UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORMN-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number811-22800

IVY HIGH INCOME OPPORTUNITIES FUND

(Exact name of registrant as specified in charter)

6300 Lamar Avenue, Overland Park, Kansas 66202

(Address of principal executive offices) (Zip code)

Jennifer K. Dulski

6300 Lamar Avenue

Overland Park, Kansas 66202

(Name and address of agent for service)

Registrant’s telephone number, including area code: (913)236-2000

Date of fiscal year end: September 30

Date of reporting period: September 30, 2019

ITEM 1. REPORTS TO STOCKHOLDERS.

| | |

| | Annual Report SEPTEMBER 30, 2019 |

|

Ivy High Income Opportunities Fund |

|

| The Fund’s common shares are listed on the New York |

|

| Stock Exchange and trade under the ticker symbol IVH |

Beginning on January 1, 2021, as permitted by regulations adopted by the U.S. Securities and Exchange Commission (SEC), paper copies of the Fund’s Annual and Semiannual Shareholder Reports no longer will be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Ivy Investments website (www.ivyinvestments.com), and you will be notified by mail each time a report is posted, and provided with a website link to access the report.

If you have already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically anytime by contacting your financial intermediary (e.g., a broker-dealer or bank).

You may elect to receive all future reports in paper format free of charge. You can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports.

The Fund is anon-diversified,closed-end management investment company designed primarily as a long-term investment and not as a trading vehicle.

IVY INVESTMENTSSM refers to the financial services offered by Ivy Distributors, Inc., a FINRA member broker dealer and the distributor of IVY FUNDS®mutual funds, and those financial services offered by its affiliates.

| | |

| CONTENTS | | IVY HIGH INCOME OPPORTUNITIES FUND |

2

| | |

| PRESIDENT’S LETTER | | IVY HIGH INCOME OPPORTUNITIES FUND |

| | |

| | SEPTEMBER 30, 2019 (UNAUDITED) |

| Philip J. Sanders, CFA | | |

Dear Shareholder,

We saw a little bit of everything during the fiscal period. The start of the fiscal year witnessed dramatic market volatility and, at the end of 2018, the worst quarter for U.S. equities since 2011. Equity markets roared back following the sharp correction, with the S&P 500 Index advancing more than 20% in 2019, as of Sept. 30, and every sector posting gains. The rally had apro-cyclical component, as information technology and real estate delivered the strongest sector returns, while energy and health care were the laggards.

The U.S. economy remains relatively healthy and remains in the longest economic expansion in U.S. history despite uncertainty about trade and signs of global weakening. We believe the underlying fundamentals — a strong job market, rising wages and low inflation — support continued growth during the rest of 2019. However, U.S. trade policy remains a wildcard and poses a major threat to the current expansion.

The U.S. Federal Reserve (Fed) held steady on interest rates for the first half of 2019, but cut the federal funds rate by 25 basis points in July and then again in September. The federal funds target range currently is1.75-2.0%. Increasing pressures from trade turmoil and uncertainty around the strength of global growth led the Fed to become more accommodative, and we believe one additional rate cut is likely by calendar year’s end.

The pace of economic growth in Europe has weakened during the fiscal period, mainly due to the drag of global trade and Brexit uncertainty. We anticipate eurozone growth will remain weak through the rest of the year, but could see some stabilization by the end of 2019. The European Central Bank introduced a broad stimulus package in September, including lower rates, a reboot of quantitative easing and a commitment to maintain these initiatives until inflation moves toward its target of just below 2%. With core inflation currently around 1%, we expect these policies to be in place for at least the next year or two.

Emerging markets faced multiple headwinds over the fiscal year, namely a strong dollar, China’s focus on deleveraging and regulation, trade wars, volatile energy prices and increased geopolitical risks. Despite near-term concerns and likely volatility across the global equity market, we believe the long-term fundamentals in emerging markets will continue to offer opportunities. By comparison, U.S. equities broadly have benefitted from a more attractive growth rate, which was the result of tax reform, lower regulatory pressures and repatriation of overseas earnings.

Looking ahead, we believe equities face intensifying headwinds as the pace of global growth slows and trade turmoil lingers. As we examine the investment landscape, we continue to put greater emphasis on the fundamentals and quality of asset classes and sectors. We believe it is important to stay focused on the merits of individual market sectors, industries and companies when making investment decisions. Those fundamentals historically have tended to outweigh external factors such as government policies and regulations. While those can affect every business and every investor, we think the innovation and management skill within individual companies are the ultimate drivers of long-term stock prices.

Economic Snapshot

| | | | | | | | |

| | | 9/30/2019 | | | 9/30/2018 | |

S&P 500 Index | | | 2,976.74 | | | | 2,913.98 | |

MSCI EAFE Index | | | 1,889.36 | | | | 1,973.60 | |

10-Year Treasury Yield | | | 1.68% | | | | 3.05% | |

U.S. unemployment rate | | | 3.5% | | | | 3.7% | |

30-year fixed mortgage rate | | | 3.64% | | | | 4.72% | |

Oil price per barrel | | $ | 54.07 | | | $ | 73.25 | |

Sources: Bloomberg, U.S. Department of Labor, MBA, CME

All government statistics shown are subject to periodic revision. The S&P 500 Index is an unmanaged index that tracks the stocks of 500 primarilylarge-cap U.S. companies. MSCI EAFE Index is an unmanaged index comprised of securities that represent the securities markets in Europe, Australasia and the Far East. It is not possible to invest directly in any of these indexes. Mortgage rates are from BankRate and reflect the overnight national average rate on a conventional30-year fixed loan. Oil prices reflect the market price of West Texas intermediate grade crude.

Respectfully,

Philip J. Sanders, CFA

President

The opinions expressed in this letter are those of the President of the Ivy High Income Opportunities Fund and are current only through the end of the period of the report, as stated on the cover. The President’s views are subject to change at any time, based on market and other conditions, and no forecasts can be guaranteed.

| | |

| MANAGEMENT DISCUSSION | | IVY HIGH INCOME OPPORTUNITIES FUND |

(UNAUDITED)

Chad A. Gunther

Below, Chad Gunther, portfolio manager of the Ivy High Income Opportunities Fund, discusses positioning, performance and results for the fiscal year ended September 30, 2019. Mr. Gunther has been manager of the Fund since 2014 and has 21 years industry experience

| | | | |

For the 12 Months Ended September 30, 2019 | | | | |

Ivy High Income Opportunities Fund (Fund at net asset value) | | | 4.10% | |

Ivy High Income Opportunities Fund (Fund at market price) | | | 6.07% | |

Investment Environment

The fiscal year stood in stark contrast to the prior fiscal year – federal funds rate hikes have pivoted to federal funds rate cuts, business confidence has declined due to worries over the U.S.-China trade war and global growth has slowed meaningfully leading to a briefly inverted yield curve. Consumer confidence,all-time lows in unemployment and the global easing cycle continue to be the glue holding together the longest economic expansion.

Interest rates, notably negative interest rates, continue to reverberate throughout the global economy. The10-year U.S. Treasury rate started the fiscal year at 3.08%, but ended the period at 1.67% due to slowing global growth and the uncertainty of trade. The spread on the Fund’s benchmark, the Bank of America Merrill Lynch U.S. High Yield Master II Index, increased from 316 basis points (bps) to 408 bps by year end. However, theyield-to-worst, a measure of the lowest possible yield from owning a bond considering all potential call dates before maturity, on the benchmark decreased from 6.28% to 5.87%.

Fund flows improved relative to the prior fiscal year, as high yield bond funds experienced outflows of approximately $5.5 billion versus last fiscal year’s more than $30 billion of outflows. Leveraged loan funds experienced more than $45 billion of outflows compared to approximately $11 billion of inflows last year. Defaults have remained steady year over year at $47 billion versus $45 billion during the previous fiscal year.

Investment Performance

During the fiscal year, the Fund underperformed its benchmark from a NAV perspective as well as from a market price perspective. The benchmark returned 6.52% for the fiscal year.

The Fund’s allocation to bonds outperformed the benchmark, returning 6.66%, but its allocation to loans and equities was a drag on relative performance, as both underperformed the benchmark. Loan credit selection in the mining, oil & gas and personal food sectors were particularly punitive during the period, while bond credit selection in the telecommunications sector helped offset the declines.

Outlook

President Donald Trump’s trade tariffs, a presidential impeachment inquiry by the House of Representatives, slowing global growth and weak business confidence continue to weigh on the markets ahead of continued trade negotiations between the U.S. and China. We believe the president needs a deal (big or small) with China to head off a recession, which we believe is likely if the next round of tariffs is put in place.

On the flip side, the strong labor market continues to help consumer confidence, while the Federal Reserve (Fed) and global central banks are easing and providing stimulus, which in turn has continued to help sectors such as housing and building materials. Assuming we are correct in our expectation of some form of U.S.-China trade deal, with high yield spreads at around 500 bps, we think credit investors have a favorable setup into year end and 2020.

Going forward, we are also finding better relative value in the loan market as a Fed easing cycle and outflows throughout the fiscal year have created what we believe are attractive risk-return profiles in first lien loans. As always, our focus when evaluating investments is to focus on a company’s business model and competitive advantages.

The investment return, price, yields, market value and NAV of a fund’s shares will fluctuate with market conditions.Closed-end funds frequently trade at a discount to their NAV, which may increase an investor’s risk of loss. At the time of sale, your shares may have a market price that is above or below NAV, and may be worth more or less than your original investment. There is no assurance that the Fund will meet its investment objective.

Risk factors: The price of the Fund’s shares will fluctuate with market conditions and other factors. Fund shares are not guaranteed or endorsed by any bank or other insured depository institution, and are not federally insured by the Federal Deposit Insurance Corporation. Investing in high-income securities may carry a greater risk of nonpayment of interest or principal than with higher-rated bonds. Loans (including loan assignments, loan participations and other loan instruments) carry other risks, including the risk of insolvency of the lending bank or other intermediary. Loans may be unsecured or not fully collateralized and may be subject to restrictions on resale and sometimes trade infrequently on the secondary market. An investment in the Fund is not appropriate for all investors and is not intended to be a complete investment program. The Fund is designed as a long-term investment and not as a trading vehicle.

