Exhibit 99.1

August 2019 Second Quarter 2019 Investor Presentation (NASDAQ: AFIN)

American Finance Trust, Inc. COMPANY HIGHLIGHTS Service Retail Focus Service Retail ( 1) properties that are more resistant to e - commerce vs. traditional retail High - Quality Portfolio 93% p ortfolio Occupancy (1) with a balance of single - tenant assets with long - term leases and retail centers focused on Experiential Retail (1) tenants Creditworthy Tenants 82 % of top - ten tenants are Investment Grade Rated (1) Strong Balance Sheet Ample Liquidity (1) with modest Net Leverage (1) of 39% Robust Acquisition Program Rent Escalators ( 1) in 81% of existing leases and a robust acquisition program of $183 million closed t hrough Q2’19 (2) Significant Leasing Upside Executed leases that have yet to commence of over 210,000 square feet as of quarter end (3) 1) See Definitions in the appendix for a full description. 2) See slide 5 for additional information. 3) See slide 10 for additional information. 2

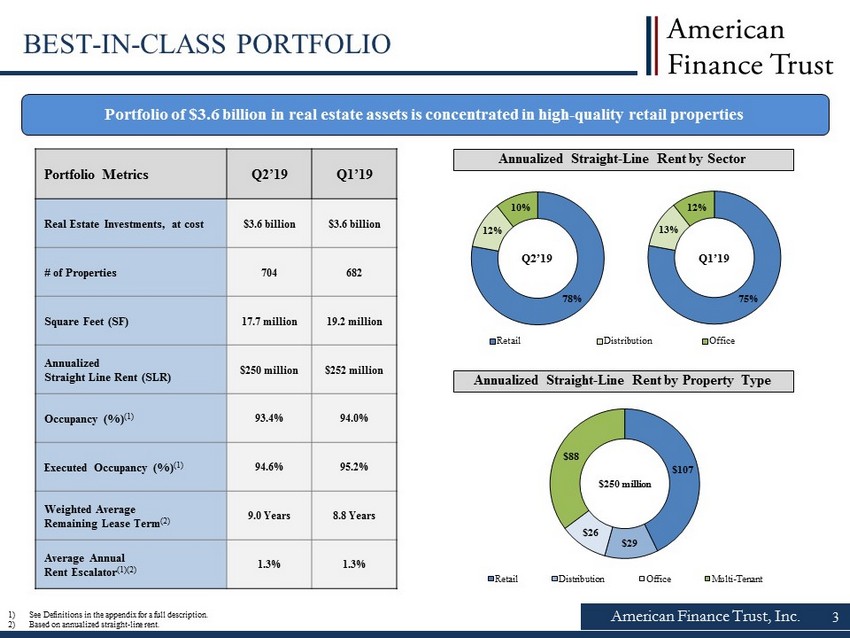

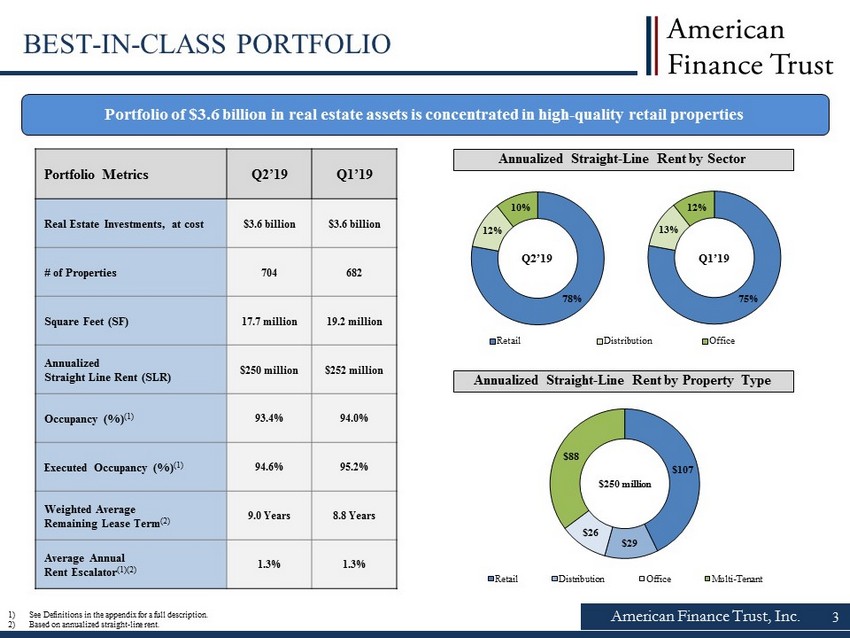

American Finance Trust, Inc. Portfolio of $3.6 billion in real estate assets is concentrated in high - quality retail properties 1) See Definitions in the appendix for a full description. 2) Based on annualized straight - line rent. Portfolio Metrics Q2’19 Q1’19 Real Estate Investments, at cost $3.6 billion $3.6 billion # of Properties 704 682 Square Feet (SF) 17.7 million 19.2 million Annualized Straight Line Rent (SLR) $250 million $252 million Occupancy (%) (1) 93.4% 94.0% Executed Occupancy (%) (1) 94.6% 95.2% Weighted Average Remaining Lease Term (2) 9.0 Years 8.8 Years Average Annual Rent Escalator (1)(2) 1.3% 1.3% Annualized Straight - Line Rent by Property Type BEST - IN - CLASS PORTFOLIO Annualized Straight - Line Rent by Sector $107 $29 $26 $88 Retail Distribution Office Multi-Tenant $250 million 78% 12% 10% Q2’19 75% 13% 12% Retail Distribution Office Q1’19 3

American Finance Trust, Inc. 4 QUARTERLY HIGHLIGHTS – Q2 2019 Significant Leasing Upside Robust Acquisition Program (1) Strategic Dispositions ▪ Acquired 32 single - tenant properties for $70 million in Q2 2019. ▪ Acquisition pipeline of $38 million, with a focus on service oriented single - tenant retail assets. ▪ Total closed and pipeline acquisitions of $221 million with a weighted average Cash Cap Rate (2) of 7.3% and a Weighted Average Cap Rate (2) of 8.1%. AFIN continues to grow and manage its superior portfolio of high - quality real estate assets ▪ The SunTrust disposition plan for vacant properties nears completion with 2 properties sold in Q2 2019 and only 2 remaining. (4) ▪ Total gross dispositions of $94 million in Q2 2019, resulting in net proceeds of $23 million which are available for future redeployment. ▪ Multi - tenant Occupancy (2) of 85.1% and Executed Occupancy (2) of 88.0% as of Q2 2019. ▪ Executed leases that have yet to commence of over 210,000 square feet as of quarter end. ▪ Multi - tenant Leasing Pipeline (2) of 10 new leases with executed letters of intent for over 46,000 square feet. (3) ▪ Since 2017, AFIN acquired 301 single - tenant properties with a weighted average lease term of 17 years (5) and sold 85 single - tenant properties with a weighted average lease term of 5 years. (5) ▪ 88% of the single - tenant assets acquired since 2017 are service - oriented retail tenants. 1) Refer to slide 6 for additional information 2) See Definitions in the appendix for a full description. 3) Includes (i) all leases executed by both parties as of July 15, 2019, but after June 30, 2019, and (ii) all leases under nego tia tion with an executed letter of intent by both parties as of July 15, 2019. There can be no assurance that the executed letters of intent, which are not binding, will become executed leases that commen ce on the same terms, or at all. 4) As of June 30, 2019. 5) Weighted average lease term remaining based on disposition date for dispositions and remaining lease term as of June 30, 2019 for acquisitions. Enhanced Portfolio (1)

