UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-22982

Eaton Vance NextShares Trust

(Exact Name of Registrant as Specified in Charter)

Two International Place, Boston, Massachusetts 02110

(Address of Principal Executive Offices)

Deidre E. Walsh

Two International Place, Boston, Massachusetts 02110

(Name and Address of Agent for Services)

(617) 482-8260

(Registrant’s Telephone Number)

October 31

Date of Fiscal Year End

October 31, 2022

Date of Reporting Period

Item 1. Reports to Stockholders

Eaton Vance

Global Income Builder NextShares (EVGBC)

Listing Exchange: The NASDAQ Stock Market LLC

Annual Report

October 31, 2022

NextShares® is a registered trademark of NextShares Solutions LLC. All rights reserved.

Commodity Futures Trading Commission Registration. The Commodity Futures Trading Commission (“CFTC”) has adopted regulations that subject registered investment companies and advisers to regulation by the CFTC if a fund invests more than a prescribed level of its assets in certain CFTC-regulated instruments (including futures, certain options and swap agreements) or markets itself as providing investment exposure to such instruments. The investment adviser has claimed an exclusion from the definition of the term “commodity pool operator” under the Commodity Exchange Act with respect to its management of the Fund. Accordingly, neither the Fund nor the adviser with respect to the operation of the Fund is subject to CFTC regulation. Because of its management of other strategies, the Fund’s adviser is registered with the CFTC as a commodity pool operator. The adviser is also registered as a commodity trading advisor.

Fund shares are not insured by the FDIC and are not deposits or other obligations of, or guaranteed by, any depository institution. Shares are subject to investment risks, including possible loss of principal invested.

This report must be preceded or accompanied by a current summary prospectus or prospectus. Before investing in NextShares, investors should consider carefully the investment objective, risks, and charges and expenses. This and other important information is contained in the summary prospectus and prospectus, which can be obtained from a financial intermediary. Prospective investors should read the prospectus carefully before investing. For further information, please call 1-800-262-1122.

Annual Report October 31, 2022

Eaton Vance

Global Income Builder NextShares

Eaton Vance

Global Income Builder NextShares

October 31, 2022

Management’s Discussion of Fund Performance†

Economic and Market Conditions

The 12-month period starting November 1, 2021, was dominated by the ongoing effects of one black swan event -- the COVID-19 pandemic -- and fallout from another -- Russia’s invasion of Ukraine in February 2022.

In the opening months of the period, stock investors as well as consumers appeared to take a “glass is half full” approach. In both the U.S. and Europe, consumers rushed to spend money saved earlier in the pandemic. Major U.S. equity indexes closed at new all-time highs during the final months of 2021.

But as the new year began, investors appeared to reevaluate the twin threats of inflation and interest rate hikes, and stock performance turned negative. In February, Russia’s invasion of Ukraine sent shock waves through U.S. and global markets, exacerbating inflationary pressures on energy and food costs. Central banks around the world -- including the U.S. Federal Reserve (the Fed), the Bank of England, and the European Central Bank (ECB) -- initiated their first interest rate hikes in years. In Europe, looming energy shortages caused by the Russia-Ukraine conflict pushed inflation rates even higher and stock prices lower during the period.

In the U.S., investors began to expect the Fed would raise interest rates at every policy meeting in 2022 and, in turn, worried that aggressive rate hikes could tip the economy into recession. At its June, July, and September 2022 meetings, the Fed hiked the federal funds rate 0.75% each time -- to a

3.00%-3.25% range -- its first moves of that magnitude since 1994. Higher interest rates, inflation, and recessionary worries drove stock prices down around the globe.

As the period came to a close in October 2022, however, U.S. and European stocks delivered positive performance for the first time in months -- driven by a combination of better-than-expected U.S. company earnings; improving investor sentiment that stocks had been oversold during the August-September market pullback; government measures to address Europe’s energy crisis; and hope that central bank rate hikes would help tame inflation.

Meanwhile in the world’s second-largest economy, China’s zero-COVID policy severely restricted economic output. The MSCI Golden Dragon Index, a measure of Chinese large-cap and mid-cap stocks, lost more ground in October and was one of the worst-performing major indexes during the period, declining 42.74%.

Major equity indexes elsewhere also suffered significant losses. For the period as a whole, the MSCI ACWI Index, a broad measure of global equities, returned -19.96%; the S&P 500® Index, a broad measure of U.S. stocks, returned -14.61%; and the technology-laden Nasdaq Composite Index returned -28.56%. The MSCI EAFE Index of developed-market international equities returned -23.00%, while the MSCI Emerging Markets Index, dragged down by its China allocation, returned -31.03% during the period.

Fund Performance

For the 12-month period ended October 31, 2022, Eaton Vance Global Income Builder NextShares (the Fund) returned -17.85% at net asset value (NAV). The Fund outperformed its primary benchmark, the MSCI World Index (the Index), which returned -18.48%; and underperformed its blended benchmark consisting of 65% MSCI World Index and 35% ICE BofA Developed Markets High Yield Ex-Subordinated Financial Index, which returned -17.26% during the period.

The Fund’s out-of-Index allocations to high yield bonds, bank loans, and preferred securities contributed to performance versus the Index during the period. Stock selections in the energy, communication services, and financials sectors, along with stock selections and an underweight position in the consumer discretionary sector, also contributed to Fund performance versus the Index.

The Fund’s high yield bond allocation outperformed the Index and the broad high yield market, as measured by the ICE BofA Developed Markets High Yield Ex-Subordinated Financial Index (the ICE BofA Index). Within that allocation, the Fund had a shorter duration and a higher average credit quality than the ICE BofA Index. That asset mix helped relative performance as interest rates rose and BB-rated and B-rated bonds outperformed CCC-rated bonds during the period. The Fund reduced its exposure to lower rated bonds early in 2022.

Security selections within the health care sector also helped performance relative to the ICE BofA Index as the Fund avoided exposure to several companies that experienced sharp declines in bond prices.

See Endnotes and Additional Disclosures in this report.

Past performance is no guarantee of future results. Investment return and principal value will fluctuate so that shares, when sold, may be worth more or less than their original cost. Performance is for the stated time period only; due to market volatility, Fund performance may be lower or higher than the quoted return. The Fund’s performance at market price will differ from its results at net asset value (NAV). The market price used to calculate the Market Price return is the midpoint between the highest bid and the lowest offer on the exchange on which the shares of the Fund are listed for trading, as of the time that the Fund’s NAV is calculated. If you trade your shares at another time during the day, your return may differ. Returns are historical and are calculated by determining the percentage change in NAV or market price (as applicable) with all distributions reinvested at NAV or closing market price (as applicable) on the payment date of the distribution, and are net of management fees and other expenses. Furthermore, returns do not reflect the deduction of taxes that shareholders may have to pay on Fund distributions or upon the sale of Fund shares. Performance for periods less than or equal to one year is cumulative. For performance as of the most recent month-end, including historical trading premiums/discounts relative to NAV, please refer to eatonvance.com.

Eaton Vance

Global Income Builder NextShares

October 31, 2022

Management’s Discussion of Fund Performance† — continued

The Fund’s small out-of-Index allocation to bank loans also contributed to performance relative to the Index as it delivered positive returns during a period of generally negative returns by most asset classes.

The Fund’s preferred securities allocation -- preferred stocks, exchange-traded funds investing primarily in preferred stocks, and corporate bonds and other debt securities with preferred characteristics -- outperformed the Index and contributed to Fund performance versus the Index. However, the preferred allocation underperformed the overall preferred market, as measured by the ICE BofA Fixed Rate Preferred Securities Index.

The Fund’s use of equity index futures contracts, a type of derivative, detracted from performance relative to the Index. Within the Fund’s common stock portfolio, the Fund’s strategy of investing in dividend-paying stocks resulted in an overweight allocation to European equities and an underweight allocation to U.S. equities relative to the Index. The Fund hedged these overweight and underweight exposures by selling short European index futures contracts and buying U.S. index futures contracts. By period-end, these index futures contracts were no longer in effect.

The Fund’s common stock allocation underperformed the Index and detracted from performance relative to the Index as well. Within the Fund’s common stock allocation, detractors from performance relative to the Index included stock selections in the industrials, information technology, and utilities sectors.

See Endnotes and Additional Disclosures in this report.

Past performance is no guarantee of future results. Investment return and principal value will fluctuate so that shares, when sold, may be worth more or less than their original cost. Performance is for the stated time period only; due to market volatility, Fund performance may be lower or higher than the quoted return. The Fund’s performance at market price will differ from its results at net asset value (NAV). The market price used to calculate the Market Price return is the midpoint between the highest bid and the lowest offer on the exchange on which the shares of the Fund are listed for trading, as of the time that the Fund’s NAV is calculated. If you trade your shares at another time during the day, your return may differ. Returns are historical and are calculated by determining the percentage change in NAV or market price (as applicable) with all distributions reinvested at NAV or closing market price (as applicable) on the payment date of the distribution, and are net of management fees and other expenses. Furthermore, returns do not reflect the deduction of taxes that shareholders may have to pay on Fund distributions or upon the sale of Fund shares. Performance for periods less than or equal to one year is cumulative. For performance as of the most recent month-end, including historical trading premiums/discounts relative to NAV, please refer to eatonvance.com.

