UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________________________________________

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

____________________________________________________

Filed by the Registrant x Filed by a Party other than the Registrant ¨

|

| | |

| Check the appropriate box: |

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

| |

| CAESARS ACQUISITION COMPANY |

| (Name of registrant as specified in its charter) |

| |

| (Name of person(s) filing proxy statement, if other than the registrant) |

|

| | | | |

| Payment of Filing Fee (Check the appropriate box): |

| | |

| x | | No fee required. |

| | |

| o | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | | |

| | | (1) | | Title of each class of securities to which transaction applies: |

| | | | | |

| | | (2) | | Aggregate number of securities to which transaction applies: |

| | | | | |

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | | | |

| | | (4) | | Proposed maximum aggregate value of transaction: |

| | | | | |

| | | (5) | | Total fee paid: |

| | | | | |

| | | | | |

| o | | Fee paid previously with preliminary materials. |

| | | |

| o | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | |

| | | (1) | | Amount Previously Paid: |

| | | | | |

| | | (2) | | Form, Schedule or Registration Statement No.: |

| | | | | |

| | | (3) | | Filing Party: |

| | | | | |

| | | (4) | | Date Filed: |

| | | | | |

| | |

| |

|

One Caesars Palace Drive

Las Vegas, Nevada 89109

April 14, 2014

Dear Fellow Stockholders:

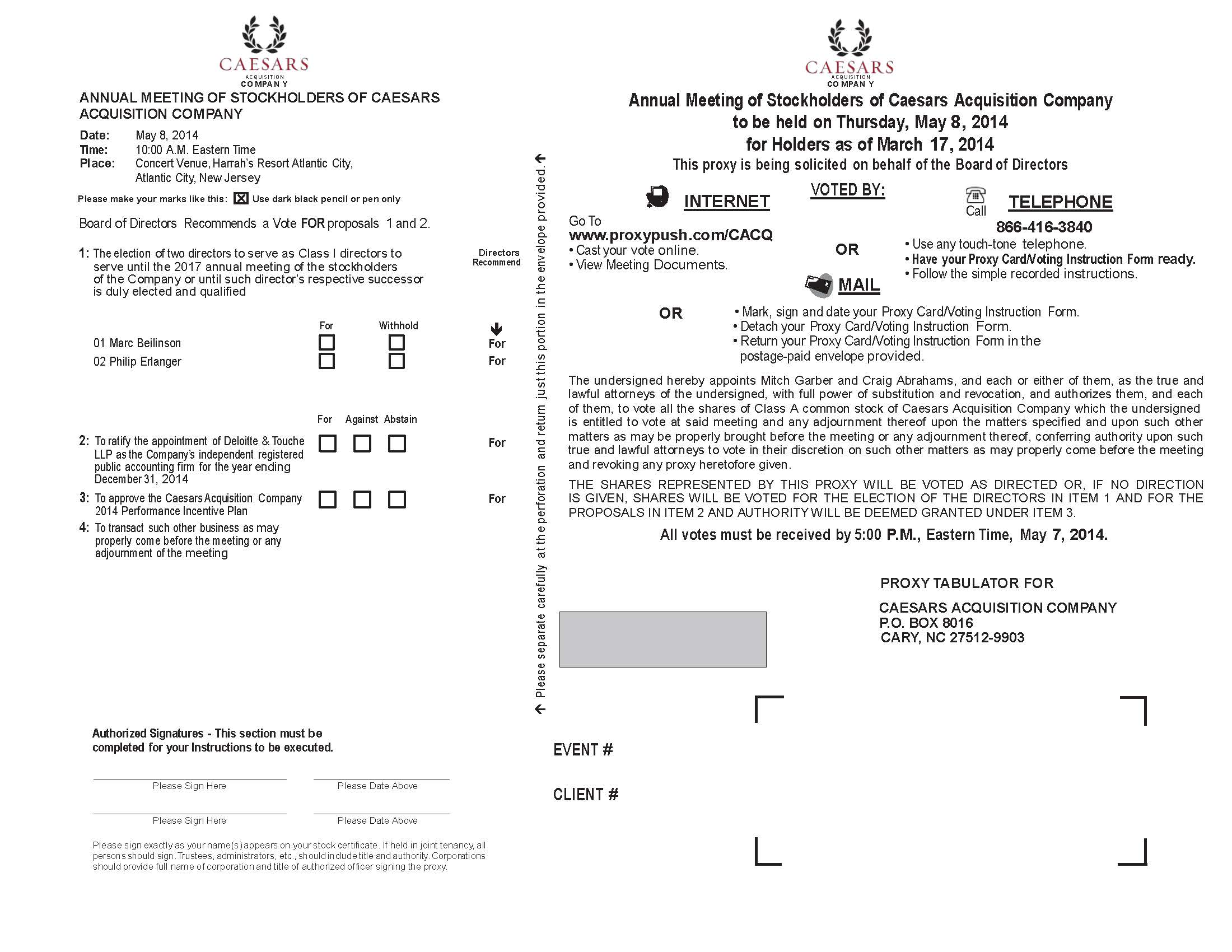

We cordially invite you to attend our 2014 Annual Meeting of Stockholders, which will be held on Thursday, May 8, 2014, at 10:00 a.m. in the Concert Venue at Harrah's Resort Atlantic City, Atlantic City, New Jersey.

At the meeting, we will vote on proposals to elect two directors, ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for 2014 and approve our performance incentive plan.

Whether or not you expect to attend the meeting, please promptly complete, sign, date and return the enclosed proxy card, or grant your proxy electronically over the Internet or by telephone, so that your shares will be represented at the meeting. If you do attend, you may vote in person even if you have sent in your proxy card or voted electronically or by telephone.

We look forward to seeing you at the meeting.

|

|

| Sincerely, |

|

Mitch Garber President and Chief Executive Officer |

One Caesars Palace Drive

Las Vegas, Nevada 89109

____________________________________

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held May 8, 2014

____________________________________

To the Stockholders of Caesars Acquisition Company:

Caesars Acquisition Company will hold its annual meeting of stockholders in the Concert Venue at Harrah's Resort Atlantic City, Atlantic City, New Jersey on Thursday, May 8, 2014, at 10:00 a.m. Eastern Time, for the following purposes:

| |

| 1. | To elect two nominees to serve as Class I directors of the Company, as recommended by the Nominating and Corporate Governance Committee of the Board of Directors, for three-year terms, with each director to serve until the 2017 annual meeting of the stockholders of the Company or until such director’s respective successor is duly elected and qualified; |

| |

| 2. | To ratify the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2014; |

| |

| 3. | To approve the Caesars Acquisition Company 2014 Performance Incentive Plan; and |

| |

| 4. | To transact such other business as may properly come before the meeting or any adjournment of the meeting. |

Only stockholders that owned Caesars Acquisition Company Class A common stock at the close of business on March 17, 2014 are entitled to notice of and may vote at this meeting or any adjournment of the meeting. A list of Caesars Acquisition Company stockholders of record will be available at the company’s corporate headquarters located at One Caesars Palace Drive, Las Vegas, Nevada 89109, during ordinary business hours, for 10 days prior to the annual meeting.

WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING IN PERSON, TO ENSURE THE PRESENCE OF A QUORUM, PLEASE VOTE OVER THE INTERNET OR BY TELEPHONE AS INSTRUCTED IN THESE MATERIALS OR COMPLETE, DATE, AND SIGN A PROXY CARD AS PROMPTLY AS POSSIBLE. IF YOU ATTEND THE MEETING AND WISH TO VOTE YOUR SHARES PERSONALLY, YOU MAY DO SO AT ANY TIME BEFORE THE PROXY IS EXERCISED.

