Filed Pursuant to Rule 424(b)(3)

Registration No. 333-191706

CARTER VALIDUS MISSION CRITICAL REIT II, INC.

SUPPLEMENT NO. 10 DATED SEPTEMBER 15, 2017

TO THE PROSPECTUS DATED APRIL 27, 2017

This document supplements, and should be read in conjunction with, the prospectus of Carter Validus Mission Critical REIT II, Inc., dated April 27, 2017, and consolidates and replaces all previous supplements to the prospectus. Unless otherwise defined in this prospectus supplement, capitalized terms used in this prospectus supplement shall have the same meanings as set forth in the prospectus.

The purpose of this prospectus supplement is to describe the following:

| |

| (1) | the status of our initial public offering of common stock, the filing of a registration statement for our follow-on offering and the termination of our initial public offering of common stock; |

| |

| (2) | the declaration of distributions to our stockholders and distributions made through September 15, 2017; |

| |

| (3) | the reallocation of shares under our charter; |

| |

| (4) | update regarding the distribution and servicing fee; |

| |

| (5) | updates to the “Questions and Answers About this Offering” section of our prospectus; |

| |

| (6) | updates to the “Management Compensation” section of our prospectus; |

| |

| (7) | updates to the compensation, fees and reimbursements incurred to our advisor or its affiliates as of June 30, 2017; |

| |

| (8) | updates to the “Incorporation of Certain Information by Reference” section of our prospectus; |

| |

| (9) | certain information regarding individually material real property acquisition, including the placement of material debt on such material real property; |

| |

| (10) | individually immaterial real property acquisitions; |

| |

| (11) | updates regarding our credit facility; |

| |

| (12) | updates regarding repurchases of our shares; |

| |

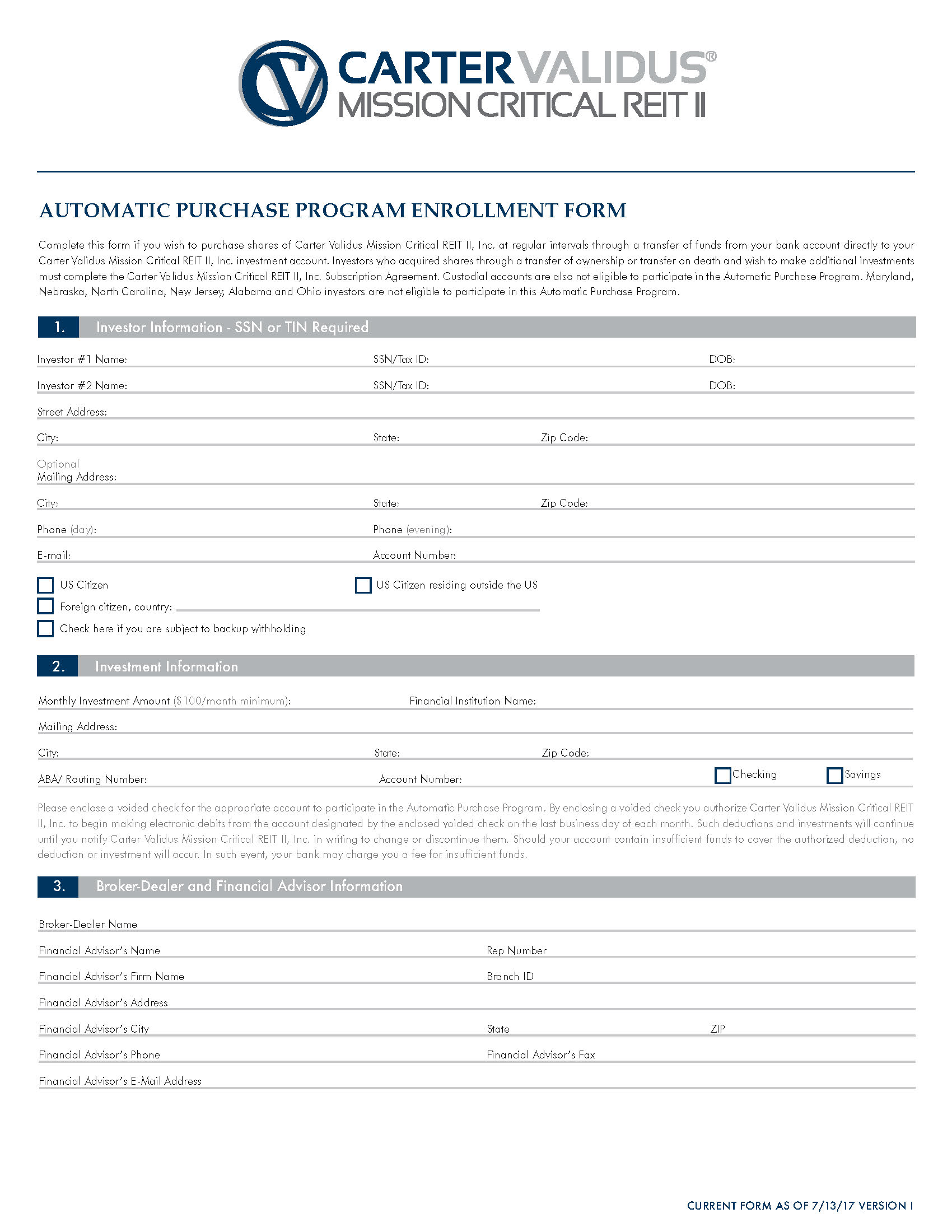

| (13) | updates regarding the automatic purchase plan; |

| |

| (14) | updates to the "Risk Factors" section of our prospectus; |

| |

| (15) | the renewal of our advisory agreement; |

| |

| (16) | the renewal of our management agreement; |

| |

| (17) | an update to the "Selected Financial Data" section of our prospectus; |

| |

| (18) | updates to the "Prior Performance Summary" section of our prospectus; |

| |

| (19) | Management’s Discussion and Analysis of Financial Condition and Results of Operations section, substantially the same as that which was filed in our Quarterly Report on Form 10-Q on August 10, 2017; |

| |

| (20) | our updated financial information; |

| |

| (21) | financial information for the individually material real property acquisition; |

