EXHIBIT 99.1

1 RCS Capital Investor Presentation October 28, 2013

2 Cautionary Note Regarding Forward - Looking Statements • Information set forth herein contains “forward - looking statements” (as defined in Section 21E of the Exchange Act), which reflect RCS Capital Corporation’s (“RCAP”) expectations regarding future events. The forward - looking statements involve a number of risks, uncertainties and other factors that could cause actual results to differ materially from those contained in the forward - looking statements. Such forward - looking statements include, but are not limited to, whether and when the transactions contemplated by the purchase of Investors Capital Holdings, Ltd. (“ICH”) will be consummated, plans for the operations of RCAP and ICH post - closing, market and other expectations, objectives, intentions, as well as any expectations or projections with respect to RCAP and ICH post - closing, including regarding future dividends and market valuations, and other statements that are not historical facts. • The following additional factors, among others, could cause actual results to differ from those set forth in the forward - looking statements: the ability to obtain requisite approvals for the merger with ICH, including, among other things, regulatory approval of certain changes in control of ICH’s FINRA - regulated broker - dealer businesses and ICH stockholder approval; market volatility; unexpected costs or unexpected liabilities that may arise from the merger with ICH, whether or not consummated; the inability to retain key personnel; the deterioration of market conditions; and future regulatory or legislative actions that could adversely affect the parties to the merger agreement relating to the merger with ICH. Additional factors that may affect future results are contained in RCAP’s filings with the Securities and Exchange Commission (“SEC”), which are available at the SEC’s website at www.sec.gov. RCAP disclaims any obligation to update and revise statements contained in these materials based on new information or otherwise.

3 Important Additional Information Filed With the SEC • RCAP plans to file with the SEC a Registration Statement on Form S - 4 in connection with the proposed transaction and Investor Capital Holdings, Ltd. plans to mail to its stockholders a proxy statement in connection with the proposed transaction, which will be included in RCAP’s Registration Statement on Form S - 4 (the “Proxy Statement/Prospectus”). THE REGISTRATION STATEMENT AND THE PROXY STATEMENT/PROSPECTUS WILL CONTAIN IMPORTANT INFORMATION ABOUT RCAP, INVESTOR CAPITAL HOLDINGS, LTD. , THE PROPOSED TRANSACTION AND RELATED MATTERS. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT AND THE PROXY STATEMENT/PROSPECTUS CAREFULLY WHEN THEY BECOME AVAILABLE. Investors and security holders will be able to obtain free copies of the Registration Statement and the Proxy Statement/Prospectus and other documents relating to the proposed transaction filed with the SEC by RCAP and Investor Capital Holdings, Ltd. through the web site maintained by the SEC at www.sec.gov. In addition, investors and security holders will be able to obtain free copies of the Registration Statement and the Proxy Statement/Prospectus and such other documents by phone, e - mail or written request by contacting the investor relations department of RCAP or Investor Capital Holdings, Ltd. as follows : • RCAP, Investor Capital Holdings, Ltd., and their respective directors and executive officers, may be deemed to be participants in the solicitation of proxies in respect of the proposed transactions contemplated by the Merger Agreement. Information regarding RCAP’s directors and executive officers is contained in RCAP’s prospectus filed with the SEC pursuant to Rule 424(b)(4) under the Securities Act of 1933, as amended, on June 6, 2013. Information regarding Investor Capital Holdings, Ltd.’s directors and executive officers is contained in Investor Capital Holdings, Ltd.’s Form 10 - K for the year ended March 31, 2013 and its definitive proxy statement dated July 11, 2013, which are filed with the SEC. A more complete description will be available in the Registration Statement and the Proxy Statement/Prospectus to be filed with the SEC.

American Realty Capital 4 Executive Summary Transaction Overview » RCAP has agreed to acquire 100 % ownership of the shares of ICH (NYSE : ICH) » Summary of transaction terms : ▪ Purchase Price : o $ 7 . 25 per share fully diluted o $ 52 . 5 million ▪ Consideration o Up to 60 % cash and up to 100 % shares of Class A Common Stock of RCAP o Exchange ratio based on RCAP’s 5 - day VWAP prior to closing » ICH will become RCAP’s 6 th primary line of business, retail brokerage and advisory services, complementing the existing wholesale distribution and investment banking, transaction management, transfer agency and potential mutual fund businesses . » ICH operates primarily through its subsidiary, Investors Capital Corporation (“ICC”), a dually - registered independent broker - dealer and investment adviser » ICC is a 4 time recipient of the Independent Broker - Dealer of the Year award given out by Investment Advisor Magazine

