UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

| x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended June 28, 2014

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 333-187556

SUMMIT MATERIALS, LLC

(Exact name of registrant as specified in its charter)

| | |

| Delaware | | 26-4138486 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| |

1550 Wynkoop Street, 3rd Floor Denver, Colorado | | 80202 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (303) 893-0012

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| | | | | | |

| Large accelerated filer | | ¨ | | Accelerated filer | | ¨ |

| | | |

| Non-accelerated filer | | x (Do not check if a smaller reporting company) | | Smaller reporting company | | ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

As of August 5, 2014, 100% of the registrant’s outstanding limited liability company interests were held by Summit Materials Intermediate Holdings, LLC.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This quarterly report on Form 10-Q (this “report”) includes “forward-looking statements” within the meaning of the federal securities laws, which involve risks and uncertainties. Forward-looking statements include all statements that do not relate solely to historical or current facts, and you can identify forward-looking statements because they contain words such as “believes,” “expects,” “may,” “will,” “should,” “seeks,” “intends,” “trends,” “plans,” “estimates,” “projects” or “anticipates” or similar expressions that concern our strategy, plans, expectations or intentions. All statements made relating to our estimated and projected earnings, margins, costs, expenditures, cash flows, growth rates and financial results are forward-looking statements. These forward-looking statements are subject to risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from future results, performance or achievements expressed or implied by such forward-looking statements. We derive many of our forward-looking statements from our operating budgets and forecasts, which are based upon many detailed assumptions. While we believe that our assumptions are reasonable, it is very difficult to predict the effect of known factors, and, of course, it is impossible to anticipate all factors that could affect our actual results. In light of the significant uncertainties inherent in the forward-looking statements included herein, the inclusion of such information should not be regarded as a representation by us or any other person that the results or conditions described in such statements or our objectives and plans will be realized. Important factors could affect our results and could cause results to differ materially from those expressed in our forward-looking statements, including but not limited to the factors discussed in the section entitled “Risk Factors” in our Annual Report on Form 10-K for the fiscal year ended December 28, 2013 (the “Form 10-K”), as filed with the Securities and Exchange Commission (the “SEC”), any factors discussed in the section entitled “Risk Factors” of this report, and the following:

| | • | | our substantial current level of indebtedness; |

| | • | | our dependence on the construction industry and the strength of the local economies in which we operate; |

| | • | | our ability to execute on our acquisition strategy, successfully integrate acquisitions with our existing operations and retain key employees of such acquired businesses; |

| | • | | the cyclical nature of our business; |

| | • | | declines in public infrastructure construction and reductions in governmental funding, including the funding by transportation authorities and other state agencies; |

| | • | | conditions in the credit markets; |

| | • | | our ability to accurately estimate the overall risks, requirements or costs when we bid on or negotiate contracts that are ultimately awarded to us; |

| | • | | risks related to weather and seasonality; |

| | • | | competition within our local markets; |

| | • | | our dependence on securing and permitting aggregate reserves in strategically located areas; |

| | • | | risks associated with our capital-intensive business; |

| | • | | any failure to meet schedule or performance requirements of our contracts; |

| | • | | changes in environmental, health, safety and climate change laws or governmental requirements or policies concerning zoning and land use; |

| | • | | our dependence on senior management and inability to attract and retain qualified management personnel; |

| | • | | special hazards related to our operations that may cause personal injury or property damage not covered by insurance; |

| | • | | material costs and losses as a result of claims that our products do not meet regulatory requirements or contractual specifications; |

| | • | | cancellation of significant contracts or our disqualification from bidding for new contracts; |

| | • | | our reliance on exemptions from certain disclosure requirements due to our status as an “emerging growth company”; |

| | • | | interruptions in our information technology systems and infrastructure; and |

| | • | | other factors as described in the Form 10-K. |

All subsequent written and oral forward-looking statements attributable to us, or persons acting on our behalf, are expressly qualified in their entirety by these cautionary statements.

2

Any forward-looking statement that we make speaks only as of the date of this report. We undertake no obligation to publicly update or revise any forward-looking statement as a result of new information, future events or otherwise, except as otherwise required by law.

As used in this report, unless otherwise noted or the context otherwise requires,

| | • | | “we,” “our,” “us,” and the “Company” refer to Summit Materials, LLC and its subsidiaries as a combined entity; |

| | • | | “Summit Materials” refers only to Summit Materials, LLC and not its subsidiaries; |

| | • | | “Finance Corp” refers only to Summit Materials Finance Corp., a wholly-owned indirect subsidiary of Summit Materials; |

| | • | | “Sponsors” refers to certain investment funds affiliated with Blackstone Capital Partners V L.P. and Silverhawk Summit, L.P.; |

| | • | | “Lafarge” refers to Lafarge North America, Inc.; |

| | • | | “Westroc” refers to Westroc, LLC; |

| | • | | “Alleyton” refers collectively to Alleyton Resource Company, LLC, Alcomat, LLC and Alleyton Services Company, LLC, formerly Alleyton Resource Corporation, Colorado Gulf, LP and certain assets of Barten Shepard Investments, LP.; |

| | • | | “Troy Vines” refers collectively to Troy Vines, Inc.; and |

| | • | | “Buckhorn Materials” refers to Buckhorn Materials, LLC, which is the surviving entity from the acquisition of Buckhorn Materials LLC and Construction Materials Group LLC. |

3

SUMMIT MATERIALS, LLC

FORM 10-Q

TABLE OF CONTENTS

| | | | | | |

| | | | | Page

No. | |

| | PART I—Financial Information | | | | |

| | |

Item 1. | | Financial Statements | | | 5 | |

| | |

| | Consolidated Balance Sheets as of June 28, 2014 (Unaudited) and December 28, 2013 | | | 5 | |

| | |

| | Unaudited Consolidated Statements of Operations for the three and six months ended June 28, 2014 and June 29, 2013 | | | 6 | |

| | |

| | Unaudited Consolidated Statements of Comprehensive Income (Loss) for the three and six months ended June 28, 2014 and June 29, 2013 | | | 7 | |

| | |

| | Unaudited Consolidated Statements of Cash Flows for the six months ended June 28, 2014 and June 29, 2013 | | | 8 | |

| | |

| | Unaudited Consolidated Statements of Changes in Redeemable Noncontrolling Interest and Member’s Interest for the six months ended June 28, 2014 and June 29, 2013 | | | 9 | |

| | |

| | Notes to Unaudited Consolidated Financial Statements | | | 10 | |

| | |

Item 2. | | Management’s Discussion and Analysis of Financial Condition and Results of Operations | | | 28 | |

| | |

Item 3. | | Quantitative and Qualitative Disclosures About Market Risk | | | 40 | |

| | |

Item 4. | | Controls and Procedures | | | 41 | |

| | |

| | PART II — Other Information | | | | |

| | |

Item 1. | | Legal Proceedings | | | 42 | |

| | |

Item 1A. | | Risk Factors | | | 42 | |

| | |

Item 2. | | Unregistered Sales of Equity Securities and Use of Proceeds | | | 42 | |

| | |

Item 3. | | Defaults Upon Senior Securities | | | 42 | |

| | |

Item 4. | | Mine Safety Disclosures | | | 42 | |

| | |

Item 5. | | Other Information | | | 42 | |

| | |

Item 6. | | Exhibits | | | 42 | |

| |

SIGNATURES | | | 44 | |

4

PART I—FINANCIAL INFORMATION

| ITEM 1. | FINANCIAL STATEMENTS |

SUMMIT MATERIALS, LLC AND SUBSIDIARIES

Consolidated Balance Sheets

(In thousands)

| | | | | | | | |

| | | June 28,

2014

(unaudited) | | | December 28,

2013

(audited) | |

Assets | | | | | | | | |

Current assets: | | | | | | | | |

Cash | | $ | 20,802 | | | $ | 14,917 | |

Accounts receivable, net | | | 143,768 | | | | 99,337 | |

Costs and estimated earnings in excess of billings | | | 21,779 | | | | 10,767 | |

Inventories | | | 119,171 | | | | 96,432 | |

Other current assets | | | 13,235 | | | | 13,181 | |

| | | | | | | | |

Total current assets | | | 318,755 | | | | 234,634 | |

| | |

Property, plant and equipment, less accumulated depreciation, depletion and amortization (June 28, 2014—$246,098 and December 28, 2013—$212,382) | | | 920,513 | | | | 831,778 | |

Goodwill | | | 317,323 | | | | 127,038 | |

Intangible assets, less accumulated amortization (June 28, 2014—$2,577 and December 28, 2013—$2,192) | | | 15,275 | | | | 15,147 | |

Other assets | | | 45,774 | | | | 39,197 | |

| | | | | | | | |

Total assets | | $ | 1,617,640 | | | $ | 1,247,794 | |

| | | | | | | | |

| | |

Liabilities, Redeemable Noncontrolling Interest and Member’s Interest | | | | | | | | |

Current liabilities: | | | | | | | | |

Current portion of debt | | $ | 69,220 | | | $ | 30,220 | |

Current portion of acquisition-related liabilities | | | 19,039 | | | | 10,635 | |

