- SILA Dashboard

- Financials

- Filings

-

Holdings

-

Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

424B3 Filing

Sila Realty Trust (SILA) 424B3Prospectus supplement

Filed: 18 Feb 16, 12:00am

Filed Pursuant to Rule 424(b)(3)

Registration No. 333-191706

CARTER VALIDUS MISSION CRITICAL REIT II, INC.

SUPPLEMENT NO. 2 DATED FEBRUARY 18, 2016

TO THE PROSPECTUS DATED DECEMBER 29, 2015

This document supplements, and should be read in conjunction with, the prospectus of Carter Validus Mission Critical REIT II, Inc. (the “Company”), dated December 29, 2015 and Supplement No. 1, dated January 27, 2016. Unless otherwise defined in this prospectus supplement, capitalized terms used in this prospectus supplement shall have the same meanings as set forth in the prospectus.

The purpose of this prospectus supplement is to describe the following:

(1) the status of the offering of shares of common stock of the Company;

(2) recent real property acquisitions;

(3) an update regarding our credit facility; and

(4) the acquisition of our Dealer Manager by Validus/Strategic Capital, LLC.

Status of Our Public Offering

We commenced our initial public offering of $2,350,000,000 of shares of our common stock (the “Offering”), consisting of up to $2,250,000,000 of shares in our primary offering and up to $100,000,000 of shares pursuant to our distribution reinvestment plan, on May 29, 2014. We are publicly offering two classes of shares of common stock, Class A shares and Class T shares, in any combination with a dollar value up to the maximum offering amount. As of February 16, 2016, we had accepted investors’ subscriptions for and issued approximately 52,910,000 shares of Class A common stock and 907,000 shares of Class T common stock in the Offering, resulting in receipt of gross proceeds of approximately $525,419,000 and $8,679,000, respectively. As of February 16, 2016, we had approximately $1,815,902,000 in Class A shares and Class T shares of common stock remaining in our Offering.

Recent Real Property Acquisitions

The following information replaces in its entirety the first sentence of the second full paragraph on page 16 of the “Prospectus Summary—Description of Real Estate Investments” section of the prospectus and the first sentence of the second full paragraph on page 131 of the “Investment Objectives, Strategy and Policies—Description of Real Estate Investments” section of the prospectus:

As of February 18, 2016 on a portfolio level, we, through wholly-owned subsidiaries of our operating partnership, owned 100% of the fee simple interest in 35 properties located in various states, consisting of approximately 1,715,000 gross rentable square feet of commercial space with a consolidated weighted average yield of 8.11% and average annual rent escalations of 1.95%.

The following information supplements, and should be read in conjunction with, the table on page 17 contained in the “Prospectus Summary—Description of Real Estate Investments” section of the prospectus and the table beginning on page 131 contained in the “Investment Objectives, Strategy and Policies—Description of Real Estate Investments” section of the prospectus:

Property Description* | Date Acquired | Year Built | Purchase Price | Property Taxes | Fees Paid to Sponsor(1) | Initial Yield (2) | Average Yield (3) | Physical Occupancy | Location (5) | |||||||||||||||

HPI Portfolio(6) | (6) | (6) | $70,868,005 | $287,938 (4) | $1,417,360 | 6.41 | % | 7.31 | % | 100.00 | % | (6) | ||||||||||||

| (1) | Fees paid to the sponsor include payments made to an affiliate of our advisor for acquisition fees in connection with the property acquisition. It does not include fees paid to any property manager, including our affiliated property manager. For more detailed information on fees paid to our advisor or its affiliates, see the section captioned “Management Compensation” beginning on page 99 of the prospectus. |

| (2) | Initial yield is calculated as the current annualized rental income for the in-place lease at the property divided by the property purchase price adjusted for certain seller credits, exclusive of acquisition costs and fees paid to our advisor or its affiliates. The properties are subject to long-term net leases. Accordingly, our management believes that current annualized rental income is a more appropriate figure from which to calculate initial yield than net operating income. |

| (3) | Average yield is calculated as the average annual rental income, adjusted for any rent incentives, for the in-place lease over the non-cancellable lease term at the property divided by the property purchase price adjusted for certain seller credits, exclusive of acquisition costs and fees paid to our advisor or its affiliates. The properties are subject to long-term net leases. Accordingly, our management believes that average annual rental income is a more appropriate figure from which to calculate average yield than net operating income. |

| (4) | Represents the real estate taxes on the property for 2014. |

| (5) | The properties are located in the Oklahoma City, OK metropolitan statistical area, or MSA, and as such may compete with other facilities for tenants if the current leases are not renewed. |

| (6) | The HPI Portfolio consists of the following seven healthcare properties: |

