UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22806

Oppenheimer Main Street Small Cap Fund

(Exact name of registrant as specified in charter)

6803 South Tucson Way, Centennial, Colorado 80112-3924

(Address of principal executive offices) (Zip code)

Arthur S. Gabinet

OFI Global Asset Management, Inc.

Two World Financial Center, New York, New York 10281-1008

(Name and address of agent for service)

Registrant’s telephone number, including area code: (303) 768-3200

Date of fiscal year end: April 30

Date of reporting period: 4/30/2014

Item 1. Reports to Stockholders.

Table of Contents

Class A Shares

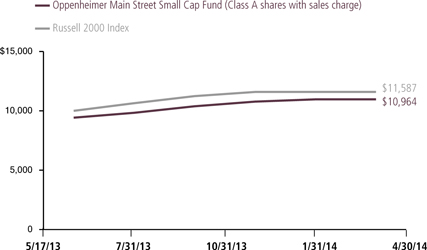

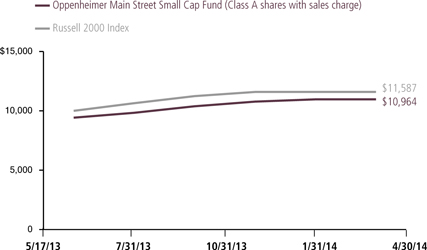

CUMULATIVE TOTAL RETURNS AT 4/30/14

| | | | | | | | |

| | | Class A Shares of the Fund | | |

| | | Without Sales Charge | | With Sales Charge | | | | Russell 2000 Index |

Since Inception (5/17/13) | | 16.33% | | 9.65% | | | | 15.28% |

Performance data quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Fund returns include changes in share price, reinvested distributions, and a 5.75% maximum applicable sales charge except where “without sales charge” is indicated. Current performance may be lower or higher than the performance quoted. Returns do not consider capital gains or income taxes on an individual’s investment. For performance data current to the most recent month-end, visit oppenheimerfunds.com or call 1.800.CALL OPP (225.5677).

2 OPPENHEIMER MAIN STREET SMALL CAP FUND

Fund Performance Discussion

Since the Fund’s inception on May 17, 2013 through April 30, 2014, its Class A shares (without sales charge) produced a return of 16.33%. In comparison, the Russell 2000 Index (the “Index”) returned 15.28% during the same period. The Fund outperformed the Index in nine out of ten sectors, led by stronger relative stock selection in the financials, industrials, health care and energy sectors. The Fund underperformed the Index in information technology, where less favorable stock selection and an underweight position hurt results.

MARKET OVERVIEW

The global economy finished 2013 with slow and steady growth throughout the developed world. U.S. growth improved during the reporting period driven by continued strength in manufacturing, reasonable employment gains and moderating housing activity. In May 2013, market volatility picked up measurably as remarks from former Federal Reserve (“Fed”) Chairman Ben Bernanke indicated a possible tapering of the Fed’s asset purchase program if the economy

continued to show improvement. However, when the Fed actually announced in December that it would reduce its asset purchases by $10 billion a month from $85 billion to $75 billion, its decision to “taper” was met with relative calm in financial markets.

In January 2014, investors worried that ongoing downturns in the emerging markets might dampen the U.S. economic recovery,

COMPARISON OF CHANGE IN VALUE OF $10,000 HYPOTHETICAL INVESTMENTS IN:

3 OPPENHEIMER MAIN STREET SMALL CAP FUND

leading to renewed volatility in stock and bond markets. In addition, over the first four months of 2014, financial headlines were full of discussion of Fed policy, turmoil in Ukraine, and the implications of a slowdown in China. The U.S. continued to grow at a moderate pace, but slowed over the first quarter of 2014, partly due to severe winter weather. The Eurozone also grew at a slightly faster pace than 2013, but has continued to struggle with very low inflation and weak bank lending. The Fed continued its program of “tapering” asset purchases by $10 billion per month for the first three months of the year, bringing its current monthly purchases to $55 billion in March (in January 2014, Janet Yellen was confirmed as next Fed chairman, succeeding Ben Bernanke).

FUND REVIEW

Top contributors to performance this reporting period included Finisar Corp., Nu Skin Enterprises, Inc. and Korn/Ferry International. Finisar is a manufacturer of optical communication components and subsystems used to connect networks. The stock rallied early in the reporting period as management reported improved profitability and increased guidance due to rising higher margin data communication sales. Nu Skin Enterprises, a distributor of personal care products and nutritional supplements, rallied over the first half of the reporting period after it reported quarterly results above expectations due to strong sales of their core product lines and the successful launch of a weight maintenance product. However, early in 2014, the market reacted quite negatively

when it was announced that a Chinese state agency had begun an investigation into the company’s selling practices. China is a significant contributor to Nu Skin’s growth, and was a key element of our investment thesis. Having previously sold the majority of our shares into strength during 2013, we chose to fully exit the stock upon this news.

Korn/Ferry International provides talent management solutions globally. Sequential quarterly beats – with the third quarter especially strong – have led to rising estimates, increased price targets, and improved market sentiment. Strong execution across “executive search” led to better than expected revenues and we believe an improving macro environment should keep the momentum positive. Additionally, with high level senior executive turnover rising, we believe “executive search” can realize a further boost to revenues and margins. The company has also experienced strong growth in its Futurestep middle management recruiting business.

The most significant detractors from performance this reporting period were Infoblox Inc., Hatteras Financial Corp. and Semtech Corp. Infoblox is a leader in “automated network control” solutions and security – allowing companies to manage large and complex data networks, and the proliferation of mobile devices connected to them. The stock suffered a setback after management preannounced a deceleration in growth and guided to a further slowdown for the full fiscal year. As a result, analyst

4 OPPENHEIMER MAIN STREET SMALL CAP FUND

estimates have been revised down significantly, putting selling pressure on the company’s stock. The disappointing guidance for both revenues and earnings was largely attributable to a “slippage” of large deal signings and ongoing weakness in business with the U.S. federal government. We exited the position subsequent to the reporting period’s end after another disappointing report and the CEO’s unexpected departure, as we lost confidence in our thesis. Hatteras Financial, a real estate investment trust (REIT) focused on investing in mortgage-backed securities guaranteed by the U.S. government and government sponsored agencies, reported disappointing earnings during the period. The firm’s book value declined as its investment portfolio fell in value, driven by the increase in interest rates following the Fed’s remarks about the potential tapering of its quantitative easing program. Hatteras also announced that it was decreasing its dividend, which was not well received by the market. We exited our position. Semtech is a supplier of analog and mixed-signal semiconductor products. In mid-December, the company negatively pre-announced revenues and earnings reflecting ongoing delays primarily in service provider capital spending that has plagued this stock throughout 2013. A push-out in new product revenue for touch sensing platforms in consumer applications was also a cause for the disappointing guidance. The company has been executing well on issues that it can influence; however, it is highly exposed to smartphones, especially Samsung’s Galaxy, whose next generation product has been

disappointing in the marketplace. As a consequence, visibility has been reduced and we have trimmed our holdings. We maintained exposure because of Semtech’s technological leadership and management’s demonstrated ability to execute.

STRATEGY & OUTLOOK

While the domestic economy continues to muddle along, fundamental company results — both top- and bottom-line growth — have slowed year-over-year. Additionally, profit margins are at, or near, historic peak levels. As we look forward, future earnings increases will likely result from an improved revenue outlook due to a pick-up in global Gross Domestic Product growth, rising pricing power, and/or market share gains. Effective allocation of capital may also contribute to higher earnings. The cash that has been built-up on balance sheets affords “Corporate America” considerable flexibility. We expect managements, which have generally demonstrated a commitment to enhancing shareholder value, to use this cash in a manner that may lead to rising returns.

Given this backdrop, our approach remains consistent. We aim to construct an “all weather” portfolio by targeting companies we believe have: 1) sustainable competitive advantages; 2) skilled management with a proven track record of executing effectively; and 3) financial resources with the potential to generate improving profitability, gain market share, and/or return significant cash to shareholders. During times of volatile or slow economic growth such companies

5 OPPENHEIMER MAIN STREET SMALL CAP FUND

frequently widen their lead over weaker competitors. We seek to invest in companies, characterized by these qualities, at compelling valuations and believe this disciplined approach is essential in seeking to generate superior long-term performance.

| | |

| |  |

| | Matthew P. Ziehl, CFA Portfolio Manager |

Matthew P. Ziehl, CFA and Lead Portfolio Manager, on behalf of the Portfolio Management team: Raymond Anello, CFA, Raman Vardharaj, CFA, Joy Budzinski, Kristin Ketner Pak, Magnus Krantz and Adam Weiner.

