UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22800

IVY HIGH INCOME OPPORTUNITIES FUND

(Exact name of registrant as specified in charter)

6300 Lamar Avenue, Overland Park, Kansas 66202

(Address of principal executive offices) (Zip code)

Jennifer K. Dulski

6300 Lamar Avenue

Overland Park, Kansas 66202

(Name and address of agent for service)

Registrant’s telephone number, including area code: (913) 236-2000

Date of fiscal year end: September 30

Date of reporting period: March 31, 2021

ITEM 1. REPORTS TO STOCKHOLDERS.

1

| | |

| | Semiannual Report MARCH 31, 2021 |

|

Ivy High Income Opportunities Fund |

|

| The Fund’s common shares are listed on the New York |

|

| Stock Exchange and trade under the ticker symbol IVH |

The Fund is a non-diversified, closed-end management investment company designed primarily as a long-term investment and not as a trading vehicle.

IVY INVESTMENTSSM refers to the investment management and investment advisory services offered by Macquarie Investment Management Business Trust (MIMBT) through its various series.

On December 2, 2020, Waddell & Reed Financial, Inc. (“WDR”), the parent company of Ivy Investment Management Company, the investment adviser of the Ivy Funds Complex (the “Ivy Funds”), and Macquarie Management Holdings, Inc., the U.S. holding company for Macquarie Group Limited’s U.S. asset management business (“Macquarie”), announced that they had entered into an agreement whereby Macquarie would acquire the investment management business of WDR (the “Transaction”).

The Transaction closed on April 30, 2021. The Fund, as part of Delaware Funds by Macquarie, is now managed by Delaware Management Company, a series of Macquarie Investment Management Business Trust.

| | |

| CONTENTS | | IVY HIGH INCOME OPPORTUNITIES FUND |

Macquarie Investment Management (MIM) is a global asset manager with offices in the United States, Europe, Asia, and Australia. As active managers, we prioritize autonomy and accountability at the investment team level in pursuit of opportunities that matter for clients. Delaware Funds is one of the longest-standing mutual fund families, with more than 80 years in existence.

If you are interested in learning more about creating an investment plan, contact your financial advisor.

Macquarie Asset Management (MAM) offers a diverse range of products including securities investment management, infrastructure and real asset management, and fund and equity-based structured products. MIM is the marketing name for certain companies comprising the asset management division of Macquarie Group. This includes the following investment advisers: Macquarie Investment Management Business Trust (MIMBT), Macquarie Funds Management Hong Kong Limited, Macquarie Investment Management Austria Kapitalanlage AG, Macquarie Investment Management Global Limited, Macquarie Investment Management Europe Limited, and Macquarie Investment Management Europe S.A.

Other than Macquarie Bank Limited (MBL), none of the entities noted are authorized deposit-taking institutions for the purposes of the Banking Act 1959 (Commonwealth of Australia). The obligations of these entities do not represent deposits or other liabilities of MBL. MBL does not guarantee or otherwise provide assurance in respect of the obligations of these entities, unless noted otherwise.

The Funds are governed by US laws and regulations. Unless otherwise noted, views expressed herein are current as of March 31, 2021, and subject to change for events occurring after such date. The Funds are not FDIC insured and are not guaranteed. It is possible to lose the principal amount invested.

Advisory services provided by Delaware Management Company, a series of MIMBT, a US registered investment advisor. All third-party marks cited are the property of their respective owners.

© 2021 Macquarie Management Holdings, Inc.

2

| | |

| PORTFOLIO HIGHLIGHTS | | IVY HIGH INCOME OPPORTUNITIES FUNDS |

ALL DATA IS AS OF MARCH 31, 2021 (UNAUDITED)

| | | | | | | | |

| Total Return(1) | | Market Price | | | NAV | |

6-month period ended 3-31-21 | | | 21.99% | | | | 16.22% | |

1-year period ended 3-31-21 | | | 54.46% | | | | 49.28% | |

5-year period ended 3-31-21 | | | 13.81% | | | | 13.45% | |

Commencement of operations (5-29-13) through 3-31-21 | | | 6.67% | | | | 8.63% | |

|

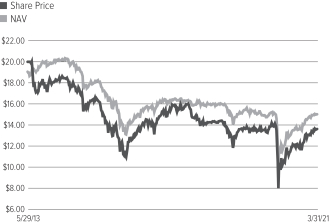

| Market Price/NAV Performance |

Commencement of operations (5-29-13) through 3-31-21 |

| | | | |

| Market Price/NAV | | | |

Market Price | | $ | 13.64 | |

NAV | | $ | 14.83 | |

Discount to NAV(3) | | | -8.02% | |

Market Price Yield(4) | | | 7.48% | |

Structural Leverage Ratio(5) | | | 25.88% | |

Effective Leverage Ratio(6) | | | 25.88% | |

Net asset value or “NAV” is the value of one share of a fund as calculated in accordance with the standard formula for valuing mutual fund shares. The price used to calculate market return (“Market Price”) is determined by using the midpoint between the highest bid and the lowest ask on the primary stock exchange on which shares of a fund are listed for trading, as of the time that such fund’s NAV is calculated.

Market and NAV returns assume that dividends and capital gain distributions have been reinvested according to the Fund’s dividend reinvestment plan.

Asset Allocation (%’s based on total investments)

| | | | |

Stocks | | | 5.6% | |

Consumer Discretionary | | | 2.0% | |

Energy | | | 1.8% | |

Financials | | | 1.8% | |

Industrials | | | 0.0% | |

Warrants | | | 0.0% | |

Bonds | | | 84.4% | |

Corporate Debt Securities | | | 59.9% | |

Loans | | | 24.5% | |

Borrowings(2) | | | -25.3% | |

Cash Equivalents+ | | | 10.0% | |

Quality Weightings (%’s based on total investments)

| | | | |

Investment Grade | | | 0.5% | |

BBB | | | 0.5% | |

Non-Investment Grade | | | 83.9% | |

BB | | | 6.2% | |

B | | | 47.6% | |

CCC | | | 27.2% | |

Below CCC | | | 0.7% | |

Non-rated | | | 2.2% | |

Borrowings(2) | | | -25.3% | |

Cash Equivalents+ and Equities | | | 15.6% | |

Our preference is to always use ratings obtained from Standard & Poor’s, Moody’s, and Fitch. It is each Portfolio’s general policy to classify such security at the lower rating level if only two ratings are available. If more than two ratings are available and a median exists, the median is used. If more than two ratings exist without a median, the lower of the two middle ratings is used. We do not evaluate these ratings, but simply assign them to the appropriate credit quality category as determined by the rating agency.

| + | Cash equivalents are defined as highly liquid securities with maturities of less than three months. Cash equivalents may include U.S. Government Treasury bills, bank certificates of deposit, bankers’ acceptances, corporate commercial paper and other money market instruments. |

| (1) | Past performance is not necessarily indicative of future performance. Total return is calculated by determining the percentage change in NAV or market price (as applicable) in the specified period. The calculation assumes that all dividends and distributions, if any, have been reinvested. Performance at market price will differ from results at NAV. Returns at market price can be influenced by factors such as changing views about the Fund, market conditions, supply and demand for the Fund’s stock, or changes in the Fund’s dividends. An investment in the Fund involves risk, including the loss of principal. Total return, market price, market price yield and NAV will fluctuate with changes in market conditions. This data is provided for information purposes only and is not intended for trading purposes. Closed-end funds, unlike open-end funds, are not continuously offered. There is a one time public offering and, once issued, shares of closed-end funds are traded in the open market through a stock exchange. NAV is equal to total assets less total liabilities divided by the total number of shares outstanding. Holdings are subject to change daily. |

| (2) | The Fund has entered into a borrowing arrangement with Pershing LLC as a means of financial leverage. See Note 7 in the Notes to Financial Statements for additional information. |

| (3) | The premium/discount is calculated as (most recent market price/most recent NAV) -1. |

| (4) | Market price yield is determined by dividing the annualized current monthly dividend per share (comprised of net investment income) by the market price per share at March 31, 2021. |

| (5) | Structural leverage consists of borrowings outstanding as a percentage of managed assets. Managed assets are the Fund’s total assets, including the assets attributable to the proceeds from any borrowings, minus liabilities other than the aggregate indebtedness entered into for the purpose of leverage. |

| (6) | The Fund’s effective leverage ratio includes both structural leverage and the leveraging effects of certain derivative instruments in the Fund’s portfolio (referred to as “portfolio leverage”), expressed as a percentage of managed assets. Portfolio leverage from the Fund’s use of forward foreign currency contracts is included in the Fund’s effective leverage values. |

| | |

| SCHEDULE OF INVESTMENTS | | IVY HIGH INCOME OPPORTUNITIES FUND (in thousands) |

MARCH 31, 2021 (UNAUDITED)