Accounts payable | | | 78,244 | | | | 72,104 | |

Accrued expenses | | | 87,913 | | | | 57,251 | |

Billings in excess of costs and estimated earnings | | | 4,902 | | | | 9,263 | |

| | | | | | | | |

Total current liabilities | | | 259,318 | | | | 179,473 | |

| | |

Long-term debt | | | 938,290 | | | | 658,767 | |

Acquisition-related liabilities | | | 40,947 | | | | 23,756 | |

Other noncurrent liabilities | | | 83,415 | | | | 77,480 | |

| | | | | | | | |

Total liabilities | | | 1,321,970 | | | | 939,476 | |

| | | | | | | | |

| | |

Commitments and contingencies (see note 9) | | | | | | | | |

| | |

Redeemable noncontrolling interest | | | 26,825 | | | | 24,767 | |

Member’s interest: | | | | | | | | |

Member’s equity | | | 512,297 | | | | 486,896 | |

Accumulated deficit | | | (239,213 | ) | | | (198,511 | ) |

Accumulated other comprehensive loss | | | (5,472 | ) | | | (6,045 | ) |

| | | | | | | | |

Member’s interest | | | 267,612 | | | | 282,340 | |

Noncontrolling interest | | | 1,233 | | | | 1,211 | |

| | | | | | | | |

Total member’s interest | | | 268,845 | | | | 283,551 | |

| | | | | | | | |

Total liabilities, redeemable noncontrolling interest and member’s interest | | $ | 1,617,640 | | | $ | 1,247,794 | |

| | | | | | | | |

See notes to unaudited consolidated financial statements.

5

SUMMIT MATERIALS, LLC AND SUBSIDIARIES

Unaudited Consolidated Statements of Operations

(In thousands)

| | | | | | | | | | | | | | | | |

| | | Three months ended | | | Six months ended | |

| | | June 28,

2014 | | | June 29,

2013 | | | June 28,

2014 | | | June 29,

2013 | |

Revenue: | | | | | | | | | | | | | | | | |

Product | | $ | 225,808 | | | $ | 169,041 | | | $ | 329,769 | | | $ | 237,181 | |

Service | | | 98,487 | | | | 85,801 | | | | 145,617 | | | | 124,490 | |

| | | | | | | | | | | | | | | | |

Total revenue | | | 324,295 | | | | 254,842 | | | | 475,386 | | | | 361,671 | |

| | | | | | | | | | | | | | | | |

| | | | |

Cost of revenue (excluding items shown separately below): | | | | | | | | | | | | | | | | |

Product | | | 155,984 | | | | 115,960 | | | | 245,003 | | | | 181,932 | |

Service | | | 75,778 | | | | 65,883 | | | | 115,434 | | | | 95,984 | |

| | | | | | | | | | | | | | | | |

Total cost of revenue | | | 231,762 | | | | 181,843 | | | | 360,437 | | | | 277,916 | |

| | | | | | | | | | | | | | | | |

General and administrative expenses | | | 34,867 | | | | 39,392 | | | | 70,355 | | | | 73,395 | |

Depreciation, depletion, amortization and accretion | | | 21,339 | | | | 18,894 | | | | 40,695 | | | | 36,026 | |

Transaction costs | | | 2,405 | | | | 982 | | | | 4,996 | | | | 2,464 | |

| | | | | | | | | | | | | | | | |

Operating income (loss) | | | 33,922 | | | | 13,731 | | | | (1,097 | ) | | | (28,130 | ) |

Other (income) expense, net | | | (697 | ) | | | (269 | ) | | | (891 | ) | | | 163 | |

Loss on debt financings | | | — | | | | — | | | | — | | | | 3,115 | |

Interest expense | | | 21,651 | | | | 14,482 | | | | 40,470 | | | | 27,849 | |

| | | | | | | | | | | | | | | | |

Income (loss) from continuing operations before taxes | | | 12,968 | | | | (482 | ) | | | (40,676 | ) | | | (59,257 | ) |

Income tax benefit | | | (864 | ) | | | (726 | ) | | | (1,460 | ) | | | (3,347 | ) |

| | | | | | | | | | | | | | | | |

Income (loss) from continuing operations | | | 13,832 | | | | 244 | | | | (39,216 | ) | | | (55,910 | ) |

(Income) loss from discontinued operations | | | (369 | ) | | | (26 | ) | | | (349 | ) | | | 97 | |

| | | | | | | | | | | | | | | | |

Net income (loss) | | | 14,201 | | | | 270 | | | | (38,867 | ) | | | (56,007 | ) |

Net income (loss) attributable to noncontrolling interest | | | 1,946 | | | | 1,939 | | | | (569 | ) | | | (1,518 | ) |

| | | | | | | | | | | | | | | | |

Net income (loss) attributable to member of Summit Materials, LLC | | $ | 12,255 | | | $ | (1,669 | ) | | $ | (38,298 | ) | | $ | (54,489 | ) |

| | | | | | | | | | | | | | | | |

See notes to unaudited consolidated financial statements.

6

SUMMIT MATERIALS, LLC AND SUBSIDIARIES

Unaudited Consolidated Statements of Comprehensive Income (Loss)

(In thousands)

| | | | | | | | | | | | | | | | |

| | | Three months ended | | | Six months ended | |

| | | June 28,

2014 | | | June 29,

2013 | | | June 28,

2014 | | | June 29,

2013 | |

Net income (loss) | | $ | 14,201 | | | $ | 270 | | | $ | (38,867 | ) | | $ | (56,007 | ) |

Other comprehensive (loss) income: | | | | | | | | | | | | | | | | |

Postretirement curtailment adjustment | | | — | | | | — | | | | (1,346 | ) | | | — | |

Postretirement liability adjustment | | | — | | | | — | | | | 2,164 | | | | — | |

| | | | | | | | | | | | | | | | |

Other comprehensive income | | | — | | | | — | | | | 818 | | | | — | |

| | | | | | | | | | | | | | | | |

Comprehensive income (loss) | | | 14,201 | | | | 270 | | | | (38,049 | ) | | | (56,007 | ) |

Less comprehensive income (loss) attributable to the noncontrolling interest | | | 1,946 | | | | 1,939 | | | | (324 | ) | | | (1,518 | ) |

| | | | | | | | | | | | | | | | |

Comprehensive income (loss) attributable to member of Summit Materials, LLC | | $ | 12,255 | | | $ | (1,669 | ) | | $ | (37,725 | ) | | $ | (54,489 | ) |

| | | | | | | | | | | | | | | | |

See notes to unaudited consolidated financial statements.

7

SUMMIT MATERIALS, LLC AND SUBSIDIARIES

Unaudited Consolidated Statements of Cash Flows

(In thousands)

| | | | | | | | |

| | | Six months ended | |

| | | June 28,

2014 | | | June 29,

2013 | |

Cash flow from operating activities: | | | | | | | | |

Net loss | | $ | (38,867 | ) | | $ | (56,007 | ) |

Adjustments to reconcile net loss to net cash used in operating activities: | | | | | | | | |

Depreciation, depletion, amortization and accretion | | | 43,296 | | | | 37,404 | |

Financing fee amortization | | | 470 | | | | 1,629 | |

Share-based compensation expense | | | 1,138 | | | | 1,114 | |

Deferred income tax benefit | | | (525 | ) | | | (2,969 | ) |

Net (gain) loss on asset disposals | | | (76 | ) | | | 5,574 | |

Loss on debt financings | | | — | | | | 2,989 | |

Other | | | 559 | | | | 755 | |

(Increase) decrease in operating assets, net of acquisitions: | | | | | | | | |

Account receivable, net | | | (28,917 | ) | | | (11,610 | ) |

Inventories | | | (17,820 | ) | | | (13,222 | ) |

Costs and estimated earnings in excess of billings | | | (10,246 | ) | | | (13,688 | ) |

Other current assets | | | (2,128 | ) | | | (491 | ) |

Other assets | | | 2,214 | | | | (118 | ) |

Increase (decrease) in operating liabilities, net of acquisitions: | | | | | | | | |

Accounts payable | | | 3,589 | | | | 6,691 | |

Accrued expenses | | | 8,511 | | | | (4,722 | ) |

Billings in excess of costs and estimated earnings | | | (4,361 | ) | | | (1,493 | ) |

Other liabilities | | | (2,717 | ) | | | 404 | |

| | | | | | | | |

Net cash used for operating activities | | | (45,880 | ) | | | (47,760 | ) |

| | | | | | | | |

| | |

Cash flow from investing activities: | | | | | | | | |

Acquisitions, net of cash acquired | | | (234,870 | ) | | | (60,779 | ) |

Purchases of property, plant and equipment | | | (49,260 | ) | | | (40,528 | ) |

Proceeds from the sale of property, plant and equipment | | | 5,985 | | | | 7,086 | |

Other | | | 757 | | | | — | |

| | | | | | | | |

Net cash used for investing activities | | | (277,388 | ) | | | (94,221 | ) |

| | | | | | | | |

| | |

Cash flow from financing activities: | | | | | | | | |

Proceeds from investment by member | | | 24,350 | | | | — | |

Proceeds from debt issuances | | | 424,750 | | | | 189,681 | |

Payments on long-term debt | | | (109,246 | ) | | | (61,343 | ) |

Payments on acquisition-related liabilities | | | (4,259 | ) | | | (3,426 | ) |

Financing costs | | | (6,354 | ) | | | (2,707 | ) |

Other | | | (88 | ) | | | — | |

| | | | | | | | |

Net cash provided by financing activities | | | 329,153 | | | | 122,205 | |

| | | | | | | | |

Net increase (decrease) in cash | | | 5,885 | | | | (19,776 | ) |

Cash—beginning of period | | | 14,917 | | | | 27,431 | |

| | | | | | | | |

Cash—end of period | | $ | 20,802 | | | $ | 7,655 | |

| | | | | | | | |

See notes to unaudited consolidated financial statements.

