UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number(s) 811-22845

Babson Capital Funds Trust

(Exact Name of Registrant as Specified in Charter)

550 South Tryon Street

Suite 3300

Charlotte, NC 28202

(Address of Principal Executive Offices)

Registrant’s telephone number, including area code: (704) 805-7200

Janice M. Bishop

Vice President, Secretary and Chief Legal Officer

c/o Babson Capital Management LLC

Independence Wharf

470 Atlantic Avenue, Boston MA 02210

(Name and Address of Agent for Service)

Date of fiscal year end: June 30

Date of reporting period: June 30, 2014

| Item 1. | Reports to Stockholders. |

The Report to Stockholders is attached hereto.

BABSON CAPITAL FUNDS TRUST

Annual Report

June 30, 2014

BCFT Service Providers

ADVISER

Babson Capital Management LLC

550 South Tryon Street

Suite 3300

Charlotte, NC 28202

SUB-ADVISER

Babson Capital Global Advisors Limited

61 Aldwych

London, UK

WC2B 4AE

COUNSEL TO THE TRUST

Ropes & Gray LLP

Prudential Tower

800 Boylston Street

Boston, MA 02110

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Deloitte & Touche LLP

200 Berkley Street

Boston, MA 02116

CUSTODIAN

State Street Bank & Trust

One Lincoln Street

Boston, MA 02111

TRANSFER AGENT AND REGISTRAR

State Street Bank & Trust

One Lincoln Street

Boston, MA 02111

FUND ADMINISTRATION/ACCOUNTING

State Street Bank & Trust

One Lincoln Street

Boston, MA 02111

FUND DISTRIBUTOR

ALPS Distributors, Inc.

1290 Broadway

Suite 1100

Denver, CO 80203

BLUE SKY ADMINISTRATION

Boston Financial Data Services

2000 Crown Colony Drive

Quincy, MA 02169

PROXY VOTING POLICIES & PROCEDURES

The Trustees of Babson Capital Funds Trust (the “Trust”) have delegated proxy voting responsibilities relating to the voting of securities held by the Trust to Babson Capital Management LLC (“Babson Capital”). A description of Babson Capital’s proxy voting policies and procedures is available (1) without charge, upon request, by calling, toll-free 1-877-766-0014; (2) on the Trust’s website at http://www.BabsonCapital.com; and (3) on the U.S. Securities and Exchange Commission’s (“SEC”) website at http://www.sec.gov.

FORM N-Q

The Trust will file its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. This information is available (i) on the SEC’s website at http://www.sec.gov; and (ii) at the SEC’s Public Reference Room in Washington, DC (which information on their operation may be obtained by calling 1-800-SEC-0330). A complete schedule of portfolio holdings as of each quarter-end is available on the Trust’s website at http://www.BabsonCapital.com or upon request by calling, toll-free, 1-877-766-0014.

Anthony Sciacca

President

Babson Capital Funds Trust

Babson Capital Funds Trust

Babson Global Floating Rate Fund

Babson Global Credit Income Opportunities Fund

Dear Shareholder,

During the second half of 2013, we saw signs that the global economic landscape was improving. That trend continued during the first and second quarters of 2014, albeit at a slower pace than we anticipated at the beginning of the year. Clearly, severe winter weather in the U.S. and geopolitics contributed to the slower-than-expected economic growth in the first half, but other factors are also present that seem to be restraining the economy. Specifically, companies are still under-investing and consumers remain cautious about their spending despite accommodative global monetary policy.

As we move into the remainder of 2014, the Fed will likely complete its quantitative easing (QE) program by year end. In the U.K., the economy has performed relatively well this year and inflation has been kept in check—that said, policy makers signaled that interest rates could rise before the end of the year. The European Central Bank continues to battle a weak economic outlook and persistent low inflation, which may portend a U.S.-style QE program to attempt to reflate the Euro zone through sovereign bond purchases. In Japan, reflationary policies are expected to continue, while China’s short-term growth outlook remains relatively unchanged despite concerns of an economic slowdown there. Overall, we expect the slow-growth, low-interest-rate environment to continue, supported by highly accommodative monetary policy from global central banks.

At Babson Capital, we take a long-term view of investing through market and economic cycles and adhere to a disciplined, repeatable investment process that’s deeply rooted in fundamental bottom-up analysis. As we reflect on the past year and celebrate the upcoming first anniversary of the Babson Capital Funds Trust which launched in September 2013, we thank you for your business. Through our mutual funds, we’re offering individual investors the same expertise and time-tested investment approach that have produced consistent risk-adjusted returns for our institutional clients for more than six decades. We value your continued partnership, and look forward to helping you achieve your investment objectives in 2014 and beyond.

Sincerely,

Anthony Sciacca

Cautionary Notice: Certain statements contained in this report maybe “forward looking” statements. Investors are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date in which they are made and which reflect management’s current estimates, projections, expectations or beliefs, and which are subject to risks and uncertainties that may cause actual results to differ materially. These statements are subject to change at anytime based upon economic, market or other conditions and may not be relied upon as investment advice or an indication of the Trust’s trading intent. References to specific securities are not recommendations of such securities, and may not be representative of the Trust’s current or future investments. We undertake no obligation to publicly update forward looking statements, whether as a result of new information, future events, or otherwise.

ALPS Distributors, Inc. is the distributor for the Babson Capital mutual funds. Shares of the funds are offered by Babson Capital Securities LLC, an affiliated broker dealer of Babson Capital Management LLC. ALPS and Babson Capital Management are separate and unaffiliated. This material must be preceded or accompanied by the current fund prospectus. Investors should carefully consider the investment objective, risks, charges and expenses of any mutual fund before investing. This and other important information is contained in the prospectus and summary prospectus.

Babson Global Floating Rate Fund 2014 Annual Report

Investment Objective

The investment objective of the Babson Global Floating Rate Fund (“Global Floating Rate Fund” or the “Fund”) is to seek a high level of current income. Preservation of capital is a secondary goal.

Portfolio Management Commentary

How did the Fund perform?

| | n | | The Fund reported a net total rate of return year-to-date through June 30, 2014 of +2.40% and underperformed the Credit Suisse Global Loan Benchmark which returned +2.59%. In addition, the Fund returned +4.04% on a net basis since the Fund’s inception date of September 16, 2013 and underperformed the Benchmark which retuned +5.06%.1 |

What factors influenced performance of the Fund?

| | n | | Returns on the Fund’s U.S. holdings were generally less than its European holdings from a total return perspective. Spreads started the year tighter in the U.S. than in Europe therefore driving more price appreciation in the European holdings and contributing to Fund performance. Ultimately, good credit selection across both the U.S. and European markets helped influence Fund performance. |

| | n | | Generally, the U.S. market could be described as a par market (or coupon clipping market) since inception and the Fund focused on investments in the primary market, which typically allocated below par and subsequently gained 50 to 100 basis points2 post allocation. While the weighting to the European market was less than the U.S., several investments in this region were purchased at a discount and helped drive Fund performance through capital appreciation. |

| | n | | The senior secured loans have contributed the most to performance since inception. However, it should be noted that the high yield bond exposure also influenced performance. Global high yield bonds outperformed global senior secured loans resulting in additional pick-up in performance. |

Describe recent portfolio activity.

| | n | | The Fund has doubled in size since the September 16, 2013 launch to a NAV of $114,631,442 as of June 30, 2014 and the portfolio managers have prudently been putting capital to work. The number of holdings in the portfolio has increased by over 100 issues, while keeping its positioning across geographies fairly consistent and still building concentrated positions in high conviction credits. |

| | n | | The Fund remains overweight to European assets relative to the weighting of the global senior secured loan market as we believe Western European senior secured loans offered more attractive investment opportunities compared to the U.S. market recently. Looking forward though and given the market rally since the beginning of 2014, the number of discounted secondary opportunities has reduced. We believe the primary market will likely offer the most attractive source of investments for both markets in the near term, which has primarily been the case in the U.S. market recently. |

Describe portfolio positioning at period end.

| | n | | The Fund finished the fiscal year-end with an 86.0% weighting to global senior secured loans. The remaining balance of the portfolio was invested in global high yield bonds (12.6%), primarily focusing on senior secured bonds. A portion of the Fund is invested in floating rate, high yield bonds (6.8%) predominantly issued by European companies, which increases the total floating rate exposure of the portfolio to 92.8%. |

| 1. | Total return describes the return to an investor based on the Class Y net expense ratio and includes the reinvestment of dividends and capital gains. Performance results reflect past performance and are no guarantee of future results. Current performance may be lower or higher than the performance data quoted. The net asset value (NAV) will fluctuate with market conditions. All returns 1-year or less are cumulative. The Credit Suisse Global Loan Benchmark is a market capitalization weighted average of the Credit Suisse Leveraged Loan Index and the Credit Suisse Western European Leveraged Loan Index. The Credit Suisse Leveraged Loan Index is designed to mirror the investable universe of the US dollar-denominated leveraged loan market. The Credit Suisse Western European Leveraged Loan Index is designed to mirror the investible universe of the Western European leveraged loan market, with loans denominated in US and Western European currencies. Indices are unmanaged. It is not possible to invest directly in an index. |

2

Babson Global Floating Rate Fund 2014 Annual Report

| 2. | A unit that is equal to 1/100th of 1% or 0.01%. |

| | n | | From an industry perspective, the Fund remains well-diversified across a number of sectors based on Moody’s Industry Classification, with higher concentrations in non-bank related Finance companies (12.7%), Healthcare, Education and Childcare (10.9%), and Diversified/Conglomerate Service (8.3%) as of fiscal year-end. Over the course of the past 6 months, there has been little change to the industry composition of the portfolio. |

| | n | | In terms of portfolio credit quality as of June 30, 2014, the Fund had the following credit quality breakdown excluding cash and accrued income: 17.1% in Ba assets, 48.0% in single-B credits and a small exposure to Caa and below at 8.1%. Approximately 25.9% of the Fund’s assets are not publicly rated, primarily consisting of European issuers that we believe have a similar ratings profile as other assets in the portfolio. Baa assets accounted for the remaining 0.9% of the portfolio assets.3 |

| | n | | The Top 5 countries in the portfolio has stayed relatively consistent and as of the fiscal year end is currently represented by the U.S. (57.0%), the U.K. (18.1%), Germany (5.8%), France (5.5%) and Canada (3.2%). Overall, the Fund has exposure to 16 different countries and supports our focus on building a well-diversified portfolio of global floating rate securities. |

Describe market and portfolio outlook.