| | | | | | | | |

| COMMON STOCKS | | Shares | | | Value | |

Consumer Discretionary | |

| |

Apparel Retail – 0.3% | |

True Religion Apparel, Inc. (A)(B)(C)(D) | | | — | * | | $ | 796 | |

| | | | | | | | |

| |

Casinos & Gaming – 2.4% | |

New Cotai Participation Corp., Class B (A)(D)(E) | | | 971 | | | | 3,575 | |

Studio City International Holdings Ltd. ADR (A) | | | 108 | | | | 1,429 | |

Studio City International Holdings Ltd. ADR (A)(E) | | | 45 | | | | 589 | |

| | | | | | | | |

| | | | | | | 5,593 | |

| | | | | | | | |

| |

Total Consumer Discretionary – 2.7% | | | | 6,389 | |

Consumer Staples | |

| |

Agricultural Products – 0.0% | |

Pinnacle Agriculture Enterprises LLC (A)(B)(D)(E) | | | 4 | | | | — | |

| | | | | | | | |

| |

Total Consumer Staples – 0.0% | | | | — | |

Energy | |

| |

Coal & Consumable Fuels – 0.5% | |

Foresight Energy L.P. (A)(D)(E) | | | 74 | | | | 1,128 | |

Westmoreland Coal Co. (A)(B) | | | 13 | | | | 46 | |

| | | | | | | | |

| | | | | | | 1,174 | |

| | | | | | | | |

| |

Oil & Gas Drilling – 0.3% | |

KCA Deutag UK Finance plc (A)(B)(D) | | | 11 | | | | 725 | |

Vantage Drilling Co., Units (A) | | | — | * | | | 1 | |

| | | | | | | | |

| | | | | | | 726 | |

| | | | | | | | |

| |

Oil & Gas Equipment & Services – 0.1% | |

Larchmont Resources LLC (A)(B)(C)(D)(E) | | | 2 | | | | 66 | |

McDermott International, Inc. (A) | | | 255 | | | | 204 | |

| | | | | | | | |

| | | | | | | 270 | |

| | | | | | | | |

| |

Oil & Gas Exploration & Production – 0.4% | |

Bellatrix Exploration Ltd. (A)(B)(D)(F) | | | 179 | | | | — | * |

California Resources Corp. (A) | | | 15 | | | | 353 | |

EP Energy Corp. (A)(B)(E) | | | 9 | | | | 645 | |

| | | | | | | | |

| | | | | | | 998 | |

| | | | | | | | |

| |

Total Energy – 1.3% | | | | 3,168 | |

Industrials | |

| |

Air Freight & Logistics – 0.0% | |

BIS Industries Ltd. (B)(D)(E) | | | 804 | | | | — | * |

| | | | | | | | |

| |

Total Industrials – 0.0% | | | | — | * |

| |

TOTAL COMMON STOCKS – 4.0% | | | $ | 9,557 | |

(Cost: $19,877) | |

| | | | | | | | |

| INVESTMENT FUNDS | | Shares | | | Value | |

Registered Investment Companies – 2.6% | |

iShares iBoxx $ High Yield Corporate Bond ETF (G) | | | 73 | | | $ | 6,364 | |

| | | | | | | | |

| |

TOTAL INVESTMENT FUNDS – 2.6% | | | $ | 6,364 | |

(Cost: $6,316) | |

| | |

| PREFERRED STOCKS | | | | | | |

Consumer Discretionary | |

| |

Apparel Retail – 0.2% | |

True Religion Apparel, Inc. (A)(B)(C) | | | — | * | | | 319 | |

| | | | | | | | |

| |

Total Consumer Discretionary – 0.2% | | | | 319 | |

Energy | |

| |

Oil & Gas Exploration & Production – 1.3% | |

Targa Resources Corp., 9.500% (E) | | | 3 | | | | 3,118 | |

| | | | | | | | |

| |

Total Energy – 1.3% | | | | 3,118 | |

| |

TOTAL PREFERRED STOCKS – 1.5% | | | $ | 3,437 | |

(Cost: $4,341) | |

| | |

| WARRANTS | | | | | | |

| |

Oil & Gas Exploration & Production – 0.0% | |

California Resources Corp., expires 10-27-24 (H) | | | 3 | | | | 14 | |

| | | | | | | | |

| |

TOTAL WARRANTS – 0.0% | | | $ | 14 | |

(Cost: $273) | |

| | |

| CORPORATE DEBT SECURITIES | | Principal | | | | |

Communication Services | |

| |

Advertising – 0.9% | |

Advantage Sales & Marketing, Inc., | | | | | | | | |

6.500%, 11-15-28 (I)(J) | | $ | 2,185 | | | | 2,272 | |

| | | | | | | | |

| |

Broadcasting – 2.7% | |

Clear Channel International B.V., | | | | | | | | |

6.625%, 8-1-25 (J) | | | 216 | | | | 226 | |

Clear Channel Outdoor Holdings, Inc., | | | | | | | | |

5.125%, 8-15-27 (I)(J) | | | 4,496 | | | | 4,522 | |

Clear Channel Worldwide Holdings, Inc., | | | | | | | | |

9.250%, 2-15-24 (I) | | | 1,835 | | | | 1,909 | |

| | | | | | | | |

| | | | | | | 6,657 | |

| | | | | | | | |

| |

Cable & Satellite – 5.5% | |

Altice France Holding S.A., | | | | | | | | |

10.500%, 5-15-27 (I)(J) | | | 4,582 | | | | 5,153 | |

Altice France S.A., | | | | | | | | |

8.125%, 2-1-27 (I)(J) | | | 2,659 | | | | 2,914 | |

CSC Holdings LLC, | | | | | | | | |

5.750%, 1-15-30 (I)(J) | | | 555 | | | | 585 | |

| | | | | | | | |

CORPORATE DEBT SECURITIES

(Continued) | | Principal | | | Value | |

Cable & Satellite (Continued) | |

DISH DBS Corp.: | | | | | | | | |

5.875%, 11-15-24 | | $ | 699 | | | $ | 731 | |

7.750%, 7-1-26 (I) | | | 1,032 | | | | 1,139 | |

7.375%, 7-1-28 | | | 279 | | | | 293 | |

LCPR Senior Secured Financing Designated Activity Co., | | | | | | | | |

5.125%, 7-15-29 (J) | | | 337 | | | | 343 | |

VTR Comunicaciones S.p.A., | | | | | | | | |

4.375%, 4-15-29 (J) | | | 1,182 | | | | 1,187 | |

VTR Finance B.V., | | | | | | | | |

6.375%, 7-15-28 (J) | | | 1,087 | | | | 1,174 | |

| | | | | | | | |

| | | | | | | 13,519 | |

| | | | | | | | |

| |

Integrated Telecommunication Services – 7.5% | |

Cablevision Lightpath LLC, | | | | | | | | |

5.625%, 9-15-28 (J) | | | 460 | | | | 467 | |

Consolidated Communications, Inc.: | | | | | | | | |

5.000%, 10-1-28 (J) | | | 417 | | | | 420 | |

6.500%, 10-1-28 (J) | | | 899 | | | | 971 | |

Frontier Communications Corp.: | | | | | | | | |

6.875%, 1-15-25 (F)(I) | | | 2,776 | | | | 1,798 | |

11.000%, 9-15-25 (F)(I) | | | 3,876 | | | | 2,650 | |

5.875%, 10-15-27 (I)(J) | | | 1,454 | | | | 1,541 | |

West Corp., | | | | | | | | |

8.500%, 10-15-25 (I)(J) | | | 7,035 | | | | 7,132 | |

Windstream Escrow LLC, | | | | | | | | |

7.750%, 8-15-28 (I)(J) | | | 3,427 | | | | 3,490 | |

| | | | | | | | |

| | | | | | | 18,469 | |

| | | | | | | | |

| |

Interactive Media & Services – 0.4% | |

Cars.com, Inc., | | | | | | | | |

6.375%, 11-1-28 (J) | | | 881 | | | | 918 | |

| | | | | | | | |

| |

Publishing – 0.6% | |

MDC Partners, Inc., | | | | | | | | |

7.500%, 5-1-24 (I)(J)(K) | | | 1,532 | | | | 1,555 | |

| | | | | | | | |

| |

Wireless Telecommunication Service – 4.8% | |

Digicel Group Ltd., | | | | | | | | |

8.750%, 5-25-24 (J) | | | 385 | | | | 397 | |

Digicel Group Ltd. (5.000% Cash and 3.000% PIK), | | | | | | | | |

8.000%, 4-1-25 (J)(L) | | | 240 | | | | 198 | |

Digicel Group Ltd. (7.000% Cash or 7.000% PIK), | | | | | | | | |

7.000%, 10-1-68 (G)(J)(L) | | | 207 | | | | 151 | |

Digicel International Finance Ltd.: | | | | | | | | |

8.750%, 5-25-24 (I)(J) | | | 6,862 | | | | 7,077 | |

8.000%, 12-31-26 (J) | | | 154 | | | | 148 | |

Digicel International Finance Ltd. (6.000% Cash and 7.000% PIK), | | | | | | | | |

13.000%, 12-31-25 (J)(L) | | | 204 | | | | 205 | |

Digicel International Finance Ltd. (8.000% Cash and 2.000% PIK or 10.000% PIK), | | | | | | | | |

10.000%, 4-1-24 (I)(L) | | | 1,542 | | | | 1,500 | |

Digicel Ltd., | | | | | | | | |

6.750%, 3-1-23 (I)(J) | | | 2,128 | | | | 1,947 | |

| | | | | | | | |

| | | | | | | 11,623 | |

| | | | | | | | |

| |

Total Communication Services – 22.4% | | | | 55,013 | |

| | |

| SCHEDULE OF INVESTMENTS | | IVY HIGH INCOME OPPORTUNITIES FUND (in thousands) |

MARCH 31, 2021 (UNAUDITED)

| | | | | | | | |

CORPORATE DEBT SECURITIES

(Continued) | | Principal | | | Value | |

Consumer Discretionary | |

| |

Apparel Retail – 0.8% | |

Abercrombie & Fitch Management Co. (GTD by Abercrombie & Fitch Co.), | | | | | | | | |