The opinions expressed in this report are those of the portfolio manager and are current only through the end of the period of the report as stated on the cover. The manager’s views are subject to change at any time based on market and other conditions, and no forecasts can be guaranteed.

| | |

| PORTFOLIO HIGHLIGHTS | | IVY HIGH INCOME OPPORTUNITIES FUND |

ALL DATA IS AS OF SEPTEMBER 30, 2019 (UNAUDITED)

| | | | | | | | |

| Total Return(1) | | Market Price | | | NAV | |

1-year period ended9-30-19 | | | 6.07% | | | | 4.10% | |

5-year period ended9-30-19 | | | 6.23% | | | | 5.82% | |

Commencement of operations(5-29-13) through9-30-19 | | | 4.41% | | | | 6.73% | |

|

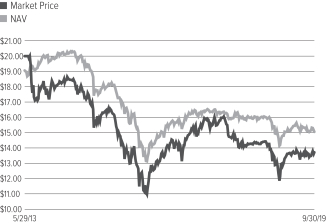

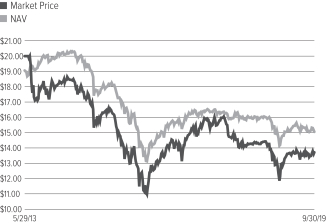

| Market Price/NAV Performance |

Commencement of operations(5-29-13) through9-30-19 |

| | | | |

| Market Price/NAV | | | |

Market Price | | $ | 13.71 | |

NAV | | $ | 15.05 | |

Discount to NAV(3) | | | -8.90% | |

Market Price Yield(4) | | | 8.75% | |

Structural Leverage Ratio(5) | | | 30.99% | |

Effective Leverage Ratio(6) | | | 30.99% | |

Net asset value or “NAV” is the value of one share of a fund as calculated in accordance with the standard formula for valuing mutual fund shares. The price used to calculate market return (“Market Price”) is determined by using the midpoint between the highest bid and the lowest ask on the primary stock exchange on which shares of a fund are listed for trading, as of the time that such fund’s NAV is calculated. Market and NAV returns assume that dividends and capital gain distributions have been reinvested according to the Fund’s dividend reinvestment plan.

Asset Allocation (%’s based on total investments)

| | | | |

Stocks | | | 1.7% | |

Energy | | | 1.1% | |

Consumer Discretionary | | | 0.6% | |

Health Care | | | 0.0% | |

Industrials | | | 0.0% | |

Consumer Staples | | | 0.0% | |

Warrants | | | 0.0% | |

Bonds | | | 91.0% | |

Corporate Debt Securities | | | 68.0% | |

Loans | | | 23.0% | |

Borrowings(2) | | | -31.6% | |

Cash Equivalents+ | | | 7.3% | |

Quality Weightings (%’s based on total investments)

| | | | |

Non-Investment Grade | | | 91.0% | |

BB | | | 9.0% | |

B | | | 49.5% | |

CCC | | | 28.2% | |

Below CCC | | | 1.2% | |

Non-rated | | | 3.1% | |

Borrowings(2) | | | -31.6% | |

Cash Equivalents+ and Equities | | | 9.0% | |

Our preference is to always use ratings obtained from Standard & Poor’s, Moody’s, and Fitch. It is each Portfolio’s general policy to classify such security at the lower rating level if only two ratings are available. If more than two ratings are available and a median exists, the median is used. If more than two ratings exist without a median, the lower of the two middle ratings is used. We do not evaluate these ratings, but simply assign them to the appropriate credit quality category as determined by the rating agency.

| + | Cash equivalents are defined as highly liquid securities with maturities of less than three months. Cash equivalents may include U.S. Government Treasury bills, bank certificates of deposit, bankers’ acceptances, corporate commercial paper and other money market instruments. |

| (1) | Past performance is not necessarily indicative of future performance. Total return is calculated by determining the percentage change in NAV or market price (as applicable) in the specified period. The calculation assumes that all dividends and distributions, if any, have been reinvested. Performance at market price will differ from results at NAV. Returns at market price can be influenced by factors such as changing views about the Fund, market conditions, supply and demand for the Fund’s stock, or changes in the Fund’s dividends. An investment in the Fund involves risk, including the loss of principal. Total return, market price, market price yield and NAV will fluctuate with changes in market conditions. This data is provided for information purposes only and is not intended for trading purposes.Closed-end funds, unlikeopen-end funds, are not continuously offered. There is a one time public offering and, once issued, shares ofclosed-end funds are traded in the open market through a stock exchange. NAV is equal to total assets less total liabilities divided by the total number of shares outstanding. Holdings are subject to change daily. |

| (2) | The Fund has entered into a borrowing arrangement with Pershing LLC as a means of financial leverage. See Note 8 in the Notes to Financial Statements for additional information. |

| (3) | The premium/discount is calculated as (most recent market price/most recent NAV)-1. |

| (4) | Market price yield is determined by dividing the annualized current monthly dividend per share (comprised of net investment income) by the market price per share at September 30, 2019. |

| (5) | Structural leverage consists of borrowings outstanding as a percentage of managed assets. Managed assets are the Fund’s total assets, including the assets attributable to the proceeds from any borrowings, minus liabilities other than the aggregate indebtedness entered into for the purpose of leverage. |

| (6) | The Fund’s effective leverage ratio includes both structural leverage and the leveraging effects of certain derivative instruments in the Fund’s portfolio (referred to as “portfolio leverage”), expressed as a percentage of managed assets. Portfolio leverage from the Fund’s use of forward foreign currency contracts is included in the Fund’s effective leverage values. |