By Order of the Board of Directors,

Michael Cohen

Corporate Secretary

Las Vegas, Nevada

April 14, 2014

One Caesars Palace Drive

Las Vegas, Nevada 89109

PROXY STATEMENT

TABLE OF CONTENTS |

| |

| | |

| COMMONLY ASKED QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING | |

| | |

| CORPORATE GOVERNANCE | |

| | |

| SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE | |

| | |

| PROPOSAL 1-ELECTION OF DIRECTORS | |

| | |

| PROPOSAL 2-RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | |

| | |

| PROPOSAL 3 - APPROVAL OF CAESARS ACQUISITION COMPANY 2014 PERFORMANCE INCENTIVE PLAN | |

| | |

| OTHER MATTERS | |

| | |

| EXECUTIVE OFFICERS | |

| | |

| EXECUTIVE COMPENSATION | |

| | |

| CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS | |

| | |

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | |

| | |

| AUDIT COMMITTEE REPORT | |

| | |

| WHERE TO FIND ADDITIONAL INFORMATION | |

| | |

| CAESARS ACQUISITION COMPANY 2014 PERFORMANCE INCENTIVE PLAN | Appendix A |

One Caesars Palace Drive

Las Vegas, Nevada 89109

____________________________________

Proxy Statement for Annual Meeting of Stockholders

to be held on May 8, 2014

____________________________________

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE STOCKHOLDER MEETING TO BE HELD ON THURSDAY, MAY 8, 2014

The Company’s Proxy Statement (including sample proxy card) and 2013 Annual Report to Stockholders are available on our website at www.caesarsacquisitioncompany.com. Additionally, and in accordance with Securities and Exchange Commission rules, you may access our proxy materials, including the Company’s Proxy Statement and 2013 Annual Report to Stockholders at https://www.proxydocs.com/cacq.

PROXY STATEMENT FOR ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 8, 2014

COMMONLY ASKED QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING

| |

| Q: | WHEN WAS THIS PROXY STATEMENT FIRST MAILED OR MADE AVAILABLE TO STOCKHOLDERS? |

| |

| A: | This proxy statement was first mailed or made available to stockholders of Caesars Acquisition Company (“CAC”, “we” or the “Company”) on or about April 14, 2014. Our 2013 Annual Report to Stockholders is being mailed or made available with this proxy statement. The annual report is not part of the proxy solicitation materials. |

| |

| Q: | WHAT IS THE PURPOSE OF THE ANNUAL MEETING AND WHAT AM I VOTING ON? |

| |

| A: | At the annual meeting you will be voting on three proposals: |

| |

| 1. | The election of two directors to serve as Class I directors to serve until the 2017 annual meeting of the stockholders of the Company or until such director’s respective successor is duly elected and qualified. This year’s board nominees are: |

| |

| 2. | A proposal to ratify the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the year ended December 31, 2014. |

| |

| 3. | A proposal to approve the Caesars Acquisition Company 2014 Performance Incentive Plan. |

| |

| Q: | WHAT ARE THE BOARD’S VOTING RECOMMENDATIONS? |

| |

| A: | The board of directors is soliciting this proxy and recommends the following votes: |

| |

| 1. | FOR each of the director nominees. |

| |

| 2. | FOR the ratification of the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the year ended December 31, 2014. |

| |

| 3. | FOR approval of the Caesars Acquisition Company 2014 Performance Incentive Plan. |

| |

| Q: | WHO MAY ATTEND THE ANNUAL MEETING? |

| |

| A: | Stockholders of record as of the close of business on March 17, 2014, which is the “Record Date,” or their duly appointed proxies, may attend the meeting. “Street name” holders (those whose shares are held through a broker or other nominee) must bring a copy of a brokerage statement reflecting their ownership of our Class A common stock as of the Record Date. Space limitations may make it necessary to limit attendance to stockholders and valid picture identification is required. Cameras, recording devices, and other electronic devices are not permitted at the meeting. Registration will begin at 9:30 a.m. local time and the annual meeting will commence at 10:00 a.m local time, in the Concert Venue, Harrah's Resort Atlantic City, Atlantic City, New Jersey. |

| |

| Q: | WHO IS ENTITLED TO VOTE AT THE ANNUAL MEETING? |

| |

| A: | Only stockholders of record as of the close of business on the Record Date are entitled to receive notice of and participate in the annual meeting. Each outstanding share of Class A common stock is entitled to one vote on each matter presented. As of the Record Date, we had 135,771,882 shares of Class A common stock outstanding. Any stockholder entitled to vote may vote either in person or by duly authorized proxy. Cumulative voting is not permitted with respect to the election of directors or any other matter to be considered at the annual meeting. |

| |

| Q: | WHO IS SOLICITING MY VOTE? |

| |

| A: | The Company’s Board of Directors is sending you and making available this proxy statement in connection with the solicitation of proxies for use at the annual meeting. The Company pays the cost of soliciting proxies. Proxies may be solicited in person or by telephone, facsimile, electronic mail, or other electronic medium by certain of our directors, officers, and employees, without additional compensation. Forms of proxies and proxy materials may also be distributed through brokers, custodians, and other like parties to the beneficial owners of shares of our Class A common stock, in which case we will reimburse these parties for their reasonable out-of-pocket expenses. |

| |

| Q: | WHAT IS THE VOTE REQUIRED TO ELECT DIRECTORS? |

| |

| A: | Directors are elected by a plurality of the votes cast in person or by proxy at the annual meeting and entitled to vote on the election of directors. “Plurality” means that the nominees receiving the greatest number of affirmative votes will be elected as directors, up to the number of directors to be chosen at the meeting. Any votes attempted to be cast “against” a candidate are not given legal effect and are not counted as votes cast in the election of directors. Therefore, any shares that are not voted, whether by withheld authority, broker non-vote or otherwise, have no effect in the election of directors except to the extent that the failure to vote for any individual results in another individual receiving a relatively larger number of votes. |

| |

| Q: | WHAT IS THE VOTE REQUIRED TO APPROVE THE RATIFICATION OF DELOITTE & TOUCHE LLP? |

| |

| A: | The ratification of the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the year ended December 31, 2014 must receive the affirmative vote of a majority of the votes cast by stockholders present in person or by proxy at the annual meeting and entitled to vote at the annual meeting. |

| |

| Q: | WHAT IS THE VOTE REQUIRED TO APPROVE THE CAESARS ACQUISITION COMPANY 2014 PERFORMANCE INCENTIVE PLAN? |

| |

| A: | The proposal to approve the Caesars Acquisition Company 2014 Performance Incentive Plan must receive the affirmative vote of a majority of the votes cast by stockholders present in person or by proxy at the annual meeting and entitled to vote at the annual meeting. |

| |

| Q: | WILL THERE BE OTHER MATTERS TO VOTE ON AT THIS ANNUAL MEETING? |

| |

| A: | We are not aware of any other matters that you will be asked to vote on at the annual meeting. Other matters may be voted on if they are properly brought before the annual meeting in accordance with our by-laws. If other matters are properly brought before the annual meeting, then the named proxies will vote the proxies they hold in their discretion on such matters. |

For matters to be included in our proxy materials for annual meeting, proposals must have been received by our Corporate Secretary no later than January 15, 2014. For matters to be properly brought before the annual meeting, we must have received written notice, together with specified information, not earlier than December 16, 2013 and not later than January 15, 2014. We did not receive notice of any matters by the deadlines for this year’s annual meeting.

| |

| Q: | WHAT CONSTITUTES A QUORUM? |

| |

| A: | The presence, in person or by proxy, of the holders of record of shares of our capital stock entitling the holders thereof to cast a majority of the votes entitled to be cast by the holders of shares of capital stock entitled to vote at the annual meeting constitutes a quorum. There must be a quorum for business to be conducted at the meeting. Failure of a quorum to be represented at the annual meeting will necessitate an adjournment or postponement of the meeting and will subject the Company to additional expense. Votes withheld from any nominee for director, abstentions, and broker non-votes are counted as present or represented for purposes of determining the presence or absence of a quorum. |

| |

| Q: | WHAT IF I ABSTAIN FROM VOTING? |

| |

| A: | If you attend the meeting or send in your signed proxy card, you will still be counted for purposes of determining whether a quorum exists. If you abstain from voting on Proposal 1, 2 or 3, your abstention will have no effect on the outcome of the vote on any of the proposals. |

| |

| Q: | WILL MY SHARES BE VOTED IF I DO NOT SIGN AND RETURN MY PROXY CARD OR VOTE BY TELEPHONE OR OVER THE INTERNET? |

| |

| A: | If you are a registered stockholder and you do not sign and return your proxy card or vote by telephone or over the Internet, your shares will not be voted at the annual meeting. Questions concerning stock certificates and registered stockholders may be directed to Computershare, P.O. Box 30170, College Station, TX 77842-3170 or Computershare, 211 Quality Circle, Ste. 210, College Station, TX 77845 or by telephone at 800-962-4284. If your shares are held in street name and you do not issue instructions to your broker, your broker may vote shares at its discretion on routine matters, but may not vote your shares on non-routine matters. Under applicable stock market rules, Proposal 2 relating to the ratification of the appointment of the independent registered public accounting firm is deemed to be a routine matter and brokers and nominees may exercise their voting discretion without receiving instructions from the beneficial owners of |

the shares. Proposals 1 and 3 are non-routine matters and, therefore, may only be voted in accordance with instructions received from the beneficial owners of the shares.