Property Description | Date Acquired | Year Built | Year Renovated | Location | ||||||||||

HPI – Oklahoma City I | 12/29/2015 | 1985 | 1998 & 2003 | Oklahoma City, OK | ||||||||||

HPI – Oklahoma City II | 12/29/2015 | 1994 | 1999 | Oklahoma City, OK | ||||||||||

HPI – Edmond | 01/20/2016 | 2002 | N/A | Edmond, OK | ||||||||||

HPI – Oklahoma City III | 01/27/2016 | 2007 | N/A | Oklahoma City, OK | ||||||||||

HPI – Oklahoma City IV | 01/27/2016 | 2006 | N/A | Oklahoma City, OK | ||||||||||

HPI – Newcastle | 02/03/2016 | 1995 | 1999 | Newcastle, OK | ||||||||||

HPI – Oklahoma City V | 02/11/2016 | 2008 | N/A | Oklahoma City, OK | ||||||||||

| * | We believe all of our properties are suitable for their present and intended purposes, and adequately covered by insurance. |

Tenant Lease Terms

The following information supplements, and should be read in conjunction with, the table beginning on page 135 contained in the “Investment Objectives, Strategy and Policies–Tenant Lease Terms” section of the prospectus:

Portfolio Description | Property | Major Tenants(1) | Total | % of | Renewal | Annual | Annual | Lease | ||||||||||||||||||

HPI Portfolio | HPI – Oklahoma City III(2) | Kim King, D.O., PLLC(4)(6) | 8,762 | 100.00 | % | 4/5 yr. | $ | 192,764 | (5) | $ | 22.00 | 01/31/2026 | ||||||||||||||

HPI Portfolio | HPI – Oklahoma City IV(2) | Healthcare Partners Investments, LLC(4)(6) | 5,000 | 100.00 | % | 4/5 yr. | $ | 110,000 | (5) | $ | 22.00 | 01/31/2031 | ||||||||||||||

HPI Portfolio | HPI – Newcastle(2) | Healthcare Partners Investments, LLC(4)(6) | 7,424 | 100.00 | % | 4/5 yr. | $ | 111,360 | (5) | $ | 15.00 | 02/28/2031 | ||||||||||||||

HPI Portfolio | HPI – Oklahoma City V(2) | Darryl D. Robinson, M.D., P.C. and Michael Sean O’Brien, D.O., P.C. | 43,686 | 100.00 | % | 4/5 yr. | $ | 960,872 | (5) | $ | 22.00 | 02/28/2026 | ||||||||||||||

| (1) | Major tenants include those tenants that occupy greater than 10% of the rentable square feet of their respective property. We believe each of these tenants is creditworthy. |

| (2) | All of the operations and principal nature of business of the tenants are healthcare related. |

2

| (3) | Represents option renewal period/term of each option. |

| (4) | The tenant entered into a net lease pursuant to which the tenant is required to pay all operating expenses and capital expenditures of the building. |

| (5) | The annual base rent under the lease increases each year by 2.0% of then-current annual base rent. |

| (6) | The tenant is not a rated entity. |

| * | We believe all of our properties are suitable for their present and intended purposes, and adequately covered by insurance. |

The following information supplements, and should be read in conjunction with, the table on page 136 contained in the “Investment Objectives, Strategy and Policies—Depreciable Tax Basis” section of the prospectus:

Property Description | Depreciable | |

HPI Portfolio | $65,328,005 |

Other Real Property Acquisitions

The following information replaces in its entirety the first sentence of the first full paragraph on page 18 of the “Prospectus Summary—Description of Real Estate Investments” section of the prospectus and the first sentence of the first full paragraph on page 133 of the “Investment Objectives, Strategy and Policies—Description of Real Estate Investments” section of the prospectus:

As of February 18, 2016, we purchased, since inception, 19 other properties for an aggregate purchase price of approximately $217,557,000, plus closing costs, and consolidated annual base rent at acquisition of approximately $16,103,000.

