Filed Pursuant to Rule 424(b)(3)

Registration No. 333-191706

CARTER VALIDUS MISSION CRITICAL REIT II, INC.

SUPPLEMENT NO. 8 DATED JULY 20, 2017

TO THE PROSPECTUS DATED APRIL 27, 2017

This Supplement No. 8 supplements, and should be read in conjunction with, the prospectus of Carter Validus Mission Critical REIT II, Inc., dated April 27, 2017, Supplement No. 2 dated May 18, 2017, which consolidated and replaced all previous supplements to the prospectus, Supplement No. 3, dated May 30, 2017, Supplement No. 6, dated June 23, 2017 and Supplement No. 7, dated July 7, 2017. Unless otherwise defined in this prospectus supplement, capitalized terms used in this prospectus supplement shall have the same meanings as set forth in the prospectus.

The purpose of this prospectus supplement is to describe the following:

| |

| (1) | the status of our offering and duration of our offering; and |

| |

| (2) | updates regarding the automatic purchase plan. |

Status of Our Offering and Duration of Our Offering

We commenced our initial public offering of $2,350,000,000 of shares of our common stock (the “Offering”), consisting of up to $2,250,000,000 of shares in our primary offering and up to $100,000,000 of shares pursuant to our distribution reinvestment plan, on May 29, 2014. As of the date of this supplement, we are publicly offering shares of Class A common stock, shares of Class I common stock and shares of Class T common stock, in any combination with a dollar value up to the maximum offering amount. As of July 18, 2017, we had accepted investors’ subscriptions for and issued approximately 77,818,000 shares of Class A common stock, 2,028,000 shares of Class I common stock and 23,105,000 shares of Class T common stock in the Offering, resulting in receipt of gross proceeds of approximately $770,868,000, $18,459,000 and $221,409,000, respectively, for total gross proceeds raised of $1,010,736,000. As of July 18, 2017, we had approximately $1,339,264,000 in Class A shares, Class I shares and Class T shares of common stock remaining in the Offering.

On May 1, 2017, we filed a Registration Statement on Form S-11 (the “Follow-On Offering Registration Statement”) under the Securities Act of 1933, as amended (the “Securities Act”) to register up to $332,500,000 of shares of Class A common stock, Class I common stock, and Class T common stock to be offered to the public on a best efforts basis pursuant to a proposed follow-on offering and up to $17,500,000 of shares of Class A common stock, Class I common stock, and Class T common stock pursuant to our distribution reinvestment plan. Accordingly, pursuant to Rule 415 promulgated under the Securities Act, we extended our current Offering until the earlier of the SEC effective date of the Follow-On Offering Registration Statement or November 25, 2017, the date that is 180 days after the third anniversary of the SEC effective date of the Offering. As of the date of this supplement, the Follow-On Offering Registration Statement has not been declared effective by the SEC. We reserve the right to terminate the Offering at any time prior to these dates.

Our board of directors determined to terminate our Offering on November 24, 2017. Our board of directors may revise the offering termination date as necessary in its discretion.

Automatic Purchase Plan

The following information supersedes and replaces the first and second sentences of the “Plan of Distribution - Automatic Purchase Plan” section beginning on page 179 of the prospectus:

Investors who desire to purchase shares in this Offering at regular intervals may be able to do so by electing to participate in the automatic purchase program by completing an enrollment form that we will provide upon request. Alabama, Maryland, Nebraska, New Jersey, North Carolina and Ohio investors are not eligible to participate in the automatic purchase program.