8

SUMMIT MATERIALS, LLC AND SUBSIDIARIES

Unaudited Consolidated Statements of Changes in Redeemable Noncontrolling Interest and Member’s Interest

(In thousands)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Total Member’s Interest | | | | | | | | | | |

| | | Member’s

equity | | | Accumulated

deficit | | | Accumulated

other

comprehensive

loss | | | Noncontrolling

interest | | | Total

member’s

interest | | | Redeemable

noncontrolling

interest | |

Balance—December 28, 2013 | | $ | 486,896 | | | $ | (198,511 | ) | | $ | (6,045 | ) | | $ | 1,211 | | | $ | 283,551 | | | $ | 24,767 | |

| | | | | | |

Contributed capital | | | 24,350 | | | | — | | | | — | | | | — | | | | 24,350 | | | | — | |

Accretion/ redemption value adjustment | | | — | | | | (2,404 | ) | | | — | | | | — | | | | (2,404 | ) | | | 2,404 | |

Net (loss) income | | | — | | | | (38,298 | ) | | | — | | | | 22 | | | | (38,276 | ) | | | (591 | ) |

Other comprehensive income | | | — | | | | — | | | | 573 | | | | — | | | | 573 | | | | 245 | |

Share-based compensation | | | 1,051 | | | | — | | | | — | | | | — | | | | 1,051 | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Balance—June 28, 2014 | | $ | 512,297 | | | $ | (239,213 | ) | | $ | (5,472 | ) | | $ | 1,233 | | | $ | 268,845 | | | $ | 26,825 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Balance—December 29, 2012 | | $ | 484,584 | | | $ | (94,085 | ) | | $ | (9,130 | ) | | $ | 1,059 | | | $ | 382,428 | | | $ | 22,850 | |

| | | | | | |

Accretion/ redemption value adjustment | | | — | | | | (1,788 | ) | | | — | | | | — | | | | (1,788 | ) | | | 1,788 | |

Net (loss) income | | | — | | | | (54,489 | ) | | | — | | | | (30 | ) | | | (54,519 | ) | | | (1,488 | ) |

Share-based compensation | | | 1,114 | | | | — | | | | — | | | | — | | | | 1,114 | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Balance—June 29, 2013 | | $ | 485,698 | | | $ | (150,362 | ) | | $ | (9,130 | ) | | $ | 1,029 | | | $ | 327,235 | | | $ | 23,150 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

See notes to unaudited consolidated financial statements.

9

SUMMIT MATERIALS, LLC

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

(Tables in thousands)

| 1. | SUMMARY OF ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES |

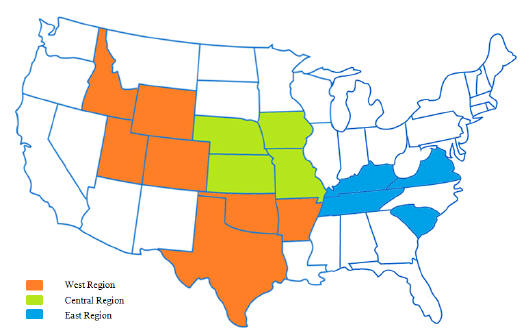

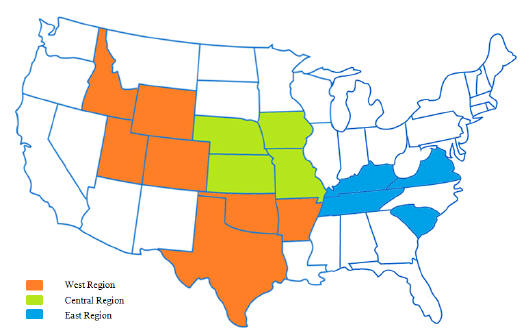

Summit Materials, LLC (“Summit Materials”) is a vertically integrated construction materials company. Across its subsidiaries, it is engaged in the production and sale of aggregates, cement, ready-mixed concrete, asphalt paving mix and concrete products. Summit Materials, through its subsidiaries (collectively, the “Company”), owns and operates quarries, sand and gravel pits, a cement plant, cement distribution terminals, ready-mixed concrete plants, asphalt plants and landfill sites. It is also engaged in paving and related services. The Company is organized by geographic region and has three operating segments, which are also its reporting segments: the West; Central; and East regions.

Summit Materials is a wholly owned indirect subsidiary of Summit Materials Holdings L.P., whose major indirect owners are certain investment funds affiliated with Blackstone Capital Partners V L.P. and Silverhawk Summit, L.P.

The consolidated financial statements of the Company include the accounts of Summit Materials and its wholly and non-wholly owned subsidiaries. All significant intercompany balances and transactions have been eliminated.

Basis of Presentation—These consolidated financial statements were prepared in accordance with U.S. generally accepted accounting principles (“GAAP”) for interim financial information, without audit, pursuant to the rules and regulations of the Securities and Exchange Commission. Certain information and footnote disclosures typically included in financial statements prepared in accordance with GAAP have been condensed or omitted pursuant to such rules and regulations. These unaudited consolidated financial statements should be read in conjunction with the Company’s audited consolidated financial statements and the notes thereto as of and for the year ended December 28, 2013. The Company continues to follow the accounting policies set forth in those consolidated financial statements. Management believes that these consolidated interim financial statements include all adjustments, normal and recurring in nature, that are necessary to present fairly the financial position of the Company as of June 28, 2014, the results of operations for the three and six month periods ended June 28, 2014 and June 29, 2013 and cash flows for the six month periods ended June 28, 2014 and June 29, 2013.

The Company’s fiscal year is based on a 52-53 week year with each quarter composed of 13 weeks ending on a Saturday. The 53 week year occurs approximately once every seven years. The additional week in the 53 week year will be included in the fourth quarter. The Company’s second quarter ended on June 28 and June 29 in 2014 and 2013, respectively. In 2013, Continental Cement Company, L.L.C. (“Continental Cement”), an indirect majority owned subsidiary of Summit Materials, changed its fiscal year to be consistent with the Company’s fiscal year. Prior to fiscal 2013, Continental Cement’s fiscal year was based on the calendar year with quarter-end dates of March 31, June 30, September 30 and December 31. The effect of this change to the Company’s financial position, results of operations and liquidity is immaterial.

Substantially all of the Company’s products and services are produced, consumed and performed outdoors, primarily in the spring, summer and fall. Seasonal changes and other weather-related conditions can affect the production and sales volumes of its products and delivery of its services. Therefore, the financial results for any interim period are not necessarily indicative of the results expected for the full year. Furthermore, the Company’s sales and earnings are sensitive to national, regional and local economic conditions and to cyclical changes in construction spending, among other factors.

Use of Estimates—Preparation of these consolidated financial statements in conformity with GAAP requires management to make estimates and assumptions. These estimates and the underlying assumptions affect the amounts of assets and liabilities reported and the disclosures about contingent assets and liabilities and reported amounts of revenue and expenses. Such estimates include the valuation of accounts receivable, inventories, goodwill, intangibles and other long-lived assets, pension and other postretirement obligations and asset retirement obligations. Estimates also include revenue earned on contracts and costs to complete contracts; most of the Company’s construction work is performed under fixed unit-price contracts with state and local governmental entities. Management regularly evaluates its estimates and assumptions based on historical experience and other factors, including the current economic environment. Management adjusts such estimates and assumptions when circumstances dictate. As future events and their effects cannot be determined with precision, actual results can differ significantly from estimates made. Changes in estimates, including those resulting from continuing changes in the economic environment, are reflected in the Company’s consolidated financial statements during the period in which the change in estimate occurs.

Business and Credit Concentrations—The Company’s operations are conducted primarily across 17 states, with the most significant revenue generated in Texas, Kansas, Kentucky, Utah and Missouri. The Company’s accounts receivable consist primarily of amounts due from customers within these areas. Therefore, collection of these accounts is dependent on the economic conditions in the aforementioned states, as well as specific situations affecting individual customers. Credit granted within the Company’s trade areas has been granted to many customers, and management does not believe that any significant concentrations of credit exist with respect to individual customers or groups of customers. No single customer accounted for more than 10% of total revenue in the three or six month periods ended June 28, 2014 and June 29, 2013.

