UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22807

Pathway Capital Opportunity Fund, Inc.

(Exact name of registrant as specified in charter)

10 East 40th Street, 42nd Floor

New York, NY 10016

(Address of principal executive offices)

M. Grier Eliasek

Chief Executive Officer

Pathway Capital Opportunity Fund, Inc.

10 East 40th Street, 42nd Floor

New York, NY 10016

(Name and address of agent for service)

Registrant’s telephone number, including area code: (212) 448-0702

Date of fiscal year end: June 30

Date of reporting period: June 30, 2018

Item 1. Report to Stockholders.

The annual report to stockholders for the year ended June 30, 2018 is filed herewith pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended.

Pathway Capital Opportunity Fund, Inc. (“Company”) is an externally managed, non-diversified, closed-end investment management company that has registered as an investment company under the Investment Company Act of 1940, as amended (the “1940 Act”). We operate as an interval fund under Rule 23c-3 of the 1940 Act. As such, on October 25, 2017 we adopted a fundamental policy to make a mandatory repurchase offer of no less than 5% of the shares outstanding in each calendar quarter of each year, at a price equal to the net asset value (“NAV”) per share. We have elected to be treated for federal income tax purposes as a regulated investment company under Subchapter M of the Internal Revenue Code of 1986, as amended.

INVESTMENT STRATEGY

The Company’s investment strategy is to invest, under normal circumstances, at least 50% of our total assets, that is net assets plus borrowings, in securities of Infrastructure companies and Infrastructure-Related companies. The Company considers Infrastructure companies to include companies that derive at least 50% of their revenues, gross profit or EBITDA from the ownership, management, development, construction, maintenance, renovation, enhancement or operation of Infrastructure assets. The Company considers Infrastructure-Related companies to be those that derive at least 50% of their revenues, gross profit or EBITDA from providing products or services to Infrastructure companies. This investment strategy may be changed by our Board of Directors if we provide our stockholders with at least 60 days prior written notice. As part of our investment objective to generate current income, the Company can invest up to 50% of our total assets in other securities, including senior debt, subordinated debt, preferred equity, dividend paying equity and the equity and junior debt tranches of a type of pools of broadly syndicated loans known as Collateralized Loan Obligations, or “CLOs.” The CLOs include a diversified portfolio of broadly syndicated loans and do not have direct exposure to real estate or mortgages.

TABLE OF CONTENTS

|

| |

| |

| |

| | |

| Index to Financial Statements | |

| |

| 8 |

| |

| |

| |

| |

| | |

| 35 |

| 36 |

| 39 |

2018 ANNUAL REPORT

Pathway Capital Opportunity Fund, Inc. 3

Letter to Stockholders

Dear Stockholders,

We are pleased to present this annual report of Pathway Capital Opportunity Fund, Inc. (“we,” “us,” “our,” the “Company” or“ Pathway”) for the year ended June 30, 2018. Pathway paid distributions of approximately $0.86 per share during the year ended June 30, 2018.

Pathway’s net asset value (“NAV”) as of June 30, 2018 was $12.71 per Class A shares and $12.73 per Class I shares. The 6.1% and 5.9% decreases in NAV, respectively, from $13.53 per share as of June 30, 2017, is primarily due to a decrease in the unrealized fair market value of its portfolio holdings, including Jonah Energy LLC, Weatherford Bermuda, and collateralized loan obligation (“CLO”) investments. These decreases were partially offset by several positive cash realizations of Pathway’s bond investments during the year ended June 30, 2018.

None of Pathway’s debt investments were on non-accrual as of June 30, 2018.

M. Grier Eliasek

Chief Executive Officer

This letter may contain certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including statements regarding the future performance of Pathway Capital Opportunity Fund, Inc. Words such as “believes,” “expects,” and “future” or similar expressions are intended to identify forward-looking statements. Any such statements, other than statements of historical fact, are highly likely to be affected by unknowable future events and conditions, including elements of the future that are or are not under the control of Pathway Capital Opportunity Fund, Inc., and that Pathway Capital Opportunity Fund, Inc. may or may not have considered. Accordingly, such statements cannot be guarantees or assurances of any aspect of future performance. Actual developments and results may vary materially from any forward-looking statements. Such statements speak only as of the time when made. Pathway Capital Opportunity Fund, Inc. undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. We caution investors that the past performance described above is not indicative of future returns. Index and asset class performance quoted above does not reflect the fees, expenses or taxes that a stockholder may incur. The results described above may not be representative of our portfolio.

2018 ANNUAL REPORT

Pathway Capital Opportunity Fund, Inc. 4

|

| | | | | | | | | | | |

| Portfolio Composition - At a Glance |

| Top Ten Holdings |

| June 30, 2018 |

| Portfolio Company | | Investment | | Fair Value | | % of Net Assets |

| Brand Energy & Infrastructure Services, Inc. | | Senior Unsecured Bonds (8.50%, due 7/15/2025) | | $ | 1,017,427 |

| | 12.18 | % |

| Jonah Energy LLC | | Senior Unsecured Bonds (7.25%, due 10/15/2025) | | 811,964 |

| | 9.72 | % |

| NGL Energy Partners LP | | Senior Unsecured Bonds (6.88%, due 10/15/2021) | | 763,327 |

| | 9.14 | % |

| Ferrellgas Partners LP | | Senior Unsecured Bonds (8.63%, due 6/15/2020) | | 727,500 |

| | 8.71 | % |

| CSI Compressco LP | | Senior Unsecured Bonds (7.25%, due 8/15/2022) | | 687,188 |

| | 8.23 | % |

| Calumet Specialty Products | | Senior Unsecured Bonds (7.75%, due 4/15/2023) | | 551,287 |

| | 6.60 | % |

| Ace Cash Express, Inc. | | Senior Unsecured Bonds (12.00%, due 12/15/2022) | | 545,750 |

| | 6.53 | % |

| Hexion Inc. | | Senior Secured Bonds (6.63% due 4/15/2020) | | 516,038 |

| | 6.18 | % |

| Archrock Partners, LP | | Senior Unsecured Bonds (6.00%, due 4/1/2021) | | 499,028 |

| | 5.97 | % |

| Martin Midstream Partners LP | | Senior Unsecured Bonds (7.25%, due 2/15/2021) | | 495,000 |

| | 5.93 | % |

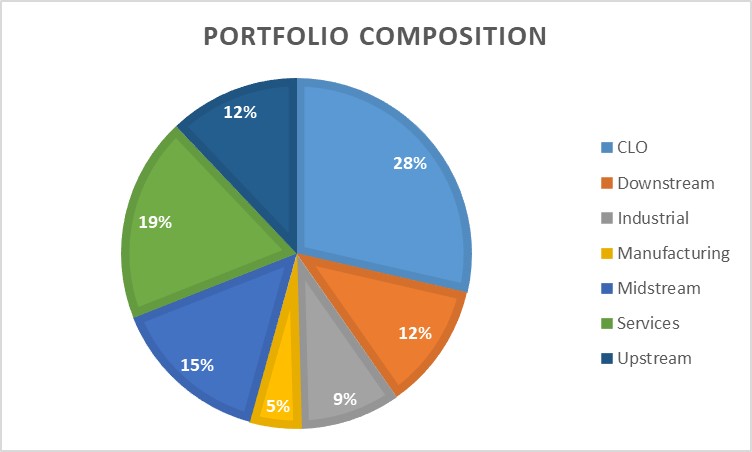

Portfolio Composition

Based on Fair Value

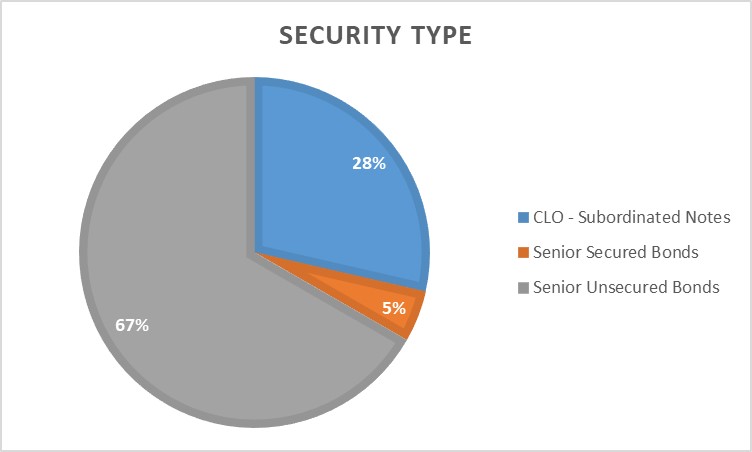

Security Type

2018 ANNUAL REPORT

Pathway Capital Opportunity Fund, Inc. 5

Report of Independent Registered Public Accounting Firm

Shareholders and Board of Directors

Pathway Capital Opportunity Fund, Inc.