6 OPPENHEIMER MAIN STREET SMALL CAP FUND

Top Holdings and Allocations

TOP TEN COMMON STOCK HOLDINGS

| | |

LaSalle Hotel Properties | | 2.5% |

EPL Oil & Gas, Inc. | | 2.4 |

Finisar Corp. | | 2.3 |

Korn/Ferry International | | 2.3 |

Dana Holding Corp. | | 2.3 |

KAR Auction Services, Inc. | | 2.3 |

Redwood Trust, Inc. | | 1.9 |

WellCare Health Plans, Inc. | | 1.8 |

Cavium, Inc. | | 1.7 |

P.H. Glatfelter Co. | | 1.7 |

Portfolio holdings and allocations are subject to change. Percentages are as of April 30, 2014, and are based on net assets. For more current Fund holdings, please visit oppenheimerfunds.com.

TOP TEN COMMON STOCK INDUSTRIES

| | |

Real Estate Investment Trusts

(REITs) | | 11.5% |

Commercial Banks | | 8.0 |

Commercial Services & Supplies | | 6.0 |

Oil, Gas & Consumable Fuels | | 5.7 |

Software | | 5.1 |

Hotels, Restaurants & Leisure | | 4.3 |

Professional Services | | 4.2 |

Health Care Equipment &

Supplies | | 4.0 |

Health Care Providers &

Services | | 3.9 |

Chemicals | | 3.7 |

Portfolio holdings and allocations are subject to change. Percentages are as of April 30, 2014, and are based on net assets.

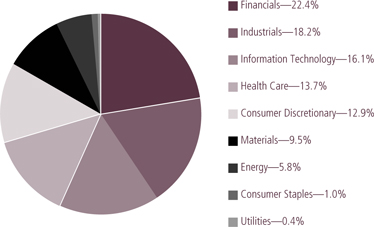

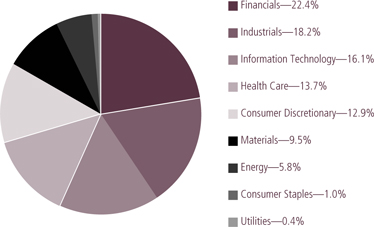

SECTOR ALLOCATION

Portfolio holdings and allocations are subject to change. Percentages are as of April 30, 2014, and are based on the total market value of common stocks.

7 OPPENHEIMER MAIN STREET SMALL CAP FUND

Share Class Performance

CUMULATIVE TOTAL RETURNS WITHOUT SALES CHARGE AS OF 4/30/14

| | | | | | | | | | | | | | | | |

| | | Inception Date | | Since Inception | | | | | | | | | | |

Class A (OSCAX) | | 5/17/13 | | 16.33% | | | | | | | | | | | | |

Class C (OSCCX) | | 5/17/13 | | 15.29% | | | | | | | | | | | | |

Class I (OSSIX) | | 5/17/13 | | 16.73% | | | | | | | | | | | | |

Class N (OSCNX) | | 5/17/13 | | 15.82% | | | | | | | | | | | | |

Class Y (OSCYX) | | 5/17/13 | | 16.76% | | | | | | | | | | | | |

CUMULATIVE TOTAL RETURNS WITH SALES CHARGE AS OF 4/30/14 | | | | |

| | | Inception Date | | Since Inception | | | | | | | | | | |

Class A (OSCAX) | | 5/17/13 | | 9.65% | | | | | | | | | | | | |

Class C (OSCCX) | | 5/17/13 | | 14.29% | | | | | | | | | | | | |

Class I (OSSIX) | | 5/17/13 | | 16.73% | | | | | | | | | | | | |

Class N (OSCNX) | | 5/17/13 | | 14.82% | | | | | | | | | | | | |

Class Y (OSCYX) | | 5/17/13 | | 16.76% | | | | | | | | | | | | |

Performance data quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. Returns do not consider capital gains or income taxes on an individual’s investment. For performance data current to the most recent month-end, visit oppenheimerfunds.com or call 1.800.CALL OPP (225.5677). Fund returns include changes in share price, reinvested distributions, and the applicable sales charge: for Class A shares, the current maximum initial sales charge of 5.75% and for Class C and N shares, the contingent deferred sales charge of 1% for the 1-year period. There is no sales charge for Class I and Y shares.

The Fund’s performance is compared to the performance of the Russell 2000 Index, which measures the performance of the small-cap segment of the U.S. equity universe a broad-based index featuring 2,500 stocks that cover the small- and mid-cap market capitalizations. The Index is unmanaged and cannot be purchased directly by investors. While index comparisons may be useful to provide a benchmark for the Fund’s performance, it must be noted that the Fund’s investments are not limited to the investments comprising the Index. Index performance includes reinvestment of income, but does not reflect transaction costs, fees, expenses or taxes. Index performance is shown for illustrative purposes only as a benchmark for the Fund’s performance, and does not predict or depict performance of the Fund. The Fund’s performance reflects the effects of the Fund’s business and operating expenses.

The Fund’s investment strategy and focus can change over time. The mention of specific fund holdings does not constitute a recommendation by OppenheimerFunds, Inc. or its affiliates.

8 OPPENHEIMER MAIN STREET SMALL CAP FUND

Before investing in any of the Oppenheimer funds, investors should carefully consider a fund’s investment objectives, risks, charges and expenses. Fund prospectuses and summary prospectuses contain this and other information about the funds, and may be obtained by asking your financial advisor, visiting oppenheimerfunds.com, or calling 1.800.CALL OPP (225.5677). Read prospectuses and summary prospectuses carefully before investing.

Shares of Oppenheimer funds are not deposits or obligations of any bank, are not guaranteed by any bank, are not insured by the FDIC or any other agency, and involve investment risks, including the possible loss of the principal amount invested.

9 OPPENHEIMER MAIN STREET SMALL CAP FUND

Fund Expenses

Fund Expenses. As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, which may include sales charges (loads) on purchase payments, contingent deferred sales charges on redemptions; and (2) ongoing costs, including management fees; distribution and service fees; and other Fund expenses. These examples are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The examples are based on an investment of $1,000.00 invested at the beginning of the period and held for the entire 6-month period ended April 30, 2014.

Actual Expenses. The first section of the table provides information about actual account values and actual expenses. You may use the information in this section for the class of shares you hold, together with the amount you invested, to estimate the expense that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600.00 account value divided by $1,000.00 = 8.60), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes. The second section of the table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio for each class of shares, and an assumed rate of return of 5% per year for each class before expenses, which is not the actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example for the class of shares you hold with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as front-end or contingent deferred sales charges (loads). Therefore, the “hypothetical” section of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

10 OPPENHEIMER MAIN STREET SMALL CAP FUND

| | | | | | | | | | | | | | | | | | |

| Actual | | Beginning Account Value

November 1, 2013 | | Ending Account Value

April 30, 2014 | | Expenses Paid During 6 Months Ended April 30, 2014 |

Class A | | $ | 1,000.00 | | | | | $ | 1,055.70 | | | | | $ | 6.39 | | | |

Class C | | | 1,000.00 | | | | | | 1,050.00 | | | | | | 11.40 | | | |

Class I | | | 1,000.00 | | | | | | 1,057.30 | | | | | | 4.09 | | | |

Class N | | | 1,000.00 | | | | | | 1,052.90 | | | | | | 8.69 | | | |

Class Y | | | 1,000.00 | | | | | | 1,057.60 | | | | | | 4.60 | | | |

| | | | | | |

| Hypothetical | | | | | | | | | | | | | | | | | | |

(5% return before expenses) | | | | | | | | | | | | | | | | | | |

Class A | | | 1,000.00 | | | | | | 1,018.60 | | | | | | 6.28 | | | |

Class C | | | 1,000.00 | | | | | | 1,013.74 | | | | | | 11.20 | | | |

Class I | | | 1,000.00 | | | | | | 1,020.83 | | | | | | 4.02 | | | |

Class N | | | 1,000.00 | | | | | | 1,016.36 | | | | | | 8.53 | | | |

Class Y | | | 1,000.00 | | | | | | 1,020.33 | | | | | | 4.52 | | | |

Expenses are equal to the Fund’s annualized expense ratio for that class, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). Those annualized expense ratios, excluding indirect expenses from affiliated funds, based on the 6-month period ended April 30, 2014 are as follows:

| | | | | | |

| Class | | Expense Ratios | | | |

Class A | | | 1.25 | % | | |

Class C | | | 2.23 | | | |

Class I | | | 0.80 | | | |

Class N | | | 1.70 | | | |

Class Y | | | 0.90 | | | |

The expense ratios reflect voluntary and/or contractual waivers and/or reimbursements of expenses by the Fund’s Manager. Some of these undertakings may be modified or terminated at any time, as indicated in the Fund’s prospectus. The “Financial Highlights” tables in the Fund’s financial statements, included in this report, also show the gross expense ratios, without such waivers or reimbursements and reduction to custodian expenses, if applicable.

