UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22836

EnTrustPermal Hedge Strategies Fund II

(Exact name of registrant as specified in charter)

620 Eighth Avenue, 49th Floor, New York, NY 10018

(Address of principal executive offices) (Zip code)

Robert I. Frenkel, Esq.

Legg Mason & Co., LLC

100 First Stamford Place

Stamford, CT 06902

(Name and address of agent for service)

Registrant’s telephone number, including area code: (877)-777-0102

Date of fiscal year end: March 31

Date of reporting period: March 31, 2017

| ITEM 1. | REPORT TO STOCKHOLDERS. |

The Annual Report to Stockholders is filed herewith.

| | |

| Annual Report | | March 31, 2017 |

ENTRUSTPERMAL

HEDGE STRATEGIES FUND II

|

| INVESTMENT PRODUCTS: NOT FDIC INSURED • NO BANK GUARANTEE • MAY LOSE VALUE |

|

FOR ACCREDITED INVESTORS ONLY |

Fund objective

The Fund’s investment objective is to seek long-term capital appreciation while attempting to reduce risk and volatility.

In seeking to achieve its objective, the Fund, through its investment in EnTrustPermal Hedge Strategies Portfolio (the “Master Fund”), provides its shareholders with access, through investments in hedge funds, to a broad range of investment strategies which may include, but are not limited to, global fixed income strategies (e.g., U.S. and non-U.S. fixed income hedge, convertible arbitrage, fixed income arbitrage, asset-backed securities, long-only, high yield, emerging markets debt), global event-driven strategies (e.g., risk arbitrage, distressed debt, special situations, activists) and global macro strategies (e.g., discretionary, systematic, natural resources) and, to a lesser extent, equity long/short strategies.

Fund name changes

Prior to July 22, 2016, EnTrustPermal Hedge Strategies Fund II and EnTrustPermal Hedge Strategies Portfolio were known as Permal Hedge Strategies Fund II and Permal Hedge Strategies Portfolio, respectively. There was no change in the Fund’s or the Master Fund’s investment objective, policies and strategies as a result of these name changes.

| | |

| II | | EnTrustPermal Hedge Strategies Fund II |

Letter from the chairman

Dear Shareholder,

We are pleased to provide the annual report of EnTrustPermal Hedge Strategies Fund II for twelve-month reporting period ended March 31, 2017. Please read on for a detailed look at prevailing economic and market conditions during the Fund’s reporting period and to learn how those conditions have affected Fund performance.

Special shareholder notice

On May 15, 2017, EnTrustPermal Hedge Strategies Fund II (the “Fund”) announced that the Board of Trustees of the Fund had approved the termination and liquidation of the Fund in accordance with the Maryland Statutory Trust Act. As part of the termination and liquidation of the Fund, the Board approved (i) a Plan of Termination and Liquidation, (ii) the suspension of the sale of Broker Shares, (iii) the suspension of the dividend reinvestment plan of the Fund, (iv) the suspension of the distribution fee payable on the Broker Shares pursuant to the Shareholder Services and Distribution Plan, (v) the mandatory redemption at net asset value of Broker Shares held by shareholders other than Legg Mason, and (vi) the deregistration of the Fund as an investment company. It is anticipated that the redemption will be completed by the end of November, 2017. Shareholders will receive the net asset value of their Fund shares as of October 31, 2017 in cash pursuant to the redemption. In addition, effective immediately, the Fund will cease to purchase additional assets in pursuit of its investment objective.

Following the redemption, the Fund will terminate and Legg Mason will become the sole shareholder of EnTrustPermal Hedge Strategies Portfolio (the “Master Fund”). The Master Fund will continue to redeem its interests in the underlying hedge funds held by the Master Fund and distribute cash to Legg Mason as those interests are redeemed. Legg Mason has agreed that, to the extent it receives cash distributions in excess of the value of its remaining investment in the Fund as determined on the valuation date for the mandatory redemption of non-Legg Mason shareholders, excess proceeds will be distributed pro rata to the non-Legg Mason former shareholders of the Fund, or donated to charity if the expenses associated with a distribution would exceed the amount of the proceeds.

For taxable shareholders, liquidating distributions, including a mandatory redemption, will generally be treated as a sale of Fund sales that may result in a taxable gain or loss to shareholders for U.S. federal income tax purposes. In addition, it is expected that the Fund will distribute dividends of net income and/or net realized capital gains expected to be realized for the taxable year on or before the date of the redemption.

Tender offers previously accepted pursuant to Offers to Purchase dated December 22, 2016 and March 27, 2017 will be completed as scheduled pursuant to the terms of the applicable Offer to Purchase.

| | |

| EnTrustPermal Hedge Strategies Fund II | | III |

Letter from the chairman (cont’d)

As always, we remain committed to providing you with excellent service and a full spectrum of investment choices. We also remain committed to supplementing the support you receive from your financial advisor. One way we accomplish this is through our website, www.leggmason.com. Here you can gain immediate access to market and investment information, including:

| • | | Fund prices and performance |

| • | | Market insights and commentaries from our portfolio managers, and |

| • | | A host of educational resources. |

We look forward to helping you meet your financial goals.

Sincerely,

Jane Trust, CFA

Chairman, President and Chief Executive Officer

May 16, 2017

| | |

| IV | | EnTrustPermal Hedge Strategies Fund II |

Investment commentary

Economic review

The pace of U.S. economic activity fluctuated during the twelve months ended March 31, 2017 (the “reporting period”). Looking back, the U.S. Department of Commerce reported that second quarter 2016 U.S. gross domestic product (“GDP”)i growth was 1.4%. GDP growth for the third quarter of 2016 was 3.5%, the strongest reading in two years. Fourth quarter 2016 GDP growth then moderated to 2.1%. Finally, the U.S. Department of Commerce’s initial reading for first quarter 2017 GDP growth — released after the reporting period ended — was 0.7%. The deceleration in growth reflected downturns in personal consumption expenditures, private inventory investment and state and local government spending.

While there was a pocket of weakness in May 2016, job growth in the U.S. was solid overall and a tailwind for the economy during the reporting period. When the reporting period ended on March 31, 2017, the unemployment rate was 4.5%, as reported by the U.S. Department of Labor. This was the lowest unemployment rate since May 2007. The percentage of longer-term unemployed also declined over the period. In March 2017, 23.3% of Americans looking for a job had been out of work for more than six months, versus 25.7% when the period began.

Turning to the global economy, in its April 2017 World Economic Outlook Update, released after the reporting period ended, the International Monetary Fund (“IMF”)ii said, “Global economic activity is picking up with a long-awaited cyclical recovery in investment, manufacturing, and trade…. Stronger activity and expectations of more robust global demand, coupled with agreed restrictions on oil supply, have helped commodity prices recover from their troughs in early 2016….If confidence and market sentiment remain strong, short-term growth could indeed surprise on the upside. But these positive developments should not distract from binding structural impediments to a stronger recovery and a balance of risks that remains tilted to the downside, especially over the medium term.” From a regional perspective, the IMF estimates 2017 growth in the Eurozone will be 1.7%, the same as in 2016. Japan’s economy is expected to expand 1.2% in 2017, compared to 1.0% in 2016. Elsewhere, the IMF projects that overall growth in emerging market countries will accelerate to 4.5% in 2017, versus 4.1% in 2016.

Looking back, after an extended period of maintaining the federal funds rateiii at a historically low range between zero and 0.25%, the Federal Reserve Board (the “Fed”)iv increased the rate at its meeting on December 16, 2015. This marked the first rate hike since 2006. In particular, the U.S. central bank raised the federal funds rate to a range between 0.25% and 0.50%. The Fed then kept rates on hold at each meeting prior to its meeting in mid-December 2016. On December 14, 2016, the Fed raised rates to a range between 0.50% and 0.75%.

After holding rates steady at its meeting that concluded on February 1, 2017, the Fed raised rates to a range between 0.75% and 1.00% at its meeting that concluded on March 15, 2017. At that time the Fed said, “The Committee expects that economic conditions will evolve in a manner that will warrant gradual increases in the federal funds rate; the federal funds rate is likely to remain, for some time, below levels that are expected to prevail in the longer run.

| | |

| EnTrustPermal Hedge Strategies Fund II | | V |

Investment commentary (cont’d)

However, the actual path of the federal funds rate will depend on the economic outlook as informed by incoming data.”