New York, New York

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities of Pathway Capital Opportunity Fund, Inc. (the “Company”), including the schedule of investments, as of June 30, 2018, the related statements of operations and cash flows for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, and the related notes, including the financial highlights for each of the two years in the period then ended and the period from August 25, 2015 (the date non-affiliate shareholders were admitted into the Company) to June 30, 2016 (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Company at June 30, 2018, the results of its operations and its cash flows for the year then ended, the changes in its net assets for each of the two years in the period then ended, and its financial highlights for each of the two years in the period then ended and the period from August 25, 2015 (the date non-affiliate shareholders were admitted into the Company) to June 30, 2016, in conformity with accounting principles generally accepted in the United States of America.

Going Concern Uncertainty

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 2 to the financial statements, the Company has not raised sufficient capital to build a large enough portfolio to generate sufficient revenue to cover its operating expenses which raises substantial doubt about its ability to continue as a going concern. Management’s plans in regard to these matters are also described in Note 2. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

Basis for Opinion

These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on the Company’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits, we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of June 30, 2018, by correspondence with the custodian. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

/s/ BDO USA, LLP

We have served as the Company's auditor since 2013.

New York, New York

August 29, 2018

2018 ANNUAL REPORT

Pathway Capital Opportunity Fund, Inc. 6

|

| | | | | | | | |

| Statement of Assets and Liabilities |

| As of June 30, 2018 |

| | | | | | | |

| Assets |

| Investments, at fair value (amortized cost $11,296,565) | $ | 10,940,179 |

|

| Cash | 587,722 |

|

| Interest receivable | 173,755 |

|

| Due from Adviser (Note 7) | 118,109 |

|

| Deferred offering costs (Note 7) | 64,500 |

|

| Prepaid expenses | 24,899 |

|

| Due from Affiliate (Note 7) | 12,018 |

|

| | | | | Total assets | 11,921,182 |

|

| Liabilities |

| Due to Adviser (Note 7) | 1,975,233 |

|

| Revolving Credit Facility (Note 6) | 1,350,000 |

|

| Accrued expenses | 128,323 |

|

| Due to Administrator (Note 7) | 45,833 |

|

| Dividends payable | 42,568 |

|

| Due to Affiliates (Note 7) | 20,953 |

|

| Interest payable | 5,108 |

|

| | | | | Total liabilities | 3,568,018 |

|

| Commitments and contingencies (Note 11) | — |

|

| Net assets | $ | 8,353,164 |

|

| | | | | | | |

| Components of net assets: | |

| Common stock, $0.01 par value (Note 5) | $ | 6,574 |

|

| Additional paid-in capital | 8,853,330 |

|

| Net unrealized loss on investments | (356,386 | ) |

| Accumulated net realized gain on investments | 37,548 |

|

| Accumulated net investment (loss) | (187,902 | ) |

| Net assets | $ | 8,353,164 |

|

2018 ANNUAL REPORT

Pathway Capital Opportunity Fund, Inc. 7

|

| | | |

| Statement of Assets and Liabilities (continued) |

| As of June 30, 2018 |

|

|

|

|

|

| Class A |

|

| Net assets | $ | 7,933,028 |

|

| Shares authorized | 70,000,000 |

|

| Par value | $ | 0.01 |

|

| Shares outstanding | 624,354 |

|

| Net asset value and redemption price per share | $ | 12.71 |

|

|

|

| Class I |

|

| Net assets | $ | 420,136 |

|

| Shares authorized | 40,000,000 |

|

| Par value | $ | 0.01 |

|

| Shares outstanding | 33,016 |

|

| Net asset value and redemption price per share | $ | 12.73 |

|

|

|

| Class C |

|

| Net assets | $ | — |

|

| Shares authorized | 40,000,000 |

|

| Par value | $ | 0.01 |

|

| Shares outstanding | — |

|

| Net asset value and redemption price per share | $ | — |

|

|

|

| Class L |

|

| Net assets | — |

|

| Shares authorized | 50,000,000 |

|

| Par value | $ | 0.01 |

|

| Shares outstanding | — |

|

| Net asset value and redemption price per share | $ | — |

|

| | |

| See accompanying notes to financial statements. |

2018 ANNUAL REPORT

Pathway Capital Opportunity Fund, Inc. 8

|

| | | | | | | | |

| Statement of Operations |

| For the year ended June 30, 2018 |

| | |

| Investment income | |

| Interest Income from bonds | $ | 823,444 |

|

| Interest Income from CLOs | 474,873 |

|

| | | | | Total investment income | 1,298,317 |

|

| Expenses | |

| Amortization of offering costs (Note 7) | 358,608 |

|

| Administrator costs (Note 7) | 357,995 |

|

| Base management fees (Note 7) | 264,101 |

|

| Adviser shared service expense (Note 7) | 216,184 |

|

| Valuation services | 145,457 |

|

| Audit and tax expense | 178,947 |

|

| Transfer agent fees and expenses | 132,577 |

|

| Insurance expense | 111,403 |

|

| Interest expense | 67,195 |

|

| Report and notice to shareholders | 56,160 |

|

| Legal expense | 49,565 |

|

| General and administrative | 27,620 |

|

| Due diligence expense | 16,463 |

|

| Shareholder servicing fees (Class A only) | 11,382 |

|

| Excise tax expense | (8,777 | ) |

| | | | | Total expenses | 1,984,880 |

|

| | | | | Expense limitation payment (Note 7) | (748,696 | ) |

| | | | | Expense support payment (Note 7) | (456,660 | ) |

| | | | | Net expenses | 779,524 |

|

| | | | | Net investment income | 518,793 |

|

| Net realized and unrealized gain (loss) on investments | |

| Net realized gain on investments | 181,008 |

|

| Net increase in unrealized loss on investments | (704,926 | ) |

| | | | | Net realized and unrealized loss on investments | (523,918 | ) |

| Net decrease in net assets resulting from operations | $ | (5,125 | ) |

| |

| See accompanying notes to financial statements. |

2018 ANNUAL REPORT

Pathway Capital Opportunity Fund, Inc. 9

|

| | | | | | | | | | | | |

| Statements of Changes in Net Assets |

| | | | | | | | | |

| | | | | | | Year Ended | | Year Ended |

| | | | | | | June 30, 2018 | | June 30, 2017 |

| | | | | | |

| | |

| Net increase in net assets resulting from operations: | | | |

| Net investment income | $ | 518,793 |

| | $ | 389,875 |

|

| Net realized gain on investments | 181,008 |

| | 17,839 |

|

| Net increase (decrease) in unrealized gain on investments | (704,926 | ) | | 357,968 |

|

| | | | | Net increase (decrease) in net assets resulting from operations | (5,125 | ) | | 765,682 |

|

| Distributions to shareholders: | | | |

| Return of capital distributions (Note 8) |

| |

|

| | | Class A (previously Class R) (Note 5) | (383,998 | ) | | (477,100 | ) |

| | | Class I (previously Class RIA and I) (Note 5) | (20,222 | ) | | (27,415 | ) |

| Capital gain (Note 8) | | | |

| | | Class A (previously Class R) (Note 5) | (153,184 | ) | | — |

|

| | | Class I (previously Class RIA and I) (Note 5) | (8,115 | ) | | — |

|

| | | | | Total distributions to shareholders | (565,519 | ) | | (504,515 | ) |

| Capital transactions: | | | |

| Gross proceeds from shares sold (Note 5) | 789,900 |

| | 2,102,877 |

|

| Commissions and fees on shares sold (Note 7) | (51,969 | ) | | (163,700 | ) |

| Reinvestment of distributions (Note 5) | 283,674 |

| | 230,005 |

|

| Repurchase of common shares (Note 5) | (503,541 | ) | | (15,837 | ) |

| Offering costs (Note 7) | — |

| | 14,877 |

|

| | | | | Net increase in net assets from capital transactions | 518,064 |

| | 2,168,222 |

|

| | | | | Total (decrease)/increase in net assets | (52,580 | ) | | 2,429,389 |

|

| Net assets: | | | |

| Beginning of year | 8,405,744 |

| | 5,976,355 |

|

End of year(a) | $ | 8,353,164 |

| | $ | 8,405,744 |

|

| | | | | | | | | |

(a) Includes accumulated net investment loss of (Note 9): | $ | (187,902 | ) | | $ | (424,002 | ) |