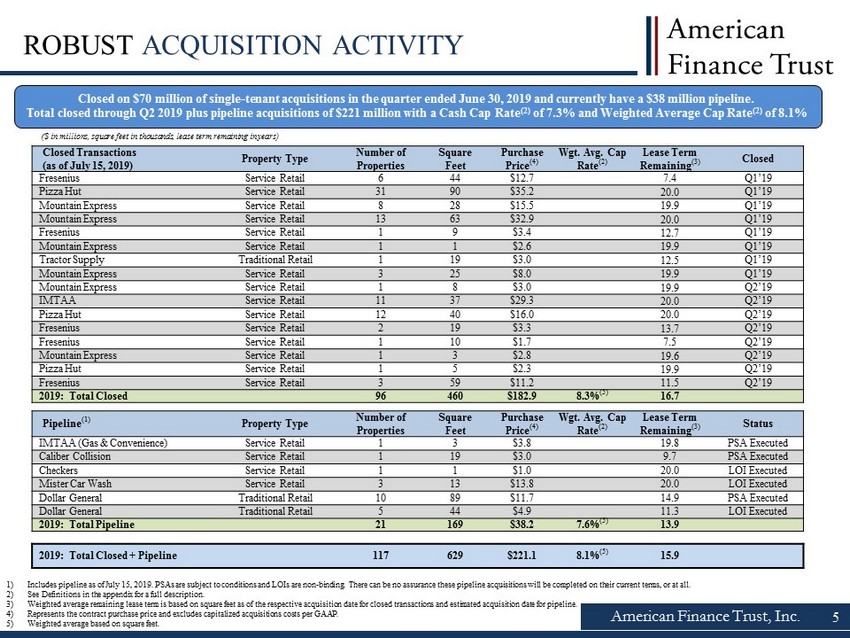

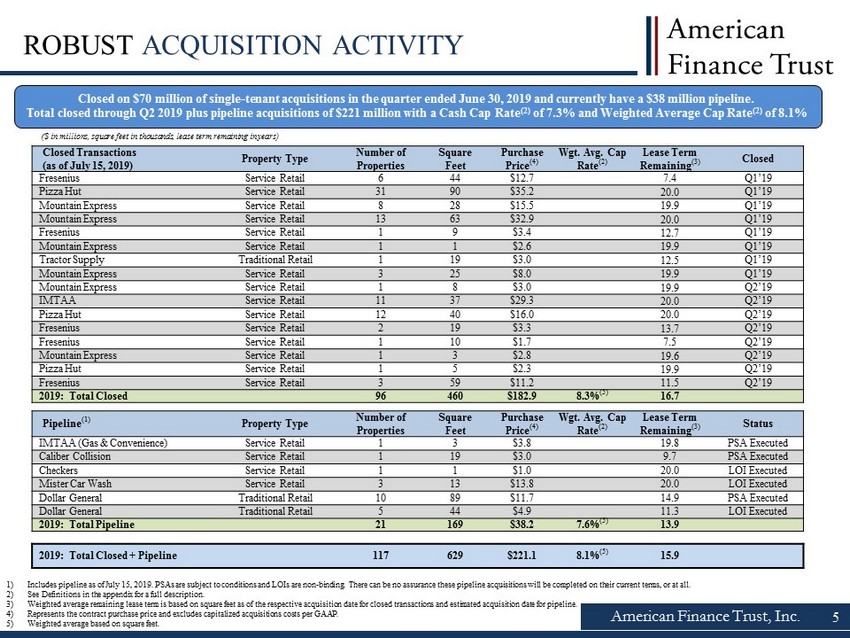

American Finance Trust, Inc. ROBUST ACQUISITION ACTIVITY Closed on $70 million of single - tenant acquisitions in the quarter ended June 30, 2019 and currently have a $38 million pipeline. Total closed through Q2 2019 plus pipeline acquisitions of $221 million with a Cash Cap Rate (2) of 7.3% and Weighted Average Cap Rate (2) of 8.1% ($ in millions, square feet in thousands, lease term remaining in years) 1) Includes pipeline as of July 15, 2019 . PSAs are subject to conditions and LOIs are non - binding. There can be no assurance these pipeline acquisitions will be comple ted on their current terms, or at all. 2) See Definitions in the appendix for a full description. 3) Weighted average remaining lease term is based on square feet as of the respective acquisition date for closed transactions a nd estimated acquisition date for pipeline. 4) Represents the contract purchase price and excludes capitalized acquisitions costs per GAAP. 5) Weighted average based on square feet. Closed Transactions ( as of July 15 , 2019) Property Type Number of Properties Square Feet Purchase Price (4) Wgt . Avg. Cap Rate (2) Lease Term Remaining (3) Closed Fresenius Service Retail 6 44 $12.7 7.4 Q1’19 Pizza Hut Service Retail 31 90 $35.2 20.0 Q1’19 Mountain Express Service Retail 8 28 $15.5 19.9 Q1’19 Mountain Express Service Retail 13 63 $32.9 20.0 Q1’19 Fresenius Service Retail 1 9 $3.4 12.7 Q1’19 Mountain Express Service Retail 1 1 $2.6 19.9 Q1’19 Tractor Supply Traditional Retail 1 19 $3.0 12.5 Q1’19 Mountain Express Service Retail 3 25 $8.0 19.9 Q1’19 Mountain Express Service Retail 1 8 $3.0 19.9 Q2’19 IMTAA Service Retail 11 37 $29.3 20.0 Q2’19 Pizza Hut Service Retail 12 40 $16.0 20.0 Q2’19 Fresenius Service Retail 2 19 $3.3 13.7 Q2’19 Fresenius Service Retail 1 10 $1.7 7.5 Q2’19 Mountain Express Service Retail 1 3 $2.8 19.6 Q2’19 Pizza Hut Service Retail 1 5 $2.3 19.9 Q2’19 Fresenius Service Retail 3 59 $11.2 11.5 Q2’19 2019: Total Closed 96 460 $182.9 8.3% (5) 16.7 Pipeline (1) Property Type Number of Properties Square Feet Purchase Price (4) Wgt . Avg. Cap Rate (2) Lease Term Remaining (3) Status IMTAA (Gas & Convenience) Service Retail 1 3 $3.8 19.8 PSA Executed Caliber Collision Service Retail 1 19 $3.0 9.7 PSA Executed Checkers Service Retail 1 1 $1.0 20.0 LOI Executed Mister Car Wash Service Retail 3 13 $13.8 20.0 LOI Executed Dollar General Traditional Retail 10 89 $11.7 14.9 PSA Executed Dollar General Traditional Retail 5 44 $4.9 11.3 LOI Executed 2019: Total Pipeline 21 169 $38.2 7.6% (5) 13.9 2019: Total Closed + Pipeline 117 629 $221.1 8.1% (5) 15.9 5

7 Years 17 Years 2017 Through Q2 2019 Dispositions 2017 Through Q2 2019 Acquisitions American Finance Trust, Inc. ACQUISITION & STRATEGIC DISPOSITION PROGRAM We continue to improve the portfolio by opportunistically acquiring service - oriented retail properties with long term leases Note: Data reflects 2017 through Q2 2019 closed dispositions and acquisitions as of June 30, 2019 . All data weighted by annualized straight - line rent as of June 30, 2019 . 1) Weighted average lease term remaining based on disposition date for dispositions and remaining lease term as of June 30, 2019 for acquisitions. 6 Metrics Dispositions Acquisitions # of Properties 85 301 Wgt . Average Lease Term Remaining (1) 7 Years 17 Years Service Retail 18% 88% Traditional Retail 2% 5% Distribution 35% 5% Office 46% 2% 2017 Through Q2 2019 Transaction Summary Wgt . Average Lease Term Remaining (1) Service Retail Acquisition Focus Recently Acquired Properties Increasing Service Retail Concentration Increasing Lease Duration 12% 88% Non-Service Retail Service Retail

