UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22836

Permal Hedge Strategies Fund II

(Exact name of registrant as specified in charter)

620 Eighth Avenue, 49th Floor, New York, NY 10018

(Address of principal executive offices) (Zip code)

Robert I. Frenkel, Esq.

Legg Mason & Co., LLC

100 First Stamford Place,

Stamford, CT 06902

(Name and address of agent for service)

Registrant’s telephone number, including area code: (888) 777-0102

Date of fiscal year end: March 31

Date of reporting period: March 31, 2015

| ITEM 1. | REPORT TO STOCKHOLDERS. |

The Annual Report to Stockholders is filed herewith.

| | |

| Annual Report | | March 31, 2015 |

PERMAL

HEDGE STRATEGIES FUND II

|

| INVESTMENT PRODUCTS: NOT FDIC INSURED • NO BANK GUARANTEE • MAY LOSE VALUE |

|

FOR ACCREDITED INVESTORS ONLY |

Fund objective

The Fund’s investment objective is to seek long-term capital appreciation while attempting to reduce risk and volatility.

Letter from the chairman

Dear Shareholder,

We are pleased to provide the annual report of Permal Hedge Strategies Fund II for twelve-month reporting period ended March 31, 2015. Please read on for a detailed look at prevailing economic and market conditions during the Fund’s reporting period and to learn how those conditions have affected Fund performance.

As always, we remain committed to providing you with excellent service and a full spectrum of investment choices. We also remain committed to supplementing the support you receive from your financial advisor. One way we accomplish this is through our website, www.permalhsf.com. Here you can gain immediate access to market and investment information, including:

| Ÿ | | Fund prices and performance |

| Ÿ | | Market insights and commentaries from our portfolio managers, and |

| Ÿ | | A host of educational resources. |

We look forward to helping you meet your financial goals.

Sincerely,

Kenneth D. Fuller

Chairman, President and Chief Executive Officer

April 24, 2015

| | |

| II | | Permal Hedge Strategies Fund II |

Investment commentary

Economic review

The U.S. economy continued to expand, but the pace sharply decelerated during the twelve month period ended March 31, 2015 (the “reporting period”). The U.S. Department of Commerce reported that second quarter 2014 U.S. gross domestic product (“GDP”)i growth was 4.6%. The economy then gained momentum as third quarter GDP growth was 5.0%, its strongest reading since the third quarter of 2003. This was driven by contributions from personal consumption expenditures (“PCE”), exports, nonresidential fixed investment and government spending. However, fourth quarter 2014 GDP growth was a modest 2.2%. The deceleration in growth primarily reflected an upturn in imports, a downturn in federal government spending and moderating nonresidential fixed investment. After the reporting period ended, the U.S. Department of Commerce reported that its initial estimate for first quarter 2015 GDP growth was 0.2%. Slower growth was attributed to a number of factors, including a deceleration in PCE and downturns in exports, nonresidential fixed investment and state and local government spending.

Activity in the U.S. manufacturing sector also moderated during the reporting period. Based on the Institute for Supply Management’s Purchasing Managers’ Index (“PMI”)ii, U.S. manufacturing expanded during all twelve months of the reporting period (a reading below 50 indicates a contraction, whereas a reading above 50 indicates an expansion). After a reading of 55.3 in April 2014, the PMI generally rose over the next several months, reaching a high of 58.1 in August, its best reading since April 2011. Manufacturing activity then moderated over much of the last seven months of the reporting period and the PMI was 51.5 in March 2015.

The labor market was largely a tailwind for the economy during the reporting period. When the period began, unemployment was 6.2%, as reported by the U.S. Department of Labor. Unemployment generally declined during the reporting period and was 5.5% in March 2015, equaling its lowest level since May 2008.

Growth outside the U.S. was mixed. In its April 2015 World Economic Outlook Update, released after the reporting period ended, the International Monetary Fund (“IMF”) said: “Global growth remains moderate, with uneven prospects across the main countries and regions. Relative to last year, the outlook for advanced economies is improving, while growth in emerging market and developing economies is projected to be lower, primarily reflecting weaker prospects for some large emerging market economies and oil-exporting countries.” From a regional perspective, the IMF projects that 2015 growth in the Eurozone will be 1.5%, versus 0.9% in 2014. Japan’s economy is expected to expand 1.0% in 2015, compared to -0.1% in 2014. Elsewhere, the IMF said that overall growth in emerging market countries will decelerate in 2015, with growth of 4.3% versus 4.6% in 2014.

The Federal Reserve Board (“Fed”)iii took a number of actions as it sought to meet its dual mandate of fostering maximum employment and price stability. As it has since December 2008, the Fed kept the federal funds rateiv at a historically low range between zero and 0.25%. The Fed also ended its asset purchase program that

| | |

| Permal Hedge Strategies Fund II | | III |

Investment commentary (cont’d)

was announced in December 2012. In December 2014, the Fed said that “it can be patient in beginning to normalize the stance of monetary policy.” Finally, at its meeting that ended on April 29, 2015, after the reporting period ended, the Fed said “economic growth slowed during the winter months, in part reflecting transitory factors…The Committee currently anticipates that, even after employment and inflation are near mandate-consistent levels, economic conditions may, for some time, warrant keeping the target federal funds rate below levels the Committee views as normal in the longer run.”

Given the economic challenges in the Eurozone, the European Central Bank (“ECB”)v took a number of actions to stimulate growth and ward off deflation. On June 5, 2014, the ECB reduced rates to a new low of 0.15% and announced it would charge commercial banks 0.10% to keep money at the ECB. This “negative deposit rate” was aimed at encouraging commercial banks to lend some of their incremental cash which, in turn, could help to spur growth. On September 4, 2014, the ECB reduced rates to yet another record low of 0.05% and it began charging commercial banks 0.20% to keep money at the ECB. Furthermore, the ECB started purchasing securitized loans and covered bonds in October 2014. Finally, on January 22, 2015, the ECB announced that beginning in March 2015 it would start a €60 billion-a-month bond buying program that is expected to run until September 2016. In other developed countries, the Bank of England kept rates on hold at 0.50% during the reporting period, as did Japan at a range of zero to 0.10%, its lowest level since 2006. At the end of October 2014, the Bank of Japan announced that it would increase its asset purchases between 10 trillion yen and 20 trillion yen ($90.7 billion to $181.3 billion) to approximately 80 trillion yen ($725 billion) annually, in an attempt to stimulate growth. Elsewhere, after holding rates steady at 6.0% since July 2012, the People’s Bank of China cut the rate to 5.60% on November 21, 2014 and to 5.35% on February 28, 2015 in an effort to stimulate growth.

As always, thank you for your confidence in our stewardship of your assets.

Sincerely,

Kenneth D. Fuller

Chairman, President and

Chief Executive Officer

April 24, 2015

All investments are subject to risk including the possible loss of principal. Past performance is no guarantee of future results. Forecasts and predictions are inherently limited and should not be relied upon as an indication of actual or future performance.

| | |

| IV | | Permal Hedge Strategies Fund II |

| i | Gross domestic product (“GDP”) is the market value of all final goods and services produced within a country in a given period of time. |

| ii | The Institute for Supply Management’s PMI is based on a survey of purchasing executives who buy the raw materials for manufacturing at more than 350 companies. It offers an early reading on the health of the U.S. manufacturing sector. |

| iii | The Federal Reserve Board (“Fed”) is responsible for the formulation of policies designed to promote economic growth, full employment, stable prices and a sustainable pattern of international trade and payments. |

| iv | The federal funds rate is the rate charged by one depository institution on an overnight sale of immediately available funds (balances at the Federal Reserve) to another depository institution; the rate may vary from depository institution to depository institution and from day to day. |

| v | The European Central Bank (“ECB”) is responsible for the monetary system of the European Union and the euro currency. |

| | |

| Permal Hedge Strategies Fund II | | V |

Fund overview

Q. What is the Fund’s investment strategy?

A. Permal Hedge Strategies Fund II seeks long-term capital appreciation, while attempting to reduce risk and volatility. The Fund pursues its investment objective by investing substantially all of its assets in Permal Hedge Strategies Portfolio (the “Master Fund”), an investment company with substantially the same investment objective, strategies and policies as the Fund. The Fund employs a “fund-of-hedge funds” approach, through its investment in the Master Fund, that provides a means for investors to participate in private investment vehicles typically referred to as hedge funds (“Portfolio Funds”) that are managed by a number of third-party investment managers. This investment program offers access to a broad range of investment strategies with a global fixed-income focus. The types of strategies include:

| Ÿ | | Global fixed-income strategies, such as U.S. and non-U.S. fixed income hedge, convertible arbitrage, fixed income arbitrage, asset-backed securities, long-only, high yield, and emerging market debts; |

| Ÿ | | Global event-driven strategies, such as risk arbitrage, distressed debt, special situations, and activists; |

| Ÿ | | Global macro strategies, such as discretionary, systematic, and natural resources; |

| Ÿ | | To a lesser extent, equity long/short strategies. |

The Master Fund employs a dynamic asset allocation process that shifts capital between credit- and non-credit strategies based on the investment subadviser’s, Permal Asset Management LLC (“Permal”), view on the credit markets. The Fund, through its investment in the Master Fund, seeks to produce investment returns that have lower risk than traditional long-only investments and over time produce above-market returns. The combination of various Portfolio Funds that utilize alternative investment strategies, and that are typically less correlated to the market than traditional long-only funds, is expected to produce a portfolio that is less volatile than the general market and less correlated to such market than traditional long-only funds investing in the same market. There is no guarantee this objective will be met.

