- SILA Dashboard

- Financials

- Filings

-

Holdings

-

Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

424B3 Filing

Sila Realty Trust (SILA) 424B3Prospectus supplement

Filed: 19 Nov 15, 12:00am

Filed Pursuant to Rule 424(b)(3)

Registration No. 333-191706

CARTER VALIDUS MISSION CRITICAL REIT II, INC.

SUPPLEMENT NO. 1 DATED NOVEMBER 19, 2015

TO THE PROSPECTUS DATED NOVEMBER 16, 2015

This document supplements, and should be read in conjunction with, the prospectus of Carter Validus Mission Critical REIT II, Inc. (the “Company”), dated November 16, 2015. Unless otherwise defined in this prospectus supplement, capitalized terms used in this prospectus supplement shall have the same meanings as set forth in the prospectus.

The purpose of this prospectus supplement is to describe the following:

(1) the status of the offering of shares of common stock of the Company;

(2) an update to the “Questions and Answers About This Offering” section of our prospectus;

(3) an update to the “Risk Factors” section of our prospectus;

(4) an update to the “Management Compensation” section of our prospectus;

(5) an update to the property statistics table included in our Annual Report on Form 10-K for the year ended December 31, 2014 filed with the Securities and Exchange Commission on March 26, 2015;

(6) Management’s Discussion and Analysis of Financial Condition and Results of Operations section, substantially the same as that which was filed in our Quarterly Report on Form 10-Q on November 16, 2015;

(7) updated financial information regarding the Company; and

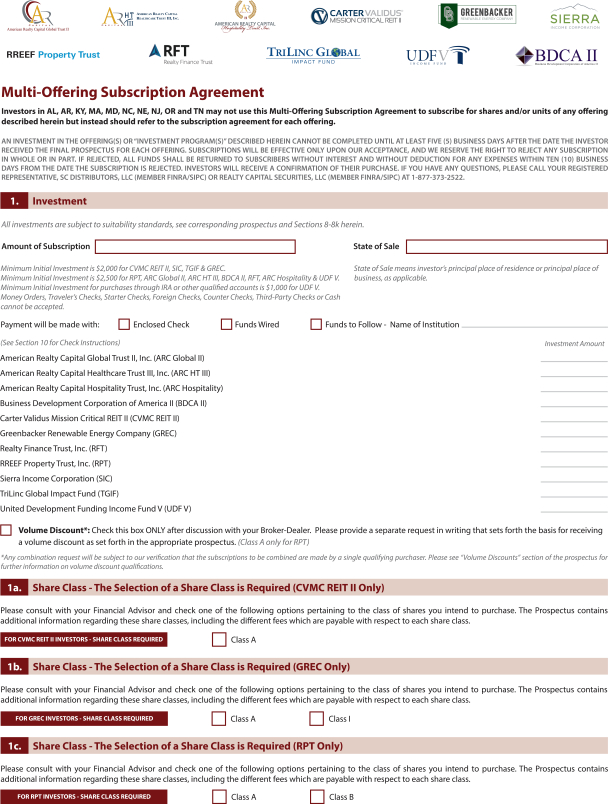

(8) revised forms of our subscription agreements.

Status of Our Public Offering

We commenced our initial public offering of $2,350,000,000 of shares of our common stock (the “Offering”), consisting of up to $2,250,000,000 of shares in our primary offering and up to $100,000,000 of shares pursuant to our distribution reinvestment plan, on May 29, 2014. We are publicly offering two classes of shares of common stock, Class A shares and Class T shares, in any combination with a dollar value up to the maximum offering amount. As of November 17, 2015, we had accepted investors’ subscriptions for and issued approximately 43,660,000 shares of Class A common stock in the Offering, resulting in receipt of gross proceeds of approximately $433,498,000. As of November 17, 2015, we had approximately $1,916,502,000 in Class A shares and Class T shares of common stock remaining in our Offering.

Questions and Answers About This Offering

The answer to the question “What is the difference between the Class A and Class T shares being offered?” contained in the “Questions and Answers About This Offering” section on page 5 of the prospectus is superseded and replaced its entirety as follows:

A: We are publicly offering two classes of shares, Class A shares and Class T shares, at the initial offering price of $10.00 per Class A share and $9.574 per Class T share for the primary offering, and $9.50 per Class A share and $9.095 per Class T share for the distribution reinvestment plan. The share classes have different selling commissions, and there will be an ongoing distribution fee with respect to Class T shares sold in the primary offering. Specifically, we pay to our dealer manager selling commissions of up to 7.0% of gross proceeds from the sale of Class A shares, and up to 3.0% of the gross proceeds from the sale of Class T shares sold in the primary offering. We pay our dealer manager a dealer manager fee of up to 3.0% of proceeds from the primary offering of Class A and Class T shares, provided, however, that the dealer manager fee we pay on the Class T shares may change in the future. In addition, for Class T shares sold in the primary offering, we will pay the dealer manager a distribution fee that accrues daily equal to 1/365th of 1.0% of the amount of the purchase price per share (or, once reported, the NAV for the Class T shares) on a continuous basis from year to year, payable out of amounts that otherwise would be distributed to holders of Class T shares. We will continue paying the distribution fees with respect to Class T shares sold in the primary offering until the earliest to occur of the following: (i) a listing of the Class T shares on a national securities exchange, (ii) upon the completion of this

Offering, total underwriting compensation in this Offering equaling 10.0% of the gross proceeds from the primary offering, (iii) such Class T shares no longer being outstanding; or (iv) the passage of four years following the first Class T purchase in the primary offering. We cannot predict when this will occur. Although we cannot predict the length of time over which stockholders will pay distribution fees due to a number of factors that are not within our control, such as the pace of fundraising and the portion of shares sold that are Class A compared to Class T, distribution fees on Class T shares may not be paid longer than four years following the first Class T purchase in the primary offering. As a result, the maximum amount of distribution fees that a Class T stockholder may pay is approximately $0.38 per share, assuming a $9.574 share price, which, when combined with selling commissions, dealer manager fees and other elements of underwriting compensation, would not exceed the 10% cap on aggregate underwriting compensation imposed by FINRA. Investors who subscribe for Class T shares after the first Class T purchase, however, will pay lower aggregate distribution fees. We will not pay selling commissions, dealer manager fees or distribution fees with respect to shares issued under our distribution reinvestment plan. Below is a summary of the differences between the Class A and Class T shares being offered.

Class A Shares

| • | A front end selling commission, which is a one-time fee charged at the time of purchase of the shares. The selling commissions and, in some cases, the dealer manager fee, will not be charged or may be reduced with regard to shares sold to or for the account of certain categories of purchasers. See “Plan of Distribution” for additional information. |

Class T Shares

| • | Lower front end selling commission than Class A shares. Selling commissions on Class T shares may be reduced or waived in certain circumstances. See “Plan of Distribution” for additional information. |

| • | Class T shares purchased in the primary offering pay a distribution fee which will accrue daily in the amount of 1/365 of 1.0% of the purchase price per share (or, once reported, the NAV for the Class T shares) of Class T shares sold in the primary offering, which may increase the cost of your investment and may cost you more than paying other types of selling commissions. The distribution fee paid in respect of Class T shares sold in the primary offering will be allocated to the Class T shares as a class cost, and these fees will impact the amount of distributions payable on all Class T shares, including those sold issued under our distribution reinvestment plan. |

The fees and expenses listed above, including the distribution fee, will be allocated on a class-specific basis. The payments of class-specific expenses are expected to result in different amounts of distributions being paid with respect to each class of shares. Specifically, we will reduce the amount of distributions that would otherwise be authorized on Class T shares to account for the ongoing distribution fee payable on Class T shares. Therefore, distributions on Class T shares will likely be lower than distributions on Class A shares because Class T shares are subject to ongoing distribution fees. In addition, as a result of the allocation of the distribution fee to the Class T shares as a class, the Class T shares could have a lower NAV per share if distributions on the Class T shares are not adjusted to take account of such fee. See “Description of Securities” and “Plan of Distribution” for a discussion of the differences between our classes of shares.

In the event of any voluntary or involuntary liquidation, dissolution or winding up of us, or any liquidating distribution of our assets, then such assets, or the proceeds therefrom, will be distributed between the holders of Class A shares and Class T shares ratably in proportion to their respective NAV for each class until the NAV for each class has been paid. The estimated value per share will be calculated on a company-wide basis, with any adjustments to Class A or Class T shares made subsequent to such company-wide calculation. Each holder of shares of a particular class of common stock will be entitled to receive, ratably with each other holder of shares of such class, that portion of such aggregate assets available for distribution as the number of outstanding shares of such class held by such holder bears to the total number of outstanding shares of such class then outstanding.

2

Until we calculate our first NAV, we intend to use the most recent price paid to acquire a share in this offering (ignoring purchase price discounts for certain categories of purchasers) as the estimated per share value of our shares. See “Description of Securities” for more details regarding our classes of shares.

Class A shares and Class T shares each are available for purchase by the general public through various distribution channels (See “Plan of Distribution”). Only Class A shares are available for purchase in this Offering by our executive officers and board of directors and their immediate family members, as well as officers and employees of the advisor and other affiliates of the advisor and their immediate family members and, if approved by our management, joint venture partners, consultants and other service providers.

Risk Factors

The following risk factor is inserted as a new risk factor in the “Risk Factors—Risks Related to an Investment in Carter Validus Mission Critical REIT II, Inc.” section beginning on page 33 of the prospectus:

The Secretary of the Commonwealth of Massachusetts has charged an affiliate of our dealer manager with fraudulent casting of shareholder proxy votes and is seeking to suspend that entity’s broker-dealer registration in Massachusetts. Suspension of our offering by participating broker-dealers due to the affiliated relationship could adversely affect our ability to raise proceeds in the Offering, and could adversely affect our ability to obtain additional debt financing.