| | n | | As we enter into the second half of 2014, the global senior secured loan market continues to benefit from accommodative global central bank policies, strong corporate fundamentals, and record Collateralized Loan Obligation (“CLO”) issuance meaning the technical picture remains strong. |

| | n | | Senior secured loan spreads in the U.S. and Europe contracted since the beginning of 2014 as demand has outweighed supply. Given the spread compression, we plan to focus on the primary market and select secondary market opportunities over the coming months as spreads across the Atlantic have aligned. |

| | n | | Furthermore, high yield corporate credit fundamentals should remain favorable, in our opinion, as we believe the current low default environment will continue resulting in attractive risk-adjusted performance for the asset class. |

| 3. | Ratings shown are the highest rating given by one of the following national rating agencies: S&P or Moody’s. Additional information about ratings can be found at www.moodys.com and www.standardandpoors.com. Credit ratings are subject to change. AAA, AA, A, and BBB are investment grade ratings; BB, B, CCC/CC/C and D are below investment grade ratings. Bonds backed by U.S. Government or agency securities are given an implied rating equal to the rating of such securities. Holdings designated Not Publicly Rated are not rated by these national rating agencies. |

3

Babson Global Floating Rate Fund 2014 Annual Report

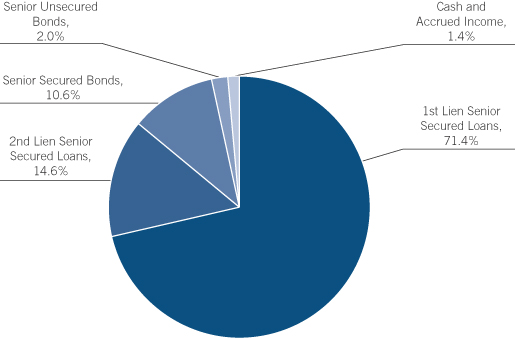

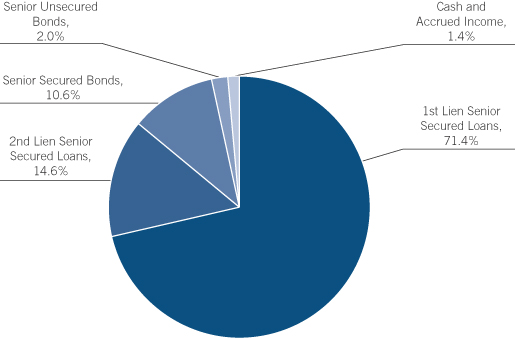

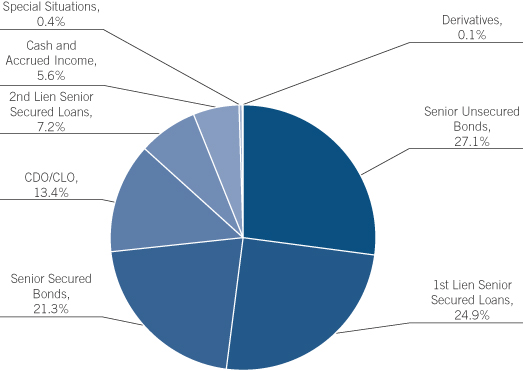

PORTFOLIO COMPOSITION (% OF ASSETS*)

| * | The percentages shown above represent a percentage of the assets as of June 30, 2014. |

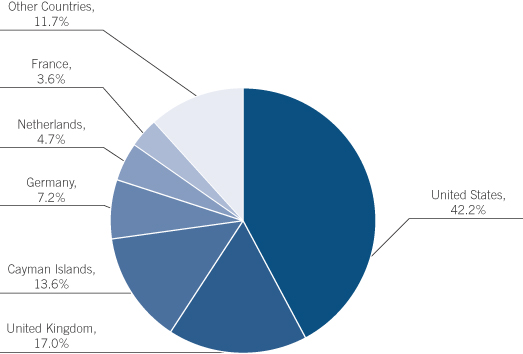

COUNTRY COMPOSITION (% OF ASSETS**)

| * | Percentage of assets are expressed by market value excluding cash and accrued income, and may vary over time. The percentages shown above represent a percentage of the assets as of June 30, 2014. |

4

Babson Global Credit Income Opportunities Fund 2014 Annual Report

Investment Objective

The investment objective of the Babson Global Credit Income Opportunities Fund (“Global Credit Income Opportunities Fund” or the “Fund”) is to seek an absolute return, primarily through current income and secondarily through capital appreciation.

Portfolio Management Commentary

How did the Fund perform?

| | n | | The Fund reported a net total rate of return year-to-date through June 30, 2014 of +4.16% and outperformed the 3 Month USD LIBOR + 500 basis points1 Benchmark which returned +2.62%. In addition, the Fund returned +7.59% on a net basis since the Fund’s inception date of September 16, 2013 and outperformed the Benchmark which returned +4.20%.2 |

What factors influenced performance of the Fund?

| | n | | U.S. senior secured loan spreads started the year tighter than in Europe therefore driving more price appreciation in European senior secured loans and contributing to Fund performance. U.S. high yield bonds, on the other hand, experienced more spread compression and capital appreciation than European high yield bonds since the beginning of 2014. Ultimately, good credit selection within each subset of the global high yield market helped influence Fund performance. |

| | n | | Generally, the U.S. senior secured loan market could be described as a par market (or coupon clipping market) since inception and the Fund focused on investments in the primary market, which typically allocated below par and subsequently gained 50 to 100 basis points2 post allocation. Within the European senior secured loan market, several investments in this region were purchased at a discount and helped drive Fund performance through capital appreciation. |

| | n | | With investors continuing to seek yield in this low interest rate environment, global high yield bond yields compressed significantly since the beginning of 2014, which led U.S. and European bonds to rally considerably. The Fund experienced a boost from its exposure to global high yield bonds relative to the performance of the global senior secured loans. |

| | n | | The Fund’s Collateralized Loan Obligation (“CLO”) holdings and special situation credits have had little influence on performance thus far; however, we believe these assets have some of the best yield potential and will contribute to the Fund’s performance in the future. |

Describe recent portfolio activity.

| | n | | The Fund has increased in size since the September 16, 2013 launch to a NAV of $63,825,458 as of June 30, 2014 and the portfolio managers have prudently been putting capital to work. The number of holdings in the portfolio has increased moderately while keeping our positioning across geographies fairly consistent and still building concentrated positions in high conviction credits. |

| | n | | Given the rally in high yield spreads and lower government yields year-to-date, the Fund recently reduced the fixed rate debt allocation and increased exposure to floating rate assets. |

| 1. | A unit that is equal to 1/100th of 1% or 0.01%. |

| 2. | Total return describes the return to an investor based on the Class Y net expense ratio and includes the reinvestment of dividends and capital gains. Performance results reflect past performance and are no guarantee of future results. Current performance may be lower or higher than the performance data quoted. The net asset value (NAV) will fluctuate with market conditions. All returns 1-year or less are cumulative. The 3 Month USD LIBOR (London Interbank Offered Rate) is an average interest rate, determined by the British Bankers Association, that banks charge one another for the use of short-term money (3 months) in England’s Eurodollar market. The return shown includes 3 Month USD LIBOR plus 500 bps, or 5% per annum. LIBOR is unmanaged. It is not possible to invest directly in LIBOR. No assurance can be given that the Fund’s performance will exceed that of LIBOR by any given increment, or at all. |

5

Babson Global Credit Income Opportunities Fund 2014 Annual Report

| | n | | In June, the Fund purchased a €18.5 million notional Put Option3 on the iTraxx CrossOver with an expiration date of December 2014. The Put Option can provide protection should spreads widen significantly in the near-term. |

Describe portfolio positioning at period end.

| | n | | The Fund finished the fiscal year-end with an allocation of 48.4%, 32.1%, and 13.4% to global high yield bonds, senior secured loans and CLOs, respectively. The remaining balance of the portfolio was invested in a few opportunistic special situation credits (0.4%) as well as one derivative (0.1%), a Put Option on the iTraxx Crossover. At this point in time, we continue to believe that global high yield bonds are more attractive than global senior secured loans from a relative value perspective. Additionally, a significant portion of the portfolio (53.4%) is senior secured in nature and can potentially mitigate principal loss in the event that default rates increase. |

| | n | | From an industry perspective, the Fund remains well-diversified across a number of sectors based on Moody’s Industry Classification, with higher concentrations in CLOs (13.4%), Oil and Gas (11.1%), and Healthcare, Education and Childcare (6.0%) as of fiscal year-end. Over the course of the past six months, the industry composition has remained relatively the same except for the build-out of its CLO position and a moderate increase in exposure to Oil and Gas companies. |

| | n | | In terms of portfolio credit quality as of June 30, 2014, the Fund had the following credit quality breakdown excluding cash and accrued income: 12.5% in Ba assets, 51.9% in single-B credits and a modest exposure to Caa and below at 15.3%. Approximately 18.9% of the Fund’s assets are not publicly rated, primarily consisting of European issuers that we believe have a similar ratings profile as other assets in the portfolio. Baa and above assets accounted for the remaining 1.4% of the portfolio assets.4 |

| | n | | The Top 5 countries in the portfolio has stayed relatively consistent and as of the fiscal year end is currently represented by the U.S. (42.2%), the U.K. (17.0%), Cayman Islands (13.6%), Germany (7.2%) and the Netherlands (4.7%). The Cayman Island exposure related to the Fund’s CLO holdings are predominantly invested in U.S. senior secured loans. Overall, the Fund has exposure to 19 different countries and supports our focus on building a well-diversified portfolio of global high yield securities. |

Describe market and portfolio outlook.

| | n | | As we enter into the second half of 2014, both the global high yield and loan markets continue to benefit from accommodative global central bank policies and record CLO issuance meaning the technical picture remains strong. |

| | n | | Furthermore, we believe the current low default rates will continue below their historical averages for the foreseeable future, as corporate fundamentals continue to remain strong. |

| | n | | Performance for these markets has remained positive for each month since the beginning of 2014, and we believe the overall market technicals will remain strong, which should lead to continued attractive opportunities for the Fund across the U.S. and European markets and across the capital structures of high yield issuers. |

| 3. | An option contract giving the owner the right, but not the obligation, to sell a specified amount of an underlying security at a specified price within a specified time. |

| 4. | Ratings shown are the highest rating given by one of the following national rating agencies: S&P or Moody’s. Additional information about ratings can be found at www.moodys.com and www.standardandpoors.com. Credit ratings are subject to change. AAA, AA, A, and BBB are investment grade ratings; BB, B, CCC/CC/C and D are below investment grade ratings. Bonds backed by U.S. Government or agency securities are given an implied rating equal to the rating of such securities. Holdings designated Not Publicly Rated are not rated by these national rating agencies. |

6

Babson Global Credit Income Opportunities Fund 2014 Annual Report

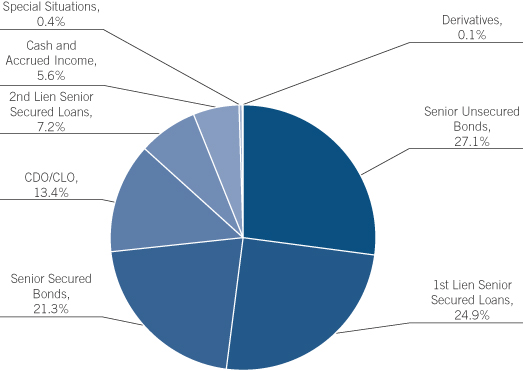

PORTFOLIO COMPOSITION (% OF ASSETS*)

| * | The percentages shown above represent a percentage of the assets as of June 30, 2014. |

