UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22836

EnTrustPermal Hedge Strategies Fund II

(Exact name of registrant as specified in charter)

620 Eighth Avenue, 49th Floor,

New York, NY 10018

(Address of principal executive offices) (Zip code)

Robert I. Frenkel, Esq.

Legg Mason & Co., LLC

100 First Stamford Place

Stamford, CT 06902

(Name and address of agent for service)

Registrant’s telephone number, including area code: (877)-777-0102

Date of fiscal year end: March 31

Date of reporting period: September 30, 2017

ITEM 1. REPORT TO STOCKHOLDERS.

The Semi-Annual Report to Stockholders is filed herewith.

[INSERT SHAREHOLDER REPORT]

| | |

| Semi-Annual Report | | September 30, 2017 |

ENTRUSTPERMAL

HEDGE STRATEGIES FUND II

|

| INVESTMENT PRODUCTS: NOT FDIC INSURED • NO BANK GUARANTEE • MAY LOSE VALUE |

|

FOR ACCREDITED INVESTORS ONLY |

Fund objective

The Fund’s investment objective is to seek long-term capital appreciation while attempting to reduce risk and volatility.

In seeking to achieve its objective, the Fund, through its investment in EnTrustPermal Hedge Strategies Portfolio (the “Master Fund”), provides its shareholders with access, through investments in hedge funds, to a broad range of investment strategies which may include, but are not limited to, global fixed income strategies (e.g., U.S. and non-U.S. fixed income hedge, convertible arbitrage, fixed income arbitrage, asset-backed securities, long-only, high yield, emerging markets debt), global event-driven strategies (e.g., risk arbitrage, distressed debt, special situations, activists) and global macro strategies (e.g., discretionary, systematic, natural resources) and, to a lesser extent, equity long/short strategies.

| | |

| II | | EnTrustPermal Hedge Strategies Fund II |

Letter from the chairman

Dear Shareholder,

We are pleased to provide the semi-annual report of EnTrustPermal Hedge Strategies Fund II for the six-month reporting period ended September 30, 2017. Please read on for Fund performance information and a detailed look at prevailing economic and market conditions during the Fund’s reporting period.

Special shareholder notice

On May 15, 2017, EnTrustPermal Hedge Strategies Fund II (the “Fund”) announced that the Board of Trustees of the Fund approved the termination and liquidation of the Fund in accordance with the Maryland Statutory Trust Act. As part of the termination and liquidation of the Fund, the Board approved (i) a Plan of Termination and Liquidation, (ii) the suspension of the sale of Broker Shares, (iii) the suspension of the dividend reinvestment plan of the Fund, (iv) the suspension of the distribution fee payable on the Broker Shares pursuant to the Shareholder Services and Distribution Plan, (v) the mandatory redemption at net asset value of Broker Shares held by shareholders other than Legg Mason, and (vi) the deregistration of the Fund as an investment company. It is anticipated that the redemption will be completed by the end of November, 2017. Shareholders will receive the net asset value of their Fund shares as of October 31, 2017 in cash pursuant to the redemption. In addition, the Fund ceased purchasing additional assets in pursuit of its investment objective.

Following the redemption, the Fund will terminate and Legg Mason will become the sole shareholder of EnTrustPermal Hedge Strategies Portfolio (the “Master Fund”). The Master Fund will continue to redeem its interests in the underlying hedge funds held by the Master Fund and distribute cash to Legg Mason as those interests are redeemed. Legg Mason has agreed that, to the extent it receives cash distributions in excess of the value of its remaining investment in the Fund as determined on the valuation date for the mandatory redemption of non-Legg Mason shareholders, excess proceeds will be distributed pro rata to the non-Legg Mason former shareholders of the Fund, or donated to charity if the expenses associated with a distribution would exceed the amount of the proceeds.

For taxable shareholders, liquidating distributions, including a mandatory redemption, will generally be treated as a sale of Fund shares that may result in a taxable gain or loss to shareholders for U.S. federal income tax purposes.

As always, we remain committed to providing you with excellent service and a full spectrum of investment choices. We also remain committed to supplementing the support you receive from your financial advisor. One way we accomplish this is through our website,

| | |

| EnTrustPermal Hedge Strategies Fund II | | III |

Letter from the chairman (cont’d)

www.leggmason.com. Here you can gain immediate access to market and investment information, including:

| • | | Fund prices and performance, |

| • | | Market insights and commentaries from our portfolio managers, and |

| • | | A host of educational resources. |

We look forward to helping you meet your financial goals.

Sincerely,

Jane Trust, CFA

Chairman, President and Chief Executive Officer

October 31, 2017

| | |

| IV | | EnTrustPermal Hedge Strategies Fund II |

Investment commentary

Economic review

The pace of U.S. economic activity fluctuated during the six months ended September 30, 2017 (the “reporting period”). Looking back, the U.S. Department of Commerce reported that first quarter 2017 U.S. gross domestic product (“GDP”)i growth, as revised, was 1.2%. Second quarter 2017 GDP growth then accelerated to 3.1%, the strongest reading in two years. Finally, the U.S. Department of Commerce’s initial estimate for third quarter 2017 GDP growth — released after the reporting period ended — was 3.0%. Slightly slower growth was attributed to a number of factors, including decelerations in personal consumption expenditures, in nonresidential fixed investment and in exports that were partly offset by an acceleration in private inventory investment and a downturn in imports.

Job growth in the U.S. was solid overall and a tailwind for the economy during the reporting period. When the reporting period ended on September 30, 2017, the unemployment rate was 4.2%, as reported by the U.S. Department of Labor. This represented the lowest unemployment rate since February 2001. However, the percentage of longer-term unemployed increased over the period. In September 2017, 25.5% of Americans looking for a job had been out of work for more than six months, versus 22.6% when the period began.

Turning to the global economy, in its October 2017 World Economic Outlook Update — released after the reporting period ended — the International Monetary Fund (“IMF”)ii said, “The pickup in growth projected in the April 2017 World Economic Outlook is strengthening. The global growth forecast for 2017 and 2018 — 3.6 percent and 3.7 percent, respectively — is 0.1 percentage point higher in both years than in the April [2017] and July [2017] forecasts. Notable pickups in investment, trade, and industrial production, coupled with strengthening business and consumer confidence, are supporting the recovery.” From a regional perspective, the IMF estimates 2017 growth in the Eurozone will be 2.1%, versus 1.8% in 2016. Japan’s economy is expected to expand 1.5% in 2017, compared to 1.0% in 2016. Elsewhere, the IMF projects that overall growth in emerging market countries will accelerate to 4.6% in 2017, versus 4.3% in 2016.

| | |

| EnTrustPermal Hedge Strategies Fund II | | V |

Investment commentary (cont’d)

Market review

Q. How did the Federal Reserve Board (the “Fed”)iii respond to the economic environment?

A. Looking back, after maintaining the federal funds rateiv at a range between zero and 0.25%, the Fed increased the rate at its meeting on December 16, 2015. In particular, the U.S. central bank raised the federal funds rate to a range between 0.25% and 0.50%. The Fed then kept rates on hold prior to its meeting on December 14, 2016, at which time, the Fed raised rates to a range between 0.50% and 0.75%.

After holding rates steady at its meeting that concluded on February 1, 2017, the Fed raised rates to a range between 0.75% and 1.00% at its meeting that ended on March 15, 2017. At its meeting that concluded on June 14, 2017, the Fed raised rates to a range between 1.00% and 1.25%. At its meeting that concluded on July 26, 2017, the Fed kept rates on hold, as expected. Finally, at its meeting that concluded on September 20, 2017, the Fed again kept rates on hold, but reiterated its intention to begin reducing its balance sheet, saying, “In October, the Committee will initiate the balance sheet normalization program….”

Q. What actions did international central banks take during the reporting period?

A. Central banks outside the U.S. largely maintained their accommodative monetary policy stances during the reporting period. In March 2016, the European Central Bank (“ECB”)v announced that it would increase its bond purchasing program to €80 billion-per-month. It also lowered its deposit rate to -0.4% and its main interest rate to 0%. In December 2016, the ECB again extended its bond buying program until December 2017. From April 2017 through December 2017, the ECB will purchase €60 billion-per-month of bonds. Finally, in October 2017, after the reporting period ended, the ECB announced that it would continue to buy bonds through September 2018, but after December 2017 it would pare their purchases to €30 billion-per-month. However, the ECB did not change its key interest rates. In other developed countries, in August 2016, the Bank of Englandvi lowered interest rates from 0.50% to 0.25%, a new record low, and rates remained constant during the reporting period. After holding rates steady at 0.10% for more than five years, in January 2016, the Bank of Japanvii announced that it cut the rate on current accounts that commercial banks hold with it to -0.10% and kept rates on hold during the reporting period. Elsewhere, the People’s Bank of Chinaviii kept rates steady at 4.35% during the reporting period.