| |

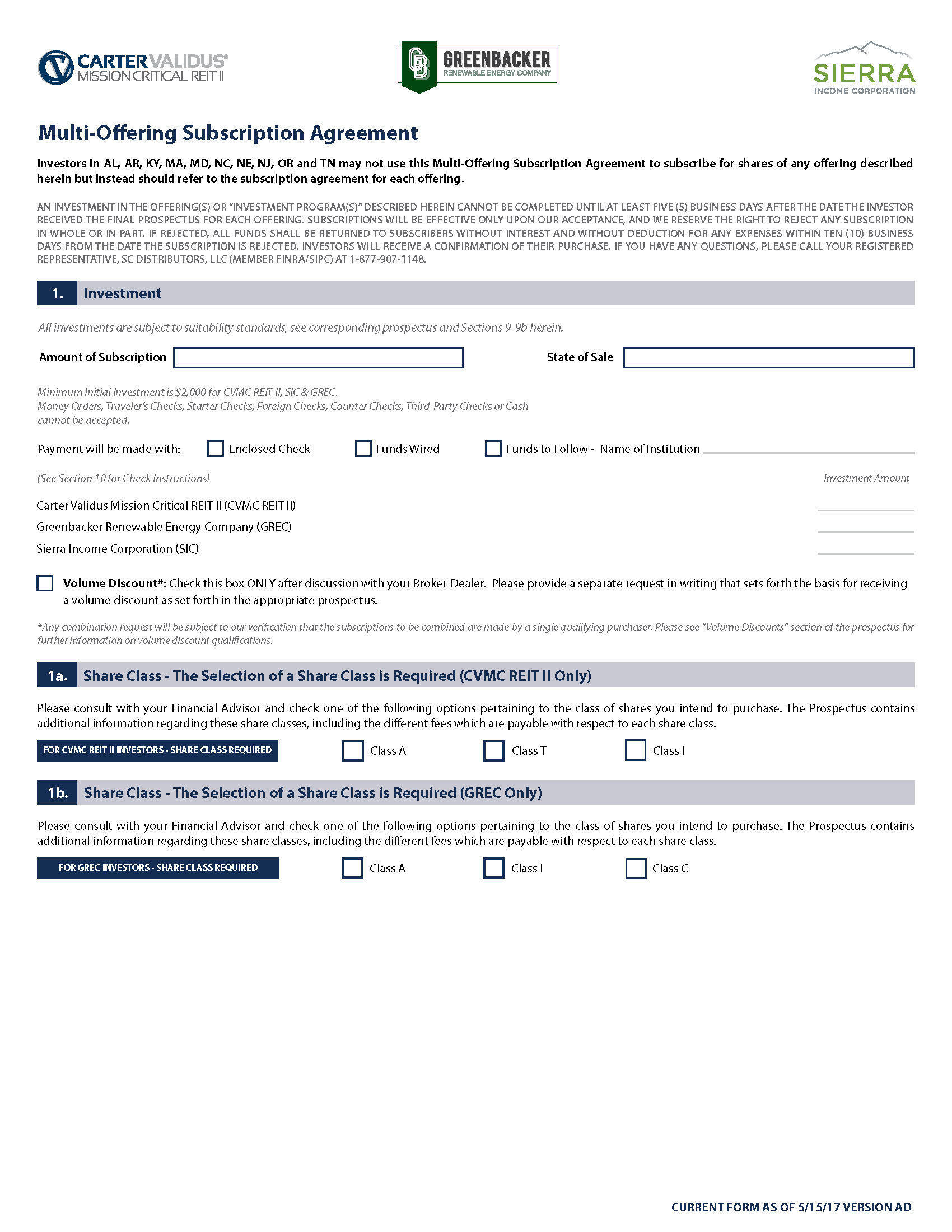

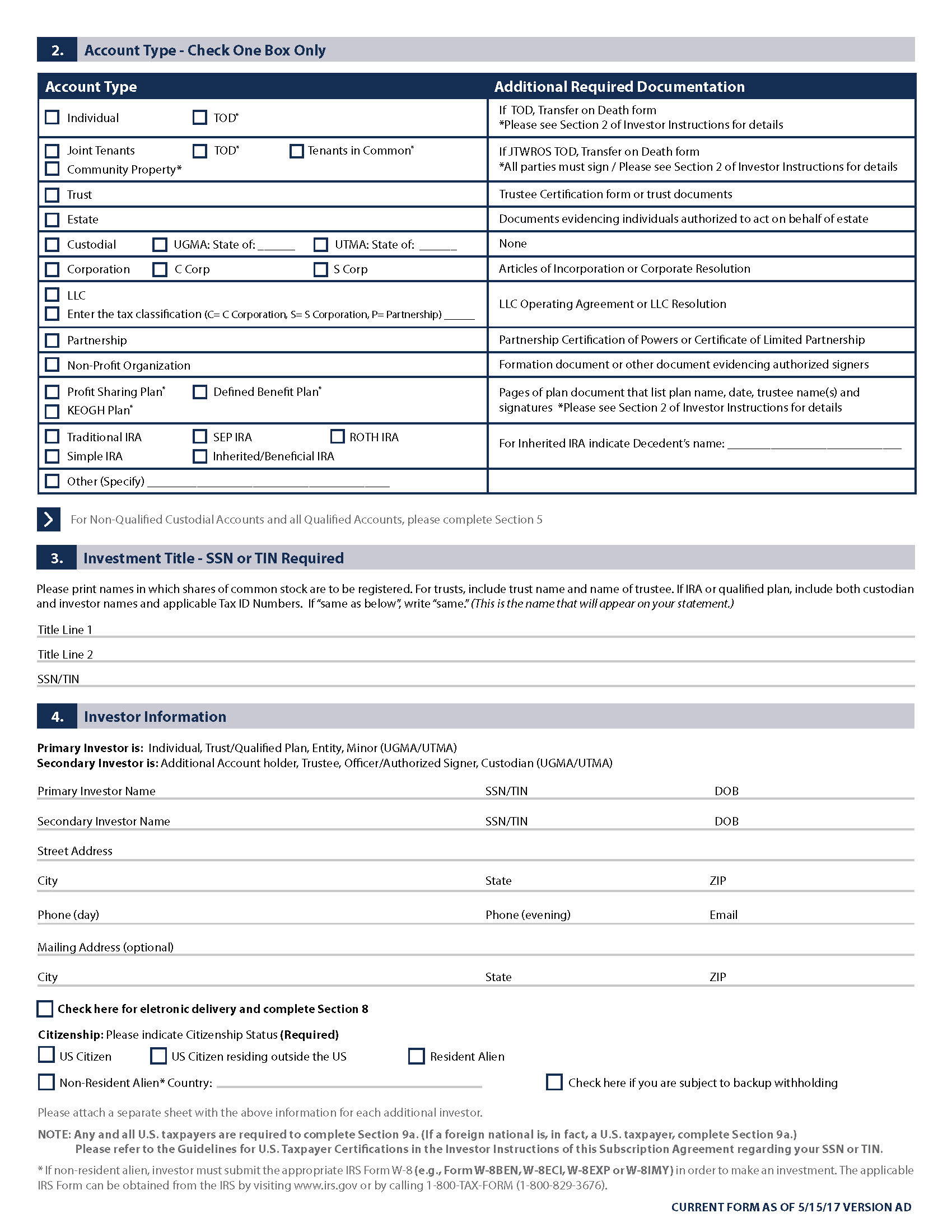

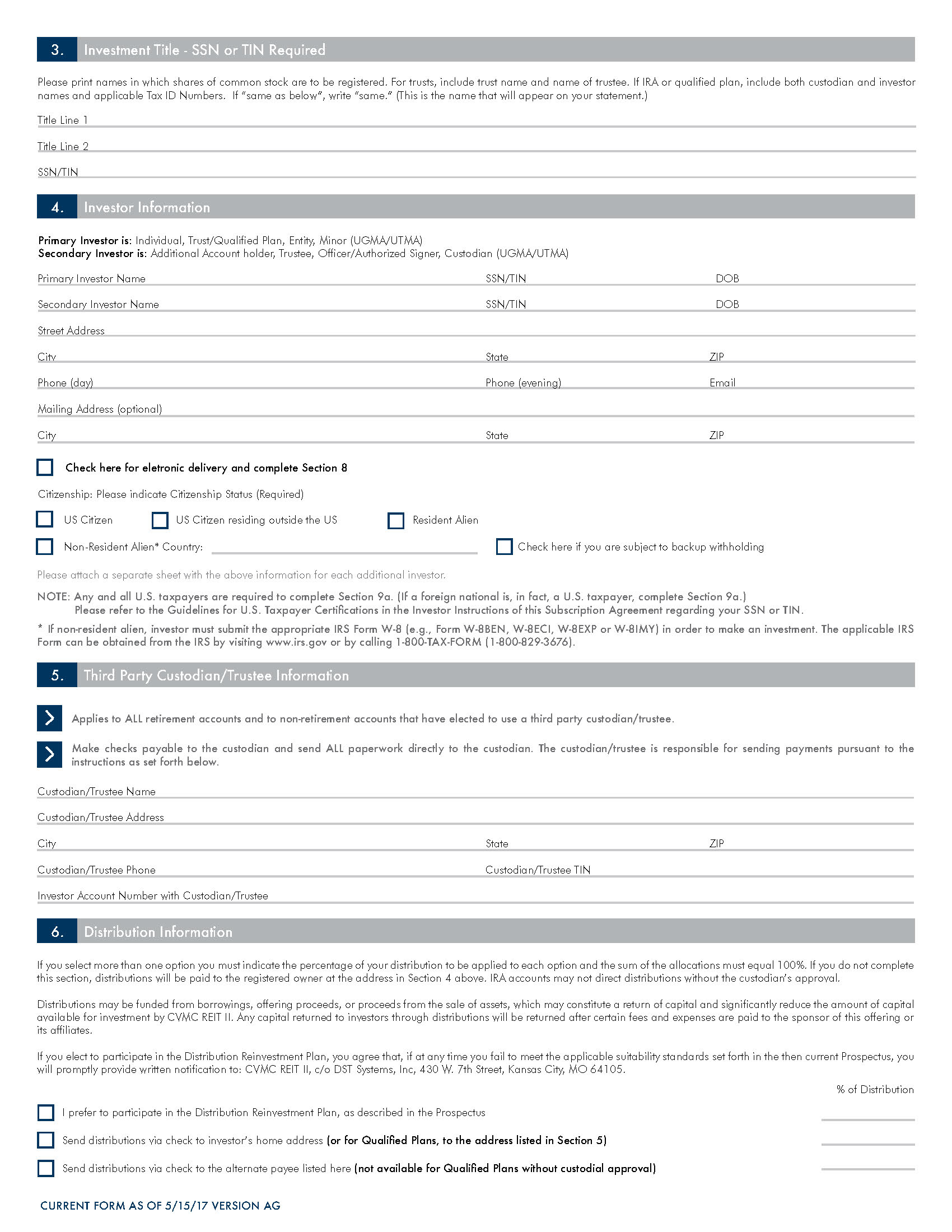

| (22) | revised forms of our subscription agreements; and |

| |

| (23) | a revised form of automatic purchase plan. |

Status of this Offering, Filing of a Registration Statement for Follow-On Offering and Termination of this Offering

We commenced our initial public offering of $2,350,000,000 of shares of our common stock (the “Offering”), consisting of up to $2,250,000,000 of shares in our primary offering and up to $100,000,000 of shares pursuant to our distribution reinvestment plan, on May 29, 2014. As of the date of this supplement, we are publicly offering shares of Class A common stock, shares of Class I common stock and shares of Class T common stock, in any combination with a dollar value up to the maximum offering amount. As of September 13, 2017, we had accepted investors’ subscriptions for and issued approximately 79,668,000 shares of Class A common stock, 3,326,000 shares of Class I common stock and 27,126,000 shares of Class T

common stock in the Offering, resulting in receipt of gross proceeds of approximately $788,961,000, $30,256,000 and $259,911,000, respectively, for total gross proceeds raised of $1,079,128,000. As of September 13, 2017, we had approximately $1,270,872,000 in Class A shares, Class I shares and Class T shares of common stock remaining in the Offering.

On May 1, 2017, we filed a Registration Statement on Form S-11 (the “Follow-On Offering Registration Statement”) under the Securities Act of 1933, as amended (the “Securities Act”) to register up to $332,500,000 of shares of Class A common stock, Class I common stock, and Class T common stock to be offered to the public on a best efforts basis pursuant to a proposed follow-on offering and up to $17,500,000 of shares of Class A common stock, Class I common stock, and Class T common stock pursuant to our distribution reinvestment plan. Accordingly, pursuant to Rule 415 promulgated under the Securities Act, we extended our current Offering until the earlier of the SEC effective date of the Follow-On Offering Registration Statement or November 25, 2017, the date that is 180 days after the third anniversary of the SEC effective date of the Offering. As of the date of this supplement, the Follow-On Offering Registration Statement has not been declared effective by the SEC. Our board of directors determined to terminate our Offering on November 24, 2017. Our board of directors may revise the offering termination date as necessary in its discretion.

Distribution Policy and Distributions

The following information supplements, and should be read in conjunction with, the discussion contained in the “Prospectus Summary — Distribution Policy” section on page 15 of the prospectus and the “Description of Securities — Distribution Policy and Distributions” section beginning on page 150 of the prospectus:

As of September 15, 2017, we had paid aggregate distributions, since inception, of approximately $100,418,000 ($44,614,000 in cash and $55,804,000 reinvested in shares of common stock pursuant to the DRIP). Our board of directors intends to continue to pay distributions monthly in arrears for so long as it decides this policy is in the best interest of our stockholders.

On August 3, 2017, the board of directors of the Company approved and declared a distribution to the Company’s Class A stockholders of record as of the close of business on each day of the period commencing on September 1, 2017 and ending on November 30, 2017. The distributions will be calculated based on 365 days in the calendar year and will be equal to $0.001767101 per share of Class A common stock, which will be equal to an annualized distribution rate of 6.40%, assuming a purchase price of $10.078 per share of Class A common stock. The distributions declared for each record date in September 2017, October 2017 and November 2017 will be paid in October 2017, November 2017 and December 2017, respectively. The distributions will be payable to stockholders from legally available funds therefor.

On August 3, 2017, the board of directors of the Company approved and declared a daily distribution to the Company’s Class I stockholders of record as of the close of business on each day of the period commencing on September 1, 2017 and ending on November 30, 2017. The distribution will be calculated based on 365 days in the calendar year and will be equal to $0.001767101 per share of Class I common stock, which will be equal to an annualized distribution rate of 7.04%, assuming a purchase price of $9.162 per share. The distributions declared for each record date in September 2017, October 2017 and November 2017 will be paid in October 2017, November 2017 and December 2017, respectively. The distributions will be payable to stockholders from legally available funds therefor.

On August 3, 2017, the board of directors of the Company approved and declared a daily distribution to the Company’s Class T stockholders of record as of the close of business on each day of the period commencing on September 1, 2017 and ending on November 30, 2017. The distribution will be calculated based on 365 days in the calendar year and will be equal to $0.001501543 per share of Class T common stock, which will be equal to an annualized distribution rate of 5.68%, assuming a purchase price of $9.649 per share. The distributions declared for each record date in September 2017, October 2017 and November 2017 will be paid in October 2017, November 2017 and December 2017, respectively. The distributions will be payable to stockholders from legally available funds therefor.