8.750%, 7-15-25 (I)(J) | | $ | 976 | | | $ | 1,078 | |

L Brands, Inc.: | | | | | | | | |

9.375%, 7-1-25 (J) | | | 253 | | | | 315 | |

6.625%, 10-1-30 (J) | | | 579 | | | | 661 | |

| | | | | | | | |

| | | | | | | 2,054 | |

| | | | | | | | |

Auto Parts & Equipment – 0.0% | |

Tenneco, Inc., | | | | | | | | |

7.875%, 1-15-29 (G)(J) | | | 59 | | | | 66 | |

| | | | | | | | |

| |

Automotive Retail – 1.3% | |

Asbury Automotive Group, Inc.: | | | | | | | | |

4.500%, 3-1-28 (I) | | | 936 | | | | 957 | |

4.750%, 3-1-30 (I) | | | 964 | | | | 996 | |

Ken Garff Automotive LLC, | | | | | | | | |

4.875%, 9-15-28 (J) | | | 290 | | | | 290 | |

Lithia Motors, Inc., | | | | | | | | |

4.375%, 1-15-31 (J) | | | 466 | | | | 484 | |

Sonic Automotive, Inc., | | | | | | | | |

6.125%, 3-15-27 (I) | | | 489 | | | | 508 | |

| | | | | | | | |

| | | | | | | 3,235 | |

| | | | | | | | |

| |

Casinos & Gaming – 2.7% | |

Boyd Gaming Corp., | | | | | | | | |

4.750%, 12-1-27 (I) | | | 863 | | | | 880 | |

Colt Merger Sub, Inc., | | | | | | | | |

6.250%, 7-1-25 (I)(J) | | | 1,114 | | | | 1,188 | |

Everi Payments, Inc., | | | | | | | | |

7.500%, 12-15-25 (I)(J) | | | 1,304 | | | | 1,357 | |

Gateway Casinos & Entertainment Ltd., | | | | | | | | |

8.250%, 3-1-24 (J) | | | 53 | | | | 50 | |

Golden Nugget, Inc., | | | | | | | | |

6.750%, 10-15-24 (I)(J) | | | 2,111 | | | | 2,135 | |

Wynn Macau Ltd., | | | | | | | | |

5.500%, 10-1-27 (I)(J) | | | 964 | | | | 1,006 | |

| | | | | | | | |

| | | | | | | 6,616 | |

| | | | | | | | |

| |

Department Stores – 0.7% | |

Nordstrom, Inc.: | | | | | | | | |

4.375%, 4-1-30 (G) | | | 834 | | | | 854 | |

5.000%, 1-15-44 | | | 795 | | | | 772 | |

| | | | | | | | |

| | | | | | | 1,626 | |

| | | | | | | | |

| |

Education Services – 1.4% | |

Adtalem Global Education, Inc., | | | | | | | | |

5.500%, 3-1-28 (I)(J) | | | 3,551 | | | | 3,506 | |

| | | | | | | | |

| |

Hotels, Resorts & Cruise Lines – 3.8% | |

Boyne USA, Inc., | | | | | | | | |

7.250%, 5-1-25 (I)(J) | | | 443 | | | | 460 | |

Carnival Corp.: | | | | | | | | |

11.500%, 4-1-23 (J) | | | 668 | | | | 766 | |

10.500%, 2-1-26 (I)(J) | | | 1,458 | | | | 1,715 | |

7.625%, 3-1-26 (J) | | | 295 | | | | 317 | |

9.875%, 8-1-27 (J) | | | 573 | | | | 674 | |

| | | | | | | | |

CORPORATE DEBT SECURITIES

(Continued) | | Principal | | | Value | |

Hotels, Resorts & Cruise Lines (Continued) | |

NCL Corp. Ltd.: | | | | | | | | |

12.250%, 5-15-24 (I)(J) | | $ | 2,342 | | | $ | 2,837 | |

10.250%, 2-1-26 (J) | | | 684 | | | | 803 | |

5.875%, 3-15-26 (J) | | | 295 | | | | 298 | |

POWDR Corp., | | | | | | | | |

6.000%, 8-1-25 (J) | | | 285 | | | | 300 | |

Royal Caribbean Cruises Ltd., | | | | | | | | |

5.500%, 4-1-28 (J) | | | 1,153 | | | | 1,159 | |

| | | | | | | | |

| | | | | | | 9,329 | |

| | | | | | | | |

| |

Internet & Direct Marketing Retail – 0.7% | |

Arches Buyer, Inc., | | | | | | | | |

4.250%, 6-1-28 (I)(J) | | | 1,768 | | | | 1,765 | |

| | | | | | | | |

| |

Leisure Facilities – 1.1% | |

Cedar Fair L.P., Magnum Management Corp., Canada’s Wonderland Co. and Millennium Operations LLC: | | | | | | | | |

5.375%, 4-15-27 (I) | | | 995 | | | | 1,020 | |

6.500%, 10-1-28 (J) | | | 466 | | | | 501 | |

Legends Hospitality Holding Co. LLC, | | | | | | | | |

5.000%, 2-1-26 (J) | | | 178 | | | | 181 | |

Live Nation Entertainment, Inc., | | | | | | | | |

4.750%, 10-15-27 (I)(J) | | | 1,013 | | | | 1,021 | |

Six Flags Theme Parks, Inc., | | | | | | | | |

7.000%, 7-1-25 (J) | | | 114 | | | | 123 | |

| | | | | | | | |

| | | | | | | 2,846 | |

| | | | | | | | |

| |

Specialized Consumer Services – 0.7% | |

Nielsen Finance LLC and Nielsen Finance Co.: | | | | | | | | |

5.625%, 10-1-28 (J) | | | 870 | | | | 914 | |

5.875%, 10-1-30 (J) | | | 725 | | | | 786 | |

| | | | | | | | |

| | | | | | | 1,700 | |

| | | | | | | | |

| |

Specialty Stores – 7.5% | |

Academy Ltd., | | | | | | | | |

6.000%, 11-15-27 (I)(J) | | | 1,460 | | | | 1,537 | |

Bed Bath & Beyond, Inc., | | | | | | | | |

5.165%, 8-1-44 | | | 594 | | | | 541 | |

Michaels Stores, Inc.: | | | | | | | | |

8.000%, 7-15-27 (J) | | | 748 | | | | 827 | |

4.750%, 10-1-27 (J) | | | 289 | | | | 314 | |

Party City Holdings, Inc.

(5.000% Cash and 5.000% PIK), | | | | | | | | |

10.000%, 8-15-26 (J)(L) | | | 91 | | | | 89 | |

Party City Holdings, Inc. (6-Month U.S. LIBOR plus 500 bps), | | | | | | | | |

5.750%, 7-15-25 (J)(M) | | | 163 | | | | 150 | |

PetSmart, Inc. and PetSmart Finance Corp., | | | | | | | | |

4.750%, 2-15-28 (J) | | | 1,485 | | | | 1,519 | |

Staples, Inc.: | | | | | | | | |

7.500%, 4-15-26 (I)(J) | | | 9,900 | | | | 10,442 | |

10.750%, 4-15-27 (I)(J) | | | 2,982 | | | | 2,945 | |

| | | | | | | | |

| | | | | | | 18,364 | |

| | | | | | | | |

| |

Total Consumer Discretionary – 20.7% | | | | 51,107 | |

| | | | | | | | |

CORPORATE DEBT SECURITIES

(Continued) | | Principal | | | Value | |

Consumer Staples | |

| |

Packaged Foods & Meats – 1.7% | |

JBS USA Lux S.A. and JBS USA Finance, Inc., | | | | | | | | |

6.750%, 2-15-28 (I)(J) | | $ | 1,282 | | | $ | 1,404 | |

Pilgrim’s Pride Corp., | | | | | | | | |

4.250%, 4-15-31 (J) | | | 1,731 | | | | 1,725 | |

Post Holdings, Inc., | | | | | | | | |

4.500%, 9-15-31 (J) | | | 598 | | | | 591 | |

Simmons Foods, Inc., | | | | | | | | |

4.625%, 3-1-29 (J) | | | 594 | | | | 599 | |

| | | | | | | | |

| | | | | | | 4,319 | |

| | | | | | | | |

| |

Total Consumer Staples – 1.7% | | | | 4,319 | |

Energy | |

| |

Oil & Gas Drilling – 0.4% | |

KCA Deutag UK Finance plc, | | | | | | | | |

9.875%, 12-1-25 | | | 555 | | | | 611 | |

Offshore Drilling Holding S.A., | | | | | | | | |

8.375%, 9-20-20 (F)(I)(J)(K) | | | 3,385 | | | | 305 | |

| | | | | | | | |

| | | | | | | 916 | |

| | | | | | | | |

| |

Oil & Gas Equipment & Services – 0.1% | |

Nine Energy Service, Inc., | | | | | | | | |

8.750%, 11-1-23 (J) | | | 806 | | | | 242 | |

| | | | | | | | |

| |

Oil & Gas Exploration & Production – 5.1% | |

Ascent Resources Utica Holdings LLC and ARU Finance Corp.: | | | | | | | | |

7.000%, 11-1-26 (J) | | | 711 | | | | 711 | |

8.250%, 12-31-28 (J) | | | 59 | | | | 61 | |

Bellatrix Exploration Ltd., | | | | | | | | |

8.500%, 9-11-23 (F) | | | 418 | | | | — | |

Bellatrix Exploration Ltd.

(3.000% Cash or 9.500% PIK), | | | | | | | | |

9.500%, 12-15-23 (F)(L) | | | 456 | | | | — | |

Chesapeake Escrow Issuer LLC: | | | | | | | | |

5.500%, 2-1-26 (J) | | | 594 | | | | 618 | |

5.875%, 2-1-29 (J) | | | 446 | | | | 473 | |

Continental Resources, Inc., | | | | | | | | |

5.750%, 1-15-31 (J) | | | 591 | | | | 668 | |

Crownrock L.P., | | | | | | | | |

5.625%, 10-15-25 (I)(J) | | | 2,707 | | | | 2,762 | |

Endeavor Energy Resources L.P., | | | | | | | | |

5.500%, 1-30-26 (I)(J) | | | 1,014 | | | | 1,052 | |

Endeavor Energy Resources L.P. and EER Finance, Inc., | | | | | | | | |

6.625%, 7-15-25 (J) | | | 678 | | | | 725 | |

Laredo Petroleum, Inc.: | | | | | | | | |

9.500%, 1-15-25 (I) | | | 3,242 | | | | 3,121 | |

10.125%, 1-15-28 (I) | | | 1,161 | | | | 1,113 | |

Murphy Oil Corp., | | | | | | | | |

6.375%, 7-15-28 | | | 238 | | | | 238 | |

Range Resources Corp., | | | | | | | | |

8.250%, 1-15-29 (J) | | | 59 | | | | 63 | |

Vine Energy Holdings LLC, | | | | | | | | |

6.750%, 4-15-29 | | | 1,152 | | | | 1,152 | |

| | | | | | | | |

| | | | | | | 12,757 | |

| | | | | | | | |

| | |

| SCHEDULE OF INVESTMENTS | | IVY HIGH INCOME OPPORTUNITIES FUND (in thousands) |

MARCH 31, 2021 (UNAUDITED)

| | | | | | | | |

CORPORATE DEBT SECURITIES

(Continued) | | Principal | | | Value | |

Oil & Gas Refining & Marketing – 3.5% | |

Callon Petroleum Co. (GTD by Callon Petroleum Operating Co.): | | | | | | | | |

6.125%, 10-1-24 (G) | | $ | 468 | | | $ | 398 | |

9.000%, 4-1-25 (J) | | | 118 | | | | 120 | |

Comstock Escrow Corp., | | | | | | | | |

9.750%, 8-15-26 (I) | | | 3,830 | | | | 4,165 | |

Comstock Resources, Inc., | | | | | | | | |

6.750%, 3-1-29 (J) | | | 891 | | | | 913 | |

CVR Energy, Inc., | | | | | | | | |

5.250%, 2-15-25 (J) | | | 568 | | | | 555 | |

PBF Holding Co. LLC, | | | | | | | | |

9.250%, 5-15-25 (J) | | | 2,422 | | | | 2,473 | |

| | | | | | | | |

| | | | | | | 8,624 | |

| | | | | | | | |

| |

Oil & Gas Storage & Transportation – 0.4% | |

Crestwood Midstream Partners L.P.: | | | | | | | | |

5.750%, 4-1-25 (G) | | | 297 | | | | 299 | |

6.000%, 2-1-29 (J) | | | 119 | | | | 117 | |

Rattler Midstream L.P., | | | | | | | | |

5.625%, 7-15-25 (J) | | | 572 | | | | 597 | |

| | | | | | | | |

| | | | | | | 1,013 | |

| | | | | | | | |

| |

Total Energy – 9.5% | | | | 23,552 | |

Financials | |

| |

Insurance Brokers – 2.8% | |

NFP Corp., | | | | | | | | |

6.875%, 8-15-28 (I)(J) | | | 6,566 | | | | 6,812 | |

| | | | | | | | |

| |

Investment Banking & Brokerage – 0.6% | |

INTL FCStone, Inc., | | | | | | | | |

8.625%, 6-15-25 (I)(J) | | | 1,423 | | | | 1,503 | |

| | | | | | | | |

| |

Property & Casualty Insurance – 1.2% | |

Amwins Group, Inc., | | | | | | | | |

7.750%, 7-1-26 (I)(J) | | | 1,136 | | | | 1,215 | |

Highlands Holdings Bond Issuer Ltd. and Highlands Holdings Bond Co-Issuer, Inc. (7.625% Cash or 8.375% PIK), | | | | | | | | |

