Filed Pursuant to Rule 424(b)(3)

Registration No. 333-191706

CARTER VALIDUS MISSION CRITICAL REIT II, INC.

SUPPLEMENT NO. 3 DATED JULY 11, 2016

TO THE PROSPECTUS DATED APRIL 27, 2016

This document supplements, and should be read in conjunction with, the prospectus of Carter Validus Mission Critical REIT II, Inc. (the “Company”), dated April 27, 2016, Supplement No. 1, dated May 6, 2016 and Supplement No. 2 dated May 12, 2016. Unless otherwise defined in this prospectus supplement, capitalized terms used in this prospectus supplement shall have the same meanings as set forth in the prospectus.

The purpose of this prospectus supplement is to describe the following:

| |

| (1) | the status of the offering of shares of common stock of the Company; |

| |

| (2) | recent real property acquisitions; |

| |

| (3) | updates regarding the Company's credit facility; |

| |

| (4) | updates regarding volume discounts associated with the offering of shares of common stock of the Company; |

| |

| (5) | an update to the suitability standards for Nebraska residents; and |

| |

| (6) | revised forms of the Company's subscription agreements. |

Status of Our Public Offering

We commenced our initial public offering of $2,350,000,000 of shares of our common stock (the “Offering”), consisting of up to $2,250,000,000 of shares in our primary offering and up to $100,000,000 of shares pursuant to our distribution reinvestment plan, on May 29, 2014. We are publicly offering shares of Class A common stock and shares of Class T common stock, in any combination with a dollar value up to the maximum offering amount. As of July 6, 2016, we had accepted investors’ subscriptions for and issued approximately 62,395,000 shares of Class A common stock and 6,243,000 shares of Class T common stock in the Offering, resulting in receipt of gross proceeds of approximately $618,922,000 and $59,737,000, respectively. As of July 6, 2016, we had approximately $1,671,341,000 in Class A shares and Class T shares of common stock remaining in the Offering.

Recent Real Property Acquisitions

The following information replaces in its entirety the first sentence of the second full paragraph on page 16 of the “Prospectus Summary—Description of Real Estate Investments” section of the prospectus and the first sentence of the second full paragraph on page 135 of the “Investment Objectives, Strategy and Policies—Description of Real Estate Investments” section of the prospectus:

As of July 11, 2016, on a portfolio level, we, through wholly-owned subsidiaries of our operating partnership, owned 100% of the fee simple interest in 42 properties located in various states, consisting of approximately 2,003,000 gross rentable square feet of commercial space with a consolidated weighted average yield of 7.98% and average annual rent escalations of 1.90%.

The following information supplements, and should be read in conjunction with, the table on page 17 contained in the “Prospectus Summary—Description of Real Estate Investments” section of the prospectus and the table beginning on page 135 contained in the “Investment Objectives, Strategy and Policies—Description of Real Estate Investments” section of the prospectus:

|

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Property Description* | | Date Acquired | | Year Constructed | | Purchase Price | | Property Taxes(4) | | Fees Paid to Sponsor(1) | | Initial Yield(2) | | Average Yield(3) | | Physical Occupancy | | Location | | MSA(5) |

| HPI Portfolio | | (6) | | (6) | | $ | 116,499,921 |

| | $ | 344,296 |

| | $ | 2,329,998 |

| | 6.41% | | 7.19% | | 100.00% | | (6) | | (6) |

| |

| (1) | Fees paid to the sponsor include payments made to an affiliate of our advisor for acquisition fees in connection with the property acquisition. It does not include fees paid to any property manager, including our affiliated property manager. For more detailed information on fees paid to our advisor or its affiliates, see the section captioned “Management Compensation” beginning on page 103 of the prospectus. |

| |

| (2) | Initial yield is calculated as the current annualized rental income for the in-place lease at the property divided by the property purchase price adjusted for certain seller credits, exclusive of acquisition costs and fees paid to our advisor or its affiliates. The property is subject to a long-term net lease. Accordingly, our management believes that current annualized rental income is a more appropriate figure from which to calculate initial yield than net operating income. |