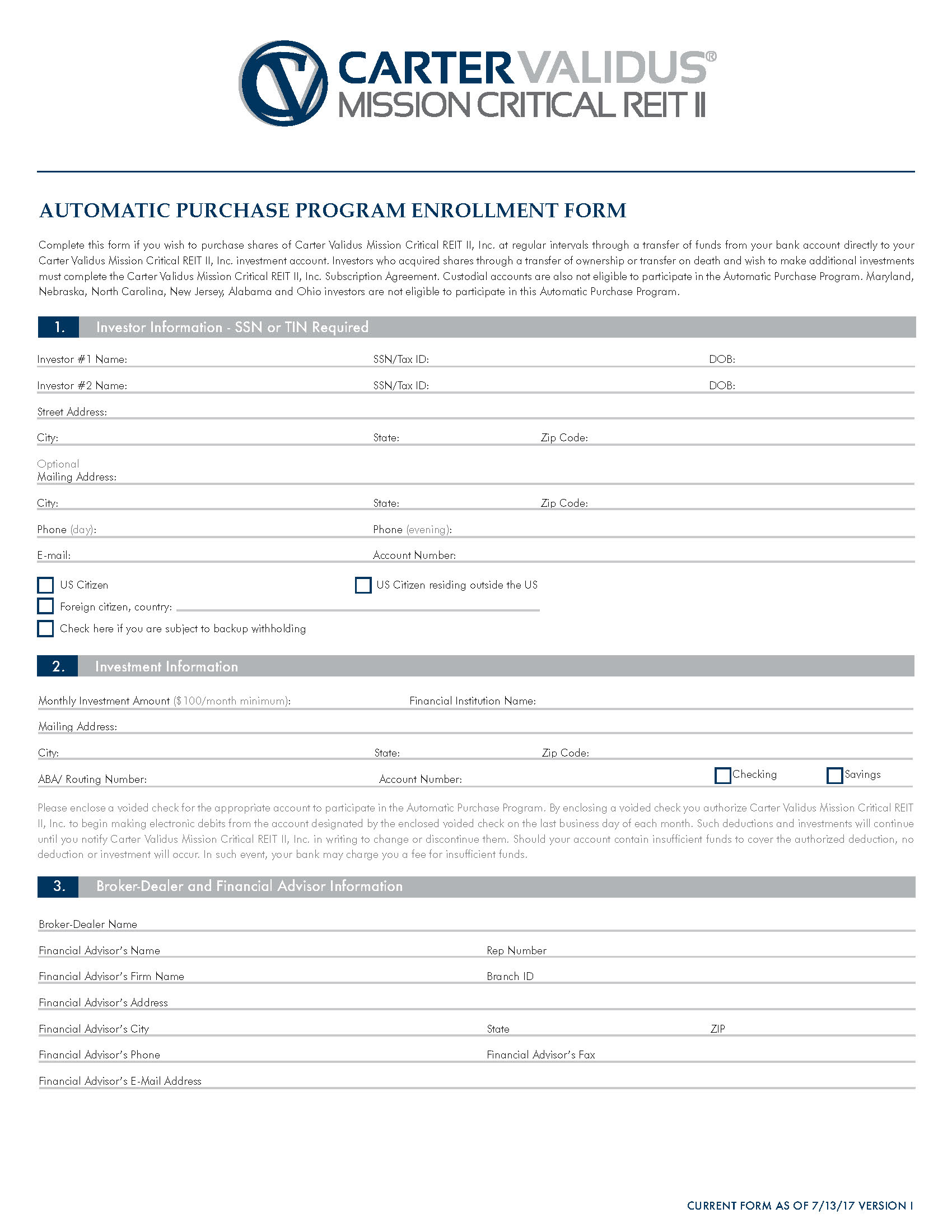

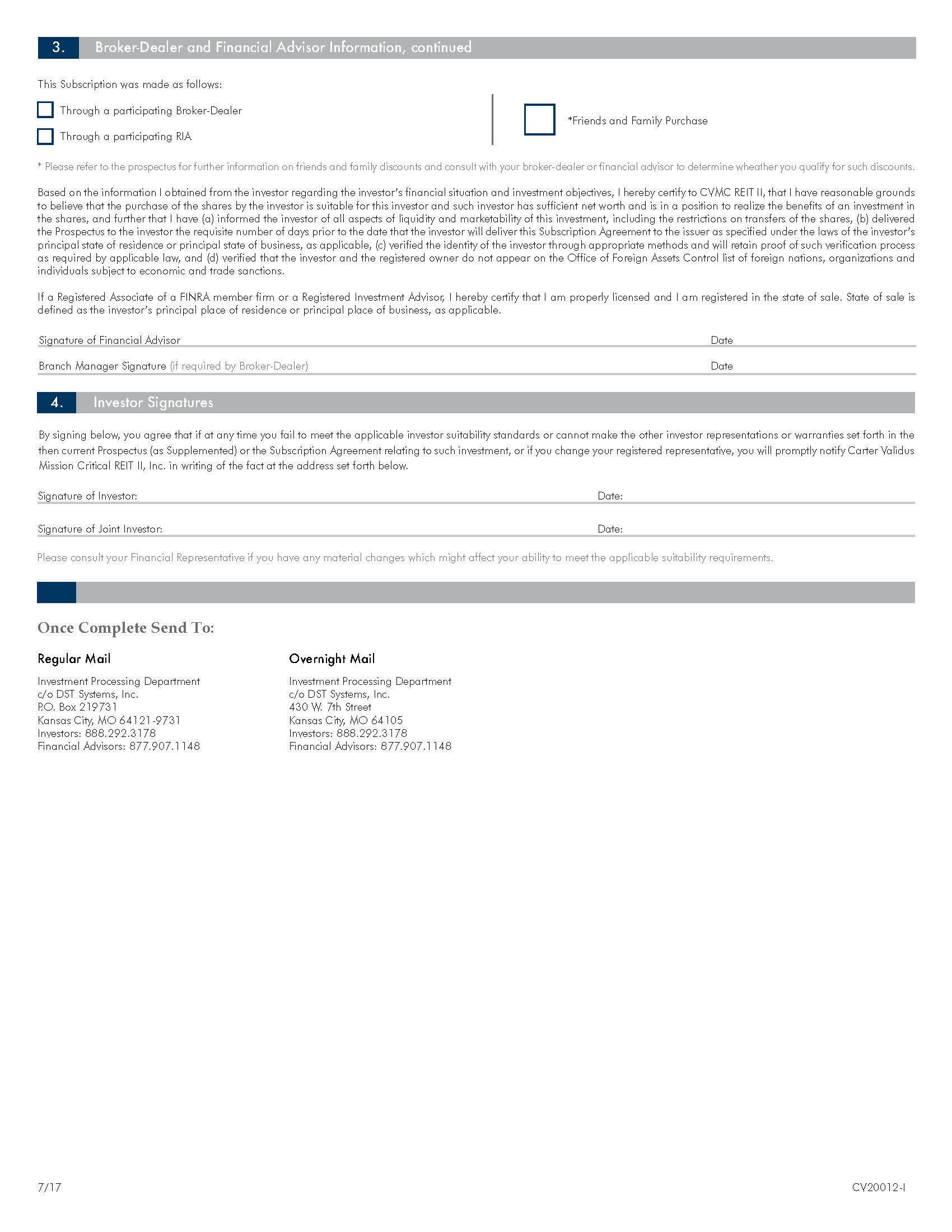

Revised Form of Automatic Purchase Program Enrollment Form

A revised form of our Automatic Purchase Program Enrollment Form is attached as Appendix D and supersedes and replaces Appendix D in the prospectus.