As filed on January 10, 2014

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Amendment No. 5

to

FORM 10

GENERAL FORM FOR REGISTRATION OF SECURITIES

Pursuant to Section 12(b) or 12(g) of the Securities Exchange Act of 1934

UBL INTERACTIVE, INC.

(Exact name of registrant as specified in its charter)

Delaware

(State of other jurisdiction of incorporation)

27-1077850

I.R.S. Employer Identification Number

6701 Carmel Road, Suite 202

Charlotte, NC 28226

(Address of Principal Executive Office) (Zip Code)

704-930-0297

(Registrant’s Telephone Number)

Copies to:

Marc Ross, Esq.

Marcelle S. Balcombe, Esq.

Sichenzia Ross Friedman Ference LLP

61 Broadway, 32nd Floor

NY, NY 10006

(212)930-9700

Securities to be registered under Section 12(b) of the Act:

| Title of each class | | Name of each exchange on which |

| To be so registered | | each class is to be registered |

| None | | None |

Securities to be registered under Section 12(g) of the Act:

| Common stock, par value $0. 01 per share | | None |

| (Title of class) | | |

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer o | | Accelerated filer o |

| | | |

Non-accelerated filer o | | Smaller reporting company x |

| (Do not check if a smaller reporting company) | | |

| | 3 |

| | 9 |

| | 15 |

| | 23 |

| | 24 |

| | 24 |

| | 26 |

| | 28 |

| | 29 |

| | 29 |

| | 29 |

| | 33 |

| | 34 |

| | F-1 |

| | 35 |

| | 36 |

Forward Looking Statements

There are statements in this Registration Statement that are not historical facts. These "forward-looking statements" can be identified by use of terminology such as "believe," "hope," "may," "anticipate," "should," "intend," "plan," "will," "expect," "estimate," "project," "positioned," "strategy" and similar expressions. You should be aware that these forward-looking statements are subject to risks and uncertainties that are beyond our control. Although we believe that the expectations reflected in such forward-looking statements, including those regarding future operations, are reasonable, we can give no assurance that such expectations will prove to be correct. Forward-looking statements are not guarantees of future performance and they involve various risks and uncertainties. Forward-looking statements contained in this document include statements regarding our proposed products, market opportunities and acceptance, expectations for revenues, cash flows and financial performance, and intentions for the future. Such forward-looking statements are included under Item 1. “Business” and Item 2. “Financial Information - Management’s Discussion and Analysis of Financial Condition and Results of Operation.” All forward-looking statements included in this document are made as of the date hereof, based on information available to us as of such date, and we assume no obligation to update any forward-looking statement. It is important to note that such statements may not prove to be accurate and that our actual results and future events could differ materially from those anticipated in such statements. Among the factors that could cause actual results to differ materially from our expectations are those described under Item 1. “Business” and Item 2. “Financial Information - Management’s Discussion and Analysis of Financial Condition and Results of Operations.” All subsequent written and oral forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by this section and other factors included elsewhere in this document. You should assume that the information contained in this document is accurate as of the date of this Form 10 only.

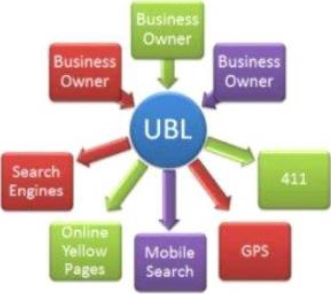

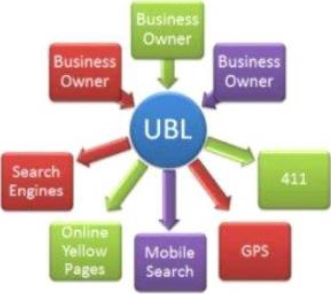

Overview

UBL Interactive Inc. (“we”, “us”, “our” or the “Company”) provides a comprehensive set of online identity management tools and services to businesses seeking to optimize their presence in location based search results on web, mobile and social platforms. These search results typically are highly structured and include name, address, phone number and enhanced profile information, as opposed to excerpts of website information. We market our services under the product brand name of Universal Business Listing and UBL and operate in part through the website www.UBL.org . Our service provides a cost-effective method for ensuring the distribution and accuracy of individual business listing data across hundreds of local web directories, search engines, mobile applications and other sources of local listings data. Our profile management services allow businesses to take control of profile pages in leading, highly trafficked, search engines and social media sites, providing enhanced content about their products and services. As part of these services, we also provide an expanding range of analytical and monitoring tools to increase our customer value proposition. We offer services in the USA, Canada, The United Kingdom and Australia.

Identity management services are key building blocks for businesses seeking an affordable way to exploit consumer usage on web, mobile and social platforms. Accurate listings generate value for clients in the form of customer leads and sales by increasing the relevance of businesses in search results. These profile management services allow companies to build and manage representations of their businesses, and provide access to large populations of consumers directly within leading search, social and mobile platforms. Given the rapidly growing volumes of local search and social activity through the web and mobile devices, we believe the services we provide are valuable to any company, from single-owner home-operated businesses, to multi-location enterprises.

We believe our revenue model is simple and powerful for users and partners alike. Our product offerings have grown from a simple single-offer “Business Listing Syndication” service at $30/year, to our current portfolio “Business Profile Management” products, targeting all sizes of businesses with a range from $79/year up to $799/year per outlet. By providing the right mix of listing and analytics products, we believe that we will be able to increase our average revenue per unit (ARPU), strengthen our relationships with customers and increase retention. With substantial discounts for wholesale agencies and commissions for online affiliates, we also believe we represent an attractive revenue generating opportunity for traditional and emerging channels seeking to transition from legacy media to online models.

We provide our listing services to businesses directly from our site, and through interactive marketing agencies and channel sales partnerships. Through our website, UBL.org (“UBL”), we offer a centralized platform for businesses to manage their online profile information and distribute accurate listing data to more than 300 search engines, directory publishers, social networks and mobile services, which collectively process substantially all of the local search queries in the United States. In addition to direct submissions through our website, we also manage bulk listing feeds from agencies and channel partners through database templates and application programming interfaces (APIs), which are direct data connections. We also operate an affiliate program which pays a referral fee (commission) for referred and closed business from our affiliates of which we have over 200. The company also has over 300 agencies under contract which manage tens of thousands of businesses submitted through the platform.

Our distribution network consists of a broad set of online business directories including Supermedia.com and YP.com, search engines including, Google, Yahoo! and Bing, social networks, like Facebook and Twitter, and local guides including AOL, CitySearch and Yelp. We also distribute listings across a wide range of 411 directory assistance, GPS navigation, mobile data services, and other mobile services including OnStar. Augmenting our direct data submissions with publishers, we also have contractual relationships with data aggregators, which provide the primary databases of business listings to major search sites such as Google and Bing. Our contractual agreements with aggregators provide for inclusion in their computerized databases, listing information compiled and submitted by the Company. These agreements provide for a fixed term with automatic annual renewals and payments based upon the number of listings we submit.

