Free Writing Prospectus

Filed Pursuant to Rule 433

File No. 333-177891-05

Free Writing Prospectus

Structural and Collateral Term Sheet

$1,107,001,430

(Approximate Aggregate Cut-off Date Balance of Mortgage Pool)

$972,777,000

(Approximate Aggregate Principal Balance of Offered Certificates)

WFRBS Commercial Mortgage Trust 2013-C15

as Issuing Entity

RBS Commercial Funding Inc.

as Depositor

The Royal Bank of Scotland

Wells Fargo Bank, National Association

NCB, FSB

Liberty Island Group I LLC

C-III Commercial Mortgage LLC

Basis Real Estate Capital II, LLC

as Sponsors and Mortgage Loan Sellers

Commercial Mortgage Pass-Through Certificates

Series 2013-C15

July 29, 2013

| | |

| RBS | | WELLS FARGO SECURITIES |

| |

| Co-Lead Manager and | | Co-Lead Manager and |

| |

| Co-Bookrunner | | Co-Bookrunner |

Deutsche Bank Securities

Co-Manager

STATEMENT REGARDING THIS FREE WRITING PROSPECTUS

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (‘‘SEC’’) (SEC File No. 333-177891) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the depositor, any underwriter, or any dealer participating in the offering will arrange to send you the prospectus after filing if you request it by calling toll free 1-866-884-2071 (8 a.m. – 5 p.m. EST) or by emailing rbscmbs@rbs.com.

Nothing in this document constitutes an offer to sell or a solicitation to buy securities in any jurisdiction where such offer, solicitation or sale is not permitted. The information contained herein is preliminary as of the date hereof, supersedes any such information previously delivered to you and will be superseded by any information subsequently delivered and ultimately by the final prospectus relating to the securities. These materials are subject to change, completion, supplement or amendment from time to time.

STATEMENT REGARDING ASSUMPTIONS AS TO SECURITIES, PRICING ESTIMATES AND OTHER INFORMATION

The attached information contains certain tables and other statistical analyses (the “Computational Materials”) which have been prepared in reliance upon information furnished by the Mortgage Loan Sellers. Numerous assumptions were used in preparing the Computational Materials, which may or may not be reflected herein. As such, no assurance can be given as to the Computational Materials’ accuracy, appropriateness or completeness in any particular context; or as to whether the Computational Materials and/or the assumptions upon which they are based reflect present market conditions or future market performance. The Computational Materials should not be construed as either projections or predictions or as legal, tax, financial or accounting advice. You should consult your own counsel, accountant and other advisors as to the legal, tax, business, financial and related aspects of a purchase of these securities. Any weighted average lives, yields and principal payment periods shown in the Computational Materials are based on prepayment and/or loss assumptions, and changes in such prepayment and/or loss assumptions may dramatically affect such weighted average lives, yields and principal payment periods. In addition, it is possible that prepayments or losses on the underlying assets will occur at rates higher or lower than the rates shown in the attached Computational Materials. The specific characteristics of the securities may differ from those shown in the Computational Materials due to differences between the final underlying assets and the preliminary underlying assets used in preparing the Computational Materials. The principal amount and designation of any security described in the Computational Materials are subject to change prior to issuance. None of RBS Securities Inc. (“RBSSI”), Wells Fargo Securities, LLC (“WFS”), Deutsche Bank Securities, Inc. or any of their respective affiliates make any representation or warranty as to the actual rate or timing of payments or losses on any of the underlying assets or the payments or yield on the securities. The information in this presentation is based upon management forecasts and reflects prevailing conditions and management’s views as of this date, all of which are subject to change. In preparing this presentation, we have relied upon and assumed, without independent verification, the accuracy and completeness of all information available from public sources or which was provided to us by or on behalf of the Mortgage Loan Sellers or which was otherwise reviewed by us.

