UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

| x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended June 29, 2013

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 333-187556

SUMMIT MATERIALS, LLC

(Exact name of registrant as specified in its charter)

| | |

| Delaware | | 24-4138486 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| |

1550 Wynkoop Street, 3rd Floor Denver, CO | | 80202 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (303) 893-0012

2900 K Street NW, Suite 100, Harbourside North Tower Building, Washington, D.C. 20007

(Former name, former address and former fiscal year, if changed since last report)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ¨ No x

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| | | | | | |

| Large accelerated filer | | ¨ | | Accelerated filer ¨ | | |

| | | |

| Non-accelerated filer | | x (Do not check if a smaller reporting company) | | Smaller reporting company | | ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

As of August 7, 2013, 100% of the registrant’s outstanding limited liability company interests were held by Summit Materials Intermediate Holdings, LLC.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This quarterly report on Form 10-Q (this “report”) includes “forward-looking statements” within the meaning of the federal securities laws, which involve risks and uncertainties. Forward-looking statements include all statements that do not relate solely to historical or current facts, and you can identify forward-looking statements because they contain words such as “believes,” “expects,” “may,” “will,” “should,” “seeks,” “intends,” “plans,” “estimates,” “projects” or “anticipates” or similar expressions that concern our strategy, plans or intentions. All statements made relating to our estimated and projected earnings, margins, costs, expenditures, cash flows, growth rates and financial results are forward-looking statements. These forward-looking statements are subject to risks, uncertainties and other factors which may cause our actual results, performance or achievements to be materially different from future results, performance or achievements expressed or implied by such forward-looking statements. We derive many of our forward-looking statements from our operating budgets and forecasts, which are based upon many detailed assumptions. While we believe that our assumptions are reasonable, it is very difficult to predict the impact of known factors, and, of course, it is impossible to anticipate all factors that could affect our actual results. In light of the significant uncertainties inherent in the forward-looking statements included herein, the inclusion of such information should not be regarded as a representation by us or any other person that the results or conditions described in such statements or our objectives and plans will be achieved. Important factors could affect our results and could cause results to differ materially from those expressed in our forward-looking statements, including but not limited to the factors discussed in the section entitled “Risk Factors” in our prospectus dated June 10, 2013 (the “Prospectus”), filed with the Securities and Exchange Commission (the “SEC”) in accordance with Rule 424(b) of the Securities Act of 1933, as amended, on June 10, 2013, any factors discussed in the section entitled “Risk Factors” of this report, and the following:

| | • | | our substantial current level of indebtedness; |

| | • | | our dependence on the construction industry and the strength of the local economies in which we operate; |

| | • | | our ability to acquire other businesses in our industry, successfully integrate them with our existing operations and retain key employees of such acquired businesses; |

| | • | | the cyclical nature of our business; |

| | • | | declines in public sector construction and reductions in governmental funding, including the funding of transportation authorities and other state agencies; |

| | • | | conditions in the credit markets; |

| | • | | our ability to accurately estimate the overall risks, requirements or costs when we bid on or negotiate a contract that is ultimately awarded to us; |

| | • | | risks related to weather and seasonality; |

| | • | | competition within our local markets; |

| | • | | our dependence on securing and permitting aggregate reserves in strategically located areas; |

| | • | | risks associated with our capital-intensive business; |

| | • | | any failure to meet schedule or performance requirements of our contracts; |

| | • | | changes in environmental, health, safety and climate change laws or governmental requirements or policies concerning zoning and land use; |

| | • | | our dependence on senior management and inability to attract and retain qualified management personnel; |

| | • | | special hazards related to our operations that may cause personal injury or property damage not covered by insurance; |

| | • | | material costs and losses as a result of claims that our products do not meet regulatory requirements or contractual specifications; |

| | • | | cancellation of significant contracts or our disqualification from bidding for new contracts; |

| | • | | our status as an “emerging growth company” which permits us to rely on exemptions from certain disclosure requirements; |

| | • | | interruptions in our information technology systems and infrastructure; and |

| | • | | other factors as described in the Prospectus. |

All subsequent written and oral forward-looking statements attributable to us, or persons acting on our behalf, are expressly qualified in their entirety by these cautionary statements.

Any forward-looking statement that we make speaks only as of the date of this report. We undertake no obligation to publicly update or revise any forward-looking statement as a result of new information, future events or otherwise, except as otherwise required by law.

As used in this report, unless otherwise noted or the context otherwise requires,

| | • | | “we,” “our,” “us,” and “the Company” refer to Summit Materials, LLC and its subsidiaries as a combined entity; |

| | • | | “Summit Materials” refers only to Summit Materials, LLC and not its subsidiaries; |

| | • | | “Sponsors” refers to Blackstone Capital Partners V L.P. and Silverhawk Summit, L.P.; |

| | • | | “Lafarge” refers to Lafarge North America, Inc.; and |

| | • | | “Westroc” refers to Westroc, LLC. |

SUMMIT MATERIALS, LLC

FORM 10-Q

TABLE OF CONTENTS

PART I—FINANCIAL INFORMATION

| ITEM 1. | FINANCIAL STATEMENTS |

SUMMIT MATERIALS, LLC AND SUBSIDIARIES

Consolidated Balance Sheets

(In thousands)

| | | | | | | | |

| | | June 29,

2013

(unaudited) | | | December 29,

2012

(audited) | |

| Assets | | | | | | | | |

Current assets: | | | | | | | | |

Cash | | $ | 7,655 | | | $ | 27,431 | |

Accounts receivable, net | | | 119,557 | | | | 100,298 | |

Costs and estimated earnings in excess of billings | | | 24,356 | | | | 11,575 | |

Inventories | | | 110,153 | | | | 92,977 | |

Other current assets | | | 11,996 | | | | 10,068 | |

| | | | | | | | |

Total current assets | | | 273,717 | | | | 242,349 | |

Property, plant and equipment, less accumulated depreciation, depletion and amortization (June 29, 2013 - $183,094 and December 29, 2012 - $156,313) | | | 858,519 | | | | 813,607 | |

Goodwill | | | 192,505 | | | | 179,120 | |

Intangible assets, less accumulated amortization (June 29, 2013 - $1,712 and December 29, 2012 - $1,354) | | | 15,595 | | | | 8,606 | |

Other assets | | | 36,429 | | | | 37,531 | |

| | | | | | | | |

Total assets | | $ | 1,376,765 | | | $ | 1,281,213 | |

| | | | | | | | |

| Liabilities, Redeemable Noncontrolling Interest and Member’s Interest | | | | | | | | |

Current liabilities: | | | | | | | | |

Current portion of debt | | $ | 108,165 | | | $ | 4,000 | |

Current portion of acquisition-related liabilities | | | 11,115 | | | | 9,525 | |

Accounts payable | | | 75,828 | | | | 61,634 | |

Accrued expenses | | | 56,263 | | | | 49,822 | |

Billings in excess of costs and estimated earnings | | | 5,583 | | | | 6,926 | |

| | | | | | | | |

Total current liabilities | | | 256,954 | | | | 131,907 | |

Long-term debt | | | 660,241 | | | | 635,843 | |

Acquisition-related liabilities | | | 28,052 | | | | 23,919 | |

Other noncurrent liabilities | | | 81,133 | | | | 84,266 | |

| | | | | | | | |

Total liabilities | | | 1,026,380 | | | | 875,935 | |

| | | | | | | | |

Commitments and contingencies (see note 9) | | | | | | | | |

Redeemable noncontrolling interest | | | 23,150 | | | | 22,850 | |

Member’s interest: | | | | | | | | |

Member’s equity | | | 485,698 | | | | 484,584 | |

Accumulated deficit | | | (150,362 | ) | | | (94,085 | ) |

Accumulated other comprehensive loss | | | (9,130 | ) | | | (9,130 | ) |

| | | | | | | | |

Member’s interest | | | 326,206 | | | | 381,369 | |

Noncontrolling interest | | | 1,029 | | | | 1,059 | |

| | | | | | | | |

Total member’s interest | | | 327,235 | | | | 382,428 | |

| | | | | | | | |

Total liabilities, redeemable noncontrolling interest and member’s interest | | $ | 1,376,765 | | | $ | 1,281,213 | |

| | | | | | | | |

See notes to unaudited consolidated financial statements.

