investor’s separate interest in a ZAIS - managed fund. If the IRR had included the effect of the rebate, the stated returns would have been higher.

HF2 F INANCIAL M ANAGEMENT I NC . Residential Mortgage Conduit Business – Overview 33 (1) As of September 30, 2014. A subsidiary of ZAIS is the investment advisor for ZAIS Financial Corp. (“ZFC”), a mortgage REIT l ist ed and traded on the New York Stock Exchange. Opportunity ▪ Financial crisis significantly reduced availability of mortgage credit ▪ Regulation has increased the cost, complexity and required capital to originate and securitize residential mortgages ▪ Government oversight and regulation of GSEs/agencies and commercial banks has created need for private capital to expand credit availability Strategy ▪ Purchase individual residential mortgage loans from originators utilizing pre - defined eligibility criteria, pricing parameters and underwriting process ▪ Allocate new loans to existing or new ZAIS - managed investment vehicles ▪ Use ZAIS’s equity capital to warehouse and securitize loans, retaining subordinate securities in ZAIS - managed investment vehicles ▪ Seek client capital to co - invest in securitized equity tranches Credentials ▪ Proven residential mortgage credit expertise and operational capabilities ▪ Significant infrastructure to source, evaluate and manage newly originated mortgage loans ▪ Experienced 9 - person team dedicated exclusively to residential mortgage platform ▪ Proprietary systems for loan analytics and pricing, data management and operations Implementation & Outlook ▪ Operational with 4 approved sellers and 4 executed loan purchase agreements for another ZAIS managed vehicle ( 1) ▪ Capital from HF2 will enable ZAIS to pursue significant scale in a very large market ▪ Access to capital and proprietary sourcing channels expected to drive growth Residential Mortgage Conduit Business Credit and Credit Derivatives Trading and Positioning CRE CLO Business Exhibit D

