UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22800

--------------------------------------------------------------------------------

DELAWARE IVY HIGH INCOME OPPORTUNITIES FUND

--------------------------------------------------------------------------------

(Exact name of registrant as specified in charter)

100 Independence, 610 Market Street, Philadelphia, PA 19106-2354

--------------------------------------------------------------------------------

(Address of principal executive offices) (Zip code)

David F. Connor, Esq.

100 Independence, 610 Market Street

Philadelphia, PA 19106-2354

--------------------------------------------------------------------------------

(Name and address of agent for service)

Registrant’s telephone number, including area code: (800) 523-1918

Date of fiscal year end: September 30

Date of reporting period: September 30, 2021

ITEM 1. REPORTS TO STOCKHOLDERS.

1

| | |

| | Annual Report SEPTEMBER 30, 2021 |

| | | | |

Delaware Ivy High Income Opportunities Fund* | | | | |

| |

*EffectiveJuly 1, 2021, the name of Ivy High Income Opportunities Fund changed to Delaware Ivy High Income Opportunities Fund | | | | |

| |

| The Fund’s common shares are listed on the New York | | | | |

| |

| Stock Exchange and trade under the ticker symbol IVH | | | | |

The Fund is a non-diversified, closed-end management investment company designed primarily as a long-term investment and not as a trading vehicle.

IVY INVESTMENTSSM refers to the investment management and investment advisory services offered by Macquarie Investment Management Business Trust (MIMBT) through its various series.

On December 2, 2020, Waddell & Reed Financial, Inc. (“WDR”), the parent company of Ivy Investment Management Company, the investment adviser of the Ivy Funds Complex (the “Ivy Funds”), and Macquarie Management Holdings, Inc., the U.S. holding company for Macquarie Group Limited’s U.S. asset management business (“Macquarie”), announced that they had entered into an agreement whereby Macquarie would acquire the investment management business of WDR (the “Transaction”).

The Transaction closed on April 30, 2021. The Fund, as part of Delaware Funds by Macquarie, is now managed by Delaware Management Company, a series of Macquarie Investment Management Business Trust.

| | |

| CONTENTS | | DELAWARE IVY HIGH INCOME OPPORTUNITIES FUND* |

| * | Effective July 1, 2021, the name of Ivy High Income Opportunities Fund changed to Delaware Ivy High Income Opportunities Fund. |

Macquarie Investment Management (MIM) is a global asset manager with offices in the United States, Europe, Asia, and Australia. As active managers, we prioritize autonomy and accountability at the investment team level in pursuit of opportunities that matter for clients. Delaware Funds is one of the longest-standing mutual fund families, with more than 80 years in existence.

If you are interested in learning more about creating an investment plan, contact your financial advisor.

Macquarie Asset Management (MAM) offers a diverse range of products including securities investment management, infrastructure and real asset management, and fund and equity-based structured products. MIM is the marketing name for certain companies comprising the asset management division of Macquarie Group. This includes the following investment advisers: Macquarie Investment Management Business Trust (MIMBT), Macquarie Funds Management Hong Kong Limited, Macquarie Investment Management Austria Kapitalanlage AG, Macquarie Investment Management Global Limited, Macquarie Investment Management Europe Limited, and Macquarie Investment Management Europe S.A.

Other than Macquarie Bank Limited (MBL), none of the entities noted are authorized deposit-taking institutions for the purposes of the Banking Act 1959 (Commonwealth of Australia). The obligations of these entities do not represent deposits or other liabilities of MBL. MBL does not guarantee or otherwise provide assurance in respect of the obligations of these entities, unless noted otherwise.

The Fund is governed by US laws and regulations. Unless otherwise noted, views expressed herein are current as of September 30, 2021, and subject to change for events occurring after such date. The Funds are not FDIC insured and are not guaranteed. It is possible to lose the principal amount invested.

Advisory services provided by Delaware Management Company, a series of MIMBT, a US registered investment advisor. All third-party

marks cited are the property of their respective owners.

© 2021 Macquarie Management Holdings, Inc.

2

| | |

| MANAGEMENT DISCUSSION | | DELAWARE IVY HIGH INCOME OPPORTUNITIES FUND* |

(UNAUDITED)

Below, Chad Gunther, portfolio manager of the Delaware Ivy High Income Opportunities Fund, discusses positioning, performance and results for the fiscal year ended September 30, 2021. Mr. Gunther has been manager of the Fund since 2014 and has 23 years of industry experience.

Fiscal Year Performance

| | | | |

For the 12 Months Ended September 30, 2021 | | | | |

Delaware Ivy High Income Opportunities Fund (Fund at net asset value) | | | 20.86% | |

Delaware Ivy High Income Opportunities Fund (Fund at market price) | | | 26.28% | |

| |

Benchmark and Morningstar Category | | | | |

ICE BofA US High Yield Index | | | 11.46% | |

(generally reflects the performance of securities representing the high-yield sector of the bond market) | | | | |

Morningstar High Yield Bond Universe Average | | | 10.50% | |

(generally reflects the performance of the universe of funds with similar investment objectives) | | | | |

Market update

The recovery in spreads that started with the US Federal Reserve’s (Fed) announcement of unlimited quantitative easing in March 2020 continued in fiscal year 2021. Spreads on the JP Morgan High Yield Index started the fiscal year at 603 basis points (bps) and by fiscal year end had declined to 385 bps. The low point in spreads during the fiscal year was 369 basis points on July 1, 2021 before a new wave of COVID-19 (Delta variant) swept through the world, causing a 47 bps widening in July and August. This widening was short lived as the number of people vaccinated continued to increase and the death rate from this new wave being much less severe than the initial coronavirus outbreak. The Fed has continued to stoke the liquidity fire, expanding its current balance sheet to an unprecedented $8.45 trillion.

Interest rates for the fiscal year reversed the downward trend seen over the past two fiscal years. The 10-year Treasury increased from 65 bps to 146 bps at fiscal year end. The three-year Treasury had an even bigger jump (on a percentage basis), going from 16 bps to 51 bps at year end. The reversal in rates can be attributed to the expansion of the Fed’s balance sheet driving growth as well as vaccination adoption increasing, albeit slowly.

Year-to-date, new issue activity for high-yield bonds totaled $409.7 billion (gross) and $150.6 billion (net). Additionally, year-to-date, leveraged loan issuance stands at $655.5 billion (gross) and $284.3 billion (net), which is up 110% and 138% (year-over-year), respectively.

2021 has seen outflows in high-yield mutual funds, with $11.8 billion leaving the asset class through September 30. That said, more recently outflows have subsided, with August and September inflowing $1.26 billion and $1.26 billion, respectively. Leveraged-loan flows, on the other hand, have been inflowing since the beginning of 2021. Year-to-date, cumulative inflows total $35.3 billion.

Over the first nine months of 2021, a total of 10 companies defaulted, totaling $4.1 billion in bonds and $3.5 billion in loans. Additionally, six companies have completed distressed transactions totaling $2.1 billion. This year’s default volume is on pace to be the lightest in a calendar year since $4.5 billion defaulted in 2007.

Portfolio strategy/performance

The Fund outperformed its benchmark index and Morningstar peer group for the fiscal year. The Fund’s loan exposure contributed 341 bps to outperformance relative to the benchmark, while the Fund’s bond exposure contributed 448 bps to relative outperformance. On the other hand, equities detracted 307 bps from performance.

The portfolio mix started the fiscal year with 70% in high-yield bonds, 26% loans and 4% other. We ended the fiscal year with bonds (64%), loans (29%) and preferred/common equity (6%). In previous communications, we said we maintained our exposure to leveraged loans as we thought they continued to offer attractive yields relative to their seniority in the capital structure. We still believe their relative attractive yields are intact. Bond holdings, broken down by ratings quality, ended the fiscal year at 7.4%, 65.4%, 24.8% and 2.5% for BB, B, CCC and below CCC, respectively.

While the Fund handily outperformed its benchmark and peer group average, performance was diminished by our investments in New Cotai Participation Corp./Studio City International Holdings Ltd. ADR, a Macau casino. COVID-19 continues to have an adverse impact on the region, limiting tourist travel to the destination. That said, the gaming market in Macau is the largest employer in the region, and we believe China’s growing middle class will offer opportunity as they look for entertainment destinations. We acknowledge short-term catalysts are limited, but the risk/reward trade-off at

current valuations looks very compelling in our view. On the bond side of the portfolio, detractors from performance were underweights in the gas midstream sector and the oil field services sector. On the loan side, Westmoreland Mining Holdings LLC negatively impacted performance.

We had several outperformers in both our bond and loan investments for the fiscal year. On the loan side, outperformance was led by Dynacast as the company was successful in refinancing its second lien term loan, meaning we were paid out at close to par after being marked at the beginning of the year closer to 50% of par. Another loan with similar performance was Cyxtera Technologies, as the company went public through a special-purpose acquisition company (SPAC). Proceeds were used to redeem our second lien at par. In our bond portfolio, credits in the services, wireless and wireline sectors handily outperformed the benchmark. Our philosophy of owning higher concentrations in higher conviction investments contributed to the outperformance. West Corp., Staples, Inc., Digicel Group Ltd. and Frontier Communications Corp. were all big outperformers during the fiscal year. Credits in the advertising sector also contributed to outperformance but to a lesser degree.

Outlook

Previously we conveyed our belief that unemployment would continue to decline especially as we moved into September and October when government stimulus payments started to expire. Over the past few weeks, we have seen an acceleration to the downside of total continuing claims which supports this view. With solid earnings, declining COVID-19 cases from the Delta variant, tax receipts increasing, and consumer net worth at an all-time high, we feel that the back drop for continued recovery and growth remain strong. The US Federal Reserve’s (Fed) acknowledgment of these trends has set up a consensus view that a taper announcement is forthcoming at the November meeting. The high-yield bond market has responded by returning just three basis points in the month of September, the lowest monthly return in the past 12 months. In sharp contrast, the leverage loan market had its best month of returns since January.

Going forward against a backdrop of rich valuations and a less favorable growth/policy mix, we expect spreads (currently at 320 basis points) will drift modestly wider in the upcoming quarters. As we stated in our last commentary, we think volatility will be centered around the direction of inflation and inflation expectations. The recent rate rally indicates the market may be signaling the overall market view is the Fed is behind the curve in tapering and ultimately raising rates. Inflation news of late has been overpowering, and if the numbers continue to surprise on the upside, the transitory hypothesis around inflation will be called more and more into question. Therefore, the biggest visible risk in our view is a significant acceleration in inflation that brings on a surge in bond yields and aggressive Fed action. Other risks include higher commodity prices, wages, Chinese property developer debt crisis (and any spillover effects), and new fiscal policies that could impact spending and/or growth.