| | |

| SCHEDULE OF INVESTMENTS | | IVY HIGH INCOME OPPORTUNITIES FUND (in thousands) |

SEPTEMBER 30, 2019

| | | | | | | | |

| COMMON STOCKS | | Shares | | | Value | |

Consumer Discretionary | |

| |

Apparel Retail – 0.0% | |

True Religion Apparel, Inc. (A)(C) | | | 34 | | | $ | — | * |

| | | | | | | | |

| |

Hotels, Resorts & Cruise Lines – 0.9% | |

Studio City International Holdings Ltd. (A) | | | 108 | | | | 2,177 | |

| | | | | | | | |

| |

Total Consumer Discretionary – 0.9% | | | | 2,177 | |

Energy | |

| |

Coal & Consumable Fuels – 0.1% | |

Westmoreland Coal Co. (A) | | | 13 | | | | 163 | |

| | | | | | | | |

| |

Oil & Gas Equipment & Services – 0.2% | |

Larchmont Resources

LLC (A)(B)(C)(D)(E) | | | 2 | | | | 415 | |

| | | | | | | | |

| |

Oil & Gas Exploration & Production – 0.0% | |

Bellatrix Exploration Ltd. (A)(B) | | | 179 | | | | 54 | |

| | | | | | | | |

| |

Total Energy – 0.3% | | | | 632 | |

Health Care | |

| |

Pharmaceuticals – 0.0% | |

Advanz Pharma Corp. (A)(B) | | | 9 | | | | 112 | |

| | | | | | | | |

| |

Total Health Care – 0.0% | | | | 112 | |

Industrials | |

| |

Air Freight & Logistics – 0.0% | |

BIS Industries Ltd. (A)(C)(D) | | | 804 | | | | 32 | |

| | | | | | | | |

| |

Total Industrials – 0.0% | | | | 32 | |

| |

TOTAL COMMON STOCKS – 1.2% | | | $ | 2,953 | |

(Cost: $2,719) | |

| | |

| PREFERRED STOCKS | | | | | | |

Consumer Staples | |

| |

Agricultural Products – 0.0% | |

Pinnacle Agriculture Enterprises LLC (A)(C)(D) | | | 1,358 | | | | 57 | |

| | | | | | | | |

| |

Total Consumer Staples – 0.0% | | | | 57 | |

Energy | |

| |

Oil & Gas Exploration & Production – 1.3% | |

Targa Resources Corp.,

9.500% (A)(D) | | | 3 | | | | 3,183 | |

| | | | | | | | |

| |

Total Energy – 1.3% | | | | 3,183 | |

| |

TOTAL PREFERRED STOCKS – 1.3% | | | $ | 3,240 | |

(Cost: $3,909) | |

| | | | | | | | |

| WARRANTS | | Shares | | | Value | |

Oil & Gas Exploration & Production – 0.0% | |

Ultra Resources, Inc.,

expires 7–14–25 (C)(F) | | | 8 | | | $ | — | * |

| | | | | | | | |

| |

TOTAL WARRANTS – 0.0% | | | $ | — | * |

(Cost: $2) | |

| | |

| CORPORATE DEBT SECURITIES | | Principal | | | | |

Communication Services | |

| |

Alternative Carriers – 0.2% | |

Consolidated Communications Finance II Co., | | | | | | | | |

6.500%, 10–1–22 (G) | | $ | 377 | | | | 349 | |

| | | | | | | | |

| |

Broadcasting – 1.6% | |

Clear Channel Outdoor Holdings, Inc., | | | | | | | | |

5.125%, 8–15–27 (H) | | | 2,246 | | | | 2,340 | |

Clear Channel Worldwide Holdings, Inc., | | | | | | | | |

9.250%, 2–15–24 (G)(H) | | | 1,627 | | | | 1,787 | |

| | | | | | | | |

| | | | | | | 4,127 | |

| | | | | | | | |

| |

Cable & Satellite – 15.8% | |

Altice Financing S.A.: | | | | | | | | |

6.625%, 2–15–23 (H) | | | 617 | | | | 633 | |

7.500%, 5–15–26 (G)(H) | | | 1,425 | | | | 1,514 | |

Altice France S.A.: | | | | | | | | |

7.375%, 5–1–26 (G)(H) | | | 3,100 | | | | 3,328 | |

8.125%, 2–1–27 (G)(H) | | | 2,659 | | | | 2,935 | |

Altice Luxembourg S.A., | | | | | | | | |

10.500%, 5–15–27 (G)(H) | | | 4,582 | | | | 5,164 | |

Altice S.A.: | | | | | | | | |

7.750%, 5–15–22 (H) | | | 1,505 | | | | 1,537 | |

7.625%, 2–15–25 (G)(H) | | | 9,212 | | | | 9,603 | |

Altice U.S. Finance I Corp.: | | | | | | | | |

5.375%, 7–15–23 (H) | | | 1,026 | | | | 1,053 | |

5.500%, 5–15–26 (H) | | | 1,216 | | | | 1,280 | |

CCO Holdings LLC and CCO Holdings Capital Corp.: | | | | | | | | |

5.500%, 5–1–26 (H) | | | 485 | | | | 508 | |

5.000%, 2–1–28 (G)(H) | | | 1,642 | | | | 1,697 | |

CSC Holdings LLC: | | | | | | | | |

5.375%, 2–1–28 (G)(H) | | | 1,940 | | | | 2,044 | |

5.750%, 1–15–30 (H) | | | 555 | | | | 580 | |

DISH DBS Corp.: | | | | | | | | |

5.875%, 7–15–22 (G) | | | 2,000 | | | | 2,080 | |

5.875%, 11–15–24 | | | 748 | | | | 741 | |

7.750%, 7–1–26 (G) | | | 1,032 | | | | 1,052 | |

Neptune Finco Corp., | | | | | | | | |

6.625%, 10–15–25 (H) | | | 394 | | | | 422 | |

VTR Finance B.V., | | | | | | | | |

6.875%, 1–15–24 (G)(H) | | | 3,172 | | | | 3,263 | |

| | | | | | | | |

| | | | | | | 39,434 | |

| | | | | | | | |

| |

Integrated Telecommunication Services – 8.1% | |

Frontier Communications Corp.: | | | | | | | | |

6.875%, 1–15–25 (G) | | | 2,776 | | | | 1,228 | |

11.000%, 9–15–25 (G) | | | 3,876 | | | | 1,752 | |

8.500%, 4–1–26 (G)(H) | | | 8,400 | | | | 8,399 | |

| | | | | | | | |

CORPORATE DEBT SECURITIES

(Continued) | | Principal | | | Value | |

Integrated Telecommunication Services(Continued) | |

GCI, Inc., | | | | | | | | |

6.875%, 4–15–25 (G) | | $ | 2,870 | | | $ | 3,021 | |

West Corp., | | | | | | | | |

8.500%, 10–15–25 (G)(H) | | | 7,035 | | | | 5,654 | |

| | | | | | | | |

| | | | | | | 20,054 | |

| | | | | | | | |

| |

Publishing – 0.5% | |

MDC Partners, Inc., | | | | | | | | |

6.500%, 5–1–24 (G)(H) | | | 1,471 | | | | 1,340 | |

| | | | | | | | |

| |

Wireless Telecommunication Service – 3.3% | |

Digicel Group Ltd.: | | | | | | | | |

6.000%, 4–15–21 (H) | | | 795 | | | | 560 | |

8.250%, 9–30–22 (H) | | | 349 | | | | 72 | |

8.250%, 12–30–22 (H)(I) | | | 1,270 | | | | 749 | |

Digicel Group Ltd. (7.125% Cash or 2.000% PIK), | | | | | | | | |

9.125%, 4–1–24 (H)(J) | | | 1,208 | | | | 115 | |

Digicel International Finance Ltd., | | | | | | | | |

8.750%, 5–25–24 (G)(H) | | | 6,359 | | | | 6,041 | |

Digicel Ltd., | | | | | | | | |

6.750%, 3–1–23 (H) | | | 1,044 | | | | 497 | |

| | | | | | | | |

| | | | | | | 8,034 | |

| | | | | | | | |

| |

Total Communication Services – 29.5% | | | | 73,338 | |

Consumer Discretionary | |

| |

Auto Parts & Equipment – 0.1% | |

Panther BF Aggregator 2 L.P., | | | | | | | | |

6.250%, 5–15–26 (H) | | | 273 | | | | 287 | |

| | | | | | | | |

| |

Automotive Retail – 0.9% | |

Allison Transmission, Inc., | | | | | | | | |

5.000%, 10–1–24 (H) | | | 315 | | | | 322 | |

Sonic Automotive, Inc.: | | | | | | | | |

5.000%, 5–15–23 (G) | | | 1,379 | | | | 1,396 | |

6.125%, 3–15–27 | | | 489 | | | | 497 | |

| | | | | | | | |

| | | | | | | 2,215 | |

| | | | | | | | |

| |

Casinos & Gaming – 2.5% | |

Everi Payments, Inc., | | | | | | | | |

7.500%, 12–15–25 (G)(H) | | | 1,684 | | | | 1,774 | |

Gateway Casinos & Entertainment Ltd., | | | | | | | | |

8.250%, 3–1–24 (H) | | | 927 | | | | 962 | |

Golden Nugget, Inc., | | | | | | | | |

6.750%, 10–15–24 (G)(H) | | | 2,111 | | | | 2,164 | |

Wynn Macau Ltd.: | | | | | | | | |

4.875%, 10–1–24 (H) | | | 340 | | | | 339 | |

5.500%, 10–1–27 (H) | | | 964 | | | | 976 | |

| | | | | | | | |

| | | | | | | 6,215 | |

| | | | | | | | |

| |

Education Services – 3.4% | |

Laureate Education, Inc., | | | | | | | | |

8.250%, 5–1–25 (G)(H) | | | 7,858 | | | | 8,546 | |

| | | | | | | | |

| |

Hotels, Resorts & Cruise Lines – 0.4% | |

Boyne USA, Inc., | | | | | | | | |

7.250%, 5–1–25 (H) | | | 1,019 | | | | 1,110 | |

| | | | | | | | |

| | |

| SCHEDULE OF INVESTMENTS | | IVY HIGH INCOME OPPORTUNITIES FUND (in thousands) |

SEPTEMBER 30, 2019

| | | | | | | | |

CORPORATE DEBT SECURITIES

(Continued) | | Principal | | | Value | |

Leisure Facilities – 0.4% | |

Cedar Fair L.P., Magnum Management Corp., Canada’s Wonderland Co. and Millennium Operations LLC, | | | | | | | | |

5.375%, 4–15–27 | | $ | 877 | | | $ | 938 | |

| | | | | | | | |

| |

Specialized Consumer Services – 0.6% | |

Nielsen Co. (Luxembourg) S.a.r.l. (The), | | | | | | | | |

5.500%, 10–1–21 (G)(H) | | | 1,071 | | | | 1,075 | |

Nielsen Finance LLC and Nielsen Finance Co., | | | | | | | | |

5.000%, 4–15–22 (H) | | | 375 | | | | 376 | |

| | | | | | | | |

| | | | | | | 1,451 | |

| | | | | | | | |

| |

Specialty Stores – 5.2% | |

Cumberland Farms, Inc., | | | | | | | | |

6.750%, 5–1–25 (H) | | | 770 | | | | 825 | |

Party City Holdings, Inc., | | | | | | | | |

6.625%, 8–1–26 (H)(I) | | | 804 | | | | 796 | |

Staples, Inc.: | | | | | | | | |

7.500%, 4–15–26 (G)(H) | | | 6,900 | | | | 7,109 | |

10.750%, 4–15–27 (H) | | | 4,140 | | | | 4,254 | |

| | | | | | | | |

| | | | | | | 12,984 | |

| | | | | | | | |

| |

Total Consumer Discretionary – 13.5% | | | | 33,746 | |

Consumer Staples | |

| |

Food Distributors – 1.1% | |

Performance Food Group, Inc.: | | | | | | | | |

5.500%, 6–1–24 (G)(H) | | | 1,054 | | | | 1,076 | |

5.500%, 10–15–27 (H) | | | 198 | | | | 208 | |

U.S. Foods, Inc., | | | | | | | | |

5.875%, 6–15–24 (G)(H) | | | 1,330 | | | | 1,370 | |

| | | | | | | | |

| | | | | | | 2,654 | |

| | | | | | | | |

| |

Packaged Foods & Meats – 6.6% | |

JBS USA LLC and JBS USA Finance, Inc.: | | | | | | | | |

5.875%, 7–15–24 (G)(H) | | | 2,002 | | | | 2,062 | |

5.750%, 6–15–25 (G)(H) | | | 1,904 | | | | 1,984 | |

JBS USA Lux S.A. and JBS USA Finance, Inc., | | | | | | | | |

6.750%, 2–15–28 (G)(H) | | | 1,282 | | | | 1,420 | |

JBS USA, JBS USA Food Co. and JBS USA Finance, Inc. (GTD by JBS S.A.): | | | | | | | | |

6.500%, 4–15–29 (H) | | | 221 | | | | 245 | |

5.500%, 1–15–30 (H) | | | 838 | | | | 888 | |

Pilgrim’s Pride Corp.: | | | | | | | | |

5.750%, 3–15–25 (H) | | | 357 | | | | 370 | |

5.875%, 9–30–27 (G)(H) | | | 1,275 | | | | 1,369 | |

Post Holdings, Inc.: | | | | | | | | |

5.500%, 3–1–25 (H) | | | 346 | | | | 363 | |

5.000%, 8–15–26 (H) | | | 523 | | | | 542 | |

5.750%, 3–1–27 (G)(H) | | | 2,222 | | | | 2,356 | |

Simmons Foods, Inc.: | | | | | | | | |

7.750%, 1–15–24 (H) | | | 701 | | | | 759 | |

5.750%, 11–1–24 (G)(H) | | | 4,255 | | | | 4,148 | |

| | | | | | | | |

| | | | | | | 16,506 | |

| | | | | | | | |

| |

Total Consumer Staples – 7.7% | | | | 19,160 | |

| | | | | | | | |

CORPORATE DEBT SECURITIES

(Continued) | | Principal | | | Value | |

Energy | |

| |

Oil & Gas Drilling – 1.1% | |

KCA Deutag UK Finance plc, | | | | | | | | |

7.250%, 5–15–21 (G)(H) | | $ | 1,793 | | | $ | 1,125 | |

Offshore Drilling Holding S.A., | | | | | | | | |

8.375%, 9–20–20 (G)(H)(K) | | | 3,385 | | | | 1,041 | |

Offshore Group Investment Ltd., | | | | | | | | |

0.000%, 11–1–19 (C)(L) | | | 883 | | | | — | * |

Valaris plc, | | | | | | | | |

7.750%, 2–1–26 (I) | | | 1,017 | | | | 544 | |

| | | | | | | | |

| | | | | | | 2,710 | |

| | | | | | | | |

| |

Oil & Gas Equipment & Services – 0.4% | |

Nine Energy Service, Inc., | | | | | | | | |

8.750%, 11–1–23 (H) | | | 806 | | | | 653 | |

SESI LLC, | | | | | | | | |

7.125%, 12–15–21 | | | 401 | | | | 273 | |

| | | | | | | | |

| | | | | | | 926 | |

| | | | | | | | |

| |

Oil & Gas Exploration & Production – 4.7% | |

Bellatrix Exploration Ltd., | | | | | | | | |

8.500%, 9–11–23 | | | 418 | | | | 425 | |

Bellatrix Exploration Ltd. (3.000% Cash or 9.500% PIK), | | | | | | | | |

9.500%, 12–15–23 (J) | | | 456 | | | | 462 | |

Brazos Valley Longhorn LLC and Brazos Valley Longhorn Finance Corp., | | | | | | | | |