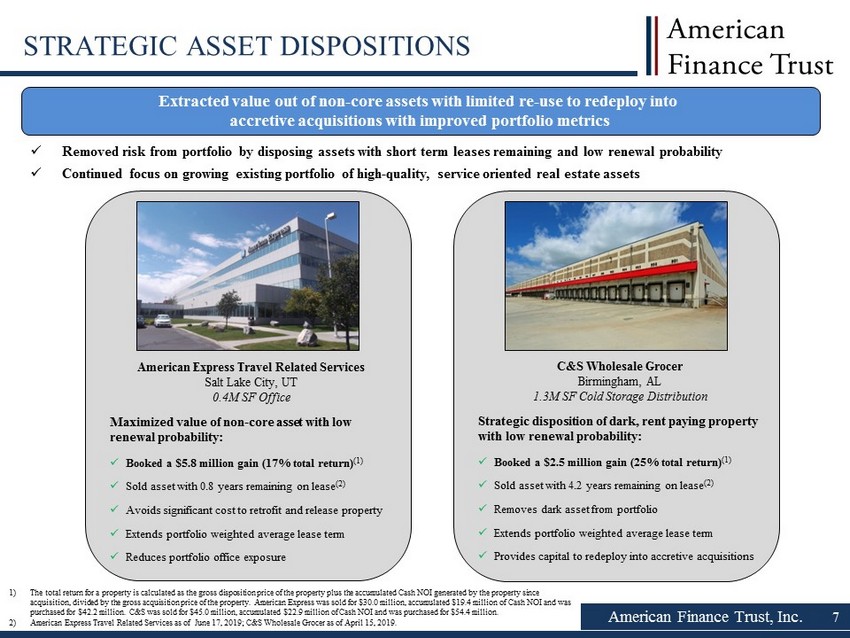

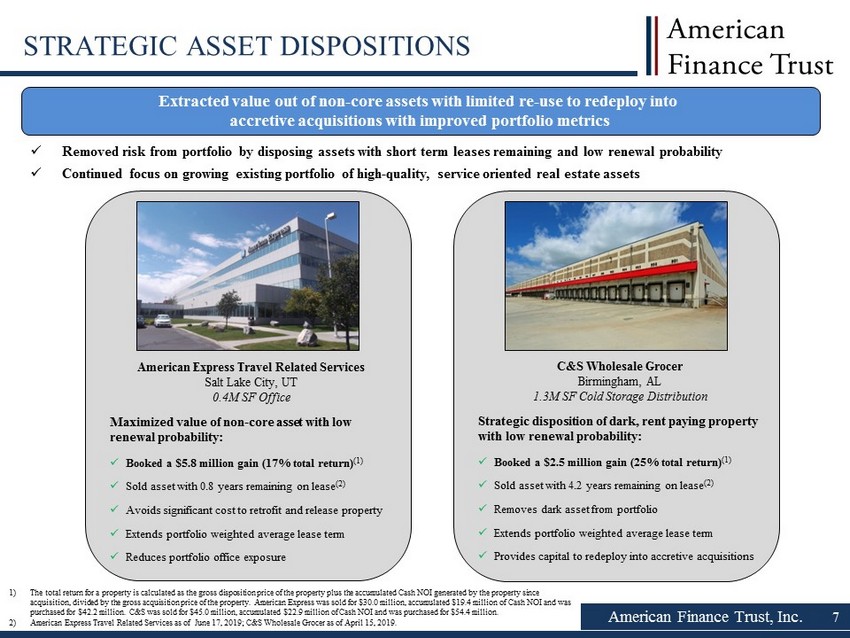

American Finance Trust, Inc. Extracted value out of non - core assets with limited re - use to redeploy into accretive acquisitions with improved portfolio metrics STRATEGIC ASSET DISPOSITIONS 7 American Express Travel Related Services Salt Lake City, UT 0.4M SF Office Maximized value of non - core asset with low renewal probability: x Booked a $5.8 million gain (17% total return) (1) x Sold asset with 0.8 years remaining on lease (2) x Avoids significant cost to retrofit and release property x Extends portfolio weighted average lease term x Reduces portfolio office exposure C&S Wholesale Grocer Birmingham, AL 1.3M SF Cold Storage Distribution Strategic disposition of dark, rent paying property with low renewal probability: x Booked a $2.5 million gain (25% total return) (1) x Sold asset with 4.2 years remaining on lease (2) x Removes dark asset from portfolio x Extends portfolio weighted average lease term x Provides capital to redeploy into accretive acquisitions x Removed risk from portfolio by disposing assets with short term leases remaining and low renewal probability x Continued focus on growing existing portfolio of high - quality, service oriented real estate assets 1) The total return for a property is calculated as the gross disposition price of the property plus the accumulated Cash NOI ge ner ated by the property since acquisition, divided by the gross acquisition price of the property. American Express was sold for $30.0 million, accumulate d $ 19.4 million of Cash NOI and was purchased for $42.2 million. C&S was sold for $45.0 million, accumulated $22.9 million of Cash NOI and was purchased for $54 .4 million. 2) American Express Travel Related Services as of June 17, 2019; C&S Wholesale Grocer as of April 15, 2019.

High - quality service - focused portfolio with long term leases to Investment Grade Tenants (1)(3) Portfolio Metrics Q2’19 Q1’19 Real Estate Investments, at cost $2.1 billion $2.1 billion # of Properties 671 649 Square Feet (SF) 10.5 million 12.0 million Annualized Straight - Line Rent (SLR) $162 million $165 million Straight - Line Rent per Leased Square Feet $15.59 $13.76 Occupancy (%) (1) 99.1% 99.5% Weighted Average Remaining Lease Term (2) 11.3 Years 10.8 Years % Investment Grade (1)(3) 76% 74% Average Annual Rent Escalator (1)(2) 1.3% 1.3% American Finance Trust, Inc. 8 SINGLE - TENANT PORTFOLIO 1) See Definitions in the appendix for a full description. 2) Based on annualized straight - line rent. 3) AFIN’s Q2 2019 single - tenant portfolio tenants are 45.0% actual investment grade rated and 30.6% implied investment grade, weigh ted by annualized straight - line rent as of June 30, 2019. Single - Tenant Property and Tenant Type (2) Retail Service Retail Restaurant 18% 56% Retail Banking 14% Gas/Convenience 12% Grocery 6% Pharmacy 3% Healthcare 2% Auto Services 1% Traditional Retail Home Improvement 3% 9% Discount Retail 3% Furniture 1% Auto Retail 1% Specialty Retail 1% Distribution 18% Office 17% Geographic Exposure