Permal provides day-to-day portfolio management with respect to the Fund’s and the Master Fund’s assets. Portfolio construction reflects both a top-down and bottom-up approach. The bottom-up process includes idea generation, due diligence and portfolio monitoring with respect to portfolio managers and Portfolio Funds. While portfolio manager selection is primarily a bottom-up approach, Permal establishes a top-down macroeconomic view that forms the basis for setting target allocations for each major strategy and region. The individuals at Permal that have primary responsibility for the day-to-day management of the Master Fund’s portfolio are Javier F. Dyer and Alexander Pillersdorf.

Q. What were the overall market conditions during the Fund’s reporting period?

A. The year ended March 31, 2015 was a good year for traditional asset allocators. Boosted by a picture of U.S. economic stability, large cap stocks (as expressed by the S&P 500 Indexi) posted positive performance in each quarter for a cumulative return of 12.73% for the year. In fixed

| | |

| Permal Hedge Strategies Fund II 2015 Annual Report | | 1 |

Fund overview (cont’d)

income markets, the widely forecasted rise of interest rates never materialized; instead government bonds rallied as European economic woes drove euro zone bond yields to historic lows (even negative nominal yields in some cases), dragging down with them U.S. Treasury yields.

This same period was however a challenging period for other risk assets, including specific industries such as Energy. Unlike large cap U.S. stocks, small cap stocks had a more volatile ride — the Russell 2000 Indexii, for example, was down 7.7% during the quarter ended September 30, 2014 and up 9.4% during the quarter ended December 31, 2014. The BofA Merrill Lynch High Yield Master II Indexiii had negative performance in both the quarters ended September 30, 2014 and December 31, 2014. Oil declined more than 10% in three out of the four quarters, with West Texas Intermediate (“WTI”) falling 14% during the quarter ended September 30, 2014 and 42% during the quarter ended December 31, 2014, and 11% during the quarter ended March 31, 2015.

It was a testing environment for our style of alternative investing. Event Driven was a strategy that met with a number of unforeseen challenges. The year started brightly as corporate activity picked up notably — as noted in last year’s letter, corporations took advantage of cheap financing or large cash balances to drive mergers and acquisitions (“M&A”) activity. In addition, more involvement by shareholder activists and greater willingness by company boards and proxy advisory services firms to listen to their ideas was also a driver behind a pickup in stock buybacks, special dividends, spin-offs, real estate investment trust (“REIT”) conversions, etc. Yet despite such a backdrop, investor risk aversion returned in early August when three multi-billion dollar merger arbitrage deals fell through, namely 21st Century withdrawing its proposal to acquire Time Warner, Sprint calling off its pursuit of T-Mobile U.S., and Walgreen Alliance Boots’ decision to not pursue its planned tax inversion structure, situations that resulted in forced selling. In October, there was further bad news, which included: 1) widely held event driven positions in the securities of mortgage agencies received adverse rulings on the last day of September; 2) event energy names were hurt by the rapid decline in the price of oil; and 3) the break-up of the $55 billion AbbVie-Shire merger which resulted in losses for a number of event driven managers and caused spreads on similar tax-advantaged deals to widen materially. With the post-2008 exit of proprietary trading desks from the event driven space, overall volatility in the sector has increased, as these traders were historically one of the largest natural buyers outside of the hedge fund community when managers were seeking to de-risk their books.

In corporate credit markets, corporate defaults remained at very low levels (according to Fitch, the U.S. high-yield default rate ended 2014 at 2.4%). Besides the $40 billion plus Chapter 11 filing of Energy Future Holdings, formerly known as TXU Corp., there were not that many high profile bankruptcy filings during the year ended March 31, 2015. Yet with U.S. Exploration & Production (“E&P”) and oil service companies largely funding operations through the high yield bond market over recent years, the dramatic fall in oil prices surprisingly did not stress this market. According to JP Morgan High Yield Strategy, energy companies have been the largest

| | |

| 2 | | Permal Hedge Strategies Fund II 2015 Annual Report |

issuers of high yield bonds since 2009. These bonds currently represent roughly 17% of the total U.S. high yield bond market, or approximately $200 billion according to Bloomberg, and almost all of the paper was trading at or near par before the recent decline in oil prices. Currently, the dramatic drop in price has caused approximately 50% of high yield energy names to trade at a yield of 10% or higher. So far, expectations of defaults are low as a meaningful portion of E&P companies have hedged their production via futures contracts, but if oil prices remain depressed, defaults in the industry are likely to increase materially in 2016, when most of the hedging books expire. Finally, liquidity in credit markets continues to be a cause for concern. Broker/dealer bond inventories have fallen almost three quarters from their pre-crisis peak of $235 billion. In contrast, U.S. retail investors have pumped more than $1 trillion into bond funds since early 2009. This has generated a liquidity mismatch, which is more acute in the high yield bond, leveraged loan and emerging market debt sub-segments, with daily liquid products investing 100% of their assets in debt securities where, in the case of leveraged loans, the settlement process can take weeks or even months. Outside of energy defaults, defaults in general may naturally start to pick up as rates normalize and default rates start to increase to their historical average. According to the credit rating agency Moody’s Investors Service, the historic annual default rate on high yield or “junk debt” is 4.5%, twice the current rate.

On the bright side, the market conditions for macro managers improved during the course of the year ended March 31, 2015. This was largely driven by diverging central bank policies, a situation that creates new investment opportunities, and the tailwind behind particular investment themes, such as Japanese reflation (e.g., long Nikkei 225 Indexiv, short Japanese Yen, and short JGBs) as Prime Minister Abe increased the quantitative easing (“QE”) program; as well as short EUR against the USD, based on contrasting recovery speeds and the likelihood of euro zone QE. We expect such themes to continue driving performance in the foreseeable future.

Q. How did we respond to these changing market conditions?

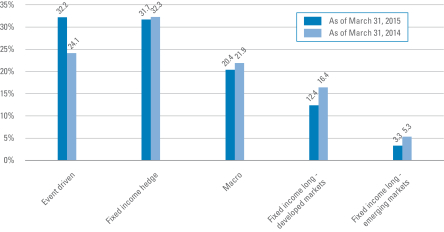

A. To take advantage of the dislocation in the event driven space, the most significant asset allocation shift was to increase the Event Driven allocation from 23% of net assets at March 31, 2014 to 31% as of March 31, 2015. This additional capital was invested in 1) managers who have an expertise in hard catalyst events and 2) managers who in the case of softer catalyst situations are hedging all unwanted market exposures.

Within our credit allocations, we decreased the allocations to Fixed Income — Developed Markets from 16% at March 31, 2014 to 12% as of March 31, 2015 to protect capital in an environment of tight credit spreads and reduced overall liquidity in credit markets. Although high yield defaults are subdued today, there are still certain niche credit markets that we favor. For example, we continue to like the opportunity set in late stage liquidations and litigations, legacy issued structured credit, as well as one off dislocations in credit markets like Puerto Rico, Energy, and the European periphery. For similar reasons (tight credit spreads and impaired liquidity), we decreased the Fixed Income — Emerging Market allocation during the period from 5% to 3%. In contrast to our allocation reductions in the long biased

| | |

| Permal Hedge Strategies Fund II 2015 Annual Report | | 3 |

Fund overview (cont’d)

credit books, we maintained constant exposure to Fixed Income Hedge managers (at 31% of NAV). Credit managers who specialize in long and short credit positions have had more success in recent years as correlations among single name credits have come down post-2012. In particular, short activities, which were challenged by the increased liquidity pumped in by central banks, have become profit centers.