On November 12, 2015, the Secretary of the Commonwealth of Massachusetts charged an affiliate of our dealer manager with fraudulent casting of shareholder proxy votes. While the complaint does not relate to us, our unaffiliated dealer manager or the Offering, the complaint does seek to revoke the broker-dealer registration in Massachusetts of our dealer manager’s affiliate. If participating broker-dealers determine to suspend, rescind or refuse to execute soliciting dealer agreements with our dealer manager as a result of this complaint, we may not be able to raise a substantial amount of additional capital in the Offering. If we are not able to raise a substantial amount of additional capital, including in our Offering and our credit facility, we may have difficulty in identifying and investing in properties or other assets that satisfy our investment objectives. This could also adversely affect our ability to pay regular distributions to stockholders.

Management Compensation

The following information replaces in its entirety the discussion following footnote (7) on page 106 in the “Management Compensation” section of the prospectus:

The following table summarizes the cumulative compensation, fees and reimbursements incurred by us, the advisor and its affiliates related to the offering stage as of September 30, 2015 and December 31, 2014 and amounts outstanding as of September 30, 2015 and December 31, 2014 (amounts are rounded):

| Incurred | Outstanding | |||||||||||||||

| As of September 30, 2015 | As of December 31, 2014 | As of September 30, 2015 | As of December 31, 2014 | |||||||||||||

Offering Stage: | ||||||||||||||||

Selling commissions(1) | $ | 24,669,000 | $ | 4,428,000 | $ | 61,000 | $ | 44,000 | ||||||||

Dealer manager fee(2) | 11,413,000 | 2,048,000 | 28,000 | 25,000 | ||||||||||||

Other organization and offering expenses(3) | 7,678,000 | 4,205,000 | 431,000 | 2,524,000 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

| $ | 43,760,000 | $ | 10,681,000 | $ | 520,000 | $ | 2,593,000 | |||||||||

|

|

|

|

|

|

|

| |||||||||

| (1) | Our dealer manager reallowed $24,677,000 and $4,428,000 of the selling commissions incurred as of September 30, 2015 and December 31, 2014, respectively. |

| (2) | Our dealer manager reallowed $3,661,000 and $525,000 of the dealer manager fees incurred as of September 30, 2015 and December 31, 2014, respectively. |

| (3) | We reimbursed our advisor approximately $7,247,000 and $1,382,000 in other organization and offering costs as of September 30, 2015 and December 31, 2014, respectively. |

3

The following table summarizes the cumulative compensation, fees and reimbursements incurred by us, our advisor and its affiliates related to the operational stage as of September 30, 2015 and December 31, 2014 and amounts outstanding as of September 30, 2015 and December 31, 2014 (amounts are rounded):

| Incurred | Outstanding | |||||||||||||||

| As of September 30, 2015 | As of December 31, 2014 | As of September 30, 2015 | As of December 31, 2014 | |||||||||||||

Acquisitions and Operations Stage: | ||||||||||||||||

Acquisition fees and expenses | $ | 6,998,000 | $ | 1,844,000 | $ | 4,000 | $ | 4,000 | ||||||||

Asset management fees | 1,205,000 | 72,000 | 217,000 | 66,000 | ||||||||||||

Property management and leasing fees and expenses | 323,000 | 9,000 | 72,000 | 3,000 | ||||||||||||

Operating expenses(1) | 874,000 | 288,000 | 75,000 | 29,000 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

| $ | 9,400,000 | $ | 2,213,000 | $ | 368,000 | $ | 102,000 | |||||||||

|

|

|

|

|

|

|

| |||||||||

| (1) | We reimbursed our advisor approximately $780,000 and $82,000 in operating expenses, including legal, accounting and board of directors’ compensation, paid by the advisor on our behalf as of September 30, 2015 and December 31, 2014, respectively. As of December 31, 2014, our advisor waived, without recourse, approximately $236,000, or 82%, of operating expenses, including overhead and payroll-related expenses incurred by the advisor in performance of the services provided to us as of such period, as a result of the limitation imposed by the NASAA Guidelines limiting general and administrative expenses to 2% of average invested assets or 25% of net income. The advisor has not agreed to waive any future costs. |

During the nine months ended September 30, 2015 and the year ended December 31, 2014, no commissions or fees were incurred for services provided by our advisor and its affiliates related to the liquidation/listing stage.

| Property | Statistics |

The following table supersedes and replaces in its entirety the table in the “Investment Objectives, Strategy and Policies—Property Statistics” section beginning on page 134 of the prospectus:

The following table shows the property diversification of our real estate portfolio as of November 19, 2015:

Property | MSA | Segment | Date | Year Built | Physical Occupancy | Gross Leased Area (Sq Ft) | Encumbrances | |||||||||||||

Cy Fair Surgical Center | Houston-The Woodlands-Sugar Land, TX | Healthcare | 07/31/2014 | 1993 | 100.0 | % | 13,645 | $ —(1) | ||||||||||||

Mercy Healthcare Facility | Cincinnati, | Healthcare | 10/29/2014 | 2001 | 100.0 | % | 14,868 | —(1) | ||||||||||||

Winston-Salem, NC IMF | Winston-Salem, NC | Healthcare | 12/17/2014 | 2004 | 100.0 | % | 22,200 | —(1) | ||||||||||||

4

Property | MSA | Segment | Date | Year Built | Physical Occupancy | Gross Leased Area (Sq Ft) | Encumbrances | |||||||||||||

New England Sinai Medical Center(2) |

Boston-Cambridge-Newton,MA-NH | Healthcare | 12/23/2014 | 1967/1973 | (3) | 100.0 | % | 180,744 | $ —(1) | |||||||||||

Baylor Surgical Hospital at Fort Worth |

Dallas-Fort Worth-Arlington, TX | Healthcare | 12/31/2014 | 2014 | 100.0 | % | 83,464 | —(1) | ||||||||||||

Baylor Surgical Hospital Integrated Medical Facility |

Dallas-Fort Worth-Arlington, TX | Healthcare | 12/31/2014 | 2014 | 87.3 | % | 7,219 | —(1) | ||||||||||||

Winter Haven Healthcare Facility | Lakeland-Winter Haven, FL | Healthcare | 01/27/2015 | 2009 | 100.0 | % | 7,560 | — | ||||||||||||

Heartland Rehabilitation Hospital | Kansas City, MO-KS | Healthcare | 02/17/2015 | 2014 | 100.0 | % | 54,568 | —(1) | ||||||||||||

Indianapolis Data Center | Indianapolis-Carmel-Anderson,IN | Data Center | 04/01/2015 | 2000 | (4) | 100.0 | % | 43,724 | —(1) | |||||||||||

Clarion IMF | Pittsburgh, PA | Healthcare | 06/01/2015 | 2012 | 100.0 | % | 33,000 | —(1) | ||||||||||||

Post Acute Webster Rehabilitation Hospital | Houston-The Woodlands-Sugar Land, TX | Healthcare | 06/05/2015 | 2015 | 100.0 | % | 53,514 | —(1) | ||||||||||||

Eagan Data Center | St. Cloud, MN | Data Center | 06/29/2015 | 1998 | (5) | 100.0 | % | 87,402 | — | |||||||||||

Houston Surgical Hospital and LTACH | Houston-The Woodlands-Sugar Land, TX | Healthcare | 06/30/2015 | 1950 | (6) | 100.0 | % | 102,369 | —(1) | |||||||||||

Kentucky Maine Ohio IMF Portfolio | (7) | Healthcare | 07/22/2015 | (8) | 100.0 | % | 293,628 | —(1) | ||||||||||||

5

Property | MSA | Segment | Date | Year Built | Physical Occupancy | Gross Leased Area (Sq Ft) | Encumbrances | |||||||||||||

Reading Surgical Hospital | Philadelphia-Camden-Wilmington, | Healthcare | 07/24/2015 | 2007 | 100.0 | % | 33,217 | $ —(1) | ||||||||||||

Post Acute Warm Springs Specialty Hospital of Luling |

Austin-Round Rock, TX | Healthcare | 07/30/2015 | 2002 | 100.0 | % | 40,901 | —(1) | ||||||||||||

Minnetonka Data Center |

Minneapolis-St. Paul- Bloomington, MN-WI | Data Center | 08/28/2015 | 1985 | 100.0 | % | 135,240 | —(1) | ||||||||||||

Nebraska Healthcare Facility | Omaha-Council Bluffs, NE-IA | Healthcare | 10/14/2015 | 2014 | 100.0 | % | 40,402 | —(1) | ||||||||||||

|

|

| ||||||||||||||||||

| 1,247,665 | $ — | |||||||||||||||||||

|

|

| ||||||||||||||||||

| (1) | Property collateralized under the KeyBank Credit Facility. As of November 19, 2015, 20 commercial real estate investments were collateralized under the KeyBank Credit Facility and we had debt of $70,000,000 outstanding thereunder. |

| (2) | The New England Sinai Medical Center consists of two buildings. |

| (3) | The New England Sinai Medical Center was renovated in 1992. |

| (4) | The Indianapolis Data Center was renovated in 2014. |

| (5) | The Eagan Data Center was renovated in 2015. |

| (6) | The Houston Surgical Hospital and LTACH was renovated in 2005 and 2008. |

| (7) | Various metropolitan and micropolitan statistical areas. |

| (8) | The Kentucky Maine Ohio IMF Portfolio consists of five properties which were constructed in various years from 1959 to 2014. The property constructed in 1959 was renovated in 1970 and 2013. |

We believe the properties are adequately covered by insurance and are suitable for their respective intended purposes. We currently have no plans for any material renovations, improvements or development of the properties. Depreciation is recorded on a straight-line basis over the estimated useful life of the building, or 40 years, and over the shorter of the lease term or useful life of the tenant improvements.

