united states

securities and exchange commission

washington, d.c. 20549

form n-csr

certified shareholder report of registered management

investment companies

Investment Company Act file number 811-22808

PREDEX

(Exact name of registrant as specified in charter)

17605 Wright Street, Suite 2, Omaha, NE 68130

(Address of principal executive offices) (Zip code)

Michael Achterberg, PREDEX

18500 Von Karman Ave, Suite 350 Irvine, CA 92612

(Name and address of agent for service)

Registrant's telephone number, including area code: 949-336-3445

Date of fiscal year end: 4/30

Date of reporting period: 4/30/18

Item 1. Reports to Stockholders.

Annual Report

April 30, 2018

INVESTOR INFORMATION: (877) 940-7202

This report and the financial statements contained herein are submitted for the general information of shareholders and are not authorized for distribution to prospective investors unless preceded or accompanied by an effective prospectus. Nothing herein contained is to be considered an offer of sale or solicitation of an offer to buy shares of PREDEX. Such offering is made only by prospectus, which includes details as to offering price and other material information.

Distributed by Northern Lights Distributors, LLC

Member FINRA

Dear Fellow Shareholders,

We are pleased to provide you with the PREDEX (the “Fund”) annual report. The Fund is invested in 18 private and non-listed institutional real estate funds representing more than 1,900 properties in $138 billion of real estate. We remain committed to utilizing a low-cost, passive investment strategy to invest in the flagship U.S. core property funds managed by the leading institutional real estate sponsors.

| Portfolio | | Gross Asset | |

| Allocation | | Value ($B) | Properties |

| 5.5% | AEW Core Property Trust | $ 8.3 | 69 |

| 5.1% | American Core Realty Fund | 6.0 | 68 |

| 5.6% | Barings Core Property Fund | 4.1 | 55 |

| 3.2% | Black Creek Diversified Property Fund, Class I | 2.1 | 48 |

| 7.2% | BlackRock US Core Property Fund | 2.5 | 31 |

| 5.0% | CBRE US Core Partners | 2.5 | 32 |

| 5.0% | Clarion Lion Properties Fund | 10.9 | 136 |

| 7.1% | Guggenheim Real Estate US Property Fund | 1.2 | 46 |

| 6.6% | Invesco Core Real Estate USA | 12.3 | 91 |

| 4.9% | JLL Income Property Trust, Class M-I | 2.6 | 69 |

| 6.6% | MEPT Edgemoor LP | 9.3 | 90 |

| 5.3% | Prologis Targeted U.S. Logistics Holdings, LP | 9.5 | 554 |

| 6.6% | PRISA LP | 24.5 | 267 |

| 5.1% | RREEF America REIT II | 12.5 | 96 |

| 4.7% | Sentinel Real Estate Fund | 1.7 | 29 |

| 4.8% | Stockbridge Smart Markets Fund | 2.1 | 56 |

| 6.5% | UBS Trumbull Property Fund | 23.7 | 211 |

| 5.2% | USAA US Government Building Fund | 2.2 | 10 |

| 100.0% | TOTAL | $138.0 | 1,958 |

Information is unaudited and holdings are subject to change. The underlying fund data is as of December 31, 2017 based on allocations by the Fund as of April 30, 2018.

Performance has been very consistent, and the Fund has continued to generate a positive return every month. Class I shares returned +6.18% for the fiscal year ended April 30, 2018. The maximum drawdown at any time since inception was only 0.19%.

In March 2018 the Fund launched two additional share classes: Class W and Class T. This should allow the Fund to attract more investor capital from previously untapped sources. We will strive to diversify and strengthen our capital base with other investors committed to incorporating private core real estate as a long-term component of their investment portfolios.

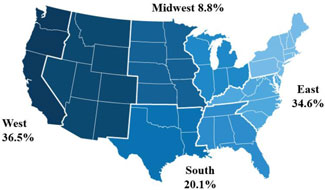

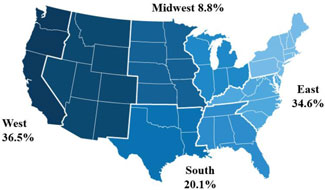

PREDEX seeks to continue to provide low volatility and relatively low correlation to the other major asset classes. The Fund is well diversified by fund manager, property type and geography.

| SECTOR | GEOGRAPHIC |

| DIVERSIFICATION | DIVERSIFICATION |

| (unaudited) | (unaudited) |

| | |

|  |

The charts represent the underlying fund holdings. Allocation, Sector and Geographic Diversification are subject to change. Diversification does not eliminate the risk of experiencing losses.

We thank you for your investment and continued confidence in the Fund.

Sincerely,

| |

|  |

| | |

| Michael Achterberg, CAIA | J. Grayson Sanders |

| Portfolio Manager | Chief Investment Officer |

7178-NLD-06/28/2018

| PREDEX |

| PORTFOLIO REVIEW (Unaudited) |

| April 30, 2018 |

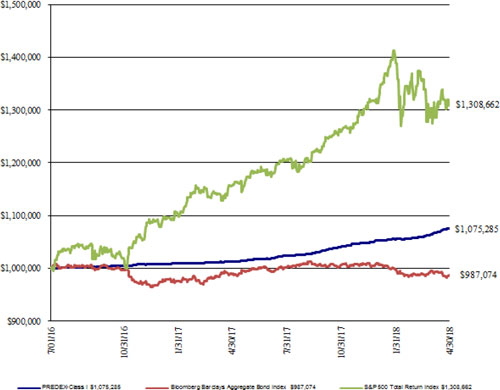

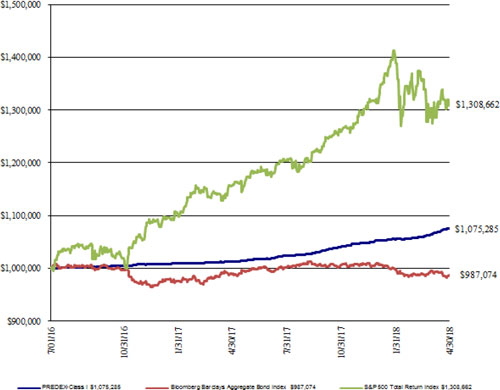

The Fund’s performance compared to its benchmarks for the periods ended April 30, 2018:

| | | | Since |

| | | Since | Inception |

| | | Inception | Class T and |

| | One Year | Class I (1) | Class W (2) |

| PREDEX: | | | |

| Class I | + 6.18% | + 4.04% | — |

| Class W | — | — | + 1.63% |

| Class T – without load | — | — | + 1.63% |

| Class T – with load (3) | — | — | - 2.69% |

| Bloomberg Barclays Aggregate Bond Index | - 0.32% | - 0.71% | - 0.11% |

| S&P 500 Total Return Index | +13.27% | +15.81% | - 2.17% |

(1) Annualized total return since July 1, 2016 when the class commenced operations.

(2) Annualized total return since March 1, 2018 when the class commenced operations.

(3) Adjusted for initial maximum sales charge of 4.25%.

The Bloomberg Barclays Aggregate Bond Index is an unmanaged index which represents the U.S. investment-grade fixed-rate bond market (including government and corporate securities, mortgage pass-through securities and asset-backed securities). The S&P 500 Total Return Index is an unmanaged market capitalization-weighted index which is comprised of 500 of the largest U.S. domiciled companies and includes the reinvestment of all dividends. Investors cannot invest directly in an index or benchmark.

Past performance is not predictive of future results. The investment return and principal value of an investment will fluctuate. An investor’s shares, when redeemed, may be worth more or less than the original cost. Total return is calculated assuming reinvestment of all dividends and distributions. The chart does not reflect the deduction of taxes that a shareholder may have to pay on Fund distributions or the redemption of the Fund shares. For performance information current to the most recent month end, please call 877-940-7202.

