Acquisition of Move, Inc. 30 September 2014 Exhibit 99.5 |

Disclaimer Forward- Looking Statements 2 New York, 30 September 2014 Additional Information Regarding the Proposed Transaction This communication does not constitute an offer to buy or a solicitation of an offer to sell any securities. No tender offer for the shares of Move has commenced at this time. In connection with the proposed transaction, News Corp intends to file tender offer documents with the SEC. Any definitive tender offer documents will be mailed to shareholders of Move. INVESTORS AND SECURITY HOLDERS OF MOVE ARE URGED TO READ THESE AND OTHER DOCUMENTS FILED WITH THE SEC CAREFULLY IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors and security holders will be able to obtain free copies of these documents (if and when available) and other documents filed with the SEC by News Corp through the SEC website at http://www.sec.gov or through the News Corp website at http://investors.newscorp.com. This document contains forward-looking statements based on current expectations or beliefs, as well as a number of assumptions about future events, and these statements are subject to factors and uncertainties that could cause actual results to differ materially from those described in the forward-looking statements. Forward-looking statements can often be identified by words such as “anticipates,” “expects,” “intends,” “plans,” “predicts,” “believes,” “seeks,” “estimates,” “may,” “will,” “should,” “would,” “could,” “potential,” “continue,” “ongoing,” similar expressions, and variations or negatives of these words. The reader is cautioned not to place undue reliance on these forward-looking statements, which are not a guarantee of future performance and are subject to a number of uncertainties, risks, assumptions and other factors, many of which are outside the control of News Corporation (“News Corp”) and Move, Inc. (“Move”). The forward-looking statements in this document address a variety of subjects including, for example, the expected date of closing of the acquisition and the potential benefits of the proposed acquisition, including integration plans and expected synergies. The following factors, among others, could cause actual results to differ materially from those described in these forward-looking statements: the risk that Move’s business will not be successfully integrated with News Corp’s business; matters arising in connection with the parties’ efforts to comply with and satisfy applicable regulatory approvals and closing conditions relating to the transaction; and other events that could adversely impact the completion of the transaction, including industry or economic conditions outside of our control. In addition, actual results are subject to other risks and uncertainties that relate more broadly to News Corp’s overall business, including those more fully described in News Corp’s filings with the U.S. Securities and Exchange Commission (“SEC”) including its annual report on Form 10-K for the fiscal year ended June 30, 2014, and its quarterly reports filed on Form 10-Q for the current fiscal year, and Move’s overall business and financial condition, including those more fully described in Move’s filings with the SEC including its annual report on Form 10-K for the fiscal year ended December 31, 2013, and its quarterly reports filed on Form 10-Q for the current fiscal year. The forward-looking statements in this document speak only as of this date. We expressly disclaim any current intention to update or revise any forward-looking statements contained in this document to reflect any change of expectations with regard thereto or to reflect any change in events, conditions, or circumstances on which any such forward-looking statement is based, in whole or in part. |

Transaction Highlights • Leading online real estate platform serving the needs of both consumers and Realtors® in partnership with the National Association of Realtors® (NAR) • Targets large addressable market: estimated $14 billion annual marketing spend in calendar year 2014 by real estate agents and brokers, with increasing digital spend • Leverages both News Corp and REA Group’s unique capabilities through planned News Corp 80% / REA 20% ownership structure • Provides entry point into dynamic market while retaining financial flexibility at News Corp • Complements and enhances News Corp’s core media properties 3 Source: Borrell and Associates Note: $950 million excludes cash on Move balance sheet. New York, 30 September 2014 Acquisition of Move (Nasdaq:MOVE), a leading US digital real estate company, for $21.00 per share or approximately $950 million, net, via an all-cash tender offer |

4 Framing the Opportunity: Large, Growing, and Dynamic US Residential Real Estate Market ~$14bn Annual Marketing Spend from Agents & Brokers US Residential Real Estate Market • 1.1 million Realtors® • More than 5 million homes bought / sold per annum $1 trillion+ in annual transaction volume ~$60 billion commissions to agents & brokers • $30 billion market opportunity Agents & Brokers $14 billion Mortgages $11 billion Rentals $3 billion Builders & Developers $2 billion Source: Borrell and Associates and BIA / Kelsey Note: Move, Zillow, and Trulia based on IBES median 2014 revenue estimates. ~$13bn outside of 3 leading portals ~$1bn at Move, Zillow, and Trulia New York, 30 September 2014 |