Given the economic challenges in the Eurozone, the European Central Bank (“ECB”)v took a number of actions to stimulate growth and ward off deflation. In December 2015, before the reporting period began, the ECB extended its €60 billion-per-month bond buying program until at least March 2017. In March 2016, the ECB announced that it would increase its bond purchasing program to €80 billion-per-month. It also lowered its deposit rate to -0.4% and its main interest rate to 0%. Finally, in December 2016 — the ECB again extended its bond buying program until December 2017. From April 2017 through December 2017, the ECB will purchase €60 billion-per-month of bonds. Looking at other developed countries, in the aftermath of the June 2016 U.K. referendum to leave the European Union (“Brexit”), the Bank of Englandvi lowered rates in October 2016 from 0.50% to 0.25% — an all-time low. After holding rates steady at 0.10% for more than five years, in January 2016, the Bank of Japanvii announced that it lowered the rate on current accounts that commercial banks hold with it to -0.10%. Elsewhere, the People’s Bank of Chinaviii kept rates steady at 4.35%.

As always, thank you for your confidence in our stewardship of your assets.

Sincerely,

Jane Trust, CFA

Chairman, President and Chief Executive Officer

April 28, 2017

All investments are subject to risk including the possible loss of principal. Past performance is no guarantee of future results. Forecasts and predictions are inherently limited and should not be relied upon as an indication of actual or future performance.

| i | Gross domestic product (“GDP”) is the market value of all final goods and services produced within a country in a given period of time. |

| ii | The International Monetary Fund (“IMF”) is an organization of 189 countries, working to foster global monetary cooperation, secure financial stability, facilitate international trade, promote high employment and sustainable economic growth, and reduce poverty around the world. |

| iii | The federal funds rate is the rate charged by one depository institution on an overnight sale of immediately available funds (balances at the Federal Reserve) to another depository institution; the rate may vary from depository institution to depository institution and from day to day. |

| iv | The Federal Reserve Board (the “Fed”) is responsible for the formulation of U.S. policies designed to promote economic growth, full employment, stable prices and a sustainable pattern of international trade and payments. |

| v | The European Central Bank (“ECB”) is responsible for the monetary system of the European Union and the euro currency. |

| vi | The Bank of England (“BoE”), formally the Governor and Company of the BoE, is the central bank of the United Kingdom. The BoE’s purpose is to maintain monetary and financial stability. |

| vii | The Bank of Japan is the central bank of Japan. The bank is responsible for issuing and handling currency and treasury securities, implementing monetary policy, maintaining the stability of the Japanese financial system and the yen currency. |

| viii | The People’s Bank of China is the central bank of the People’s Republic of China with the power to carry out monetary policy and regulate financial institutions in mainland China. |

| | |

| VI | | EnTrustPermal Hedge Strategies Fund II |

Fund overview

Q. What is the Fund’s investment strategy?

A. EnTrustPermal Hedge Strategies Fund II seeks long-term capital appreciation, while attempting to reduce risk and volatility. The Fund pursues its investment objective by investing substantially all of its assets in EnTrustPermal Hedge Strategies Portfolio (the “Master Fund”), an investment company with the same investment objective and strategies and substantially the same policies as the Fund. The Fund employs a “fund-of hedge funds” approach, through its investment in the Master Fund, that provides a means for investors to participate in private investment vehicles typically referred to as hedge funds (“Portfolio Funds”) that are managed by a number of third-party investment managers. This investment program offers access to a broad range of investment strategies with a global fixed-income focus. The types of strategies include:

| • | | Global fixed-income strategies, such as U.S. and non-U.S. fixed income hedge, convertible arbitrage, fixed income arbitrage, asset-backed securities, long only, high yield, and emerging market debts; |

| • | | Global event-driven strategies, such as risk arbitrage, distressed debt, special situations, and activists; |

| • | | Global macro strategies, such as discretionary, systematic, and natural resources; and |

| • | | To a lesser extent, equity long/short strategies. |

The Master Fund employs a dynamic asset allocation process that shifts capital between credit- and non-credit strategies based on the investment subadviser’s view on the credit markets. The Fund, through its investment in the Master Fund, seeks to produce investment returns that have lower risk than traditional long-only investments and over time produce above-market returns. The combination of various Portfolio Funds that utilize alternative investment strategies, and that are typically less correlated to the market than traditional long only funds, is expected to produce a portfolio that is less volatile than the general market and less correlated to such market than traditional long-only funds investing in the same market. There is no guarantee this objective will be met.

The subadviser, EnTrustPermal Management LLC, provides day-to-day portfolio management with respect to the Fund’s and the Master Fund’s assets. Portfolio construction reflects both a top-down and bottom-up approach. The bottom-up process includes idea generation, due diligence and portfolio monitoring with respect to portfolio managers and Portfolio Funds. While portfolio manager selection is primarily a bottom up approach, the subadviser establishes a top-down macroeconomic view that forms the basis for setting target allocations for each major strategy and region. The individuals that have primary responsibility for the day-to-day management of the Master Fund’s portfolio are Javier F. Dyer and Alexander Pillersdorf.

Q. What were the overall market conditions during the Fund’s reporting period?

A. After a challenging calendar year 2015 — the worst year for credit since 2008 — and a rough first calendar quarter in 2016, credit markets rebounded and had a strong finish for the twelve-month reporting period ended

| | |

| EnTrustPermal Hedge Strategies Fund II 2017 Annual Report | | 1 |

Fund overview (cont’d)

March 31, 2017. The broader high yield bond market’s strong overall performance was led by lower quality credits and by the recovery in commodities. Credit conditions improved markedly in the latter half of 2016 and, similarly, default activity was frontloaded. Overall defaults were led once again by defaults in the Energy sector and metals/mining industry; the commodity sub-sectors accounted for over two-thirds of the year’s total default volume.

Markets were quite volatile during the summer following the surprising decision U.K. voters made in June 2016 to leave the European Union (“Brexit”). The decision prompted Prime Minister David Cameron to announce his resignation and the vote initially sent global markets crashing over the potential dismantling of a union designed to ensure peace and security for a continent ravaged by two world wars. Despite the initial sell-off, markets quickly rebounded, more than recovering their losses.

However, President Donald Trump’s election was the single most noteworthy event of the reporting period, as it was followed by sharp security re-ratings based on the market’s assessment of his proposals to cut rates, roll back regulation, and promote faster economic growth. U.S. equities overall moved up although sector performance diverged dramatically. The Financials sector rallied significantly on expectations of reduced regulations and higher interest rates that would boost banks’ net interest margins. The Energy, Industrials and Materials sectors also posted strong returns in anticipation of higher spending for infrastructure and defense. On the other hand, the Real Estate sector retreated on concerns of higher mortgage rates, and the Health Care sector was affected by President Trump’s intent to repeal Obamacare and to rein in high drug prices.

Fixed-income markets struggled post-election as optimism for greater economic growth translated to higher interest rates and expectations of rising inflation. Not only did the entire yield curvei move higher, but it also steepened, as is typically the case when economic expectations are rising.

Except for short lived periods around Brexit and the U.S. election, volatility across equity, currency, and fixed income markets remained stubbornly low during the twelve-month reporting period ended March 31, 2017.

Q. How did we respond to these changing market conditions?

A. Our managers entered the period with a cautious approach that generally entailed decreased net exposures through a combination of trimmed long positions and/or increased short exposure. Broadly speaking, the performance of the Fund’s managers was driven by company-specific catalysts and exposure to a few themes.

Managers remained cautious on corporate credit markets. Broadly speaking, credit valuations ranged from fully priced to frothy while the market environment was full of risks that could trigger a sharp increase in corporate defaults and corporate spread widening (e.g., a reigniting of China slowdown fears, a more material increase in interest rates, etc). Corporate defaults increased from basically non-existent multi-year lows, and our distressed debt managers took advantage of those opportunities, particularly in the energy space. However, given the rally in commodity prices during

| | |

| 2 | | EnTrustPermal Hedge Strategies Fund II 2017 Annual Report |

the period, managers anticipated a slowdown in the pace of corporate defaults as the year progressed.

The most meaningful portfolio allocation change during the reporting period was a decrease in the macro allocation from 22% of net asset value (“NAV”)ii as of March 31, 2016 to 13% of NAV at March 31, 2017. The main reason driving the reduction was the environment of dramatically low levels of volatility, which tends to be directly correlated to the performance of macro managers.

