Filed Pursuant to Rule 424(b)(3)

Registration No. 333-193480

STRATEGIC STORAGE GROWTH TRUST, INC.

SUPPLEMENT NO. 1 DATED OCTOBER 5, 2015

TO THE PROSPECTUS DATED SEPTEMBER 28, 2015

This document supplements, and should be read in conjunction with, the prospectus of Strategic Storage Growth Trust, Inc. dated September 28, 2015. Unless otherwise defined in this supplement, capitalized terms used in this supplement shall have the same meanings as set forth in the prospectus.

The purpose of this supplement is to disclose:

| | · | | an update on the status of our public offering; |

| | · | | a revision to our state-specific suitability standards; |

| | · | | an update regarding our sponsor; and |

| | · | | an update to the “Where You Can Find More Information” section of our prospectus. |

Status of Our Offering

On June 17, 2013, we commenced a private offering of up to $109.5 million in shares of our common stock to accredited investors only pursuant to a confidential private placement memorandum. On May 23, 2014, we reached the minimum offering amount of $1.0 million in sales of shares in our private offering and we commenced operations. On January 16, 2015, we terminated the private offering of which we raised a total of $7.8 million. On January 20, 2015, our public offering was declared effective. As of September 30, 2015, we have received gross offering proceeds of approximately $11.3 million from the sale of approximately 1.2 million Class A shares in our private and public offerings. As of September 30, 2015, approximately $1.09 billion in shares remained available for sale to the public under our initial public offering, including shares available under our distribution reinvestment plan.

Suitability Standards

The state-specific suitability standard for the State of Alabama contained in the “Suitability Standards” section immediately behind the cover page of our prospectus is hereby deleted and replaced with the following:

| | · | | For Alabama Residents – In addition to the general suitability standards, this investment will only be sold to Alabama residents representing that they have a liquid net worth of at least 10 times their investment in us and our affiliates. |

Update to Our Sponsor

On October 1, 2015, SmartStop Self Storage, Inc. (“SmartStop”) and Extra Space Storage Inc. (“Extra Space”), along with subsidiaries of each of SmartStop and Extra Space, closed on its merger transaction in which SmartStop was acquired by Extra Space for $13.75 per share in cash, representing an enterprise value of approximately $1.4 billion. Prior to the closing of the merger transaction, SmartStop was our sponsor.

1

Upon the closing of the merger, SmartStop Asset Management, LLC (formerly known as Strategic Storage Realty Group, LLC) (“SmartStop Asset Management”), the owner of our property manager and majority and sole voting member of our advisor, became our sponsor. SmartStop Asset Management is indirectly owned and controlled by H. Michael Schwartz, our Chairman of the Board of Directors, Chief Executive Officer and President. The executive management team of SmartStop continues to serve as the executive management team for our new sponsor, SmartStop Asset Management. In addition, our management team remains the same, as well as the management team of our advisor and property manager.

At the closing of the merger, our property manager entered into sub-property management agreements with Extra Space for the management of our properties. Furthermore, Extra Space acquired the rights to the “SmartStop® Self Storage” brand in the United States through the merger and we can no longer utilize this brand. The properties we own are being re-branded under the Extra Space name. However, any properties owned or acquired in Canada will be managed by a subsidiary of SmartStop Asset Management and will continue to be branded using the SmartStop® Self Storage brand.

In all places in our prospectus where our sponsor or SmartStop is mentioned, our sponsor and SmartStop shall mean SmartStop Asset Management, LLC.

Our Sponsor

The following information should be read in conjunction with the paragraph under the “Our Sponsor” subsection of the “Prospectus Summary” section on page 11 of our prospectus, the “Affiliated Companies” subsection of the “Management” section on page 93 of our prospectus, the first paragraph of the “Interests in Other Real Estate Programs and Other Concurrent Offerings” subsection of the “Conflicts of Interest” section on page 104 of our prospectus, the “General” subsection of the “Plan of Distribution” section on page 171 of our prospectus and all similar discussions appearing throughout the prospectus:

Below is some information about our new sponsor immediately following the merger transaction with Extra Space:

| | · | | SmartStop Asset Management and its subsidiaries now serve as our sponsor, advisor and property manager, and the sponsor, advisor, and property manager of Strategic Storage Trust II, Inc. (“SST II”), a public non-traded REIT focused on stabilized self storage assets; |

| | · | | SmartStop Asset Management is a limited liability company focused on providing self storage advisory, asset management and property management services; |

| | · | | The executive officers of SmartStop Asset Management are the same executive officers of our prior sponsor; and |

| | · | | SmartStop Asset Management indirectly owns a 15% non-voting equity interest in our dealer manager, Select Capital Corporation. |

Concurrent Offerings

The following information should be read in conjunction with the paragraph under the “Concurrent Offerings” subsection of the “Prospectus Summary” section on page 12 of our prospectus and the “Interests in Other Real Estate Programs and Other Concurrent Offerings” subsection of the “Conflicts of Interest” section on page 104 of our prospectus.

SmartStop Asset Management is our new sponsor and also sponsors SST II. SST II is, as of the date of this prospectus, raising capital pursuant to a public offering of its shares of its common stock. As of September 30, 2015, SST II has raised approximately $57.0 million of gross offering proceeds in its public offering.