7.625%, 10-15-25 (I)(J)(L) | | | 1,457 | | | | 1,563 | |

| | | | | | | | |

| | | | | | | 2,778 | |

| | | | | | | | |

| |

Specialized Finance – 3.3% | |

BCPE Cycle Merger Sub II, Inc., | | | | | | | | |

10.625%, 7-15-27 (I)(J) | | | 2,224 | | | | 2,446 | |

Compass Group Diversified Holdings LLC: | | | | | | | | |

8.000%, 5-1-26 (I)(J) | | | 3,053 | | | | 3,194 | |

5.250%, 4-15-29 (J) | | | 2,380 | | | | 2,495 | |

| | | | | | | | |

| | | | | | | 8,135 | |

| | | | | | | | |

| |

Thrifts & Mortgage Finance – 0.9% | |

Provident Funding Associates L.P. and PFG Finance Corp., | | | | | | | | |

6.375%, 6-15-25 (I)(J) | | | 2,236 | | | | 2,231 | |

| | | | | | | | |

| |

Total Financials – 8.8% | | | | 21,459 | |

| | | | | | | | |

CORPORATE DEBT SECURITIES

(Continued) | | Principal | | | Value | |

Health Care | |

| |

Health Care Facilities – 2.0% | |

Providence Service Corp. (The), | | | | | | | | |

5.875%, 11-15-25 (J) | | $ | 872 | | | $ | 918 | |

RegionalCare Hospital Partners Holdings, Inc. and Legend Merger Sub, Inc., | | | | | | | | |

9.750%, 12-1-26 (I)(J) | | | 1,165 | | | | 1,261 | |

Surgery Center Holdings, Inc., | |

10.000%, 4-15-27 (I)(J) | | | 2,469 | | | | 2,722 | |

| | | | | | | | |

| | | | | | | 4,901 | |

| | | | | | | | |

| |

Health Care Services – 0.8% | |

Heartland Dental LLC, | | | | | | | | |

8.500%, 5-1-26 (I)(J) | | | 1,931 | | | | 2,004 | |

| | | | | | | | |

| |

Health Care Technology – 1.8% | |

Verscend Holding Corp., | | | | | | | | |

9.750%, 8-15-26 (I)(J) | | | 3,957 | | | | 4,243 | |

| | | | | | | | |

| |

Pharmaceuticals – 2.2% | |

Advanz Pharma Corp., | | | | | | | | |

8.000%, 9-6-24 | | | 177 | | | | 182 | |

Bausch Health Cos., Inc., | | | | | | | | |

8.500%, 1-31-27 (J) | | | 2,141 | | | | 2,375 | |

P&L Development LLC and PLD Finance Corp., | | | | | | | | |

7.750%, 11-15-25 (J) | | | 1,460 | | | | 1,562 | |

Par Pharmaceutical, Inc., | | | | | | | | |

7.500%, 4-1-27 (J) | | | 1,188 | | | | 1,260 | |

| | | | | | | | |

| | | | | | | 5,379 | |

| | | | | | | | |

| |

Total Health Care – 6.8% | | | | 16,527 | |

Industrials | |

| |

Aerospace & Defense – 6.0% | |

TransDigm UK Holdings plc, | | | | | | | | |

6.875%, 5-15-26 (I) | | | 1,143 | | | | 1,203 | |

TransDigm, Inc. (GTD by TransDigm Group, Inc.): | | | | | | | | |

6.375%, 6-15-26 | | | 1,000 | | | | 1,034 | |

7.500%, 3-15-27 (I) | | | 1,094 | | | | 1,165 | |

5.500%, 11-15-27 (I) | | | 2,821 | | | | 2,920 | |

4.625%, 1-15-29 (J) | | | 592 | | | | 584 | |

Wolverine Escrow LLC: | | | | | | | | |

8.500%, 11-15-24 (I)(J) | | | 3,081 | | | | 3,073 | |

9.000%, 11-15-26 (I)(J) | | | 4,499 | | | | 4,495 | |

13.125%, 11-15-27 (J) | | | 343 | | | | 295 | |

| | | | | | | | |

| | | | | | | 14,769 | |

| | | | | | | | |

| |

Diversified Support Services – 1.4% | |

Ahern Rentals, Inc., | | | | | | | | |

7.375%, 5-15-23 (I)(J) | | | 2,037 | | | | 1,834 | |

Nesco Holdings II, Inc., | | | | | | | | |

5.500%, 4-15-29 (J) | | | 1,675 | | | | 1,718 | |

| | | | | | | | |

| | | | | | | 3,552 | |

| | | | | | | | |

| | | | | | | | |

CORPORATE DEBT SECURITIES

(Continued) | | Principal | | | Value | |

Security & Alarm Services – 0.4% | |

Prime Security Services Borrower LLC and Prime Finance, Inc., | | | | | | | | |

6.250%, 1-15-28 (I)(J) | | $ | 867 | | | $ | 903 | |

| | | | | | | | |

| |

Total Industrials – 7.8% | | | | 19,224 | |

Information Technology | |

| |

Application Software – 0.5% | |

J2 Global, Inc., | | | | | | | | |

4.625%, 10-15-30 (J) | | | 349 | | | | 352 | |

Kronos Acquisition Holdings, Inc. and KIK Custom Products, Inc., | | | | | | | | |

5.000%, 12-31-26 (J) | | | 875 | | | | 875 | |

| | | | | | | | |

| | | | | | | 1,227 | |

| | | | | | | | |

| |

Electronic Equipment & Instruments – 2.1% | |

NCR Corp.: | | | | | | | | |

5.750%, 9-1-27 (J) | | | 307 | | | | 325 | |

5.000%, 10-1-28 (J) | | | 856 | | | | 864 | |

5.125%, 4-15-29 (J) | | | 3,172 | | | | 3,196 | |

6.125%, 9-1-29 (J) | | | 393 | | | | 416 | |

5.250%, 10-1-30 (J) | | | 285 | | | | 289 | |

| | | | | | | | |

| | | | | | | 5,090 | |

| | | | | | | | |

| |

IT Consulting & Other Services – 0.2% | |

Sabre GLBL, Inc. (GTD by Sabre Holdings Corp.): | | | | | | | | |

9.250%, 4-15-25 (J) | | | 288 | | | | 344 | |

7.375%, 9-1-25 (J) | | | 114 | | | | 124 | |

| | | | | | | | |

| | | | | | | 468 | |

| | | | | | | | |

| |

Technology Hardware, Storage & Peripherals – 0.4% | |

Brightstar Escrow Corp., | | | | | | | | |

9.750%, 10-15-25 (I)(J) | | | 804 | | | | 872 | |

| | | | | | | | |

| |

Total Information Technology – 3.2% | | | | 7,657 | |

Materials | |

| |

Commodity Chemicals – 1.4% | |

LSF9 Atlantis Holdings LLC and Victra Finance Corp., | | | | | | | | |

7.750%, 2-15-26 (I)(J) | | | 1,485 | | | | 1,520 | |

NOVA Chemicals Corp.: | | | | | | | | |

4.875%, 6-1-24 (I)(J) | | | 1,215 | | | | 1,269 | |

5.250%, 6-1-27 (I)(J) | | | 666 | | | | 699 | |

| | | | | | | | |

| | | | | | | 3,488 | |

| | | | | | | | |

| |

Construction Materials – 1.0% | |

Hillman Group, Inc. (The), | | | | | | | | |

6.375%, 7-15-22 (I)(J) | | | 2,401 | | | | 2,404 | |

| | | | | | | | |

| |

Metal & Glass Containers – 0.4% | |

ARD Finance S.A. (6.500% Cash or 7.250% PIK), | | | | | | | | |

6.500%, 6-30-27 (I)(J)(L) | | | 859 | | | | 902 | |

| | | | | | | | |

| |

Total Materials – 2.8% | | | | 6,794 | |

| |

TOTAL CORPORATE DEBT SECURITIES – 83.7% | | | $ | 205,652 | |

(Cost: $201,072) | |

| | |

| SCHEDULE OF INVESTMENTS | | IVY HIGH INCOME OPPORTUNITIES FUND (in thousands) |

MARCH 31, 2021 (UNAUDITED)