The Problem

Businesses of all sizes now need to be found online, and they invest resources in achieving that goal, principally through interactive marketing including advertising, website creation, search engine optimization, managing external directory listings and creating business profile pages on highly trafficked web sites. While many businesses use paid search and search engine optimization (SEO) to improve visibility, the intense competition among businesses seeking to reach consumers through paid search and SEO has led to a rapid increase in costs. Managing paid listing campaigns across multiple search providers is also complicated and time consuming for most companies, particularly small businesses. Managing SEO campaigns can also be expensive and there is no guarantee of success in a rapidly changing search landscape. As a result of the high overall costs of search marketing, many businesses, large and small, are expanding their activities to include listing and profile page management.

While the opportunity for businesses seeking to take advantage of online traffic through listing and profile management is clear, the large number of directories and the resulting fragmentation of consumer usage makes maintaining a fully-distributed, accurate, online identity difficult for businesses of every size. As the popular ” Local Search Ecosystem” map from GetListed.org below illustrates, the sheer volume and complexity of listing traffic sources makes the task of identifying and listing accurate and consistent information across the directory landscape burdensome. Ongoing maintenance of listing information is a critical and time consuming process particularly for large enterprises with hundreds or thousands of outlets. Submitting business listings annually to the most popular search engines and directories is a time-consuming process and in many instances publishers do not permit submissions.

Industry experts1 estimate that there are a large number of errors in the name, address, phone number and website address information of small business and enterprise listings resulting in a high cost to business in lost revenue. Enhanced profile information, such as product descriptions and hours of operation, is regularly found to be inconsistent, incomplete or missing entirely. While small business listings are less volatile, at the enterprise level, changes caused by mergers, office relocations, branch closures, phone system changes and local managers not following corporate branding conventions, frequently result in inaccurate information across listings. Correcting these issues requires regular maintenance and management on a broad scale.

1 (http://screenwerk.com/2013/03/04/the-high-cost-of-missing-listings-10-billion-or-more/)

Profile pages, particularly on large, highly trafficked search engines, social media sites and vertical content sites represent a key source of information about the business and drive significant volume of their customer connections. As the web evolves, profile “places” pages in major search engines and “fan” pages on social media sites are becoming a key element in their strategies to capture rich, relevant business information and establish relationships with small businesses and enterprises. In a similar way, profile pages on vertical and local media sites in high value categories are an increasingly important part of the underlying business models of these publishers.

For businesses, profile pages represent a powerful format for converting consumers into active sales leads, particularly in search engines where competition is fierce and listings are prominently featured at the top of search results. The combination of prominence, rich presentation attributes, and a growing set of promotional tools gives businesses, small and large, the ability to generate free leads and lower acquisition costs. In the same way, highly trafficked search, social, vertical and local sites competing to attract a critical mass of consumers for high frequency local searches, benefit from rich and relevant business content and offers. Given high levels of competition between these sites in the race to lock in local search audiences, competitors in all of these categories will continue to promote business profiles, expanding the range of features and tools to stimulate adoption.

For small businesses and multi-location enterprises, managing owner-verified or “claimed” business profiles across search, social and vertical sites presents many of the same challenges as basic listings management. Regular updates, proprietary tool sets and data elements, particularly for businesses that need representation across multiple search, social and vertical sites, make the process time consuming and complex. As with listings management, we believe that for many, if not all small businesses and multi-outlet enterprises the complexities of profile management will ultimately force them to out-source these activities to specialist companies like us, which operate at scale and have the processes and technologies to manage identity management across thousands of businesses.

The other aspect of the problem is that businesses find it difficult to analyze the accuracy of their data online as well as to monitor the activity coming from these listings. Whilst website analytics are very established for owned sites, the ability to analyze information across numerous publishers is very challenging. This includes data reports on where the listings are present, and if they are accurate or incomplete. In addition, Companies are increasingly looking for additional data on user interactions including reviews, ratings, and what pageviews, clicks, or calls have occurred.

Our solution:

We provide a self-serve platform and managed services that help businesses of all sizes to manage listing information and business profiles across key distribution networks. Our platform operates as a direct-to-business e-commerce platform for purchase and management of profiles through a user-friendly interface and reporting dashboard. The platform is highly scalable and can be used by agencies and resellers for bulk uploading of enterprise files. To facilitate bulk uploads the platform has APIs and can be private labeled for partners looking to manage customers under their own brands. As part of our offering, we also provide managed services for customers who do not want to use our self-service interfaces.

Listings managed by us are normalized and distributed to more than 300 directory publishers. Profile pages are distributed across major search engines, social media and directory sites. At the listing level our platform ensures accurate and current business data are regularly updated and distributed across the web. At an owner-verified profile page level, our managed services ensure that information about a business is available to consumers in highly trafficked search, social and vertical sites. By using our platform and profile claiming services, we believe businesses save time and money, immediately increase their visibility (online and mobile), improve organic search results, increase the number of leads and sales, and minimize the opportunity cost of inaccurate data.

For the individual entity the value of our service is seen as cost-efficient and more comprehensive than they could do themselves. For the reseller channels there is the additional value of ease of integration, and pure white labeling of a service that adds to their revenue and customer retention.

As part of our service we provide identity “audits” for both individual businesses and enterprises, which analyze the consistency of listings across the major search, and directory sites, highlighting inaccuracies. Based on this data, we are able to show our customers the effectiveness of our listing management processes. We also provide customers with visibility reports across the time-span of the year, so they can track the growth and effectiveness of the number of sites that display the profiles. Advanced agencies are able to track clicks or visits from such links and leverage this information to extrapolate a financial return for their clients.

Products

Our products, which serve the need for business identity management, can be categorized as follows:

Listing Syndication – Our listing syndication packages are sold as tiered packages, with components based on the varying needs of businesses, from basic identity distribution to full optimization of content for search engine visibility. In addition to our use of database aggregators for listing syndication and distribution, we are increasingly establishing direct data relationships with publishers in the interests of speed, reporting and performance. The move to direct relationships is made possible by the increasing availability of APIs that allow automated export of listing and profile data directly into publisher databases .We expect that this trend will continue and that over time, we will have a much broader base of direct listing partnerships. We call our publisher feeds, UBL Direct. The syndication packages we currently sell include:

| ● | Basic – Core listing to over 300 consumer search locations (e.g. local search, yellow pages, 411, GPS, social networks) through submission to the main listings databases, and public SEO-optimized web card, showing the profile. This is only available to Enterprise customers with many locations, and often includes bulk Google and Bing data uploads. |

| | |

| ● | Essential – Includes the basic package described above and UBL Direct submissions to 20 major sites and distributors (eg: Yelp, Yahoo Local, Foursquare, Local.com, Factual) and visibility report which shows the growth of distribution as a result of the syndication. |

| | |

| ● | Premium – Includes the Essential package described above, plus password-protection claimed “ownership” of profiles on key search and social sites (e.g. Yahoo, Bing, Google, Facebook, Twitter, SuperPages, Mapquest and YP.com). |

| | |

| ● | Professional – Includes premium package described above, as well as content, features and functions to optimize a business identity for search engine discovery. This includes production of a video profile and submission to video search engines, articles creation and blog submissions. |

| | |

| ● | UBL Express – Adds real-time capability for insertion and updating of listings, as well as activity data. |

Analytics and Reputation Management – We also sell a set of presence auditing tools that analyze, monitor and send alerts to businesses about information relating to the visibility, accuracy or their business profiles online. This includes monitoring reviews, ratings, sentiments and blog mentions on local businesses. It also includes visibility reports that show in detail the accuracy of listings online and the growing numbers of links generated on external directories from the UBL syndication process. These are sold individually or a series of reports, as well as a subscription service under the company’s LocationMonitor.com branded website. LocationMonitor is also available as a white-label and API solution for large partners and channels.