The Fund’s investment adviser has contractually agreed to reduce its fees and absorb expenses of the Fund at least until August 31, 2019 so that the annual operating expenses (including offering expenses, but excluding taxes interest, brokerage commissions, acquired fund fees and expenses and extraordinary expenses) will not exceed 1.20%, 1.45% and 1.45% per annum of the average daily net assets of Class I, Class T and Class W, respectively. Without the waiver the expenses would be 1.48% for Class I and 1.88% for Class T and Class W annualized (gross expenses as per the Fund’s prospectus dated February 12, 2018). Please review the accompanying Financial Highlights and the Fund’s Prospectus for more details regarding the Fund’s fees and expenses.

| PREDEX |

| PORTFOLIO REVIEW (Unaudited) (Continued) |

| April 30, 2018 |

Comparison of the Change in Value of a $1,000,000 Investment (since inception through April 30, 2018):

Portfolio Composition as of April 30, 2018 (Unaudited)

| | | Percent of | |

| | | Net Assets | |

| Real Estate Investment Funds | | | 92.4 | % |

| Short-Term Investments | | | 6.4 | % |

| Total Investments | | | 98.8 | % |

| Other Assets in Excess of Liabilities | | | 1.2 | % |

| Total Net Assets | | | 100.0 | % |

See the Portfolio of Investments in this Annual Report for a more detailed account of the Fund’s holdings.

| PREDEX |

| PORTFOLIO OF INVESTMENTS |

| April 30, 2018 |

| Shares | | | | | Fair Value | |

| | | | | REAL ESTATE INVESTMENTS (92.4%) | | | | |

| | | | | Private Investment Funds * (84.9%) | | | | |

| | 2,241 | | | AEW Core Property Trust (U.S.), Inc. | | $ | 2,241,646 | |

| | 17 | | | American Core Realty Fund, LP | | | 2,072,029 | |

| | 17,606 | | | Barings Core Property Fund LP | | | 2,264,820 | |

| | n/a | | | BlackRock US Core Property Fund, LP | | | 2,931,289 | |

| | 1,470,118 | | | CBRE U.S. Core Partners, LP | | | 2,034,938 | |

| | 1,412 | | | Clarion Lion Properties Fund, LP | | | 2,050,451 | |

| | n/a | | | Guggenheim Real Estate U.S. Property Fund LP | | | 2,893,915 | |

| | 15 | | | Invesco Core Real Estate USA, LP | | | 2,689,552 | |

| | 1,313 | | | MEPT Edgemoor LP | | | 2,678,481 | |

| | 1,468 | | | Prologis Targeted U.S. Logistics Holdings, LP | | | 2,136,072 | |

| | 1,715 | | | PRISA LP | | | 2,699,909 | |

| | 17,044 | | | RREEF America REIT II, Inc. | | | 2,061,646 | |

| | 22 | | | Sentinel Real Estate Fund, LP | | | 1,930,210 | |

| | 1,277 | | | Stockbridge Smart Markets Fund, LP | | | 1,939,651 | |

| | 240 | | | UBS Trumbull Property Fund LP | | | 2,659,495 | |

| | n/a | | | USAA US Government Building Fund | | | 2,103,128 | |

| | | | | Total Private Investment Funds (Cost $35,663,222) | | | 37,387,232 | |

| | | | | | | | | |

| | | | | Public Non-Traded Funds (7.5%) | | | | |

| | 172,614 | | | Black Creek Diversified Property Fund (Class I) | | | 1,287,564 | |

| | 169,065 | | | Jones Lang LaSalle Income Property Trust, Inc. (Class M-I) | | | 1,994,970 | |

| | | | | Total Public Non-Traded Funds (Cost $3,087,323) | | | 3,282,534 | |

| | | | | | | | | |

| | | | | TOTAL REAL ESTATE INVESTMENTS (Cost $38,750,545) | | | 40,669,766 | |

| | | | | | | | | |

| | | | | SHORT-TERM INVESTMENT (6.4%) | | | | |

| | 2,841,457 | | | Dreyfus Treasury & Agency Cash Management, Institutional Shares, 1.54% + (Cost $2,841,457) | | | 2,841,457 | |

| | | | | | | | | |

| | | | | TOTAL INVESTMENTS (98.8%) | | | 43,511,223 | |

| | | | | (Cost $41,592,002) | | | | |

| | | | | | | | | |

| | | | | OTHER ASSETS IN EXCESS OF LIABILITIES (1.2%) | | | 528,930 | |

| | | | | | | | | |

| | | | | NET ASSETS (100.0%) | | $ | 44,040,153 | |

| | LP - | Limited Partnership |

| + | Money market fund; interest rate reflects seven-day effective yield on April 30, 2018. |

| | * | Fair value estimated using Fair Valuation Procedures adopted by the Board of Trustees as discussed in Note 2. |

See Notes to Financial Statements.

| PREDEX |

| STATEMENT OF ASSETS AND LIABILITIES |

| April 30, 2018 |

| ASSETS | | | | |

| Investments at fair value (identified cost $41,592,002) | | $ | 43,511,223 | |

| Advance contribution to private investment fund | | | 400,000 | |

| Dividends receivable | | | 103,115 | |

| Due from advisor, net | | | 26,123 | |

| Cash | | | 831 | |

| Prepaid expenses and other assets | | | 57,094 | |

| Total Assets | | | 44,098,386 | |

| | | | | |

| LIABILITIES | | | | |

| Distribution fees payable | | | 2 | |

| Accrued expenses and other liabilities | | | 58,231 | |

| Total Liabilities | | | 58,233 | |

| NET ASSETS | | $ | 44,040,153 | |

| | | | | |

| COMPONENTS OF NET ASSETS | | | | |

| Paid-in capital | | $ | 41,596,601 | |

| Accumulated net investment income | | | 524,331 | |

| Net unrealized appreciation of investments | | | 1,919,221 | |

| NET ASSETS | | $ | 44,040,153 | |

| | | | | |

| Class I | | | | |

| Net assets | | $ | 44,034,891 | |

| Shares of beneficial interest outstanding (no par value; unlimited shares authorized) | | | 1,686,997 | |

| Net asset value, offering and redemption price per share | | $ | 26.10 | |

| | | | | |

| Class T | | | | |

| Net assets | | $ | 2,631 | |

| Shares of beneficial interest outstanding (no par value; unlimited shares authorized) | | | 101 | |

| Net asset value and redemption price per share | | $ | 26.09 | (a) |

| Maximum offering price per share (maximum sales charge of 4.25%) | | $ | 27.25 | |

| | | | | |

| Class W | | | | |

| Net assets | | $ | 2,631 | |

| Shares of beneficial interest outstanding (no par value; unlimited shares authorized) | | | 101 | |

| Net asset value, offering and redemption price per share | | $ | 26.09 | (a) |

| (a) | NAV does not appear to recalculate because it is based upon the fractional quantity of shares. |

See Notes to Financial Statements.

| PREDEX |

| STATEMENT OF OPERATIONS |

| For the Year Ended April 30, 2018 |

| INVESTMENT INCOME | | | | |

| Dividend income | | $ | 1,156,223 | |

| Interest income | | | 40,538 | |

| Total Investment Income | | | 1,196,761 | |

| | | | | |

| EXPENSES | | | | |

| Investment advisory fees | | | 227,232 | |

| Distribution fees: | | | | |

| Class T | | | 1 | |

| Class W | | | 1 | |

| Shareholder service fees | | | 83,796 | |

| Trustees fees | | | 66,635 | |

| Legal fees | | | 53,919 | |

| Professional fees | | | 44,646 | |

| Audit and tax fees | | | 44,203 | |

| Administration fees | | | 43,417 | |

| Registration fees | | | 34,735 | |

| Fund accounting fees | | | 24,589 | |

| Transfer agent fees | | | 20,503 | |

| Insurance fees | | | 18,835 | |

| Printing fees | | | 15,170 | |

| Amortization of deferred offering costs | | | 11,528 | |

| Custodian fees | | | 6,907 | |

| Miscellaneous expenses | | | 19,942 | |

| Total Expenses | | | 716,059 | |

| Less: Fees waived by advisor | | | (219,901 | ) |

| Net Expenses | | | 496,158 | |

| Net Investment Income | | | 700,603 | |

| | | | | |

| REALIZED AND UNREALIZED GAIN ON INVESTMENTS | | | | |

| Distribution of long-term capital gain from investment funds | | | 20,805 | |

| Net change in unrealized appreciation on investments | | | 1,779,979 | |

| Net Realized and Unrealized Gain on Investments | | | 1,800,784 | |

| | | | | |

| Net Increase in Net Assets Resulting from Operations | | $ | 2,501,387 | |

See Notes to Financial Statements.