| |

| (3) | Average yield is calculated as the average annual rental income, adjusted for any rent incentives, for the in-place lease over the non-cancellable lease term at the property divided by the property purchase price adjusted for certain seller credits, exclusive of acquisition costs and fees paid to our advisor or its affiliates. The properties are subject to a long-term net leases. Accordingly, our management believes that average annual rental income is a more appropriate figure from which to calculate average yield than net operating income. |

| |

| (4) | Represents the real estate taxes on the properties for 2014. |

| |

| (5) | Our properties are located in one metropolitan statistical area, or MSA, and as such may compete with other facilities for tenants if the current leases are not renewed. |

| |

| (6) | The HPI Portfolio consists of the following nine healthcare properties: |

|

| | | | | | | | | | |

| Property Description | | Date Acquired | | Year Constructed | | Year Renovated | | Location | | MSA |

| HPI - Oklahoma City I | | 12/29/2015 | | 1985 | | 1998 & 2003 | | Oklahoma City, OK | | Oklahoma City, OK |

| HPI - Oklahoma City II | | 12/29/2015 | | 1994 | | 1999 | | Oklahoma City, OK | | Oklahoma City, OK |

| HPI - Edmond | | 01/20/2016 | | 2002 | | N/A | | Edmond, OK | | Oklahoma City, OK |

| HPI - Oklahoma City III | | 01/27/2016 | | 2007 | | N/A | | Oklahoma City, OK | | Oklahoma City, OK |

| HPI - Oklahoma City IV | | 01/27/2016 | | 2006 | | N/A | | Oklahoma City, OK | | Oklahoma City, OK |

| HPI - Newcastle | | 02/03/2016 | | 1995 | | 1999 | | Newcastle, OK | | Oklahoma City, OK |

| HPI - Oklahoma City V | | 02/11/2016 | | 2008 | | N/A | | Oklahoma City, OK | | Oklahoma City, OK |

| HPI - Oklahoma City VI | | 03/07/2016 | | 2007 | | N/A | | Oklahoma City, OK | | Oklahoma City, OK |

| HPI - Oklahoma City VII | | 06/22/2016 | | 2016 | | N/A | | Oklahoma City, OK | | Oklahoma City, OK |

* We believe all of our properties are suitable for their present and intended purposes, and adequately covered by insurance.

Tenant Lease Terms

The following information supplements, and should be read in conjunction with, the table beginning on page 141 contained in the “Investment Objectives, Strategy and Policies–Tenant Lease Terms” section of the prospectus:

|

| | | | | | | | | | | | | | | | | | | | |

| Portfolio Description | | Property

Description(*) | | Major

Tenants(1) | | Total Square Feet Leased | | % of Total Square Feet Leased | | Renewal Options(3) | | Annual Base Rent at Acquisition | | Annual Base Rent Per Square Foot at Acquisition | | Lease Expiration |

HPI Portfolio(2) | | HPI - Oklahoma City VII | | Community Hospital, LLC(4)(6) | | 102,141 | | 100.00% | | 4/5 yr. | | $ | 2,602,959 |

| (5) | $ | 25.48 |

| | 06/30/2031 |

| |

| (1) | Major tenants include those tenants that occupy greater than 10% of the rentable square feet of their respective property. We believe each of these tenants is creditworthy. |

| |

| (2) | All of the operations and the principal nature of the business of the tenants are healthcare related. |

| |

| (3) | Represents option renewal period/term of each option. |

| |

| (4) | The tenant entered into a net lease pursuant to which the tenant is required to pay all operating expenses and capital expenditures of the building. |

| |

| (5) | The annual base rent under the lease increases every five years by 8.0% of then-current annual base rent. |

| |

| (6) | This tenant is not a credit rated entity. |

* We believe our property is suitable for its present and intended purpose, and adequately covered by insurance.