Effective June 2012, we entered into an internet services and co-location agreement with Charlotte Colocation Center, LLC for the provision of internet connectivity services and co-location services. The agreement is for a one year term with automatic renewals unless sooner terminated pursuant to its terms and provides for a monthly payment of $424.95 and $0.50 per month per IP address. Any interruption in our network services may cause disruptions in the provision of our services. While we believe that we may be able to replace our current provider with other providers, doing so would require a managed effort to ensure no downtime that my impact our business.

Technology

We own and control our technology platform, but also integrate third party data sources, solutions and technologies depending on factors such as the cost/benefit of development, market experimentation and competition. Our platform runs on Microsoft .Net and Sequel technologies, housed in a secure data center in Charlotte, North Carolina backed up daily, off-site and with redundant fail-over servers. Our team is experienced in managing customer-facing web sites and content databases. We have developed specialized technologies and processes for the purpose of listing syndication and identity analytics. We intend to continue to invest in these technologies to provide the most advanced set of solutions for our customer base.

We provide our customers with a comprehensive list of data fields to describe their business so that information sought by publishers is available for their databases. We are continually expanding our data model to broaden the range of products and services we can represent for our customers. We have also developed advanced conversion systems that allow us to categorize, convert and structure data in the wide range of proprietary formats required by database vendors and publishers.

We believe we have valuable intellectual property and are preparing multiple patents for our methods of managing the claiming process of listing management, as well as certain analytics aggregation.

Sales and Marketing

We sell our products through four distinct sales channels, (1) Direct Website Sales, (2) Enterprise Customers and their Marketing Agencies, and (3) Channel Resellers as described below.

| 1) | Direct Website Sales – Direct e-commerce customers are typically small businesses or their agents in local markets |

| | |

| 2) | Enterprise & Agencies: Multi-outlet enterprises such as national or regional bank chains, national insurance agencies, rental car firms, retailers, restaurant chains and franchises. Agency customers are typically stand-alone specialized internet marketing or SEO, local SEO, web design firms or groups within general agencies. |

| | |

| 3) | Channel partners: Channel partners are typically publishers and business services suppliers with large bases of small and medium businesses such as Yellow Page directories, newspapers, check and business card printers, or telecommunication companies. |

UBL Direct E-Commerce – Sales to businesses via Website

We promote our services through both “inbound” and “outbound” marketing programs. Inbound marketing programs focus on search engine optimization (SEO), and search engine marketing (SEM) which lead users from major search engines to our website. Businesses that purchase directly from us or their agencies can log on via our website to submit listings, select packages, pay, and subsequently manage their listings within us through a self-service dashboard.

Social media promotion focuses on UBL and independent industry commentators publishing articles, blogs, and “tweets”, about the success of our solution. We also promote our direct retail services through an affiliate program where referrers to our website earn a commission on resultant sales.

Our marketing strategy for retail acquisition includes:

| ● | Search Engine Optimization – ensuring all our site pages communicate their content well |

| ● | Site design, communication and customer purchase flow – adding shopping cart, videos and instructions |

| ● | Search Marketing – buying keywords on Google, Bing |

| ● | Industry sites and blogs – advertising on content-specific forums |

| ● | Social Advertising – LinkedIn, Facebook, Twitter |

| ● | Social Networks and Blogs – creating compelling content and communications |

| ● | Public Relations – Press releases, article contributions and comments |

| ● | Email marketing – list marketing and re-marketing to existing customers |

| ● | Affiliate network promotions |

Agency Sales

Sales of our products through ad agencies and other resellers are an important part of our business and we use a variety of methods to promote our services to them. For the reseller market, in particular the large interactive agencies and agencies selling into the business directories, we staff a small dedicated national sales team with decades of marketing experience in the field. This consultative sales team maintains an active database of potential customers and will regularly call and visit with them in person around the country or at the trade conferences.

We promote our services through presentations and exhibition at industry events and actively participate in industry organizations serving the advertising, franchise and enterprises marketing industries. As members of the Interactive Advertising Bureau (IAB) we were key contributors to the IAB Local Search White Paper. Our website presents multiple opportunities for agencies, SEO and Search Engine Marking companies, website designers, and other businesses to understand our products and the opportunity to resell our services. We also provide a wide range of resellers the ability to log on to our website to submit listings, select packages, pay, and manage their customers’ listings utilizing our self-service user interface.

Channel Resellers

Larger resellers with substantial numbers of small and medium sized businesses include our services as integral components of their own offerings, sometimes directly to end businesses and sometimes integrated into platforms that they provide to their own channel partners. We anticipate that these resellers, who combined, touch most small businesses in the USA, will continue to be an important part of our customer mix. Many of these channels are seeking to expand their relationships with their customers and products like ours fit well in their strategies.

We reach channel resellers through promotion methods similar to those we use to reach agency channels and through targeted business development activities. Reseller partnerships have a longer sales cycle and typically require technical integration and ongoing marketing and sales assistance. In many cases our channel partners’ users interact with our own sales channels, which may be tele-sales, field-sales, or self-service website dashboard and require targeted messaging related to their bundles of other services, integration through the UBL service APIs and/or through our bulk upload.

Market Opportunity

In the United States, there are approximately 29 million business establishments2, approximately 2.2 million in the U.K., approximately and 1 million in Canada.) It is important for every one of these locations that their identity is well managed. Furthermore, additional data points and meaningful identity descriptors are being added every year. Through our work online with global interactive advertising agencies and channel partners, we believe we are in a position to provide foundational identity services to businesses worldwide.

We also believe that profile claiming and management will become increasingly important for businesses as highly trafficked search, social and vertical sites promote proprietary profile formats in their search results and extend functionality in an effort to stimulate adoption and usage among businesses of all sizes. As the number and importance of profile products increases, we believe that businesses of all sizes will begin outsourcing profile management to specialists like UBL.

Competition

We operate in a competitive industry. We face competition from some data aggregators, such as Localeze, who feed business listings to search platforms. These data aggregators offer a service to have clients feed direct into their dataset, but each is limited only to their own distribution channels. We also face competition from interactive agencies. Several of the larger interactive agencies, particularly those from the Yellow Pages industry, have contracted direct with data aggregators and offer aspects of our service. We also face competition from emerging platform providers focused on real-time updating of listing information within limited paid syndication networks of secondary sites.

We believe success in the listings management space is driven by an integrated combination of data, distribution relationships, managed services, analytics and technologies. Assets and expertise in each of these areas are required to stay competitive today and will become increasingly important as the market matures. We believe that we are well positioned in all of these areas:

Distribution - We have created a broad listings distribution network and direct publisher relationships. We also have long standing partnerships with key database distributors who supply national and international directories, search engines and device manufacturers with core date sets.