11 OPPENHEIMER MAIN STREET SMALL CAP FUND

|

|

| STATEMENT OF INVESTMENTS April 30, 2014 |

|

| | | | | | | | | | |

| | | Shares | | | Value | | | |

| | |

Common Stocks—98.4% | | |

| | |

Consumer Discretionary—12.7% | | |

| | |

Auto Components—2.3% | | |

Dana Holding Corp. | | | 27,358 | | | $ | 579,169 | | |

| | |

Diversified Consumer Services—1.9% | | | | | | |

LifeLock, Inc.1 | | | 23,104 | | | | 362,733 | | |

| | |

Matthews | | | | | | | | | |

International Corp., Cl. A | | | 3,143 | | | | 126,820 | | |

| | | | | | | | | |

| | | | | | | 489,553 | | |

| | |

Hotels, Restaurants & Leisure—4.3% | | | | | | |

Brinker | | | | | | | | | |

International, Inc. | | | 6,469 | | | | 317,887 | | |

| | |

Dunkin’ Brands Group, Inc. | | | 3,392 | | | | 154,370 | | |

| | |

| Popeyes Louisiana Kitchen, Inc.1 | | | 6,432 | | | | 245,059 | | |

| | |

Texas Roadhouse, Inc. | | | 14,372 | | | | 355,563 | | |

| | | | | | | | | |

| | | | | | | 1,072,879 | | |

| | |

Household Durables—0.7% | | | | | | |

KB Home | | | 11,144 | | | | 183,987 | | |

| | |

Specialty Retail—3.5% | | | | | | |

Mattress Firm Holding Corp.1 | | | 7,650 | | | | 345,704 | | |

| | |

Monro Muffler Brake, Inc. | | | 2,278 | | | | 128,479 | | |

| | |

Pier 1 Imports, Inc. | | | 12,111 | | | | 221,147 | | |

| | |

Signet Jewelers Ltd. | | | 1,739 | | | | 176,195 | | |

| | | | | | | | | |

| | | | | | | | 871,525 | | |

Consumer Staples—1.0% | | | | | | |

Food Products—1.0% | | | | | | |

Flowers Foods, Inc. | | | 11,745 | | | | 241,007 | | |

| | |

Energy—5.7% | | | | | | |

| | |

Oil, Gas & Consumable Fuels—5.7% | | | | | | |

EPL Oil & Gas, Inc.1 | | | 15,719 | | | | 615,242 | | |

| | |

| Renewable Energy Group, Inc.1 | | | 21,804 | | | | 256,633 | | |

| | |

Valero Energy Partners LP | | | 7,085 | | | | 291,973 | | |

| | |

Western Refining, Inc. | | | 6,363 | | | | 276,790 | | |

| | | | | | | | | |

| | | | | | | 1,440,638 | | |

| | |

Financials—22.1% | | | | | | |

| | |

Capital Markets—0.8% | | | | | | |

| WisdomTree Investments, Inc.1 | | | 19,186 | | | | 216,610 | | |

| | | | | | | | |

| | | Shares | | | Value | |

| |

Commercial Banks—8.0% | |

BancorpSouth, Inc. | | | 13,248 | | | $ | 309,473 | |

| |

BankUnited, Inc. | | | 10,607 | | | | 349,925 | |

| |

First Niagara Financial Group, Inc. | | | 39,645 | | | | 353,634 | |

| |

FirstMerit Corp. | | | 14,803 | | | | 287,030 | |

| |

MB Financial, Inc. | | | 10,726 | | | | 287,886 | |

| |

Talmer Bancorp, Inc., Cl. A1 | | | 9,553 | | | | 128,106 | |

| |

Webster Financial Corp. | | | 9,960 | | | | 300,194 | |

| | | | | | | | |

| | | | | | | 2,016,248 | |

| |

Insurance—1.0% | |

AmTrust Financial Services, Inc. | | | 6,450 | | | | 249,421 | |

| |

Real Estate Investment Trusts (REITs)—11.5% | |

Apollo Commercial Real Estate Finance, Inc. | | | 19,549 | | | | 332,528 | |

| |

Chatham Lodging Trust | | | 15,526 | | | | 315,643 | |

| |

DuPont Fabros Technology, Inc. | | | 10,112 | | | | 245,014 | |

| |

LaSalle Hotel Properties | | | 18,753 | | | | 620,349 | |

| |

| Mid-America Apartment Communities, Inc. | | | 5,101 | | | | 355,285 | |

| |

Redwood Trust, Inc. | | | 22,222 | | | | 484,440 | |

| |

STAG Industrial, Inc. | | | 14,448 | | | | 339,961 | |

| |

Starwood Property Trust, Inc. | | | 8,552 | | | | 205,676 | |

| | | | | | | | |

| | | | | | | 2,898,896 | |

| |

Thrifts & Mortgage Finance—0.8% | |

Oritani Financial Corp. | | | 12,926 | | | | 191,693 | |

| |

Health Care—13.4% | |

| |

Biotechnology—1.3% | |

Celldex Therapeutics, Inc.1 | | | 5,204 | | | | 78,060 | |

| |

Keryx Biopharmaceuticals, Inc.1 | | | 12,757 | | | | 188,421 | |

| |

Ultragenyx Pharmaceutical, Inc.1 | | | 1,576 | | | | 61,117 | |

| | | | | | | | |

| | | | | | | 327,598 | |

12 OPPENHEIMER MAIN STREET SMALL CAP FUND

| | | | | | | | | | |

| | | Shares | | | Value | | | |

| | |

Health Care Equipment & Supplies—4.0% | | |

DexCom, Inc.1 | | | 5,944 | | | $ | 192,823 | | |

| | |

Endologix, Inc.1 | | | 11,769 | | | | 149,231 | | |

| | |

Greatbatch, Inc.1 | | | 5,014 | | | | 230,795 | | |

| | |

| Integra LifeSciences Holdings Corp.1 | | | 4,504 | | | | 205,292 | | |

| | |

Spectranetics Corp.1 | | | 10,736 | | | | 228,247 | | |

| | | | | | | | | |

| | | | | | | 1,006,388 | | |

| | |

Health Care Providers & Services—3.9% | | |

HealthSouth Corp. | | | 9,751 | | | | 337,775 | | |

| | |

Team Health Holdings, Inc.1 | | | 4,113 | | | | 199,398 | | |

| | |

WellCare Health Plans, Inc.1 | | | 6,596 | | | | 445,032 | | |

| | | | | | | | | |

| | | | | | | 982,205 | | |

| | |

Health Care Technology—0.6% | | |

HMS Holdings Corp.1 | | | 9,316 | | | | 150,640 | | |

| | |

Life Sciences Tools & Services—0.8% | | |

Fluidigm Corp.1 | | | 2,238 | | | | 84,059 | | |

| | |

MorphoSys AG1 | | | 1,412 | | | | 120,947 | | |

| | | | | | | | | |

| | | | | | | 205,006 | | |

| | |

Pharmaceuticals—2.8% | | |

AcelRx Pharmaceuticals, Inc.1 | | | 5,597 | | | | 60,560 | | |

| | |

Aratana Therapeutics, Inc.1 | | | 5,243 | | | | 72,249 | | |

| | |

Horizon Pharma, Inc.1 | | | 10,555 | | | | 149,670 | | |

| | |

Prestige Brands Holdings, Inc.1 | | | 13,022 | | | | 436,497 | | |

| | | | | | | | | |

| | | | | | | 718,976 | | |

| | |

Industrials—17.9% | | |

| | |

Aerospace & Defense—1.0% | | |

Orbital Sciences Corp.1 | | | 8,807 | | | | 258,926 | | |

| | |

Air Freight & Couriers—0.7% | | |

XPO Logistics, Inc.1 | | | 6,668 | | | | 180,969 | | |

| | |

Airlines—0.8% | | |

Spirit Airlines, Inc.1 | | | 3,432 | | | | 195,075 | | |

| | |

Commercial Services & Supplies—6.0% | | |

ABM Industries, Inc. | | | 6,582 | | | | 178,306 | | |

| | |

ACCO Brands Corp.1 | | | 39,278 | | | | 240,774 | | |

| | | | | | | | |

| | | Shares | | | Value | |

| |

Commercial Services & Supplies (Continued) | |

| |

KAR Auction Services, Inc. | | | 19,234 | | | $ | 572,789 | |

| |

Mobile Mini, Inc. | | | 5,089 | | | | 224,832 | |

| |

Waste Connections, Inc. | | | 6,652 | | | | 297,078 | |

| | | | | | | | |

| | | | | | | 1,513,779 | |

| |

Construction & Engineering—0.9% | |

AECOM Technology Corp.1 | | | 6,721 | | | | 217,895 | |

| |

Machinery—1.6% | |

Greenbrier Cos., Inc. (The)1 | | | 2,770 | | | | 145,259 | |

| |

Titan International, Inc. | | | 7,234 | | | | 126,667 | |

| |

Wabash National Corp.1 | | | 9,253 | | | | 123,620 | |

| | | | | | | | |

| | | | | | | 395,546 | |

| |

Professional Services—4.2% | |

Korn/Ferry International1 | | | 20,152 | | | | 585,416 | |

| |

Paylocity Holding Corp.1 | | | 2,600 | | | | 49,166 | |

| |

Robert Half International, Inc. | | | 9,474 | | | | 424,435 | |

| | | | | | | | |

| | | | | | | 1,059,017 | |

| |

Road & Rail—1.8% | |

Saia, Inc.1 | | | 5,591 | | | | 230,182 | |

| |

Swift Transportation Co.1 | | | 9,884 | | | | 237,710 | |

| | | | | | | | |

| | | | | | | 467,892 | |

| |

Transportation Infrastructure—0.9% | |

Wesco Aircraft Holdings, Inc.1 | | | 11,858 | | | | 240,243 | |

| |