2

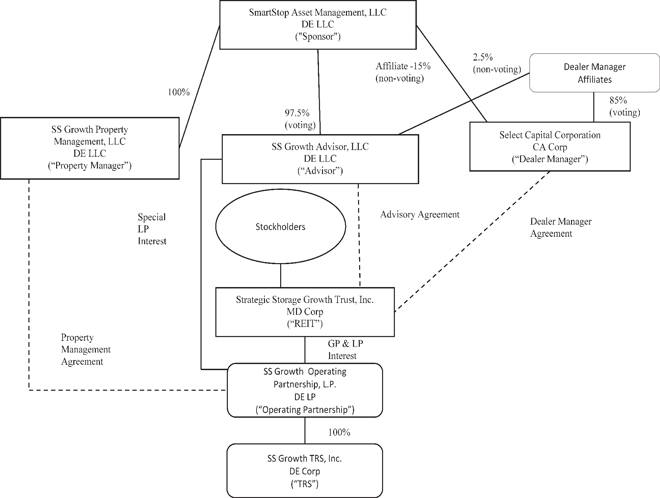

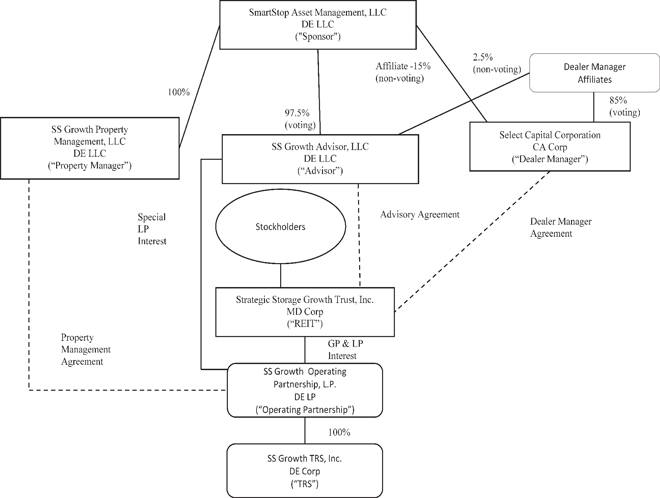

The chart and notes under the “Our Structure” subsection of the “Prospectus Summary” section on page 13 of our prospectus and the “Certain Conflict Resolution Procedures” subsection of the “Conflicts of Interest” section on page 111 of our prospectus is hereby amended and replaced with the following chart, as of October 1, 2015:

Our Property Manager

The following information should be read in conjunction with the “Our Property Manager” subsection of the “Prospectus Summary” section on page 12 of our prospectus and “Our Property Manager” sub-sub-section of the “Affiliated Companies” sub-section of the “Management” section on page 94 of our prospectus.

On October 1, 2015, in connection with the merger of SmartStop and Extra Space, our property manager entered into sub-property management agreements with Extra Space Management, Inc., an affiliate of Extra Space, for the management of our existing properties and will enter into similar sub-property management agreements for the management of any future properties we acquire in the United States.

3

“SmartStop Self Storage” Brand

The following should be read in connection with the “Trademark Sub-License Agreement” sub-section of the “Management” section on page 93 of our prospectus:

At the closing of the merger, Extra Space acquired the rights to the “SmartStop® Self Storage” brand in the United States through the merger and we can no longer utilize this brand. The properties we own are being re-branded under the Extra Space name. However, any properties owned or acquired in Canada will be managed by a subsidiary of SmartStop Asset Management and will continue to be branded using the SmartStop® Self Storage brand.

Tenant Insurance Business

Extra Space is entitled to receive all tenant insurance and tenant reinsurance revenues generated at our properties. Therefore, the “Tenant Reinsurance Program” sub-section of the “Conflicts of Interest” section on page 106 of our prospectus is hereby deleted and any references to the tenant reinsurance program or tenant insurance business in our prospectus are hereby deleted.

Risk Factors

The following risk factors are hereby deleted from our prospectus:

We do not own or control the intellectual property rights to the “SmartStop® Self Storage” brand and other trademarks and intellectual property that we expect to use in connection with our self storage facilities.

Our tenant insurance business is subject to significant governmental regulation, which may adversely affect our results.

The following risk factor is added to the “General Risks Related to Investments in Real Estate” sub-section of the “Risk Factors” section of our prospectus:

We rely on our sub-property manager to operate our self storage facilities.

Our property manager has entered into sub-property management agreements with Extra Space Management, Inc. in connection with the management of our self storage facilities. We do not supervise our sub-property manager or its personnel on a day-to-day basis, and we cannot assure you that our sub-property manager will manage our properties in a manner that is consistent with its obligations under the sub-property management agreements, that our sub-property manager will not be negligent in its performance or engage in other criminal or fraudulent activity, or that our sub-property manager will not otherwise default on its management obligations to us. If any of the foregoing occurs, we could incur liabilities resulting from loss or injury to our property or to persons at our properties, any of which could have a material adverse effect on our operating results and financial condition, as well as our ability to pay distributions to stockholders.

Where You Can Find More Information

The following is added to the “Where You Can Find More Information” section of our prospectus:

| | · | | Current Report on Form 8-K filed on September 29, 2015. |

4