Product & Services - Our platform provides a single direct website for clients, enterprise clients and resellers, allowing us to balance our revenues and opportunities with a single platform. Additionally, any marketing that is targeted to one sector spills over in value to the others. We offer a wide range of products and services for small businesses and large volume enterprises

Analytics & Reputation Management – We provide detailed reporting on the presence and accuracy of business listings. We also provide reputation management tools that offer details and alerts about reviews, ratings and other user engagement with listings.

Technology - We believe we have developed patentable IP to blend automated and hand-crafted submission activities in a way that produces higher yields and more cost effective lead generation .

Intellectual Property

We are filing for provisional patents on our platform and two of our programming applications. We have filed for a trademark on the name Universal Business Listing but this had not yet been approved by the trademark office.

Research and Development (R&D)

On an ongoing basis, we review our products and services to improve our customer-interfaces and refine our processes for syndication, analysis, presentation and validation, and implement improvements, as necessary, to core existing products. We regularly research new geographic markets, technology enhancements and related identity management concepts as part of standard business development and technology activities. We have not undertaken and do not anticipate that we will engage in any material research and development activities outside of work done in the course of operating and improving our services through the efforts of our technical staff.

2 http://www.census.gov/econ/smallbus.html

Government Regulation

At this time, our business is not subject to any laws and regulations that we are aware of that may have a material adverse effect on our operations. New laws and regulations (or new interpretations of existing laws and regulations) may also impact our business. The costs of compliance with new laws and regulations may be high and may subject us to significant liabilities and other penalties should we fail to comply with new laws and regulations.

Corporate Information

We are a Delaware corporation headquartered in Charlotte, NC. Our principal office is located at 6701 Carmel Road, Suite 202, Charlotte, NC 28226 and our telephone number is 704-930-0302. We maintain a website at www.UBL.org. The contents of our website are not part of this prospectus and should not be relied upon with respect to this offering.

Employees

We currently have 26 employees, of which 18 are full time employees. Our employees work from our headquarters in Charlotte, with approximately nine (9) employees working from home offices in North Carolina, California and New York, primarily engaged in sales.

Risks Related to Our Business

We are a developing company and may never earn a profit.

We are a developing company and have incurred losses since we were formed. As of September 30, 2012 and September 30, 2013, we have an accumulated total deficit of $4,052,534 and $6,013,373, respectively. For the fiscal year ended September 30, 2012 and September 30, 2013, we had net losses of $2,036,216 and $1,960,839, respectively. We cannot predict the extent of future net losses, or when we may attain profitability, if at all. If we are unable to generate significant revenue or attain profitability, we will not be able to sustain operations.

Because of the numerous risks and uncertainties associated with developing and commercializing our technology, we are unable to predict the extent of any future losses or when we will become profitable, if ever. We may never become profitable and you may never receive a return on an investment in our common stock. An investor in our common stock must carefully consider the substantial challenges, risks and uncertainties inherent in the attempted development and commercialization of our technology.

We have a limited operating history and are subject to the risks encountered by early-stage companies.

Because we have a limited operating history, we encounter risks and uncertainties frequently experienced by early-stage companies in rapidly evolving markets. For us, these risks include:

| ● | risks associated with our dependence on our premier platforms and related services; |

| | |

| ● | risks that our growth strategy may not be successful; and |

| | |

| ● | risks that fluctuations in our operating results will be significant relative to our revenues. |

Our future growth will depend substantially on our ability to address these and the other risks described in this section. If we do not successfully address these risks, our business would be significantly harmed.

Our independent registered public accounting firm has expressed doubt about our ability to continue as a going concern, which may hinder our ability to obtain future financing.

In their report dated December 30, 2013 our independent registered public accountants stated that our financial statements for the year ended September 30, 2013 were prepared assuming that we would continue as a going concern. Our ability to continue as a going concern, which may hinder our ability to obtain future financing, is an issue raised as a result of recurring losses from operations. We continue to experience net operating losses. Our ability to continue as a going concern is subject to our ability to generate a profit and/or obtain necessary funding from outside sources, including obtaining additional funding from the sale of our securities, increasing sales or obtaining loans and grants from various financial institutions where possible. Our continued net operating losses increase the difficulty in meeting such goals and there can be no assurances that such methods will prove successful.

We will need to raise substantial additional capital to commercialize our technology, and our failure to obtain funding when needed may force us to delay, reduce or eliminate our product development programs or collaboration efforts.

As of September 30, 2013 our cash balance was $125,517 and our working capital deficit was $2,084,186. Our existing capital resources are not sufficient to fund our operations for the next 12 months. At our current burn rate, we estimate that our existing capital resources will fund our operations for only the next month. We estimate that we will require approximately $1,200,000 over the next 12 months in order to sustain our operations and implement our business strategy. Consequently, we will be required to raise additional capital to complete the development and commercialization of our current product candidates. The development of our business will require substantial additional capital in the future to conduct research and development and commercialize our technology. When we seek additional capital, we may seek to sell additional equity and/or debt securities or to obtain a credit facility, which we may not be able to do on favorable terms, or at all. Our ability to obtain additional financing will be subject to a number of factors, including market conditions, our operating performance and investor sentiment. If we are unable to raise additional capital when required or on acceptable terms, we may have to significantly delay, scale back or discontinue the development and/or commercialization of one or more of our product candidates, restrict our operations or obtain funds by entering into agreements on unattractive terms.

Our stockholders may experience significant dilution as a result of any additional financing using our equity securities and/or debt securities or upon trigger of the ratchet provision in our convertible notes and warrants issued in January 2012,September 2012, July 2013 and October 2013.

To the extent that we raise additional funds by issuing equity securities or convertible debt securities, our stockholders may experience significant dilution. Sale of additional equity and/or convertible debt securities at prices below certain levels will trigger anti-dilution provisions with respect to certain securities we have previously sold. If additional funds are raised through a credit facility or the issuance of debt securities or preferred stock, lenders under the credit facility or holders of these debt securities or preferred stock would likely have rights that are senior to the rights of holders of our common stock, and any credit facility or additional securities could contain covenants that would restrict our operations.

In addition, certain of our convertible notes in the principal amount of $995,000 and warrants to purchase 3,450,000 shares of common stock include adjustment provisions which provide for the adjustment of the conversion price in the case of the Notes, and the exercise price in the case of the warrants, if we issue any securities at prices below the conversion price or the exercise price, except for certain excepted issuances. The conversion price of the Notes is $0.10 and the exercise price of the warrants is $0.15. As of the date hereof, the convertible notes are convertible into 9,950,000 shares of common stock and the warrants upon exercise will result in proceeds to the Company of $531,750. If we were to issue securities which do not fall under one of the issuances that are categorized as excepted issuance, at a price that is less than $0.10, the conversion price of the Notes and the exercise price of the warrants will adjust to the price at which the new securities are issued, which will result in us having to issue more shares to the investors upon conversion of their notes or in the case of the warrants, upon exercise thereof, will result in the Company receiving less proceeds, resulting in dilution to our existing shareholders.

