|

| |

| | Eversheds Sutherland (US) LLP 700 Sixth Street, NW, Suite 700

Washington, DC 20001-3980 D: +1 202.383.0937

F: +1 202.637.3593 cynthiabeyea@ eversheds-sutherland.com |

[Letterhead of Eversheds Sutherland (US) LLP]

September 7, 2017

VIA EDGAR

Jay Williamson, Esq.

Division of Investment Management

United States Securities and Exchange Commission

100 F Street, N.E.

Washington, D.C. 20549

Re: Pathway Energy Infrastructure Fund, Inc. – Preliminary Proxy Statement

Dear Mr. Williamson:

On behalf of Pathway Energy Infrastructure Fund, Inc. (the “Fund”) set forth below are the Fund’s responses to the oral comments provided by the staff of the Division of Investment Management (the “Staff”) of the Securities and Exchange Commission (the “SEC”) to the Fund on August 17, 2017 regarding the Fund’s Preliminary Proxy Statement on Schedule 14A (File No. 811-22807) (the “Proxy Statement”). References to the “Act” below refer to the Investment Company Act of 1940, as amended.

| |

| 1. | Please respond to our comments in writing and file your responses as correspondence on EDGAR. Where a comment asks for revised disclosure or revisions are contemplated by the response, please provide us with draft disclosure with the letter. Please allow us sufficient time to review the response prior to filing the definitive. |

Response: The Fund acknowledges the Staff’s comment. In order to allow the Staff to review the revisions, attached to this letter are marked versions of each of proposals 1 through 5 contained in the Proxy Statement showing the changes that have been made to those proposals in response to Staff comments.

| |

| 2. | Two of the proposals to be acted upon appear to require SEC exemptive relief. We note the reference to multiclass relief later in the document, but are unable to locate the order on which the Fund relies. In addition please describe for us any material terms and conditions associated with the order and explain how the Fund intends to comply with them. It may be appropriate to state that the Fund has complied with the terms and conditions of the order. |

Response: The Fund is relying on the order granted by the SEC in the matter of Vertical Capital Income Fund and Oakline Advisors, LLC, (IC Release No. 32766) issued on July 31, 2017 (the “Order”). The Order applies to any continuously offered registered closed-end investment company for which Oakline Advisors, LLC (“Oakline”) or any entity controlling, controlled by, or under common control with Oakline acts as investment advisor and which operates as an interval fund pursuant to Rule 23c-3. The Fund’s investment advisory, Pathway Energy Income Management, LLC, is under common control with Oakline.

The condition on the Fund’s reliance on the Order is set forth in SEC’s notice of proposed order (Investment Company Act Release No. 32723), dated July 3, 2017. The condition generally requires that the Fund comply with the provisions of rules 6c-10, 12b-1, 17d-3, 18f-3, 22d-1, and, where applicable, 11a-3 under the Act as if those rules applied to closed-end management investment companies, and with the FINRA Sales Charge Rule as if that rule applied to closed-end management investment companies. The Fund will comply with this condition and will revise its disclosure in the Proxy Statement to state that it will comply with the condition.

|

|

| Eversheds Sutherland (US) LLP is part of a global legal practice, operating through various separate and distinct legal entities, under Eversheds Sutherland. For a full description of the structure and a list of offices, please visit www.eversheds-sutherland.com. |

| |

| 3. | Please explain the rationale for the statement that the Fund is not part of a family of investment companies under the 1940 Act. |

Response: The Fund has reviewed the Staff’s comment and will add disclosure related to its family of investment companies in the Proxy Statement.

| |

| 4. | Please revise the discussion under “Suspension or Postponement of Mandatory Repurchase” to reference the board approval necessary to suspend or postpone mandatory repurchases. In addition, revise to address the notice that the Fund will provide to investors if the Fund suspends or postpones such repurchases. |

Response: The Fund has revised its disclosure accordingly.

| |

| 5. | For all proposals and specifically with regard to proposals 2 through 4, please provide additional disclosure explaining the implications and risks for investors if the proposal is approved. For example, under proposal 4, we note that the Fund does not address the negative consequences to investors if the Fund is no longer required to hold annual meetings. Please revise to fully inform the Fund’s shareholders of the implications of each proposal using clear, concise and understandable language. |