Management’s Discussion and Analysis of Financial Condition and Results of Operations.

The following discussion and analysis of our financial condition and results of operations should be read in conjunction with our condensed consolidated financial statements and the notes thereto, and the other unaudited financial information appearing elsewhere in this prospectus supplement.

The terms “we,” “our,” and the “Company” refer to Carter Validus Mission Critical REIT II, Inc., Carter Validus Operating Partnership II, LP, or our Operating Partnership, and all wholly-owned subsidiaries.

6

Overview

We were formed on January 11, 2013 under the laws of Maryland to acquire and operate a diversified portfolio of income-producing commercial real estate with a focus on data centers and healthcare properties, preferably with long-term net leases to investment grade and other creditworthy tenants, as well as to make other real estate-related investments that relate to such property types. We commenced principal operations on July 3, 2014 when we satisfied our minimum offering requirement and issued approximately 213,333 shares of our Class A common stock for gross proceeds of $2,000,000. We elected to be taxed as a real estate investment trust, or REIT, for federal income tax purposes beginning with the taxable year ended December 31, 2014. We are offering for sale to the public on a “best efforts” basis a maximum of $2,350,000,000 in shares of common stock, which we refer to as our Offering, which consists of up to $2,250,000,000 of shares in our primary offering and up to $100,000,000 of shares of common stock to be made available pursuant to a distribution reinvestment plan, or the DRIP, pursuant to our registration statement on Form S-11, or our Registration Statement, filed with the SEC under the Securities Act of 1933, as amended, or the Securities Act, which was declared effective by the SEC on May 29, 2014. We are offering two classes of shares of common stock, Class A shares and Class T shares, in any combination, with a dollar value up to the maximum offering amount. The initial offering price for the shares in our primary offering is $10.00 per Class A share and $9.574 per Class T share.

As of September 30, 2015, we had accepted investors’ subscriptions for and issued approximately 39,073,000 shares of Class A common stock (including shares of common stock issued pursuant to the DRIP) in our Offering, resulting in receipt of gross proceeds of approximately $388,054,000, before selling commissions and dealer manager fees of approximately $36,082,000 and other offering costs of approximately $8,983,000. We had special escrow requirements for subscriptions from residents of Washington, conditions of which were satisfied on September 8, 2014, and Pennsylvania, the conditions of which were satisfied on February 19, 2015. As of September 30, 2015, we had approximately $1,961,946,000 in Class A shares and Class T shares of common stock remaining in our Offering.

Substantially all of our operations are conducted through Carter Validus Operating Partnership II, LP, or our Operating Partnership. We are externally advised by Carter Validus Advisors II, LLC, or our Advisor, pursuant to an advisory agreement between us and our Advisor, which is our affiliate. Our Advisor supervises and manages our day-to-day operations and selects the properties and real estate-related investments we acquire, subject to the oversight and approval of our board of directors. Our Advisor also provides marketing, sales and client services on our behalf. Our Advisor engages affiliated entities to provide various services to us. Our Advisor is managed by and is a subsidiary of our sponsor, Carter Validus REIT Management Company II, LLC. We have no paid employees.

As of September 30, 2015, we had purchased 17 real estate investments comprising approximately 1,208,000 of gross rental square feet for a purchase price of approximately $346,379,000.

Critical Accounting Policies

Our critical accounting policies were disclosed in our 2014 Annual Report on Form 10-K. There have been no material changes to our critical accounting policies as disclosed therein.

Interim Unaudited Financial Data

Our accompanying condensed consolidated financial statements have been prepared by us in accordance with GAAP in conjunction with the rules and regulations of the SEC. Certain information and footnote disclosures required for annual financial statements have been condensed or excluded pursuant to SEC rules and regulations. Accordingly, our accompanying condensed consolidated financial statements do not include all of the information and footnotes required by GAAP for complete financial statements. Our accompanying condensed consolidated financial statements reflect all adjustments, which are, in our view, of a normal recurring nature and necessary for a fair presentation of our financial position, results of operations and cash flows for the

7

interim period. Interim results of operations are not necessarily indicative of the results to be expected for the full year; such full year results may be less favorable. Our accompanying condensed consolidated financial statements should be read in conjunction with the audited consolidated financial statements and the notes thereto included in our 2014 Annual Report on Form 10-K.

Qualification as a REIT

We qualified and elected to be taxed as a REIT under Sections 856 through 860 of the Internal Revenue Code of 1986, as amended, or the Code, beginning with our taxable year ended December 31, 2014. To maintain our qualification as a REIT, we must meet certain organizational and operational requirements, including a requirement to currently distribute at least 90.0% of our REIT taxable income, without regard to the deduction for dividends paid and excluding net capital gain, to our stockholders. As a REIT, we generally are not be subject to federal income tax on taxable income that we distribute to our stockholders.

If we fail to maintain our qualification as a REIT in any taxable year, we would then be subject to federal income taxes on our taxable income at regular corporate rates and would not be permitted to qualify for treatment as a REIT for federal income tax purposes for four years following the year during which qualification is lost unless the Internal Revenue Service grants us relief under certain statutory provisions. Such an event could have a material adverse effect on our net income and net cash available for distribution to our stockholders.

Recently Issued Accounting Pronouncements

For a discussion of recently issued accounting pronouncements, see Note 2—“Summary of Significant Accounting Policies—Recently Issued Accounting Pronouncements” to our condensed consolidated financial statements that are a part of this prospectus supplement.

Segment Reporting

We report our financial performance based on two reporting segments—commercial real estate investments in data centers and healthcare. See Note 12—“Segment Reporting” to the condensed consolidated financial statements for additional information on our two reporting segments.

Results of Operations

Our results of operations are influenced by the timing of acquisitions and the operating performance of our real estate investments. The following table shows the property statistics of our real estate investments as of September 30, 2015 and 2014:

| September 30, | ||||||||

| 2015 | 2014 | |||||||

Number of commercial operating real estate investments | 17 | 1 | ||||||

Leased rentable square feet | 1,207,000 | 13,645 | ||||||

Weighted average percentage of rentable square feet leased | 100 | % | 100 | % | ||||

The following table summarizes our real estate investment activity for the three and nine months ended September 30, 2015 and 2014:

| Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||

| 2015 | 2014 | 2015 | 2014 | |||||||||||||

Commercial operating real estate investments acquired | 4 | 1 | 11 | 1 | ||||||||||||

Approximate aggregate purchase price of acquired real estate investments | 133,331,000 | 4,450,000 | 257,138,000 | 4,450,000 | ||||||||||||

Leased rentable square feet | 503,000 | 13,645 | 885,000 | 13,645 | ||||||||||||

8

As shown in the tables above, we owned 17 commercial operating real estate investments as of September 30, 2015 compared to one commercial operating real estate investment as of September 30, 2014. Accordingly, our results of operations for the three and nine months ended September 30, 2015 as compared to the three and nine months ended September 30, 2014 are not comparable; therefore, we have not included the percentage change.

We are not aware of any material trends or uncertainties, other than national economic conditions affecting real estate generally, that may be reasonably expected to have a material impact, favorable or unfavorable, on revenues or incomes from the acquisition, management and operation of properties other than those set forth in our Annual Report on Form 10-K for the year ended December 31, 2014 and in Part II, Item 1A. “Risk Factors” of our Quarterly Report on Form 10-Q.

Three Months Ended September 30, 2015 Compared to Three Months Ended September 30, 2014

Revenue

For the three months ended September 30, 2015, revenue increased $6,819,000 to $6,884,000, as compared to $65,000 for the three months ended September 30, 2014. For the three months ended September 30, 2015, revenue was comprised of rental revenue of $6,230,000 and tenant reimbursement revenue of $654,000. For the three months ended September 30, 2014, revenue was comprised of rental revenue of $65,000. We did not generate tenant reimbursement revenue for the three months ended September 30, 2014. The increase in rental revenue and tenant reimbursement revenue was primarily due to owning 17 operating real estate investments with leases in-place as of September 30, 2015, as compared to owning one operating real estate investment with a lease in-place as of September 30, 2014.

Rental Expenses

Rental expenses increased $823,000 to $827,000 for the three months ended September 30, 2015, as compared to $4,000 for the three months ended September 30, 2014. The increase was primarily due to owning 17 operating real estate investment with leases in-place as of September 30, 2015, as compared to owning one operating real estate investment with a lease in-place as of September 30, 2014, which resulted in increased real estate taxes of $317,000, increased property management fees of $172,000, increased repair and maintenance costs of $119,000, increased utility costs of $106,000, increased insurance costs of $52,000 and increased other rental expenses of $57,000 for such period.

General and Administrative Expenses

General and administrative expenses increased $259,000 to $439,000 for the three months ended September 30, 2015 as compared to $180,000 for the three months ended September 30, 2014. The increase was primarily due to increased allocated personnel costs from our Advisor and allocated overhead costs associated with our growth, which resulted in increased personnel costs and professional fees of $185,000 and increased other administrative expenses of $74,000.

Acquisition Related Expenses

Acquisition fees and expenses associated with transactions determined to be business combinations are expensed as incurred. Acquisition related expenses increased $3,491,000 to $3,760,000 for the three months ended September 30, 2015 as compared to $269,000 for the three months ended September 30, 2014. The increase was primarily related to acquisition fees and expenses associated with the purchase of four real estate investments for an aggregate purchase price of $133,331,000 acquired during the three months ended September 30, 2015, which were determined to be business combinations. For the three months ended September 30, 2014, acquisition fees and expenses related to the acquisition of one real estate investment for an aggregate purchase price of $4,500,000.