| | | | | | | | |

| LOANS (M) | | Principal | | | Value | |

Communication Services | |

| |

Advertising – 0.9% | |

Advantage Sales & Marketing, Inc. (ICE LIBOR plus 525 bps), | | | | | | | | |

5.469%, 10-28-27 | | $ | 2,205 | | | $ | 2,200 | |

| | | | | | | | |

| |

Broadcasting – 1.0% | |

Clear Channel Outdoor Holdings, Inc. (ICE LIBOR plus 350 bps), | | | | | | | | |

3.712%, 8-21-26 | | | 2,652 | | | | 2,543 | |

| | | | | | | | |

| |

Integrated Telecommunication Services – 3.1% | |

Consolidated Communications, Inc. (ICE LIBOR plus 475 bps), | | | | | | | | |

5.750%, 10-2-27 | | | 828 | | | | 827 | |

West Corp. (3-Month ICE LIBOR plus 400 bps), | | | | | | | | |

5.000%, 10-10-24 | | | 6,463 | | | | 6,250 | |

Windstream Services LLC (ICE LIBOR plus 625 bps), | | | | | | | | |

7.250%, 9-21-27 | | | 532 | | | | 531 | |

| | | | | | | | |

| | | | | | | 7,608 | |

| | | | | | | | |

| |

Wireless Telecommunication Service – 1.2% | |

Digicel International Finance Ltd. (ICE LIBOR plus 325 bps), | | | | | | | | |

3.510%, 5-27-24 | | | 3,172 | | | | 3,008 | |

| | | | | | | | |

| |

Total Communication Services – 6.2% | | | | 15,359 | |

Consumer Discretionary | |

| |

Automotive Retail – 0.1% | |

Midas Intermediate Holdco II LLC (ICE LIBOR plus 675 bps), | | | | | | | | |

7.500%, 12-22-25 | | | 234 | | | | 240 | |

| | | | | | | | |

| |

Casinos & Gaming – 0.1% | |

New Cotai LLC (14.000% Cash or 14.000% PIK), | | | | | | | | |

14.000%, 9-10-25 (L) | | | 272 | | | | 279 | |

| | | | | | | | |

| |

Internet & Direct Marketing Retail – 0.3% | |

CNT Holdings I Corp. (ICE LIBOR plus 375 bps), | | | | | | | | |

4.500%, 11-8-27 | | | 727 | | | | 725 | |

| | | | | | | | |

| |

Leisure Facilities – 0.9% | |

United PF Holdings LLC (ICE LIBOR plus 400 bps), | | | | | | | | |

4.203%, 12-30-26 | | | 1,781 | | | | 1,716 | |

United PF Holdings LLC (ICE LIBOR plus 850 bps), | | | | | | | | |

9.500%, 11-12-26 (D) | | | 397 | | | | 398 | |

| | | | | | | | |

| | | | | | | 2,114 | |

| | | | | | | | |

| |

Specialized Consumer Services – 0.1% | |

Asurion LLC (ICE LIBOR plus 525 bps), | | | | | | | | |

5.359%, 2-3-28 | | | 395 | | | | 402 | |

| | | | | | | | |

| | | | | | | | |

| LOANS (M) (Continued) | | Principal | | | Value | |

Specialty Stores – 3.2% | |

Bass Pro Group LLC (ICE LIBOR plus 425 bps), | | | | | | | | |

5.000%, 3-5-28 | | $ | 258 | | | $ | 258 | |

Jo-Ann Stores, Inc. (ICE LIBOR plus 500 bps), | | | | | | | | |

6.000%, 10-16-23 | | | 2,201 | | | | 2,191 | |

PetSmart, Inc. (ICE LIBOR plus 375 bps), | | | | | | | | |

4.250%, 2-12-28 | | | 2,718 | | | | 2,712 | |

Staples, Inc. (ICE LIBOR plus 500 bps), | | | | | | | | |

5.205%, 4-12-26 | | | 2,440 | | | | 2,377 | |

Woof Holdings LLC (ICE LIBOR plus 375 bps), | | | | | | | | |

4.500%, 12-21-27 | | | 341 | | | | 339 | |

| | | | | | | | |

| | | | | | | 7,877 | |

| | | | | | | | |

| |

Textiles – 1.1% | |

SIWF Holdings, Inc. (ICE LIBOR plus 425 bps), | | | | | | | | |

4.359%, 6-15-25 | | | 2,702 | | | | 2,687 | |

| | | | | | | | |

| |

Total Consumer Discretionary – 5.8% | | | | 14,324 | |

Energy | |

| |

Coal & Consumable Fuels – 0.5% | |

Foresight Energy LLC (ICE LIBOR plus 800 bps), | | | | | | | | |

9.500%, 6-29-27 | | | 619 | | | | 762 | |

Westmoreland Coal Co. (ICE LIBOR plus 650 bps), | | | | | | | | |

9.250%, 3-15-22 | | | 121 | | | | 119 | |

Westmoreland Mining Holdings LLC (15.000% Cash or 15.000% PIK), | | | | | | | | |

15.000%, 3-15-29 (L) | | | 1,028 | | | | 528 | |

| | | | | | | | |

| | | | | | | 1,409 | |

| | | | | | | | |

| |

Oil & Gas Equipment & Services – 0.4% | |

Larchmont Resources LLC (9.000% Cash or 9.000% PIK), | | | | | | | | |

9.000%, 8-9-21 (C)(L) | | | 1,284 | | | | 546 | |

McDermott Technology Americas, Inc. (1.115% Cash or 1.115% PIK), | | | | | | | | |

1.115%, 6-30-25 (L) | | | 586 | | | | 318 | |

| | | | | | | | |

| | | | | | | 864 | |

| | | | | | | | |

| |

Oil & Gas Exploration & Production – 0.3% | |

Ascent Resources Utica Holdings LLC (1-Month ICE LIBOR plus 900 bps), | | | | | | | | |

10.000%, 11-1-25 | | | 625 | | | | 691 | |

| | | | | | | | |

| |

Oil & Gas Storage & Transportation – 0.7% | |

EPIC Crude Services L.P. (ICE LIBOR plus 500 bps), | | | | | | | | |

5.260%, 3-1-26 | | | 2,388 | | | | 1,733 | |

| | | | | | | | |

| |

Total Energy – 1.9% | | | | 4,697 | |

| | | | | | | | |

| LOANS (M) (Continued) | | Principal | | | Value | |

Financials | |

| |

Asset Management & Custody Banks – 0.7% | |

Edelman Financial Holdings II, Inc. (ICE LIBOR plus 675 bps), | | | | | | | | |

6.860%, 7-20-26 | | $ | 1,703 | | | $ | 1,699 | |

| | | | | | | | |

| |

Property & Casualty Insurance – 1.3% | |

Amynta Agency Borrower, Inc. (ICE LIBOR plus 400 bps), | | | | | | | | |

4.609%, 2-28-25 | | | 3,296 | | | | 3,249 | |

| | | | | | | | |

Specialized Finance – 0.8% | |

Gulf Finance LLC (ICE LIBOR plus 525 bps), | | | | | | | | |

6.250%, 8-25-23 | | | 2,421 | | | | 1,999 | |

Lealand Finance Co. B.V., | | | | | | | | |

0.000%, 6-30-24 (D)(N) | | | 10 | | | | 8 | |

Lealand Finance Co. B.V. (ICE LIBOR plus 300 bps), | | | | | | | | |

3.115%, 6-30-24 (D) | | | 30 | | | | 24 | |

| | | | | | | | |

| | | | | | | 2,031 | |

| | | | | | | | |

| |

Total Financials – 2.8% | | | | 6,979 | |

Health Care | |

| |

Health Care Facilities – 0.2% | |

Surgery Center Holdings, Inc. (ICE LIBOR plus 325 bps), | | | | | | | | |

4.250%, 8-31-24 | | | 422 | | | | 417 | |

Surgery Center Holdings, Inc. (ICE LIBOR plus 800 bps), | | | | | | | | |

9.000%, 8-31-24 | | | 143 | | | | 145 | |

| | | | | | | | |

| | | | | | | 562 | |

| | | | | | | | |

| |

Health Care Services – 4.0% | |

Heartland Dental LLC (ICE LIBOR plus 375 bps), | | | | | | | | |

3.609%, 4-30-25 | | | 2,712 | | | | 2,663 | |

U.S. Renal Care, Inc. (3-Month ICE LIBOR plus 500 bps), | | | | | | | | |

5.125%, 6-26-26 | | | 7,231 | | | | 7,183 | |

| | | | | | | | |

| | | | | | | 9,846 | |

| | | | | | | | |

| |

Pharmaceuticals – 0.2% | |

Concordia International Corp. (ICE LIBOR plus 550 bps), | | | | | | | | |

6.500%, 9-6-24 | | | 574 | | | | 573 | |

| | | | | | | | |

| |

Total Health Care – 4.4% | | | | 10,981 | |

Industrials | |

| |

Building Products – 0.9% | |

CP Atlas Buyer, Inc. (ICE LIBOR plus 375 bps), | | | | | | | | |

4.250%, 11-23-27 | | | 1,743 | | | | 1,730 | |

Park River Holdings, Inc. (1-Month ICE LIBOR plus 325 bps), | | | | | | | | |

4.000%, 12-28-27 | | | 392 | | | | 389 | |

| | | | | | | | |

| | | | | | | 2,119 | |

| | | | | | | | |

| | |

| SCHEDULE OF INVESTMENTS | | IVY HIGH INCOME OPPORTUNITIES FUND (in thousands) |

MARCH 31, 2021 (UNAUDITED)

| | | | | | | | |

| LOANS (M) (Continued) | | Principal | | | Value | |

Construction & Engineering – 0.3% | |

WaterBridge Midstream Operating LLC, | | | | | | | | |

0.000%, 6-21-26 (N) | | $ | 177 | | | $ | 167 | |

WaterBridge Midstream Operating LLC (3-Month ICE LIBOR plus 575 bps), | | | | | | | | |