| |

| See accompanying notes to financial statements. |

2018 ANNUAL REPORT

Pathway Capital Opportunity Fund, Inc. 10

|

| | | | | | | | |

| Statement of Cash Flows |

| For the year ended June 30, 2018 |

| | | | | | | |

| Cash flows provided by operating activities: | |

| Net decrease in net assets resulting from operations | $ | (5,125 | ) |

| Adjustments to reconcile net decrease in net assets resulting from operations to | |

| net cash provided by operating activities: | |

| Amortization of offering costs | 358,608 |

|

| Purchases of investments | (4,551,898 | ) |

| Proceeds from sales and redemptions of investments | 5,230,764 |

|

| Net increase in unrealized loss on investments | 704,926 |

|

| Net realized gain on investments | (181,008 | ) |

| Accretion of purchase discount on investments, net | (82,530 | ) |

| Decrease (Increase) in operating assets: | |

| Due from Adviser (Note 7) | (118,109 | ) |

| Due from Affiliate (Note 7) | (12,018 | ) |

| Deferred offering costs (Note 7) | (227,362 | ) |

| Interest receivable | (5,413 | ) |

| Prepaid expenses | 4,473 |

|

| Increase (Decrease) in operating liabilities: | |

| Due to Adviser (Note 7) | 119,558 |

|

| Due to Affiliates (Note 7) | 13,744 |

|

| Interest payable | 116 |

|

| Due to Administrator (Note 7) | 13,302 |

|

| Accrued expenses | 39,323 |

|

| Net cash provided by operating activities | 1,301,351 |

|

| Cash flows used in financing activities: | |

| Gross proceeds from shares sold (Note 5) | 809,900 |

|

| Commissions and fees on shares sold (Note 7) | (52,366 | ) |

| Distributions paid to stockholders | (293,792 | ) |

| Repurchase of common shares (Note 5) | (503,541 | ) |

| Borrowings under Revolving Credit Facility (Note 6) | 325,000 |

|

| Repayments under Revolving Credit Facility (Note 6) | (1,600,000 | ) |

| Net cash used in financing activities | (1,314,799 | ) |

| Net decrease in cash | (13,448 | ) |

| Cash, beginning of year | 601,170 |

|

| Cash, end of year | $ | 587,722 |

|

| | |

| Supplemental information | |

| Value of shares issued through reinvestment of distributions | $ | 283,674 |

|

| Interest paid during the year | $ | 67,079 |

|

| | |

| See accompanying notes to financial statements. |

2018 ANNUAL REPORT

Pathway Capital Opportunity Fund, Inc. 11

|

| | | | | | | | | | | | | | |

| Schedule of Investments |

| As of June 30, 2018 |

|

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | June 30, 2018 |

Portfolio Investments (1) | | Industry | | Sector (2) | | Coupon/Yield | | Legal Maturity | | Principal Amount | | Amortized Cost | | Fair Value (3) | | % of Net Assets |

| |

LEVEL 2 PORTFOLIO INVESTMENTS (4) |

| Senior Unsecured Bonds | | | | | | | | | | | | | | | | |

| Ace Cash Express, Inc. | | Financial | | Services | | 12.00 | % | | 12/15/2022 | | $ | 500,000 |

| | $ | 493,110 |

| | $ | 545,750 |

| | 6.5 | % |

| Archrock Partners, LP | | Energy | | Services | | 6.00 | % | | 4/1/2021 | | 500,000 |

| | 497,145 |

| | 499,027 |

| | 6.0 | % |

| Brand Energy & Infrastructure Services, Inc. | | Energy | | Industrial | | 8.50 | % | | 7/15/2025 | | 1,000,000 |

| | 1,000,000 |

| | 1,017,427 |

| | 12.2 | % |

| Calumet Specialty Products | | Energy | | Downstream | | 7.75 | % | | 4/15/2023 | | 550,000 |

| | 523,838 |

| | 551,287 |

| | 6.6 | % |

| Carrizo Oil and Gas, Inc. | | Energy | | Upstream | | 7.50 | % | | 9/15/2020 | | 191,000 |

| | 193,012 |

| | 192,074 |

| | 2.3 | % |

| CSI Compressco LP | | Energy | | Services | | 7.25 | % | | 8/15/2022 | | 750,000 |

| | 675,537 |

| | 687,188 |

| | 8.2 | % |

| Ferrellgas Partners LP | | Energy | | Downstream | | 8.63 | % | | 6/15/2020 | | 750,000 |

| | 750,000 |

| | 727,500 |

| | 8.7 | % |

| Global Partners LP | | Energy | | Midstream | | 7.00 | % | | 6/15/2023 | | 350,000 |

| | 330,947 |

| | 349,540 |

| | 4.2 | % |

| Jonah Energy LLC | | Energy | | Upstream | | 7.25 | % | | 10/15/2025 | | 1,000,000 |

| | 1,000,000 |

| | 811,964 |

| | 9.7 | % |

| Martin Midstream Partners LP | | Energy | | Midstream | | 7.25 | % | | 2/15/2021 | | 500,000 |

| | 484,935 |

| | 495,000 |

| | 5.9 | % |

| NGL Energy Partners LP | | Energy | | Midstream | | 6.88 | % | | 10/15/2021 | | 750,000 |

| | 745,753 |

| | 763,327 |

| | 9.1 | % |

| RSP Permian, Inc. | | Energy | | Upstream | | 6.63 | % | | 10/1/2022 | | 300,000 |

| | 292,376 |

| | 315,397 |

| | 3.8 | % |

| Weatherford Bermuda | | Energy | | Services | | 9.88 | % | | 3/1/2039 | | 350,000 |

| | 322,886 |

| | 340,764 |

| | 4.1 | % |

| | | | | Total Senior Unsecured Bonds | | | $ | 7,309,539 |

| | $ | 7,296,245 |

| | 87.3 | % |

| | | | | | | | | | | | | | | | | |

| Senior Secured Bonds |

| Hexion Inc. | | Chemicals | | Manufacturing | | 6.63 | % | | 4/15/2020 | | $ | 550,000 |

| | $ | 524,156 |

| | $ | 516,038 |

| | 6.2 | % |

| Total Senior Secured Bonds | | | $ | 524,156 |

| | $ | 516,038 |

| | 6.2 | % |

| | | | | | | | | | | | | | | | | |

| Total Level 2 Portfolio Investments | | | $ | 7,833,695 |

| | $ | 7,812,283 |

| | 93.5 | % |

2018 ANNUAL REPORT

Pathway Capital Opportunity Fund, Inc. 12

|

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | June 30, 2018 |

Portfolio Investments (1) | | Industry | | Sector (2) | | Coupon/Yield | | Legal Maturity | | Principal Amount | | Amortized Cost | | Fair Value (3) | | % of Net Assets |

| LEVEL 3 PORTFOLIO INVESTMENTS |

CLO - subordinated notes(5)(6) |

| Carlyle Global Market Strategies CLO 2014-4-R, Ltd. | | Structured Finance | | N/A | | 20.67 | % | | 7/15/2030 | | $ | 250,000 |

| | $ | 174,970 |

| | $ | 184,133 |

| | 2.2 | % |

| Carlyle Global Market Strategies CLO 2017-5, Ltd. | | Structured Finance | | N/A | | 15.86 | % | | 1/22/2030 | | 500,000 |

| | 506,401 |

| | 457,386 |

| | 5.5 | % |

| Galaxy XIX CLO, Ltd. | | Structured Finance | | N/A | | 12.13 | % | | 7/24/2030 | | 250,000 |

| | 166,384 |

| | 139,761 |

| | 1.7 | % |

GoldenTree 2013-7A, Ltd.(7) | | Structured Finance | | N/A | | — | % | | 10/29/2026 | | 250,000 |

| | 73,064 |

| | 55,357 |

| | 0.7 | % |

| GoldenTree Loan Opportunities IX, Ltd. | | Structured Finance | | N/A | | 12.84 | % | | 10/29/2026 | | 250,000 |

| | 180,520 |

| | 168,922 |

| | 2.0 | % |

Madison Park Funding XIII,

Ltd. | | Structured Finance | | N/A | | 18.76 | % | | 4/22/2030 | | 250,000 |

| | 176,111 |

| | 166,338 |

| | 2.0 | % |

Madison Park Funding XIV,

Ltd. | | Structured Finance | | N/A | | 17.32 | % | | 7/20/2026 | | 250,000 |

| | 194,188 |

| | 190,356 |

| | 2.3 | % |

| Octagon Investment Partners XIV, Ltd. | | Structured Finance | | N/A | | 18.07 | % | | 7/16/2029 | | 850,000 |