9

Asset Management Fees

Asset management fees increased $633,000 to $639,000 for the three months ended September 30, 2015 as compared to $6,000 for the three months ended September 30, 2014. The increase in asset management fees was attributable to an increase in the weighted average real estate-related investments of $118,643,000 as of September 30, 2015, as compared to $747,000 as of September 30, 2014.

Depreciation and Amortization

Depreciation and amortization increased $2,404,000 to $2,438,000 for the three months ended September 30, 2015, as compared to $34,000 for the three months ended September 30, 2014. The increase was primarily due to an increase in the weighted average depreciable basis of real estate properties to $121,774,000 as of September 30, 2015, as compared to $616,000 as of September 30, 2014.

Interest Expense

Interest expense increased $488,000 to $542,000 for the three months ended September 30, 2015, as compared to $54,000 for the three months ended September 30, 2014. The increase was due to increased interest on our secured credit facility of $347,000 and increased amortization of debt issue costs of $167,000, offset by interest income earned on the money market bank accounts of $26,000. The increase in interest expense on our secured credit facility of $347,000 was due to an outstanding balance of $70,000,000 as of September 30, 2015. As of September 30, 2014, we had no debt outstanding under our secured credit facility.

Nine Months Ended September 30, 2015 Compared to the Nine Months Ended September 30, 2014

Revenue

Revenue increased $12,196,000 to $12,261,000 for the nine months ended September 30, 2015, as compared to approximately $65,000 for the nine months ended September 30, 2014. For the nine months ended September 30, 2015, revenue was comprised of rental revenue of $11,419,000 and tenant reimbursement revenue of $842,000. For the nine months ended September 30, 2014, revenue was comprised of rental revenue of $65,000. We did not generate tenant reimbursement revenue for the nine months ended September 30, 2014. The increase in rental revenue and tenant reimbursement revenue was primarily due to owning 17 operating real estate investments with leases in-place as of September 30, 2015, as compared to owning one operating real estate investment with a lease in-place as of September 30, 2014.

Rental Expenses

Rental expenses increased $1,145,000 to $1,149,000 for the nine months ended September 30, 2015, as compared to $4,000 for the nine months ended September 30, 2014. The increase was primarily due to owning 17 operating real estate investment with leases in-place as of September 30, 2015, as compared to owning one operating real estate investment with a lease in-place as of September 30, 2014, which resulted in increased real estate taxes of $397,000, increased property management fees of $312,000, increased repair and maintenance costs of $137,000, increased utility costs of $108,000, increased insurance costs of $97,000, increased franchise and margin taxes of $43,000 and increased other rental expenses of $51,000.

General and Administrative Expenses

General and administrative expenses increased $1,167,000 to $1,366,000 for the nine months ended September 30, 2015 as compared to $199,000 for the nine months ended September 30, 2014. The increase was primarily due to increased allocated personnel costs from our Advisor and allocated overhead costs associated with our growth, which resulted in increased personnel costs and professional fees of $864,000 and increased other administrative expenses of $303,000.

10

Acquisition Related Expenses

Acquisition fees and expenses associated with transactions determined to be business combinations are expensed as incurred. Acquisition related expenses increased $6,983,000 to $7,287,000 for the nine months ended September 30, 2015 as compared to $304,000 for the nine months ended September 30, 2014. The increase was primarily related to acquisition fees and expenses associated with the purchase of 10 real estate investments for an aggregate purchase price of $249,404,000 acquired during the nine months ended September 30, 2015, which were determined to be business combinations. For the nine months ended September 30, 2014, acquisition fees and expenses related to the acquisition of one real estate investment for an aggregate purchase price of $4,500,000.

Asset Management Fees

Asset management fees increased $1,127,000 to $1,133,000 for the nine months ended September 30, 2015 as compared to $6,000 for the nine months ended September 30, 2014. The increase in asset management fees was attributable to an increase in the weighted average real estate-related investments of $118,643,000 as of September 30, 2015, as compared to $747,000 as of September 30, 2014.

Depreciation and Amortization

Depreciation and amortization increased $4,014,000 to $4,048,000 for the nine months ended September 30, 2015, as compared to $34,000 for the nine months ended September 30, 2014. The increase was primarily due to an increase in the weighted average depreciable basis of real estate properties to $121,774,000 as of September 30, 2015, as compared to $616,000 as of September 30, 2014.

Interest Expense

Interest expense increased $1,149,000 to $1,203,000 for the nine months ended September 30, 2015, as compared to $54,000 for the nine months ended September 30, 2014. The increase was due to increased interest on our secured credit facility of $733,000 and increased amortization of debt issue costs of $458,000, offset by interest income earned on the money market bank accounts of $42,000. The increase in interest expense on our secured credit facility of $733,000 was due to an outstanding balance of $70,000,000 as of September 30, 2015. As of September 30, 2014, we had no debt outstanding under our secured credit facility.

Organization and Offering Costs

We reimburse our Advisor or its affiliates for organization and offering costs it incurs on our behalf, but only to the extent the reimbursement would not cause the selling commissions, dealer manager fees, distribution fees and other organization and offering costs incurred by us to exceed 15% of gross offering proceeds as of the date of the reimbursement. We expect that other organization and offering costs (other than selling commissions, dealer manager fees and distribution fees) will be approximately 1.25% of the gross offering proceeds. Our Advisor and its affiliates incurred other organization and offering costs on our behalf of approximately $7,678,000 as of September 30, 2015. As of September 30, 2015, we reimbursed our Advisor or its affiliates approximately $7,247,000 in offering expenses and accrued approximately $431,000 of other organization and offering expenses, the total of which represents our maximum liability for other organization and offering costs as of September 30, 2015. As of September 30, 2015, we paid approximately $36,082,000 in selling commissions and dealer manager fees to SC Distributors, LLC, or our Dealer Manager. For the nine months ended September 30, 2015, no Class T shares were sold and no distribution fees were paid. Other offering costs (other than selling commissions and dealer manager fees) were approximately $8,983,000 as of September 30, 2015.

When incurred, organization costs are expensed and offering costs, including selling commissions, dealer manager fees, distribution fees and other offering costs are charged to stockholders’ equity. For a further discussion of other organization and offering costs, see Note 9—“Related-Party Transactions and Arrangements” to the condensed consolidated financial statements that are a part of this prospectus supplement.

11

Inflation

We are exposed to inflation risk as income from long-term leases is the primary source of our cash flows from operations. There are provisions in certain of our tenant leases that are intended to protect us from, and mitigate the risk of, the impact of inflation. These provisions include reimbursement billings for operating expenses, pass-through charges and real estate tax and insurance reimbursements. However, due to the long-term nature of our leases, among other factors, the leases may not reset frequently enough to adequately offset the effects of inflation.

Liquidity and Capital Resources

Our sources of funds are primarily the net proceeds of our Offering, operating cash flows, our secured credit facility and other borrowings. Our principal demand for funds are for acquisitions of real estate and real estate-related investments, to pay operating expenses and interest on our future indebtedness and to pay distributions to our stockholders. In addition, we require resources to make certain payments to our Advisor and our Dealer Manager, which, during our Offering, include payments to our Advisor and its affiliates for reimbursement of other organization and offering expenses and other costs incurred on our behalf, and payments to our Dealer Manager and its affiliates for selling commissions, dealer manager fees, distribution fees, and offering expenses.

Generally, cash needs for items other than acquisitions of real estate and real estate-related investments are met from operations, borrowings, and the net proceeds of our Offering. However, there may be a delay between the sale of shares of our common stock and our investments in real estate and real estate-related investments, which could result in a delay in the benefits to our stockholders, if any, of returns generated from our investment operations.

Our Advisor evaluates potential additional investments and engages in negotiations with real estate sellers, developers, brokers, investment managers, lenders and others on our behalf. Until we invest all of the proceeds of our Offering in properties and real estate-related investments, we may invest in short-term, highly liquid or other authorized investments. Such short-term investments will not earn significant returns, and we cannot predict how long it will take to fully invest the proceeds in properties and real estate-related investments. The number of properties we acquire and other investments we make will depend upon the number of shares sold in our Offering and the resulting amount of net proceeds available for investment.

When we acquire a property, our Advisor prepares a capital plan that contemplates the estimated capital needs of that investment. In addition to operating expenses, capital needs may also include costs of refurbishment, tenant improvements or other major capital expenditures. The capital plan also sets forth the anticipated sources of the necessary capital, which may include a line of credit or other loans established with respect to the investment, operating cash generated by the investment, additional equity investments from us or joint venture partners or, when necessary, capital reserves. Any capital reserves would be established from the gross proceeds of our Offering, proceeds from sales of other investments, operating cash generated by other investments or other cash on hand. In some cases, a lender may require us to establish capital reserves for a particular investment. The capital plan for each investment will be adjusted through ongoing, regular reviews of our portfolio or as necessary to respond to unanticipated additional capital needs.

Capital Expenditures

We estimate that we will require approximately $1.0 million in expenditures for capital improvements over the next 12 months. We cannot provide assurances, however, that actual expenditures will not exceed these estimated expenditure levels. As of September 30, 2015, we had $2.4 million of restricted cash in escrow reserve accounts for such capital expenditures.

Credit Facility

As of September 30, 2015, the total pool availability was $180,000,000 and the remaining aggregate pool availability was $110,000,000 under our secured credit facility. We believe we were in compliance with all financial covenant requirements as of September 30, 2015.