| PREDEX |

| STATEMENTS OF CHANGES IN NET ASSETS |

| | | For the | | | For the | |

| | | Year Ended | | | Year Ended | |

| | | April 30, 2018 | | | April 30, 2017 | |

| INCREASE IN NET ASSETS FROM OPERATIONS | | | | | | | | |

| Net investment income | | $ | 700,603 | | | $ | 2,328 | |

| Distributions of long-term capital gain from investment fund | | | 20,805 | | | | 59,102 | |

| Net change in unrealized appreciation on investments | | | 1,779,979 | | | | 139,242 | |

| Net Increase in Net Assets Resulting from Operations | | | 2,501,387 | | | | 200,672 | |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS | | | | | | | | |

| Class I: | | | | | | | | |

| From net investment income | | | (349,135 | ) | | | (60,531 | ) |

| From net realized gain | | | — | | | | (7,202 | ) |

| From return of capital | | | (676,677 | ) | | | — | |

| Class T*: | | | | | | | | |

| From return of capital | | | (22 | ) | | | — | |

| Class W*: | | | | | | | | |

| From return of capital | | | (22 | ) | | | — | |

| Total Distributions to Shareholders | | | (1,025,856 | ) | | | (67,733 | ) |

| | | | | | | | | |

| BENEFICIAL INTEREST TRANSACTIONS | | | | | | | | |

| Class I: | | | | | | | | |

| Proceeds from shares issued | | | 4,877,762 | | | | 42,427,234 | |

| Distributions reinvested | | | 22,094 | | | | 1,044 | |

| Payments for shares redeemed | | | (2,211,165 | ) | | | (2,790,508 | ) |

| Class T*: | | | | | | | | |

| Proceeds from shares issued | | | 2,589 | | | | — | |

| Distributions reinvested | | | 22 | | | | — | |

| Class W*: | | | | | | | | |

| Proceeds from shares issued | | | 2,589 | | | | — | |

| Distributions reinvested | | | 22 | | | | — | |

| Total Beneficial Interest Transactions | | | 2,693,913 | | | | 39,637,770 | |

| Increase in Net Assets | | | 4,169,444 | | | | 39,770,709 | |

| | | | | | | | | |

| NET ASSETS | | | | | | | | |

| Beginning of year | | | 39,870,709 | | | | 100,000 | |

| End of year* | | $ | 44,040,153 | | | $ | 39,870,709 | |

| | | | | | | | | |

| * Includes accumulated net investment income (loss) of | | $ | 524,331 | | | $ | (63,813 | ) |

| | | | | | | | | |

| SHARE ACTIVITY | | | | | | | | |

| Class I: | | | | | | | | |

| Shares issued | | | 189,537 | | | | 1,689,632 | |

| Shares reinvested | | | 858 | | | | 42 | |

| Shares redeemed | | | (86,130 | ) | | | (110,942 | ) |

| Net increase in shares of beneficial interest outstanding | | | 104,265 | | | | 1,578,732 | |

| Class T*: | | | | | | | | |

| Shares issued | | | 100 | | | | — | |

| Shares reinvested | | | 1 | | | | — | |

| Net increase in shares of beneficial interest outstanding | | | 101 | | | | — | |

| Class W*: | | | | | | | | |

| Shares issued | | | 100 | | | | — | |

| Shares reinvested | | | 1 | | | | — | |

| Net increase in shares of beneficial interest outstanding | | | 101 | | | | — | |

| * | Class T and Class W commenced operations on March 1, 2018. |

See Notes to Financial Statements.

| PREDEX |

| STATEMENT OF CASH FLOWS |

| For the Year Ended April 30, 2018 |

| Cash Flows from Operating Activities | | | | |

| Net increase in net assets resulting from operations | | $ | 2,501,387 | |

| Adjustments to reconcile net increase in net assets resulting from operations to net cash used in operating activities: | | | | |

| Purchases of investments | | | (13,175,215 | ) |

| Net purchase of short term investments | | | (2,841,457 | ) |

| Net distribution of realized gain from investment funds | | | (20,805 | ) |

| Net change in unrealized appreciation on investments | | | (1,779,979 | ) |

| Amortization of deferred offering costs | | | 11,528 | |

| (Increase)/Decrease in assets: | | | | |

| Advance contributions to private investment funds | | | 5,700,610 | |

| Due from advisor | | | 22,323 | |

| Dividends receivable | | | (40,424 | ) |

| Prepaid expenses and other assets | | | (29,729 | ) |

| Increase/(Decrease) in liabilities: | | | | |

| Payable to related parties | | | (14,732 | ) |

| Distribution fees payable | | | 2 | |

| Accrued expenses and other liabilities | | | 17,468 | |

| Net cash used in operating activities | | | (9,649,023 | ) |

| | | | | |

| Cash Flows from Financing Activities | | | | |

| Proceeds from shares issued | | | 4,882,940 | |

| Payments for shares redeemed | | | (2,211,165 | ) |

| Cash distributions paid | | | (1,003,718 | ) |

| Net cash provided by financing activities | | | 1,668,057 | |

| | | | | |

| Net decrease in cash | | | (7,980,966 | ) |

| Cash at beginning of year | | | 7,981,797 | |

| Cash at end of year | | $ | 831 | |

| | | | | |

| Supplemental disclosure of non-cash activity: | | | | |

| Non-cash financing activities not included herein consists of reinvestment of dividends | | $ | 22,138 | |

See Notes to Financial Statements.

| PREDEX |

| FINANCIAL HIGHLIGHTS |

The table below sets forth financial data for one share of capital stock outstanding throughout each year presented.

| | | Class I | |

| | | For the | | | For the | | | For the | | | For the | | | For the | |

| | | Year Ended | | | Year Ended | | | Year Ended | | | Year Ended | | | Year Ended | |

| | | April 30, | | | April 30, | | | April 30, | | | April 30, | | | April 30, | |

| | | 2018 | | | 2017 (1) | | | 2016 | | | 2015 | | | 2014 | |

| | | | | | | | | | | | | | | | |

| Net Asset Value, Beginning of Year | | $ | 25.19 | | | $ | 25.00 | | | $ | 25.00 | | | $ | 25.00 | | | $ | 25.00 | |

| | | | | | | | | | | | | | | | | | | | | |

| From Operations: | | | | | | | | | | | | | | | | | | | | |

| Net investment income (a) | | | 0.43 | | | | 0.00 | | | | — | | | | — | | | | — | |

| Net gain from investments (both realized and unrealized) | | | 1.11 | | | | 0.31 | | | | — | | | | — | | | | — | |

| Total from operations | | | 1.54 | | | | 0.31 | | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | |

| Less Distributions: | | | | | | | | | | | | | | | | | | | | |

| From net investment income | | | (0.21 | ) | | | (0.11 | ) | | | — | | | | — | | | | — | |

| From net realized gain | | | — | | | | (0.01 | ) | | | — | | | | — | | | | — | |

| From return of capital | | | (0.42 | ) | | | — | | | | — | | | | — | | | | — | |

| Total distributions | | | (0.63 | ) | | | (0.12 | ) | | | — | | | | — | | | | — | |

| Net Asset Value, End of Year | | $ | 26.10 | | | $ | 25.19 | | | $ | 25.00 | | | $ | 25.00 | | | $ | 25.00 | |

| | | | | | | | | | | | | | | | | | | | | |

| Total Return (b) | | | 6.18 | % | | | 1.27 | % | | | 0.00 | % | | | 0.00 | % | | | 0.00 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Ratios/Supplemental Data: | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of year (in 000’s) | | $ | 44,034 | | | $ | 39,871 | | | $ | 100 | | | $ | 100 | | | $ | 100 | |

| Ratio of expenses to average net assets (c): | | | | | | | | | | | | | | | | | | | | |

| before reimbursement | | | 1.73 | % | | | 3.63 | % (e) | | | 57.26 | % | | | 2.25 | % | | | 30.01 | % |

| net of reimbursement | | | 1.20 | % | | | 1.20 | % (e) | | | 0.00 | % | | | 0.00 | % | | | 0.00 | % |

| Ratio of net investment income to average net assets (c) (d) | | | 1.70 | % | | | 0.02 | % (e) | | | 0.00 | % | | | 0.00 | % | | | 0.00 | % |

| Portfolio turnover rate | | | 0 | % | | | 0 | % | | | 0 | % | | | 0 | % | | | 0 | % |

| (1) | Commencement of operations was July 1, 2016. |

| (a) | Per share amounts calculated using the average shares method, which more appropriately presents the per share data for the year. |

| (b) | Total returns are historical in nature and assume changes in share price, reinvestment of dividends and capital gain distributions, if any. |

| (c) | Does not include expenses of investment companies in which the Fund invests. |

| (d) | Recognition of net investment income by the Fund is affected by the timing and declaration of dividends by the underlying investment companies in which the Fund invests. |

| (e) | Recurring expenses that were not charged until the fund commenced operations on July 1, 2016 have been annualized. |

See Notes to Financial Statements.

| PREDEX |

| FINANCIAL HIGHLIGHTS (Continued) |

The table below sets forth financial data for one share of capital stock outstanding throughout the period presented.