Performance review

For the twelve months ended March 31, 2017, Broker Shares of EnTrustPermal Hedge Strategies Fund II, excluding sales charges, returned 7.42%. The Fund’s unmanaged benchmarks, the HFRX Global Hedge Fund Indexiii and the Bloomberg Barclays U.S. Aggregate Indexiv, returned 6.19% and 0.44%, respectively, for the same period.

The Fund operates in a master/feeder structure. The Fund pursues its investment objective by investing all of its investable assets in an underlying mutual fund, EnTrustPermal Hedge Strategies Portfolio, which has the same investment objective and strategies as the Fund. Unless otherwise indicated, references to the Fund include the investment company, EnTrustPermal Hedge Strategies Portfolio.

| | | | | | | | |

Performance Snapshot as of March 31, 2017

(unaudited) | |

| (excluding sales charges) | | 6 months | | | 12 months | |

EnTrustPermal Hedge

Strategies Fund II: | | | | | | | | |

Broker Shares | | | 3.32 | % | | | 7.42 | % |

| HFRX Global Hedge Fund Index | | | 2.83 | % | | | 6.19 | % |

Bloomberg Barclays U.S.

Aggregate Index | | | -2.18 | % | | | 0.44 | % |

The performance shown represents past performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown above. Principal value and investment returns will fluctuate and investors’ shares, when redeemed, may be worth more or less than their original cost. Total returns assume the reinvestment of all distributions at net asset value and the deduction of all Fund expenses. Returns have not been adjusted to include the maximum initial sales charge of 3.0% that may apply. If sales charges were reflected, the performance quoted would be lower. Performance figures for periods shorter than one year represent cumulative figures and are not annualized. To obtain performance data current to the most recent month-end, please visit our website at www.entrustpermalhsf.com.

Fund performance figures reflect fee waivers and/or expense reimbursements, without which the performance would have been lower.

| | |

| Total Annual Operating Expenses (unaudited) |

As of the Fund’s current prospectus dated August 1, 2016, the gross total annual operating expense ratio for the Fund’s Broker Shares was 7.44%.

Actual expenses may be higher. For example, expenses may be higher than those shown if average net assets decrease. Net assets are more likely to decrease and Fund expense ratios are more likely to increase when markets are volatile.

The Fund’s manager has agreed to waive fees and/or reimburse the Fund’s expenses (including organization and offering expenses) to the extent necessary to ensure that the total annual fund operating expenses will not exceed 2.65% for Broker Shares (excluding fees and expenses, including incentive or performance allocations and fees, attributable to Portfolio Funds, estimated to be 3.90% as of the Fund’s current prospectus dated August 1

| | |

| EnTrustPermal Hedge Strategies Fund II 2017 Annual Report | | 3 |

Fund overview (cont’d)

2016, brokerage, interest expense, taxes and extraordinary expenses). This expense limitation arrangement cannot be terminated prior to December 31, 2017 without the Board of Trustees’ consent.

The manager is permitted to recapture amounts previously waived and/or reimbursed to a class within three years after the year in which the manager earned the fee or incurred the expense if the class’ total annual operating expenses have fallen to a level below the expense limitation (“expense cap”) in effect at the time the fees were earned or the expenses incurred. In no case will the manager recapture any amount that would result, on any particular business day of the Fund, in the class’ total annual operating expenses exceeding the expense cap or any other lower limit then in effect.

Q. What were the leading contributors to performance?

A. Energy Credits — The Fund’s Fixed-Income Developed Markets and Fixed-Income Hedge managers benefitted from Oil & Gas related exposure in 2016. One area contributing to positive returns was performing debt situations trading at distressed prices where the underlying exploration & production (“E&P”) companies operate in low cost production shale formations, while also having a long runway of liquidity that allow them to navigate a protracted volatile commodity environment. As oil prices rebounded, the debt securities of these companies appreciated meaningfully, and later continued their ascent as the market acknowledged the superior quality of assets and solid liquidity footing. A second area contributing to meaningful performance was distressed debt restructurings related to E&P and oil services firms. In many cases, these companies went through aggressive debt for equity swaps that led them to emerge from Chapter 11 with conservative financial positions, which made them the target of strategic mergers & acquisitions (“M&A”) deals. Until mid-last year, coal had been the poster child for an out-of-favor industry, in fact left out for dead by many in the face of increasing environmentally-driven regulation and low commodity prices. However, around last summer the fate of the industry started to turn when metallurgical coal prices rose astronomically following floods that affected Asian producers exposing a dramatic supply/demand imbalance created by several mine closures. Later in the year, U.S. thermal prices also started increasing — albeit in a less dramatic manner — driven by a decreased supply base and rising prices of natural gas (a competing input for power generation). Donald Trump’s election was also a positive development for the industry, as the new president elect made a number of campaign promises to bring coal back.

Gaming was a big driver of performance for the Fund’s Event Driven and Fixed-Income Hedge managers as the prices of credit securities rose as the sector recorded fundamental improvements in its gambling and lodging segments. The Fund was exposed to the companies mentioned below via underlying managers invested directly in securities/loans issued by the companies. Caesars, the most high profile distressed situation in the sector was subject to a key event in late September 2016, when — after years of legal conflict — creditors and private equity sponsors signed a restructuring agreement. Smaller situations also were rewarded. For example, Alliante Casinos, a small local Las Vegas market operator, received a premium takeover bid by Boyd Gaming, a larger publicly traded competitor.

The Alternative Lending sub-sector (mainly pay day lending) benefitted Event Driven and Fixed-Income Hedge managers as the industry

| | |

| 4 | | EnTrustPermal Hedge Strategies Fund II 2017 Annual Report |

underwent a dislocation in 2016, driven by dramatically tighter regulation of their activities by the Consumer Protection Agency. Sifting through the rubble, many of the Fund’s managers found companies that were lumped into the pay day lending category when in fact their business model was quite different (in a classic case of the “baby thrown out with the bathwater”), and eventually recorded gains when the market became more educated about the differences.

Q. What were the leading detractors from performance?

A. The main detracting themes in 2016 related to a Fixed-Income Developed Markets manager’s long exposure to Shipping — as shipping rates across many shipping sub-segments continued to plunge on an oversupply of vessels — and Retail — as pressure from online channels continued to mount in the brick-and-mortar retail space.

Thank you for your investment in EnTrustPermal Hedge Strategies Fund II. As always, we appreciate that you have chosen us to manage your assets.

Sincerely,

Javier F. Dyer

Deputy Chief Investment Officer and Portfolio Manager

EnTrustPermal Management LLC

Alexander Pillersdorf

Portfolio Manager

EnTrustPermal Management LLC

April 18, 2017

RISKS: An investment in the Fund is illiquid and should be considered speculative. An investment in the Fund entails unique risks because the investment funds or “underlying funds” in which the Fund invests through its investment in EnTrustPermal Hedge Strategies Portfolio (the “Master Fund”) are private entities with limited regulatory oversight and disclosure obligations. All investments are subject to risk, including the possible loss of principal. The Fund is a non-diversified closed-end management investment company. As a non-diversified investment company, the Fund may be subject to greater risk and volatility than if the Fund’s portfolio were invested in securities of a broader range of issuers. In addition to the Fund’s operating expenses, you will indirectly bear the operating expenses of the underlying funds in which the Master Fund invests, which can be substantially higher than fees associated with mutual funds. The Fund, through its investment in the Master Fund, invests in unregistered hedge funds which are highly speculative investments that employ aggressive investment strategies and carry substantial risk. Investments in hedge funds are generally illiquid, difficult to value and may carry significant transfer restrictions. Some of the underlying funds employ leverage, which increases the volatility of investment return and subjects the Fund to magnified losses if an investment of an underlying fund declines in value. The Fund, the Master Fund and some of the underlying funds may use derivatives, such as options and futures, which can be illiquid, may disproportionately increase losses, and may have a potentially large impact on Fund performance. Some of the underlying funds may employ short selling, a speculative strategy. Unlike the possible loss on a security that is purchased, there is no limit on the amount of loss on an appreciating security that

| | |

| EnTrustPermal Hedge Strategies Fund II 2017 Annual Report | | 5 |

Fund overview (cont’d)

is sold short. The Master Fund and each underlying fund may engage in active and frequent trading, resulting in higher portfolio turnover and transaction costs. There is no assurance that these and other strategies used by the Master Fund or underlying funds will be successful. Equity securities are subject to market and price fluctuations. International investments are subject to special risks including currency fluctuations, social, economic and political uncertainties, which could increase volatility. These risks are magnified in emerging markets. Small and mid-cap stocks involve greater risks and volatility than large-cap stocks. Fixed income securities involve interest rate, credit, inflation, and reinvestment risks. As interest rates rise, the value of fixed income securities falls. High-yield bonds possess greater price volatility, illiquidity, and possibility of default. Because the Fund, through its investment in the Master Fund, invests in underlying funds, the managers may not be able to shift allocations in time to capture an immediate or sudden spike in the market. Diversification does not guarantee a profit or protect against a loss. Please see the Fund’s prospectus for a more complete discussion of these and other risks, investor requirements, and the Fund’s investment strategies.