Q. Did Treasury yields trend higher or lower during the reporting period?

A. Short-term Treasury yields moved higher, whereas longer-term rates declined during the six-month reporting period ended September 30, 2017. The yield for the two-year Treasury note began the reporting period at 1.27% and ended the period at 1.47% — equaling the peak for the period. The low for the period of 1.18% occurred on April 18, 2017. The yield for the ten-year Treasury began the reporting period at 2.40% and ended the period at 2.33%. The peak of 2.42% occurred on May 9, 2017, and the low of 2.05% for the period took place on September 7, 2017.

| | |

| VI | | EnTrustPermal Hedge Strategies Fund II |

Q. What factors impacted the spread sectors (non-Treasuries) during the reporting period?

A. The spread sectors posted mixed results during the reporting period. Performance fluctuated given shifting expectations for global growth, questions regarding future central bank monetary policy and several geopolitical issues. The broad U.S. bond market, as measured by the Bloomberg Barclays U.S. Aggregate Indexix, returned 2.31% during the six months ended September 30, 2017.

Q. How did the high-yield bond market perform over the reporting period?

A. The U.S. high-yield bond market, as measured by the Bloomberg Barclays U.S. Corporate High Yield — 2% Issuer Cap Indexx, gained 4.19% for the six months ended September 30, 2017. The high-yield market rallied from April through July 2017. This was driven by overall robust demand from investors looking to generate incremental yield in the low interest rate environment. The high yield market was then relatively flat in August 2017 and again moved higher in September 2017.

Q. How did the emerging market debt asset class perform over the reporting period?

A. The JPMorgan Emerging Markets Bond Index Globalxi returned 4.65% during the six months ended September 30, 2017. The asset class posted positive results during the first two months of the reporting period. This was triggered by overall strong investor demand, less concern over a significant shift in U.S. trade policy and a weakening U.S. dollar. The asset class then modestly declined in June 2017, but moved higher from July through September 2017.

Performance review

For the six-month period ended September 30, 2017, Broker Shares of EnTrustPermal Hedge Strategies Fund II, excluding sales charges, returned 1.54%. The Fund’s unmanaged benchmarks, the HFRX Global Hedge Fund Indexxii and the Bloomberg Barclays U.S. Aggregate Index, returned 2.73% and 2.31%, respectively, for the same period.

The Fund operates in a master/feeder structure. Subject to the Plan of Termination and Liquidation, the Fund pursues its investment objective by investing substantially all of its assets in an underlying investment company, EnTrustPermal Hedge Strategies Portfolio, which has the same investment objective and strategies as the Fund. Unless otherwise indicated, references to the Fund include the investment company, EnTrustPermal Hedge Strategies Portfolio.

| | | | |

Performance Snapshot as of September 30, 2017 (unaudited) | |

| (excluding sales charges) | | 6 months | |

| EnTrustPermal Hedge Strategies Fund II: | | | | |

Broker Shares | | | 1.54 | % |

| HFRX Global Hedge Fund Index | | | 2.73 | % |

| Bloomberg Barclays U.S. Aggregate Index | | | 2.31 | % |

The performance shown represents past performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown above. Principal value and investment returns will fluctuate and investors’ shares, when redeemed, may be worth more or less than their original cost. Total returns assume the reinvestment of all distributions at net asset value and the deduction of all Fund expenses. Returns have not been adjusted to include the maximum initial sales charge of 3.0% that may apply. If sales charges were reflected, the performance quoted would be lower. Performance figures for periods

| | |

| EnTrustPermal Hedge Strategies Fund II | | VII |

Investment commentary (cont’d)

shorter than one year represent cumulative figures and are not annualized. To obtain performance data current to the most recent month-end, please visit our website at www.entrustpermalhsf.com.

Fund performance figures reflect fee waivers and/or expense reimbursements, without which the performance would have been lower.

|

Total Annual Operating Expenses (unaudited) |

As of the Fund’s current prospectus dated August 1, 2016, the gross total annual fund operating expense ratio for the Fund’s Broker Shares was 7.44%.

Actual expenses may be higher. For example, expenses may be higher than those shown if average net assets decrease. Net assets are more likely to decrease and Fund expense ratios are more likely to increase when markets are volatile.

The Fund’s manager has agreed to waive fees and/or reimburse the Fund’s expenses (including organization and offering expenses) to the extent necessary to ensure that the total annual fund operating expenses do not exceed 2.65% for Broker Shares (excluding fees and expenses, including incentive or performance allocations and fees, attributable to Portfolio Funds, estimated to be 3.90% as of the Fund’s current prospectus dated August 1, 2016, brokerage, interest expense, taxes and extraordinary expenses). This expense limitation arrangement cannot be terminated prior to December 31, 2017 without the Board of Trustees’ consent.

The manager is permitted to recapture amounts previously waived and/or reimbursed to a class within three years after the year in which the manager earned the fee or incurred the expense if the class’ total annual operating expenses have fallen to a level below the expense limitation (“expense cap”) in effect at the time the fees were earned or the expenses incurred. In no case will the manager recapture any amount that would result, on any particular business of the Fund, in the class’ total annual operating expenses exceeding the expense cap or any other lower limit then in effect.

As always, thank you for your confidence in our stewardship of your assets.

Sincerely,

Jane Trust, CFA

Chairman, President and Chief Executive Officer

October 31, 2017

RISKS: An investment in the Fund is illiquid and should be considered speculative. An investment in the Fund entails unique risks because the investment funds or “underlying funds” in which the Fund invests through its investment in EnTrustPermal Hedge Strategies Portfolio (the “Master Fund”) are private entities with limited regulatory oversight and disclosure obligations. All investments are subject to risk, including the possible loss of principal. The Fund is a non-diversified closed-end management investment company. As a non-diversified investment company, the Fund may be subject to greater risk and volatility than if the Fund’s portfolio were invested in securities of a broader range of issuers. In addition to the Fund’s operating expenses, you will indirectly bear the operating expenses of the underlying funds in which the Master Fund invests, which can be substantially higher than fees

| | |

| VIII | | EnTrustPermal Hedge Strategies Fund II |

associated with mutual funds. The Fund, through its investment in the Master Fund, invests in unregistered hedge funds which are highly speculative investments that employ aggressive investment strategies and carry substantial risk. Investments in hedge funds are generally illiquid, difficult to value and may carry significant transfer restrictions. Some of the underlying funds employ leverage, which increases the volatility of investment return and subjects the Fund to magnified losses if an investment of an underlying fund declines in value. The Fund, the Master Fund and some of the underlying funds may use derivatives, such as options and futures, which can be illiquid, may disproportionately increase losses, and may have a potentially large impact on Fund performance. Some of the underlying funds may employ short selling, a speculative strategy. Unlike the possible loss on a security that is purchased, there is no limit on the amount of loss on an appreciating security that is sold short. The Master Fund and each underlying fund may engage in active and frequent trading, resulting in higher portfolio turnover and transaction costs. There is no assurance that these and other strategies used by the Master Fund or underlying funds will be successful. Equity securities are subject to market and price fluctuations. International investments are subject to special risks including currency fluctuations, social, economic and political uncertainties, which could increase volatility. These risks are magnified in emerging markets. Small and mid-cap stocks involve greater risks and volatility than large-cap stocks. Fixed income securities involve interest rate, credit, inflation, and reinvestment risks. As interest rates rise, the value of fixed income securities falls. High-yield bonds possess greater price volatility, illiquidity, and possibility of default. Because the Fund, through its investment in the Master Fund, invests in underlying funds, the managers may not be able to shift allocations in time to capture an immediate or sudden spike in the market. Diversification does not guarantee a profit or protect against a loss. Please see the Fund’s prospectus for a more complete discussion of these and other risks, investor requirements and the Fund’s investment strategies.

All investments are subject to risk including the possible loss of principal. Past performance is no guarantee of future results. All index performance reflects no deduction for fees, expenses or taxes. Please note that an investor cannot invest directly in an index.