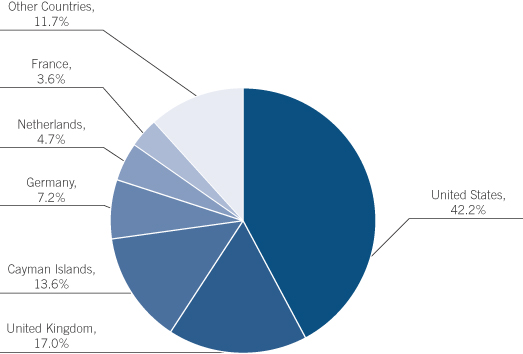

COUNTRY COMPOSITION (% OF ASSETS**)

| ** | Percentage of assets are expressed by market value excluding cash and accrued income, and may vary over time. The percentages shown above represent a percentage of the assets as of June 30, 2014. |

7

Babson Capital Funds Trust 2014 Annual Report

SHAREHOLDER EXPENSES (UNAUDITED)

As a shareholder of Babson Global Floating Rate Fund or Babson Global Credit Income Opportunities Fund, you incur ongoing expenses, such as management fees, shareholder service fees, distribution fees and other fund expenses. The following table is intended to help you understand your ongoing expenses (in dollars and cents) of investing in the Funds and to compare these expenses with the ongoing expenses of investing in other funds.

The table is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from January 1, 2014 to June 30, 2014.

Actual Expenses

The first line in the table below provides information about the actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line for the Fund under the heading entitled “Operating Expenses Incurred” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line in the table below provides information about the hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account value and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Babson Global Floating Rate Fund

| | | | | | | | | | | | | | | | | | | | |

| | | EXPENSE

RATIO | | | BEGINNING

AMOUNT | | | ENDING

VALUE | | | AVERAGE

VALUE | | | OPERATING

EXPENSE

INCURRED* | |

Class A | | | | | | | | | | | | | | | | | | | | |

Actual | | | 1.05 | % | | $ | 1,000.00 | | | $ | 1,021.80 | | | $ | 1,010.90 | | | $ | 5.26 | |

Hypothetical | | | 1.05 | % | | | 1,000.00 | | | | 1,019.60 | | | | 1,009.80 | | | | 5.26 | |

| | | | | |

Class C | | | | | | | | | | | | | | | | | | | | |

Actual | | | 1.80 | % | | | 1,000.00 | | | | 1,018.30 | | | | 1,009.15 | | | | 9.01 | |

Hypothetical | | | 1.80 | % | | | 1,000.00 | | | | 1,015.90 | | | | 1,007.95 | | | | 9.00 | |

| | | | | |

Class I | | | | | | | | | | | | | | | | | | | | |

Actual | | | 0.75 | % | | | 1,000.00 | | | | 1,024.00 | | | | 1,012.00 | | | | 3.76 | |

Hypothetical | | | 0.75 | % | | | 1,000.00 | | | | 1,021.10 | | | | 1,010.55 | | | | 3.76 | |

| | | | | |

Class Y | | | | | | | | | | | | | | | | | | | | |

Actual | | | 0.75 | % | | | 1,000.00 | | | | 1,024.00 | | | | 1,012.00 | | | | 3.76 | |

Hypothetical | | | 0.75 | % | | | 1,000.00 | | | | 1,021.10 | | | | 1,010.55 | | | | 3.76 | |

| * | For each Class of the Fund, net expenses are equal to the annualized expense ratio for such class multiplied by the average account value over the period, multiplied by 181/365. |

8

Babson Capital Funds Trust 2014 Annual Report

SHAREHOLDER EXPENSES (UNAUDITED) (CONTINUED)

Babson Global Credit Income Opportunities Fund

| | | | | | | | | | | | | | | | | | | | |

| | | EXPENSE

RATIO | | | BEGINNING

AMOUNT | | | ENDING

VALUE | | | AVERAGE

VALUE | | | OPERATING

EXPENSE

INCURRED* | |

Class A | | | | | | | | | | | | | | | | | | | | |

Actual | | | 1.20 | % | | $ | 1,000.00 | | | $ | 1,038.70 | | | $ | 1,019.35 | | | $ | 6.07 | |

Hypothetical | | | 1.20 | % | | | 1,000.00 | | | | 1,018.80 | | | | 1,009.40 | | | | 6.01 | |

| | | | | |

Class C | | | | | | | | | | | | | | | | | | | | |

Actual | | | 1.95 | % | | | 1,000.00 | | | | 1,036.40 | | | | 1,018.20 | | | | 9.85 | |

Hypothetical | | | 1.95 | % | | | 1,000.00 | | | | 1,015.10 | | | | 1,007.55 | | | | 9.74 | |

| | | | | |

Class I | | | | | | | | | | | | | | | | | | | | |

Actual | | | 0.95 | % | | | 1,000.00 | | | | 1,041.60 | | | | 1,020.80 | | | | 4.81 | |

Hypothetical | | | 0.95 | % | | | 1,000.00 | | | | 1,020.10 | | | | 1,010.05 | | | | 4.76 | |

| | | | | |

Class Y | | | | | | | | | | | | | | | | | | | | |

Actual | | | 0.95 | % | | | 1,000.00 | | | | 1,041.60 | | | | 1,020.80 | | | | 4.81 | |

Hypothetical | | | 0.95 | % | | | 1,000.00 | | | | 1,020.10 | | | | 1,010.05 | | | | 4.76 | |

| * | For each Class of the Fund, net expenses are equal to the annualized expense ratio for such class multiplied by the average account value over the period, multiplied by 181/365. |

9

Babson Capital Funds Trust 2014 Annual Report

FINANCIAL REPORT

10

Babson Capital Funds Trust 2014 Annual Report

STATEMENTS OF ASSETS AND LIABILITIES

June 30, 2014

| | | | | | | | |

| | | BABSON GLOBAL

FLOATING RATE FUND | | | BABSON GLOBAL

CREDIT INCOME

OPPORTUNITIES FUND | |

| | |

| Assets | | | | | | | | |

| Investments, at fair value (cost $125,431,812 and $67,231,965, respectively) | | $ | 126,431,978 | | | $ | 68,637,367 | |

| Foreign currency, at value (cost $5,919,101 and $676,538, respectively) | | | 5,976,757 | | | | 678,950 | |

| Receivable for investments sold | | | 1,362,720 | | | | 1,023,124 | |

| Receivable for Fund shares sold | | | 127,970 | | | | 83,717 | |

| Interest receivable | | | 523,010 | | | | 707,511 | |

| Receivable from adviser (see Note 3) | | | 107,793 | | | | 67,755 | |

| Foreign tax reclaims receivable | | | — | | | | 434 | |

| Unrealized appreciation on forward foreign currency exchange contracts | | | 15,454 | | | | 13,677 | |

| Prepaid expenses | | | 29,880 | | | | 25,136 | |

| | | | | | | | |

Total assets | | | 134,575,562 | | | | 71,237,671 | |

| | | | | | | | |

| Liabilities | | | | | | | | |

| Payable for investments purchased | | | 18,241,432 | | | | 6,772,251 | |

| Investments purchased on a when-issued basis | | | 1,166,405 | | | | 274,531 | |

| Investment advisery fee payable (see Note 3) | | | 59,724 | | | | 36,344 | |

| Distribution fees payable | | | 4,224 | | | | 1,070 | |

| Unrealized depreciation on forward foreign currency exchange contracts | | | 349,623 | | | | 230,142 | |

| Accrued expenses and other liabilities | | | 122,712 | | | | 97,875 | |

| | | | | | | | |

Total liabilities | | | 19,944,120 | | | | 7,412,213 | |

| | | | | | | | |

Total net assets | | $ | 114,631,442 | | | $ | 63,825,458 | |

| | | | | | | | |

| Composition of net assets | | | | | | | | |

| Shares of beneficial interest outstanding (par value $0.00001 per share), unlimited number of shares authorized | | $ | 112 | | | $ | 61 | |

| Additional paid-in capital | | | 113,581,148 | | | | 61,576,005 | |

| Undistributed net investment income | | | 334,169 | | | | 216,465 | |

| Accumulated net realized gain (loss) | | | (22 | ) | | | 850,470 | |

| Net unrealized appreciation | | | 716,035 | | | | 1,182,457 | |

| | | | | | | | |

Total net assets | | $ | 114,631,442 | | | $ | 63,825,458 | |

| | | | | | | | |

| Class A | | | | | | | | |

| Net assets applicable to outstanding shares | | $ | 12,464,353 | | | $ | 2,590,562 | |

| | | | | | | | |

| Shares of beneficial interest outstanding | | | 1,222,232 | | | | 247,784 | |

| | | | | | | | |

| Net asset value per share outstanding | | $ | 10.20 | | | $ | 10.45 | |

| | | | | | | | |

| Maximum offering price per share outstanding (Net asset value plus sales charge of 3.00% and 3.75%, respectively) | | $ | 10.52 | | | $ | 10.86 | |

| | | | | | | | |

| Class C | | | | | | | | |

| Net assets applicable to outstanding shares | | $ | 2,396,150 | | | $ | 944,197 | |

| | | | | | | | |

| Shares of beneficial interest outstanding | | | 235,796 | | | | 90,376 | |

| | | | | | | | |

| Net asset value per share outstanding | | $ | 10.16 | | | $ | 10.45 | |

| | | | | | | | |

| Class I | | | | | | | | |

| Net assets applicable to outstanding shares | | $ | 32,771,965 | | | $ | 26,405,814 | |

| | | | | | | | |

| Shares of beneficial interest outstanding | | | 3,209,873 | | | | 2,525,277 | |

| | | | | | | | |

| Net asset value per share outstanding | | $ | 10.21 | | | $ | 10.46 | |

| | | | | | | | |

| Class Y | | | | | | | | |

| Net assets applicable to outstanding shares | | $ | 66,998,974 | | | $ | 33,884,885 | |

| | | | | | | | |

| Shares of beneficial interest outstanding | | | 6,563,103 | | | | 3,240,351 | |