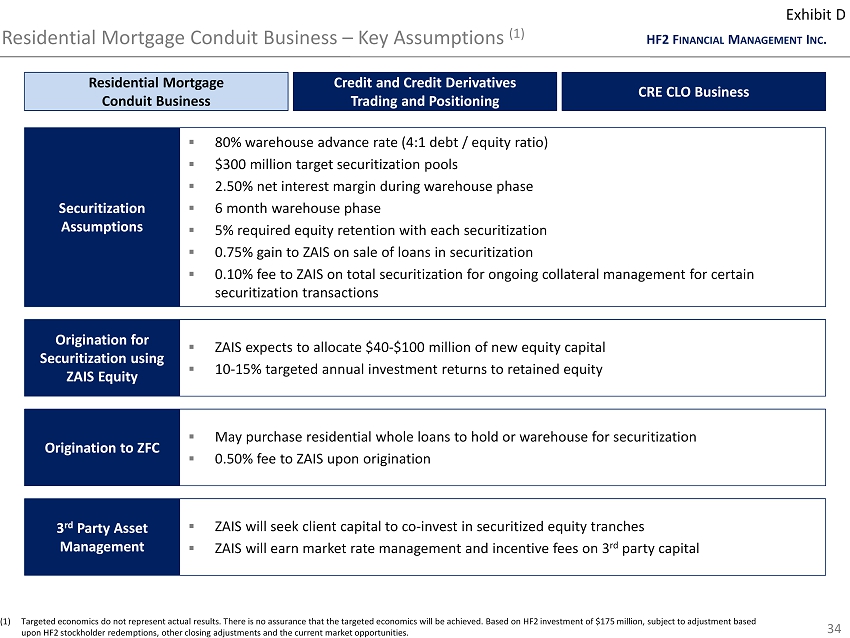

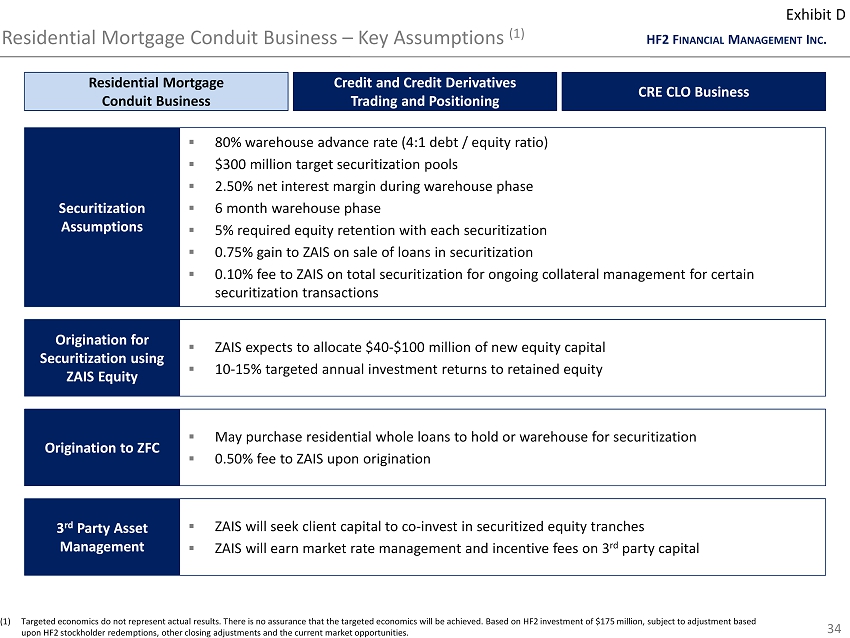

HF2 F INANCIAL M ANAGEMENT I NC . Residential Mortgage Conduit Business – Key Assumptions (1) 34 Securitization Assumptions ▪ 80% warehouse advance rate (4:1 debt / equity ratio) ▪ $ 300 million target securitization pools ▪ 2.50% net interest margin during warehouse phase ▪ 6 month warehouse phase ▪ 5 % required equity retention with each securitization ▪ 0.75% gain to ZAIS on sale of loans in securitization ▪ 0.10% fee to ZAIS on total securitization for ongoing collateral management for certain securitization transactions Origination to ZFC ▪ May purchase residential whole loans to hold or warehouse for securitization ▪ 0.50% fee to ZAIS upon origination Origination for Securitization using ZAIS Equity ▪ ZAIS expects to allocate $40 - $100 million of new equity capital ▪ 10 - 15 % targeted annual investment returns to retained equity 3 rd Party Asset Management ▪ ZAIS will seek client capital to co - invest in securitized equity tranches ▪ ZAIS will earn market rate management and incentive fees on 3 rd party capital Residential Mortgage Conduit Business (1) Targeted economics do not represent actual results. There is no assurance that the targeted economics will be achieved. Based on HF2 investment of $175 million, subject to adjustment based upon HF2 stockholder redemptions, other closing adjustments and the current market opportunities. Exhibit D Credit and Credit Derivatives Trading and Positioning CRE CLO Business

HF2 F INANCIAL M ANAGEMENT I NC . 35 Opportunity ▪ Regulatory pressures will drive significant changes over the next several years ▪ Disintermediation of banks as liquidity providers ▪ Proprietary trading shifting away from banks ▪ Capitalize by expanding access to and liquidity of structured products via indexes, ETFs, and anonymized electronic trading platforms Strategy ▪ Seed new commingled fund to begin trading credit and credit derivatives ▪ Shift across asset classes and employ multiple trading strategies to exploit market inefficiencies Credentials ▪ Established and recognized proficiency in structured credit investing ▪ Over $1 billion of notional principal invested in target strategies in 2014 ▪ Robust infrastructure and technological capabilities ▪ Successful history of structuring and implementing complex investment strategies Implementation & Outlook ▪ Capital from HF2 may be deployed immediately in existing investment strategies ▪ Will continue to refine existing models and software; develop new models as necessary ▪ Expect to launch a fund for third party investors Credit and Credit Derivatives Trading and Positioning Target Economics (1) ▪ ZAIS expects to allocate $40 - $100 million of new equity capital ▪ 15 - 20% targeted annual investment returns ▪ ZAIS will earn market rate management and incentive fees on 3 rd party capital (1) Targeted economics do not represent actual results. There is no assurance that the targeted economics will be achieved. Based on HF2 investment of $175 million, subject to adjustment based upon HF2 stockholder redemptions, other closing adjustments and the current market opportunities . Returns to external capital would be lower due to management and incentive fees. Exhibit D Residential Mortgage Conduit Business Credit and Credit Derivatives Trading and Positioning CRE CLO Business