Although the year ended March 31, 2014 was a challenging period for macro managers, we maintained our exposure mostly unchanged (around 20% of NAV) in the year ended March 31, 2015 due to the aforementioned themes and trends we see emerging.

Performance review

For the twelve months ended on March 31, 2015, Broker Shares of Permal Hedge Strategies Fund II, excluding sales charges, returned 0.11%. The Fund’s unmanaged benchmarks, the HFRX Global Hedge Fund Indexv, and the Barclays U.S. Aggregate Bond Indexvi, returned 0.36% and 5.72%, respectively, for the same period.

The Fund operates in a master/feeder structure. The Fund pursues its investment objective by investing substantially all of its investable assets in an investment company, Permal Hedge Strategies Portfolio, which has the same investment objective and strategies as the Fund.

| | | | | | | | |

Performance Snapshot as of March 31, 2015

(unaudited) | |

| (excluding sales charges) | | 6 months | | | 12 months | |

| Permal Hedge Strategies Fund II: | |

Broker Shares | | | 0.02 | % | | | 0.11 | % |

| HFRX Global Hedge Fund Index | | | 0.28 | % | | | 0.36 | % |

| Barclays U.S. Aggregate Bond Index | | | 3.43 | % | | | 5.72 | % |

The performance shown represents past performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown above. Principal value and investment returns will fluctuate and investors’ shares, when redeemed, may be worth more or less than their original cost. Total returns assume the reinvestment of all distributions at net asset value and the deduction of all Fund expenses. Returns have not been adjusted to include the maximum initial sales charge of 3.0% that may apply. If sales charges were reflected, the performance quoted would be lower. Performance figures for periods shorter than one year represent cumulative figures and are not annualized. To obtain performance data current to the most recent month-end, please visit our website at www.permalhsf.com.

Fund performance figures reflect fee waivers and/or expense reimbursements, without which the performance would have been lower.

| | |

| 4 | | Permal Hedge Strategies Fund II 2015 Annual Report |

|

| Total Annual Operating Expenses (unaudited) |

As of the Fund’s current prospectus dated July 30, 2014, the gross total annual operating expense ratio for the Fund’s Broker Shares was 11.88%.

Actual expenses may be higher. For example, expenses may be higher than those shown if average net assets decrease. Net assets are more likely to decrease and Fund expense ratios are more likely to increase when markets are volatile.

The Fund’s manager has agreed to waive fees and/or reimburse the Fund’s expenses (including organization and offering expenses) to the extent necessary to ensure that the Fund’s total annual Fund operating expenses do not exceed 2.65% for Broker Shares (excluding fees and expenses, including incentive or performance allocations and fees, attributable to Portfolio Funds, estimated to be 6.69% as of the Fund’s current prospectus dated July 30, 2014, brokerage, interest expense, taxes and extraordinary expenses). This expense limitation arrangement cannot be terminated prior to December 31, 2016 without the Board of Trustees’ consent.

The manager is permitted to recapture amounts previously waived and/or reimbursed to a class within three years after the year in which the manager earned the fee or incurred the expense if the class’ total annual operating expenses have fallen to a level below the expense limitation (“expense cap”) in effect at the time the fees were earned or the expenses incurred. In no case will the manager recapture any amount that would result, on any particular business of the Fund, in the class’ total annual operating expenses exceeding the expense cap or any other lower limit then in effect.

Q. What were the leading contributors to performance?

A. At the close of the reporting period, the Fund’s leading contributors to year-over-year performance were the allocations to Macro (+181 basis points), Fixed-Income Long — Developed Markets (+84 basis points), and Event Driven (+73 basis points).

The macro allocation benefited from central banks diverging monetary policies. The greatest contributions related to foreign exchange transactions, primarily short EUR/USD and short JPY/USD. Fixed-Income Long — Developed Markets benefited from their allocations to U.S. distressed debt, including positions in late-stage bankruptcies, non-agency Residential Mortgage-Backed Securities (“RMBS”), and post reorganization equities. Finally, Event Driven benefitted from the increased amount of deal activity, especially M&A in the healthcare space.

Q. What were the leading detractors from performance?

A. At the close of the reporting period, the Fund’s leading detractors were the allocations to Fixed Income-Hedge (-76 basis points) and Fixed-Income Long — Emerging Markets (-12 basis points). Fixed Income-Hedge managers benefitted from correlations coming down in the credit space, but lost money related to various litigation opportunities; the most noteworthy loss was tied to the adverse court ruling relating to Government Sponsored Entities (“GSEs”), namely Fannie Mae and Freddie Mac. Fixed Income Long — Emerging Markets losses related to negative events in Argentina, Greece, and Venezuela.

| | |

| Permal Hedge Strategies Fund II 2015 Annual Report | | 5 |

Fund overview (cont’d)

Thank you for your investment in Permal Hedge Strategies Fund II. As always, we appreciate that you have chosen us to manage your assets and we remain focused on achieving the Fund’s investment goals.

Sincerely,

Javier F. Dyer

Deputy Chief Investment Officer and Portfolio Manager

Permal Asset Management LLC

Alexander Pillersdorf

Portfolio Manager

Permal Asset Management LLC

April 14, 2015

RISKS: An investment in the Fund is illiquid and should be considered speculative. An investment in the Fund entails unique risks because the investment funds or “underlying funds” in which the Fund invests through its investment in Permal Hedge Strategies Portfolio (the “Master Fund”) are private entities with limited regulatory oversight and disclosure obligations. All investments are subject to risk, including the possible loss of principal. The Fund is a non-diversified closed-end management investment company with a limited history of operations. As a non-diversified investment company, the Fund may be subject to greater risk and volatility than if the Fund’s portfolio were invested in securities of a broader range of issuers. In addition to the Fund’s operating expenses, you will indirectly bear the operating expenses of the underlying funds in which the Master Fund invests, which can be substantially higher than fees associated with mutual funds. The Fund, through its investment in the Master Fund, invests in unregistered hedge funds which are highly speculative investments that employ aggressive investment strategies and carry substantial risk. Investments in hedge funds are generally illiquid, difficult to value and may carry significant transfer restrictions. Some of the underlying funds employ leverage, which increases the volatility of investment return and subjects the Fund to magnified losses if an investment of an underlying fund declines in value. The Fund, the Master Fund and some of the underlying funds may use derivatives, such as options and futures, which can be illiquid, may disproportionately increase losses, and may have a potentially large impact on Fund performance. Some of the underlying funds may employ short selling, a speculative strategy. Unlike the possible loss on a security that is purchased, there is no limit on the amount of loss on an appreciating security that is sold short. The Master Fund and each underlying fund may engage in active and frequent trading, resulting in higher portfolio turnover and transaction costs. There is no assurance that these and other strategies used by the Master Fund or underlying funds will be successful. Equity securities are subject to price fluctuation. International investments are subject to special risks including currency fluctuations, social, economic and political uncertainties, which could increase volatility.

| | |

| 6 | | Permal Hedge Strategies Fund II 2015 Annual Report |

These risks are magnified in emerging markets. Small and mid-cap stocks involve greater risks and volatility than large-cap stocks. Fixed income securities involve interest rate, credit, inflation, and reinvestment risks. As interest rates rise, the value of fixed income securities falls. High-yield bonds possess greater price volatility, illiquidity, and possibility of default. Because the Fund, through its investment in the Master Fund, invests in underlying funds, the managers may not be able to shift allocations in time to capture an immediate or sudden spike in the market. Diversification does not guarantee a

profit or protect against a loss. Please see the Fund’s prospectus for a more complete discussion of these and other risks, investor requirements, and the Fund’s investment strategies.

All investments are subject to risk including the possible loss of principal. Past performance is no guarantee of future results. All index performance reflects no deduction for fees, expenses or taxes. Please note that an investor cannot invest directly in an index.