10

Fair Value Measurements—Certain acquisitions made by the Company require the payment of contingent amounts of purchase consideration. These payments are contingent on specified operating results being achieved in periods subsequent to the acquisition and will not be made if earn-out thresholds are not achieved. Contingent consideration obligations are measured at fair value each reporting period, and any adjustments to fair value are recognized in earnings in the period identified. As of June 28, 2014 and December 28, 2013, contingent consideration obligations of $3.6 million and $1.9 million were included in the non-current portion of acquisition-related liabilities and, as of June 28, 2014, $2.5 million was included in the current portion of acquisition related liabilities. The $4.2 million increase in contingent consideration obligations relates to the January 17, 2014 acquisition of Alleyton Resource Corporation, Colorado Gulf, LP and certain assets of Barten Shepard Investments, LP (collectively, “Alleyton”).

The fair value of the contingent consideration obligations approximated their carrying value of $6.1 million and $1.9 million as of June 28, 2014 and December 28, 2013, respectively. The fair values are based on unobservable, or Level 3, inputs, including projected probability-weighted cash payments and an 11.0% discount rate, which reflects a market discount rate. Changes in fair value may occur as a result of a change in actual or projected cash payments, the probability weightings applied by the Company to projected payments or a change in the discount rate. Significant increases or decreases in any of these inputs in isolation could result in a lower, or higher, fair value measurement. There were no material valuation adjustments to contingent consideration obligations in the three or six month periods ended June 28, 2014 or June 29, 2013.

Financial Instruments—The Company’s financial instruments include certain acquisition-related liabilities (deferred consideration and noncompete obligations) and debt. The fair value of the deferred consideration and noncompete obligations approximate their carrying value of $46.9 million and $6.9 million, respectively, as of June 28, 2014, and $28.3 million and $4.2 million, respectively, as of December 28, 2013. The $21.3 million increase in the deferred consideration and noncompete obligations primarily relate to the acquisitions completed in 2014. The fair value was determined based on unobservable, or Level 3 inputs, including the cash payment terms in the purchase agreements and a discount rate reflecting the Company’s credit risk.

The fair value of long-term debt approximated $990.8 million and $696.5 million as of June 28, 2014 and December 28, 2013, respectively, compared to its carrying value of $927.8 million and $663.0 million, respectively. Fair value was determined based on observable, or Level 2 inputs, such as interest rates, bond yields and quoted prices in inactive markets.

Redeemable Noncontrolling Interest—The Company owns all of the outstanding Class A Units of Continental Cement, which represent a 69.7% economic interest. Continental Cement’s Class B Units, which represent a 30.3% economic interest, are subordinate to the Class A Units. The Class B Units can be put to Continental Cement in the future based on the passage of time, which can be accelerated upon the occurrence of a contingent event; therefore, the noncontrolling interest of the Class B unit holders is classified in temporary equity. The redemption value was based upon the estimated fair value of Continental Cement at the date of acquisition and the Company has elected to accrete changes in the redemption value of the noncontrolling interest over the period from the date of issuance to the earliest anticipated redemption date, which is currently May 2016. The accretion is recognized through an adjustment to accumulated deficit. The redemption value of the redeemable noncontrolling interest as of June 28, 2014 and December 28, 2013 approximated its carrying value.

The Company completed a number of immaterial acquisitions during 2014 and 2013. The operating results of the acquired businesses have been included in the Company’s results of operations since the respective dates of the acquisitions. Assets acquired and liabilities assumed are measured at their acquisition-date fair value. Goodwill recognized in connection with the Company’s acquisitions is primarily attributable to the expected profitability, assembled workforces and operational infrastructure of the acquired businesses and the synergies expected to result after integration of those acquired businesses. The purchase price allocation for the 2014 acquisitions has not been finalized due to the recent timing of the acquisitions.

2014 Acquisitions

West region

| | • | | On March 31, 2014, the Company acquired all of the stock of Troy Vines, Inc., an integrated aggregates and ready-mixed concrete business headquartered in Midland, Texas, which serves the Permian Basin region of West Texas. The acquisition was funded with cash on hand. |

| | • | | On January 17, 2014, the Company acquired all of the membership interests of Alleyton Resource Corporation, Colorado Gulf, LP and certain assets of Barten Shepard Investments, LP, an aggregates and ready-mixed concrete business in Houston, Texas. The Alleyton acquisition was funded with a portion of the proceeds from the January 17, 2014 issue and sale of $260.0 million aggregate principal amount of 10.5% senior notes due 2020 by the Company. |

11

East region

| | • | | On June 9, 2014, the Company acquired all of the membership interests of Buckhorn Materials LLC, an aggregates quarry in South Carolina, and Construction Materials Group LLC, a sand pit in South Carolina. The acquisition was funded with borrowings under the Company’s revolving credit facility. |

2013 Acquisitions

West region

| | • | | On April 1, 2013, the Company acquired all of the membership interests of Westroc, LLC, an aggregates and ready-mixed concrete provider near Salt Lake City, Utah, with borrowings under the Company’s revolving credit facility. |

Central region

| | • | | On April 1, 2013, the Company acquired certain aggregates, ready-mixed concrete and asphalt assets of Lafarge North America, Inc. in and around Wichita, Kansas, with borrowings under the Company’s revolving credit facility. |

Changes in the carrying amount of goodwill, by reportable segment, from December 28, 2013 to June 28, 2014 are summarized as follows:

| | | | | | | | | | | | | | | | |

| | | West | | | Central | | | East | | | Total | |

Balance, December 28, 2013 | | $ | 54,249 | | | $ | 72,789 | | | $ | — | | | $ | 127,038 | |

Acquisitions | | | 164,125 | | | | — | | | | 26,160 | | | | 190,285 | |

| | | | | | | | | | | | | | | | |

Balance, June 28, 2014 | | $ | 218,374 | | | $ | 72,789 | | | $ | 26,160 | | | $ | 317,323 | |

| | | | | | | | | | | | | | | | |

| 4. | ACCOUNTS RECEIVABLE, NET |

Accounts receivable, net consisted of the following as of June 28, 2014 and December 28, 2013:

| | | | | | | | |

| | | June 28,

2014 | | | December 28,

2013 | |

Trade accounts receivable | | $ | 131,026 | | | $ | 85,188 | |

Retention receivables | | | 14,185 | | | | 15,966 | |

Receivables from related parties | | | 1,262 | | | | 202 | |

| | | | | | | | |

Accounts receivable | | | 146,473 | | | | 101,356 | |

Less: Allowance for doubtful accounts | | | (2,705 | ) | | | (2,019 | ) |

| | | | | | | | |

Accounts receivable, net | | $ | 143,768 | | | $ | 99,337 | |

| | | | | | | | |

Retention receivables are amounts earned by the Company but held by customers until paving and related service contracts and projects are near completion or fully completed. Amounts are expected to be billed and collected within one year.

12

Inventories consisted of the following as of June 28, 2014 and December 28, 2013:

| | | | | | | | |

| | | June 28,

2014 | | | December 28,

2013 | |

Aggregate stockpiles | | $ | 80,232 | | | $ | 70,300 | |

Finished goods | | | 14,104 | | | | 11,207 | |

Work in process | | | 4,629 | | | | 2,623 | |

Raw materials | | | 20,206 | | | | 12,302 | |

| | | | | | | | |

Total | | $ | 119,171 | | | $ | 96,432 | |

| | | | | | | | |

Accrued expenses consist of the following as of June 28, 2014 and December 28, 2013:

| | | | | | | | |

| | | June 28, | | | December 28, | |

| | | 2014 | | | 2013 | |

Interest | | $ | 27,633 | | | $ | 16,456 | |

Payroll and benefits | | | 16,066 | | | | 16,368 | |

Capital lease obligations | | | 13,528 | | | | 2,068 | |

Insurance | | | 8,212 | | | | 7,445 | |

Taxes (1) | | | 6,084 | | | | 4,168 | |

Professional fees | | | 2,177 | | | | 2,352 | |

Other (2) | | | 14,213 | | | | 8,394 | |

| | | | | | | | |

Total | | $ | 87,913 | | | $ | 57,251 | |

| | | | | | | | |

| | (1) | Consists primarily of real estate, personal property and sales taxes. |

| | (2) | Consists primarily of subcontractor, management fee and working capital settlement accruals. |

Debt consisted of the following as of June 28, 2014 and December 28, 2013:

| | | | | | | | |

| | | June 28, | | | December 28, | |

| | | 2014 | | | 2013 | |

Revolver | | $ | 65,000 | | | $ | 26,000 | |

| | | | | | | | |

| | |

Long-term debt: | | | | | | | | |

$510.0 million senior notes, including a $17.3 million net premium at June 28, 2014 and $250 million senior notes, net of $4.0 million discount at December 28, 2013 | | | 527,319 | | | | 245,971 | |

$417.8 million credit facility, term loan, net of $2.6 million and $2.9 million discount at June 28, 2014 and December 28, 2013, respectively | | | 415,191 | | | | 417,016 | |

| | | | | | | | |

Total | | | 942,510 | | | | 662,987 | |

Current portion of long-term debt | | | 4,220 | | | | 4,220 | |

| | | | | | | | |

Long-term debt | | $ | 938,290 | | | $ | 658,767 | |

| | | | | | | | |

13

The contractual payments of long-term debt, including current maturities, for the five years subsequent to June 28, 2014, are as follows:

| | | | |

2014 (six months) | | $ | 2,110 | |

2015 | | | 5,275 | |

2016 | | | 4,220 | |

2017 | | | 4,220 | |

2018 | | | 3,165 | |

2019 | | | 398,790 | |

Thereafter | | | 510,000 | |

| | | | |

Total | | | 927,780 | |

Plus: Original issue net premium | | | 14,730 | |

| | | | |

Total debt | | $ | 942,510 | |

| | | | |

Senior Notes—Summit Materials and its wholly-owned indirect subsidiary, Summit Materials Finance Corp. (“Finance Corp.” and, together with Summit Materials, the “Issuers”), are co-issuers of the 10.5% Senior Notes due January 31, 2020 (the “Senior Notes”) that have been issued under an indenture dated as of January 30, 2012 (as amended and supplemented, the “Indenture”). The Senior Notes bear interest at 10.5% per year, payable semi-annually in arrears. The Indenture contains covenants limiting, among other things, the ability of Summit Materials and its restricted subsidiaries to incur additional indebtedness or issue certain preferred shares, pay dividends, redeem stock or make other distributions, make certain investments, sell or transfer certain assets, create liens, consolidate, merge, sell or otherwise dispose of all or substantially all of the Company’s assets, enter into certain transactions with affiliates, and designate subsidiaries as unrestricted subsidiaries. The Indenture also contains customary events of default.