6.875%, 2–1–25 | | | 274 | | | | 236 | |

Chesapeake Energy Corp.: | | | | | | | | |

7.000%, 10–1–24 (G) | | | 1,867 | | | | 1,340 | |

8.000%, 1–15–25 (I) | | | 157 | | | | 113 | |

Crownrock L.P., | | | | | | | | |

5.625%, 10–15–25 (G)(H) | | | 2,927 | | | | 2,945 | |

Endeavor Energy Resources L.P.: | | | | | | | | |

5.500%, 1–30–26 (H) | | | 1,014 | | | | 1,055 | |

5.750%, 1–30–28 (H) | | | 728 | | | | 773 | |

Extraction Oil & Gas, Inc., | | | | | | | | |

5.625%, 2–1–26 (G)(H) | | | 1,490 | | | | 913 | |

Laredo Petroleum, Inc., | | | | | | | | |

6.250%, 3–15–23 (I) | | | 339 | | | | 297 | |

Sanchez Energy Corp., | | | | | | | | |

7.250%, 2–15–23 (H)(I)(M) | | | 257 | | | | 185 | |

Seven Generations Energy Ltd.: | | | | | | | | |

6.750%, 5–1–23 (G)(H) | | | 1,866 | | | | 1,885 | |

5.375%, 9–30–25 (G)(H) | | | 975 | | | | 965 | |

Ultra Resources, Inc. (9.000% Cash or 2.000% PIK), | | | | | | | | |

11.000%, 7–12–24 (J) | | | 411 | | | | 57 | |

| | | | | | | | |

| | | | | | | 11,651 | |

| | | | | | | | |

| |

Oil & Gas Refining & Marketing – 2.2% | |

Callon Petroleum Co. (GTD by Callon Petroleum Operating Co.): | | | | | | | | |

6.125%, 10–1–24 | | | 468 | | | | 461 | |

6.375%, 7–1–26 | | | 158 | | | | 154 | |

Comstock Escrow Corp., | | | | | | | | |

9.750%, 8–15–26 (G) | | | 4,556 | | | | 3,804 | |

EP Energy LLC and Everest Acquisition Finance, Inc.: | | | | | | | | |

9.375%, 5–1–24 (H) | | | 550 | | | | 15 | |

8.000%, 2–15–25 (H)(M) | | | 588 | | | | 15 | |

7.750%, 5–15–26 (H) | | | 793 | | | | 595 | |

| | | | | | | | |

CORPORATE DEBT SECURITIES

(Continued) | | Principal | | | Value | |

Oil & Gas Refining & Marketing(Continued) | |

QEP Resources, Inc., | | | | | | | | |

5.625%, 3–1–26 | | $ | 628 | | | $ | 540 | |

| | | | | | | | |

| | | | | | | 5,584 | |

| | | | | | | | |

| |

Total Energy – 8.4% | | | | 20,871 | |

Financials | |

| |

Consumer Finance – 1.1% | |

CURO Group Holdings Corp., | | | | | | | | |

8.250%, 9–1–25 (G)(H) | | | 1,227 | | | | 1,070 | |

Quicken Loans, Inc., | | | | | | | | |

5.750%, 5–1–25 (G)(H) | | | 1,688 | | | | 1,741 | |

| | | | | | | | |

| | | | | | | 2,811 | |

| | | | | | | | |

| |

Financial Exchanges & Data – 1.5% | |

Refinitiv U.S. Holdings, Inc.: | | | | | | | | |

6.250%, 5–15–26 (G)(H) | | | 1,068 | | | | 1,146 | |

8.250%, 11–15–26 (G)(H) | | | 2,458 | | | | 2,713 | |

| | | | | | | | |

| | | | | | | 3,859 | |

| | | | | | | | |

| |

Insurance Brokers – 1.8% | |

NFP Corp., | | | | | | | | |

6.875%, 7–15–25 (G)(H) | | | 4,647 | | | | 4,612 | |

| | | | | | | | |

| |

Other Diversified Financial Services – 1.8% | |

New Cotai LLC and New Cotai Capital Corp. (10.625% Cash or 10.625% PIK), | | | | | | | | |

10.625%,

5–1–19 (G)(H)(J)(M) | | | 8,251 | | | | 4,372 | |

| | | | | | | | |

| |

Property & Casualty Insurance – 1.4% | |

Amwins Group, Inc., | | | | | | | | |

7.750%, 7–1–26 (H) | | | 1,329 | | | | 1,428 | |

Hub International Ltd., | | | | | | | | |

7.000%, 5–1–26 (G)(H) | | | 1,941 | | | | 1,997 | |

| | | | | | | | |

| | | | | | | 3,425 | |

| | | | | | | | |

| |

Specialized Finance – 2.1% | |

BCPE Cycle Merger Sub II, Inc., | | | | | | | | |

10.625%, 7–15–27 (G)(H) | | | 2,224 | | | | 2,146 | |

Compass Group Diversified Holdings LLC, | | | | | | | | |

8.000%, 5–1–26 (G)(H) | | | 1,050 | | | | 1,110 | |

Tervita Escrow Corp., | | | | | | | | |

7.625%, 12–1–21 (H) | | | 529 | | | | 538 | |

TMX Finance LLC and TitleMax Finance Corp., | | | | | | | | |

11.125%, 4–1–23 (G)(H) | | | 1,524 | | | | 1,410 | |

| | | | | | | | |

| | | | | | | 5,204 | |

| | | | | | | | |

| |

Thrifts & Mortgage Finance – 0.5% | |

Provident Funding Associates L.P. and PFG Finance Corp., | | | | | | | | |

6.375%, 6–15–25 (G)(H) | | | 1,220 | | | | 1,186 | |

| | | | | | | | |

| |

Total Financials – 10.2% | | | | 25,469 | |

| | |

| SCHEDULE OF INVESTMENTS | | IVY HIGH INCOME OPPORTUNITIES FUND (in thousands) |

SEPTEMBER 30, 2019

| | | | | | | | |

CORPORATE DEBT SECURITIES

(Continued) | | Principal | | | Value | |

Health Care | |

| |

Health Care Facilities – 3.0% | |

Regional Care Hospital Partners Holdings, Inc. and Legend Merger Sub, Inc., | | | | | | | | |

9.750%, 12–1–26 (G)(H) | | $ | 4,682 | | | $ | 5,009 | |

Surgery Center Holdings, Inc., | | | | | | | | |

10.000%, 4–15–27 (G)(H) | | | 2,469 | | | | 2,506 | |

| | | | | | | | |

| | | | | | | 7,515 | |

| | | | | | | | |

| |

Health Care Services – 0.8% | |

Heartland Dental LLC, | | | | | | | | |

8.500%, 5–1–26 (G)(H) | | | 1,931 | | | | 1,876 | |

| | | | | | | | |

| |

Health Care Technology – 1.7% | |

Verscend Holding Corp., | | | | | | | | |

9.750%, 8–15–26 (G)(H) | | | 3,957 | | | | 4,213 | |

| | | | | | | | |

| |

Life Sciences Tools & Services – 1.2% | |

Avantor, Inc., | | | | | | | | |

9.000%, 10–1–25 (G)(H) | | | 2,788 | | | | 3,133 | |

| | | | | | | | |

| |

Pharmaceuticals – 3.2% | |

Advanz Pharma Corp., | | | | | | | | |

8.000%, 9–6–24 | | | 177 | | | | 172 | |

Bausch Health Cos., Inc.: | | | | | | | | |

6.125%, 4–15–25 (H) | | | 715 | | | | 742 | |

9.000%, 12–15–25 (H) | | | 351 | | | | 394 | |

Eagle Holding Co. II LLC (7.750% Cash or 7.750% PIK), | | | | | | | | |

7.750%, 5–15–22 (G)(H)(J) | | | 2,480 | | | | 2,499 | |

Par Pharmaceutical, Inc., | | | | | | | | |

7.500%, 4–1–27 (H) | | | 1,475 | | | | 1,342 | |

Valeant Pharmaceuticals International, Inc.: | | | | | | | | |

9.250%, 4–1–26 (H) | | | 1,042 | | | | 1,184 | |

8.500%, 1–31–27 (H) | | | 1,338 | | | | 1,502 | |

| | | | | | | | |

| | | | | | | 7,835 | |

| | | | | | | | |

| |

Total Health Care – 9.9% | | | | 24,572 | |

Industrials | |

| |

Aerospace & Defense – 2.6% | |

TransDigm UK Holdings plc, | | | | | | | | |

6.875%, 5–15–26 | | | 893 | | | | 960 | |

TransDigm, Inc. (GTD by TransDigm Group, Inc.): | | | | | | | | |

6.500%, 7–15–24 (G) | | | 2,260 | | | | 2,330 | |

6.500%, 5–15–25 | | | 471 | | | | 489 | |

6.250%, 3–15–26 (H) | | | 1,529 | | | | 1,642 | |

7.500%, 3–15–27 | | | 1,094 | | | | 1,190 | |

| | | | | | | | |

| | | | | | | 6,611 | |

| | | | | | | | |

| |

Air Freight & Logistics – 0.9% | |

XPO Logistics, Inc., | | | | | | | | |

6.750%, 8–15–24 (G)(H) | | | 2,044 | | | | 2,213 | |

| | | | | | | | |

| |

Diversified Support Services – 0.8% | |

Ahern Rentals, Inc., | | | | | | | | |

7.375%, 5–15–23 (G)(H) | | | 2,037 | | | | 1,734 | |

| | | | | | | | |

CORPORATE DEBT SECURITIES

(Continued) | | Principal | | | Value | |

Diversified Support Services(Continued) | |

United Rentals (North America), Inc. (GTD by United Rentals, Inc.), | | | | | | | | |