All investments are subject to risk including the possible loss of principal. Past performance is no guarantee of future results. All index performance reflects no deduction for fees, expenses or taxes. Please note that an investor cannot invest directly in an index.

The information provided is not intended to be a forecast of future events, a guarantee of future results or investment advice. Views expressed may differ from those of the firm as a whole.

| i | The yield curve is the graphical depiction of the relationship between the yield on bonds of the same credit quality but different maturities. |

| ii | Net asset value (“NAV”) is the dollar value of a single mutual fund share, based on the value of the underlying assets of the fund minus its liabilities, divided by the number of shares outstanding. NAV is calculated as of the close of business on the last day of each calendar month. |

| iii | The HFRX Global Hedge Fund Index is designed to be representative of the overall composition of the hedge fund universe. It is comprised of all eligible hedge fund strategies; including but not limited to convertible arbitrage, distressed securities, equity hedge, equity market neutral, event-driven, macro, merger arbitrage, and relative value arbitrage. The strategies are asset weighted based on the distribution of assets in the hedge fund industry. |

| iv | The Bloomberg Barclays U.S. Aggregate Index is a broad-based bond index comprised of government, corporate, mortgage- and asset-backed issues, rated investment grade or higher, and having at least one year to maturity. |

| | |

| 6 | | EnTrustPermal Hedge Strategies Fund II 2017 Annual Report |

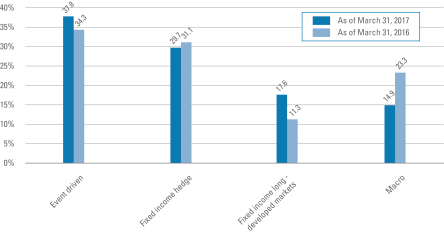

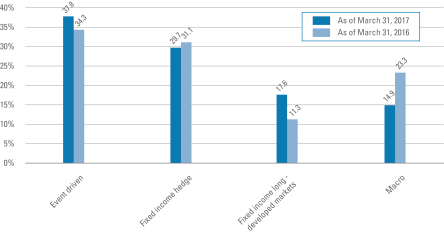

Portfolio at a glance† (unaudited)

EnTrustPermal Hedge Strategies Portfolio

The Fund invests substantially all of its assets in EnTrustPermal Hedge Strategies Portfolio, the investment breakdown of which is shown below.

Investment breakdown (%) as a percent of total investments

| † | The bar graph above represents the composition of the portfolio’s investments as of March 31, 2017 and March 31, 2016. The portfolio is actively managed. As a result, the composition of the portfolio’s investments is subject to change at any time. |

| | |

| EnTrustPermal Hedge Strategies Fund II 2017 Annual Report | | 7 |

Statement of assets and liabilities

March 31, 2017

| | | | |

| |

| Assets | | | | |

Investment in EnTrustPermal Hedge Strategies Portfolio, at value | | $ | 25,743,755 | |

Cash | | | 297,273 | |

Redemptions receivable from EnTrustPermal Hedge Strategies Portfolio | | | 875,000 | |

Receivable for reimbursement from adviser | | | 10,113 | |

Prepaid expenses | | | 417 | |

Total Assets | | | 26,926,558 | |

| |

| Liabilities | | | | |

Capital withdrawals payable | | | 835,452 | |

Service and/or distribution fees payable | | | 17,894 | |

Trustees’ fees payable | | | 1,550 | |

Accrued expenses | | | 74,639 | |

Total Liabilities | | | 929,535 | |

| Total Net Assets | | $ | 25,997,023 | |

| |

| Net Assets | | | | |

Paid-in capital (Note 3) | | $ | 27,155,505 | |

Overdistributed net investment income | | | (512,230) | |

Accumulated net realized loss on investments allocated from EnTrustPermal Hedge Strategies Portfolio | | | (1,880,278) | |

Net unrealized appreciation on investments allocated from EnTrustPermal Hedge Strategies Portfolio | | | 1,234,026 | |

| Total Net Assets | | $ | 25,997,023 | |

| |

| Shares Outstanding: | | | | |

Broker Shares | | | 2,668,674 | |

| |

| Net Asset Value: | | | | |

Broker Shares | | | $9.74 | |

| Maximum Public Offering Price Per Share: | | | | |

Broker Shares (based on maximum initial sales charge of 3.00%) | | | $10.04 | |

See Notes to Financial Statements.

| | |

| 8 | | EnTrustPermal Hedge Strategies Fund II 2017 Annual Report |

Statement of operations

For the Year Ended March 31, 2017

| | | | |

| |

| Investment Income | | | | |

Income from EnTrustPermal Hedge Strategies Portfolio | | $ | 5,800 | |

Allocated expenses from EnTrustPermal Hedge Strategies Portfolio | | | (601,966) | |

Allocated waiver from EnTrustPermal Hedge Strategies Portfolio | | | 56,061 | |

Total Investment Loss | | | (540,105) | |

| |

| Fund Expenses | | | | |

Service and/or distribution fees (Note 2) | | | 238,503 | |

Printing expenses | | | 86,993 | |

Legal fees | | | 81,956 | |

Audit and tax fees | | | 53,400 | |

Transfer agent fees | | | 33,681 | |

Registration fees | | | 22,748 | |

Trustees’ fees | | | 12,434 | |

Administration fees | | | 7,500 | |

Custodian fees | | | 3,693 | |

Miscellaneous expenses | | | 5,529 | |

Total Operating Expenses | | | 546,437 | |

Less: Fee waivers and /or expense reimbursements (Note 2) | | | (302,827) | |

Net Expenses | | | 243,610 | |

| Net Investment Loss | | | (783,715) | |

| Net Realized Gain on Investments From EnTrustPermal Hedge Strategies Portfolio | | | 170,947 | |

Net Change in Unrealized Appreciation From Investments in

EnTrustPermal Hedge Strategies Portfolio | | | 2,834,899 | |

| Net Increase in Net Assets Resulting From Operations | | $ | 2,222,131 | |

See Notes to Financial Statements.

| | |

| EnTrustPermal Hedge Strategies Fund II 2017 Annual Report | | 9 |

Statements of changes in net assets

| | | | | | | | |

| For the Years Ended March 31, | | 2017 | | | 2016 | |

| | |

| Net Increase (Decrease) in Net Assets: | | | | | | | | |

| | |

| Operations: | | | | | | | | |

Net investment loss | | $ | (783,715) | | | $ | (960,780) | |

Net realized gain | | | 170,947 | | | | 742,187 | |

Net change in unrealized appreciation (depreciation) | | | 2,834,899 | | | | (3,474,225) | |

Net Increase (Decrease) in Net Assets Resulting From Operations | | | 2,222,131 | | | | (3,692,818) | |

| | |

| Distributions to Shareholders From (Notes 1 and 4): | | | | | | | | |

Net investment income | | | — | | | | (549,997) | |

Net realized gains | | | (40,768) | | | | (706,145) | |

Net Decrease in Net Assets From Distributions to Shareholders | | | (40,768) | | | | (1,256,142) | |

| | |

| Fund Share Transactions (Note 3): | | | | | | | | |

Net proceeds from issuance of shares | | | 768,340 | | | | 2,457,680 | |

Reinvestment of distributions | | | 34,992 | | | | 1,169,833 | |

Value of withdrawals | | | (9,754,967) | | | | (3,989,541) | |

Net Decrease in Net Assets From Fund Share Transactions | | | (8,951,635) | | | | (362,028) | |

Decrease in Net Assets | | | (6,770,272) | | | | (5,310,988) | |

| | |

| Net Assets: | | | | | | | | |

Beginning of year | | | 32,767,295 | | | | 38,078,283 | |

End of year* | | $ | 25,997,023 | | | $ | 32,767,295 | |

*Includes overdistributed net investment income of: | | | $(512,230) | | | | $(743,939) | |

See Notes to Financial Statements.