| |

| Q: | WHAT IS A “BROKER NON-VOTE”? |

| |

| A: | Under the rules of the stock exchanges, brokers and nominees may exercise their voting discretion without receiving instructions from the beneficial owner of the shares on proposals that are deemed to be routine matters. If a proposal is a non-routine matter, a broker or nominee may not vote the shares on the proposal without receiving instructions from the beneficial owner of the shares. If a broker turns in a proxy card expressly stating that the broker is not voting on a non-routine matter, such action is referred to as a “broker non-vote.” |

| |

| Q: | WHAT IS THE EFFECT OF A BROKER NON-VOTE? |

| |

| A: | Broker non-votes will be counted for purposes of determining the presence of a quorum but will not be counted for purposes of determining the outcome on Proposal 1, Proposal 2 or Proposal 3. |

| |

| Q: | HOW DO I VOTE IF MY SHARES ARE REGISTERED DIRECTLY IN MY NAME? |

| |

| A: | We offer four methods for you to vote your shares at the annual meeting. While we offer four methods, we encourage you to vote through the Internet or by telephone, as they are the most cost-effective methods. We also recommend that you vote as soon as possible, even if you are planning to attend the annual meeting, so that the vote count will not be delayed. Both the Internet and the telephone provide convenient, cost-effective alternatives to returning your proxy card by mail. There is no charge to vote your shares via the Internet, though you may incur costs associated with electronic access, such as usage charges from Internet access providers. If you choose to vote your shares through the Internet or by telephone, there is no need for you to mail your proxy card. |

You may (i) vote in person at the annual meeting or (ii) authorize the persons named as proxies on the enclosed proxy card, Mitch Garber and Craig Abrahams, to vote your shares by returning the enclosed proxy card by mail, through the Internet or by telephone.

| |

| • | By internet: Go to www.proxypush.com/CACQ. Have your proxy card available when you access the website. You will need the control number from your proxy card to vote. |

| |

| • | By telephone: Call 866-416-3840 toll-free (in the United States, U.S. territories and Canada), on a touch-tone telephone. Have your proxy card available when you call. You will need the control number from your proxy card to vote. |

| |

| • | By mail: Complete, sign and date the proxy card, and return it in the postage paid envelope provided with the proxy material. |

| |

| Q: | HOW DO I VOTE MY SHARES IF THEY ARE HELD IN THE NAME OF MY BROKER (STREET NAME)? |

| |

| A: | If your shares are held in street name, you will receive a form from your broker or nominee seeking instruction as to how your shares should be voted. You should contact your broker or other nominee with questions about how to provide or revoke your instructions. |

| |

| Q: | WHO WILL COUNT THE VOTE? |

| |

| A: | Mediant Communications, LLC has been engaged as our independent inspector of election to tabulate stockholder votes for the 2014 annual meeting. |

| |

| Q: | CAN I CHANGE MY VOTE AFTER I RETURN OR SUBMIT MY PROXY? |

| |

| A: | Yes. Even after you have submitted your proxy, you can revoke your proxy or change your vote at any time before the proxy is exercised by appointing a new proxy or by providing written notice to the Corporate Secretary or acting secretary of the meeting and by voting in person at the meeting. Presence at the annual meeting of a stockholder who has appointed a proxy does not in itself revoke a proxy. |

| |

| Q: | MAY I VOTE AT THE ANNUAL MEETING? |

| |

| A: | If you complete a proxy card, or vote through the Internet or by telephone, then you may still vote in person at the annual meeting. To vote at the meeting, please give written notice that you would like to revoke your original proxy to the Corporate Secretary or acting secretary of the meeting. |

If a broker, bank or other nominee holds your shares and you wish to vote in person at the annual meeting you must obtain a proxy issued in your name from the broker, bank or other nominee; otherwise you will not be permitted to vote in person at the annual meeting.

| |

| Q: | WHERE CAN I FIND THE VOTING RESULTS OF THE ANNUAL MEETING? |

| |

| A: | We intend to announce preliminary voting results at the annual meeting and publish final results in a Current Report on Form 8-K that will be filed with the SEC following the annual meeting. All reports we file with the SEC are available when filed. Please see the question “Where to Find Additional Information” below. |

| |

| Q: | WHEN ARE STOCKHOLDER PROPOSALS AND STOCKHOLDER NOMINATIONS DUE FOR THE 2015 ANNUAL MEETING? |

| |

| A: | Under Rule 14a-8 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), the Corporate Secretary must receive a stockholder proposal no later than November 28, 2014 in order for the proposal to be considered for inclusion in our proxy materials for the 2015 annual meeting. To otherwise bring a proposal or nomination before the 2015 annual meeting, you must comply with our by-laws. Currently, our by-laws require written notice to the Corporate Secretary between January 8, 2015 or after February 7, 2015. The purpose of this requirement is to assure adequate notice of, and information regarding, any such matter as to which stockholder action may be sought. If we receive your notice before January 8, 2015 or after February 7, 2015, then your proposal or nomination will be untimely. In addition, your proposal or nomination must comply with the procedural provisions of our by-laws. If you do not comply with these procedural provisions, your proposal or nomination can be excluded. Should the board nevertheless choose to present your proposal, the named proxies will be able to vote on the proposal using their best judgment. |

| |

| Q: | HOW MANY COPIES SHOULD I RECEIVE IF I SHARE AN ADDRESS WITH ANOTHER STOCKHOLDER? |

| |

| A: | The SEC has adopted rules that permit companies and intermediaries, such as brokers, to satisfy the delivery requirements for proxy statements and annual reports with respect to two or more stockholders sharing the same address by delivering a single proxy statement addressed to those stockholders. This process, commonly referred to as “householding,” potentially provides extra convenience for stockholders and cost savings for companies. The Company and some brokers may be householding our proxy materials by delivering a single proxy statement and annual report to multiple stockholders sharing an address unless contrary instructions have been received from the affected stockholders. Once you have received notice from your broker or us that they or we will be householding materials to your address, householding will continue until you are notified otherwise or until you revoke your consent. If any time you no longer wish to participate in householding and would prefer to receive a separate proxy statement and annual report, or if you are receiving multiple copies of the proxy statement and annual report and wish to receive only one, please notify your broker if your shares are held in a brokerage account or us if you are a stockholder of record. You can notify us by sending a written request to our Corporate Secretary at Caesars Acquisition Company, One Caesars Palace Drive, Las Vegas, Nevada 89109, or by calling the Corporate Secretary at (702) 407-6000. In addition, we will promptly deliver, upon written or oral request to the address or telephone number above, a separate copy of the annual report and proxy statement to a stockholder at a shared address to which a single copy of the documents was delivered. |

| |

| Q: | HOW DOES THE RECENT RIGHTS OFFERNING AND OUR RECENT LISTING ON NASDAQ AFFECT THIS PROXY STATEMENT? |

| |

| A: | On October 21, 2013, (i) CAC, Caesars Growth Partners, LLC (“Growth Partners”) and Caesars Entertainment Corporation (“CEC”) and its subsidiaries consummated the Contribution Transaction (as defined below), (ii) affiliates of Apollo Global Management, LLC (“Apollo”) and affiliates of TPG Global, LLC (“TPG” and, together with Apollo, the “Sponsors”) exercised their basic subscription rights in full to purchase $457.8 million worth of our Class A common stock at a price of $8.64 per whole share and CAC used such proceeds to acquire all of the voting units of Growth Partners, and (iii) Growth Partners used the proceeds to consummate the Purchase Transaction (as defined below, and together with the Contribution Transaction, the “Transactions”). In connection with the consummation of the Transactions, CEC contributed all of the shares of Caesars Interactive Entertainment, Inc.’s (“CIE”) outstanding common stock held by a subsidiary of CEC and approximately $1.1 billion in aggregate principal amount of senior notes (the “CEOC Notes”) previously issued by Caesars Entertainment Operating Company, Inc. (“CEOC”) that are owned by another subsidiary of CEC in exchange for non-voting units of Growth Partners (collectively, the “Contribution Transaction”). Additionally, on October 21, 2013, Growth Partners used $360.0 million of proceeds received from CAC to purchase from subsidiaries of CEC (i) the Planet Hollywood Resort and Casino Located in Las Vegas, Nevada, (ii) CEC’s joint venture interests in a casino to be developed by CBAC Gaming, LLC (the “Maryland Joint Venture”) in Baltimore, Maryland , and (iii) a 50% interest in the management fee revenues for both of those properties (collectively, |

the “Purchase Transaction”). Also on October 21, 2013, CEC distributed to its stockholders as of October 17, 2013 subscription rights to purchase shares of our Class A common stock in connection with a rights offering (the “Rights Offering”). The Rights Offering closed on November 18, 2013 and our Class A common stock began trading on the NASDAQ Global Select Market under the symbol “CACQ” on November 19, 2013. As a result of the consummation of the Rights Offering, we are holding our first annual meeting of stockholders as a public company. This is therefore the first proxy statement that we are sending to our stockholders for an annual meeting. To the extent that this proxy statement describes actions or information prior to November 19, 2013, they occurred prior to our becoming a public company, and therefore at a time when various SEC and NASDAQ rules did not yet apply to us.