This free writing prospectus contains certain forward-looking statements. If and when included in this free writing prospectus, the words “expects”, “intends”, “anticipates”, “estimates” and analogous expressions and all statements that are not historical facts, including statements about our beliefs or expectations, are intended to identify forward-looking statements. Any forward-looking statements are made subject to risks and uncertainties which could cause actual results to differ materially from those stated. Those risks and uncertainties include, among other things, declines in general economic and business conditions, increased competition, changes in demographics, changes in political and social conditions, regulatory initiatives and changes in customer preferences, many of which are beyond our control and the control of any other person or entity related to this offering. The forward-looking statements made in this free writing prospectus are made as of the date stated on the cover. We have no obligation to update or revise any forward-looking statement.

RBS is a trade name for the investment banking business of RBSSI. Securities, syndicated loan arranging, financial advisory and other investment banking activities are performed by RBSSI and their securities affiliates. Lending, derivatives and other commercial banking activities are performed by The Royal Bank of Scotland plc and their banking affiliates. RBSSI is a member of SIPC, FINRA and the NYSE.

Wells Fargo Securities is the trade name for the capital markets and investment banking services of Wells Fargo & Company and its subsidiaries, including Wells Fargo Securities, LLC, a member of FINRA, NYSE, NFA and SIPC, Wells Fargo Institutional Securities, LLC, a member of FINRA and SIPC, Wells Fargo Prime Services, LLC, a member of FINRA, NFA and SIPC and Wells Fargo Bank, N.A.

IRS CIRCULAR 230 NOTICE

THIS TERM SHEET IS NOT INTENDED OR WRITTEN TO BE USED, AND CANNOT BE USED, FOR THE PURPOSE OF AVOIDING U.S. FEDERAL, STATE OR LOCAL TAX PENALTIES. THIS TERM SHEET IS WRITTEN AND PROVIDED BY THE DEPOSITOR IN CONNECTION WITH THE PROMOTION OR MARKETING BY THE DEPOSITOR AND THE CO-LEAD BOOKRUNNING MANAGERS OF THE TRANSACTION OR MATTERS ADDRESSED HEREIN. INVESTORS SHOULD SEEK ADVICE BASED ON THEIR PARTICULAR CIRCUMSTANCES FROM AN INDEPENDENT TAX ADVISOR.

IMPORTANT NOTICE REGARDING THE OFFERED CERTIFICATES

The offered certificates referred to in these materials and the asset pool backing them are subject to modification or revision (including the possibility that one or more classes of certificates may be split, combined or eliminated at any time prior to issuance or availability of a final prospectus) and are offered on a “when, as and if issued” basis. Prospective investors should understand that, when considering the purchase of the offered certificates, a contract of sale will come into being no sooner than the date on which the relevant class of certificates has been priced and the underwriters have confirmed the allocation of certificates to be made to investors; any “indications of interest” expressed by any prospective investor, and any “soft circles” generated by the underwriters, will not create binding contractual obligations for such prospective investors, on the one hand, or the underwriters, the depositor or any of their respective agents or affiliates, on the other hand.

As a result of the foregoing, a prospective investor may commit to purchase certificates that have characteristics that may change, and each prospective investor is advised that all or a portion of the certificates referred to in these materials may be issued that differ from the characteristics described in these materials. The underwriters’ obligation to sell certificates to any prospective investor is conditioned on the certificates and the transaction having the characteristics described in these materials. If the underwriters determine that a condition is not satisfied in any material respect, such prospective investor will be notified, and neither the depositor nor the underwriters will have any obligation to such prospective investor to deliver any portion of the offered certificates which such prospective investor has committed to purchase, and there will be no liability between the underwriters, the depositor or any of their respective agents or affiliates, on the one hand, and such prospective investor, on the other hand, as a consequence of the non-delivery.

Each prospective investor has requested that the underwriters provide to such prospective investor information in connection with such prospective investor’s consideration of the purchase of the certificates described in these materials. These materials are being provided to each prospective investor for informative purposes only in response to such prospective investor’s specific request. The underwriters described in these materials may from time to time perform investment banking services for, or solicit investment banking business from, any company named in these materials. The underwriters and/or their affiliates or respective employees may from time to time have a long or short position in any security or contract discussed in these materials.

The information contained herein supersedes any previous such information delivered to any prospective investor and will be superseded by information delivered to such prospective investor prior to the time of sale.