| | | Class T | | | Class W | |

| | | For the | | | For the | |

| | | Period Ended | | | Period Ended | |

| | | April 30, | | | April 30, | |

| | | 2018 (1) | | | 2018 (1) | |

| | | | | | | |

| Net Asset Value, Beginning of Period | | $ | 25.89 | | | $ | 25.89 | |

| | | | | | | | | |

| From Operations: | | | | | | | | |

| Net investment income (a) | | | 0.08 | | | | 0.08 | |

| Net gain from investments (both realized and unrealized) | | | 0.34 | | | | 0.34 | |

| Total from operations | | | 0.42 | | | | 0.42 | |

| | | | | | | | | |

| Less Distributions: | | | | | | | | |

| From return of capital | | | (0.22 | ) | | | (0.22 | ) |

| Total distributions | | | (0.22 | ) | | | (0.22 | ) |

| | | | | | | | | |

| Net Asset Value, End of Period | | $ | 26.09 | | | $ | 26.09 | |

| | | | | | | | | |

| Total Return (b) (f) | | | 1.63 | % | | | 1.63 | % |

| | | | | | | | | |

| Ratios/Supplemental Data: | | | | | | | | |

| Net assets, end of period (in 000’s) | | $ | 3 | | | $ | 3 | |

| Ratio of expenses to average net assets (c) (e) | | | | | | | | |

| before reimbursement | | | 2.41 | % | | | 2.41 | % |

| net of reimbursement | | | 1.45 | % | | | 1.45 | % |

| Ratio of net investment income to average net assets (c) (d) (e) | | | 1.87 | % | | | 1.87 | % |

| Portfolio turnover rate (f) | | | 0 | % | | | 0 | % |

| (1) | Commencement of operations was March 1, 2018. |

| (a) | Per share amounts calculated using the average shares method, which more appropriately presents the per share data for the period. |

| (b) | Total returns are historical in nature and assume changes in share price, reinvestment of dividends and capital gain distributions, if any. |

| (c) | Does not include expenses of investment companies in which the Fund invests. |

| (d) | Recognition of net investment income by the Fund is affected by the timing and declaration of dividends by the underlying investment companies in which the Fund invests. |

See Notes to Financial Statements.

| PREDEX |

| NOTES TO FINANCIAL STATEMENTS |

| April 30, 2018 |

| |

PREDEX (the “Fund”) is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as a closed-end management investment company. The Fund is non-diversified, engages in a continuous offering of shares and operates as an interval fund that offers to make quarterly repurchases of shares at net asset value. The Fund’s investment advisor is PREDEX Capital Management, LLC (the “Advisor”).

The primary investment objective of the Fund is to seek consistent current income while secondarily seeking long-term capital appreciation with moderate volatility.

The Fund was organized as a statutory trust on February 5, 2013 (date of organization), under the laws of the State of Delaware. There were no organizational costs during the period prior to commencement of trading.

The Fund currently offers Class I, Class T and Class W shares. The Fund commenced operations July 1, 2016 with a single class of shares which was renamed Class I on March 1, 2018. Class T and Class W shares commenced operations on March 1, 2018. Class T shares are offered at net asset value plus a maximum sales charge of 4.25%. Class I and Class W shares are offered at net asset value. Each class represents an interest in the same assets of the Fund and classes are identical except for differences in their sales charge structures and ongoing service and distribution charges. All classes of shares have equal voting privileges except that each class has exclusive voting rights with respect to its service and/or distribution plans. The Fund’s income, expenses (other than class specific distribution fees) and realized and unrealized gains and losses are allocated proportionately each day based upon the relative net assets of each class.

| (2) | SIGNIFICANT ACCOUNTING POLICIES |

The following is a summary of significant accounting policies followed by the Fund in preparation of its financial statements. These policies are in conformity with accounting principles generally accepted in the United States of America (“GAAP”). The Fund is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (FASB) Accounting Standard Codification Topic 946 “Financial Services Investment Companies” including FASB Accounting Standard Update ASU 2013-08. The preparation of financial statements requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and expenses for the period. Actual results could differ from those estimates.

Security Valuation – Investments in public non-traded funds are valued at their reported net asset value. The Fund otherwise uses fair valuation procedures to value a substantial portion of its assets. The Fund uses the fair value of a security to calculate its net asset value (“NAV”) when, for example, (1) a portfolio security is not traded in a public market or the principal market in which the security trades is closed, (2) trading in a portfolio security is suspended and not resumed prior to the normal market close, (3) a portfolio security is not traded in significant volume for a substantial period, or (4) the Advisor determines that the quotation or price for a portfolio security provided by a broker-dealer or independent pricing service is inaccurate.

Valuation of Private Investment Funds – The Fund invests a significant portion of its assets in Private Investment Funds (each a “Private Fund” and collectively, the “Private Funds”). The Private Funds measure their real estate investments at fair value, and report a NAV per share on a calendar quarter basis. The Fund estimates the fair value of each Private Fund by adjusting the most recent NAV for each Private Fund by

| PREDEX |

| NOTES TO FINANCIAL STATEMENTS (Continued) |

| April 30, 2018 |

| |

the change in a proprietary benchmark that the Fund has deemed to be representative of the entire Private Fund market.

Fair Value Process – The “fair value” of securities may be difficult to determine and thus judgment plays a greater role in the valuation process. The fair valuation methodology may include or consider the following guidelines, as appropriate: (1) evaluation of all relevant factors, including but not limited to, pricing history, current market level, supply and demand of the respective security; (2) comparison to the values and current pricing of securities that have comparable characteristics; (3) knowledge of historical market information with respect to the security; (4) other factors relevant to the security which would include, but not be limited to, duration, yield, fundamental analytical data, the Treasury yield curve, and credit quality.

The values assigned to fair valued investments will be based on available information and will not necessarily represent amounts that might ultimately be realized, since such amounts depend on future developments inherent in long-term investments. Changes in the fair valuation of portfolio securities may be less frequent and of greater magnitude than changes in the price of portfolio securities valued at their last sale price, by an independent pricing service, or based on market quotations. Imprecision in estimating fair value can also impact the amount of unrealized appreciation or depreciation recorded for a particular portfolio security and differences in the assumptions used could result in a different determination of fair value, and those differences could be material.

The Fund utilizes various methods to measure the fair value of its investments on a recurring basis. GAAP establishes a hierarchy that prioritizes inputs to valuation methods. The three levels of input are:

Level 1 – Unadjusted quoted prices in active markets for identical assets and liabilities that the Fund has the ability to access.

Level 2 – Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data.

Level 3 – Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing the Fund’s own assumptions about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available.

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3.

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety, is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

| PREDEX |

| NOTES TO FINANCIAL STATEMENTS (Continued) |

| April 30, 2018 |

| |

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. The following tables summarize the inputs used as of April 30, 2018 for the Fund’s assets and liabilities measured at fair value:

| Investments* | | Level 1 | | | Level 2 | | | Level 3 | | | Total Value | |

| Real Estate Investment Funds | | $ | 3,282,534 | | | $ | — | | | $ | 37,387,232 | | | $ | 40,669,766 | |

| Short-Term Investments | | | 2,841,457 | | | | — | | | | — | | | | 2,841,457 | |

| Total | | $ | 6,123,991 | | | $ | — | | | $ | 37,387,232 | | | $ | 43,511,223 | |

| | | | | | | | | | | | | | | | | |

* Refer to the Portfolio of Investments for a more detailed account of the Fund’s holdings.

There were no transfers into or out of Level 1, Level 2, and Level 3 during the current year presented. It is the Fund’s policy to record transfers into or out of any Level at the end of the reporting period.

As of April 30, 2018, there was no significant change in fair value from the most recent NAV for each Private Fund. The following is a reconciliation of assets in which Level 3 inputs were used in determining fair value:

| | | Private | |

| | | Investment | |

| | | Funds | |

| Beginning balance | | $ | 23,861,294 | |

| Cost of purchases | | | 11,897,492 | |

| Change in unrealized appreciation | | | 1,628,446 | |

| Proceeds from sales | | | — | |

| Realized gain (loss) | | | — | |

| Net transfers in/out of Level 3 | | | — | |

| | | | | |

| Ending balance | | $ | 37,387,232 | |

Security Transactions and Investment Income – Investment security transactions are accounted for on a trade date basis. Cost is determined and gains and losses are based upon the specific identification method for both financial statement and federal income tax purposes. Dividend income is recorded on the ex-dividend date and interest income is recorded on the accrual basis. Purchase discounts and premiums on securities are accreted and amortized over the life of the respective securities.