Eaton Vance

Global Income Builder NextShares

October 31, 2022

Performance

Portfolio Manager(s) Christopher M. Dyer, CFA and Jeffrey D. Mueller, of Eaton Vance Advisers International Ltd.; John H. Croft, CFA, and Derek J.V. DiGregorio, of Boston Management and Research

| | | | | | | | | | | | | | | | | | | | | | | | |

| % Average Annual Total Returns1,2,3 | | Fund

Inception Date | | | Performance

Inception Date | | | One Year | | | Five Years | | | Ten Years | | | Since Fund

Inception | |

| | | | | | |

Fund at NAV | | | 03/30/2016 | | | | 11/30/2005 | | | | (17.85 | )% | | | 3.87 | % | | | 6.75 | % | | | 5.71 | % |

Fund at Market Price | | | 03/30/2016 | | | | 03/30/2016 | | | | (17.83 | ) | | | 3.89 | | | | — | | | | 5.72 | |

|

| |

| | | | | | |

MSCI World Index | | | — | | | | — | | | | (18.48 | )% | | | 6.37 | % | | | 8.93 | % | | | 6.44 | % |

ICE BofA Developed Markets High Yield Ex-Subordinated Financial Index | | | — | | | | — | | | | (15.20 | ) | | | 0.56 | | | | 3.16 | | | | 5.40 | |

| | | | | | |

Blended Index | | | | | | | | | | | (17.26 | ) | | | 4.43 | | | | 6.97 | | | | 6.20 | |

| | | | | | |

| % Total Annual Operating Expense Ratios4 | | | | | | | | | | | | | | | | | | |

| | | | | | |

Gross | | | | | | | | | | | | | | | | | | | | | | | 2.16 | % |

Net | | | | | | | | | | | | | | | | | | | | | | | 0.85 | |

Growth of $10,000

This graph shows the change in value of a hypothetical investment of $10,000 in Global Income Builder NextShares for the period indicated. For comparison, the same investment is shown in the indicated index.

See Endnotes and Additional Disclosures in this report.

Past performance is no guarantee of future results. Investment return and principal value will fluctuate so that shares, when sold, may be worth more or less than their original cost. Performance is for the stated time period only; due to market volatility, Fund performance may be lower or higher than the quoted return. The Fund’s performance at market price will differ from its results at net asset value (NAV). The market price used to calculate the Market Price return is the midpoint between the highest bid and the lowest offer on the exchange on which the shares of the Fund are listed for trading, as of the time that the Fund’s NAV is calculated. If you trade your shares at another time during the day, your return may differ. Returns are historical and are calculated by determining the percentage change in NAV or market price (as applicable) with all distributions reinvested at NAV or closing market price (as applicable) on the payment date of the distribution, and are net of management fees and other expenses. Furthermore, returns do not reflect the deduction of taxes that shareholders may have to pay on Fund distributions or upon the sale of Fund shares. Performance for periods less than or equal to one year is cumulative. For performance as of the most recent month-end, including historical trading premiums/discounts relative to NAV, please refer to eatonvance.com.

Eaton Vance

Global Income Builder NextShares

October 31, 2022

Fund Profile

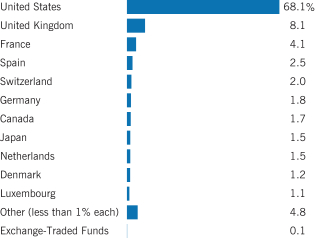

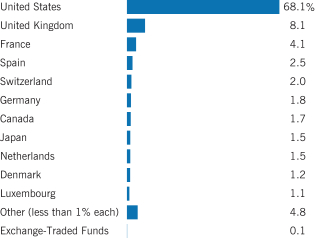

Country Allocation (% of net assets)

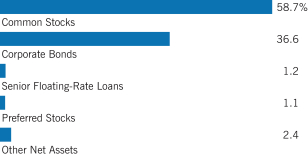

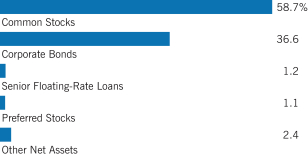

Asset Allocation (% of net assets)(2)

Top 10 Holdings (% of net assets)(1)

| | | | |

Alphabet, Inc., Class C | | | 2.7 | % |

Microsoft Corp. | | | 2.3 | |

Apple, Inc. | | | 1.9 | |

EOG Resources, Inc. | | | 1.9 | |

Eli Lilly & Co. | | | 1.8 | |

Amazon.com, Inc. | | | 1.5 | |

Nestle S.A. | | | 1.4 | |

Coca-Cola Co. (The) | | | 1.4 | |

Walt Disney Co. (The) | | | 1.3 | |

| |

Novo Nordisk A/S, Class B | | | 1.2 | |

| |

Total | | | 17.4 | % |

Footnotes:

Fund invests in an affiliated investment company (Portfolio) with the same objective(s) and policies as the Fund. References to investments are to the Portfolio’s holdings.

| 1 | Excludes cash and cash equivalents. |

| 2 | Other Net Assets represents other assets less liabilities and includes any investment type that represents less than 1% of net assets. |

Eaton Vance

Global Income Builder NextShares

October 31, 2022

Endnotes and Additional Disclosures

| † | The views expressed in this report are those of the portfolio manager(s) and are current only through the date stated at the top of this page. These views are subject to change at any time based upon market or other conditions, and Eaton Vance and the Fund(s) disclaim any responsibility to update such views. These views may not be relied upon as investment advice and, because investment decisions are based on many factors, may not be relied upon as an indication of trading intent on behalf of any Eaton Vance fund. This commentary may contain statements that are not historical facts, referred to as “forward-looking statements.” The Fund’s actual future results may differ significantly from those stated in any forward-looking statement, depending on factors such as changes in securities or financial markets or general economic conditions, the volume of sales and purchases of Fund shares, the continuation of investment advisory, administrative and service contracts, and other risks discussed from time to time in the Fund’s filings with the Securities and Exchange Commission. |

| 1 | MSCI World Index is an unmanaged index of equity securities in the developed markets. MSCI indexes are net of foreign withholding taxes. Source: MSCI. MSCI data may not be reproduced or used for any other purpose. MSCI provides no warranties, has not prepared or approved this report, and has no liability hereunder. ICE BofA Developed Markets High Yield Ex-Subordinated Financial Index is an unmanaged index of global developed market, below investment grade corporate bonds. ICE® BofA® indices are not for redistribution or other uses; provided ‘‘as is’’, without warranties, and with no liability. Eaton Vance has prepared this report and ICE Data Indices, LLC does not endorse it, or guarantee, review, or endorse Eaton Vance’s products. BofA® is a licensed registered trademark of Bank of America Corporation in the United States and other countries. The Blended Index consists of 65% MSCI World Index and 35% ICE BofA Developed Markets High Yield Ex-Subordinated Financial Index, rebalanced monthly. Unless otherwise stated, index returns do not reflect the effect of any applicable sales charges, commissions, expenses, taxes or leverage, as applicable. It is not possible to invest directly in an index. Performance since inception for an index, if presented, is the performance since the Fund’s or oldest share class’ inception, as applicable. |

| 2 | Shares of NextShares funds are normally bought and sold in the secondary market through a broker, and may not be individually purchased or redeemed from the fund. In the secondary market, buyers and sellers transact with each other, rather than with the fund. NextShares funds issue and redeem shares only in specified creation unit quantities in transactions by or through Authorized Participants. In such transactions, a fund issues and redeems shares in exchange for the basket of securities, other instruments and/or cash that the fund specifies each business day. By transacting in kind, a NextShares fund can lower its trading costs and enhance fund tax efficiency by avoiding forced sales of securities to meet redemptions. Redemptions may be effected partially or entirely in cash when in-kind delivery is not practicable or deemed not in the best interests of shareholders. A fund’s basket is not intended to be representative of the fund’s current portfolio positions and may vary significantly from current positions. As exchange-traded securities, NextShares can operate with low transfer agency expenses by utilizing the same highly efficient share processing system as used for exchange-listed stocks and exchange-traded funds. Market trading prices of NextShares are linked to the fund’s next-computed net asset value (NAV) and will vary from NAV by a |

| | market-determined premium or discount, which may be zero. Buyers and sellers of NextShares will not know the value of their purchases and sales until after the fund’s NAV is determined at the end of the trading day. Market trading prices may vary significantly from anticipated levels. NextShares do not offer investors the opportunity to buy and sell intraday based on current (versus end-of-day) determinations of fund value. NextShares trade execution prices will fluctuate based on changes in NAV. Although limit orders may be used to control trading costs, they cannot be used to control or limit trade execution prices. As a new type of fund, NextShares have a limited operating history and may initially be available through a limited number of brokers. There can be no guarantee that an active trading market for NextShares will develop or be maintained, or that their listing will continue unchanged. Buying and selling NextShares may require payment of brokerage commissions and expose transacting shareholders to other trading costs. Frequent trading may detract from realized investment returns. The return on a shareholder’s NextShares investment will be reduced if the shareholder sells shares at a greater discount or narrower premium to NAV than he or she acquired the shares. |

| 3 | The Fund pursues its investment objective by investing in a separate investment fund (the Portfolio). The returns at NAV for periods before the date the Fund commenced operations are for a mutual fund that invests in the Portfolio (the Portfolio Investor). The performance during such period does not represent the performance of the Fund. The prior investment performance of the Portfolio Investor (rather than the Portfolio itself) is shown because it reflects the expenses typically borne by a retail fund investing in the Portfolio. The Portfolio Investor returns are not adjusted to reflect differences between the total net operating expenses of the Fund and the Portfolio Investor during the periods shown. If such an adjustment were made, the performance presented would be higher, because the Fund’s total net operating expenses are lower than those of the Portfolio Investor. Performance is for a share class of the Portfolio Investor offered at net asset value. Performance presented in the Financial Highlights included in the financial statements is not linked. |