| | | | | | | | |

| Net asset value per share outstanding | | $ | 10.21 | | | $ | 10.46 | |

| | | | | | | | |

See accompanying Notes to Financial Statements

11

Babson Capital Funds Trust 2014 Annual Report

STATEMENTS OF OPERATIONS

Period from September 16, 2013 through June 30, 2014*

| | | | | | | | |

| | | BABSON GLOBAL

FLOATING RATE FUND | | | BABSON GLOBAL

CREDIT INCOME

OPPORTUNITIES FUND | |

| | |

| Investment Income | | | | | | | | |

Interest income | | $ | 2,616,825 | | | $ | 2,454,035 | |

Other income | | | 42,902 | | | | 43,535 | |

| | | | | | | | |

Total investment income | | | 2,659,727 | | | | 2,497,570 | |

| | | | | | | | |

| | |

| Operating Expenses | | | | | | | | |

Advisory fees | | | 381,129 | | | | 313,137 | |

12b-1 distribution and servicing plan | | | | | | | | |

Class A | | | 8,248 | | | | 2,121 | |

Class C | | | 6,648 | | | | 2,120 | |

Professional fees | | | 124,591 | | | | 124,591 | |

Administrator fees | | | 125,045 | | | | 96,433 | |

Custody fees | | | 104,608 | | | | 83,364 | |

Directors’ fees | | | 60,977 | | | | 57,199 | |

Transfer agent fees | | | 69,312 | | | | 64,418 | |

Printing and mailing expenses | | | 15,000 | | | | 15,000 | |

Registration fees | | | 15,938 | | | | 9,243 | |

Other operating expenses | | | 30,833 | | | | 36,733 | |

| | | | | | | | |

Total operating expenses | | | 942,329 | | | | 804,359 | |

Reimbursement of expenses | | | | | | | | |

Class A | | | (40,403 | ) | | | (23,291 | ) |

Class C | | | (21,097 | ) | | | (18,118 | ) |

Class I | | | (186,577 | ) | | | (177,924 | ) |

Class Y | | | (237,608 | ) | | | (184,145 | ) |

| | | | | | | | |

Net operating expenses | | | 456,644 | | | | 400,881 | |

| | | | | | | | |

Net investment income | | | 2,203,083 | | | | 2,096,689 | |

| | | | | | | | |

| | |

| Realized and Unrealized Gains (Losses) on Investments | | | | | | | | |

Net realized gain on investments | | | 451,960 | | | | 1,157,172 | |

Net realized loss on forward foreign currency exchange contracts | | | (365,754 | ) | | | (456,467 | ) |

Net realized loss on foreign currency and translation | | | (225,876 | ) | | | (158,863 | ) |

| | | | | | | | |

Net realized gain (loss) | | | (139,670 | ) | | | 541,842 | |

| | | | | | | | |

Net change in unrealized appreciation on investments | | | 1,000,166 | | | | 1,405,402 | |

Net change in unrealized depreciation on forward foreign currency exchange contracts | | | (334,169 | ) | | | (216,465 | ) |

Net change in unrealized appreciation (depreciation) on foreign currency and translation | | | 50,038 | | | | (6,480 | ) |

| | | | | | | | |

Net change in unrealized appreciation | | | 716,035 | | | | 1,182,457 | |

| | | | | | | | |

Net realized and unrealized gains on investments | | | 576,365 | | | | 1,724,299 | |

| | | | | | | | |

Net increase in net assets resulting from operations | | $ | 2,779,448 | | | $ | 3,820,988 | |

| | | | | | | | |

| * | | Funds commenced operations on September 16, 2013. |

See accompanying Notes to Financial Statements

12

Babson Capital Funds Trust 2014 Annual Report

STATEMENTS OF CHANGES IN NET ASSETS

| | | | | | | | |

| | | BABSON GLOBAL

FLOATING RATE FUND | | | BABSON GLOBAL

CREDIT INCOME

OPPORTUNITIES FUND | |

| | | PERIOD FROM

SEPTEMBER 16, 2013

THROUGH JUNE 30, 2014 (1) | | | PERIOD FROM

SEPTEMBER 16, 2013

THROUGH JUNE 30, 2014 (1) | |

| | |

| Operations | | | | | | | | |

Net investment income | | $ | 2,203,083 | | | $ | 2,096,689 | |

Net realized gain (loss) on investments | | | (139,670 | ) | | | 541,842 | |

Net change in unrealized appreciation on investments | | | 716,035 | | | | 1,182,457 | |

| | | | | | | | |

Net increase in net assets resulting from operations | | | 2,779,448 | | | | 3,820,988 | |

| | | | | | | | |

| | |

| Dividends to Common Shareholders | | | | | | | | |

Net investment income | | | | | | | | |

Class A | | | (140,982 | ) | | | (36,805 | ) |

| | | | | | | | |

Class C | | | (26,146 | ) | | | (10,571 | ) |

| | | | | | | | |

Class I | | | (610,026 | ) | | | (734,939 | ) |

| | | | | | | | |

Class Y | | | (1,014,718 | ) | | | (790,102 | ) |

| | | | | | | | |

Total dividends to common shareholders | | | (1,791,872 | ) | | | (1,572,417 | ) |

| | | | | | | | |

| | |

| Capital Share Transactions | | | | | | | | |

Net proceeds from sale of shares | | | 114,172,093 | | | | 60,160,874 | |

Net Asset Value of shares issued to shareholders in payment of distributions declared | | | 1,770,684 | | | | 1,559,384 | |

Cost of shares redeemed | | | (2,298,911 | ) | | | (143,371 | ) |

| | | | | | | | |

Net increase in net assets resulting from capital stock transactions | | | 113,643,866 | | | | 61,576,887 | |

| | | | | | | | |

Total increase in net assets | | | 114,631,442 | | | | 63,825,458 | |

| | | | | | | | |

| | |

| Net Assets | | | | | | | | |

Beginning of period | | | – | | | | – | |

| | | | | | | | |

End of period (includes undistributed net investment income of $334,169 and $216,465, respectively) | | $ | 114,631,442 | | | $ | 63,825,458 | |

| | | | | | | | |

| (1) | | Fund commenced operations on September 16, 2013. |

See accompanying Notes to Financial Statements

13

Babson Global Floating Rate Fund 2014 Annual Report

FINANCIAL HIGHLIGHTS

| | | | |

| | | CLASS A | |

| | | PERIOD FROM

SEPTEMBER 16, 2013

THROUGH JUNE 30, 2014 (1) | |

| |

| Per Common Share Data | | | | |

Net asset value, beginning of period | | $ | 10.00 | |

Income from investment operations: | | | | |

Net investment income (2) | | | 0.30 | |

Net realized and unrealized gain on investments | | | 0.08 | |

| | | | |

Total increase from investment operations | | | 0.38 | |

| | | | |

Less dividends and distributions: | | | | |

From net investment income | | | (0.18 | ) |

| | | | |

Net asset value, at end of period | | $ | 10.20 | |

| | | | |

Total investment return (3)(4) | | | 3.81 | % |

| | | | |

| |

| Supplemental Data and Ratios | | | | |

Net assets, end of period (000’s) | | $ | 12,464 | |

Ratio of total expenses (before reductions and reimbursements) to average net assets (5)(6) | | | 2.27 | % |

Ratio of net expenses to average net assets (5) | | | 1.05 | % |

Ratio of net investment income to average net assets (5) | | | 3.76 | % |

Portfolio turnover rate (4) | | | 49.51 | % |

| (1) | | Fund commenced operations on September 16, 2013. |

| (2) | | Calculated using average shares outstanding. |

| (3) | | Total investment return calculation does not consider the effects of sales loads and assumes the reinvestment of dividends at actual prices pursuant to the Fund’s dividend reinvestment plan. |

| (5) | | Annualized for periods less than one full year. |

| (6) | | The Adviser has agreed to waive and/or reimburse fees and/or expense so that, on an annualized basis, such expenses incurred will not exceed 1.05% as a percentage of average daily net assets. |

See accompanying Notes to Financial Statements

14

Babson Global Floating Rate Fund 2014 Annual Report

FINANCIAL HIGHLIGHTS (CONTINUED)

| | | | |

| | | CLASS C | |

| | | PERIOD FROM

SEPTEMBER 16, 2013

THROUGH JUNE 30, 2014 (1) | |

| |

| Per Common Share Data | | | | |

Net asset value, beginning of period | | $ | 10.00 | |

Income from investment operations: | | | | |

Net investment income (2) | | | 0.24 | |

Net realized and unrealized gain on investments | | | 0.07 | |

| | | | |

Total increase from investment operations | | | 0.31 | |

| | | | |

Less dividends and distributions: | | | | |

From net investment income | | | (0.15 | ) |

| | | | |

Net asset value, at end of period | | $ | 10.16 | |

| | | | |

Total investment return (3)(4) | | | 3.15 | % |

| | | | |

| |

| Supplemental Data and Ratios | | | | |

Net assets, end of period (000’s) | | $ | 2,396 | |

Ratio of total expenses (before reductions and reimbursements) to average net assets (5)(6) | | | 4.97 | % |

Ratio of net expenses to average net assets (5) | | | 1.80 | % |

Ratio of net investment income to average net assets (5) | | | 3.07 | % |

Portfolio turnover rate (4) | | | 49.51 | % |

| (1) | | Fund commenced operations on September 16, 2013. |

| (2) | | Calculated using average shares outstanding. |

| (3) | | Total investment return calculation does not consider the effects of sales loads and assumes the reinvestment of dividends at actual prices pursuant to the Fund’s dividend reinvestment plan. |

| (5) | | Annualized for periods less than one full year. |

| (6) | | The Adviser has agreed to waive and/or reimburse fees and/or expense so that, on an annualized basis, such expenses incurred will not exceed 1.80% as a percentage of average daily net assets. |

See accompanying Notes to Financial Statements

15

Babson Global Floating Rate Fund 2014 Annual Report

FINANCIAL HIGHLIGHTS (CONTINUED)

| | | | |

| | | CLASS I | |

| | | PERIOD FROM

SEPTEMBER 16, 2013

THROUGH JUNE 30, 2014 (1) | |

| |

| Per Common Share Data | | | | |

Net asset value, beginning of period | | $ | 10.00 | |

Income from investment operations: | | | | |

Net investment income (2) | | | 0.30 | |

Net realized and unrealized gain on investments | | | 0.10 | |

| | | | |

Total increase from investment operations | | | 0.40 | |

| | | | |

Less dividends and distributions: | | | | |

From net investment income | | | (0.19 | ) |

| | | | |

Net asset value, at end of period | | $ | 10.21 | |

| | | | |

Total investment return (3)(4) | | | 4.04 | % |

| | | | |

| |

| Supplemental Data and Ratios | | | | |

Net assets, end of period (000’s) | | $ | 32,772 | |

Ratio of total expenses (before reductions and reimbursements) to average net assets (5)(6) | | | 1.52 | % |

Ratio of net expenses to average net assets (5) | | | 0.75 | % |

Ratio of net investment income to average net assets (5) | | | 3.72 | % |

Portfolio turnover rate (4) | | | 49.51 | % |

| (1) | | Fund commenced operations on September 16, 2013. |

| (2) | | Calculated using average shares outstanding. |

| (3) | | Total investment return calculation assumes the reinvestment of dividends at actual prices pursuant to the Fund’s dividend reinvestment plan. |

| (5) | | Annualized for periods less than one full year. |

| (6) | | The Adviser has agreed to waive and/or reimburse fees and/or expense so that, on an annualized basis, such expenses incurred will not exceed .75% as a percentage of average daily net assets. |