| |

| Q: | CAN YOU DESCRIBE THE ASSET PURCHASE TRANSACTION CAESARS ACQUISITION COMPANY ANNOUNCED ON MARCH 3, 2014? |

| |

| A: | On March 1, 2014, CAC entered into a transaction agreement (the “Property Sale Agreement”) by and among CEC, CEOC, Caesars License Company, LLC, Harrah’s New Orleans Management Company ("HNOMC"), Corner Investment Company, LLC, 3535 LV Corp., Parball Corporation, JCC Holding Company II, LLC and Growth Partners. Pursuant to the terms of the Property Sale Agreement, Growth Partners (or one or more of its designated direct or indirect subsidiaries) agreed to acquire from CEOC or one or more of its affiliates, (i) The Cromwell (f/k/a Bill’s Gamblin’ Hall & Saloon), The Quad Resort & Casino ("The Quad"), Bally’s Las Vegas and Harrah’s New Orleans (each a “Property” and collectively, the “Properties”), (ii) 50% of the ongoing management fees and any termination fees payable under the Property Management Agreements to be entered between a property manager and the owners of each of the Properties (the “Property Management Agreements”); and (iii) certain intellectual property that is specific to each of the Properties. |

The Property Sale Agreement was fully negotiated by and between a Special Committee of CEC’s Board of Directors (the “CEC Special Committee”) and a Special Committee of CAC’s Board of Directors (the “CAC Special Committee”), each comprised solely of independent directors, and was recommended by both committees and approved by the Boards of Directors of CEC and CAC. The CEC Special Committee, the CAC Special Committee and the Boards of Directors of CEC and CAC each received fairness opinions from firms with experience in valuation matters, which stated that, based upon and subject to (and in reliance on) the assumptions made, matters considered and limits of such review, in each case as set forth in the opinions, the purchase price was fair from a financial point of view to CEC and Growth Partners, respectively.

The transaction is subject to certain closing conditions, including the receipt of gaming and other required governmental approvals, accuracy of representations and warranties, compliance with covenants and receipt by CEC and the CEC Special Committee of certain opinions with respect to CEOC. In addition, the consummation of the transaction by CAC is subject to CAC’s receipt of financing on terms and conditions satisfactory to CAC and Growth Partners.

CORPORATE GOVERNANCE

Director Independence. Hamlet Holdings LLC (“Hamlet Holdings”), the members of which are comprised of an equal number of individuals affiliated with each of the Sponsors, beneficially owns approximately 63.9% of our Class A common stock as of the Record Date, pursuant to an irrevocable proxy providing Hamlet Holdings with sole voting and sole dispositive power over those shares, and, as a result, the Sponsors have the power to elect all of our directors. As a result, we are a “controlled company” under NASDAQ corporate governance standards, and we have elected not to comply with the NASDAQ corporate governance requirement that a majority of our Board and human resources (i.e., compensation) and nominating and corporate governance committees consist of independent directors. See “Certain Relationships and Related Person Transactions.”

Our Board of Directors affirmatively determines the independence of each director and director nominee in accordance with guidelines it has adopted, which include all elements of independence set forth in the applicable rules of listing standards of NASDAQ. These guidelines are contained in our Corporate Governance Guidelines which are posted on the Corporate Governance page of our web site located at http://investor.caesarsacquisitioncompany.com.

As of the date of this proxy statement, our Board of Directors consisted of seven members: Marc Rowan, David Sambur, Karl Peterson, Philip Erlanger, Dhiren Fonseca, Marc Beilinson and Don Kornstein. Based upon the listing standards of the NASDAQ, we do not believe that Messrs. Rowan, Sambur, or Peterson would be considered independent because of their relationships with certain affiliates of the Sponsors and other relationships with us. Our Board of Directors has affirmatively determined that Messrs. Fonseca, Beilinson, Erlanger and Kornstein are independent from our management under the NASDAQ listing standards. The Board has also affirmatively determined that Messrs. Beilinson, Erlanger and Kornstein, members of our Audit Committee, each meet the independence requirements of Rule 10A-3 of the Exchange Act.

Executive Sessions. Our Corporate Governance Guidelines provide that the independent directors shall meet at least twice annually in executive session.

Stockholder Nominees. Our by-laws provide that stockholders seeking to nominate candidates for election as directors or to bring business before an annual meeting of stockholders must provide timely notice of their proposal in writing to the Secretary of the Company. Generally, to be timely, a stockholder’s notice must be delivered to or mailed and received at our principal executive offices, addressed to the secretary of the Company, no earlier than 120 days and no later than 90 days prior to the first anniversary of the date of the preceding year’s annual meeting (which anniversary date, in the case of this annual meeting (i.e., our first annual meeting following the closing of the Rights Offering), shall be deemed to be April 15, 2014); provided, however, that if the annual meeting is advanced by more than 30 days, or delayed by more than 70 days, from the first anniversary of the preceding year’s annual meeting, to be timely the stockholder notice must be received no earlier than 120 days before such annual meeting and no later than the later of 90 days before such annual meeting or the tenth day after the day on which public disclosure of the date of such meeting is first made. In no event shall the public announcement of an adjournment or postponement of an annual meeting of stockholders commence a new time period (or extend any time period) for the giving of the stockholder notice. You should consult our by-laws for more detailed information regarding the process by which stockholders may nominate directors. Our by-laws are posted on the Corporate Governance page of our web site located at http://investor.caesarsacquisitioncompany.com.

Board Committees. Our Board has four standing committees: the Audit Committee, the Human Resources Committee, the Nominating and Corporate Governance Committee and the Executive Committee. The Board has determined that all of the members of the Audit Committee and two of the members of the Nominating and Corporate Governance Committee are independent as defined in the NASDAQ listing standards and in our Corporate Governance Guidelines. The Board has adopted a written charter for each of these committees. The charters for each of these committees are available on the Corporate Governance page of our web site located at http://investor.caesarsacquisitioncompany.com.

The chart below reflects the current composition of the standing committees:

|

| | | | |

| Name of Director | Audit | Human Resources | Nominating and Corporate Governance | Executive |

| Marc Rowan | | X | | X |

| David Sambur | | | X | |

| Karl Peterson | | X | | X |

| Marc Beilinson | X | | X | |

| Philip Erlanger | X | | X | |

| Dhiren Fonseca | | | | |

| Don Kornstein | X | X | | |

Audit Committee

Our audit committee consists of Marc Beilinson, Philip Erlanger and Don Kornstein. Our audit committee met on two occasions during 2013. Our Board has determined that Mr. Beilinson qualifies as an “audit committee financial expert” as such term is defined in Item 407(d)(5) of Regulation S-K and that Messrs. Beilinson, Erlanger and Kornstein are independent as independence is defined in Rule 10A-3 of the Exchange Act and under the NASDAQ listing standards. The purpose of the audit committee is to oversee our accounting and financial reporting processes and the audits of our financial statements, provide an avenue of communication among our independent auditors, management, our internal auditors and our Board, and prepare the audit-related report required by the SEC to be included in our annual proxy statement or annual report on Form 10-K. The principal duties and responsibilities of our audit committee are to oversee and monitor the following:

| |

| • | preparation of annual audit committee report to be included in our annual proxy statement; |

| |

| • | our financial reporting process and internal control system; |

| |

| • | the integrity of our financial statements; |

| |

| • | the independence, qualifications and performance of our independent auditor; |

| |

| • | the performance of our internal audit function; and |

| |

| • | our compliance with legal, ethical and regulatory matters. |

The audit committee has the power to investigate any matter brought to its attention within the scope of its duties. It also has the authority to retain counsel and advisors to fulfill its responsibilities and duties.