Response: The Fund has revised its disclosure accordingly.

| |

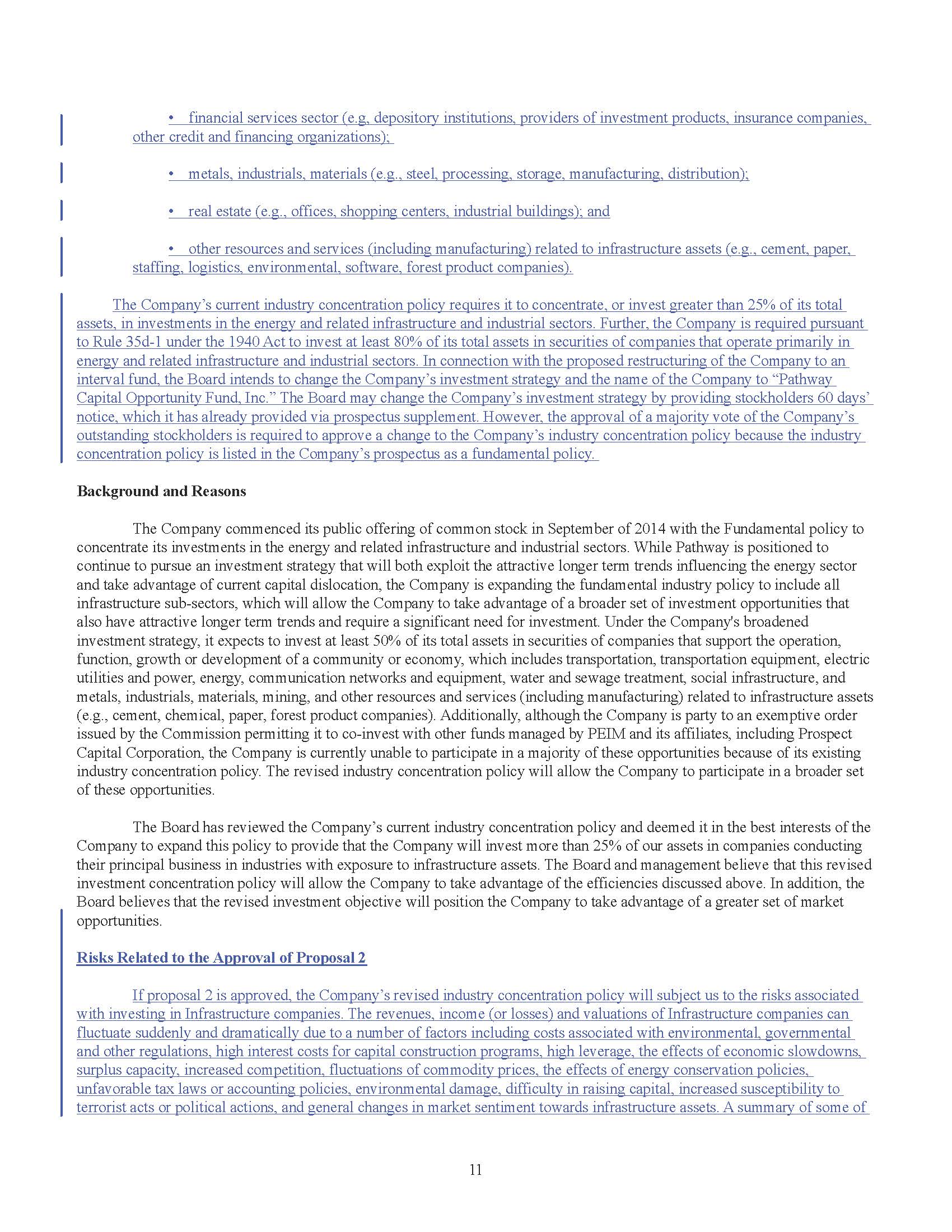

| 6. | As written, the definition of infrastructure assets and the Fund’s reference to companies conducting their principal business in industries with exposure to infrastructure assets are unclear and do not inform investors of the types of investments that will qualify. In addition, it is unclear whether the Fund has explained any new or incremental risks to investors as a result in the shift in concentration policies. Please revise or advise as appropriate. |

Response: The Fund has revised its disclosure to include a more detailed explanation of what it considers infrastructure companies and to provide examples of industries that it considers to have exposure to infrastructure assets.