The following information supplements, and should be read in conjunction with, the table beginning on page 18 contained in the “Prospectus Summary—Description of Real Estate Investments” section of the prospectus and the table beginning on page 133 contained in the “Investment Objectives, Strategy and Policies—Description of Real Estate Investments” section of the prospectus:

Property | Major | Location(3) | Date | Purchase | Property | Fees Paid to | Total | % of | Lease | |||||||||||||||||||||||

Alpharetta Data Center III | Sungard Availability Services, LP (6) | Alpharetta, GA | 02/02/2016 | $ | 15,750,000 | $ | 158,169 | (4) | $ | 315,000 | 77,322 | 100.00 | % | 11/30/2019 | ||||||||||||||||||

Flint Data Center | Online Tech, LLC (6) | Flint, MI | 02/02/2016 | $ | 8,500,000 | $ | 25,400 | (5) | $ | 170,000 | 32,500 | 100.00 | % | 02/28/2031 | ||||||||||||||||||

| (1) | Fees paid to the sponsor include payments made to an affiliate of our advisor for acquisition fees in connection with the property acquisition. It does not include fees paid to any property manager, including our affiliated property manager. For more detailed information on fees paid to our advisor or its affiliates, see the section captioned “Management Compensation” beginning on page 99 of the prospectus. |

| (2) | Major tenants include those tenants who occupy greater than 10% of the rentable square feet of their respective property. We believe this tenant is creditworthy. |

| (3) | The Alpharetta Data Center III is located in the Alpharetta-Sandy Springs-Roswell, GA MSA and the Flint Data Center is located in the Flint, MI MSA and as such may compete with other facilities for tenants if the current leases are not renewed. |

| (4) | Represents real estate taxes for 2014. |

3

| (5) | Represents real estate taxes for 2015. |

| (6) | This tenant is not a rated entity. |

| * | We believe all of our properties are suitable for their present and intended purposes, and adequately covered by insurance. |

Credit Facility

The following information supplements, and should be read in conjunction with, the table on page 137 contained in the “Investment Objectives, Strategy and Policies—Entry into a Credit Facility” section of the prospectus:

Property(1) | Date Added | Pool | ||||||

Baylor Surgery Center at Fort Worth | 02/03/2016 | $ | 8,614,530 | |||||

HPI – Oklahoma City I | 02/03/2016 | $ | 20,815,336 | |||||

HPI – Oklahoma City II | 02/03/2016 | $ | 6,195,467 | |||||

Waco Data Center | 02/03/2016 | $ | 6,420,000 | |||||

| (1) | CVOP II has pledged a security interest in the property that serves as collateral for the KeyBank Credit Facility pursuant to the terms of the KeyBank Credit Facility Amendment. |

| (2) | The actual amount of credit available under the KeyBank Credit Facility is a function of certain loan-to-cost, loan-to-value and debt service coverage ratios contained in the KeyBank Credit Facility Amendment. |

As of February 18, 2016, CVOP II’s total pool availability was $243,444,635 and $133,444,635 remained available to be drawn.

The Acquisition of Our Dealer Manager by Validus/Strategic Capital, LLC

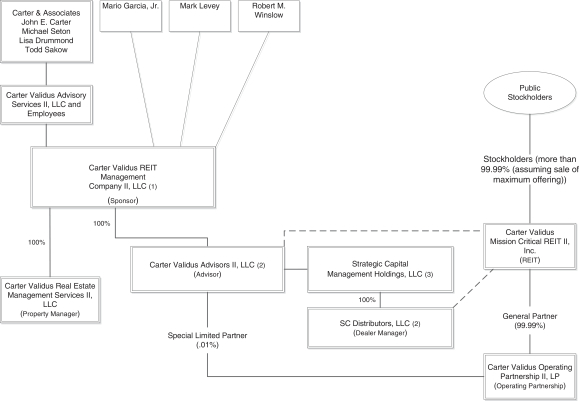

On January 29, 2016, Validus/Strategic Capital, LLC, an affiliate of our advisor, acquired Strategic Capital Management Holdings, LLC (f/k/a Carter Validus Holdings II, LLC and f/k/a Validus/Strategic Capital Partners, LLC), the indirect owner of our dealer manager and a non-voting member of the owner of our advisor, from RCS Capital Corporation, or RCAP. The modifications below reflect the updates to the ownership structure of our dealer manager pursuant to this transaction.