| | 506,864 |

| | 431,794 |

| | 5.2 | % |

| Octagon Investment Partners XXI, Ltd. | | Structured Finance | | N/A | | 19.37 | % | | 11/14/2026 | | 300,000 |

| | 181,468 |

| | 190,379 |

| | 2.3 | % |

| Octagon Investment Partners 30, Ltd. | | Structured Finance | | N/A | | 15.73 | % | | 3/17/2030 | | 475,000 |

| | 454,309 |

| | 398,348 |

| | 4.8 | % |

| OZLM XII, Ltd. | | Structured Finance | | N/A | | 10.53 | % | | 4/30/2027 | | 275,000 |

| | 216,577 |

| | 166,721 |

| | 2.0 | % |

| Voya IM CLO 2013-1, Ltd. | | Structured Finance | | N/A | | 16.20 | % | | 10/15/2030 | | 278,312 |

| | 179,813 |

| | 163,625 |

| | 1.9 | % |

| Voya CLO 2016-1, Ltd. | | Structured Finance | | N/A | | 20.90 | % | | 1/21/2031 | | 250,000 |

| | 208,899 |

| | 212,472 |

| | 2.5 | % |

| THL Credit Wind River 2013-1 CLO, Ltd. | | Structured Finance | | N/A | | 16.13 | % | | 7/30/2030 | | 325,000 |

| | 243,302 |

| | 202,304 |

| | 2.4 | % |

| Total CLO - subordinated notes | | | $ | 3,462,870 |

| | $ | 3,127,896 |

| | 37.5 | % |

| | | | | | | | | | | | | | | | | |

| Total Level 3 Portfolio Investments | | | $ | 3,462,870 |

| | $ | 3,127,896 |

| | 37.5 | % |

| | | | | | | |

| Total Portfolio Investments | | $ | 11,296,565 |

| | $ | 10,940,179 |

| | 131.0 | % |

| Liabilities in excess of other assets | | | | (2,070,977 | ) | | (24.8 | )% |

| Net Assets | | | | $ | 8,353,164 |

| | 100.0 | % |

| |

(1) The Company does not "control" and is not an "affiliate" of any of the portfolio investments, each term as defined in the Investment Company Act of 1940, as amended (the "1940 Act"). In general, under the 1940 Act, the Company would be presumed to "control" a portfolio company if the Company owned 25% or more of its voting securities and would be an "affiliate" of a portfolio company if the Company owned 5% or more of its voting securities. |

(2) The upstream sector includes businesses that locate, develop or extract energy in its most basic, raw form. The midstream sector includes businesses that process, gather, transport, ship, transmit or store raw energy resources or by-products in a form suitable for refining or power generation. The downstream sector includes businesses that refine, market or distribute energy to end-user customers. |

(3) Fair value is determined by or under the direction of the Company's Board of Directors (see Note 3). |

(4) All Level 2 securities are pledged as collateral supporting the amounts outstanding under a revolving credit facility with BNP Paribas Prime Brokerage International, Ltd. that was closed on August 25, 2015. |

(5) The CLO subordinated notes and preference/preferred shares are considered equity positions in the Collateralized Loan Obligations (“CLOs”). The CLO equity investments are entitled to recurring distributions which are generally equal to the excess cash flow generated from the underlying investments after payment of the contractual payments to debt holders and fund expenses. The current estimated yield is based on the current projections of this excess cash flow taking into account assumptions which have been made regarding expected prepayments, losses and future reinvestment rates. These assumptions are periodically reviewed and adjusted. Ultimately, the actual yield may be higher or lower than the estimated yield if actual results differ from those used for the assumptions. |

(6) All CLO subordinated notes are co-investments with other entities managed by an affiliate of the Adviser (see Note 7). |

(7) Security was called for redemption and the liquidation of the underlying loan portfolio is ongoing. | | |

| |

| See accompanying notes to financial statements. |

2018 ANNUAL REPORT

Pathway Capital Opportunity Fund, Inc. 13

Notes to Financial Statements

June 30, 2018

Note 1. Principal Business and Organization

Pathway Capital Opportunity Fund, Inc. (formerly known as Pathway Energy Infrastructure Fund, Inc.) (the “Company,” “us,” “our,” or “we”) was incorporated under the general corporation laws of the State of Maryland on February 19, 2013 and was inactive from that date to August 25, 2015 except for matters relating to its organization and registration as an externally managed, non-diversified, closed-end investment company under the Investment Company Act of 1940, as amended (“1940 Act”). In addition, the Company has elected to be treated for tax purposes as a regulated investment company, or “RIC,” under Subchapter M of the Internal Revenue Code of 1986, as amended (the “Code”). On August 25, 2015, the Company satisfied its minimum offering requirement by raising over $2.5 million from selling shares to persons not affiliated with the Company or the Adviser, defined below, (the “Minimum Offering Requirement”), and as a result, broke escrow and commenced making investments. The Company’s investment objective is to generate current income and, as a secondary objective, long-term capital appreciation. To achieve this investment objective, the Company’s investment strategy is to invest, under normal circumstances, at least 50% of our total assets, that is net assets plus borrowings, in securities of Infrastructure companies and Infrastructure-Related companies. The Company considers Infrastructure companies to include companies that derive at least 50% of their revenues, gross profit or EBITDA from the ownership, management, development, construction, maintenance, renovation, enhancement or operation of Infrastructure assets. The Company considers Infrastructure-Related companies to be those that derive at least 50% of their revenues, gross profit or EBITDA from providing products or services to Infrastructure companies. This investment strategy may be changed by our Board of Directors (the “Board”) if we provide our stockholders with at least 60 days prior written notice. As part of our investment objective to generate current income, the Company can invest up to 50% of our total assets in other securities, including senior debt, subordinated debt, preferred equity, dividend paying equity and the equity and junior debt tranches of a type of pools of broadly syndicated loans known as Collateralized Loan Obligations, or “CLOs.” The CLOs include a diversified portfolio of broadly syndicated loans and do not have direct exposure to real estate or mortgages.

On October 31, 2017, the Company converted to an interval fund. An interval fund is a closed-end management investment company that has adopted a fundamental policy to conduct periodic repurchases of its outstanding shares of common stock pursuant to Rule 23c-3 of the 1940 Act. Additionally, the Company began offering its shares on a continuous basis with this change. Also at this time, the Company changed its industry concentration policy from concentrating its investments in the energy and related infrastructure and industrial sectors to investing more than 25% of its assets in companies conducting their principal business in industries with exposure to Infrastructure assets. Further, the Company was required, pursuant to Rule 35d-1 under the 1940 Act, to invest at least 80% of its total assets in securities of companies that operate primarily in energy and related infrastructure and industrial sectors. In connection with the restructuring of the Company to an interval fund, the Board changed the Company’s investment strategy and the name of the Company from Pathway Energy Infrastructure Fund, Inc. to Pathway Capital Opportunity Fund, Inc.

The Company is managed by Pathway Capital Opportunity Fund Management, LLC (formerly know as Pathway Energy Infrastructure Management, LLC) (the “Adviser”), that is registered as an investment adviser under the Investment Advisers Act of 1940, as amended. The Adviser is 50% owned by Prospect Capital Management L.P. (“PCM”) and 50% by Stratera Holdings, LLC (“Stratera Holdings”).

The Company is offering up to 200,000,000 shares of its common stock, on a best efforts basis, at an initial offering price of $15.00 per share.

Note 2. Going Concern Matters

The Company’s financial statements have been prepared using accounting principles generally accepted in the United States of America applicable to a going concern, which contemplates the realization of assets and liquidation of liabilities in the normal course of business for the foreseeable future. Because many of the costs of operating the Company are not proportional to the size of the Company’s investment portfolio, including accounting/auditing, legal, insurance and administrative costs (which includes the reimbursement of the compensation of the chief financial officer, chief compliance officer, treasurer, secretary and other administrative personnel of our Administrator, as defined in Note 7), the Company must raise sufficient capital in order to build a portfolio that generates sufficient revenue to cover the Company’s expenses. As of June 30, 2018, the Company has not raised sufficient capital to build a large enough portfolio to generate sufficient revenue to cover its operating expenses and has only been able to fund distributions to shareholders through Expense Support and Expense Limitation Payments from the Adviser. Under the Expense Limitation Agreement (as defined in Note 7), the Adviser agrees to contractually waive its fees and to pay or absorb the ordinary operating expenses of the Company to help continue its operations through October 31, 2018. The preceding circumstances raise substantial doubt about the Company’s ability to continue as a going concern for at least one year after

2018 ANNUAL REPORT

Pathway Capital Opportunity Fund, Inc. 14

August 29, 2018, the date the financial statements are issued. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

Note 3. Summary of Significant Accounting Policies

The following is a summary of significant accounting policies followed by the Company in the preparation of its financial statements.