The information provided is not intended to be a forecast of future events, a guarantee of future results or investment advice. Views expressed may differ from those of the firm as a whole.

| i | The S&P 500 Index is an unmanaged index of 500 stocks and is generally representative of the performance of larger companies in the U.S. |

| ii | The Russell 2000 Index measures the performance of the small-cap segment of the U.S. equity universe. The Russell 2000 is a subset of the Russell 3000 Index representing approximately 10% of the total market capitalization of that index. It includes approximately 2,000 of the smallest securities based on a combination of their market cap and current index membership. The Russell 3000 Index measures the performance of the 3,000 largest U.S. companies based on total market capitalization, which represents approximately 98% of the U.S. equity market. |

| iii | The BofA Merrill Lynch U.S. High Yield Master II Index tracks the performance of below investment grade, but not in default, U.S. dollar-denominated corporate bonds publicly issued in the U.S. domestic market, and includes issues with a credit rating of BBB or below, as rated by Moody’s and S&P. |

| iv | The NIKKEI 225 Index is a price-weighted average of 225 top-rated Japanese companies listed in the First Section of the Tokyo Stock Exchange. |

| v | The HFRX Global Hedge Fund Index is designed to be representative of the overall composition of the hedge fund universe. It is comprised of all eligible hedge fund strategies; including but not limited to convertible arbitrage, distressed securities, equity hedge, equity market neutral, event-driven, macro, merger arbitrage, and relative value arbitrage. The strategies are asset weighted based on the distribution of assets in the hedge fund industry. |

| vi | The Barclays U.S. Aggregate Bond Index is a broad-based bond index comprised of government, corporate, mortgage- and asset-backed issues, rated investment grade or higher, and having at least one year to maturity. |

| | |

| Permal Hedge Strategies Fund II 2015 Annual Report | | 7 |

Portfolio at a glance† (unaudited)

Permal Hedge Strategies Portfolio

The Fund invests substantially all of its investable assets in Permal Hedge Strategies Portfolio, the investment breakdown of which is shown below.

Investment breakdown (%) as a percent of total investments

| † | The bar graph above represents the composition of the Portfolio’s investments as of March 31, 2015 and March 31, 2014. The Portfolio is actively managed. As a result, the composition of the Portfolio’s investments is subject to change at any time. |

| | |

| 8 | | Permal Hedge Strategies Fund II 2015 Annual Report |

Statement of assets and liabilities

March 31, 2015

| | | | |

| |

| Assets | | | | |

Investment in Permal Hedge Strategies Portfolio, at value | | $ | 38,076,438 | |

Cash | | | 244,562 | |

Investments in Permal Hedge Strategies Portfolio paid in advance | | | 311,000 | |

Receivable for reimbursement from adviser | | | 32,068 | |

Prepaid expenses | | | 405 | |

Total Assets | | | 38,664,473 | |

| |

| Liabilities | | | | |

Contributions received in advance | | | 391,000 | |

Capital withdrawals payable | | | 81,074 | |

Professional fees payable | | | 61,701 | |

Service and/or distribution fees payable | | | 25,435 | |

Trustees’ fees payable | | | 423 | |

Accrued expenses | | | 26,557 | |

Total Liabilities | | | 586,190 | |

| Total Net Assets | | $ | 38,078,283 | |

| |

| Net Assets | | | | |

Paid-in capital (Note 3) | | $ | 37,637,641 | |

Overdistributed net investment income | | | (432,754) | |

Accumulated net realized loss on investments allocated from Permal Hedge Strategies Portfolio | | | (999,956) | |

Net unrealized appreciation on investments allocated from Permal Hedge Strategies Portfolio | | | 1,873,352 | |

| Total Net Assets | | $ | 38,078,283 | |

| |

| Shares Outstanding: | | | | |

Broker Shares | | | 3,665,546 | |

| |

| Net Asset Value: | | | | |

Broker Shares | | | $10.39 | |

See Notes to Financial Statements.

| | |

| Permal Hedge Strategies Fund II 2015 Annual Report | | 9 |

Statement of operations

For the Year Ended March 31, 2015

| | | | |

| |

| Investment Income | | | | |

Income from Permal Hedge Strategies Portfolio | | $ | 27,892 | |

Allocated expenses from Permal Hedge Strategies Portfolio | | | (649,324) | |

Allocated waiver from Permal Hedge Strategies Portfolio | | | 86,895 | |

Total Investment Loss | | | (534,537) | |

| |

| Fund Expenses | | | | |

Service and/or distribution fees (Note 2) | | | 244,138 | |

Professional fees | | | 198,509 | |

Offering expenses (Note 1) | | | 65,947 | |

Printing expenses | | | 55,951 | |

Administration fees | | | 40,408 | |

Registration fees | | | 24,047 | |

Trustees’ fees | | | 9,985 | |

Custodian fees | | | 5,038 | |

Miscellaneous expenses | | | 6,174 | |

Total Operating Expenses | | | 650,197 | |

Less: Fee waivers and /or expense reimbursements (Note 2) | | | (404,455) | |

Net Expenses | | | 245,742 | |

| Net Investment Loss | | | (780,279) | |

| Net Realized Gain on Investments from Permal Hedge Strategies Portfolio | | | 153,224 | |

| Net Change in Unrealized Appreciation from Investments in Permal Hedge Strategies Portfolio | | | 682,885 | |

| Net Increase in Net Assets Resulting from Operations | | $ | 55,830 | |

See Notes to Financial Statements.

| | |

| 10 | | Permal Hedge Strategies Fund II 2015 Annual Report |

Statements of changes in net assets

| | | | | | | | |

| For the Years Ended March 31, | | 2015 | | | 2014† | |

| | |

| Net Increase (Decrease) in Net Assets: | | | | | | | | |

| Operations: | | | | | | | | |

Net investment loss | | | $(780,279) | | | $ | (309,689) | |

Net realized gain | | | 153,224 | | | | 103,479 | |

Net change in unrealized appreciation | | | 682,885 | | | | 1,190,467 | |

Net Increase in Net Assets Resulting from Operations | | | 55,830 | | | | 984,257 | |

| | |

| Distributions to Shareholders From (Notes 1 and 4): | | | | | | | | |

Net investment income | | | (150,017) | | | | (175,000) | |

Net realized gains | | | (350,000) | | | | — | |

Net Decrease in Net Assets from Distributions to Shareholders | | | (500,017) | | | | (175,000) | |

| | |

| Fund Share Transactions (Note 3): | | | | | | | | |

In-kind capital contribution | | | — | | | | 13,281,935 | |

Net proceeds from issuance of shares | | | 19,174,638 | | | | 4,687,335 | |

Reinvestment of distributions | | | 480,182 | | | | 173,875 | |

Value of withdrawals | | | (84,752) | | | | — | |

Net Increase in Net Assets from Fund Share Transactions | | | 19,570,068 | | | | 18,143,145 | |

Increase in Net Assets | | | 19,125,881 | | | | 18,952,402 | |

| | |

| Net Assets | | | | | | | | |

Beginning of year | | | 18,952,402 | | | | — | |

End of year* | | | $38,078,283 | | | $ | 18,952,402 | |

*Includes overdistributed net investment income of: | | | $(432,754) | | | | $(442,262) | |

| † | For the period June 28, 2013 (commencement of operations) to March 31, 2014. |

See Notes to Financial Statements.

| | |

| Permal Hedge Strategies Fund II 2015 Annual Report | | 11 |

Statement of cash flows

For the Year Ended March 31, 2015

| | | | |

| |

| Cash Used in Operating Activities | | | | |

Net increase in net assets resulting from operations | | $ | 55,830 | |

Adjustments to reconcile net increase in net assets resulting from operations to net cash used in operating activities | | | | |

Purchases of investment in Permal Hedge Strategies Fund | | | (18,944,410) | |

Net realized gain on investments from Permal Hedge Strategies Portfolio | | | (153,224) | |

Net change in unrealized appreciation from investments in Permal Hedge Strategies Portfolio | | | (682,885) | |

Net investment loss allocated from Permal Hedge Strategies Portfolio | | | 534,537 | |

Decrease in investments in Permal Hedge Strategies Portfolio paid in advance | | | 1,244,500 | |