HF2 F INANCIAL M ANAGEMENT I NC . 36 Opportunity ▪ Over $1 trillion of total commercial real estate loans due by the end of 2017 (1) ▪ Many loans fall short of lender criteria for long - term, stabilized loans; require bridge financing Strategy ▪ Originate, invest in and securitize floating rate commercial real estate bridge loans ▪ Focus on middle - market class A and B properties in secondary and tertiary markets ▪ Finance through warehouse facility initially, then obtain long - term financing via CRE CLOs ▪ Minimize competition with large institutions and traditional commercial lenders by targeting assets in transition in the $5 to $25 million range ▪ Seek client capital to co - invest in securitized equity tranches Credentials ▪ Credit - centric CRE / CMBS team with extensive knowledge of market loan terms and structures ▪ Track record of investing in CRE ▪ Experience structuring, originating and securitizing CLOs ▪ Ability to actively manage return targets through structural leverage and distribution strategies Implementation & Outlook ▪ Much of the infrastructure and personnel in place today; will add talent selectively to expand origination capabilities ▪ Intend to originate loans with warehouse financing and complete first CRE CLO transaction as conditions permit CRE CLO Business – Overview (1) Source: GreensLedge Capital Markets LLC, referencing Maximus Advisors, Mortgage Bankers Association, Commercial Mortgage Ale rt. Exhibit D Residential Mortgage Conduit Business Credit and Credit Derivatives Trading and Positioning CRE CLO Business

HF2 F INANCIAL M ANAGEMENT I NC . 37 CRE CLO Business – Key Assumptions (1) (1) Targeted economics do not represent actual results. There is no assurance that the targeted economics will be achieved. Based on HF2 investment of $175 million, subject to adjustment based upon HF2 stockholder redemptions, other closing adjustments and the current market opportunities. Securitization Assumptions ▪ 75% warehouse advance rate (3:1 debt / equity ratio) ▪ $250 million target securitization pools ▪ 1.00% fee to ZAIS upon origination of loans ▪ 2.50% net interest margin during warehouse phase ▪ 6 month warehouse phase ▪ 5% required equity retention with each securitization ▪ 0.50% fee to ZAIS on total securitization for ongoing collateral management Origination for Securitization using ZAIS Equity ▪ ZAIS expects to allocate $20 - $60 million of new equity capital ▪ 15 - 18% targeted annual investment returns to retained CLO equity 3 rd Party Asset Management ▪ ZAIS will seek client capital to co - invest in securitized equity tranches ▪ ZAIS will earn market rate management and incentive fees on 3 rd party capital Exhibit D Residential Mortgage Conduit Business Credit and Credit Derivatives Trading and Positioning CRE CLO Business