Human Resources Committee

The HRC serves as our compensation committee with the specific purpose of designing, approving, and evaluating the administration of our compensation plans, policies, and programs. The HRC’s role is to ensure that compensation programs are designed to encourage high performance, promote accountability and align employee interests with the interests of our stockholders. The HRC is also charged with reviewing and approving the compensation of the Chief Executive Officer and our other senior executives, including all of the named executive officers, as well as providing oversight concerning selection of officers and management succession planning. The HRC operates under our Human Resources Committee Charter. The HRC Charter was adopted as of October 18, 2013. It is reviewed no less than once per year with any recommended changes presented to our Board for approval.

The HRC currently consists of Marc Rowan, Karl Peterson and Don Kornstein. The qualifications of the HRC members stem from roles as corporate leaders, private investors, and board members of several large corporations. Their knowledge, intelligence, and experience in company operations, financial analytics, business operations, and understanding of human capital management enables the members to carry out the objectives of the HRC. We have chosen the “controlled company” exception under the NASDAQ rules which exempts us from the requirement that we have a compensation committee composed entirely of independent directors.

In fulfilling its responsibilities, the HRC is entitled to delegate any or all of its responsibilities to a subcommittee of the HRC or to specified executives of Caesars, except that it may not delegate its responsibilities for any matters where it has determined such compensation is intended to comply with the exemptions under Section 16(b) of the Exchange Act.

HRC Consultant Relationships. The HRC has the authority to engage services of independent legal counsel, consultants and subject matter experts in order to analyze, review, recommend and approve actions with regard to Board

compensation, executive officer compensation, or general compensation and plan provisions. We provide for appropriate funding for any such services commissioned by the HRC. These consultants are used by the HRC for purposes of executive compensation review, analysis, and recommendations. With respect to 2013 compensation, the HRC did not engage any consultants.

2013 HRC Activity

The HRC did not meet in 2013; however, the HRC did meet on February 10, 2014 and as delineated in the Human Resources Committee Charter, the HRC provided approval for the payout of bonuses to our NEOs under the CIE Annual Management Bonus Plan.

Role of Human Resources Committee. The HRC has sole authority in setting the material compensation of our senior executives, including base pay, incentive pay and equity awards. The HRC receives information and input from CEC's Executive Vice President of Human Resources, and CEC's Vice President of Compensation and Leadership, each pursuant to the CGP Management Services Agreement (as described below under "Certain Relationships and Related Party Transactions") and our senior executives, to help establish these material compensation determinations, but the HRC is the final arbiter on these decisions.

Role of Company executives in establishing compensation. When determining the pay levels for the Chief Executive Officer and our Chief Financial Officer, the HRC solicits advice and counsel from internal and may solicit advice from external resources. Under the CGP Management Services Agreement, we utilize the services of the Chief Executive Officer, Chief Financial Officer and Executive Vice President, Human Resources, of CEC and Vice President of Compensation and Leadership, of CEC as resources. The Executive Vice President, Human Resources, of CEC is responsible for helping to develop and implement our business plans and strategies for all company-wide human resource functions, as well as day-to-day human resources operations. Our Chief Financial Financial Officer and the Vice President of Compensation and Leadership, of CEC, are responsible for the design, execution, and daily administration of our compensation, benefits, and human resources shared-services operations. The Executive Vice President, Human Resources, of CEC, and Vice President of Compensation and Leadership, of CEC, attend the HRC meetings, at the request of the HRC, and act as a source of informational resources and serve in an advisory capacity. Based on the CGP Management Services Agreement, the Corporate Secretary of CEC is also in attendance at each of the HRC meetings and, with assistance of the Law Department of CEC, oversees the legal aspects of our executive compensation and benefit plans, updates the HRC regarding changes in laws and regulations affecting our compensation policies, and records the minutes of each HRC meeting.

Role of outside consultants in establishing compensation. Our Chief Financial Officer and the Executive Vice President, Human Resources, of CEC, and Vice President of Compensation and Leadership, of CEC, may engage outside consultants to provide advice related to our compensation policies. During 2013, the HRC did not engage any outside consultants.

Nominating and Corporate Governance Committee

Our Board has established a nominating and corporate governance committee whose members are David Sambur, Marc Beilinson and Philip Erlanger. Our nominating and corporate governance committee did not meet in 2013. The principal duties and responsibilities of the nominating and corporate governance committee are as follows:

| |

| • | to establish criteria for board and committee membership and recommend to our Board proposed nominees for election to the Board and for membership on committees of our Board; |

| |

| • | to make recommendations regarding proposals submitted by our stockholders; and |

| |

| • | to make recommendations to our Board regarding board governance matters and practices. |

We have chosen the “controlled company” exception under the NASDAQ rules which exempts us from the requirement that we have a nominating and corporate governance committee composed entirely of independent directors.

Executive Committee

Our executive committee consists of Karl Peterson and Marc Rowan. The executive committee has all the powers of our Board in the management of our business and affairs other than those enumerated in its charter, including without limitation, the establishment of additional committees or subcommittees of our Board and the delegation of authority to such committees and subcommittees, and may act on behalf of our Board to the fullest extent permitted under Delaware law and our organizational documents. The executive committee serves at the pleasure of our Board and may act by a majority of its members, provided that at least one member affiliated with TPG and Apollo must approve any action of the executive

committee. This committee and any requirements or voting mechanics or participants may continue or be changed if Apollo and TPG no longer own a controlling interest in us.

Director Qualifications. The Board of Directors seeks to ensure the Board is composed of members whose particular experience, qualifications, attributes and skills, when taken together, will allow the Board to satisfy its oversight responsibilities effectively. In identifying candidates for membership on the Board, the Board takes into account (1) minimum individual qualifications, such as high ethical standards, integrity, mature and careful judgment, industry knowledge or experience and an ability to work collegially with the other members of the Board and (2) all other factors it considers appropriate, including alignment with our stockholders, especially investment funds affiliated with the Sponsors. While we do not have any specific diversity policies for considering Board candidates, we believe each director contributes to the Board of Directors’ overall diversity, meaning a variety of opinions, perspectives, personal and professional experiences and backgrounds.

When considering whether the Board’s directors and nominees have the experience, qualifications, attributes and skills, taken as a whole, to enable the Board to satisfy its oversight responsibilities effectively in light of the Company’s business and structure, the Board focused primarily on the information discussed in each of the Board members’ biographical information set forth below under “Proposal 1-Election of Directors.”

Each of the Company’s directors possesses high ethical standards, acts with integrity, and exercises careful, mature judgment. Each is committed to employing their skills and abilities to aid the long-term interests of the stakeholders of the Company. In addition, our directors are knowledgeable and experienced in one or more business, governmental, or civic endeavors, which further qualifies them for service as members of the Board. Alignment with our stockholders is important in building value at the Company over time.

Each of the directors other than Messrs. Beilinson, Erlanger, Fonseca and Kornstein was elected to the Board pursuant to the Omnibus Voting Agreement (as defined below). Under the Omnibus Voting Agreement, until we cease to be a “controlled company” within the meaning of the NASDAQ rules, each of the Sponsors have the right to nominate two directors to our Board of Directors. In addition, under the Omnibus Voting Agreement, until we cease to be a “controlled company” each of the Sponsors has the right to designate two members of each committee of our Board of Directors except to the extent that such a designee is not permitted to serve on a committee under applicable law, rule, regulation or listing standards. Pursuant to the Omnbius Voting Agreement, Messrs. Rowan and Sambur were appointed to the Board as a consequence of their respective relationships with Apollo and Mr. Peterson was appointed to the Board as a consequence of his respective relationship with TPG.

Criteria for Director Nomination. Our Nominating and Corporate Governance Committee identifies and recommends to the Board persons to be nominated to serve as directors of the Company. Directors are selected based on, among other things, understanding of elements relevant to the success of a large publicly traded company, understanding of the Company’s business and educational and professional background. The Nominating and Corporate Governance Committee also considers the requirements of any stockholders or voting agreements in existence (as such may be amended from time to time), including but not limited to the Omnibus Voting Agreement, which governs the composition requirements of the Company’s Board of Directors and committees. In recruiting and evaluating new director candidates, the Nominating and Corporate Governance Committee also considers such factors as industry background, financial and business experience, public company experience, other relevant education and experience, general reputation, independence and diversity. The Company endeavors to have a Board composition encompassing a broad range of skills, expertise, industry knowledge and diversity of background and experience. The Nominating and Corporate Governance Committee considers, consistent with applicable law, the Company’s certificate of incorporation and by-laws and the criteria set forth in our Corporate Governance Guidelines, and any candidates proposed by any senior executive officer, director or stockholder.