Information Technology—15.9% | |

| |

Communications Equipment—2.3% | |

Finisar Corp.1 | | | 22,507 | | | | 588,558 | |

| |

Internet Software & Services—2.1% | |

j2 Global, Inc. | | | 4,568 | | | | 211,772 | |

| |

Web.com Group, Inc.1 | | | 10,635 | | | | 326,601 | |

| | | | | | | | |

| | | | | | | 538,373 | |

| |

IT Services—2.9% | |

Booz Allen Hamilton Holding Corp. | | | 9,493 | | | | 220,618 | |

13 OPPENHEIMER MAIN STREET SMALL CAP FUND

|

|

| STATEMENTOF INVESTMENTS Continued |

|

| | | | | | | | | | |

| | | Shares | | | Value | | | |

| | |

IT Services (Continued) | | |

| | |

MAXIMUS, Inc. | | | 6,590 | | | $ | 280,536 | | |

| | |

Unisys Corp.1 | | | 8,987 | | | | 219,013 | | |

| | | | | | | | | |

| | | | | | | 720,167 | | |

| | |

Semiconductors & Semiconductor Equipment—3.5% | | |

Cavium, Inc.1 | | | 10,368 | | | | 439,292 | | |

| | |

Semtech Corp.1 | | | 8,172 | | | | 195,965 | | |

| | |

Skyworks Solutions, Inc.1 | | | 5,685 | | | | 233,369 | | |

| | | | | | | | | |

| | | | | | | 868,626 | | |

| | |

Software—5.1% | | |

FleetMatics Group plc1 | | | 3,471 | | | | 104,234 | | |

| | |

Fortinet, Inc.1 | | | 17,779 | | | | 390,782 | | |

| | |

Guidewire Software, Inc.1 | | | 8,905 | | | | 336,253 | | |

| | |

Imperva, Inc.1 | | | 3,730 | | | | 85,342 | | |

| | |

Infoblox, Inc.1 | | | 11,522 | | | | 226,062 | | |

| | |

Proofpoint, Inc.1 | | | 5,879 | | | | 149,562 | | |

| | | | | | | | | |

| | | | | | | 1,292,235 | | |

| | |

Materials—9.3% | | |

| | |

Chemicals—3.7% | | |

| | |

A. Schulman, Inc. | | | 7,107 | | | | 255,284 | | |

| | |

Cytec Industries, Inc. | | | 2,703 | | | | 257,650 | | |

| | |

Intrepid Potash, Inc.1 | | | 11,828 | | | | 192,796 | | |

| | |

Tronox Ltd., Cl. A | | | 8,759 | | | | 214,596 | | |

| | | | | | | | | |

| | | | | | | 920,326 | | |

| | |

Containers & Packaging—0.6% | | |

Packaging Corp. of America | | | 2,408 | | | | 160,445 | | |

| | | | | | | | |

| | | Shares | | | Value | |

Metals & Mining—2.2% | |

Century Aluminum Co.1 | | | 16,192 | | | $ | 222,640 | |

| |

Kaiser Aluminum Corp. | | | 4,615 | | | | 324,896 | |

| | | | | | | | |

| | | | | | | 547,536 | |

| |

Paper & Forest Products—2.8% | |

Boise Cascade Co.1 | | | 11,254 | | | | 281,575 | |

| |

P.H. Glatfelter Co. | | | 17,108 | | | | 436,596 | |

| | | | | | | | |

| | | | | | | 718,171 | |

| |

Utilities—0.4% | |

| |

Water Utilities—0.4% | |

Aqua America, Inc. | | | 4,242 | | | | 106,432 | |

| | | | | | | | |

Total Common Stocks (Cost $23,681,340) | | | | | | | 24,832,650 | |

Investment Company—2.7% | |

| |

Oppenheimer Institutional Money Market Fund, Cl. E, 0.08%2,3 (Cost $682,204) | | | 682,204 | | | | 682,204 | |

| |

Total Investments, at Value (Cost $24,363,544) | | | 101.1 | % | | | 25,514,854 | |

| |

Liabilities in Excess of Other Assets | | | (1.1 | ) | | | (276,523 | ) |

| | | | |

Net Assets | | | 100.0 | % | | $ | 25,238,331 | |

| | | | |

Footnotes to Statement of Investments

1. Non-income producing security.

2. Rate shown is the 7-day yield as of April 30, 2014.

14 OPPENHEIMER MAIN STREET SMALL CAP FUND

Footnotes to Statement of Investments (Continued)

3. Is or was an affiliate, as defined in the Investment Company Act of 1940, at or during the period ended April 30, 2014, by virtue of the Fund owning at least 5% of the voting securities of the issuer or as a result of the Fund and the issuer having the same investment adviser. Transactions during the period in which the issuer was an affiliate are as follows:

| | | | | | | | | | | | | | | | |

| | | Shares May 17, 2013

(Commencement

of Operations) | | | Gross

Additions | | | Gross

Reductions | | | Shares

April 30, 2014 | |

Oppenheimer Institutional Money Market Fund, Cl. E | | | — | | | | 10,598,313 | | | | 9,916,109 | | | | 682,204 | |

| | | | |

| | | | | | | | | Value | | | Income | |

Oppenheimer Institutional Money Market Fund, Cl. E | | | | | | | $ | 682,204 | | | $ | 380 | |

See accompanying Notes to Financial Statements.

15 OPPENHEIMER MAIN STREET SMALL CAP FUND

|

|

| STATEMENT OF ASSETS AND LIABILITIES April 30, 2014 |

|

| | | | |

Assets | | | | |

Investments, at value—see accompanying statement of investments: | | | | |

Unaffiliated companies (cost $23,681,340) | | $ | 24,832,650 | |

Affiliated companies (cost $682,204) | | | 682,204 | |

| | | | |

| | | 25,514,854 | |

| |

Receivables and other assets: | | | | |

Shares of beneficial interest sold | | | 184,634 | |

Investments sold | | | 34,818 | |

Dividends | | | 14,243 | |

Other | | | 6,052 | |

| | | | |

Total assets | | | 25,754,601 | |

|

| |

Liabilities | | | | |

Payables and other liabilities: | | | | |

Investments purchased | | | 330,973 | |

Shares of beneficial interest redeemed | | | 157,038 | |

Distribution and service plan fees | | | 5,023 | |

Trustees’ compensation | | | 1,022 | |

Shareholder communications | | | 789 | |

Other | | | 21,425 | |

| | | | |

Total liabilities | | | 516,270 | |

|

| |

Net Assets | | $ | 25,238,331 | |

| | | | |

| | | | |

Composition of Net Assets | | | | |

Par value of shares of beneficial interest | | $ | 2,183 | |

| |

Additional paid-in capital | | | 23,305,032 | |

| |

Accumulated net investment income | | | 48,645 | |

| |

Accumulated net realized gain on investments and foreign currency transactions | | | 731,161 | |

| |

Net unrealized appreciation on investments and translation of assets and liabilities denominated in foreign currencies | | | 1,151,310 | |

| | | | |

Net Assets | | $ | 25,238,331 | |

| | | | |

16 OPPENHEIMER MAIN STREET SMALL CAP FUND

| | | | |

Net Asset Value Per Share | | | | |

Class A Shares: | | | | |

| |

| Net asset value and redemption price per share (based on net assets of $21,891,983 and 1,891,895 shares of beneficial interest outstanding) | | $ | 11.57 | |

| Maximum offering price per share (net asset value plus sales charge of 5.75% of offering price) | | $ | 12.28 | |

| |

| |

| Class C Shares: | | | | |

| |

| Net asset value, redemption price (excludes applicable contingent deferred sales charge) and offering price per share (based on net assets of $2,252,122 and 195,949 shares of beneficial interest outstanding) | | $ | 11.49 | |

| |

| |

| Class I Shares: | | | | |

| |

| Net asset value, redemption price and offering price per share (based on net assets of $11,585 and 1,000 shares of beneficial interest outstanding) | | $ | 11.58 | |

| |

| |

| Class N Shares: | | | | |

| |

| Net asset value, redemption price (excludes applicable contingent deferred sales charge) and offering price per share (based on net assets of $650,282 and 56,389 shares of beneficial interest outstanding) | | $ | 11.53 | |

| |

| |

| Class Y Shares: | | | | |

| |

| Net asset value, redemption price and offering price per share (based on net assets of $432,359 and 37,314 shares of beneficial interest outstanding) | | $ | 11.59 | |

See accompanying Notes to Financial Statements.