6.750%, 6-21-26 | | | 571 | | | | 540 | |

| | | | | | | | |

| | | | | | | 707 | |

| | | | | | | | |

| |

Industrial Conglomerates – 2.3% | |

PAE Holding Corp. (ICE LIBOR plus 450 bps), | | | | | | | | |

5.250%, 10-19-27 | | | 5,817 | | | | 5,813 | |

| | | | | | | | |

| |

Industrial Machinery – 1.5% | |

Form Technologies LLC, | | | | | | | | |

0.000%, 7-22-25 (N) | | | 2,784 | | | | 2,766 | |

Form Technologies LLC (ICE LIBOR plus 475 bps), | | | | | | | | |

5.750%, 7-22-25 | | | 985 | | | | 979 | |

| | | | | | | | |

| | | | | | | 3,745 | |

| | | | | | | | |

| |

Research & Consulting Services – 0.5% | |

Ankura Consulting Group LLC (ICE LIBOR plus 450 bps), | | | | | | | | |

5.250%, 3-17-28 (D) | | | 1,173 | | | | 1,163 | |

| | | | | | | | |

| |

Total Industrials – 5.5% | | | | 13,547 | |

Information Technology | |

| |

Communications Equipment – 1.1% | |

MLN U.S. Holdco LLC (ICE LIBOR plus 450 bps), | | | | | | | | |

4.603%, 11-30-25 | | | 2,542 | | | | 2,227 | |

MLN U.S. Holdco LLC (ICE LIBOR plus 875 bps), | | | | | | | | |

8.853%, 11-30-26 | | | 1,214 | | | | 593 | |

| | | | | | | | |

| | | | | | | 2,820 | |

| | | | | | | | |

| | | | | | | | |

| LOANS (M) (Continued) | | Principal | | | Value | |

Data Processing & Outsourced Services – 2.2% | |

Cardtronics USA, Inc. (ICE LIBOR plus 400 bps), | | | | | | | | |

5.000%, 6-29-27 | | $ | 949 | | | $ | 946 | |

CommerceHub, Inc. (ICE LIBOR plus 400 bps), | | | | | | | | |

4.750%, 12-2-27 | | | 1,130 | | | | 1,131 | |

Cyxtera DC Holdings, Inc. (ICE LIBOR plus 300 bps), | | | | | | | | |

8.250%, 5-1-25 | | | 1,434 | | | | 1,420 | |

Cyxtera DC Holdings, Inc. (ICE LIBOR plus 325 bps), | | | | | | | | |

4.000%, 5-1-24 | | | 2,138 | | | | 2,045 | |

| | | | | | | | |

| | | | | | | 5,542 | |

| | | | | | | | |

| |

Internet Services & Infrastructure – 0.7% | |

Informatica LLC, | | | | | | | | |

7.125%, 2-25-25 | | | 1,629 | | | | 1,663 | |

| | | | | | | | |

| |

IT Consulting & Other Services – 1.6% | |

Gainwell Acquisition Corp., | | | | | | | | |

0.000%, 10-1-27 (N) | | | 1,006 | | | | 1,001 | |

Gainwell Acquisition Corp. (ICE LIBOR plus 400 bps), | | | | | | | | |

4.750%, 10-1-27 | | | 1,978 | | | | 1,968 | |

Ivanti Software, Inc. (1-Month ICE LIBOR plus 400 bps), | | | | | | | | |

4.750%, 12-1-27 | | | 277 | | | | 275 | |

Ivanti Software, Inc. (1-Month ICE LIBOR plus 475 bps), | | | | | | | | |

5.750%, 12-1-27 | | | 701 | | | | 703 | |

| | | | | | | | |

| | | | | | | 3,947 | |

| | | | | | | | |

| |

Total Information Technology – 5.6% | | | | 13,972 | |

Materials | |

| |

Construction Materials – 1.8% | |

Hillman Group, Inc. (The) (ICE LIBOR plus 350 bps), | | | | | | | | |

4.109%, 5-31-25 | | | 4,417 | | | | 4,409 | |

| | | | | | | | |

| | | | | | | | |

| LOANS (M) (Continued) | | Principal | | | Value | |

Specialty Chemicals – 0.1% | |

NIC Acquisition Corp. (1-Month ICE LIBOR plus 375 bps), | | | | | | | | |

4.500%, 12-29-27 | | $ | 296 | | | $ | 296 | |

| | | | | | | | |

| |

Total Materials – 1.9% | | | | 4,705 | |

| |

TOTAL LOANS – 34.1% | | | $ | 84,564 | |

(Cost: $86,568) | |

| | |

| SHORT-TERM SECURITIES | | Shares | | | | |

| |

Money Market Funds(P) – 13.9% | |

Dreyfus Institutional Preferred Government Money Market Fund – Institutional Shares, | | | | | | | | |

0.010% (O) | | | 6,956 | | | | 6,956 | |

State Street Institutional U.S. Government Money Market Fund – Premier Class, | | | | | | | | |

0.040% | | | 27,313 | | | | 27,313 | |

| | | | | | | | |

| | | | | | | 34,269 | |

| | | | | | | | |

| |

TOTAL SHORT-TERM SECURITIES – 13.9% | | | $ | 34,269 | |

(Cost: $34,269) | |

| |

TOTAL INVESTMENT SECURITIES – 139.8% | | | $ | 343,857 | |

(Cost: $352,716) | |

| |

BORROWINGS (Q) – (35.4)% | | | | (87,000 | ) |

| |

LIABILITIES, NET OF CASH AND OTHER ASSETS – (4.4)% | | | | (11,051 | ) |

| |

NET ASSETS – 100.0% | | | $ | 245,806 | |

Notes to Schedule of Investments

| * | Not shown due to rounding. |

| (A) | No dividends were paid during the preceding 12 months. |

| (B) | Listed on an exchange outside the United States. |

| (C) | Deemed to be an affiliate due to the Fund owning at least 5% of the voting securities. |

| (D) | Securities whose value was determined using significant unobservable inputs. |

| | |

| SCHEDULE OF INVESTMENTS | | IVY HIGH INCOME OPPORTUNITIES FUND (in thousands) |

MARCH 31, 2021 (UNAUDITED)

| (E) | Restricted securities. At March 31, 2021, the Fund owned the following restricted securities: |

| | | | | | | | | | | | | | | | | | | | |

| Security | | Acquisition Date(s) | | | Shares | | | Cost | | | Value | |

BIS Industries Ltd. | | | 12-22-17 | | | | 804 | | | $ | 76 | | | $ | – | * | | | | |

EP Energy Corp. | | | 10-6-20 | | | | 9 | | | | 168 | | | | 646 | | | | | |

Foresight Energy L.P. | | | 6-30-20-9-8-20 | | | | 74 | | | | 1,453 | | | | 1,128 | | | | | |

Larchmont Resources LLC | | | 12-8-16 | | | | 2 | | | | 561 | | | | 67 | | | | | |

New Cotai Participation Corp., Class B | | | 9-29-20 | | | | 971 | | | | 8,782 | | | | 3,575 | | | | | |

Pinnacle Agriculture Enterprises LLC | | | 3-10-17 | | | | 4 | | | | 617 | | | | – | * | | | | |

Studio City International Holdings Ltd. ADR | | | 8-5-20 | | | | 45 | | | | 694 | | | | 589 | | | | | |

Targa Resources Corp., 9.500% | | | 10-24-17 | | | | 3 | | | | 3,292 | | | | 3,118 | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | $ | 15,643 | | | $ | 9,123 | | | | | |

| | | | | | | | | | | | |

The total value of these securities represented 3.7% of net assets at March 31, 2021.

| (F) | Non-income producing as the issuer has either missed its most recent interest payment or declared bankruptcy. |

| (G) | All or a portion of securities with an aggregate value of $6,868 are on loan. |

| (H) | Warrants entitle the Fund to purchase a predetermined number of shares of common stock and are non-income producing. The purchase price and number of shares are subject to adjustment under certain conditions until the expiration date, if any. |

| (I) | All or a portion of securities with an aggregate value of $97,285 have been pledged as collateral on open borrowings. |

| (J) | Securities were purchased pursuant to an exemption from registration available under Rule 144A under the Securities Act of 1933 and may only be resold in transactions exempt from registration, normally to qualified institutional buyers. At March 31, 2021 the total value of these securities amounted to $171,503 or 69.8% of net assets. |

| (K) | Step bond that pays an initial coupon rate for the first period and then a higher or lower coupon rate for the following periods. Interest rate disclosed is that which is in effect at March 31, 2021. |

| (L) | Payment-in-kind bond which may pay interest in additional par and/or in cash. Rates shown are the current rate and possible payment rates. |

| (M) | Variable rate security. Interest rate disclosed is that which is in effect at March 31, 2021. Description of the reference rate and spread, if applicable, are included in the security description. |

| (N) | All or a portion of this position has not settled. Full contract rates do not take effect until settlement date. |

| (O) | Investment made with cash collateral received from securities on loan. |

| (P) | Rate shown is the annualized 7-day yield at March 31, 2021. |

| (Q) | Borrowings payable as a percentage of total investment securities is 25.0%. |

| | |

| SCHEDULE OF INVESTMENTS | | IVY HIGH INCOME OPPORTUNITIES FUND (in thousands) |

MARCH 31, 2021 (UNAUDITED)

The following table is a summary of the valuation of the Fund’s investments by the fair value hierarchy levels as of March 31, 2021. See Note 3 to the Financial Statements for further information regarding fair value measurement.

| | | | | | | | | | | | |

| | | Level 1 | | | Level 2 | | | Level 3 | |

Assets | | | | | | | | | | | | |

Investments in Securities | | | | | | | | | | | | |

Common Stocks | | | | | | | | | | | | |

Consumer Discretionary | | $ | 2,018 | | | $ | — | | | $ | 4,371 | |

Energy | | | 557 | | | | 692 | | | | 1,919 | |

Industrials | | | — | | | | — | | | | — | * |

Total Common Stocks | | $ | 2,575 | | | $ | 692 | | | $ | 6,290 | |

Investment Funds | | | 6,364 | | | | — | | | | — | |

Preferred Stocks | | | — | | | | 3,437 | | | | — | |

Warrants | | | 14 | | | | — | | | | — | |

Corporate Debt Securities | | | — | | | | 205,652 | | | | — | |

Loans | | | — | | | | 82,971 | | | | 1,593 | |

Short-Term Securities | | | 34,269 | | | | — | | | | — | |

Total | | $ | 43,222 | | | $ | 292,752 | | | $ | 7,883 | |

| | | |

Liabilities | | | | | | | | | | | | |

Payable for Borrowing | | $ | — | | | $ | 87,000 | | | $ | — | |

The following table is a reconciliation of Level 3 investments for which significant unobservable inputs were used to determine fair value:

| | | | | | | | |

| | | Common

Stocks | | | Loans | |

Beginning Balance 10-1-20 | | $ | 5,959 | | | $ | 3,173 | |

Net realized gain (loss) | | | (237 | ) | | | 15 | |

Net change in unrealized appreciation (depreciation) | | | (2,665 | ) | | | 352 | |

Purchases | | | — | | | | 1,171 | |

Sales | | | — | | | | (1,672 | ) |

Amortization/Accretion of premium/discount | | | — | | | | 2 | |

Transfers into Level 3 during the period | | | 3,233 | | | | — | |

Transfers out of Level 3 during the period | | | — | | | | (1,448 | ) |

| | | | |

Ending Balance 3-31-21 | | $ | 6,290 | | | $ | 1,593 | |

| | | | |

Net change in unrealized appreciation (depreciation) for all Level 3 investments still held as of 3-31-21 | | $ | (2,902 | ) | | $ | 3 | |

| | | | |

Transfers from Level 2 to Level 3 occurred primarily due to the lack of observable market data due to decreased market activity or information for these securities. Transfers from Level 3 to Level 2 occurred primarily due to the increased availability of observable market data due to increased market activity or information.

Information about Level 3 fair value measurements:

| | | | | | | | | | | | |

| | | Fair Value at 3-31-21 | | | Valuation Technique(s) | | Unobservable Input(s) | | Input

Value(s) | |

Assets | | | | | | | | | | | | |

| | | | |

Common Stocks | | $ | 66 | | | Third-party valuation service | | Broker quote | | | N/A | |

| | | 725 | | | Market approach | | Broker quote | | | N/A | |

| | | 796 | | | Market approach | | Adjusted EBITDA multiple | | | 8.23x | |

| | | 1,128 | | | Market approach | | Illiquidity discount | | | 30.00% | |

| | | 3,575 | | | Market approach | | Market premium | | | 20.00% | |

| | | | |

Loans | | | 1,593 | | | Third-party vendor pricing service | | Broker quotes | | | N/A | |

| | | | | | |

| 10 | | SEMIANNUAL REPORT | | 2021 | | |

| | |

| SCHEDULE OF INVESTMENTS | | IVY HIGH INCOME OPPORTUNITIES FUND (in thousands) |

MARCH 31, 2021 (UNAUDITED)

The following acronyms are used throughout this schedule:

ADR = American Depositary Receipt

GTD = Guaranteed

ICE = Intercontinental Exchange

LIBOR = London Interbank Offered Rate

PIK = Payment in kind

See Accompanying Notes to Financial Statements.