IMPORTANT NOTICE RELATING TO AUTOMATICALLY-GENERATED EMAIL DISCLAIMERS

Any legends, disclaimers or other notices that may appear at the bottom of, or attached to, any email communication to which this free writing prospectus is attached relating to (1) these materials not constituting an offer (or a solicitation of an offer), (2) no representation that these materials are accurate or complete and may not be updated or (3) these materials possibly being confidential, are not applicable to these materials and should be disregarded. Such legends, disclaimers or other notices have been automatically generated as a result of these materials having been sent via Bloomberg or another system.

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

2

| | |

| WFRBS Commercial Mortgage Trust 2013-C15 | | Issue Characteristics |

| | | | | | | | | | | | | | | | |

| Class | | Expected Ratings

(Fitch/KBRA/Moody’s)(1) | | Approximate

Initial Certificate

Principal Balance

or Notional

Amount(2) | | Approx.

Initial Credit

Support(3) | | Pass-Through

Rate

Description | | Weighted

Average

Life

(Years)(4) | | Expected

Principal

Window(4) | | Certificate

Principal to

Value Ratio(5) | | Certificate

Principal

U/W NOI

Debt Yield(6) |

| | | Offered Certificates | | | | | | | | | | | | | | |

A-1 | | AAA(sf)/AAA(sf)/Aaa(sf) | | $60,151,000 | | 30.000% | | (7) | | 2.73 | | 9/13 - 7/18 | | 27.3% | | 21.1% |

A-2 | | AAA(sf)/AAA(sf)/Aaa(sf) | | $48,146,000 | | 30.000% | | (7) | | 4.94 | | 7/18 - 8/18 | | 27.3% | | 21.1% |

A-3 | | AAA(sf)/AAA(sf)/Aaa(sf) | | $260,000,000 | | 30.000% | | (7) | | 9.84 | | 5/23 - 7/23 | | 27.3% | | 21.1% |

A-4 | | AAA(sf)/AAA(sf)/Aaa(sf) | | $301,785,000 | | 30.000% | | (7) | | 9.90 | | 7/23 - 7/23 | | 27.3% | | 21.1% |

A-SB | | AAA(sf)/AAA(sf)/Aaa(sf) | | $104,819,000 | | 30.000% | | (7) | | 7.41 | | 8/18 - 5/23 | | 27.3% | | 21.1% |

A-S(8) | | AAA(sf)/AAA(sf)/Aaa(sf) | | $80,257,000 | | 22.750% | | (7) | | 9.92 | | 7/23 - 8/23 | | 30.2% | | 19.1% |

B(8) | | AA-(sf)/AA-(sf)/Aa3(sf) | | $74,723,000 | | 16.000% | | (7) | | 9.99 | | 8/23 - 8/23 | | 32.8% | | 17.6% |

C(8) | | A-(sf)/A-(sf)/A3(sf) | | $42,896,000 | | 12.125% | | (7) | | 9.99 | | 8/23 - 8/23 | | 34.3% | | 16.8% |

PEX(8) | | A-(sf)/A-(sf)/A1(sf) | | $197,876,000 | | 12.125% | | (7) | | 9.96 | | 7/23 - 8/23 | | 34.3% | | 16.8% |

X-A | | AAA(sf)/AAA(sf)/Aaa(sf) | | $855,158,000(9) | | NAP | | Variable(10) | | NAP | | NAP | | N/A | | N/A |

| | | | | | | |

| | | Non-Offered Certificates | | | | | | | | | | | | |

D | | BBB-(sf)/BBB-(sf)/NR(sf) | | $62,269,000 | | 6.500% | | (7) | | 9.99 | | 8/23 - 8/23 | | 36.5% | | 15.8% |

E | | BB(sf)/BB(sf)/NR(sf) | | $22,140,000 | | 4.500% | | (7) | | 9.99 | | 8/23 - 8/23 | | 37.3% | | 15.5% |

F | | B(sf)/B(sf)/NR(sf) | | $11,070,000 | | 3.500% | | (7) | | 9.99 | | 8/23 - 8/23 | | 37.7% | | 15.3% |