The following information supplements, and should be read in conjunction with, the table on page 142 contained in the “Investment Objectives, Strategy and Policies—Depreciable Tax Basis” section of the prospectus:

|

| | | | |

| Property Description | | Depreciable Tax Basis |

| HPI Portfolio | | $ | 106,909,921 |

|

Other Real Property Acquisitions

The following information replaces in its entirety the first sentence of the first full paragraph on page 18 of the “Prospectus Summary—Description of Real Estate Investments” section of the prospectus and the first sentence of the first full paragraph on page 137 of the “Investment Objectives, Strategy and Policies—Description of Real Estate Investments” section of the prospectus:

As of July 11, 2016, we purchased, since inception, 28 other properties for an aggregate purchase price of approximately $426,371,000, plus closing costs, and consolidated annual base rent at acquisition of approximately $28,890,000.

The following information supplements, and should be read in conjunction with, the table beginning on page 18 contained in the “Prospectus Summary—Description of Real Estate Investments” section of the prospectus and the table beginning on page 137 contained in the “Investment Objectives, Strategy and Policies—Description of Real Estate Investments” section of the prospectus:

The following table summarizes the three other properties acquired since April 27, 2016 in order of acquisition date:

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Property Description* |

| Location |

| MSA(3) |

| Date Acquired |

| Purchase Price |

| Property Taxes |

| Fees Paid to Sponsor (1) |

| Major Tenant (2) |

| Total Rentable Square Feet |

| % of Total Rentable Square Feet Leased for Major Tenants |

| % of Total Rentable Square Feet Leased |

| Lease Expiration for Major Tenants |

| Post Acute Las Vegas Rehabilitation Hospital |

| Las Vegas, NV |

| Las Vegas-Henderson-Paradise, NV |

| 06/24/2016 |

| $ | 2,613,600 |

| (7) | $ | 31,792 |

| (4) | $ | 481,052 |

| (7) | PAM Squared at Las Vegas, LLC(5) |

| 56,220 |

| (6) | (8) |

| (8) |

| (8) |

| Somerset Data Center |

| Somerset, NJ |

| New York-Newark-Jersey City, NY-NJ-PA |

| 06/29/2016 |

| $ | 12,375,000 |

|

| $ | 179,094 |

| (9) | $ | 247,500 |

|

| Datapipe, Inc.(10) |

| 36,114 |

|

| 100.00% |

| 100.00% |

| 07/05/2028 |

| Integris Lakeside Women's Hospital |

| Oklahoma City, OK |

| Oklahoma City, OK |

| 06/30/2016 |

| $ | 19,840,000 |

|

| $ | 128,862 |

| (9) | $ | 396,800 |

|

| Lakeside Women's Hospital, LLC (5) |

| 62,857 |

|

| 100.00% |

| 100.00% |

| 12/31/2027 |

| |

| (1) | Fees paid to the sponsor include payments made to an affiliate of our advisor for acquisition fees in connection with the property acquisition. It does not include fees paid to any property manager, including our affiliated property manager. For more detailed information on fees paid to our advisor or its affiliates, see the section captioned "Management Compensation" beginning on page 103 of the prospectus. |

| |

| (2) | Major tenants include those tenants who occupy greater than 10% of the rentable square feet of their respective property. We believe each of these tenants is creditworthy. |

| |

| (3) | Our properties are located in the MSAs of their respective cities and as such may compete with other facilities for tenants if the current leases are not renewed. |

| |

| (4) | Represents the real estate taxes for 2016. |

| |

| (5) | These tenants are not rated entities. |

| |

| (6) | Represents the total estimated rentable square feet of the Post Acute Las Vegas Rehabilitation Hospital after construction is completed. |

| |

| (7) | Future construction costs for the Post Acute Las Vegas Rehabilitation Hospital are budgeted at $21.4 million. The fees paid to the sponsor were based on the total estimated cost of the property, including budgeted future construction costs. |

| |

| (8) | The lease with PAM Squared at Las Vegas, LLC was entered into on June 24, 2016, and occupancy will commence upon the completion of construction in accordance with the terms of the lease agreement. The lease expiration date is 20 years from the lease commencement date. |

| |

| (9) | Represents the real estate taxes for 2015. |

| |

| (10) | Datapipe, Inc. has a credit rating of B3 by Moody's Investor Services and a credit rating of B by Standard & Poor's Rating Services. |

* We believe all of our properties are suitable for their present and intended purposes, and adequately covered by insurance.