Prior to December 7, 2015, the Portfolio Investor invested at least 80% of net assets in dividend-paying common and preferred stocks. Effective December 7, 2015, the Portfolio Investor changed its name and its principal investment strategies to invest in common stocks, preferred stocks and other hybrid securities and income instruments of U.S. and foreign issuers. As of such date, the Portfolio Investor was no longer required to invest at least 80% of its net assets in dividend-paying common and preferred stocks.

| 4 | Source: Fund prospectus. Net expense ratios reflect a contractual expense reimbursement that continues through 2/28/23. The expense ratios for the current reporting period can be found in the Financial Highlights section of this report. Performance reflects expenses waived and/or reimbursed, if applicable. Without such waivers and/or reimbursements, performance would have been lower. |

Fund profile subject to change due to active management.

Additional Information

S&P 500® Index is an unmanaged index of large-cap stocks commonly used as a measure of U.S. stock market performance. S&P Dow Jones Indices are a product of S&P Dow Jones Indices LLC

Eaton Vance

Global Income Builder NextShares

October 31, 2022

Endnotes and Additional Disclosures — continued

(“S&P DJI”) and have been licensed for use. S&P® and S&P 500® are registered trademarks of S&P DJI; Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”); S&P DJI, Dow Jones and their respective affiliates do not sponsor, endorse, sell or promote the Fund, will not have any liability with respect thereto and do not have any liability for any errors, omissions, or interruptions of the S&P Dow Jones Indices. Nasdaq Composite Index is a market capitalization-weighted index of all domestic and international securities listed on Nasdaq. Source: Nasdaq, Inc. The information is provided by Nasdaq (with its affiliates, are referred to as the “Corporations”) and Nasdaq’s third party licensors on an “as is” basis and the Corporations make no guarantees and bear no liability of any kind with respect to the information or the Fund. MSCI Golden Dragon Index is an unmanaged index of common stocks traded in China, Hong Kong and Taiwan. MSCI ACWI Index is an unmanaged free-float-adjusted, market-capitalization-weighted index designed to measure the equity market performance of developed and emerging markets. MSCI EAFE Index is an unmanaged index of equities in the developed markets, excluding the U.S. and Canada. MSCI Emerging Markets Index is an unmanaged index of emerging markets common stocks. ICE BofA Fixed Rate Preferred Securities Index is an unmanaged index of fixed-rate, preferred securities issued in the U.S.

Important Notice to Shareholders

Effective November 18, 2022, the Fund is managed by Christopher M. Dyer, CFA, Derek J.V. DiGregorio and Jeffrey D. Mueller.

Eaton Vance

Global Income Builder NextShares

October 31, 2022

Fund Expenses

Example

As a Fund shareholder, you incur two types of costs: (1) transaction costs, including brokerage commissions on purchases and sales of Fund shares; and (2) ongoing costs, including management fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of Fund investing and to compare these costs with the ongoing costs of investing in other funds. The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (May 1, 2022 to October 31, 2022).

Actual Expenses

The first section of the table below provides information about actual account values and actual expenses. You may use the information in this section, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second section of the table below provides information about hypothetical account values and hypothetical expenses based on the actual Fund expense ratio and an assumed rate of return of 5% per year (before expenses), which is not the actual Fund return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as brokerage commissions on purchases and sales of Fund shares. Therefore, the second section of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would be higher.

| | | | | | | | | | | | | | | | |

| | | Beginning

Account Value

(5/1/22) | | | Ending

Account Value

(10/31/22) | | | Expenses Paid

During Period*

(5/1/22 – 10/31/22) | | | Annualized

Expense

Ratio | |

| | | | |

Actual | | | | | | | | | | | | | | | | |

| | $ | 1,000.00 | | | $ | 928.90 | | | $ | 4.13 | ** | | | 0.85 | % |

| | | | | |

Hypothetical | | | | | | | | | | | | | | | | |

(5% return per year before expenses) | | | | | | | | | | | | | | | | |

| | $ | 1,000.00 | | | $ | 1,020.92 | | | $ | 4.33 | ** | | | 0.85 | % |

| * | Expenses are equal to the Fund’s annualized expense ratio, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). The Example assumes that the $1,000 was invested at the net asset value per share determined at the close of business on April 30, 2022. The Example reflects the expenses of both the Fund and the Portfolio. |

| ** | Absent an allocation of certain expenses to affiliates, expenses would be higher. |

Eaton Vance

Global Income Builder NextShares

October 31, 2022

Statement of Assets and Liabilities

| | | | |

| Assets | | October 31, 2022 | |

| |

Investment in Global Income Builder Portfolio, at value (identified cost $0) | | $ | 1,002,130 | |

| |

Receivable from affiliates | | | 6,912 | |

| |

Total assets | | $ | 1,009,042 | |

|

| Liabilities | |

| |

Payable to affiliates: | | | | |

| |

Administration fee | | $ | 118 | |

| |

Operations agreement fee | | | 39 | |

| |

Trustees’ fees | | | 42 | |

| |

Accrued expenses | | | 58,413 | |

| |

Total liabilities | | $ | 58,612 | |

| |

Net Assets | | $ | 950,430 | |

|

| Sources of Net Assets | |

| |

Paid-in capital | | $ | 7,471,235 | |

| |

Accumulated loss | | | (6,520,805 | ) |

| |

Net Assets | | $ | 950,430 | |

| |

| Net Asset Value Per Share | | | | |

| |

($950,430 ÷ 100,000 shares issued and outstanding) | | $ | 9.50 | |

| | | | |

| | 9 | | See Notes to Financial Statements. |

Eaton Vance

Global Income Builder NextShares

October 31, 2022

Statement of Operations

| | | | |

| Investment Income | | Year Ended

October 31, 2022 | |

| |

Dividend income allocated from Portfolio (net of foreign taxes withheld of $2,978) | | $ | 24,634 | |

| |

Interest and other income allocated from Portfolio (net of foreign taxes withheld of $25) | | | 25,523 | |

| |

Expenses allocated from Portfolio | | | (7,062 | ) |

| |

Total investment income from Portfolio | | $ | 43,095 | |

| |

| Expenses | | | | |

| |

Administration fee | | $ | 1,604 | |

| |

Operations agreement fee | | | 535 | |

| |

Trustees’ fees and expenses | | | 500 | |

| |

Custodian fee | | | 21,906 | |

| |

Transfer and dividend disbursing agent fees | | | 13,802 | |

| |

Legal and accounting services | | | 31,645 | |

| |

Printing and postage | | | 3,909 | |

| |

Listing fee | | | 7,200 | |

| |

Intraday pricing fee | | | 12,000 | |

| |

Miscellaneous | | | 5,076 | |

| |

Total expenses | | $ | 98,177 | |

| |

Deduct: | | | | |

| |

Waiver and/or reimbursement of expenses by affiliates | | $ | 96,062 | |

| |

Total expense reductions | | $ | 96,062 | |

| |

Net expenses | | $ | 2,115 | |

| |

Net investment income | | $ | 40,980 | |

|

| Realized and Unrealized Gain (Loss) | |

| |

Net realized gain (loss): | | | | |

| |

Investment transactions - affiliated Portfolio | | $ | 51,271 | |

| |

Net realized gain (loss) allocated from affiliated Portfolio: | | | | |

| |

Investment transactions (net of foreign capital gains taxes of $13) | | | (14,564 | ) |

| |

Futures contracts | | | (4,572 | ) |

| |

Foreign currency transactions | | | (620 | ) |

| |

Forward foreign currency exchange contracts | | | 53 | |

| |

Net realized gain | | $ | 31,568 | |

| |

Change in unrealized appreciation (depreciation): | | | | |

| |

Investments - affiliated Portfolio | | $ | (51,271 | ) |

| |

Change in unrealized appreciation (depreciation) allocated from affiliated Portfolio: | | | | |

| |

Investments (including net increase in accrued foreign capital gains taxes of $132) | | | (229,596 | ) |

