Filed Pursuant to Rule 424(b)(3)

Registration No. 333-191706

CARTER VALIDUS MISSION CRITICAL REIT II, INC.

SUPPLEMENT NO. 5 DATED JULY 28, 2016

TO THE PROSPECTUS DATED APRIL 27, 2016

This document supplements, and should be read in conjunction with, the prospectus of Carter Validus Mission Critical REIT II, Inc. (the “Company”), dated April 27, 2016, Supplement No. 1 dated May 6, 2016, Supplement No. 2 dated May 12, 2016, Supplement No. 3 dated July 11, 2016 and Supplement No. 4 dated July 19, 2016. Unless otherwise defined in this prospectus supplement, capitalized terms used in this prospectus supplement shall have the same meanings as set forth in the prospectus.

The purpose of this prospectus supplement is to describe the following:

(1) the status of the offering of shares of common stock of the Company;

(2) updates to our management;

(3) an update to the suitability standards for Nebraska residents; and

(4) revised forms of the Company’s subscription agreements.

Status of Our Public Offering

We commenced our initial public offering of $2,350,000,000 of shares of our common stock (the “Offering”), consisting of up to $2,250,000,000 of shares in our primary offering and up to $100,000,000 of shares pursuant to our distribution reinvestment plan, on May 29, 2014. We are publicly offering shares of Class A common stock and shares of Class T common stock, in any combination with a dollar value up to the maximum offering amount. As of July 27, 2016, we had accepted investors’ subscriptions for and issued approximately 63,250,000 shares of Class A common stock and 6,988,000 shares of Class T common stock in the Offering, resulting in receipt of gross proceeds of approximately $627,375,000 and $66,861,000, respectively. As of July 27, 2016, we had approximately $1,655,764,000 in Class A shares and Class T shares of common stock remaining in the Offering.

Updates to Our Management

On July 25, 2016, in accordance with our bylaws and charter, the remaining directors of our board of directors elected Robert M. Winslow as a director to fill a vacancy on the board of directors, to serve in accordance with our bylaws for the remainder of the full term of the directorship and until his successor is duly elected and qualifies or until his earlier resignation or removal in accordance with our organizational documents and applicable law.

The table on page 86 of the “Management - Executive Officers and Directors” section of the prospectus is hereby deleted in its entirety and replaced with the following:

|

| | | | |

| Name | | Age | | Position(s) |

| John E. Carter | | 56 | | Chairman of the Board and Chief Executive Officer |

| Robert M. Winslow | | 66 | | Director |

| Jonathan Kuchin | | 65 | | Independent Director |

| Randall Greene | | 67 | | Independent Director |

| Ronald Rayevich | | 73 | | Independent Director |

| Lisa A. Drummond | | 52 | | Chief Operating Officer and Secretary |

| Todd M. Sakow | | 44 | | Chief Financial Officer and Treasurer |

| Michael A. Seton | | 44 | | President |

The table on page 94 of the "Management - The Advisor" section of the prospectus is hereby deleted in its entirety and replaced with the following:

|

| | | | |

| Name | | Age | | Position(s) |

| John E. Carter | | 56 | | Co-Chief Executive Officer and Member of Investment Committee |

| Michael A. Seton | | 44 | | Co-Chief Executive Officer, President and Member of Investment Committee |

| Lisa A. Drummond | | 52 | | Chief Operating Officer and Secretary |

| Todd M. Sakow | | 44 | | Chief Financial Officer and Treasurer |

| Christof Hammerli | | 42 | | Chief Acquisitions Officer |

| Alex Stacy | | 40 | | Chief Acquisitions Officer, Healthcare |

| Robert M. Winslow | | 66 | | Executive Vice President of Construction, Development and Special Projects and Member of Investment Committee |

| Jimmy Yu, Sr. | | 49 | | Senior Vice President of Asset Management |

| Jamie Yoakum | | 45 | | Senior Vice President of Accounting |

| Mario Garcia, Jr. | | 45 | | Member of Investment Committee |

| Robert Peterson | | 64 | | Member of Investment Committee |

| Mark Levey | | 54 | | Member of Investment Committee |

The following biographical information of Mr. Winslow is hereby inserted in the “Management - Executive Officers and Directors” section of the prospectus beginning on page 86 and deleted from the “Management - The Advisor” section beginning on page 94 of the prospectus:

Robert M. Winslow has been a director since July 2016. Mr. Winslow has served as the Executive Vice President of Construction, Development and Special Projects since May 2015 and a member of the Investment Committee of Carter Validus Advisors II, LLC since January 2013. Mr. Winslow also served as the Executive Vice President of Asset Management of Carter Validus Advisors II, LLC from January 2013 to May 2015. He has also served as Executive Vice President of Construction, Development and Special Projects since May 2015 and a member of the Management Committee and Investment Committee of Carter/Validus Advisors, LLC since December 2009. Mr. Winslow also served as the Executive Vice President of Asset Management of Carter/Validus Advisors, LLC from December 2009 to May 2015. He has more than 35 years of real estate experience throughout the United States. Mr. Winslow has packaged and managed more than 50 commercial investments in hotels, offices, shopping centers and industrial properties with a value exceeding $300 million. He has served as President and Chief Executive Officer of Global Building and Consulting Corporation, a multi-service residential and commercial investment company specializing in performance-oriented management of real estate assets since 1996. From 1987 to 1989, Mr. Winslow structured a joint venture with Prentiss Properties to serve as the Florida Development Manager for proposed office projects for tenants including, among others, AT&T and Loral Federal Systems. In July 1980, Mr. Winslow founded and served as managing General Partner of Global Properties, LTD through 1985. Global Properties, LTD was a full service real estate brokerage firm that grew to 120 sales associates, and was the first firm with whom Merrill Lynch Realty signed a Letter of Intent to purchase when it entered the Orlando market. Prior to founding Global Properties, LTD in 1980, Mr. Winslow served as Vice President of Winter Park Land Company, an old line private real estate holding company where he reversed two unprofitable divisions and created compatible new construction and real estate brokerage strategies. Mr. Winslow obtained a Bachelor of Arts from Rollins College in Business Administration/Economics in 1971 and an MBA in International Finance from the Roy E. Crummer Graduate School of Business at Rollins College in Winter Park, Florida in 1973.

The following information replaces in its entirety the first sentence immediately following the first table on page 94 of the “Management - The Advisor” section of the prospectus:

The backgrounds of John E. Carter, Todd M. Sakow, Michael A. Seton, Lisa A. Drummond and Robert M. Winslow are described in the “Management - Executive Officers and Directors” section of this prospectus.

The “Principal Stockholders” section on page 112 of the prospectus is hereby deleted in its entirety and replaced with the following:

PRINCIPAL STOCKHOLDERS

The following table provides, as of the date of this prospectus, information regarding the number and percentage of shares of our common stock beneficially owned by each director, each executive officer, all directors and executive officers as a group and any person known to us to be the beneficial owner of more than 5.0% of our outstanding shares. As of July 27, 2016, we had 16,584 stockholders of record and 63,090,893 and 6,988,218 shares of Class A and Class T common stock outstanding, respectively. Beneficial ownership includes outstanding shares and shares which are not outstanding, but that any person has

the right to acquire within 60 days after the date of this prospectus. However, any such shares which are not outstanding are not deemed to be outstanding for the purpose of computing the percentage of outstanding shares beneficially owned by any other person. Except as otherwise provided, the person named in the table has sole voting and investing power with respect to all shares beneficially owned by it.

|

| | | | | |

Beneficial Owner (1) | | Number of Class A Shares Beneficially Owned | | Percent of Class |

| Carter Validus REIT Management Company II, LLC | | 20,000 |

| | * |

| Directors | | | | |

John E. Carter (2) | | 20,000 |

| | * |

Robert M. Winslow (3) | | 20,000 |

| | * |

| Jonathan Kuchin | | 9,598 |

| | * |

| Randall Greene | | 9,656 |

| | * |

| Ronald Rayevich | | 9,000 |

| | * |

| Executive Officers | | | | |

Lisa A. Drummond (4) | | 20,000 |

| | * |

Todd M. Sakow (5) | | 20,000 |

| | * |

Michael A. Seton (6) | | 20,000 |

| | * |

| All executive officers and directors as a group (8 persons) | | 48,254 |

| | * |

| |

| * | Represents less than 1.0% of the outstanding common stock. |

| |

| (1) | The business address of the beneficial owner is 4890 W. Kennedy Blvd., Suite 650, Tampa, FL 33609. |

| |

| (2) | Mr. Carter is the Co-Chief Executive Officer of Carter Validus REIT Management Company II, LLC, which directly owns 20,000 shares of Class A common stock in our company. Mr. Carter disclaims beneficial ownership of the shares held by Carter Validus REIT Management Company II, LLC, except to the extent of his pecuniary interest. |

| |

| (3) | Mr. Winslow directly or indirectly controls Carter Validus REIT Management Company II, LLC, which directly owns 20,000 shares of Class A common stock in our company. Mr. Winslow disclaims beneficial ownership of the shares held by Carter Validus REIT Management Company II, LLC, except to the extent of his pecuniary interest. |