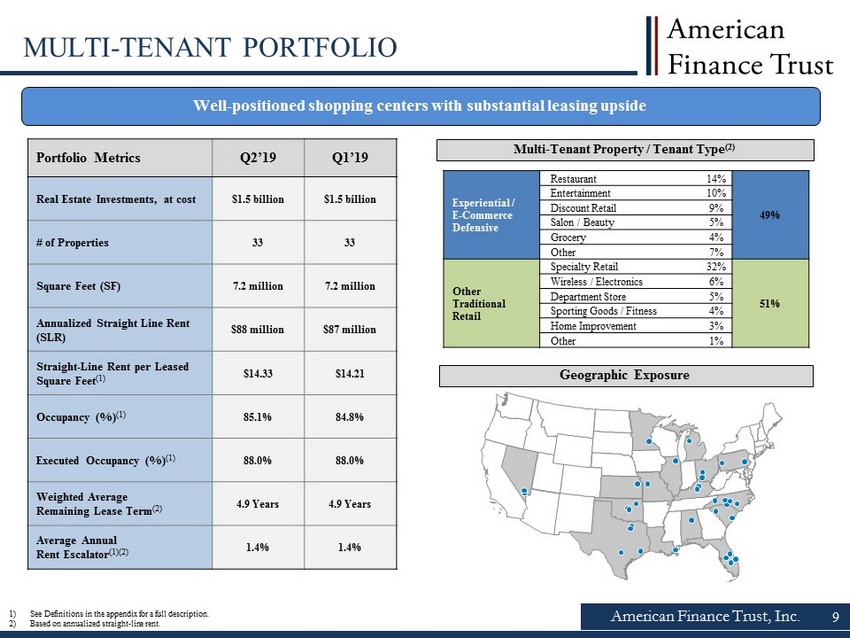

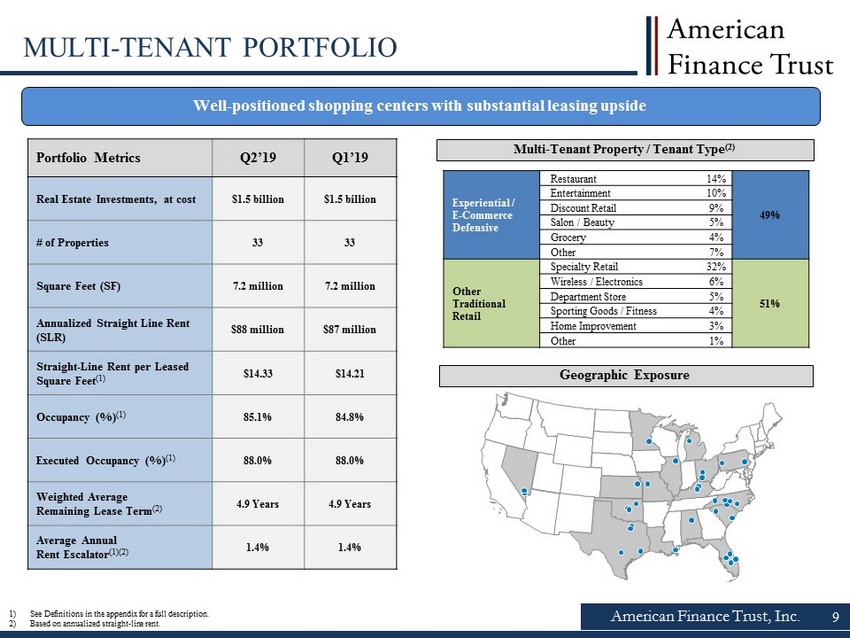

American Finance Trust, Inc. MULTI - TENANT PORTFOLIO Well - positioned shopping centers with substantial leasing upside Portfolio Metrics Q2’19 Q1’19 Real Estate Investments, at cost $1.5 billion $1.5 billion # of Properties 33 33 Square Feet (SF) 7.2 million 7.2 million Annualized Straight Line Rent (SLR) $88 million $87 million Straight - Line Rent per Leased Square Feet (1) $14.33 $14.21 Occupancy (%) (1) 85.1% 84.8% Executed Occupancy (%) (1) 88.0% 88.0% Weighted Average Remaining Lease Term (2) 4.9 Years 4.9 Years Average Annual Rent Escalator (1)(2) 1.4% 1.4% Multi - Tenant Property / Tenant Type (2) 1) See Definitions in the appendix for a full description. 2) Based on annualized straight - line rent. Experiential / E - Commerce Defensive Restaurant 14% 49% Entertainment 10% Discount Retail 9% Salon / Beauty 5% Grocery 4% Other 7% Other Traditional Retail Specialty Retail 32% 51% Wireless / Electronics 6% Department Store 5% Sporting Goods / Fitness 4% Home Improvement 3% Other 1% Geographic Exposure 9

6,132 6,132 6,132 211 211 47 6,132 6,343 6,382 85.1% 88.0% Q2'19 Occupancy Q2'19 Executed Occupancy Q2'19 Leasing Pipeline Q2'19 Occupancy Q2'19 Executed Occupancy Q2'19 Leasing Pipeline American Finance Trust, Inc. MULTI - TENANT LEASING ACTIVITY Multi - Tenant occupancy continues to grow as we execute on our leasing initiatives, including executed leases that have yet to commence on primarily dark or vacant properties of over 210,000 square feet as of quarter end Note: Industry Research sourced from ICSC Industry Insights published on September 19, 2018. 1) See Definitions in the appendix for a full description. 2) Data as of July 15, 2019. 3) The net cash flow for a property is calculated as the annualized total income a property is expected to generate less the annualized total operating expenses expected to be paid. 4) There can be no assurance that the new lease will generate such net cash flow on their current lease terms or generate at all Occupied Square Feet Grows from 6,132k to 6,382k (Square feet in thousands) Occupancy (1) Statistics (thousands) Leased SF % Leased Q2 2019: Occupancy 6,132 85.1% Q2 2019: Executed Occupancy 211 88.0% Leasing Pipeline: Under Contract & LOI (1) Executed 47 Pipeline: Terminations/Expirations (2) (8) Total 6,382 Leasing Highlights and Industry Research Leasing Highlights: AFIN improved occupancy across the multi - tenant portfolio while increasing annualized straight - line rent Jefferson Commons (Louisville, KY) x New 10 - year lease with Ulta and relocation of two existing tenants realized a net gain of over 10,000 SF and increased occupancy from 94% to 99% Northwood Marketplace (North Charleston, SC) x New 10 - year, 25,000 SF lease with Aldi expected to generate over $2.5 million of net cash flow (3) while lowering Barnes and Noble exposure at the property (4) Industry Research: Industry insights from the leading International Council of Shopping Centers (ICSC) describe how Gen Z shopping behaviors support retail real estate: x Communal aspect draws young consumers into brick - and - mortar stores x Three - quarters of Gen Z say that shopping in physical stores provides a better experience compared with shopping online x For key product categories, Gen Zers make most of their purchases in physical stores x Just over three - fifths of Gen Z take advantage of omni channel choices and use all online and in - store options for shopping offered by retailers x Gen Z cites the abilities to socialize, physically see items and get them immediately as their top reasons for going to stores x About eight of 10 Gen Zers say they have purchased items in stores as a direct result of seeing them on social media. Among them, YouTube is the most influential platform AFIN’s continued focus on experiential and e - commerce defensive real estate fits within ICSC’s criteria to cater to the rising Generation Z demographic 10

American Finance Trust, Inc. RE - LEASING CASE STUDY: PRAIRIE TOWNE CENTER – SCHAUMBURG, IL Successfully negotiated a lease termination fee from a dark, cash paying anchor tenant while extending the weighted average lease term from 6 years to 13 years (1)(2) 1) Based on annualized straight - line rent. 2) Lease term is calculated as of April 1, 2019 termination date through lease expiration for Lowe’s; expected lease commencemen t d ates of October 1, 2019 for At Home and February 1, 2020 for 24 - hour Fitness through their respective lease expiration dates. 3) There can be no assurance as to the final build out costs and free rent for release of such space. 11 Tenant Status Dark Re - leased concurrently with termination fee Rent expected to commence in Q2’2020 Rent expected to commence in Q3’2020 Term (2) 6 years New Long - Term Leases 10 years 1 5 years Annualized SLR $1.2 million (dark) Combined SLR of $1.1 million from rent paying tenants $0.5 million $0.6 million New Leases Prairie Towne Center Case Study: Re - Leasing Dark Anchor Space x Successfully negotiated a $7.6 million lease termination fee from Lowe’s and concurrently entered into leases with At Home (10 years) and 24 - Hour Fitness (15 years) to lease entirety of the building x The $7.6 million lease termination fee is expected to cover the $6.6 million of estimated buildout costs and free rent related to releasing the space (3) x Extends lease duration from 6 years to 13 years (1)(2) x Eliminates dark anchor tenant and diversifies rental income x Activates center and generates leasing upside to fill remaining vacancy x Q2’19 Executed Occupancy at Prairie Towne Center: 95%

0% 0% 3% 1% 2% 1% 2% 5% 51% 2% 3% 4% 4% 4% 6% 5% 1% 6% 0% 10% 20% 30% 40% 50% 60% 2019 2020 2021 2022 2023 2024 2025 2026 Thereafter 8% 7% 5% 5% 4% 3% 3% 2% 2% 2% 59% 0% 20% 40% 60% 80% x 82 % of top ten tenants are Investment Grade Rated (1)(2) x Largest tenant is SunTrust, an investment grade tenant, with a weighted average lease term remaining of 10 .1 years (1) American Finance Trust, Inc. PORTFOLIO TENANT OVERVIEW 1) Based on annualized straight - line rent as of June 30, 2019 . 2) Ratings information is as of June 30, 2019. AFIN’s top 10 tenants are 53% actual investment grade rated and 29% implied inves tme nt grade. Top Tenant Overview (1) Remaining Tenants Moody’s/S&P Credit Rating: 12 Baa1 A1 Aaa Ba1 Baa1 Baa2 A2 n.a. Portfolio Lease Expiration Schedule (1) Single - Tenant Properties – 11.3 years weighted average lease term remaining Multi - Tenant Properties – 4.9 years weighted average lease term remaining x Single - tenant portfolio has limited lease expirations through 2025 x Multi - tenant portfolio has balanced lease expirations Baa1 A3