American Realty Capital 5 » Based in Lynnfield, MA, ICH is led by Timothy Murphy ; President and CEO » ICC is one of the premier independent broker - dealers in the United States with over 450 brokers located throughout the United States ▪ $ 84 . 9 million 2013 Estimated Revenue ▪ $ 195 , 000 average annual production per advisor » Other ICC Products and Services : » Asset Management » Financial Planning » Insurance and Annuities Executive Summary ICH Overview Market Information (As of 10/25/13) Ticker NYSE: ICH 52 - Week Price Range $2.96 - $8.90 Closing Price $6.66 Shares Outstanding 7.1 million Market Cap $47.3 million Price / Book 5.8x

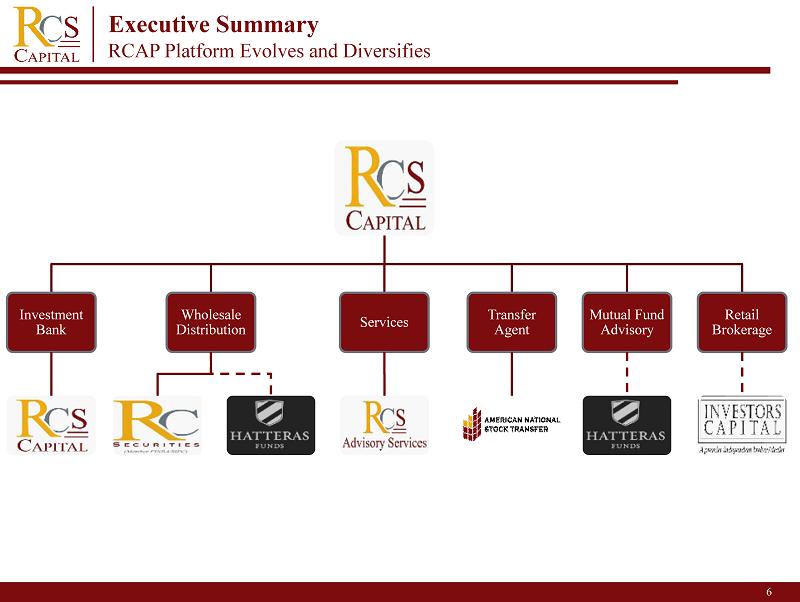

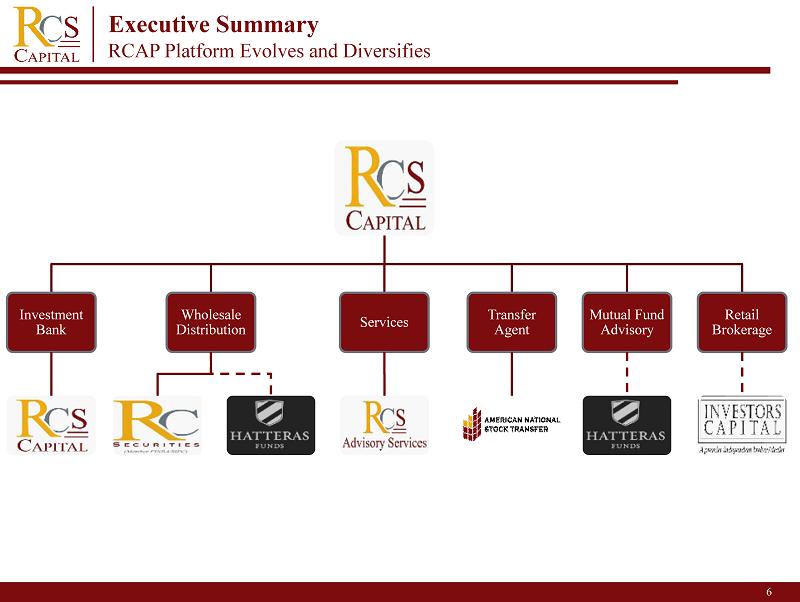

6 Executive Summary RCAP Platform Evolves and Diversifies Investment Bank Wholesale Distribution Services Transfer Agent Mutual Fund Advisory Retail Brokerage

7 Transaction Rationales ICH will add a retail network to RCAP’s diversified business line platform. » Diversify and enhance revenue » Expand and complement existing distribution channels through a sales force of 550 financial advisors » Widen geographic footprint » Enhance organic business growth profile » Expand management team expertise » Gain synergies from back office, compliance and distribution functions » Accretive to RCAP earnings