The following information supersedes and replaces in its entirety the section entitled “Prospectus Summary – Our Dealer Manager” on page 11 of the prospectus:

SC Distributors, LLC, or our dealer manager, is a Delaware limited liability company formed in March 2009 and serves as the dealer manager for our Offering. At the commencement of our Offering, the indirect owner of our dealer manager was an affiliate of our advisor. On August 29, 2014, RCS Capital Corporation, or RCAP, acquired Strategic Capital Management Holdings, LLC, and the dealer manager ceased to be under common control with our advisor. On January 29, 2016, Strategic Capital Management Holdings, LLC was sold by RCAP to Validus/Strategic Capital, LLC, which is owned by substantially similar persons as originally owned Strategic Capital Management Holdings, LLC. As a result of this transaction, our dealer manager is an affiliate of our advisor.

Our dealer manager coordinates the distribution of the shares of our common stock on a best efforts basis, manages our relationships with participating broker-dealers and provides assistance in connection with compliance matters relating to marketing the Offering. Our dealer manager provides only the foregoing distribution-related services to us on a contractual basis pursuant to the amended and restated dealer manager agreement and exercises no control or influence over our investment, asset management or accounting functions or any other aspect of our management or operations. Our dealer manager is a member firm of FINRA, and is located at 695 Town Center Drive, Suite 600, Costa Mesa, California 92626.

4

The following chart supersedes and replaces in its entirety the chart on page 22 contained in the “Prospectus Summary – Organizational Structure” section of the prospectus as well as the chart on page 115 contained in the “Conflicts of Interest – Organizational Structure” section of the prospectus:

| 1. | Sponsor owns 20,000 shares of common stock (less than 0.01% assuming maximum offering). |

| 2. | Our advisor and dealer manager are owned through wholly-owned holding companies that are not shown on this Organizational Structure. |

| 3. | Strategic Capital Management Holdings, LLC, which is wholly owned by Validus/Strategic Capital, LLC, and is the indirect owner of Strategic Capital Advisory Services, LLC and SC Distributors, LLC, has a 22.5% participation in gross fees paid to, however, has no voting interest in, Carter Validus Advisors II, LLC. |

5

The following risk factor is inserted as a new risk factor in the “Risk Factors – Risks Related to This Offering and Our Corporate Structure” section beginning on page 41 of the prospectus:

Our dealer manager is one of our affiliates; therefore, you will not have the benefit of the type of independent review of the Offering or us as customarily performed in underwritten offerings.

Our dealer manager, SC Distributors, LLC, is one of our affiliates and will not conduct an independent review of us or the Offering. Accordingly, you will have to rely on your own broker-dealer to conduct an independent review of the terms of this Offering. If your broker-dealer does not conduct such a review, you will not have the benefit of an independent review of the terms of this Offering. Further, the due diligence investigation of us by our dealer manager cannot be considered to be an independent review and, therefore, may not be as meaningful as a review conducted by an unaffiliated broker-dealer or investment banker. In addition, we do not, and do not expect to, have research analysts reviewing our performance or our securities on an ongoing basis. Therefore, you will not have an independent review of our performance and the value of our common stock relative to publicly traded companies.