In addition, individual directors and any person nominated to serve as a director should demonstrate high ethical standards and integrity in their personal and professional dealings and be willing to act on and remain accountable for their boardroom decisions, and be in a position to devote an adequate amount of time to the effective performance of director duties.

Prior to nominating a person to serve as a director, the Nominating and Corporate Governance Committee evaluates the candidate based on the criteria described above. In addition, prior to accepting renomination, each director should evaluate himself or herself as to whether he or she satisfies the criteria described above.

Board Leadership Structure. Our Board is currently comprised of seven members. Four of the directors on our Board are independent and the three remaining directors are affiliated with our Sponsors. Our Chief Executive Officer does not serve as chairman or a director on our Board. Our Sponsors, through Hamlet Holdings, have sole voting and dispositive control over 66.3% of our Class A common stock and have the power to elect all of our directors. As a result of this controlled structure, our

Board has not appointed a chairman of the Board at this time. The secretary attends the meetings of the Board and sets the agenda for those meetings as advised by the Board.

Board’s Role in Risk Oversight. The Board exercises its role in the oversight of risk as a whole and through the Audit Committee. The Audit Committee receives regular reports from the Company’s risk management and compliance departments.

Board Meetings and Committees; Policy Regarding Director Attendance at Annual Meeting of Stockholders. During 2013, our Board of Directors held two meetings. All directors attended at least 75% of the Board meetings and meetings of the committees of the Board on which the director served except for Mr. Peterson, who attend fewer than 75% of the Audit Committee meetings. Following the consummation of the Rights Offering, it is our policy that directors are encouraged to attend the Company’s annual stockholder meeting.

Policy Regarding Communication with Board of Directors. Stockholders and other interested parties may contact the Board of Directors as a group or to any individual director by sending a letter (signed or anonymous) to: c/o Board of Directors, Caesars Acquisition Company, One Caesars Palace Drive, Las Vegas, NV 89109, Attention: Corporate Secretary.

We will forward all such communications to the applicable Board member(s), except for material that is unduly hostile, threatening, illegal or similarly unsuitable. In addition, the Company’s Board has requested that certain items which are unrelated to the duties and responsibilities of the Board should be excluded, such as product complaints, suggestions, resumes and other forms of job inquires, surveys and business solicitations or advertisements. The Law Department will review the communication and concerns will be addressed through our regular procedures for addressing such matters. Depending on the nature of the concern, management also may refer it to our internal audit, legal, finance or other appropriate department. If the volume of communication becomes such that the Board adopts a process for determining which communications will be relayed to Board members, that process will appear on the Corporate Governance page of our web site located at http://investor.caesarsacquisitioncompany.com.

Corporate Governance Guidelines. The Company has adopted Corporate Governance Guidelines that we believe reflect the Board’s commitment to a system of governance that enhances corporate responsibility and accountability. The Corporate Governance Guidelines contain provisions addressing the following matters, among others:

| |

| • | board composition (i.e., size); |

| |

| • | director qualifications; |

| |

| • | classification of directors into three classes; |

| |

| • | director retirement policy and changes in a non-employee director’s primary employment; |

| |

| • | director term limits (and the lack thereof); |

| |

| • | director responsibilities, including director access to officers and employees; |

| |

| • | board meetings and attendance and participation at those meetings; |

| |

| • | director orientation and continuing education; |

| |

| • | chief executive officer evaluation and compensation; |

| |

| • | management succession planning; |

| |

| • | performance evaluation of the Board and its committees; and |

The Corporate Governance Guidelines are available on the Corporate Governance page of our web site located at http://investor.caesarsacquisitioncompany.com. We intend to disclose any future amendments to the Corporate Governance Guidelines on our website.

Code of Ethics. We have a Code of Business Conduct and Ethics, which is applicable to all of our directors, officers and employees (the “Code of Ethics”). The Code of Ethics is available on the Corporate Governance page of our web site located at http://investor.caesarsacquisitioncompany.com. To the extent required pursuant to applicable SEC regulations, we intend to post amendments to or waivers from our Code of Ethics (to the extent applicable to our chief executive officer,

principal financial officer or principal accounting officer) at this location on our website or report the same on a Current Report on Form 8-K. Our Code of Ethics is available free of charge upon request to our Corporate Secretary, Caesars Acquisition Company, One Caesars Palace Drive, Las Vegas, Nevada 89109.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Exchange Act requires our directors, executive officers and greater than ten-percent stockholders to file initial reports of ownership and reports of changes in ownership of any of our securities with the SEC and us. We believe that during the 2013 fiscal year, all of our directors, executive officers and greater than ten-percent stockholders complied with the requirements of Section 16(a). This belief is based on our review of forms filed or written notice that no reports were required.

PROPOSAL 1-ELECTION OF DIRECTORS

The current Board of Directors of Caesars consists of seven directors. Our Board of Directors recommends that the nominees listed below be elected as members of the Board of Directors at the annual meeting.

Pursuant to our certificate of incorporation, our Board of Directors is divided into three classes. The members of each class will serve for a staggered, three-year term. Upon the expiration of the term of a class of directors, directors in that class will be elected for three-year terms at the annual meeting of stockholders in the year in which their term expires. Each of the nominees, if re-elected, will serve a three year term as a director until the annual meeting of stockholders in 2017 or until his respective successor is duly elected and qualified or until the earlier of his death, resignation or removal. If a nominee becomes unable or unwilling to accept nomination or election, the person or persons voting the proxy will vote for such other person or persons as may be designated by the Board of Directors, unless the Board of Directors chooses to reduce the number of directors serving on the Board. The Board of Directors has no reason to believe that any of the nominees will be unable or unwilling to serve as a director if re-elected.

|

| | | | | | |

| Name | | Age (1) | | Director Since | | Position(s) |

| Directors whose terms will expire at the 2014 Annual Meeting | | | | | | |

| Marc Beilinson | | 55 | | 2013 | | Director |

| Philip Erlanger | | 58 | | 2013 | | Director |

| | | | | | | |

| Directors whose terms will expire at the 2015 Annual Meeting | | | | | | |

| Karl Peterson | | 43 | | 2013 | | Director |

| David Sambur | | 34 | | 2013 | | Director |

| Don Kornstein | | 62 | | 2014 | | Director |

| | | | | | | |

| Director whose term will expire at the 2016 Annual Meeting | | | | | | |

| Marc Rowan | | 51 | | 2013 | | Director |

| Dhiren Fonseca | | 49 | | 2013 | | Director |

______________________________

| |

(1) | As of April 14, 2014. |

As of February 28, 2014, the following is a brief description of the background and business experience of each of our directors and nominees as of :

Nominees

Marc Beilinson became a member of our board of directors in October 2013 and is an independent director under the NASDAQ Marketplace rules. Since August 2011, Mr. Beilinson has been the Managing Partner of Beilinson Advisory Group, a financial restructuring and hospitality advisory group that specializes in assisting distressed companies. Mr. Beilinson has served as Chief Restructuring Officer and Chief Executive Officer of Eagle Hospitality Properties Trust, Inc. since May 2011, and previously served as the Chief Restructuring Officer and Chief Executive Officer of Innkeepers USA Trust through March 2012. In 2007, Mr. Beilinson retired from Pachulski, Stang, Ziehl & Jones, a nationally recognized boutique law firm specializing in corporate reorganization, where he had practiced since 1992. Mr. Beilinson currently serves on the Board of Directors and Audit Committees of Athene Annuity and Life Insurance Company and MFG Assurance Company Limited. Mr. Beilinson has previously served on the Board of Directors and Audit Committees of a number of public and privately held companies including Wyndham International, Inc., Apollo Commercial Real Estate Finance Inc., Innkeepers USA Trust and JER/Jameson Properties LLC. Mr. Beilinson graduated from the University of California, Los Angeles, magna cum laude, where he served as student body president, and from the University of California Davis Law School. Mr. Beilinson is a member of the Company’s Audit Committee and Nominating and Corporate Governance Committee. Due to the foregoing experience and qualifications, Mr. Beilinson was elected as a member of our Board.