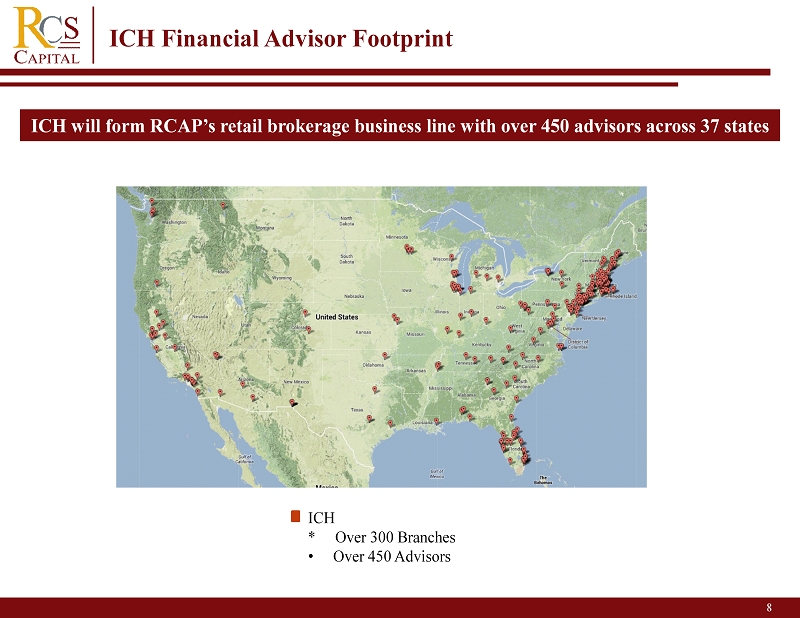

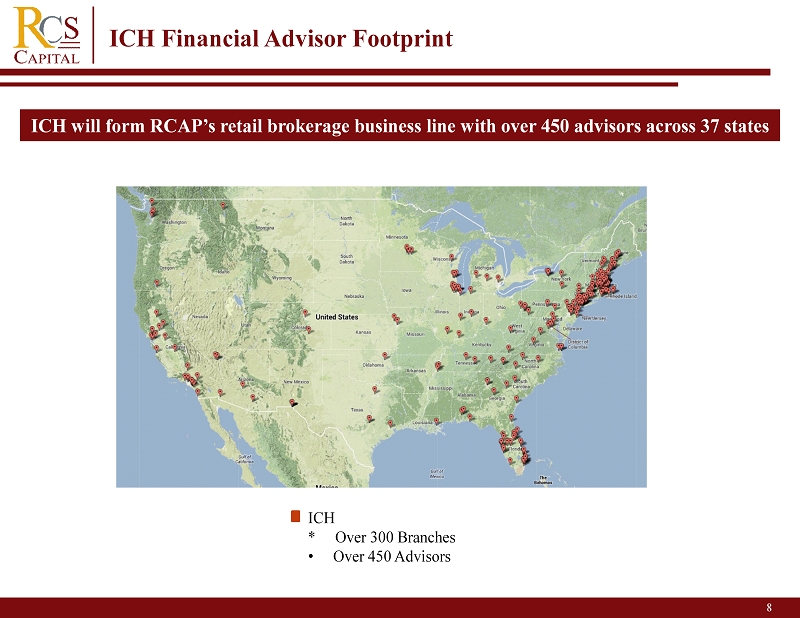

8 ICH Financial Advisor Footprint ICH * over 300 Branches • over 450 Advisors ICH will form RCAP’s retail brokerage business line with 450 advisors across 37 states