The following illustrates the number of shares we would potentially have to issue upon conversion of the convertible notes if we were to issue securities at the prices shown below:

| Ratchet Price | | No. of additional shares to the Investors |

| $0.08 | | 2,437,500 |

| $0.05 | | 9,950,000 |

The following illustrates the proceeds to the Company upon exercise of the warrants if we were to issue securities that at the prices shown below:

| Ratchet Price | | Proceeds to the Company upon exercise of the Warrants |

| $0.08 | | $283,600 |

| $0.05 | | $177,250 |

Any adjustment in the conversion prices of the convertible notes and exercise price of the warrants will result in dilution to our existing shareholders.

If our product is unable to compete effectively with current and future online media and web marketing companies targeting similar markets as our potential products, our commercial opportunities will be reduced or eliminated.

The web marketing industry is intensely competitive and characterized by rapid technological progress. In each of our potential product areas, we face significant competition from larger and better funded companies. The technologies associated with the web marketing and online media industry are evolving rapidly and there is intense competition within such industry. Moreover, these and other future competitors have or may have considerably greater resources than we do in terms of technology, sales, marketing, commercialization and capital resources. These competitors may have substantial advantages over us in terms of research and development expertise, brand name exposure and expertise in sales and marketing as well as in operating web marketing services. Many of these organizations have financial, marketing and human resources greater than ours; therefore, there can be no assurance that we can successfully compete with present or potential competitors or that such competition will not have a materially adverse effect on our business, financial position or results of operations.

Our business depends on a strong brand, and if we are not able to maintain and enhance our brand, or if we receive unfavorable media coverage, our ability to expand our base of clients will be impaired and our business and operating results will be harmed.

We believe that the brand identity that we have developed has significantly contributed to the success of our business. We also believe that maintaining and enhancing the "UBL" brand is critical to expanding our base of clients. Maintaining and enhancing our brand may require us to make substantial investments and these investments may not be successful. If we fail to promote and maintain the "UBL" brand, or if we incur excessive expenses in this effort, our business, prospects, operating results and financial condition will be materially and adversely affected. We anticipate that, as our market becomes increasingly competitive, maintaining and enhancing our brand may become increasingly difficult and expensive. Unfavorable publicity or consumer perception of our platforms, applications, practices or services, could adversely affect our reputation, resulting in difficulties in recruiting, decreased revenue and a negative impact on the number of clients and the size of our, the loyalty of our clients and the number and variety of services we offer each day. As a result, our business, prospects, results of operation and financial condition could be materially and adversely affected.

New tax treatment of companies engaged in internet commerce may adversely affect the commercial use of our services and our financial results.

Due to the global nature of internet services, it is possible that various states or foreign countries might attempt to regulate our transmissions or levy sales, income or other taxes relating to our activities. Tax authorities at the international, federal, state and local levels are currently reviewing the appropriate treatment of companies engaged in internet commerce. New or revised international, federal, state or local tax regulations may subject us or our publishers to additional sales, income and other taxes. We cannot predict the effect of current attempts to impose sales, income or other taxes on commerce over social media. New or revised taxes and, in particular, sales taxes, VAT and similar taxes would likely increase the cost of doing business online and decrease the attractiveness of advertising and selling goods and services over social media. New taxes could also create significant increases in internal costs necessary to capture data, and collect and remit taxes. Any of these events could have an adverse effect on our business and results of operations.

Two customers accounted for a large portion of our revenue, the loss of either one of these clients will affect our revenues.

For the year ended September 30, 2012, one customer accounted for 12% of our revenues and for the year ended September 30, 2013, one customer accounted for 15% of our revenues. Any disruption in the relationships between us and these clients would adversely affect our business. In addition, to the extent that we are unable to generate orders from new customers, we may have difficulty operating our business and may have to scale back our operations.

Our business depends on our ability to maintain and scale the network infrastructure necessary to operate our platforms and applications, and any significant disruption in service on our platforms and applications could result in a loss of publishers or clients.

Clients access our services through our platforms and applications. Our reputation and ability to acquire, retain and serve our clients are dependent upon the reliable performance of our platforms and applications and the underlying network infrastructure. As our client base continues to grow, we will need an increasing amount of network capacity and computing power. We have spent and expect to continue to spend substantial amounts for data centers and equipment and related network infrastructure to handle the traffic on our platforms and applications. The operation of these systems is expensive and complex and could result in operational failures. In the event that our client base or the amount of traffic on our platforms and applications grows more quickly than anticipated, we may be required to incur significant additional costs. Interruptions in these systems, whether due to system failures, computer viruses or physical or electronic break-ins, could affect the security or availability of our platforms and applications, and prevent our publishers and advertisers from accessing our services. A substantial portion of our network infrastructure is hosted by third-party providers. Any disruption in these services or any failure of these providers to handle existing or increased traffic could significantly harm our business. Any financial or other difficulties these providers face may adversely affect our business, and we exercise little control over these providers, which increases our vulnerability to problems with the services they provide. If we do not maintain or expand our network infrastructure successfully or if we experience operational failures, we could lose current and potential publishers and clients, which could harm our operating results and financial condition.

We depend upon our officers, and if we are not able to retain them or recruit additional qualified personnel, the commercialization of our product candidates and any future tests that we develop could be delayed or negatively impacted.

Our success is largely dependent upon the continued contributions of our officers, including Doyal Bryant, our co-founder and Chief Executive Officer, Chris Travers, our Co-Founder and Chief Revenue Officer and President. These executives have significant background and knowledge of the industry and we depend on them to lead our commercialization efforts and develop new business opportunities for the Company. We do not maintain key man life insurance on our executives. If we were to lose the services of Messrs. Bryant and Travers, we may lose our ability to fully commercialize our universal business listing service and expand our business which will significantly impact our financial viability and prospects.

Our success also depends in part on our ability to attract and retain highly qualified scientific, commercial and administrative personnel. In order to pursue our business strategies, we will need to attract and hire, or engage as consultants, additional personnel with specialized experience in a number of disciplines. There is intense competition for personnel in the fields in which we operate. If we are unable to attract new employees and retain existing employees, the development and commercialization of our product candidates could be delayed or negatively impacted.

New U.S. and foreign laws could subject us to claims or otherwise harm our business.

New laws and regulations (or new interpretations of existing laws and regulations) may impact our business. The costs of compliance with new laws and regulations may be high. Any failure on our part to comply with any new laws and regulations can result in negative publicity and diversion of management time and effort and may subject us to significant liabilities and other penalties.

If we are unable to protect our intellectual property effectively, we may be unable to prevent third parties from using our technologies, which would impair our competitive advantage.

We rely on a combination of trade secret protection, and other contractual restrictions to protect our proprietary technologies, all of which provide limited protection and may not adequately protect our rights or permit us to gain or keep any competitive advantage. We require our employees and third parties to sign confidentiality agreements and employees to also sign agreements assigning to us all intellectual property arising from their work for us. Nevertheless, we cannot guarantee that these measures will be effective in protecting our intellectual property rights.

If we fail to protect our intellectual property, we will be unable to prevent third parties from using our technologies and they will be able to compete more effectively against us.