| |

| 7. | Please revise the description for proposal 3 to explain what the first charter amendment is designed to accomplish. |

Response: The Fund has revised its disclosure accordingly.

| |

| 8. | It appears that proposal 3 includes two proposals, the first relates to the Fund’s ability to issue multiple share classes and the second relates to the forced conversion of existing shareholders. Please advise why shareholders are not being separately asked to approve the conversion into new share classes or include a separate vote. |

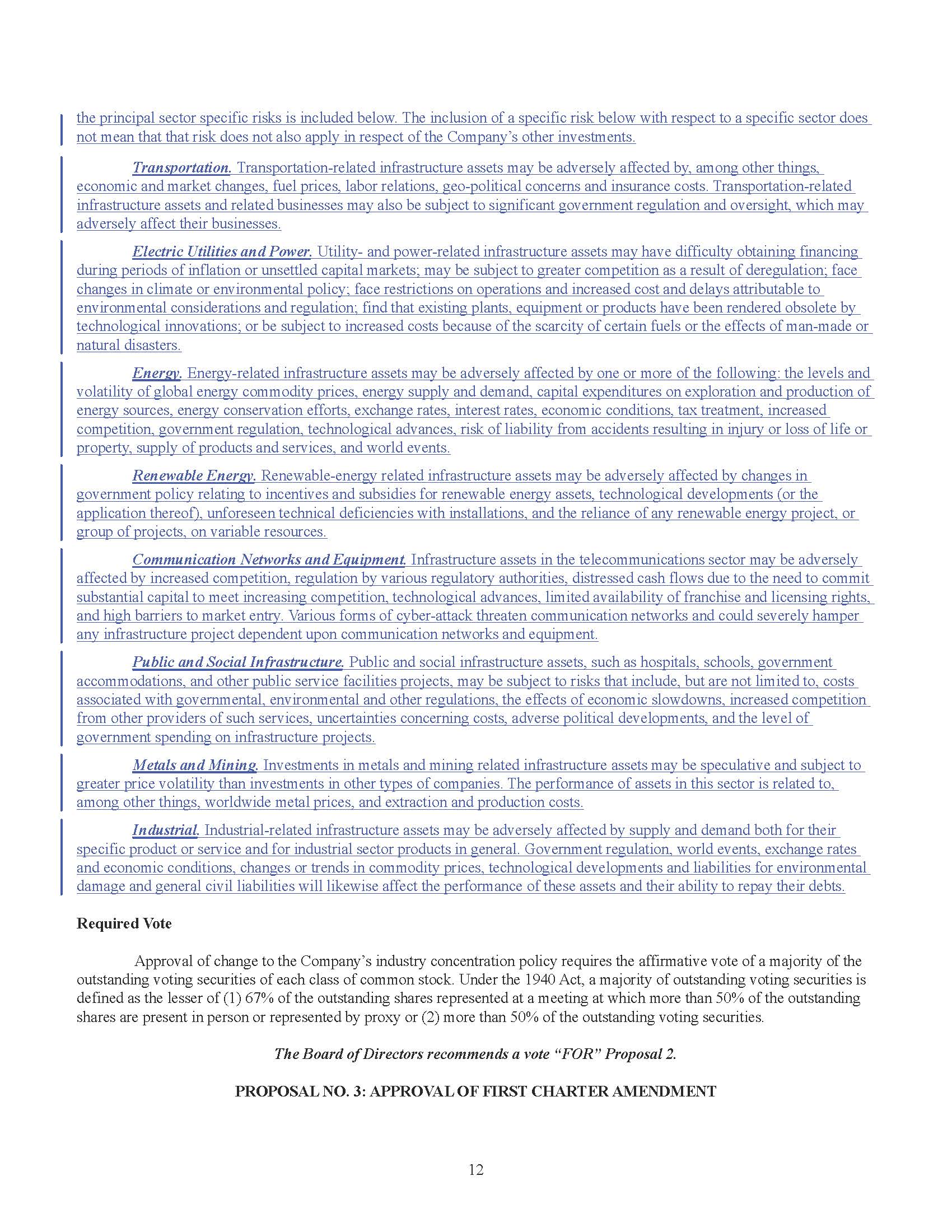

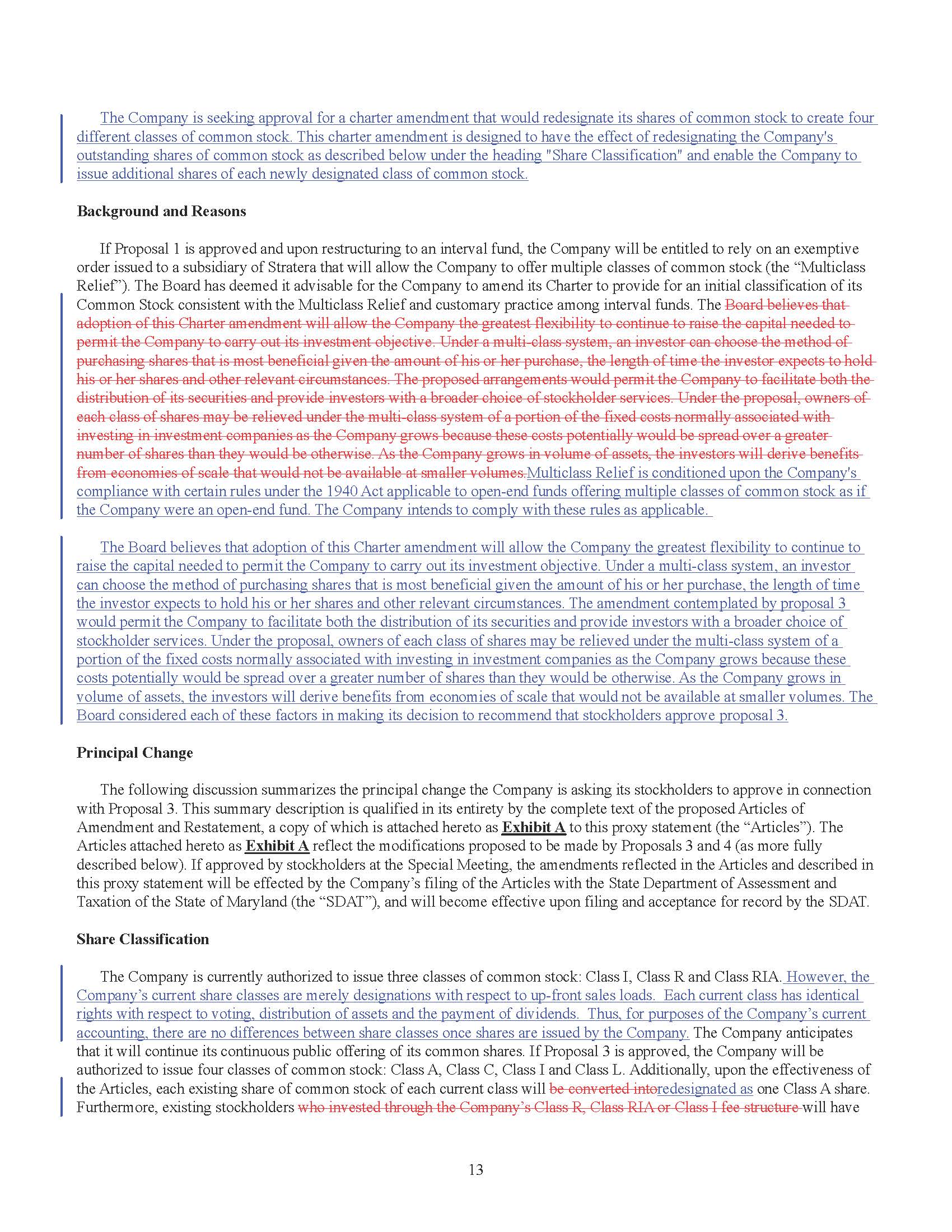