12

Cash Flows

Operating Activities. During the nine months ended September 30, 2015, net cash provided by operating activities was approximately $900,000. During the nine months ended September 30, 2015, net cash provided by operating activities primarily related to the operations of our property acquisitions, partially offset by operating expenses. During the nine months ended September 30, 2014, net cash used in operating activities was approximately $242,000.

Investing Activities. During the nine months ended September 30, 2015, net cash used in investing activities was approximately $257,581,000. During the nine months ended September 30, 2015, net cash used in investing activities primarily related to the acquisition of 11 real estate investments in the amount of approximately $257,138,000, capital expenditures in the amount of approximately $640,000 and payments for real estate deposits of approximately $281,000, offset by receipts of escrow funds of $478,000. During the nine months ended September 30, 2014, net cash used in investing activities was approximately $4,450,000.

Financing Activities. During the nine months ended September 30, 2015, net cash provided by financing activities was approximately $303,342,000. During the nine months ended September 30, 2015, net cash provided by financing activities primarily related to proceeds from the issuance of common stock of approximately $311,955,000 and proceeds from our secured credit facility of approximately $72,000,000; offset by $39,500,000 in payments on our secured credit facility, $36,618,000 in offering costs related to the issuance of common stock, $3,759,000 in cash distributions to stockholders, $581,000 in payments of deferred financing costs and $155,000 in repurchases of our common stock. During the nine months ended September 30, 2014, net cash provided by financing activities was approximately $16,060,000.

Distributions

The amount of distributions payable to our stockholders is determined by our board of directors and is dependent on a number of factors, including our funds available for distribution, financial condition, capital expenditure requirements and the annual distribution requirements needed to maintain our status as a REIT under the Code. Our board of directors may reduce the amount of distributions paid or suspend distribution payments at any time and, therefore, distribution payments are not guaranteed. Our Advisor may also defer, suspend and/or waive fees and expense reimbursements if we have not generated sufficient cash flow from our operations and other sources to fund distributions. Additionally, our organizational documents permit us to pay distributions from unlimited amounts of any source, and we may use sources other than operating cash flows to fund distributions, including proceeds from our Offering, which may reduce the amount of capital we ultimately invest in properties or other real estate-related investments.

We have funded distributions with operating cash flows from our properties and proceeds raised in our Offering. To the extent that we do not have taxable income, distributions paid will be considered a return of capital to stockholders. The following table shows distributions paid during the nine months ended September 30, 2015 and 2014 (amounts in thousands):

| Nine Months Ended September 30, | ||||||||||||||||

| 2015 | 2014 | |||||||||||||||

Distributions paid in cash—common stockholders | $ | 3,759 | $ | 4 | ||||||||||||

Distributions reinvested (shares issued) | 5,795 | 21 | ||||||||||||||

|

|

|

| |||||||||||||

Total distributions | $ | 9,554 | $ | 25 | ||||||||||||

|

|

|

| |||||||||||||

Source of distributions: | ||||||||||||||||

Cash flows provided by operations(1) | $ | 900 | 9 | % | $ | — | — | % | ||||||||

Offering proceeds from issuance of common stock(1) | 2,859 | 30 | % | 4 | 16 | % | ||||||||||

Offering proceeds from issuance of common stock pursuant to the DRIP(1) | 5,795 | 61 | % | 21 | 84 | % | ||||||||||

|

|

|

|

|

|

|

| |||||||||

Total sources | $ | 9,554 | 100 | % | $ | 25 | 100 | % | ||||||||

|

|

|

|

|

|

|

| |||||||||

| (1) | Percentages were calculated by dividing the respective source amount by the total sources of distributions. |

13

Total distributions declared but not paid as of September 30, 2015 were approximately $1,982,000 for common stockholders. These distributions were paid on October 1, 2015.

For the nine months ended September 30, 2015, we paid and declared distributions of approximately $9,554,000 to common stockholders, including shares issued pursuant to the DRIP, as compared to FFO (as defined below) for the nine months ended September 30, 2015 of approximately $123,000. The payment of distributions from sources other than FFO may reduce the amount of proceeds available for investment and operations or cause us to incur additional interest expense as a result of borrowed funds.

For a discussion of distributions paid subsequent to September 30, 2015, see Note 15—“Subsequent Events” to the condensed consolidated financial statements included in this prospectus supplement.

Contractual Obligations

Our contractual obligations as of September 30, 2015 were as follows (amounts in thousands):

| Less than 1 Year | 1-3 Years | 3-5 Years | More than 5 Years | Total | ||||||||||||||||

Principal payments—variable rate debt | $ | — | $ | 70,000 | $ | — | $ | — | $ | 70,000 | ||||||||||

Interest payments—variable rate debt | 1,262 | 3,096 | — | — | 4,358 | |||||||||||||||

Capital expenditures | 1,044 | 1,418 | — | — | 2,462 | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Total | $ | 2,306 | $ | 74,514 | $ | — | $ | — | $ | 76,820 | ||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Off-Balance Sheet Arrangements

As of September 30, 2015, we had no off-balance sheet arrangements.

Related-Party Transactions and Arrangements

We have entered into agreements with our Advisor and its affiliates whereby we agree to pay certain fees to, or reimburse certain expenses of, our Advisor or its affiliates for acquisition fees and expenses, organization and offering expenses, asset and property management fees and reimbursement of operating costs. Refer to Note 9—“Related-Party Transactions and Arrangements” to our condensed consolidated financial statements that are a part of this prospectus supplement for a detailed discussion of the various related-party transactions and agreements.

Funds from Operations and Modified Funds from Operations

One of our objectives is to provide cash distributions to our stockholders from cash generated by our operations. The purchase of real estate assets and real estate-related investments, and the corresponding expenses associated with that process, is a key operational feature of our business plan in order to generate cash from operations. Due to certain unique operating characteristics of real estate companies, the National Association of Real Estate Investment Trusts, or NAREIT, an industry trade group, has promulgated a measure known as funds from operations, or FFO, which we believe is an appropriate supplemental measure to reflect the operating performance of a REIT. The use of FFO is recommended by the REIT industry as a supplemental performance measure. FFO is not equivalent to our net income (loss) as determined under GAAP.

We define FFO, consistent with NAREIT’s definition, as net income (loss) (computed in accordance with GAAP), excluding gains (or losses) from sales of property and asset impairment write-downs, plus depreciation and amortization of real estate assets, and after adjustments for unconsolidated partnership and joint ventures. Adjustments for unconsolidated partnerships and joint ventures will be calculated to reflect FFO on the same basis.

14

We, along with the others in the real estate industry, consider FFO to be an appropriate supplemental measure of a REIT’s operating performance because it is based on a net income (loss) analysis of property portfolio performance that excludes non-cash items such as depreciation and amortization and asset impairment write-downs, which we believe provides a more complete understanding of our performance to investors and to our management, and when compared year over year, reflects the impact on our operations from trends in occupancy.

Historical accounting convention (in accordance with GAAP) for real estate assets requires companies to report its investment in real estate at its carrying value, which consists of capitalizing the cost of acquisitions, development, construction, improvements and significant replacements, less depreciation and amortization and asset impairment write-downs, if any, which is not necessarily equivalent to the fair market value of its investment in real estate assets.

The historical accounting convention requires straight-line depreciation of buildings and improvements, which implies that the value of real estate assets diminishes predictably over time, which could be the case if such assets are not adequately maintained or repaired and renovated as required by relevant circumstances and/or as requested or required by lessees for operational purposes in order to maintain the value disclosed. We believe that, since fair value of real estate assets historically rises and falls with market conditions including, but not limited to, inflation, interest rates, the business cycle, unemployment and consumer spending, presentations of operating results for a REIT using historical accounting for depreciation could be less informative.

In addition, we believe it is appropriate to disregard asset impairment write-downs as it is a non-cash adjustment to recognize losses on prospective sales of real estate assets. Since losses from sales of real estate assets are excluded from FFO, we believe it is appropriate that asset impairment write-downs in advancement of realization of losses should be excluded. Impairment write-downs are based on negative market fluctuations and underlying assessments of general market conditions, which are independent of our operating performance, including, but not limited to, a significant adverse change in the financial condition of our tenants, changes in supply and demand for similar or competing properties, changes in tax, real estate, environmental and zoning law, which can change over time. When indicators of potential impairment suggest that the carrying value of real estate and related assets may not be recoverable, we assess the recoverability by estimating whether we will recover the carrying value of the asset through undiscounted future cash flows and eventual disposition (including, but not limited to, net rental and lease revenues, net proceeds on the sale of property and any other ancillary cash flows at a property or group level under GAAP). If based on this analysis, we do not believe that we will be able to recover the carrying value of the real estate asset, we will record an impairment write-down to the extent that the carrying value exceeds the estimated fair value of the real estate asset. Testing for indicators of impairment is a continuous process and is analyzed on a quarterly basis. Investors should note, however, that determinations of whether impairment charges have been incurred are based partly on anticipated operating performance, because estimated undiscounted future cash flows from a property, including estimated future net rental and lease revenues, net proceeds on the sale of the property, and certain other ancillary cash flows, are taken into account in determining whether an impairment charge has been incurred. While impairment charges are excluded from the calculation of FFO as described above, investors are cautioned that due to the fact that impairments are based on estimated future undiscounted cash flows and that we intend to have a relatively limited term of our operations, it could be difficult to recover any impairment charges through the eventual sale of the property. No impairment losses have been recorded to date.