G | | NR/NR/NR | | $38,745,430 | | 0.000% | | (7) | | 10.46 | | 8/23 - 8/28 | | 39.1% | | 14.8% |

Notes:

| | (1) | The expected ratings presented are those of Fitch, Inc. (“Fitch”), Kroll Bond Ratings Agency, Inc. (“KBRA”) and Moody’s Investors Service, Inc. (“Moody’s”), which the depositor hired to rate the rated offered certificates. One or more other nationally recognized statistical ratings organizations, as defined in Section 3(a)(62) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), that were not hired by the depositor may use information they receive pursuant to Rule 17g-5 under the Securities Exchange Act or otherwise to rate or provide market reports and/or published commentary related to the offered certificates. We cannot assure you as to what ratings a non-hired nationally recognized statistical rating organization would assign or that its reports will not express differing, possibly negative, views of the mortgage loans and/or the offered certificates. See “Risk Factors–Risks Related to the Offered Certificates–Nationally Recognized Statistical Rating Organizations May Assign Different Ratings to the Certificates; Ratings of the Certificates Reflect Only the Views of the Applicable Rating Agencies as of the Dates Such Ratings Were Issued; Ratings May Affect ERISA Eligibility; Ratings May be Downgraded” in the free writing prospectus, dated July 29, 2013 (the “Free Writing Prospectus”). |

| | (2) | The principal balances and notional amounts set forth in the table are approximate. The actual initial principal balances and notional amounts may be larger or smaller depending on the aggregate cut-off date principal balance of the mortgage loans definitively included in the pool of mortgage loans, which aggregate cut-off date principal balance may be as much as 5% larger or smaller than the amount presented in the Free Writing Prospectus. |

| | (3) | The approximate initial credit support with respect to the Class A-1, A-2, A-3, A-4 and A-SB Certificates represents the approximate credit enhancement for the Class A-1, A-2, A-3, A-4 and A-SB Certificates in the aggregate. The Initial Subordination Level for the Class C and PEX certificates are equal to the Subordination Amount of the Class C regular interest. |

| | (4) | Weighted Average Lives and Expected Principal Windows are calculated based on an assumed prepayment rate of 0% CPR and the “Structuring Assumptions” described on Annex D to the Free Writing Prospectus. |

| | (5) | The Certificate Principal to Value Ratio for each Class of Certificates (other than the Class A-1, A-2, A-3, A-4, A-SB and X-A) is calculated by dividing the aggregate principal balance of such class of certificates and all classes of certificates (other than Class X-A) senior to such class by the aggregate appraised value of $2,833,587,130 (calculated as described in the Free Writing Prospectus) of the mortgaged properties securing the mortgage loans (excluding, with respect to the Augusta Mall and Carolina Place loan combinations, a pro rata portion of the related appraised value allocated to the related companion loan based on its cut-off date principal balance). The Certificate Principal to Value Ratios for each of the Class A-1, A-2, A-3, A-4 and A-SB Certificates are calculated by dividing the aggregate principal balance of the Class A-1, A-2, A-3, A-4 and A-SB Certificates by such aggregate appraised value (excluding, with respect to the Augusta Mall and Carolina Place loan combinations, a pro rata portion of the related appraised value allocated to the related companion loan based on its cut-off date principal balance). However, excess mortgaged property value associated with a mortgage loan will not be available to offset losses on any other mortgage loan (unless such mortgage loans are cross-collateralized and the cross-collateralization remains in effect). |

| | (6) | The Certificate Principal U/W NOI Debt Yield for each Class of Certificates (other than the Class A-1, A-2, A-3, A-4, A-SB and X-A) is calculated by dividing the underwritten net operating income (which excludes, with respect to the Augusta Mall and Carolina Place loan combinations, a pro rata portion of the related underwritten net operating income allocated to the related companion loan based on its cut-off date principal balance) for the mortgage pool of $163,383,262 (calculated as described in the Free Writing Prospectus) by the aggregate principal balance of such class of certificates and all classes of certificates (other than Class X-A) senior to such class of certificates. The Certificate Principal U/W NOI Debt Yield for each of the Class A-1, A-2, A-3, A-4 and A-SB Certificates is calculated by dividing such mortgage pool underwritten net operating income (which excludes, with respect to the Augusta Mall and Carolina Place loan combinations, a pro rata portion of the related underwritten net operating income allocated to the related companion loan based on its cut-off date principal balance) by the aggregate principal balance of the Class A-1, A-2, A-3, A-4 and A-SB Certificates. However, cash flow from each mortgaged property supports only the related mortgage loan and will not be available to support any other mortgage loan (unless such mortgage loans are cross-collateralized and the cross-collateralization remains in effect). |