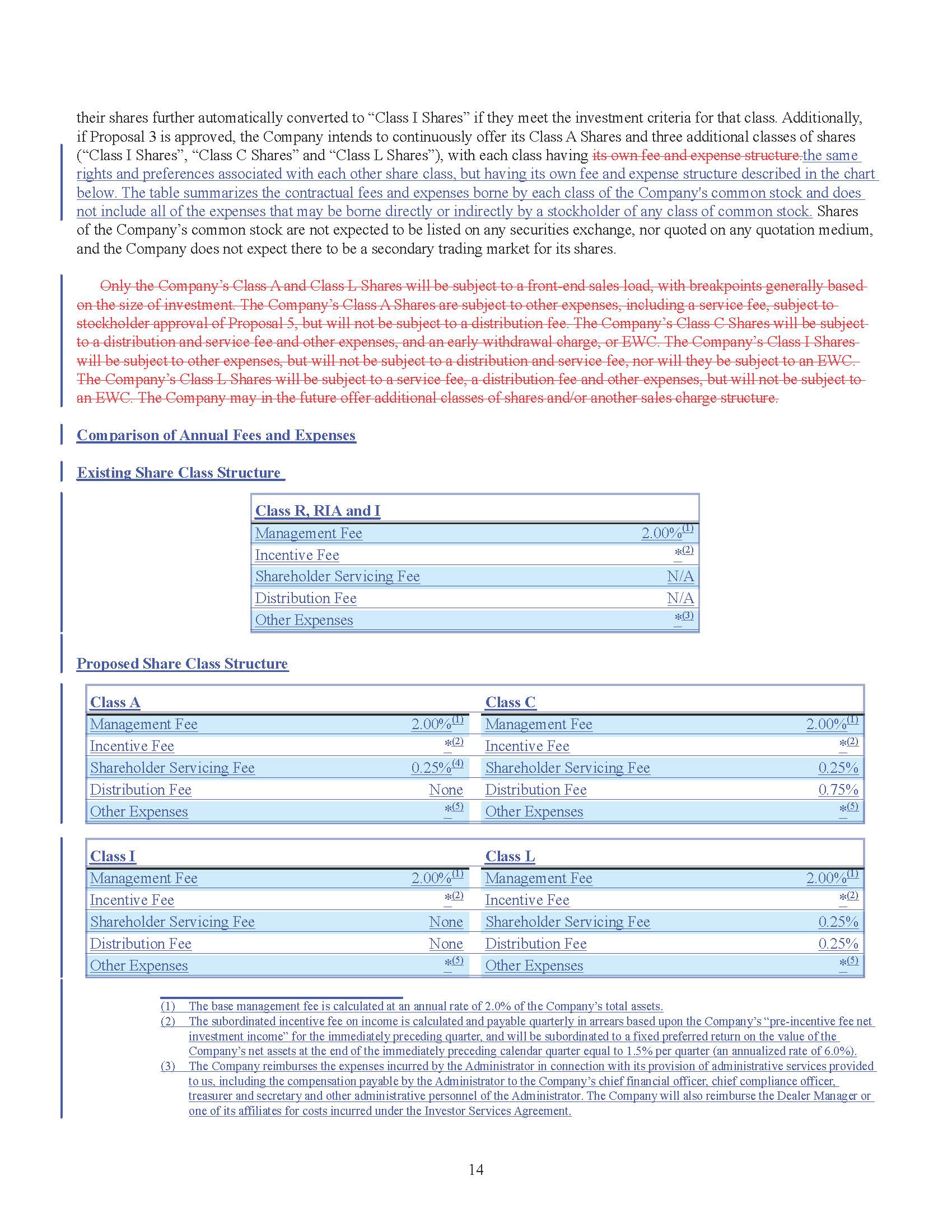

Response: The Fund advises the Staff that proposal 3 includes one proposal, the amendment of the Fund’s charter to revise its current common stock class structure. Specifically, the charter amendment will redesignate the Fund’s shares of common stock, authorizing the Fund to issue four classes of common stock. Once effective, the charter amendment will have the effect of changing the class designation of outstanding shares of common stock held by the Fund’s stockholders. The charter amendment will also have the effect of authorizing the Fund to issue additional shares of common stock in the classes created by the charter amendment. Although the adoption of this proposal will effect both of these outcomes, the proposal involves the Fund taking one action. Because these two outcomes are linked to the same corporate action, the Fund believes that it would not be appropriate to subject each to a separate vote.

| |

| 9. | The disclosure in proposal 3 suggest that proposal 1 must be approved in order for the Fund to be entitled to rely on the multiclass relief. However the disclosure under the heading “share classification” suggests that the Fund already has multiple share classes outstanding. Please explain. |