| |

Foreign currency | | | (916 | ) |

| |

Forward foreign currency exchange contracts | | | (4 | ) |

| |

Net change in unrealized appreciation (depreciation) | | $ | (281,787 | ) |

| |

Net realized and unrealized loss | | $ | (250,219 | ) |

| |

Net decrease in net assets from operations | | $ | (209,239 | ) |

| | | | |

| | 10 | | See Notes to Financial Statements. |

Eaton Vance

Global Income Builder NextShares

October 31, 2022

Statements of Changes in Net Assets

| | | | | | | | |

| | | Year Ended October 31, | |

| Increase (Decrease) in Net Assets | | 2022 | | | 2021 | |

| | |

From operations: | | | | | | | | |

| | |

Net investment income | | $ | 40,980 | | | $ | 194,430 | |

| | |

Net realized gain | | | 31,568 | | | | 521,210 | (1) |

| | |

Net change in unrealized appreciation (depreciation) | | | (281,787 | ) | | | 845,953 | |

| | |

Net increase (decrease) in net assets from operations | | $ | (209,239 | ) | | $ | 1,561,593 | |

| | |

Distributions to shareholders | | $ | (69,730 | ) | | $ | (247,140 | ) |

| | |

Transactions in Fund shares: | | | | | | | | |

| | |

Cost of shares redeemed | | $ | — | | | $ | (5,959,180 | ) |

| | |

Transaction fees | | | — | | | | 659 | |

| | |

Net decrease in net assets from Fund share transactions | | $ | — | | | $ | (5,958,521 | ) |

| | |

Other capital: | | | | | | | | |

| | |

Portfolio transaction fee contributed to Portfolio | | $ | (399 | ) | | $ | (1,634 | ) |

| | |

Portfolio transaction fee allocated from Portfolio | | | 488 | | | | 3,446 | |

| | |

Net increase in net assets from other capital | | $ | 89 | | | $ | 1,812 | |

| | |

Net decrease in net assets | | $ | (278,880 | ) | | $ | (4,642,256 | ) |

|

| Net Assets | |

| | |

At beginning of year | | $ | 1,229,310 | | | $ | 5,871,566 | |

| | |

At end of year | | $ | 950,430 | | | $ | 1,229,310 | |

| | |

| Changes in shares outstanding | | | | | | | | |

| | |

Shares outstanding, beginning of year | | | 100,000 | | | | 600,000 | |

| | |

Shares redeemed | | | — | | | | (500,000 | ) |

| | |

Shares outstanding, end of year | | | 100,000 | | | | 100,000 | |

| (1) | Includes $65,181 of net realized gains from redemptions in-kind. |

| | | | |

| | 11 | | See Notes to Financial Statements. |

Eaton Vance

Global Income Builder NextShares

October 31, 2022

Financial Highlights

| | | | | | | | | | | | | | | | | | | | |

| | | Year Ended October 31, | |

| | | 2022 | | | 2021 | | | 2020 | | | 2019 | | | 2018 | |

| | | | | |

Net asset value — Beginning of year | | $ | 12.290 | | | $ | 9.790 | | | $ | 9.890 | | | $ | 9.990 | | | $ | 11.200 | |

| | | | | |

| Income (Loss) From Operations | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net investment income(1) | | $ | 0.410 | | | $ | 0.338 | | | $ | 0.390 | | | $ | 0.469 | | | $ | 0.358 | |

| | | | | |

Net realized and unrealized gain (loss) | | | (2.504 | ) | | | 2.571 | | | | (0.147 | ) | | | 0.535 | | | | (0.435 | ) |

| | | | | |

Total income (loss) from operations | | $ | (2.094 | ) | | $ | 2.909 | | | $ | 0.243 | | | $ | 1.004 | | | $ | (0.077 | ) |

| | | | | |

| Less Distributions | | | | | | | | | | | | | | | | | | | | |

| | | | | |

From net investment income | | $ | (0.396 | ) | | $ | (0.412 | ) | | $ | (0.347 | ) | | $ | (0.369 | ) | | $ | (1.083 | ) |

| | | | | |

From net realized gain | | | (0.301 | ) | | | — | | | | — | | | | (0.608 | ) | | | (0.051 | ) |

| | | | | |

Tax return of capital | | | — | | | | — | | | | — | | | | (0.130 | ) | | | — | |

| | | | | |

Total distributions | | $ | (0.697 | ) | | $ | (0.412 | ) | | $ | (0.347 | ) | | $ | (1.107 | ) | | $ | (1.134 | ) |

| | | | | |

Portfolio transaction fee, net(1) | | $ | 0.001 | | | $ | 0.003 | | | $ | 0.004 | | | $ | 0.003 | | | $ | 0.001 | |

| | | | | |

Net asset value — End of year | | $ | 9.500 | | | $ | 12.290 | | | $ | 9.790 | | | $ | 9.890 | | | $ | 9.990 | |

| | | | | |

Total Return on Net Asset Value(2)(3) | | | (17.85 | )% | | | 30.18 | % | | | 2.57 | % | | | 11.48 | % | | | (1.10 | )% |

| | | | | |

| Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Net assets, end of year (000’s omitted) | | $ | 950 | | | $ | 1,229 | | | $ | 5,872 | | | $ | 6,182 | | | $ | 6,243 | |

| | | | | |

Ratios (as a percentage of average daily net assets):(4) | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Expenses(3) | | | 0.85 | %(5) | | | 0.85 | % | | | 0.85 | % | | | 0.88 | % | | | 0.91 | %(6) |

| | | | | |

Net investment income | | | 3.84 | % | | | 2.91 | % | | | 4.02 | % | | | 4.91 | % | | | 3.32 | % |

| | | | | |

Portfolio Turnover of the Portfolio | | | 59 | % | | | 60 | % | | | 118 | % | | | 86 | % | | | 102 | % |

| (1) | Computed using average shares outstanding. |

| (2) | Returns are historical and are calculated by determining the percentage change in net asset value with all distributions reinvested and do not reflect the effect of a market-determined premium or discount. Investment returns assume that all distributions have been reinvested at net asset value. |

| (3) | The administrator and sub-adviser reimbursed certain operating expenses (equal to 8.99%, 1.31%, 2.08%, 1.70% and 1.57% of average daily net assets for the years ended October 31, 2022, 2021, 2020, 2019 and 2018, respectively). Absent this reimbursement, total return would be lower. |

| (4) | Includes the Fund’s share of the Portfolio’s allocated expenses. |

| (5) | Includes a reduction by the investment adviser of a portion of the Portfolio’s adviser fee due to the Portfolio’s investment in the Liquidity Fund (equal to less than 0.005% of average daily net assets for the year ended October 31, 2022). |

| (6) | Includes interest expense, including allocated from the Portfolio of 0.01% and 0.01% for the years ended October 31, 2018 and October 31, 2017, respectively. |

| | | | |

| | 12 | | See Notes to Financial Statements. |

Eaton Vance

Global Income Builder NextShares

October 31, 2022

Notes to Financial Statements

1 Significant Accounting Policies

Eaton Vance Global Income Builder NextShares (the Fund) is a diversified series of Eaton Vance NextShares Trust (the Trust), a Massachusetts business trust registered under the Investment Company Act of 1940, as amended (the 1940 Act). The Fund is an exchange-traded managed fund operating pursuant to an order issued by the SEC granting an exemption from certain provisions of the 1940 Act. Individual shares of the Fund may be purchased and sold only on a national securities exchange or alternative trading system through a broker-dealer that offers NextShares, and may not be directly purchased or redeemed from the Fund. Market trading prices for the Fund are directly linked to the Fund’s next-computed net asset value per share (NAV) and will vary from NAV by a market-determined premium or discount, which may be zero. The Fund invests all of its investable assets in interests in Global Income Builder Portfolio (the Portfolio), a Massachusetts business trust, having substantially the same investment objective and policies as the Fund. The value of the Fund’s investment in the Portfolio reflects the Fund’s proportionate interest in the net assets of the Portfolio (0.5% at October 31, 2022). The performance of the Fund is directly affected by the performance of the Portfolio. The financial statements of the Portfolio, including the portfolio of investments, are included elsewhere in this report and should be read in conjunction with the Fund’s financial statements.

The following is a summary of significant accounting policies of the Fund. The policies are in conformity with accounting principles generally accepted in the United States of America (U.S. GAAP). The Fund is an investment company and follows accounting and reporting guidance in the Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 946.

A Investment Valuation — Valuation of securities by the Portfolio is discussed in Note 1A of the Portfolio’s Notes to Financial Statements, which are included elsewhere in this report.

B Income — The Fund’s net investment income or loss consists of the Fund’s pro-rata share of the net investment income or loss of the Portfolio, less all actual and accrued expenses of the Fund.

C Federal Taxes — The Fund’s policy is to comply with the provisions of the Internal Revenue Code applicable to regulated investment companies and to distribute to shareholders each year substantially all of its net investment income, and all or substantially all of its net realized capital gains. Accordingly, no provision for federal income or excise tax is necessary.

As of October 31, 2022, the Fund had no uncertain tax positions that would require financial statement recognition, de-recognition, or disclosure. The Fund files a U.S. federal income tax return annually after its fiscal year-end, which is subject to examination by the Internal Revenue Service for a period of three years from the date of filing.

D Expenses — The majority of expenses of the Trust are directly identifiable to an individual fund. Expenses which are not readily identifiable to a specific fund are allocated taking into consideration, among other things, the nature and type of expense and the relative size of the funds.

E Use of Estimates — The preparation of the financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of income and expense during the reporting period. Actual results could differ from those estimates.