We have made the following distributions to our Class A stockholders:

|

| | | | | | |

| Period Ended | | Date Paid | | Distribution |

| July 31, 2014 | | August 1, 2014 | | $ | 439 |

|

| August 31, 2014 | | September 2, 2014 | | $ | 24,635 |

|

| September 30, 2014 | | October 1, 2014 | | $ | 66,751 |

|

| October 31, 2014 | | November 3, 2014 | | $ | 131,229 |

|

| November 30, 2014 | | December 1, 2014 | | $ | 207,526 |

|

| December 31, 2014 | | January 2, 2015 | | $ | 324,704 |

|

| January 31, 2015 | | February 2, 2015 | | $ | 446,359 |

|

| February 28, 2015 | | March 2, 2015 | | $ | 537,939 |

|

| March 31, 2015 | | April 1, 2015 | | $ | 823,200 |

|

| April 30, 2015 | | May 1, 2015 | | $ | 1,039,171 |

|

| May 31, 2015 | | June 1, 2015 | | $ | 1,299,964 |

|

| June 30, 2015 | | July 1, 2015 | | $ | 1,471,336 |

|

| July 31, 2015 | | August 3, 2015 | | $ | 1,715,689 |

|

| August 31, 2015 | | September 1, 2015 | | $ | 1,894,852 |

|

| September 30, 2015 | | October 1, 2015 | | $ | 1,982,158 |

|

| October 31, 2015 | | November 2, 2015 | | $ | 2,200,851 |

|

| November 30, 2015 | | December 1, 2015 | | $ | 2,285,962 |

|

| December 31, 2015 | | January 4, 2016 | | $ | 2,547,214 |

|

| January 31, 2016 | | February 1, 2016 | | $ | 2,719,623 |

|

| February 29, 2016 | | March 1, 2016 | | $ | 2,676,459 |

|

| March 31, 2016 | | April 1, 2016 | | $ | 2,979,045 |

|

| April 30, 2016 | | May 2, 2016 | | $ | 3,006,480 |

|

| May 31, 2016 | | June 1, 2016 | | $ | 3,210,172 |

|

| June 30, 2016 | | July 1, 2016 | | $ | 3,202,527 |

|

| July 31, 2016 | | August 1, 2016 | | $ | 3,397,713 |

|

| August 30, 2016 | | September 1, 2016 | | $ | 3,485,007 |

|

| September 30, 2016 | | October 3, 2016 | | $ | 3,441,197 |

|

| October 31, 2016 | | November 1, 2016 | | $ | 3,645,779 |

|

| November 30, 2016 | | December 1, 2016 | | $ | 3,584,726 |

|

| December 31, 2016 | | January 3, 2017 | | $ | 3,772,059 |

|

| January 31, 2017 | | February 1, 2017 | | $ | 3,846,146 |

|

| February 28, 2017 | | March 1, 2017 | | $ | 3,531,060 |

|

| March 31, 2017 | | April 3, 2017 | | $ | 3,974,566 |

|

| April 30, 2017 | | May 1, 2017 | | $ | 3,913,291 |

|

| May 31, 2017 | | June 1, 2017 | | $ | 4,106,771 |

|

| June 30, 2017 | | July 3, 2017 | | $ | 4,028,071 |

|

| July 31, 2017 | | August 1, 2017 | | $ | 4,203,103 |

|

| August 31, 2017 | | September 1, 2017 | | $ | 4,247,975 |

|

| Total Class A distributions | | | | $ | 89,971,749 |

|

We have made the following distributions to our Class I stockholders:

|

| | | | | | |

| Period Ended | | Date Paid | | Distribution |

| March 9, 2017 to March 31, 2017 | | April 3, 2017 | | $ | 1,060 |

|

| April 30, 2017 | | May 1, 2017 | | $ | 9,304 |

|

| May 31, 2017 | | June 1, 2017 | | $ | 37,369 |

|

| June 30, 2017 | | July 3, 2017 | | $ | 71,602 |

|

| July 31, 2017 | | August 1, 2017 | | $ | 106,622 |

|

| August 31, 2017 | | September 1, 2017 | | $ | 139,472 |

|

| Total Class I distributions | | | | $ | 365,429 |

|

We have made the following distributions to our Class T stockholders:

|

| | | | | | |

| Period Ended | | Date Paid | | Distribution |

| January 21, 2016 to January 31, 2016 | | February 1, 2016 | | $ | 5,101 |

|

| February 29, 2016 | | March 1, 2016 | | $ | 36,989 |

|

| March 31, 2016 | | April 1, 2016 | | $ | 81,312 |

|

| April 30, 2016 | | May 2, 2016 | | $ | 131,960 |

|

| May 31, 2016 | | June 1, 2016 | | $ | 196,058 |

|

| June 30, 2016 | | July 1, 2016 | | $ | 241,283 |

|

| July 31, 2016 | | August 1, 2016 | | $ | 303,461 |

|

| August 30, 2016 | | September 1, 2016 | | $ | 350,322 |

|

| September 30, 2016 | | October 3, 2016 | | $ | 384,775 |

|

| October 31, 2016 | | November 1, 2016 | | $ | 444,087 |

|

| November 30, 2016 | | December 1, 2016 | | $ | 477,528 |

|

| December 31, 2016 | | January 3, 2017 | | $ | 563,099 |

|

| January 31, 2017 | | February 1, 2017 | | $ | 636,143 |

|

| February 28, 2017 | | March 1, 2017 | | $ | 629,645 |

|

| March 31, 2017 | | April 3, 2017 | | $ | 761,728 |

|

| April 30, 2017 | | May 1, 2017 | | $ | 797,400 |

|

| May 31, 2017 | | June 1, 2017 | | $ | 881,721 |

|

| June 30, 2017 | | July 3, 2017 | | $ | 933,731 |

|

| July 31, 2017 | | August 1, 2017 | | $ | 1,061,369 |

|

| August 31, 2017 | | September 1, 2017 | | $ | 1,162,709 |

|

| Total Class T distributions | | | | $ | 10,080,421 |

|

For the six months ended June 30, 2017, we paid distributions of approximately $27,461,000, of which $12,812,000 was cash and $14,649,000 was reinvested in shares of our common stock pursuant to the DRIP, as compared to FFO for the six months ended June 30, 2017 of approximately $26,067,000. We define FFO, a non-GAAP measure, consistent with the standards established by the White Paper on FFO approved by the Board of Governors of National Association of Real Estate Investment Trusts, as revised in February 2004, or the White Paper. The White Paper defines FFO as net income or loss computed in accordance with generally accepted accounting principles in the United States, or GAAP, excluding gains or losses from sales of property and asset impairment writedowns, plus depreciation or amortization, and after adjustments for unconsolidated partnerships and joint ventures. Agreements for unconsolidated partnerships and joint ventures are calculated to reflect FFO. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Funds from Operations and Modified Funds from Operations” for the six months ended June 30, 2017, included in this prospectus supplement, for information regarding why we present funds from operations and for reconciliations of this non-GAAP financial measure to net income attributable to common stockholders. The payment of distributions from sources other than FFO may reduce the amount of proceeds available for investment and operations may cause us to incur additional interest expense as a result of borrowed funds and may cause subsequent investors to experience dilution.

The following table presents distributions and source of distributions for the six months ended June 30, 2017 (amounts are rounded and in thousands):

|

| | | | | | | |

| | | Six Months Ended June 30, |

| | | 2017 |

| Distributions paid in cash - common stockholders | | $ | 12,812 |

| | |

| Distributions reinvested | | 14,649 |

| | |

| Total distributions | | $ | 27,461 |

| | |

| Source of distributions: | | | | |

Cash flows provided by operations (1) | | $ | 12,812 |

| | 47 | % |

Offering proceeds from issuance of common stock pursuant to the DRIP (1) | | 14,649 |

| | 53 | % |

| Total sources | | $ | 27,461 |

| | 100 | % |

| |

| (1) | Percentages were calculated by dividing the respective source amount by the total sources of distributions. |

Reallocation of Shares Under Our Charter

All references to the allocation of shares authorized under our charter are updated as follows:

On June 2, 2017, we filed Articles Supplementary to the Second Articles of Amendment and Restatement with the State Department of Assessments and Taxation of Maryland reclassifying our Class A shares, Class I shares and Class T shares as Class T2 shares. Our charter permits our board of directors to issue up to 500,000,000 shares of common stock, of which 175,000,000 are designated as Class A shares, 75,000,000 are designated as Class I shares, 175,000,000 are designated as Class T shares and 75,000,000 are designated as Class T2 shares, and 100,000,000 shares of preferred stock. We currently do not plan to offer Class T2 shares.

Update Regarding the Distribution and Servicing Fee

On May 26, 2017, we executed the sixth amendment to our dealer manager agreement by and among us, SC Distributors, LLC, our dealer manager, and our advisor to amend certain terms of the distribution and servicing fee payable in connection with Class T shares sold in our primary offering. All references to the distribution and servicing fee are hereby updated accordingly:

With respect to Class T shares sold in the primary offering, we pay the dealer manager a distribution and servicing fee that accrues daily in an amount equal to 1/365th of up to 1.0% of the most recent offering price per Class T share on a continuous basis from year to year, payable out of amounts that otherwise would be distributed to holders of Class T shares; provided, however, that upon the termination of our primary offering, the distribution and servicing fee shall be an amount that accrues daily equal to 1/365th of up to 1.0% of the most recent estimated NAV per Class T share on a continuous basis from year to year. The dealer manager will reallow all of the distribution and servicing fees with respect to Class T shares sold in the primary offering to participating broker-dealers; provided, however, effective June 1, 2017, a participating broker-dealer may give written notice to the dealer manager that it waives all or a portion of the reallowance of the distribution and servicing fee, which waiver shall be irrevocable and will not retroactively apply to Class T shares that were previously sold through such participating broker-dealer. We will cease paying the distribution and servicing fee to the dealer manager on the earliest to occur of the following: (i) a listing of the Class T shares on a national securities exchange; (ii) following the completion of this Offering, the date on which total underwriting compensation in this Offering equals (a) 10% of the gross proceeds from our primary offering less (b) the total amount of distribution and servicing fees waived by participating broker-dealers; (iii) the date on which there are no longer any Class T shares outstanding; (iv) the fourth anniversary of the last day of the fiscal quarter in which our primary offering terminates; (v) with respect to a Class T share sold in the primary offering, the date on which a participating broker-dealer receives (a) total underwriting compensation equal to 10% of the gross offering proceeds of such Class T share less (b) the amount of any waived distribution and servicing fees by such participating broker-dealer; or (vi) the date on which the holder of such Class T share or its agent notifies us or our agent that he or she is represented by a new participating broker-dealer; provided that we will continue paying the Class T distribution and servicing fee, which shall be re-allowed to the new participating broker-dealer, if the new participating broker-dealer enters into a participating broker-dealer agreement with our dealer manager or otherwise agrees to provide the services set forth in the dealer manager agreement. We cannot predict when this will occur. The distribution and servicing fee paid in respect of Class T shares sold in the primary offering is allocated to the Class T shares as a class cost, and, therefore, these fees will impact the amount of distributions payable on all Class T shares, including those issued under our distribution reinvestment plan. We deduct the distribution and servicing fee from amounts that would otherwise be available for distribution to Class T stockholders on a class basis. We will continue to deduct the full amount of the distribution and servicing fee that we would have paid to the dealer manager (which the dealer manager would have reallowed to a participating broker-dealer) from amounts otherwise available

for distribution to all Class T stockholders if we cease paying the distribution and servicing fee to the dealer manager because (i) a participating broker-dealer waives its right to receive reallowance of all of the distribution and servicing fees payable with respect to a Class T share or (ii) a Class T stockholder is represented by a new participating broker-dealer that does not enter into a participating broker-dealer agreement with our dealer manager or does not otherwise agree to provide the services set forth in the dealer manager agreement.