American Finance Trust, Inc. POSITIVE IMPACT FROM SUNTRUST – BB&T MERGER 13 1) Portfolio as of June 30, 2019 ; excludes two vacant properties. 2) Based on annualized straight - line rent as of June 30, 2019 . 3) Per the SunTrust and BB&T merger presentation filed by SunTrust Banks Inc. with the Securities and Exchange Commission on Feb rua ry 7, 2019. Moody’s Corporate Credit Rating A2 Baa1 x Potential two - notch credit enhancement Assets (3) $226 billion $216 billion x 6 th largest U.S. bank (3) Compelling Transaction ▪ The parties believe the c ombination of strong branch deposits creates significant scale and should strengthen the company’s position within the US banking market (3) Transaction Highlights AFIN’s largest tenant, SunTrust, announced a $66 billion merger with BB&T on February 7, 2019, creating the 6 th largest U.S. bank and a premier investment - grade financial institution (3) » AFIN has a strong portfolio of 131 occupied SunTrust properties (1) with desirable lease characteristics: ▪ The SunTrust portfolio has a remaining lease term of 10.1 years (2) , equating to a portfolio lease maturity in 2030 ▪ 1.50% annual rent escalations for the entire portfolio ▪ Investment - grade corporate guaranty » AFIN is contractually entitled to receive rent payments from these SunTrust properties through the full duration of the lease term, regardless of any potential synergies associated with the merger Combined Company: Truist

American Finance Trust, Inc. Reducing SunTrust Exposure (2) Redeploying proceeds from occupied SunTrust dispositions into accretive acquisitions with improved portfolio metrics x AFIN completed the sale of 6 occupied SunTrust assets during Q2 2019 with a weighted average lease term of 10 years at a 5.4% we ighted average cash cap rate, generating $18.4 million of gross proceeds (1) ($4.5 million premium above original purchase price) x AFIN is under contract to sell 5 occupied SunTrust assets with a weighted average lease term of 10 years at a 5.5% weighted a ver age cash cap rate, generating $20.9 million of gross proceeds (1) ($4.9 million premium above original purchase price) x AFIN’s acquisition pipeline has a weighted average cash cap rate of 7.6 % (3) with a 14 year remaining lease term (3) , allowing the company to benefit from attractive spreads compared to the SunTrust dispositions x This initiative also allows AFIN to selectively reduce its SunTrust exposure, extend lease duration and further diversify its po rtfolio SUNTRUST REDEPLOYMENT INITIATIVE Key Benefits 14 Note: The analysis above excludes data related to any vacant SunTrust properties. As of June 30, 2019 , AFIN owned 133 SunTrust properties which included 2 vacant properties and 131 occupied properties . There can be no assurance that these dispositions will be completed on their current terms, or at all. 1) Gross proceeds represents contract sale price exclusive of closing costs and associated mortgage payoffs. Mortgage payoffs re lat ed to Q2 2019 dispositions of $6.6 million. Estimated mortgage payoffs related to SunTrust dispositions under contract are $8.1 million. 2) Based on annualized straight - line rent. 3) Based on 2019 pipeline as of July 15, 2019. See slide 5 for additional information. 11.2% 8.1% 7.7% 183 Occupied Properties 131 Occupied Properties 126 Occupied Properties 12/31/2017 6/30/2019 Post Sale of SunTrust Dispositions Under Contract

American Finance Trust, Inc. Notes Initial Principal Balance S&P Rating Term Coupon Rate Anticipated Repayment Date Class A - 1 (AAA) Notes $121 Million AAA 7 Years 3.8% May 2026 Class A - 2 (A) Notes $121 Million A 10 Years 4.5% May 2029 Summary of Terms AFIN subsidiaries issued $242 million of long - term fixed - rate notes to institutional investors in an ABS financing at a weighted average coupon of 4.18% and a weighted average term of 8.3 years The ABS financing was a significant milestone for the Company as the offering provided additional balance sheet flexibility, reduced AFIN’s overall interest rate and extended its average debt maturity : x Weighted average interest rate decreased from 4.59% (1) to 4.55% (2) x Weighted average debt maturity increased from 3.8 years (1) to 4.1 years (2) 15 COMPLETION OF INAUGURAL ABS FINANCING Number of Properties 202 Number of Leases 121 Number of Tenants 30 Number of States 30 Aggregate Collateral Value (3) $345.4 million Average Collateral Value $1.7 million Collateral Pool Snapshot Restaurant 45% Gas/Convenience 37% Healthcare 10% Specialty Retail 5% Education 3% Industry Diversification (2) 1) Based on balances outstanding, interest rates and debt maturities as of March 31, 2019. 2) Based on balances outstanding, interest rates and debt maturities as of June 30, 2019. This includes the completion of the ABS financing on May 30, 2019 with application of t hose net proceeds used to repay $204.9 million of indebtedness related to 192 of the Company’s single tenant properties that, together with the rela ted leases and certain other rights and interests which serve as part of the collateral pool of the ABS financing. 3) Weighted by allocated loan amount. 4) As determined by an independent appraisal in connection with the ABS financing.

American Finance Trust, Inc. Q2 2019 FINANCIAL HIGHLIGHTS Debt Capitalization (6) ($mm) Single - Tenant Mortgages $1,054 Multi - Tenant Mortgages $272 Total Secured Debt $1,326 Revolving Credit Facility $258 Total Unsecured Debt $258 Total Debt $1,584 Weighted Average Interest Rate (1) 4.6% Key Capitalization Metrics ($mm) Net Debt (2)(6) $1,492 Real Estate Investments, at cost $3,582 Net Debt (2)(6) / Adjusted EBITDA (3)(4) 7.9x Net Debt (2)(6) / Gross Asset Value (2) 39% Note: Metrics as of and for the three months ended June 30, 2019 . Current availability under the credit facility is $ 56.4 million as of June 30, 2019 . See Definitions in the appendix for a full description of terms. 1) Weighted average interest rate based on balance outstanding as of June 30, 2019 . 2) See Definitions in the appendix for a full description. 3) Adjusted EBITDA is annualized based on Q2 2019 results. Annualized results were adjusted for termination fee income of $7.6 million which was recorded in the second quarter of 2019. 4) See appendix for Non - GAAP reconciliations. 5) Includes the Company’s one - time right to extend the maturity date for an additional term of one year. 6) Excludes the effect of deferred financing costs, net and mortgage premiums, net. Balanced Capital Structure AFIN continues to actively manage its capital structure and is focused on locking in long - term debt at low fixed interest rates to support its real estate portfolio Earnings Summary ($mm) Net Income Attributable to Stockholders $7.9 NOI (2)(4) $66.0 Cash NOI (2)(4) $62.7 Adjusted Funds from Operations (AFFO) (2)(4) $30.0 Funds from Operations (FFO) (2)(4) per Share $0.23 Adjusted Funds from Operations (AFFO) (2) per Share $0.28 Weighted Average Diluted Shares Outstanding 106.4 x Strong balance sheet with substantial liquidity provides flexibility to pursue corporate initiatives and new acquisitions x $540 million credit facility with significant term that does not mature until 2023 ( 5 ) x AFIN has extended the overall debt maturity profile of its capital structure with long - term mortgage debt locking in low, fixed interest rates 16