In developing estimates of expected future cash flow, we make certain assumptions regarding future market rental income amounts subsequent to the expiration of current lease arrangements, property operating expenses, terminal capitalization and discount rates, the expected number of months it takes to re-lease the property, required tenant improvements and the number of years the property will be held for investment. The use of alternative assumptions in the future cash flow analysis could result in a different determination of the property’s future cash flows and a different conclusion regarding the existence of an asset impairment, the extent of such loss, if any, as well as the carrying value of the real estate asset.

15

Publicly registered, non-listed REITs, such as ours, typically have a significant amount of acquisition activity and are substantially more dynamic during their initial years of investment and operations. While other start up entities may also experience significant acquisition activity during their initial years, we believe that publicly registered, non-listed REITs are unique in that they have a limited life with targeted exit strategies within a relatively limited time frame after the acquisition activity ceases. We will use the proceeds raised in our offering to acquire real estate assets and real estate-related investments, and we intend to begin the process of achieving a liquidity event (i.e., listing of our shares of common stock on a national securities exchange, a merger or sale, the sale of all or substantially all of our assets, or another similar transaction) within five years after the completion of our offering stage, which is generally comparable to other publicly registered, non-listed REITs. Thus, we do not intend to continuously purchase real estate assets and intend to have a limited life. Due to these factors and other unique features of publicly registered, non-listed REITS, the Investment Program Association, or the IPA, an industry trade group, has standardized a measure known as modified funds from operations, or MFFO, which we believe to be another appropriate supplemental measure to reflect the operating performance of a publicly registered, non-listed REIT. MFFO is a metric used by management to evaluate sustainable performance and dividend policy. MFFO is not equivalent to our net income (loss) as determined under GAAP.

We define MFFO, a non-GAAP measure, consistent with the IPA’s definition: FFO further adjusted for the following items included in the determination of GAAP net income (loss); acquisition fees and expenses; amounts related to straight-line rental income and amortization of above and below intangible lease assets and liabilities; accretion of discounts and amortization of premiums on debt investments; mark-to-market adjustments included in net income; nonrecurring gains or losses included in net income from the extinguishment or sale of debt, hedges, foreign exchange, derivatives or securities holdings where trading of such holdings is not a fundamental attribute of the business plan, unrealized gains or losses resulting from consolidation from, or deconsolidation to, equity accounting, adjustments related to contingent purchase price obligations where such adjustments have been included in the derivation of GAAP net income, and after adjustments for a consolidated and unconsolidated partnership and joint ventures, with such adjustments calculated to reflect MFFO on the same basis. Our MFFO calculation complies with the IPA’s Practice Guideline, described above. In calculating MFFO, we exclude paid and accrued acquisition fees and expenses that are reported in our condensed consolidated statement of operations, amortization of above and below-market leases, amounts related to straight-line rents (which are adjusted in order to reflect such payments from a GAAP accrual basis to closer to an expected to be received cash basis of disclosing the rent and lease payments); and the adjustments of such items related to noncontrolling interests in our Operating Partnership. The other adjustments included in the IPA’s guidelines are not applicable to us.

Since MFFO excludes acquisition fees and expenses, it should not be construed as a historic performance measure. Acquisition fees and expenses are paid in cash by us, and we have not set aside or put into escrow any specific amount of proceeds from our offerings to be used to fund acquisition fees and expenses. Acquisition fees and expenses include payments to our Advisor or its affiliates and third parties. Such fees and expenses will not be reimbursed by our Advisor or its affiliates and third parties, and therefore if there are no further proceeds from the sale of shares of our common stock to fund future acquisition fees and expenses, such fees and expenses will need to be paid from either additional debt, operational earnings or cash flows, net proceeds from the sale of properties, or from ancillary cash flows. As a result, the amount of proceeds available for investment and operations would be reduced, or we may incur additional interest expense as a result of borrowed funds. Nevertheless, our Advisor or its affiliates will not accrue any claim on our assets if acquisition fees and expenses are not paid from the proceeds of our offerings. Under GAAP, acquisition fees and expenses related to the acquisition of properties determined to be business combinations are expensed as incurred, including investment transactions that are no longer under consideration, and are included in acquisition related expenses in the accompanying condensed consolidated statement of operations and acquisition fees and expenses associated with transactions determined to be an asset purchase are capitalized.

All paid and accrued acquisition fees and expenses have negative effects on returns to investors, the potential for future distributions, and cash flows generated by us, unless earnings from operations or net sales

16

proceeds from the disposition of other properties are generated to cover the purchase price of the real estate asset, these fees and expenses and other costs related to such property. In addition, MFFO may not be an indicator of our operating performance, especially during periods in which properties are being acquired.

In addition, certain contemplated non-cash fair value and other non-cash adjustments are considered operating non-cash adjustments to net income (loss) in determining cash flows from operations in accordance with GAAP.

We use MFFO and the adjustments used to calculate it in order to evaluate our performance against other publicly registered, non-listed REITs, which intend to have limited lives with short and defined acquisition periods and targeted exit strategies shortly thereafter. As noted above, MFFO may not be a useful measure of the impact of long-term operating performance if we do not continue to operate in this manner. We believe that our use of MFFO and the adjustments used to calculate it allow us to present our performance in a manner that reflects certain characteristics that are unique to publicly registered, non-listed REITs, such as their limited life, limited and defined acquisition period and targeted exit strategy, and hence the use of such measures may be useful to investors. For example, acquisition fees and expenses are intended to be funded from the proceeds of our offering and other financing sources and not from operations. By excluding acquisition fees and expenses, the use of MFFO provides information consistent with management’s analysis of the operating performance of its real estate assets. Additionally, fair value adjustments, which are based on the impact of current market fluctuations and underlying assessments of general market conditions, but can also result from operational factors such as rental and occupancy rates, may not be directly related or attributable to our current operating performance. By excluding such charges that may reflect anticipated and unrealized gains or losses, we believe MFFO provides useful supplemental information.

Presentation of this information is intended to assist management and investors in comparing the operating performance of different REITs, although it should be noted that not all REITs calculate FFO and MFFO the same way, so comparisons with other REITs may not be meaningful. Furthermore, FFO and MFFO are not necessarily indicative of cash flow available to fund cash needs and should not be considered as an alternative to net income (loss) as an indication of our performance, as an indication of our liquidity, or indicative of funds available to fund our cash needs, including our ability to make distributions to our stockholders. FFO and MFFO should be reviewed in conjunction with other measurements as an indication of our performance. MFFO has limitations as a performance measure in an offering such as ours where the price of a share of common stock is stated value and there is no asset value determination during the offering stage for a period thereafter. MFFO may be useful in assisting management and investors in assessing the sustainability of operating performance in future operating periods, and in particular, after the offering and acquisition stages are complete and net asset value is disclosed. MFFO is not a useful measure in evaluating net asset value since impairment write-downs are taken into account in determining net asset value but not in determining MFFO.

FFO and MFFO, as described above, should not be construed to be more relevant or accurate than the current GAAP methodology in calculating net income (loss) or in its applicability in evaluating our operational performance. The method used to evaluate the value and performance of real estate under GAAP should be construed as a more relevant measure of operation performance and considered more prominently than the non-GAAP FFO and measures and the adjustments to GAAP in calculating FFO and MFFO. MFFO has not been scrutinized to the level of other similar non-GAAP performance measures by the SEC or any other regulatory body.

17

The following is a reconciliation of net income/(loss) attributable to controlling interests, which is the most directly comparable GAAP financial measure, to FFO and MFFO for the three and nine months ended September 30, 2015 and 2014 (amounts in thousands, except share data and per share amounts):

| Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||

| 2015 | 2014 | 2015 | 2014 | |||||||||||||

Net loss attributable to common stockholders | $ | (1,761 | ) | $ | (482 | ) | $ | (3,925 | ) | $ | (536 | ) | ||||

Adjustments: | ||||||||||||||||

Depreciation and amortization—real estate | 2,438 | 34 | 4,048 | 34 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

FFO | $ | 677 | $ | (448 | ) | $ | 123 | $ | (502 | ) | ||||||

|

|

|

|

|

|

|

| |||||||||

Adjustments: | ||||||||||||||||

Acquisition related expenses(1) | $ | 3,760 | $ | 269 | $ | 7,287 | $ | 304 | ||||||||

Amortization of above—and below-market leases(2) | (30 | ) | — | (24 | ) | — | ||||||||||

Straight-line rents(3) | (802 | ) | — | (1,549 | ) | — | ||||||||||

|

|

|

|

|

|

|

| |||||||||

MFFO | $ | 3,605 | $ | (179 | ) | $ | 5,837 | $ | (198 | ) | ||||||

|

|

|

|

|

|

|

| |||||||||

Weighted average Class A common shares outstanding—basic and diluted | 34,794,832 | 671,425 | 23,573,522 | 239,528 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