1

SUMMIT MATERIALS, LLC AND SUBSIDIARIES

Unaudited Consolidated Statements of Operations

(In thousands)

| | | | | | | | | | | | | | | | |

| | | Three months ended | | | Six months ended | |

| | | June 29,

2013 | | | June 30,

2012 | | | June 29,

2013 | | | June 30,

2012 | |

Revenue: | | | | | | | | | | | | | | | | |

Product | | $ | 169,041 | | | $ | 166,436 | | | $ | 237,181 | | | $ | 233,996 | |

Service | | | 85,801 | | | | 89,120 | | | | 124,490 | | | | 141,443 | |

| | | | | | | | | | | | | | | | |

Total revenue | | | 254,842 | | | | 255,556 | | | | 361,671 | | | | 375,439 | |

| | | | | | | | | | | | | | | | |

Cost of revenue (exclusive of items shown separately below): | | | | | | | | | | | | | | | | |

Product | | | 115,960 | | | | 123,655 | | | | 181,932 | | | | 186,967 | |

Service | | | 65,883 | | | | 71,126 | | | | 95,984 | | | | 118,576 | |

| | | | | | | | | | | | | | | | |

Total cost of revenue | | | 181,843 | | | | 194,781 | | | | 277,916 | | | | 305,543 | |

| | | | | | | | | | | | | | | | |

General and administrative expenses | | | 39,392 | | | | 34,923 | | | | 73,395 | | | | 65,917 | |

Depreciation, depletion, amortization and accretion | | | 18,894 | | | | 17,240 | | | | 36,026 | | | | 33,603 | |

Transaction costs | | | 982 | | | | (403 | ) | | | 2,464 | | | | 1,532 | |

| | | | | | | | | | | | | | | | |

Operating income (loss) | | | 13,731 | | | | 9,015 | | | | (28,130 | ) | | | (31,156 | ) |

Other (income) expense, net | | | (269 | ) | | | 587 | | | | 163 | | | | 941 | |

(Gain) loss on debt financings | | | — | | | | (879 | ) | | | 3,115 | | | | 8,160 | |

Interest expense | | | 14,482 | | | | 14,713 | | | | 27,849 | | | | 28,826 | |

| | | | | | | | | | | | | | | | |

Loss from continuing operations before taxes | | | (482 | ) | | | (5,406 | ) | | | (59,257 | ) | | | (69,083 | ) |

Income tax (benefit) expense | | | (726 | ) | | | 215 | | | | (3,347 | ) | | | (1,963 | ) |

| | | | | | | | | | | | | | | | |

Income (loss) from continuing operations | | | 244 | | | | (5,621 | ) | | | (55,910 | ) | | | (67,120 | ) |

Income (loss) from discontinued operations | | | 26 | | | | (2,221 | ) | | | (97 | ) | | | (1,724 | ) |

| | | | | | | | | | | | | | | | |

Net income (loss) | | | 270 | | | | (7,842 | ) | | | (56,007 | ) | | | (68,844 | ) |

Net income (loss) attributable to noncontrolling interest | | | 1,939 | | | | (175 | ) | | | (1,518 | ) | | | (519 | ) |

| | | | | | | | | | | | | | | | |

Net loss attributable to member of Summit Materials, LLC | | $ | (1,669 | ) | | $ | (7,667 | ) | | $ | (54,489 | ) | | $ | (68,325 | ) |

| | | | | | | | | | | | | | | | |

See notes to unaudited consolidated financial statements.

2

SUMMIT MATERIALS, LLC AND SUBSIDIARIES

Unaudited Consolidated Statements of Cash Flows

(In thousands)

| | | | | | | | |

| | | Six months ended | |

| | | June 29,

2013 | | | June 30,

2012 | |

Cash flow from operating activities: | | | | | | | | |

Net loss | | $ | (56,007 | ) | | $ | (68,844 | ) |

Adjustments to reconcile net loss to net cash used in operating activities: | | | | | | | | |

Depreciation, depletion, amortization and accretion | | | 39,033 | | | | 37,512 | |

Share-based compensation expense | | | 1,114 | | | | 1,419 | |

Deferred income tax benefit | | | (2,969 | ) | | | (540 | ) |

Loss on property, plant and equipment disposals and revaluations | | | 5,574 | | | | 340 | |

Loss on debt financings | | | 2,989 | | | | 8,160 | |

Other | | | 755 | | | | 1,194 | |

(Increase) decrease in operating assets, net of acquisitions: | | | | | | | | |

Account receivable | | | (11,610 | ) | | | (23,788 | ) |

Inventories | | | (13,222 | ) | | | (6,044 | ) |

Costs and estimated earnings in excess of billings | | | (13,688 | ) | | | (10,247 | ) |

Other current assets | | | (491 | ) | | | (1,701 | ) |

Other assets | | | (118 | ) | | | 2,226 | |

Increase (decrease) in operating liabilities, net of acquisitions: | | | | | | | | |

Accounts payable | | | 6,691 | | | | 15,736 | |

Accrued expenses | | | (4,722 | ) | | | 16,787 | |

Billings in excess of costs and estimated earnings | | | (1,493 | ) | | | 1,133 | |

Other liabilities | | | 404 | | | | (1,796 | ) |

| | | | | | | | |

Net cash used in operating activities | | | (47,760 | ) | | | (28,453 | ) |

| | | | | | | | |

Cash flow from investing activities: | | | | | | | | |

Acquisitions, net of cash acquired | | | (60,779 | ) | | | (42,933 | ) |

Purchases of property, plant and equipment | | | (40,528 | ) | | | (24,669 | ) |

Proceeds from the sale of property, plant and equipment | | | 7,086 | | | | 2,946 | |

| | | | | | | | |

Net cash used for investing activities | | | (94,221 | ) | | | (64,656 | ) |

| | | | | | | | |

Cash flow from financing activities: | | | | | | | | |

Net proceeds from debt issuance | | | 186,974 | | | | 693,434 | |

Payments on long-term debt | | | (61,343 | ) | | | (618,441 | ) |

Payments on acquisition-related liabilities | | | (3,426 | ) | | | (2,670 | ) |

Other | | | — | | | | (701 | ) |

| | | | | | | | |

Net cash provided by financing activities | | | 122,205 | | | | 71,622 | |

| | | | | | | | |

Net decrease in cash | | | (19,776 | ) | | | (21,487 | ) |

Cash – beginning of period | | | 27,431 | | | | 42,790 | |

| | | | | | | | |

Cash – end of period | | $ | 7,655 | | | $ | 21,303 | |

| | | | | | | | |

See notes to unaudited consolidated financial statements.

3

SUMMIT MATERIALS, LLC AND SUBSIDIARIES

Unaudited Consolidated Statements of Changes in Redeemable Noncontrolling Interest and Member’s Interest

(In thousands)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Total Member’s Interest | | | | | | | | | | |

| | | Member’s

Equity | | | Accumulated

deficit | | | Accumulated

other

comprehensive

loss (AOCI) | | | Noncontrolling

interest | | | Total

member’s

interest | | | Redeemable

noncontrolling

interest | |

Balance — December 29, 2012 | | $ | 484,584 | | | $ | (94,085 | ) | | $ | (9,130 | ) | | $ | 1,059 | | | $ | 382,428 | | | $ | 22,850 | |

Accretion | | | — | | | | (300 | ) | | | — | | | | — | | | | (300 | ) | | | 300 | |

Redemption value adjustment | | | — | | | | (1,488 | ) | | | — | | | | — | | | | (1,488 | ) | | | 1,488 | |

Net loss | | | — | | | | (54,489 | ) | | | — | | | | (30 | ) | | | (54,519 | ) | | | (1,488 | ) |

Share-based compensation | | | 1,114 | | | | — | | | | — | | | | — | | | | 1,114 | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Balance — June 29, 2013 | | $ | 485,698 | | | $ | (150,362 | ) | | $ | (9,130 | ) | | $ | 1,029 | | | $ | 327,235 | | | $ | 23,150 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Balance — December 31, 2011 | | $ | 482,707 | | | $ | (40,932 | ) | | $ | (6,577 | ) | | $ | 1,174 | | | $ | 436,372 | | | $ | 21,300 | |

Accretion | | | — | | | | (400 | ) | | | — | | | | — | | | | (400 | ) | | | 400 | |

Net loss | | | — | | | | (68,325 | ) | | | — | | | | (119 | ) | | | (68,444 | ) | | | (400 | ) |

Repurchase of member’s interest | | | (656 | ) | | | — | | | | — | | | | — | | | | (656 | ) | | | — | |

Share-based compensation | | | 1,419 | | | | — | | | | — | | | | — | | | | 1,419 | | | | — | |

Payment of dividends | | | — | | | | — | | | | — | | | | (45 | ) | | | (45 | ) | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Balance — June 30, 2012 | | $ | 483,470 | | | $ | (109,657 | ) | | $ | (6,577 | ) | | $ | 1,010 | | | $ | 368,246 | | | $ | 21,300 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

See notes to unaudited consolidated financial statements.

4

SUMMIT MATERIALS, LLC

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

(In Thousands)

| 1. | SUMMARY OF ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES |

Summit Materials, LLC (the “Company”) is a vertically integrated heavy-side building materials company. Across its subsidiaries, it is engaged in the manufacturing and sale of aggregate material,hot-mix asphalt, cement and ready mixed concrete. It is also engaged in road paving and related construction services. The Company owns and operates stone quarries, asphalt plants, ready mix plants and landfill sites. Most of the Company’s construction work is performed under fixed unit-price contracts with state and local governmental entities.

The Company is a wholly owned subsidiary of Summit Materials Holdings L.P. whose major indirect owners are certain investment funds affiliated with Blackstone Capital Partners V L.P. (“BCP”). The Company has several subsidiaries, which have individually made a number of acquisitions since the Company was formed in August 2009.

The consolidated financial statements of the Company include the accounts of Summit Materials, LLC, its wholly owned subsidiaries and its noncontrolling interests. Noncontrolling interests represent a 30% redeemable ownership in Continental Cement Company, L.L.C. (“Continental Cement”) and a 20% ownership of Ohio Valley Asphalt, LLC. All significant intercompany balances and transactions have been eliminated.