Basis of Presentation

The accompanying financial statements have been prepared in accordance with U.S. generally accepted accounting principles (“U.S. GAAP”) pursuant to the requirements of ASC 946, Financial Services - Investment Companies (“ASC 946”), and Articles 6 and 12 of Regulation S-X.

Use of Estimates

The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of income, expenses and gains or losses during the reporting period. Actual results could differ from those estimates and those differences could be material.

Cash

Cash represents funds deposited with financial institutions.

Investment Valuation

The Company follows guidance under U.S. GAAP, which classifies the inputs used to measure fair values into the following hierarchy:

Level 1. Unadjusted quoted prices in active markets for identical assets or liabilities that the Company has the ability to access at the measurement date.

Level 2. Quoted prices for similar assets or liabilities in active markets, or quoted prices for identical or similar assets or liabilities on an inactive market, or other observable inputs other than quoted prices.

Level 3. Unobservable inputs for the asset or liability.

In all cases, the level in the fair value hierarchy within which the fair value measurement in its entirety falls is determined based

on the lowest level input that is significant to the fair value measurement in its entirety. The assessment of the significance of a particular input to the fair value measurement in its entirety requires judgment and considers factors specific to each investment.

Investments for which market quotations are readily available are valued at such market quotations and are classified in Level 1 of the fair value hierarchy.

Securities traded on a national securities exchange are valued at the last sale price on such exchange on the date of valuation or, if there was no sale on such day, at the mean between the last bid and asked prices on such day or at the last bid price on such day in the absence of an asked price. Securities traded on the Nasdaq market are valued at the Nasdaq official closing price (“NOCP”) on the day of valuation or, if there was no NOCP issued, at the last sale price on such day. Securities traded on the Nasdaq market for which there is no NOCP and no last sale price on the day of valuation are valued at the mean between the last bid and asked prices on such day or at the last bid price on such day in the absence of an asked price.

Securities traded in the over-the-counter market are valued by an independent pricing agent or more than one principal market maker, if available, otherwise a principal market maker or a primary market dealer. The Company valued over-the-counter securities by using the midpoint of the prevailing bid and ask prices from dealers on the date of the relevant period end, which were provided by an independent pricing agent and screened for validity by such service. Such securities are categorized in Level 2 of the fair value hierarchy.

With respect to investments for which market quotations are not readily available, or when such market quotations are deemed not to represent fair value, the Board has approved a multi-step valuation process for each quarter, as described below, and such investments are classified in Level 3 of the fair value hierarchy:

| |

| 1. | Each portfolio investment is reviewed by investment professionals of the Adviser with the independent valuation firm engaged by the Board. |

2018 ANNUAL REPORT

Pathway Capital Opportunity Fund, Inc. 15

| |

| 2. | The independent valuation firm prepares independent valuations based on its own independent assessments and issue its report. |

| |

| 3. | The Audit Committee of the Board (the “Audit Committee”) reviews and discusses with the independent valuation firm the valuation report, and then makes a recommendation to the Board of the value for each investment. |

| |

| 4. | The Board discusses valuations and determines the fair value of such investments in the Company’s portfolio in good faith based on the input of the Adviser, the respective independent valuation firm and the Audit Committee. |

Generally, the Company's investments in loans are classified as Level 3 fair value measured securities under ASC 820 and are valued utilizing a combination of yield analysis and discounted cash flow technique, as appropriate. The yield analysis uses loan spreads and other relevant information implied by market data involving identical or comparable assets or liabilities. The discounted cash flow technique converts future cash flows or earnings to a range of fair values from which a single estimate may be derived utilizing an appropriate yield, i.e. discount rate. The measurement is based on the net present value indicated by current market expectations about those future amounts.

The Company's investments in CLOs are classified as Level 3 fair value measured securities under ASC 820 and are valued using both a discounted single-path cash flow model and a discounted multi-path cash flow model. The CLO structures are analyzed to identify the risk exposures and to determine an appropriate call date (i.e., expected maturity). These risk factors are sensitized in the multi-path cash flow model using Monte Carlo simulations, which is a simulation used to model the probability of different outcomes, to generate probability-weighted (i.e., multi-path) cash flows from the underlying assets and liabilities. These cash flows, after payments to debt tranches senior to our equity positions, are discounted using appropriate market discount rates, and relevant data in the CLO market as well as certain benchmark credit indices are considered, to determine the value of each CLO investment. In addition, we generate a single-path cash flow utilizing our best estimate of expected cash receipts, and assess the reasonableness of the implied discount rate that would be effective for the value derived from the multi-path cash flows. We are not responsible for and have no influence over the asset management of the portfolios underlying the CLO investments we hold, as those portfolios are managed by non-affiliated third party CLO collateral managers. The main risk factors are default risk, prepayment risk, interest rate risk, downgrade risk, and credit spread risk.

The types of factors that are taken into account in fair value determination include, as relevant, market changes in expected returns for similar investments, performance improvement or deterioration, security covenants, call protection provisions, and information rights, the nature and realizable value of any collateral, the issuer’s ability to make payments and its earnings and cash flows, the principal markets in which the issuer does business, comparisons to traded securities, and other relevant factors.

Securities Transactions

Securities transactions are recorded on trade date. Realized gains or losses on investments are calculated by using the specific

identification method.

Revenue Recognition

Interest income, adjusted for amortization of premium and accretion of discount, is recorded on an accrual basis. Accretion of such purchase discounts or amortization of such premiums is calculated using the effective interest method as of the settlement date and adjusted only for material amendments or prepayments. Upon the prepayment of a bond, any unamortized discount or premium is recorded as interest income.

Interest income from investments in the “equity” positions of CLOs (typically income notes or subordinated notes) is recorded based on an estimation of an effective yield to expected maturity utilizing assumed future cash flows. The Company monitors the expected cash inflows from CLO equity investments, including the expected residual payments, and the estimated effective yield is determined and updated periodically.

Due to and from Adviser

Amounts due from the Adviser are for expense support and expense limitation payments and amounts due to the Adviser are for base management fees, shareholder fees, routine non-compensation overhead, operating expenses paid on behalf of the Company and offering and organization expenses paid on behalf of the Company. The due to and due from Adviser balances are presented net on the Statement of Assets and Liabilities in accordance with ASC 210-20-45-1 because the amounts owed between the two parties are determinable, the Company has the right to offset the amount owed from the Adviser against the amount that it owes the Adviser and the Company intends to offset these balances. Amounts included on the Statement of Assets and Liabilities are presented net only to the extent that the Company or the Adviser have a current obligation to pay the amounts. All balances due from the Adviser are settled quarterly.

2018 ANNUAL REPORT

Pathway Capital Opportunity Fund, Inc. 16

Offering Costs

Prior to the conversion to an interval fund, offering costs incurred by the Company were capitalized to deferred offering costs on the Statement of Assets and Liabilities and amortized to expense over the 12 month period following such capitalization on a straight line basis.

Offering expenses consist of costs for the registration, certain marketing and distribution of the Company’s shares. These expenses include, but are not limited to, expenses for legal, accounting, printing and certain marketing, and include salaries and direct expenses of the Adviser’s employees, employees of its affiliates and others for providing these services.

Dividends and Distributions

Dividends and distributions to stockholders, which are determined in accordance with federal income tax regulations, are recorded on the record date. The amount to be paid out as a dividend or distribution is approved by the Board. Net realized capital gains, if any, are generally distributed or deemed distributed at least annually.

Income Taxes

The Company has elected to be treated as a RIC for U.S. federal income tax purposes and intends to comply with the requirement of the Code applicable to RICs. Among other things, the Company is required to distribute at least 90% of its investment company taxable income (the “Annual Distribution Requirement”) and intends to distribute all of the Company’s investment company taxable income and net capital gain to stockholders; therefore, the Company has made no provision for income taxes. The character of income and gains that the Company will distribute is determined in accordance with income tax regulations that may differ from U.S. GAAP. Book and tax basis differences relating to stockholders’ dividends and distributions and other permanent book and tax differences are reclassified to paid-in capital.