Federal Income Taxes – The Fund intends to qualify as a “regulated investment company” under Subchapter M of the Internal Revenue Code of 1986, as amended, and, if so qualified, will not be liable for federal income taxes to the extent earnings are distributed to shareholders on a timely basis. Accordingly, no provision for Federal income taxes is required in the financial statements.

As of April 30, 2018, the Fund had no uncertain tax positions that would require financial statement recognition, de-recognition or disclosure. Management has analyzed the Fund’s tax positions and has concluded that no liability for unrecognized tax benefits should be recorded related to uncertain tax positions for open tax year ended April 30, 2017 or expected to be taken in the Fund’s April 30, 2018 year-end tax return. The Fund’s federal tax returns are subject to examination by the Internal Revenue Service for a period of three years after filing.

| PREDEX |

| NOTES TO FINANCIAL STATEMENTS (Continued) |

| April 30, 2018 |

| |

Distributions to Shareholders – Distributions from investment income, if any, are declared and paid quarterly. Distributions from net realized capital gains, if any, are declared and paid annually and are recorded on the ex-dividend date. The character of income and gains to be distributed is determined in accordance with income tax regulations, which may differ from GAAP.

Indemnification – The Fund indemnifies its officers and trustees for certain liabilities that may arise from the performance of their duties to the Fund. Additionally, in the normal course of business, the Fund enters into contracts that contain a variety of representations and warranties which provide general indemnities. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred. However, the Fund expects the risk of loss due to these warranties and indemnities to be remote.

| (3) | INVESTMENT ADVISORY AGREEMENT AND TRANSACTIONS WITH RELATED PARTIES |

Advisory Fees – Pursuant to an investment advisory agreement with the Trust, with respect to the Fund (the “Advisory Agreement”), investment advisory services are provided to the Fund by the Advisor. Under the terms of the Advisory Agreement, the Advisor receives monthly fees calculated at an annual rate of 0.55% of the average daily net assets of the Fund. For the year ended April 30, 2018, the Advisor earned advisory fees of $227,232.

The Advisor, pursuant to an Expense Limitation Agreement (the “Agreement”) has contractually agreed to reduce its fees and/or absorb expenses of the Fund at least until August 31, 2019 so that Net Annual Operating Expenses (including organizational and offering expenses, but excluding taxes, interest, brokerage commissions, acquired fund fees and expenses and extraordinary expenses) will not exceed 1.20%, 1.45% and 1.45% per annum of the average daily net assets of Class I, Class T and Class W, respectively. During the year ended April 30, 2018, the Advisor waived fees of $219,901.

The Agreement allows the Advisor to recover amounts previously reimbursed for operating expenses to the Fund to the extent that the Fund’s expense ratio falls below the above indicated expense limitation. The amount that can be recovered will be limited to the difference between the actual expense ratio and the amount of the expense limitation. Under the Agreement, the Advisor can only recover such amounts for a period of up to three fiscal years subsequent to the fiscal year fees were waived or reimbursed by the Advisor. As of April 30, 2018, the amount recoverable by the Advisor under the Agreement was $595,477. $57,261, $318,315 and $219,901 are subject to recapture by April 30, 2019, April 30, 2020, and April 30, 2021, respectively.

Northern Lights Distributors, LLC (the “Distributor”) is serving as the Fund’s principal underwriter and acts as the distributor of the Fund’s shares on a best efforts basis, subject to various conditions. The Fund’s Board of Trustees (the “Board”) has adopted, on behalf of the Fund, a Shareholder Services Plan under which the Fund may compensate financial industry professionals for providing ongoing services in respect of clients with whom they have distributed shares of the Fund. Under the Shareholder Services Plan, the Fund may pay 0.25% per year of its average daily net assets attributed to Class I, Class T and Class W shares, respectively, for such services. For the year ended April 30, 2018, the Fund incurred shareholder servicing fees of $83,796 for Class I. The Class T and Class W shares also pay to the Distributor a distribution fee, payable under distribution plans adopted by the Board (“Distribution Plans”), for certain activities relating to the distribution of shares to investors and maintenance of shareholder accounts. These activities including marketing and other activities to support the distribution of the Class T and Class W shares. Under the Distribution Plans, the Fund pays 0.25% per year of its average daily net assets for such

| PREDEX |

| NOTES TO FINANCIAL STATEMENTS (Continued) |

| April 30, 2018 |

| |

services for Class T and Class W shares, respectively. For the year ended April 30, 2018, the Fund incurred distributions fees of $1 and $1 for Class T and Class W shares, respectively.

In addition, certain affiliates of the Distributor provide services to the Fund as follows:

Gemini Fund Services, LLC (“GFS”) – GFS, an affiliate of the Distributor, provides administration, fund accounting, and transfer agent services to the Trust. Pursuant to a separate servicing agreement with GFS, the Fund pays GFS customary fees for providing administration, fund accounting and transfer agency services to the Fund. Certain officers of the Fund are also officers of GFS, and are not paid any fees directly by the Fund for servicing in such capacities.

Northern Lights Compliance Services, LLC (“NLCS”) – NLCS, an affiliate of GFS and the Distributor, provides a Chief Compliance Officer to the Fund, as well as related compliance services, pursuant to a consulting agreement between NLCS and the Fund. Under the terms of such agreement, NLCS receives customary fees from the Fund.

Blu Giant, LLC (“Blu Giant”) – Blu Giant, an affiliate of GFS and the Distributor, provides EDGAR conversion and filing services as well as print management services for the Fund on an ad-hoc basis. For the provision of these services, Blu Giant receives customary fees from the Fund.

Trustees – The Fund pays each Trustee who is not affiliated with the Fund or Advisor an annual fee of $20,000, as well as reimbursement for any reasonable expenses incurred attending the meetings. The Trustee who serves a Chairperson of the Audit Committee receives an additional annual fee of $5,000. The “interested persons” who serve as Trustees of the Fund receive no compensation for their services as Trustees. None of the executive officers receive compensation from the Fund.

| (4) | INVESTMENT TRANSACTIONS |

The cost of purchases and proceeds from the sale of securities, other than short-term securities, for the year ended April 30, 2018 amounted to $13,175,215 and $0, respectively.

The identified cost of investments for federal income tax purposes, and its respective unrealized appreciation and depreciation at April 30, 2018, were as follows:

| | | | Gross Unrealized | | | Gross Unrealized | | | Net Unrealized | |

| Tax Cost | | | Appreciation | | | Depreciation | | | Appreciation | |

| $ | 40,868,356 | | | $ | 2,642,867 | | | $ | — | | | $ | 2,642,867 | |

| PREDEX |

| NOTES TO FINANCIAL STATEMENTS (Continued) |

| April 30, 2018 |

| |

| (6) | DISTRIBUTIONS TO SHAREHOLDERS AND TAX COMPONENTS OF CAPITAL |

The tax character of distributions paid was as follows:

| | | Fiscal Year | | | Fiscal Year | |

| | | Ended April | | | Ended April | |

| | | 30, 2018 | | | 30, 2017 | |

| Long-term capital gain | | $ | 349,135 | | | $ | 67,733 | |

| Return of capital | | | 676,721 | | | | — | |

| | | $ | 1,025,856 | | | $ | 67,733 | |

| | | | | | | | | |

As of April 30, 2018, the components of accumulated earnings/ (deficit) on a tax basis were as follows:

| Post October Loss | | | Other Book/Tax | | | Net Unrealized | | | Total Accumulated | |

| and Late Year Loss | | | Differences | | | Appreciation | | | Earnings | |

| $ | (121,720 | ) | | $ | (77,595 | ) | | $ | 2,642,867 | | | $ | 2,443,552 | |

| | | | | | | | | | | | | | | |

The difference between book basis and tax basis accumulated net investment income/loss and unrealized appreciation from investments is primarily attributable to tax adjustments for partnerships.

Late year losses incurred after December 31 within the fiscal year are deemed to arise on the first business day of the following fiscal year for tax purposes. The Fund incurred and elected to defer such late year losses of $121,720.

For the year ended April 30, 2018, the following reclassifications, which had no impact on results of operations or net assets, were recorded to reflect tax character.

| | | | Undistributed Net | | | Accumulated Net | |

| Paid-in Capital | | | Investment Income | | | Realized (Loss) | |

| $ | (155,651 | ) | | $ | 236,676 | | | $ | (81,025 | ) |

| | | | | | | | | | | |

Pursuant to Rule 23c-3 under the Investment Company Act of 1940, as amended, the Fund offers shareholders on a quarterly basis the option of redeeming shares, at net asset value, of no less than 5% and no more than 25% of the shares outstanding. There is no guarantee that shareholders will be able to sell all of the shares they desire in a quarterly repurchase offer, although each shareholder will have the right to require the Fund to purchase up to and including 5% of such shareholder’s shares in each quarterly repurchase. Liquidity will be provided to shareholders only through the Fund’s quarterly repurchases.