Credit Facility

The following information supplements, and should be read in conjunction with, the table on page 143 contained in the "Investment Objectives, Strategy and Policies - Entry into a Credit Facility" section of the prospectus:

The following table summarizes information on the properties in which CVOP II has pledged a security interest that serve as collateral for the credit facility since April 27, 2016.

|

| | | | | | |

| Property | | Date Added | | Pool Availability |

| HPI — Oklahoma City VI | | 06/01/2016 | | $ | 3,030,000 |

|

| Flint Data Center | | 06/01/2016 | | $ | 5,100,000 |

|

| Eagan Data Center | | 06/01/2016 | | $ | 3,480,000 |

|

As of July 11, 2016, CVOP II had a total pool availability under the KeyBank Credit Facility of $233,778,000 and an aggregate outstanding balance of $95,000,000. As of July 11, 2016, $138,778,000 remained to be drawn on the KeyBank Credit Facility.

Volume Discounts

The following information replaces in its entirety the first sentence of the first full paragraph on page 209 of the “Plan of Distribution—Volume Discounts” section of the prospectus:

In connection with sales of $500,000 and over in Class A shares or Class T shares to a qualifying purchaser (as defined below), a participating broker-dealer may offer such qualifying purchaser a volume discount by reducing or eliminating the selling commissions, where applicable, and/or reducing dealer manager fees.

The table on page 209 of the “Plan of Distribution - Volume Discounts” section of the prospectus is hereby deleted in its entirety and replaced with the following:

|

| | | | | | | | | | | | | | | | |

| Dollar Amount of Shares Purchased | | Class A | | Class T |

| | Selling Commission Percentage | | Dealer Manager Fee | | Purchase Price per Share to Investor | | Selling Commission Percentage | | Dealer Manager Fee | | Purchase Price per Share to Investor(1) |

| $499,999 or less | | 7.00 | % | | 3.00 | % | | $10.00 | | 3.00 | % | | 3.00 | % | | $9.574 |

| $500,000-$999,999 | | 6.00 | % | | 3.00 | % | | $9.890 | | 2.50 | % | | 3.00 | % | | $9.524 |

| $1,000,000-$1,999,999 | | 5.00 | % | | 3.00 | % | | $9.783 | | 2.50 | % | | 3.00 | % | | $9.524 |

| $2,000,000-$2,999,999 | | 4.00 | % | | 3.00 | % | | $9.677 | | 2.00 | % | | 3.00 | % | | $9.474 |

| $3,000,000-$4,999,999 | | 3.00 | % | | 2.60 | % | | $9.534 | | 2.00 | % | | 2.60 | % | | $9.434 |

| $5,000,000-$9,999,999 | | 2.00 | % | | 2.60 | % | | $9.434 | | 1.50 | % | | 2.60 | % | | $9.385 |

| $10,000,000 and above | | 1.00 | % | | 2.40 | % | | $9.317 | | 1.00 | % | | 2.40 | % | | $9.317 |

| |

| (1) | We will also pay the dealer manager a distribution and servicing fee with respect to the Class T shares sold in the primary offering, which will accrue daily in an amount equal to 1/365th of 1.0% of the amount of the purchase price per share (or, once reported, the NAV for the Class T shares) on a continuous basis from year to year, payable out of amounts that would otherwise be authorized as distributions to holders of Class T shares. |

The following information replaces in its entirety the third full paragraph on page 209 of the “Plan of Distribution—Volume Discounts” section of the prospectus:

We will apply the reduced per share purchase price, selling commission, if applicable, and dealer manager fee, set forth in the table above to the entire purchase for that particular class of shares, not just the portion of the purchase which exceeds the $499,999 share purchase threshold, provided the purchase of all such shares is made at one time. For example, a purchase of $3,000,000 in Class A shares, which would result in the issuance of 314,663 Class A shares, in a single transaction would result in a purchase price $9.534 per share and selling commissions of $90,000. You may not combine amounts purchased for Class A shares with amounts purchased for Class T shares for purposes of obtaining a volume discount.