Basis of Presentation—Management prepared these consolidated interim financial statements in accordance with U.S. generally accepted accounting principles (“GAAP”) for interim financial information. The consolidated interim financial statements of the Company included herein have been prepared, without audit, pursuant to the rules and regulations of the Securities and Exchange Commission. Certain information and footnote disclosures normally included in financial statements prepared in accordance with GAAP have been condensed or omitted pursuant to such rules and regulations. These unaudited consolidated interim financial statements should be read in conjunction with the Company’s audited consolidated financial statements and the notes thereto as of and for the year ended December 29, 2012. The Company continues to follow the accounting policies set forth in those consolidated financial statements. Management believes that these consolidated interim financial statements include all adjustments, normal and recurring in nature, that are necessary to present fairly the financial position of the Company as of June 29, 2013, the results of operations for the three and six month periods ended June 29, 2013 and June 30, 2012 and cash flows for the six month periods ended June 29, 2013 and June 30, 2012.

The Company’s fiscal quarters are based on a 4-4-5 schedule; each quarter is comprised of 13 weeks and ends on a Saturday. The Company’s second quarter ended on June 29 and June 30 in 2013 and 2012, respectively. In 2013, Continental Cement changed its fiscal year to be consistent with the Company’s fiscal year. Prior to fiscal 2013, Continental Cement’s fiscal year was based on the calendar with quarter-end dates of March 31, June 30, September 30 and December 31. The impact of this change to the Company’s financial position, results of operations and liquidity is immaterial.

Substantially all of the Company’s products and services are produced, consumed and performed outdoors primarily in the spring, summer and fall. Seasonal changes and other weather-related conditions can affect the production and sales volumes of its products and delivery of its services. Therefore, the financial results for any interim period do not necessarily indicate the results expected for the year. Furthermore, the Company’s sales and earnings are sensitive to national, regional and local economic conditions and to cyclical swings in construction spending. The level of construction spending is affected by changing interest rates and demographic and population fluctuations among other factors.

Use of Estimates—Preparation of these consolidated interim financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts and disclosures herein. These estimates and the underlying assumptions affect the amounts of assets and liabilities reported, disclosures about contingent assets and liabilities and reported amounts of revenues and expenses. Such estimates include the valuation of accounts receivable, inventories, goodwill, intangibles and otherlong-lived assets, pension and other postretirement obligations and asset retirement obligations. Estimates also include revenue earned on contracts and of costs to complete contracts. Management evaluates its estimates and assumptions on an ongoing basis using historical experience and other factors, including the current economic environment. Management adjusts such estimates and assumptions when circumstances dictate. As future events and their effects cannot be determined with precision, actual results could differ significantly from estimates made. Changes in estimates, including those resulting from continuing changes in the economic environment, will be reflected in the Company’s consolidated financial statements in the period in which the change in estimate occurs.

5

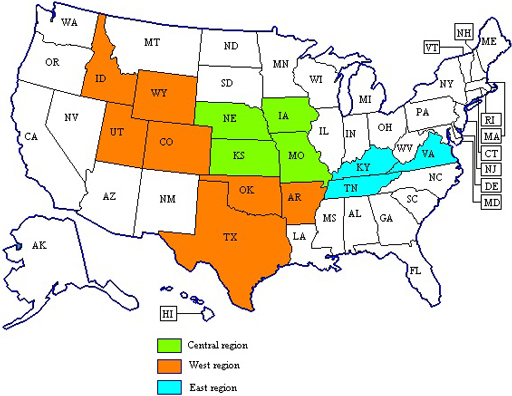

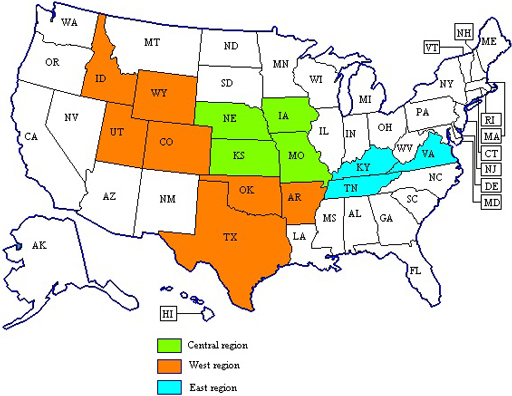

Business and Credit Concentrations—The operations of the Company are conducted primarily across 20 states, with the most significant revenues generated in Texas, Kansas, Kentucky, Missouri and Utah. The Company’s accounts receivable consist primarily of amounts due from individuals, corporations and governmental entities within these areas. Collection of these accounts is, therefore, dependent on the economic conditions in the aforementioned states, as well as specific situations affecting individual customers. However, credit granted within the Company’s trade areas has been granted to a wide variety of customers and management does not believe that any significant concentrations of credit exist with respect to individual customers or groups of customers. No single customer accounted for more than 10% of total revenue.

Fair Value Measurements—Certain acquisitions made by the Company require the payment of contingent amounts of purchase consideration. These payments are contingent on specified operating results being achieved in periods subsequent to the acquisition date. As of June 29, 2013 and December 29, 2012, contingent consideration obligations in the current portion of acquisition-related liabilities was $0.6 million and $0.7 million, respectively, and the portion included in long term acquisition-related liabilities was $1.3 million and $1.9 million, respectively. Contingent consideration obligations are measured at fair value each reporting period and any adjustments to fair value are recognized in earnings in the period identified. These payments will not be made if earn-out thresholds are not achieved. In the six month period ended June 29, 2013, earn-out payments of $0.7 million were made.

The fair value of the contingent consideration obligations approximate their carrying value of $1.9 million and $2.6 million as of June 29, 2013 and December 29, 2012, respectively. The fair values are based on unobservable inputs, or Level 3 inputs, including projected probability-weighted cash payments and a 9.1% discount rate, which reflects the Company’s credit risk. Changes in fair value may occur as a result of a change in actual or projected cash payments, the probability weightings applied by the Company to projected payments or a change in the discount rate. Significant increases or decreases in any of these inputs in isolation could result in a lower, or higher, fair value measurement. There were no adjustments to the fair value of contingent consideration in the three or six month periods ended June 29, 2013 and June 30, 2012.

Financial Instruments—The Company’s financial instruments include certain acquisition-related liabilities (deferred consideration and noncompete obligations) and debt. The fair value of the deferred consideration and noncompete obligations approximate their carrying value of $30.5 million and $6.8 million, respectively, as of June 29, 2013, and $23.4 million and $7.4 million, respectively, as of December 29, 2012. The fair value was determined based on unobservable inputs, or Level 3 inputs, including the cash payment terms in the purchase agreements and a discount rate reflecting the Company’s credit risk.

The fair value of long-term debt approximates $688.4 million and $670.7 million as of June 29, 2013 and December 29, 2012, respectively, compared to its carrying value of $663.4 million and $639.8 million, respectively. Fair value was determined based on observable inputs, or Level 2 inputs, such as interest rates, bond yields and quoted prices in inactive markets.

Redeemable Noncontrolling Interest—The Company owns Class A Units of Continental Cement, which represent a 69.7% economic interest. Continental Cement’s Class B Units, which represent a 30.3% economic interest, are subordinate to the Class A Units. The Class B Units are puttable in the future based on the passage of time, which can be accelerated upon the occurrence of a contingent event; therefore, the Company’s noncontrolling interest is classified in temporary equity. The redemption value was based upon the estimated fair value of Continental Cement at the date of acquisition and the Company has elected to accrete changes in the redemption value of the noncontrolling interest over the period from the date of issuance to the earliest anticipated redemption date, which is currently May 2016, using an interest method. The accretion is as an adjustment to accumulated deficit. The redemption value of the redeemable noncontrolling interest as of June 29, 2013 approximated its carrying value.

2013 Acquisitions—The following describes the acquisitions that occurred in 2013 by region.

Central region

| | • | | On April 1, 2013, the Company acquired certain assets of Lafarge North America, Inc. in Wichita, Kansas, with borrowings under the Company’s revolving credit facility. |

West region

| | • | | On April 1, 2013, the Company acquired the membership interest of Westroc, LLC near Salt Lake City, Utah, with borrowings under the Company’s revolving credit facility. |

6

2012 Acquisitions—The following describes the acquisitions that occurred in 2012 by region.

Central region

| | • | | On February 29, 2012, the Company acquired certain assets of Norris Quarries, LLC (“Norris”), an aggregates business in northwest Missouri, with proceeds from debt, including the Company’s revolving credit facility. |

West region

| | • | | On November 30, 2012, the Company acquired the stock of Sandco, Inc., an aggregates and ready-mix business in Colorado, with cash on-hand. |

East region

| | • | | On October 5, 2012, the Company acquired certain assets of Kay & Kay Contracting, LLC, an aggregates, asphalt and paving business in Kentucky, with cash on-hand. |

The operating results of each acquisition have been included in the Company’s results of operations since the respective dates of the acquisitions. Assets acquired and liabilities assumed are measured at their acquisition-date fair value. The goodwill recognized in connection with the Company’s acquisitions is primarily attributable to the expected profitability, assembled workforces and operational infrastructure of the acquired businesses and the synergies expected to arise after the acquisition of those businesses.