Despite the risks mentioned above, there are several current or likely tailwinds worth noting: Massive monetary stimulus, more reopening, unprecedented surge in consumer net worth and consumer excess saving, supply chain problems ease, and inventory rebuilding extends the business cycle. Default forecasts predict a continuation of low defaults for the foreseeable future and into 2022 as well. Our outlook for returns continues to be benign, and we expect the rest of the year to be a coupon-clipping exercise with bouts of volatility related to rates, inflation, and the growth outlook in a post-pandemic world.

Significant Event(s): Effective November 15, 2021, the Fund’s portfolio management team consists of Adam H. Brown and John P. McCarthy.

*Effective July 1, 2021, the Fund name changed from Ivy High Income Opportunities Fund.

The investment return, price, yields, market value and NAV of a fund’s shares will fluctuate with market conditions. Closed-end funds frequently trade at a discount to their NAV, which may increase an investor’s risk of loss. At the time of sale, your shares may have a market price that is above or below NAV, and it may be worth more or less than your original investment. There is no assurance that the Fund will meet its investment objective.

Risk factors: The price of the Fund’s shares will fluctuate with market conditions and other factors. Fund shares are not guaranteed or endorsed by any bank or other insured depository institution and are not federally insured by the Federal Deposit Insurance Corporation. Investing in high-income securities may carry a greater risk of nonpayment of interest or principal than with higher-rated bonds. Loans (including loan assignments, loan participations and other loan instruments) carry other risks, including the risk of insolvency of the lending bank or other intermediary. Loans that are unsecured or not fully collateralized may be subject to restrictions on resale and its resale may trade infrequently on the secondary market. An investment in the Fund is not appropriate for all investors and is not intended to be a complete investment program. The Fund is designed as a long-term investment and not as a trading vehicle. The opinions expressed in this report are those of the portfolio manager and are current only through the end of the period of the report as stated on the cover. The portfolio manager’s views are subject to change at any time based on market and other conditions, and no forecasts can be guaranteed.

| | |

| PORTFOLIO HIGHLIGHTS | | DELAWARE IVY HIGH INCOME OPPORTUNITIES FUND(a) |

ALL DATA IS AS OF SEPTEMBER 30, 2021 (UNAUDITED)

| | | | | | | | |

| Total Return(1) | | Market Price | | | NAV | |

1-year period ended 9-30-21 | | | 23.59% | | | | 18.29% | |

5-year period ended 9-30-21 | | | 10.61% | | | | 10.68% | |

Commencement of operations (5-29-13) through 9-30-21 | | | 6.69% | | | | 8.43% | |

|

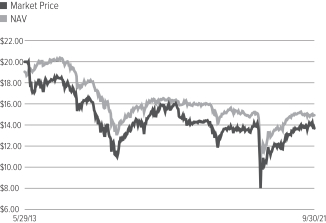

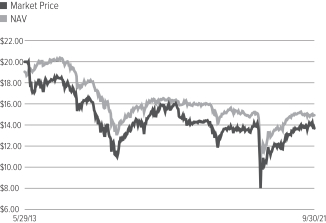

| Market Price/NAV Performance |

Commencement of operations (5-29-13) through 9-30-21 |

| | | | |

| Market Price/NAV | | | |

Market Price | | $ | 13.67 | |

NAV | | $ | 14.93 | |

Discount to NAV(3) | | | (8.44)% | |

Market Price Yield(4) | | �� | 6.14% | |

Structural Leverage Ratio(5) | | | 26.02% | |

Effective Leverage Ratio(6) | | | 26.17% | |

Net asset value or “NAV” is the value of one share of a fund as calculated in accordance with the standard formula for valuing mutual fund shares. The price used to calculate market return (“Market Price”) is determined by using the midpoint between the highest bid and the lowest ask on the primary stock exchange on which shares of a fund are listed for trading, as of the time that such fund’s NAV is calculated. Market and NAV returns assume that dividends and capital gain distributions have been reinvested according to the Fund’s dividend reinvestment plan.

Asset Allocation (%’s based on total investments)

| | | | |

Stocks | | | 6.2% | |

Financials | | | 1.9% | |

Energy | | | 1.7% | |

Consumer Discretionary | | | 1.4% | |

Communication Services | | | 1.2% | |

Industrials | | | 0.0% | |

Warrants | | | 0.0% | |

Bonds | | | 78.7% | |

Corporate Debt Securities | | | 54.1% | |

Loans | | | 24.6% | |

Borrowings(2) | | | -25.6% | |

Cash Equivalents+ | | | 15.1% | |

Quality Weightings (%’s based on total investments)

| | | | |

Non-Investment Grade | | | 78.7% | |

BB | | | 5.5% | |

B | | | 51.9% | |

CCC | | | 19.4% | |

Below CCC | | | 0.3% | |

Non-rated | | | 1.6% | |

Borrowings(2) | | | -25.6% | |

Cash Equivalents+ and Equities | | | 21.3% | |

Our preference is to always use ratings obtained from Standard & Poor’s, Moody’s, and Fitch. It is each Portfolio’s general policy to classify such security at the lower rating level if only two ratings are available. If more than two ratings are available and a median exists, the median is used. If more than two ratings exist without a median, the lower of the two middle ratings is used. We do not evaluate these ratings, but simply assign them to the appropriate credit quality category as determined by the rating agency.

| + | Cash equivalents are defined as highly liquid securities with maturities of less than three months. Cash equivalents may include U.S. Government Treasury bills, bank certificates of deposit, bankers’ acceptances, corporate commercial paper and other money market instruments. |

| (1) | Past performance is not necessarily indicative of future performance. Total return is calculated by determining the percentage change in NAV or market price (as applicable) in the specified period. The calculation assumes that all dividends and distributions, if any, have been reinvested. Performance at market price will differ from results at NAV. Returns at market price can be influenced by factors such as changing views about the Fund, market conditions, supply and demand for the Fund’s stock, or changes in the Fund’s dividends. An investment in the Fund involves risk, including the loss of principal. Total return, market price, market price yield and NAV will fluctuate with changes in market conditions. This data is provided for information purposes only and is not intended for trading purposes. Closed-end funds, unlike open-end funds, are not continuously offered. There is a one time public offering and, once issued, shares of closed-end funds are traded in the open market through a stock exchange. NAV is equal to total assets less total liabilities divided by the total number of shares outstanding. Holdings are subject to change daily. |

| (2) | The Fund has entered into a borrowing arrangement with Pershing LLC as a means of financial leverage. See Note 8 in the Notes to Financial Statements for additional information. |

| (3) | The premium/discount is calculated as (most recent market price/most recent NAV) -1. |

| (4) | Market price yield is determined by dividing the annualized current monthly dividend per share (comprised of net investment income) by the market price per share at September 30, 2021. |

| (5) | Structural leverage consists of borrowings outstanding as a percentage of managed assets. Managed assets are the Fund’s total assets, including the assets attributable to the proceeds from any borrowings, minus liabilities other than the aggregate indebtedness entered into for the purpose of leverage. |

| (6) | The Fund’s effective leverage ratio includes both structural leverage and the leveraging effects of certain derivative instruments in the Fund’s portfolio (referred to as “portfolio leverage”), expressed as a percentage of managed assets. Portfolio leverage from the Fund’s use of forward foreign currency contracts is included in the Fund’s effective leverage values. |

| (a) | Effective July 1, 2021, the name of Ivy High Income Opportunities Fund changed to Delaware Ivy High Income Opportunities Fund. |