Investor Suitability Standards

The following information supersedes and replaces in its entirety the investor suitability standard for Nebraska located on page ii of the prospectus:

Nebraska. In addition to the general suitability standards listed above, Nebraska investors must limit their investment in us and in the securities of other direct participation programs to 10% of such investor's net worth. An investment by a Nebraska investor that is an accredited investor within the meaning of the Federal securities laws is not subject to the foregoing limitations.

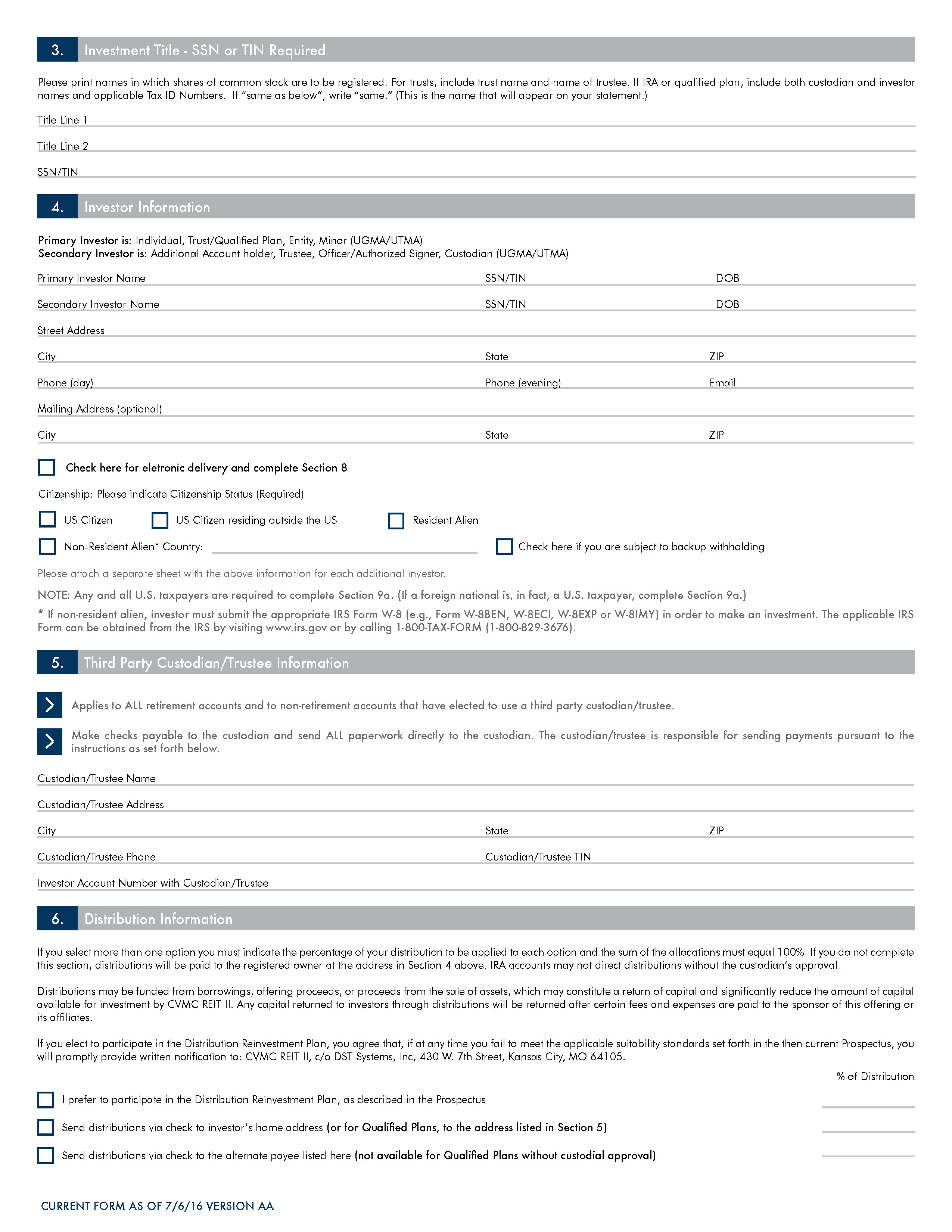

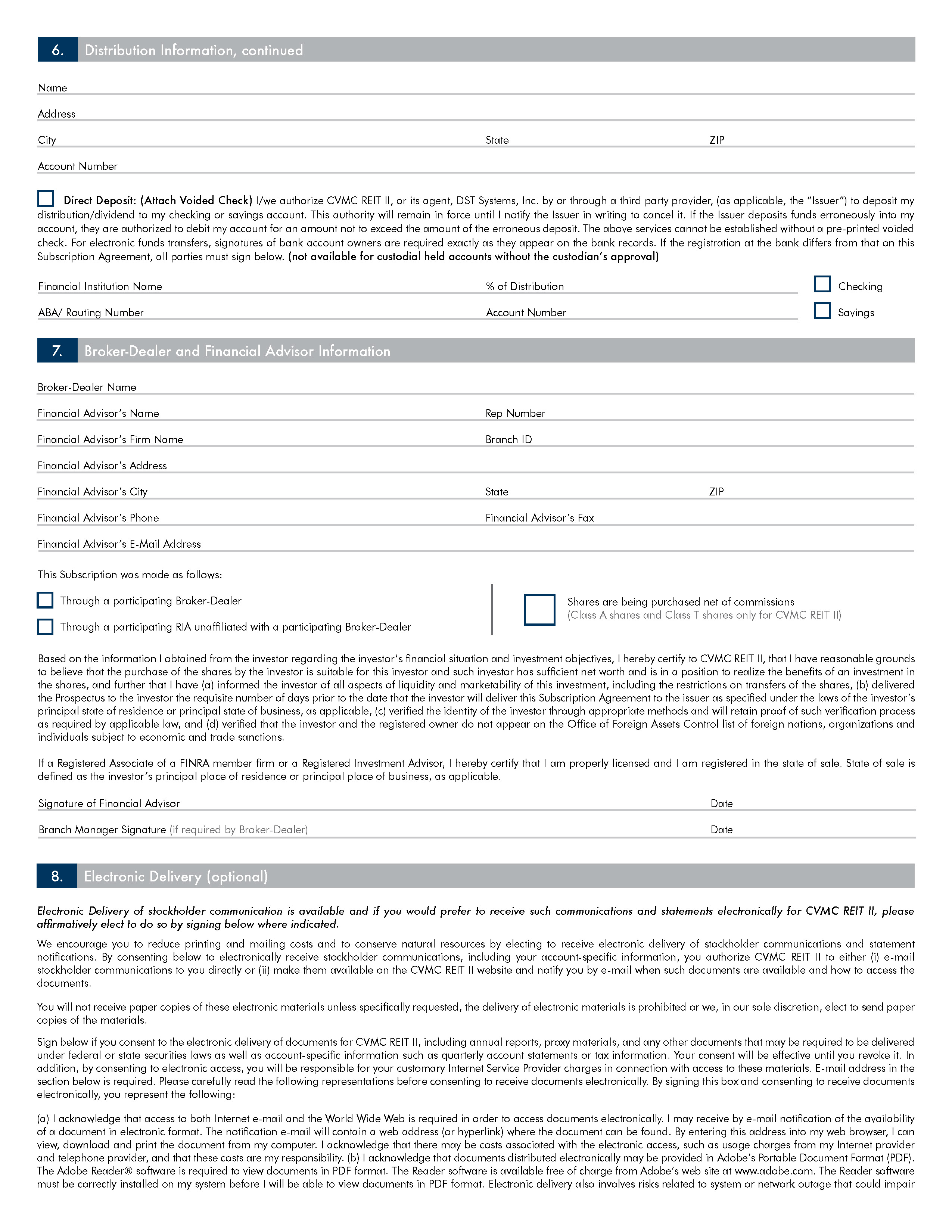

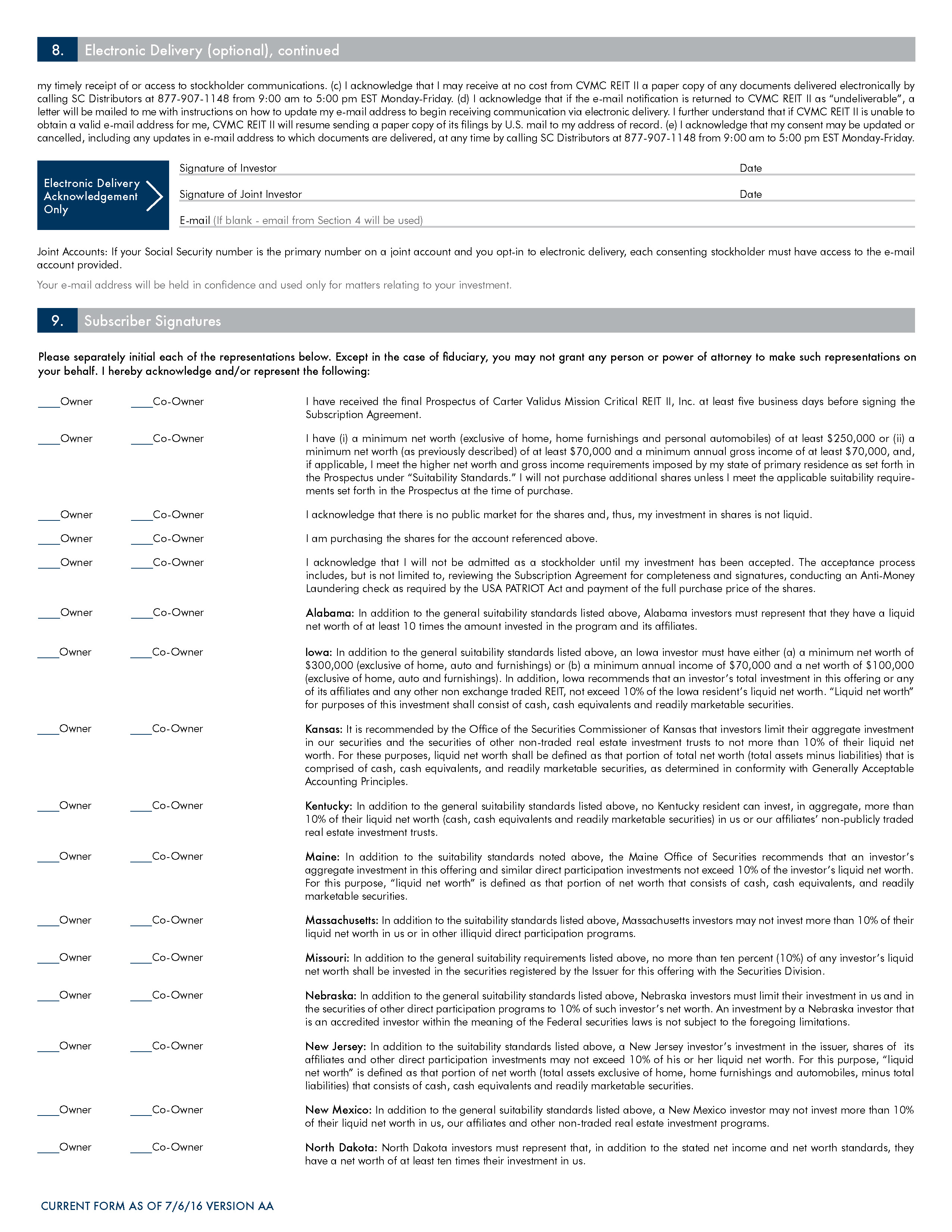

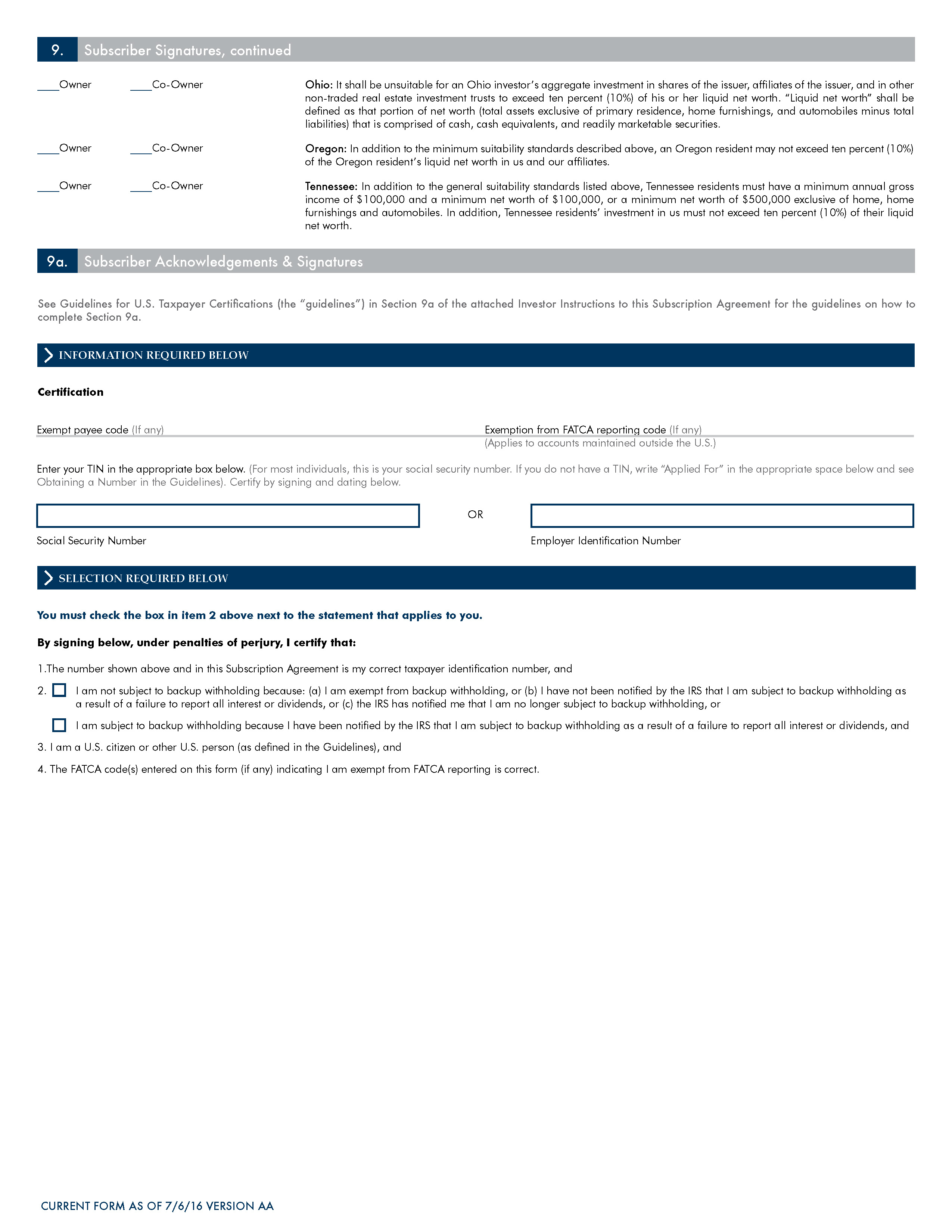

Revised Forms of Subscription Agreements

Revised forms of our Subscription Agreement, Additional Subscription Agreement and Multi-Product Subscription Agreement are attached as Appendices B, C and F, respectively, and supersede and replace Appendices B, C, and F included in our prospectus.