17 OPPENHEIMER MAIN STREET SMALL CAP FUND

|

|

| STATEMENT OF OPERATIONS For the Period Ended April 30, 20141 |

| | | | |

Investment Income | | | | |

| |

Dividends: | | | | |

Unaffiliated companies | | $ | 285,512 | |

Affiliated companies | | | 380 | |

| |

Interest | | | 11 | |

| | | | |

Total investment income | | | 285,903 | |

Expenses | | | | |

Management fees | | | 117,445 | |

| |

Distribution and service plan fees: | | | | |

Class A | | | 11,759 | |

Class C | | | 8,316 | |

Class N | | | 1,267 | |

| |

Transfer and shareholder servicing agent fees: | | | | |

Class A | | | 31,279 | |

Class C | | | 1,830 | |

Class I | | | 4 | |

Class N | | | 565 | |

Class Y | | | 751 | |

| |

Shareholder communications: | | | | |

Class A | | | 3,444 | |

Class C | | | 773 | |

Class N | | | 134 | |

Class Y | | | 52 | |

| |

Legal, auditing and other professional fees | | | 37,178 | |

| |

Trustees’ compensation | | | 8,252 | |

| |

Custodian fees and expenses | | | 537 | |

| |

Other | | | 5,031 | |

| | | | |

Total expenses | | | 228,617 | |

Less waivers and reimbursements of expenses | | | (24,596) | |

| | | | |

Net expenses | | | 204,021 | |

Net Investment Income | | | 81,882 | |

Realized and Unrealized Gain | | | | |

Net realized gain on: | | | | |

Investments from unaffiliated companies | | | 867,919 | |

Foreign currency transactions | | | 53 | |

| | | | |

Net realized gain | | | 867,972 | |

| |

Net change in unrealized appreciation/depreciation on: | | | | |

Investments | | | 1,150,464 | |

Translation of assets and liabilities denominated in foreign currencies | | | 846 | |

| | | | |

Net change in unrealized appreciation/depreciation | | | 1,151,310 | |

Net Increase in Net Assets Resulting from Operations | | $ | 2,101,164 | |

| | | | |

1. For the period from May 17, 2013 (commencement of operations) to April 30, 2014.

See accompanying Notes to Financial Statements.

18 OPPENHEIMER MAIN STREET SMALL CAP FUND

|

|

| STATEMENT OF CHANGES IN NET ASSETS |

| | | | |

| | | Period Ended

April 30, 20141 | |

| |

Operations | | | | |

Net investment income | | $ | 81,882 | |

| |

Net realized gain | | | 867,972 | |

| |

Net change in unrealized appreciation/depreciation | | | 1,151,310 | |

| | | | |

Net increase in net assets resulting from operations | | | 2,101,164 | |

Dividends and/or Distributions to Shareholders | | | | |

Dividends from net investment income: | | | | |

Class A | | | (30,606 | ) |

Class C | | | — | |

Class I | | | (50 | ) |

Class N | | | (381 | ) |

Class Y | | | (1,463 | ) |

| | | | |

| | | (32,500 | ) |

| |

Distributions from net realized gain: | | | | |

Class A | | | (50,616 | ) |

Class C | | | (3,263 | ) |

Class I | | | (37 | ) |

Class N | | | (1,209 | ) |

Class Y | | | (1,245 | ) |

| | | | |

| | | (56,370 | ) |

Beneficial Interest Transactions | | | | |

Net increase (decrease) in net assets resulting from beneficial interest transactions: | | | | |

Class A | | | 19,964,080 | |

Class C | | | 2,174,405 | |

Class I | | | (1,429 | ) |

Class N | | | 617,205 | |

Class Y | | | 371,776 | |

| | | | |

| | | 23,126,037 | |

Net Assets | | | | |

Total increase | | | 25,138,331 | |

| |

Beginning of period | | | 100,000 | 2 |

| | | | |

End of period (including accumulated net investment income of $48,645) | | $ | 25,238,331 | |

| | | | |

1. For the period from May 17, 2013 (commencement of operations) to April 30, 2014.

2. Reflects the value of the Manager’s seed money invested on February 21, 2013.

See accompanying Notes to Financial Statements.

19 OPPENHEIMER MAIN STREET SMALL CAP FUND

| | | | |

| Class A | | Period Ended

April 30,

20141 | |

| |

Per Share Operating Data | | | | |

| Net asset value, beginning of period | | $ | 10.00 | |

| |

| Income (loss) from investment operations: | | | | |

| Net investment income2 | | | 0.06 | |

| Net realized and unrealized gain | | | 1.57 | |

| | | | |

| Total from investment operations | | | 1.63 | |

| |

| Dividends and/or distributions to shareholders: | | | | |

| Dividends from net investment income | | | (0.02) | |

| Distributions from net realized gain | | | (0.04) | |

| | | | |

| Total dividends and/or distributions to shareholders | | | (0.06) | |

| |

| Net asset value, end of period | | $ | 11.57 | |

| | | | |

| | | | |

| |

| Total Return, at Net Asset Value3 | | | 16.33% | |

| |

| Ratios/Supplemental Data | | | | |

| Net assets, end of period (in thousands) | | $ | 21,892 | |

| |

| Average net assets (in thousands) | | $ | 14,944 | |

| |

| Ratios to average net assets:4 | | | | |

| Net investment income | | | 0.57% | |

| Total expenses5 | | | 1.40% | |

| Expenses after payments, waivers and/or reimbursements and reduction to custodian expenses | | | 1.24% | |

| |

| Portfolio turnover rate | | | 52% | |

1. For the period from May 17, 2013 (commencement of operations) to April 30, 2014.

2. Per share amounts calculated based on the average shares outstanding during the period.

3. Assumes an initial investment on the business day before the first day of the fiscal period, with all dividends and distributions reinvested in additional shares on the reinvestment date, and redemption at the net asset value calculated on the last business day of the fiscal period. Sales charges are not reflected in the total returns. Total returns are not annualized for periods less than one full year. Returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

4. Annualized for periods less than one full year.

5. Total expenses including indirect expenses from affiliated fund were as follows:

| | | | | | | | |

| | Period Ended April 30, 2014 | | | 1.40 | % | | |

See accompanying Notes to Financial Statements.

20 OPPENHEIMER MAIN STREET SMALL CAP FUND

| | | | |

| Class C | | Period Ended

April 30,

20141 | |

| |

Per Share Operating Data | | | | |

| Net asset value, beginning of period | | $ | 10.00 | |

| |

| Income (loss) from investment operations: | | | | |

| Net investment loss2 | | | (0.04) | |

| Net realized and unrealized gain | | | 1.57 | |

| | | | |

| Total from investment operations | | | 1.53 | |

| |

| Dividends and/or distributions to shareholders: | | | | |

| Dividends from net investment income | | | (0.00) | |

| Distributions from net realized gain | | | (0.04) | |

| | | | |

| Total dividends and/or distributions to shareholders | | | (0.04) | |

| |

| Net asset value, end of period | | $ | 11.49 | |

| | | | |

| | | | |

| |

| Total Return, at Net Asset Value3 | | | 15.29% | |

| |

| Ratios/Supplemental Data | | | | |

| Net assets, end of period (in thousands) | | $ | 2,252 | |

| |

| Average net assets (in thousands) | | $ | 879 | |

| |

| Ratios to average net assets:4 | | | | |

| Net investment loss | | | (0.34)% | |

| Total expenses5 | | | 2.31% | |

| Expenses after payments, waivers and/or reimbursements and reduction to custodian expenses | | | 2.23% | |

| |

| Portfolio turnover rate | | | 52% | |

1. For the period from May 17, 2013 (commencement of operations) to April 30, 2014.

2. Per share amounts calculated based on the average shares outstanding during the period.

3. Assumes an initial investment on the business day before the first day of the fiscal period, with all dividends and distributions reinvested in additional shares on the reinvestment date, and redemption at the net asset value calculated on the last business day of the fiscal period. Sales charges are not reflected in the total returns. Total returns are not annualized for periods less than one full year. Returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

4. Annualized for periods less than one full year.

5. Total expenses including indirect expenses from affiliated fund were as follows:

| | | | | | | | |

| | Period Ended April 30, 2014 | | | 2.31 | % | | |

See accompanying Notes to Financial Statements.