| | |

SCHEDULE OF INVESTMENTS | | DELAWARE IVY HIGH INCOME OPPORTUNITIES FUND (in thousands) |

SEPTEMBER 30, 2021

| | | | | | | | |

| COMMON STOCKS | | Shares | | | Value | |

Communication Services | |

| |

Integrated Telecommunication Services – 1.7% | |

Frontier Communications Corp. (A) | | | 148 | | | $ | 4,138 | |

| | | | | | | | |

| |

Total Communication Services – 1.7% | | | | 4,138 | |

Consumer Discretionary | |

| |

Apparel Retail – 0.6% | |

True Religion Apparel, Inc. (A)(B)(C) | | | — | * | | | 1,383 | |

| | | | | | | | |

| |

Casinos & Gaming – 1.3% | |

New Cotai Participation Corp., Class B (A)(B)(C)(D) | | | 971 | | | | 2,087 | |

Studio City International Holdings Ltd. ADR (A) | | | 108 | | | | 885 | |

Studio City International Holdings Ltd. ADR (A)(D) | | | 45 | | | | 364 | |

| | | | | | | | |

| | | | | | | 3,336 | |

| | | | | | | | |

| |

Total Consumer Discretionary – 1.9% | | | | 4,719 | |

Energy | |

| |

Coal & Consumable Fuels – 0.7% | |

Foresight Energy L.P. (A)(C)(D) | | | 74 | | | | 1,566 | |

Westmoreland Coal Co. (A)(E) | | | 13 | | | | 20 | |

| | | | | | | | |

| | | | | | | 1,586 | |

| | | | | | | | |

| |

Oil & Gas Drilling – 0.4% | |

KCA Deutag UK Finance plc (A)(E) | | | 11 | | | | 918 | |

Vantage Drilling Co., Units (A) | | | — | * | | | 1 | |

| | | | | | | | |

| | | | | | | 919 | |

| | | | | | | | |

| |

Oil & Gas Equipment & Services – 0.0% | |

Larchmont Resources LLC (A)(B)(D)(E) | | | 2 | | | | 2 | |

| | | | | | | | |

| |

Total Energy – 1.1% | | | | 2,507 | |

Industrials | |

| |

Air Freight & Logistics – 0.0% | |

BIS Industries Ltd. (C)(D)(E) | | | 804 | | | | — | * |

| | | | | | | | |

| |

Total Industrials – 0.0% | | | | — | * |

| |

TOTAL COMMON STOCKS – 4.7% | | | $ | 11,364 | |

(Cost: $20,155) | |

| | |

INVESTMENT FUNDS | | | | | | | | |

Registered Investment Companies – 2.6% | |

iShares iBoxx $ High Yield Corporate Bond ETF (F) | | | 73 | | | | 6,387 | |

| | | | | | | | |

| |

TOTAL INVESTMENT FUNDS – 2.6% | | | $ | 6,387 | |

(Cost: $6,315) | |

| | | | | | | | |

| PREFERRED STOCKS | | Shares | | | Value | |

Consumer Discretionary | |

| |

Apparel Retail – 0.1% | |

True Religion Apparel,

Inc. (A)(B)(E) | | | — | * | | $ | 318 | |

| | | | | | | | |

| |

Total Consumer Discretionary – 0.1% | | | | 318 | |

Energy | |

| |

Oil & Gas Exploration & Production – 1.4% | |

Targa Resources Corp., | | | | | | | | |

9.500% (A)(D) | | | 3 | | | | 3,415 | |

| | | | | | | | |

| |

Total Energy – 1.4% | | | | 3,415 | |

| |

TOTAL PREFERRED STOCKS – 1.5% | | | $ | 3,733 | |

(Cost: $4,572) | |

| | |

WARRANTS | | | | | | | | |

Oil & Gas Exploration & Production – 0.0% | |

California Resources Corp., | | | | | | | | |

expires 10–27–24 (G) | | | 3 | | | | 38 | |

| | | | | | | | |

| |

TOTAL WARRANTS – 0.0% | | | $ | 38 | |

(Cost: $273) | |

| | |

| CORPORATE DEBT SECURITIES | | Principal | | | | |

Communication Services | |

| |

Advertising – 2.4% | |

Advantage Sales & Marketing, Inc., | | | | | | | | |

6.500%, 11–15–28 (H)(I) | | $ | 2,185 | | | | 2,280 | |

Centerfield Media Holdings LLC, | | | | | | | | |

6.625%, 8–1–26 (I) | | | 595 | | | | 614 | |

Midas OpCo Holdings LLC, | | | | | | | | |

5.625%, 8–15–29 (I) | | | 2,991 | | | | 3,099 | |

| | | | | | | | |

| | | | | | | 5,993 | |

| | | | | | | | |

| |

Broadcasting – 2.0% | |

Clear Channel International B.V., | | | | | | | | |

6.625%, 8–1–25 (I) | | | 216 | | | | 226 | |

Clear Channel Outdoor Holdings, Inc., | | | | | | | | |

5.125%, 8–15–27 (H)(I) | | | 4,496 | | | | 4,658 | |

| | | | | | | | |

| | | | | | | 4,884 | |

| | | | | | | | |

| |

Cable & Satellite – 8.4% | |

Altice Financing S.A., | | | | | | | | |

5.750%, 8–15–29 (H)(I) | | | 2,086 | | | | 2,023 | |

Altice France Holding S.A., | | | | | | | | |

10.500%, 5–15–27 (H)(I) | | | 4,582 | | | | 5,017 | |

Altice France S.A.: | | | | | | | | |

8.125%, 2–1–27 (H)(I) | | | 2,659 | | | | 2,865 | |

5.125%, 7–15–29 (H)(I) | | | 866 | | | | 850 | |

5.500%, 10–15–29 (I) | | | 469 | | | | 465 | |

CSC Holdings LLC: | | | | | | | | |

5.750%, 1–15–30 (H)(I) | | | 555 | | | | 565 | |

5.000%, 11–15–31 (I) | | | 862 | | | | 827 | |

DIRECTV Holdings LLC and DIRECTV Financing Co., Inc., | | | | | | | | |

5.875%, 8–15–27 (I) | | | 565 | | | | 590 | |

| | | | | | | | |

CORPORATE DEBT SECURITIES

(Continued) | | Principal | | | Value | |

Cable & Satellitee (Continued) | |

DISH DBS Corp.: | | | | | | | | |

7.750%, 7–1–26 (H) | | $ | 1,032 | | | $ | 1,167 | |

7.375%, 7–1–28 | | | 279 | | | | 296 | |

5.125%, 6–1–29 | | | 1,201 | | | | 1,178 | |

LCPR Senior Secured Financing Designated Activity Co., | | | | | | | | |

5.125%, 7–15–29 (I) | | | 337 | | | | 348 | |

Telesat Canada and Telesat LLC, | | | | | | | | |

5.625%, 12–6–26 (H)(I) | | | 2,310 | | | | 2,221 | |

VTR Comunicaciones S.p.A., | | | | | | | | |

4.375%, 4–15–29 (I) | | | 1,182 | | | | 1,220 | |

VTR Finance B.V., | | | | | | | | |

6.375%, 7–15–28 (I) | | | 1,087 | | | | 1,173 | |

| | | | | | | | |

| | | | | | | 20,805 | |

| | | | | | | | |

| |

Integrated Telecommunication Services – 5.5% | |

Cablevision Lightpath LLC, | | | | | | | | |

5.625%, 9–15–28 (I) | | | 460 | | | | 463 | |

Consolidated Communications, Inc.: | | | | | | | | |

5.000%, 10–1–28 (I) | | | 417 | | | | 431 | |

6.500%, 10–1–28 (H)(I) | | | 899 | | | | 978 | |

Frontier Communications Corp.: | | | | | | | | |

5.875%, 10–15–27 (I) | | | 121 | | | | 128 | |

5.875%, 11–1–29 | | | 456 | | | | 462 | |

West Corp., | | | | | | | | |

8.500%, 10–15–25 (H)(I) | | | 7,035 | | | | 6,999 | |

Windstream Escrow LLC, | | | | | | | | |

7.750%, 8–15–28 (H)(I) | | | 3,949 | | | | 4,131 | |

| | | | | | | | |

| | | | | | | 13,592 | |

| | | | | | | | |

| |

Interactive Media & Services – 0.4% | |

Cars.com, Inc., | | | | | | | | |

6.375%, 11–1–28 (H)(I) | | | 881 | | | | 930 | |

| | | | | | | | |

| |

Movies & Entertainment – 2.0% | |

Premier Entertainment Sub LLC and Premier Entertainment Finance Corp.: | | | | | | | | |

5.625%, 9–1–29 (I) | | | 2,984 | | | | 3,018 | |

5.875%, 9–1–31 (I) | | | 1,908 | | | | 1,930 | |

| | | | | | | | |

| | | | | | | 4,948 | |

| | | | | | | | |

| |

Wireless Telecommunication Service – 4.8% | |

Digicel Group Ltd., | | | | | | | | |

8.750%, 5–25–24 (I) | | | 385 | | | | 399 | |

Digicel Group Ltd. (5.000% Cash and 3.000% PIK), | | | | | | | | |

8.000%, 4–1–25 (I)(J) | | | 250 | | | | 222 | |

Digicel Group Ltd. (7.000% Cash or 7.000% PIK), | | | | | | | | |

7.000%, 10–1–68 (I)(J) | | | 214 | | | | 176 | |

Digicel International Finance Ltd.: | | | | | | | | |

8.750%, 5–25–24 (H)(I) | | | 6,862 | | | | 7,113 | |

8.000%, 12–31–26 (I) | | | 154 | | | | 149 | |

Digicel International Finance Ltd. (6.000% Cash and 7.000% PIK), | | | | | | | | |

13.000%, 12–31–25 (I)(J) | | | 211 | | | | 213 | |

Digicel International Finance Ltd. (8.000% Cash and 2.000% PIK or 10.000% PIK), | | | | | | | | |