The following risk factor supersedes and replaces in its entirety the risk factor beginning with “Recent disclosures made by American Realty Capital Properties, Inc., or ARCP. . .” located in the “Risk Factors – Risks Related to an Investment in Carter Validus Mission Critical REIT II, Inc.” on page 39 of the prospectus:

VEREIT, Inc., which was formerly known as American Realty Capital Properties, Inc., or VEREIT, a publicly-traded real estate investment trust, made disclosures regarding accounting errors made by VEREIT employees that have led to market concerns regarding Realty Capital Securities, LLC, or RCS, and RCS Capital Corporation, or RCAP, the parent of RCS and formerly the parent of the dealer manager, and at least one pending class-action stockholder lawsuit against RCAP. Separately, RCAP announced a settlement of an administrative complaint with the Securities Division of the Commonwealth of Massachusetts, or the Massachusetts Securities Division. These investigations and lawsuits may negatively impact the dealer manager.

On October 29, 2014, VEREIT announced that it was restating its earnings after VEREIT’s audit committee discovered that several employees “intentionally made” accounting mistakes that caused VEREIT to understate net losses during the first half of 2014. These accounting errors resulted in the resignations of both VEREIT’s then-chief financial officer and VEREIT’s then-chief accounting officer. Subsequently, additional executives of VEREIT resigned. The SEC, as well as the Federal Bureau of Investigation, announced that they have each opened criminal investigations into VEREIT’s accounting practices, in conjunction with an investigation by the U.S. Attorney’s Office for the Southern District of New York. In addition, VEREIT’s Audit Committee conducted an investigation with the assistance of independent advisors. On March 2, 2015, VEREIT’s audit committee concluded its investigation and VEREIT restated its earnings for the year ended December 31, 2013 and the first two quarters of 2014. VEREIT also issued a press release regarding the results of its audit committee’s investigation, illustrating the accounting errors that had occurred. VEREIT is also the defendant in at least one class-action stockholder lawsuit.

On November 12, 2015, the Massachusetts Securities Division filed a complaint against RCS alleging that RCS fraudulently fabricated shareholder proxy votes. On December 2, 2015, RCAP announced that it had reached a settlement with the Massachusetts Securities Division pursuant to which RCS will pay a fine, and that RCS has decided to voluntarily withdraw its broker-dealer license in Massachusetts and all other state and federal jurisdictions. Our proxy voting process for the past annual meeting of stockholders was conducted by a third-party firm completely separate and independent of RCS and RCAP.

On February 1, 2016, RCAP announced that it filed a prearranged plan of reorganization under Chapter 11 with the United States Bankruptcy Court for the District of Delaware.

On January 29, 2016, the dealer manager was sold by RCAP to Validus/Strategic Capital, LLC. Nevertheless, there can be no assurance that the foregoing developments will not have a negative impact on the dealer manager and its ability to distribute our stock.

6

The section entitled “Management – Dealer Manager” beginning on page 97 of the prospectus is hereby deleted in its entirety. The following information is inserted as a new section in the “Management – Affiliated Companies” section beginning on page 96 of the prospectus:

Dealer Manager

SC Distributors, LLC, our dealer manager, was organized in March 2009. SC Distributors, LLC is a member firm of FINRA and is registered under the applicable federal and state securities laws and qualified to do business as a securities broker-dealer throughout the United States. Patrick J. Miller, the president of our dealer manager, has over 25 years of experience in the financial services business, including extensive experience overseeing national sales and marketing. At the commencement of our Offering, the indirect owner of our dealer manager was an affiliate of our advisor. On August 29, 2014, RCS Capital Corporation, or RCAP, acquired Strategic Capital Management Holdings, LLC, and the dealer manager ceased to be under common control with our advisor. On January 29, 2016, Strategic Capital Management Holdings, LLC was sold by RCAP to Validus/Strategic Capital, LLC, which is owned by substantially similar persons as originally owned Strategic Capital Management Holdings, LLC. As a result of this transaction, our dealer manager is an affiliate of our advisor.

Our dealer manager provides certain wholesaling, sales, promotional and marketing assistance services to us in connection with the distribution of the shares offered pursuant to this prospectus. It also may sell a limited number of shares at the retail level. The compensation we pay to SC Distributors, LLC in connection with this Offering is described in the section of this prospectus captioned “Management Compensation.” See also “Plan of Distribution — Dealer Manager and Underwriting Compensation.”

