Q4 & Full Year 2021 Earnings February 2022 Exhibit 99.2

Forward-Looking Statements Certain statements in this presentation are forward-looking as defined in the Private Securities Litigation Reform Act of 1995. Any statements contained herein (including, but not limited to, statements to the effect that Sprouts Farmers Market, Inc. (the “Company”) or its management "anticipates," "plans," "estimates," "expects," "believes," or the negative of these terms and other similar expressions) that are not statements of historical fact should be considered forward-looking statements, including, without limitation, statements regarding the Company’s guidance, outlook, strategy, financial targets, growth and opportunities. These statements involve certain risks and uncertainties that may cause actual results to differ materially from expectations as of the date of this presentation. These risks and uncertainties include, without limitation, risks associated with the COVID-19 pandemic; the Company’s ability to execute on its long-term strategy; the Company’s ability to successfully compete in its competitive industry; the Company’s ability to successfully open new stores; the Company’s ability to manage its rapid growth; the Company’s ability to maintain or improve its comparable store sales and operating margins; the Company’s ability to identify and react to trends in consumer preferences; product supply disruptions; equipment supply disruptions; general economic conditions; accounting standard changes; and other factors as set forth from time to time in the Company’s Securities and Exchange Commission filings. The Company intends these forward-looking statements to speak only as of the date of this presentation and does not undertake to update or revise them as more information becomes available, except as required by law. Non-GAAP Financial Measures We refer to EBIT, adjusted EBIT, adjusted EBIT Margin, and adjusted diluted earnings per share, each of which is a Non-GAAP Financial Measure. These measures are not prepared in accordance with, and are not intended as alternatives to, generally accepted accounting principles in the United States, or GAAP. The Company's management believes that such measures provide useful information to management, analysts and investors regarding certain additional financial and business trends relating to its results of operations and financial condition. In addition, management uses these measures for reviewing the financial results of the Company, and certain of these measures may be used as components of incentive compensation. The Company defines EBIT, as net income before interest expense and provision for income tax, and adjusted EBIT as EBIT, excluding the impact of special items. Adjusted EBIT Margin reflects adjusted EBIT, divided by net sales for the applicable period. The Company defines adjusted diluted earnings per share as diluted earnings per share excluding the impact of special items. Non-GAAP measures are intended to provide additional information only and do not have any standard meanings prescribed by GAAP. Use of these terms may differ from similar measures reported by other companies. Because of their limitations, non-GAAP measures should not be considered as a measure of discretionary cash available to use to reinvest in the growth of the Company’s business, or as a measure of cash that will be available to meet the Company’s obligations. Each non-GAAP measure has its limitations as an analytical tool, and you should not consider them in isolation or as a substitute for analysis of the Company’s results as reported under GAAP. To the extent forward looking non-GAAP financial measures are provided herein, they are not reconciled to comparable forward-looking GAAP measures due to the inherent difficulty in forecasting and quantifying certain amounts that are necessary for such reconciliation.

Jack Sinclair CEO

2021 Was a Year of Meaningful Accomplishments Opened 2 new fresh Distribution Centers Opened 12 new stores & one relocation Launched 4 new format stores, including one remodel Launched over 5,700 new products Greatly improved our ESG reporting, resulting in AAA rating from MSCI Encouraged that 4th quarter traffic was positive EPS up 68% over 2019 baseline