Questions and Answers About This Offering

The "Questions and Answers About This Offering — Why are we offering three classes of common stock, and what are the similarities and differences among the classes" section beginning on page 4 of the prospectus is hereby superseded and replaced with the following:

Q: Why are we offering three classes of our common stock, and what are the similarities and differences among the classes?

A: We are offering three classes of our common stock in order to provide investors with more flexibility in making their investment in us and to provide participating broker-dealers more flexibility to facilitate investment in us. Class A and Class T shares are available through brokerage and transaction-based accounts. Class I shares are available for purchase in this offering only (1) through fee-based programs of participating broker-dealers, also known as wrap accounts, that provide access to Class I shares, (2) through registered investment advisers not affiliated with a participating broker-dealer, (3) by endowments, foundations, pension funds and other institutional investors or (4) other categories of investors that we name in an amendment or supplement to this prospectus. Before making your investment decision, please consult with your investment adviser regarding your account type and the classes of common stock you may be eligible to purchase.

Each share of our common stock, regardless of class, will be entitled to one vote per share on matters presented to the common stockholders for approval, including election of directors. The differences between each class relate to the fees and selling commissions payable in respect of each class. The following summarizes the differences in fees and selling commissions among the classes of our common stock offered in our primary offering:

|

| | | | | |

| | Per Class A Share | | Per Class I Share | | Per Class T Share |

| Primary Offering Price | $10.078 | | $9.162 | | $9.649 |

| Selling Commissions | 7.0% | | — | | 3.0% |

| Dealer Manager Fee | 3.0% | | 1.0% (1) | | 3.0% |

Distribution and Servicing Fee (3) | — | | — | | 1.0% (2) |

| |

| (1) | The dealer manager may receive up to 2.0% of the gross offering proceeds from the sale of Class I shares as a dealer manager fee, of which 1.0% will be funded by our advisor without reimbursement from us. The 1.0% of the dealer manager fee paid from offering proceeds will be waived in the event an investor purchases Class I shares through a registered investment adviser that is not affiliated with a broker dealer. In such event, the per share purchase price of the Class I shares would be $9.07. The dealer manager may reallow all or a portion of such dealer manager fee to participating broker-dealers. |

| |

| (2) | With respect to Class T shares sold in the primary offering, we will pay our dealer manager a distribution and servicing fee that accrues daily equal to 1/365th of 1.0% of the amount of the most recent purchase price per Class T share on a continuous basis from year to year, payable out of amounts that otherwise would be distributed to holders of Class T shares; provided, however, that upon the termination of our primary offering, the distribution and servicing fee shall be an amount that accrues daily equal to 1/365th of up to 1.0% of the most recent estimated NAV per Class T share on a continuous basis from year to year. We will cease paying distribution and servicing fees with respect to all Class T shares sold in the primary offering (other than pursuant to the DRIP Offering) on the earliest to occur of the following: (i) a listing of the Class T shares on a national securities exchange, (ii) following the completion of this Offering, total underwriting compensation in this Offering equaling 10.0% of the gross proceeds from the primary offering, (iii) there are no longer any Class T shares outstanding, (iv) the fourth anniversary of the last day of the fiscal quarter in which our primary offering terminates, (v) with respect to a Class T share sold in the primary offering, the date on which a participating broker-dealer receives (a) total underwriting compensation equal to 10% of the gross offering proceeds of such Class T share less (b) the amount of any waived distribution and servicing fees by such participating broker-dealer; or (vi) the date on which the holder of such Class T share or its agent notifies us or our agent that he or she is represented by a new participating broker-dealer; provided that we will continue paying the Class T distribution and servicing fee, which shall be re-allowed to the new participating broker-dealer, if the new participating broker-dealer |

enters into a participating broker-dealer agreement with our dealer manager or otherwise agrees to provide the services set forth in the dealer manager agreement. We cannot predict the length of time over which we will pay distribution and servicing fees due to a number of factors that are not within our control, such as the pace of fundraising and the portion of shares sold that are Class A and Class I compared to Class T. As of September 13, 2017, we had $1,226,672,000 in gross proceeds remaining for sale in the primary offering. Assuming the remaining $1,226,672,000 in gross proceeds come solely from the sale of Class T shares, the aggregate amount of distribution and servicing fees we may pay is approximately $52,764,000, assuming no distribution and servicing fees are waived. We will not pay selling commissions, dealer manager fees or distribution and servicing fees with respect to shares issued under our DRIP.

| |

| (3) | The distribution and servicing fee will be paid with respect to ongoing services provided to our stockholders, which ongoing services may include providing ongoing or regular account or portfolio maintenance for the stockholder, assisting with recordkeeping, responding to investor inquiries regarding distribution payments, providing services to investors related to the share repurchase program, offering to meet with a stockholder to provide overall guidance on the stockholder’s investment in us or to answer questions about the account statement or valuations, and/or providing other similar services as the stockholder may reasonably require in connection with his or her investment. While we expect that the participating broker-dealer of record for a Class A stockholder or Class I stockholder may provide similar services to a Class A stockholder or Class I stockholder, it is under no contractual obligation to do so and we will not pay a distribution and servicing fee for such services. |

Class A Shares

| |

| • | An upfront selling commission, which is a one-time fee charged at the time of purchase of the shares. The selling commissions and, in some cases, the dealer manager fee, will not be charged or may be reduced with regard to shares sold to or for the account of certain categories of purchasers. Class A shares are available through brokerage and transaction-based accounts. See “Plan of Distribution” for additional information. |

| |

| • | No distribution and servicing fee. |

| |

| • | Assuming (i) a constant primary offering price of $10.078 per Class A share; (ii) that shares are sold through distribution channels associated with the highest possible selling commissions and dealer manager fees; and (iii) that none of the shares purchased are repurchased or otherwise disposed of, we expect that with respect to a one-time $10,000 investment in Class A shares, $700 in selling commissions will be paid at the time of the investment and $300 in dealer manager fees will be paid at the time of investment, for a total of $1,000 in selling commissions and dealer manager fees. |

Class I Shares

| |

| • | No upfront selling commission and lower dealer manager fee than Class A and Class T shares. |

| |

| • | No distribution and servicing fee. |

| |

| • | Class I shares are available for purchase in this offering only (1) through fee-based programs of participating broker-dealers, also known as wrap accounts, that provide access to Class I shares, (2) through registered investment advisers not affiliated with a participating broker-dealer, (3) by endowments, foundations, pension funds and other institutional investors or (4) other categories of investors that we name in an amendment or supplement to this prospectus. |

| |

| • | Assuming (i) a constant primary offering price of $9.162 per Class I share; (ii) that shares are sold with a 1.0% dealer manager fee (ii) that none of the shares purchased are repurchased or otherwise disposed of, we expect that with respect to a one-time $10,000 investment in Class I shares, $100 in dealer manager fees will be paid by an investor at the time of investment. Please see footnote (1) on page 6 of this prospectus supplement for more information on the dealer manager fees payable in connection with Class I shares. |

Class T Shares

| |

| • | Lower upfront selling commission than Class A shares. The selling commissions and, in some cases, the dealer manager fee, will not be charged or may be reduced with regard to shares sold to or for the account of certain categories of purchasers. Class T shares are available through brokerage and transaction-based accounts. See “Plan of Distribution” for additional information. |

| |

| • | Class T shares purchased in the primary offering pay a distribution and servicing fee which will accrue daily in the amount of 1/365th of 1.0% of the amount of the most recent offering price per Class T share on a continuous basis from year to year, payable out of amounts that otherwise would be distributed to holders of Class T shares; provided, however, that upon the termination of our primary offering, the distribution and servicing fee shall be an amount that accrues daily equal to 1/365th of up to 1.0% of the most recent estimated NAV per Class T share on a continuous basis |

from year to year. Such fee may increase the cost of your investment and may cost you more than paying other types of selling commissions. The distribution and servicing fee paid in respect of Class T shares sold in the primary offering will be allocated to the Class T shares as a class cost, and these fees will impact the amount of distributions payable on all Class T shares, including those issued under our distribution reinvestment plan.

| |

| • | Assuming (i) a constant primary offering price of $9.649 per Class T share; (ii) that shares are sold through distribution channels associated with the highest possible selling commissions and dealer manager fees and (iii) that none of such shares purchased are redeemed or otherwise disposed of and that distribution and servicing fees are paid over four years after the last day of the fiscal quarter in which our primary offering terminates, we expect that with respect to a one-time investment of $10,000, $300 in selling commissions will be paid at the time of investment, $300 in dealer manager fees will be paid at the time of investment, and approximately $600 in distribution and servicing fees will be deducted from amounts otherwise distributable to Class T stockholders, assuming that the Class T stockholder purchased the Class T share in the primary offering on January 6, 2016, the date that we sold the first Class T share in the primary offering, and that the distribution and servicing fee is paid through the fourth anniversary of the last day of the fiscal quarter in which our primary offering terminates, which for purposes of this example, we have assumed a termination date of November 24, 2017, which is the termination date set by our board of directors. Our board of directors may revise the offering termination date as necessary in its discretion. |

The fees and expenses listed above, including the distribution and servicing fee, will be allocated on a class-specific basis. The payments of class-specific expenses are expected to result in different amounts of distributions being paid with respect to each class of shares. Specifically, we will reduce the amount of distributions that would otherwise be authorized on Class T shares to account for the ongoing distribution and servicing fee payable on Class T shares. Therefore, distributions on Class T shares are expected to be lower than distributions on Class A shares and Class I shares because Class T shares are subject to ongoing distribution and servicing fees. In addition, as a result of the allocation of the distribution and servicing fee to the Class T shares as a class, the Class T shares could have a lower NAV per share than Class A shares and Class I shares if distributions on the Class T shares are not adjusted to take account of such fee. See “Description of Securities” and “Plan of Distribution” for a discussion of the differences between our classes of shares.