| | |

| 10 | | EnTrustPermal Hedge Strategies Fund II 2017 Annual Report |

Statement of cash flows

For the Year Ended March 31, 2017

| | | | |

| |

| Cash Provided by Operating Activities | | | | |

Net increase in net assets resulting from operations | | $ | 2,222,131 | |

Adjustments to reconcile net increase in net assets resulting from operations

to net cash provided by operating activities: | | | | |

Purchases of investment in EnTrustPermal Hedge Strategies Portfolio | | | (768,340) | |

Proceeds from the disposition of investments in EnTrustPermal Hedge Strategies Portfolio | | | 10,595,000 | |

Net realized gain on investments from EnTrustPermal Hedge Strategies Portfolio | | | (170,947) | |

Net change in unrealized appreciation from investments in EnTrustPermal Hedge Strategies Portfolio | | | (2,834,899) | |

Net investment loss allocated from EnTrustPermal Hedge Strategies Portfolio | | | 540,105 | |

Decrease in receivable for reimbursement from adviser | | | 6,483 | |

Decrease in prepaid expenses | | | 94 | |

Decrease in trustees’ fees payable | | | (27) | |

Decrease in service and/or distribution fees payable | | | (5,008) | |

Decrease in accrued expenses | | | (6,242) | |

Net Cash Provided by Operating Activities | | | 9,578,350 | |

| |

| Cash Used in Financing Activities | | | | |

Proceeds from issuance of shares | | | 770,020 | |

Value of withdrawals | | | (10,444,858) | |

Distributions paid | | | (5,776) | |

Net Cash Used in Financing Activities | | | (9,680,614) | |

| |

| Cash | | | | |

Net decrease in cash | | | (102,264) | |

Cash at beginning of year | | | 399,537 | |

Cash at end of year | | $ | 297,273 | |

| |

| Supplemental Non-Cash Information | | | | |

Reinvestment of distributions | | $ | 34,992 | |

See Notes to Financial Statements.

| | |

| EnTrustPermal Hedge Strategies Fund II 2017 Annual Report | | 11 |

Financial highlights

| | | | | | | | | | | | | | | | |

For a share of beneficial interest outstanding throughout each year ended March 31,

unless otherwise noted: | |

| Broker Shares | | 2017 | | | 2016 | | | 2015 | | | 20141 | |

| | | | |

| Net asset value per share, beginning of period: | | | $9.07 | | | | $10.39 | | | | $10.53 | | | | $10.00 | |

| | | | |

| Income (loss) from investment operations:2 | | | | | | | | | | | | | | | | |

Net investment loss | | | (0.25) | | | | (0.26) | | | | (0.26) | | | | (0.21) | |

Net realized and unrealized gain (loss) | | | 0.93 | | | | (0.72) | | | | 0.27 | | | | 0.85 | |

Total income (loss) from investment operations | | | 0.68 | | | | (0.98) | | | | 0.01 | | | | 0.64 | |

| | | | |

| Less distributions from: | | | | | | | | | | | | | | | | |

Net investment income | | | — | | | | (0.15) | | | | (0.05) | | | | (0.11) | |

Net realized gains | | | (0.01) | | | | (0.19) | | | | (0.10) | | | | — | |

Total distributions | | | (0.01) | | | | (0.34) | | | | (0.15) | | | | (0.11) | |

| | | | |

| Net asset value per share, end of year: | | | $9.74 | | | | $9.07 | | | | $10.39 | | | | $10.53 | |

Total return3 | | | 7.42 | % | | | (9.42) | % | | | 0.11 | % | | | 6.45 | % |

| | | | |

| Net assets, end of year (000s) | | | $25,997 | | | | $32,767 | | | | $38,078 | | | | $18,952 | |

| | | | |

| Ratios to average net assets: | | | | | | | | | | | | | | | | |

Gross expenses5,6 | | | 3.86 | % | | | 3.54 | % | | | 4.26 | % | | | 7.17 | %4 |

Net expenses5,6,7,8 | | | 2.65 | % | | | 2.65 | % | | | 2.65 | % | | | 2.65 | %4 |

Net investment loss | | | (2.63) | % | | | (2.63) | % | | | (2.56) | % | | | (2.60) | %4 |

| | | | |

| Portfolio turnover9 | | | 0 | %10 | | | 16 | %11 | | | 5 | % | | | 5 | % |

The above ratios may vary for individual investors based on the timing of Fund share transactions during the period.

| 1 | For the period June 28, 2013 (commencement of operations) to March 31, 2014. |

| 2 | Per share data for income (loss) from investment operations is computed using the net income (loss) for the period divided by the average monthly shares. |

| 3 | Performance figures, exclusive of sales charges, may reflect compensating balance arrangements, fee waivers and/or expense reimbursements. In the absence of compensating balance arrangements, fee waivers and/or expense reimbursements, the total return would have been lower. Past performance is no guaranteed of future results. The total returns for periods less than one year have not been annualized. |

| 5 | Does not include expenses of the Portfolio Funds in which EntrustPermal Hedge Strategies Portfolio (formerly Permal Hedge Strategies Portfolio) invests. |

| 6 | Includes the Fund’s share of EnTrustPermal Hedge Strategies Portfolio’s allocated expenses. |

| 7 | As a result of an expense limitation arrangement, the ratio of total annual fund operating expenses (excluding fees and expenses, including incentive or performance allocations and fees, attributable to Portfolio Funds, brokerage, interest expense, taxes and extraordinary expenses) to average net assets of Broker Shares did not exceed 2.65%. This expense limitation arrangement cannot be terminated prior to December 31, 2017 without the Board of Trustees’ consent. |

| 8 | Reflects fee waivers and/or expense reimbursements. |

| 9 | Represents the portfolio turnover rate of EnTrustPermal Hedge Strategies Portfolio. |

| 10 | Amount represents less than 0.5%. |

| 11 | Includes an in-kind transfer where EntrustPermal Hedge Strategies Portfolio’s interests in a Portfolio Fund were transferred to another Portfolio Fund. Absent this transaction, the portfolio turnover would have been 14%. |

See Notes to Financial Statements.

| | |

| 12 | | EnTrustPermal Hedge Strategies Fund II 2017 Annual Report |

Notes to financial statements

1. Organization and significant accounting policies

EnTrustPermal Hedge Strategies Fund II (formerly Permal Hedge Strategies Fund II) (the “Fund”) is a Maryland statutory trust registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as a non-diversified, closed-end management investment company. The Fund is a “feeder” fund in a “master feeder” structure and invests substantially all of its assets in EnTrustPermal Hedge Strategies Portfolio (formerly Permal Hedge Strategies Portfolio), a Maryland statutory trust (the “Master Fund”), in return for an interest in the Master Fund. The Master Fund is an investment company with the same investment objective and strategies, and substantially the same policies as the Fund. The Master Fund employs a “fund-of-hedge funds” investment program that provides a means for the Fund to participate in investments in private investment vehicles, typically referred to as hedge funds (“Portfolio Funds”), by providing a single portfolio of interests in underlying Portfolio Funds, which are managed by a number of third party investment managers (the “Portfolio Managers”). The financial statements of the Master Fund, including its schedule of investments and notes to financial statements, are an integral part of these financial statements and should be read in conjunction with these financial statements. The Fund offers one class of shares (the “Shares” or the “Broker Shares”).

The Fund has the same investment objective and strategies as the Master Fund. The Fund’s investment objective is to seek long-term capital appreciation while attempting to reduce risk and volatility. In seeking to achieve its objective, the Fund, through its investment in the Master Fund, will provide its shareholders with access, through investments in the Portfolio Funds to a broad range of investment strategies which may include, but are not limited to, global fixed income strategies (e.g., U.S. and non-U.S. fixed income hedge, convertible arbitrage, fixed income arbitrage, asset-backed securities, long-only, high yield, emerging markets debt), global event-driven strategies (e.g., risk arbitrage, distressed debt, special situations, activists) and global macro strategies (e.g., discretionary, systematic, natural resources) and, to a lesser extent, equity long/short strategies.

The following are significant accounting policies consistently followed by the Fund and are in conformity with U.S. generally accepted accounting principles (“U.S. GAAP”). Estimates and assumptions are required to be made regarding assets, liabilities and changes in net assets resulting from operations when financial statements are prepared. Changes in the economic environment, financial markets and any other parameters used in determining these estimates could cause actual results to differ.