21 OPPENHEIMER MAIN STREET SMALL CAP FUND

|

|

| FINANCIAL HIGHLIGHTS Continued |

|

| | | | |

| Class I | | Period Ended

April 30,

20141 | |

| |

Per Share Operating Data | | | | |

| Net asset value, beginning of period | | $ | 10.00 | |

| |

| Income (loss) from investment operations: | | | | |

| Net investment income2 | | | 0.09 | |

| Net realized and unrealized gain | | | 1.58 | |

| | | | |

| Total from investment operations | | | 1.67 | |

| |

| Dividends and/or distributions to shareholders: | | | | |

| Dividends from net investment income | | | (0.05) | |

| Distributions from net realized gain | | | (0.04) | |

| | | | |

| Total dividends and/or distributions to shareholders | | | (0.09) | |

| |

| Net asset value, end of period | | $ | 11.58 | |

| | | | |

| | | | |

| |

| Total Return, at Net Asset Value3 | | | 16.73% | |

| |

| Ratios/Supplemental Data | | | | |

| Net assets, end of period (in thousands) | | $ | 12 | |

| |

| Average net assets (in thousands) | | $ | 12 | |

| |

| Ratios to average net assets:4 | | | | |

| Net investment income | | | 0.86% | |

| Total expenses5 | | | 1.09% | |

| Expenses after payments, waivers and/or reimbursements and reduction to custodian expenses | | | 0.80% | |

| |

| Portfolio turnover rate | | | 52% | |

1. For the period from May 17, 2013 (commencement of operations) to April 30, 2014.

2. Per share amounts calculated based on the average shares outstanding during the period.

3. Assumes an initial investment on the business day before the first day of the fiscal period, with all dividends and distributions reinvested in additional shares on the reinvestment date, and redemption at the net asset value calculated on the last business day of the fiscal period. Sales charges are not reflected in the total returns. Total returns are not annualized for periods less than one full year. Returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

4. Annualized for periods less than one full year.

5. Total expenses including indirect expenses from affiliated fund were as follows:

| | | | | | | | |

| | Period Ended April 30, 2014 | | | 1.09 | % | | |

See accompanying Notes to Financial Statements.

22 OPPENHEIMER MAIN STREET SMALL CAP FUND

| | | | |

| Class N | | Period Ended

April 30,

20141 | |

| |

Per Share Operating Data | | | | |

| Net asset value, beginning of period | | $ | 10.00 | |

| |

| Income (loss) from investment operations: | | | | |

| Net investment income2 | | | 0.02 | |

| Net realized and unrealized gain | | | 1.56 | |

| | | | |

| Total from investment operations | | | 1.58 | |

| |

| Dividends and/or distributions to shareholders: | | | | |

| Dividends from net investment income | | | (0.01) | |

| Distributions from net realized gain | | | (0.04) | |

| | | | |

| Total dividends and/or distributions to shareholders | | | (0.05) | |

| |

| Net asset value, end of period | | $ | 11.53 | |

| | | | |

| | | | |

| |

| Total Return, at Net Asset Value3 | | | 15.82% | |

| |

| Ratios/Supplemental Data | | | | |

| Net assets, end of period (in thousands) | | $ | 650 | |

| |

| Average net assets (in thousands) | | $ | 271 | |

| |

| Ratios to average net assets:4 | | | | |

| Net investment income | | | 0.19% | |

| Total expenses5 | | | 1.76% | |

| Expenses after payments, waivers and/or reimbursements and reduction to custodian expenses | | | 1.71% | |

| |

| Portfolio turnover rate | | | 52% | |

1. For the period from May 17, 2013 (commencement of operations) to April 30, 2014.

2. Per share amounts calculated based on the average shares outstanding during the period.

3. Assumes an initial investment on the business day before the first day of the fiscal period, with all dividends and distributions reinvested in additional shares on the reinvestment date, and redemption at the net asset value calculated on the last business day of the fiscal period. Sales charges are not reflected in the total returns. Total returns are not annualized for periods less than one full year. Returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

4. Annualized for periods less than one full year.

5. Total expenses including indirect expenses from affiliated fund were as follows:

| | | | | | | | |

| | Period Ended April 30, 2014 | | | 1.76 | % | | |

See accompanying Notes to Financial Statements.

23 OPPENHEIMER MAIN STREET SMALL CAP FUND

|

|

| FINANCIAL HIGHLIGHTS Continued |

| | | | |

| Class Y | | Period Ended

April 30,

20141 | |

| |

Per Share Operating Data | | | | |

| Net asset value, beginning of period | | $ | 10.00 | |

| |

| Income (loss) from investment operations: | | | | |

| Net investment income2 | | | 0.09 | |

| Net realized and unrealized gain | | | 1.58 | |

| | | | |

| Total from investment operations | | | 1.67 | |

| |

| Dividends and/or distributions to shareholders: | | | | |

| Dividends from net investment income | | | (0.04) | |

| Distributions from net realized gain | | | (0.04) | |

| | | | |

| Total dividends and/or distributions to shareholders | | | (0.08) | |

| |

| Net asset value, end of period | | $ | 11.59 | |

| | | | |

| | | | |

| |

| Total Return, at Net Asset Value3 | | | 16.76% | |

| |

| Ratios/Supplemental Data | | | | |

| Net assets, end of period (in thousands) | | $ | 432 | |

| |

| Average net assets (in thousands) | | $ | 358 | |

| |

| Ratios to average net assets:4 | | | | |

| Net investment income | | | 0.89% | |

| Total expenses5 | | | 1.33% | |

| Expenses after payments, waivers and/or reimbursements and reduction to custodian expenses | | | 0.90% | |

| |

| Portfolio turnover rate | | | 52% | |

1. For the period from May 17, 2013 (commencement of operations) to April 30, 2014.

2. Per share amounts calculated based on the average shares outstanding during the period.

3. Assumes an initial investment on the business day before the first day of the fiscal period, with all dividends and distributions reinvested in additional shares on the reinvestment date, and redemption at the net asset value calculated on the last business day of the fiscal period. Sales charges are not reflected in the total returns. Total returns are not annualized for periods less than one full year. Returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

4. Annualized for periods less than one full year.

5. Total expenses including indirect expenses from affiliated fund were as follows:

| | | | | | | | |

| | Period Ended April 30, 2014 | | | 1.33 | % | | |

See accompanying Notes to Financial Statements.

24 OPPENHEIMER MAIN STREET SMALL CAP FUND

|

|

| NOTES TO FINANCIAL STATEMENTS April 30, 2014 |

|

1. Significant Accounting Policies

Oppenheimer Main Street Small Cap Fund (the “Fund”) is registered under the Investment Company Act of 1940, as amended, as a diversified open-end management investment company. The Fund’s investment objective is to seek capital appreciation. The Fund’s investment adviser is OFI Global Asset Management, Inc. (“OFI Global” or the “Manager”), a wholly-owned subsidiary of OppenheimerFunds, Inc. (“OFI” or the “Sub-Adviser”). The Manager has entered into a sub-advisory agreement with OFI. As of April 30, 2014, approximately 46% of the shares of the Fund were owned by the Manager, other funds advised or sub-advised by the Manager or an affiliate of the Manager.

The Fund offers Class A, Class C, Class I, Class N and Class Y shares. Class A shares are sold at their offering price, which is normally net asset value plus a front-end sales charge. Class C and Class N shares are sold without a front-end sales charge but may be subject to a contingent deferred sales charge (“CDSC”). Class N shares are sold only through retirement plans. Retirement plans that offer Class N shares may impose charges on those accounts. Class I and Class Y shares are sold to certain institutional investors or intermediaries without either a front-end sales charge or a CDSC, however, the intermediaries may impose charges on their accountholders who beneficially own Class I and Class Y shares. All classes of shares have identical rights and voting privileges with respect to the Fund in general and exclusive voting rights on matters that affect that class alone. Earnings, net assets and net asset value per share may differ due to each class having its own expenses, such as transfer and shareholder servicing agent fees and shareholder communications, directly attributable to that class. Class A, C and N shares have separate distribution and/or service plans under which they pay fees. Class I and Class Y shares do not pay such fees.

The following is a summary of significant accounting policies consistently followed by the Fund.

Investment in Oppenheimer Institutional Money Market Fund. The Fund is permitted to invest daily available cash balances in an affiliated money market fund. The Fund may invest the available cash in Class E shares of Oppenheimer Institutional Money Market Fund (“IMMF”) to seek current income while preserving liquidity. IMMF is a registered open-end management investment company, regulated as a money market fund under the Investment Company Act of 1940, as amended. The Manager is the investment adviser of IMMF, and the Sub-Adviser provides investment and related advisory services to IMMF. When applicable, the Fund’s investment in IMMF is included in the Statement of Investments. Shares of IMMF are valued at their net asset value per share. As a shareholder, the Fund is subject to its proportional share of IMMF’s Class E expenses, including its management fee. The Manager will waive fees and/or reimburse Fund expenses in an amount equal to the indirect management fees incurred through the Fund’s investment in IMMF.

Foreign Currency Translation. The Fund’s accounting records are maintained in U.S. dollars. The values of securities denominated in foreign currencies and amounts related to the purchase and sale of foreign securities and foreign investment income are translated into U.S. dollars as of the close of the New York Stock Exchange (the “Exchange”), normally 4:00 P.M.

25 OPPENHEIMER MAIN STREET SMALL CAP FUND

|

|

| NOTES TO FINANCIAL STATEMENTS Continued |

|

| 1. Significant Accounting Policies (Continued) |

Eastern time, on each day the Exchange is open for trading. Foreign exchange rates may be valued primarily using a reliable bank, dealer or service authorized by the Board of Trustees.