As of June 30, 2018, the cost basis of investments for tax purposes was $11,043,815 resulting in estimated gross unrealized

appreciation and depreciation of $397,440 and $501,076 respectively.

If the Company does not distribute (or is not deemed to have distributed) at least (1) 98% of its annual ordinary income; (2) 98.2% of its capital gains for the one-year period ending October 31 in that calendar year; and (3) any income recognized but not distributed in the preceding years and on which the Company paid no corporate-level tax, the Company will generally be required to pay an excise tax equal to 4% of such excess amounts. To the extent that the Company determines that its estimated current calendar year taxable income will be in excess of estimated current calendar year dividend distributions from such taxable income, the Company accrues excise taxes, if any, on estimated excess taxable income. As of June 30, 2018, we do not expect to have any excise tax due for 2018 calendar year. Thus, we have not accrued any excise tax for this period.

If the Company fails to satisfy the Annual Distribution Requirement or otherwise fails to qualify as a RIC in any taxable year, the

Company would be subject to tax on all of its taxable income at regular corporate rates. The Company would not be able to deduct distributions to stockholders, nor would the Company be required to make distributions. Distributions would generally be taxable to the Company’s individual and other non-corporate taxable stockholders as ordinary dividend income eligible for the reduced maximum rate applicable to qualified dividend income to the extent of the Company’s current and accumulated earnings and profits, provided certain holding period and other requirements are met. Subject to certain limitations under the Code, corporate distributions would be eligible for the dividends-received deduction. To qualify again to be taxed as a RIC in a subsequent year, the Company would be required to distribute to its stockholders the Company’s accumulated earnings and profits attributable to non-RIC years reduced by an interest charge of 50% of such earnings and profits payable by us as an additional tax. In addition, if the Company failed to qualify as a RIC for a period greater than two taxable years, then, in order to qualify as a RIC in a subsequent year, the Company would be required to elect to recognize and pay tax on any net built-in gain (the excess of aggregate gain, including items of income, over aggregate loss that would have been realized if the Company had been liquidated) or, alternatively, be subject to taxation on such built-in gain recognized for a period of five years.

In September 2016, the IRS and U.S. Treasury Department issued proposed regulations that, if finalized, would provide that the income inclusions from a Passive Foreign Investment Company (“PFIC”) with a Qualified Electing Fund (“QEF”) election or a Controlled Foreign Corporation (“CFC”) would not be good income for purposes of the 90% Income Test unless the Company receives a cash distribution from such entity in the same year attributable to the included income. If such income were not considered “good income” for purposes of the 90% income test, the Company may fail to qualify as a RIC.

It is unclear whether or in what form these regulations will be adopted or, if adopted, whether such regulations would have a significant impact on the income that could be generated by the Company. If adopted, the proposed regulations would apply to

2018 ANNUAL REPORT

Pathway Capital Opportunity Fund, Inc. 17

taxable years of the Company beginning on or after 90 days after the regulations are published as final. The Company is monitoring the status of the proposed regulations and is assessing the potential impact of the proposed tax regulation on its operations.

The Company follows ASC 740, Income Taxes (“ASC 740”). ASC 740 provides guidance for how uncertain tax positions should be recognized, measured, presented, and disclosed in the financial statements. ASC 740 requires the evaluation of tax positions taken or expected to be taken in the course of preparing the Company’s tax returns to determine whether the tax positions are “more-likely-than-not” of being sustained by the applicable tax authority. Tax positions not deemed to meet the more-likely-than not threshold are recorded as a tax benefit or expense in the current period. As of June 30, 2018 and for the year then ended, the Company did not have a liability for any unrecognized tax benefits. Management has analyzed the Company’s positions expected to be taken on its income tax return for the year ended June 30, 2018 and has concluded that as of June 30, 2018 no provision for uncertain tax position is required in the Company’s financial statements. Management’s determinations regarding ASC 740 may be subject to review and adjustment at a later date based upon factors including, but not limited to, an on-going analysis of tax laws, regulations and interpretations thereof. All federal and state income tax returns for each tax year in the three-year period ended June 30, 2017 and for the year ended June 30, 2018 remain subject to examination by the Internal Revenue Service and state departments of revenue.

Recent Accounting Pronouncements

In June 2016, the FASB issued ASU 2016-13, Financial Instruments-Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments (“ASU 2016-13”), which amends the financial instruments impairment guidance so that an entity is required to measure expected credit losses for financial assets based on historical experience, current conditions and reasonable and supportable forecasts. As such, an entity will use forward-looking information to estimate credit losses. ASU 2016-13 also amends the guidance in FASB ASC Subtopic No. 325-40, Investments-Other, Beneficial Interests in Securitized Financial Assets, related to the subsequent measurement of accretable yield recognized as interest income over the life of a beneficial interest in securitized financial assets under the effective yield method. ASU 2016-13 is effective for financial statements issued for fiscal years beginning after December 15, 2019, including interim periods within those fiscal years. Early adoption is permitted as of the fiscal years beginning after December 15, 2018, including interim periods within those fiscal years. We are currently evaluating the impact, if any, of adopting this ASU on our financial statements.

In August 2016, the FASB issued ASU 2016-15, Statement of Cash Flows (Topic 230): Classification of Certain Cash Receipts and Cash Payments (“ASU 2016-15”), which addresses certain aspects of cash flow statement classification. One such amendment requires cash payments for debt prepayment or debt extinguishment costs to be classified as cash outflows for financing activities. ASU 2016-15 is effective for financial statements issued for fiscal years beginning after December 15, 2017, and interim periods within those fiscal years. Early adoption is permitted, including adoption in an interim period. If an entity early adopts the amendments in an interim period, any adjustments should be reflected as of the beginning of the fiscal year that includes that interim period. An entity that elects early adoption must adopt all of the amendments in the same period. The adoption of the amended guidance in ASU 2016-15 is not expected to have a significant effect on our financial statements and disclosures.

In October 2016, the SEC adopted significant reforms under the 1940 Act that impose extensive new disclosure and reporting obligations on most 1940 Act funds (collectively, the “Reporting Rules”). The Reporting Rules greatly expand the volume of information regarding fund portfolio holdings and investment practices that must be disclosed. The adopted amendments to Regulation S-X for 1940 Act funds require additional information to be disclosed in the schedule of investments filing (among other changes). The amendments to Regulation S-X are effective for reporting periods ending after August 1, 2017. The increased reporting did not have a material impact on our financial statements.

In March 2017, the FASB issued ASU 2017-08, Receivables - Nonrefundable Fees and Other Costs (“ASU 2017-08”). The amendments in ASU 2017-08 require premiums on purchased callable debt securities to be amortized to the security’s earliest call date. Prior to this ASU, premiums and discounts on purchased callable debt securities were generally required to be amortized to the security’s maturity date. The amendments in ASU 2017-08 do not require any changes to treatment of securities held at a discount. ASU 2017-08 is effective on January 1, 2019, with early adoption permitted. Although the Company is still evaluating the effect of ASU 2017-08, it does not expect the amendments to have a material impact on its financial statements.

In May 2014, the FASB issued ASU No. 2014-09, Revenue from Contracts with Customers (Topic 606), which amends accounting guidance for revenue recognition arising from contracts with customers. Under the new guidance, an entity should recognize revenue to depict the transfer of promised goods or services to customers in an amount that reflects the consideration the entity expects to be entitled to in exchange for those goods or services. In August 2015, the FASB also issued ASU 2015-14, Revenue from Contracts with Customers (Topic 606): Deferral of the Effective Date, which deferred the effective date of the standard for one year. As a result, the guidance is effective for financial statements issued for fiscal years beginning after December 15, 2017, and interim periods within those fiscal years. Early adoption is permitted as of fiscal years beginning after December 15, 2016,

2018 ANNUAL REPORT

Pathway Capital Opportunity Fund, Inc. 18

including interim periods within those fiscal years. Based on the scope exception in Topic 606, this guidance will have no impact on the Company.

Note 4. Portfolio Investments

Purchases of investment securities (excluding short-term securities) for the year ended June 30, 2018 were $4,551,898.

Sales and redemptions of investment securities (excluding short-term securities) for the year ended June 30, 2018 were $5,230,764.