In the event of any voluntary or involuntary liquidation, dissolution or winding up of us, or any liquidating distribution of our assets, then such assets, or the proceeds therefrom, will be distributed between the holders of Class A shares, Class I shares, and Class T shares ratably in proportion to their respective NAV for each class until the NAV for each class has been paid. The estimated value per share will be calculated on a company-wide basis, with any adjustments to Class A shares, Class I shares, or Class T shares made subsequent to such company-wide calculation. Each holder of shares of a particular class of common stock will be entitled to receive, ratably with each other holder of shares of such class, that portion of such aggregate assets available for distribution as the number of outstanding shares of such class held by such holder bears to the total number of outstanding shares of such class then outstanding. See “Description of Securities” for more details regarding our classes of shares.

Only Class A shares (when Class A shares are purchased through a broker-dealer that sells Class A and Class T shares) and Class T shares (when Class T shares are purchased through a broker-dealer that only sells Class T shares) are available for purchase in this Offering by our executive officers and board of directors and their immediate family members, as well as officers and employees of the advisor and other affiliates of the advisor and their immediate family members and, if approved by our management, joint venture partners, consultants and other service providers. Before making your investment decision, please consult with your financial advisor regarding your account type and the classes of common stock you may be eligible to purchase.

Management Compensation Table

The following rows and footnotes supersede and replace the corresponding rows and footnotes in the table contained in the “Prospectus summary — Compensation to Our Advisor and Its Affiliates” section beginning on page 17 of the prospectus and the table contained in the “Management Compensation” table section beginning on page 83 of the prospectus:

|

| | | | |

| | | | | |

| Type of Compensation/Affiliate | | Determination of Amount | | Estimated Amount for Maximum Offering |

| | | | | |

| Distribution and Servicing Fee – Class T shares – SC Distributors, LLC | | With respect to Class T shares sold in our primary offering, we pay the dealer manager a distribution and servicing fee that accrues daily in an amount equal to 1/365th of up to1.0% of the most recent offering price per Class T share on a continuous basis from year to year, payable out of amounts that otherwise would be distributed to holders of Class T shares; provided, however, that upon the termination of our primary offering, the distribution and servicing fee shall be an amount that accrues daily equal to 1/365th of up to 1.0% of the most recent estimated NAV per Class T share on a continuous basis from year to year. The dealer manager will reallow all of the distribution and servicing fee to participating broker-dealers unless, on or after June 1, 2017 and until we cease offering Class T shares in our primary offering, a participating broker-dealer waived its right to receive reallowance of all of the distribution and servicing fee. We will cease paying the distribution and servicing fee to the dealer manager on the earliest to occur of the following: (i) a listing of the Class T shares on a national securities exchange; (ii) following the completion of this Offering, the date on which total underwriting compensation in this Offering equals (a) 10% of the gross proceeds from our primary offering less (b) the total amount of distribution and servicing fees waived by participating broker-dealers; (iii) the date on which there are no longer any Class T shares outstanding; (iv) the fourth anniversary of the last day of the fiscal quarter in which our primary offering terminates; (v) with respect to a Class T share sold in the primary offering, the date on which a participating broker-dealer receives (a) total underwriting compensation equal to 10% of the gross offering proceeds of such Class T share less (b) the amount of any waived distribution and servicing fees by such participating broker-dealer, or (vi) the date on which the holder of such Class T share or its agent notifies us or our agent that he or she is represented by a new participating broker-dealer; provided that we will continue paying the Class T distribution and servicing fee, which shall be re-allowed to the new participating broker-dealer, if the new participating broker-dealer enters into a participating broker-dealer agreement with our dealer manager or otherwise agrees to provide the services set forth in the dealer manager agreement. We cannot predict when this will occur. The distribution and servicing fee in connection with Class T shares is payable monthly in arrears. We will not pay a distribution and servicing fee with respect to Class A shares, Class I shares or any shares issued under our distribution reinvestment plan. | | Actual amounts depend upon the number of Class T shares sold and, therefore, cannot be determined at this time. We currently estimate that we will pay the distribution and servicing fees up to 6 years, but in no event will our underwriting expenses exceed 10% of our gross offering proceeds. We cannot predict the length of time over which we will pay distribution and servicing fees due to a number of factors that are not within our control, such as the pace of fundraising and the portion of shares sold that are Class A and Class I compared to Class T. As of September 13, 2017, we had $1,226,672,000 in shares remaining for sale in the primary offering. Assuming the remaining $1,226,672,000 in gross proceeds come solely from the sale of Class T shares, the aggregate amount of distribution and servicing fees we may pay is approximately $52,764,000, assuming no distribution and servicing fees are waived. |

| | | | | |

| Operating Expenses – Carter Validus Advisors II, LLC | | We reimburse our advisor at the end of each fiscal quarter for operating expenses incurred on our behalf, subject to the limitation that we will not reimburse our advisor for any amount by which our operating expenses (2) (including the asset management fee) in the four immediately preceding fiscal quarters exceeds the greater of (a) 2.0% of average invested assets or (b) 25.0% of net income other than any additions to reserves for depreciation, bad debt or other similar non-cash reserves and excluding any gain from the sale of assets for that period, unless our independent directors have determined that such excess expenses are justified, based on unusual and non-recurring factors that they deem sufficient. Operating expenses do not include the property management and leasing fee or construction management fee. For these purposes, “average invested assets” means, for any period, the average of the aggregate book value of our assets invested, directly or indirectly, in equity interests in and loans secured by real estate assets before deducting depreciation, bad debts or other similar non-cash reserves, computed by taking the average of these values at the end of each month during the period. Additionally, we will not reimburse our advisor for personnel costs in connection with services for which our advisor receives acquisition fees or disposition fees.

We perform the above calculation on a quarterly basis to ensure that the operating expense reimbursements are within these limitations.

| | Not determinable at this time. |

|

| | | | |

| | | | | |

| Type of Compensation/Affiliate | | Determination of Amount | | Estimated Amount for Maximum Offering |

| | | | | |

Property Management and Leasing Fees – Carter Validus Real Estate Management Services II, LLC (2) | | In connection with the rental, leasing, operation and management of our properties, we pay our property manager and its affiliates aggregate fees equal to 3.0% of gross revenues from the properties managed. We also reimburse the property manager and its affiliates for property-level expenses that any of them pay or incur on our behalf, including salaries, bonuses and benefits of persons employed by the property manager and its affiliates except for the salaries, bonuses and benefits of persons who also serve as one of our executive officers. Our property manager and its affiliates may subcontract the performance of their duties to third parties and pay all or a portion of the property management fee to the third parties with whom they contract for these services. If we contract directly with third parties for such services, we will pay them customary market fees and may pay our property manager an oversight fee equal to 1.0% of the gross revenues of the property managed. In no event will we pay our property manager, our advisor or any affiliate both a property management fee and an oversight fee with respect to any particular property. (1)

We also will pay our property manager a separate fee in connection with leasing properties to new tenants or renewals or expansions of existing leases with existing tenants in an amount not to exceed the fee customarily charged in arm’s-length transactions by others rendering similar services in the same geographic area for similar properties as determined by a survey of brokers and agents in such area and which is typically less than $1,000. | | Not determinable at this time. Because the fees are based on a fixed percentage of gross revenue or market rates, there is no maximum dollar amount of these fees. |

| | | | | |

Construction Management Fee – Carter Validus Real Estate Management Services II, LLC (2) | | For acting as general contractor and/or construction manager to supervise or coordinate projects or to provide major repairs or rehabilitation on our properties, we may pay up to 5.0% of the cost of the projects, repairs and/or rehabilitation, as applicable. | | Not determinable at this time. Because the fee is based on a fixed percentage of certain costs, there is no maximum dollar amount of this fee. |

| |

| (1) | Notwithstanding the foregoing, our advisor and its affiliates may be entitled to receive higher fees if our property manager demonstrates to the satisfaction of a majority of our directors (including a majority of the independent directors) that a higher competitive fee is justified for the services rendered. |

| |

| (2) | Property management and leasing fees and construction management fees are not operating expenses and therefore are not subject to the North American Securities Administrators Association, or NASAA, REIT Guidelines' limitations on operating expenses. The construction management fee is considered an acquisition fee pursuant to the NASAA REIT Guidelines and is subject to the NASAA REIT Guidelines' limitations on acquisition fees. |

Compensation, Fees and Reimbursements Incurred to our Advisor and its Affiliates

The section that immediately follows the Management Compensation table beginning on page 83 of the prospectus supplements and should be read in conjunction with the following information:

The following table summarizes the cumulative compensation, fees and reimbursements related to the offering stage during the period reflected below and amounts outstanding during the period reflected below (amounts are rounded):

|

| | | | | | | | |

| | | Incurred | | Outstanding |

| | | As of June 30, 2017 | | As of June 30, 2017 |

| Offering Stage: | | | | |

Selling commissions (1) | | $ | 51,856,000 |

| | $ | — |

|

Dealer manager fee (2) | | 27,587,000 |

| | — |

|

Distribution and servicing fees (3) | | 10,672,000 |

| | 9,475,000 |

|

Other offering expenses (4) | | 15,510,000 |

| | 627,000 |

|

| | | $ | 105,625,000 |

| | $ | 10,102,000 |

|

| |

| (1) | Our dealer manager re-allowed approximately $51,856,000 of the selling commissions incurred as of June 30, 2017. |

| |

| (2) | Our dealer manager re-allowed approximately $9,731,000 of the dealer manager fees incurred as of June 30, 2017. |

| |

| (3) | Our dealer manager re-allowed approximately $1,197,000 of the distribution and servicing fees that were paid as of June 30, 2017. As of June 30, 2017, we had accrued approximately $9,475,000 of distribution and servicing fees, which represents the maximum amount the Company may pay in the future with respect to Class T shares issued in the primary portion of our offering. |

| |

| (4) | We reimbursed our advisor or its affiliates approximately $14,528,000 in other offering costs as of June 30, 2017, and we paid our advisor or its affiliates $355,000 in other offering costs related to subscription agreements as of June 30, 2017. |

The following table summarizes the cumulative compensation, fees and reimbursements related to the operational stage as of the period reflected below (amounts are rounded):

|

| | | | | | | | |

| | | Incurred | | Outstanding |

| | | As of June 30, 2017 | | As of June 30, 2017 |

| Acquisitions and Operations Stage: | | | | |

| Acquisition fees | | $ | 28,790,000 |

| | $ | — |

|

| Asset management fees | | 11,249,000 |

| | 883,000 |

|

| Property management and leasing fees and expenses | | 3,452,000 |

| | 352,000 |

|

| Construction management fees | | 1,157,000 |

| | 182,000 |

|

| Operating expenses | | 3,222,000 |

| | 397,000 |

|

| | | $ | 47,870,000 |

| | $ | 1,814,000 |

|

As of June 30, 2017, no commissions or fees were incurred for services provided by our advisor and its affiliates related to the liquidation/listing stage.