The purchase price allocation for the Norris acquisition has been finalized. However, the purchase price allocation for the other 2012 acquisitions and the 2013 acquisitions has not been finalized due to the recent timing of the acquisitions. The following table summarizes the fair value of the assets acquired and liabilities assumed in conjunction with the 2013 and 2012 acquisitions:

| | | | | | | | |

| | | Six months ended

June 29, 2013 | | | Year ended

December 29, 2012 | |

Financial assets | | $ | 8,149 | | | $ | 1,403 | |

Inventories | | | 3,954 | | | | 6,988 | |

Plant and equipment | | | 42,930 | | | | 21,508 | |

Intangible assets | | | 7,356 | | | | 3,172 | |

Other assets | | | 51 | | | | 1,330 | |

Financial liabilities | | | (6,056 | ) | | | (944 | ) |

Other long term liabilities | | | (1,221 | ) | | | (364 | ) |

| | | | | | | | |

Net assets acquired | | | 55,163 | | | | 33,093 | |

Goodwill from current period acquisitions and working capital adjustments | | | 13,385 | | | | 26,259 | |

| | | | | | | | |

Purchase price | | | 68,548 | | | | 59,352 | |

| | | | | | | | |

Noncash transactions: | | | | | | | | |

Acquisition related liabilities | | | (7,769 | ) | | | (10,547 | ) |

Other | | | — | | | | (48 | ) |

| | | | | | | | |

Total noncash transactions | | | (7,769 | ) | | | (10,595 | ) |

| | | | | | | | |

Net cash paid for acquisitions | | $ | 60,779 | | | $ | 48,757 | |

| | | | | | | | |

Pro forma Financial Information (Unaudited)—The following unaudited supplemental pro forma information presents the financial results as if the 2012 acquisitions occurred on January 1, 2011. This supplemental pro forma information has been prepared for comparative purposes and does not purport to be indicative of what would have occurred had the acquisitions been made on January 1, 2011, nor is it indicative of any future results. The 2013 acquisitions were not material individually or in the aggregate.

7

| | | | | | | | |

| | | Three months ended

June 30, 2012 | | | Six months ended

June 30, 2012 | |

Revenue | | $ | 258,152 | | | $ | 381,276 | |

Net income (loss) | | | (7,681 | ) | | | (67,314 | ) |

Changes in the carrying amount of goodwill, by reportable segment, from December 29, 2012 to June 29, 2013 are summarized as follows:

| | | | | | | | | | | | | | | | |

| | | Central | | | West | | | East | | | Total | |

Balance, December 29, 2012 | | $ | 72,789 | | | $ | 91,393 | | | $ | 14,938 | | | $ | 179,120 | |

Acquisitions(i) | | | — | | | | 13,385 | | | | — | | | | 13,385 | |

| | | | | | | | | | | | | | | | |

Balance, June 29, 2013 | | $ | 72,789 | | | $ | 104,778 | | | $ | 14,938 | | | $ | 192,505 | |

| | | | | | | | | | | | | | | | |

| | (i) | Includes goodwill from a 2013 acquisition, a working capital settlement of $1.9 million that is clearly and directly associated with the purchase price consideration and working capital adjustments. |

| 4. | DISCONTINUED OPERATIONS |

The Company’s discontinued operations include railroad construction and repair business (referred to herein as railroad), environmental operations and certain concrete paving operations. The concrete paving operations were wound down in the second quarter of 2013; management expects the related assets to be sold within the next twelve months. The environmental operations primarily involved building retaining walls and removal and remediation of underground fuel storage tanks. The railroad and environmental operations were sold in 2012 in separate transactions for an aggregate $3.1 million. Prior to recognition as discontinued operations, these businesses were included in the East region’s operations.

Debt and interest expense were not allocated to discontinued operations since there was no debt specifically attributable to the operations. The businesses included in discontinued operations are organized within a limited liability company and pass their tax attributes for Federal and state tax purposes to their parent company. Revenue and loss before income tax expense included in discontinued operations for the three and six month periods ended June 29, 2013 and June 30, 2012 are summarized below:

| | | | | | | | | | | | | | | | |

| | | Three months ended | | | Six months ended | |

| | | June 29,

2013(1) | | | June 30,

2012(2) | | | June 29,

2013(1) | | | June 30,

2012(2) | |

Revenue | | $ | 304 | | | $ | 16,681 | | | $ | 3,805 | | | $ | 25,900 | |

Income (loss) from discontinued operations before income tax expense | | | 26 | | | | (2,221 | ) | | | (97 | ) | | | (1,724 | ) |

| | (1) | Consists of concrete paving operations (rail and environmental operations were sold in 2012) |

| | (2) | Consists of concrete paving, railroad and environmental operations |

8

| 5. | ACCOUNTS RECEIVABLE, NET |

Accounts receivable, net consists of the following:

| | | | | | | | |

| | | June 29,

2013 | | | December 29,

2012 | |

Trade accounts receivable | | $ | 107,514 | | | $ | 88,637 | |

Retention receivables | | | 13,861 | | | | 13,181 | |

Receivables from related parties | | | 1,292 | | | | 1,871 | |

| | | | | | | | |

Accounts receivable | | | 122,667 | | | | 103,689 | |

Less: Allowance for doubtful accounts | | | (3,110 | ) | | | (3,391 | ) |

| | | | | | | | |

Accounts receivable, net | | $ | 119,557 | | | $ | 100,298 | |

| | | | | | | | |

Retention receivables are amounts earned by the Company but held by customers until construction contracts and projects have been fully completed or near completion. Amounts are expected to be billed and collected within a year.

Inventories consist of the following:

| | | | | | | | |

| | | June 29,

2013 | | | December 29,

2012 | |

Aggregate stockpiles | | $ | 72,905 | | | $ | 62,872 | |

Finished goods | | | 12,668 | | | | 9,342 | |

Work in process | | | 4,153 | | | | 2,679 | |

Raw materials | | | 20,427 | | | | 18,084 | |

| | | | | | | | |

Total | | $ | 110,153 | | | $ | 92,977 | |

| | | | | | | | |

Debt consists of the following:

| | | | | | | | |

| | | June 29,

2013 | | | December 29,

2012 | |

Senior Secured Credit Facility, revolver(1) | | $ | 105,000 | | | $ | — | |

| | | | | | | | |

Long-term debt: | | | | | | | | |

$250.0 million senior notes, net of discount of $4.4 million at June 29, 2013 and $4.7 million at December 29, 2012 | | | 245,633 | | | | 245,303 | |

$420.9 million senior secured credit facility, term loan net of discount of $3.2 million at June 29, 2013 and $3.5 million at December 29, 2012 | | | 417,773 | | | | 394,540 | |

| | | | | | | | |

Total | | | 663,406 | | | | 639,843 | |

Current portion of long-term debt | | | 3,165 | | | | 4,000 | |

| | | | | | | | |

Long-term debt | | $ | 660,241 | | | $ | 635,843 | |

| | | | | | | | |

| | (1) | Five-year revolving Senior Secured Credit Facility due in 2017. |

9

The contractual payments of long-term debt, including current maturities and excluding the revolver, for the five years subsequent to June 29, 2013, are as follows:

| | | | |

2013 (six months) | | $ | 1,055 | |

2014 | | | 4,220 | |

2015 | | | 4,220 | |

2016 | | | 5,275 | |

2017 | | | 4,220 | |

2018 | | | 3,165 | |

Thereafter | | | 648,790 | |

| | | | |

Total | | | 670,945 | |

Less: Original issue discount | | | (7,539 | ) |

| | | | |

Total debt | | $ | 663,406 | |

| | | | |

Accrued interest on long term debt as of June 29, 2013 and December 29, 2012 was $12.5 million and $19.7 million, respectively. Interest expense related to debt totaled $12.8 million and $24.6 million for the three and six month periods ended June 29, 2013, respectively, and $13.4 million and $25.6 million for the three and six month periods ended June 30, 2012, respectively.

In January 2012, the Company and Summit Materials Finance Corp. issued $250.0 million aggregate principal amount of 10.5% Senior Notes due January 31, 2020 (“Senior Notes”) under an indenture (the “Indenture”). In addition to the Senior Notes, the Company has a credit facility which provides for term loans in an aggregate amount of $422.0 million and revolving credit commitments in an aggregate amount of $150.0 million (the “Senior Secured Credit Facility”). The debt was initially issued with an original issuance discount of $9.5 million, which was recorded as a reduction to debt and is being accreted with a charge to earnings over the term of the debt.

Senior Notes—The Senior Notes bear interest at 10.5% per year, payable semi-annually in arrears; interest payments commenced on July 31, 2012. The Indenture contains covenants limiting, among other things, the Company and its restricted subsidiaries’ ability to incur additional indebtedness or issue certain preferred shares, pay dividends, redeem stock or make other distributions, make certain investments, sell or transfer certain assets, create liens, consolidate, merge, sell or otherwise dispose of all or substantially all of the Company’s assets, enter into certain transactions with affiliates, and designate subsidiaries as unrestricted subsidiaries. The Indenture also contains customary events of default. As of June 29, 2013 and December 29, 2012, the Company was in compliance with all covenants.