Decrease in receivable for reimbursement from adviser | | | 19,771 | |

Increase in prepaid expenses | | | (405) | |

Decrease in deferred offering expenses | | | 65,947 | |

Increase in service fees and/or distribution fees payable | | | 12,826 | |

Increase in trustees’ fees payable | | | 239 | |

Decrease in professional fees payable | | | (18) | |

Decrease in accrued expenses | | | (12,983) | |

Net Cash Used in Operating Activities | | | (17,860,275) | |

| |

| Cash Provided by Financing Activities | | | | |

Proceeds from issuance of shares | | | 18,010,138 | |

Value of withdrawals | | | (3,678) | |

Distributions paid | | | (19,835) | |

Net Cash Provided by Financing Activities | | | 17,986,625 | |

| |

| Cash | | | | |

Net increase in cash | | | 126,350 | |

Cash at beginning of year | | | 118,212 | |

Cash at end of year | | $ | 244,562 | |

| |

| Supplemental Non-Cash Information | | | | |

Reinvestment of distributions | | $ | 480,182 | |

See Notes to Financial Statements.

| | |

| 12 | | Permal Hedge Strategies Fund II 2015 Annual Report |

Financial highlights

| | | | | | | | |

| For a share of beneficial interest outstanding throughout each year ended March 31, unless otherwise noted: | |

| Broker Shares | | 2015 | | | 20141 | |

| | |

| Net asset value per share, beginning of year: | | | $10.53 | | | | $10.00 | |

| | |

| Income (loss) from investment operations:2 | | | | | | | | |

Net investment loss | | | (0.26) | | | | (0.21) | |

Net realized and unrealized gain | | | 0.27 | | | | 0.85 | |

Total income from investment operations | | | 0.01 | | | | 0.64 | |

| | |

| Less distributions from: | | | | | | | | |

Net investment income/(loss) | | | (0.05) | | | | (0.11) | |

Net realized gains | | | (0.10) | | | | — | |

Total distributions | | | (0.15) | | | | (0.11) | |

| | |

| Net asset value per share, end of year: | | | $10.39 | | | | $10.53 | |

Total return3 | | | 0.11 | % | | | 6.45 | % |

| | |

| Net assets, end of year (000s) | | | $38,078 | | | | $18,952 | |

| | |

| Ratios to average net assets: | | | | | | | | |

Gross expenses5,6 | | | 4.26 | % | | | 7.17 | %4 |

Net expenses5,6,7,8 | | | 2.65 | % | | | 2.65 | %4 |

Net investment loss | | | (2.56) | % | | | (2.60) | %4 |

| | |

| Portfolio turnover9 | | | 5 | % | | | 5 | % |

The above ratios may vary for individual investors based on the timing of Fund share transactions during the period.

| 1 | For the period June 28, 2013 (commencement of operations) to March 31, 2014. |

| 2 | Per share data for income (loss) from investment operations is computed using the net income (loss) for the period divided by the average monthly shares. |

| 3 | Performance figures, exclusive of sales charges, may reflect fee waivers and/or expense reimbursements. In the absence of fee waivers and/or expense reimbursements, the total return would have been lower. Past performance is no guaranteed of future results. The total returns for periods less than one year have not been annualized. |

| 5 | Does not include expenses of the Portfolio Funds in which Permal Hedge Strategies Portfolio invests. |

| 6 | Includes the Fund’s share of Permal Hedge Strategies Portfolio’s allocated expenses. |

| 7 | As a result of an expense limitation arrangement, the ratio of expenses (excluding fees and expenses, including incentive or performance allocations and fees, attributable to Portfolio Funds, brokerage, interest expense, taxes and extraordinary expenses) to average net assets of Broker Shares did not exceed 2.65%. This expense limitation arrangement cannot be terminated prior to December 31, 2016 without the Board of Trustees’ consent. |

| 8 | Reflects fee waivers and/or expense reimbursements. |

| 9 | Represents the portfolio turnover rate of Permal Hedge Strategies Portfolio. |

See Notes to Financial Statements.

| | |

| Permal Hedge Strategies Fund II 2015 Annual Report | | 13 |

Notes to financial statements

1. Organization and significant accounting policies

Permal Hedge Strategies Fund II (the “Fund”) is a Maryland statutory trust registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as a non-diversified, closed-end management investment company. The Fund is a “feeder” fund in a “master feeder” structure and invests substantially all of its assets in Permal Hedge Strategies Portfolio, a Maryland statutory trust (the “Master Fund”). The Master Fund employs a “fund-of hedge funds” investment program that provides a means for the Fund to participate in investments in private investment vehicles, typically referred to as hedge funds (“Portfolio Funds”), by providing a single portfolio of interests in underlying Portfolio Funds, which are managed by a number of third-party investment managers (the “Portfolio Managers”). On June 27, 2013, Permal Hedge Strategies Fund I, an affiliated feeder fund that also invests substantially all of its assets in the Master Fund, declared a special distribution in the aggregate amount of approximately 59% of its interest in the Master Fund, a substantial portion of which was subsequently invested in the Fund. The financial statements of the Master Fund, including its schedule of investments and notes to financial statements, are an integral part of these financial statements and should be read in conjunction with these financial statements. The Fund offers one class of shares (the “Shares” or the “Broker Shares”).

The Fund has substantially the same investment objective and strategies as the Master Fund. The Fund’s investment objective is to seek long-term capital appreciation while attempting to reduce risk and volatility. In seeking to achieve its objective, the Fund, through its investment in the Master Fund, will provide its shareholders with access, through investments in the Portfolio Funds to a broad range of investment strategies which may include, but are not limited to, global fixed income strategies (e.g., U.S. and non-U.S. fixed income hedge, convertible arbitrage, fixed income arbitrage, asset-backed securities, long-only, high yield, emerging markets debt), global event-driven strategies (e.g., risk arbitrage, distressed debt, special situations, activists) and global macro strategies (e.g., discretionary, systematic, natural resources) and, to a lesser extent, equity long/short strategies.

The following are significant accounting policies consistently followed by the Fund and are in conformity with U.S. generally accepted accounting principles (“U.S. GAAP”). Estimates and assumptions are required to be made regarding assets, liabilities and changes in net assets resulting from operations when financial statements are prepared. Changes in the economic environment, financial markets and any other parameters used in determining these estimates could cause actual results to differ.

(a) Investment valuation. The Fund records its investment in the Master Fund at value. The value of such investment in the Master Fund reflects the Fund’s proportionate interest (65% at March 31, 2015) in the net assets of the Master Fund. The performance of the Fund is directly affected by the performance of the Master Fund. Valuation of the investments held by the Master Fund is discussed in the notes to the Master Fund’s financial statements, which are attached to this report.

| | |

| 14 | | Permal Hedge Strategies Fund II 2015 Annual Report |

(b) Net asset value determination. The net asset value of the Fund is determined as of the close of business at the end of each month in accordance with the valuation principles set forth in Note 1(a) of the Master Fund’s Notes to Financial Statements, which are included elsewhere in this report or as may be determined from time to time pursuant to policies established by the Board of Trustees (the “Board”). The net asset value of the Fund will equal the value of the Fund’s total assets including its investment in the Master Fund, less all of its liabilities, including accrued fees and expenses. The net asset value per share of each class will equal the net asset value of the class divided by the number of outstanding shares for each class.

(c) Cash. The cash at March 31, 2015 consists of deposit accounts with The Bank of New York Mellon. Such cash, at times, may exceed U.S. federally insured limits. The Fund has not experienced any losses in such accounts and does not believe it is exposed to any significant credit risk on such bank deposits.

(d) Investment transactions and investment income. Purchases and sales of interest in the Master Fund are recorded on a trade-date basis and related revenues and expenses are recorded on an accrual basis. The Fund adopted the tax allocation rules provided for in Section 704(b) of the Internal Revenue Code. Accordingly, its proportionate share of the Master Fund’s income, expenses, realized and unrealized gains and losses are allocated monthly using the aggregate method. In addition, the Fund records its own investment income and operating expenses on an accrual basis.

(e) Distributions to shareholders. Distributions from net investment income and distributions of net realized gains, if any, are declared at least annually. Distributions to shareholders of the Fund are recorded on the ex-dividend date and are determined in accordance with income tax regulations, which may differ from U.S. GAAP.

(f) Compensating balance arrangements. The Fund has an arrangement with its custodian bank whereby a portion of the custodian’s fees is paid indirectly by credits earned on the Fund’s cash on deposit with the bank.