The following table summarizes the inputs used to value the Company’s investments measured at fair value as of June 30, 2018:

|

| | | | | | | | | | | | | | | |

| | Level 1 | | Level 2 | | Level 3 | | Total |

| Assets | | | | | | | |

| Senior Unsecured Bonds | $ | — |

| | $ | 7,296,245 |

| | $ | — |

| | $ | 7,296,245 |

|

| Senior Secured Bonds | — |

| | 516,038 |

| | — |

| | 516,038 |

|

| CLO - subordinated notes | — |

| | — |

| | 3,127,896 |

| | 3,127,896 |

|

| Total | $ | — |

| | $ | 7,812,283 |

| | $ | 3,127,896 |

| | $ | 10,940,179 |

|

The following is a reconciliation of investments for which Level 3 inputs were used in determining fair value:

|

| | | | | | | | | | | |

| | Second Lien Term Loan | | CLO - subordinated notes | | Total |

| Fair Value at June 30, 2017 | $ | 967,000 |

| | $ | 1,680,205 |

| | $ | 2,647,205 |

|

| Realized gain on investments | — |

| | — |

| | — |

|

| Net increase/(decrease) in unrealized gain on investments | 11,515 |

| | (378,010 | ) | | (366,495 | ) |

| Purchases of investments | — |

| | 1,832,522 |

| | 1,832,522 |

|

| Proceeds from redemption of investment | (1,000,000 | ) | | — |

| | (1,000,000 | ) |

| Accretion (amortization) of purchase discount and premium, net | 21,485 |

| | (6,821 | ) | | 14,664 |

|

Transfers into Level 3(1) | — |

| | — |

| | — |

|

Transfers out of Level 3(1) | — |

| | — |

| | — |

|

| Fair Value at June 30, 2018 | $ | — |

| | $ | 3,127,896 |

| | $ | 3,127,896 |

|

| | | | | | |

| Net increase in unrealized loss attributable to Level 3 investments still held at the end of the year | $ | — |

| | $ | (378,010 | ) | | $ | (378,010 | ) |

| | | | | | |

(1) There were no transfers between Level 1 and Level 2 during the year. |

The following table provides quantitative information about significant unobservable inputs used in the fair value measurement of Level 3 investments as of June 30, 2018:

|

| | | | | | | | | | | |

| | | | | | Unobservable Input |

| Asset Category | Fair Value | | Primary Valuation Technique | | Input | | Range(1)(2) | | Weighted Average(1)(2) |

| CLO - subordinated notes | $ | 3,127,896 |

| | Discounted Cash Flow | | Discount Rate | | 15.78% - 22.78% | | 19.74% |

| Total Level 3 Investments | $ | 3,127,896 |

| | | | | | | | |

(1) Excludes investments that have been called for redemption.

(2) Represents the implied discount rate based on our internally generated single-cash flows that is derived from the fair value estimated by the corresponding multi-path cash flow model utilized by the independent valuation firm.

In determining the range of values for the Company's investments in the term loan, management and the independent valuation firm estimated corporate and security credit ratings and identified corresponding yields to maturity for the loan from relevant

2018 ANNUAL REPORT

Pathway Capital Opportunity Fund, Inc. 19

market data. A discounted cash flow analysis is then prepared using the appropriate yield to maturity as the discount rate, to determine a range of values. As of June 30, 2018, there were no term loans held.

In determining the range of values for our investments in CLOs, the independent valuation firm uses a discounted multi-path cash flow model. The valuations were accomplished through the analysis of the CLO deal structures to identify the risk exposures from the modeling point of view as well as to determine an appropriate call date (i.e., expected maturity). These risk factors are sensitized in the multi-path cash flow model using Monte Carlo simulations to generate probability-weighted (i.e., multi-path) cash flows for the underlying assets and liabilities. These cash flows are discounted using appropriate market discount rates, and relevant data in the CLO market and certain benchmark credit indices are considered, to determine the value of each CLO investment. In addition, we generate a single-path cash flow utilizing our best estimate of expected cash receipts, and assess the reasonableness of the implied discount rate that would be effective for the value derived from the corresponding multi-path cash flow model.

The significant unobservable input used to value the loan based on the yield analysis and discounted cash flow technique is the market yield (or applicable discount rate) used to discount the estimated future cash flows expected to be received from the underlying investment, which includes both future principal and interest/dividend payments. Increases or decreases in the market yield (or applicable discount rate) would result in a decrease or increase, respectively, in the fair value measurement. Management and the independent valuation firm consider the following factors when selecting market yields or discount rates: risk of default, rating of the investment and comparable company investments, and call provisions.

The significant unobservable input used to value the CLOs is the discount rate applied to the estimated future cash flows expected to be received from the underlying investment, which includes both future principal and interest payments. Included in the consideration and selection of the discount rate are the following factors: risk of default, comparable investments, and call provisions. An increase or decrease in the discount rate applied to projected cash flows, where all other inputs remain constant, would result in a decrease or increase, respectively, in the fair value measurement.

The Company is not responsible for and has no influence over the management of the portfolios underlying the CLO investments the Company holds as those portfolios are managed by non-affiliated third party CLO collateral managers. CLO investments may be riskier and less transparent to the Company than direct investments in underlying companies. CLOs typically will have no significant assets other than their underlying senior secured loans. Therefore, payments on CLO investments are and will be payable solely from the cash flows from such senior secured loans.

The Company’s subordinated (i.e., residual interest) investments in CLOs involve a number of significant risks. CLOs are typically very highly levered (10 - 14 times), and therefore the residual interest tranches that the Company invests in are subject to a higher degree of risk of total loss. In particular, investors in CLO residual interests indirectly bear risks of the underlying loan investments held by such CLOs. The Company generally has the right to receive payments only from the CLOs, and generally does not have direct rights against the underlying borrowers or the entity that sponsored the CLO. While the CLOs the Company targets generally enable the investor to acquire interests in a pool of senior loans without the expenses associated with directly holding the same investments, the Company’s prices of indices and securities underlying CLOs will rise or fall. These prices (and, therefore, the values of the CLOs) will be influenced by the same types of political and economic events that affect issuers of securities and capital markets generally. The failure of a CLO investment to satisfy financial covenants, including with respect to adequate collateralization and/or interest coverage tests, could lead to a reduction in its payments to the Company. In the event that a CLO fails certain tests, holders of debt senior to the Company may be entitled to additional payments that would, in turn, reduce the payments the Company would receive. Separately, the Company may incur expenses to the extent necessary to seek recovery upon default or to negotiate new terms with a defaulting CLO or any other investment the Company may make. If any of these occur, it could materially and adversely affect the Company’s operating results and cash flows.

The interests the Company has acquired in CLOs are generally thinly traded or have only a limited trading market. CLOs are typically privately offered and sold, even in the secondary market. As a result, investments in CLOs may be characterized as illiquid securities. In addition to the general risks associated with investing in debt securities, CLO residual interests carry additional risks, including, but not limited to: (i) the possibility that distributions from collateral securities will not be adequate to make interest or other payments; (ii) the quality of the collateral may decline in value or default; (iii) the fact that the Company’s investments in CLO tranches will likely be subordinate to other senior classes of note tranches thereof; and (iv) the complex structure of the security may not be fully understood at the time of investment and may produce disputes with the CLO investment or unexpected investment results. The Company’s net asset value may also decline over time if the Company’s principal recovery with respect to CLO residual interests is less than the price that the Company paid for those investments. The Company’s CLO investments and/or the underlying senior secured loans may prepay more quickly than expected, which could have an adverse impact on its value.

2018 ANNUAL REPORT

Pathway Capital Opportunity Fund, Inc. 20

An increase in LIBOR would materially increase the CLO’s financing costs. Since most of the collateral positions within the CLOs have LIBOR floors, there may not be corresponding increases in investment income (if LIBOR increases but stays below the LIBOR floor rate of such investments) resulting in materially smaller distribution payments to the residual interest investors.

If the Company acquires more than 10% of the shares in a foreign corporation that is treated as a CFC (including residual interest tranche investments in a CLO investment treated as a CFC), for which the Company is treated as receiving a deemed distribution (taxable as ordinary income) each year from such foreign corporation in an amount equal to its pro rata share of the corporation’s income for the tax year (including both ordinary earnings and capital gains), the Company is required to include such deemed distributions from a CFC in its income and the Company is required to distribute such income to maintain its RIC tax treatment regardless of whether or not the CFC makes an actual distribution during such year.

The Company owns shares in PFICs (including residual interest tranche investments in CLOs that are PFICs), and may be subject to federal income tax on a portion of any “excess distribution” or gain from the disposition of such shares even if such income is distributed as a taxable dividend to its stockholders. Certain elections may be available to mitigate or eliminate such tax on excess distributions, but such elections (if available) will generally require the Company to recognize its share of the PFICs income for each year regardless of whether the Company receives any distributions from such PFICs. The Company must nonetheless distribute such income to maintain its tax treatment as a RIC.