The current officers of SC Distributors, LLC are:

Name | Age | Position(s) | ||

Patrick Miller | 52 | President | ||

Michael McDaniel | 49 | Vice President and Secretary |

Patrick Miller is a co-founder of SC Distributors, LLC and has served as President since its formation in March 2009. He also served as the Executive Vice President of Carter Validus Advisors II, LLC from January 2013 until February 2015 and Executive Vice President of Carter/Validus Advisors, LLC from December 2009 until February 2015. He is co-founder and Managing Director of Strategic Capital Companies, LLC, a distribution and advisory business focused on marketing alternative investment products via professional financial intermediaries which was formed in June 2009. Mr. Miller is responsible for overall strategy and new business development at Strategic Capital Companies, LLC. Mr. Miller has served as the Executive Vice President of Trilinc Advisors, LLC since February 2013. In addition, Mr. Miller has served on the Board of Trustees for the Investment Program Association from June 2008 to 2013. Prior to founding Strategic Capital Companies, LLC, he served as President of KBS Capital Markets Group, LLC, or KBS, since the company’s inception in October 2005. During his tenure, KBS raised approximately $1.7 billion in investment capital for KBS Real Estate Investment Trust and successfully launched KBS Real Estate Investment Trust II, Inc. From 2002 until joining KBS Capital Markets Group in October 2005, Mr. Miller served as President and Chief Executive Officer of Financial Campus, an online education and training company serving the financial services industry. He was responsible for facilitating the successful acquisition of the company by the Thomson Corporation in 2004. Mr. Miller also served as Chief Executive Officer of Equitable Distributors Inc., the wholesale distribution subsidiary of AXA Financial until 2001. Mr. Miller was elected Chief Executive Officer in 2000 after having joined Equitable Distributors at its inception in 1996 as President of the Wirehouse Division. Mr. Miller obtained a Bachelor of Arts from the University of California at Los Angeles in 1985.

Michael McDaniel is a co-founder of SC Distributors, LLC and has been its National Sales Manager since the company’s formation in June 2009. Mr. McDaniel is responsible for overall sales, wholesaling and strategic relationship management at SC Distributors. Prior to co-founding SC Distributors, Mr. McDaniel served as National Sales Manager of KBS Capital Markets Group, LLC from October 2005 to May 2009. During Mr. McDaniel’s tenure, KBS Capital Markets Group, LLC assembled a team of 18 wholesalers and raised

7

approximately $2 billion of investment capital for KBS Real Estate Investment Trust, Inc. and KBS Real Estate Investment Trust II, Inc. From 1996 to 2005, Mr. McDaniel served as Senior Vice President and National Sales Manager at AXA Financial, Inc. During his nine years at AXA Financial, Mr. McDaniel held several positions, including Regional Vice President and Divisional Vice President, and, in 2000, Mr. McDaniel was named President and National Sales Manager for the Broker Dealer Channel. While in senior management at AXA Financial, Mr. McDaniel’s broker dealer channels were responsible for raising in excess of $20 billion in assets. From 1995 to 1996, Mr. McDaniel was the Midwest Director of Mutual Fund Sales for Mainstay Funds, a division of New York Life Insurance, a mutual life insurance provider. Mr. McDaniel is a graduate of Rollins College in Winter Park, FL in 1989.

The following information is inserted as a new section of the “Conflicts of Interest” section beginning on page 109 of the prospectus:

Affiliated Dealer Manager

Since SC Distributors, LLC, our dealer manager, is an affiliate of our advisor,we will not have the benefit of an independent due diligence review and investigation of the type normally performed by an unaffiliated, independent underwriter in connection with the offering of securities. See the section entitled “Plan of Distribution” in this prospectus.

The following information supersedes and replaces in its entirety the “Plan of Distribution – Dealer Manager” section on page 198 of the prospectus:

Dealer Manager

Our dealer manager is SC Distributors, LLC, an affiliate of our advisor and a member of FINRA. Our dealer manager is headquartered at 695 Town Center Drive, Suite 600, Costa Mesa, CA 92626. Our dealer manager will act as a distributor of securities offered by this prospectus. For additional information about SC Distributors, LLC, please refer to the section of this prospectus captioned “Management — Affiliated Companies — Dealer Manager.”

8