(g) U.S. federal and other taxes. It is the Fund’s policy to comply with the federal income and excise tax requirements of the Internal Revenue Code of 1986 (the “Code”), as amended, applicable to regulated investment companies. Accordingly, the Fund intends to distribute its taxable income and net realized gains, if any, to shareholders in accordance with timing requirements imposed by the Code. Therefore, no U.S. federal or state income tax provision is required in the Fund’s financial statements.

Management has analyzed the Fund’s tax positions taken on income tax returns for all open tax years and has concluded that as of March 31, 2015, no provision for income tax is required in the Fund’s financial statements. The Fund’s federal and state income and federal excise tax returns for tax years for which the applicable statues of limitations have not expired are subject to examination by Internal Revenue Service and state departments of revenue.

(h) Offering costs. Costs incurred by the Fund in connection with commencement of the Fund’s operations are being amortized on a straight line basis over twelve months.

| | |

| Permal Hedge Strategies Fund II 2015 Annual Report | | 15 |

Notes to financial statements (cont’d)

(i) Reclassification. U.S. GAAP requires that certain components of net assets be reclassified to reflect permanent differences between financial and tax reporting. These reclassifications have no effect on net assets or net asset values per share. During the current year, the following reclassifications have been made:

| | | | | | | | | | | | |

| | | Overdistributed Net

Investment Income | | | Accumulated Net

Realized Loss | | | Paid-in

Capital | |

| (a) | | $ | 33,145 | | | | — | | | $ | (33,145) | |

| (b) | | | 906,659 | | | $ | (906,659) | | | | — | |

| (a) | Reclassifications are due to the book/tax differences in the treatment of non-deductible offering costs. |

| (b) | Reclassifications are due to book/tax differences in the treatment of passive foreign investment companies and partnership investments held by Permal Hedge Strategies Portfolio. |

2. Investment management agreement and other transactions with affiliates

Legg Mason Partners Fund Advisor, LLC (“LMPFA”) serves as investment manager (the “Manager”) and is responsible for the day-to-day operations of the Fund and the Master Fund. Permal Asset Management LLC (“Permal”) is the Fund’s and the Master Fund’s sub-adviser (the “sub-adviser”) and is a member of the Permal Group, owned indirectly by Permal Group Ltd., a holding company of an international financial group of companies. LMPFA delegates to Permal the day to day portfolio management of the Fund and the Master Fund. LMPFA is a wholly-owned subsidiary of Legg Mason Inc. (“Legg Mason”). Permal Group Ltd. is a subsidiary of Legg Mason.

Under the investment management agreement between the Master Fund and LMPFA, the Master Fund pays an investment management fee, calculated and paid monthly, at an annual rate of 1.10% of the Master Fund’s average monthly managed assets. “Managed assets” means net assets plus the principal amount of any borrowings and assets attributable to any preferred shares that may be outstanding.

The management fee and related terms of the Fund’s investment management agreement with LMPFA are substantially the same as the terms of the Master Fund’s investment management agreement with LMPFA. Since the Fund invests all or substantially all of its assets in the Master Fund, the investment management fee of the Fund will be reduced by the investment management fee allocated to the Fund by the Master Fund.

LMPFA has agreed to waive fees and/or reimburse expenses (including organization and offering expenses) to the extent necessary to ensure that the total annual Fund operating expenses attributable to the Broker Shares will not exceed 2.65% (excluding fees and expenses, including incentive or performance allocations and fees, attributable to Portfolio Funds, brokerage, interest expense, taxes and extraordinary expenses). These expense limitation arrangements cannot be terminated prior to December 31, 2016 without the Board’s consent.

The Master Fund will bear its own similar fees and expenses, including the management fee. It also pays fees and expenses incidental to the purchase, holding and sale of interests in, and bears a pro rata share of the fees, including, but not limited to, any commitment

| | |

| 16 | | Permal Hedge Strategies Fund II 2015 Annual Report |

fees, and expenses of, any Portfolio Fund and recurring investment-related expenses, including, but not limited to, the management fee, brokerage commissions, dealer mark-ups, and other transactions costs on cash management; interest expense on any borrowings; and any subscription or redemption charges imposed by the Portfolio Funds. These expenses are indirectly borne, on a pro rata basis, by the Fund.

During the year ended March 31, 2015, fees waived and/or expenses reimbursed by LMPFA for the Fund amounted to $404,455.

LMPFA is also permitted to recapture amounts waived or reimbursed within three years after the year in which LMPFA earned the fee or incurred the expense if the Fund’s total annual Fund operating expenses have fallen to a level below the limit described above. In no case will LMPFA recapture any amount that would result in the Fund’s total annual Fund operating expenses exceeding the limit described above.

Pursuant to these agreements, at March 31, 2015, the Fund had remaining fee waivers and/or expense reimbursements subject to recapture by LMPFA and respective dates of expiration as follows:

| | | | |

| Expires March 31, 2017 | | $ | 412,433 | |

| Expires March 31, 2018 | | | 404,455 | |

| Total fee waivers/expense reimbursements subject to recapture | | $ | 816,888 | |

Legg Mason Investor Services, LLC (“LMIS”), a wholly-owned broker dealer subsidiary of Legg Mason, serves as principal underwriter and distributor of the Fund. The Fund pays LMIS a shareholder services fee of 0.25% of the Fund’s average monthly net assets attributable to Broker Shares and a distribution fee of 0.55% of the Fund’s average monthly net assets attributable to Broker Shares, each on an annualized basis.

There is a maximum initial sales charge of 3.00% of the amount invested in Broker Shares. For the year ended March 31, 2015, LMIS and affiliates did not receive any sales charges on sales of the Fund’s Broker Shares.

All officers and one Trustee of the Fund are employees of Legg Mason or its affiliates and do not receive compensation from the Fund.

3. Shares of beneficial interest

Shares in the Fund (“shares”) are sold to eligible investors (“shareholders”) who meet the definition of an accredited investor as defined in Regulation D under the Securities Act of 1933. The minimum initial investment in the Broker Shares from each shareholder is $25,000; the minimum additional investment is $10,000. Dealers may impose different investment minimums.

At March 31, 2015, the Fund had an unlimited number of shares of beneficial interest authorized with a par value of $0.00001 per share. The Fund intends to accept initial and additional purchases of shares as of the first business day of each calendar month. The Fund reserves the right to reject, in whole or in part, any purchase of shares and may

| | |

| Permal Hedge Strategies Fund II 2015 Annual Report | | 17 |

Notes to financial statements (cont’d)

suspend the offering of shares at any time and from time to time. The Fund may from time to time repurchase shares from shareholders at the net asset value per share pursuant to written tenders by shareholders, and on those terms and conditions as the Board may determine in its sole discretion. The Fund anticipates that each such repurchase offer will generally be limited to between 5% and 25% of the net assets of the Fund. In determining whether the Fund should offer to repurchase shares from shareholders, the Board will consider the recommendation of LMPFA, in consultation with Permal. LMPFA, in consultation with Permal, expects that generally it will recommend the Board repurchase shares from shareholders quarterly, with such repurchases based on fund valuations as of each March 31, June 30, September 30 and December 31 (or, if any such date is not a business day, with such repurchases to occur as of the immediately preceding business day).

Transactions in shares of the Fund were as follows:

| | | | | | | | | | | | | | | | |

| | | Year Ended

March 31, 2015 | | | Year Ended

March 31, 2014† | |

| | | Shares | | | Amount | | | Shares | | | Amount | |

| Broker Shares | | | | | | | | | | | | | | | | |

| In-kind capital contribution | | | — | | | | — | | | | 1,328,202 | | | $ | 13,281,935 | |

| Shares issued | | | 1,827,422 | | | $ | 19,174,638 | | | | 454,214 | | | | 4,687,335 | |

| Shares issued on reinvestment | | | 47,169 | | | | 480,182 | | | | 16,703 | | | | 173,875 | |

| Value of withdrawals | | | (8,164) | | | | (84,752) | | | | — | | | | — | |

| Net increase | | | 1,866,427 | | | $ | 19,570,068 | | | | 1,799,119 | | | $ | 18,143,145 | |

| † | For the period June 28, 2013 (commencement of operations) to March 31, 2014. |