Philip Erlanger became a member of our board of directors in December 2013 and is an independent director. Mr. Erlanger, formerly with Barclays Capital and its predecessor, Lehman Brothers, led the firm’s West Coast Financial Services banking practice and subsequently, its Financial Sponsor coverage effort. He was Chairman of Lehman’s Los Angeles office, a member of its Business Development Committee and a charter member of its Senior Client Council. He is currently the Managing Partner of PREv2 Holdings, which he founded in 2010. Mr. Erlanger also serves on the Board of Directors of Bonk

Breaker, LLC, and the Board of Governors of Cedars-Sinai Medical Center. He previously served as a board member of Ares Dynamic Credit Allocation Fund, Ares Multi-Strategy Credit Fund, and the Los Angeles Philharmonic. Mr. Erlanger holds a Doctorate in Economics from the University of Pennsylvania and an M.B.A. from the Wharton School. Mr. Erlanger is a member of the Company’s Audit Committee and Nominating and Corporate Governance Committee. Due to the foregoing experience and qualifications, Mr. Erlanger was elected as a member of our Board.

THE BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE “FOR” EACH OF THE DIRECTOR NOMINEES.

Class II Directors (Current Term Will Expire at the 2015 Annual Meeting)

David Sambur became a member of our board of directors in July 2013. Mr. Sambur is a Partner of Apollo Global Management, having joined in 2004. Mr. Sambur has experience in financing, analyzing, investing in and/or advising public and private companies and their board of directors. Prior to joining Apollo, Mr. Sambur was a member of the Leveraged Finance Group of Salomon Smith Barney Inc. Mr. Sambur serves on the board of directors of Verso Paper Corp., Momentive Performance Materials Holdings, Momentive Specialty Chemical, Inc., Caesars Entertainment Corporation and AP Gaming Voteco, LLC. Mr. Sambur graduated summa cum laude and Phi Beta Kappa from Emory University with a BA in Economics. He is a member of the Company’s Nominating and Corporate Governance Committee. Due to the foregoing experience and qualifications, Mr. Sambur was elected as a member of our Board.

Karl Peterson became a member of our board of directors in July 2013. Mr. Peterson is a senior partner of TPG Capital where he leads the firm’s European business. He rejoined TPG in 2004 after serving as President and Chief Executive Officer of Hotwire, Inc. Mr. Peterson led Hotwire, Inc. from inception through its sale to IAC/InterActiveCorp. Before his work at Hotwire, Inc., Mr. Peterson was a principal of TPG in San Francisco. He holds a bachelor’s degree from the University of Notre Dame and has previously served on the board of directors of Univision Communications, Inc. and Caesars Entertainment Corporation. Mr. Peterson currently serves on the boards of directors of Norwegian Cruise Lines, Sabre Holdings Corporation, Saxo Bank and TES Global. Mr. Peterson is a member of the Company’s Executive Committee and Human Resources Committee. Due to the foregoing experience and qualifications, Mr. Peterson was elected as a member of our Board.

Don Kornstein became a member of our board of directors in January 2014 and is an independent director. Mr. Kornstein founded and has served as the managing member of the strategic, management and financial consulting firm Alpine Advisors LLC and currently serves as a non-executive director on the board of Gala Coral Group, a diversified gaming company based in the United Kingdom. He has previously served on the board of directors of Affinity Gaming, Inc., Bally Total Fitness Corporation, Circuit City Stores, Inc., Cash Systems, Inc. , Shuffle Master, Inc. and Varsity Brands, Inc. Mr. Kornstein previously served as Chief Executive Officer, President and Director of Jackpot Enterprises, Inc., and was an investment banker and Senior Managing Director of Bear, Stearns & Co. Inc. Mr. Kornstein earned his B.A. , Magna Cum Laude, from the University of Pennsylvania and his M.B.A. from Columbia University Graduate School of Business. Mr. Kornstein is a member of the Company’s Audit Committee and Human Resources Committee. Due to the foregoing experience and qualifications, Mr. Kornstein was elected as a member of our Board.

Class III Directors(Current Term Will Expire at the 2016 Annual Meeting)

Marc Rowan became a member of our board of directors in July 2013. Mr. Rowan is a co-founder and Senior Managing Director of Apollo Global Management, LLC, a leading alternative asset manager focused on contrarian and value oriented investments across private equity, credit-oriented capital markets and real estate. He currently serves on the boards of directors of the general partner of AP Alternative Assets, L.P., Apollo Global Management, LLC, Athene Holding Ltd., Caesars Entertainment Corp., Caesars Acquisition Co., Norwegian Cruise Lines and Beats Music. He has previously served on the boards of directors of AMC Entertainment, Inc., CableCom Gmbh., Countrywide PLC, Culligan Water Technologies, Inc., Furniture Brands International, Mobile Satellite Ventures, National Cinemedia, Inc., National Financial Partners, Inc., New World Communications, Inc., Quality Distribution, Inc., Samsonite Corporation, SkyTerra Communications, Inc., Unity Media SCA, Vail Resorts, Inc. and Wyndham International, Inc. He is a founding member and Chairman of Youth Renewal Fund and a member of the Board of Overseers of The Wharton School. He serves on the boards of directors of Jerusalem Online and the New York City Police Foundation. Mr. Rowan graduated Summa Cum Laude from the University of Pennsylvania’s Wharton School of Business with a BS and an MBA in Finance. Mr. Rowan is a member of the Company’s Executive Committee and the Human Resources Committee. Due to the foregoing experience and qualifications, Mr. Rowan was elected as a member of our Board.

Dhiren Fonseca become a member of our board in December 2013 and is an independent director. Mr. Fonseca serves as Chief Commercial Officer for Expedia, Inc., but on March 18, 2014, Mr. Fonseca announced that he will be leaving Expedia

in the spring of 2014. Prior to his current role, he served as Expedia’s Co-President, Partner Services Group, as Senior Vice President, Corporate Development and Strategy, and as Vice President, Corporate Development Strategy. Prior to Expedia, Mr. Fonseca was a longtime Microsoft Corporation employee, and a member of the management team responsible for creating Expedia.com in 1996, while still part of the Microsoft Corporation. Mr. Fonseca serves on the Board of Directors for eLong.com (NASDAQ: Long). Due to the foregoing experience and qualifications, Mr. Fonseca was elected as a member of our Board.

PROPOSAL 2-RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee has appointed Deloitte & Touche LLP as our independent registered public accounting firm for the year ending December 31, 2014. Services provided to the Company and its subsidiaries by Deloitte & Touche LLP for the year ending December 31, 2013 are described below and under “Audit Committee Report” located in this proxy statement.

Fees and Services

The following table summarizes the aggregate fees paid or accrued by the Company to Deloitte & Touche LLP during 2013 and 2012:

|

| | | | | | | |

| | 2013 | | 2012 |

| | (in thousands) |

Audit Fees (a) | $ | 5,746 |

| | $ | — |

|

Audit-Related Fees (b) | — |

| | — |

|

Tax Fees (c) | — |

| | — |

|

| Total | $ | 5,746 |

| | $ | — |

|

| |

| (a) | Audit Fees-Fees for audit services billed in 2013 consisted of: |

| |

| • | Audit of the Company’s annual financial statements, including the audits of the various subsidiaries conducting gaming operations as required by the regulations of the respective jurisdictions; |

| |

| • | Sarbanes-Oxley Act, Section 404 attestation services; |

| |

| • | Reviews of the Company’s quarterly financial statements; and |

| |

| • | Comfort letters, statutory and regulatory audits, consents, and other services related to SEC matters. |

| |

| • | Include fees for the audits of 2011 and 2012 for CAC registration statement |

| |

| (b) | Audit-Related Fees-Fees for audit-related services billed in 2013 consisted of: |

| |

| • | Quarterly revenue and compliance audits performed at certain of our properties as required by state gaming regulations; |

| |

| • | Internal control reviews; and |

| |

| • | Agreed-upon procedures engagements. |

| |

| (c) | Tax Fees-Fees for tax services paid in 2013 consisted of tax compliance and tax planning and advice: |

| |

| • | CAC nor Growth Partners incurred fees for tax compliance services in 2013. Tax compliance services are services rendered based upon facts already in existence or transactions that have already occurred to document, compute, and obtain government approval for amounts to be included in tax filings and consisted of: |

| |

| i. | Federal, state, and local income tax return assistance |

| |

| ii. | Requests for technical advice from taxing authorities |

| |

| iii. | Assistance with tax audits and appeals |

| |

| • | CAC nor Growth Partners incurred fees for tax planning and advice services in 2013. Tax planning and advice are services rendered with respect to proposed transactions or that alter a transaction to obtain a particular tax result. Such services consisted of: |

| |

| i. | Tax advice related to structuring certain proposed mergers, acquisitions, and disposals |

| |

| ii. | Tax advice related to the alteration of employee benefit plans |

| |

| iii. | Tax advice related to an intra-group restructuring |

In considering the nature of the services provided by the independent auditor, the Audit Committee determined that such services are compatible with the provision of independent audit services. The Audit Committee discussed these services with the independent auditor and Company management to determine that they are permitted under the rules and regulations concerning auditor independence promulgated by the SEC to implement the Sarbanes-Oxley Act of 2002, as well as the American Institute of Certified Public Accountants.