Net loss per Class A common share—basic and diluted | $ | (0.05 | ) | $ | (0.72 | ) | $ | (0.17 | ) | $ | (2.24 | ) | ||||

|

|

|

|

|

|

|

| |||||||||

FFO per Class A common share—basic and diluted | $ | 0.02 | $ | (0.67 | ) | $ | 0.01 | $ | (2.10 | ) | ||||||

|

|

|

|

|

|

|

| |||||||||

| (1) | In evaluating investments in real estate assets, management differentiates the costs to acquire the investment from the operations derived from the investment. Such information would be comparable only for publicly registered, non-listed REITs that have completed their acquisitions activities and have other similar operating characteristics. By excluding expensed acquisition related expenses, management believes MFFO provides useful supplemental information that is comparable for each type of real estate investment and is consistent with management’s analysis of the investing and operating performance of our properties. Acquisition fees and expenses include payments in cash to our Advisor and third parties. Acquisition fees and expenses incurred in a business combination, under GAAP, are considered operating expenses and as expenses are included in the determination of net income (loss), which is a performance measure under GAAP. All paid and accrued acquisition fees and expenses will have negative effects on returns to investors, the potential for future distributions, and cash flows generated by us, unless earnings from operations or net sales proceeds from the disposition of properties are generated to cover the purchase price of the property, these fees and expenses and other costs related to the property. |

| (2) | Under GAAP, certain intangibles are accounted for at cost and reviewed at least annually for impairment, and certain intangibles are assumed to diminish predictably in value over time and are amortized, similar to depreciation and amortization of real estate-related assets that are excluded from FFO. However, because real estate values and market lease rates historically rise or fall with market conditions, management believes that by excluding charges related to amortization of these intangibles, MFFO provides useful supplemental information on the performance of the real estate. |

| (3) | Under GAAP, rental revenue is recognized on a straight-line basis over the terms of the related lease (including rent holidays if applicable). This may result in income recognition that is significantly different than the underlying contract terms. By adjusting for the change in deferred rent receivables, MFFO may provide useful supplemental information on the realized economic impact of lease terms, providing insight on the expected contractual cash flows of such lease terms, and aligns with our analysis of operating performance. |