Chip Molloy CFO

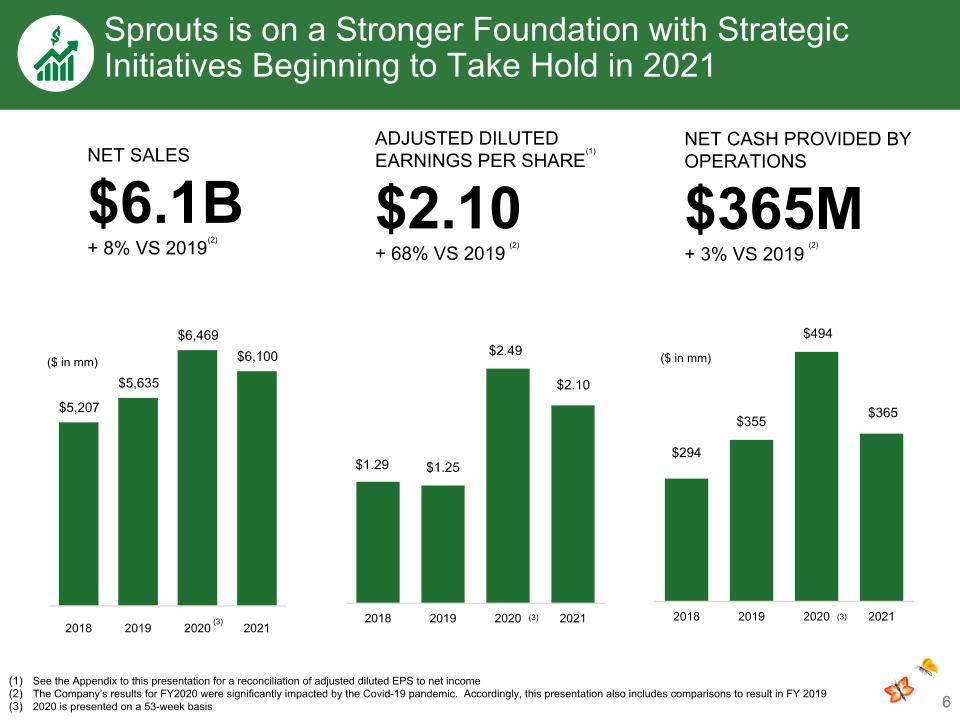

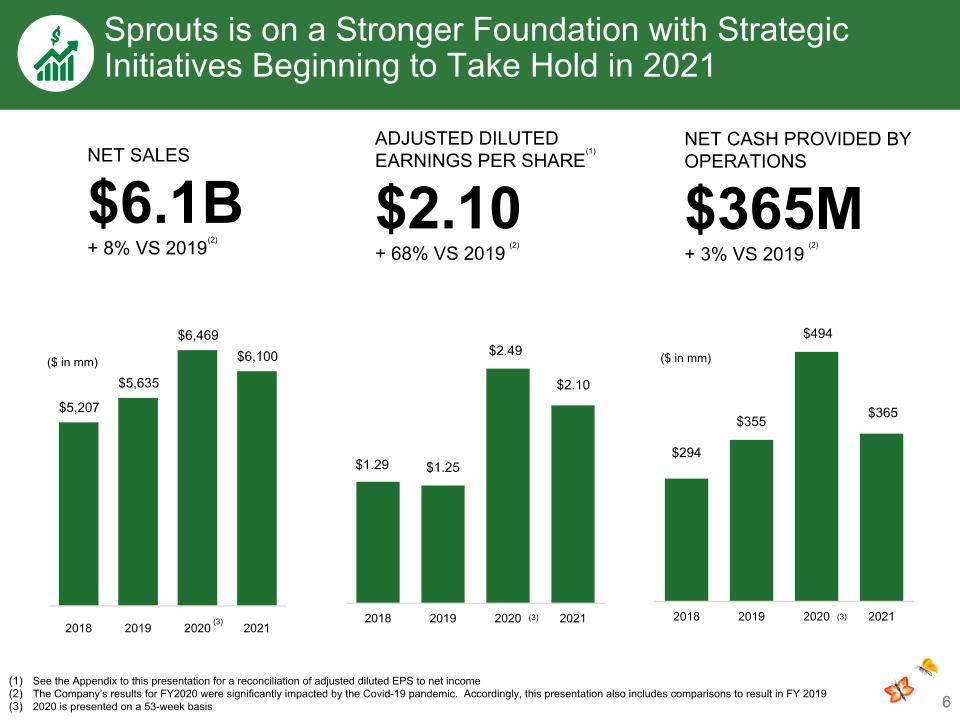

6 NET SALES $6.1B + 8% vs 2019 NET CASH PROVIDED by OPERATIONS $365M + 3% vs 2019 ADJUSTED DILUTED Earnings Per Share $2.10 + 68% vs 2019 ($ in mm) ($ in mm) (1) (3) (3) (3) See the Appendix to this presentation for a reconciliation of adjusted diluted EPS to net income The Company’s results for FY2020 were significantly impacted by the Covid-19 pandemic. Accordingly, this presentation also includes comparisons to result in FY 2019 2020 is presented on a 53-week basis Sprouts is on a Stronger Foundation with Strategic Initiatives Beginning to Take Hold in 2021 (2) (2) (2)