The information provided is not intended to be a forecast of future events, a guarantee of future results or investment advice. Views expressed may differ from those of the firm as a whole. Forecasts and predictions are inherently limited and should not be relied upon as an indication of actual or future performance.

| | |

| EnTrustPermal Hedge Strategies Fund II | | IX |

Investment commentary (cont’d)

| i | Gross domestic product (“GDP”) is the market value of all final goods and services produced within a country in a given period of time. |

| ii | The International Monetary Fund (“IMF”) is an organization of 189 countries, working to foster global monetary cooperation, secure financial stability, facilitate international trade, promote high employment and sustainable economic growth, and reduce poverty around the world. |

| iii | The Federal Reserve Board (the “Fed”) is responsible for the formulation of U.S. policies designed to promote economic growth, full employment, stable prices and a sustainable pattern of international trade and payments. |

| iv | The federal funds rate is the rate charged by one depository institution on an overnight sale of immediately available funds (balances at the Federal Reserve) to another depository institution; the rate may vary from depository institution to depository institution and from day to day. |

| v | The European Central Bank (“ECB”) is responsible for the monetary system of European Union and the euro currency. |

| vi | The Bank of England (“BoE”), formally the Governor and Company of the BoE, is the central bank of the United Kingdom. The BoE’s purpose is to maintain monetary and financial stability. |

| vii | The Bank of Japan is the central bank of Japan. The bank is responsible for issuing and handling currency and treasury securities, implementing monetary policy, maintaining the stability of the Japanese financial system and the yen currency. |

| viii | The People’s Bank of China is the central bank of the People’s Republic of China with the power to carry out monetary policy and regulate financial institutions in mainland China. |

| ix | The Bloomberg Barclays U.S. Aggregate Index is a broad-based bond index comprised of government, corporate, mortgage- and asset-backed issues, rated investment grade or higher, and having at least one year to maturity. |

| x | The Bloomberg Barclays U.S. Corporate High Yield — 2% Issuer Cap Index is an index of the 2% Issuer Cap component of the Bloomberg Barclays U.S. Corporate High Yield Index, which covers the U.S. dollar-denominated, non-investment grade, fixed-rate, taxable corporate bond market. |

| xi | The JPMorgan Emerging Markets Bond Index Global (“EMBI Global”) tracks total returns for U.S. dollar-denominated debt instruments issued by emerging market sovereign and quasi-sovereign entities: Brady bonds, loans, Eurobonds and local market instruments. |

| xii | The HFRX Global Hedge Fund Index is designed to be representative of the overall composition of the hedge fund universe. It is comprised of all eligible hedge fund strategies; including but not limited to convertible arbitrage, distressed securities, equity hedge, equity market neutral, event-driven, macro, merger arbitrage, and relative value arbitrage. The strategies are asset weighted based on the distribution of assets in the hedge fund industry. |

| | |

| X | | EnTrustPermal Hedge Strategies Fund II |

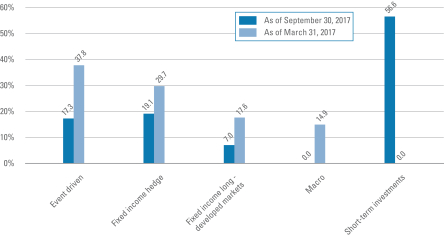

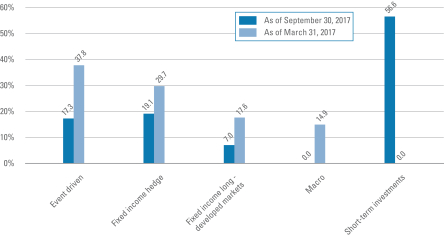

Portfolio at a glance† (unaudited)

EnTrustPermal Hedge Strategies Portfolio

The Fund invests substantially all of its assets in EnTrustPermal Hedge Strategies Portfolio, the investment breakdown of which is shown below.

Investment breakdown (%) as a percent of total investments

| † | The bar graph above represents the composition of the portfolio’s investments as of September 30, 2017 and March 31, 2017. The portfolio is actively managed. As a result, the composition of the portfolio’s investments is subject to change at any time. |

| | |

| EnTrustPermal Hedge Strategies Fund II 2017 Semi-Annual Report | | 1 |

Statement of assets and liabilities (unaudited)

September 30, 2017

| | | | |

| |

| Assets | | | | |

Investment in EnTrustPermal Hedge Strategies Portfolio, at value | | $ | 25,457,624 | |

Cash | | | 280,905 | |

Prepaid expenses | | | 461 | |

Total Assets | | | 25,738,990 | |

| |

| Liabilities | | | | |

Service and/or distribution fees payable | | | 5,343 | |

Trustees’ fees payable | | | 941 | |

Accrued expenses | | | 91,540 | |

Total Liabilities | | | 97,824 | |

| Total Net Assets | | $ | 25,641,166 | |

| |

| Net Assets | | | | |

Paid-in capital (Note 3) | | $ | 26,408,476 | |

Overdistributed net investment income | | | (801,934) | |

Accumulated net realized loss on investments allocated from EnTrustPermal Hedge Strategies Portfolio | | | 376,655 | |

Net unrealized depreciation on investments allocated from EnTrustPermal Hedge Strategies Portfolio | | | (342,031) | |

| Total Net Assets | | $ | 25,641,166 | |

| |

| Shares Outstanding: | | | | |

Broker Shares | | | 2,592,446 | |

| |

| Net Asset Value: | | | | |

Broker Shares | | | $9.89 | |

| Maximum Public Offering Price Per Share: | | | | |

Broker Shares (based on maximum initial sales charges of 3.00%) | | | $10.20 | |

See Notes to Financial Statements.

| | |

| 2 | | EnTrustPermal Hedge Strategies Fund II 2017 Semi-Annual Report |

Statement of operations (unaudited)

For the Six Months Ended September 30, 2017

| | | | |

| |

| Investment Income | | | | |

Income from EnTrustPermal Hedge Strategies Portfolio | | $ | 18,490 | |

Allocated expenses from EnTrustPermal Hedge Strategies Portfolio | | | (232,021) | |

Allocated waiver from EnTrustPermal Hedge Strategies Portfolio | | | 46,524 | |

Total Investment Loss | | | (167,007) | |

| |

| Fund Expenses | | | | |

Legal fees | | | 77,585 | |

Service and/or distribution fees (Note 2) | | | 50,218 | |

Transfer agent fees | | | 14,825 | |

Printing expenses | | | 13,692 | |

Tax fees | | | 12,857 | |

Registration fees | | | 5,960 | |

Trustees’ fees | | | 3,430 | |

Administration fees | | | 3,214 | |

Custodian fees | | | 1,359 | |

Miscellaneous expenses | | | 2,574 | |

Total Operating Expenses | | | 185,714 | |

Less: Fee waivers and/or expense reimbursements (Note 2) | | | (63,017) | |

Net Expenses | | | 122,697 | |

| Net Investment Loss | | | (289,704) | |

| Net Realized Gain on Investments From EnTrustPermal Hedge Strategies Portfolio | | | 2,256,933 | |

Net Change in Unrealized Depreciation From Investments in

EnTrustPermal Hedge Strategies Portfolio | | | (1,576,057) | |

| Net Increase in Net Assets Resulting From Operations | | $ | 391,172 | |

See Notes to Financial Statements.

| | |

| EnTrustPermal Hedge Strategies Fund II 2017 Semi-Annual Report | | 3 |

Statements of changes in net assets

| | | | | | | | |

For the Six Months Ended September 30, 2017 (unaudited)

and the Year Ended March 31, 2017 | | September 30 | | | March 31 | |

| | |

| Net Increase (Decrease) in Net Assets: | | | | | | | | |

| | |

| Operations: | | | | | | | | |

Net investment loss | | $ | (289,704) | | | $ | (783,715) | |

Net realized gain | | | 2,256,933 | | | | 170,947 | |

Net change in unrealized appreciation (depreciation) | | | (1,576,057) | | | | 2,834,899 | |

Net Increase in Net Assets Resulting From Operations | | | 391,172 | | | | 2,222,131 | |

| | |

| Distributions to Shareholders From (Notes 1 and 4): | | | | | | | | |

Net realized gains | | | — | | | | (40,768) | |

Net Decrease in Net Assets From Distributions to Shareholders | | | — | | | | (40,768) | |

| | |

| Fund Share Transactions (Note 3): | | | | | | | | |

Net proceeds from issuance of shares | | | — | | | | 768,340 | |

Reinvestment of distributions | | | — | | | | 34,992 | |

Value of withdrawals | | | (747,029) | | | | (9,754,967) | |

Net Decrease in Net Assets From Fund Share Transactions | | | (747,029) | | | | (8,951,635) | |

Decrease in Net Assets | | | (355,857) | | | | (6,770,272) | |

| | |

| Net Assets: | | | | | | | | |

Beginning of period | | | 25,997,023 | | | | 32,767,295 | |

End of period* | | $ | 25,641,166 | | | $ | 25,997,023 | |

*Includes overdistributed net investment income of: | | | $(801,934) | | | | $(512,230) | |

See Notes to Financial Statements.

| | |

| 4 | | EnTrustPermal Hedge Strategies Fund II 2017 Semi-Annual Report |

Statement of cash flows (unaudited)

For the Six Months Ended September 30, 2017

| | | | |

| |

| Cash Provided by Operating Activities | | | | |

Net increase in net assets resulting from operations | | $ | 391,172 | |

Adjustments to reconcile net increase in net assets resulting from operations

to net cash provided by operating activities: | | | | |

Proceeds from the disposition of investments in EnTrustPermal Hedge Strategies Portfolio | | | 1,675,000 | |