10.000%, 4–1–24 (H)(J) | | | 1,619 | | | | 1,621 | |

| | |

| SCHEDULE OF INVESTMENTS | | DELAWARE IVY HIGH INCOME OPPORTUNITIES FUND (in thousands) |

SEPTEMBER 30, 2021

| | | | | | | | |

CORPORATE DEBT SECURITIES

(Continued) | | Principal | | | Value | |

Wireless Telecommunication Service (Continued) | |

Digicel Ltd., | | | | | | | | |

6.750%, 3–1–23 (H)(I) | | $ | 2,128 | | | $ | 2,009 | |

| | | | | | | | |

| | | | | | | 11,902 | |

| | | | | | | | |

| |

Total Communication Services – 25.5% | | | | 63,054 | |

Consumer Discretionary | |

| |

Apparel Retail – 0.7% | |

Victoria’s Secret & Co.,

| | | | | | | | |

4.625%, 7–15–29 (H)(I) | | | 1,634 | | | | 1,668 | |

| | | | | | | | |

| |

Automotive Retail – 1.6% | |

Asbury Automotive Group, Inc.: | | | | | | | | |

4.500%, 3–1–28 (H) | | | 936 | | | | 962 | |

4.750%, 3–1–30 (H) | | | 964 | | | | 1,007 | |

Ken Garff Automotive LLC, | | | | | | | | |

4.875%, 9–15–28 (I) | | | 290 | | | | 298 | |

Lithia Motors, Inc.: | | | | | | | | |

3.875%, 6–1–29 (I) | | | 602 | | | | 626 | |

4.375%, 1–15–31 (I) | | | 466 | | | | 498 | |

Sonic Automotive, Inc., | | | | | | | | |

6.125%, 3–15–27 (H) | | | 489 | | | | 509 | |

| | | | | | | | |

| | | | | | | 3,900 | |

| | | | | | | | |

| |

Casinos & Gaming – 0.3% | |

Everi Holdings, Inc., | | | | | | | | |

5.000%, 7–15–29 (I) | | | 594 | | | | 610 | |

| | | | | | | | |

| |

Education Services – 1.5% | |

Adtalem Global Education, Inc., | | | | | | | | |

5.500%, 3–1–28 (H)(I) | | | 3,551 | | | | 3,589 | |

| | | | | | | | |

| |

Homefurnishing Retail – 0.1% | |

Ambience Merger Sub, Inc., | | | | | | | | |

4.875%, 7–15–28 (I) | | | 178 | | | | 178 | |

| | | | | | | | |

| |

Hotels, Resorts & Cruise Lines – 3.7% | |

Boyne USA, Inc., | | | | | | | | |

4.750%, 5–15–29 (I) | | | 288 | | | | 298 | |

Carnival Corp.: | | | | | | | | |

11.500%, 4–1–23 (I) | | | 112 | | | | 125 | |

10.500%, 2–1–26 (H)(I) | | | 1,458 | | | | 1,694 | |

7.625%, 3–1–26 (I) | | | 295 | | | | 315 | |

5.750%, 3–1–27 (H)(I) | | | 923 | | | | 955 | |

9.875%, 8–1–27 (I) | | | 573 | | | | 662 | |

NCL Corp. Ltd.: | | | | | | | | |

12.250%, 5–15–24 (H)(I) | | | 2,342 | | | | 2,766 | |

10.250%, 2–1–26 (I) | | | 684 | | | | 786 | |

5.875%, 3–15–26 (I) | | | 295 | | | | 303 | |

Royal Caribbean Cruises Ltd.: | | | | | | | | |

11.500%, 6–1–25 (I) | | | 105 | | | | 120 | |

5.500%, 4–1–28 (I) | | | 1,153 | | | | 1,181 | |

| | | | | | | | |

| | | | | | | 9,205 | |

| | | | | | | | |

| |

Internet & Direct Marketing Retail – 0.7% | |

Arches Buyer, Inc., | | | | | | | | |

4.250%, 6–1–28 (H)(I) | | | 1,768 | | | | 1,795 | |

| | | | | | | | |

| |

Leisure Facilities – 0.5% | |

Legends Hospitality Holding Co. LLC, | | | | | | | | |

5.000%, 2–1–26 (I) | | | 178 | | | | 183 | |

| | | | | | | | |

CORPORATE DEBT SECURITIES

(Continued) | | Principal | | | Value | |

Leisure Facilities (Continued) | |

Live Nation Entertainment, Inc., | | | | | | | | |

4.750%, 10–15–27 (H)(I) | | $ | 1,013 | | | $ | 1,031 | |

| | | | | | | | |

| | | | | | | 1,214 | |

| | | | | | | | |

| |

Specialized Consumer Services – 0.7% | |

Nielsen Finance LLC and Nielsen Finance Co.: | | | | | | | | |

5.625%, 10–1–28 (H)(I) | | | 870 | | | | 904 | |

5.875%, 10–1–30 (I) | | | 725 | | | | 764 | |

| | | | | | | | |

| | | | | | | 1,668 | |

| | | | | | | | |

| |

Specialty Stores – 6.6% | |

Bed Bath & Beyond, Inc., | | | | | | | | |

5.165%, 8–1–44 | | | 713 | | | | 615 | |

Magic MergerCo, Inc., | | | | | | | | |

5.250%, 5–1–28 (H)(I) | | | 1,009 | | | | 1,042 | |

Party City Holdings, Inc. (5.000% Cash and 5.000% PIK), | | | | | | | | |

10.000%, 8–15–26 (I)(J) | | | 93 | | | | 92 | |

Party City Holdings, Inc. (6-Month U.S. LIBOR plus 500 bps), | | | | | | | | |

5.750%, 7–15–25 (I)(K) | | | 163 | | | | 153 | |

PetSmart, Inc. and PetSmart Finance Corp., | | | | | | | | |

4.750%, 2–15–28 (H)(I) | | | 1,485 | | | | 1,528 | |

Staples, Inc.: | | | | | | | | |

7.500%, 4–15–26 (H)(I) | | | 9,900 | | | | 10,054 | |

10.750%, 4–15–27 (H)(I) | | | 2,982 | | | | 2,907 | |

| | | | | | | | |

| | | | | | | 16,391 | |

| | | | | | | | |

| |

Total Consumer Discretionary – 16.4% | | | | 40,218 | |

Consumer Staples | |

| |

Food Distributors – 0.8% | |

Performance Food Group, Inc., | | | | | | | | |

4.250%, 8–1–29 (I) | | | 1,905 | | | | 1,912 | |

| | | | | | | | |

| |

Packaged Foods & Meats – 1.1% | |

Pilgrim’s Pride Corp., | | | | | | | | |

4.250%, 4–15–31 (H)(I) | | | 1,372 | | | | 1,476 | |

Post Holdings, Inc., | | | | | | | | |

4.500%, 9–15–31 (I) | | | 598 | | | | 592 | |

Simmons Foods, Inc., | | | | | | | | |

4.625%, 3–1–29 (I) | | | 594 | | | | 599 | |

| | | | | | | | |

| | | | | | | 2,667 | |

| | | | | | | | |

| |

Total Consumer Staples – 1.9% | | | | 4,579 | |

Energy | |

| |

Oil & Gas Drilling – 0.4% | |

KCA Deutag UK Finance plc: | | | | | | | | |

9.875%, 12–1–25 (I) | | | 115 | | | | 126 | |

KCA Deutag UK Finance plc: | | | | | | | | |

9.875%, 12–1–25 | | | 555 | | | | 605 | |

Offshore Drilling Holding S.A., | | | | | | | | |

8.375%, 9–20–20 (H)(I)(L)(M) | | | 3,385 | | | | 324 | |

| | | | | | | | |

| | | | | | | 1,055 | |

| | | | | | | | |

| |

Oil & Gas Equipment & Services – 0.1% | |

Nine Energy Service, Inc., | | | | | | | | |

8.750%, 11–1–23 (I) | | | 806 | | | | 388 | |

| | | | | | | | |

| | | | | | | | |

CORPORATE DEBT SECURITIES

(Continued) | | Principal | | | Value | |

Oil & Gas Exploration & Production – 5.3% | |

Antero Resources Corp., | | | | | | | | |

5.375%, 3–1–30 (I) | | $ | 241 | | | $ | 254 | |

Ascent Resources Utica Holdings LLC and ARU Finance Corp.: | | | | | | | | |

7.000%, 11–1–26 (H)(I) | | | 711 | | | | 736 | |

8.250%, 12–31–28 (I) | | | 59 | | | | 64 | |

5.875%, 6–30–29 (I) | | | 296 | | | | 303 | |

California Resources Corp., | | | | | | | | |

7.125%, 2–1–26 (I) | | | 173 | | | | 183 | |

Chesapeake Escrow Issuer LLC: | | | | | | | | |

5.500%, 2–1–26 (I) | | | 594 | | | | 622 | |

5.875%, 2–1–29 (I) | | | 446 | | | | 477 | |

Colgate Energy Partners III LLC, | | | | | | | | |

5.875%, 7–1–29 (I) | | | 237 | | | | 239 | |

Crownrock L.P., | | | | | | | | |

5.625%, 10–15–25 (H)(I) | | | 2,820 | | | | 2,890 | |

CrownRock L.P. and CrownRock Finance, Inc., | | | | | | | | |

5.000%, 5–1–29 (I) | | | 289 | | | | 302 | |

Endeavor Energy Resources L.P., | | | | | | | | |

5.500%, 1–30–26 (H)(I) | | | 956 | | | | 997 | |

Laredo Petroleum, Inc.: | | | | | | | | |

9.500%, 1–15–25 (H) | | | 3,242 | | | | 3,363 | |

10.125%, 1–15–28 (H) | | | 1,161 | | | | 1,257 | |

Murphy Oil Corp., | | | | | | | | |

6.375%, 7–15–28 | | | 238 | | | | 252 | |

Range Resources Corp., | | | | | | | | |

8.250%, 1–15–29 (I) | | | 59 | | | | 66 | |

Vine Energy Holdings LLC, | | | | | | | | |

6.750%, 4–15–29 | | | 1,152 | | | | 1,245 | |

| | | | | | | | |

| | | | | | | 13,250 | |

| | | | | | | | |

| |

Oil & Gas Refining & Marketing – 2.5% | |

Callon Petroleum Co. (GTD by Callon Petroleum Operating Co.): | | | | | | | | |

6.125%, 10–1–24 | | | 468 | | | | 461 | |

9.000%, 4–1–25 (I) | | | 118 | | | | 128 | |

Comstock Resources, Inc.: | | | | | | | | |

6.750%, 3–1–29 (H)(I) | | | 1,360 | | | | 1,470 | |

5.875%, 1–15–30 (I) | | | 717 | | | | 747 | |

CVR Energy, Inc., | | | | | | | | |

5.250%, 2–15–25 (I) | | | 568 | | | | 563 | |

PBF Holding Co. LLC, | | | | | | | | |

9.250%, 5–15–25 (H)(I) | | | 3,018 | | | | 2,864 | |

| | | | | | | | |

| | | | | | | 6,233 | |

| | | | | | | | |

| |

Oil & Gas Storage & Transportation – 0.7% | |

Crestwood Midstream Partners L.P.: | | | | | | | | |

5.750%, 4–1–25 | | | 297 | | | | 304 | |

5.625%, 5–1–27 (I) | | | 597 | | | | 615 | |

6.000%, 2–1–29 (I) | | | 119 | | | | 125 | |

Hess Midstream Operations L.P., | | | | | | | | |

4.250%, 2–15–30 (I) | | | 238 | | | | 241 | |

Rattler Midstream L.P., | | | | | | | | |

5.625%, 7–15–25 (I) | | | 572 | | | | 596 | |

| | | | | | | | |

| | | | | | | 1,881 | |

| | | | | | | | |

| |

Total Energy – 9.0% | | | | 22,807 | |

| | |

| SCHEDULE OF INVESTMENTS | | DELAWARE IVY HIGH INCOME OPPORTUNITIES FUND (in thousands) |

SEPTEMBER 30, 2021

| | | | | | | | |

CORPORATE DEBT SECURITIES

(Continued) | | Principal | | | Value | |

Financials | |

| |

Insurance Brokers – 2.7% | |

NFP Corp., | | | | | | | | |

6.875%, 8–15–28 (H)(I) | | $ | 6,566 | | | $ | 6,713 | |

| | | | | | | | |

| |

Investment Banking & Brokerage – 0.6% | |

INTL FCStone, Inc., | | | | | | | | |

8.625%, 6–15–25 (H)(I) | | | 1,423 | | | | 1,531 | |

| | | | | | | | |

| |

Property & Casualty Insurance – 0.7% | |

Highlands Holdings Bond Issuer Ltd. and Highlands Holdings Bond Co-Issuer, Inc. (7.625% Cash or 8.375% PIK), | | | | | | | | |