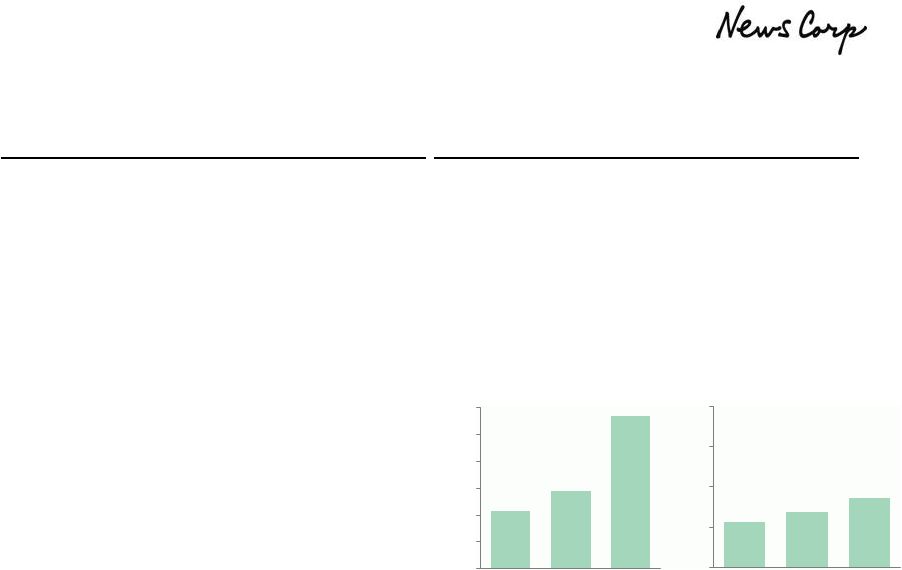

Overview of Move • $227 million of revenue and $29 million of Adjusted EBITDA 3 for the year ended December 31, 2013 • HQ in San Jose, CA • 913 employees 5 New York, 30 September 2014 At-A-Glance 2 Key Assets • A leading platform for consumer search with the most accurate and timely for-sale listings data • Highly engaged and transaction-ready audience of approximately 35 million monthly unique visitors 1 • Strong relationship with NAR provides unique access to MLSs and Realtors® • Coverage of more than 98% of existing homes listed for sale provides high quality leads • Owns and operates ListHub, which syndicates listings to over 130 publishers across the web 1. Move, Inc. internal data (August 2014). 2. Move, Inc. public filings. 3. Adjusted EBITDA excludes stock-based compensation. $ 170 $ 180 $ 190 $ 200 $ 210 $ 220 $ 230 $ 192 $ 199 $ 227 2011 2012 2013 Revenue ($mm) $ 20 $ 25 $ 30 $ 35 $ 40 $ 26 $ 27 $ 29 2011 2012 2013 Adj. EBITDA ($mm) |

Move’s Unique Relationship with NAR 6 • Move has exclusive and perpetual right to operate realtor.com®, the official site of the National Association of Realtors® (NAR) • NAR supports realtor.com® through its own advertising budget • Long-term platform to support the value that Realtors® provide in the marketplace • NAR has global alliances with over 80 real estate associations in nearly 60 countries • NAR has consented to the proposed acquisition and agreed to tender its shares of Move New York, 30 September 2014 |

Move Provides Leading Destinations for Consumers to Find Homes 7 Leading Destinations for Consumers to Find Their Home (%) #1 Source of Leads for Realtors® (%) Source: Move, Inc. public filings. • Move gets listings data directly from 800 MLSs around the country covering more than 98% of for-sale home listings • Over 90% of listings are updated every 15 minutes • Extensive sales history and sold/pending data in real time New York, 30 September 2014 Revenue per Unique Visitor Competitor 1 Competitor 2 Competitor 1 Competitor 2 Competitor 2 Competitor 1 Source: PAA Research and California Association of Realtors® 2013 Survey of California Home Buyers Note: Revenue per unique visitor based on Q2 2014 company-reported data. $0.97 $1.24 $1.86 3.4 3.6 9.8 31 23 13 |

News Corp and REA Uniquely Positioned to Capture Move’s Long-Term Opportunity 8 New York, 30 September 2014 • Large scale technology infrastructure at News Corp • Audience monetization and cross-platform promotion expertise • Accelerate product development and innovation • Extensive News Corp marketing resources and reach 500mm average monthly page views through WSJ Digital Network including MarketWatch Nearly 74mm households through News America Marketing 146mm monthly page views at New York Post Digital Network • Leverage existing digital real estate assets: REA and WSJ Mansion Product Innovation Broad Reach of Media Footprint Know-how and Expertise • News Corp media platforms outside the US • NAR international partnerships Global Opportunity Source: 1. Adobe Omniture (monthly average for year ended June 30, 2014), 2. News Corp public filings, and 3. Google Analytics (August 2014). 1 2 3 |

Transaction Overview • Signed acquisition agreement between News Corp and Move to be followed by a tender offer and merger • REA Group (ASX:REA), majority-owned by News Corp, plans to hold a 20% stake in Move 9 New York, 30 September 2014 Structure Value Financing Timing • Acquisition of 100% of Move for $21.00 / share in cash • Approximately $950 million aggregate net purchase price • Funded by available cash from consolidated cash balance of News Corp • Tender offer to commence within the next 10 business days • Transaction expected to close in Q4 of CY2014 |

Summary Large, underdeveloped digital real estate market opportunity in world’s largest market Acquisition of digital platform with unique strategic attributes: listings data, customer software, and NAR relationship News Corp and REA well-positioned and committed to accelerate growth and innovation at Move Complements and enhances the strengths of News Corp’s US media platforms Accelerate News Corp’s transition to digital media through prudent deployment of capital 10 New York, 30 September 2014 |