Net realized gain on investments from EnTrustPermal Hedge Strategies Portfolio | | | (2,256,933) | |

Net change in unrealized depreciation from investments in EnTrustPermal Hedge Strategies Portfolio | | | 1,576,057 | |

Net investment loss allocated from EnTrustPermal Hedge Strategies Portfolio | | | 167,007 | |

Decrease in receivable for reimbursement from adviser | | | 10,113 | |

Increase in prepaid expenses | | | (44) | |

Decrease in trustees’ fees payable | | | (609) | |

Decrease in service and/or distribution fees payable | | | (12,551) | |

Increase in accrued expenses | | | 16,901 | |

Net Cash Provided by Operating Activities | | | 1,566,113 | |

| |

| Cash Used in Financing Activities | | | | |

Value of withdrawals | | | (1,582,481) | |

Net Cash Used in Financing Activities | | | (1,582,481) | |

| |

| Cash | | | | |

Net decrease in cash | | | (16,368) | |

Cash at beginning of period | | | 297,273 | |

Cash at end of period | | $ | 280,905 | |

See Notes to Financial Statements.

| | |

| EnTrustPermal Hedge Strategies Fund II 2017 Semi-Annual Report | | 5 |

Financial highlights

| | | | | | | | | | | | | | | | | | | | |

For a share of beneficial interest outstanding throughout each year ended March 31,

unless otherwise noted: | |

| Broker Shares | | 20171 | | | 2017 | | | 2016 | | | 2015 | | | 20142 | |

| | | | | |

| Net asset value per share, beginning of period: | | | $9.74 | | | | $9.07 | | | | $10.39 | | | | $10.53 | | | | $10.00 | |

| | | | | |

| Income (loss) from investment operations:3 | | | | | | | | | | | | | | | | | | | | |

Net investment loss | | | (0.11) | | | | (0.25) | | | | (0.26) | | | | (0.26) | | | | (0.21) | |

Net realized and unrealized gain (loss) | | | 0.26 | | | | 0.93 | | | | (0.72) | | | | 0.27 | | | | 0.85 | |

Total income (loss) from investment operations | | | 0.15 | | | | 0.68 | | | | (0.98) | | | | 0.01 | | | | 0.64 | |

| | | | | |

| Less distributions from: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | — | | | | — | | | | (0.15) | | | | (0.05) | | | | (0.11) | |

Net realized gains | | | — | | | | (0.01) | | | | (0.19) | | | | (0.10) | | | | — | |

Total distributions | | | — | | | | (0.01) | | | | (0.34) | | | | (0.15) | | | | (0.11) | |

| | | | | |

| Net asset value per share, end of period: | | | $9.89 | | | | $9.74 | | | | $9.07 | | | | $10.39 | | | | $10.53 | |

Total return4 | | | 1.54 | % | | | 7.42 | % | | | (9.42 | %) | | | 0.11 | % | | | 6.45 | % |

| | | | | |

| Net assets, end of period (000s) | | | $25,641 | | | | $25,997 | | | | $32,767 | | | | $38,078 | | | | $18,952 | |

| | | | | |

| Ratios to average net assets: | | | | | | | | | | | | | | | | | | | | |

Gross expenses6,7 | | | 3.24 | %5 | | | 3.86 | % | | | 3.54 | % | | | 4.26 | % | | | 7.17 | %5 |

Net expenses6,7,8,9 | | | 2.39 | %5 | | | 2.65 | % | | | 2.65 | % | | | 2.65 | % | | | 2.65 | %5 |

Net investment loss | | | (2.32 | %)5 | | | (2.63 | %) | | | (2.63 | %) | | | (2.56 | %) | | | (2.60 | %)5 |

| | | | | |

| Portfolio turnover10 | | | 0 | %11 | | | 0 | %11 | | | 16 | %12 | | | 5 | % | | | 5 | % |

The above ratios may vary for individual investors based on the timing of Fund share transactions during the period.

See Notes to Financial Statements.

| | |

| 6 | | EnTrustPermal Hedge Strategies Fund II 2017 Semi-Annual Report |

| 1 | For the six months ended September 30, 2017 (unaudited) |

| 2 | For the period June 28, 2013 (commencement of operations) to March 31, 2014. |

| 3 | Per share data for income (loss) from investment operations is computed using the net income (loss) for the period divided by the average monthly shares. |

| 4 | Performance figures, exclusive of sales charges, may reflect compensating balance arrangements, fee waivers and/or expense reimbursements. In the absence of compensating balance arrangements, fee waivers and/or expense reimbursements, the total return would have been lower. Past performance is no guaranteed of future results. The total returns for periods less than one year have not been annualized. |

| 6 | Does not include expenses of the Portfolio Funds in which EnTrustPermal Hedge Strategies Portfolio invests. |

| 7 | Includes the Fund’s share of EnTrustPermal Hedge Strategies Portfolio’s allocated expenses. |

| 8 | As a result of an expense limitation arrangement, the ratio of total annual fund operating expenses (excluding fees and expenses, including incentive or performance allocations and fees, attributable to Portfolio Funds, brokerage, interest expense, taxes and extraordinary expenses) to average net assets of Broker Shares did not exceed 2.65%. This expense limitation arrangement cannot be terminated prior to December 31, 2017 without the Board of Trustees’ consent. |

| 9 | Reflects fee waivers and/or expense reimbursements. |

| 10 | Represents the portfolio turnover rate of EnTrustPermal Hedge Strategies Portfolio. |

| 11 | Amount represents less than 0.5% |

| 12 | Includes an in-kind transfer where EnTrustPermal Hedge Strategies Portfolio’s interests in a Portfolio Fund were transferred to another Portfolio Fund. Absent this transaction, the portfolio turnover would have been 14%. |

See Notes to Financial Statements.

| | |

| EnTrustPermal Hedge Strategies Fund II 2017 Semi-Annual Report | | 7 |

Notes to financial statements (unaudited)

1. Organization and significant accounting policies

EnTrustPermal Hedge Strategies Fund II (the “Fund”) is a Maryland statutory trust registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as a non-diversified, closed-end management investment company. The Fund is a “feeder” fund in a “master feeder” structure and invests substantially all of its assets in EnTrustPermal Hedge Strategies Portfolio, a Maryland statutory trust (the “Master Fund”), in return for an interest in the Master Fund. The Master Fund is an investment company with the same investment objective and strategies, and substantially the same policies as the Fund. The Master Fund employs a “fund-of hedge funds” investment program that provides a means for the Fund to participate in investments in private investment vehicles, typically referred to as hedge funds (“Portfolio Funds”), by providing a single portfolio of interests in underlying Portfolio Funds, which are managed by a number of third-party investment managers (the “Portfolio Managers”). The financial statements of the Master Fund, including its schedule of investments and notes to financial statements, are an integral part of these financial statements and should be read in conjunction with these financial statements. The Fund offers one class of shares (the “Shares” or the “Broker Shares”).

The Fund announced on May 15, 2017 that the Board of Trustees of the Fund had approved the termination and liquidation of the Fund in accordance with the Maryland Statutory Trust Act. As part of the termination and liquidation of the Fund, the Board approved (i) a Plan of Termination and Liquidation, (ii) the suspension of the sale of Broker Shares, (iii) the suspension of the dividend reinvestment plan of the Fund, (iv) the suspension of the distribution fee payable on the Broker Shares pursuant to the Shareholder Services and Distribution Plan, (v) the mandatory redemption at net asset value of Broker Shares held by shareholders other than Legg Mason Inc. (“Legg Mason”), and (vi) the deregistration of the Fund as an investment company. It is anticipated that the redemption will be completed on or about November 28, 2017. Shareholders will receive the net asset value of their Fund shares as of October 31, 2017 in cash pursuant to the redemption. In addition, effective May 15, 2017, the Fund ceased to purchase additional assets in pursuit of its investment objective.

Following the redemption, the Fund will terminate, and Legg Mason will become the sole shareholder of the Master Fund. The Master Fund will continue to redeem its interests in the underlying hedge funds held by the Master Fund and distribute cash to Legg Mason as those interests are redeemed. Legg Mason has agreed that, to the extent it receives cash distributions in excess of the value of its remaining investment in the Fund as determined on the valuation date for the mandatory redemption of non-Legg Mason shareholders, excess proceeds will be distributed pro rata to the non-Legg Mason former shareholders of the Fund, or donated to charity if the expenses associated with a distribution would exceed the amount of the proceeds.