7.625%, 10–15–25 (H)(I)(J) | | | 1,457 | | | | 1,549 | |

| | | | | | | | |

| |

Specialized Finance – 2.0% | |

BCPE Cycle Merger Sub II, Inc., | | | | | | | | |

10.625%, 7–15–27 (H)(I) | | | 2,224 | | | | 2,367 | |

Compass Group Diversified Holdings LLC, | | | | | | | | |

5.250%, 4–15–29 (H)(I) | | | 2,380 | | | | 2,493 | |

| | | | | | | | |

| | | | | | | 4,860 | |

| | | | | | | | |

| |

Thrifts & Mortgage Finance – 0.9% | |

Provident Funding Associates L.P. and PFG Finance Corp., | | | | | | | | |

6.375%, 6–15–25 (H)(I) | | | 2,236 | | | | 2,279 | |

| | | | | | | | |

| |

Total Financials – 6.9% | | | | 16,932 | |

Health Care | |

| |

Health Care Services – 0.7% | |

Heartland Dental LLC, | | | | | | | | |

8.500%, 5–1–26 (H)(I) | | | 369 | | | | 383 | |

ModivCare Escrow Issuer, Inc., | | | | | | | | |

5.000%, 10–1–29 (I) | | | 1,270 | | | | 1,318 | |

| | | | | | | | |

| | | | | | | 1,701 | |

| | | | | | | | |

| |

Health Care Supplies – 1.0% | |

Mozart Debt Merger Sub, Inc., | | | | | | | | |

3.875%, 4–1–29 (I) | | | 2,413 | | | | 2,413 | |

| | | | | | | | |

| |

Pharmaceuticals – 1.2% | |

P&L Development LLC and PLD Finance Corp., | | | | | | | | |

7.750%, 11–15–25 (H)(I) | | | 1,818 | | | | 1,891 | |

Par Pharmaceutical, Inc., | | | | | | | | |

7.500%, 4–1–27 (H)(I) | | | 1,188 | | | | 1,212 | |

| | | | | | | | |

| | | | | | | 3,103 | |

| | | | | | | | |

| |

Total Health Care – 2.9% | | | | 7,217 | |

Industrials | |

| |

Aerospace & Defense – 4.4% | |

TransDigm, Inc. (GTD by TransDigm Group, Inc.): | | | | | | | | |

7.500%, 3–15–27 (H) | | | 1,094 | | | | 1,147 | |

5.500%, 11–15–27 (H) | | | 2,821 | | | | 2,902 | |

4.625%, 1–15–29 | | | 592 | | | | 592 | |

| | | | | | | | |

CORPORATE DEBT SECURITIES

(Continued) | | Principal | | | Value | |

Aerospace & Defense (Continued) | |

Wolverine Escrow LLC: | | | | | | | | |

8.500%, 11–15–24 (H)(I) | | $ | 2,535 | | | $ | 2,361 | |

9.000%, 11–15–26 (H)(I) | | | 3,810 | | | | 3,524 | |

13.125%, 11–15–27 (I) | | | 343 | | | | 229 | |

| | | | | | | | |

| | | | | | | 10,755 | |

| | | | | | | | |

| |

Diversified Support Services – 1.6% | |

Ahern Rentals, Inc., | | | | | | | | |

7.375%, 5–15–23 (H)(I) | | | 1,507 | | | | 1,447 | |

Deluxe Corp., | | | | | | | | |

8.000%, 6–1–29 (I) | | | 752 | | | | 787 | |

Nesco Holdings II, Inc., | | | | | | | | |

5.500%, 4–15–29 (H)(I) | | | 1,675 | | | | 1,739 | |

| | | | | | | | |

| | | | | | | 3,973 | |

| | | | | | | | |

| |

Security & Alarm Services – 0.4% | |

Prime Security Services Borrower LLC and Prime Finance, Inc., | | | | | | | | |

6.250%, 1–15–28 (H)(I) | | | 867 | | | | 897 | |

| | | | | | | | |

| |

Total Industrials – 6.4% | | | | 15,625 | |

Information Technology | |

| |

Application Software – 2.6% | |

J2 Global, Inc., | | | | | | | | |

4.625%, 10–15–30 (I) | | | 349 | | | | 371 | |

Kronos Acquisition Holdings, Inc. and KIK Custom Products, Inc., | | | | | | | | |

5.000%, 12–31–26 (I) | | | 875 | | | | 875 | |

NCR Corp.: | | | | | | | | |

5.750%, 9–1–27 (I) | | | 307 | | | | 324 | |

5.000%, 10–1–28 (I) | | | 856 | | | | 876 | |

5.125%, 4–15–29 (H)(I) | | | 3,172 | | | | 3,275 | |

6.125%, 9–1–29 (I) | | | 393 | | | | 427 | |

5.250%, 10–1–30 (I) | | | 285 | | | | 300 | |

| | | | | | | | |

| | | | | | | 6,448 | |

| | | | | | | | |

| |

Data Processing & Outsourced Services – 0.1% | |

MoneyGram International, Inc., | | | | | | | | |

5.375%, 8–1–26 (I) | | | 298 | | | | 303 | |

| | | | | | | | |

| |

Internet Services & Infrastructure – 0.4% | |

Consensus Cloud Solutions, Inc.: | | | | | | | | |

6.000%, 10–15–26 (I) | | | 301 | | | | 310 | |

6.500%, 10–15–28 (I) | | | 722 | | | | 751 | |

| | | | | | | | |

| | | | | | | 1,061 | |

| | | | | | | | |

| |

IT Consulting & Other Services – 0.2% | |

Sabre GLBL, Inc. (GTD by Sabre Holdings Corp.): | | | | | | | | |

9.250%, 4–15–25 (I) | | | 288 | | | | 333 | |

7.375%, 9–1–25 (I) | | | 114 | | | | 122 | |

| | | | | | | | |

| | | | | | | 455 | |

| | | | | | | | |

| |

Technology Hardware, Storage & Peripherals – 0.3% | |

Brightstar Escrow Corp., | | | | | | | | |

9.750%, 10–15–25 (H)(I) | | | 804 | | | | 863 | |

| | | | | | | | |

| |

Total Information Technology – 3.6% | | | | 9,130 | |

| | | | | | | | |

CORPORATE DEBT SECURITIES

(Continued) | | Principal | | | Value | |

Materials | |

| |

Commodity Chemicals – 1.1% | |

LSF9 Atlantis Holdings LLC and Victra Finance Corp., | | | | | | | | |

7.750%, 2–15–26 (H)(I) | | $ | 1,485 | | | $ | 1,542 | |

NOVA Chemicals Corp.: | | | | | | | | |

5.250%, 6–1–27 (H)(I) | | | 666 | | | | 700 | |

4.250%, 5–15–29 (I) | | | 576 | | | | 577 | |

| | | | | | | | |

| | | | | | | 2,819 | |

| | | | | | | | |

| |

Metal & Glass Containers – 0.4% | |

ARD Finance S.A. (6.500% Cash or 7.250% PIK), | | | | | | | | |

6.500%, 6–30–27 (H)(I)(J) | | | 859 | | | | 914 | |

| | | | | | | | |

| |

Total Materials – 1.5% | | | | 3,733 | |

Real Estate | |

| |

Specialized REITs – 0.1% | |

Uniti Group L.P., Uniti Group Finance 2019, Inc. and CSL Capital LLC (GTD by Uniti Group, Inc.), | | | | | | | | |

4.750%, 4–15–28 (I) | | | 144 | | | | 147 | |

| | | | | | | | |

| |

Total Real Estate – 0.1% | | | | 147 | |

| |

TOTAL CORPORATE DEBT

SECURITIES – 74.2% | | | $ | 183,442 | |

(Cost: $180,132) | |

| | |

| LOANS (K) | | | | | | |

Communication Services | |

| |

Advertising – 1.3% | |

Advantage Sales & Marketing, Inc. (ICE LIBOR plus 525 bps), | | | | | | | | |

6.000%, 10–28–27 | | | 3,163 | | | | 3,184 | |

| | | | | | | | |

| | | | | | | 3,184 | |

| | | | | | | | |

| |

Broadcasting – 1.0% | |

Clear Channel Outdoor Holdings, Inc. (ICE LIBOR plus 350 bps), | | | | | | | | |

3.629%, 8–21–26 | | | 2,638 | | | | 2,588 | |

| | | | | | | | |

| |

Cable & Satellite – 0.7% | |

DIRECTV Financing LLC (1-Month ICE LIBOR plus 500 bps), | | | | | | | | |

5.750%, 7–22–27 | | | 1,664 | | | | 1,667 | |

| | | | | | | | |

| |

Integrated Telecommunication Services – 2.7% | |

West Corp. (3-Month ICE LIBOR plus 400 bps), | | | | | | | | |

5.000%, 10–10–24 | | | 6,269 | | | | 6,186 | |

Windstream Services LLC (ICE LIBOR plus 625 bps), | | | | | | | | |

7.250%, 9–21–27 | | | 529 | | | | 532 | |

| | | | | | | | |

| | | | | | | 6,718 | |

| | | | | | | | |

| | |

| SCHEDULE OF INVESTMENTS | | DELAWARE IVY HIGH INCOME OPPORTUNITIES FUND (in thousands) |

SEPTEMBER 30, 2021

| | | | | | | | |

| LOANS (K) (Continued) | | Principal | | | Value | |

Wireless Telecommunication Service – 1.2% | |

Digicel International Finance Ltd. (ICE LIBOR plus 325 bps), | | | | | | | | |

3.430%, 5–27–24 | | $ | 3,156 | | | $ | 3,054 | |

| | | | | | | | |

| |

Total Communication Services – 6.9% | | | | 17,211 | |

Consumer Discretionary | |

| |

Apparel Retail – 0.7% | |

Torrid LLC (1-Month ICE LIBOR plus 550 bps), | | | | | | | | |

6.250%, 6–14–28 (C) | | | 1,805 | | | | 1,816 | |

| | | | | | | | |

| |

Casinos & Gaming – 0.1% | |

New Cotai LLC (14.000% Cash or 14.000% PIK), | | | | | | | | |

14.000%, 9–10–25 (D)(J) | | | 293 | | | | 290 | |

| | | | | | | | |

| |

Homefurnishing Retail – 0.5% | |

Ambience Merger Sub, Inc. (1-Month ICE LIBOR plus 425 bps), | | | | | | | | |

4.750%, 6–25–28 | | | 1,189 | | | | 1,190 | |

| | | | | | | | |

| |

Internet & Direct Marketing Retail – 0.3% | |

CNT Holdings I Corp. (ICE LIBOR plus 375 bps), | | | | | | | | |

4.500%, 11–8–27 | | | 723 | | | | 725 | |

| | | | | | | | |

| |

Leisure Facilities – 0.8% | |

United PF Holdings LLC (ICE LIBOR plus 400 bps), | | | | | | | | |

4.132%, 12–30–26 | | | 1,772 | | | | 1,725 | |

United PF Holdings LLC (ICE LIBOR plus 850 bps), | | | | | | | | |

9.500%, 11–12–26 (C) | | | 395 | | | | 397 | |

| | | | | | | | |

| | | | | | | 2,122 | |

| | | | | | | | |

| |

Leisure Products – 0.5% | |

MajorDrive Holdings IV LLC (1-Month ICE LIBOR plus 400 bps), | | | | | | | | |

4.500%, 6–1–28 | | | 1,342 | | | | 1,346 | |

| | | | | | | | |

| |

Specialty Stores – 4.0% | |

Bass Pro Group LLC (ICE LIBOR plus 425 bps), | | | | | | | | |

5.000%, 3–5–28 | | | 257 | | | | 259 | |

Jo-Ann Stores, Inc. (1-Month ICE LIBOR plus 475 bps), | | | | | | | | |

5.500%, 6–30–28 | | | 3,207 | | | | 3,129 | |

Michaels Cos., Inc. (The) (1-Month ICE LIBOR plus 425 bps), | | | | | | | | |

5.000%, 4–15–28 | | | 1,151 | | | | 1,154 | |

PetSmart, Inc. (ICE LIBOR plus 375 bps), | | | | | | | | |

4.500%, 2–12–28 | | | 2,718 | | | | 2,728 | |

Staples, Inc. (ICE LIBOR plus 500 bps), | | | | | | | | |

5.126%, 4–12–26 | | | 2,427 | | | | 2,321 | |

Woof Holdings LLC (ICE LIBOR plus 375 bps), | | | | | | | | |

4.500%, 12–21–27 | | | 339 | | | | 340 | |

| | | | | | | | |

| | | | | | | 9,931 | |

| | | | | | | | |

| | | | | | | | |

| LOANS (K) (Continued) | | Principal | | | Value | |

Textiles – 1.1% | |

SIWF Holdings, Inc. (ICE LIBOR plus 425 bps), | | | | | | | | |

4.334%, 6–15–25 | | $ | 2,688 | | | $ | 2,691 | |

| | | | | | | | |

| |

Total Consumer Discretionary – 8.0% | | | | 20,111 | |

Energy | |

| |

Coal & Consumable Fuels – 0.3% | |

Foresight Energy LLC (ICE LIBOR plus 800 bps), | | | | | | | | |

9.500%, 6–29–27 (D) | | | 512 | | | | 512 | |

Westmoreland Mining Holdings LLC (15.000% Cash or 15.000% PIK), | | | | | | | | |