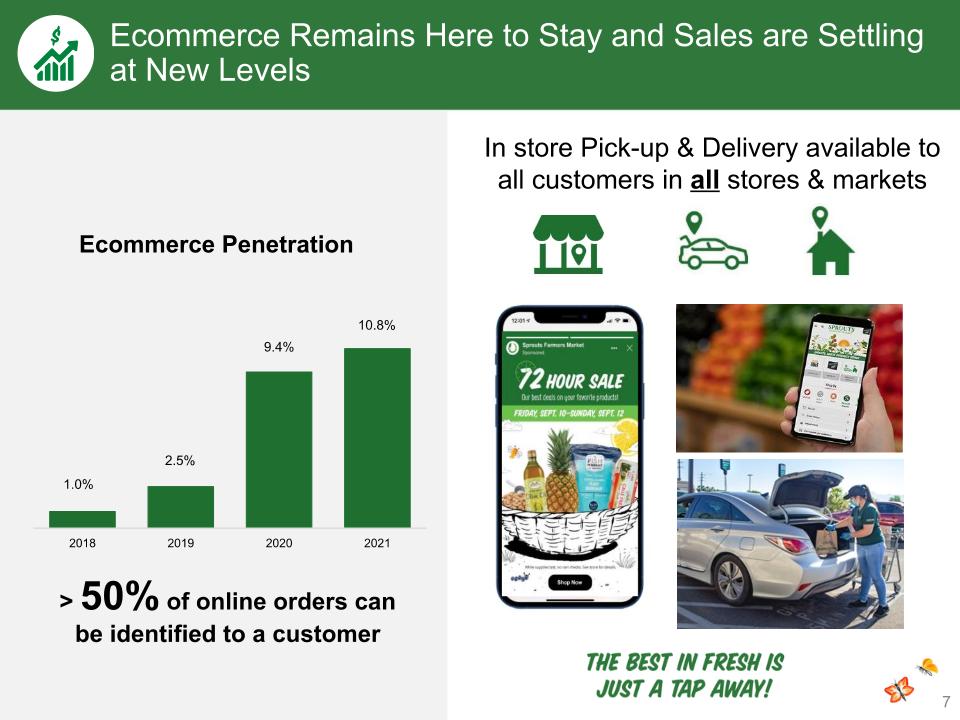

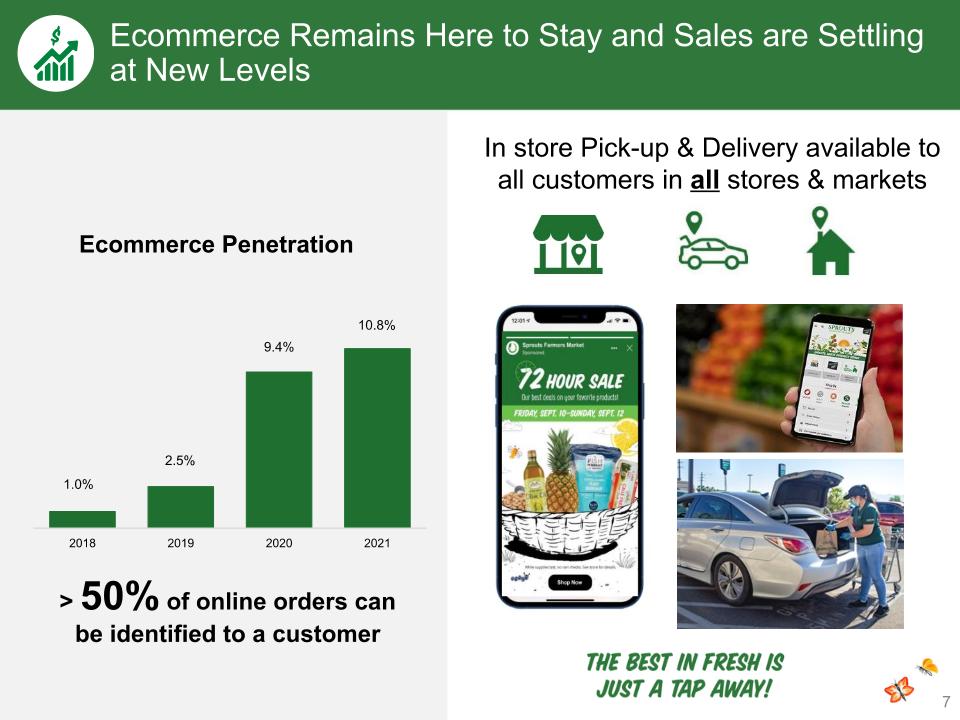

Ecommerce Remains Here to Stay and Sales are Settling at New Levels Ecommerce Penetration > 50% of online orders can be identified to a customer In store Pick-up & Delivery available to all customers in all stores & markets