The Issuers issued $250.0 million aggregate principal amount of Senior Notes (the “Existing Notes”) in January 2012. On January 17, 2014, the Issuers issued an additional $260.0 million aggregate principal amount of Senior Notes (the “Additional Notes”), receiving proceeds of $282.8 million, before payment of fees and expenses and including a $22.8 million premium. The proceeds from the sale of the Additional Notes were used for the purchase of Alleyton, to make payments on the Company’s Revolver (discussed and defined below) and for general corporate purposes. The Additional Notes are treated as a single series with the Existing Notes and have substantially the same terms as those of the Existing Notes. The Additional Notes and the Existing Notes vote as one class under the Indenture.

Credit Facility—The Company has a senior secured credit facility (the “Credit Facility”) providing for term loans in an aggregate amount of $422.0 million (the “Term Debt”) and revolving credit commitments in an aggregate amount of $150.0 million (the “Revolver”). The Company is required to make principal repayments of 0.25% of borrowings under the Term Debt on the last business day of each March, June, September and December. The current outstanding principal amount of Term Debt and applicable interest rate reflect the terms of a repricing consummated by the Company in February 2013, which included additional borrowings of $25.0 million, an interest rate reduction of 1.0% and a deferral of the March 2013 principal payment. The unpaid principal balance of Term Debt is due in full on the maturity date, which is January 30, 2019. On January 16, 2014, the Credit Facility was amended to allow for the issuance of the Additional Notes.

The Revolver matures on January 30, 2017 and bears interest per annum equal to an applicable margin of 3.25% plus, at the Company’s option, either (i) a base rate determined by reference to the highest of (a) the federal funds rate plus 0.50%, (b) the prime rate of Bank of America, N.A. and (c) the British Bankers Association London Interbank Offered Rate (“LIBOR”) plus 1.00% or (ii) a British Bankers Association LIBOR rate determined by reference to Reuters prior to the interest period relevant to such borrowing adjusted for certain additional costs. As of June 28, 2014, the borrowing capacity under the Revolver was $62.2 million, which is net of $22.8 million of outstanding letters of credit. The outstanding letters of credit are renewed annually and support required bonding on construction projects and the Company’s insurance liabilities.

The Company must adhere to certain financial covenants related to its borrowings under the Credit Facility and interest leverage ratios, as defined in the Credit Facility. The consolidated first lien net leverage ratio, reported each quarter, should be no greater than 4.75:1.0 from April 1, 2012 through June 30, 2014; 4.50:1.0 from July 1, 2014 to June 30, 2015, and 4.25:1.0 thereafter. The interest coverage ratio must be at least 1.70:1.0 from January 1, 2013 to December 31, 2014 and 1.85:1.0 thereafter.

As of June 28, 2014 and December 28, 2013, the Company was in compliance with all covenants applicable to the Senior Notes and the Credit Facility. The Company’s wholly-owned subsidiary companies and its non wholly-owned subsidiary, Continental Cement, are named as issuers or guarantors, as applicable, of the Senior Notes and the Credit Facility. In addition, the Company has pledged substantially all of its assets as collateral for the Credit Facility.

14

Accrued interest on long-term debt as of June 28, 2014 and December 28, 2013 was $27.4 million and $17.1 million, respectively. Interest expense related to the debt totaled $19.3 million and $36.5 million for the three and six month periods ended June 28, 2014, respectively, and $12.8 million and $24.6 million for the three and six month periods ended June 29, 2013, respectively. As of June 28, 2014 and December 28, 2013, $16.3 million and $11.5 million, respectively, of deferred financing fees were being amortized over the term of the debt using the effective interest method.

Summit Materials is a limited liability company and passes its tax attributes for federal and state tax purposes to its parent company and is generally not subject to federal or state income tax. However, certain subsidiary entities file federal and state income tax returns due to their status as C corporations. The provision for income taxes is composed of federal, state and local income taxes for the subsidiary entities that have C corporation status.

The effective income tax rate for these entities differs from the statutory federal rate primarily due to (1) depletion expense and domestic production activities deduction, which are allowed as deductions for tax purposes but not recorded under GAAP, (2) state income taxes and the effect of graduated tax rates and (3) certain non-recurring items, such as differences in the treatment of transaction costs, which are often not deductible for tax purposes.

As of June 28, 2014 and December 28, 2013, the Company has not recognized any liabilities for uncertain tax positions. The Company records interest and penalties as a component of the income tax provision. No material interest or penalties were recognized in income tax expense for the three or six month periods ended June 28, 2014 and June 29, 2013.

| 9. | COMMITMENTS AND CONTINGENCIES |

The Company is party to certain legal actions arising from the ordinary course of business activities. Accruals are recorded when the outcome is probable and can be reasonably estimated in accordance with applicable accounting requirements. While the ultimate results of claims and litigation cannot be predicted with certainty, management expects that the ultimate resolution of all pending or threatened claims and litigation will not have a material effect on the Company’s consolidated results of operations, financial position or liquidity. The Company’s policy is to record legal fees as incurred.

Litigation and Claims—The Company is obligated under an indemnification agreement entered into with the sellers of Harper Contracting, Inc., Harper Sand and Gravel, Inc., Harper Ready Mix Company, Inc. and Harper Investments, Inc. (collectively, “Harper”) for the sellers’ ownership interests in a joint venture agreement. The Company has the rights to any benefits under the joint venture as well as the assumption of any obligations, but does not own equity interests in the joint venture. The joint venture incurred significant losses on a highway project in Utah, which resulted in requests for funding from the joint venture partners and, ultimately, from the Company. Through June 28, 2014, the Company has funded $8.8 million, of which $4.0 million was funded in 2012 and $4.8 million was funded in 2011. As of June 28, 2014 and December 28, 2013, an accrual of $4.3 million was recorded in other noncurrent liabilities for this matter.

During the course of business, there may be revisions to project costs and conditions that can give rise to change orders on construction contracts. Revisions can also result in claims made against a customer or subcontractor to recover project variances that have not been satisfactorily addressed through change orders with a customer. As of June 28, 2014 and December 28, 2013, unapproved change orders and claims totaled $4.0 million ($0.5 million in costs and estimated earnings in excess of billings, $1.2 million in accounts receivable and $2.3 million in other assets) and $3.2 million ($0.5 million in costs and estimated earnings in excess of billings and $2.7 million in other assets), respectively.

Environmental Remediation—The Company’s operations are subject to and affected by federal, state and local laws and regulations relating to the environment, health and safety and other regulatory matters. These operations require environmental operating permits, which are subject to modification, renewal and revocation. Management regularly monitors and reviews its operations, procedures and policies for compliance with these laws and regulations. Despite these compliance efforts, risk of environmental liability is inherent in the operation of the Company’s business, as it is with other companies engaged in similar businesses, and there can be no assurance that environmental liabilities will not have a material adverse effect on the Company’s consolidated financial position, results of operations or liquidity in the future.

Other—In February 2011, the Company incurred a property loss related to a sunken barge with cement product aboard. During the six months ended June 29, 2013, the Company recorded a $1.8 million charge for costs to remove the barge from the waterway. As of June 28, 2014 and December 28, 2013, the Company had $0.4 million and $0.9 million, respectively, included in accrued expenses as management’s best estimate of the remaining costs to remove the barge.

In the ordinary course of business, the Company enters into various firm purchase commitments with terms generally less than one year for certain raw materials and services. Management does not expect any significant changes in the market value of these goods and services during the commitment period that would have a material adverse effect on the financial position, results of operations or liquidity of the Company.