| |

| (4) | Ms. Drummond is the Chief Operating Officer of Carter Validus REIT Management Company II, LLC, which directly owns 20,000 shares of Class A common stock in our company. Ms. Drummond disclaims beneficial ownership of the shares held by Carter Validus REIT Management Company II, LLC, except to the extent of her pecuniary interest. |

| |

| (5) | Mr. Sakow is the Chief Financial Officer of Carter Validus REIT Management Company II, LLC, which directly owns 20,000 shares of Class A common stock in our company. Mr. Sakow disclaims beneficial ownership of the shares held by Carter Validus REIT Management Company II, LLC, except to the extent of his pecuniary interest. |

| |

| (6) | Mr. Seton is the Co-Chief Executive Officer of Carter Validus REIT Management Company II, LLC, which directly owns 20,000 shares of Class A common stock in our company. Mr. Seton disclaims beneficial ownership of the shares held by Carter Validus REIT Management Company II, LLC except to the extent of his pecuniary interest. |

Investor Suitability Standards

The following information supersedes and replaces in its entirety the investor suitability standard for Nebraska located on page ii of the prospectus:

Nebraska. In addition to the general suitability standards listed above, Nebraska investors must limit their aggregate investment in us and in the securities of other non-publicly traded real estate investment trusts to 10% of such investor’s net worth. Accredited investors in Nebraska, as defined in 17 C.F.R. § 230.501, are not subject to this limitation.