American Finance Trust, Inc. 17 EXPERIENCED MANAGEMENT Jason Slear Executive Vice President of Real Estate Acquisitions and Dispositions ▪ Responsible for sourcing, negotiating, and closing AR Global's real estate acquisitions and dispositions ▪ Oversaw the acquisition of over $3.5 billion of real estate assets and the lease - up of over 10 million square feet during professional career Michael Weil Chief Executive Officer, President and Chairman of the Board of Directors ▪ Founding partner of AR Global ▪ Previously served as Senior VP of sales and leasing for American Financial Realty Trust ▪ Served as president of the Board of Directors of the Real Estate Investment Securities Association Katie Kurtz Chief Financial Officer, Treasurer and Secretary ▪ Previously served as chief financial officer at American Realty Capital - Retail Centers of America, Inc., Business Development Co rporation of America II and Crossroads Capital, Inc. (formerly BDCA Venture, Inc.). ▪ Previously served as chief accounting officer at Carlyle GMS Finance, Inc., The Carlyle Group’s business development company, Di rector of Finance and Controller for New Mountain Finance Corporation, and Controller at Solar Capital Ltd ▪ Mrs. Kurtz began her career at PricewaterhouseCoopers, LLP and is a certified public accountant in New York State Zachary Pomerantz Senior Vice President of Asset Management ▪ Former Asset Manager for New York REIT, a nearly 2 million square foot portfolio of New York City properties ▪ Previously worked at ProMed Properties, Swig Equities, Tishman Speyer and Mall Properties Boris Korotkin Senior Vice President of Capital Markets and Corporate Strategy ▪ Responsible for leading all debt capital market transactions ▪ Former Executive Vice President of Transaction Structuring for American Financial Realty Trust

Confidential – Not for Distribution 18 18 Legal Notices

American Finance Trust, Inc. 19 PROJECTIONS This presentation includes estimated projections of future operating results. These projections were not prepared in accordan ce with published guidelines of the SEC or the guidelines established by the American Institute of Certified Public Accountants for p rep aration and presentation of financial projections. This information is not fact and should not be relied upon as being necessarily in dic ative of future results; the projections were prepared in good faith by management and are based on numerous assumptions that may prov e t o be wrong. Important factors that may affect actual results and cause the projections to not be achieved include, but are not lim ite d to, risks and uncertainties relating to the company and other factors described in the “Risk Factors” section of the Company's Annual R epo rt on Form 10 - K for the year ended December 31, 2018, the Company's subsequent Quarterly Reports on Form 10 - Q and in future filings wi th the SEC. The projections also reflect assumptions as to certain business decisions that are subject to change. As a result, a ctu al results may differ materially from those contained in the estimates. Accordingly, there can be no assurance that the estimates will b e r ealized. This presentation also contains estimates and information concerning our industry, including market position, market size, an d g rowth rates of the markets in which we participate, that are based on industry publications and reports. This information involves a n umber of assumptions and limitations, and you are cautioned not to give undue weight to these estimates. We have not independently ver ifi ed the accuracy or completeness of the data contained in these industry publications and reports. The industry in which we operate i s s ubject to a high degree of uncertainty and risk due to variety of factors, including those described in the “Risk Factors” and "Managem ent 's Discussion and Analysis of Financial Condition and Results of Operations" sections of the Company's Annual Report on Form 10 - K f or the year ended December 31, 2018, filed with the SEC on March 7, 2019, and the Company's subsequent Quarterly Reports on Form 10 - Q filed with the SEC. These and other factors could cause results to differ materially from those expressed in these publicat ion s and reports.

American Finance Trust, Inc. 20 FORWARD - LOOKING STATEMENTS Certain statements made in this presentation are “forward - looking statements” (as defined in Section 21E of the Exchange Act), w hich reflect the expectations of the Company regarding future events. The forward - looking statements involve a number of risks, uncertainties and other factors that could ca use actual results to differ materially from those contained in the forward - looking statements. Such forward - looking statements include, but are not limited to, market and other e xpectations, objectives, and intentions, as well as any other statements that are not historical facts. Our potential risks and uncertainties are presented in the section titled “Item 1A - Risk Factors” disclosed in our Annual Report on Form 10 - K for the year ended December 31, 2018 filed with the SEC on March 7, 2019, and the Company's subsequent Quarterly Reports on Form 10 - Q filed with the SEC. We di sclaim any obligation to update and revise statements contained in these materials to reflect changed assumptions, the occurrence of unanticipated events or changes to fut ure operating results over time, unless required by law. The following are some of the risks and uncertainties relating to us, although not all risks and uncertainties, that cou ld cause our actual results to differ materially from those presented in our forward - looking statements: ▪ All of our executive officers are also officers, managers, employees or holders of a direct or indirect controlling interest in American Finance Advisors, LLC (the “Advisor”) or other entities under common control with AR Global Investments, LLC (the successor business to AR Capital, LLC, “AR Global”). As a result, our executive officers, the Advisor and its affiliates face conflicts of interest, including significant conflicts created by the Advisor’s compensation arr angements with us and other investment programs advised by affiliates of AR Global and conflicts in allocating time among these entities and us, which could negatively impac t o ur operating results. ▪ The trading price of our Class A common stock and 7.50% Series A Cumulative Redeemable Perpetual Preferred Stock, $0.01 par v alu e per share (the “Series A Preferred Stock”), may fluctuate significantly. ▪ Lincoln Retail REIT Services, LLC (“Lincoln”) and its affiliates, which provide services to the Advisor in connection with ou r r etail portfolio, faces conflicts of interest in allocating its employees’ time between providing real estate - related services to the Advisor and other programs and activities i n which they are presently involved or may be involved in the future. ▪ The performance of our retail portfolio is linked to the market for retail space generally and factors that may impact our re tai l tenants, such as the increasing use of the Internet by retailers and consumers. ▪ Our rental revenue is dependent upon the success and economic viability of our tenants. ▪ We may be unable to enter into and consummate property acquisitions on advantageous terms or our property acquisitions may no t p erform as we expect. ▪ Provisions in our revolving unsecured corporate credit facility may limit our ability to pay dividends on our Class A common sto ck, our Series A Preferred Stock or any other stock we may issue. ▪ We have not generated, and in the future may not generate, operating cash flows sufficient to fund all of the dividends we pa y o ur stockholders, and, as such, we may be forced to fund dividends from other sources, including borrowings, which may not be available on favorable terms, or at all. ▪ We may be unable to pay or maintain cash dividends at the current rate or increase dividends over time. ▪ We are obligated to pay fees, which may be substantial, to the Advisor and its affiliates. ▪ Our operating results are affected by economic and regulatory changes that have an adverse impact on the real estate market i n g eneral, and we are subject to risks associated with any dislocation or liquidity disruptions that may exist or occur in global financial markets, including the credit marke ts of the United States of America. ▪ We may fail to continue to qualify to be treated as a real estate investment trust (“REIT”) for U.S. federal income tax purpo ses , which would result in higher taxes, may adversely affect our operations and would reduce the value of an investment in our common stock and our cash available for di vid ends.