F Indemnifications — Under the Trust’s organizational documents, its officers and Trustees may be indemnified against certain liabilities and expenses arising out of the performance of their duties to the Fund. Under Massachusetts law, if certain conditions prevail, shareholders of a Massachusetts business trust (such as the Trust) could be deemed to have personal liability for the obligations of the Trust. However, the Trust’s Declaration of Trust contains an express disclaimer of liability on the part of Fund shareholders and the By-laws provide that the Trust shall assume, upon request by the shareholder, the defense on behalf of any Fund shareholders. Moreover, the By-laws also provide for indemnification out of Fund property of any shareholder held personally liable solely by reason of being or having been a shareholder for all loss or expense arising from such liability. Additionally, in the normal course of business, the Fund enters into agreements with service providers that may contain indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred.

G Other — Investment transactions are accounted for on a trade date basis.

2 Distributions to Shareholders and Income Tax Information

It is the present policy of the Fund to make monthly distributions of all or substantially all of its net investment income and to distribute annually all or substantially all of its net realized capital gains. Distributions are paid in cash and cannot be automatically reinvested in additional shares of the Fund. Distributions to shareholders are recorded on the ex-dividend date. Distributions to shareholders are determined in accordance with income tax regulations, which may differ from U.S. GAAP. As required by U.S. GAAP, only distributions in excess of tax basis earnings and profits are reported in the financial statements as a return of capital. Permanent differences between book and tax accounting relating to distributions are reclassified to paid-in capital. For tax purposes, distributions from short-term capital gains are considered to be from ordinary income.

Eaton Vance

Global Income Builder NextShares

October 31, 2022

Notes to Financial Statements — continued

The tax character of distributions declared for the years ended October 31, 2022 and October 31, 2021 was as follows:

| | | | | | | | |

| | | Year Ended October 31, | |

| | | 2022 | | | 2021 | |

| | |

Ordinary income | | $ | 39,620 | | | $ | 247,140 | |

| | |

Long-term capital gains | | $ | 30,110 | | | $ | — | |

During the year ended October 31, 2022, accumulated loss was increased by $2,717,605 and paid-in capital was increased by $2,717,605 due to differences between book and tax accounting, primarily for redemptions in-kind. These reclassifications had no effect on the net assets or net asset value per share of the Fund.

As of October 31, 2022, the components of distributable earnings (accumulated loss) on a tax basis were as follows:

| | | | |

| | |

Undistributed ordinary income | | $ | 1,530 | |

| |

Undistributed long-term capital gains | | | 156,117 | |

| |

Net unrealized depreciation | | | (6,678,452 | ) |

| |

Accumulated loss | | $ | (6,520,805 | ) |

3 Investment Adviser, Administration Fees and Other Transactions with Affiliates

The investment adviser fee is earned by Eaton Vance Management (EVM), an indirect, wholly-owned subsidiary of Morgan Stanley, as compensation for investment advisory services rendered to the Fund. The investment adviser fee is computed at an annual rate as a percentage of the Fund’s average daily net assets that are not invested in other investment companies for which EVM or its affiliates serve as investment adviser and receive an advisory fee as follows and is payable monthly:

| | | | |

| Average Daily Net Assets | | Annual Fee Rate | |

| |

Up to $500 million | | | 0.550 | % |

| |

$500 million but less than $1 billion | | | 0.525 | % |

| |

$1 billion but less than $2.5 billion | | | 0.500 | % |

| |

$2.5 billion and over | | | 0.475 | % |

For the year ended October 31, 2022, the Fund incurred no investment adviser fee on such assets.

Pursuant to an investment sub-advisory agreement, EVM has delegated a portion of the investment management of the Fund to Eaton Vance Advisers International Ltd. (EVAIL), an affiliate of EVM and an indirect, wholly-owned subsidiary of Morgan Stanley. EVM pays EVAIL a portion of its investment adviser fee for sub-advisory services provided to the Fund. To the extent the Fund’s assets are invested in the Portfolio, the Fund is allocated its share of the Portfolio’s investment adviser fee. The Portfolio has engaged Boston Management and Research (BMR), a subsidiary of EVM, to render investment advisory services. See Note 2 of the Portfolio’s Notes to Financial Statements which are included elsewhere in this report. The administration fee is earned by EVM for administering the business affairs of the Fund. The administration fee is computed at an annual rate of 0.15% of the Fund’s average daily net assets. For the year ended October 31, 2022, the administration fee amounted to $1,604.

The Trust, on behalf of the Fund, has entered into an operations agreement with EVM pursuant to which EVM provides the Fund with services required for it to operate as a NextShares exchange-traded managed fund in accordance with the exemptive order obtained by EVM and the Trust. Pursuant to the agreement, the Fund pays EVM a monthly fee at an annual rate of 0.05% of the Fund’s average daily net assets provided the average net assets of NextShares funds sponsored by EVM (“Covered Assets”) are less than $10 billion. The annual rate is reduced if Covered Assets are $10 billion and above. For the year ended October 31, 2022, the operations agreement fee amounted to $535 or 0.05% of the Fund’s average daily net assets.

EVM and EVAIL have agreed to reimburse the Fund’s expenses to the extent that total annual operating expenses (relating to ordinary operating expenses only and excluding such expenses as borrowing costs, taxes or litigation expenses) exceed 0.85% of the Fund’s average daily net assets through February 28, 2023. Thereafter, the reimbursement may be changed or terminated at any time. Pursuant to this agreement, EVM and EVAIL were allocated $96,062 in total of the Fund’s operating expenses for the year ended October 31, 2022.

Trustees and officers of the Fund who are members of EVM’s or BMR’s organizations receive remuneration for their services to the Fund out of the investment adviser fee. Certain officers and Trustees of the Fund and the Portfolio are officers of the above organizations.

Eaton Vance

Global Income Builder NextShares

October 31, 2022

Notes to Financial Statements — continued

4 Investment Transactions

For the year ended October 31, 2022, increases and decreases in the Fund’s investment in the Portfolio aggregated $95,175 and $169,927, respectively. In addition, a Portfolio transaction fee is imposed by the Portfolio on the combined daily inflows or outflows of the Fund and the Portfolio’s other investors as more fully described at Note 1L of the Portfolio’s financial statements included herein. Such fee is allocated to the Fund based on its pro-rata interest in the Portfolio. The amount of the Portfolio transaction fee imposed on the Fund, if any, and the allocation of such fee are presented as Other capital on the Statements of Changes in Net Assets.

5 Capital Share Transactions

The Trust may issue an unlimited number of shares of capital stock (no par value per share) in one or more series (such as the Fund). The Fund issues and redeems shares only in blocks of 25,000 shares or multiples thereof (“Creation Units”). The Fund issues and redeems Creation Units in return for the securities, other instruments and/or cash (the “Basket”) that the Fund specifies each business day. Creation Units may be purchased or redeemed only by or through Authorized Participants, which are broker-dealers or institutional investors that have entered into agreements with the Fund’s distributor for this purpose. The Fund imposes a transaction fee on Creation Units issued and redeemed to offset the estimated cost to the Fund of processing the transaction, which is paid by the Authorized Participants directly to a third-party administrator. In addition, Authorized Participants pay the Fund a variable charge for converting the Basket to or from the desired portfolio composition. Such variable charges are reflected as Transaction fees on the Statements of Changes in Net Assets.

At October 31, 2022, EVM owned approximately 81% of the outstanding shares of the Fund.

6 Fund Liquidation

In November 2022, the Board of Trustees of the Trust, on behalf of the Fund, approved the liquidation of the Fund, which is expected to take place on or about December 23, 2022. Effective prior to the open of business on December 16, 2022, the Fund no longer accepted Creation Unit purchase orders. The last day of secondary market trading of shares for the Fund was December 16, 2022.

Eaton Vance

Global Income Builder NextShares

October 31, 2022

Report of Independent Registered Public Accounting Firm

To the Trustees of Eaton Vance NextShares Trust and Shareholders of Eaton Vance Global Income Builder NextShares:

Opinion on the Financial Statements and Financial Highlights

We have audited the accompanying statement of assets and liabilities of Eaton Vance Global Income Builder NextShares (the “Fund”) (one of the funds constituting Eaton Vance NextShares Trust), as of October 31, 2022, the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, the financial highlights for each of the five years in the period then ended, and the related notes. In our opinion, the financial statements and financial highlights present fairly, in all material respects, the financial position of the Fund as of October 31, 2022, and the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements and financial highlights based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement, whether due to error or fraud. The Fund is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits, we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements and financial highlights, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements and financial highlights. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements and financial highlights. We believe that our audits provide a reasonable basis for our opinion.

Emphasis of Matter

As disclosed in Note 6 to the financial statements, the Board of Trustees of Eaton Vance NextShares Trust approved the liquidation of the Fund, which is expected to take place on or about December 23, 2022. Our opinion is not modified with respect to this matter.

/s/ Deloitte & Touche LLP

Boston, Massachusetts

December 22, 2022

We have served as the auditor of one or more Eaton Vance investment companies since 1959.