4. Income tax information and distributions to shareholders

The tax character of distributions paid during the fiscal years ended March 31, was as follows:

| | | | | | | | |

| | | 2015 | | | 2014 | |

| Distributions paid from: | | | | | | | | |

| Ordinary income | | $ | 150,017 | | | $ | 175,000 | |

| Net long-term capital gains | | | 350,000 | | | | — | |

| Total distributions paid | | $ | 500,017 | | | $ | 175,000 | |

As of March 31, 2015, the components of accumulated earnings on a tax basis were as follows:

| | | | |

| Undistributed ordinary income — net | | $ | 617,939 | |

| Undistributed long-term capital gains — net | | | 962,013 | |

| Total undistributed earnings | | $ | 1,579,952 | |

| Other book/tax temporary differences(a) | | | (96,173) | |

| Unrealized appreciation (depreciation)(b) | | | (1,043,137) | |

| Total accumulated earnings (losses) — net | | $ | 440,642 | |

| (a) | Other book/tax temporary differences are attributable to book/tax differences in the timing of the deductibility of various expenses. |

| | |

| 18 | | Permal Hedge Strategies Fund II 2015 Annual Report |

| (b) | The difference between book-basis and tax-basis unrealized appreciation (depreciation) is attributable to the differences between the book and tax cost basis of investments in passive foreign investment companies that are marked to market for tax purposes and book/tax differences in the income and realized gains allocated from Permal Hedge Strategies Portfolio. |

5. Subsequent events

On March 26, 2015, the Fund commenced an offer to purchase (the “Offer”) up to 25% of the Fund’s outstanding Broker Shares at a price equal to the Broker Shares’ net asset value effective as of June 30, 2015. As of April 24, 2015, the expiration date of the Offer, there were 39,500 Broker Shares tendered.

Management has evaluated the impact of all subsequent events on the Fund through the date financial statements were issued and has determined that there were no additional subsequent events requiring recognition or disclosure in the financial statements.

| | |

| Permal Hedge Strategies Fund II 2015 Annual Report | | 19 |

Report of independent registered public accounting firm

The Board of Trustees and Shareholders

Permal Hedge Strategies Fund II:

We have audited the accompanying statement of assets and liabilities of Permal Hedge Strategies Fund II (the “Fund”) as of March 31, 2015, and the related statements of operations and cash flows for the year then ended, and the statements of changes in net assets and the financial highlights for the year then ended and for the period from June 28, 2013 (commencement of operations) to March 31, 2014. These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included verification of investments owned as of March 31, 2015 by examination of the underlying Permal Hedge Strategies Portfolio. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of Permal Hedge Strategies Fund II as of March 31, 2015, the results of its operations and cash flows for the year then ended, and the changes in its net assets and the financial highlights for the year then ended and for the period from June 28, 2013 (commencement of operations) to March 31, 2014, in conformity with U.S. generally accepted accounting principles.

New York, New York

May 26, 2015

| | |

| 20 | | Permal Hedge Strategies Fund II 2015 Annual Report |

Board approval of management and sub-advisory agreements (unaudited)

Background

The Investment Company Act of 1940, as amended (the “1940 Act”), requires that the Board of Directors (the “Feeder Fund Board”) of Permal Hedge Strategies Fund II (the “Feeder Fund”), including a majority of its members who are not considered to be “interested persons” under the 1940 Act (the “Independent Directors”) voting separately, approve on an annual basis the continuation of the investment management contract (the “Feeder Fund Management Agreement”) with the Feeder Fund’s manager, Legg Mason Partners Fund Advisor, LLC (the “Manager”), and the sub-advisory agreement (the “Feeder Fund Sub-Advisory Agreement”) with the Manager’s affiliate, Permal Asset Management, LLC (the “Sub-Adviser”). At a meeting (the “Contract Renewal Meeting”) held in-person on November 12 and 13, 2014, the Feeder Fund Board, including the Independent Directors, considered and approved the continuation of each of the Feeder Fund Management Agreement and the Feeder Fund Sub-Advisory Agreement for an additional one-year term. The Feeder Fund is a “feeder fund” in a master-feeder structure and as such intends to invest all or substantially all of its assets in the Permal Hedge Strategies Portfolio (the “Master Fund,” and together with the Feeder Fund, the “Funds”). The Master Fund employs a “fund of hedge funds” investment strategy pursuant to which the Master Fund invests primarily in underlying private investment vehicles (“Portfolio Funds”), typically referred to as “hedge funds.” At the Contract Renewal Meeting, the Board of Directors of the Master Fund (the “Master Fund Board,” and together with the Feeder Fund Board, the “Boards”) also considered and approved the continuation of the management agreement between the Master Fund and the Manager (the “Master Fund Management Agreement,” and together with the Feeder Fund Management Agreement, the “Management Agreements”) and the sub-advisory agreement (the “Master Fund Sub-Advisory Agreement,” and together with the Feeder Fund Sub-Advisory Agreement,” the “Sub-Advisory Agreements”) between the Manager and the Sub-Adviser for an additional one-year term. The memberships of the Feeder Fund Board and the Master Fund Board are identical. To assist in their respective consideration of the renewals of the Management Agreements and the Sub-Advisory Agreements, the Boards received and considered a variety of information (together with the information provided at the Contract Renewal Meeting, the “Contract Renewal Information”) about the Manager and the Sub-Adviser, as well as the management and sub-advisory arrangements for the Funds and other funds in the same complex under the Boards’ supervision (collectively, the “Legg Mason Funds”), certain portions of which are discussed below. Presentations made to the Boards by the Manager and the Sub-Adviser at the Contract Renewal Meeting in connection with their respective evaluations of the Management Agreements and the Sub-Advisory Agreements encompassed the Funds and the other Legg Mason Funds. In addition to the Contract Renewal Information, the Boards received performance and other information throughout the year related to the respective services rendered by the Manager and the Sub-Adviser to the Funds. Each Board’s evaluation took into account the information received throughout the year and also reflected the knowledge and familiarity gained as members of such Board and other Legg Mason Funds with respect to the services provided to the Funds by the Manager and the Sub-Adviser.

| | |

| Permal Hedge Strategies Fund II | | 21 |

Board approval of management and sub-advisory agreements (unaudited) (cont’d)

The Manager provides the Feeder Fund with investment advisory and administrative services pursuant to the Feeder Fund Management Agreement and the Sub-Adviser provides the Feeder Fund with certain investment sub-advisory and other services pursuant to the Feeder Fund Sub-Advisory Agreement. The Manager provides the Master Fund with investment advisory and administrative services pursuant to the Master Fund Management Agreement and the Sub-Adviser provides the Master Fund with certain investment sub-advisory and other services pursuant to the Master Fund Sub-Advisory Agreement. The discussion below covers both the advisory and administrative functions being rendered by the Manager to each of the Funds, each such function being encompassed by the Feeder Fund Management Agreement, in the case of the Feeder Fund, and by the Master Fund Management Agreement, in the case of the Master Fund, and the investment sub-advisory functions being rendered by the Sub-Adviser.

Board approval of feeder fund management agreement and feeder fund sub-advisory agreement

In its deliberations regarding renewal of the Feeder Fund Management Agreement and the Feeder Fund Sub-Advisory Agreement, the Feeder Fund Board, including the Independent Directors, considered the factors below.

Nature, extent and quality of the services under the management agreements and sub-advisory agreements

The Feeder Fund Board received and considered Contract Renewal Information regarding the nature, extent and quality of services provided to the Funds by the Manager under the respective Management Agreements and by the Sub-Adviser under the respective Sub-Advisory Agreements. The Feeder Fund Board also reviewed Contract Renewal Information regarding the Funds’ compliance policies and procedures established pursuant to the 1940 Act and reviewed the compliance programs and capabilities of the Manager and the Sub-Adviser with the Chief Compliance Officer of each of the Funds.

The Feeder Fund Board considered the qualifications, backgrounds and responsibilities of the senior personnel and the portfolio management team primarily responsible for the day-to-day portfolio management of the Funds. The Feeder Fund Board also considered, based on its knowledge of the Manager and its affiliates, the Contract Renewal Information and the Feeder Fund Board’s discussions with the Manager and the Sub-Adviser at the Contract Renewal Meeting, the general reputation and investment performance records of the Manager, the Sub-Adviser, and their affiliates and the financial resources available to the corporate parent of the Manager and the Sub-Adviser, Legg Mason, Inc. (“Legg Mason”), to support their activities in respect of the Funds and the other Legg Mason Funds.