For taxable shareholders, liquidating distributions, including a mandatory redemption, will generally be treated as a sale of Fund shares that may result in a taxable gain or loss to shareholders for U.S. federal income tax purposes.

| | |

| 8 | | EnTrustPermal Hedge Strategies Fund II 2017 Semi-Annual Report |

The Fund has the same investment objective and strategies as the Master Fund. Subject to the Plan of Termination and Liquidation, the Fund’s investment objective is to seek long-term capital appreciation while attempting to reduce risk and volatility. In seeking to achieve its objective, the Fund, through its investment in the Master Fund, provides its shareholders with access, through investments in the Portfolio Funds to a broad range of investment strategies which may include, but are not limited to, global fixed income strategies (e.g., U.S. and non-U.S. fixed income hedge, convertible arbitrage, fixed income arbitrage, asset-backed securities, long-only, high yield, emerging markets debt), global event-driven strategies (e.g., risk arbitrage, distressed debt, special situations, activists) and global macro strategies (e.g., discretionary, systematic, natural resources) and, to a lesser extent, equity long/short strategies.

The following are significant accounting policies consistently followed by the Fund and are in conformity with U.S. generally accepted accounting principles (“U.S. GAAP”). Estimates and assumptions are required to be made regarding assets, liabilities and changes in net assets resulting from operations when financial statements are prepared. Changes in the economic environment, financial markets and any other parameters used in determining these estimates could cause actual results to differ.

(a) Investment valuation. The Fund records its investment in the Master Fund at value. The value of such investment in the Master Fund reflects the Fund’s proportionate interest (62% at September 30, 2017) in the net assets of the Master Fund. The performance of the Fund is directly affected by the performance of the Master Fund. Valuation of the investments held by the Master Fund is discussed in the notes to the Master Fund’s financial statements, which are attached to this report.

(b) Net asset value determination. The net asset value of the Fund is determined as of the close of business at the end of each month in accordance with the valuation principles set forth in Note 1(a) of the Master Fund’s Notes to Financial Statements, which are included elsewhere in this report or as may be determined from time to time pursuant to policies established by the Board of Trustees (the “Board”). The net asset value of the Fund will equal the value of the Fund’s total assets including its investment in the Master Fund, less all of its liabilities, including accrued fees and expenses. The net asset value per share of each class will equal the net asset value of the class divided by the number of outstanding shares for each class.

(c) Cash. The cash at September 30, 2017 consists of deposit accounts with The Bank of New York Mellon. Such cash, at times, may exceed U.S. federally insured limits. The Fund has not experienced any losses in such accounts and does not believe it is exposed to any significant credit risk on such bank deposits.

(d) Investment transactions and investment income. Purchases and sales of interest in the Master Fund are recorded on a trade-date basis and related revenues and expenses are recorded on an accrual basis. The Fund adopted the tax allocation rules provided for in Section 704(b) of the Internal Revenue Code of 1986, as amended (the “Code”).

| | |

| EnTrustPermal Hedge Strategies Fund II 2017 Semi-Annual Report | | 9 |

Notes to financial statements (unaudited) (cont’d)

Accordingly, its proportionate share of the Master Fund’s income, expenses, realized and unrealized gains and losses are allocated monthly using the aggregate method. In addition, the Fund records its own investment income and operating expenses on an accrual basis.

(e) Distributions to shareholders. Distributions from net investment income and distributions of net realized gains, if any, are declared at least annually. Distributions to shareholders of the Fund are recorded on the ex-dividend date and are determined in accordance with income tax regulations, which may differ from U.S. GAAP.

(f) Compensating balance arrangements. The Fund has an arrangement with its custodian bank whereby a portion of the custodian’s fees is paid indirectly by credits earned on the Fund’s cash on deposit with the bank.

(g) U.S. federal and other taxes. It is the Fund’s policy to comply with the federal income and excise tax requirements of the Code applicable to regulated investment companies (“RICs”). Accordingly, the Fund intends to distribute its taxable income and net realized gains, if any, to shareholders in accordance with timing requirements imposed by the Code. Therefore, no federal or state income tax provision is required in the Fund’s financial statements.

Management has analyzed the Fund’s tax positions taken on income tax returns for all open tax years and has concluded that as of March 31, 2017, no provision for income tax is required in the Fund’s financial statements. The Fund’s federal and state income and federal excise tax returns for the current tax year are subject to examination by Internal Revenue Service and state departments of revenue.

On September 28, 2016, the U.S. Department of the Treasury and the Internal Revenue Service issued proposed regulations that, if finalized, would treat income inclusions that RICs recognize from passive foreign investment companies (“PFICs”) for which a qualified electing fund election has been made (“QEFs”), as qualifying income only to the extent that the income is distributed to the RIC by the QEF. The proposed regulations would treat QEF income inclusions, to the extent not distributed, as non-qualifying income for RIC qualification purposes.

The Master Fund currently makes QEF elections for the majority of its PFIC investments and those PFICs generally do not distribute their income. Accordingly, under the proposed regulations, the Fund would need to change to making a mark-to-market election for the PFICs rather than the QEF election made by the Master Fund in order to ensure its continued RIC qualification. This change could result in higher taxable ordinary income and therefore higher distributions paid by the Fund since mark-to-market requires the Fund to include unrealized appreciation on the PFICs in its taxable income as ordinary income rather than its pro-rata share of the PFIC’s ordinary income and capital gains as with the QEF election.

The proposed regulations, if adopted, would apply to taxable years beginning on or after 90 days following the publication of the final regulations in the Federal Register. Thus, it is anticipated that this change would not be effective until the Fund’s March 31, 2019 fiscal year or later.

| | |

| 10 | | EnTrustPermal Hedge Strategies Fund II 2017 Semi-Annual Report |

(h) Reclassification. U.S. GAAP requires that certain components of net assets be reclassified to reflect permanent differences between financial and tax reporting. These reclassifications have no effect on net assets or net asset values per share.

2. Investment management agreement and other transactions with affiliates

Legg Mason Partners Fund Advisor, LLC (“LMPFA”) is the Fund’s and the Master Fund’s investment manager and prior to August 11, 2017 EnTrustPermal Management LLC (“EnTrustPermal”) was the Fund’s and the Master Fund’s sub-adviser (the “sub-adviser”). Effective August 11, 2017, LMPFA assumed responsibility for the day-to-day management of the Fund’s and the Master Fund’s portfolio, as well as continuing to provide administrative and certain oversight services to the Fund and the Master Fund. Following LMPFA’s assumption of the day-to-day management of the Fund’s and the Master Fund’s portfolio, the Fund and the Master Fund no longer have a subadviser. LMPFA is a wholly-owned subsidiary of Legg Mason and EnTrustPermal is a subsidiary of Legg Mason.

Under the investment management agreement between the Master Fund and LMPFA, the Master Fund pays an investment management fee, calculated and paid monthly, at an annual rate of 1.10% of the Master Fund’s average monthly managed assets. “Managed assets” means net assets plus the principal amount of any borrowings and assets attributable to any preferred shares that may be outstanding.

The management fee and related terms of the Fund’s investment management agreement with LMPFA are substantially the same as the terms of the Master Fund’s investment management agreement with LMPFA. Since the Fund invests all or substantially all of its assets in the Master Fund, the investment management fee of the Fund will be reduced by the investment management fee allocated to the Fund by the Master Fund.

LMPFA has agreed to waive fees and/or reimburse expenses (including organization and offering expenses) to the extent necessary to ensure that the total annual Fund operating expenses attributable to the Broker Shares will not exceed 2.65% (excluding fees and expenses, including incentive or performance allocations and fees, attributable to Portfolio Funds, brokerage, interest expense, taxes and extraordinary expenses). This expense limitation arrangement cannot be terminated prior to December 31, 2017 without the Board’s consent.

The Master Fund will bear its own similar fees and expenses, including the management fee. It also pays fees and expenses incidental to the purchase, holding and sale of interests in, and bears a pro rata share of the fees, including, but not limited to, any commitment fees, and expenses of, any Portfolio Fund and recurring investment-related expenses, including, but not limited to, the management fee, brokerage commissions, dealer mark-ups, and other transactions costs on cash management; interest expense on any borrowings; and any subscription or redemption charges imposed by the Portfolio Funds. These expenses are indirectly borne, on a pro rata basis, by the Fund.

During the six months ended September 30, 2017, fees waived and/or expenses reimbursed by LMPFA for the Fund amounted to $63,017.

LMPFA is permitted to recapture amounts waived and/or reimbursed within three years after the year in which LMPFA earned the fee or incurred the expense if the Fund’s total

| | |

| EnTrustPermal Hedge Strategies Fund II 2017 Semi-Annual Report | | 11 |

Notes to financial statements (unaudited) (cont’d)

annual Fund operating expenses have fallen to a level below the limit described above. In no case will LMPFA recapture any amount that would result in the Fund’s total annual Fund operating expenses exceeding the limit described above.