15

| 10. | SUPPLEMENTAL CASH FLOW INFORMATION |

Supplemental cash flow information is as follows:

| | | | | | | | |

| | | Six months ended | |

| | | June 28,

2014 | | | June 29,

2013 | |

Cash payments: | | | | | | | | |

Interest | | $ | 25,881 | | | $ | 31,439 | |

Income taxes | | | 1,320 | | | | 653 | |

The Company has determined that it has three operating segments, which are its reportable segments: the West; Central; and East regions. These segments are consistent with the Company’s management reporting structure. Each region’s operations consist of various activities related to the production, distribution and sale of construction materials, products and the provision of construction services. Assets employed by segment include assets directly identified with those operations. Corporate assets consist primarily of cash, property, plant and equipment for corporate operations and other assets not directly identifiable with a reportable business segment. The accounting policies applicable to each segment are consistent with those used in preparing the consolidated financial statements. The following tables display selected financial data for the Company’s reportable segments:

| | | | | | | | | | | | | | | | |

| | | Three months ended | | | Six months ended | |

| | | June 28,

2014 | | | June 29,

2013 | | | June 28,

2014 | | | June 29,

2013 | |

Revenue: | | | | | | | | | | | | | | | | |

West region | | $ | 172,236 | | | $ | 119,656 | | | $ | 267,130 | | | $ | 179,719 | |

Central region | | | 109,117 | | | | 92,780 | | | | 156,659 | | | | 128,680 | |

East region | | | 42,942 | | | | 42,406 | | | | 51,597 | | | | 53,272 | |

| | | | | | | | | | | | | | | | |

Total revenue | | $ | 324,295 | | | $ | 254,842 | | | $ | 475,386 | | | $ | 361,671 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | Three months ended | | | Six months ended | |

| | | June 28,

2014 | | | June 29,

2013 | | | June 28,

2014 | | | June 29,

2013 | |

Segment profit: | | | | | | | | | | | | | | | | |

West region | | $ | 30,750 | | | $ | 6,807 | | | $ | 32,541 | | | $ | 85 | |

Central region | | | 28,823 | | | | 25,136 | | | | 28,400 | | | | 19,182 | |

East region | | | 7,932 | | | | 7,155 | | | | (1,406 | ) | | | (2,377 | ) |

Corporate and other | | | (11,547 | ) | | | (6,204 | ) | | | (19,046 | ) | | | (12,272 | ) |

| | | | | | | | | | | | | | | | |

Total reportable segments and corporate | | | 55,958 | | | | 32,894 | | | | 40,489 | | | | 4,618 | |

Interest expense | | | 21,651 | | | | 14,482 | | | | 40,470 | | | | 27,849 | |

Depreciation, depletion, amortization and accretion | | | 21,339 | | | | 18,894 | | | | 40,695 | | | | 36,026 | |

| | | | | | | | | | | | | | | | |

Income (loss) from continuing operations before taxes | | $ | 12,968 | | | $ | (482 | ) | | $ | (40,676 | ) | | $ | (59,257 | ) |

| | | | | | | | | | | | | | | | |

16

| | | | | | | | |

| | | Six months ended | |

| | | June 28,

2014 | | | June 29,

2013 | |

Cash paid for capital expenditures: | | | | | | | | |

West region | | $ | 17,924 | | | $ | 14,194 | |

Central region | | | 23,372 | | | | 19,826 | |

East region | | | 5,533 | | | | 5,742 | |

| | | | | | | | |

Total reportable segments | | | 46,829 | | | | 39,762 | |

Corporate and other | | | 2,431 | | | | 766 | |

| | | | | | | | |

Total capital expenditures | | $ | 49,260 | | | $ | 40,528 | |

| | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | Three months ended | | | Six months ended | |

| | | June 28,

2014 | | | June 29,

2013 | | | June 28,

2014 | | | June 29,

2013 | |

Depreciation, depletion, amortization and accretion: | | | | | | | | | | | | | | | | |

West region | | $ | 7,667 | | | $ | 6,456 | | | $ | 14,414 | | | $ | 12,291 | |

Central region | | | 9,504 | | | | 8,687 | | | | 18,351 | | | | 16,329 | |

East region | | | 3,831 | | | | 3,729 | | | | 7,288 | | | | 7,362 | |

| | | | | | | | | | | | | | | | |

Total reportable segments | | | 21,002 | | | | 18,872 | | | | 40,053 | | | | 35,982 | |

Corporate and other | | | 337 | | | | 22 | | | | 642 | | | | 44 | |

| | | | | | | | | | | | | | | | |

Total depreciation, depletion, amortization and accretion | | $ | 21,339 | | | $ | 18,894 | | | $ | 40,695 | | | $ | 36,026 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | |

| | | June 28,

2014 | | | December 28,

2013 | |

Total assets: | | | | | | | | |

West region | | $ | 664,913 | | | $ | 383,544 | |

Central region | | | 697,318 | | | | 657,421 | |

East region | | | 240,081 | | | | 192,486 | |

| | | | | | | | |

Total reportable segments | | | 1,602,312 | | | | 1,233,451 | |

Corporate and other | | | 15,328 | | | | 14,343 | |

| | | | | | | | |

Total | | $ | 1,617,640 | | | $ | 1,247,794 | |

| | | | | | | | |

17

| | | | | | | | | | | | | | | | |

| | | Three months ended | | | Six months ended | |

| | | June 28,

2014 | | | June 29,

2013 | | | June 28,

2014 | | | June 29,

2013 | |

Revenue by product:* | | | | | | | | | | | | | | | | |

Aggregates | | $ | 59,816 | | | $ | 47,439 | | | $ | 91,365 | | | $ | 68,304 | |

Cement | | | 26,181 | | | | 21,474 | | | | 33,387 | | | | 30,914 | |

Ready-mixed concrete | | | 71,389 | | | | 33,279 | | | | 113,769 | | | | 46,412 | |

Asphalt | | | 74,686 | | | | 55,857 | | | | 99,082 | | | | 75,208 | |

Paving and related services | | | 143,918 | | | | 125,536 | | | | 199,420 | | | | 171,946 | |

Other | | | (51,695 | ) | | | (28,743 | ) | | | (61,637 | ) | | | (31,113 | ) |

| | | | | | | | | | | | | | | | |

Total revenue | | $ | 324,295 | | | $ | 254,842 | | | $ | 475,386 | | | $ | 361,671 | |

| | | | | | | | | | | | | | | | |

| | * | Revenue by product includes intracompany sales transferred at market value. The elimination of intracompany transactions is included in Other. | |

| 12. | RELATED PARTY TRANSACTIONS |

The Company incurred certain management fees due to Blackstone Management Partners L.L.C. (“BMP”) totaling $1.3 million and $2.3 million during the three and six month periods ended June 28, 2014, respectively, and $0.6 million and $1.2 million during the three and six month periods ended June 29, 2013, respectively. Under the terms of an agreement with Summit Materials Holdings L.P. and BMP, BMP provides monitoring, advisory and consulting services to the Company. In consideration for these services, the Company pays BMP the greater of $300,000 or 2.0% of the Company’s annual consolidated profit, as defined in the agreement. The management fees paid pursuant to this agreement are included in general and administrative expenses.

BMP also undertakes financial and structural analysis, due diligence investigations, corporate strategy and other advisory services and negotiation assistance related to acquisitions, for which the Company pays BMP a transaction fee equal to 1.0% of the aggregate enterprise value of any acquired entity or, if such transaction is structured as an asset purchase or sale, 1.0% of the consideration paid for or received in respect of the assets acquired or disposed. Under the terms of the agreement, BMP is permitted to assign, and has assigned, a portion of the fees to which it is entitled to Silverhawk Summit, L.P. and to certain other equity-holding current and former employees and board members. During the three and six months ended June 28, 2014, the Company paid BMP $0.6 million and $2.3 million, respectively, under this agreement and paid immaterial amounts to Silverhawk Summit, L.P. and to other equityholders. The acquisition-related fees paid pursuant to this agreement are included in transaction costs.

Blackstone Advisory Partners L.P., an affiliate of The Blackstone Group L.P., served as an initial purchaser of $13.0 million principal amount of the Additional Notes issued in January 2014 and received compensation in connection therewith.

In addition to the fees paid to BMP pursuant to the agreements described above, the Company reimburses BMP for direct expenses incurred, which were not material in the three and six month periods ended June 28, 2014 and June 29, 2013.

The Company had an immaterial amount of revenue from unconsolidated affiliates during the three and six month periods ended June 28, 2014 and $0.4 million both during the three and six month periods ended June 29, 2013. As of June 28, 2014 and December 28, 2013, accounts receivable from affiliates was zero and $0.4 million, respectively.

Cement sales to companies owned by a noncontrolling member of Continental Cement were approximately $4.5 million and $6.2 million during the three and six month periods ended June 28, 2014, respectively, and $3.5 million and $5.1 million during the three and six month periods ended June 29, 2013, respectively. Accounts receivables due from the noncontrolling member were $1.2 million and $0.2 million as of June 28, 2014 and December 28, 2013, respectively. In addition, as of December 28, 2013, the Company had accrued interest payments of $0.7 million due to a certain noncontrolling member for a related party note, which the Company paid in the first quarter of 2014. The principal balance on the note was repaid in January 2012.

In the six months ended June 28, 2014, the Company sold certain assets associated with the production of concrete blocks, including inventory and equipment, to a related party for $2.3 million.