Reported net realized gains and losses from foreign currency transactions arise from sales of portfolio securities, sales and maturities of short-term securities, sales of foreign currencies, exchange rate fluctuations between the trade and settlement dates on securities transactions, and the difference between the amounts of dividends, interest, and foreign withholding taxes recorded on the Fund’s books and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized appreciation and depreciation on the translation of assets and liabilities denominated in foreign currencies arise from changes in the values of assets and liabilities, including investments in securities at fiscal period end, resulting from changes in exchange rates.

The effect of changes in foreign currency exchange rates on investments is separately identified from the fluctuations arising from changes in market values of securities held and reported with all other foreign currency gains and losses in the Fund’s Statement of Operations.

Allocation of Income, Expenses, Gains and Losses. Income, expenses (other than those attributable to a specific class), gains and losses are allocated on a daily basis to each class of shares based upon the relative proportion of net assets represented by such class. Operating expenses directly attributable to a specific class are charged against the operations of that class.

Federal Taxes. The Fund intends to comply with provisions of the Internal Revenue Code applicable to regulated investment companies and to distribute substantially all of its investment company taxable income, including any net realized gain on investments not offset by capital loss carryforwards, if any, to shareholders. Therefore, no federal income or excise tax provision is required. The Fund files income tax returns in U.S. federal and applicable state jurisdictions. The statute of limitations on the Fund’s tax return filings generally remain open for the three preceding fiscal reporting period ends.

The tax components of capital shown in the following table represent distribution requirements the Fund must satisfy under the income tax regulations, losses the Fund may be able to offset against income and gains realized in future years and unrealized appreciation or depreciation of securities and other investments for federal income tax purposes.

| | | | | | | | | | | | |

Undistributed Net Investment Income | | Undistributed

Long-Term

Gain | | | Accumulated

Loss

Carryforward1 | | | Net Unrealized

Appreciation

Based on cost of

Securities and

Other Investments

for Federal Income

Tax Purposes | |

$790,828 | | | $712 | | | | $— | | | | $1,140,598 | |

1. During the fiscal period ended April 30, 2014, the Fund did not utilize any capital loss carryforward.

26 OPPENHEIMER MAIN STREET SMALL CAP FUND

|

|

|

|

| 1. Significant Accounting Policies (Continued) |

Net investment income (loss) and net realized gain (loss) may differ for financial statement and tax purposes. The character of dividends and distributions made during the fiscal year from net investment income or net realized gains may differ from their ultimate characterization for federal income tax purposes. Also, due to timing of dividends and distributions, the fiscal year in which amounts are distributed may differ from the fiscal year in which the income or net realized gain was recorded by the Fund.

Accordingly, the following amounts have been reclassified for April 30, 2014. Net assets of the Fund were unaffected by the reclassifications.

| | | | | | | | |

Increase to Paid-in Capital | | Reduction to Accumulated

Net Investment

Income | | | Reduction

to Accumulated Net

Realized Gain on Investments2 | |

$81,178 | | | $737 | | | | $80,441 | |

2. $83,675, including $80 of long-term capital gain, was distributed in connection with Fund share redemptions.

The tax character of distributions paid during the period ended April 30, 2014 was as follows:

| | | | |

| | | Period Ended April 30, 2014 | |

Distributions paid from: | | | | |

Ordinary income | | $ | 88,870 | |

The aggregate cost of securities and other investments and the composition of unrealized appreciation and depreciation of securities and other investments for federal income tax purposes as of April 30, 2014 are noted in the following table. The primary difference between book and tax appreciation or depreciation of securities and other investments, if applicable, is attributable to the tax deferral of losses or tax realization of financial statement unrealized gain or loss.

| | | | |

Federal tax cost of securities | | $ | 24,374,256 | |

| | | | |

| |

Gross unrealized appreciation | | $ | 2,320,280 | |

Gross unrealized depreciation | | | (1,179,682) | |

| | | | |

Net unrealized appreciation | | $ | 1,140,598 | |

| | | | |

Trustees’ Compensation. The Board of Trustees has adopted a compensation deferral plan for independent trustees that enables trustees to elect to defer receipt of all or a portion of the annual compensation they are entitled to receive from the Fund. For purposes of determining the amount owed to the Trustee under the plan, deferred amounts are treated as though equal dollar amounts had been invested in shares of the Fund or in other Oppenheimer funds selected by the Trustee. The Fund purchases shares of the funds selected

27 OPPENHEIMER MAIN STREET SMALL CAP FUND

|

|

| NOTES TO FINANCIAL STATEMENTS Continued |

|

| 1. Significant Accounting Policies (Continued) |

for deferral by the Trustee in amounts equal to his or her deemed investment, resulting in a Fund asset equal to the deferred compensation liability. Such assets are included as a component of “Other” within the asset section of the Statement of Assets and Liabilities. Deferral of trustees’ fees under the plan will not affect the net assets of the Fund, and will not materially affect the Fund’s assets, liabilities or net investment income per share. Amounts will be deferred until distributed in accordance with the compensation deferral plan.

Dividends and Distributions to Shareholders. Dividends and distributions to shareholders, which are determined in accordance with income tax regulations and may differ from U.S. generally accepted accounting principles, are recorded on the ex-dividend date. Income and capital gain distributions, if any, are declared and paid annually or at other times as deemed necessary by the Manager.

Investment Income. Dividend income is recorded on the ex-dividend date or upon ex-dividend notification in the case of certain foreign dividends where the ex-dividend date may have passed. Non-cash dividends included in dividend income, if any, are recorded at the fair market value of the securities received. Interest income is recognized on an accrual basis. Discount and premium, which are included in interest income on the Statement of Operations, are amortized or accreted daily.

Custodian Fees. “Custodian fees and expenses” in the Statement of Operations may include interest expense incurred by the Fund on any cash overdrafts of its custodian account during the period. Such cash overdrafts may result from the effects of failed trades in portfolio securities and from cash outflows resulting from unanticipated shareholder redemption activity. The Fund pays interest to its custodian on such cash overdrafts, to the extent they are not offset by positive cash balances maintained by the Fund, at a rate equal to the Federal Funds Rate plus 0.50%. The “Reduction to custodian expenses” line item, if applicable, represents earnings on cash balances maintained by the Fund during the period. Such interest expense and other custodian fees may be paid with these earnings.

Security Transactions. Security transactions are recorded on the trade date. Realized gains and losses on securities sold are determined on the basis of identified cost.

Indemnifications. The Fund’s organizational documents provide current and former trustees and officers with a limited indemnification against liabilities arising in connection with the performance of their duties to the Fund. In the normal course of business, the Fund may also enter into contracts that provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknown as this would be dependent on future claims that may be made against the Fund. The risk of material loss from such claims is considered remote.

Other. The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates

28 OPPENHEIMER MAIN STREET SMALL CAP FUND

|

|

|

|

| 1. Significant Accounting Policies (Continued) |

and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

2. Securities Valuation

The Fund calculates the net asset value of its shares as of the close of the New York Stock Exchange (the “Exchange”), normally 4:00 P.M. Eastern time, on each day the Exchange is open for trading.

The Fund’s Board has adopted procedures for the valuation of the Fund’s securities and has delegated the day-to-day responsibility for valuation determinations under those procedures to the Manager. The Manager has established a Valuation Committee which is responsible for determining a “fair valuation” for any security for which market quotations are not “readily available.” The Valuation Committee’s fair valuation determinations are subject to review, approval and ratification by the Fund’s Board at its next regularly scheduled meeting covering the calendar quarter in which the fair valuation was determined.

Valuation Methods and Inputs

Securities are valued using unadjusted quoted market prices, when available, as supplied primarily by third party pricing services or dealers.

The following methodologies are used to determine the market value or the fair value of the types of securities described below:

Securities traded on a registered U.S. securities exchange (including exchange-traded derivatives other than futures and futures options) are valued based on the last sale price of the security reported on the principal exchange on which it is traded, prior to the time when the Fund’s assets are valued. In the absence of a sale, the security is valued at the last sale price on the prior trading day, if it is within the spread of the current day’s closing “bid” and “asked” prices, and if not, at the current day’s closing bid price. A security of a foreign issuer traded on a foreign exchange, but not listed on a registered U.S. securities exchange, is valued based on the last sale price on the principal exchange on which the security is traded, as identified by the third party pricing service used by the Manager, prior to the time when the Fund’s assets are valued. If the last sale price is unavailable, the security is valued at the most recent official closing price on the principal exchange on which it is traded. If the last sales price or official closing price for a foreign security is not available, the security is valued at the mean between the bid and asked price per the exchange or, if not available from the exchange, obtained from two dealers. If bid and asked prices are not available from either the exchange or two dealers, the security is valued by using one of the following methodologies (listed in order of priority): (1) using a bid from the exchange, (2) the mean between the bid and asked price as provided by a single dealer, or (3) a bid from a single dealer.

Shares of a registered investment company that are not traded on an exchange are valued at that investment company’s net asset value per share.