5.875%, 9–15–26 | | $ | 217 | | | $ | 232 | |

| | | | | | | | |

| | | | | | | 1,966 | |

| | | | | | | | |

| |

Environmental & Facilities Services – 1.1% | |

GFL Environmental, Inc.: | | | | | | | | |

5.625%, 5–1–22 (H) | | | 339 | | | | 347 | |

7.000%, 6–1–26 (G)(H) | | | 1,578 | | | | 1,661 | |

8.500%, 5–1–27 (H) | | | 386 | | | | 428 | |

Waste Pro USA, Inc., | | | | | | | | |

5.500%, 2–15–26 (H) | | | 198 | | | | 204 | |

| | | | | | | | |

| | | | | | | 2,640 | |

| | | | | | | | |

| |

Industrial Machinery – 0.1% | |

Apex Tool Group LLC and BC Mountain Finance, Inc., | | | | | | | | |

9.000%, 2–15–23 (H) | | | 297 | | | | 264 | |

| | | | | | | | |

| |

Security & Alarm Services – 1.1% | |

Prime Security Services Borrower LLC and Prime Finance, Inc., | | | | | | | | |

9.250%, 5–15–23 (G)(H) | | | 2,736 | | | | 2,876 | |

| | | | | | | | |

| |

Total Industrials – 6.6% | | | | 16,570 | |

Information Technology | |

| |

Application Software – 2.7% | |

Kronos Acquisition Holdings, Inc., | | | | | | | | |

9.000%, 8–15–23 (G)(H) | | | 3,668 | | | | 3,237 | |

Solera LLC and Solera Finance, Inc., | | | | | | | | |

10.500%, 3–1–24 (G)(H) | | | 3,379 | | | | 3,572 | |

| | | | | | | | |

| | | | | | | 6,809 | |

| | | | | | | | |

| |

Data Processing & Outsourced Services – 1.9% | |

Italics Merger Sub, Inc., | | | | | | | | |

7.125%, 7–15–23 (G)(H) | | | 4,191 | | | | 4,264 | |

j2 Cloud Services LLC and j2 Global, Inc., | | | | | | | | |

6.000%, 7–15–25 (H) | | | 468 | | | | 494 | |

| | | | | | | | |

| | | | | | | 4,758 | |

| | | | | | | | |

| |

Electronic Equipment & Instruments – 0.3% | |

NCR Corp.: | | | | | | | | |

5.750%, 9–1–27 (H) | | | 393 | | | | 407 | |

6.125%, 9–1–29 (H) | | | 393 | | | | 414 | |

| | | | | | | | |

| | | | | | | 821 | |

| | | | | | | | |

| |

IT Consulting & Other Services – 1.5% | |

Cardtronics, Inc. and Cardtronics USA, Inc., | | | | | | | | |

5.500%, 5–1–25 (H) | | | 294 | | | | 298 | |

NCR Escrow Corp., | | | | | | | | |

6.375%, 12–15–23 (G) | | | 1,765 | | | | 1,814 | |

Pioneer Holding Corp., | | | | | | | | |

9.000%, 11–1–22 (G)(H) | | | 1,461 | | | | 1,534 | |

| | | | | | | | |

| | | | | | | 3,646 | |

| | | | | | | | |

| |

Total Information Technology – 6.4% | | | | 16,034 | |

| | | | | | | | |

CORPORATE DEBT SECURITIES

(Continued) | | Principal | | | Value | |

Materials | |

| |

Aluminum – 1.6% | |

Constellium N.V.: | | | | | | | | |

6.625%, 3–1–25 (G)(H) | | $ | 1,803 | | | $ | 1,879 | |

5.875%, 2–15–26 (H) | | | 911 | | | | 950 | |

Novelis Corp. (GTD by Novelis, Inc.): | | | | | | | | |

6.250%, 8–15–24 (H) | | | 674 | | | | 704 | |

5.875%, 9–30–26 (H) | | | 446 | | | | 468 | |

| | | | | | | | |

| | | | | | | 4,001 | |

| | | | | | | | |

| |

Commodity Chemicals – 0.7% | |

NOVA Chemicals Corp.: | | | | | | | | |

4.875%, 6–1–24 (G)(H) | | | 1,215 | | | | 1,249 | |

5.250%, 6–1–27 (G)(H) | | | 486 | | | | 506 | |

| | | | | | | | |

| | | | | | | 1,755 | |

| | | | | | | | |

| |

Construction Materials – 0.9% | |

Hillman Group, Inc. (The), | | | | | | | | |

6.375%, 7–15–22 (G)(H) | | | 2,401 | | | | 2,251 | |

| | | | | | | | |

| |

Fertilizers & Agricultural Chemicals – 0.3% | |

Pinnacle Operating Corp., | | | | | | | | |

9.000%, 5–15–23 (G)(H) | | | 1,956 | | | | 685 | |

| | | | | | | | |

| |

Metal & Glass Containers – 0.6% | |

ARD Finance S.A. (7.125% Cash or 7.875% PIK), | | | | | | | | |

7.125%, 9–15–23(J) | | | 248 | | | | 256 | |

ARD Securities Finance S.a.r.l. (8.750% Cash or 8.750% PIK), | | | | | | | | |

8.750%, 1–31–23 (H)(I)(J) | | | 684 | | | | 707 | |

HudBay Minerals, Inc.: | | | | | | | | |

7.250%, 1–15–23 (H) | | | 188 | | | | 194 | |

7.625%, 1–15–25 (H) | | | 282 | | | | 286 | |

| | | | | | | | |

| | | | | | | 1,443 | |

| | | | | | | | |

| |

Specialty Chemicals – 0.5% | |

Kraton Polymers LLC and Kraton Polymers Capital Corp., | | | | | | | | |

7.000%, 4–15–25 (H)(I) | | | 1,100 | | | | 1,147 | |

TPC Group, Inc., | | | | | | | | |

10.500%, 8–1–24 (H) | | | 112 | | | | 117 | |

| | | | | | | | |

| | | | | | | 1,264 | |

| | | | | | | | |

| |

Total Materials – 4.6% | | | | 11,399 | |

| |

TOTAL CORPORATE DEBT

SECURITIES – 96.8% | | | $ | 241,159 | |

(Cost: $249,528) | |

| | |

| LOANS (N) | | | | | | |

Communication Services | |

| |

Advertising – 0.5% | |

Advantage Sales & Marketing, Inc. (ICE LIBOR plus 325 bps), | | | | | | | | |

5.294%, 7–25–21 | | | 326 | | | | 302 | |

Advantage Sales & Marketing, Inc. (ICE LIBOR plus 650 bps), | | | | | | | | |

8.544%, 7–25–22 | | | 1,196 | | | | 1,030 | |

| | | | | | | | |

| | | | | | | 1,332 | |

| | | | | | | | |

| | |

| SCHEDULE OF INVESTMENTS | | IVY HIGH INCOME OPPORTUNITIES FUND (in thousands) |

SEPTEMBER 30, 2019

| | | | | | | | |

| LOANS (N)(Continued) | | Principal | | | Value | |

Broadcasting – 1.1% | |

Clear Channel Outdoor Holdings, Inc. (ICE LIBOR plus 350 bps), | | | | | | | | |

5.544%, 8–23–26 | | $ | 2,692 | | | $ | 2,698 | |

| | | | | | | | |

| |

Cable & Satellite – 0.0% | |

Liberty Cablevision of Puerto Rico LLC (ICE LIBOR plus 350 bps), | | | | | | | | |

5.528%, 1–7–22 (C) | | | 39 | | | | 39 | |

| | | | | | | | |

| |

Integrated Telecommunication Services – 1.5% | |

West Corp.(3-Month ICE LIBOR plus 400 bps), | | | | | | | | |

6.044%, 10–10–24 | | | 4,260 | | | | 3,798 | |

| | | | | | | | |

| |

Publishing – 0.2% | |

Recorded Books, Inc. (ICE LIBOR plus 450 bps), | | | | | | | | |

6.544%, 8–31–25 | | | 477 | | | | 478 | |

| | | | | | | | |

| |

Wireless Telecommunication Service – 0.1% | |

Digicel International Finance Ltd. (ICE LIBOR plus 325 bps), | | | | | | | | |

5.340%, 5–27–24 | | | 381 | | | | 330 | |

| | | | | | | | |

| |

Total Communication Services – 3.4% | | | | 8,675 | |

Consumer Discretionary | |

| |

Apparel Retail – 2.4% | |

Talbots, Inc. (The) (ICE LIBOR plus 700 bps), | | | | | | | | |

9.044%, 11–28–22 (C) | | | 2,238 | | | | 2,188 | |

TRLG Intermediate Holdings LLC, | | | | | | | | |

10.000%, 10–27–22 (C) | | | 4,080 | | | | 3,835 | |

| | | | | | | | |

| | | | | | | 6,023 | |

| | | | | | | | |

| |

Department Stores – 0.3% | |

Belk, Inc. (ICE LIBOR plus 475 bps), | | | | | | | | |

6.803%, 12–10–22 | | | 924 | | | | 670 | |

| | | | | | | | |

| |

Housewares & Specialties – 0.4% | |

KIK Custom Products, Inc. (ICE LIBOR plus 400 bps), | | | | | | | | |

6.256%, 5–15–23 | | | 1,162 | | | | 1,099 | |

| | | | | | | | |

| |

Leisure Facilities – 0.5% | |

United PF Holdings LLC (ICE LIBOR plus 450 bps): | | | | | | | | |

0.000%, 6–14–26 (O) | | | 125 | | | | 124 | |

6.544%, 6–14–26 | | | 1,099 | | | | 1,094 | |

| | | | | | | | |

| | | | | | | 1,218 | |

| | | | | | | | |

| |

Restaurants – 0.8% | |

CEC Entertainment, Inc. (ICE LIBOR plus 650 bps), | | | | | | | | |

8.544%, 8–30–26 | | | 1,690 | | | | 1,652 | |

NPC International, Inc. (ICE LIBOR plus 750 bps), | | | | | | | | |

9.544%, 4–18–25 | | | 1,346 | | | | 384 | |

| | | | | | | | |

| | | | | | | 2,036 | |

| | | | | | | | |

| | | | | | | | |

| LOANS (N)(Continued) | | Principal | | | Value | |

Specialized Consumer Services – 0.3% | |

Asurion LLC (ICE LIBOR plus 600 bps), | | | | | | | | |

8.544%, 8–4–25 | | $ | 765 | | | $ | 777 | |

| | | | | | | | |

| |

Specialty Stores – 1.5% | |

Jo-Ann Stores, Inc. (ICE LIBOR plus 500 bps): | | | | | | | | |

7.046%, 10–16–23 | | | 34 | | | | 23 | |

7.259%, 10–16–23 | | | 900 | | | | 614 | |

Jo-Ann Stores, Inc. (ICE LIBOR plus 925 bps), | | | | | | | | |

11.511%, 5–21–24 | | | 1,660 | | | | 515 | |

Staples, Inc. (ICE LIBOR plus 500 bps), | | | | | | | | |

7.123%, 4–12–26 | | | 2,477 | | | | 2,440 | |

| | | | | | | | |

| | | | | | | 3,592 | |

| | | | | | | | |

| |

Textiles – 0.7% | |

SIWF Holdings, Inc. (ICE LIBOR plus 425 bps), | | | | | | | | |

6.304%, 6–15–25 | | | 1,733 | | | | 1,703 | |

| | | | | | | | |

| |

Total Consumer Discretionary – 6.9% | | | | 17,118 | |

Energy | |

| |

Coal & Consumable Fuels – 0.9% | |

Foresight Energy LLC (ICE LIBOR plus 725 bps), | | | | | | | | |

7.874%, 3–28–22 | | | 2,775 | | | | 1,470 | |

Westmoreland Coal Co. (ICE LIBOR plus 650 bps), | | | | | | | | |

10.389%, 3–15–22 | | | 302 | | | | 302 | |

Westmoreland Mining Holdings LLC (15.000% Cash or 15.000% PIK), | | | | | | | | |