Senior Secured Credit Facility—Under the Senior Secured Credit Facility, the Company has entered into term loans totaling $422.0 million with required principal repayments of 0.25% of term debt due on the last business day of each March, June, September and December. In February 2013, the Company consummated a repricing, which included additional borrowings of $25.0 million, an interest rate reduction on the term loan by 1.0% and a deferral of the March 2013 principal payment. The unpaid principal balance is due in full on the maturity date, which is January 30, 2019.

Under the Senior Secured Credit Facility, the Company has revolving credit commitments of $150.0 million. The revolving credit facility matures on January 30, 2017 and bears interest per annum equal to an applicable margin of 3.5% plus, at the Company’s option, either (i) a base rate determined by reference to the highest of (a) the Federal Funds rate plus 0.50%, (b) the prime rate of Bank of America, N.A. and (c) the British Bankers Association London Interbank Offered Rate (“LIBOR”) plus 1.00% or (ii) a British Bankers Association LIBOR rate determined by reference to Reuters prior to the interest period relevant to such borrowing adjusted for certain additional costs. The interest rate in effect at June 29, 2013 was 3.7%.

There was a $105.0 million outstanding balance under the revolver facility as of June 29, 2013, leaving remaining borrowing capacity, net of $14.5 million of outstanding letters of credit, of $30.5 million.

The Company must adhere to certain financial covenants related to its debt and interest leverage ratios, as defined in the Senior Secured Credit Facility. The consolidated first lien net leverage ratio, reported each quarter should be no greater than 4.75:1.0 from April 1, 2012 through June 30, 2014; 4.50:1.0 from July 1, 2014 to June 30, 2015, and 4.25:1.0 thereafter. The interest coverage ratio must be at least 1.70:1.0 from January 1, 2013 to December 31, 2014 and 1.85:1.0 thereafter. As of June 29, 2013 and December 29, 2012, the Company was in compliance with all covenants. The Company, along with all of its wholly-owned subsidiary companies and its non wholly-owned subsidiary, Continental Cement, are named as guarantors of the Senior Notes and the Senior Secured Credit Facility. In addition, the Company has pledged substantially all of its assets as collateral for the Senior Secured Credit Facility.

As of June 29, 2013 and December 29, 2012, $11.9 million and $12.6 million, respectively, of deferred financing fees were being amortized over the term of the debt using the effective interest method.

10

The Company is a limited liability company and passes its tax attributes for Federal and state tax purposes to its parent company and is generally not subject to Federal or state income tax. However, there are certain subsidiary entities that file Federal and state income tax returns due to their status as C corporations. The provision for income taxes is composed of Federal, state and local income taxes for the subsidiary entities that have C corporation status.

The effective income tax rate for these entities differs from the statutory Federal rate primarily due to (1) depletion expense and domestic production activities deduction, which are allowed as deductions for tax purposes but not recorded under GAAP, (2) state income taxes and the effect of graduated tax rates and (3) certain non-recurring items, such as differences in the treatment of transaction costs, which are often not deductible for tax purposes.

As of June 29, 2013 and December 29, 2012, the Company has not recognized a liability for uncertain tax positions. The Company records interest and penalties as a component of the income tax provision. No material interest or penalties were recognized in income tax expense for the three and six month periods ended June 29, 2013 and June 30, 2012.

| 9. | COMMITMENTS AND CONTINGENCIES |

Litigation and Claims—The Company is party to certain legal actions, claims and regulatory matters arising from the normal course of business. In the opinion of management, these actions are without merit or the ultimate disposition, if any, resulting from them will not have a material effect on the Company’s consolidated financial position, results of operations or liquidity. The Company records legal fees as incurred.

The Company is obligated under an indemnification agreement entered into with the sellers of Harper Contracting, Inc., Harper Sand and Gravel, Inc., Harper Ready Mix Company, Inc. and Harper Investments, Inc. (collectively, “Harper”) for the sellers’ ownership interests in a joint venture agreement. The Company has the rights to any benefits under the joint venture as well as the assumption of any obligations, but does not own equity interests in the joint venture. The joint venture has incurred significant losses on a highway project in Utah, which have resulted in requests for funding from the joint venture partners and, ultimately, from the Company. Through June 29, 2013, the Company has funded $8.8 million, $4.0 million of which was funded in the three and six month periods ended June 30, 2012. As of June 29, 2013 and December 29, 2012, an accrual of $4.3 million is recorded in other noncurrent liabilities as management’s best estimate of future funding obligations.

In 2013, a dispute with the sellers of Harper related to the calculation of working capital in connection with the August 2010 acquisition of Harper was settled. The working capital dispute was submitted to binding arbitration, the outcome of which resulted in the payment of $1.9 million to the sellers. In addition, various other acquisition-related disputes with Harper were settled in 2013 for approximately $0.8 million. The total payments of $2.7 million were made in the second quarter of 2013. There was no material impact to 2013 earnings as a result of these settlements.

During the course of business, there may be revisions to project costs and conditions that can give rise to change orders. Revisions can also result in claims made against a customer or subcontractor to recover project variances that have not been satisfactorily addressed through change orders with a customer. As of June 29, 2013 and December 29, 2012, unapproved change orders and claims totaled $3.7 million ($0.1 million in costs and estimated earnings in excess of billings and $3.6 million in other assets) and $4.8 million ($1.6 million in costs and estimated earnings in excess of billings and $3.2 million in other assets), respectively.

Environmental Remediation—The Company’s mining operations are subject to and affected by Federal, state and local laws and regulations relating to the environment, health and safety and other regulatory matters. These operations require environmental operating permits, which are subject to modification, renewal and revocation. Management regularly monitors and reviews its operations, procedures and policies for compliance with these laws and regulations. Despite these compliance efforts, risk of environmental liability is inherent in the operation of the Company’s business, as it is with other companies engaged in similar businesses, and there can be no assurance that environmental liabilities will not have a material adverse effect on the Company’s consolidated financial position, results of operations or liquidity in the future.

Other—In February 2011, the Company incurred a property loss related to a sunken barge with cement product aboard. Through June 29, 2013, the Company has recognized $3.3 million of charges for lost product aboard the barge and costs to remove the barge from the waterway. As of June 29, 2013, $1.8 million is included in accrued expenses as management’s best estimate of the remaining costs to remove the barge, which was recognized in earnings in the six months ended June 29, 2013.

The Company is obligated under various firm purchase commitments for certain raw materials and services that are in the ordinary course of business. Management does not expect any significant changes in the market value of these goods and services during the commitment period that would have a material adverse affect on the financial position, results of operations or liquidity of the Company.

11

| 10. | SUPPLEMENTAL CASH FLOW INFORMATION |

Supplemental cash flow information is as follows:

| | | | | | | | |

| | | Six months ended | |

| | | June 29,

2013 | | | June 30,

2012 | |

Cash payments: | | | | | | | | |

Interest | | $ | 31,439 | | | $ | 15,722 | |

Income taxes | | | 653 | | | | 670 | |

The Company has determined that it has three operating segments, which are its reportable segments: Central region, West region and East region. These segments are consistent with the Company’s management reporting structure. The operating results of each segment are regularly reviewed and evaluated separately by the Chief Executive Officer, the Company’s Chief Operating Decision Maker (“CODM”). The CODM evaluates the performance of its segments and allocates resources to them based on several factors, including a measurement of segment profit, which is computed as earnings before interest, taxes, depreciation, depletion, amortization and accretion. In addition, certain items such as management fees are excluded from the calculation of segment profit.

Each region has several acquired subsidiaries that are engaged in various activities related to the production, distribution and sale of construction materials and the provision of construction services. Assets employed by segment include assets directly identified with those operations. Corporate assets consist primarily of cash, property, plant and equipment for corporate operations and other assets not directly identifiable with a reportable business segment. The accounting policies applicable to each segment are consistent with those used in the consolidated financial statements. The following tables display selected financial data for the Company’s reportable business segments:

| | | | | | | | | | | | | | | | |

| | | Three months ended | | | Six months ended | |

| | | June 29,

2013 | | | June 30,

2012 | | | June 29,

2013 | | | June 30,

2012 | |

Revenue by region: | | | | | | | | | | | | | | | | |

Central region | | $ | 92,780 | | | $ | 86,006 | | | $ | 128,680 | | | $ | 128,497 | |

West region | | | 119,656 | | | | 128,867 | | | | 179,719 | | | | 196,125 | |

East region | | | 42,406 | | | | 40,683 | | | | 53,272 | | | | 50,817 | |

| | | | | | | | | | | | | | | | |

Total revenue | | $ | 254,842 | | | $ | 255,556 | | | $ | 361,671 | | | $ | 375,439 | |

| | | | | | | | | | | | | | | | |

12

| | | | | | | | | | | | | | | | |

| | | Three months ended | | | Six months ended | |

| | | June 29,

2013 | | | June 30,

2012 | | | June 29,

2013 | | | June 30,

2012 | |

Segment profit (loss): | | | | | | | | | | | | | | | | |

Central region | | $ | 25,136 | | | $ | 23,901 | | | $ | 19,182 | | | $ | 22,617 | |