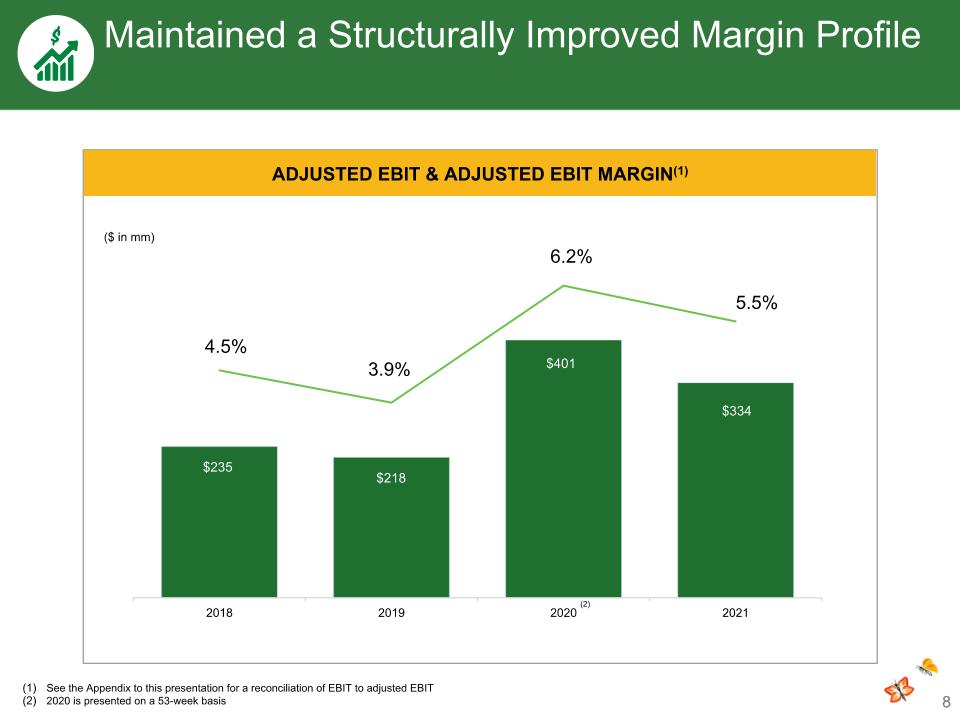

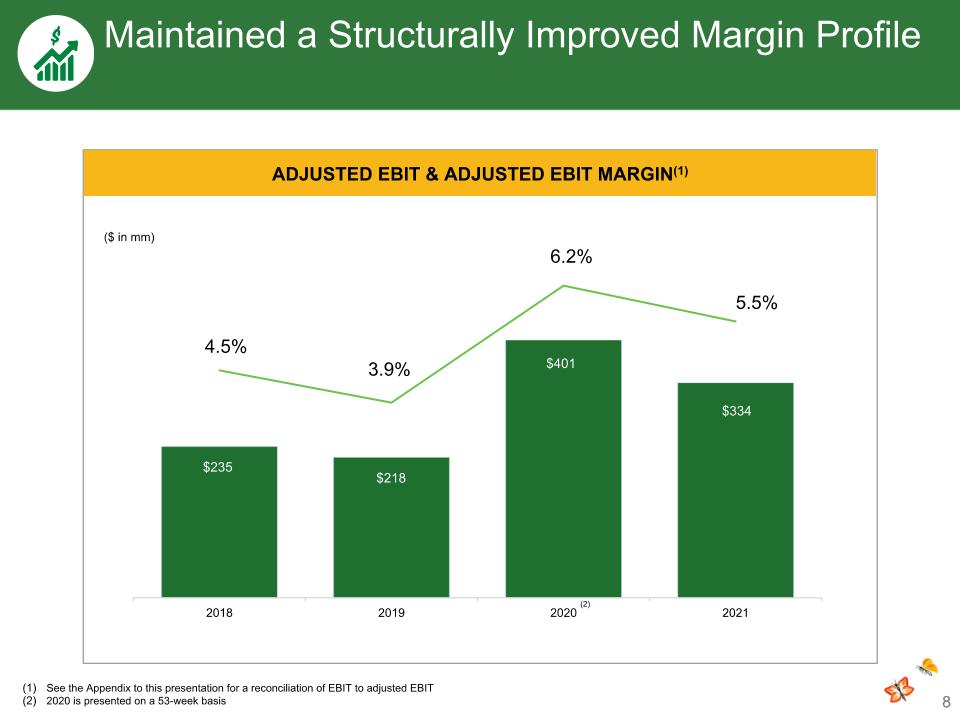

Maintained a Structurally Improved Margin Profile 8 ($ in mm) ADJUSTED EBIT & Adjusted EBIT Margin(1) See the Appendix to this presentation for a reconciliation of EBIT to adjusted EBIT 2020 is presented on a 53-week basis (2)