(a) Investment valuation. The Fund records its investment in the Master Fund at value. The value of such investment in the Master Fund reflects the Fund’s proportionate interest (62% at March 31, 2017) in the net assets of the Master Fund. The performance of the Fund is directly affected by the performance of the Master Fund. Valuation of the investments held by the Master Fund is discussed in the notes to the Master Fund’s financial statements, which are attached to this report.

(b) Net asset value determination. The net asset value of the Fund is determined as of the close of business at the end of each month in accordance with the valuation principles

| | |

| EnTrustPermal Hedge Strategies Fund II 2017 Annual Report | | 13 |

Notes to financial statements (cont’d)

set forth in Note 1(a) of the Master Fund’s Notes to Financial Statements, which are included elsewhere in this report or as may be determined from time to time pursuant to policies established by the Board of Trustees (the “Board”). The net asset value of the Fund will equal the value of the Fund’s total assets including its investment in the Master Fund, less all of its liabilities, including accrued fees and expenses. The net asset value per share of each class will equal the net asset value of the class divided by the number of outstanding shares for each class.

(c) Cash. The cash at March 31, 2017 consists of deposit accounts with The Bank of New York Mellon. Such cash, at times, may exceed U.S. federally insured limits. The Fund has not experienced any losses in such accounts and does not believe it is exposed to any significant credit risk on such bank deposits.

(d) Investment transactions and investment income. Purchases and sales of interest in the Master Fund are recorded on a trade-date basis and related revenues and expenses are recorded on an accrual basis. The Fund adopted the tax allocation rules provided for in Section 704(b) of the Internal Revenue Code of 1986, as amended (the “Code”). Accordingly, its proportionate share of the Master Fund’s income, expenses, realized and unrealized gains and losses are allocated monthly using the aggregate method. In addition, the Fund records its own investment income and operating expenses on an accrual basis.

(e) Distributions to shareholders. Distributions from net investment income and distributions of net realized gains, if any, are declared at least annually. Distributions to shareholders of the Fund are recorded on the ex-dividend date and are determined in accordance with income tax regulations, which may differ from U.S. GAAP.

(f) Compensating balance arrangements. The Fund has an arrangement with its custodian bank whereby a portion of the custodian’s fees is paid indirectly by credits earned on the Fund’s cash on deposit with the bank.

(g) U.S. federal and other taxes. It is the Fund’s policy to comply with the federal income and excise tax requirements of the Code applicable to regulated investment companies (“RICs”). Accordingly, the Fund intends to distribute its taxable income and net realized gains, if any, to shareholders in accordance with timing requirements imposed by the Code. Therefore, no federal or state income tax provision is required in the Fund’s financial statements.

Management has analyzed the Fund’s tax positions taken on income tax returns for all open tax years and has concluded that as of March 31, 2017, no provision for income tax is required in the Fund’s financial statements. The Fund’s federal and state income and federal excise tax returns for tax years for which the applicable statutes of limitations have not yet expired are subject to examination by Internal Revenue Service and state departments of revenue.

On September 28, 2016, the U.S. Department of the Treasury and the Internal Revenue Service issued proposed regulations that, if finalized, would treat income inclusions that RICs recognize from passive foreign investment companies (“PFICs”) for which a qualified

| | |

| 14 | | EnTrustPermal Hedge Strategies Fund II 2017 Annual Report |

electing fund election has been made (“QEFs”), as qualifying income only to the extent that the income is distributed to the RIC by the QEF. The proposed regulations would treat QEF income inclusions, to the extent not distributed, as non-qualifying income for RIC qualification purposes.

The Master Fund currently makes QEF elections for the majority of its PFIC investments and those PFICs generally do not distribute their income. Accordingly, under the proposed regulations, the Fund would need to change to making a mark-to-market election for the PFICs rather than the QEF election made by the Master Fund in order to ensure its continued RIC qualification. This change could result in higher taxable ordinary income and therefore higher distributions paid by the Fund since mark-to-market requires the Fund to include unrealized appreciation on the PFICs in its taxable income as ordinary income rather than its pro-rata share of the PFIC’s ordinary income and capital gains as with the QEF election.

The proposed regulations, if adopted, would apply to taxable years beginning on or after 90 days following the publication of the final regulations in the Federal Register. Thus, it is anticipated that this change would not be effective until the Fund’s March 31, 2019 fiscal year or later.

(h) Reclassification. U.S. GAAP requires that certain components of net assets be reclassified to reflect permanent differences between financial and tax reporting. These reclassifications have no effect on net assets or net asset values per share. During the current year, the following reclassifications have been made:

| | | | | | | | | | | | |

| | | Overdistributed Net

Investment Income | | | Accumulated Net

Realized Loss | | | Paid-in

Capital | |

| (a) | | $ | 720,953 | | | $ | 28 | | | $ | (720,981) | |

| (b) | | | 294,471 | | | | (294,471) | | | | — | |

| (a) | Reclassifications are due to tax net operating losses and a taxable overdistribution. |

| (b) | Reclassifications are due to book/tax differences in the treatment of passive foreign investment companies held by the Master Fund. |

2. Investment management agreement and other transactions with affiliates

Legg Mason Partners Fund Advisor, LLC (“LMPFA”) is the Fund’s and the Master Fund’s investment manager and EnTrustPermal Management LLC (“EnTrustPermal”) is the Fund’s and the Master Fund’s sub-adviser (the “sub-adviser”). Prior to May 2, 2016, Permal Asset Management LLC (“Permal”) was the Fund’s and the Master Fund’s sub-adviser. LMPFA is a wholly-owned subsidiary of Legg Mason, Inc. (“Legg Mason”) and EnTrustPermal is a subsidiary of Legg Mason. Permal was a wholly-owned subsidiary of Legg Mason.

Under the investment management agreement between the Master Fund and LMPFA, the Master Fund pays an investment management fee, calculated and paid monthly, at an annual rate of 1.10% of the Master Fund’s average monthly managed assets. “Managed assets” means net assets plus the principal amount of any borrowings and assets attributable to any preferred shares that may be outstanding.

| | |

| EnTrustPermal Hedge Strategies Fund II 2017 Annual Report | | 15 |

Notes to financial statements (cont’d)

The management fee and related terms of the Fund’s investment management agreement with LMPFA are substantially the same as the terms of the Master Fund’s investment management agreement with LMPFA. Since the Fund invests all or substantially all of its assets in the Master Fund, the investment management fee of the Fund will be reduced by the investment management fee allocated to the Fund by the Master Fund.

LMPFA has agreed to waive fees and/or reimburse expenses (including organization and offering expenses) to the extent necessary to ensure that the total annual Fund operating expenses attributable to the Broker Shares will not exceed 2.65% (excluding fees and expenses, including incentive or performance allocations and fees, attributable to Portfolio Funds, brokerage, interest expense, taxes and extraordinary expenses). This expense limitation arrangement cannot be terminated prior to December 31, 2017 without the Board’s consent.

The Master Fund will bear its own similar fees and expenses, including the management fee. It also pays fees and expenses incidental to the purchase, holding and sale of interests in, and bears a pro rata share of the fees, including, but not limited to, any commitment fees, and expenses of, any Portfolio Fund and recurring investment-related expenses, including, but not limited to, the management fee, brokerage commissions, dealer mark-ups, and other transactions costs on cash management; interest expense on any borrowings; and any subscription or redemption charges imposed by the Portfolio Funds. These expenses are indirectly borne, on a pro rata basis, by the Fund.

During the year ended March 31, 2017, fees waived and/or expenses reimbursed by LMPFA for the Fund amounted to $302,827.

LMPFA is permitted to recapture amounts waived and/or reimbursed within three years after the year in which LMPFA earned the fee or incurred the expense if the Fund’s total annual Fund operating expenses have fallen to a level below the limit described above. In no case will LMPFA recapture any amount that would result in the Fund’s total annual Fund operating expenses exceeding the limit described above.

Pursuant to these agreements, at March 31, 2017, the Fund had remaining fee waivers and/or expense reimbursements subject to recapture by LMPFA and respective dates of expiration as follows:

| | | | |

| Expires March 31, 2018 | | $ | 404,455 | |

| Expires March 31, 2019 | | | 305,265 | |

| Expires March 31, 2020 | | | 302,827 | |

| Total fee waivers/expense reimbursements subject to recapture | | $ | 1,012,547 | |

For the year ended March 31, 2017, LMPFA did not recapture any fees.