15.000%, 3–15–29 (J) | | | 822 | | | | 604 | |

| | | | | | | | |

| | | | | | | 2,376 | |

| | | | | | | | |

| |

Oil & Gas Drilling – 0.1% | |

KCA Deutag U.S. Finance LLC (ICE LIBOR plus 675 bps), | | | | | | | | |

8.794%, 2–28–23 | | | 374 | | | | 233 | |

| | | | | | | | |

| |

Oil & Gas Equipment & Services – 0.4% | |

Larchmont Resources LLC (9.140% Cash or 9.140% PIK), | | | | | | | | |

9.140%, 8–7–20 (C)(E)(J) | | | 1,249 | | | | 1,149 | |

| | | | | | | | |

| |

Oil & Gas Exploration & Production – 0.7% | |

California Resources Corp. (ICE LIBOR plus 1,037.50 bps), | | | | | | | | |

12.419%, 12–31–21 | | | 1,170 | | | | 1,016 | |

California Resources Corp. (ICE LIBOR plus 475 bps), | | | | | | | | |

6.794%, 12–31–22 | | | 761 | | | | 674 | |

| | | | | | | | |

| | | | | | | 1,690 | |

| | | | | | | | |

| |

Oil & Gas Storage & Transportation – 1.9% | |

Bowie Resources Holdings LLC (ICE LIBOR plus 1,075 bps), | | | | | | | | |

12.874%, 2–16–21 | | | 1,032 | | | | 968 | |

Bowie Resources Holdings LLC (ICE LIBOR plus 575 bps), | | | | | | | | |

7.874%, 8–12–20 | | | 1,308 | | | | 1,275 | |

| | | | | | | | |

| LOANS (N)(Continued) | | Principal | | | Value | |

Oil & Gas Storage & Transportation(Continued) | |

EPIC Crude Services L.P. (ICE LIBOR plus 500 bps), | | | | | | | | |

7.040%, 3–1–26 | | $ | 2,400 | | | $ | 2,271 | |

Lower Cadence Holdings LLC (ICE LIBOR plus 400 bps), | | | | | | | | |

6.054%, 5–8–26 | | | 282 | | | | 275 | |

| | | | | | | | |

| | | | | | | 4,789 | |

| | | | | | | | |

| |

Total Energy – 4.0% | | | | 10,237 | |

Financials | |

| |

Asset Management & Custody Banks – 0.7% | |

Edelman Financial Holdings II, Inc. (ICE LIBOR plus 675 bps), | | | | | | | | |

8.807%, 7–20–26 | | | 1,703 | | | | 1,699 | |

| | | | | | | | |

| |

Financial Exchanges & Data – 0.6% | |

Hudson River Trading LLC(3-Month U.S. LIBOR plus 350 bps), | | | | | | | | |

5.544%, 4–3–25 | | | 1,387 | | | | 1,386 | |

| | | | | | | | |

| |

Insurance Brokers – 0.4% | |

NFP Corp. (ICE LIBOR plus 300 bps), | | | | | | | | |

5.044%, 1–8–24 | | | 988 | | | | 971 | |

| | | | | | | | |

| |

Investment Banking & Brokerage – 0.8% | |

Jane Street Group LLC (ICE LIBOR plus 300 bps), | | | | | | | | |

5.044%, 8–25–22 | | | 2,103 | | | | 2,095 | |

| | | | | | | | |

| |

Other Diversified Financial Services – 0.0% | |

New Cotai LLC, | | | | | | | | |

0.000%, 7–20–20 (O) | | | 37 | | | | 37 | |

New Cotai LLC (U.S. Prime Rate plus 25 bps), | | | | | | | | |

5.250%, 7–20–20 | | | 23 | | | | 23 | |

| | | | | | | | |

| | | | | | | 60 | |

| | | | | | | | |

| |

Property & Casualty Insurance – 1.3% | |

Amynta Agency Borrower, Inc. (ICE LIBOR plus 400 bps), | | | | | | | | |

6.544%, 2–28–25 | | | 3,338 | | | | 3,235 | |

| | | | | | | | |

| |

Specialized Finance – 1.2% | |

Amynta Agency Borrower, Inc. (ICE LIBOR plus 850 bps), | | | | | | | | |

10.544%, 2–28–26 | | | 1,153 | | | | 1,160 | |

Gulf Finance LLC (ICE LIBOR plus 525 bps), | | | | | | | | |

7.360%, 8–25–23 | | | 2,290 | | | | 1,730 | |

| | | | | | | | |

| | | | | | | 2,890 | |

| | | | | | | | |

| |

Total Financials – 5.0% | | | | 12,336 | |

Health Care | |

| |

Health Care Equipment – 0.1% | |

LifeScan Global Corp.(3-Month ICE LIBOR plus 950 bps), | | | | | | | | |

12.160%, 10–1–25 | | | 266 | | | | 230 | |

| | | | | | | | |

| | |

| SCHEDULE OF INVESTMENTS | | IVY HIGH INCOME OPPORTUNITIES FUND (in thousands) |

SEPTEMBER 30, 2019

| | | | | | | | |

| LOANS (N)(Continued) | | Principal | | | Value | |

Health Care Facilities – 2.3% | |

Gentiva Health Services, Inc.(3-Month ICE LIBOR plus 375 bps), | | | | | | | | |

5.813%, 7–2–25 | | $ | 3,088 | | | $ | 3,104 | |

Regional Care Hospital Partners Holdings, Inc. (ICE LIBOR plus 450 bps), | | | | | | | | |

6.554%, 11–16–25 | | | 2,709 | | | | 2,709 | |

| | | | | | | | |

| | | | | | | 5,813 | |

| | | | | | | | |

| |

Health Care Services – 2.3% | |

Heartland Dental LLC, | | | | | | | | |

0.000%, 4–30–25 (O) | | | 37 | | | | 36 | |

Heartland Dental LLC (ICE LIBOR plus 375 bps), | | | | | | | | |

5.794%, 4–30–25 | | | 1,635 | | | | 1,598 | |

U.S. Renal Care, Inc.(3-Month ICE LIBOR plus 500 bps), | | | | | | | | |

7.063%, 6–14–26 | | | 4,448 | | | | 4,192 | |

| | | | | | | | |

| | | | | | | 5,826 | |

| | | | | | | | |

| |

Health Care Technology – 1.5% | |

Verscend Holding Corp. (ICE LIBOR plus 450 bps), | | | | | | | | |

6.544%, 8–27–25 | | | 3,703 | | | | 3,712 | |

| | | | | | | | |

| |

Pharmaceuticals – 0.2% | |

Concordia International Corp. (ICE LIBOR plus 550 bps), | | | | | | | | |

7.528%, 9–6–24 | | | 478 | | | | 450 | |

| | | | | | | | |

| |

Total Health Care – 6.4% | | | | 16,031 | |

Industrials | |

| |

Building Products – 0.3% | |

Hampton Rubber Co. & SEI Holding Corp. (ICE LIBOR plus 800 bps), | | | | | | | | |

10.044%, 3–27–22 | | | 857 | | | | 840 | |

| | | | | | | | |

| |

Construction & Engineering – 0.8% | |

McDermott Technology (Americas), Inc. (ICE LIBOR plus 500 bps), | | | | | | | | |

7.104%, 5–10–25 | | | 2,298 | | | | 1,445 | |

Tensar International Corp. (ICE LIBOR plus 850 bps), | | | | | | | | |

10.604%, 7–10–22 | | | 603 | | | | 536 | |

| | | | | | | | |

| | | | | | | 1,981 | |

| | | | | | | | |

| |

Industrial Conglomerates – 0.9% | |

PAE Holding Corp. (ICE LIBOR plus 550 bps), | | | | | | | | |

7.604%, 10–20–22 | | | 1,839 | | | | 1,839 | |

| | | | | | | | |

| LOANS (N)(Continued) | | Principal | | | Value | |

Industrial Conglomerates(Continued) | |

PAE Holding Corp. (ICE LIBOR plus 950 bps), | | | | | | | | |

11.604%, 10–20–23 | | $ | 349 | | | $ | 342 | |

| | | | | | | | |

| | | | | | | 2,181 | |

| | | | | | | | |

| |

Industrial Machinery – 2.4% | |

Dynacast International LLC (ICE LIBOR plus 850 bps), | | | | | | | | |

10.604%, 1–30–23 (C) | | | 5,469 | | | | 5,277 | |

Form Technologies LLC (ICE LIBOR plus 325 bps), | | | | | | | | |

5.354%, 1–28–22 | | | 684 | | | | 656 | |

| | | | | | | | |

| | | | | | | 5,933 | |

| | | | | | | | |

| |

Total Industrials – 4.4% | | | | 10,935 | |

Information Technology | |

| |

Application Software – 0.4% | |

Applied Systems, Inc. (ICE LIBOR plus 700 bps), | | | | | | | | |

9.104%, 9–19–25 | | | 788 | | | | 794 | |

Kronos Acquisition Holdings, Inc. (ICE LIBOR plus 700 bps), | | | | | | | | |

9.256%, 5–15–23 (C) | | | 218 | | | | 216 | |

| | | | | | | | |

| | | | | | | 1,010 | |

| | | | | | | | |

| |

Communications Equipment – 0.5% | |

MLN U.S. Holdco LLC (ICE LIBOR plus 450 bps), | | | | | | | | |

6.612%, 11–30–25 | | | 798 | | | | 738 | |

MLN U.S. Holdco LLC (ICE LIBOR plus 875 bps), | | | | | | | | |

10.862%, 11–30–26 | | | 757 | | | | 641 | |

| | | | | | | | |

| | | | | | | 1,379 | |

| | | | | | | | |

| |

Data Processing & Outsourced Services – 0.9% | |

Commerce Hub, Inc. (ICE LIBOR plus 375 bps), | | | | | | | | |

5.544%, 5–21–25 | | | 1,298 | | | | 1,277 | |

Cyxtera DC Holdings, Inc. (ICE LIBOR plus 300 bps), | | | | | | | | |

9.300%, 5–1–25 | | | 917 | | | | 747 | |

Cyxtera DC Holdings, Inc. (ICE LIBOR plus 325 bps), | | | | | | | | |

5.040%, 5–1–24 | | | 111 | | | | 99 | |

| | | | | | | | |

| | | | | | | 2,123 | |

| | | | | | | | |

| |

Total Information Technology – 1.8% | | | | 4,512 | |

| | | | | | | | |

| LOANS (N)(Continued) | | Principal | | | Value | |

Materials | |

| |

Construction Materials – 0.7% | |

Hillman Group, Inc. (The) (ICE LIBOR plus 350 bps), | | | | | | | | |

6.044%, 5–31–25 | | $ | 1,798 | | | $ | 1,742 | |

| | | | | | | | |

| |

Total Materials – 0.7% | | | | 1,742 | |

| |

TOTAL LOANS – 32.6% | | | $ | 81,586 | |

(Cost: $89,387) | |

| | |

| SHORT-TERM SECURITIES | | | | | | |

Commercial Paper (P) – 6.9% | |

Sonoco Products Co., | | | | | | | | |

2.150%, 10–1–19 | | | 6,584 | | | | 6,584 | |

Sysco Corp., | | | | | | | | |

2.180%, 10–1–19 | | | 10,630 | | | | 10,629 | |

| | | | | | | | |

| | | | | | | 17,213 | |

| | | | | | | | |

| |

Master Note – 3.0% | |

Toyota Motor Credit Corp.(1-Month U.S. LIBOR plus 15 bps), | | | | | | | | |

2.170%, 10–7–19 (Q) | | | 7,587 | | | | 7,587 | |

| | | | | | | | |

| |

Money Market Funds – 0.5% | |

Dreyfus Institutional Preferred Government Money Market Fund – Institutional Shares, | | | | | | | | |