West region | | | 6,807 | | | | 980 | | | | 85 | | | | (9,650 | ) |

East region | | | 7,155 | | | | 5,575 | | | | (2,377 | ) | | | (8,573 | ) |

Corporate and other (1) | | | (6,204 | ) | | | (3,909 | ) | | | (12,272 | ) | | | (11,048 | ) |

| | | | | | | | | | | | | | | | |

Total reportable segments and corporate | | | 32,894 | | | | 26,547 | | | | 4,618 | | | | (6,654 | ) |

Interest expense | | | 14,482 | | | | 14,713 | | | | 27,849 | | | | 28,826 | |

Depreciation, depletion, amortization and accretion | | | 18,894 | | | | 17,240 | | | | 36,026 | | | | 33,603 | |

| | | | | | | | | | | | | | | | |

Loss from continuing operations before taxes | | $ | (482 | ) | | $ | (5,406 | ) | | $ | (59,257 | ) | | $ | (69,083 | ) |

| | | | | | | | | | | | | | | | |

| | (1) | Corporate results primarily consist of compensation and office expenses for employees included in the Company’s headquarters and transactions costs. The increase in cost is primarily attributable to increased transaction costs in 2013 as a result of the Lafarge and Westroc acquisitions. |

| | | | | | | | |

| | | Six months ended | |

| | | June 29,

2013 | | | June 30,

2012 | |

Cash paid for capital expenditures: | | | | | | | | |

Central region | | $ | 19,826 | | | $ | 13,817 | |

West region | | | 14,194 | | | | 7,033 | |

East region | | | 5,742 | | | | 3,755 | |

| | | | | | | | |

Total reportable segments | | | 39,762 | | | | 24,605 | |

Corporate and other | | | 766 | | | | 64 | |

| | | | | | | | |

Total capital expenditures | | $ | 40,528 | | | $ | 24,669 | |

| | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | Three months ended | | | Six months ended | |

| | | June 29,

2013 | | | June 30,

2012 | | | June 29,

2013 | | | June 30,

2012 | |

Depreciation, depletion, amortization and accretion: | | | | | | | | | | | | | | | | |

Central region | | $ | 8,687 | | | $ | 7,684 | | | $ | 16,329 | | | $ | 14,877 | |

West region | | | 6,456 | | | | 5,980 | | | | 12,291 | | | | 11,662 | |

East region | | | 3,729 | | | | 3,552 | | | | 7,362 | | | | 7,023 | |

| | | | | | | | | | | | | | | | |

Total reportable segments | | | 18,872 | | | | 17,216 | | | | 35,982 | | | | 33,562 | |

Corporate and other | | | 22 | | | | 24 | | | | 44 | | | | 41 | |

| | | | | | | | | | | | | | | | |

Total depreciation, depletion, amortization and accretion | | $ | 18,894 | | | $ | 17,240 | | | $ | 36,026 | | | $ | 33,603 | |

| | | | | | | | | | | | | | | | |

13

| | | | | | | | |

| | | June 29,

2013 | | | December 29,

2012 | |

Total assets: | | | | | | | | |

Central region | | $ | 675,270 | | | $ | 610,003 | |

West region | | | 472,032 | | | | 428,115 | |

East region | | | 226,024 | | | | 224,603 | |

| | | | | | | | |

Total reportable segments | | | 1,373,326 | | | | 1,262,721 | |

Corporate and other | | | 3,439 | | | | 18,492 | |

| | | | | | | | |

Total | | $ | 1,376,765 | | | $ | 1,281,213 | |

| | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | Three months ended | | | Six months ended | |

| | | June 29,

2013 | | | June 30,

2012 | | | June 29,

2013 | | | June 30,

2012 | |

Revenue by product:* | | | | | | | | | | | | | | | | |

Aggregates | | $ | 47,439 | | | $ | 42,735 | | | $ | 68,304 | | | $ | 66,681 | |

Asphalt | | | 55,857 | | | | 62,960 | | | | 75,208 | | | | 82,166 | |

Ready mix | | | 33,279 | | | | 30,942 | | | | 46,412 | | | | 46,537 | |

Cement | | | 21,474 | | | | 21,096 | | | | 30,914 | | | | 31,377 | |

Construction and paving | | | 125,536 | | | | 130,750 | | | | 171,946 | | | | 184,087 | |

Other | | | (28,743 | ) | | | (32,927 | ) | | | (31,113 | ) | | | (35,409 | ) |

| | | | | | | | | | | | | | | | |

Total revenue | | $ | 254,842 | | | $ | 255,556 | | | $ | 361,671 | | | $ | 375,439 | |

| | | | | | | | | | | | | | | | |

| | * | Revenue by product includes intercompany sales transferred at market value. The elimination of intercompany transactions is included in Other |

| 12. | RELATED PARTY TRANSACTIONS |

The Company incurred certain management fees due to Blackstone Management Partners L.L.C. (“BMP”) totaling $0.6 million and $1.2 million during the three and six month periods ended June 29, 2013, respectively, and $0.3 million and $0.9 million during the three and six month periods ended June 30, 2012, respectively, under terms of an agreement with Summit Materials Holdings L.P., and BMP. Under the terms of the agreement, BMP is permitted to, and has, assigned a portion of the fees to which it is entitled to receive to Silverhawk Summit, L.P. and to certain equity-holding members of management. The fees were paid for consultancy services related to acquisition activities and are included in general and administrative expenses.

The Company had $0.4 million of revenue from unconsolidated affiliates during both the three and six month periods ended June 29, 2013 and $0.8 million and $3.1 million during the three and six month periods ended June 30, 2012, respectively. As of June 29, 2013 and December 29, 2012, accounts receivable from affiliates was $0.1 million and $1.9 million, respectively.

Cement sales to companies owned by a noncontrolling member of Continental Cement were approximately $3.5 million and $5.1 million during the three and six month periods ended June 29, 2013, respectively, and $3.0 million and $5.2 million during the three and six month periods ended June 30, 2012, respectively. Accounts receivables due from the noncontrolling member were $1.3 million and $1.0 million as of June 29, 2013 and December 29, 2012, respectively. In addition, as of June 29, 2013 and December 29, 2012, the Company owed $1.0 million and $2.1 million, respectively, to a noncontrolling member of Continental Cement for accrued interest on a related party note. The principal balance on the note was repaid in January 2012.

| 13. | GUARANTOR AND NON GUARANTOR FINANCIAL INFORMATION |

The Company, along with its domestic wholly-owned subsidiary companies (“Wholly-owned Guarantors”) and non wholly-owned subsidiary, Continental Cement (“Non Wholly-owned Guarantor”), are named as guarantors (collectively, the “Guarantors”) of the Senior Notes and the Senior Secured Credit Facility. Certain other partially owned subsidiaries, do not guarantee the Senior Notes (collectively, the “Non-Guarantors”), which includes a subsidiary of Continental Cement. The Guarantors provide a joint and several, full and unconditional guarantee of the Senior Notes. There are no significant restrictions on the Company’s ability to obtain funds from any of the Guarantor Subsidiaries in the form of a dividend or loan. Additionally, there are no significant restrictions on a Guarantor Subsidiary’s ability to obtain funds from the Company or its direct or indirect subsidiaries.

14

The following condensed consolidating balance sheets, statements of operations and cash flows are provided for the Company (referred to as “Parent” in the condensed financial statements below), the Non-Wholly-owned Guarantor, the Wholly-owned Guarantors and the Non-Guarantors. Summit Materials Finance Corp. as a co-issuer of the Senior Notes had no transactions during the respective periods or assets as of June 29, 2013 and December 29, 2012. Earnings from subsidiaries are included in other (income) expense in the condensed consolidated statements of operations below. The financial information may not necessarily be indicative of results of operations, cash flows or financial position had the guarantor or non-guarantor subsidiaries operated as independent entities.

15

Condensed Consolidating Balance Sheets

June 29, 2013

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Summit

Materials

LLC

(Parent) | | | Non-

Wholly-

owned

Guarantor | | | Wholly-

owned

Guarantors | | | Non-

Guarantors | | | Eliminations | | | Consolidated | |

| Assets | | | | | | | | | | | | | | | | | | | | | | | | |

Current assets: | | | | | | | | | | | | | | | | | | | | | | | | |

Cash | | $ | 947 | | | $ | 8 | | | $ | 11,329 | | | $ | 107 | | | $ | (4,736 | ) | | $ | 7,655 | |

Accounts receivable, net | | | — | | | | 10,492 | | | | 107,362 | | | | 3,320 | | | | (1,617 | ) | | | 119,557 | |

Intercompany receivables | | | 13,887 | | | | — | | | | 59,863 | | | | — | | | | (73,750 | ) | | | — | |

Cost and estimated earnings in excess of billings | | | — | | | | — | | | | 24,070 | | | | 286 | | | | — | | | | 24,356 | |

Inventories | | | — | | | | 9,634 | | | | 98,066 | | | | 2,453 | | | | — | | | | 110,153 | |

Other current assets | | | 834 | | | | 713 | | | | 10,912 | | | | 261 | | | | (724 | ) | | | 11,996 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total current assets | | | 15,668 | | | | 20,847 | | | | 311,602 | | | | 6,427 | | | | (80,827 | ) | | | 273,717 | |

Property, plant and equipment, net | | | 1,796 | | | | 298,939 | | | | 550,389 | | | | 7,395 | | | | — | | | | 858,519 | |