Response: The Fund advises the Staff that although it currently offers its shares of common stock in three “classes”, the “class” distinction is not the traditional multi-class structure, such as that contemplated in the Order. Instead, the Fund’s separate classes of common stock have identical rights with respect to voting, distribution of assets and the payment of dividends. Specifically, the classes are intended solely to clarify for potential investors the different sales loads that may be charged for an investment in the Fund, depending on the nature of the investor involved. The Fund conveyed this response in a letter to the Staff, dated April 16, 2013, in response to comments on the Fund’s registration statement (File Nos. 333-187877 and 811-22807).

| |

| 10. | We note the disclosure that upon the effectiveness of the Fund’s amended and restated charter, each existing share of common stock of each current class will be converted to one class A share and existing shareholders that invested through the Fund’s Class R, Class RIA or Class I fee structure will have their shares further automatically converted to Class I shares if they meet the investor criteria for that class. Please: |

| |

| i. | explain why class specific voting is not required for this proposal or revise to provide it; |

| |

| ii. | provide clear, concise and understandable disclosure of any material changes on a class by class basis; |

| |

| iii. | disclose the reasons why the board recommended the proposal; |

| |

| iv. | provide a comparison of old and new class terms, (i.e., fees and expenses and any rights and preferences, etc.); and |

| |

| v. | explain why the conversion is being done and how the Fund concluded it is exempt from Securities Act registration. |

Response: The Fund respectfully advises the Staff that specific class approval is not required, because the redesignation of shares contemplated by proposal 3 treats each of the Fund’s existing share classes the same.

The Fund has revised the disclosure in proposal 3 to describe any material changes on a class by class basis. The Fund has also revised its disclosure to describe the reasons why the board has recommended the proposal. Finally, by virtue of its disclosure regarding material changes on a class by class basis, the Fund provided the disclosure requested in romanette iv above.

While the Fund has described the transaction as a “conversion” in the Proxy Statement, the shares of common stock hold by its stockholders are not converting into a different security for the purposes of the Securities Act. Stockholders will continue to hold a share of common stock and the only difference upon the redesignation of such common stock will be the fees paid by investors in that class. Because the Fund is not offering a different security, the action stemming from the approval of proposal 3 will not constitute an offer and sale of a security subject to the registration requirements of Section 5 of the Securities Act.

| |

| 11. | Please revise the description of proposal 4 to explain what the charter amendment is designed to accomplish. |

Response: The Fund has revised the disclosure accordingly.

| |

| 12. | Please revise to explain why the board deemed it advisable and in the Fund’s interest to remove the requirement that they be periodically elected and replaced with an indefinite term. In responding, please note that our expectation is that the disclosure go beyond stating the fact that Maryland law permits this. Rather the Fund should explain why the board believes that annual director elections are an unnecessary expense. |

Response: The Fund has revised the disclosure to include the explanation requested by the Staff’s comment.

| |

| 13. | We note the reference to removing a bylaw provision that requires the Fund to hold an annual meeting. Please clarify whether the board is unilaterally amending the bylaws or seeking shareholder approval to do so. If the later, please clarify why this is not a separate proposal. |

Response: The Fund advises the Staff that its board of directors intends to unilaterally amend the Fund’s bylaws pursuant to its authority pursuant to Article XV of the Fund’s bylaws.

| |

| 14. | Under the heading “Section 16(a) Beneficial Ownership Reporting Compliance”, revise to provide the information requested by Item 405 of Regulation S-K. |

Response: The Fund will revise the disclosure to include the disclosure required by Item 405 of Regulation S-K.

| |

| 15. | In the second to last paragraph of the Audit Committee Report, it appears that the reference to the fiscal year ended June 30, 2016 be to the fiscal year ending June 30, 2017. Please revise. |

Response: The Fund will correct the date as noted by the Staff.

| |

| 16. | In Article 5 of the Amended and Restated Charter, it appears that Section 4.4 is misplaced or mislabeled, please advise. |

Response: The Fund will revise Section 4.4 to number it Section 5.4.

* * * * *

If you have any questions or additional comments concerning the foregoing, please contact the undersigned at (202) 383-0472.

Sincerely,

/s/Cynthia R. Beyea

Cynthia R. Beyea

cc: M. Grier Eliasek, Prospect Capital Management L.P.

Stanton Eigenbrodt, Stratera Holdings, LLC