1.900%, (R)(S) | | | 1,215 | | | | 1,215 | |

| | | | | | | | |

| |

TOTAL SHORT-TERM SECURITIES – 10.4% | | | $ | 26,015 | |

(Cost: $26,016) | |

| |

TOTAL INVESTMENT SECURITIES – 142.3% | | | $ | 354,953 | |

(Cost: $371,561) | |

| |

BORROWINGS (T) – (44.9)% | | | | (112,000 | ) |

| |

CASH AND OTHER ASSETS, NET OF LIABILITIES – 2.6% | | | | 6,479 | |

| |

NET ASSETS – 100.0% | | | $ | 249,432 | |

Notes to Schedule of Investments

| * | Not shown due to rounding. |

| (A) | No dividends were paid during the preceding 12 months. |

| (B) | Listed on an exchange outside the United States. |

| (C) | Securities whose value was determined using significant unobservable inputs. |

| | |

| SCHEDULE OF INVESTMENTS | | IVY HIGH INCOME OPPORTUNITIES FUND (in thousands) |

SEPTEMBER 30, 2019

| (D) | Restricted securities. At September 30, 2019, the Fund owned the following restricted securities: |

| | | | | | | | | | | | | | | | | | | | |

| Security | | Acquisition Date(s) | | | Shares | | | Cost | | | Market Value | | | | |

BIS Industries Ltd. | | | 12–22–17 | | | | 804 | | | $ | 76 | | | $ | 32 | | | | | |

Larchmont Resources LLC | | | 12–8–16 | | | | 2 | | | | 560 | | | | 415 | | | | | |

Pinnacle Agriculture Enterprises LLC | | | 3–10–17 | | | | 1,358 | | | | 617 | | | | 57 | | | | | |

Targa Resources Corp., 9.500% | | | 10–24–17 | | | | 3 | | | | 3,292 | | | | 3,183 | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | $ | 4,545 | | | $ | 3,687 | | | | | |

| | | | | | | | | | | | |

| | The total value of these securities represented 1.5% of net assets at September 30, 2019. |

| (E) | Deemed to be an affiliate due to the Fund owning at least 5% of the voting securities. |

| (F) | Warrants entitle the Fund to purchase a predetermined number of shares of common stock and arenon-income producing. The purchase price and number of shares are subject to adjustment under certain conditions until the expiration date, if any. |

| (G) | All or a portion of securities with an aggregate value of $123,362 have been pledged as collateral on open borrowings. |

| (H) | Securities were purchased pursuant to an exemption from registration available under Rule 144A under the Securities Act of 1933 and may only be resold in transactions exempt from registration, normally to qualified institutional buyers. At September 30, 2019 the total value of these securities amounted to $211,956 or 85.0% of net assets. |

| (I) | All or a portion of securities with an aggregate value of $1,642 are on loan. |

| (J) | Payment-in-kind bond which may pay interest in additional par and/or in cash. Rates shown are the current rate and possible payment rates. |

| (K) | Step bond that pays an initial coupon rate for the first period and then a higher or lower coupon rate for the following periods. Interest rate disclosed is that which is in effect at September 30, 2019. |

| (M) | Non-income producing as the issuer has either missed its most recent interest payment or declared bankruptcy. |

| (N) | Variable rate security. Interest rate disclosed is that which is in effect at September 30, 2019. Description of the reference rate and spread, if applicable, are included in the security description. |

| (O) | All or a portion of this position has not settled. Full contract rates do not take effect until settlement date. |

| (P) | Rate shown is the yield to maturity at September 30, 2019. |

| (Q) | Variable rate security. Interest rate disclosed is that which is in effect at September 30, 2019. Date shown represents the date that the variable rate resets. Description of the reference rate and spread, if applicable, are included in the security description. |

| (R) | Investment made with cash collateral received from securities on loan. |

| (S) | Rate shown is the annualized7-day yield at September 30, 2019. |

| (T) | Borrowings payable as a percentage of total investment securities is 31.6%. |

| | |

| SCHEDULE OF INVESTMENTS | | IVY HIGH INCOME OPPORTUNITIES FUND (in thousands) |

SEPTEMBER 30, 2019

The following table is a summary of the valuation of the Fund’s investments by the fair value hierarchy levels as of September 30, 2019. See Note 3 to the Financial Statements for further information regarding fair value measurement.

| | | | | | | | | | | | |

| | | Level 1 | | | Level 2 | | | Level 3 | |

Assets | | | | | | | | | | | | |

Investments in Securities | | | | | | | | | | | | |

Common Stocks | | | | | | | | | | | | |

Consumer Discretionary | | $ | 2,177 | | | $ | — | | | $ | — | * |

Energy | | | 54 | | | | 163 | | | | 415 | |

Health Care | | | 112 | | | | — | | | | — | |

Industrials | | | — | | | | — | | | | 32 | |

Total Common Stocks | | $ | 2,343 | | | $ | 163 | | | $ | 447 | |

Preferred Stocks | | | — | | | | 3,183 | | | | 57 | |

Warrants | | | — | | | | — | | | | — | * |

Corporate Debt Securities | | | — | | | | 241,159 | | | | — | * |

Loans | | | — | | | | 68,882 | | | | 12,704 | |

Short-Term Securities | | | 1,215 | | | | 24,800 | | | | — | |

Total | | $ | 3,558 | | | $ | 338,187 | | | $ | 13,208 | |

| | | |

Liabilities | | | | | | | | | | | | |

Payable for Borrowing | | $ | — | | | $ | 112,000 | | | $ | — | |

The following table is a reconciliation of Level 3 investments for which significant unobservable inputs were used to determine fair value:

| | | | | | | | | | | | |

| | | Common

Stocks | | | Preferred

Stocks | | | Loans | |

Beginning Balance10-1-18 | | $ | 4,384 | | | $ | 758 | | | $ | 19,981 | |

Net realized gain (loss) | | | 296 | | | | — | | | | 12 | |

Net change in unrealized appreciation (depreciation) | | | (2,200 | ) | | | (701 | ) | | | (378 | ) |

Purchases | | | — | | | | — | | | | 5,124 | |

Sales | | | (2,490 | ) | | | — | | | | (1,338 | ) |

Amortization/Accretion of premium/discount | | | — | | | | — | | | | 118 | |

Transfers into Level 3 during the period | | | 457 | | | | — | | | | 4,022 | |

Transfers out of Level 3 during the period | | | — | | | | — | | | | (14,837 | ) |

| | | | |

Ending Balance9-30-19 | | $ | 447 | | | $ | 57 | | | $ | 12,704 | |

| | | | |

Net change in unrealized appreciation (depreciation) for all Level 3 investments still held as of9-30-19 | | $ | (1,966 | ) | | $ | (701 | ) | | $ | (378 | ) |

| | | | |

Transfers from Level 2 to Level 3 occurred primarily due to the lack of observable market data due to decreased market activity or information for these securities. Transfers from Level 3 to Level 2 occurred primarily due to the increased availability of observable market data due to increased market activity or information.

Information about Level 3 fair value measurements:

| | | | | | | | | | | | |

| | | Fair Value at 9-30-19 | | | Valuation Technique(s) | | Unobservable Input(s) | | Input

value(s) | |

Assets | | | | | | | | | | | | |

| | | | |

Common Stocks | | $ | 32 | | | Market comparable approach | | Adjusted EBITDA multiple | | | 5.59x | |

| | | 415 | | | Third-party valuation service | | Broker quotes | | | N/A | |

| | | — | * | | Net asset approach | | Adjusted book value | | | 1.00x | |

| | | | |

Preferred Stocks | | | 57 | | | Market comparable approach | | Adjusted EBITDA multiple | | | 9.82x | |

| | | | | | Option pricing model | | Volatility | | | 9.88% | |

| | | | | | | | Illiquidity discount | | | 10% | |

| | | | |

Loans | | | 12,704 | | | Third-party valuation service | | Broker quotes | | | N/A | |

Significant increases (decreases) in the adjusted EBITDA multiple inputs as of the reporting date would result in a higher (lower) fair value measurement. However, significant increases (decreases) in the illiquidity discount input as of the reporting date would result in a lower (higher) fair value measurement.

| | |

| SCHEDULE OF INVESTMENTS | | IVY HIGH INCOME OPPORTUNITIES FUND (in thousands) |

SEPTEMBER 30, 2019

The following acronyms are used throughout this schedule:

GTD = Guaranteed

ICE = Intercontinental Exchange

LIBOR = London Interbank Offered Rate

PIK = Payment in kind

See Accompanying Notes to Financial Statements.

| | |

| STATEMENT OF ASSETS AND LIABILITIES | | IVY HIGH INCOME OPPORTUNITIES FUND |

AS OF SEPTEMBER 30, 2019

| | | | |

| (In thousands, except per share amounts) | | | |

ASSETS | | | | |

Investments in unaffiliated securities at value+^ | | $ | 353,389 | |

Investments in affiliated securities at market value+ | | | 1,564 | |

Investments at Value | | | 354,953 | |

Cash | | | 1,036 | |

Investment securities sold receivable | | | 1,027 | |

Dividends and interest receivable | | | 6,166 | |

Receivable from securities lending income — net | | | 2 | |

Prepaid and other assets | | | 7 | |

Total Assets | | | 363,191 | |

| |

LIABILITIES | | | | |

Cash collateral on securities loaned at value | | | 1,215 | |

Investment securities purchased payable | | | 342 | |

Independent Trustees and Chief Compliance Officer fees payable | | | 10 | |

Shareholder servicing payable | | | 5 | |

Investment management fee payable | | | 10 | |

Accounting services fee payable | | | 10 | |

Payable for borrowing | | | 112,000 | |

Interest payable for borrowing | | | 95 | |

Other liabilities | | | 72 | |

Total Liabilities | | | 113,759 | |

Commitments and Contingencies (See Note 2 and Note 11) | | | | |

Total Net Assets | | $ | 249,432 | |

| |

NET ASSETS | | | | |

Capital paid in | | $ | 315,820 | |

Accumulated earnings (loss) | | | (66,388 | ) |

Total Net Assets | | $ | 249,432 | |

| |

CAPITAL SHARES OUTSTANDING | | | 16,570 | |

| |

NET ASSET VALUE PER SHARE | | | $15.05 | |

| |

+COST | | | | |

Investments in unaffiliated securities at cost | | $ | 369,770 | |

Investments in affiliated securities at cost | | $ | 1,791 | |

^Securities loaned at value | | $ | 1,642 | |

See Accompanying Notes to Financial Statements.

| | |

| STATEMENT OF OPERATIONS | | IVY HIGH INCOME OPPORTUNITIES FUND |

FOR THE YEAR ENDED SEPTEMBER 30, 2019

| | | | |

| (In thousands) | | | |

INVESTMENT INCOME | |

Dividends from unaffiliated securities | | $ | 279 | |

Interest and amortization from unaffiliated securities | | | 28,298 | |

Interest and amortization from affiliated securities | | | 135 | |

Securities lending income — net | | | 28 | |

Total Investment Income | | | 28,740 | |

| |

EXPENSES | | | | |

Investment management fee | | | 3,657 | |

Interest expense for borrowing | | | 3,605 | |

Shareholder servicing | | | 101 | |

Custodian fees | | | 9 | |

Independent Trustees and Chief Compliance Officer fees | | | 16 | |

Accounting services fee | | | 119 | |

Professional fees | | | 380 | |

Other | | | 58 | |

Total Expenses | | | 7,945 | |

Net Investment Income | | | 20,795 | |

| |

REALIZED AND UNREALIZED GAIN (LOSS) | | | | |

Net realized gain (loss) on: | | | | |

Investments in unaffiliated securities | | | 562 | |

Investments in affiliated securities | | | 1 | |

Forward foreign currency contracts | | | 27 | |

Foreign currency exchange transactions | | | — | * |

Net change in unrealized appreciation (depreciation) on: | | | | |

Investments in unaffiliated securities | | | (14,350 | ) |

Investments in affiliated securities | | | (142 | ) |

Forward foreign currency contracts | | | (2 | ) |

Foreign currency exchange transactions | | | — | * |

Net Realized and Unrealized Loss | | | (13,904 | ) |

Net Increase in Net Assets Resulting from Operations | | $ | 6,891 | |

*Not shown due to rounding.