Pursuant to these agreements, at September 30, 2017, the Fund had remaining fee waivers and/or expense reimbursements subject to recapture by LMPFA and respective dates of expiration as follows:

| | | | |

| Expires March 31, 2018 | | $ | 404,455 | |

| Expires March 31, 2019 | | | 305,265 | |

| Expires March 31, 2020 | | | 302,827 | |

| Expires March 31, 2021 | | | 63,017 | |

| Total fee waivers/expense reimbursements subject to recapture | | $ | 1,075,564 | |

For the six months ended September 30, 2017, LMPFA did not recapture any fees.

Legg Mason Investor Services, LLC (“LMIS”), a wholly-owned broker dealer subsidiary of Legg Mason, serves as principal underwriter and distributor of the Fund. The Fund pays LMIS a shareholder services fee of 0.25% of the Fund’s average monthly net assets attributable to Broker Shares and a distribution fee of 0.55% of the Fund’s average monthly net assets attributable to Broker Shares, each on an annualized basis. Effective May 15, 2017, the distribution fee was suspended.

There is a maximum initial sales charge of 3.00% of the amount invested in Broker Shares, with breakpoints generally based on size of investment. For the six months ended September 30, 2017, LMIS and affiliates did not receive any sales charges on sales of the Fund’s Broker Shares.

All officers and one Trustee of the Fund are employees of Legg Mason or its affiliates and do not receive compensation from the Fund.

As of September 30, 2017, Legg Mason and its affiliates owned 55% of the Fund.

3. Shares of beneficial interest

Prior to May 15, 2017, shares in the Fund (“shares”) were sold to eligible investors (“shareholders”) who met the definition of an accredited investor as defined in Regulation D under the Securities Act of 1933.

The minimum initial investment in the Broker Shares from each shareholder was $25,000; the minimum additional investment was $10,000. Dealers may have imposed different investment minimums.

At September 30, 2017, the Fund had an unlimited number of shares of beneficial interest authorized with a par value of $0.00001 per share. Prior to May 15, 2017, the Fund intended to accept initial and additional purchases of shares as of the first business day of each calendar month. The Fund reserved the right to reject, in whole or in part, any purchase of shares and may have suspended the offering of shares at any time and from time to time. The Fund may have from time to time repurchased shares from shareholders at the net asset value per share pursuant to written tenders by shareholders, and on those terms and

| | |

| 12 | | EnTrustPermal Hedge Strategies Fund II 2017 Semi-Annual Report |

conditions as the Board may have determined in its sole discretion. The Fund anticipated that each such repurchase offer would generally be limited to between 5% and 25% of the net assets of the Fund. In determining whether the Fund should offer to repurchase shares from shareholders, the Board would consider the recommendation of LMPFA, in consultation with EnTrustPermal. LMPFA, in consultation with EnTrustPermal, expected that generally it would recommend the Board repurchase shares from shareholders quarterly, with such repurchases based on fund valuations as of each March 31, June 30, September 30 and December 31 (or, if any such date was not a business day, with such repurchases to occur as of the immediately preceding business day).

Transactions in shares of the Fund were as follows:

| | | | | | | | | | | | | | | | |

| | | Six Months Ended

September 30, 2017 | | | Year Ended

March 31, 2017 | |

| | | Shares | | | Amount | | | Shares | | | Amount | |

| Broker Shares | | | | | | | | | | | | | | | | |

| Shares issued | | | — | | | | — | | | | 81,786 | | | $ | 768,340 | |

| Shares issued on reinvestment | | | — | | | | — | | | | 3,604 | | | | 34,992 | |

| Value of withdrawals | | | (76,228) | | | $ | (747,029) | | | | (1,031,178) | | | | (9,754,967) | |

| Net decrease | | | (76,228) | | | $ | (747,029) | | | | (945,788) | | | $ | (8,951,635) | |

4. Distributions to shareholders

| | | | | | | | |

| | | Six Months Ended

September 30, 2017 | | | Year Ended

March 31, 2017 | |

| Distributions paid from: | | | | | | | | |

| Net long-term capital gains | | | — | | | $ | 40,768 | |

| Total distributions paid | | | — | | | $ | 40,768 | |

5. Deferred capital losses

As of September 30, 2017, the Fund had deferred capital losses of $900,882, which have no expiration date, that will be available to offset future taxable capital gains.

6. Recent accounting pronouncement

In October 2016, the U.S. Securities and Exchange Commission adopted new rules and amended existing rules (together, the “final rules”) intended to modernize the reporting and disclosure of information by registered investment companies. In part, the final rules amend Regulation S-X and require standardized, enhanced disclosure about derivatives in investment company financial statements, as well as other amendments. The compliance date for the amendments to Regulation S-X was August 1, 2017. The Fund has adopted the amendments to Regulation S-X and upon evaluation, has concluded that the amendments do not materially impact the financial statement amounts; however, as required, additional or enhanced disclosure has been included.

7. Subsequent events

Management has evaluated the impact of all subsequent events on the Fund through the date financial statements were issued and has determined that there were no additional subsequent events requiring recognition or disclosure in the financial statements.

| | |

| EnTrustPermal Hedge Strategies Fund II 2017 Semi-Annual Report | | 13 |

Additional information (unaudited)

Change in Independent Registered Public Accounting Firm

On August 14, 2017, KPMG LLP (“KPMG”) resigned, at the request of the Fund, as the independent registered public accounting firm to the Fund. The Audit Committee of the Fund’s Board of Trustees participated in, and approved, the decision to change the independent registered public accounting firm. KPMG’s reports on the Fund’s financial statements for the fiscal periods ended March 31, 2017 and March 31, 2016 contained no adverse opinion or disclaimer of opinion nor were they qualified or modified as to uncertainty, audit scope or accounting principle. During the Fund’s fiscal periods ended March 31, 2017 and March 31, 2016 and the subsequent interim period through August 14, 2017, (i) there were no disagreements with KPMG on any matter of accounting principles or practices, financial statement disclosure or auditing scope or procedure, which disagreements, if not resolved to the satisfaction of KPMG, would have caused them to make reference to the subject matter of the disagreements in connection with their reports on the Fund’s financial statements for such periods, and (ii) there were no “reportable events” of the kind described in Item 304(a)(1)(v) of Regulation S-K under the Securities Exchange Act of 1934, as amended.

The Audit Committee of the Fund’s Board of Trustees approved the engagement of PricewaterhouseCoopers LLP (“PwC”) as the Fund’s independent registered public accounting firm for the fiscal year ending March 31, 2018. The selection of PwC does not reflect any disagreements with or dissatisfaction by the Fund or the Board of Trustees with the performance of the Fund’s prior independent registered public accounting firm, KPMG. During the Fund’s fiscal periods ended March 31, 2017 and March 31, 2016, and the subsequent interim period through August 14, 2017, neither the Fund, nor anyone on its behalf, consulted with PwC on items which: (i) concerned the application of accounting principles to a specified transaction, either completed or proposed, or the type of audit opinion that might be rendered on the Fund’s financial statements; or (ii) concerned the subject of a disagreement (as defined in paragraph (a)(1)(iv) of Item 304 of Regulation S-K) or reportable events (as described in paragraph (a)(1)(v) of said Item 304).

| | |

| 14 | | EnTrustPermal Hedge Strategies Fund II |

Dividend reinvestment plan (unaudited)

The Fund announced on May 15, 2017 that the Board of Trustees of the Fund had approved the termination and liquidation of the Fund in accordance with the Maryland Statutory Trust Act. As part of the termination and liquidation of the Fund, the Board approved the suspension of the dividend reinvestment plan of the Fund.

Subject to the foregoing, holders of shares of beneficial interest, par value $0.00001 per share (the “Shares”) of EnTrustPermal Hedge Strategies Fund II (the “Fund”) who participate (the “Participants”) in the Fund’s Dividend Reinvestment Plan (the “Plan”) are advised as follows:

1. Enrollment of Participants. Each holder of Shares (a “Shareholder”) will automatically be a Participant. A Shareholder whose Shares are registered in the name of a nominee (such as an intermediary firm through which the Shareholder acquired Shares (an “Intermediary”)) must contact the nominee regarding the Shareholder’s status under the Plan.

2. The Plan Agent. The Bank of New York Mellon (the “Plan Agent”) will act as Plan Agent for each Participant.

3. Distributions. If the Fund declares income dividends and/or capital gains distributions (collectively, “Distributions”) payable either in Shares or in cash, non-participants in the Plan will receive Shares (in the case of a share distribution) or cash (in the case of a cash distribution), and Participants will receive Shares (in the case of a share distribution) or, in the case of a cash distribution, the equivalent amount in Shares. To the extent that a Participant reinvests Distributions in additional Shares, the Participant will receive an amount of Shares of the Fund equal to the amount of the Distribution on that Participant’s Shares divided by the net asset value per Share (“NAV”) of the Fund determined on the next valuation date following the record date for the payment of the applicable Distribution by the Fund.