Deloitte & Touche LLP was engaged by CEC's Board of Directors and Audit Committee to perform services for CAC in 2013 and 2012 prior to CAC's formation. On November 13, 2013, CAC's Audit Committee approved Deloitte & Touche LLP's 2013 Audit Fees. CAC's Audit Committee also any requests for audit services must be submitted to the Audit Committee for specific approval and cannot commence until such approval has been granted. Except for such services which fall under the de minimis provision of the pre-approval policy, any requests for audit-related, tax, or other services also must be submitted to the Audit Committee for specific pre-approval and cannot commence until such approval has been granted. Normally, pre-approval is provided at regularly scheduled meetings. However, the authority to grant specific pre-approval between meetings, as necessary, has been delegated to the Chairperson of the Audit Committee. The Chairperson must update the Audit Committee at the next regularly scheduled meeting of any services that were granted specific pre-approval.

In addition, although not required by the rules and regulations of the SEC, the Audit Committee generally requests a range of fees associated with each proposed service. Providing a range of fees for a service incorporates appropriate oversight and control of the independent auditor relationship, while permitting the Company to receive immediate assistance from the independent auditor when time is of the essence.

The policy contains a de minimis provision that operates to provide retroactive approval for permissible non-audit, tax, and other services under certain circumstances. The provision allows for the pre-approval requirement to be waived if all of the following criteria are met:

1. The service is not an audit, review, or other attest service;

2. The estimated fees for such services to be provided under this provision do not exceed a defined amount of

total fees paid to the independent auditor in a given fiscal year;

3. Such services were not recognized at the time of the engagement to be non-audit services; and

4. Such services are promptly brought to the attention of the Audit Committee and approved by the Audit

Committee or its designee.

No fees were approved under the de minimis provision in 2013 or 2012.

Representatives of Deloitte & Touche LLP will be present at the annual meeting. They will have the opportunity to make a statement if they desire to do so, and we expect that they will be available to respond to questions.

Ratification of the appointment of Deloitte & Touche LLP requires affirmative votes from the holders of a majority of the shares present in person or represented by proxy at the annual meeting and entitled to vote. If the Company’s stockholders do not ratify the appointment of Deloitte & Touche LLP, the Audit Committee will reconsider the appointment and may affirm the appointment or retain another independent accounting firm. Even if the appointment is ratified, the Audit Committee may in the future replace Deloitte & Touche LLP as our independent registered public accounting firm if it is determined that it is in the Company’s best interests to do so.

THE AUDIT COMMITTEE AND THE BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE “FOR” THE RATIFICATION OF THE APPOINTMENT OF DELOITTE & TOUCHE LLP AS THE INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM OF THE COMPANY FOR THE YEAR ENDING DECEMBER 31, 2014.

PROPOSAL 3 - APPROVAL OF THE CAESARS ACQUISITION COMPANY 2014 PERFORMANCE INCENTIVE PLAN

At the annual meeting, stockholders will be asked to approve the Caesars Acquisition Company 2014 Performance Incentive Plan (the “2014 Incentive Plan”), which was adopted by our Board of Directors (the “Board”) on April 9, 2014. A copy of the 2014 Incentive Plan is attached as Appendix A to this Proxy Statement. Our Board recommends a vote for the approval of the 2014 Incentive Plan because it believes the plan is in the best interests of the Company and its stockholders because it allows the Company to retain and motivate key personnel and also to align director, employee and stockholder interests.

Summary of the 2014 Performance Incentive Plan

The purpose of the 2014 Incentive Plan is to provide participants with an incentive to promote the success of the Company and to align their interests with those of our shareholders. The following is a summary of certain terms and conditions of the 2014 Incentive Plan. This summary is qualified in its entirety by reference to the 2014 Incentive Plan attached as Appendix A to this proxy statement. You are encouraged to read the full 2014 Incentive Plan.

Eligibility

Officers, employees, directors, individual consultants or advisors who render or have rendered bona fide service to us or one of our subsidiaries may be selected by the plan administrator to receive awards under the 2014 Incentive Plan.

Administration

Our Board or a subcommittee thereof has the authority to administer the 2014 Incentive Plan. Our Board may delegate its authority, including the authority to determine award recipients, terms and sizes, to a subcommittee of the Board or, to the extent permitted by applicable law, one or more of our officers.

For awards intended to satisfy the requirements for performance-based compensation under Section 162(m) of the Internal Revenue Code, the 2014 Incentive Plan will be administered by a committee consisting solely of two or more outside directors. Awards or transactions intended to be exempt under Rule 16b-3 of the Securities Exchange Act, will be authorized by the Board or a committee consisting solely of two or more non-employee directors (as such requirement is applied under Rule 16b-3). And, to the extent required by any applicable listing agency, the 2014 Incentive Plan shall be administered by a committee composed entirely of “independent directors,” within the meaning of the applicable listing agency.

The Board or any person or group properly delegated to administer the 2014 Incentive Plan is referred to in this summary as the “plan administrator.”

The plan administrator has broad authority, subject to express provisions of the 2014 Incentive Plan, to:

| |

| • | select participants and determine the types of awards they are to receive; |

| |

| • | determine the number of shares that are to be subject to awards and the terms and conditions of awards (including the price (if any) to be paid for the shares or award, vesting schedules, performance targets and the events of termination of such awards); |

| |

| • | approve the form of agreements evidencing the awards, which need not be identical as to type of award or among participants; |

| |

| • | cancel, modify or waive rights with respect to, or modify, discontinue, suspend or terminate any or all outstanding awards, subject to any required consents; |

| |

| • | accelerate or extend the vesting or exercisability of, or extend the term of, any or all outstanding awards, subject to the terms of the 2014 Incentive Plan; |

| |

| • | construe and interpret the 2014 Incentive Plan and any agreements relating to the 2014 Incentive Plan; |

| |

| • | subject to the other provisions of the 2014 Incentive Plan, make certain adjustments to outstanding awards, including to the number of shares of our common stock subject to any award, the price of any award or previously imposed terms and conditions; |

| |

| • | authorize the termination, conversion, substitution or succession of awards upon the occurrence of certain events; |

| |

| • | allow the purchase price of an award or shares of our common stock to be paid in the form of cash, check or electronic funds transfer, by the delivery of previously-owned shares of our common stock or by a reduction of the number of shares deliverable pursuant to the award, by services rendered by the recipient of the award, by notice and third party payment or cashless exercise on such terms as the plan administrator may authorize, or any other form permitted by law; and |

| |

| • | determine the date of grant of awards, which may be after, but not before, the plan administrator’s action and, unless otherwise designated by the plan administrator, will be the date of the plan administrator’s action. |

The plan administrator will have full discretion to take such actions as it deems necessary or desirable for the administration of the 2014 Incentive Plan. Plan administrator decisions relating to the 2014 Incentive Plan are final and binding.

Number of Shares Authorized and Award Limits

Subject to adjustment in connection with changes in capitalization, the maximum number of shares of our common stock that may be delivered pursuant to awards under the 2014 Incentive Plan is 3,000,000.

This maximum share reserve will be reduced in accordance with the rules in this paragraph:

| |

| • | to the extent an award is settled in cash or a form other than shares of our common stock, the shares that would have been delivered had there been no such cash or other settlement will not be counted against the shares available for issuance under the 2014 Incentive Plan; |

| |

| • | if shares of our common stock are delivered in respect of a dividend equivalent right, the actual number of shares delivered with respect to the award will be counted against the share limits; |

| |

| • | if shares of our common stock are delivered pursuant to the exercise of a stock appreciation right or option granted under the 2014 Incentive Plan, the number of underlying shares as to which the exercise related will be counted against the applicable share limits, as opposed to only counting the shares actually issued; and |

| |