| | | | | | | | | | | | |

| | | 2021 | | | | SEMIANNUAL REPORT | | | | 11 | |

| | |

| STATEMENT OF ASSETS AND LIABILITIES | | IVY HIGH INCOME OPPORTUNITIES FUND |

AS OF MARCH 31, 2021 (UNAUDITED)

| | | | |

| (In thousands, except per share amounts) | | | |

ASSETS | | | | |

Investments in unaffiliated securities at value+^ | | $ | 342,130 | |

Investments in affiliated securities at market value+ | | | 1,727 | |

Investments at Value | | | 343,857 | |

Cash | | | 126 | |

Investment securities sold receivable | | | 3,196 | |

Dividends and interest receivable | | | 4,589 | |

Receivable from securities lending income — net | | | 9 | |

Prepaid and other assets | | | 2 | |

Total Assets | | | 351,779 | |

| |

LIABILITIES | | | | |

Cash collateral on securities loaned at value | | | 6,956 | |

Investment securities purchased payable | | | 11,944 | |

Independent Trustees and Chief Compliance Officer fees payable | | | 11 | |

Shareholder servicing payable | | | 3 | |

Investment management fee payable | | | 9 | |

Accounting services fee payable | | | 8 | |

Payable for borrowing | | | 87,000 | |

Interest payable for borrowing | | | 27 | |

Other liabilities | | | 15 | |

Total Liabilities | | | 105,973 | |

Commitments and Contingencies (See Note 2 and Note 10) | | | | |

Total Net Assets | | $ | 245,806 | |

| |

NET ASSETS | | | | |

Capital paid in | | $ | 315,694 | |

Accumulated earnings loss | | | (69,888 | ) |

Total Net Assets | | $ | 245,806 | |

| |

CAPITAL SHARES OUTSTANDING | | | 16,570 | |

| |

NET ASSET VALUE PER SHARE | | | $14.83 | |

| |

+COST | | | | |

Investments in unaffiliated securities at cost | | $ | 347,051 | |

Investments in affiliated securities at cost | | $ | 5,665 | |

| |

^Securities loaned at value | | $ | 6,868 | |

See Accompanying Notes to Financial Statements.

| | | | | | |

| 12 | | SEMIANNUAL REPORT | | 2021 | | |

| | |

| STATEMENT OF OPERATIONS | | IVY HIGH INCOME OPPORTUNITIES FUND |

FOR THE SIX MONTHS ENDED MARCH 31, 2021 (UNAUDITED)

| | | | |

| (In thousands) | | | |

INVESTMENT INCOME | | | | |

Dividends from unaffiliated securities | | $ | 236 | |

Interest and amortization from unaffiliated securities | | | 10,580 | |

Interest and amortization from affiliated securities | | | 64 | |

Securities lending income — net | | | 16 | |

Total Investment Income | | | 10,896 | |

| |

EXPENSES | | | | |

Investment management fee | | | 1,628 | |

Interest expense for borrowing | | | 392 | |

Shareholder servicing | | | 24 | |

Custodian fees | | | 2 | |

Independent Trustees and Chief Compliance Officer fees | | | 11 | |

Accounting services fee | | | 48 | |

Professional fees | | | 68 | |

Other | | | 44 | |

Total Expenses | | | 2,217 | |

Net Investment Income | | | 8,679 | |

| |

REALIZED AND UNREALIZED GAIN (LOSS) | | | | |

Net realized gain (loss) on: | | | | |

Investments in unaffiliated securities | | | (1,879 | ) |

Net change in unrealized appreciation (depreciation) on: | | | | |

Investments in unaffiliated securities | | | 25,431 | |

Investments in affiliated securities | | | (2,710 | ) |

Net Realized and Unrealized Gain | | | 20,842 | |

Net Increase in Net Assets Resulting from Operations | | $ | 29,521 | |

See Accompanying Notes to Financial Statements.

| | | | | | | | | | | | |

| | | 2021 | | | | SEMIANNUAL REPORT | | | | 13 | |

| | |

| STATEMENTS OF CHANGES IN NET ASSETS | | IVY HIGH INCOME OPPORTUNITIES FUND |

| | | | | | | | |

| (In thousands) | | Six-month

period ended

3-31-2021

(unaudited) | | | Year ended

9-30-20 | |

INCREASE (DECREASE) IN NET ASSETS | | | | | | | | |

Operations: | | | | | | | | |

Net investment income | | $ | 8,679 | | | $ | 18,602 | |

Net realized loss on investments | | | (1,879 | ) | | | (7,697 | ) |

Net change in unrealized appreciation (depreciation) | | | 22,721 | | | | (14,972 | ) |

Net Increase (Decrease) in Net Assets Resulting from Operations | | | 29,521 | | | | (4,067 | ) |

| | |

Distributions to Shareholders From: | | | | | | | | |

Accumulated Earnings (combined net investment income and net realized gains) | | | (8,699 | ) | | | (20,381 | ) |

Total Distributions to Shareholders | | | (8,699 | ) | | | (20,381 | ) |

| | |

Capital Share Transactions: | | | | | | | | |

Net proceeds from the sale of shares | | | — | | | | — | |

Net Increase In net assets from share transactions | | | — | | | | — | |

Net Increase (Decrease) in Net Assets | | | 20,822 | | | | (24,448 | ) |

Net Assets, Beginning of Period | | | 224,984 | | | | 249,432 | |

Net Assets, End of Period | | $ | 245,806 | | | $ | 224,984 | |

See Accompanying Notes to Financial Statements.

| | | | | | |

| 14 | | SEMIANNUAL REPORT | | 2021 | | |

| | |

| STATEMENT OF CASH FLOWS | | IVY HIGH INCOME OPPORTUNITIES FUND |

FOR THE SIX MONTHS ENDED MARCH 31, 2021 (UNAUDITED)

| | | | |

| (In thousands) | | | |

Cash flows provided by operating activities: | |

Net increase in net assets resulting from operations | | $ | 29,529 | |

Adjustments to reconcile net increase in net assets from operations to net cash provided by operating activities: | | | | |

Purchases of long-term investment securities | | | (96,422 | ) |

Proceeds from sales of long-term investment securities | | | 104,339 | |

Purchases of short-term portfolio investment securities, net | | | (14,821 | ) |

Decrease in dividends and interest receivable | | | 250 | |

Increase in receivable from securities lending income | | | (8 | ) |

Decrease in prepaid and other assets | | | 5 | |

Increase in cash collateral on securities loaned at value | | | 6,641 | |

Increase in trustees and chief compliance officer fees payable | | | 1 | |

Increase in shareholder servicing payable | | | 1 | |

Increase in investment management fee payable | | | 1 | |

Increase in interest payable for borrowing | | | 5 | |

Decrease in other liabilities | | | (33 | ) |

Net realized loss on investments in unaffiliated securities | | | 1,879 | |

Net change in unrealized appreciation on investments in unaffiliated securities | | | (25,431 | ) |

Net change in unrealized depreciation on investments in affiliated securities | | | 2,710 | |

Net accretion and payment in kind income on investment securities | | | (598 | ) |

Net cash provided by operating activities | | | 8,048 | |

Cash flows used for financing activities: | | | | |

Cash dividends paid | | | (8,699 | ) |

Net cash used for financing activities | | | (8,699 | ) |

Net decrease in cash and foreign currency | | | (651 | ) |

Cash and foreign currency, at beginning of period | | | 777 | |

Cash and foreign currency, at end of period | | $ | 126 | |

Supplemental disclosure of cash flow information: | | | | |

Interest expense paid during the period | | $ | 365 | |

See Accompanying Notes to Financial Statements.

| | | | | | | | | | | | |

| | | 2021 | | | | SEMIANNUAL REPORT | | | | 15 | |

| | |

| FINANCIAL HIGHLIGHTS | | IVY HIGH INCOME OPPORTUNITIES FUND |

FOR A SHARE OF CAPITAL STOCK OUTSTANDING THROUGHOUT EACH PERIOD

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Six-month

period ended

3-31-2021

(unaudited) | | | Year ended

9-30-2020 | | | Year ended

9-30-2019 | | | Year ended

9-30-2018 | | | Year ended

9-30-2017 | | | Year ended

9-30-2016 | |

Net Asset Value, Beginning of Period | | $ | 13.58 | | | $ | 15.05 | | | $ | 15.96 | | | $ | 16.34 | | | $ | 15.65 | | | $ | 15.60 | |

Net Investment Income(1) | | | 0.52 | | | | 1.12 | | | | 1.25 | | | | 1.36 | | | | 1.51 | | | | 1.57 | |

Net Realized and Unrealized Gain (Loss) on Investments | | | 1.26 | | | | (1.36 | ) | | | (0.84 | ) | | | (0.46 | ) | | | 0.66 | | | | 0.08 | |

Total from Investment Operations | | | 1.78 | | | | (0.24 | ) | | | 0.41 | | | | 0.90 | | | | 2.17 | | | | 1.65 | |

Distributions From Net Investment Income | | | (0.53 | ) | | | (1.23 | ) | | | (1.32 | ) | | | (1.28 | ) | | | (1.48 | ) | | | (1.60 | ) |

Net Asset Value, End of Period | | $ | 14.83 | | | $ | 13.58 | | | $ | 15.05 | | | $ | 15.96 | | | $ | 16.34 | | | $ | 15.65 | |

Market Price, End of Period | | $ | 13.64 | | | $ | 11.90 | | | $ | 13.71 | | | $ | 14.26 | | | $ | 15.97 | | | $ | 14.38 | |

Total Return(2) — Net Asset Value | | | 16.22 | % | | | (0.24 | )% | | | 4.10 | % | | | 6.68 | % | | | 15.14 | % | | | 13.71 | % |

Total Return(2) — Market Price(3) | | | 21.99 | % | | | (4.04 | )% | | | 6.07 | % | | | (2.47 | )% | | | 22.55 | % | | | 25.67 | % |

Net Assets, End of Period (in millions) | | $ | 246 | | | $ | 225 | | | $ | 249 | | | $ | 264 | | | $ | 271 | | | $ | 259 | |

Managed Assets(4), End of Period (in millions) | | $ | 333 | | | $ | 312 | | | $ | 361 | | | $ | 386 | | | $ | 399 | | | $ | 370 | |

Ratio of Expenses to Average Net Assets | | | 1.86 | %(5) | | | 2.60 | % | | | 3.16 | % | | | 2.77 | % | | | 2.35 | % | | | 2.09 | % |

Ratio of Expenses to Average Net Assets Excluding Interest Expense | | | 1.53 | %(5) | | | 1.82 | % | | | 1.73 | % | | | 1.59 | % | | | 1.58 | % | | | 1.56 | % |

Ratio of Net Investment Income to Average Net Assets | | | 7.27 | %(5) | | | 8.18 | % | | | 8.27 | % | | | 8.50 | % | | | 9.31 | % | | | 10.59 | % |

Ratio of Expenses to Average Managed Assets(4) | | | 1.42 | %(5) | | | 1.82 | % | | | 2.17 | % | | | 1.90 | % | | | 1.62 | % | | | 1.44 | % |

Ratio of Expenses to Average Managed Assets(4) Excluding Interest Expense | | | 1.17 | %(5) | | | 1.27 | % | | | 1.19 | % | | | 1.09 | % | | | 1.09 | % | | | 1.08 | % |