Incorporation of Certain Information By Reference

The section entitled “Incorporation of Certain Information By Reference” on page 184 of the prospectus is superseded and replaced in its entirety as follows:

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

We have elected to “incorporate by reference” certain information into this prospectus. By incorporating by reference, we are disclosing important information to you by referring you to documents we have filed separately with the SEC. The information incorporated by reference is deemed to be part of this prospectus, except for information incorporated by reference that is superseded by information contained in this prospectus. You may read and copy any document we have electronically filed with the SEC at the SEC’s public reference room in Washington, D.C. at 100 F Street, N.E., Washington, D.C. 20549. Call the SEC at 1-800-SEC-0330 for further information about the operation of the public reference room. In addition, any document we have electronically filed with the SEC is available at no cost to the public over the Internet at the SEC’s website at www.sec.gov. You can also access documents that are incorporated by reference into this prospectus at our website, www.cvmissioncriticalreit2.com. The contents of our website are not incorporated by reference in, or otherwise a part of, this prospectus.

The following documents filed with the SEC are incorporated by reference in this prospectus, except for any document or portion thereof deemed to be “furnished” and not filed in accordance with SEC rules:

| |

| • | Annual Report on Form 10-K for the fiscal year ended December 31, 2016, filed with the SEC on March 16, 2017; |

| |

| • | Quarterly Report on Form 10-Q for the quarter ended March 31, 2017, filed with the SEC on May 12, 2017; |

| |

| • | Quarterly Report on Form 10-Q for the quarter ended June 30, 2017, filed with the SEC on August 10, 2017; |

| |

| • | The information specifically incorporated by reference into our Annual Report on Form 10-K for the fiscal year ended December 31, 2016 from our Definitive Proxy Statement on Schedule 14A, filed with the SEC on April 26, 2017; and |

| |

| • | Current Reports on Form 8-K and on Form 8-K/A filed with the SEC on January 18, 2017, February 10, 2017, March 6, 2017, March 23, 2017, April 4, 2017, May 5, 2017, May 15, 2017, May 17, 2017, May 30, 2017, June 6, 2017, June 21, 2017, June 22, 2017, July 5, 2017, July 17, 2017, July 21, 2017, August 7, 2017, August 18, 2017, August 22, 2017, August 29, 2017 and August 31, 2017. |

We will provide to each person to whom this prospectus is delivered a copy of any or all of the information that we have incorporated by reference into this prospectus, as supplemented, but not delivered with this prospectus. To receive a free copy

of any of the reports or documents incorporated by reference in this prospectus, other than exhibits, unless they are specifically incorporated by reference in those documents, write or call us at 4890 West Kennedy Blvd., Suite 650, Tampa, Florida 33609, (888) 292-3178, Attn: Investor Services. The information relating to us contained in this prospectus does not purport to be comprehensive and should be read together with the information contained in the documents incorporated or deemed to be incorporated by reference in this prospectus.

Description of Real Estate Investments

The following information replaces in its entirety the first full paragraph and the second full paragraph on page 14 of the “Prospectus Summary—Description of Real Estate Investments” section of the prospectus and on page 108 of the “Investment Objectives, Strategy and Policies—Description of Real Estate Investments” section of the prospectus:

We engage in the acquisition and ownership of quality income-producing commercial real estate with a focus on data centers and healthcare facilities, preferably with long-term creditworthy tenants.

As of September 15, 2017, on a portfolio level, we, through wholly-owned subsidiaries of our operating partnership, owned a combination of the fee simple interest and leasehold interest in 63 properties located in various states, consisting of approximately 4,656,000 gross rentable square feet of commercial space. As of September 15, 2017, our properties that are subject to net leases have a consolidated weighted average yield of 7.87%. As of September 15, 2017, our leases have average annual rent escalations of 2.12%.

The following information replaces in its entirety the first sentence of the first full paragraph on the cover page of the prospectus:

Carter Validus Mission Critical REIT II, Inc. is a Maryland corporation incorporated on January 11, 2013 that intends to invest primarily in quality income-producing commercial real estate, with a focus on the data center and healthcare property sectors, net leased to long-term creditworthy tenants, as well as making other real estate investments that relate to such property types.

Individually Material Real Property Acquisitions

The following information supplements, and should be read in conjunction with, the "Investment Objectives, Strategy and Policies - Description of Real Estate Investments" section beginning on page 108 of the prospectus:

On June 15, 2017, we, through CVOP II, acquired from an unaffiliated third-party seller a combination of fee simple and leasehold interests in a 995,728 gross rentable square foot data center, or the 250 Williams Atlanta Data Center, located in Atlanta, Georgia, which we consider a material property acquisition. We funded the acquisition with (1) a loan in the aggregate principal amount of $116,200,000 from KeyBank National Association, which is secured by the 250 Williams Atlanta Data Center, (2) net proceeds from our Offering and (3) proceeds from our secured credit facility.

The following information replaces in its entirety the table beginning on page 108 contained in the “Investment Objectives, Strategy and Policies—Description of Real Estate Investments” section of the prospectus:

The following table summarizes our material real estate property as of September 15, 2017:

|

| | | | | | | | | | | | | | | | | | | | | | | | |

| Property Description* | | Date Acquired | | Year Constructed | | Contract Purchase Price (1) | | Property Taxes | | Fees Paid to Sponsor (2) | | Total Rentable Square Feet | | Physical Occupancy | | Location | | MSA(3) |

| 250 Williams Atlanta Data Center | | 06/15/2017 | | 1989 (4) | | $ | 166,000,000 |

| | $ | 2,034,000 |

| (5) | $ | 3,320,000 |

| | 995,728 | | 88.3% | | Atlanta, GA | | Atlanta - Sandy Springs - Roswell, GA |

| |

| (1) | Contract purchase price excludes acquisition fees and costs. |

| |

| (2) | Fees paid to the sponsor include payments made to an affiliate of our advisor for acquisition fees in connection with the property acquisition. It does not include fees paid to any property manager, including our affiliated property manager. For more detailed information on fees paid to our advisor or its affiliates, see the section captioned “Management Compensation” beginning on page 83 of the prospectus. |

| |

| (3) | Our property is located in one metropolitan statistical area, or MSA, and as such may compete with other facilities for tenants if the current leases are not renewed. |

| |

| (4) | The 250 Williams Atlanta Data Center was renovated in 2007. |

| |

| (5) | Represents the real estate taxes for 2016. |

| |

| * | We believe the property is suitable for its present and intended purposes and adequately covered by insurance. |

Tenant Lease Terms

The following information replaces in its entirety the table on page 113 contained in the “Investment Objectives, Strategy and Policies–Tenant Lease Terms” section of the prospectus:

|

| | | | | | | | | | | | | | |

Property

Description | | Major

Tenants (1) | | Total Square Feet Leased | | % of Total Square Feet Leased | | Number of Renewal Options (2) | | Annual Base Rent at Acquisition | | Annual Base Rent Per Square Foot at Acquisition | | Lease Expiration |

| 250 Williams Atlanta Data Center | | American Cancer Society, Inc. (3) | | 273,707 | | 27.49% | | 2/5 yr. or 1/10 yr. | | $4,789,872 | (7) | $17.50 | | 06/30/2022 |

| | | 2,964 | | 0.30% | | None | | $41,869 | (8) | $14.13 | | 11/30/2018 |

| 250 Williams Atlanta Data Center | | U.S. South Communications, Inc. (4) | | 195,805 | | 19.66% | | 2/5 yr. | | $3,853,276 | (9) | $19.68 | | 12/31/2021 |

| 250 Williams Atlanta Data Center | | Internap Network Services Corporation (5) | | 131,976 | | 13.25% | | 1/5 yr. | | $3,705,686 | (10) | $28.08 | | 04/30/2020 |

| 250 Williams Atlanta Data Center | | Georgia Lottery Corporation (6) | | 102,568 | | 10.30% | | 1/10 yr. | | $2,006,366 | (11) | $19.56 | | 06/30/2023 |

| |

| (1) | Major tenants include those that occupy greater than 10% of the rentable square feet of their respective property. We believe each of these tenants is creditworthy. |

| |

| (2) | Represents the number of option renewal period/term of each option. |

| |

| (3) | The tenant entered into a modified gross lease pursuant to which the tenant is required to pay its pro rata share of operating expenses as defined in the lease. We are responsible for the roof, foundation, all structural portions of the building, the building mechanical, electrical, plumbing and HVAC systems, the parking facilities, the common areas, the landscaped areas, the base building life safety systems and exterior surface of the building. |

| |

| (4) | The tenant entered into a modified gross lease pursuant to which the tenant is required to pay its pro rata share of operating expenses as defined in the lease. We are responsible for the building, the parking facilities, the public areas and the landscaped areas. |

| |

| (5) | The tenant entered into a modified gross lease pursuant to which the tenant is required to pay its pro rata share of operating expenses as defined in the lease. We are responsible for the roof, structural portions of the exterior and interior of the building, the base building systems, including base building mechanical, electrical, plumbing, vertical transportation, and life safety systems, and the landscaped areas. |

| |

| (6) | The tenant entered into a modified gross lease pursuant to which the tenant is required to pay its pro rata share of operating expenses as defined in the lease. We are responsible to maintain in good order and repair the building, including the roof and structural portions of the exterior and interior of the building, and the building systems. |

| |

| (7) | The annual base rent under the lease increased by $2.25 per leased square foot on July 1, 2017 and no escalations thereafter. |

| |

| (8) | The annual base rent under the lease increases by approximately 3.0% of the then-current annual base rent. |

| |

| (9) | The annual base rent associated with 191,709 leased square feet increases by 2.0% of the then-current annual base rent, and the annual base rent associated with 4,096 leased square feet has no rental escalations. |

| |

| (10) | The annual base rent associated with 110,797 leased square feet increases by an amount equal to 15 times the percentage increase in the Consumer Price Index of the then-current annual base rent, provided that in no event shall the annual base rent be less than the prior year, and in no event greater than the amounts provided in the lease. The annual base rent associated with 18,822 leased square feet increases by approximately 2.5% of the then-current annual base rent, and the annual base rent associated with 2,357 leased square feet increases by approximately 3.0% of the then-current annual base rent. |

| |

| (11) | The annual base rent associated with 95,905 leased square feet increases by $2.00 per leased square foot on both July 1, 2017 and July 1, 2021 of the then-current annual base rent. The annual base rent associated with 5,900 leased square feet increases by approximately $0.45 per leased square foot on October 1, 2017 and by one cent per leased square foot each year thereafter. The annual base rent associated with 763 leased square feet increased by $2.35 per leased square foot on July 1, 2017 and $2.36 per leased square foot on July 1, 2021. |