See Accompanying Notes to Financial Statements.

| | |

| STATEMENTS OF CHANGES IN NET ASSETS | | IVY HIGH INCOME OPPORTUNITIES FUND |

| | | | | | | | |

| (In thousands) | | Year ended

9-30-19 | | | Year ended

9-30-18 | |

INCREASE (DECREASE) IN NET ASSETS | | | | | | | | |

Operations: | | | | | | | | |

Net investment income | | $ | 20,795 | | | $ | 22,561 | |

Net realized gain (loss) on investments | | | 590 | | | | (18,513 | ) |

Net change in unrealized appreciation (depreciation) | | | (14,494 | ) | | | 10,901 | |

Net Increase in Net Assets Resulting from Operations | | | 6,891 | | | | 14,949 | |

| | |

Distributions to Shareholders From: | | | | | | | | |

Net investment income | | | | | | | (21,210 | ) |

Net realized gains | | | | | | | — | |

Accumulated earnings (combined net investment income and net realized gains) | | | (21,873 | ) | | | | |

Total Distributions to Shareholders | | | (21,873 | ) | | | (21,210 | ) |

| | |

Capital Share Transactions: | | | | | | | | |

Net proceeds from the sale of shares | | | — | | | | 51 | |

Net Increase In net assets from share transactions | | | — | | | | 51 | |

Net Decrease in Net Assets | | | (14,982 | ) | | | (6,210 | ) |

Net Assets, Beginning of Period | | | 264,414 | | | | 270,624 | |

Net Assets, End of Period | | $ | 249,432 | | | $ | 264,414 | |

Undistributed net investment income | | | | | | $ | 1,875 | |

See Accompanying Notes to Financial Statements.

| | |

| STATEMENT OF CASH FLOWS | | IVY HIGH INCOME OPPORTUNITIES FUND |

FOR THE YEAR ENDED SEPTEMBER 30, 2019

| | | | |

| (In thousands) | | | |

Cash flows provided by operating activities: | |

Net increase in net assets resulting from operations | | $ | 6,891 | |

Adjustments to reconcile net increase in net assets from operations to net cash provided by operating activities: | | | | |

Purchases of long-term investment securities | | | (124,720 | ) |

Proceeds from sales of long-term investment securities | | | 140,089 | |

Purchases of short-term portfolio investment securities, net | | | (5,457 | ) |

Decrease in dividends and interest receivable | | | 82 | |

Increase in receivable from securities lending income | | | (1 | ) |

Increase in cash collateral on securities loaned at value | | | 690 | |

Increase in independent trustees and chief compliance officer fees payable | | | 2 | |

Decrease in shareholder servicing payable | | | (1 | ) |

Decrease in investment management fee payable | | | (22 | ) |

Decrease in interest payable for borrowing | | | (16 | ) |

Increase in other liabilities | | | 66 | |

Net realized gain on investments in unaffiliated securities | | | (562 | ) |

Net realized gain on investments in affiliated securities | | | (1 | ) |

Net change in unrealized depreciation on investments in unaffiliated securities | | | 14,350 | |

Net change in unrealized depreciation on investments in affiliated securities | | | 142 | |

Net change in unrealized depreciation on forward foreign currency contracts | | | 2 | |

Net amortization and payment in kind income on investment securities | | | 18 | |

Net cash provided by operating activities | | | 31,552 | |

Cash flows used for financing activities: | | | | |

Cash dividends paid | | | (21,873 | ) |

Payments for borrowing | | | (10,000 | ) |

Net cash used for financing activities | | | (31,873 | ) |

Net decrease in cash and foreign currency | | | (321 | ) |

Cash and foreign currency, at beginning of period | | | 1,357 | |

Cash and foreign currency, at end of period | | | 1,036 | |

Supplemental disclosure of cash flow information: | | | | |

Interest expense paid during the period | | | 3,621 | |

See Accompanying Notes to Financial Statements.

| | |

| FINANCIAL HIGHLIGHTS | | IVY HIGH INCOME OPPORTUNITIES FUND |

FOR A SHARE OF CAPITAL STOCK OUTSTANDING THROUGHOUT EACH PERIOD

| | | | | | | | | | | | | | | | | | | | |

| | | Year ended 9-30-2019 | | | Year ended

9-30-2018 | | | Year ended 9-30-2017 | | | Year ended 9-30-2016 | | | Year ended 9-30-2015 | |

Net Asset Value, Beginning of Year | | $ | 15.96 | | | $ | 16.34 | | | $ | 15.65 | | | $ | 15.60 | | | $ | 19.35 | |

Net Investment Income(1) | | | 1.25 | | | | 1.36 | | | | 1.51 | | | | 1.57 | | | | 1.62 | |

Net Realized and Unrealized Gain (Loss) on Investments | | | (0.84 | ) | | | (0.46 | ) | | | 0.66 | | | | 0.08 | | | | (3.41 | ) |

Total from Investment Operations | | | 0.41 | | | | 0.90 | | | | 2.17 | | | | 1.65 | | | | (1.79 | ) |

Distributions From Net Investment Income | | | (1.32 | ) | | | (1.28 | ) | | | (1.48 | ) | | | (1.60 | ) | | | (1.66 | ) |

Distributions From Net Realized Gains | | | — | | | | — | | | | — | | | | — | | | | (0.30 | ) |

Total Distributions | | | (1.32 | ) | | | (1.28 | ) | | | (1.48 | ) | | | (1.60 | ) | | | (1.96 | ) |

Net Asset Value, End of Year | | $ | 15.05 | | | $ | 15.96 | | | $ | 16.34 | | | $ | 15.65 | | | $ | 15.60 | |

Market Price, End of Year | | $ | 13.71 | | | $ | 14.26 | | | $ | 15.97 | | | $ | 14.38 | | | $ | 12.97 | |

Total Return(2) — Net Asset Value | | | 4.10 | % | | | 6.68 | % | | | 15.14 | % | | | 13.71 | % | | | (8.76 | )% |

Total Return(2) — Market Price(3) | | | 6.07 | % | | | (2.47 | )% | | | 22.55 | % | | | 25.67 | % | | | (15.11 | )% |

Net Assets, End of Year (in millions) | | $ | 249 | | | $ | 264 | | | $ | 271 | | | $ | 259 | | | $ | 258 | |

Managed Assets(4), End of Year (in millions) | | $ | 361 | | | $ | 386 | | | $ | 399 | | | $ | 370 | | | $ | 383 | |

Ratio of Expenses to Average Net Assets | | | 3.16 | % | | | 2.77 | % | | | 2.35 | % | | | 2.09 | % | | | 1.98 | % |

Ratio of Expenses to Average Net Assets Excluding Interest Expense | | | 1.73 | % | | | 1.59 | % | | | 1.58 | % | | | 1.56 | % | | | 1.55 | % |

Ratio of Net Investment Income to Average Net Assets | | | 8.27 | % | | | 8.50 | % | | | 9.31 | % | | | 10.59 | % | | | 9.07 | % |

Ratio of Expenses to Average Managed Assets(4) | | | 2.17 | % | | | 1.90 | % | | | 1.62 | % | | | 1.44 | % | | | 1.36 | % |

Ratio of Expenses to Average Managed Assets(4) Excluding Interest Expense | | | 1.19 | % | | | 1.09 | % | | | 1.09 | % | | | 1.08 | % | | | 1.07 | % |

Ratio of Net Investment Income to Average Managed Assets(4) | | | 5.69 | % | | | 5.81 | % | | | 6.43 | % | | | 7.28 | % | | | 6.24 | % |

Portfolio Turnover Rate | | | 34 | % | | | 46 | % | | | 39 | % | | | 39 | % | | | 47 | % |

| (1) | Based on average weekly shares outstanding. |

| (2) | Total investment return is calculated assuming a purchase of common stock on the opening of the first day and a sale on the closing of the last day of each period reported. Dividends and distributions, if any, are assumed, for purposes of this calculation, to be reinvested at prices obtained under the Fund’s dividend reinvestment plan. Total returns based on Net Asset Value and Market Price do not reflect a sales charge or contingent deferred sales charge, if applicable. Total returns for periods less than one year are not annualized. |

| (3) | Total investment return at market price will differ from results at NAV. Returns at market price can be influenced by factors such as changing views about the Fund, market conditions, supply and demand for the Fund’s stock, or changes in the Fund’s dividends. |

| (4) | The term Managed Assets means the Fund’s total assets, including the assets attributable to the proceeds from any borrowings or other forms of structural leverage, minus liabilities, other than the aggregate indebtedness entered into for purposes of leverage. |

See Accompanying Notes to Financial Statements.

| | |

| NOTES TO FINANCIAL STATEMENTS | | IVY HIGH INCOME OPPORTUNITIES FUND |

SEPTEMBER 30, 2019

Ivy High Income Opportunities Fund (the “Fund”) is registered under the Investment Company Act of 1940, as amended (the “1940 Act”) as anon-diversified,closed-end management investment company. The Fund was organized as a Delaware statutory trust on January 30, 2013, pursuant to an Agreement and Declaration of Trust, as amended and restated on March 28, 2013, governed by the laws of the State of Delaware. The Fund commenced operations on May 29, 2013. Prior to that date, the Fund had no operations other than matters relating to its organization and the sale and issuance of 5,236 common shares of beneficial interest to Ivy Investment Management Company (“IICO” or the “Adviser”), the Fund’s investment adviser. The Fund’s common shares are listed on the New York Stock Exchange (the “NYSE”) and trade under the ticker symbol “IVH”.