| | (7) | The pass-through rates for the Class A-1, A-2, A-3, A-4, A-SB, D, E, F and G Certificates and the Class A-S, B and C regular interests, in each case, will be one of the following: (i) a fixed rate per annum, (ii) the WAC Rate (as defined in the Free Writing Prospectus) for the related distribution date, (iii) a variable rate per annum equal to the lesser of (a) a fixed rate and (b) the WAC Rate for the related distribution date or (iv) a variable rate per annum equal to the WAC Rate for the related distribution date minus a specified percentage. The Class PEX Certificates will not have a pass-through rate, but will be entitled to receive the sum of the interest distributable on the percentage interests of the Class A-S, B and C regular interests represented by the Class PEX Certificates. The pass-through rates on the Class A-S, B and C certificates will at all times be the same as the pass-through rates of the Class A-S, B and C regular interests. |

| | (8) | The Class A-S, Class B, Class C and Class PEX Certificates are “Exchangeable Certificates”. On the closing date, the upper-tier REMIC of the issuing entity will issue the Class A-S, Class B and Class C regular interests (each a “regular interest”) which will have outstanding principal balances on the closing date of $80,257,000, $74,723,000 and $42,896,000, respectively. The regular interests will be held in a grantor trust for the benefit of the holders of the Class A-S, Class B, Class C and Class PEX Certificates. The Class A-S, Class B, Class C and Class PEX Certificates will, at all times, represent undivided beneficial ownership interests in a grantor trust that will hold those regular interests. Each class of the Class A-S, Class B, Class C and Class PEX Certificates will, at all times, represent an undivided beneficial ownership interest in a percentage of the outstanding certificate principal balances of the Class A-S, Class B and Class C regular interests. Following any exchange of Class A-S, Class B and Class C Certificates for Class PEX Certificates or any exchange of Class PEX Certificates for Class A-S, Class B and Class C Certificates as described in the Free Writing Prospectus, the percentage interest of the outstanding certificate principal balances of the Class A-S, Class B and Class C regular interest that is represented by the Class A-S, Class B, Class C and Class PEX Certificates will be increased or decreased accordingly. The initial certificate principal balance of each of the Class A-S, Class B and Class C Certificates shown in the table represents the maximum certificate principal balance of such class without giving effect to any issuance of Class PEX certificates. The initial certificate principal balance of the Class PEX Certificates shown in the table is equal to the aggregate of the maximum initial Certificate Principal Balance of the Class A-S, Class B |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

3

| | |

| WFRBS Commercial Mortgage Trust 2013-C15 | | Issue Characteristics |

| | and Class C Certificates, representing the maximum certificate principal balance of the Class PEX Certificates that could be issued in an exchange. The certificate principal balances of the Class A-S, Class B and Class C Certificates to be issued on the closing date will be reduced, in required proportions, by an amount equal to the certificate principal balance of the Class PEX Certificates issued on the closing date. Distributions and allocations of payments and losses with respect to the Exchangeable Certificates are described in this Term Sheet under “Allocations and Distributions on the Class A-S, Class B, Class C and Class PEX Certificates” and under “Description of the Offered Certificates—Distributions” in the Free Writing Prospectus. The maximum certificate principal balance of the Class PEX Certificates is set forth in the table but is not included in the certificate principal balance of the certificates set forth on the cover page of this Term Sheet or on the top of the cover page of the Free Writing Prospectus. |

| | (9) | The Class X-A Certificates are notional amount certificates. The Notional Amount of the Class X-A Certificates will be equal to the aggregate principal balance of the Class A-1, A-2, A-3, A-4, A-SB Certificates and the Class A-S regular interest outstanding from time to time. The Class X-A Certificates will not be entitled to distributions of principal. |

| | (10) | The pass-through rate for the Class X-A Certificates for any distribution date will be a perannum rate equal to the excess, if any, of (a) the WAC Rate for the related distribution date, over (b) the weighted average of the pass-through rates on the Class A-1, A-2, A-3, A-4 and A-SB Certificates and the A-S regular interest for the related distribution date, weighted on the basis of their respective aggregate principal balances outstanding immediately prior to that distribution date. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