The following is a schedule of historical five year occupancy and average effective rent per square foot for the 250 Williams Atlanta Data Center:

|

| | | | | | |

| Year | | Occupancy Rate | | Average Effective Rent Per Square Foot |

| 2012 | | 82.3% | | $ | 18.74 |

|

| 2013 | | 82.6% | | $ | 19.58 |

|

| 2014 | | 85.2% | | $ | 19.16 |

|

| 2015 | | 86.6% | | $ | 19.98 |

|

| 2016 | | 87.0% | | $ | 20.37 |

|

Depreciable Tax Basis

The following information replaces in its entirety the table on page 113 contained in the“Investment Objectives, Strategy and Policies—Depreciable Tax Basis” section of the prospectus:

|

| | |

| Property Description | | Depreciable Tax Basis |

| 250 Williams Atlanta Data Center | | $149,429,000 |

Placement of Material Debt on Certain Real Property

The following information supplements, and should be read in conjunction with, the "Investment Objectives, Strategy and Policies - Description of Real Estate Investments" section beginning on page 108 of the prospectus:

As of September 15, 2017, we had the following material note payable in connection with one property:

|

| | | | | | | | | | |

| Property Description | | Lender | | Loan Balance (1) | | Interest Rate (2) | | Loan Date |

| 250 Williams Atlanta Data Center | | KeyBank National Association | | $ | 116,200,000 |

| (3) | 3.99% | | 06/15/2017 - 07/01/2027 |

| |

| (1) | Principal balance outstanding on the loan is as of the loan origination date. |

| |

| (2) | Represents the fixed interest rate per annum. |

| |

| (3) | The material terms of the Loan Agreement provide for the following: (i) a fixed interest rate of 3.99%; (ii) a default interest rate equal to the lesser of (x) the maximum legal rate, as defined in the Loan Agreement or (y) 5.0% above the interest rate; (iii) a maturity date of July 1, 2027; and (iv) prepayment is generally prohibited, except for certain limited circumstances as stated in the Loan Agreement. The Loan Agreement also contains a requirement to escrow certain funds for capital reserves, taxes, insurance and replacement reserve costs. Subject to certain exceptions, the loan is nonrecourse as to DCII-250 Williams , a wholly-owned subsidiary of CVOP II, and CVOP II, but both entities are liable jointly and severally for customary non-recourse carve-outs. The Loan Agreement also contains various affirmative and negative covenants that are customary for loan agreements and transactions of this type, including limitations on the incurrence of debt by DCII-250 Williams. |

Individually Immaterial Real Property Acquisitions

The following information replaces in its entirety the first sentence of the first full paragraph on page 109 of the “Investment Objectives, Strategy and Policies—Description of Real Estate Investments” section of the prospectus:

As of September 15, 2017, we purchased, since inception, 62 individually immaterial properties for an aggregate contract purchase price of approximately $1,231,152,000 plus closing costs, with total annualized base rent at acquisition of approximately $84,378,000.

The following table replaces in its entirety the table beginning on page 109 contained in the “Investment Objectives, Strategy and Policies—Description of Real Estate Investments” section of the prospectus:

The following tables summarizes the 62 individually immaterial properties acquired since July 31, 2014 in order of acquisition date:

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Property Description* | | Location | | MSA/µSA (1) | | Date Acquired | | Contract Purchase Price (2) | | Property Taxes (3) | | Fees Paid to Sponsor (4) | | Major Tenants (5) | | Total Rentable Square Feet | | % of Total Rentable Square Feet Leased to Major Tenants | | % of Total Rentable Square Feet Leased | | Lease Expiration for Major Tenants |

| Cy Fair Surgical Center | | Houston, TX | | Houston-The Woodlands-Sugar Land, TX | | 07/31/2014 | | $ | 4,450,000 |

| | $ | 68,776 |

| | $ | 89,000 |

| | Cy Fair Surgery Center, LTD. | | 13,645 | | 100.00% | | 100.00% | | 07/31/2025 |

| Mercy Healthcare Facility | | Cincinnati, OH | | Cincinnati, OH-KY-IN | | 10/29/2014 | | 4,100,000 |

| | 100,718 |

| | 82,000 |

| | Mercy Health Physicians Cincinnati, LLC | | 14,868 | | 100.00% | | 100.00% | | 05/31/2024 |

| Winston-Salem, NC IMF | | Winston-Salem, NC | | Winston-Salem, NC | | 12/17/2014 | | 6,254,000 |

| | 46,713 |

| | 125,080 |

| | Piedmont Ear, Nose and Throat Associates, P.A. | | 22,200 | | 100.00% | | 100.00% | | 12/31/2024 |

| New England Sinai Medical Center | | Stoughton, MA | | Boston-Cambridge- Newton, MA-NH | | 12/23/2014 | | 23,398,094 |

| | 360,823 |

| | 526,400 |

| | New England Sinai Hospital, A Steward Family Hospital, Inc. | | 180,744 | | 100.00% | | 100.00% | | 12/31/2029 |

| Baylor Surgical Hospital at Fort Worth | | Fort Worth, TX | | Dallas-Fort Worth-Arlington, TX | | 12/31/2014 | | 48,210,548 |

| | 793,508 |

| | 964,211 |

| | Fort Worth Surgicare Partners, Ltd. | | 83,464 | | 100.00% | | 100.00% | | 10/31/2031 |

| Baylor Surgical Hospital Integrated Medical Facility | | Fort Worth, TX | | Dallas-Fort Worth-Arlington, TX | | 12/31/2014 | | 2,340,000 |

| | 23,149 |

| | 46,800 |

| | Fort Worth Surgicare Partners, Ltd. | | 8,268 | | 50.00% | | 87.31% | | 09/30/2019 |

| | | | | | | | THVG Bariatric, LLC | | | 37.31% | | | 04/30/2022 |

| Winter Haven Healthcare Facility | | Winter Haven, FL | | Lakeland-Winter Haven, FL | | 01/27/2015 | | 3,803,640 |

| | 24,613 |

| | 76,073 |

| | Central Polk, LLC | | 7,560 | | 100.00% | | 100.00% | | 06/30/2029 |

| Heartland Rehabilitation Hospital | | Overland Park, KS | | Kansas City, MO-KS | | 02/17/2015 | | 24,579,302 |

| | 365,531 |

| | 491,586 |

| | Heartland Rehabilitation Hospital, LLC | | 54,568 | | 100.00% | | 100.00% | | 12/31/2034 |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Property Description* | | Location | | MSA/µSA (1) | | Date Acquired | | Contract Purchase Price (2) | | Property Taxes (3) | | Fees Paid to Sponsor (4) | | Major Tenants (5) | | Total Rentable Square Feet | | % of Total Rentable Square Feet Leased to Major Tenants | | % of Total Rentable Square Feet Leased | | Lease Expiration for Major Tenants |

| Indianapolis Data Center | | Indianapolis, IN | | Indianapolis-Carmel-Anderson, IN | | 04/01/2015 | | 7,500,000 |

| | 62,959 |

| | 150,000 |

| | Online Tech, LLC | | 43,724 | | 100.00% | | 100.00% | | 03/31/2030 |

| Clarion IMF | | Clarion, PA | | Pittsburgh, PA | | 06/01/2015 | | 6,920,000 |

| | (6) |

| | 138,400 |

| | The Primary Health Network | | 33,000 | | 100.00% | | 100.00% | | 10/31/2027 |

| Post Acute Webster Rehabilitation Hospital | | Webster, TX | | Houston-The Woodlands-Sugar Land, TX | | 06/05/2015 | | 25,719,927 |

| | 111,071 |

| | 514,399 |

| | Clear Lake Institute for Rehabilitation, LLC | | 53,514 | | 100.00% | | 100.00% | | 05/06/2035 |

| Eagan Data Center | | Eagan, MN | | St. Cloud, MN | | 06/29/2015 | | 5,800,000 |

| | 126,308 |

| | 116,000 |

| | DataBank Holdings, LTD. | | 87,402 | | 100.00% | | 100.00% | | 09/30/2029 |

| Houston Surgical Hospital and LTACH | | Houston, TX | | Houston-The Woodlands-Sugar Land, TX | | 06/30/2015 | | 49,250,000 |

| | 551,053 |

| | 985,000 |

| | Victory Medical Center Houston, LP | | 102,369 | | 55.54% | | 100.00% | | 10/31/2035 |

| | | | | | | | CHG Cornerstone Hospital of South Houston, LP | | | 36.42% | | | 09/30/2022 |

| KMO IMF - Cincinnati I | | Cincinnati, OH | | Cincinnati, OH-KY-IN | | 07/22/2015 | | 29,696,445 |

| | 566,118 |

| | 593,929 |

| | The Christ Hospital | | 139,428 | | 90.39% | | 100.00% | | 12/31/2025 |

| KMO IMF - Cincinnati II | | Cincinnati, OH | | Cincinnati, OH-KY-IN | | 07/22/2015 | | 12,548,760 |

| | 283,100 |

| | 250,975 |

| | UC Health | | 41,600 | | 100.00% | | 100.00% | | 08/31/2029 |

| KMO IMF - Florence | | Florence, KY | | Cincinnati, OH-KY-IN | | 07/22/2015 | | 12,067,438 |

| | 144,326 |

| | 241,349 |

| | UC Health | | 41,600 | | 100.00% | | 100.00% | | 09/30/2029 |

| KMO IMF - Augusta | | Augusta, ME | | Augusta-Waterville, ME (µSA) | | 07/22/2015 | | 18,029,143 |

| | 207,067 |

| | 360,583 |

| | MaineGeneral Medical Center | | 51,000 | | 100.00% | | 100.00% | | 04/30/2029 |

| KMO IMF - Oakland | | Oakland, ME | | Augusta-Waterville, ME (µSA) | | 07/22/2015 | | 6,743,633 |

| | 55,556 |

| | 134,873 |

| | MaineGeneral Medical Center | | 20,000 | | 100.00% | | 100.00% | | 05/31/2029 |

| Reading Surgical Hospital | | Wyomissing, PA | | Philadelphia-Camden-Wilmington, PA-NJ-DE-MD | | 07/24/2015 | | 24,990,000 |

| | 190,396 |

| | 499,800 |

| | Surgical Institute of Reading, LP | | 33,217 | | 100.00% | | 100.00% | | 07/31/2030 |

| Post Acute Warm Springs Specialty Hospital of Luling | | Luling, TX | | Austin-Round Rock, TX | | 07/30/2015 | | 9,675,000 |

| | 93,375 |

| | 193,500 |

| | Post Acute Medical at Luling, LLC | | 40,901 | | 100.00% | | 100.00% | | 07/31/2030 |

| Minnetonka Data Center | | Minnetonka, MN | | Minneapolis-St. Paul-Bloomington, MN-WI | | 08/28/2015 | | 19,900,000 |