The Feeder Fund Board considered the responsibilities of the Manager and the Sub-Adviser under the Management Agreements and the Sub-Advisory Agreements, respectively, including the Manager’s coordination and oversight of the services provided to the Funds by the Sub-Adviser and others. Each of the Management Agreements permits the Manager to

| | |

| 22 | | Permal Hedge Strategies Fund II |

delegate certain of its responsibilities thereunder, including its investment advisory duties, provided that the Manager, in each case, will supervise the activities of the delegee. Pursuant to this provision in each of the Management Agreements, the Manager does not provide day-to-day portfolio management services to the Feeder Fund or the Master Fund. Rather, management of the assets of the Feeder Fund and the Master Fund assets is provided by the Sub-Adviser pursuant to the Feeder Fund Sub-Advisory Agreement and the Master Fund Sub-Advisory Agreement, respectively. As noted above, the Feeder Fund, as a feeder fund in a master-feeder structure invests substantially all of its assets in the Master Fund and the Feeder Fund’s performance therefore is substantially dependent upon the performance of the Master Fund.

In reaching its determinations regarding continuation of the Feeder Fund Management Agreement and the Feeder Fund Sub-Advisory Agreement, the Feeder Fund Board took into account that Feeder Fund shareholders, in pursuing their investment goals and objectives, likely purchased their shares based upon the reputation and the investment style, philosophy and strategy of the Manager and the Sub-Adviser, as well as the resources available to the Manager and the Sub-Adviser.

The Feeder Fund Board concluded that, overall, the nature, extent and quality of the management and other services provided to the Feeder Fund have been satisfactory under the circumstances.

Fund performance

Although the boards of directors of the other Legg Mason Funds at the Contract Renewal Meeting received and considered comparative performance information and analyses for those other Legg Mason Funds prepared by Lipper, Inc. (“Lipper”), an independent provider of investment company data, the Feeder Fund Board has been advised by the Manager that Lipper does not actively track the performance of “funds of hedge funds.” The Feeder Fund Board noted that it had received and discussed with the Manager and the Sub-Adviser at periodic intervals throughout the year information reporting on the Feeder Fund’s performance in absolute terms and comparing the Feeder Fund’s performance against its benchmark. At the Contract Renewal Meeting, the Feeder Fund Board considered information prepared and provided by the Manager as to the Feeder Fund’s performance in absolute terms and relative to its benchmark in evaluating the Feeder Fund’s (broker class shares) performance. As noted above, the Feeder Fund invests substantially all of its assets in the Master Fund and the Feeder Fund’s performance therefore is substantially dependent upon the performance of the Master Fund. This information indicated that the Feeder Fund’s return on its broker class shares, with no sales charge, for the twelve months ended June 30, 2014 was 8.37%. On a net asset value basis, the Feeder Fund outperformed its benchmark by 310 basis points for that period. The Feeder Fund Board noted the limited performance history of the Feeder Fund and Master Fund and its inability to assess the Feeder Fund’s performance relative to comparable funds selected by an independent third party in light of the unavailability of comparative performance information from Lipper.

| | |

| Permal Hedge Strategies Fund II | | 23 |

Board approval of management and sub-advisory agreements (unaudited) (cont’d)

Based on the reviews and discussions of the Feeder Fund’s performance and considering other relevant factors, including those noted above, the Feeder Fund Board concluded that, under the circumstances, continuation of the Feeder Fund Management Agreement and the Feeder Fund Sub-Advisory Agreement for an additional one-year period would be consistent with the interests of the Feeder Fund and its shareholders.

Management fees and expense ratios

The Feeder Fund Board reviewed and considered the management fee (the “Feeder Fund Management Fee”) payable by the Feeder Fund to the Manager under the Feeder Fund Management Agreement and the sub-advisory fee (the “Feeder Fund Sub-Advisory Fee”) payable to the Sub-Adviser under the Feeder Fund Sub-Advisory Agreement in light of the nature, extent and overall quality of the management, investment advisory and other services provided by the Manager and the Sub-Adviser.

The Feeder Fund Board noted the Manager’s continuing belief that the nature of the master-feeder structure requires the Feeder Fund Board to examine the combined services provided to the Feeder Fund and the Master Fund in order to evaluate the Feeder Fund Management Fee and did so in reliance on that belief. The Feeder Fund Board also noted that for its services under the Master Fund Management Agreement, the Manager receives a management fee (the “Master Fund Management Fee,” and together with the Feeder Fund Management Fee, the “Management Fees”) and the Sub-Adviser for its services under the Master Fund Sub-Advisory Agreement receives a sub-advisory fee (the “Master Fund Sub-Advisory Fee,” and together with the Feeder Fund Sub-Advisory Fee, the “Sub-Advisory Fees”). The Feeder Fund is required to pay not only the Feeder Fund Management Fee but also indirectly a portion of the Master Fund Management Fee as a Master Fund shareholder. The Feeder Fund Management Agreement, however, provides that, to the extent the Feeder Fund invests all or substantially all of its assets in another registered investment company for which the Manager or an affiliate of the Manager serves as investment adviser, such as the Master Fund, the annual Feeder Fund Management Fee will be reduced by the aggregate management fees allocated to the Feeder Fund for its then-current fiscal year from such other registered investment company. Under this provision, the Feeder Fund currently pays no direct management fee to the Manager for services provided to the Feeder Fund under the Feeder Fund Management Agreement but indirectly pays a portion of the Master Fund Management Fee. The Feeder Fund Board noted further that the Sub-Advisory Fees payable to the Sub-Adviser under the Sub-Advisory Agreements are paid by the Manager, not the Funds, and, accordingly, that the retention of the Sub-Adviser does not increase the fees or expenses otherwise incurred by the shareholders of the Feeder Fund or the Master Fund pursuant to the Sub-Advisory Agreements. Lastly, the Feeder Fund Board noted the Manager’s past advice that the Master Fund’s shareholders, including the Feeder Fund, may pay management fees at two levels. In this regard, the Master Fund’s shareholders, including the Feeder Fund, pay management fees directly through the Master Fund Management Fee and indirectly through management and incentive fees charged by the Portfolio Funds.

| | |

| 24 | | Permal Hedge Strategies Fund II |

The Feeder Fund Board was advised by the Manager that Lipper does not track “funds of hedge funds” and that the Fund does not fit in any of the fund categories within Lipper’s classification system. Consequently, the Feeder Fund Board received and considered information and analyses prepared by the Manager (the “Expense Information”) comparing the Feeder Fund Management Fee and the Feeder Fund’s overall expenses with those of ten funds in a custom peer group (the “Expense Group”) selected and provided by the Manager. The comparison was based upon the constituent funds’ latest fiscal years. The Expense Group consisted of ten other investment funds regarded by the Manager as comparable to the Fund. The Expense Group included open-end investment companies, limited liability companies and registered hedge funds. The Board noted its inability to assess the Fund’s expenses relative to comparable funds selected by an independent third party in light of the unavailability of Lipper comparative expense information. The Board, also noting the disparate composition of the Expense Group, questioned the value of the Expense Group comparison provided. The Expense Information did not report net common share assets for four of the Expense Group funds. The remaining Expense Group funds varied widely in size, with assets ranging from $45.2 million to $4.98 billion. As of June 30, 2014, the Fund had $25.5 million in assets.

The Feeder Fund Board considered that the Feeder Fund not only incurs and pays its own direct operating expenses but also indirectly pays a share of the operating expenses of the Portfolio Funds, including management fees, performance-based incentive fees, administration fees, professional fees, and other operating expenses. Hedge funds also incur trading expenses and dividend and interest expenses which are a by-product of leveraging or hedging activities by the funds.

The Manager noted that it has entered into an expense waiver arrangement (the “Expense Waiver”) with the Feeder Fund pursuant to which the Manager has agreed to waive fees and/or to reimburse the Feeder Fund’s expenses to the extent necessary to limit the Feeder Fund’s annualized ordinary expenses (excluding brokerage, interest expense, fees and expenses (including incentive or performance allocations and fees) attributable to hedge funds, taxes, and extraordinary expenses) to 2.65% (the “Expense Cap”) for the Feeder Fund’s broker class shares, provided that the Manager is permitted to recapture amounts or is reimbursed within three years after the year in which the Manager earned the fee or incurred the expense if the total annual Feeder Fund operating expenses attributable to the broker class shares have fallen to a level below the Expense Cap (any such recapture being hereinafter referred to as an “Expense Recovery”). The Expense Waiver is scheduled to expire on December 31, 2015.