If the Company is required to include amounts in income prior to receiving distributions representing such income, the Company may have to sell some of its investments at times and/or at prices management would not consider advantageous, raise additional debt or equity capital or forgo new investment opportunities for this purpose. If the Company is not able to obtain cash from other sources, it may fail to qualify for RIC tax treatment and thus become subject to corporate-level income tax.

A portion of the Company’s portfolio is concentrated in CLO vehicles, which is subject to a risk of loss if that sector experiences a market downturn. The Company is subject to credit risk in the normal course of pursuing its investment objectives. The Company’s maximum risk of loss from credit risk for the portfolio of CLO investments is the inability of the CLO collateral managers to return up to the cost value due to defaults occurring in the underlying loans of the CLOs.

Investments in CLO residual interests generally offer less liquidity than other investment grade or high-yield corporate debt, and may be subject to certain transfer restrictions. The Company’s ability to sell certain investments quickly in response to changes in economic and other conditions and to receive a fair price when selling such investments may be limited, which could prevent the Company from making sales to mitigate losses on such investments. In addition, CLOs are subject to the possibility of liquidation upon an event of default of certain minimum required coverage ratios, which could result in full loss of value to the CLO residual interests and junior debt investors.

The fair value of the Company’s investments may be significantly affected by changes in interest rates. The Company’s investments in senior secured loans through CLOs are sensitive to interest rate levels and volatility. In the event of a significant rising interest rate environment and/or economic downturn, loan defaults may increase and result in credit losses which may adversely affect the Company’s cash flow, fair value of its investments and operating results. In the event of a declining interest rate environment, a faster than anticipated rate of prepayments is likely to result in a lower than anticipated yield.

Due to the inherent uncertainty of determining the fair value of investments that do not have a readily available market value, the fair value of the Company’s investments may fluctuate from period to period. Additionally, the fair value of the Company’s investments may differ significantly from the values that would have been used had a ready market existed for such investments and may differ materially from the values that we may ultimately realize. Further, such investments are generally subject to legal and other restrictions on resale or otherwise are less liquid than publicly traded securities. If the Company was required to liquidate a portfolio investment in a forced or liquidation sale, the Company could realize significantly less than the value at which the Company has recorded it.

In addition, changes in the market environment and other events that may occur over the life of the investments may cause the gains or losses ultimately realized on these investments to be different than the unrealized gains or losses reflected in the currently assigned valuations.

Note 5. Capital

Prior to October 31, 2017, the Company offered three classes of shares: Class R shares, Class RIA shares and Class I shares. Class R shares were available to the general public. Class RIA shares were only available to accounts managed by registered investment advisers. Class I shares were available for purchase only through (1) fee-based programs, also known as wrap accounts, of investment dealers, (2) participating broker-dealers that have alternative fee arrangements with their clients, (3) certain registered investment

2018 ANNUAL REPORT

Pathway Capital Opportunity Fund, Inc. 21

advisers or (4) bank trust departments or any other organization or person authorized to act in a fiduciary capacity for its clients or customers. These classes of shares differed only with respect to the sales load purchasers in the offering paid, as follows:

•For Class R shares, purchasers paid selling commissions of up to 6.0% and dealer manager fees of 2.0%;

•For Class RIA shares, purchasers paid dealer manager fees of 2.0%, but no selling commissions; and

•For Class I shares, purchasers paid no selling commissions or dealer manager fees.

The Company’s authorized stock consists of 200,000,000 shares of stock, par value $0.01 per share, all of which were initially designated as common stock comprising 180,000,000 of Class R shares, 10,000,000 of Class RIA shares and 10,000,000 of Class I shares. Each class of shares had identical voting and distributions rights, and bore its own pro rata portion of the Company’s expenses and had the same net asset value.

With the conversion to an interval fund, the Company’s authorized stock consists of 200,000,000 shares of stock, par value $0.01 per share, all of which are initially designated as common stock comprising 70,000,000 of Class A shares, 40,000,000 of Class I shares, 40,000,000 of Class C shares and 50,000,000 of Class L shares. All shareholders bear the common expenses of the Company and earn income and realized gains/losses from the portfolio pro rata on the average daily net assets of each class, without distinction between share classes. The classes differ in expenses and pay as follows:

•For Class A shares, purchasers pay selling commissions of up to 5.75%;

•For Class L shares, purchasers pay selling commissions of up to 4.25%;

•For Class C and Class I shares, purchasers pay no selling commissions;

•For Class A, L, and C shares, shareholders pay servicing fees of up to 0.25% of average weekly net assets;

•For Class I shares, shareholders pay no servicing fees;

•For Class L shares, shareholders pay distribution fees of up to 0.25% of our average weekly net assets;

•For Class C shares, shareholders pay distribution fees of up to 0.75% of our average weekly net assets; and

•For Class A and I shares, shareholders pay no distribution fees.

All Class R shares were converted to Class A and all Class RIA and Class I shares were converted to Class I shares as a one for one share conversion as of October 31, 2017. The dollar amount of the transfer represented the Company’s net asset value as of October 31, 2017.

Transactions in shares of common stock were as follows during the year ended June 30, 2018 and for the year ended June 30, 2017:

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Class R Shares | | Class RIA Shares | | Class A Shares | | Class I Shares | | Total |

| Year Ended June 30, 2018 | Shares | | Amount | | Shares | | Amount | | Shares | | Amount | | Shares | | Amount | | Shares | Amount |

| Shares sold | 41,068 |

| | $ | 629,900 |

| | — |

| | $ | — |

| | 11,712 |

| | $ | 160,000 |

| | — |

| | $ | — |

| | 52,780 |

| $ | 789,900 |

|

| Shares issued from reinvestment of distributions | 9,224 |

| | 124,160 |

| | 94 |

| | 1,264 |

| | 11,752 |

| | 156,592 |

| | 125 |

| | 1,658 |

| | 21,195 |

| 283,674 |

|

| Repurchase of common shares | (10,046 | ) | | (136,524 | ) | | — |

| | — |

| | (27,935 | ) | | (367,017 | ) | | — |

| | — |

| | (37,981 | ) | (503,541 | ) |

Transfer of shares (out)(1) | (628,825 | ) | | (8,501,714 | ) | | (6,454 | ) | | (87,258 | ) | |

|

| |

|

| | (26,437 | ) | | (357,428 | ) | | (661,716 | ) | (8,946,400 | ) |

Transfer of shares in (1) | — |

| | — |

| | — |

| | — |

| | 628,825 |

| | 8,501,714 |

| | 32,891 |

| | 444,686 |

| | 661,716 |

| 8,946,400 |

|

| Net increase/(decrease) from capital transactions | (588,579 | ) | | $ | (7,884,178 | ) | | (6,360 | ) | | $ | (85,994 | ) | | 624,354 |

| | $ | 8,451,289 |

| | 6,579 |

| | $ | 88,916 |

| | 35,994 |

| $ | 570,033 |

|

| (1) This represents the transfer of shares that occurred as part of the conversion to an interval fund. |

2018 ANNUAL REPORT

Pathway Capital Opportunity Fund, Inc. 22

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Class R Shares | | Class RIA Shares | | Class A Shares | | Class I Shares | | Total |

| Year ended June 30, 2017 | Shares | | Amount | | Shares | | Amount | | Shares | | Amount | | Shares | | Amount | | Shares | Amount |

| Shares sold | 133,321 |

| | $ | 2,028,877 |

| | 5,194 |

| | $ | 74,000 |

| | — |

| | $ | — |

| | — |

| | $ | — |

| | 138,515 |

| $ | 2,102,877 |

|

| Shares issued from reinvestment of distributions | 16,790 |

| | 223,475 |

| | 135 |

| | 1,801 |

| | — |

| | — |

| | 357 |

| | 4,729 |

| | 17,282 |

| 230,005 |

|

| Repurchase of common shares | (1,131 | ) | | (15,837 | ) | | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | (1,131 | ) | (15,837 | ) |

| Net increase from capital transactions | 148,980 |

| | $ | 2,236,515 |

| | 5,329 |

| | $ | 75,801 |

| | — |

| | $ | — |

| | 357 |

| | $ | 4,729 |

| | 154,666 |

| $ | 2,317,045 |

|

At June 30, 2018, the Company has 624,354 and 33,016 of Class A shares and Class I shares issued and outstanding, respectively.