Goodwill | | | — | | | | 23,124 | | | | 168,409 | | | | 972 | | | | — | | | | 192,505 | |

Intangible assets, net | | | — | | | | 692 | | | | 14,903 | | | | — | | | | — | | | | 15,595 | |

Other assets | | | 321,569 | | | | 13,401 | | | | 154,857 | | | | 1,232 | | | | (454,630 | ) | | | 36,429 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total assets | | $ | 339,033 | | | $ | 357,003 | | | $ | 1,200,160 | | | $ | 16,026 | | | $ | (535,457 | ) | | $ | 1,376,765 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Liabilities, Redeemable Noncontrolling Interest and Member’s Interest | | | | | | | | | | | | | | | | | | | | | | | | |

Current liabilities: | | | | | | | | | | | | | | | | | | | | | | | | |

Current portion of debt | | $ | — | | | $ | 763 | | | $ | 107,402 | | | $ | — | | | $ | — | | | $ | 108,165 | |

Current portion of acquisition-related liabilities | | | — | | | | — | | | | 11,115 | | | | — | | | | — | | | | 11,115 | |

Accounts payable | | | 2,512 | | | | 8,815 | | | | 65,104 | | | | 1,014 | | | | (1,617 | ) | | | 75,828 | |

Accrued expenses | | | 10,031 | | | | 8,667 | | | | 41,745 | | | | 1,280 | | | | (5,460 | ) | | | 56,263 | |

Intercompany payables | | | — | | | | 8,788 | | | | 60,212 | | | | 4,750 | | | | (73,750 | ) | | | — | |

Billings in excess of costs and estimated earnings | | | — | | | | — | | | | 5,476 | | | | 107 | | | | — | | | | 5,583 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total current liabilities | | | 12,543 | | | | 27,033 | | | | 291,054 | | | | 7,151 | | | | (80,827 | ) | | | 256,954 | |

Long-term debt | | | — | | | | 155,100 | | | | 505,141 | | | | — | | | | — | | | | 660,241 | |

Acquisition-related liabilities | | | — | | | | — | | | | 28,052 | | | | — | | | | — | | | | 28,052 | |

Other noncurrent liabilities | | | 353 | | | | 26,098 | | | | 54,682 | | | | — | | | | — | | | | 81,133 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total liabilities | | | 12,896 | | | | 208,231 | | | | 878,929 | | | | 7,151 | | | | (80,827 | ) | | | 1,026,380 | |

Redeemable noncontrolling interest | | | — | | | | — | | | | — | | | | — | | | | 23,150 | | | | 23,150 | |

Redeemable members’ interest | | | — | | | | 23,150 | | | | — | | | | — | | | | (23,150 | ) | | | — | |

Total member’s interest | | | 326,137 | | | | 125,622 | | | | 321,231 | | | | 8,875 | | | | (454,630 | ) | | | 327,235 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total liabilities, redeemable noncontrolling interest and member’s interest | | $ | 339,033 | | | $ | 357,003 | | | $ | 1,200,160 | | | $ | 16,026 | | | $ | (535,457 | ) | | $ | 1,376,765 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

16

Condensed Consolidating Balance Sheets

December 29, 2012

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Summit

Materials

LLC

(Parent) | | | Non-

Wholly-

owned

Guarantor | | | Wholly-

owned

Guarantors | | | Non-

Guarantors | | | Eliminations | | | Consolidated | |

| Assets | | | | | | | | | | | | | | | | | | | | | | | | |

Current assets: | | | | | | | | | | | | | | | | | | | | | | | | |

Cash | | $ | 697 | | | $ | 397 | | | $ | 30,981 | | | $ | 680 | | | $ | (5,324 | ) | | $ | 27,431 | |

Accounts receivable, net | | | — | | | | 7,421 | | | | 90,765 | | | | 3,255 | | | | (1,143 | ) | | | 100,298 | |

Intercompany receivables | | | 14,931 | | | | 15,557 | | | | 9,018 | | | | — | | | | (39,506 | ) | | | — | |

Cost and estimated earnings in excess of billings | | | — | | | | — | | | | 11,428 | | | | 147 | | | | — | | | | 11,575 | |

Inventories | | | — | | | | 7,073 | | | | 84,555 | | | | 1,349 | | | | — | | | | 92,977 | |

Other current assets | | | 25 | | | | 726 | | | | 8,447 | | | | 2,409 | | | | (1,539 | ) | | | 10,068 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total current assets | | | 15,653 | | | | 31,174 | | | | 235,194 | | | | 7,840 | | | | (47,512 | ) | | | 242,349 | |

Property, plant and equipment, net | | | 1,074 | | | | 287,677 | | | | 517,994 | | | | 6,862 | | | | — | | | | 813,607 | |

Goodwill | | | — | | | | 23,124 | | | | 155,024 | | | | 972 | | | | — | | | | 179,120 | |

Intangible assets, net | | | — | | | | 742 | | | | 7,864 | | | | — | | | | — | | | | 8,606 | |

Other assets | | | 374,581 | | | | 11,891 | | | | 161,442 | | | | 1,315 | | | | (511,698 | ) | | | 37,531 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total assets | | $ | 391,308 | | | $ | 354,608 | | | $ | 1,077,518 | | | $ | 16,989 | | | $ | (559,210 | ) | | $ | 1,281,213 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Liabilities, Redeemable Noncontrolling Interest and Member’s Interest | | | | | | | | | | | | | | | | | | | | | | | | |

Current liabilities: | | | | | | | | | | | | | | | | | | | | | | | | |

Current portion of debt | | $ | — | | | $ | 965 | | | $ | 3,035 | | | $ | — | | | $ | — | | | $ | 4,000 | |

Current portion of acquisition-related liabilities | | | — | | | | — | | | | 9,525 | | | | — | | | | — | | | | 9,525 | |

Accounts payable | | | 2,745 | | | | 6,715 | | | | 51,179 | | | | 2,138 | | | | (1,143 | ) | | | 61,634 | |

Accrued expenses | | | 6,877 | | | | 10,742 | | | | 38,050 | | | | 1,015 | | | | (6,862 | ) | | | 49,822 | |

Intercompany payables | | | — | | | | — | | | | 33,396 | | | | 6,110 | | | | (39,506 | ) | | | — | |

Billings in excess of costs and estimated earnings | | | — | | | | — | | | | 6,656 | | | | 270 | | | | — | | | | 6,926 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total current liabilities | | | 9,622 | | | | 18,422 | | | | 141,841 | | | | 9,533 | | | | (47,511 | ) | | | 131,907 | |

Long-term debt | | | — | | | | 155,394 | | | | 480,449 | | | | — | | | | — | | | | 635,843 | |

Acquisition-related liabilities | | | — | | | | — | | | | 23,919 | | | | — | | | | — | | | | 23,919 | |

Other noncurrent liabilities | | | 395 | | | | 27,091 | | | | 56,780 | | | | — | | | | — | | | | 84,266 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total liabilities | | | 10,017 | | | | 200,907 | | | | 702,989 | | | | 9,533 | | | | (47,511 | ) | | | 875,935 | |

Redeemable noncontrolling interest | | | — | | | | — | | | | — | | | | — | | | | 22,850 | | | | 22,850 | |

Redeemable members’ interest | | | — | | | | 22,850 | | | | — | | | | — | | | | (22,850 | ) | | | — | |

Total member’s interest | | | 381,291 | | | | 130,851 | | | | 374,529 | | | | 7,456 | | | | (511,699 | ) | | | 382,428 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total liabilities, redeemable noncontrolling interest and member’s interest | | $ | 391,308 | | | $ | 354,608 | | | $ | 1,077,518 | | | $ | 16,989 | | | $ | (559,210 | ) | | $ | 1,281,213 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

17

Condensed Consolidating Statements of Operations

For the three months ended June 29, 2013

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Summit

Materials

LLC

(Parent) | | | Non-

Wholly-

owned

Guarantor | | | Wholly-

owned

Guarantors | | | Non-

Guarantors | | | Eliminations | | | Consolidated | |

Revenue | | $ | — | | | $ | 22,888 | | | $ | 221,141 | | | $ | 14,559 | | | $ | (3,746 | ) | | $ | 254,842 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Cost of revenue (exclusive of items shown separately below) | | | — | | | | 13,328 | | | | 162,633 | | | | 9,628 | | | | (3,746 | ) | | | 181,843 | |

General and administrative expenses | | | 1,244 | | | | 1,695 | | | | 36,139 | | | | 314 | | | | — | | | | 39,392 | |

Depreciation, depletion, amortization and accretion | | | 22 | | | | 2,868 | | | | 15,743 | | | | 261 | | | | — | | | | 18,894 | |

Transaction costs | | | — | | | | — | | | | 982 | | | | — | | | | — | | | | 982 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Operating (loss) income | | | (1,266 | ) | | | 4,997 | | | | 5,644 | | | | 4,356 | | | | — | | | | 13,731 | |

Other expense (income), net | | | 403 | | | | (1,240 | ) | | | (1,632 | ) | | | 47 | | | | 2,153 | | | | (269 | ) |

Interest expense | | | — | | | | 2,692 | | | | 12,825 | | | | 114 | | | | (1,149 | ) | | | 14,482 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