Legg Mason Investor Services, LLC (“LMIS”), a wholly-owned broker dealer subsidiary of Legg Mason, serves as principal underwriter and distributor of the Fund. The Fund pays LMIS a shareholder services fee of 0.25% of the Fund’s average monthly net assets attributable to Broker Shares and a distribution fee of 0.55% of the Fund’s average monthly net assets attributable to Broker Shares, each on an annualized basis.

| | |

| 16 | | EnTrustPermal Hedge Strategies Fund II 2017 Annual Report |

There is a maximum initial sales charge of 3.00% of the amount invested in Broker Shares, with breakpoints generally based on size of investment. For the year ended March 31, 2017, LMIS and affiliates did not receive any sales charges on sales of the Fund’s Broker Shares.

All officers and one Trustee of the Fund are employees of Legg Mason or its affiliates and do not receive compensation from the Fund.

As of March 31, 2017, Legg Mason and its affiliates owned 53% of the Fund.

3. Shares of beneficial interest

Shares in the Fund (“shares”) are sold to eligible investors (“shareholders”) who meet the definition of an accredited investor as defined in Regulation D under the Securities Act of 1933.

The minimum initial investment in the Broker Shares from each shareholder is $25,000; the minimum additional investment is $10,000. Dealers may impose different investment minimums.

At March 31, 2017, the Fund had an unlimited number of shares of beneficial interest authorized with a par value of $0.00001 per share. The Fund intends to accept initial and additional purchases of shares as of the first business day of each calendar month. The Fund reserves the right to reject, in whole or in part, any purchase of shares and may suspend the offering of shares at any time and from time to time. The Fund may from time to time repurchase shares from shareholders at the net asset value per share pursuant to written tenders by shareholders, and on those terms and conditions as the Board may determine in its sole discretion. The Fund anticipates that each such repurchase offer will generally be limited to between 5% and 25% of the net assets of the Fund. In determining whether the Fund should offer to repurchase shares from shareholders, the Board will consider the recommendation of LMPFA, in consultation with EnTrustPermal. LMPFA, in consultation with EnTrustPermal, expects that generally it will recommend the Board repurchase shares from shareholders quarterly, with such repurchases based on fund valuations as of each March 31, June 30, September 30 and December 31 (or, if any such date is not a business day, with such repurchases to occur as of the immediately preceding business day).

Transactions in shares of the Fund were as follows:

| | | | | | | | | | | | | | | | |

| | | Year Ended

March 31, 2017 | | | Year Ended

March 31, 2016 | |

| | | Shares | | | Amount | | | Shares | | | Amount | |

| Broker shares | | | | | | | | | | | | | | | | |

| Shares issued | | | 81,786 | | | $ | 768,340 | | | | 242,442 | | | $ | 2,457,680 | |

| Shares issued on reinvestment | | | 3,604 | | | | 34,992 | | | | 125,384 | | | | 1,169,833 | |

| Value of withdrawals | | | (1,031,178) | | | | (9,754,967) | | | | (418,910) | | | | (3,989,541) | |

| Net decrease | | | (945,788) | | | $ | (8,951,635) | | | | (51,084) | | | $ | (362,028) | |

| | |

| EnTrustPermal Hedge Strategies Fund II 2017 Annual Report | | 17 |

Notes to financial statements (cont’d)

4. Income tax information and distributions to shareholders

The tax character of distributions paid during the fiscal years ended March 31, was as follows:

| | | | | | | | |

| | | 2017 | | | 2016 | |

| Distributions paid from: | | | | | | | | |

| Ordinary income | | | — | | | $ | 549,996 | |

| Net long-term capital gains | | $ | 40,768 | | | | 706,146 | |

| Total distributions paid | | $ | 40,768 | | | $ | 1,256,142 | |

As of March 31, 2017, the components of accumulated earnings (losses) on a tax basis were as follows:

| | | | |

| Deferred capital losses* | | $ | (900,882) | |

| Other book/tax temporary differences(a) | | | (242,562) | |

| Unrealized appreciation (depreciation)(b) | | | (15,038) | |

| Total accumulated earnings (losses) — net | | $ | (1,158,482) | |

| * | These capital losses have been deferred in the current year as either short-term or long-term losses. The losses will be deemed to occur on the first day of the next taxable year in the same character as they were originally deferred and will be available to offset future taxable capital gains. |

| (a) | Other book/tax temporary differences are attributable to the deferral of certain late year losses for tax purposes and book/tax differences in the timing of the deductibility of various expenses. |

| (b) | The difference between book-basis and tax-basis unrealized appreciation (depreciation) is attributable to the differences between the book and tax cost basis of investments in passive foreign investment companies that are marked to market for tax purposes and book/tax differences in the income and realized gains allocated from the Master Fund. |

5. Recent accounting pronouncement

In October 2016, the U.S. Securities and Exchange Commission adopted new rules and amended existing rules (together, the “final rules”) intended to modernize the reporting and disclosure of information by registered investment companies. In part, the final rules amend Regulation S-X and require standardized, enhanced disclosure about derivatives in investment company financial statements, as well as other amendments. The compliance date for the amendments to Regulation S-X is August 1, 2017. Management is currently evaluating the impact that the adoption of the amendments to Regulation S-X will have on the Fund’s financial statements and related disclosures.

6. Subsequent events

On March 27, 2017, the Fund commenced an offer to purchase (the “Offer”) up to 25% of the Fund’s outstanding Broker Shares at a price equal to the Broker Shares’ net asset value effective as of June 30, 2017. As of April 26, 2017, the expiration date of the Offer, there were 76,227 Broker Shares tendered.

* * *

The Fund announced on May 15, 2017 that the Board of Trustees of the Fund had approved the termination and liquidation of the Fund in accordance with the Maryland Statutory Trust Act. As part of the termination and liquidation of the Fund, the Board approved (i) a Plan of

| | |

| 18 | | EnTrustPermal Hedge Strategies Fund II 2017 Annual Report |

Termination and Liquidation, (ii) the suspension of the sale of Broker Shares, (iii) the suspension of the dividend reinvestment plan of the Fund, (iv) the suspension of the distribution fee payable on the Broker Shares pursuant to the Shareholder Services and Distribution Plan, (v) the mandatory redemption at net asset value of Broker Shares held by shareholders other than Legg Mason, and (vi) the deregistration of the Fund as an investment company. It is anticipated that the redemption will be completed by the end of November, 2017. Shareholders will receive the net asset value of their Fund shares as of October 31, 2017 in cash pursuant to the redemption. In addition, effective immediately, the Fund will cease to purchase additional assets in pursuit of its investment objective.

Following the redemption, the Fund will terminate and Legg Mason will become the sole shareholder of the Master Fund. The Master Fund will continue to redeem its interests in the underlying hedge funds held by the Master Fund and distribute cash to Legg Mason as those interests are redeemed. Legg Mason has agreed that, to the extent it receives cash distributions in excess of the value of its remaining investment in the Fund as determined on the valuation date for the mandatory redemption of non-Legg Mason shareholders, excess proceeds will be distributed pro rata to the non-Legg Mason former shareholders of the Fund, or donated to charity if the expenses associated with a distribution would exceed the amount of the proceeds.

For taxable shareholders, liquidating distributions, including a mandatory redemption, will generally be treated as a sale of Fund shares that may result in a taxable gain or loss to shareholders for U.S. federal income tax purposes. In addition, it is expected that the Fund will distribute dividends of net income and/or net realized capital gains expected to be realized for the taxable year on or before the date of the redemption.

Tender offers previously accepted pursuant to Offers to Purchase dated December 22, 2016 and March 27, 2017 will be completed as scheduled pursuant to the terms of the applicable Offer to Purchase.

* * *

Management has evaluated the impact of all subsequent events on the Fund through the date financial statements were issued and has determined that there were no additional subsequent events requiring recognition or disclosure in the financial statements.

| | |

| EnTrustPermal Hedge Strategies Fund II 2017 Annual Report | | 19 |

Report of independent registered public accounting firm

The Board of Trustees and Shareholders EnTrustPermal Hedge Strategies Fund II:

We have audited the accompanying statement of assets and liabilities of EnTrustPermal Hedge Strategies Fund II (formerly Permal Hedge Strategies Fund II) (the “Fund”) as of March 31, 2017, and the related statements of operations and cash flows for the year then ended, the statements of changes in net assets for each of the years in the two-year period then ended, and the financial highlights for each of the years in the three-year period then ended and for the period from June 28, 2013 (commencement of operations) to March 31, 2014. These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included verification of securities owned as of March 31, 2017, by examination of the underlying EnTrustPermal Hedge Strategies Portfolio. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of EnTrustPermal Hedge Strategies Fund II as of March 31, 2017, the results of its operations and cash flows for the year then ended, the changes in its net assets for each of the years in the two-year period then ended, and the financial highlights for each of the years in the three-year period then ended and for the period from June 28, 2013 (commencement of operations) to March 31, 2014, in conformity with U.S. generally accepted accounting principles.