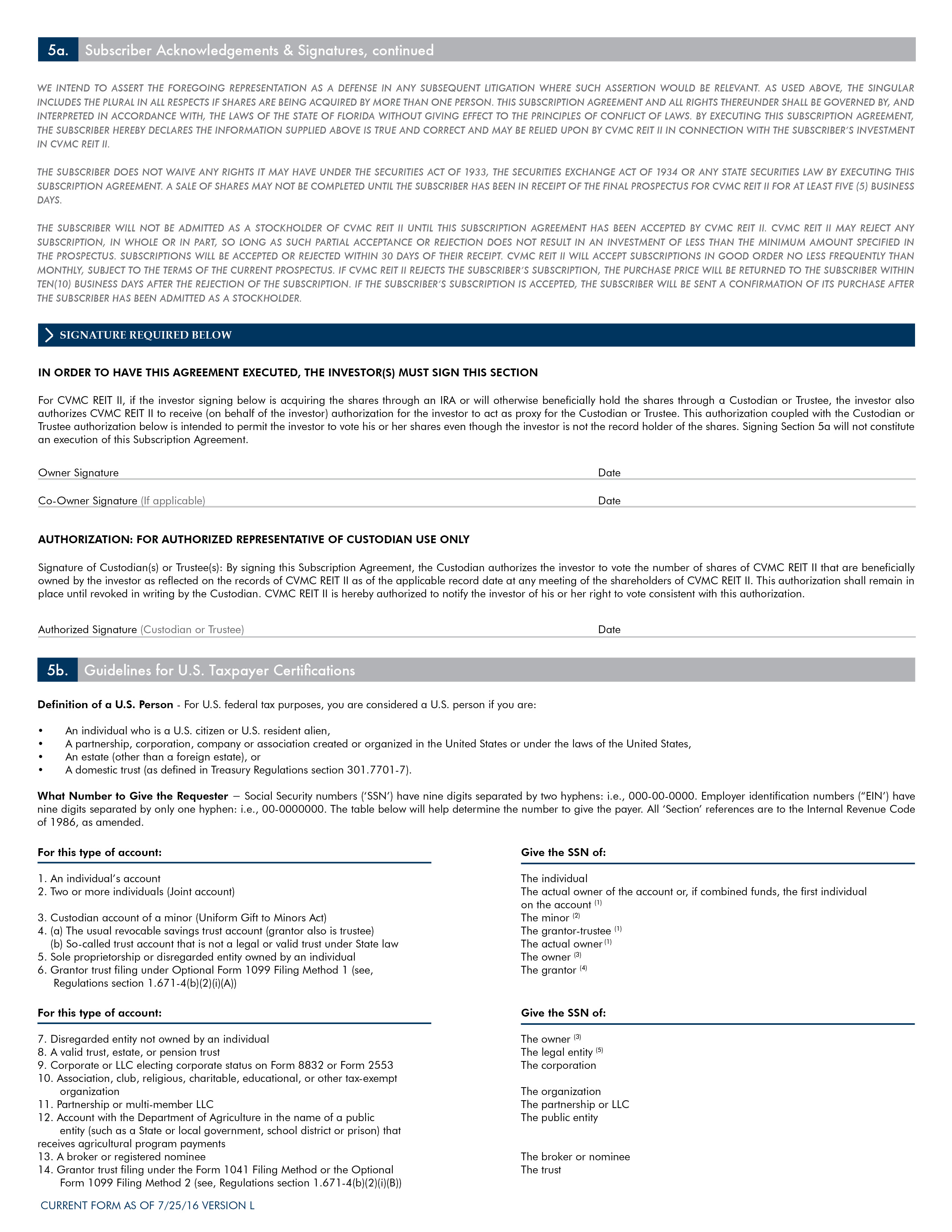

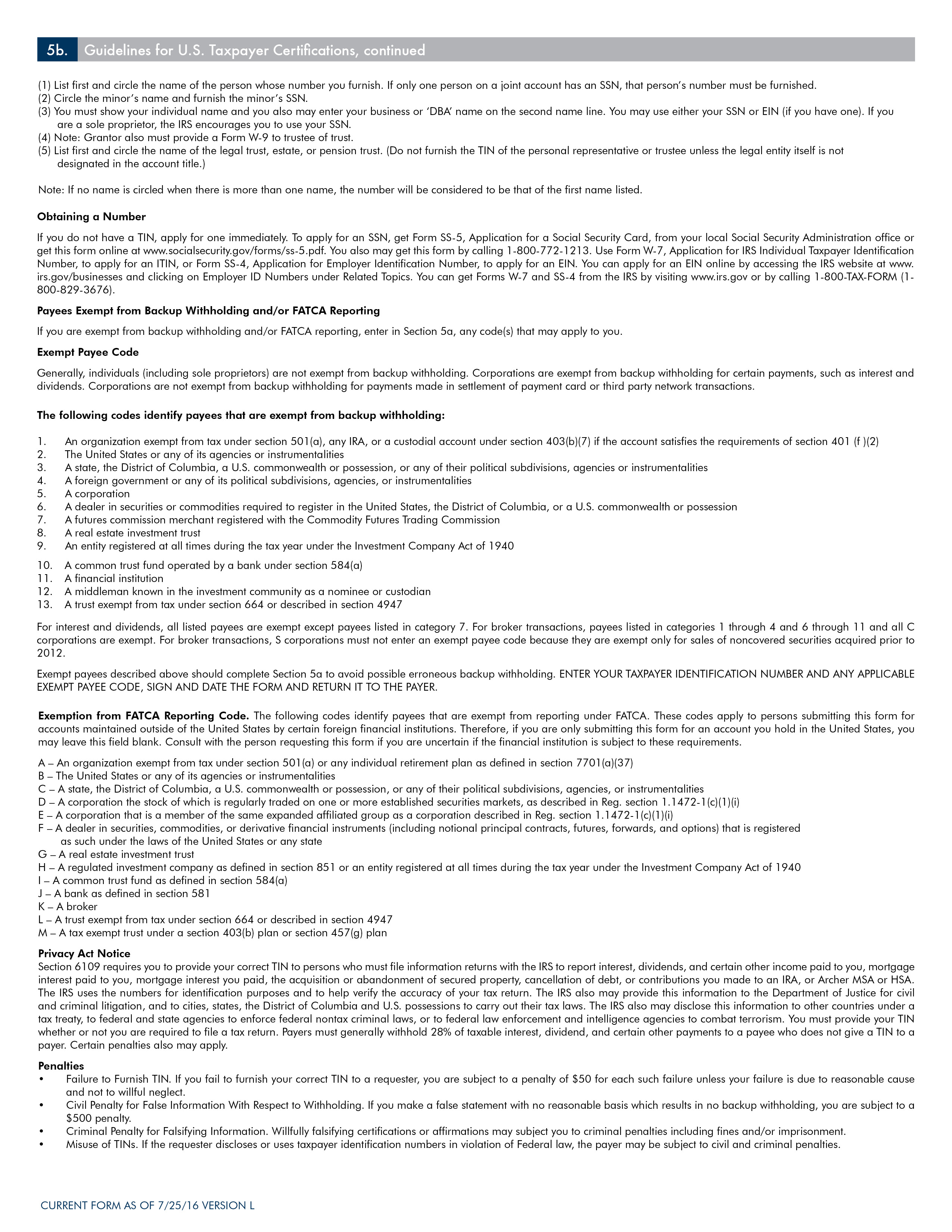

Revised Forms of Subscription Agreements

Revised forms of our Subscription Agreement and Additional Subscription Agreement are attached as Appendices B and C, respectively, and supersede and replace Appendices B and C included in our prospectus.