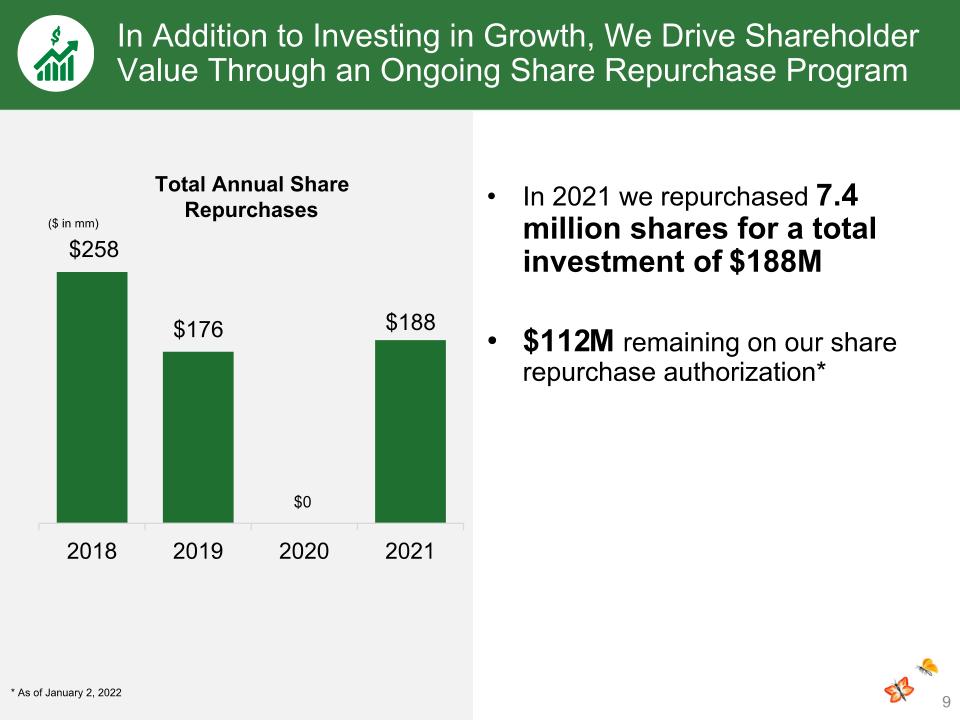

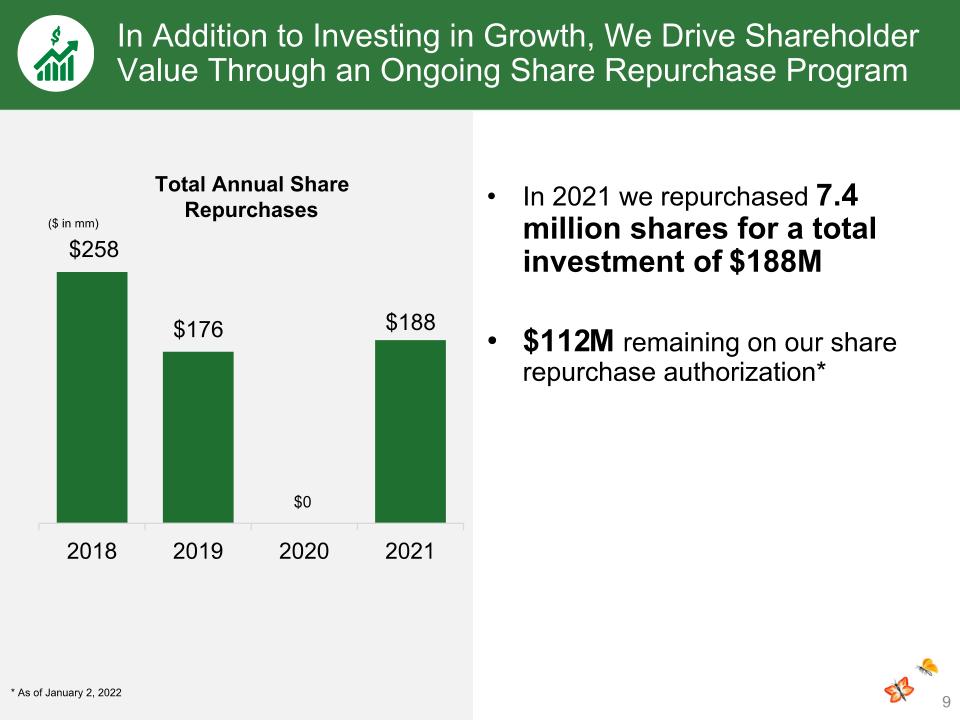

In 2021 we repurchased 7.4 million shares for a total investment of $188M $112M remaining on our share repurchase authorization* $0 ($ in mm) Total Annual Share Repurchases * As of January 2, 2022 In Addition to Investing in Growth, We Drive Shareholder Value Through an Ongoing Share Repurchase Program