Eaton Vance

Global Income Builder NextShares

October 31, 2022

Federal Tax Information (Unaudited)

The Form 1099-DIV you receive in February 2023 will show the tax status of all distributions paid to your account in calendar year 2022. Shareholders are advised to consult their own tax adviser with respect to the tax consequences of their investment in the Fund. As required by the Internal Revenue Code and/or regulations, shareholders must be notified regarding the status of qualified business income, qualified dividend income for individuals, the dividends received deduction for corporations, 163(j) interest dividends and capital gains dividends.

Qualified Business Income. For the fiscal year ended October 31, 2022 the Fund designates approximately $121 or up to the maximum amount of such dividends allowable pursuant to the Internal Revenue Code, as qualified business income.

Qualified Dividend Income. For the fiscal year ended October 31, 2022, the Fund designates approximately $26,482 or up to the maximum amount of such dividends allowable pursuant to the Internal Revenue Code, as qualified dividend income eligible for the reduced tax rate of 15%.

Dividends Received Deduction. Corporate shareholders are generally entitled to take the dividends received deduction on the portion of the Fund’s dividend distribution that qualifies under tax law. For the Fund’s fiscal 2022 ordinary income dividends, 13.34% qualifies for the corporate dividends received deduction.

163(j) Interest Dividends. For the fiscal year ended October 31, 2022, the Fund designates 45.00% of distributions from net investment income as a 163(j) interest dividend.

Capital Gains Dividends. The Fund hereby designates as a capital gain dividend with respect to the taxable year ended October 31, 2022, $156,124 or, if subsequently determined to be different, the net capital gain of such year.