HF2 F INANCIAL M ANAGEMENT I NC . ZGP GAAP Income Statements (1) 38 Exhibit E (1) These financials include revenue and expenses of investment vehicles required to be consolidated in accordance with GAAP. Please refer to page 39 for the reconciliation of GAAP to Non - GAAP performance measures, which ZAIS management uses to evaluate the operating performance of the business, and pages 40 and 41 for the expla nat ions for the Non - GAAP adjustments . US Dollars in millions, unless noted otherwise 9 Months Ended 12 Months Ended 6 Months Ended June 30, Year Ended December 31, September 30, 2014 June 30, 2014 2014 2013 2013 2012 (audited) (audited) Revenues Management fee income 14.7$ 23.2$ 10.4$ 13.8$ 26.6$ 30.5$ Incentive income 41.7 53.1 36.8 2.5 18.8 99.6 Other revenues 0.5 1.0 0.4 0.7 1.3 1.1 Income of Consolidated Funds 88.1 103.2 57.7 63.2 108.7 116.1 Total Revenues 145.0 180.5 105.3 80.2 155.4 247.3 Expenses Employee compensation and benefits 37.6 57.1 28.1 24.1 53.1 64.2 General, administrative and other 13.1 13.6 7.6 14.1 20.1 24.4 Depreciation and amortization 0.4 0.5 0.2 0.2 0.5 0.4 Expenses of Consolidated Funds 99.8 106.7 88.0 21.4 40.1 96.6 Total Expenses 150.9 177.9 123.9 59.8 113.8 185.6 Other Income (Loss) Net gain (loss) on investments (0.1) (0.5) (0.0) 0.1 (0.4) (0.5) Other income (expense) 0.2 0.1 0.0 (0.1) 0.0 (0.1) Net gains of Consolidated Funds' investments 72.2 75.7 67.8 (0.1) 7.8 120.0 Total Other Income 72.3 75.3 67.8 (0.1) 7.4 119.4 Income from continuing operations before income taxes 66.4 77.9 49.2 20.3 49.0 181.1 Income taxes 0.0 0.2 0.0 0.1 0.3 0.4 Income from continuing operations 66.4 77.7 49.2 20.2 48.7 180.7 Discountinued Operations Income (loss) from operations of discontinued business component - - - - - (1.3) Income tax expense (benefit) - - - - - 0.0 Income (loss) on discontinued operations, net of tax - - - - - (1.3) Consolidated Net Income (Loss) 66.4 77.7 49.2 20.2 48.7 179.4 Other Comprehensive Income, Net of Tax Foreign currency translation adjustment 0.6 (0.3) (0.2) 0.0 (0.1) 1.0 Total Comprehensive Income (Loss) 67.0$ 77.4$ 49.0$ 20.2$ 48.6$ 180.4$

HF2 F INANCIAL M ANAGEMENT I NC . ZGP Non - GAAP Performance Measures (1) 39 Exhibit E (1) Please refer to the following page for further disclosure and an explanation of these Non - GAAP performance measures . US Dollars in millions, unless noted otherwise 9 Months Ended 12 Months Ended 6 Months Ended June 30, Year Ended December 31, September 30, 2014 June 30, 2014 2014 2013 2013 2012 Total Comprehensive Income (Loss) 67.0$ 77.4$ 49.0$ 20.2$ 48.6$ 180.4$ Addback: Eliminations to Management fee income 8.7 10.3 7.5 7.4 10.2 6.8 Addback: Eliminations to Incentive income 10.8 18.6 9.7 10.3 19.2 28.0 Addback: Eliminations to Other revenues 0.0 0.1 0.0 0.1 0.1 0.3 Less: Income of Consolidated Funds (88.1) (103.2) (57.7) (63.2) (108.7) (116.1) Plus: Expenses of Consolidated Funds 99.8 106.7 88.0 21.4 40.1 96.6 Less: Net gains of Consolidated Funds' investments (72.2) (75.7) (67.8) 0.1 (7.8) (120.0) Less: Unrealized gain (loss) on investments (0.0) 0.1 0.1 (0.1) (0.0) (0.1) Plus: Compensation attributable to Income Unit Plan 6.2 6.1 4.1 2.0 4.0 - Reclassification of incentive compensation (7.7) 1.0 (6.8) (0.9) 6.9 (13.0) Distributable Earnings (1) 24.5$ 41.4$ 26.1$ (2.7)$ 12.6$ 62.9$ Plus: Depreciation and amortization 0.4 0.5 0.2 0.2 0.5 0.4 Plus: Income taxes 0.0 0.2 0.0 0.1 0.3 0.4 Adjusted EBITDA (1) 24.9$ 42.1$ 26.3$ (2.4)$ 13.4$ 63.7$