See accompanying Notes to Financial Statements

16

Babson Global Floating Rate Fund 2014 Annual Report

FINANCIAL HIGHLIGHTS (CONTINUED)

| | | | |

| | | CLASS Y | |

| | | PERIOD FROM

SEPTEMBER 16, 2013

THROUGH JUNE 30, 2014 (1) | |

| |

| Per Common Share Data | | | | |

Net asset value, beginning of period | | $ | 10.00 | |

Income from investment operations: | | | | |

Net investment income (2) | | | 0.30 | |

Net realized and unrealized gain on investments | | | 0.10 | |

| | | | |

Total increase from investment operations | | | 0.40 | |

| | | | |

Less dividends and distributions: | | | | |

From net investment income | | | (0.19 | ) |

| | | | |

Net asset value, at end of period | | $ | 10.21 | |

| | | | |

Total investment return (3)(4) | | | 4.04 | % |

| | | | |

| |

| Supplemental Data and Ratios | | | | |

Net assets, end of period (000’s) | | $ | 66,999 | |

Ratio of total expenses (before reductions and reimbursements) to average net assets (5)(6) | | | 1.53 | % |

Ratio of net expenses to average net assets (5) | | | 0.75 | % |

Ratio of net investment income to average net assets (5) | | | 3.80 | % |

Portfolio turnover rate (4) | | | 49.51 | % |

| (1) | | Fund commenced operations on September 16, 2013. |

| (2) | | Calculated using average shares outstanding. |

| (3) | | Total investment return calculation assumes the reinvestment of dividends at actual prices pursuant to the Fund’s dividend reinvestment plan. |

| (5) | | Annualized for periods less than one full year. |

| (6) | | The Adviser has agreed to waive and/or reimburse fees and/or expense so that, on an annualized basis, such expenses incurred will not exceed .75% as a percentage of average daily net assets. |

See accompanying Notes to Financial Statements

17

Babson Global Credit Income Opportunities Fund 2014 Annual Report

FINANCIAL HIGHLIGHTS (CONTINUED)

| | | | |

| | | CLASS A | |

| | | PERIOD FROM

SEPTEMBER 16, 2013

THROUGH JUNE 30, 2014 (1) | |

| |

| Per Common Share Data | | | | |

Net asset value, beginning of period | | $ | 10.00 | |

Income from investment operations: | | | | |

Net investment income (2) | | | 0.40 | |

Net realized and unrealized gain on investments | | | 0.33 | |

| | | | |

Total increase from investment operations | | | 0.73 | |

| | | | |

Less dividends and distributions: | | | | |

From net investment income | | | (0.28 | ) |

| | | | |

Net asset value, at end of period | | $ | 10.45 | |

| | | | |

Total investment return (3)(4) | | | 7.30 | % |

| | | | |

| |

| Supplemental Data and Ratios | | | | |

Net assets, end of period (000’s) | | $ | 2,591 | |

Ratio of total expenses (before reductions and reimbursements) to average net assets (5)(6) | | | 3.95 | % |

Ratio of net expenses to average net assets (5) | | | 1.20 | % |

Ratio of net investment income to average net assets (5) | | | 4.88 | % |

Portfolio turnover rate (4) | | | 99.72 | % |

| (1) | | Fund commenced operations on September 16, 2013. |

| (2) | | Calculated using average shares outstanding. |

| (3) | | Total investment return calculation does not consider the effects of sales loads and assumes the reinvestment of dividends at actual prices pursuant to the Fund’s dividend reinvestment plan. |

| (5) | | Annualized for periods less than one full year. |

| (6) | | The Adviser has agreed to waive and/or reimburse fees and/or expense so that, on an annualized basis, such expenses incurred will not exceed 1.20% as a percentage of average daily net assets. |

See accompanying Notes to Financial Statements

18

Babson Global Credit Income Opportunities Fund 2014 Annual Report

FINANCIAL HIGHLIGHTS (CONTINUED)

| | | | |

| | | CLASS C | |

| | | PERIOD FROM

SEPTEMBER 16, 2013

THROUGH JUNE 30, 2014 (1) | |

| |

| Per Common Share Data | | | | |

Net asset value, beginning of period | | $ | 10.00 | |

Income from investment operations: | | | | |

Net investment income (2) | | | 0.35 | |

Net realized and unrealized gain on investments | | | 0.32 | |

| | | | |

Total increase from investment operations | | | 0.67 | |

| | | | |

Less dividends and distributions: | | | | |

From net investment income | | | (0.22 | ) |

| | | | |

Net asset value, at end of period | | $ | 10.45 | |

| | | | |

Total investment return (3)(4) | | | 6.75 | % |

| | | | |

| |

| Supplemental Data and Ratios | | | | |

Net assets, end of period (000’s) | | $ | 944 | |

Ratio of total expenses (before reductions and reimbursements) to average net assets (5)(6) | | | 10.50 | % |

Ratio of net expenses to average net assets (5) | | | 1.95 | % |

Ratio of net investment income to average net assets (5) | | | 4.39 | % |

Portfolio turnover rate (4) | | | 99.72 | % |

| (1) | | Fund commenced operations on September 16, 2013. |

| (2) | | Calculated using average shares outstanding. |

| (3) | | Total investment return calculation does not consider the effects of sales loads and assumes the reinvestment of dividends at actual prices pursuant to the Fund’s dividend reinvestment plan. |

| (5) | | Annualized for periods less than one full year. |

| (6) | | The Adviser has agreed to waive and/or reimburse fees and/or expense so that, on an annualized basis, such expenses incurred will not exceed 1.95% as a percentage of average daily net assets. |

See accompanying Notes to Financial Statements

19

Babson Global Credit Income Opportunities Fund 2014 Annual Report

FINANCIAL HIGHLIGHTS (CONTINUED)

| | | | |

| | | CLASS I | |

| | | PERIOD FROM

SEPTEMBER 16, 2013

THROUGH JUNE 30, 2014 (1) | |

| |

| Per Common Share Data | | | | |

Net asset value, beginning of period | | $ | 10.00 | |

Income from investment operations: | | | | |

Net investment income (2) | | | 0.41 | |

Net realized and unrealized gain on investments | | | 0.35 | |

| | | | |

Total increase from investment operations | | | 0.76 | |

| | | | |

Less dividends and distributions: | | | | |

From net investment income | | | (0.30 | ) |

| | | | |

Net asset value, at end of period | | $ | 10.46 | |

| | | | |

Total investment return (3)(4) | | | 7.59 | % |

| | | | |

| |

| Supplemental Data and Ratios | | | | |

Net assets, end of period (000’s) | | $ | 26,406 | |

Ratio of total expenses (before reductions and reimbursements) to average net assets (5)(6) | | | 1.83 | % |

Ratio of net expenses to average net assets (5) | | | 0.95 | % |

Ratio of net investment income to average net assets (5) | | | 5.02 | % |

Portfolio turnover rate (4) | | | 99.72 | % |

| (1) | | Fund commenced operations on September 16, 2013. |

| (2) | | Calculated using average shares outstanding. |

| (3) | | Total investment return calculation assumes the reinvestment of dividends at actual prices pursuant to the Fund’s dividend reinvestment plan. |

| (5) | | Annualized for periods less than one full year. |

| (6) | | The Adviser has agreed to waive and/or reimburse fees and/or expense so that, on an annualized basis, such expenses incurred will not exceed .95% as a percentage of average daily net assets. |

See accompanying Notes to Financial Statements

20

Babson Global Credit Income Opportunities Fund 2014 Annual Report

FINANCIAL HIGHLIGHTS (CONTINUED)

| | | | |

| | | CLASS Y | |

| | | PERIOD FROM

SEPTEMBER 16, 2013

THROUGH JUNE 30, 2014 (1) | |

| |

| Per Common Share Data | | | | |

Net asset value, beginning of period | | $ | 10.00 | |

Income from investment operations: | | | | |

Net investment income (2) | | | 0.41 | |

Net realized and unrealized gain on investments | | | 0.35 | |

| | | | |

Total increase from investment operations | | | 0.76 | |

| | | | |

Less dividends and distributions: | | | | |

From net investment income | | | (0.30 | ) |

| | | | |

Net asset value, at end of period | | $ | 10.46 | |

| | | | |

Total investment return (3)(4) | | | 7.59 | % |

| | | | |

| |

| Supplemental Data and Ratios | | | | |

Net assets, end of period (000’s) | | $ | 33,885 | |

Ratio of total expenses (before reductions and reimbursements) to average net assets (5)(6) | | | 1.84 | % |

Ratio of net expenses to average net assets (5) | | | 0.95 | % |

Ratio of net investment income to average net assets (5) | | | 5.04 | % |

Portfolio turnover rate (4) | | | 99.72 | % |

| (1) | | Fund commenced operations on September 16, 2013. |

| (2) | | Calculated using average shares outstanding. |

| (3) | | Total investment return calculation assumes the reinvestment of dividends at actual prices pursuant to the Fund’s dividend reinvestment plan. |

| (5) | | Annualized for periods less than one full year. |

| (6) | | The Adviser has agreed to waive and/or reimburse fees and/or expense so that, on an annualized basis, such expenses incurred will not exceed .95% as a percentage of average daily net assets. |

See accompanying Notes to Financial Statements

21

Babson Global Floating Rate Fund 2014 Annual Report

SCHEDULE OF INVESTMENTS

June 30, 2014

| | | | | | | | | | | | | | | | | | | | |

| | | EFFECTIVE

INTEREST RATE ‡ | | | DUE DATE | | | PRINCIPAL ‡‡ | | | COST | | | FAIR VALUE | |

Fixed Income — 98.3%*: | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Bank Loans — 85.7%*§: | | | | | | | | | | | | | | | | | | | | |

| | | | | |

Aerospace and Defense — 1.1%*: | | | | | | | | | | | | | | | | | | | | |

DAE Aviation Holdings, Inc. | | | 7.75 | % | | | 8/5/2019 | | | | 142,982 | | | | $141,651 | | | | $145,127 | |

TransDigm Group, Inc. | | | 3.75 | | | | 2/28/2020 | | | | 496,222 | | | | 494,010 | | | | 494,361 | |

TransDigm Group, Inc. | | | 3.75 | | | | 6/4/2021 | | | | 660,582 | | | | 657,507 | | | | 657,279 | |

| | | | | | | | | | | | | | | | | | | | |

Total Aerospace and Defense | | | | | | | | | | | 1,299,786 | | | | 1,293,168 | | | | 1,296,767 | |

| | | | | | | | | | | | | | | | | | | | |

| | |

Automobile — 0.5%*: | | | | | | | | | |

Cooper Standard Automotive, Inc. | | | 4.00 | | | | 4/4/2021 | | | | 54,474 | | | | 54,209 | | | | 54,383 | |