18

| 13. | SENIOR NOTES’ GUARANTOR AND NON-GUARANTOR FINANCIAL INFORMATION |

Summit Materials’ wholly-owned subsidiary companies other than Finance Corp. (“Wholly-owned Guarantors”) and non wholly-owned subsidiary, Continental Cement (“Non Wholly-owned Guarantor”), are named as guarantors (collectively, the “Guarantors”) of the Senior Notes. Certain other partially-owned subsidiaries, including a subsidiary of Continental Cement, do not guarantee the Senior Notes (collectively, the “Non-Guarantors”). Summit Materials (“Parent”) and Finance Corp. (collectively, the “Issuers”) were co-issuers of the Senior Notes. The Guarantors provide a joint and several, full and unconditional guarantee of the Senior Notes. There are no significant restrictions on Summit Materials ability to obtain funds from any of the Guarantor Subsidiaries in the form of dividends or loans. Additionally, there are no significant restrictions on a Guarantor Subsidiary’s ability to obtain funds from Summit Materials or its direct or indirect subsidiaries.

The following condensed consolidating balance sheets, statements of operations and cash flows are provided for the Issuers, the Non-Wholly-owned Guarantor, the Wholly-owned Guarantors and the Non-Guarantors. Earnings from subsidiaries are included in other income in the condensed consolidated statements of operations below. The financial information may not necessarily be indicative of results of operations, cash flows or financial position had the guarantor or non-guarantor subsidiaries operated as independent entities.

19

Condensed Consolidating Balance Sheets

June 28, 2014

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Issuers | | | Non-Wholly-owned

Guarantor | | | Wholly-

owned

Guarantors | | | Non-

Guarantors | | | Elim-

inations | | | Consol-

idated | |

| Assets | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Current assets: | | | | | | | | | | | | | | | | | | | | | | | | |

Cash | | $ | 21,685 | | | $ | 7 | | | $ | 2,681 | | | $ | 4,723 | | | $ | (8,294 | ) | | $ | 20,802 | |

Accounts receivable, net | | | — | | | | 12,338 | | | | 128,876 | | | | 4,922 | | | | (2,368 | ) | | | 143,768 | |

Intercompany receivables | | | 264,955 | | | | — | | | | 33,532 | | | | — | | | | (298,487 | ) | | | — | |

Cost and estimated earnings in excess of billings | | | — | | | | — | | | | 21,018 | | | | 761 | | | | — | | | | 21,779 | |

Inventories | | | — | | | | 14,569 | | | | 102,293 | | | | 2,309 | | | | — | | | | 119,171 | |

Other current assets | | | 2,791 | | | | 722 | | | | 9,645 | | | | 375 | | �� | | (298 | ) | | | 13,235 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total current assets | | | 289,431 | | | | 27,636 | | | | 298,045 | | | | 13,090 | | | | (309,447 | ) | | | 318,755 | |

Property, plant and equipment, net | | | 5,755 | | | | 305,274 | | | | 602,744 | | | | 6,740 | | | | — | | | | 920,513 | |

Goodwill | | | — | | | | 23,124 | | | | 293,227 | | | | 972 | | | | — | | | | 317,323 | |

Intangible assets, net | | | — | | | | 592 | | | | 14,683 | | | | — | | | | — | | | | 15,275 | |

Other assets | | | 499,692 | | | | 20,378 | | | | 63,234 | | | | 1,235 | | | | (538,765 | ) | | | 45,774 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total assets | | $ | 794,878 | | | $ | 377,004 | | | $ | 1,271,933 | | | $ | 22,037 | | | $ | (848,212 | ) | | $ | 1,617,640 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| Liabilities, Redeemable Noncontrolling Interest and Member’s Interest | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Current liabilities: | | | | | | | | | | | | | | | | | | | | | | | | |

Current portion of debt | | $ | 69,220 | | | $ | 1,018 | | | $ | 3,192 | | | $ | — | | | $ | (4,210 | ) | | $ | 69,220 | |

Current portion of acquisition-related liabilities | | | 1,141 | | | | — | | | | 17,898 | | | | — | | | | — | | | | 19,039 | |

Accounts payable | | | 4,517 | | | | 7,978 | | | | 64,426 | | | | 3,691 | | | | (2,368 | ) | | | 78,244 | |

Accrued expenses | | | 25,566 | | | | 7,691 | | | | 62,068 | | | | 1,180 | | | | (8,592 | ) | | | 87,913 | |

Intercompany payables | | | 101,411 | | | | 21,810 | | | | 174,376 | | | | 890 | | | | (298,487 | ) | | | — | |

Billings in excess of costs and estimated earnings | | | — | | | | — | | | | 4,877 | | | | 25 | | | | — | | | | 4,902 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total current liabilities | | | 201,855 | | | | 38,497 | | | | 326,837 | | | | 5,786 | | | | (313,657 | ) | | | 259,318 | |

Long-term debt | | | 938,290 | | | | 154,081 | | | | 482,993 | | | | — | | | | (637,074 | ) | | | 938,290 | |

Acquisition-related liabilities | | | — | | | | — | | | | 40,947 | | | | — | | | | — | | | | 40,947 | |

Other noncurrent liabilities | | | 879 | | | | 17,570 | | | | 64,966 | | | | — | | | | — | | | | 83,415 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total liabilities | | | 1,141,024 | | | | 210,148 | | | | 915,743 | | | | 5,786 | | | | (950,731 | ) | | | 1,321,970 | |

Redeemable noncontrolling interest | | | — | | | | — | | | | — | | | | — | | | | 26,825 | | | | 26,825 | |

Redeemable members’ interest | | | — | | | | 23,750 | | | | — | | | | — | | | | (23,750 | ) | | | — | |

Total member’s interest | | | (346,146 | ) | | | 143,106 | | | | 356,190 | | | | 16,251 | | | | 99,444 | | | | 268,845 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total liabilities, redeemable noncontrolling interest and member’s interest | | $ | 794,878 | | | $ | 377,004 | | | $ | 1,271,933 | | | $ | 22,037 | | | $ | (848,212 | ) | | $ | 1,617,640 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

20

Condensed Consolidating Balance Sheets

December 28, 2013

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Issuers | | | Non-Wholly-owned

Guarantor | | | Wholly-

owned

Guarantors | | | Non-

Guarantors | | | Elim-

inations | | | Consol-

idated | |

| Assets | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Current assets: | | | | | | | | | | | | | | | | | | | | | | | | |

Cash | | $ | 10,375 | | | $ | 9 | | | $ | 3,442 | | | $ | 3,631 | | | $ | (2,540 | ) | | $ | 14,917 | |

Accounts receivable, net | | | — | | | | 4,587 | | | | 93,102 | | | | 3,100 | | | | (1,452 | ) | | | 99,337 | |

Intercompany receivables | | | 38,134 | | | | 3,433 | | | | 30,787 | | | | — | | | | (72,354 | ) | | | — | |

Cost and estimated earnings in excess of billings | | | — | | | | — | | | | 10,539 | | | | 228 | | | | — | | | | 10,767 | |

Inventories | | | — | | | | 10,402 | | | | 85,372 | | | | 658 | | | | — | | | | 96,432 | |

Other current assets | | | 750 | | | | 444 | | | | 11,715 | | | | 272 | | | | — | | | | 13,181 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total current assets | | | 49,259 | | | | 18,875 | | | | 234,957 | | | | 7,889 | | | | (76,346 | ) | | | 234,634 | |

Property, plant and equipment, net | | | 3,969 | | | | 301,908 | | | | 518,935 | | | | 6,966 | | | | — | | | | 831,778 | |

Goodwill | | | — | | | | 23,124 | | | | 102,942 | | | | 972 | | | | — | | | | 127,038 | |

Intangible assets, net | | | — | | | | 642 | | | | 14,505 | | | | — | | | | — | | | | 15,147 | |

Other assets | | | 296,494 | | | | 17,973 | | | | 37,535 | | | | 1,303 | | | | (314,108 | ) | | | 39,197 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total assets | | $ | 349,722 | | | $ | 362,522 | | | $ | 908,874 | | | $ | 17,130 | | | $ | (390,454 | ) | | $ | 1,247,794 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| Liabilities, Redeemable Noncontrolling Interest and Member’s Interest | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Current liabilities: | | | | | | | | | | | | | | | | | | | | | | | | |

Current portion of debt | | $ | 26,010 | | | $ | 1,018 | | | $ | 3,192 | | | $ | — | | | $ | — | | | $ | 30,220 | |

Current portion of acquisition-related liabilities | | | 2,000 | | | | — | | | | 8,635 | | | | — | | | | — | | | | 10,635 | |

Accounts payable | | | 5,455 | | | | 9,387 | | | | 57,142 | | | | 1,572 | | | | (1,452 | ) | | | 72,104 | |

Accrued expenses | | | 12,041 | | | | 9,185 | | | | 37,342 | | | | 1,223 | | | | (2,540 | ) | | | 57,251 | |

Intercompany payables | | | — | | | | — | | | | 71,556 | | | | 798 | | | | (72,354 | ) | | | — | |

Billings in excess of costs and estimated earnings | | | — | | | | — | | | | 8,837 | | | | 426 | | | | — | | | | 9,263 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total current liabilities | | | 45,506 | | | | 19,590 | | | | 186,704 | | | | 4,019 | | | | (76,346 | ) | | | 179,473 | |