Confidential – Not for Distribution 21 21 Appendix

American Finance Trust, Inc. 22 DEFINITIONS AFFO : In calculating AFFO, we start with FFO, then we exclude certain income or expense items from AFFO that we consider to be more reflective of investing activities, such as fees related to the listing of our Class A common stock on the Nasdaq Global Select Market, non - cash income and expense items and the income and expense effects of other activities that are not a fundamental attribute of our day to day operating business plan, such as amounts related to the RCA merger litigation . These amounts include legal costs incurred as a result of the litigation, portions of which have been and may in the future be reimbursed under insurance policies maintained by us . Insurance reimbursements in future periods are deducted from AFFO in the period of reimbursement . We believe that excluding the litigation costs and subsequent insurance reimbursements, if any, helps to provide a better understanding of the operating performance of our business . Other income and expense items also include early extinguishment of debt and unrealized gains and losses, which may not ultimately be realized, such as gains or losses on derivative instruments and gains and losses on investments . In addition, by excluding non - cash income and expense items such as amortization of above - market and below - market leases intangibles, amortization of deferred financing costs, straight - line rent, vesting and conversion of the Class B Units and share - based compensation related to restricted shares and the 2018 outperformance agreement with the Advisor from AFFO, we believe we provide useful information regarding those income and expense items which have a direct impact on our ongoing operating performance . By providing AFFO, we believe we are presenting useful information that can be used to better assess the sustainability of our ongoing operating performance without the impact of transactions or other items that are not related to the ongoing performance of our portfolio of properties . AFFO presented by us may not be comparable to AFFO reported by other REITs that define AFFO differently . Annualized Straight - Line Rent : Straight line rent which is annualized and calculated using most recent available lease terms as of June 30 , 2019 . Cash Cap Rate : For acquisitions, cash cap rate is a rate of return on a real estate investment property based on the expected, annualized cash rental income during the first year of ownership that the property will generate under its existing lease . For dispositions, cash cap rate is a rate of return based on the annualized cash rental income of the property to be sold . For acquisitions, cash cap rate is calculated by dividing the annualized cash rental income the property will generate (before debt service and depreciation and after fixed costs and variable costs) and the purchase price of the property . For dispositions, cash cap rate is calculated by dividing the annualized cash rental income by the contract sales price for the property . The weighted - average cash cap rate is based upon square feet . Cash NOI : We define Cash NOI as net operating income excluding amortization of above/below market lease intangibles and straight - line adjustments that are included in GAAP lease revenues . Executed Occupancy : Includes Occupancy as of June 30 , 2019 as defined below as well as all leases executed by both parties as of June 30 , 2019 where the tenant has yet to take possession as of such date . Experiential Retail : We define Experiential Retail as multi - tenant properties leased to tenants in the restaurant, discount retail, entertainment, salon/beauty, and grocery sectors, among others . FFO : We define FFO, a non - GAAP measure, consistent with the standards established over time by the Board of Governors of NAREIT, as restated in a White Paper and approved by the Board of Governors of NAREIT effective in December 2018 (the "White Paper") . The White Paper defines FFO as net income or loss computed in accordance with GAAP excluding depreciation and amortization related to real estate, gains and losses from sales of certain real estate assets, gain and losses from change in control and impairment write - downs of certain real estate assets and investments in entities when the impairment is directly attributable to decreases in the value of depreciable real estate held by the entity . Adjustments for unconsolidated partnerships and joint ventures are calculated to exclude the proportionate share of the non - controlling interest to arrive at FFO attributable to stockholders . Our FFO calculation complies with NAREIT's definition . Gross Asset Value : Total assets plus accumulated depreciation and amortization .

American Finance Trust, Inc. 23 DEFINITIONS (CONTINUED) Investment Grade Rating : As used herein, investment grade includes both actual investment grade ratings of the tenant or guarantor, if available, or implied investment grade . Implied investment grade may include actual ratings of tenant parent, guarantor parent (regardless of whether or not the parent has guaranteed the tenant’s obligation under the lease) or by using a proprietary Moody’s analytical tool, which generates an implied rating by measuring a company’s probability of default . Ratings information is as of June 30 , 2019 . Single - tenant portfolio tenants are 45 . 0 % actual investment grade rated and 30 . 6 % implied investment grade rate . Leasing Pipeline : Includes (i) all leases fully executed by both parties as of July 15 , 2019 , but after June 30 , 2019 , and (ii) all leases under negotiation with an executed LOI by both parties as of July 15 , 2019 . Leasing pipeline includes 9 new leases totaling approximately 46 , 000 square feet . There can be no assurance that such lease will commence on their current terms, or at all . Leasing pipeline should not be considered an indication of future performance . Liquidity : Liquidity includes the amount available for future borrowings under the Company's credit facility of $ 56 . 4 million and cash and cash equivalents of $ 92 million as of June 30 , 2019 . The $ 56 . 4 million is exclusive of $ 2 . 7 million in letters of credit posted against the amount available for future borrowings as of June 30 , 2019 . In accordance with the Company's credit facility, if the Company were to make any restricted payments or certain other payments, it would be required to have a combination of cash, cash equivalents and amount available for future borrowings of not less than $ 40 . 0 million . LOI : Represents a non - binding letter of intent Net Debt : Total debt of $ 1 . 6 billion less cash and cash equivalents of $ 91 million as of June 30 , 2019 . Net Debt / Adjusted EBITDA : Represents ratio of net debt as of June 30 , 2019 of $ 1 . 5 billion, to the Company’s calculation of its adjusted earnings before interest, tax, depreciation and amortization (“EBITDA”) multiplied by 4 for the three months ended June 30 , 2019 . Net Leverage : Represents “Net Debt” as defined above divided by “Gross Asset Value” as defined above shown as a percentage . NOI : Defined as a non - GAAP financial measure used by us to evaluate the operating performance of our real estate . NOI is equal to total revenues, excluding contingent purchase price consideration, less property operating and maintenance expense . NOI excludes all other items of expense and income included in the financial statements in calculating net loss . Occupancy : Represents percentage of square footage of which the tenant has taken possession of divided by the respective total rentable square feet as of the date or period end indicated . PSA : Represents a definitive purchase and sale agreement . Rent Escalators : Contractual rent increases include fixed percent or actual increases, or CPI - indexed increases . Annual averages are based on annualized straight - line rent as of June 30 , 2019 . Service Retail : AFIN definition of Service Retail includes single - tenant retail properties leased to tenants in the retail banking, restaurant, grocery, pharmacy, gas/convenience, fitness, and auto services sectors . Traditional Retail : AFIN definition of Traditional Retail includes single - tenant retail properties leased to tenants in the discount retail, home improvement, furniture, specialty retail, auto retail, sporting goods sectors, wireless/electronics, department stores, and home improvement . Weighted Average Cap Rate : Weighted average capitalization rate is a rate of return on a real estate investment property based on the expected, annualized straight - lined rental income that the property will generate under its existing lease during its first year of ownership . Weighted average capitalization rate is calculated by dividing the annualized straight - lined rental income the property will generate (before debt service and depreciation and after fixed costs and variable costs) and the purchase price of the property . The weighted - average capitalization rate is based upon square feet .

American Finance Trust, Inc. 24 NON - GAAP RECONCILIATIONS —— [1] For the three months ended June 30, 2019 includes income from a lease termination fee of $7.6 million, which is recorded in R evenue from tenants in the consolidated statements of operations. [2] For the three months ended June 30, 2019, includes litigation costs related to the merger between the Company and American Re alt y Capital – Retail Centers of America, Inc. completed in February 2017 (the “Merger”) of $0.2 million. For the three months ended March 31, 2019, December 31, 2018 and September 30, 2018, includes litigation costs relat ed to the Merger of $0.3 million, $0.4 million and $0.4 million, respectively, which were previously classified as general and administrative expenses. [3] For the three months ended June 30, 2019, includes equity - based compensation expense related to the Company's restricted comm on shares of $0.3 million. For the three months ended March 31, 2019, December 31, 2018 and September 30, 2018, includes equity - based compensation related to the Company's restricted common shares of $0.3 million, $0.3 m illion and $0.1 million, respectively, that was previously classified as general and administrative expenses. Non - GAAP Measures Amounts in thousands Three Months Ended June 30, 2019 March 31, 2019 December 31, 2018 September 30, 2018 (Unaudited) (Unaudited) (Unaudited) (Unaudited) EBITDA: Net income (loss) $ 8,540 $ (3,200 ) $ (13,546 ) $ (27,291 ) Depreciation and amortization 30,924 32,086 32,638 35,332 Interest expense 21,995 18,440 17,623 17,017 EBITDA [1] 61,459 47,326 36,715 25,058 Impairment charges 4 823 11,023 1,172 Acquisition, transaction and other costs [2] 1,892 854 1,616 1,549 Listing fees — — — 4,988 Vesting and conversion of Class B Units — — — 15,786 Equity - based compensation [3] 3,268 3,021 2,935 2,240 Gain on sale of real estate investments (14,365 ) (2,873 ) (2,186 ) (1,328 ) Other income (667 ) (2,545 ) (794 ) (9 ) Goodwill impairment 1,605 — — — Adjusted EBITDA [1] 53,196 46,606 49,309 49,456 Asset management fees to related party 6,335 6,038 5,848 5,849 General and administrative 6,441 6,061 5,876 6,086 NOI [1] 65,972 58,705 61,033 61,391 Amortization of market lease and other intangibles, net (1,723 ) (1,839 ) (6,054 ) (5,766 ) Straight - line rent (1,566 ) (1,196 ) (2,119 ) (2,589 ) Cash NOI [1] $ 62,683 $ 55,670 $ 52,860 $ 53,036 Cash Paid for Interest: Interest expense $ 21,995 $ 18,440 $ 17,623 $ 17,017 Amortization of deferred financing costs, net and change in accrued interest (3,062 ) (1,329 ) (1,461 ) (1,734 ) Amortization of mortgage premiums on borrowings 839 794 1,097 857 Total cash paid for interest $ 19,772 $ 17,905 $ 17,259 $ 16,140