4. Opt-Out. A Participant wishing to receive cash must affirmatively elect to receive both income dividends and capital gain distributions, if any, in cash. A Participant holding Shares through an Intermediary may elect to receive cash by notifying the Intermediary (who should be directed to inform the Fund). A Shareholder is free to change this election at any time, subject to the provisions of Section 9 below.

5. Recordkeeping. The Plan Agent will reflect each Participant’s Shares acquired pursuant to the Plan together with the Shares of other shareholders of the Fund acquired pursuant to the Plan in noncertificated form. Each Participant will be sent a confirmation by the Plan Agent of each acquisition made for his, her or its account as soon as practicable, but not later than 60 days after the date thereof. Distributions on fractional Shares will be credited to each Participant’s account to three decimal places. In the event of termination of a Participant’s account under the Plan, the Plan Agent will adjust for any such undivided fractional interest in cash at the NAV of Shares at the time of termination. Any Share Distributions or split shares distributed by the Fund on Shares held by the Plan Agent for Participants will be credited to their accounts.

6. Fees. The Plan Agent’s service fee for handling Distributions will be paid by the Fund.

| | |

| EnTrustPermal Hedge Strategies Fund II | | 15 |

Dividend reinvestment plan (unaudited) (cont’d)

7. Termination of the Plan. The Plan may be terminated by the Fund at any time upon written notice mailed to the Participants at least 30 days prior to the record date for the payment of any Distribution by the Fund for which the termination is to be effective.

8. Amendment of the Plan. The Plan may be amended or supplemented by the Fund upon notice in writing mailed to Participants at least 30 days prior to the record date for the payment of any Distribution by the Fund for which the amendment is to be effective.

9. Withdrawal from the Plan. Participants may withdraw from the Plan (i.e., opt-out) by notifying the Plan Agent in writing at BNY Investors Services c/o EnTrustPermal Hedge Strategies Fund II, 400 Bellevue Parkway, Wilmington, DE 19809, Mail Stop 19C-0204 or by calling the Plan Agent at 866-211-4521. Such withdrawal will be effective immediately if notice is received by the Plan Agent not less than ten business days prior to any dividend or distribution record date; otherwise such withdrawal will be effective as soon as practicable after the Plan Agent’s investment of the most recently declared dividend or distribution on the Shares.

10. Standard of Care. The Plan Agent shall at all times act in good faith and agree to use its best efforts within reasonable limits to insure the accuracy of all services performed under the Plan and to comply with applicable law, but the Plan Agent assumes no responsibility and shall not be liable for loss or damage due to errors unless such error is caused by its negligence, bad faith or willful misconduct of the Plan Agent or its employees.

11. Applicable Law. These terms and conditions shall be governed by the laws of the State of New York.

| | |

| 16 | | EnTrustPermal Hedge Strategies Fund II |

Schedule of investments (unaudited)

September 30, 2017

EnTrustPermal Hedge Strategies Portfolio

| | | | | | | | | | | | | | | | |

| | | | | | Cost | | | Fair

Value | | | % of

Net Assets | |

| Investments in Portfolio Funds | |

Event Driven | |

Axar Offshore Fund, Ltd.*(a)(c) | | | | | | $ | 1,599,359 | | | $ | 2,016,724 | | | | 4.89 | % |

Empyrean Capital Overseas Fund, Ltd.*(a)(c) | | | | | | | 1,365,107 | | | | 1,641,354 | | | | 3.98 | |

Fortelus Special Situations Fund, Ltd.*(d) | | | | | | | 65,763 | | | | 200,313 | | | | 0.48 | |

H Offshore Fund, Ltd.*(a)(c) | | | | | | | 325,000 | | | | 776,520 | | | | 1.88 | |

Palomino Fund, Ltd.*(b) | | | | | | | 863,467 | | | | 924,065 | | | | 2.24 | |

Total Event Driven | | | | | | | 4,218,696 | | | | 5,558,976 | | | | 13.47 | |

Fixed Income Hedge | |

Apollo Strategic Value Offshore Fund, Ltd.*(e) | | | | | | | 7,761 | | | | 2,379 | | | | 0.01 | |

Canyon Balanced Fund (Cayman), Ltd.*(a)(c) | | | | | | | 1,287,072 | | | | 1,556,037 | | | | 3.77 | |

Reef Road Fund Ltd.*(b) | | | | | | | 1,250,000 | | | | 1,234,661 | | | | 2.99 | |

River Birch International, Ltd.*(a)(c) | | | | | | | 1,186,758 | | | | 1,230,265 | | | | 2.98 | |

Standard General Offshore Fund, Ltd.*(a)(c) | | | | | | | 1,799,890 | | | | 2,098,735 | | | | 5.09 | |

Stone Lion Fund, Ltd.*(e) | | | | | | | 66,289 | | | | 41,700 | | | | 0.10 | |

Total Fixed Income Hedge | | | | | | | 5,597,770 | | | | 6,163,777 | | | | 14.94 | |

Fixed Income Long — Developed Markets | |

Monarch Debt Recovery Fund, Ltd.*(b)(f) | | | | | | | 1,350,000 | | | | 1,851,220 | | | | 4.48 | |

Shenkman Energy Opportunity Fund Ltd.*(a) | | | | | | | 304,500 | | | | 400,229 | | | | 0.97 | |

Total Fixed Income Long — Developed Markets | | | | | | | 1,654,500 | | | | 2,251,449 | | | | 5.45 | |

Total Investments in Portfolio Funds before Short-Term Investments | | | | | | | 11,470,966 | | | | 13,974,202 | | | | 33.86 | |

| | | | |

| | | Rate | | | | | | Value | | | | |

| Short-Term Investments | | | | | | | | | | | | | | | | |

Dreyfus Government Cash Management | | | 0.67 | % | | | 18,219,953 | | | | 18,219,953 | | | | 44.15 | |

Total Investments | | | | | | $ | 29,690,919 | | | | 32,194,155 | | | | 78.01 | |

Other Assets Less Liabilities | | | | | | | | | | | 9,070,865 | | | | 21.99 | |

Net Assets | | | | | | | | | | $ | 41,265,020 | | | | 100.00 | % |

Note: Investments in underlying Portfolio Funds are categorized by investment strategy.

| * | Non-income producing securities. |

| (a) | Redemptions permitted quarterly. |

| (b) | Redemptions permitted annually. |

| (c) | Subject to investor level gates if a significant portion of the investment is redeemed. |

| (d) | EnTrustPermal Hedge Strategies Portfolio’s interest in the Portfolio Fund is held in a side pocket and is redeemable only when the underlying investment is realized or converted to regular interest in the Portfolio Fund. |

| (e) | EnTrustPermal Hedge Strategies Portfolio’s interest in the Portfolio Fund is in liquidation. In addition to any redemption proceeds that may have already been received, EnTrustPermal Hedge Strategies Portfolio will continue to receive proceeds periodically as the Portfolio Fund is able to liquidate the underlying investments. |

| (f) | $279,804 of this investment is subject to a minimum lock-up period. |

See Notes to Financial Statements.

| | |

| EnTrustPermal Hedge Strategies Portfolio 2017 Semi-Annual Report | | 17 |

Statement of assets and liabilities (unaudited)

September 30, 2017

| | | | |

|

| Assets | |

Investments in Portfolio Funds, at fair value (Cost — $11,470,966) | | $ | 13,974,202 | |

Investments in Short-Term Investments (Cost — $18,219,953) | | | 18,219,953 | |

Redemptions receivable from Portfolio Funds | | | 9,147,162 | |

Interest receivable | | | 10,174 | |

Total Assets | | | 41,351,491 | |

|

| Liabilities | |

Trustees’ fees payable | | | 1,506 | |

Accrued expenses | | | 84,965 | |

Total Liabilities | | | 86,471 | |

| Total Net Assets | | $ | 41,265,020 | |

|

| Net Assets Consist of | |

Investors’ capital | | $ | 38,761,784 | |

Net unrealized appreciation/depreciation | | | 2,503,236 | |

| Total Net Assets | | $ | 41,265,020 | |

See Notes to Financial Statements.

| | |

| 18 | | EnTrustPermal Hedge Strategies Portfolio 2017 Semi-Annual Report |

Statement of operations (unaudited)

For the Six Months Ended September 30, 2017

| | | | |

| |

| Investment Income | | | | |

Income | | $ | 29,862 | |

Total Investment Income | | | 29,862 | |

| |

| Fund Expenses | | | | |

Investment management fee (Note 2) | | | 227,374 | |

Administration fees | | | 76,064 | |

Legal fees | | | 41,456 | |

Tax fees | | | 17,143 | |

Trustees’ fees | | | 5,520 | |

Miscellaneous expenses | | | 6,549 | |

Total Operating Expenses | | | 374,106 | |

Less: Fee waivers and /or expense reimbursements (Note 2) | | | (75,412) | |

Net Expenses | | | 298,694 | |

| Net Investment Loss | | | (268,832) | |

| Net Realized Gain From Investments in Portfolio Funds | | | 3,641,629 | |

| Net Change in Unrealized Depreciation From Investments in Portfolio Funds | | | (2,543,560) | |

| Net Increase in Net Assets Resulting From Operations | | $ | 829,237 | |

See Notes to Financial Statements.