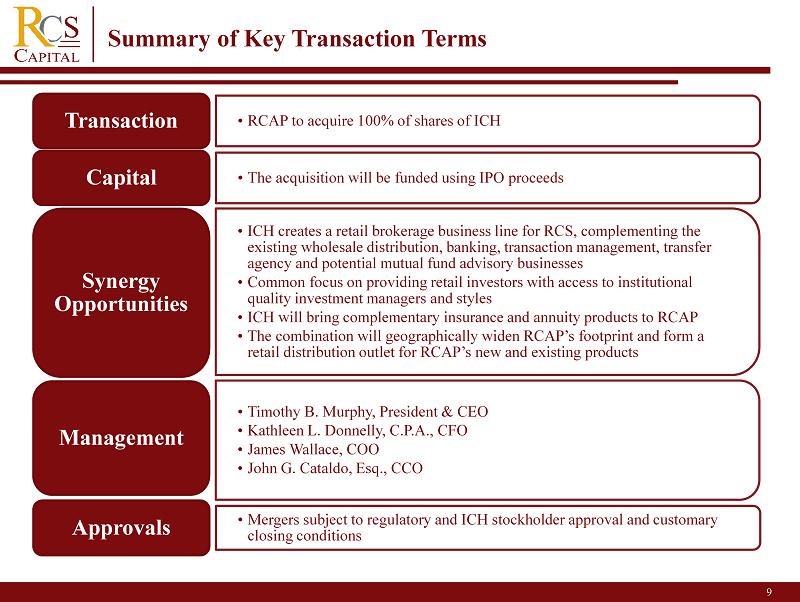

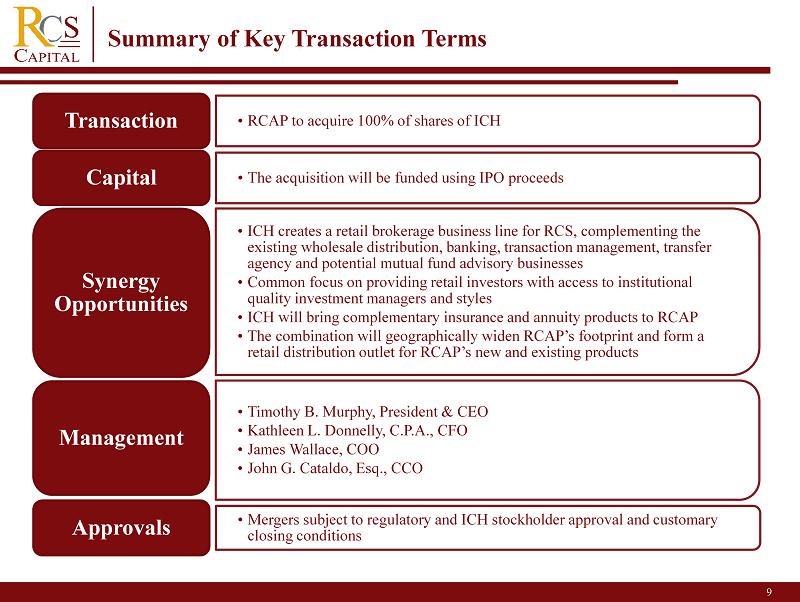

American Realty Capital 9 Summary of Key Transaction Terms • RCAP to acquire 100% of shares of ICH Transaction • The acquisition will be funded using IPO proceeds Capital • ICH creates a retail brokerage business line for RCS, complementing the existing wholesale distribution, banking, transaction management, transfer agency and potential mutual fund advisory businesses • Common focus on providing retail investors with access to institutional quality investment managers and styles • ICH will bring complementary insurance and annuity products to RCAP • The combination will geographically widen RCAP’s footprint and form a retail distribution outlet for RCAP’s new and existing products Synergy Opportunities • Timothy B. Murphy, President & CEO • Kathleen L. Donnelly, C.P.A., CFO • James Wallace, COO • John G. Cataldo, Esq., CCO Management • Mergers subject to regulatory and ICH stockholder approval and customary closing conditions Approvals

10 2 Leadership Team Biographies John G. Cataldo, Esq. – Chief Compliance Officer » Joined the Firm in March 2009 » Formerly member of the securities practice group at a major international law firm and an enforcement counsel in the Securities Division of the Office of the Secretary of the Commonwealth of Massachusetts. Holds Series 7, 79 and 24 licenses Kathleen L. Donnelly, C.P.A. – Chief Financial Officer » Joined Investors Capital in 2007 as a corporate accountant and assumed the role of Chief Financial Officer in January 2009 » Formerly employed by a public accounting firm for twelve years, focusing in the financial services sector Timothy B. Murphy – President and CEO » Director of the Company since 1995. Served as EVP from 1995 and was promoted to CEO in 2008 » S erved as Treasurer and Chief Financial Officer from 1995 until 2009. Mr. Murphy has been President of ICC since 1995 » Member of the board of directors of the Financial Services Institute. Holds Series 6 , 7, 24, 27, 53, 63 and 65 licenses James Wallace – Chief Operating Officer » Joined Investors Capital in 2000 as Vice President of Trading » Formerly employed by Boston - based Fidelity Investments for over 10 years in various customer service, trading and operations positions » Holds Series 4, 6, 7, 8, 24, 27, 55, 63, and 65 licenses