We believe we have developed patentable IP and are filing for provisions patents on our platform and two of our programming applications, we cannot assure you that any future patent applications will result in issued patents, or that any patents issued to us will not be challenged, invalidated or held unenforceable. We cannot guarantee you that we will be successful in defending challenges made in connection with our patents and patent applications.

If we fail to maintain an effective system of internal control over financial reporting and other business practices, and of Board-level oversight, we may not be able to report our financial results accurately or prevent and detect fraud and other improprieties. ��Consequently, investors could lose confidence in our financial reporting, and this may decrease the trading price of our stock.

We must maintain effective internal controls to provide reliable financial reports and to prevent and detect fraud and other improprieties. We are responsible to review and assess our internal controls and implement additional controls when improvement is needed. Failure to implement any required changes to our internal controls or any others that we identify as necessary to maintain an effective system of internal controls could harm our operating results and cause investors to lose confidence in our reported financial information. Any such loss of confidence would have a negative effect on the market price of our stock.

Because we are relatively small, our internal control procedures may not be fully mature. We have limited internal personnel to implement procedures and must scale our procedures to be compatible with our resources. We also rely on outside professionals including accountants and attorneys to support our control procedures.

Sarbanes-Oxley Act requirements regarding internal control over financial reporting, and other internal controls over business practices, are costly to implement and maintain, and such costs are relatively more burdensome for smaller companies such as us than for larger companies.

If we fail to comply in a timely manner with Section 404 of the Sarbanes Oxley Act of 2002, our business could be harmed and our stock price could decline.

Rules adopted by the SEC pursuant to Section 404 of the Sarbanes-Oxley Act of 2002 require annual assessment of our internal controls over financial reporting. The standards that must be met for management to assess the internal controls over financial reporting as effective are evolving and complex, and require significant documentation, testing and possible remediation to meet the detailed standards. We expect to incur significant expenses and to devote resources to Section 404 compliance on an ongoing basis. It is difficult for us to predict how long it will take or costly it will be to complete the assessment of the effectiveness of our internal control over financial reporting for each year and to remediate any deficiencies in our internal control over financial reporting. As a result, we may not be able to complete the assessment and remediation process on a timely basis. In the event that our chief executive officer or chief financial officer determine that our internal control over financial reporting is not effective as defined under Section 404, we cannot predict how regulators will react or how the market price of our shares will be affected; as such, we believe that there is a risk that investor confidence and share value may be negatively impacted.

We are in default of the terms of loan obtained from the SBA

On January 16, 2006, we secured a loan for $386,300 from the United States Small Business Administration ("SBA"). The loan matures in January 2036 and bears interest at the rate of 4% per annum. We are currently in violation of the covenant not to consummate a merger with any other company without the written consent of the SBA upon consummation of a merger transaction pursuant to that certain Agreement and Plan of Merger on January 18, 2010 with Bounceback Technologies.Com without prior written consent of the SBA. The circumstances that led to these violations have not been cured. If the SBA were to accelerate payment on the loan and require that we immediately repay the outstanding amount under loan, we would be forced to use our limited cash reserves to repay the loan which will affect our ability to continue our business.

Risks Related to Our Common Stock

We will incur increased costs as a result of being a public company, which could affect our profitability and operating results.

We are obligated to file annual, quarterly and current reports with the SEC pursuant to the Securities Exchange Act of 1934, as amended (the “Exchange Act”). In addition, the Sarbanes-Oxley Act of 2002 (“Sarbanes-Oxley”) and the rules subsequently implemented by the SEC and the Public Company Accounting Oversight Board have imposed various requirements on public companies, including requiring changes in corporate governance practices. We expect these rules and regulations to increase our legal and financial compliance costs and to make some activities of ours more time-consuming and costly. We expect to spend between $200,000 and $250,000 in legal and accounting expenses annually to comply with our reporting obligations and Sarbanes-Oxley. These costs could affect profitability and our results of operations.

There is no established trading market for our common stock and as a result you may not be able to sell our common stock.

There is no established market for our common stock and there may never be a market for our common stock. In the absence of an active trading market, you may have difficulty buying and selling or obtaining market quotations; the market visibility for our stock may be limited, and the lack of visibility for our common stock may have a depressive effect on the market price for our common stock.

The rights of the holders of common stock may be impaired by the potential issuance of preferred stock.

Our certificate of incorporation gives our board of directors the right to create new series of preferred stock. As a result, the board of directors may, without stockholder approval, issue preferred stock with voting, dividend, conversion, liquidation or other rights which could adversely affect the voting power and equity interest of the holders of common stock. Preferred stock, which could be issued with the right to more than one vote per share, could be utilized as a method of discouraging, delaying or preventing a change of control. The possible impact on takeover attempts could adversely affect the price of our common stock. Although we have no present intention to issue any additional shares of preferred stock or to create any new series of preferred stock, we may issue such shares in the future.

Our common stock price may be volatile and could fluctuate widely in price, which could result in substantial losses for investors.

The market price of our common stock is likely to be highly volatile and could fluctuate widely in price in response to various factors, many of which are beyond our control, including:

| ● | technological innovations or new products and services by us or our competitors; |

| | |

| ● | the establishment of partnerships with third parties; |

| | |

| ● | intellectual property disputes; |

| | |

| ● | additions or departures of key personnel; |

| | |

| ● | sales of our common stock; |

| | |

| ● | our ability to integrate operations, technology, products and services; |

| | |

| ● | our ability to execute our business plan; |

| | |

| ● | operating results below expectations; |

| | |

| ● | loss of any strategic relationship; |

| | |

| ● | industry developments; |

| | |

| ● | economic and other external factors; and |

| | |

| ● | period-to-period fluctuations in our financial results. |

In addition, trading in stock traded over the counter on the pink sheets is often thin and characterized by wide fluctuations in trading prices, due to many factors that may have little to do with a company’s operations or business prospects. This volatility could depress the market price of our common stock for reasons unrelated to our business or operating performance. Moreover, trading is often more sporadic than the trading of securities listed on a quotation system like NASDAQ or a stock exchange like the NYSE Amex. Accordingly, shareholders may have difficulty reselling any of their shares of common stock.

If our common stock is subject to the SEC’s penny stock rules, broker-dealers may experience difficulty in completing customer transactions and trading activity in our securities may be adversely affected.

Unless our securities are listed on a national securities exchange, or we have net tangible assets of $5,000,000 or more and our common stock has a market price per share of $5.00 or more, transactions in our common stock will be subject to the SEC’s “penny stock” rules. If our common stock is subject to the “penny stock” rules promulgated under the Securities Exchange Act of 1934, broker-dealers may find it difficult to effectuate customer transactions and trading activity in our securities may be adversely affected.

Under these rules, broker-dealers who recommend such securities to persons other than institutional accredited investors must:

| ● | make a special written suitability determination for the purchaser; |

| | |

| ● | receive the purchaser’s written agreement to the transaction prior to sale; |

| | |

| ● | provide the purchaser with risk disclosure documents which identify certain risks associated with investing in “penny stocks” and which describe the market for these “penny stocks” as well as a purchaser’s legal remedies; and |

| | |

| ● | obtain a signed and dated acknowledgment from the purchaser demonstrating that the purchaser has actually received the required risk disclosure document before a transaction in a “penny stock” can be completed. |

As a result, if our common stock becomes subject to the penny stock rules, the market price of our securities may be depressed, and you may find it more difficult to sell our securities.