(Loss) income from continuing operations before taxes | | | (1,669 | ) | | | 3,545 | | | | (5,549 | ) | | | 4,195 | | | | (1,004 | ) | | | (482 | ) |

Income tax expense | | | — | | | | — | | | | (726 | ) | | | — | | | | — | | | | (726 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

(Loss) income from continuing operations | | | (1,669 | ) | | | 3,545 | | | | (4,823 | ) | | | 4,195 | | | | (1,004 | ) | | | 244 | |

Income from discontinued operations | | | — | | | | — | | | | 26 | | | | — | | | | — | | | | 26 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net (loss) income | | | (1,669 | ) | | | 3,545 | | | | (4,797 | ) | | | 4,195 | | | | (1,004 | ) | | | 270 | |

Net income attributable to noncontrolling interest | | | — | | | | — | | | | — | | | | — | | | | 1,939 | | | | 1,939 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net (loss) income attributable to member of Summit Materials, LLC | | $ | (1,669 | ) | | $ | 3,545 | | | $ | (4,797 | ) | | $ | 4,195 | | | $ | (2,943 | ) | | $ | (1,669 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

18

Condensed Consolidating Statements of Operations

For the three months ended June 30, 2012

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Summit

Materials

LLC

(Parent) | | | Non-

Wholly-

owned

Guarantor | | | Wholly-

owned

Guarantors | | | Non-

Guarantors | | | Eliminations | | | Consolidated | |

Revenue | | | — | | | | 22,157 | | | | 226,682 | | | | 8,339 | | | | (1,622 | ) | | | 255,556 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Cost of revenue (exclusive of items shown separately below) | | | — | | | | 12,836 | | | | 179,661 | | | | 3,906 | | | | (1,622 | ) | | | 194,781 | |

General and administrative expenses | | | 1,563 | | | | 1,515 | | | | 31,581 | | | | 264 | | | | — | | | | 34,923 | |

Depreciation, depletion, amortization and accretion | | | 23 | | | | 2,555 | | | | 14,404 | | | | 258 | | | | — | | | | 17,240 | |

Transaction costs | | | — | | | | — | | | | (403 | ) | | | — | | | | — | | | | (403 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Operating (loss) income | | | (1,586 | ) | | | 5,251 | | | | 1,439 | | | | 3,911 | | | | — | | | | 9,015 | |

Other expense (income), net | | | 6,076 | | | | (1,140 | ) | | | (672 | ) | | | — | | | | (4,556 | ) | | | (292 | ) |

Interest expense | | | — | | | | 2,955 | | | | 11,935 | | | | 155 | | | | (332 | ) | | | 14,713 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

(Loss) income from continuing operations before taxes | | | (7,662 | ) | | | 3,436 | | | | (9,824 | ) | | | 3,756 | | | | 4,888 | | | | (5,406 | ) |

Income tax expense | | | 5 | | | | — | | | | 210 | | | | — | | | | — | | | | 215 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

(Loss) income from continuing operations | | | (7,667 | ) | | | 3,436 | | | | (10,034 | ) | | | 3,756 | | | | 4,888 | | | | (5,621 | ) |

Loss from discontinued operations | | | — | | | | — | | | | (2,221 | ) | | | — | | | | — | | | | (2,221 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net (loss) income | | | (7,667 | ) | | | 3,436 | | | | (12,255 | ) | | | 3,756 | | | | 4,888 | | | | (7,842 | ) |

Net loss attributable to noncontrolling interest | | | — | | | | — | | | | — | | | | — | | | | (175 | ) | | | (175 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net (loss) income attributable to member of Summit Materials, LLC | | | (7,667 | ) | | | 3,436 | | | | (12,255 | ) | | | 3,756 | | | | 5,063 | | | | (7,667 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

19

Condensed Consolidating Statements of Operations

For the six months ended June 29, 2013

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Summit

Materials

LLC

(Parent) | | | Non-

Wholly-

owned

Guarantor | | | Wholly-

owned

Guarantors | | | Non-

Guarantors | | | Eliminations | | | Consolidated | |

Revenue | | $ | — | | | $ | 32,799 | | | $ | 314,895 | | | $ | 20,486 | | | $ | (6,509 | ) | | $ | 361,671 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Cost of revenue (exclusive of items shown separately below) | | | — | | | | 27,833 | | | | 243,357 | | | | 13,235 | | | | (6,509 | ) | | | 277,916 | |

General and administrative expenses | | | 2,896 | | | | 5,083 | | | | 64,832 | | | | 584 | | | | — | | | | 73,395 | |

Depreciation, depletion, amortization and accretion | | | 44 | | | | 5,532 | | | | 29,938 | | | | 512 | | | | — | | | | 36,026 | |

Transaction costs | | | — | | | | — | | | | 2,464 | | | | — | | | | — | | | | 2,464 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Operating (loss) income | | | (2,940 | ) | | | (5,649 | ) | | | (25,696 | ) | | | 6,155 | | | | — | | | | (28,130 | ) |

Other expense (income), net | | | 51,549 | | | | (1,295 | ) | | | 1,529 | | | | 174 | | | | (48,679 | ) | | | 3,278 | |

Interest expense | | | — | | | | 5,423 | | | | 24,095 | | | | 239 | | | | (1,908 | ) | | | 27,849 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

(Loss) income from continuing operations before taxes | | | (54,489 | ) | | | (9,777 | ) | | | (51,320 | ) | | | 5,742 | | | | 50,587 | | | | (59,257 | ) |

Income tax benefit | | | — | | | | — | | | | (3,347 | ) | | | — | | | | — | | | | (3,347 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

(Loss) income from continuing operations | | | (54,489 | ) | | | (9,777 | ) | | | (47,973 | ) | | | 5,742 | | | | 50,587 | | | | (55,910 | ) |

Loss from discontinued operations | | | — | | | | — | | | | (97 | ) | | | — | | | | — | | | | (97 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net (loss) income | | | (54,489 | ) | | | (9,777 | ) | | | (48,070 | ) | | | 5,742 | | | | 50,587 | | | | (56,007 | ) |

Net loss attributable to noncontrolling interest | | | — | | | | — | | | | — | | | | — | | | | (1,518 | ) | | | (1,518 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net (loss) income attributable to member of Summit Materials, LLC | | $ | (54,489 | ) | | $ | (9,777 | ) | | $ | (48,070 | ) | | $ | 5,742 | | | $ | 52,105 | | | $ | (54,489 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

20

Condensed Consolidating Statements of Operations

For the six months ended June 30, 2012

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Summit

Materials

LLC

(Parent) | | | Non-

Wholly-

owned

Guarantor | | | Wholly-

owned

Guarantors | | | Non-

Guarantors | | | Eliminations | | | Consolidated | |

Revenue | | $ | — | | | $ | 33,002 | | | $ | 335,871 | | | $ | 12,852 | | | $ | (6,286 | ) | | $ | 375,439 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Cost of revenue (exclusive of items shown separately below) | | | — | | | | 26,290 | | | | 279,063 | | | | 6,476 | | | | (6,286 | ) | | | 305,543 | |

General and administrative expenses | | | 2,822 | | | | 2,912 | | | | 59,633 | | | | 550 | | | | — | | | | 65,917 | |

Depreciation, depletion, amortization and accretion | | | 41 | | | | 4,992 | | | | 28,052 | | | | 518 | | | | — | | | | 33,603 | |

Transaction costs | | | — | | | | — | | | | 1,532 | | | | — | | | | — | | | | 1,532 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Operating (loss) income | | | (2,863 | ) | | | (1,192 | ) | | | (32,409 | ) | | | 5,308 | | | | — | | | | (31,156 | ) |

Other expense (income), net | | | 65,457 | | | | (495 | ) | | | 8,454 | | | | 80 | | | | (64,395 | ) | | | 9,101 | |

Interest expense | | | — | | | | 6,121 | | | | 23,203 | | | | 309 | | | | (807 | ) | | | 28,826 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

(Loss) income from conitnuing operations before taxes | | | (68,320 | ) | | | (6,818 | ) | | | (64,066 | ) | | | 4,919 | | | | 65,202 | | | | (69,083 | ) |

Income tax expense (benefit) | | | 5 | | | | — | | | | (1,968 | ) | | | — | | | | — | | | | (1,963 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

(Loss) income from continuing operations | | | (68,325 | ) | | | (6,818 | ) | | | (62,098 | ) | | | 4,919 | | | | 65,202 | | | | (67,120 | ) |

Loss from discontinued operations | | | — | | | | — | | | | (1,724 | ) | | | — | | | | — | | | | (1,724 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net (loss) income | | | (68,325 | ) | | | (6,818 | ) | | | (63,822 | ) | | | 4,919 | | | | 65,202 | | | | (68,844 | ) |

Net loss attributable to noncontrolling interest | | | — | | | | — | | | | — | | | | — | | | | (519 | ) | | | (519 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net (loss) income attributable to member of Summit Materials, LLC | | $ | (68,325 | ) | | $ | (6,818 | ) | | $ | (63,822 | ) | | $ | 4,919 | | | $ | 65,721 | | | $ | (68,325 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

21

Condensed Consolidating Statements of Cash Flows

For the six months ended June 29, 2013