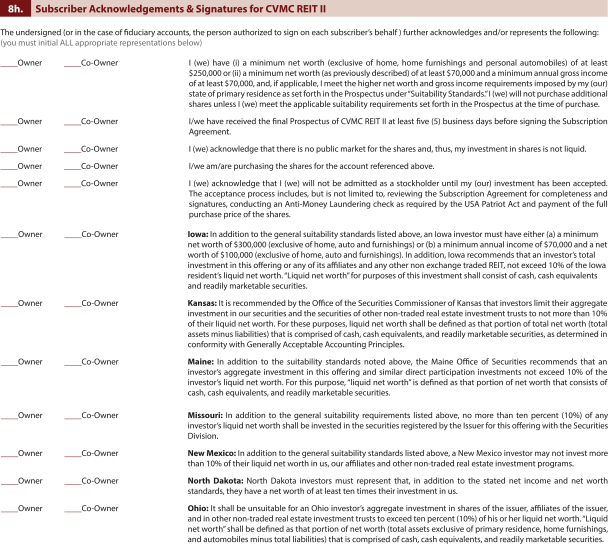

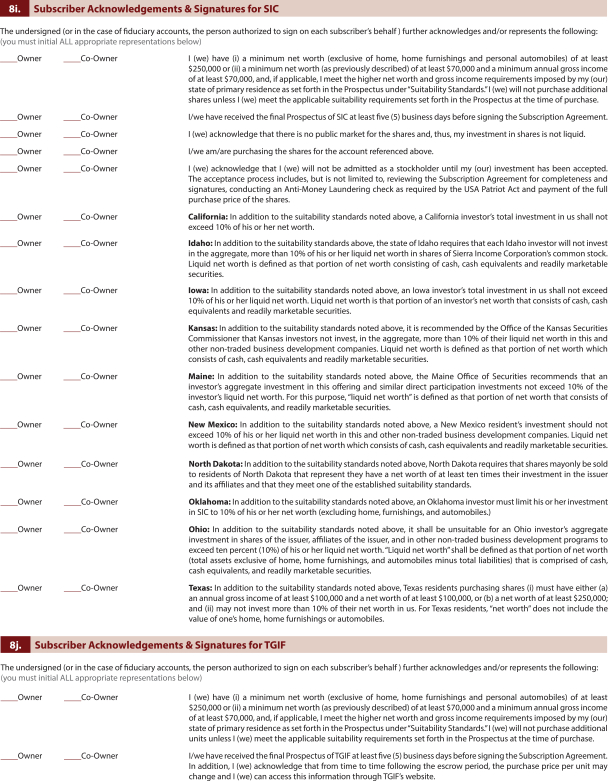

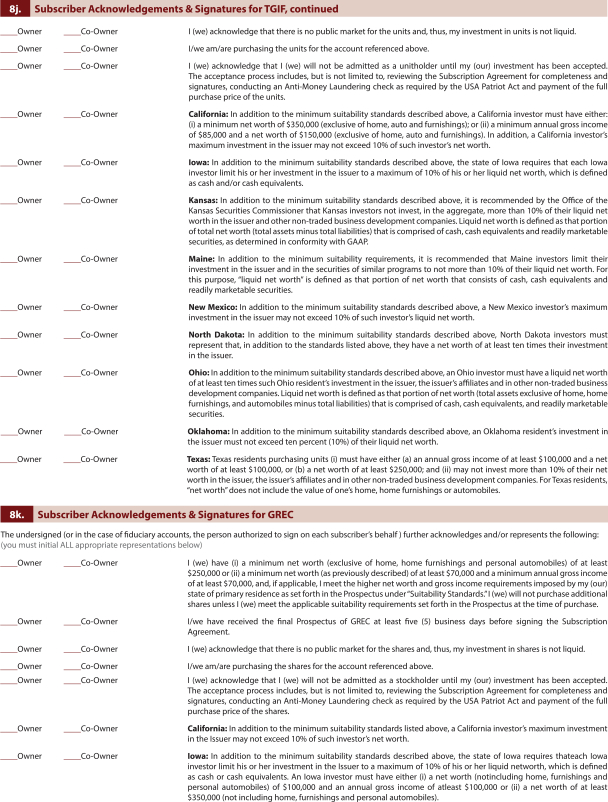

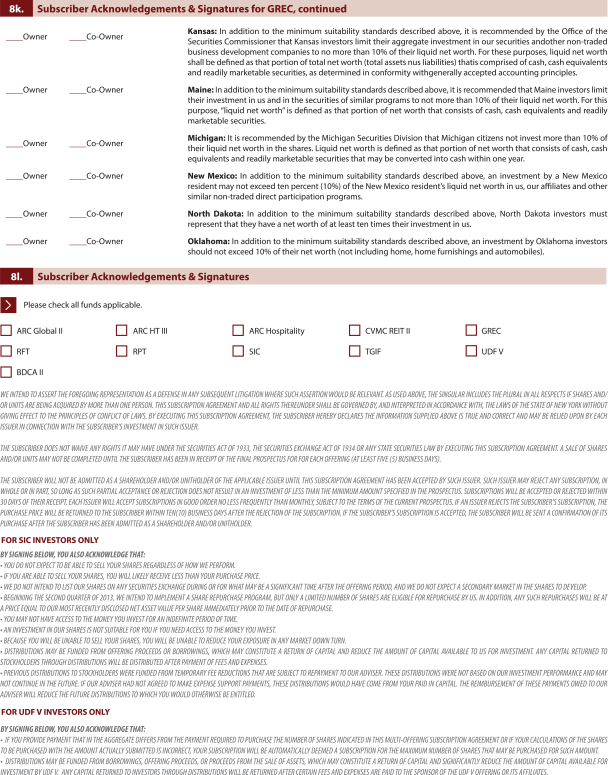

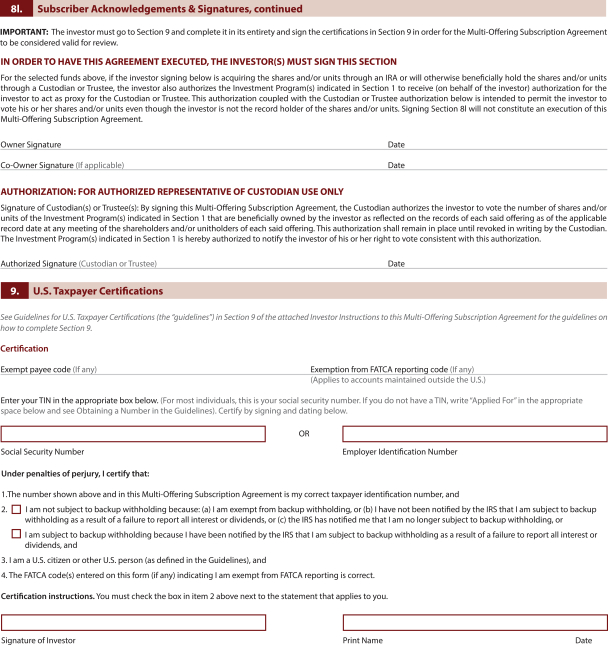

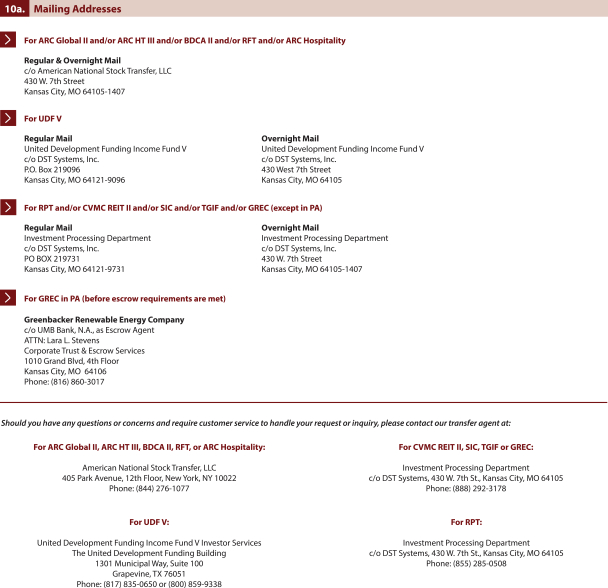

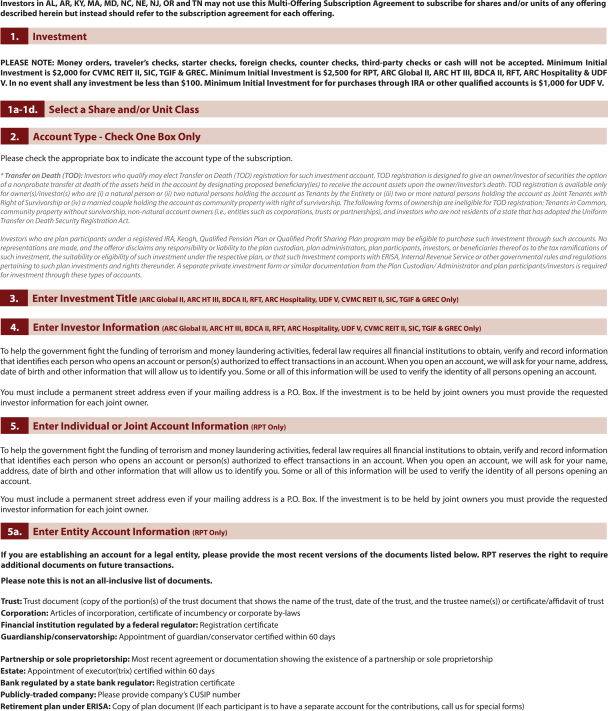

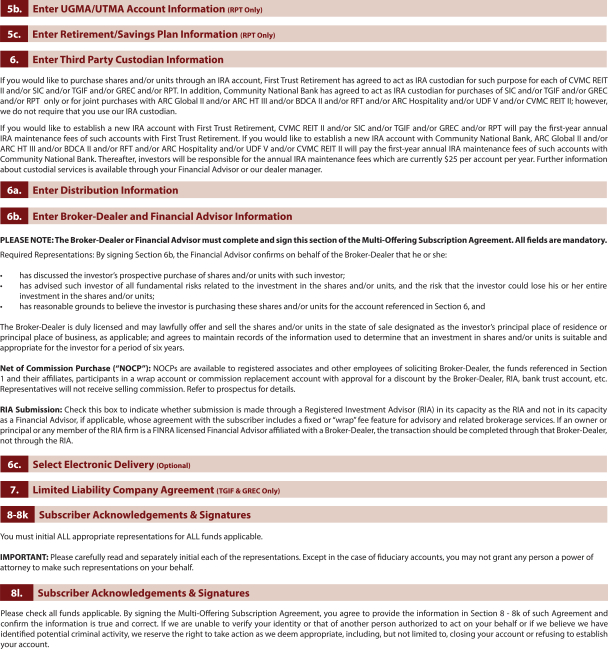

Revised Forms of Subscription Agreements

Revised forms of our Subscription Agreement and Multi-Product Subscription Agreement are attached as Appendices B and F, respectively, and supersede and replace Appendices B and F included in our prospectus.

18

INDEX TO CONDENSED CONSOLIDATED

FINANCIAL STATEMENTS OF

CARTER VALIDUS MISSION CRITICAL REIT II, INC.

(A Maryland Corporation)

| Page | ||||

| F-1 | ||||

Condensed Consolidated Balance Sheets as of September 30, 2015 and December 31, 2014 | F-2 | |||

| F-3 | ||||

| F-4 | ||||

| F-5 | ||||

| F-6 | ||||

F-1

CARTER VALIDUS MISSION CRITICAL REIT II, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

As of September 30, 2015 and December 31, 2014

(in thousands, except share data)

| (Unaudited) | ||||||||

| September 30, 2015 | December 31, 2014 | |||||||

| ASSETS | ||||||||

Real estate: | ||||||||

Land | $ | 36,119 | $ | 14,515 | ||||

Buildings and improvements, less accumulated depreciation of $3,145 and $133, respectively | 269,535 | 68,100 | ||||||

Acquired intangible assets, less accumulated amortization of $1,113 and $58, respectively | 38,786 | 6,442 | ||||||

|

|

|

| |||||

Total real estate, net | 344,440 | 89,057 | ||||||

Cash and cash equivalents | 50,355 | 3,694 | ||||||

Other assets | 8,385 | 5,115 | ||||||

|

|

|

| |||||

Total assets | $ | 403,180 | $ | 97,866 | ||||

|

|

|

| |||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY | ||||||||

Liabilities: | ||||||||

Credit facility | $ | 70,000 | $ | 37,500 | ||||

Accounts payable due to affiliates | 799 | 2,626 | ||||||

Accounts payable and other liabilities | 5,861 | 628 | ||||||

Intangible lease liabilities, less accumulated amortization of $44 and $0, respectively | 1,635 | 7 | ||||||

|

|

|

| |||||

Total liabilities | 78,295 | 40,761 | ||||||

Stockholders’ equity: | ||||||||

Preferred stock, $0.01 par value per share, 100,000,000 shares authorized; none issued and outstanding | — | — | ||||||

Class A common stock, $0.01 par value per share, 250,000,000 shares authorized; 39,094,948 and 7,110,501 shares issued, respectively; 39,079,437 and 7,110,501 shares outstanding, respectively | 391 | 71 | ||||||

Class T common stock, $0.01 par value per share, 250,000,000 shares authorized; none issued and outstanding | — | — | ||||||

Additional paid-in capital | 342,677 | 60,081 | ||||||

Accumulated deficit | (18,185 | ) | (3,049 | ) | ||||

|

|

|

| |||||

Total stockholders’ equity | 324,883 | 57,103 | ||||||

Noncontrolling interests | 2 | 2 | ||||||

|

|

|

| |||||

Total equity | 324,885 | 57,105 | ||||||

|

|

|

| |||||

Total liabilities and stockholders’ equity | $ | 403,180 | $ | 97,866 | ||||

|

|

|

| |||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

F-2

CARTER VALIDUS MISSION CRITICAL REIT II, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

For the Three and Nine Months Ended September 30, 2015 and 2014

(in thousands, except share data and per share amounts)

(Unaudited)

| Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||

| 2015 | 2014 | 2015 | 2014 | |||||||||||||

Revenue: | ||||||||||||||||

Rental revenue | $ | 6,230 | $ | 65 | $ | 11,419 | $ | 65 | ||||||||

Tenant reimbursement revenue | 654 | — | 842 | — | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

Total revenue | 6,884 | 65 | 12,261 | 65 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

Expenses: | ||||||||||||||||

Rental expenses | 827 | 4 | 1,149 | 4 | ||||||||||||

General and administrative expenses | 439 | 180 | 1,366 | 199 | ||||||||||||

Acquisition related expenses | 3,760 | 269 | 7,287 | 304 | ||||||||||||

Asset management fees | 639 | 6 | 1,133 | 6 | ||||||||||||

Depreciation and amortization | 2,438 | 34 | 4,048 | 34 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

Total expenses | 8,103 | 493 | 14,983 | 547 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

Loss from operations | (1,219 | ) | (428 | ) | (2,722 | ) | (482 | ) | ||||||||

Interest expense, net | 542 | 54 | 1,203 | 54 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

Net loss attributable to common stockholders | $ | (1,761 | ) | $ | (482 | ) | $ | (3,925 | ) | $ | (536 | ) | ||||

|

|

|

|

|

|

|

| |||||||||

Weighted average number of common shares outstanding: | ||||||||||||||||

Class A basic and diluted | 34,794,832 | 671,425 | 23,573,522 | 239,528 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

Net loss per common share attributable to common stockholders: | ||||||||||||||||

Class A basic and diluted | $ | (0.05 | ) | $ | (0.72 | ) | $ | (0.17 | ) | $ | (2.24 | ) | ||||

|

|

|

|

|

|

|

| |||||||||

Distributions declared per common share | $ | 0.16 | $ | 0.14 | $ | 0.48 | $ | 0.38 | ||||||||

|

|

|

|

|

|

|

| |||||||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

F-3

CARTER VALIDUS MISSION CRITICAL REIT II, INC.

CONDENSED CONSOLIDATED STATEMENT OF STOCKHOLDERS’ EQUITY

For the Nine Months Ended September 30, 2015

(in thousands, except for share data)

(Unaudited)

| Common Stock | Additional Paid in Capital | Accumulated Deficit | Total Stockholders’ Equity | Noncontrolling Interests | Total Equity | |||||||||||||||||||||||

| Class A | ||||||||||||||||||||||||||||

| No. of Shares | Par Value | |||||||||||||||||||||||||||

Balance, December 31, 2014 | 7,110,501 | $ | 71 | $ | 60,081 | $ | (3,049 | ) | $ | 57,103 | $ | 2 | $ | 57,105 | ||||||||||||||

Issuance of common stock | 31,372,349 | 314 | 311,641 | — | 311,955 | — | 311,955 | |||||||||||||||||||||

Issuance of common stock under the distribution reinvestment plan | 609,848 | 6 | 5,789 | — | 5,795 | — | 5,795 | |||||||||||||||||||||

Vesting of restricted common stock | 2,250 | — | — | — | — | — | — | |||||||||||||||||||||

Commissions on sale of common stock and related dealer manager fees | — | — | (29,606 | ) | — | (29,606 | ) | — | (29,606 | ) | ||||||||||||||||||

Other offering costs | — | — | (5,096 | ) | — | (5,096 | ) | — | (5,096 | ) | ||||||||||||||||||

Redemption of common stock | (15,511 | ) | — | (155 | ) | — | (155 | ) | — | (155 | ) | |||||||||||||||||

Stock-based compensation | — | — | 23 | — | 23 | — | 23 | |||||||||||||||||||||

Distributions declared to common stockholders | — | — | — | (11,211 | ) | (11,211 | ) | — | (11,211 | ) | ||||||||||||||||||

Net loss | — | — | — | (3,925 | ) | (3,925 | ) | — | (3,925 | ) | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||