Gates Global, Inc. | | | 4.25 | | | | 7/5/2021 | | | | 500,000 | | | | 494,618 | | | | 498,205 | |

| | | | | | | | | | | | | | | | | | | | |

Total Automobile | | | | | | | | | | | 554,474 | | | | 548,827 | | | | 552,588 | |

| | | | | | | | | | | | | | | | | | | | |

| | |

Beverage, Food and Tobacco — 2.4%*: | | | | | | | | | |

Acosta, Inc. | | | 4.25 | | | | 3/2/2018 | | | | 461,349 | | | | 463,030 | | | | 463,195 | |

CEC Entertainment Concepts LP | | | 4.25 | | | | 2/14/2021 | | | | 751,156 | | | | 747,461 | | | | 745,522 | |

Del Monte Foods, Inc. | | | 4.25 | | | | 2/18/2021 | | | | 249,375 | | | | 248,190 | | | | 247,869 | |

Del Monte Foods, Inc. | | | 8.25 | | | | 8/18/2021 | | | | 156,342 | | | | 154,847 | | | | 153,215 | |

Deoleo S.A.+ | | | 4.50 | | | | 5/12/2021 | | | | 500,000 | | | | 676,526 | | | | 679,090 | |

JBS USA Holdings, Inc. | | | 3.75 | | | | 9/18/2020 | | | | 496,250 | | | | 497,382 | | | | 493,977 | |

| | | | | | | | | | | | | | | | | | | | |

Total Beverage, Food and Tobacco | | | | | | | | | | | 2,614,472 | | | | 2,787,436 | | | | 2,782,868 | |

| | | | | | | | | | | | | | | | | | | | |

| | |

Broadcasting and Entertainment — 6.8%*: | | | | | | | | | |

All3Media International+ | | | 5.25 | | | | 6/30/2021 | | | | 500,000 | | | | 833,489 | | | | 851,421 | |

All3Media International+ | | | 8.25 | | | | 6/30/2022 | | | | 500,000 | | | | 670,554 | | | | 681,227 | |

Charter Communications Operating LLC | | | 3.00 | | | | 1/3/2021 | | | | 497,487 | | | | 496,312 | | | | 489,612 | |

Cumulus Media Holdings, Inc. | | | 4.25 | | | | 12/23/2020 | | | | 369,318 | | | | 365,885 | | | | 370,241 | |

Learfield Communications, Inc. | | | 4.50 | | | | 10/9/2020 | | | | 417,500 | | | | 416,996 | | | | 420,631 | |

Learfield Communications, Inc. | | | 8.75 | | | | 10/8/2021 | | | | 1,000,000 | | | | 1,021,347 | | | | 1,017,500 | |

Telecommunications Management LLC | | | 4.75 | | | | 4/30/2020 | | | | 69,992 | | | | 69,992 | | | | 70,429 | |

Tyrol Acquisitions 2 SAS+ | | | 3.23 | | | | 1/29/2016 | | | | 2,158,726 | | | | 2,847,990 | | | | 2,849,324 | |

Univision Communications, Inc. | | | 4.00 | | | | 3/2/2020 | | | | 993,725 | | | | 991,991 | | | | 993,039 | |

| | | | | | | | | | | | | | | | | | | | |

Total Broadcasting and Entertainment | | | | | | | | | | | 6,506,748 | | | | 7,714,556 | | | | 7,743,424 | |

| | | | | | | | | | | | | | | | | | | | |

| | |

Buildings and Real Estate — 1.5%*: | | | | | | | | | |

Alstom Auxiliary Components+ | | | 5.50 | | | | 6/15/2021 | | | | 297,257 | | | | 294,285 | | | | 294,657 | |

Autobahn Tank & Rast GmbH+ | | | 3.73 | | | | 12/4/2018 | | | | 250,000 | | | | 336,546 | | | | 341,801 | |

Autobahn Tank & Rast GmbH+ | | | 3.98 | | | | 12/10/2019 | | | | 200,000 | | | | 271,730 | | | | 274,279 | |

Interline Brands, Inc. | | | 4.00 | | | | 3/17/2021 | | | | 86,077 | | | | 85,870 | | | | 85,790 | |

Quikrete Holdings, Inc. | | | 4.00 | | | | 9/28/2020 | | | | 693,254 | | | | 690,186 | | | | 693,469 | |

| | | | | | | | | | | | | | | | | | | | |

Total Buildings and Real Estate | | | | | | | | | | | 1,526,588 | | | | 1,678,617 | | | | 1,689,996 | |

| | | | | | | | | | | | | | | | | | | | |

| | |

Cargo Transport — 0.7%*: | | | | | | | | | |

Direct ChassisLink, Inc.¤ | | | 8.25 | | | | 10/31/2019 | | | | 497,619 | | | | 490,872 | | | | 497,619 | |

Mirror Bidco Corp. | | | 4.25 | | | | 12/28/2019 | | | | 62,865 | | | | 62,570 | | | | 62,786 | |

Swift Transportation Co. LLC | | | 3.75 | | | | 6/9/2021 | | | | 230,453 | | | | 229,879 | | | | 230,453 | |

| | | | | | | | | | | | | | | | | | | | |

Total Cargo Transport | | | | | | | | | | | 790,937 | | | | 783,321 | | | | 790,858 | |

| | | | | | | | | | | | | | | | | | | | |

See accompanying Notes to Financial Statements

22

Babson Global Floating Rate Fund 2014 Annual Report

SCHEDULE OF INVESTMENTS (CONTINUED)

June 30, 2014

| | | | | | | | | | | | | | | | | | | | |

| | | EFFECTIVE

INTEREST RATE ‡ | | | DUE DATE | | | PRINCIPAL ‡‡ | | | COST | | | FAIR VALUE | |

Bank Loans (Continued) | | | | | | | | | |

| | |

Chemicals, Plastics and Rubber — 3.3%*: | | | | | | | | | |

Chromaflo Technologies Corp. | | | 4.50 | % | | | 12/2/2019 | | | | 623,274 | | | | $624,318 | | | | $624,832 | |

Colouroz Investment 1 GmbH+ | | | 4.75 | | | | 5/2/2021 | | | | 414,958 | | | | 410,809 | | | | 415,867 | |

Colouroz Investment 1 GmbH+ | | | 4.75 | | | | 5/3/2021 | | | | 231,534 | | | | 229,219 | | | | 232,042 | |

Flint Group SA+ | | | 5.48 | | | | 12/30/2016 | | | | 217,710 | | | | 216,406 | | | | 217,710 | |

Flint Group SA+ | | | 5.48 | | | | 12/31/2016 | | | | 782,290 | | | | 777,603 | | | | 782,290 | |

Univar, Inc. | | | 5.00 | | | | 6/30/2017 | | | | 994,854 | | | | 993,091 | | | | 998,585 | |

Vantage Specialties, Inc. | | | 5.00 | | | | 2/10/2019 | | | | 496,207 | | | | 495,130 | | | | 497,447 | |

| | | | | | | | | | | | | | | | | | | | |

Total Chemicals, Plastics and Rubber | | | | | | | | | | | 3,760,827 | | | | 3,746,576 | | | | 3,768,773 | |

| | | | | | | | | | | | | | | | | | | | |

| | |

Containers, Packaging and Glass — 4.3%*: | | | | | | | | | |

Ardagh Holdings USA, Inc. | | | 4.25 | | | | 12/17/2019 | | | | 73,649 | | | | 73,311 | | | | 73,864 | |

Chesapeake Corp. | | | 4.25 | | | | 9/30/2020 | | | | 1,149,753 | | | | 1,149,283 | | | | 1,149,397 | |

Chesapeake Corp.+ | | | 6.00 | | | | 9/30/2020 | | | | 496,250 | | | | 790,907 | | | | 855,473 | |

Consolidated Container Co. LLC | | | 7.75 | | | | 1/3/2020 | | | | 188,280 | | | | 184,516 | | | | 185,456 | |

Coveris | | | 5.25 | | | | 5/8/2019 | | | | 386,702 | | | | 384,974 | | | | 392,503 | |

Coveris | | | 5.75 | | | | 5/8/2019 | | | | 497,500 | | | | 683,476 | | | | 686,622 | |

Libbey Glass, Inc. | | | 3.75 | | | | 4/9/2021 | | | | 877,465 | | | | 875,292 | | | | 876,368 | |

Mauser Industrieverpackungen GmbH+ | | | 3.98 | | | | 6/25/2021 | | | | 500,000 | | | | 679,013 | | | | 685,937 | |

Mauser Industrieverpackungen GmbH+ | | | 4.25 | | | | 6/4/2021 | | | | 65,411 | | | | 65,084 | | | | 65,411 | |

| | | | | | | | | | | | | | | | | | | | |

Total Containers, Packaging and Glass | | | | | | | | | | | 4,235,010 | | | | 4,885,856 | | | | 4,971,031 | |

| | | | | | | | | | | | | | | | | | | | |

| | |

Diversified/Conglomerate Manufacturing — 1.9%*: | | | | | | | | | |

Applied Systems, Inc. | | | 4.25 | | | | 1/25/2021 | | | | 67,486 | | | | 67,327 | | | | 67,644 | |

Filtration Group Corp. | | | 4.50 | | | | 11/21/2020 | | | | 365,125 | | | | 363,444 | | | | 367,499 | |

Information Resources, Inc. | | | 4.75 | | | | 9/30/2020 | | | | 158,242 | | | | 157,529 | | | | 159,230 | |

Marine Acquisition Corp. | | | 5.25 | | | | 1/30/2021 | | | | 110,111 | | | | 109,591 | | | | 111,075 | |

Quality Home Brands Holdings LLC | | | 7.75 | | | | 5/25/2018 | | | | 262,354 | | | | 260,007 | | | | 264,322 | |

Rexnord LLC | | | 4.00 | | | | 8/21/2020 | | | | 924,052 | | | | 918,995 | | | | 922,666 | |

STS Operating, Inc. | | | 4.75 | | | | 2/19/2021 | | | | 316,100 | | | | 316,430 | | | | 317,285 | |

| | | | | | | | | | | | | | | | | | | | |

Total Diversified/Conglomerate Manufacturing | | | | | | | | | | | 2,203,470 | | | | 2,193,323 | | | | 2,209,721 | |

| | | | | | | | | | | | | | | | | | | | |

| | |

Diversified/Conglomerate Service — 8.3%*: | | | | | | | | | |

Aquilex Holdings LLC | | | 5.00 | | | | 12/31/2020 | | | | 199,142 | | | | 198,675 | | | | 198,146 | |