Corporate and government debt securities (of U.S. or foreign issuers) and municipal debt securities, event-linked bonds, loans, mortgage-backed securities, collateralized mortgage

29 OPPENHEIMER MAIN STREET SMALL CAP FUND

|

|

| NOTES TO FINANCIAL STATEMENTS Continued |

|

| 2. Securities Valuation (Continued) |

obligations, and asset-backed securities are valued at the mean between the “bid” and “asked” prices utilizing evaluated prices obtained from third party pricing services or broker-dealers who may use matrix pricing methods to determine the evaluated prices.

Short-term money market type debt securities with a remaining maturity of sixty days or less are valued at cost adjusted by the amortization of discount or premium to maturity (amortized cost), which approximates market value. Short-term debt securities with a remaining maturity in excess of sixty days are valued at the mean between the “bid” and “asked” prices utilizing evaluated prices obtained from third party pricing services or broker-dealers.

A description of the standard inputs that may generally be considered by the third party pricing vendors in determining their evaluated prices is provided below.

| | |

| Security Type | | Standard inputs generally considered by third-party pricing vendors |

| Corporate debt, government debt, municipal, mortgage-backed and asset-backed securities | | Reported trade data, broker-dealer price quotations, benchmark yields, issuer spreads on comparable securities, the credit quality, yield, maturity, and other appropriate factors. |

| Loans | | Information obtained from market participants regarding reported trade data and broker-dealer price quotations. |

| Event-linked bonds | | Information obtained from market participants regarding reported trade data and broker-dealer price quotations. |

If a market value or price cannot be determined for a security using the methodologies described above, or if, in the “good faith” opinion of the Manager, the market value or price obtained does not constitute a “readily available market quotation,” or a significant event has occurred that would materially affect the value of the security the security is fair valued either (i) by a standardized fair valuation methodology applicable to the security type or the significant event as previously approved by the Valuation Committee and the Fund’s Board or (ii) as determined in good faith by the Manager’s Valuation Committee. The Valuation Committee considers all relevant facts that are reasonably available, through either public information or information available to the Manager, when determining the fair value of a security. Fair value determinations by the Manager are subject to review, approval and ratification by the Fund’s Board at its next regularly scheduled meeting covering the calendar quarter in which the fair valuation was determined. Those fair valuation standardized methodologies include, but are not limited to, valuing securities at the last sale price or initially at cost and subsequently adjusting the value based on: changes in company specific fundamentals, changes in an appropriate securities index, or changes in the value of similar securities which may be further adjusted for any discounts related to security-specific resale restrictions. When possible, such methodologies use observable market inputs such as unadjusted quoted prices of similar securities, observable interest rates, currency rates and yield curves. The methodologies used for valuing securities are not necessarily an indication of the risks associated with investing in those securities nor can it be assured that the Fund can obtain the fair value assigned to a security if it were to sell the security.

To assess the continuing appropriateness of security valuations, the Manager, or its third party service provider who is subject to oversight by the Manager, regularly compares prior

30 OPPENHEIMER MAIN STREET SMALL CAP FUND

|

|

|

|

| 2. Securities Valuation (Continued) |

day prices, prices on comparable securities, and sale prices to the current day prices and challenges those prices exceeding certain tolerance levels with the third party pricing service or broker source. For those securities valued by fair valuations, whether through a standardized fair valuation methodology or a fair valuation determination, the Valuation Committee reviews and affirms the reasonableness of the valuations based on such methodologies and fair valuation determinations on a regular basis after considering all relevant information that is reasonably available.

Classifications

Each investment asset or liability of the Fund is assigned a level at measurement date based on the significance and source of the inputs to its valuation. Various data inputs are used in determining the value of each of the Fund’s investments as of the reporting period end. These data inputs are categorized in the following hierarchy under applicable financial accounting standards:

1) Level 1-unadjusted quoted prices in active markets for identical assets or liabilities (including securities actively traded on a securities exchange)

2) Level 2-inputs other than unadjusted quoted prices that are observable for the asset or liability (such as unadjusted quoted prices for similar assets and market corroborated inputs such as interest rates, prepayment speeds, credit risks, etc.)

3) Level 3-significant unobservable inputs (including the Manager’s own judgments about assumptions that market participants would use in pricing the asset or liability).

The inputs used for valuing securities are not necessarily an indication of the risks associated with investing in those securities.

The table below categorizes amounts that are included in the Fund’s Statement of Assets and Liabilities as of April 30, 2014 based on valuation input level:

| | | | | | | | | | | | | | | | |

| | | Level 1—

Unadjusted

Quoted Prices | | | Level 2—

Other Significant

Observable Inputs | | | Level 3—

Significant

Unobservable

Inputs | | | Value | |

Assets Table | | | | | | | | | | | | | | | | |

Investments, at Value: | | | | | | | | | | | | | | | | |

Common Stocks | | | | | | | | | | | | | | | | |

Consumer Discretionary | | $ | 3,197,113 | | | $ | — | | | $ | — | | | $ | 3,197,113 | |

Consumer Staples | | | 241,007 | | | | — | | | | — | | | | 241,007 | |

Energy | | | 1,440,638 | | | | — | | | | — | | | | 1,440,638 | |

Financials | | | 5,572,868 | | | | — | | | | — | | | | 5,572,868 | |

Health Care | | | 3,269,866 | | | | 120,947 | | | | — | | | | 3,390,813 | |

Industrials | | | 4,529,342 | | | | — | | | | — | | | | 4,529,342 | |

Information Technology | | | 4,007,959 | | | | — | | | | — | | | | 4,007,959 | |

Materials | | | 2,346,478 | | | | — | | | | — | | | | 2,346,478 | |

Utilities | | | 106,432 | | | | — | | | | — | | | | 106,432 | |

Investment Company | | | 682,204 | | | | — | | | | — | | | | 682,204 | |

Total Assets | | $ | 25,393,907 | | | $ | 120,947 | | | $ | — | | | $ | 25,514,854 | |

31 OPPENHEIMER MAIN STREET SMALL CAP FUND

|

|

| NOTES TO FINANCIAL STATEMENTS Continued |

|

| 2. Securities Valuation (Continued) |

Currency contracts and forwards, if any, are reported at their unrealized appreciation/depreciation at measurement date, which represents the change in the contract’s value from trade date. Futures, if any, are reported at their variation margin at measurement date, which represents the amount due to/from the Fund at that date. All additional assets and liabilities included in the above table are reported at their market value at measurement date.

3. Shares of Beneficial Interest

The Fund has authorized an unlimited number of $0.001 par value shares of beneficial interest of each class. Transactions in shares of beneficial interest were as follows:

| | | | | | | | |

| | | Period Ended April 30, 20141,2 | |

| | | Shares | | | Amount | |

Class A | | | | | | | | |

Sold | | | 2,013,937 | | | $ | 21,441,242 | |

Dividends and/or distributions reinvested | | | 1,963 | | | | 21,472 | |

Redeemed | | | (130,005 | ) | | | (1,498,634) | |

| | | | |

Net increase | | | 1,885,895 | | | $ | 19,964,080 | |

| | | | |

| | | | | | | |

Class C | | | | | | | | |

Sold | | | 216,755 | | | $ | 2,412,429 | |

Dividends and/or distributions reinvested | | | 296 | | | | 3,225 | |

Redeemed | | | (22,102 | ) | | | (241,249) | |

| | | | |

Net increase | | | 194,949 | | | $ | 2,174,405 | |

| | | | |

| | | | | | | |

Class I | | | | | | | | |

Sold | | | 4,704 | | | $ | 53,377 | |

Dividends and/or distributions reinvested | | | — | | | | — | |

Redeemed | | | (4,704 | ) | | | (54,806) | |

| | | | |

Net decrease | | | — | | | $ | (1,429) | |

| | | | |

| | | | | | | |

Class N | | | | | | | | |

Sold | | | 57,841 | | | $ | 645,832 | |

Dividends and/or distributions reinvested | | | 141 | | | | 1,541 | |

Redeemed | | | (2,593 | ) | | | (30,168) | |

| | | | |

Net increase | | | 55,389 | | | $ | 617,205 | |

| | | | |

| | | | | | | |

Class Y | | | | | | | | |

Sold | | | 49,740 | | | $ | 505,486 | |

Dividends and/or distributions reinvested | | | 240 | | | | 2,627 | |

Redeemed | | | (13,666 | ) | | | (136,337) | |

| | | | |

Net increase | | | 36,314 | | | $ | 371,776 | |

| | | | |

32 OPPENHEIMER MAIN STREET SMALL CAP FUND

3. Shares of Beneficial Interest (Continued)

1. For the period ended May 17, 2013 (commencement of operations) to April 30, 2014.

2. The Fund sold 6,000 shares of Class A at a value of $60,000 and 1,000 shares of Class C, Class I, Class N and Class Y at a value of $10,000, respectively, to the Manager upon seeding of the Fund on February 21, 2013.

4. Purchases and Sales of Securities