During the year ended April 30, 2018, the Fund completed four quarterly repurchase offers. In those offers, the Fund offered to repurchase up to 5% (and an additional 2% at the Fund’s discretion) of the number of its outstanding shares as of the Repurchase Pricing Dates. The result of those repurchase offers were as follows:

| PREDEX |

| NOTES TO FINANCIAL STATEMENTS (Continued) |

| April 30, 2018 |

| | Repurchase | Repurchase | Repurchase | Repurchase |

| | Offer #1 | Offer #2 | Offer #3 | Offer #4 |

| Commencement Date | 6/28/2017 | 9/27/2017 | 12/28/2017 | 3/28/2018 |

| Repurchase Request Deadline | 7/28/2017 | 10/30/2017 | 1/30/2018 | 4/27/2018 |

| Repurchase Pricing Deadline | 7/28/2017 | 10/30/2017 | 1/30/2018 | 4/27/2018 |

| Net Asset Value as of Repurchase Pricing Date | $ 25.47 | $ 25.68 | $ 25.83 | $ 26.09 |

| Amount Repurchased | $ 1,215,952 | $ 217,871 | $ 282,403 | $ 489,681 |

| | | | | |

Management has evaluated subsequent events through the date of issuance of the financial statements, and determined that there are no other material events or transactions that would require recognition or disclosure in the Fund’s financial statements.

Report of independent Registered Public Accounting Firm

To the Board of Trustees and Shareholders of PREDEX

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities, includinq the portfolio of investments, of PREDEX (the Fund) as of April 30, 2018, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, the statement of cash flows for the year then ended and the financial highlights for each of the five years in the period then ended (collectively, the financial statements). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of April 30, 2018, and the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, the statement of cash flows for the year then ended and their financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audit. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audit in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Fund is not required to have, nor were we engaged to perform, an audit of their internal control over financial reporting. As part of our audit, we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audit included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audit also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. Our procedures included confirmation of securities owned as of April 30, 2018, by correspondence with the custodians, brokers and underlying fund managers. We believe that our audit provides a reasonable basis for our opinion.

We have served as the auditor to PREDEX since 2013

Denver, Colorado

June 29, 2018

| PREDEX |

| SUPPLEMENTAL INFORMATION (Unaudited) |

| April 30, 2018 |

| |

This chart provides information about the Trustees and Officers who oversee the Fund. Officers elected by the Trustees manage the day-to-day operations of the Fund and execute policies formulated by the Trustees. The following is a list of the Trustees and executive officers of the Trust and each person’s principal occupation over the last five years. The address of each Trustee and Officer is 17605 Wright Street, Suite 2, Omaha, Nebraska 68130 unless otherwise noted.

Independent Trustees

| Name, Address and Age | Position/Term

of Office* | Principal Occupation

During the Past Five

Years | Number of

Portfolios in

Fund

Complex**

Overseen by

Trustee | Other

Directorships

held by Trustee |

Carol A. Broad

Born: 1955 | Trustee since March 2013 | Trustee, San Diego City Employees’ Retirement System, April 2015 to present; Retired, March 2011 to March 2015; Director- Private Real Estate, Russell Investments, Inc. (investment adviser), Nov. 1999 to Feb. 2011. | 1 | None |

Addison Piper

Born: 1946 | Trustee since May 2013 | Director, Piper Jaffray Companies 2006 to present. | 1 | Leuthold Funds, Inc. (5 portfolios), Piper Jaffray Companies |

Dr. Kerry Vandell

Born: 1947 | Trustee since March 2016 | Professor and Director, Center for Real Estate, Merage School of Business, University of California – Irvine, July 2006 to June 2017; Professor Emeritus, University of California – Irvine, July 2017 to present; Founder and Principal, KDV Associates (economic and financial consulting), 1980 to present. | 1 | Steadfast Apt. REIT (Oct. 2013 to present) |

| PREDEX |

| SUPPLEMENTAL INFORMATION (Unaudited)(Continued) |

| April 30, 2018 |

| |

Officers

Name, Address***

and Age | Position/Term of

Office* | Principal Occupation

During the Past Five

Years | Number of

Portfolios in

Fund

Complex**

Overseen by

Trustee | Other

Directorships

held by Trustee |

J. Grayson Sanders

Born: 1940 | President since March 2013 | President and Chief Investment Officer, Managing Principal, Mission Realty Advisors, LLC (real estate advisory and investment banking), Feb., 2011 to present; None, Apr. 2010 to Jan. 2011; President, Steadfast Advisor Group, Mar. 2009 to Mar. 2010. | n/a | n/a |

Michael Achterberg

Born: 1963 | Treasurer since July 2013; Secretary since March 2017 | Chief Operating Officer, PREDEX Capital Management, Mar. 2013 to present; CFO/CCO, TriLinc Global (investment adviser), July 2012 to Oct. 2012; CFO, CSIP Group (private equity and investment banking), Nov. 2009 to Jan. 2012. | n/a | n/a |

William Kimme

Born: 1962 | Chief Compliance Officer since March 2013 | Senior Compliance Officer of Northern Lights Compliance Services, LLC (since 2011); Due Diligence and Compliance Consultant, Mick & Associates (August, 2009-September 2011). | n/a | n/a |

| * | The term of office for each Trustee and officer listed above will continue indefinitely. |

| ** | The term “Fund Complex” refers to the Fund. |

| *** | The address for all officers is c/o PREDEX, 17605 Wright Street, Suite 2, Omaha, NE 68130. |

The Fund’s Statement of Additional Information includes additional information about the Trustees and is available free of charge, upon request, by calling toll-free 1-877-940-7202.

| PRIVACY NOTICE |

| |

| FACTS | WHAT DOES PREDEX DO WITH YOUR PERSONAL INFORMATION? |

| | |

| Why? | Financial companies choose how they share your personal information. Federal law gives consumers the right to limit some but not all sharing. Federal law also requires us to tell you how we collect, share, and protect your personal information. Please read this notice carefully to understand what we do. |

| | |

| What? | The types of personal information we collect and share depend on the product or service you have with us. This information can include: |

| | ■ Social Security number ■ Assets ■ Retirement Assets ■ Transaction History ■ Checking Account Information | ■ Purchase History ■ Account Balances ■ Account Transactions ■ Wire Transfer Instructions |

| | | |

| | When you are no longer our customer, we continue to share your information as described in this notice. |

| | |

| How? | All financial companies need to share customers’ personal information to run their everyday business. In the section below, we list the reasons financial companies can share their customers’ personal information; the reasons PREDEX chooses to share; and whether you can limit this sharing. |

| | | |

| Reasons we can share your personal information | Does PREDEX

share? | Can you limit this

sharing? |

For our everyday business purposes –

such as to process your transactions, maintain your account(s), respond to court orders and legal investigations, or report to credit bureaus | Yes | No |

For our marketing purposes –

to offer our products and services to you | No | We don’t share |

| For joint marketing with other financial companies | No | We don’t share |

For our affiliates’ everyday business purposes –

information about your transactions and experiences | No | We don’t share |

For our affiliates’ everyday business purposes –

information about your creditworthiness | No | We don’t share |

| For nonaffiliates to market to you | No | We don’t share |

| Questions? | Call 1-877-940-7202 |

| Who we are |

| Who is providing this notice? | PREDEX |

| What we do |

| How does PREDEX protect my personal information? | To protect your personal information from unauthorized access and use, we use security measures that comply with federal law. These measures include computer safeguards and secured files and buildings. Our service providers are held accountable for adhering to strict policies and procedures to prevent any misuse of your nonpublic personal information. |

| How does PREDEX collect my personal information? | We collect your personal information, for example, when you ■ Open an account ■ Provide account information ■ Give us your contact information ■ Make deposits or withdrawals from your account ■ Make a wire transfer ■ Tell us where to send the money ■ Tells us who receives the money ■ Show your government-issued ID ■ Show your driver’s license We also collect your personal information from other companies. |

| Why can’t I limit all sharing? | Federal law gives you the right to limit only ■ Sharing for affiliates’ everyday business purposes – information about your creditworthiness ■ Affiliates from using your information to market to you ■ Sharing for nonaffiliates to market to you State laws and individual companies may give you additional rights to limit sharing. |

| Definitions |

| Affiliates | Companies related by common ownership or control. They can be financial and nonfinancial companies. ■ PREDEX does not share with our affiliates. |