As discussed in Note 6 to the financial statements, the Fund’s Board of Trustees approved the liquidation and termination of the Fund subsequent to the date of the statement of assets and liabilities. Our opinion is not modified with respect to this matter.

New York, New York

May 23, 2017

| | |

| 20 | | EnTrustPermal Hedge Strategies Fund II 2017 Annual Report |

Board approval of management and sub-advisory agreements (unaudited)

Background

The Investment Company Act of 1940, as amended (the “1940 Act”), requires that the Board of Directors (the “Feeder Fund Board”) of EnTrustPermal Hedge Strategies Fund II (the “Feeder Fund”), including a majority of its members who are not considered to be “interested persons” under the 1940 Act (the “Independent Directors”) voting separately, approve initially for a term not exceeding two years and, thereafter, approve on an annual basis, the continuation of the investment management contract (the “Feeder Fund Management Agreement”) with the Feeder Fund’s manager, Legg Mason Partners Fund Advisor, LLC (the “Manager”), and the sub-advisory agreement (the “Feeder Fund Sub-Advisory Agreement”) with the Manager’s affiliate, EnTrustPermal Management LLC (the “Sub-Adviser”). At a meeting (the “Contract Renewal Meeting”) held in-person on November 9 and 10, 2016, the Feeder Fund Board, including the Independent Directors, considered and approved the continuation of the Feeder Fund Management Agreement and the Feeder Fund Sub-Advisory Agreement for an additional one-year term. The Feeder Fund Board considered and approved continuation of the Feeder Fund Sub-Advisory Agreement even though not required to do so under the 1940 Act or by the terms of such agreement. In this regard, the Feeder Fund Sub-Advisory Agreement was approved by the Feeder Fund Board and by the shareholders of the Feeder Fund in May 2016, for an initial term of two years. The Feeder Fund is a “feeder fund” in a master-feeder structure and, as such, intends to invest all or substantially all of its assets in the EnTrustPermal Hedge Strategies Portfolio (the “Master Fund,” and together with the Feeder Fund, the “Funds”). The Master Fund employs a “fund of hedge funds” investment strategy pursuant to which the Master Fund invests primarily in underlying private investment vehicles (“Portfolio Funds”), typically referred to as “hedge funds.” At the Contract Renewal Meeting, the Board of Directors of the Master Fund (the “Master Fund Board,” and together with the Feeder Fund Board, the “Boards”) also considered and approved the continuation of the management agreement between the Master Fund and the Manager (the “Master Fund Management Agreement,” and together with the Feeder Fund Management Agreement, the “Management Agreements”) and the sub-advisory agreement (the “Master Fund Sub-Advisory Agreement,” and together with the Feeder Fund Sub-Advisory Agreement,” the “Sub-Advisory Agreements”) between the Manager and the Sub-Adviser for an additional one-year term. As in the case of the Feeder Fund Board’s approval of the Feeder Fund Sub-Advisory Agreement, the Master Fund Board considered and approved the Master Fund Sub-Advisory Agreement even though it was not required to do so under the 1940 Act or by the terms of such agreement. In this regard, the Master Fund Sub-Advisory Agreement was approved by Master Fund Board and the Master Fund’s shareholders for an initial term of two years in May 2016. The memberships of the Feeder Fund Board and the Master Fund Board are identical. To assist in their respective consideration of the renewals of the Management Agreements and the Sub-Advisory Agreements, the Boards received and considered a variety of information (together with the information provided at the Contract Renewal Meeting, the “Contract Renewal Information”) about the Manager and the

| | |

| EnTrustPermal Hedge Strategies Fund II | | 21 |

Board approval of management and sub-advisory agreements (unaudited) (cont’d)

Sub-Adviser, as well as the management and sub-advisory arrangements for the Funds and other funds in the same complex under the Boards’ supervision (collectively, the “Legg Mason Funds”), certain portions of which are discussed below. Presentations made to the Boards by the Manager and the Sub-Adviser at the Contract Renewal Meeting in connection with their respective evaluations of the Management Agreements and the Sub-Advisory Agreements encompassed the Funds and the other Legg Mason Funds. In addition to the Contract Renewal Information, the Boards received performance and other information throughout the year related to the respective services rendered by the Manager and the Sub-Adviser to the Funds. Each Board’s evaluation took into account the information received throughout the year and also reflected the knowledge and familiarity gained as members of such Board and other Legg Mason Funds with respect to the services provided to the Funds by the Manager and the Sub-Adviser.

At a meeting held by conference call on November 2, 2016, the Independent Directors in preparation for the Contract Renewal Meeting met in a private session with their independent counsel to review Contract Renewal Information in respect of the Legg Mason Funds, including the Fund, received to that date. No representatives of the Manager or the Sub-Adviser participated in this meeting. The discussion below reflects all of these reviews.

The Manager provides the Feeder Fund with investment advisory and administrative services pursuant to the Feeder Fund Management Agreement and the Sub-Adviser provides the Feeder Fund with certain investment sub-advisory services pursuant to the Feeder Fund Sub-Advisory Agreement. The Manager provides the Master Fund with investment advisory and administrative services pursuant to the Master Fund Management Agreement and the Sub-Adviser provides the Master Fund with certain investment sub-advisory services pursuant to the Master Fund Sub-Advisory Agreement. The discussion below covers both the advisory and administrative functions being rendered by the Manager to each of the Funds, each such function being encompassed by the Feeder Fund Management Agreement, in the case of the Feeder Fund, and by the Master Fund Management Agreement, in the case of the Master Fund, and the investment sub-advisory functions being rendered by the Sub-Adviser.

Board approval of feeder fund management agreement and feeder fund sub-advisory agreement

In its deliberations regarding renewal of the Feeder Fund Management Agreement and the Feeder Fund Sub-Advisory Agreement, the Feeder Fund Board, including the Independent Directors, considered the factors below.

Nature, extent and quality of the services under the management agreements and sub-advisory agreements

The Feeder Fund Board received and considered Contract Renewal Information regarding the nature, extent, and quality of services provided to the Funds by the Manager under the respective Management Agreements and by the Sub-Adviser under the respective

| | |

| 22 | | EnTrustPermal Hedge Strategies Fund II |

Sub-Advisory Agreements during the past year. The Feeder Fund Board also reviewed Contract Renewal Information regarding the Funds’ compliance policies and procedures established pursuant to the 1940 Act.

The Feeder Fund Board reviewed the qualifications, backgrounds, and responsibilities of the Funds’ senior personnel and the portfolio management team primarily responsible for the day-to-day portfolio management of the Funds. The Feeder Fund Board also considered, based on its knowledge of the Manager and its affiliates, the Contract Renewal Information and the Feeder Fund Board’s discussions with the Manager and the Sub-Adviser at the Contract Renewal Meeting, the general reputation and investment performance records of the Manager, the Sub-Adviser, and their affiliates and the financial resources available to the corporate parent of the Manager and the Sub-Adviser, Legg Mason, Inc. (“Legg Mason”), to support their activities in respect of the Funds and the other Legg Mason Funds.

The Feeder Fund Board reviewed the responsibilities of the Manager and the Sub-Adviser under the Management Agreements and the Sub-Advisory Agreements, respectively, including the Manager’s coordination and oversight of the services provided to the Funds by the Sub-Adviser and others. Each of the Management Agreements permits the Manager to delegate certain of its responsibilities, including its investment advisory duties thereunder, provided that the Manager, in each case, will supervise the activities of the delegee. Pursuant to this provision in each of the Management Agreements, the Manager does not provide day-to-day portfolio management services to the Feeder Fund or the Master Fund. Rather, management of the assets of the Feeder Fund and the Master Fund assets is provided by the Sub-Adviser pursuant to the Feeder Fund Sub-Advisory Agreement and the Master Fund Sub-Advisory Agreement, respectively. As noted above, the Feeder Fund, as a feeder fund in a master-feeder structure invests substantially all of its assets in the Master Fund and the Feeder Fund’s performance therefore is substantially dependent upon the performance of the Master Fund.