15.000%, 3–15–29 (J) | | | 1,108 | | | | 230 | |

| | | | | | | | |

| | | | | | | 742 | |

| | | | | | | | |

| |

Oil & Gas Equipment & Services – 0.5% | |

Larchmont Resources LLC (9.000% Cash or 9.000% PIK), | | | | | | | | |

9.000%, 8–7–22 (B)(C)(J) | | | 1,253 | | | | 1,191 | |

| | | | | | | | |

| |

Oil & Gas Exploration & Production – 0.4% | |

Ascent Resources Utica Holdings LLC, | | | | | | | | |

0.000%, 11–1–25 (N) | | | 180 | | | | 198 | |

Ascent Resources Utica Holdings LLC (1-Month ICE LIBOR plus 900 bps), | | | | | | | | |

10.000%, 11–1–25 | | | 625 | | | | 688 | |

| | | | | | | | |

| | | | | | | 886 | |

| | | | | | | | |

| |

Oil & Gas Storage & Transportation – 0.7% | |

EPIC Crude Services L.P. (ICE LIBOR plus 500 bps), | | | | | | | | |

5.121%, 3–1–26 | | | 2,215 | | | | 1,676 | |

| | | | | | | | |

| |

Total Energy – 1.9% | | | | 4,495 | |

Financials | |

| |

Asset Management & Custody Banks – 0.7% | |

Edelman Financial Holdings II, Inc. (ICE LIBOR plus 675 bps), | | | | | | | | |

6.834%, 7–20–26 | | | 1,703 | | | | 1,721 | |

| | | | | | | | |

| |

Property & Casualty Insurance – 1.3% | |

Amynta Agency Borrower, Inc. (ICE LIBOR plus 400 bps), | | | | | | | | |

4.584%, 2–28–25 | | | 3,270 | | | | 3,270 | |

| | | | | | | | |

| |

Specialized Finance – 1.2% | |

Gulf Finance LLC (ICE LIBOR plus 525 bps), | | | | | | | | |

6.250%, 8–25–23 | | | 2,409 | | | | 2,322 | |

Lealand Finance Co. B.V., | | | | | | | | |

0.000%, 6–30–24 (C)(N) | | | 10 | | | | 6 | |

Lealand Finance Co. B.V. (ICE LIBOR plus 300 bps), | | | | | | | | |

3.085%, 6–30–24 (C) | | | 30 | | | | 18 | |

Sunset Debt Merger Sub, Inc., | | | | | | | | |

0.000%, 9–17–28 (C)(N) | | | 602 | | | | 598 | |

| | | | | | | | |

| | | | | | | 2,944 | |

| | | | | | | | |

| |

Total Financials – 3.2% | | | | 7,935 | |

| | | | | | | | |

| LOANS (K) (Continued) | | Principal | | | Value | |

Health Care | |

| |

Health Care Facilities – 0.2% | |

Surgery Center Holdings, Inc. (1-Month ICE LIBOR plus 375 bps), | | | | | | | | |

4.500%, 8–31–26 | | $ | 420 | | | $ | 421 | |

| | | | | | | | |

| |

Health Care Services – 3.6% | |

Heartland Dental LLC (ICE LIBOR plus 375 bps), | | | | | | | | |

3.584%, 4–30–25 | | | 1,822 | | | | 1,809 | |

U.S. Renal Care, Inc. (3-Month ICE LIBOR plus 500 bps), | | | | | | | | |

5.125%, 7–26–26 | | | 7,194 | | | | 7,191 | |

| | | | | | | | |

| | | | | | | 9,000 | |

| | | | | | | | |

| |

Total Health Care – 3.8% | | | | 9,421 | |

Industrials | |

| |

Building Products – 0.7% | |

CP Atlas Buyer, Inc. (ICE LIBOR plus 375 bps), | | | | | | | | |

4.250%, 11–23–27 | | | 1,734 | | | | 1,732 | |

| | | | | | | | |

| |

Construction & Engineering – 0.3% | |

WaterBridge Midstream Operating LLC (3-Month ICE LIBOR plus 575 bps), | | | | | | | | |

6.750%, 6–21–26 | | | 745 | | | | 729 | |

| | | | | | | | |

| |

Industrial Conglomerates – 2.3% | |

PAE Holding Corp. (ICE LIBOR plus 450 bps), | | | | | | | | |

5.250%, 10–19–27 | | | 5,803 | | | | 5,806 | |

| | | | | | | | |

| |

Industrial Machinery – 1.5% | |

Form Technologies LLC (ICE LIBOR plus 475 bps), | | | | | | | | |

5.750%, 7–22–25 (C) | | | 3,756 | | | | 3,775 | |

| | | | | | | | |

| |

Research & Consulting Services – 0.2% | |

Ankura Consulting Group LLC (ICE LIBOR plus 450 bps), | | | | | | | | |

5.250%, 3–17–28 | | | 585 | | | | 587 | |

| | | | | | | | |

| |

Total Industrials – 5.0% | | | | 12,629 | |

Information Technology | |

| |

Communications Equipment – 1.3% | |

MLN U.S. Holdco LLC (ICE LIBOR plus 450 bps), | | | | | | | | |

4.583%, 11–30–25 | | | 2,529 | | | | 2,307 | |

MLN U.S. Holdco LLC (ICE LIBOR plus 875 bps), | | | | | | | | |

8.833%, 11–30–26 | | | 1,214 | | | | 790 | |

| | | | | | | | |

| | | | | | | 3,097 | |

| | | | | | | | |

| |

Data Processing & Outsourced Services – 1.4% | |

CommerceHub, Inc. (ICE LIBOR plus 400 bps), | | | | | | | | |

4.750%, 12–2–27 | | | 1,125 | | | | 1,128 | |

| | |

| SCHEDULE OF INVESTMENTS | | DELAWARE IVY HIGH INCOME OPPORTUNITIES FUND (in thousands) |

SEPTEMBER 30, 2021

| | | | | | | | |

| LOANS (K) (Continued) | | Principal | | | Value | |

Data Processing & Outsourced Services (Continued) | |

Cyxtera DC Holdings, Inc. (ICE LIBOR plus 325 bps), | | | | | | | | |

4.000%, 5–1–24 | | $ | 1,839 | | | $ | 1,828 | |

MoneyGram International, Inc., | | | | | | | | |

0.000%, 7–14–26 (N) | | | 477 | | | | 478 | |

| | | | | | | | |

| | | | | | | 3,434 | |

| | | | | | | | |

| |

Internet Services & Infrastructure – 0.3% | |

Informatica LLC, | | | | | | | | |

7.125%, 2–25–25 | | | 727 | | | | 739 | |

| | | | | | | | |

| |

IT Consulting & Other Services – 1.6% | |

Gainwell Acquisition Corp. (ICE LIBOR plus 400 bps), | | | | | | | | |

4.750%, 10–1–27 | | | 2,969 | | | | 2,980 | |

Ivanti Software, Inc. (1-Month ICE LIBOR plus 400 bps), | | | | | | | | |

4.750%, 12–1–27 | | | 276 | | | | 277 | |

Ivanti Software, Inc. (1-Month U.S. LIBOR plus 475 bps), | | | | | | | | |

5.750%, 12–1–27 | | | 698 | | | | 700 | |

| | | | | | | | |

| | | | | | | 3,957 | |

| | | | | | | | |

| |

Total Information Technology – 4.6% | | | | 11,227 | |

| | | | | | | | |

| LOANS (K) (Continued) | | Principal | | | Value | |

Materials | |

| |

Specialty Chemicals – 0.1% | |

NIC Acquisition Corp. (1-Month ICE LIBOR plus 375 bps), | | | | | | | | |

4.500%, 12–29–27 | | $ | 295 | | | $ | 294 | |

| | | | | | | | |

| |

Total Materials – 0.1% | | | | 294 | |

| |

TOTAL LOANS – 33.5% | | | $ | 83,323 | |

(Cost: $84,530) | |

| | |

| SHORT-TERM SECURITIES | | Shares | | | | |

Money Market Funds (P) – 20.8% | |

Dreyfus Institutional | | | | | | | | |

Preferred Government Money Market Fund – Institutional Shares, 0.010% (O) | | | 5,880 | | | | 5,880 | |

State Street Institutional | | | | | | | | |

U.S. Government Money Market Fund – Premier Class, 0.030% | | | 45,532 | | | | 45,532 | |

| | | | | | | | |

| | | | | | | 51,412 | |

| | | | | | | | |

| |

TOTAL SHORT-TERM SECURITIES – 20.8% | | | $ | 51,412 | |

(Cost: $51,412) | |

| | | | | | |

| | | | | Value | |

| |

TOTAL INVESTMENT SECURITIES – 137.3% | | $ | 339,699 | |

(Cost: $347,389) | |

| |

BORROWINGS (Q) – (35.2)% | | | (87,000 | ) |

| |

LIABILITIES, NET OF CASH AND OTHER ASSETS – (2.1)% | | | (5,334 | ) |

| |

NET ASSETS – 100.0% | | $ | 247,365 | |

Notes to Schedule of Investments

| * | Not shown due to rounding. |

| (A) | No dividends were paid during the preceding 12 months. |

| (B) | Deemed to be an affiliate due to the Fund owning at least 5% of the voting securities. |

| (C) | Securities whose value was determined using significant unobservable inputs. |

| (D) | Restricted securities. At September 30, 2021, the Fund owned the following restricted securities: |

| | | | | | | | | | | | | | | | | | | | |

| Security | | Acquisition Date(s) | | | Shares | | | Cost | | | Value | |

BIS Industries Ltd. | | | 12–22–17 | | | | 804 | | | $ | 76 | | | $ | — | * | | | | |