HF2 F INANCIAL M ANAGEMENT I NC . Explanation of Non - GAAP Performance Measures 40 Exhibit E In addition to analyzing results on a GAAP basis, ZAIS management also reviews its results on a “Distributable Earnings ” and “Adjusted EBITDA” basis . Distributable Earnings and Adjusted EBITDA exclude the adjustments described below that are required for presentation of results on a GAAP basis, but that ZAIS management does not consider when evaluating operating performance in any given period . ZAIS management, therefore, uses Distributable Earnings and Adjusted EBITDA as the basis on which it evaluates its financial performance . ZAIS management considers it important that investors review the same operating information that it uses . Distributable Earnings Distributable Earnings is a measure of operating performance before U . S . federal and state income taxes that is intended to show the amount of net realized earnings without the effects of consolidation of the Consolidated Funds, and other non - cash or non - operating items . Distributable Earnings excludes the following from results on a GAAP basis : ▪ Amounts related to the ZAIS Consolidated Funds, including the related eliminations of management fee income, incentive income an d other revenues, as ZAIS management reviews the total amount of management fee income, incentive income and other revenues earned in re lation to total assets under management and fund performance. Management fee income allocations from ZAIS Consolidated Funds are ac cru ed as earned and are calculated and paid monthly, quarterly, or annually, depending on the individual agreements, consistent with t he revenue recognition policy for the funds ZAIS does not consolidate. ZAIS also defers the recognition of incentive income allocations fr om the ZAIS Consolidated Funds until it is ( i ) contractually receivable (ii) fixed or determinable (“crystallized”), and (iii) all related contingencies have been removed and collection is reasonably assured, consistent with the revenue recognition policy for the funds ZAIS does not cons oli date. ▪ Net unrealized gains (losses) on investments in ZAIS funds, as ZAIS management does not consider these non - cash items to be reflective of operating performance. ▪ Employee compensation and benefits amounts attributable to ZAIS’s Income Unit Plan. The Income Unit Plan was initially implemented in 201 3 and was designed to deliver equity - like participation in ZAIS’s pre - tax income to key employees. Payments under the Income Unit Plan are recognized as compensation under GAAP. The Income Unit Plan will terminate at the end of 2014. Employees will participate in ZA IS’s profits and growth going forward through the equity allocations set forth elsewhere in this presentation . ▪ Adjustments to reclassify certain of ZAIS’s legacy incentive compensation programs that were not designed for a GAAP environment. These programs provided incentive compensation payments equal to a fixed percentage of incentive fees received by ZAIS and were due an d payable in the period ZAIS received the incentive fees. Under GAAP, a portion of these incentive compensation payments are required to be recognized in accounting periods prior to the accounting periods in which the related incentive fees were received and recognized. These adjustments reclassify these certain incentive compensation expenses into the accounting period in which the associated incentive fees we re received and recognized. One of ZAIS’s existing incentive compensation programs with respect to one single separate account may cause a similar timing issue in the future. Otherwise , none of ZAIS’s current or ongoing incentive compensation programs are expected to cause similar timing issues for financial statements prepared in accordance with GAAP . ▪ Amounts related to equity - based compensation, as ZAIS management does not consider these non - cash expenses to be reflective of its operating performance . ▪ Certain other non - cash and non - operating items.

HF2 F INANCIAL M ANAGEMENT I NC . Explanation of Non - GAAP Performance Measures (cont.) 41 Exhibit E Adjusted EBITDA Adjusted EBITDA is a component of Distributable Earnings and is used to measure ZAIS’s ability to cover recurring operating expenses from cash earnings . Adjusted EBITDA is computed as Distributable Earnings excluding any applicable taxes, interest expense, and depreciation and amortization expenses . As a result of the adjustments described above, management fee income, incentive income and other revenues as presented on both a Distributable Earnings and Adjusted EBITDA basis are also non - GAAP measures . ZAIS’s non - GAAP financial measures should not be considered as alternatives to its GAAP net income (loss), or as indicative of l iquidity or the cash available to fund operations. ZAIS’s non - GAAP performance measures may not be comparable to similarly titled measures used by o ther companies.