Atrium Innovations, Inc.+ | | | 4.25 | | | | 2/15/2021 | | | | 836,120 | | | | 834,565 | | | | 828,453 | |

Atrium Innovations, Inc.+ | | | 7.75 | | | | 8/13/2021 | | | | 598,409 | | | | 608,418 | | | | 597,661 | |

Bauer Performance Sports Ltd. | | | 4.50 | | | | 4/15/2021 | | | | 92,906 | | | | 92,453 | | | | 92,965 | |

Brickman Group Ltd. LLC | | | 7.50 | | | | 12/17/2021 | | | | 82,405 | | | | 82,016 | | | | 83,710 | |

EIG Investors Corp. | | | 5.00 | | | | 11/9/2019 | | | | 598,517 | | | | 600,947 | | | | 598,517 | |

Garda World Security Corp.+ | | | 4.00 | | | | 11/6/2020 | | | | 173,489 | | | | 172,698 | | | | 173,199 | |

Go Daddy Operating Company LLC | | | 4.75 | | | | 5/13/2021 | | | | 368,625 | | | | 366,766 | | | | 366,436 | |

Internet Brands, Inc. | | | 5.25 | | | | 7/8/2021 | | | | 151,623 | | | | 150,106 | | | | 151,074 | |

Internet Brands, Inc. | | | 8.50 | | | | 6/27/2022 | | | | 400,000 | | | | 396,000 | | | | 397,752 | |

MPH Acquisition Holdings LLC | | | 4.00 | | | | 3/31/2021 | | | | 866,761 | | | | 864,634 | | | | 863,900 | |

Northgate Information Solutions Ltd.+ | | | 4.23 | | | | 3/7/2018 | | | | 502,514 | | | | 671,579 | | | | 633,045 | |

Northgate Information Solutions Ltd.+ | | | 4.73 | | | | 3/6/2018 | | | | 501,257 | | | | 669,831 | | | | 631,462 | |

See accompanying Notes to Financial Statements

23

Babson Global Floating Rate Fund 2014 Annual Report

SCHEDULE OF INVESTMENTS (CONTINUED)

June 30, 2014

| | | | | | | | | | | | | | | | | | | | |

| | | EFFECTIVE

INTEREST RATE ‡ | | | DUE DATE | | | PRINCIPAL ‡‡ | | | COST | | | FAIR VALUE | |

Bank Loans (Continued) | | | | | | | | | |

| | |

Diversified/Conglomerate Service (Continued) | | | | | | | | | |

Power Team Services LLC | | | 8.25 | % | | | 11/6/2020 | | | | 500,000 | | | | $495,410 | | | | $487,500 | |

Protection One, Inc. | | | 4.25 | | | | 3/21/2019 | | | | 356,917 | | | | 355,948 | | | | 356,917 | |

RP Crown Parent LLC | | | 6.00 | | | | 12/21/2018 | | | | 553,768 | | | | 555,964 | | | | 553,535 | |

RP Crown Parent LLC | | | 11.25 | | | | 12/20/2019 | | | | 678,571 | | | | 693,001 | | | | 683,661 | |

Sabre, Inc. | | | 4.50 | | | | 2/19/2019 | | | | 496,250 | | | | 496,250 | | | | 497,491 | |

SkillSoft Corp. | | | 4.50 | | | | 4/28/2021 | | | | 449,713 | | | | 447,514 | | | | 449,434 | |

Triple Point Technology, Inc. | | | 5.25 | | | | 7/10/2020 | | | | 422,272 | | | | 386,066 | | | | 376,527 | |

Triple Point Technology, Inc.†† | | | 9.25 | | | | 7/9/2021 | | | | 182,877 | | | | 169,238 | | | | 161,389 | |

Vantiv LLC | | | 3.75 | | | | 5/12/2021 | | | | 206,042 | | | | 205,014 | | | | 207,072 | |

Vogue International, Inc. | | | 5.25 | | | | 2/14/2020 | | | | 145,111 | | | | 143,735 | | | | 145,565 | |

| | | | | | | | | | | | | | | | | | | | |

Total Diversified/Conglomerate Service | | | | | | | | | | | 9,363,289 | | | | 9,656,828 | | | | 9,535,411 | |

| | | | | | | | | | | | | | | | | | | | |

| | |

Ecological — 2.9%*: | | | | | | | | | |

ADS Waste Holdings, Inc. | | | 3.75 | | | | 10/9/2019 | | | | 724,939 | | | | 724,016 | | | | 720,988 | |

Biffa Waste Services Ltd.+ | | | 5.23 | | | | 1/30/2018 | | | | 1,000,000 | | | | 1,648,899 | | | | 1,673,749 | |

Emerald 3 Ltd.+ | | | 8.00 | | | | 5/9/2022 | | | | 390,426 | | | | 386,522 | | | | 388,962 | |

Emerald US, Inc.+ | | | 5.00 | | | | 5/9/2021 | | | | 492,511 | | | | 487,586 | | | | 488,512 | |

| | | | | | | | | | | | | | | | | | | | |

Total Ecological | | | | | | | | | | | 2,607,876 | | | | 3,247,023 | | | | 3,272,211 | |

| | | | | | | | | | | | | | | | | | | | |

| | |

Electronics — 2.6%*: | | | | | | | | | |

AI Avocado Holding B.V.+ | | | 4.98 | | | | 11/17/2020 | | | | 500,000 | | | | 681,600 | | | | 688,073 | |

Avago Technologies Cayman Ltd.+ | | | 3.75 | | | | 5/6/2021 | | | | 556,041 | | | | 553,316 | | | | 557,582 | |

Freescale Semiconductor, Inc. | | | 4.25 | | | | 2/28/2020 | | | | 995,000 | | | | 995,000 | | | | 994,174 | |

Kronos, Inc. | | | 4.50 | | | | 10/30/2019 | | | | 198,839 | | | | 197,496 | | | | 200,231 | |

Kronos, Inc. | | | 9.75 | | | | 4/30/2020 | | | | 221,994 | | | | 220,425 | | | | 230,041 | |

Magic Newco LLC+ | | | 5.00 | | | | 12/12/2018 | | | | 96,109 | | | | 96,109 | | | | 96,758 | |

Presidio, Inc. | | | 5.00 | | | | 3/31/2017 | | | | 137,011 | | | | 136,377 | | | | 137,525 | |

Renaissance Learning, Inc. | | | 4.50 | | | | 4/9/2021 | | | | 82,960 | | | | 82,555 | | | | 82,856 | |

| | | | | | | | | | | | | | | | | | | | |

Total Electronics | | | | | | | | | | | 2,787,954 | | | | 2,962,878 | | | | 2,987,240 | |

| | | | | | | | | | | | | | | | | | | | |

| | |

Farming and Agriculture — 0.1%*: | | | | | | | | | |

Dole Food Co., Inc. | | | 4.50 | | | | 11/1/2018 | | | | 150,524 | | | | 149,867 | | | | 150,649 | |

| | | | | | | | | | | | | | | | | | | | |

| | |

Finance — 11.2%*: | | | | | | | | | |

AssuredPartners Capital, Inc. | | | 4.50 | | | | 3/31/2021 | | | | 307,844 | | | | 306,350 | | | | 307,940 | |

AssuredPartners Capital, Inc. | | | 7.75 | | | | 4/4/2022 | | | | 136,864 | | | | 135,530 | | | | 136,864 | |

Confie Seguros Holdings II Co. | | | 5.75 | | | | 11/9/2018 | | | | 454,540 | | | | 452,592 | | | | 454,540 | |

Confie Seguros Holdings II Co. | | | 10.25 | | | | 5/8/2019 | | | | 297,015 | | | | 297,015 | | | | 298,687 | |

Cunningham Lindsey US, Inc. | | | 9.25 | | | | 6/10/2020 | | | | 748,546 | | | | 750,381 | | | | 748,082 | |

Evertec Group LLC | | | 3.50 | | | | 4/17/2020 | | | | 674,829 | | | | 662,984 | | | | 663,863 | |

First Data Corp. | | | 3.73 | | | | 3/24/2017 | | | | 500,000 | | | | 500,000 | | | | 499,585 | |

First Data Corp. | | | 4.23 | | | | 3/24/2018 | | | | 500,000 | | | | 497,365 | | | | 500,625 | |

GENEX Services, Inc. | | | 5.25 | | | | 5/21/2021 | | | | 184,978 | | | | 184,063 | | | | 185,903 | |

GENEX Services, Inc. | | | 8.75 | | | | 5/20/2022 | | | | 500,000 | | | | 495,038 | | | | 503,750 | |

Intertrust Group Holding B.V.+ | | | 8.00 | | | | 4/16/2022 | | | | 192,451 | | | | 191,039 | | | | 193,092 | |

See accompanying Notes to Financial Statements

24

Babson Global Floating Rate Fund 2014 Annual Report

SCHEDULE OF INVESTMENTS (CONTINUED)

June 30, 2014

| | | | | | | | | | | | | | | | | | | | |

| | | EFFECTIVE

INTEREST RATE ‡ | | | DUE DATE | | | PRINCIPAL ‡‡ | | | COST | | | FAIR VALUE | |

Bank Loans (Continued) | | | | | | | | | |

| | |

Finance (Continued) | | | | | | | | | |

Intertrust Group Holding B.V.+ | | | 8.00 | % | | | 4/16/2022 | | | | 500,000 | | | | $680,147 | | | | $690,470 | |

Moneygram International, Inc. | | | 4.25 | | | | 3/27/2020 | | | | 91,581 | | | | 91,470 | | | | 90,265 | |

NAB Holdings LLC | | | 4.75 | | | | 5/31/2021 | | | | 112,774 | | | | 111,938 | | | | 113,056 | |

National Financial Partners Corp. | | | 5.25 | | | | 7/1/2020 | | | | 132,862 | | | | 132,862 | | | | 133,459 | |

Nets Holding A/S+ | | | 3.73 | | | | 5/14/2021 | | | | 500,000 | | | | 680,953 | | | | 685,616 | |

Nuveen Investments, Inc. | | | 4.23 | | | | 5/15/2017 | | | | 500,000 | | | | 496,010 | | | | 500,625 | |

Nuveen Investments, Inc. | | | 6.50 | | | | 2/28/2019 | | | | 500,000 | | | | 491,217 | | | | 504,195 | |

P2 Newco Acquisition, Inc. | | | 5.50 | | | | 10/22/2020 | | | | 450,133 | | | | 446,055 | | | | 450,696 | |

P2 Newco Acquisition, Inc. | | | 9.50 | | | | 10/22/2021 | | | | 500,000 | | | | 495,411 | | | | 500,000 | |

SAM Finance Lux Sarl+ | | | 4.25 | | | | 12/17/2020 | | | | 497,500 | | | | 495,184 | | | | 499,057 | |

SAM Finance Lux Sarl+ | | | 5.00 | | | | 12/17/2020 | | | | 497,500 | | | | 802,726 | | | | 851,421 | |