Foresight Energy L.P. | | | 6–30–20 to 9–8–20 | | | | 74 | | | | 1,453 | | | | 1,566 | | | | | |

Larchmont Resources LLC | | | 12–8–16 | | | | 2 | | | | 560 | | | | 2 | | | | | |

New Cotai Participation Corp., Class B | | | 9–29–20 | | | | 971 | | | | 8,782 | | | | 2,087 | | | | | |

Studio City International Holdings Ltd. ADR | | | 8–5–20 | | | | 45 | | | | 694 | | | | 364 | | | | | |

Targa Resources Corp., 9.500% | | | 10–24–17 | | | | 3 | | | | 3,522 | | | | 3,415 | | | | | |

| | | | | |

| | | | | | Principal | | | | | | | | | | |

Foresight Energy LLC (ICE LIBOR plus 800 bps), 9.500%, 06–29–27 | | | 12–31–20 | | | $ | 512 | | | | 512 | | | | 512 | | | | | |

New Cotai LLC (14.000% Cash or 14.000% PIK), 14.000%, 09–10–25 | | | 9–10–20 to 3–16–21 | | | | 293 | | | | 293 | | | | 290 | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | $ | 15,892 | | | $ | 8,236 | | | | | |

| | | | | | | | | | | | |

| | The total value of these securities represented 3.3% of net assets at September 30, 2021. |

| (E) | Listed on an exchange outside the United States. |

| (F) | All or a portion of securities with an aggregate value of $5,755 are on loan. |

| | |

| SCHEDULE OF INVESTMENTS | | DELAWARE IVY HIGH INCOME OPPORTUNITIES FUND (in thousands) |

SEPTEMBER 30, 2021

| (G) | Warrants entitle the Fund to purchase a predetermined number of shares of common stock and are non-income producing. The purchase price and number of shares are subject to adjustment under certain conditions until the expiration date, if any. |

| (H) | All or a portion of securities with an aggregate value of $135,075 have been pledged as collateral on open borrowings. |

| (I) | Securities were purchased pursuant to an exemption from registration available under Rule 144A under the Securities Act of 1933 and may only be resold in transactions exempt from registration, normally to qualified institutional buyers. At September 30, 2021 the total value of these securities amounted to $163,497 or 66.1% of net assets. |

| (J) | Payment-in-kind bond which may pay interest in additional par and/or in cash. Rates shown are the current rate and possible payment rates. |

| (K) | Variable rate security. Interest rate disclosed is that which is in effect at September 30, 2021. Description of the reference rate and spread, if applicable, are included in the security description. |

| (L) | Non-income producing as the issuer has either missed its most recent interest payment or declared bankruptcy. |

| (M) | Step bond that pays an initial coupon rate for the first period and then a higher or lower coupon rate for the following periods. Interest rate disclosed is that which is in effect at September 30, 2021. |

| (N) | All or a portion of this position has not settled. Full contract rates do not take effect until settlement date. |

| (O) | Investment made with cash collateral received from securities on loan. |

| (P) | Rate shown is the annualized 7-day yield at September 30, 2021. |

| (Q) | Borrowings payable as a percentage of total investment securities is 25.6%. |

The following futures contracts were outstanding at September 30, 2021 (contracts unrounded):

| | | | | | | | | | | | | | | | | | | | | | | | |

| Description | | Type | | | Number of

Contracts | | | Expiration Date | | | Notional

Amount | | | Value | | | Unrealized Appreciation | |

U.S. Treasury Long Bond | | | Short | | | | 2 | | | | 12–21–21 | | | | 200 | | | $ | (319 | ) | | $ | 9 | |

U.S. Treasury Ultra Long Bond | | | Short | | | | 1 | | | | 12–21–21 | | | | 100 | | | | (191 | ) | | | 7 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | $ | (510 | ) | | $ | 16 | |

| | | | | | | | | | | | | | | | | | | | |

The following table is a summary of the valuation of the Fund’s investments by the fair value hierarchy levels as of September 30, 2021. See Note 3 to the Financial Statements for further information regarding fair value measurement.

| | | | | | | | | | | | |

| | | Level 1 | | | Level 2 | | | Level 3 | |

Assets | | | | | | | | | | | | |

Investments in Securities | | | | | | | | | | | | |

Common Stocks | | | | | | | | | | | | |

Communication Services | | $ | 4,138 | | | $ | — | | | $ | — | |

Consumer Discretionary | | | 1,249 | | | | — | | | | 3,470 | |

Energy | | | — | | | | 941 | | | | 1,566 | |

Industrials | | | — | | | | — | | | | — | * |

Total Common Stocks | | $ | 5,387 | | | $ | 941 | | | $ | 5,036 | |

Investment Funds | | | 6,387 | | | | — | | | | — | |

Preferred Stocks | | | — | | | | 3,733 | | | | — | |

Warrants | | | 38 | | | | — | | | | — | |

Corporate Debt Securities | | | — | | | | 183,442 | | | | — | |

Loans | | | — | | | | 75,522 | | | | 7,801 | |

Short-Term Securities | | | 51,412 | | | | — | | | | — | |

Total | | $ | 63,224 | | | $ | 263,638 | | | $ | 12,837 | |

Futures Contracts | | $ | 16 | | | $ | — | | | $ | — | |

| | |

| SCHEDULE OF INVESTMENTS | | DELAWARE IVY HIGH INCOME OPPORTUNITIES FUND (in thousands) |

SEPTEMBER 30, 2021

The following table is a reconciliation of Level 3 investments for which significant unobservable inputs were used to determine fair value:

| | | | | | | | |

| | | Common

Stocks | | | Loans | |

Beginning Balance 10-1-20 | | $ | 5,531 | | | $ | 3,173 | |

Net realized gain (loss) | | | (509 | ) | | | 18 | |

Net change in unrealized appreciation (depreciation) | | | (2,699 | ) | | | 1,104 | |

Purchases | | | — | | | | 6,174 | |

Sales | | | — | | | | (2,676 | ) |

Amortization/Accretion of premium/discount | | | — | | | | 8 | |

Transfers into Level 3 during the period | | | 2,779 | | | | — | |

Transfers out of Level 3 during the period | | | (66 | ) | | | — | |

| | | | |

Ending Balance 9-30-21 | | $ | 5,036 | | | $ | 7,801 | |

| | | | |

Net change in unrealized appreciation (depreciation) for all Level 3 investments still held as of 9-30-21 | | $ | (3,208 | ) | | $ | 768 | |

| | | | |

Transfers from Level 2 to Level 3 occurred primarily due to the lack of observable market data due to decreased market activity or information for these securities. Transfers from Level 3 to Level 2 occurred primarily due to the increased availability of observable market data due to increased market activity or information.

Information about Level 3 fair value measurements:

| | | | | | | | | | | | |

| | | Fair Value at

9-30-21 | | | Valuation Technique(s) | | Unobservable Input(s) | | Input

value(s) | |

Assets | | | | | | | | | | | | |

| | | | |

Common Stocks | | $ | 1,383 | | | Market approach | | Revenue multiple | | | 0.67x | |

| | | | | | | | EBITDA multiple | | | 4.62x | |

| | | 1,566 | | | Market approach | | Discount for lack of marketability | | | 30.00% | |

| | | 2,087 | | | Market approach | | Financials | | | N/A | |

| | | | | | | | Premium | | | 20.00% | |

| | | | |

Loans | | | 7,801 | | | Third-party valuation service | | Broker quotes | | | N/A | |

The following acronyms are used throughout this schedule:

ADR = American Depositary Receipt

GTD = Guaranteed

ICE = Intercontinental Exchange

LIBOR = London Interbank Offered Rate

PIK = Payment in kind

REIT = Real Estate Investment Trust

See Accompanying Notes to Financial Statements.

| | |

| STATEMENT OF ASSETS AND LIABILITIES | | DELAWARE IVY HIGH INCOME OPPORTUNITIES FUND(1) |

AS OF SEPTEMBER 30, 2021

| | | | |

| (In thousands, except per share amounts) | | | |

ASSETS | | | | |

Investments in unaffiliated securities at value+^ | | | 334,718 | |

Investments in affiliated securities at market value+ | | | 4,981 | |

Investments at Value | | | 339,699 | |

Cash | | | 112 | |

Due to Morgan Stanley | | | 14 | |

Investment securities sold receivable | | | 1,759 | |

Dividends and interest receivable | | | 4,192 | |

Variation margin receivable | | | — | * |

Receivable from securities lending income – net | | | 8 | |

Prepaid and other assets | | | 1 | |

Total Assets | | | 345,785 | |

| |

LIABILITIES | | | | |

Cash collateral on securities loaned at value | | | 5,880 | |

Investment securities purchased payable | | | 5,197 | |

Independent Trustees and Chief Compliance Officer fees payable | | | 8 | |

Shareholder servicing payable | | | 2 | |

Investment management fee payable | | | 9 | |

Accounting services fee payable | | | 8 | |

Variation margin payable | �� | | — | * |

Payable for borrowing | | | 87,000 | |

Interest payable for borrowing | | | 24 | |

Other liabilities | | | 292 | |

Total Liabilities | | | 98,420 | |

Commitments and Contingencies (See Note 2 and Note 11) | | | | |

Total Net Assets | | $ | 247,365 | |

| |

NET ASSETS | | | | |

Capital paid in | | $ | 315,694 | |

Accumulated earnings loss | | | (68,329 | ) |

Total Net Assets | | $ | 247,365 | |

| |

CAPITAL SHARES OUTSTANDING | | | 16,570 | |

| |

NET ASSET VALUE PER SHARE | | | $14.93 | |

| |

+COST | | | | |

Investments in unaffiliated securities at cost | | $ | 332,979 | |

Investments in affiliated securities at cost | | $ | 14,411 | |

^Securities loaned at value | | $ | 5,755 | |

| * | Not shown due to rounding. |

| (1) | Effective July 1, 2021, the Fund’s name changed from Ivy High Income Opportunities Fund to Delaware Ivy High Income Opportunities Fund. |

See Accompanying Notes to Financial Statements.