Global Income Builder Portfolio

October 31, 2022

Portfolio of Investments

| | | | | | | | | | | | |

| Common Stocks — 58.7% | |

| Security | | | | | Shares | | | Value | |

| | | |

| Aerospace & Defense — 0.8% | | | | | | | | | |

| | | |

Safran S.A. | | | | | | | 15,665 | | | $ | 1,744,609 | |

| | | |

| | | | | | | | | | | $ | 1,744,609 | |

| | | |

| Air Freight & Logistics — 0.5% | | | | | | | | | |

| | | |

GXO Logistics, Inc.(1) | | | | | | | 27,738 | | | $ | 1,013,547 | |

| | | |

| | | | | | | | | | | $ | 1,013,547 | |

| | | |

| Automobiles — 0.4% | | | | | | | | | |

| | | |

Stellantis NV | | | | | | | 61,872 | | | $ | 834,750 | |

| | | |

| | | | | | | | | | | $ | 834,750 | |

| | | |

| Banks — 2.7% | | | | | | | | | |

| | | |

Banco Santander S.A. | | | | | | | 581,915 | | | $ | 1,509,182 | |

| | | |

Citigroup, Inc. | | | | | | | 19,891 | | | | 912,201 | |

| | | |

Citizens Financial Group, Inc. | | | | | | | 22,606 | | | | 924,586 | |

| | | |

HDFC Bank, Ltd. | | | | | | | 65,884 | | | | 1,195,053 | |

| | | |

ING Groep NV | | | | | | | 21,302 | | | | 209,603 | |

| | | |

M&T Bank Corp. | | | | | | | 3,936 | | | | 662,704 | |

| | | |

Standard Chartered PLC | | | | | | | 104,185 | | | | 622,478 | |

| | | |

| | | | | | | | | | | $ | 6,035,807 | |

| | | |

| Beverages — 2.3% | | | | | | | | | |

| | | |

Coca-Cola Co. (The) | | | | | | | 51,744 | | | $ | 3,096,878 | |

| | | |

Diageo PLC | | | | | | | 46,546 | | | | 1,915,483 | |

| | | |

| | | | | | | | | | | $ | 5,012,361 | |

| | | |

| Biotechnology — 0.5% | | | | | | | | | |

| | | |

CSL, Ltd. | | | | | | | 5,787 | | | $ | 1,035,962 | |

| | | |

| | | | | | | | | | | $ | 1,035,962 | |

| | | |

| Building Products — 0.4% | | | | | | | | | |

| | | |

Assa Abloy AB, Class B | | | | | | | 41,989 | | | $ | 847,845 | |

| | | |

| | | | | | | | | | | $ | 847,845 | |

| | | |

| Capital Markets — 1.4% | | | | | | | | | |

| | | |

Bank of New York Mellon Corp. (The) | | | | | | | 8,377 | | | $ | 352,756 | |

| | | |

State Street Corp. | | | | | | | 26,629 | | | | 1,970,546 | |

| | | |

Stifel Financial Corp. | | | | | | | 10,745 | | | | 664,793 | |

| | | |

| | | | | | | | | | | $ | 2,988,095 | |

| | | | | | | | | | |

| Security | | | | Shares | | | Value | |

| | | |

| Chemicals — 0.2% | | | | | | | | |

| | | |

Sika AG | | | | | 2,412 | | | $ | 543,847 | |

| | | |

| | | | | | | | | $ | 543,847 | |

| | | |

| Consumer Finance — 0.2% | | | | | | | | |

| | | |

Capital One Financial Corp. | | | | | 4,078 | | | $ | 432,350 | |

| | | |

| | | | | | | | | $ | 432,350 | |

| | | |

| Diversified Financial Services — 0.7% | | | | | | | | |

| | | |

Berkshire Hathaway, Inc., Class B(1) | | | | | 5,465 | | | $ | 1,612,667 | |

| | | |

| | | | | | | | | $ | 1,612,667 | |

| | | |

| Electric Utilities — 1.4% | | | | | | | | |

| | | |

Iberdrola S.A. | | | | | 158,553 | | | $ | 1,612,369 | |

| | | |

NextEra Energy, Inc. | | | | | 20,455 | | | | 1,585,262 | |

| | | |

| | | | | | | | | $ | 3,197,631 | |

| | | |

| Electrical Equipment — 1.4% | | | | | | | | |

| | | |

AMETEK, Inc. | | | | | 12,139 | | | $ | 1,573,943 | |

| | | |

Schneider Electric SE | | | | | 11,379 | | | | 1,438,946 | |

| | | |

| | | | | | | | | $ | 3,012,889 | |

| |

| Electronic Equipment, Instruments & Components — 2.7% | | | | |

| | | |

CDW Corp. | | | | | 12,312 | | | $ | 2,127,637 | |

| | | |

Halma PLC | | | | | 37,153 | | | | 900,933 | |

| | | |

Keyence Corp. | | | | | 1,870 | | | | 705,112 | |

| | | |

Keysight Technologies, Inc.(1) | | | | | 5,325 | | | | 927,349 | |

| | | |

Riverbed Technology, Inc.(2) | | | | | 3,977 | | | | 1,998 | |

| | | |

TE Connectivity, Ltd. | | | | | 10,606 | | | | 1,296,371 | |

| | | |

Zebra Technologies Corp., Class A(1) | | | | | 8 | | | | 2,266 | |

| | | |

| | | | | | | | | $ | 5,961,666 | |

| | | |

| Entertainment — 1.3% | | | | | | | | |

| | | |

Walt Disney Co. (The)(1) | | | | | 26,531 | | | $ | 2,826,613 | |

| | | |

| | | | | | | | | $ | 2,826,613 | |

| |

| Equity Real Estate Investment Trusts (REITs) — 0.5% | | | | |

| | | |

American Tower Corp. | | | | | 2,955 | | | $ | 612,246 | |

| | | |

Healthpeak Properties, Inc. | | | | | 19,485 | | | | 462,379 | |

| | | |

| | | | | | | | | $ | 1,074,625 | |

| | | |

| Food Products — 2.4% | | | | | | | | |

| | | |

Mondelez International, Inc., Class A | | | | | 36,703 | | | $ | 2,256,500 | |

| | | |

Nestle S.A. | | | | | 28,517 | | | | 3,104,327 | |

| | | |

| | | | | | | | | $ | 5,360,827 | |

| | | | |

| | 18 | | See Notes to Financial Statements. |

Global Income Builder Portfolio

October 31, 2022

Portfolio of Investments — continued

| | | | | | | | | | |

| Security | | | | Shares | | | Value | |

| | | |

| Health Care Equipment & Supplies — 2.1% | | | | | | | | |

| | | |

Alcon, Inc. | | | | | 9,732 | | | $ | 592,536 | |

| | | |

Boston Scientific Corp.(1) | | | | | 49,310 | | | | 2,125,754 | |

| | | |

Intuitive Surgical, Inc.(1) | | | | | 5,640 | | | | 1,390,091 | |

| | | |

Straumann Holding AG | | | | | 6,492 | | | | 617,852 | |

| | | |

| | | | | | | | | $ | 4,726,233 | |

| | | |

| Health Care Providers & Services — 1.0% | | | | | | | | |

| | | |

Elevance Health, Inc.(1) | | | | | 4,192 | | | $ | 2,292,060 | |

| | | |

| | | | | | | | | $ | 2,292,060 | |

| | | |

| Hotels, Restaurants & Leisure — 1.4% | | | | | | | | |

| | | |

Compass Group PLC | | | | | 110,338 | | | $ | 2,323,919 | |

| | | |

InterContinental Hotels Group PLC | | | | | 16,248 | | | | 873,016 | |

| | | |

| | | | | | | | | $ | 3,196,935 | |

| | | |

| Industrial Conglomerates — 0.7% | | | | | | | | |

| | | |

Siemens AG | | | | | 13,710 | | | $ | 1,497,255 | |

| | | |

| | | | | | | | | $ | 1,497,255 | |

| | | |

| Insurance — 1.4% | | | | | | | | |

| | | |

AIA Group, Ltd. | | | | | 124,092 | | | $ | 939,971 | |

| | | |

Allstate Corp. (The) | | | | | 3,512 | | | | 443,390 | |

| | | |

Aviva PLC | | | | | 2 | | | | 10 | |

| | | |

AXA S.A. | | | | | 35,341 | | | | 872,742 | |

| | | |

RenaissanceRe Holdings, Ltd. | | | | | 5,720 | | | | 884,769 | |

| | | |

| | | | | | | | | $ | 3,140,882 | |

| | | |

| Interactive Media & Services — 2.7% | | | | | | | | |

| | | |

Alphabet, Inc., Class C(1) | | | | | 63,380 | | | $ | 5,999,551 | |

| | | |

| | | | | | | | | $ | 5,999,551 | |

| | | |

| Internet & Direct Marketing Retail — 1.5% | | | | | | | | |

| | | |

Amazon.com, Inc.(1) | | | | | 32,242 | | | $ | 3,302,870 | |

| | | |

| | | | | | | | | $ | 3,302,870 | |

| | | |

| IT Services — 2.4% | | | | | | | | |

| | | |

Amadeus IT Group S.A.(1) | | | | | 15,592 | | | $ | 813,205 | |

| | | |

Fidelity National Information Services, Inc. | | | | | 22,304 | | | | 1,851,009 | |

| | | |

Global Payments, Inc. | | | | | 7,929 | | | | 905,968 | |

| | | |

Visa, Inc., Class A | | | | | 7,964 | | | | 1,649,822 | |

| | | |

| | | | | | | | | $ | 5,220,004 | |

| | | |

| Leisure Products — 0.5% | | | | | | | | |

| | | |

Yamaha Corp. | | | | | 31,333 | | | $ | 1,182,954 | |

| | | |

| | | | | | | | | $ | 1,182,954 | |

| | | | | | | | | | |

| Security | | | | Shares | | | Value | |

| | | |

| Life Sciences Tools & Services — 0.6% | | | | | | | | |

| | | |

Danaher Corp. | | | | | 2,894 | | | $ | 728,333 | |

| | | |

Lonza Group AG | | | | | 1,051 | | | | 541,038 | |

| | | |

| | | | | | | | | $ | 1,269,371 | |

| | | |

| Machinery — 1.0% | | | | | | | | |

| | | |

Graco, Inc. | | | | | 11,106 | | | $ | 772,755 | |

| | | |

Ingersoll Rand, Inc. | | | | | 28,004 | | | | 1,414,202 | |

| | | |

| | | | | | | | | $ | 2,186,957 | |

| | | |

| Metals & Mining — 0.3% | | | | | | | | |

| | | |

Alleima AB(1) | | | | | 1,121 | | | $ | 3,819 | |

| | | |

Rio Tinto, Ltd. | | | | | 13,256 | | | | 752,273 | |

| | | |

| | | | | | | | | $ | 756,092 | |

| | | |

| Multi-Utilities — 0.2% | | | | | | | | |

| | | |

CMS Energy Corp. | | | | | 8,069 | | | $ | 460,336 | |

| | | |

| | | | | | | | | $ | 460,336 | |

| | | |

| Oil, Gas & Consumable Fuels — 3.4% | | | | | | | | |

| | | |

Chevron Corp. | | | | | 13,558 | | | $ | 2,452,642 | |

| | | |

EOG Resources, Inc. | | | | | 30,347 | | | | 4,142,973 | |

| | | |

Phillips 66 | | | | | 2,171 | | | | 226,414 | |

| | | |

Pioneer Natural Resources Co. | | | | | 2,523 | | | | 646,922 | |

| | | |

| | | | | | | | | $ | 7,468,951 | |

| | | |

| Personal Products — 0.3% | | | | | | | | |

| | | |

Kose Corp. | | | | | 6,101 | | | $ | 609,005 | |

| | | |

| | | | | | | | | $ | 609,005 | |

| | | |

| Pharmaceuticals — 5.9% | | | | | | | | |

| | | |

AstraZeneca PLC | | | | | 12,755 | | | $ | 1,496,571 | |

| | | |

Eli Lilly & Co. | | | | | 10,732 | | | | 3,885,950 | |

| | | |

Novo Nordisk A/S, Class B | | | | | 24,134 | | | | 2,624,120 | |

| | | |

Roche Holding AG PC | | | | | 5,541 | | | | 1,838,493 | |

| | | |

Sanofi | | | | | 18,821 | | | | 1,619,694 | |

| | | |

Zoetis, Inc. | | | | | 9,931 | | | | 1,497,396 | |

| | | |

| | | | | | | | | $ | 12,962,224 | |

| | | |

| Professional Services — 1.6% | | | | | | | | |

| | | |

Recruit Holdings Co., Ltd. | | | | | 26,791 | | | $ | 824,391 | |

| | | |

RELX PLC | | | | | 61,295 | | | | 1,646,413 | |

| | | |

Verisk Analytics, Inc. | | | | | 5,788 | | | | 1,058,220 | |

| | | |

| | | | | | | | | $ | 3,529,024 | |

| | | | |

| | 19 | | See Notes to Financial Statements. |

Global Income Builder Portfolio

October 31, 2022

Portfolio of Investments — continued

| | | | | | | | | | | | |

| Security | | | | | Shares | | | Value | |

| |

| Semiconductors & Semiconductor Equipment — 2.5% | | | | |

| | | |

ASML Holding NV | | | | | | | 4,161 | | | $ | 1,951,869 | |

| | | |

Infineon Technologies AG | | | | | | | 47,793 | | | | 1,159,719 | |

| | | |

Micron Technology, Inc. | | | | | | | 24,254 | | | | 1,312,142 | |

| | | |

Taiwan Semiconductor Manufacturing Co., Ltd. ADR | | | | | | | 18,045 | | | | 1,110,670 | |

| | | |

| | | | | | | | | | | $ | 5,534,400 | |

| | | |

| Software — 4.0% | | | | | | | | | |

| | | |

Adobe, Inc.(1) | | | | | | | 5,104 | | | $ | 1,625,624 | |

| | | |

Dassault Systemes SE | | | | | | | 25,680 | | | | 860,762 | |

| | | |

Intuit, Inc. | | | | | | | 3,022 | | | | 1,291,905 | |

| | | |

Microsoft Corp. | | | | | | | 22,225 | | | | 5,159,089 | |

| | | |

| | | | | | | | | | | $ | 8,937,380 | |

| | | |

| Specialty Retail — 1.7% | | | | | | | | | |

| | | |

Lowe’s Cos., Inc. | | | | | | | 9,071 | | | $ | 1,768,391 | |

| | | |

TJX Cos., Inc. (The) | | | | | | | 28,068 | | | | 2,023,703 | |

| | | |

| | | | | | | | | | | $ | 3,792,094 | |

| |

| Technology Hardware, Storage & Peripherals — 1.9% | | | | |

| | | |

Apple, Inc. | | | | | | | 28,022 | | | $ | 4,296,893 | |

| | | |

| | | | | | | | | | | $ | 4,296,893 | |

| | | |

| Textiles, Apparel & Luxury Goods — 0.6% | | | | | | | | | |

| | | |

LVMH Moet Hennessy Louis Vuitton SE | | | | | | | 2,261 | | | $ | 1,426,679 | |

| | | |

| | | | | | | | | | | $ | 1,426,679 | |

| | | |

| Trading Companies & Distributors — 0.5% | | | | | | | | | |

| | | |

Ashtead Group PLC | | | | | | | 21,543 | | | $ | 1,122,240 | |

| | | |

| | | | | | | | | | | $ | 1,122,240 | |

| | | |

| Wireless Telecommunication Services — 0.7% | | | | | | | | | |

| | | |

Vodafone Group PLC | | | | | | | 1,242,622 | | | $ | 1,450,639 | |

| | | |

| | | | | | | | | | | $ | 1,450,639 | |

| | | |

Total Common Stocks

(identified cost $97,043,807) | | | | | | | | | | $ | 129,897,120 | |

| | | |

| Convertible Bonds — 0.1% | | | | | | | | | | | | |

| Security | | | | | Principal Amount (000’s omitted) | | | Value | |

| | | |

| Leisure Products — 0.1% | | | | | | | | | |

| | | |

Peloton Interactive, Inc., 0.00%, 2/15/26 | | | | | | $ | 310 | | | $ | 223,213 | |

| | | |

| | | | | | | | | | | $ | 223,213 | |

| | | | | | | | | | | | |

| Security | | | | | Principal Amount (000’s omitted) | | | Value | |

| | | |

| Software — 0.0%(3) | | | | | | | | | |

| | | |

1Life Healthcare, Inc., 3.00%, 6/15/25 | | | | | | $ | 81 | | | $ | 78,813 | |

| | | |

| | | | | | | | | | | $ | 78,813 | |

| | | |

Total Convertible Bonds

(identified cost $345,465) | | | | | | | | | | $ | 302,026 | |

| | | |

| Convertible Preferred Stocks — 0.1% | | | | | | | | | | | | |

| Security | | | | | Shares | | | Value | |

| | | |

| Health Care Equipment & Supplies — 0.1% | | | | | | | | | |

| | | |

Becton Dickinson and Co., Series B, 6.00% | | | | | | | 3,268 | | | $ | 159,282 | |