Long-term debt | | | 19,587 | | | | 154,590 | | | | 484,590 | | | | — | | | | — | | | | 658,767 | |

Acquisition-related liabilities | | | 85 | | | | — | | | | 23,671 | | | | — | | | | — | | | | 23,756 | |

Other noncurrent liabilities | | | 959 | | | | 20,306 | | | | 56,215 | | | | — | | | | — | | | | 77,480 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total liabilities | | | 66,137 | | | | 194,486 | | | | 751,180 | | | | 4,019 | | | | (76,346 | ) | | | 939,476 | |

Redeemable noncontrolling interest | | | — | | | | — | | | | — | | | | — | | | | 24,767 | | | | 24,767 | |

Redeemable members’ interest | | | — | | | | 23,450 | | | | — | | | | — | | | | (23,450 | ) | | | — | |

Total member’s interest | | | 283,585 | | | | 144,586 | | | | 157,694 | | | | 13,111 | | | | (315,425 | ) | | | 283,551 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total liabilities, redeemable noncontrolling interest and member’s interest | | $ | 349,722 | | | $ | 362,522 | | | $ | 908,874 | | | $ | 17,130 | | | $ | (390,454 | ) | | $ | 1,247,794 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

21

Condensed Consolidating Statements of Operations

For the three months ended June 28, 2014

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Issuers | | | Non-Wholly-owned

Guarantor | | | Wholly-

owned

Guarantors | | | Non-

Guarantors | | | Elim-

inations | | | Consol-

idated | |

Revenue | | $ | — | | | $ | 27,557 | | | $ | 287,307 | | | $ | 14,942 | | | $ | (5,511 | ) | | $ | 324,295 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Cost of revenue (excluding items shown separately below) | | | — | | | | 16,724 | | | | 210,693 | | | | 9,856 | | | | (5,511 | ) | | | 231,762 | |

General and administrative expenses | | | 10,002 | | | | 1,900 | | | | 25,080 | | | | 290 | | | | — | | | | 37,272 | |

Depreciation, depletion, amortization and accretion | | | 338 | | | | 3,703 | | | | 17,020 | | | | 278 | | | | — | | | | 21,339 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Operating (loss) income | | | (10,340 | ) | | | 5,230 | | | | 34,514 | | | | 4,518 | | | | — | | | | 33,922 | |

Other (income) expense, net | | | (29,100 | ) | | | (1,261 | ) | | | (1,360 | ) | | | (3 | ) | | | 31,027 | | | | (697 | ) |

Interest expense | | | 7,932 | | | | 3,011 | | | | 12,643 | | | | 31 | | | | (1,966 | ) | | | 21,651 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Income from continuing operations before taxes | | | 10,828 | | | | 3,480 | | | | 23,231 | | | | 4,490 | | | | (29,061 | ) | | | 12,968 | |

Income tax benefit (expense) | | | (1,427 | ) | | | — | | | | 563 | | | | — | | | | — | | | | (864 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Income from continuing operations | | | 12,255 | | | | 3,480 | | | | 22,668 | | | | 4,490 | | | | (29,061 | ) | | | 13,832 | |

Income from discontinued operations | | | — | | | | — | | | | (369 | ) | | | — | | | | — | | | | (369 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net income | | | 12,255 | | | | 3,480 | | | | 23,037 | | | | 4,490 | | | | (29,061 | ) | | | 14,201 | |

Net income attributable to minority interest | | | — | | | | — | | | | — �� | | | | — | | | | 1,946 | | | | 1,946 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net income attributable to member of Summit Materials, LLC | | $ | 12,255 | | | $ | 3,480 | | | $ | 23,037 | | | $ | 4,490 | | | $ | (31,007 | ) | | $ | 12,255 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Comprehensive income attributable to member of Summit Materials, LLC | | $ | 12,255 | | | $ | 3,480 | | | $ | 23,037 | | | $ | 4,490 | | | $ | (31,007 | ) | | $ | 12,255 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

22

Condensed Consolidating Statements of Operations

For the three months ended June 29, 2013

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Issuers | | | Non-Wholly-owned

Guarantor | | | Wholly-

owned

Guarantors | | | Non-

Guarantors | | | Elim-

inations | | | Consol-

idated | |

Revenue | | $ | — | | | $ | 22,888 | | | $ | 221,141 | | | $ | 14,559 | | | $ | (3,746 | ) | | $ | 254,842 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Cost of revenue (excluding items shown separately below) | | | — | | | | 13,328 | | | | 162,633 | | | | 9,628 | | | | (3,746 | ) | | | 181,843 | |

General and administrative expenses | | | 1,244 | | | | 1,695 | | | | 37,121 | | | | 314 | | | | — | | | | 40,374 | |

Depreciation, depletion, amortization and accretion | | | 22 | | | | 2,868 | | | | 15,743 | | | | 261 | | | | — | | | | 18,894 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Operating (loss) income | | | (1,266 | ) | | | 4,997 | | | | 5,644 | | | | 4,356 | | | | — | | | | 13,731 | |

Other expense (income), net | | | 403 | | | | (1,240 | ) | | | (1,632 | ) | | | 47 | | | | 2,153 | | | | (269 | ) |

Interest expense | | | — | | | | 2,692 | | | | 12,825 | | | | 114 | | | | (1,149 | ) | | | 14,482 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

(Loss) income from continuing operations before taxes | | | (1,669 | ) | | | 3,545 | | | | (5,549 | ) | | | 4,195 | | | | (1,004 | ) | | | (482 | ) |

Income tax benefit | | | — | | | | — | | | | (726 | ) | | | — | | | | — | | | | (726 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

(Loss) income from continuing operations | | | (1,669 | ) | | | 3,545 | | | | (4,823 | ) | | | 4,195 | | | | (1,004 | ) | | | 244 | |

Income from discontinued operations | | | — | | | | — | | | | (26 | ) | | | — | | | | — | | | | (26 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net (loss) income | | | (1,669 | ) | | | 3,545 | | | | (4,797 | ) | | | 4,195 | | | | (1,004 | ) | | | 270 | |

Net income attributable to noncontrolling interest | | | — | | | | — | | | | — | | | | — | | | | 1,939 | | | | 1,939 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net (loss) income attributable to member of Summit Materials, LLC | | $ | (1,669 | ) | | $ | 3,545 | | | $ | (4,797 | ) | | $ | 4,195 | | | $ | (2,943 | ) | | $ | (1,669 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

23

Condensed Consolidating Statements of Operations

For the six months ended June 28, 2014

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Issuers | | | Non-Wholly-owned

Guarantor | | | Wholly-

owned

Guarantors | | | Non-

Guarantors | | | Elim-

inations | | | Consol-

idated | |

Revenue | | $ | — | | | $ | 35,264 | | | $ | 427,717 | | | $ | 21,274 | | | $ | (8,869 | ) | | $ | 475,386 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Cost of revenue (excluding items shown separately below) | | | — | | | | 27,626 | | | | 328,318 | | | | 13,362 | | | | (8,869 | ) | | | 360,437 | |

General and administrative expenses | | | 17,690 | | | | 3,574 | | | | 53,521 | | | | 566 | | | | — | | | | 75,351 | |

Depreciation, depletion, amortization and accretion | | | 642 | | | | 6,777 | | | | 32,731 | | | | 545 | | | | — | | | | 40,695 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Operating (loss) income | | | (18,332 | ) | | | (2,713 | ) | | | 13,147 | | | | 6,801 | | | | — | | | | (1,097 | ) |

Other expense (income), net | | | 7,725 | | | | (1,358 | ) | | | (1,553 | ) | | | 45 | | | | (5,750 | ) | | | (891 | ) |

Interest expense | | | 13,668 | | | | 5,857 | | | | 24,415 | | | | 56 | | | | (3,526 | ) | | | 40,470 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

(Loss) income from continuing operations before taxes | | | (39,725 | ) | | | (7,212 | ) | | | (9,715 | ) | | | 6,700 | | | | 9,276 | | | | (40,676 | ) |

Income tax benefit | | | (1,427 | ) | | | — | | | | (33 | ) | | | — | | | | — | | | | (1,460 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

(Loss) income from continuing operations | | | (38,298 | ) | | | (7,212 | ) | | | (9,682 | ) | | | 6,700 | | | | 9,276 | | | | (39,216 | ) |

Income from discontinued operations | | | — | | | | — | | | | (349 | ) | | | — | | | | — | | | | (349 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net (loss) income | | | (38,298 | ) | | | (7,212 | ) | | | (9,333 | ) | | | 6,700 | | | | 9,276 | | | | (38,867 | ) |

Net loss attributable to noncontrolling interest | | | — | | | | — | | | | — | | | | — | | | | (569 | ) | | | (569 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net (loss) income attributable to member of Summit Materials, LLC | | $ | (38,298 | ) | | $ | (7,212 | ) | | $ | (9,333 | ) | | $ | 6,700 | | | $ | 9,845 | | | $ | (38,298 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Comprehensive (loss) income attributable to member of Summit Materials, LLC | | $ | (38,298 | ) | | $ | (6,394 | ) | | $ | (9,333 | ) | | $ | 6,700 | | | $ | 9,600 | | | $ | (37,725 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

24

Condensed Consolidating Statements of Operations