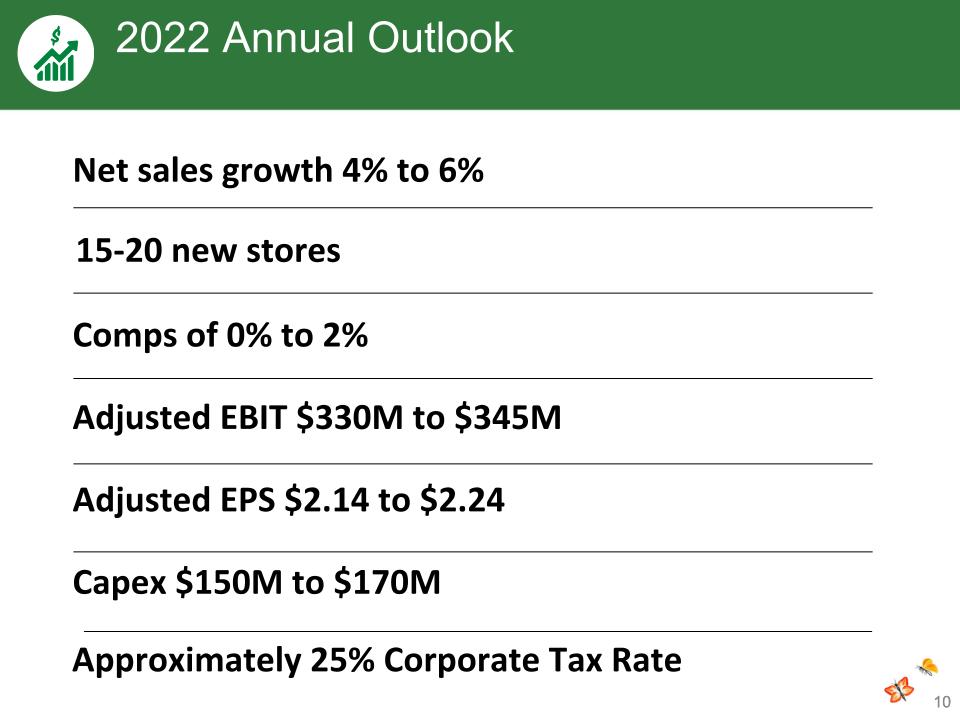

2022 Annual Outlook 10 Net sales growth 4% to 6% 15-20 new stores Comps of 0% to 2% Adjusted EBIT $330M to $345M Adjusted EPS $2.14 to $2.24 Capex $150M to $170M Approximately 25% Corporate Tax Rate

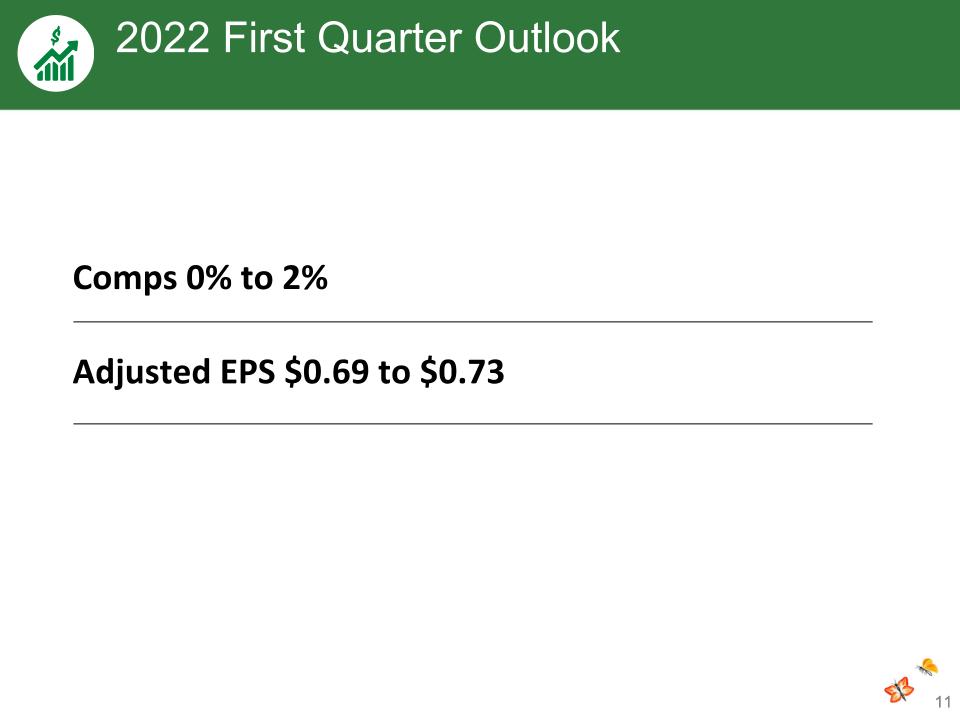

2022 First Quarter Outlook 11 Adjusted EPS $0.69 to $0.73 Comps 0% to 2%

Jack Sinclair CEO

Fourth Quarter Sales Highlights Released new deli meals created by our in-house chef as well as other attribute focused items Bakery continues to see year over year growth supported by seasonal events and innovation Vitamins benefited from immunity boosting products Grocery benefited from a strong holiday program, innovation and the 250 bulk tables we have converted to innovation displays