Because certain of our stockholders control a significant number of shares of our common stock, they may have effective control over actions requiring stockholder approval.

As of September 19, 2013, our directors, executive officers and principal stockholders, and their respective affiliates, beneficially own approximately 40% of our outstanding shares of common stock. As a result, these stockholders, acting together, would have the ability to control the outcome of matters submitted to our stockholders for approval, including the election of directors and any merger, consolidation or sale of all or substantially all of our assets. In addition, these stockholders, acting together, would have the ability to control the management and affairs of our company. Accordingly, this concentration of ownership might harm the market price of our common stock by:

| ● | delaying, deferring or preventing a change in corporate control; |

| | |

| ● | impeding a merger, consolidation, takeover or other business combination involving us; or |

| | |

| ● | discouraging a potential acquirer from making a tender offer or otherwise attempting to obtain control of us. |

We have not paid dividends on our common stock in the past and do not expect to pay dividends on our common stock for the foreseeable future. Any return on investment may be limited to the value of our common stock.

No cash dividends have been paid on our common stock. We expect that any income received from operations will be devoted to our future operations and growth. We do not expect to pay cash dividends on our common stock in the near future. Payment of dividends would depend upon our profitability at the time, cash available for those dividends, and other factors as our board of directors may consider relevant. If we do not pay dividends, our common stock may be less valuable because a return on an investor’s investment will only occur if our stock price appreciates. Investors in our common stock should not rely on an investment in our company if they require dividend income.

Delaware law and our corporate charter and bylaws will contain anti-takeover provisions that could delay or discourage takeover attempts that stockholders may consider favorable.

Provisions in our certificate of incorporation and bylaws may have the effect of delaying or preventing a change of control or changes in our management. For example, our board of directors have the authority to issue up to 10,000,000 shares of preferred stock in one or more series and to fix the powers, preferences and rights of each series without stockholder approval. The ability to issue preferred stock could discourage unsolicited acquisition proposals or make it more difficult for a third party to gain control of our company, or otherwise could adversely affect the market price of our common stock. Our bylaws require that any stockholder proposals or nominations for election to our board of directors must meet specific advance notice requirements and procedures, which make it more difficult for our stockholders to make proposals or director nominations.

Furthermore, because we are incorporated in Delaware, we are governed by the provisions of Section 203 of the Delaware General Corporation Law. These provisions may prohibit or restrict large stockholders, in particular those owning 15% or more of our outstanding voting stock, from merging or combining with us. These provisions in our certificate of incorporation and bylaws and under Delaware law could discourage potential takeover attempts and could reduce the price that investors might be willing to pay for shares of our common stock in the future and result in our market price being lower than it would without these provisions.

A sale of a substantial number of shares of our common stock may cause the price of our common stock to decline and may impair our ability to raise capital in the future.

The market price of our common stock could decline as a result of sales of substantial amounts of our common stock in the public market, or the perception that these sales could occur. In addition, these factors could make it more difficult for us to raise funds through future offerings of common stock.

You should read this discussion together with the Financial Statements, related Notes and other financial information included elsewhere in this Form 10. The following discussion contains assumptions, estimates and other forward-looking statements that involve a number of risks and uncertainties, including those discussed under “Risk Factors,” and elsewhere in this Form 10. These risks could cause our actual results to differ materially from those anticipated in these forward-looking statements.

OVERVIEW

We provide a comprehensive set of online identity management tools and services to businesses seeking to optimize their presence in location based search results on Web, Mobile and Social platforms. These search results typically highly structured and include name, address, phone number and enhanced profile information, as opposed to excerpts of website information. Our Universal Business Listing (www.UBL.org) service provides a powerful, cost-effective method for ensuring the distribution and accuracy of individual business listing data across hundreds of local web directories, search engines, mobile applications and other sources of local listings data. Our profile management services allow businesses to take control of profile pages in leading, highly trafficked, search engines, social media sites, providing enhanced content about their products and services. As part of these services we also provide an expanding range of analytical and monitoring tools to increase our customer value proposition. The company offers services in the USA, Canada, The United Kingdom and Australia.

Results of Operations for the year ended September 30, 2013 and 2012

The following table sets forth the summary income statement for the year ended September 30, 2013 and 2012:

| | | Year Ended | |

| | | September 30, 2013 | | | September 30, 2012 | |

| | | | | | | |

| Revenues | | $ | 3,430,177 | | | $ | 2,655,985 | |

| Gross Margin | | $ | 2,031,661 | | | $ | 1,401,458 | |

| Operating Expenses | | $ | (2,989,210 | ) | | $ | (3,290,105 | ) |

| Other Income (Expense), net | | $ | (1,003,290 | ) | | $ | (147,569 | ) |

| Net Loss | | $ | (1,960,839 | ) | | $ | (2,036,216 | ) |

Revenues: Revenue increased by approximately 29% to $3,430,177 during the year ended September 30, 2013, from $2,655,985 during the corresponding year ended September 30, 2012. The increase in revenue was driven by an increase in the average revenue per unit (ARPU) in the Company’s business listing services and increased unit sales of its reputation management services. The total number of units sold for the period was 183,834 compared to 154, 310 for the prior period, an increase of 29,524 units or 19%. The number of business listings unit sold for the period was 69,225 compared to 92,731 for the prior period, a decrease of 23,506 units or 25%. The ARPU of business listing services for the period was $40.11/unit compared to 23.65/unit in the prior period which is a 70% increase. This increase in ARPU was the main contributing factor to the company’s revenue growth for the period. Increased ARPU is reflective of continued customer acceptance of the Company’s higher priced products and higher product feature values. The number of reputation management services units sold for the period was 114,609 compared to 61,579, an increase of 53,030 units or 86%. The ARPU for reputation management services was $5.64 for the period compared to $6.15 in the prior period, an 8% decrease. The unit growth in reputation management services was the other significant factor contributing to the Company’s period over period revenue growth. Approximately 93% of the Company’s sales were made through its network of resellers and channel partners compared to 90% for the prior period. The Company had 3,184 resellers and channel partners at period end compared to 2,507 at the end of the prior period, and increase of 677.

Gross Margin: The gross profit margin was 59% for the year ended September 30, 2013 as compared to 53% for the year ended September 30, 2012. The Company’s increased ARPU, driven by its business listing services, was the main factor for the improved margin for the period. Additionally, the Company’s average total cost per unit declined 6% compared to the previous period. Costs in the business listing services products we up 28% and reputation management costs per unit were down 12% compared to the prior period. The company’s cost of revenue consists mainly of expenses paid to third parties for listings distribution services and reputation management services.

Operating Expenses: Operating expenses consist primarily of compensation and related costs for personnel and facilities, and include costs related to our facilities, finance, human resources, information technology, and fees for professional services. Professional services are principally comprised of outside legal, audit, information technology consulting, marketing and outsourcing services.