| Nonaffiliates | Companies not related by common ownership or control. They can be financial and nonfinancial companies ■ PREDEX does not share with nonaffiliates so they can market to you. |

| Joint marketing | A formal agreement between nonaffiliated financial companies that together market financial products or services to you. ■ PREDEX doesn’t jointly market. |

| Investment Advisor |

| PREDEX Capital Management, LLC |

| 18500 Von Karman Ave, Suite 350 |

| Irvine, CA 92612 |

| |

| |

| Distributor |

| Northern Lights Distributors, LLC |

| 17605 Wright Street |

| Omaha, NE 68130 |

| |

| |

| Legal Counsel |

| Thompson Hine LLP |

| 41 South High Street, Suite 1700 |

| Columbus, OH 43215 |

| |

| |

| Independent Registered Public Accounting Firm |

| RSM US LLP |

| 555 Seventeenth Street, Suite 1000 |

| Denver, CO 80202 |

| |

| |

| |

| |

| |

| |

| |

| |

| |

How to Obtain Proxy Voting Information

Information regarding how the Fund voted proxies relating to portfolio securities for the 12 month period ended June 30th as well as a description of the policies and procedures that the Fund used to determine how to vote proxies is available without charge, upon request, by calling (877) 940-7202 or by referring to the Securities and Exchange Commission’s (“SEC”) website at http://www.sec.gov.

How to Obtain 1st and 3rd Fiscal Quarter Portfolio Holdings

The Fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. Form N-Q is available on the SEC’s website at http://www.sec.gov and may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC (1-800-SEC-0330). The information on Form N-Q is available without charge, upon request, by calling (877) 940-7202.

Item 2. Code of Ethics. Attached

(a) As of the end of the period covered by this report, the registrant has adopted a code of ethics that applies to the registrant's principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, regardless of whether these individuals are employed by the registrant or a third party.

(b) For purposes of this item, “code of ethics” means written standards that are reasonably designed to deter wrongdoing and to promote:

| (1) | Honest and ethical conduct, including the ethical handling of actual or apparent conflicts of interest between personal and professional relationships; |

| (2) | Full, fair, accurate, timely, and understandable disclosure in reports and documents that a registrant files with, or submits to, the Commission and in other public communications made by the registrant; |

(3) Compliance with applicable governmental laws, rules, and regulations;

| (4) | The prompt internal reporting of violations of the code to an appropriate person or persons identified in the code; and |

(5) Accountability for adherence to the code.

(c) Amendments: During the period covered by the report, there have not been any amendments to the provisions of the code of ethics.

(d) Waivers: During the period covered by the report, the registrant has not granted any express or implicit waivers from the provisions of the code of ethics.

(e) The Code of Ethics is not posted on Registrant’ website.

(f) A copy of the Code of Ethics is attached as an exhibit.

Item 3. Audit Committee Financial Expert.

(a) The Registrant’s board of trustees has determined that Carol A. Broad is a financial expert, as defined in Item 3 of Form N-CSR. Carol A. Broad is independent for purposes of this Item.

Item 4. Principal Accountant Fees and Services.

2018 - $36,750

2017 - $33,500

2018 - $0

2017 - $0

2018 - $5,250

2017 - $5,000

Preparation of Federal & State income tax returns, assistance with calculation of required income, capital gain and excise distributions and preparation of Federal excise tax returns.

2018 - $0

2017 - $0

| (e) | (1) Audit Committee’s Pre-Approval Policies |

The registrant’s Audit Committee is required to pre-approve all audit services and, when appropriate, any non-audit services (including audit-related, tax and all other services) to the registrant. The registrant’s Audit Committee also is required to pre-approve, when appropriate, any non-audit services (including audit-related, tax and all other services) to its adviser, or any entity controlling, controlled by or under common control with the adviser that provides ongoing services to the registrant, to the extent that the services may be determined to have an impact on the operations or financial reporting of the registrant. Services are reviewed on an engagement by engagement basis by the Audit Committee.

| (2) | Percentages of Services Approved by the Audit Committee |

| | | 2018 | | 2017 |

| Audit-Related Fees: | | | 0.00 | % | | | 0.00 | % |

| Tax Fees: | | | 0.00 | % | | | 0.00 | % |

| All Other Fees: | | | 0.00 | % | | | 0.00 | % |

| (f) | During the audit of registrant's financial statements for the most recent fiscal year, less than 50 percent of the hours expended on the principal accountant's engagement were attributed to work performed by persons other than the principal accountant's full-time, permanent employees. |

| (g) | The aggregate non-audit fees billed by the registrant's accountant for services rendered to the registrant, and rendered to the registrant's investment adviser (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser), and any entity controlling, controlled by, or under common control with the adviser that provides ongoing services to the registrant: |

2018 - $5,250

2017 - $5,000

(h) The registrant's audit committee has considered whether the provision of non-audit services to the registrant's investment adviser (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser), and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant, that were not pre-approved pursuant to paragraph (c)(7)(ii) of Rule 2-01 of Regulation S-X, is compatible with maintaining the principal accountant's independence.

Item 5. Audit Committee of Listed Companies. Not applicable

Item 6. Schedule of Investments. Schedule of investments in securities of unaffiliated issuers is included under Item 1.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Funds.

| 11.0 | Proxy Voting Procedures |

Section 206(4) of the Investment Advisers Act of 1940 addresses an investment adviser's fiduciary obligation to its clients when the adviser has authority to vote their proxies. In accordance with SEC Release No. IA-2106, the rule requires an investment adviser that exercises voting authority over client proxies to adopt policies and procedures reasonably designed to ensure that the adviser votes proxies in the best interests of clients, to disclose to clients information about those policies and procedures, and to disclose to clients how they may obtain information on how the adviser has voted their proxies. The rule must also describe how the adviser addresses and resolves material conflicts between its interests and those of its clients with respect to proxy voting. The rule amendments also require advisers to maintain certain records relating to proxy voting. The rule and rule amendments are designed to ensure that advisers vote proxies in the best interest of their clients and provide clients with information about how their proxies are voted.

| 11.1 | Voting Client Proxies |

Under the Advisers Act, an adviser is a fiduciary that owes each of its clients “duties of care and loyalty” with respect to all services undertaken on the client's behalf, including proxy voting. The duty of care requires an adviser with proxy voting authority to monitor corporate events and to vote the proxies. To satisfy its duty of loyalty, the adviser must cast the proxy votes in a manner consistent with the best interest of its client and must not subrogate client interests to its own.

Therefore, advisers that have implicit as well as explicit voting authority must comply with Rule 206(4)-6. The rule thus applies when the advisory contract is silent but the adviser's voting authority is implied by an overall delegation of discretionary authority. The rule does not apply, however, to advisers that provide clients with advice about voting proxies but do not have authority to vote the proxies.

The duty of care requires an adviser with voting authority to monitor corporate actions and vote client proxies. Therefore, the adviser should have procedures in place designed to ensure that it fulfills these duties. However, the SEC does not suggest that an adviser that fails to vote every proxy would necessarily violate its fiduciary obligations. For example, there may even be times when refraining from voting a proxy is in the client's best interest, such as when the adviser determines that the cost of voting the proxy exceeds the expected benefit to the client. However, an adviser may not ignore or be negligent in fulfilling its assumed obligations toward voting client proxies. ►►

Implementation Strategy

The Board has adopted Proxy Voting Policies and Procedures on behalf of the Trust, which delegate the responsibility for voting proxies to the Firm, subject to the Board's continuing oversight. The Policies require that the Firm vote proxies received in a manner consistent with the best interests of PREDEX and shareholders.

| 11.2 | Potential Conflicts of Interest |

An investment adviser may have a number of conflicts that can affect how it votes proxies. For example, an adviser may manage a pension plan, administer employee benefit plans, or provide brokerage, underwriting, insurance, or banking services to a company whose management is soliciting proxies.

Failure to vote in favor of management may harm the adviser's relationship with the company. The adviser may also have business or personal relationships with participants in proxy contests, corporate directors or candidates for directorships.

Therefore, in order to prevent material conflicts of interest from affecting the manner in which investment advisers may vote clients' proxies, SEC rule 206(4)-6 requires advisers to adopt and implement policies and procedures for voting proxies in the best interest of clients, to describe the procedures to clients, and to tell clients how they may obtain information about how the adviser has actually voted their proxies.