Successfully Launched 2 Additional New Format Stores in Q4 with Similar Results EARLY DAYS… 2 more New Format stores FL (1) and GA (1) - 4 in total for 2021 Phoenix relocation – sales up significantly despite new store being 23% smaller Frozen sales up dramatically Protein sales above company average with the emphasis on center of plate in the front of the store Deli sales above company average with more grab and go items Total of 4 New Format stores for 2021

Growing our Customer Engagement Currently “speaking” to more than 5 million customers via multiple digital platforms +26% + 76% +36% (1) Growth rate is 2021 vs. 2020 (1) (1) (1)

Appendix

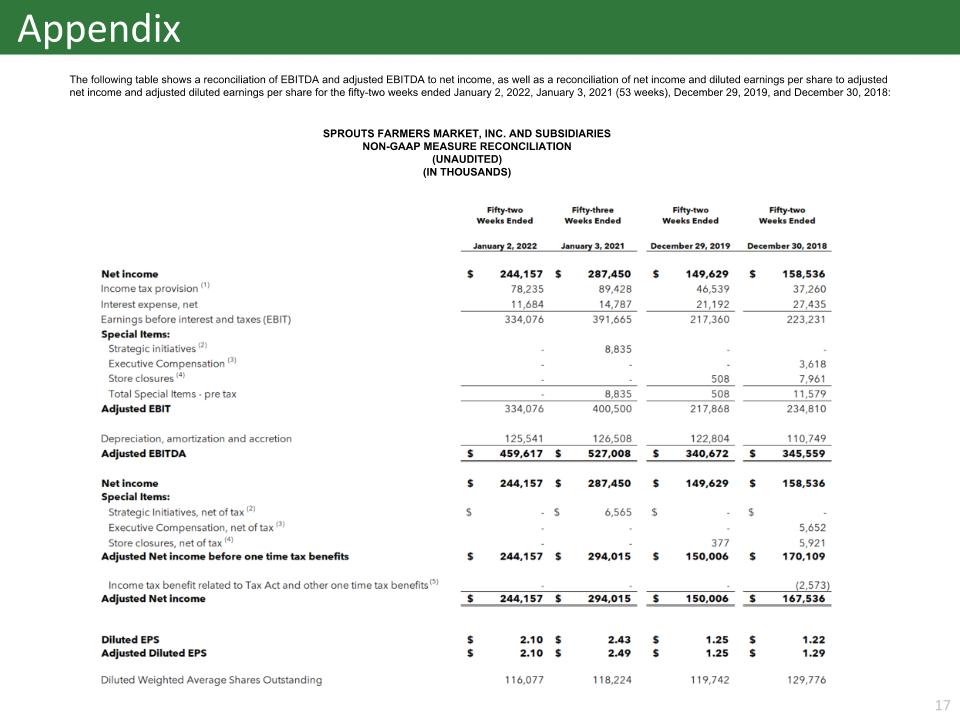

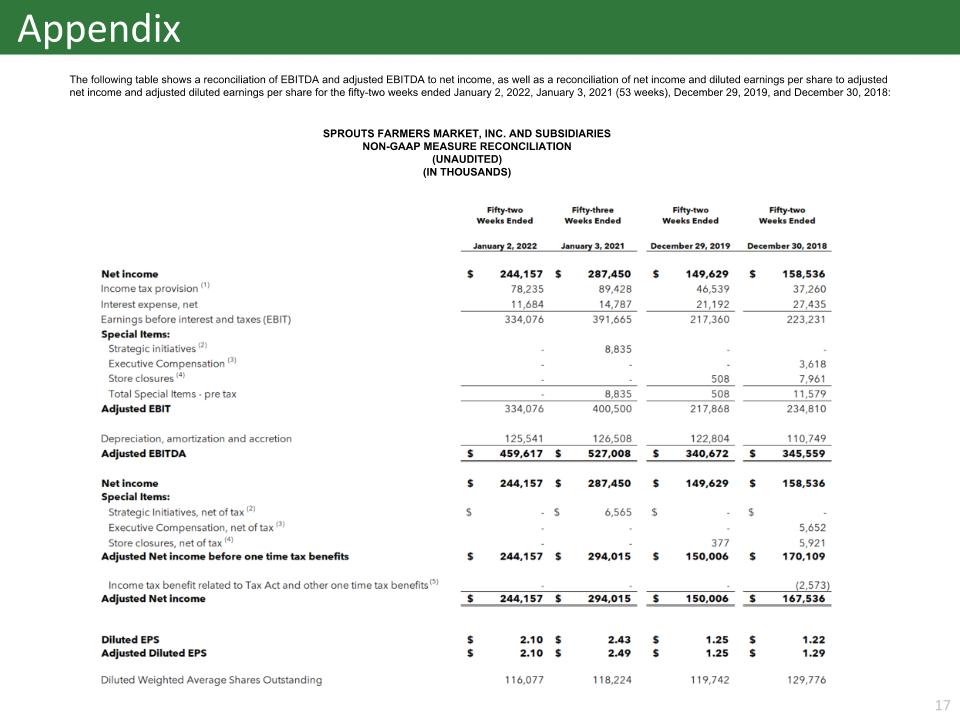

SPROUTS FARMERS MARKET, INC. AND SUBSIDIARIES NON-GAAP MEASURE RECONCILIATION (UNAUDITED) (IN THOUSANDS) Appendix The following table shows a reconciliation of EBITDA and adjusted EBITDA to net income, as well as a reconciliation of net income and diluted earnings per share to adjusted net income and adjusted diluted earnings per share for the fifty-two weeks ended January 2, 2022, January 3, 2021 (53 weeks), December 29, 2019, and December 30, 2018:

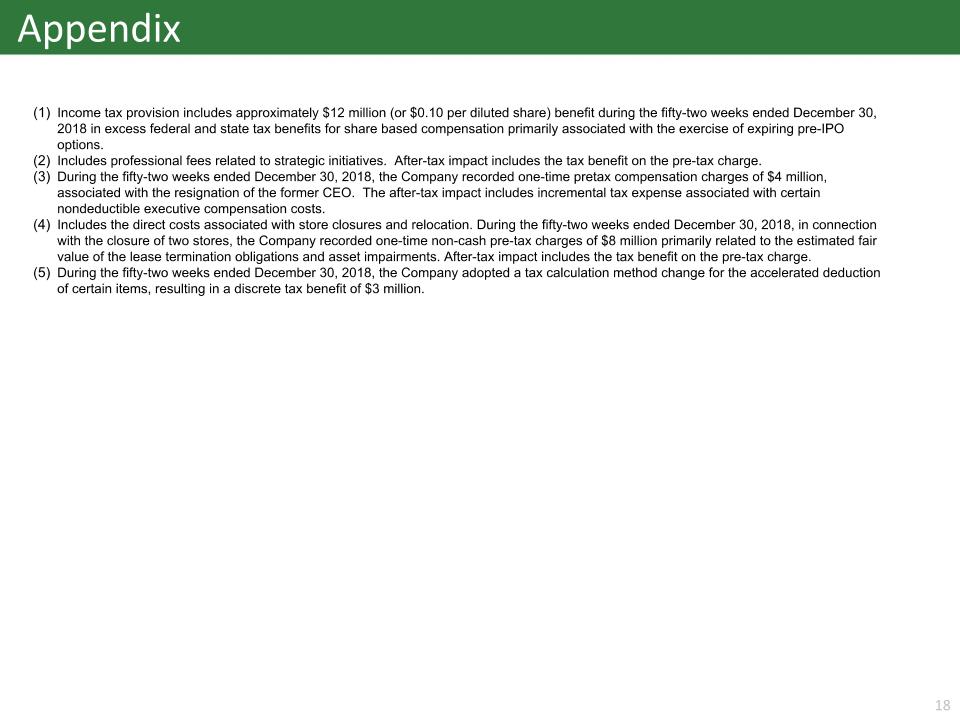

Appendix Income tax provision includes approximately $12 million (or $0.10 per diluted share) benefit during the fifty-two weeks ended December 30, 2018 in excess federal and state tax benefits for share based compensation primarily associated with the exercise of expiring pre-IPO options. Includes professional fees related to strategic initiatives. After-tax impact includes the tax benefit on the pre-tax charge. During the fifty-two weeks ended December 30, 2018, the Company recorded one-time pretax compensation charges of $4 million, associated with the resignation of the former CEO. The after-tax impact includes incremental tax expense associated with certain nondeductible executive compensation costs. Includes the direct costs associated with store closures and relocation. During the fifty-two weeks ended December 30, 2018, in connection with the closure of two stores, the Company recorded one-time non-cash pre-tax charges of $8 million primarily related to the estimated fair value of the lease termination obligations and asset impairments. After-tax impact includes the tax benefit on the pre-tax charge. During the fifty-two weeks ended December 30, 2018, the Company adopted a tax calculation method change for the accelerated deduction of certain items, resulting in a discrete tax benefit of $3 million.