| | | |

| | | | | | | | | | | $ | 159,282 | |

| | | |

| Software — 0.0%(3) | | | | | | | | | |

| | | |

Riverbed Technology, Inc., Series A, 6.50%, (1.50% cash, 5.00% PIK)(1)(2) | | | | | | | 2,480 | | | $ | 2,480 | |

| | | |

| | | | | | | | | | | $ | 2,480 | |

| | | |

Total Convertible Preferred Stocks

(identified cost $244,405) | | | | | | | | | | $ | 161,762 | |

| | | |

| Corporate Bonds — 36.6% | | | | | | | | | | | | |

| Security | | Principal

Amount

(000’s omitted)* | | | Value | |

| | | |

| Aerospace & Defense — 0.8% | | | | | | | | | |

| | | |

Moog, Inc., 4.25%, 12/15/27(4) | | | | | | | 170 | | | $ | 152,397 | |

| | | |

Rolls-Royce PLC, 5.75%, 10/15/27(4) | | | | | | | 492 | | | | 445,919 | |

| | | |

TransDigm UK Holdings PLC, 6.875%, 5/15/26 | | | | | | | 200 | | | | 195,480 | |

| | | |

| TransDigm, Inc.: | | | | | | | | | |

| | | |

4.625%, 1/15/29 | | | | | | | 185 | | | | 157,833 | |

| | | |

5.50%, 11/15/27 | | | | | | | 106 | | | | 96,867 | |

| | | |

6.25%, 3/15/26(4) | | | | | | | 419 | | | | 414,029 | |

| | | |

7.50%, 3/15/27 | | | | | | | 327 | | | | 322,710 | |

| | | |

| | | | | | | | | | | $ | 1,785,235 | |

| | | |

| Airlines — 0.4% | | | | | | | | | |

| | | |

Air Canada, 3.875%, 8/15/26(4) | | | | | | | 101 | | | $ | 89,516 | |

| | | |

Air France-KLM, 1.875%, 1/16/25(5) | | | EUR | | | | 100 | | | | 88,429 | |

| | | |

| American Airlines, Inc./AAdvantage Loyalty IP, Ltd.: | | | | | | | | | |

| | | |

5.50%, 4/20/26(4) | | | | | | | 314 | | | | 299,534 | |

| | | |

5.75%, 4/20/29(4) | | | | | | | 144 | | | | 131,297 | |

| | | | |

| | 20 | | See Notes to Financial Statements. |

Global Income Builder Portfolio

October 31, 2022

Portfolio of Investments — continued

| | | | | | | | | | | | |

| Security | | Principal

Amount

(000’s omitted)* | | | Value | |

| | | |

| Airlines (continued) | | | | | | | | | |

| | | |

Deutsche Lufthansa AG, 2.875%, 2/11/25(5) | | | EUR | | | | 200 | | | $ | 184,792 | |

| | | |

United Airlines, Inc., 4.625%, 4/15/29(4) | | | | | | | 193 | | | | 165,406 | |

| | | |

| | | | | | | | | | | $ | 958,974 | |

| | | |

| Auto Components — 0.6% | | | | | | | | | |

| | | |

| Clarios Global, L.P./Clarios US Finance Co.: | | | | | | | | | |

| | | |

4.375%, 5/15/26(5) | | | EUR | | | | 681 | | | $ | 631,104 | |

| | | |

8.50%, 5/15/27(4) | | | | | | | 194 | | | | 190,449 | |

| | | |

IHO Verwaltungs GmbH, 6.375%, (6.375% cash or 7.125% PIK), 5/15/29(4)(6) | | | | | | | 200 | | | | 171,614 | |

| | | |

Real Hero Merger Sub 2, Inc., 6.25%, 2/1/29(4) | | | | | | | 54 | | | | 38,844 | |

| | | |

TI Automotive Finance PLC, 3.75%, 4/15/29(5) | | | EUR | | | | 200 | | | | 143,664 | |

| | | |

Wheel Pros, Inc., 6.50%, 5/15/29(4) | | | | | | | 213 | | | | 100,566 | |

| | | |

| | | | | | | | | | | $ | 1,276,241 | |

| | | |

| Automobiles — 0.7% | | | | | | | | | |

| | | |

Allison Transmission, Inc., 3.75%, 1/30/31(4) | | | | | | | 54 | | | $ | 43,213 | |

| | | |

| Ford Motor Co.: | | | | | | | | | |

| | | |

3.25%, 2/12/32 | | | | | | | 364 | | | | 273,919 | |

| | | |

4.75%, 1/15/43 | | | | | | | 197 | | | | 137,540 | |

| | | |

9.625%, 4/22/30 | | | | | | | 26 | | | | 29,059 | |

| | | |

| Ford Motor Credit Co., LLC: | | | | | | | | | |

| | | |

3.087%, 1/9/23 | | | | | | | 231 | | | | 230,188 | |

| | | |

3.37%, 11/17/23 | | | | | | | 200 | | | | 193,318 | |

| | | |

4.125%, 8/17/27 | | | | | | | 555 | | | | 494,055 | |

| | | |

5.125%, 6/16/25 | | | | | | | 200 | | | | 193,278 | |

| | | |

| | | | | | | | | | | $ | 1,594,570 | |

| | | |

| Automotives — 0.3% | | | | | | | | | |

| | | |

| Goodyear Tire & Rubber Co. (The): | | | | | | | | | |

| | | |

5.00%, 7/15/29 | | | | | | | 336 | | | $ | 292,243 | |

| | | |

5.25%, 7/15/31 | | | | | | | 270 | | | | 229,122 | |

| | | |

Jaguar Land Rover Automotive PLC, 2.20%, 1/15/24(5) | | | EUR | | | | 100 | | | | 93,021 | |

| | | |

| | | | | | | | | | | $ | 614,386 | |

| | | |

| Banks — 2.0% | | | | | | | | | |

| | | |

Banco Mercantil del Norte S.A./Grand Cayman, 7.625% to 1/10/28(4)(7)(8) | | | | | | | 200 | | | $ | 164,490 | |

| | | |

Bank of America Corp., Series TT, 6.125% to 4/27/27(7)(8) | | | | | | | 89 | | | | 84,328 | |

| | | |

Bank of Nova Scotia (The), 8.625% to 10/27/27, 10/27/82(8) | | | | | | | 200 | | | | 201,223 | |

| | | |

Barclays PLC, 8.00% to 3/15/29(7)(8) | | | | | | | 200 | | | | 179,671 | |

| | | |

BNP Paribas S.A., 7.75% to 8/16/29(4)(7)(8) | | | | | | | 200 | | | | 189,067 | |

| | | |

Citigroup, Inc., Series W, 4.00% to 12/10/25(7)(8) | | | | | | | 51 | | | | 43,146 | |

| | | |

Credit Suisse Group AG, 9.75% to 6/23/27(4)(7)(8) | | | | | | | 200 | | | | 190,525 | |

| | | | | | | | | | | | |

| Security | | Principal

Amount

(000’s omitted)* | | | Value | |

| | | |

| Banks (continued) | | | | | | | | | |

| | | |

Farm Credit Bank of Texas, Series 3, 6.20% to 6/15/28(4)(7)(8) | | | | | | | 220 | | | $ | 195,056 | |

| | | |

HSBC Holdings PLC, 4.60% to 12/17/30(7)(8) | | | | | | | 200 | | | | 132,440 | |

| | | |

Huntington Bancshares, Inc., Series F, 5.625% to 7/15/30(7)(8) | | | | | | | 125 | | | | 114,231 | |

| | | |

| JPMorgan Chase & Co.: | | | | | | | | | |

| | | |

Series KK, 3.65% to 6/1/26(7)(8) | | | | | | | 251 | | | | 208,317 | |

| | | |

Series S, 6.75%, to 2/1/24(7)(8) | | | | | | | 215 | | | | 215,134 | |

| | | |

Lloyds Banking Group PLC, 7.50% to 9/27/25(7)(8) | | | | | | | 200 | | | | 186,000 | |

| | | |

Natwest Group PLC, 4.60% to 6/28/31(7)(8) | | | | | | | 200 | | | | 129,630 | |

| | | |

PNC Financial Services Group, Inc. (The), Series V, 6.20% to 9/15/27(7)(8) | | | | | | | 100 | | | | 94,970 | |

| | | |

Societe Generale S.A., 5.375% to

11/18/30(4)(7)(8) | | | | | | | 200 | | | | 145,370 | |

| | | |

Standard Chartered PLC, 4.75% to

1/14/31(4)(7)(8) | | | | | | | 229 | | | | 152,942 | |

| | | |

| SVB Financial Group: | | | | | | | | | |

| | | |

4.10% to 2/15/31(7)(8) | | | | | | | 311 | | | | 192,737 | |

| | | |

Series C, 4.00% to 5/15/26(7)(8) | | | | | | | 58 | | | | 40,661 | |

| | | |