Operating expenses decreased by 9% during the year ended September 30, 2013, as compared to the year ended September 30, 2012. The overall $300,895 decrease in operating expenses is primarily attributable the following approximate net increases (decreases) in operating expenses:

| · | An increase of payroll and related expenses of $575,000 was primarily due to an increase of full and part time staff which accounted for $315,000 of the increase, the addition of an executive and increased executive compensation which accounted for $234,000 of the increase and other expenses including the cost of employee benefits, which accounted for roughly $28,000 of such increase. |

| · | An increase in advertising and marketing expenses of $25,000 was due to the use of a third party media service and increased expenditures for attendance at industry conferences. |

| · | An increase of research and development expenses of $49,000. Research and development expenses consist primarily of payments to third parties for the development of software. . We expense research and development costs as incurred. |

| · | An increase of travel related expenses of $52,000 due to increased sales and promotion of the company through attendance of industry conferences, and company business meetings both internal and external. |

| · | A decrease in stock based compensation expense of $(928,000). The decrease was primarily due to stock awards issued during the prior period to existing and new employees and to new consultants during the prior period. |

| · | An increase in bad debt expense of $53,000 due to the Company exhausting collection efforts and writing off an account during the period. |

| · | An increase in rent expense of $46,000 due to the Company entering into new lease agreements for its office facility and corporate apartment during the year. |

| · | A decrease in legal and professional fees of $(168,000). In the prior period the Company incurred higher legal, tax preparation and audit fees in preparation for the filing of Form 10. The Company also incurred litigation expenses and engaged more outside consultants. |

Other Income (Expense)-net: Other income (expenses) consist primarily of gains and losses on the change in fair value of derivative liabilities, derivative expense, gains and losses on extinguishment of debt and interest expense all primarily related to the Company’s convertible promissory note and warrant issuances.

Other income (expenses) - net increased by $855,721 to $(1,003,290) for the year ended September 30, 2013 as compared to other income (expenses) - net of $(147,569) during the year ended September 30, 2012. For the year ended September 30, 2013 other income (expenses) consisted of $341 in interest income, $(219,761) in interest expense, a gain on change in fair value of derivative liabilities of $199,654, derivative expense of $(491,676), a loss on extinguishment of debt of $(491,745), and miscellaneous expense of $(103). For the year ended September 30, 2012 other income (expenses) consisted of $8 in interest income, $(221,565) in interest expense, a gain on change in fair value of derivative liabilities of $590,737, derivative expense of (538,460), a loss on extinguishment of debt of $(8,667), a loss on disposition of fixed assets of $(5,455), a gain on settlement of employee liabilities of $34,988 and miscellaneous income of $845.

Liquidity and Capital Resources

The following table summarizes total current assets, liabilities and working capital at September 30, 2013 compared to September 30, 2012:

| | | Year Ended | | | | |

| | | September 30, 2013 | | | September 30, 2012 | | | Increase/ (Decrease) | |

| Current Assets | | $ | 759,537 | | | $ | 929,271 | | | $ | (169,734 | ) |

| Current Liabilities | | $ | 2,843,723 | | | $ | 2,448,993 | | | $ | 394,730 | |

| Working Capital Deficit | | $ | (2,084,186 | ) | | $ | (1,519,722 | ) | | $ | 564,464 | |

As of September 30, 2013, we had a working capital deficit of $2,084,186 as compared to a working capital deficit of $1,519,722 as of September 30, 2012, an increase of $564,464. Our increase in working capital deficit is primarily attributable to our growing accounts payable and accrued liabilities increasing during the period approximately $410,000 and our decreasing accounts receivable and deferred costs decreasing approximately $108,000 and 73,000, respectively.

Our principal source of liquidity is our cash. As of December 23, 2013 we had $67,000 in cash. We believe our existing available cash will enable the Company to meet the working capital requirements for at least the next month. We estimate that we will require approximately $1,200,000 over the next 12 months in order to sustain our operations and implement our business strategy. Consequently, we will be required to raise additional capital to complete the development and commercialization of our current product candidates. In order to boost sales, we continue to explore potential expansion opportunities in the industry through mergers and acquisitions, enhancement of our existing products and development of new products.

We will incur increased costs as a result of being a public company, which could affect our profitability and operating results.

We are obligated to file annual, quarterly and current reports with the SEC pursuant to the Securities Exchange Act of 1934, as amended (the “Exchange Act”). In addition, the Sarbanes-Oxley Act of 2002 (“Sarbanes-Oxley”) and the rules subsequently implemented by the SEC and the Public Company Accounting Oversight Board have imposed various requirements on public companies, including requiring changes in corporate governance practices. We expect these rules and regulations to increase our legal and financial compliance costs and to make some activities of ours more time-consuming and costly. We expect to spend between $200,000 and $250,000 in legal and accounting expenses annually to comply with our reporting obligations and Sarbanes-Oxley. These costs could affect profitability and our results of operations.

Our Data Contribution and Service Agreement with InfoUSA, Inc., as amended, effective November 12, 2012, requires an annual minimum fee of $300,000. Any shortfall in the annual minimum fee is required to be paid in a lump sum within 30 days of the end of the contract period. InfoUSA provides data distribution services to us, For the contract period from August 21, 2012 through August 20, 2013, we met the annual minimum fee based upon the purchases we made through our normal operations and anticipate that based on our current operations to date, we will meet the annual minimum fee for the contract period from August 21, 2013 through August 20, 2014. If our operations were to decrease below current levels, we may not meet the annual minimum fee and may be forced to use cash on hand or seek to raise funds through the sale of our securities to meet the required payment. There can be no assurance such funding will be available on terms acceptable to the us, or at all.

Management has determined that additional capital will be required in the form of equity or debt securities. In addition, if we cannot raise additional short term capital we will be forced to continue to further accrue liabilities due to our limited cash reserves. There are no assurances that management will be able to raise capital on terms acceptable to the Company. If we are unable to obtain sufficient amounts of additional capital, we may be required to reduce the scope of our planned development, which could harm our business, financial condition and operating results. If we obtain additional funds by selling any of our equity securities or by issuing common stock to pay current or future obligations, the percentage ownership of our stockholders will be reduced, stockholders may experience additional dilution, or the equity securities may have rights preferences or privileges senior to the common stock. If adequate funds are not available to us when needed on satisfactory terms, we may be required to cease operating or otherwise modify our business strategy.

As reflected in the accompanying consolidated financial statements, the Company has a net loss and net cash used in operations of $1,960,839 and $413,255, respectively, for the year ended September 30, 2013.

The ability of the Company to continue its operations is dependent on management’s plans, which include the raising of capital through debt and/or equity markets, with some additional funding from other traditional financing sources, including term notes, until such time that funds provided by operations are sufficient to fund working capital requirements. The Company may need to incur additional liabilities with certain related parties to sustain the Company’s existence. There can be no assurance that the Company will be able to raise any additional capital.

We may also require additional funding to finance the growth of our anticipated future operations as well as to achieve our strategic objectives. There can be no assurance that financing will be available in amounts or terms acceptable to the Company, if at all. In that event, the Company would be required to change its growth strategy and seek funding on that basis, if at all.