| | |

| EnTrustPermal Hedge Strategies Portfolio 2017 Semi-Annual Report | | 19 |

Statements of changes in net assets

| | | | | | | | |

For the Six Months Ended September 30, 2017 (unaudited)

and the Year Ended March 31, 2017 | | September 30 | | | March 31 | |

| | |

| Net Increase (Decrease) in Net Assets: | | | | | | | | |

| | |

| Operations: | | | | | | | | |

Net investment loss | | $ | (268,832) | | | $ | (854,154) | |

Net realized gain from investments in Portfolio Funds | | | 3,641,629 | | | | 269,825 | |

Net change in unrealized appreciation (depreciation) from investments in Portfolio Funds | | | (2,543,560) | | | | 4,470,173 | |

Net Increase in Net Assets Resulting From Operations | | | 829,237 | | | | 3,885,844 | |

|

| Capital Transactions: | |

Proceeds from contributions | | | — | | | | 1,208,340 | |

Value of withdrawals | | | (855,500) | | | | (14,705,000) | |

Net Decrease in Net Assets From Capital Transactions | | | (855,500) | | | | (13,496,660) | |

Decrease in Net Assets | | | (26,263) | | | | (9,610,816) | |

|

| Net Assets: | |

Beginning of period | | | 41,291,283 | | | | 50,902,099 | |

End of period | | $ | 41,265,020 | | | $ | 41,291,283 | |

See Notes to Financial Statements.

| | |

| 20 | | EnTrustPermal Hedge Strategies Portfolio 2017 Semi-Annual Report |

Statement of cash flows (unaudited)

For the Six Months Ended September 30, 2017

| | | | |

| |

| Cash Provided by Operating Activities | | | | |

Net increase in net assets resulting from operations | | $ | 829,237 | |

Adjustments to reconcile net increase in net assets resulting from operations to net cash provided by operating activities: | | | | |

Purchases of investments in Portfolio Funds | | | (999) | |

Proceeds from the disposition of investments in Portfolio Funds | | | 16,129,651 | |

Net purchases, sales and maturities of Short-Term Investments | | | (18,219,953) | |

Net realized gain on investments in Portfolio Funds | | | (3,641,629) | |

Net change in unrealized depreciation from investments in Portfolio Funds | | | 2,543,560 | |

Decrease in receivable for reimbursement from adviser | | | 586 | |

Increase in Interest receivable | | | (10,174) | |

Decrease in trustees’ fees payable | | | (894) | |

Decrease in management fees payable | | | (38,807) | |

Decrease in accrued expenses | | | (156,347) | |

Net Cash Provided by Operating Activities | | | (2,565,769) | |

|

| Cash Used in Financing Activities | |

Value of withdrawals | | | (1,860,500) | |

Net Cash Used in Financing Activities | | | (1,860,500) | |

|

| Cash | |

Net decrease in cash | | | (4,426,269) | |

Cash at beginning of period | | $ | 4,426,269 | |

Cash at end of period | | | — | |

See Notes to Financial Statements.

| | |

| EnTrustPermal Hedge Strategies Portfolio 2017 Semi-Annual Report | | 21 |

Financial highlights

| | | | | | | | | | | | | | | | | | | | |

| For each year ended March 31, unless otherwise noted: | |

| | | 20171 | | | 2017 | | | 2016 | | | 2015 | | | 20142 | |

| | | | | |

| Net assets, end of period (000s) | | | $41,265 | | | | $41,291 | | | | $50,902 | | | | $58,410 | | | | $32,354 | |

Total return3 | | | 2.03 | % | | | 8.63 | % | | | (8.71 | %) | | | 0.85 | % | | | 5.49 | % |

|

| Ratios to average net assets: | |

Gross expenses4 | | | 1.81 | %5 | | | 2.04 | % | | | 1.90 | % | | | 2.14 | % | | | 2.97 | %5 |

Net expenses4,6 | | | 1.44 | %5 | | | 1.85 | % | | | 1.85 | % | | | 1.85 | % | | | 2.01 | %5 |

Net investment loss | | | (1.30 | %)5 | | | (1.83 | %) | | | (1.83 | %) | | | (1.76 | %) | | | (1.96 | %)5 |

| | | | | |

| Portfolio turnover | | | 0 | %7 | | | 0 | %7 | | | 16 | %8 | | | 5 | % | | | 5 | % |

| 1 | For the six months ended September 30, 2017 (unaudited). |

| 2 | For the period June 12, 2013 (commencement of operations) to March 31, 2014. |

| 3 | EnTrustPermal Hedge Strategies Portfolio is a closed-end fund, the shares of which are offered to the feeder funds. No secondary market for EnTrustPermal Hedge Strategies Portfolio’s shares exists. Performance figures may reflect compensating balance arrangements, fee waivers and/or expense reimbursements. In the absence of compensating balance arrangements, fee waivers and/or expense reimbursements, the total return would have been lower. Past performance is no guarantee of future results. The total return for periods less than one year has not been annualized. |

| 4 | Does not include expenses of the Portfolio Funds in which EnTrustPermal Hedge Strategies Portfolio invests. |

| 6 | Reflects fee waivers and/or expense reimbursements. |

| 7 | Amount represents less than 0.5%. |

| 8 | Includes an in-kind transfer where EnTrustPermal Hedge Strategies Portfolio’s interests in a Portfolio Fund were transferred to another Portfolio Fund. Absent this transaction, the portfolio turnover would have been 14%. |

See Notes to Financial Statements.

| | |

| 22 | | EnTrustPermal Hedge Strategies Portfolio 2017 Semi-Annual Report |

Notes to financial statements (unaudited)

1. Organization and significant accounting policies

EnTrustPermal Hedge Strategies Portfolio (the “Master Fund”) is a Maryland statutory trust registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as a non-diversified, closed-end management investment company. The Master Fund employs a “fund-of-hedge funds” investment program that provides a means for investors to participate in investments in private investment vehicles, typically referred to as hedge funds (“Portfolio Funds”), by providing a single portfolio of interests in underlying Portfolio Funds, which are managed by a number of third-party investment managers (the “Portfolio Managers”).

On May 15, 2017, the Master Fund’s two feeder funds, EnTrustPermal Hedge Strategies Fund I and EnTrustPermal Hedge Strategies Fund II (the “Feeder Funds”), announced that the Board of Trustees of each Feeder Fund had approved the termination and liquidation of the Feeder Funds in accordance with the Maryland Statutory Trust Act. As part of the termination and liquidation of each Feeder Fund, the Board approved the mandatory redemption at net asset value of Feeder Fund shares held by shareholders other than Legg Mason. It is anticipated that the redemption will be completed on or about November 28, 2017. Effective May 15, 2017, the Feeder Funds and the Master Fund each ceased to purchase additional assets in pursuit of their investment objective.

Following the redemption, each Feeder Fund will terminate, and Legg Mason will become the sole shareholder of the Master Fund. The Master Fund will continue to redeem its interests in the underlying hedge funds held by the Master Fund and distribute cash to Legg Mason as those interests are redeemed. In addition, the Master Fund will seek to deregister as an investment company following the redemption.

Subject to the plan of termination and liquidation noted above, the Master Fund’s investment objective is to seek long-term capital appreciation while attempting to reduce risk and volatility. In seeking to achieve its objective, the Master Fund provides its shareholders, through investments primarily in the Portfolio Funds, access to a broad range of investment strategies with a global fixed income focus, which may include, but are not limited to, global fixed income strategies (e.g., U.S. and non-U.S. fixed income hedge, convertible arbitrage, fixed income arbitrage, asset-backed securities, long-only, high yield, emerging markets debt), global event-driven strategies (e.g., risk arbitrage, distressed debt, special situations, activists) and global macro strategies (e.g., discretionary, systematic, natural resources) and, to a lesser extent, equity long/short strategies.

The following are significant accounting policies consistently followed by the Master Fund and are in conformity with U.S. generally accepted accounting principles (“U.S. GAAP”). Estimates and assumptions are required to be made regarding assets, liabilities and changes in net assets resulting from operations when financial statements are prepared. Changes in the economic environment, financial markets and any other parameters used in determining these estimates could cause actual results to differ.

(a) Investment valuation. The Master Fund primarily invests in Portfolio Funds. The net asset values of Portfolio Funds (“Underlying NAV”) are generally not readily available from

| | |

| EnTrustPermal Hedge Strategies Portfolio 2017 Semi-Annual Report | | 23 |

Notes to financial statements (cont’d)