Under Rule 206(4)-6, it is a fraudulent, deceptive, or manipulative act, practice or course of business within the meaning of section 206(4) of the Act for an investment adviser to exercise voting authority with respect to client securities unless (i) the adviser has adopted and implemented written policies and procedures that are reasonably designed to ensure that the adviser votes proxies in the best interest of its clients; (ii) the adviser describes its proxy voting procedures to its clients and provides copies on request; and (iii) the adviser discloses to clients how they may obtain information on how the adviser voted their proxies. ►►

Implementation Strategy

The Board has adopted Proxy Voting Policies and Procedures on behalf of the Trust, which delegate the responsibility for voting proxies to the Firm, subject to the Board's continuing oversight. The Policies require that the Firm vote proxies received in a manner consistent with the best interests of PREDEX and shareholders. The Policies also require the Firm to present to the Board, at least annually, the Firm's Proxy Policies and a record of each proxy voted by the Firm on behalf of PREDEX, including a report on the resolution of all proxies identified by the Firm involving a conflict of interest.

| 11.3 | Resolving Conflicts of Interest |

According to the SEC’s position on resolving conflicts of interest, an adviser's policy of disclosing the conflict to clients and obtaining their consents before voting would satisfy the requirements of the rule and, when implemented, would fulfill the adviser's fiduciary obligations under the Advisers Act. However, in the absence of client disclosure and consent, an adviser that has a material conflict of interest with its clients must take other steps designed to ensure, and must be able to demonstrate that those steps resulted in, a decision to vote the proxies that was based on the clients' best interest and was not the product of the conflict.

Investment advisers may use various means of ensuring that proxy votes are voted in their clients' best interest and not affected by the advisers' conflicts of interest. Therefore, the following procedures detail how the Adviser may insulate its decision on how to vote client proxies from any perceived conflict. ►►

Implementation Strategy

The Board has adopted Proxy Voting Policies and Procedures on behalf of the Trust, which delegate the responsibility for voting proxies to the Firm, subject to the Board's continuing oversight. The Policies require that the Firm vote proxies received in a manner consistent with the best interests of PREDEX and shareholders. The Policies also require the Firm to present to the Board, at least annually, the Firm's Proxy Policies and a record of each proxy voted by the Firm on behalf of PREDEX, including a report on the resolution of all proxies identified by the Firm involving a conflict of interest.

| 11.4 | Description and Issuance of Proxy Voting Policy |

In accordance with Rule 206(4)-6, advisers are required to disclose how clients can obtain information from the adviser on how their securities were voted. The Rule also requires advisers to describe their proxy voting policies and procedures to clients, and upon request, to provide clients with a copy of those policies and procedures. The description should be a concise summary of the adviser's proxy voting process rather than a reiteration of the adviser's policies and procedures, and should indicate that a copy of the policies and procedures is available upon request. If a client requests a copy of the policies and procedures, the adviser must supply it.

Note: Although the SEC requires public disclosure as a means of informing fund shareholders how the fund (or its adviser) voted proxies of the shareholders' fund, public disclosure is unnecessary for advisers to communicate to each client how the adviser has voted that client's proxies. Because public disclosure of proxy votes by some advisers would potentially reveal client holdings and thus client confidence, the SEC has determined that advisers are not required to disclose their votes publicly.

Advisers may choose any means to make this disclosure, provided that it is clear, not "buried" in a longer document, and received by clients within 180 days after publication. For example, an adviser could send clients the disclosure together with a periodic account statement, deliver it in a separate mailing, or include it in its brochure (or Part 2 of Form ADV). Advisers that use their brochure or Part 2 to make the disclosure must deliver (not merely offer) the revised brochure to existing clients within 180 days after publication, and should accompany the delivery with a letter identifying the new disclosure. ►►

Implementation Strategy

The Firm may issue a brief summary disclosing its proxy voting process. Additionally, the disclosure information should also indicate that a copy of the Firm's full policies and procedures on proxy voting may be provided upon request.

| 11.5 | Record Keeping Requirements |

Under Rule 204-2, as amended, advisers must retain (i) their proxy voting policies and procedures; (ii) proxy statements received regarding client securities; (iii) records of votes they cast on behalf of clients;

(iv) records of client requests for proxy voting information, and (v) any documents prepared by the adviser that were material to making a decision how to vote, or that memorialized the basis for the decision. The amendments permit an adviser to rely on proxy statements filed on EDGAR instead of keeping its own copies, and to rely on proxy statements and records of proxy votes cast by the adviser that are maintained with a third party such as a proxy voting service, provided that the adviser has obtained an undertaking from the third party to provide a copy of the documents promptly upon request. ►►

Implementation Strategy

In accordance with Rule 204-2, as amended, the Firm will ensure that it is maintaining the following records:

■ proxy voting policies and procedures;

■ proxy statements received regarding client securities (unless such statement are filed through the EDGAR system);

■ records of votes cast by Adviser on behalf of clients (unless maintained with a third party such as a proxy voting service, provided that the Firm has obtained an undertaking from the third party to provide a copy of the documents promptly upon request );

■ records of client requests for proxy voting information, and

■ any documents prepared by the Firm that were material to making a decision how to vote, or that memorialized the basis for the decision.

Item 8. Portfolio Managers of Closed-End Management Investment Companies.

The management of the Registrant’s investment portfolio will be the responsibility of the Adviser and its Co-Portfolio Managers Grayson Sanders and Michael Achterberg.

J. Grayson Sanders

J. Grayson Sanders serves as President and Chief Investment Officer of the Adviser, a position he has held since the inception of the Adviser. Additionally, Mr. Sanders serves as Managing Principal of Mission Realty Advisors, LLC, a position held since February 2011. Mr. Sanders served as President of CNL Fund Advisors, Co., from 2004 to 2009 where he created and managed a global REIT mutual fund. He served from 2000 to 2004 as a Managing Director with AIG Global Real Estate Investment Corp. in New York, where he managed product development and capital formation for several international, opportunistic real estate funds for large institutional investors, investing in Europe, Asia and Mexico. Prior to AIG, Mr. Sanders was Executive Managing Director for CB Richard Ellis Investors where he was involved in product development and placement with institutional investors.

From 1991 to 1996 Mr. Sanders served as Director of Real Estate for the Ameritech Pension Trust in Chicago, where he managed the $1.5 billion real estate portfolio within the $13 billion defined benefit plan. In 1972, Mr. Sanders co-founded a real estate investment and consulting firm, The Landsing Corporation, which sponsored finite-life REITs and private partnerships. It grew to employ over 200 professionals. After serving as an officer in the U.S. Navy for four years, Mr. Sanders began his business career at Alex Brown & Sons, the Baltimore based investment banking firm.

Mr. Sanders served on the Boards of both the Pension Real Estate Association (PREA) and the National Association of Real Estate Investment Trusts (NAREIT) where he was co-chairman of its Institutional Investor Committee. He has also served on the boards of several non-profits. He was a lecturer at Stanford Business School in 1985 where he taught a course entitled, "Essentials of Real Estate Investment and Development". He has been a frequent speaker at trade association events and other forums over his entire career.

Mr. Sanders received a BA from the University of Virginia and an MBA from Stanford Business School where he was later President of the Alumni Association.

Michael Achterberg

Michael Achterberg serves as Chief Operating Officer of the Adviser, a position held since March 2013, and has 29 years of experience in the investment industry. He has extensive experience in fund management including due diligence, allocation of capital and general supervision for multi-manager funds. Previously, Mr. Achterberg served as Chief Financial Officer for more than two years at CITIC Securities International Partners which conducted China focused investment banking and private equity from offices in Los Angeles, New York, Hong Kong and Beijing. Prior to that he was a partner for 15 years at Strome Investment Management whose principal products were funds-of-funds and a global macro multi-manager strategy. Until 1994 he was an Audit Manager for Coopers & Lybrand working exclusively in the investment industry with advisers and funds. While there he served on the national quality review program for the Investment Company practice.

Other accounts managed by Portfolio Managers:

| | | | | |

| Other Accounts By Type | Total Number of Accounts by Account Type | Total Assets By Account Type | Number of Accounts by Type Subject to a Performance Fee | Total Assets By Account Type Subject to a Performance Fee |

| Registered Investment Companies | 0 | $0 | 0 | $0 |

| Other Pooled Investment Vehicles | 0 | $0 | 0 | $0 |

| Other Accounts | 0 | $0 | 0 | $0 |

Both Portfolio Managers receive a fixed salary.

As of April 30, 2018, the Portfolio Managers’ ownership of the Fund was as follows:

| Portfolio Manager | Dollar Range of Shares Owned |

| J. Grayson Sanders | $10,001 to $50,000 |

| Michael Achterberg | over $100,000 |

Item 9. Purchases of Equity Securities by Closed-End Funds. Not applicable