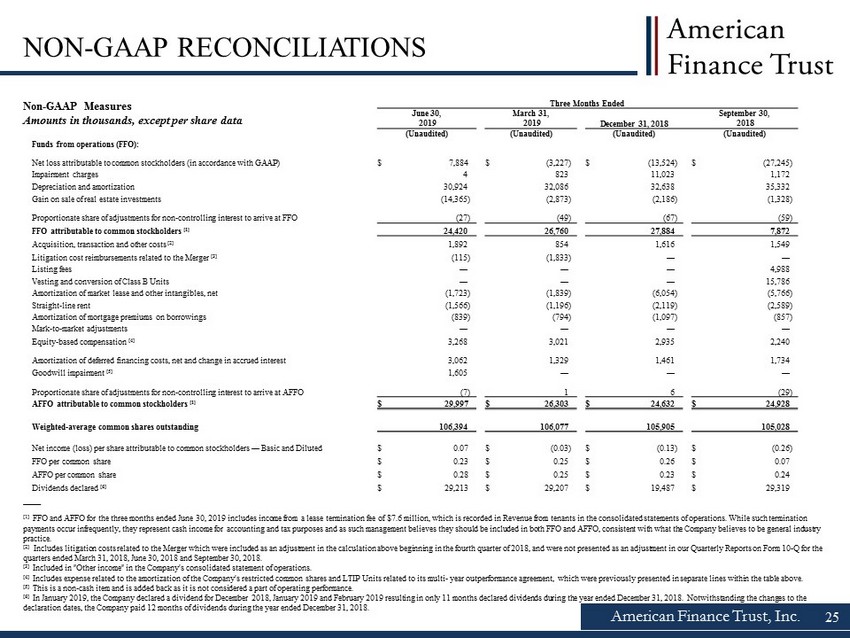

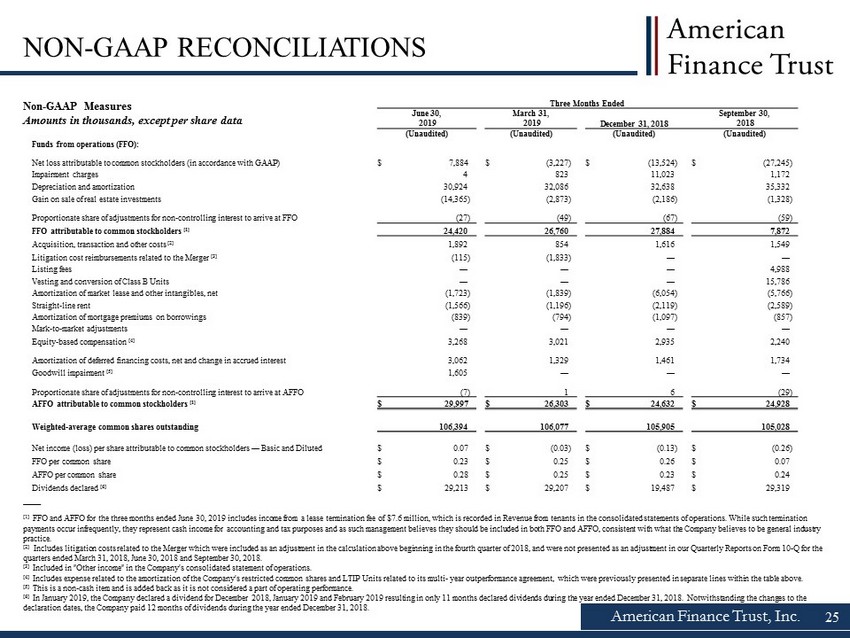

American Finance Trust, Inc. 25 NON - GAAP RECONCILIATIONS Non - GAAP Measures Amounts in thousands, except per share data —— [1] FFO and AFFO for the three months ended June 30, 2019 includes income from a lease termination fee of $7.6 million, which is re corded in Revenue from tenants in the consolidated statements of operations. While such termination payments occur infrequently, they represent cash income for accounting and tax purposes and as such management believes they sho uld be included in both FFO and AFFO, consistent with what the Company believes to be general industry practice. [2] Includes litigation costs related to the Merger which were included as an adjustment in the calculation above beginning in th e fourth quarter of 2018, and were not presented as an adjustment in our Quarterly Reports on Form 10 - Q for the quarters ended March 31, 2018, June 30, 2018 and September 30, 2018. [3] Included in "Other income" in the Company's consolidated statement of operations. [4] Includes expense related to the amortization of the Company's restricted common shares and LTIP Units related to its multi - year outperformance agreement, which were previously presented in separate lines within the table above. [5] This is a non - cash item and is added back as it is not considered a part of operating performance. [6] In January 2019, the Company declared a dividend for December 2018, January 2019 and February 2019 resulting in only 11 month s d eclared dividends during the year ended December 31, 2018. Notwithstanding the changes to the declaration dates, the Company paid 12 months of dividends during the year ended December 31, 2018. Three Months Ended June 30, 2019 March 31, 2019 December 31, 2018 September 30, 2018 (Unaudited) (Unaudited) (Unaudited) (Unaudited) Funds from operations (FFO): Net loss attributable to common stockholders (in accordance with GAAP) $ 7,884 $ (3,227 ) $ (13,524 ) $ (27,245 ) Impairment charges 4 823 11,023 1,172 Depreciation and amortization 30,924 32,086 32,638 35,332 Gain on sale of real estate investments (14,365 ) (2,873 ) (2,186 ) (1,328 ) Proportionate share of adjustments for non - controlling interest to arrive at FFO (27 ) (49 ) (67 ) (59 ) FFO attributable to common stockholders [1] 24,420 26,760 27,884 7,872 Acquisition, transaction and other costs [2] 1,892 854 1,616 1,549 Litigation cost reimbursements related to the Merger [3] (115 ) (1,833 ) — — Listing fees — — — 4,988 Vesting and conversion of Class B Units — — — 15,786 Amortization of market lease and other intangibles, net (1,723 ) (1,839 ) (6,054 ) (5,766 ) Straight - line rent (1,566 ) (1,196 ) (2,119 ) (2,589 ) Amortization of mortgage premiums on borrowings (839 ) (794 ) (1,097 ) (857 ) Mark - to - market adjustments — — — — Equity - based compensation [4] 3,268 3,021 2,935 2,240 Amortization of deferred financing costs, net and change in accrued interest 3,062 1,329 1,461 1,734 Goodwill impairment [5] 1,605 — — — Proportionate share of adjustments for non - controlling interest to arrive at AFFO (7 ) 1 6 (29 ) AFFO attributable to common stockholders [1] $ 29,997 $ 26,303 $ 24,632 $ 24,928 Weighted - average common shares outstanding 106,394 106,077 105,905 105,028 Net income (loss) per share attributable to common stockholders — Basic and Diluted $ 0.07 $ (0.03 ) $ (0.13 ) $ (0.26 ) FFO per common share $ 0.23 $ 0.25 $ 0.26 $ 0.07 AFFO per common share $ 0.28 $ 0.25 $ 0.23 $ 0.24 Dividends declared [6] $ 29,213 $ 29,207 $ 19,487 $ 29,319