Ratio of Net Investment Income to Average Managed Assets(4) | | | 5.55 | %(5) | | | 5.71 | % | | | 5.69 | % | | | 5.81 | % | | | 6.43 | % | | | 7.28 | % |

Portfolio Turnover Rate | | | 45 | % | | | 45 | % | | | 34 | % | | | 46 | % | | | 39 | % | | | 39 | % |

| (1) | Based on average weekly shares outstanding. |

| (2) | Total investment return is calculated assuming a purchase of common stock on the opening of the first day and a sale on the closing of the last day of each period reported. Dividends and distributions, if any, are assumed, for purposes of this calculation, to be reinvested at prices obtained under the Fund’s dividend reinvestment plan. Total returns based on Net Asset Value and Market Price do not reflect a sales charge or contingent deferred sales charge, if applicable. Total returns for periods less than one year are not annualized. |

| (3) | Total investment return at market price will differ from results at NAV. Returns at market price can be influenced by factors such as changing views about the Fund, market conditions, supply and demand for the Fund’s stock, or changes in the Fund’s dividends. |

| (4) | The term Managed Assets means the Fund’s total assets, including the assets attributable to the proceeds from any borrowings or other forms of structural leverage, minus liabilities, other than the aggregate indebtedness entered into for purposes of leverage. |

See Accompanying Notes to Financial Statements.

| | | | | | |

| 16 | | SEMIANNUAL REPORT | | 2021 | | |

| | |

| NOTES TO FINANCIAL STATEMENTS | | IVY HIGH INCOME OPPORTUNITIES FUND |

MARCH 31, 2021 (UNAUDITED)

Ivy High Income Opportunities Fund (the “Fund”) is registered under the Investment Company Act of 1940, as amended (the “1940 Act”) as a non-diversified, closed-end management investment company. The Fund was organized as a Delaware statutory trust on January 30, 2013, pursuant to an Agreement and Declaration of Trust, as amended and restated on March 28, 2013, governed by the laws of the State of Delaware. The Fund commenced operations on May 29, 2013. Prior to that date, the Fund had no operations other than matters relating to its organization and the sale and issuance of 5,236 common shares of beneficial interest to Ivy Investment Management Company (“IICO” or the “Adviser”), the Fund’s former investment adviser. The Fund’s common shares are listed on the New York Stock Exchange (the “NYSE”) and trade under the ticker symbol “IVH”.

The Fund’s investment objective is to seek to provide total return through a combination of a high level of current income and capital appreciation. The Fund will seek to achieve its investment objective by investing primarily in a portfolio of high yield corporate bonds of varying maturities and other fixed income instruments of predominantly corporate issuers, including secured and unsecured loan assignments, loan participations and other loan instruments (“Loans”). Under normal circumstances, the Fund will invest at least 80% of its Managed Assets (as defined in the prospectus) in a portfolio of U.S. and foreign bonds, loans and other fixed income instruments, as well as other investments (including derivatives) with similar economic characteristics. The Fund will invest primarily in instruments that are, at the time of purchase, rated below investment grade (below Baa3 by Moody’s Investors Service, Inc. (“Moody’s”) or below BBB- by either Standard & Poor’s Rating Services (“S&P”) or Fitch, Inc. (“Fitch”), or comparably rated by another nationally recognized statistical rating organization (“NRSRO”)), or unrated but judged by the Adviser to be of comparable quality.

| 2. | | SIGNIFICANT ACCOUNTING POLICIES |

The following is a summary of significant accounting policies consistently followed by the Fund.

Security Transactions and Related Investment Income. Security transactions are accounted for on the trade date (date the order to buy or sell is executed). Realized gains and losses are calculated on the identified cost basis. Interest income is recorded on the accrual basis and includes paydown gain (loss) and accretion of discounts and amortization of premiums. Dividend income is recorded on the ex-dividend date, except certain dividends from foreign securities where the ex-dividend date may have passed, which are recorded as soon as the Fund is informed of the ex-dividend date. All or a portion of the distributions received from a real estate investment trust or publicly traded partnership may be designated as a reduction of cost of the related investment or realized gain. The financial statements reflect an estimate of the reclassification of the distribution character.

Foreign Currency Translation. The Fund’s accounting records are maintained in U.S. dollars. All assets and liabilities denominated in foreign currencies are translated into U.S. dollars daily, using foreign exchange rates obtained from an independent pricing service approved by the Board of Trustees of the Fund (the “Board”). Purchases and sales of investment securities and accruals of income and expenses are translated at the rate of exchange prevailing on the date of the transaction. For assets and liabilities other than investments in securities, net realized and unrealized gains and losses from foreign currency translation arise from changes in currency exchange rates. The Fund combines fluctuations from currency exchange rates and fluctuations in value when computing net realized gain (loss) and net change in unrealized appreciation (depreciation) on investments. Foreign exchange rates are typically valued as of the close of the NYSE, normally 4:00 P.M. Eastern time, on each day the NYSE is open for trading.

Dividends and Distributions to Shareholders. Dividends to shareholders are declared monthly. Distributions from net realized capital gains from investment transactions, if any, are declared and distributed to shareholders at least annually. Net investment income dividends and capital gains distributions are determined in accordance with income tax regulations, which may differ from accounting principles generally accepted in the United States of America (“U.S. GAAP”). If the total dividends and distributions made in any tax year exceed net investment income and accumulated realized capital gains, a portion of the total distribution may be treated as a return of capital for tax purposes.

Income Taxes. It is the policy of the Fund to distribute all of its taxable income and capital gains to its shareholders and to otherwise qualify as a regulated investment company under Subchapter M of the Internal Revenue Code. In addition, the Fund intends to pay distributions as required to avoid imposition of excise tax. Accordingly, no provision has been made for Federal income taxes. The Fund files income tax returns in U.S. federal and applicable state jurisdictions. The Fund’s tax returns are subject to examination by the relevant taxing authority until expiration of the applicable statute of limitations, which is generally three years after the filing of the tax returns. Management of the Fund periodically reviews all tax positions to assess whether it is more likely than not that the position would be sustained upon examination by the relevant tax authority based on the technical merits of each position. As of the date of these financial statements, management believes that no liability for unrecognized tax positions is required.

| | | | | | | | | | | | |

| | | 2021 | | | | SEMIANNUAL REPORT | | | | 17 | |

Segregation and Collateralization. In cases in which the 1940 Act and the interpretive positions of the Securities and Exchange Commission (“SEC”), the Dodd Frank Wall Street Reform and Consumer Protection Act, or the interpretive rules and regulations of the U.S. Commodities Futures Trading Commission require that the Fund either deliver collateral or segregate assets in connection with certain investments (e.g., dollar rolls, financial futures contracts, foreign currency exchange contracts, options written, securities with extended settlement periods, and swaps), the Fund will segregate collateral or designate on its books and records, cash or other liquid securities having a value at least equal to the amount that is required to be physically segregated for the benefit of the counterparty. Furthermore, based on requirements and agreements with certain exchanges and third party broker-dealers, each party has requirements to deliver/deposit cash or securities as collateral for certain investments. Certain countries require that cash reserves be held while investing in companies incorporated in that country. These cash reserves and cash collateral that has been pledged to cover obligations of the Fund under derivative contracts, if any, will be reported separately on the Statement of Assets and Liabilities as “Restricted cash”. Securities collateral pledged for the same purpose, if any, is noted on the Schedule of Investments.

Concentration of Market and Credit Risk. In the normal course of business, the Fund invests in securities and enters into transactions where risks exist due to fluctuations in the market (market risk) or failure of the issuer of a security to meet all its obligations (issuer credit risk). The value of securities held by the Fund may decline in response to certain events, including those directly involving the issuers whose securities are owned by the Fund; conditions affecting the general economy; overall market changes; local, regional or global political, social or economic instability; and currency and interest rate and price fluctuations. Similar to issuer credit risk, the Fund may be exposed to counterparty credit risk, or the risk that an entity with which the Fund has unsettled or open transactions may fail to or be unable to perform on its commitments. The Fund manages counterparty credit risk by entering into transactions only with counterparties that it believes have the financial resources to honor their obligations and by monitoring the financial stability of those counterparties. Financial assets, which potentially expose the Fund to market, issuer and counterparty credit risks, consist principally of financial instruments and receivables due from counterparties. The extent of the Fund’s exposure to market, issuer and counterparty credit risks with respect to these financial assets is generally approximated by their value recorded on the Fund’s Statement of Assets and Liabilities, less any collateral held by the Fund.

The Fund may hold high-yield or non-investment-grade bonds, that may be subject to a greater degree of credit risk. Credit risk relates to the ability of the issuer to meet interest or principal payments or both as they become due. While the Fund may not invest in issues (such as secured debt issues or corporate debt issues) that are in default at the time of purchase, issuers in which the Fund may invest may become subject to a bankruptcy reorganization proceeding, subject to some other form of a public or private debt restructuring or otherwise become in default or in significant risk of default in the payment of interest or repayment of principal or trading at prices substantially below other below-investment grade debt securities of companies in similar industries.

The Fund may enter into financial instrument transactions (such as swaps, futures, options and other derivatives) that may have off-balance sheet market risk. Off-balance sheet market risk exists when the maximum potential loss on a particular financial instrument is greater than the value of such financial instrument, as reflected on the Statement of Assets and Liabilities.

If the Fund invests directly in foreign currencies or in securities that trade in, and receive revenues in, foreign currencies, or in financial derivatives that provide exposure to foreign currencies, it will be subject to the risk that those currencies will decline in value relative to the base currency of the Fund, or, in the case of hedging positions, that the Fund’s base currency will decline in value relative to the currency being hedged. Currency rates in foreign countries may fluctuate significantly over short periods of time for a number of reasons, including changes in interest rates, intervention (or the failure to intervene) by U.S. or foreign governments, central banks or supranational entities such as the International Monetary Fund, or by the imposition of currency controls or other political developments in the United States or abroad.

The London Interbank Offered Rate “LIBOR” is an indicative measure of the average interest rate at which major global banks could borrow from one another. LIBOR is quoted in multiple currencies and multiple time frames using data reported by private-sector banks. LIBOR is used extensively in the United States and globally as a “benchmark” or “reference rate” for various commercial and financial contracts, including corporate and municipal bonds and loans, floating rate mortgages, asset-backed securities, consumer loans, and interest rate swaps and other derivatives.

It is expected that a number of private-sector banks currently reporting information used to set LIBOR will stop doing so after 2021 when their current reporting commitment ends, which could either cause LIBOR to stop publication immediately or cause LIBOR’s regulator to determine that its quality has degraded to the degree that it is no longer representative of its underlying market.

Management believes that, with respect to any significant investments by the Fund in instruments linked to LIBOR, the impact on investments and discontinuation of LIBOR may represent a significant risk.