Sedgwick, Inc. | | | 3.75 | | | | 3/1/2021 | | | | 498,750 | | | | 497,560 | | | | 490,645 | |

Sedgwick, Inc. | | | 6.75 | | | | 2/28/2022 | | | | 561,418 | | | | 560,723 | | | | 559,874 | |

Ship US Bidco, Inc.+ | | | 4.50 | | | | 11/30/2019 | | | | 374,888 | | | | 371,494 | | | | 376,200 | |

TransUnion LLC | | | 4.00 | | | | 4/9/2021 | | | | 498,750 | | | | 497,540 | | | | 498,571 | |

VFH Parent LLC | | | 5.75 | | | | 11/6/2019 | | | | 1,173,504 | | | | 1,165,563 | | | | 1,164,702 | |

Wall Street Systems Delaware, Inc. | | | 4.50 | | | | 4/30/2021 | | | | 296,789 | | | | 295,250 | | | | 296,976 | |

| | | | | | | | | | | | | | | | | | | | |

Total Finance | | | | | | | | | | | 12,183,516 | | | | 12,784,460 | | | | 12,898,759 | |

| | | | | | | | | | | | | | | | | | | | |

| | |

Healthcare, Education and Childcare — 10.2%*: | | | | | | | | | |

Accellent, Inc. | | | 4.50 | | | | 3/12/2021 | | | | 948,602 | | | | 946,109 | | | | 944,457 | |

Aenova Holding GmbH+ | | | 5.23 | | | | 9/27/2019 | | | | 600,000 | | | | 799,020 | | | | 822,098 | |

Britax US Holdings, Inc. | | | 4.50 | | | | 10/15/2020 | | | | 437,432 | | | | 435,454 | | | | 414,104 | |

CareCore National LLC | | | 5.50 | | | | 3/5/2021 | | | | 376,852 | | | | 378,812 | | | | 379,916 | |

CEVA Sante Animale+ | | | 4.50 | | | | 3/31/2021 | | | | 700,000 | | | | 960,478 | | | | 964,501 | |

Community Health Systems, Inc. | | | 4.25 | | | | 1/27/2021 | | | | 336,869 | | | | 335,276 | | | | 338,668 | |

Drumm Investors LLC | | | 6.75 | | | | 5/4/2018 | | | | 894,523 | | | | 886,113 | | | | 896,204 | |

Envision Healthcare Corp. | | | 4.00 | | | | 5/25/2018 | | | | 494,895 | | | | 494,895 | | | | 495,761 | |

Heartland Dental Care, Inc. | | | 5.50 | | | | 12/21/2018 | | | | 390,041 | | | | 388,304 | | | | 391,016 | |

Kindred Healthcare, Inc. | | | 4.00 | | | | 4/9/2021 | | | | 206,613 | | | | 206,112 | | | | 206,700 | |

Ortho-Clinical Diagnostics, Inc. | | | 4.75 | | | | 6/30/2021 | | | | 554,399 | | | | 548,857 | | | | 558,629 | |

PharMedium Healthcare Corp. | | | 4.25 | | | | 1/28/2021 | | | | 99,862 | | | | 99,391 | | | | 99,529 | |

PharMedium Healthcare Corp. | | | 7.75 | | | | 1/28/2022 | | | | 93,590 | | | | 93,145 | | | | 94,643 | |

Phibro Animal Health Corp. | | | 4.00 | | | | 4/16/2021 | | | | 178,608 | | | | 178,172 | | | | 178,533 | |

PRA Holdings, Inc. | | | 4.50 | | | | 9/23/2020 | | | | 859,697 | | | | 852,012 | | | | 854,505 | |

RadNet Management, Inc. | | | 4.25 | | | | 10/10/2018 | | | | 122,417 | | | | 121,984 | | | | 123,182 | |

Radnet Management, Inc. | | | 8.00 | | | | 3/25/2021 | | | | 71,927 | | | | 71,235 | | | | 72,107 | |

Rodenstock GmbH+ | | | 4.73 | | | | 5/31/2019 | | | | 500,000 | | | | 664,736 | | | | 678,659 | |

Synarc-Biocore Holdings LLC | | | 5.50 | | | | 3/5/2021 | | | | 498,750 | | | | 493,957 | | | | 497,503 | |

Synarc-Biocore Holdings LLC | | | 9.25 | | | | 3/4/2022 | | | | 500,000 | | | | 495,170 | | | | 495,000 | |

TriZetto Group, Inc. (The) | | | 4.75 | | | | 5/2/2018 | | | | 840,904 | | | | 794,770 | | | | 843,006 | |

Tunstall Group Holdings Ltd.+ | | | 5.23 | | | | 10/16/2020 | | | | 500,000 | | | | 792,213 | | | | 690,173 | |

Vitalia Holdco Sarl+ | | | 5.23 | | | | 7/27/2018 | | | | 500,000 | | | | 666,900 | | | | 692,353 | |

| | | | | | | | | | | | | | | | | | | | |

Total Healthcare, Education and Childcare | | | | | | | | | | | 10,705,981 | | | | 11,703,115 | | | | 11,731,247 | |

| | | | | | | | | | | | | | | | | | | | |

See accompanying Notes to Financial Statements

25

Babson Global Floating Rate Fund 2014 Annual Report

SCHEDULE OF INVESTMENTS (CONTINUED)

June 30, 2014

| | | | | | | | | | | | | | | | | | | | |

| | | EFFECTIVE

INTEREST RATE ‡ | | | DUE DATE | | | PRINCIPAL ‡‡ | | | COST | | | FAIR VALUE | |

Bank Loans (Continued) | | | | | | | | | |

| | |

Home and Office Furnishings, Housewares, and Durable Consumer Products — 0.5%*: | | | | | | | | | |

Leslie’s Poolmart, Inc. | | | 4.25 | % | | | 10/16/2019 | | | | 545,493 | | | | $545,493 | | | | $545,493 | |

| | | | | | | | | | | | | | | | | | | | |

| | |

Hotels, Motels, Inns and Gaming — 1.2%*: | | | | | | | | | |

Belmond Interfin Ltd. | | | 4.00 | | | | 3/21/2021 | | | | 84,080 | | | | 83,675 | | | | 84,238 | |

Gala Group Ltd.+ | | | 5.23 | | | | 5/28/2018 | | | | 500,000 | | | | 833,659 | | | | 860,946 | |

La Quinta Intermediate Holdings LLC | | | 4.00 | | | | 4/14/2021 | | | | 254,771 | | | | 253,532 | | | | 254,931 | |

Marina District Finance Co., Inc. | | | 6.75 | | | | 8/15/2018 | | | | 128,447 | | | | 127,040 | | | | 129,851 | |

| | | | | | | | | | | | | | | | | | | | |

Total Hotels, Motels, Inns and Gaming | | | | | | | | | | | 967,298 | | | | 1,297,906 | | | | 1,329,966 | |

| | | | | | | | | | | | | | | | | | | | |

| | |

Insurance — 2.1%*: | | | | | | | | | |

AmWINS Group LLC | | | 5.00 | | | | 9/6/2019 | | | | 152,921 | | | | 152,579 | | | | 153,048 | |

Asurion LLC | | | 5.00 | | | | 5/24/2019 | | | | 985,366 | | | | 984,437 | | | | 990,913 | |

Asurion LLC | | | 8.50 | | | | 3/3/2021 | | | | 52,738 | | | | 51,981 | | | | 54,663 | |

Hub International Ltd. | | | 4.25 | | | | 10/2/2020 | | | | 992,512 | | | | 988,062 | | | | 993,197 | |

USI, Inc. | | | 4.25 | | | | 12/27/2019 | | | | 239,559 | | | | 237,217 | | | | 239,710 | |

| | | | | | | | | | | | | | | | | | | | |

Total Insurance | | | | | | | | | | | 2,423,096 | | | | 2,414,276 | | | | 2,431,531 | |

| | | | | | | | | | | | | | | | | | | | |

| | |

Leisure, Amusement, Entertainment — 0.2%*: | | | | | | | | | |

Jacobs Entertainment, Inc. | | | 5.25 | | | | 10/29/2018 | | | | 58,415 | | | | 58,416 | | | | 58,707 | |

Town Sports International, Inc. | | | 4.50 | | | | 11/16/2020 | | | | 150,812 | | | | 150,123 | | | | 139,124 | |

| | | | | | | | | | | | | | | | | | | | |

Total Leisure, Amusement, Entertainment | | | | | | | | | | | 209,227 | | | | 208,539 | | | | 197,831 | |

| | | | | | | | | | | | | | | | | | | | |

| | |

Machinery Non-Agriculture, Non-Construction, Non-Electronic — 2.6%*: | | | | | | | | | |

Capital Safety North America Holdings, Inc. | | | 4.00 | | | | 3/29/2021 | | | | 380,796 | | | | 380,330 | | | | 378,256 | |

Capital Safety North America Holdings, Inc. | | | 6.50 | | | | 3/28/2022 | | | | 251,661 | | | | 251,353 | | | | 252,396 | |

Doncasters Finance US LLC+ | | | 4.50 | | | | 4/9/2020 | | | | 997,479 | | | | 995,051 | | | | 1,000,601 | |

Doosan Infracore International, Inc. | | | 4.50 | | | | 5/28/2021 | | | | 381,386 | | | | 379,493 | | | | 384,247 | |

Husky Injection Molding Systems Ltd.+ | | | 4.25 | | | | 6/30/2021 | | | | 195,048 | | | | 194,073 | | | | 194,073 | |

Husky Injection Molding Systems Ltd.+ | | | 7.25 | | | | 6/30/2022 | | | | 89,262 | | | | 88,816 | | | | 89,597 | |

Intelligrated, Inc. | | | 4.50 | | | | 7/30/2018 | | | | 120,803 | | | | 120,538 | | | | 120,954 | |

Silver II US Holdings LLC | | | 4.00 | | | | 12/13/2019 | | | | 481,231 | | | | 481,231 | | | | 479,686 | |

TCH-2 Holding LLC | | | 5.50 | | | | 5/6/2021 | | | | 109,237 | | | | 108,161 | | | | 109,237 | |

| | | | | | | | | | | | | | | | | | | | |

Total Machinery Non-Agriculture, Non-Construction, Non-Electronic | | | | | | | | | | | 3,006,903 | | | | 2,999,046 | | | | 3,009,047 | |

| | | | | | | | | | | | | | | | | | | | |

| | |

Mining, Steel, Iron and Non-Precious Metals — 1.4%*: | | | | | | | | | |

Boomerang Tube LLC†† | | | 11.00 | | | | 10/11/2017 | | | | 256,140 | | | | 250,878 | | | | 230,526 | |

H.C. Starck GmbH+ | | | 2.98 | | | | 5/30/2016 | | | | 500,000 | | | | 679,250 | | | | 683,651 | |