| | |

| STATEMENT OF OPERATIONS | | DELAWARE IVY HIGH INCOME OPPORTUNITIES FUND(1) |

FOR THE YEAR ENDED SEPTEMBER 30, 2021

| | | | |

| (In thousands) | | | |

INVESTMENT INCOME | |

Dividends from unaffiliated securities | | $ | 507 | |

Interest and amortization from unaffiliated securities | | | 20,329 | |

Interest and amortization from affiliated securities | | | 129 | |

Securities lending income – net | | | 66 | |

Total Investment Income | | | 21,031 | |

| |

EXPENSES | | | | |

Investment management fee | | | 3,311 | |

Interest expense for borrowing | | | 765 | |

Shareholder servicing | | | 42 | |

Custodian fees | | | 8 | |

Independent Trustees and Chief Compliance Officer fees | | | 19 | |

Accounting services fee | | | 96 | |

Professional fees | | | 137 | |

Other | | | 57 | |

Total Expenses | | | 4,435 | |

Net Investment Income | | | 16,596 | |

| |

REALIZED AND UNREALIZED GAIN (LOSS) | | | | |

Net realized gain (loss) on: | | | | |

Investments in unaffiliated securities | | | (1,923 | ) |

Futures contracts | | | (41 | ) |

Net change in unrealized appreciation (depreciation) on: | | | | |

Investments in unaffiliated securities | | | 28,147 | |

Investments in affiliated securities | | | (4,258 | ) |

Futures contracts | | | 16 | |

Net Realized and Unrealized Gain | | | 21,941 | |

Net Increase in Net Assets Resulting from Operations | | $ | 38,537 | |

| (1) | Effective July 1, 2021, the Fund’s name changed from Ivy High Income Opportunities Fund to Delaware Ivy High Income Opportunities Fund. |

See Accompanying Notes to Financial Statements.

| | |

| STATEMENTS OF CHANGES IN NET ASSETS | | DELAWARE IVY HIGH INCOME OPPORTUNITIES FUND(1) |

| | | | | | | | |

| (In thousands) | | Year ended

9-30-21 | | | Year ended

9-30-20 | |

INCREASE (DECREASE) IN NET ASSETS | | | | | | | | |

Operations: | | | | | | | | |

Net investment income | | $ | 16,596 | | | $ | 18,602 | |

Net realized loss on investments | | | (1,964 | ) | | | (7,697 | ) |

Net change in unrealized appreciation (depreciation) | | | 23,905 | | | | (14,972 | ) |

Net Increase (Decrease) in Net Assets Resulting from Operations | | | 38,537 | | | | (4,067 | ) |

| | |

Distributions to Shareholders From: | | | | | | | | |

Accumulated Earnings | | | | | | | | |

(combined net investment income and net realized gains) | | | (16,156 | ) | | | (20,381 | ) |

Total Distributions to Shareholders | | | (16,156 | ) | | | (20,381 | ) |

| | |

Capital Share Transactions: | | | | | | | | |

Net proceeds from the sale of shares | | | — | | | | — | |

Net Increase in net assets from share transactions | | | — | | | | — | |

Net Increase (Decrease) in Net Assets | | | 22,381 | | | | (24,448 | ) |

Net Assets, Beginning of Period | | | 224,984 | | | | 249,432 | |

Net Assets, End of Period | | $ | 247,365 | | | $ | 224,984 | |

| (1) | Effective July 1, 2021, the Fund’s name changed from Ivy High Income Opportunities Fund to Delaware Ivy High Income Opportunities Fund. |

See Accompanying Notes to Financial Statements.

| | |

| STATEMENT OF CASH FLOWS | | DELAWARE IVY HIGH INCOME OPPORTUNITIES FUND(1) |

FOR THE YEAR ENDED SEPTEMBER 30, 2021

| | | | |

| (In thousands) | | | |

Cash flows provided by operating activities: | | | | |

Net increase in net assets resulting from operations | | $ | 38,537 | |

Adjustments to reconcile net increase in net assets from operations to net cash provided by operating activities: | | | | |

Purchases of long-term investment securities | | | (167,898 | ) |

Proceeds from sales of long-term investment securities | | | 194,037 | |

Purchases of short-term portfolio investment securities, net | | | (33,040 | ) |

Due to Morgan Stanley | | | (14 | ) |

Decrease in dividends and interest receivable | | | 647 | |

Increase in receivable from securities lending income | | | (7 | ) |

Decrease in prepaid and other assets | | | 6 | |

Increase in cash collateral on securities loaned at value | | | 5,565 | |

Decrease in independent trustees and chief compliance officer fees | | | (2 | ) |

Increase in investment management fee payable | | | 1 | |

Increase in interest payable for borrowing | | | 2 | |

Increase in other liabilities | | | 244 | |

Net realized loss on investments in unaffiliated securities | | | 1,923 | |

Net change in unrealized appreciation on investments in unaffiliated securities | | | (28,147 | ) |

Net change in unrealized depreciation on investments in affiliated securities | | | 4,258 | |

Net change in unrealized appreciation on futures contracts | | | (16 | ) |

Net accretion and payment in kind income on investment securities | | | (605 | ) |

Net cash provided by operating activities | | | 15,491 | |

Cash flows used for financing activities: | | | | |

Cash dividends paid+ | | | (16,156 | ) |

Net cash used for financing activities | | | (16,156 | ) |

Net decrease in cash and foreign currency | | | (665 | ) |

Cash and foreign currency, at beginning of period | | | 777 | |

Cash and foreign currency, at end of period | | $ | 112 | |

Supplemental disclosure of cash flow information: | | | | |

Interest expense paid during the period | | $ | 767 | |

| (1) | Effective July 1, 2021, the Fund’s name changed from Ivy High Income Opportunities Fund to Delaware Ivy High Income Opportunities Fund. |

See Accompanying Notes to Financial Statements.

| | |

| FINANCIAL HIGHLIGHTS | | DELAWARE IVY HIGH INCOME OPPORTUNITIES FUND^ |

FOR A SHARE OF CAPITAL STOCK OUTSTANDING THROUGHOUT EACH PERIOD

| | | | | | | | | | | | | | | | | | | | |

| | | Year ended

9-30-2021 | | | Year ended

9-30-2020 | | | Year ended

9-30-2019 | | | Year ended

9-30-2018 | | | Year ended

9-30-2017 | |

Net Asset Value, Beginning of Period | | $ | 13.58 | | | $ | 15.05 | | | $ | 15.96 | | | $ | 16.34 | | | $ | 15.65 | |

Net Investment Income(1) | | | 1.00 | | | | 1.12 | | | | 1.25 | | | | 1.36 | | | | 1.51 | |

Net Realized and Unrealized Gain (Loss) on Investments | | | 1.32 | | | | (1.36 | ) | | | (0.84 | ) | | | (0.46 | ) | | | 0.66 | |

Total from Investment Operations | | | 2.32 | | | | (0.24 | ) | | | 0.41 | | | | 0.90 | | | | 2.17 | |

Distributions From Net Investment Income | | | (0.97 | ) | | | (1.23 | ) | | | (1.32 | ) | | | (1.28 | ) | | | (1.48 | ) |

Net Asset Value, End of Period | | $ | 14.93 | | | $ | 13.58 | | | $ | 15.05 | | | $ | 15.96 | | | $ | 16.34 | |

Market Price, End of Period | | $ | 13.67 | | | $ | 11.90 | | | $ | 13.71 | | | $ | 14.26 | | | $ | 15.97 | |

Total Return(2) — Net Asset Value | | | 18.29 | % | | | (0.24 | )% | | | 4.10 | % | | | 6.68 | % | | | 15.14 | % |

Total Return(2) — Market Price(3) | | | 23.59 | % | | | (4.04 | )% | | | 6.07 | % | | | (2.47 | )% | | | 22.55 | % |

Net Assets, End of Period (in millions) | | $ | 247 | | | $ | 225 | | | $ | 249 | | | $ | 264 | | | $ | 271 | |

Ratio of Expenses to Average Net Assets(4) | | | 1.82 | % | | | 2.60 | % | | | 3.16 | % | | | 2.77 | % | | | 2.35 | % |

Ratio of Expenses to Average Net Assets Excluding Interest Expense(5) | | | 1.50 | % | | | 1.82 | % | | | 1.73 | % | | | 1.59 | % | | | 1.58 | % |

Ratio of Net Investment Income to Average Net Assets(6) | | | 6.80 | % | | | 8.18 | % | | | 8.27 | % | | | 8.50 | % | | | 9.31 | % |

Portfolio Turnover Rate | | | 55 | % | | | 45 | % | | | 34 | % | | | 46 | % | | | 39 | % |

| (1) | Based on average weekly shares outstanding. |

| (2) | Total investment return is calculated assuming a purchase of common stock on the opening of the first day and a sale on the closing of the last day of each period reported. Dividends and distributions, if any, are assumed, for purposes of this calculation, to be reinvested at prices obtained under the Fund’s dividend reinvestment plan. Total returns for periods less than one year are not annualized. |

| (3) | Total investment return at market price will differ from results at NAV. Returns at market price can be influenced by factors such as changing views about the Fund, market conditions, supply and demand for the Fund’s stock, or changes in the Fund’s dividends. |

| (4) | The ratio of expenses to adjusted average net assets (excluding debt outstanding) for the years ended September 30, 2021, 2020, 2019, 2018 and 2017 are 1.34%, 1.82%, 2.17%, 1.90% and 1.62%, respectively. |

| (5) | The ratio of expenses to adjusted average net assets excluding interest expense (excluding debt outstanding) for the years ended September 30, 2021, 2020, 2019, 2018 and 2017 are 1.11%, 1.27%, 1.19%, 1.09% and 1.09%, respectively. |

| (6) | The ratio of net investment income to adjusted average net assets (excluding debt outstanding) for the years ended September 30, 2021, 2020, 2019, 2018 and 2017 are 5.01%, 5.71%, 5.69%, 5.81% and 6.43%, respectively. |

| ^ | Effective July 1, 2021, the Fund’s name changed from Ivy High Income Opportunities Fund to Delaware Ivy High Income Opportunities Fund. |

See Accompanying Notes to Financial Statements.

| | |

| NOTES TO FINANCIAL STATEMENTS | | DELAWARE IVY HIGH INCOME OPPORTUNITIES FUND |

SEPTEMBER 30, 2021

Delaware Ivy High Income Opportunities Fund (formerly known as Ivy High Income Opportunities Fund) (the “Fund”) is registered under the Investment Company Act of 1940, as amended (the “1940 Act”) as a non-diversified, closed-end management investment company. The Fund was organized as a Delaware statutory trust on January 30, 2013, pursuant to an Agreement and Declaration of Trust, as amended and restated on March 28, 2013, governed by the laws of the State of Delaware. The Fund commenced operations on May 29, 2013. Prior to that date, the Fund had no operations other than matters relating to its organization and the sale and issuance of 5,236 common shares of beneficial interest to Ivy Investment Management Company (“IICO” or the “Adviser”), the Fund’s former investment adviser. Effective April 30, 2021, the Fund’s investment adviser is Delaware Management Company (“DMC” or the “Adviser”). The Fund’s common shares are listed on the New York Stock Exchange (the “NYSE”) and trade under the ticker symbol “IVH”.