| | 320,770 |

| | 398,000 |

| | tw telecom of minnesota llc | | 135,240 | | 78.43% | | 100.00% | | 06/30/2024 |

| | | | | | | | Uroplasty, LLC | | | 13.50% | | | 06/30/2019 |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Property Description* | | Location | | MSA/µSA (1) | | Date Acquired | | Contract Purchase Price (2) | | Property Taxes (3) | | Fees Paid to Sponsor (4) | | Major Tenants (5) | | Total Rentable Square Feet | | % of Total Rentable Square Feet Leased to Major Tenants | | % of Total Rentable Square Feet Leased | | Lease Expiration for Major Tenants |

| Nebraska Healthcare Facility | | Omaha, NE | | Omaha-Council Bluffs, NE-IA | | 10/14/2015 | | 13,011,247 |

| | 184,511 |

| | 260,225 |

| | SNF Omaha Operating Company, LLC | | 40,402 | | 100.00% | | 100.00% | | 04/30/2036 |

| Heritage Park - Sherman I | | Sherman, TX | | Sherman-Denison, TX | | 11/20/2015 | | 30,040,000 |

| | 787,212 |

| | 600,800 |

| | Heritage Park Surgical Hospital, LLC | | 57,576 | | 100.00% | | 100.00% | | 05/31/2030 |

| Heritage Park - Sherman II | | Sherman, TX | | Sherman-Denison, TX | | 11/20/2015 | | 3,900,000 |

| | 41,432 |

| | 78,000 |

| | Heritage Park Surgical Hospital, LLC | | 8,055 | | 100.00% | | 100.00% | | 05/31/2030 |

| Baylor Surgery Center at Fort Worth | | Fort Worth, TX | | Dallas-Fort Worth-Arlington, TX | | 12/23/2015 | | 14,382,550 |

| | 225,756 |

| | 287,651 |

| | Physicians Surgical Center of Fort Worth, LLP | | 36,800 | | 91.46% | | 100.00% | | 11/30/2025 |

| HPI - Oklahoma City I | | Oklahoma City, OK | | Oklahoma City, OK | | 12/29/2015 | | 34,692,226 |

| | 320,955 |

| | 693,844 |

| | Community Hospital, LLC | | 94,076 | | 100.00% | | 100.00% | | 12/31/2030 |

| HPI - Oklahoma City II | | Oklahoma City, OK | | Oklahoma City, OK | | 12/29/2015 | | 10,325,779 |

| | 151,100 |

| | 206,516 |

| | Healthcare Partners Investments, LLC | | 41,394 | | 100.00% | | 100.00% | | 12/31/2030 |

| Waco Data Center | | Waco, TX | | Waco, TX | | 12/30/2015 | | 10,700,000 |

| | 223,633 |

| | 214,000 |

| | CVMS Waco Data Partners, LLC | | 43,596 | | 100.00% | | 100.00% | | 12/31/2035 |

| HPI - Edmond | | Edmond, OK | | Oklahoma City, OK | | 01/20/2016 | | 4,400,000 |

| | 28,627 |

| | 88,000 |

| | Healthcare Partners Investments, LLC | | 17,700 | | 100.00% | | 100.00% | | 01/31/2031 |

| HPI - Oklahoma City III | | Oklahoma City, OK | | Oklahoma City, OK | | 01/27/2016 | | 3,000,000 |

| | 16,669 |

| | 60,000 |

| | Kim King, D.O., PLLC | | 8,762 | | 100.00% | | 100.00% | | 01/31/2026 |

| HPI - Oklahoma City IV | | Oklahoma City, OK | | Oklahoma City, OK | | 01/27/2016 | | 1,700,000 |

| | 11,275 |

| | 34,000 |

| | Healthcare Partners Investments, LLC | | 5,000 | | 100.00% | | 100.00% | | 01/31/2031 |

| Alpharetta Data Center III | | Alpharetta, GA | | Atlanta-Sandy Springs-Roswell, GA | | 02/02/2016 | | 15,750,000 |

| | 178,285 |

| | 315,000 |

| | Sungard Availability Services, LP | | 77,322 | | 100.00% | | 100.00% | | 11/30/2019 |

| Flint Data Center | | Flint, MI | | Flint, MI | | 02/02/2016 | | 8,500,000 |

| | 25,826 |

| | 170,000 |

| | Online Tech, LLC | | 32,500 | | 100.00% | | 100.00% | | 02/28/2031 |

| HPI - Newcastle | | Newcastle, OK | | Oklahoma, OK | | 02/03/2016 | | 1,750,000 |

| | 12,778 |

| | 35,000 |

| | Healthcare Partners Investments, LLC | | 7,424 | | 100.00% | | 100.00% | | 02/28/2031 |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Property Description* | | Location | | MSA/µSA (1) | | Date Acquired | | Contract Purchase Price (2) | | Property Taxes (3) | | Fees Paid to Sponsor (4) | | Major Tenants (5) | | Total Rentable Square Feet | | % of Total Rentable Square Feet Leased to Major Tenants | | % of Total Rentable Square Feet Leased | | Lease Expiration for Major Tenants |

| HPI - Oklahoma City V | | Oklahoma City, OK | | Oklahoma City, OK | | 02/11/2016 | | 15,000,000 |

| | 91,471 |

| | 300,000 |

| | Darryl D. Robinson, M.D., P.C. and Michael Sean O'Brien, D.O., P.C. | | 43,676 | | 100.00% | | 100.00% | | 02/28/2026 |

| Vibra Rehabilitation Hospital | | Rancho Mirage, CA | | Riverside-San Bernardino-Ontario, CA | | 03/01/2016 | | 9,466,287 |

| (7) | 64,100 |

| | 741,876 |

| (7) | Vibra Rehabilitation Hospital of Rancho, LLC | | 40,688 | (8) | (9) | | (9) | | (9) |

| HPI - Oklahoma City VI | | Oklahoma City, OK | | Oklahoma City, OK | | 03/07/2016 | | 5,050,000 |

| | 35,090 |

| | 101,000 |

| | Michael H. Wright, M.D., P.C. | | 14,676 | | 100.00% | | 100.00% | | 03/31/2026 |

| Tennessee Data Center | | Franklin, TN | | Nashville-Davidson-Murfreesboro-Franklin, TN | | 03/31/2016 | | 19,400,000 |

| | 52,471 |

| | 388,000 |

| | Peak 10 Rentech, LLC | | 71,726 | | 100.00% | | 100.00% | | 11/30/2031 |

| HPI - Oklahoma City VII | | Oklahoma City, OK | | Oklahoma City, OK | | 06/22/2016 | | 40,581,916 |

| | 20,658 |

| | 811,638 |

| | Community Hospital, LLC | | 102,978 | | 100.00% | | 100.00% | | 06/30/2031 |

| Post Acute Las Vegas Rehabilitation Hospital | | Las Vegas, NV | | Las Vegas-Henderson-Paradise, NV | | 06/24/2016 | | 2,613,600 |

| (10) | 31,792 |

| | 481,052 |

| (10) | PAM Squared at Las Vegas, LLC | | 56,220 | (11) | (12) | | (12) | | (12) |

| Somerset Data Center | | Somerset, NJ | | New York-Newark-Jersey City, NY-NJ-PA | | 06/29/2016 | | 12,375,000 |

| | 180,322 |

| | 247,500 |

| | Datapipe, Inc. | | 36,114 | | 100.00% | | 100.00% | | 07/05/2028 |

| Integris Lakeside Women's Hospital | | Oklahoma City, OK | | Oklahoma City, OK | | 06/30/2016 | | 19,840,000 |

| | 126,533 |

| | 396,800 |

| | Lakeside Women's Hospital, LLC | | 62,857 | | 100.00% | | 100.00% | | 12/31/2027 |

| AT&T Hawthorne Data Center | | Hawthorne, CA | | Los Angeles-Long Beach-Anaheim, CA | | 09/27/2016 | | 79,500,000 |

| | 648,020 |

| | 1,590,000 |

| | AT&T Corporation | | 288,000 | | 100.00% | | 100.00% | | 05/31/2026 |

| McLean I | | McLean, VA | | Washington-Arlington-Alexandria, DC-VA-MD-WV | | 10/17/2016 | | 39,000,000 |

| | 278,618 |

| | 780,000 |

| | Level 3 Communications, LLC | | 69,329 | | 94.90% | | 94.90% | | 04/30/2033 |

| McLean II | | McLean, VA | | Washington-Arlington-Alexandria, DC-VA-MD-WV | | 10/17/2016 | | 46,000,000 |

| | 532,335 |

| | 920,000 |

| | PAETEC Communications, Inc. | | 62,002 | | 100.00% | | 100.00% | | 03/31/2024 |

| Select Medical Rehabilitation Facility | | Marlton, NJ | | Philadelphia-Camden-Wilmington, PA-NJ-DE-MD | | 11/01/2016 | | 63,580,000 |

| | 264,847 |

| | 1,271,600 |

| | Kessler Institute for Rehabilitation, Inc. | | 89,000 | | 100.00% | | 100.00% | | 10/31/2031 |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Property Description* | | Location | | MSA/µSA (1) | | Date Acquired | | Contract Purchase Price (2) | | Property Taxes (3) | | Fees Paid to Sponsor (4) | | Major Tenants (5) | | Total Rentable Square Feet | | % of Total Rentable Square Feet Leased to Major Tenants | | % of Total Rentable Square Feet Leased | | Lease Expiration for Major Tenants |

| Andover Data Center II | | Andover, MA | | Boston-Cambridge-Newton, MA-NH | | 11/08/2016 | | 37,000,000 |

| | 390,627 |

| | 740,000 |

| | NaviSite, LLC | | 153,000 | | 64.89% | | 100.00% | | 01/31/2029 |

| | | | | | | | WSI Corporation | | | 35.11% | | | 11/30/2018 |

| Grand Rapids Healthcare Facility | | Grand Rapids, MI | | Grand Rapids-Wyoming, MI | | 12/07/2016 | | 43,500,000 |

| | 449,869 |

| | 870,000 |

| | Grand Rapids Women's Health, P.C. | | 106,807 | | 27.53% | | 92.68% | | 06/30/2018 - 07/31/2026 |

| | | | | | | | Metropolitan Hospital | | | 25.94% | | |

| | | | | | | | Orthopaedic Associates of Grand Rapids, P.C. | | | 10.98% | | |

| | | | | | | | Spectrum Health Hospitals | | | 10.82% | | |

| Corpus Christi Surgery Center | | Corpus Christi, TX | | Corpus Christi, TX | | 12/22/2016 | | 6,350,000 |

| | 47,700 |

| | 127,000 |

| | Shoreline Surgery Center, LLP | | 25,102 | | 61.31% | | 100.00% | | 12/31/2026 |

| | | | | | | | Abdominal Specialists of South Texas, LLP | | | 38.69% | | | 08/31/2026 |