4

| | |

| WFRBS Commercial Mortgage Trust 2013-C15 | | Issue Characteristics |

| II. | Transaction Highlights |

Mortgage Loan Sellers:

| | | | | | | | | | | | |

Mortgage Loan Seller | | Number of

Mortgage

Loans | | Number of

Mortgaged

Properties | | Aggregate Cut-off

Date Balance | | % of Cut-off

Date Pool

Balance |

| | | | | |

The Royal Bank of Scotland(1) | | 12 | | 14 | | | $475,138,887 | | | | | 42.9% |

| | | | | |

Wells Fargo Bank, National Association | | 19 | | 56 | | | 345,599,436 | | | | | 31.2 |

| | | | | |

NCB, FSB | | 24 | | 24 | | | 104,081,895 | | | | | 9.4 |

| | | | | |

Liberty Island Group I LLC | | 8 | | 12 | | | 72,589,554 | | | | | 6.6 |

| | | | | |

C-III Commercial Mortgage LLC | | 17 | | 18 | | | 67,678,094 | | | | | 6.1 |

| | | | | |

Basis Real Estate Capital II, LLC | | 6 | | 12 | | | 41,913,563 | | | | | 3.8 |

| | | | | | | | | | | | |

| | | | | |

Total | | 86 | | 136 | | | $1,107,001,430 | | | | | 100.0% |

| | | | | | | | | | | | |

| | | | |

(1) | | The mortgage loan seller referred to herein as The Royal Bank of Scotland is comprised of two affiliated companies: The Royal Bank of Scotland plc and RBS Financial Products Inc. With respect to the mortgage loans being sold for deposit into the trust by The Royal Bank of Scotland: (a) 9 mortgage loans, having an aggregate cut-off date principal balance of $266,468,887 and representing approximately 24.1% of the aggregate principal balance of the pool of mortgage loans as of the cut-off date, were originated, and are being sold to the issuing entity, only by The Royal Bank of Scotland plc, (b) 2 mortgage loans, having an aggregate cut-off date principal balance of $104,900,000 and representing approximately 9.5% of the aggregate principal balance of the pool of mortgage loans as of the cut-off date, were originated, and are being sold to the issuing entity, only by RBS Financial Products Inc. and (c) 1 mortgage loan, having an aggregate cut-off date principal balance of $103,770,000 and representing approximately 9.4% of the aggregate principal balance of the pool of mortgage loans as of the cut-off date, was co-originated, and is being sold to the issuing entity, by The Royal Bank of Scotland plc and RBS Financial Products Inc. | | |

Loan Pool:

| | | | |

Cut-off Date Balance: | | | $1,107,001,430 | |

Number of Mortgage Loans: | | | 86 | |

Average Cut-off Date Balance per Mortgage Loan: | | | $12,872,110 | |

Number of Mortgaged Properties: | | | 136 | |

Average Cut-off Date Balance per Mortgaged Property(1): | | | $8,139,716 | |

Weighted Average Mortgage Interest Rate: | | | 4.526% | |

Ten Largest Mortgage Loans as % of Cut-off Date Pool Balance: | | | 56.2% | |

Weighted Average Original Term to Maturity or ARD (months): | | | 118 | |

Weighted Average Remaining Term to Maturity or ARD (months): | | | 117 | |

Weighted Average Original Amortization Term (months)(2): | | | 347 | |

Weighted Average Remaining Amortization Term (months)(2): | | | 347 | |

Weighted Average Seasoning (months): | | | 1 | |

| | | | |

| (1) | | Information regarding mortgage loans secured by multiple properties is based on an allocation according to relative appraised values or the allocated loan amounts or property-specific release prices set forth in the related loan documents or such other allocation as the related mortgage loan seller deemed appropriate. | | |

| | |

| (2) | | Excludes any mortgage loan that does not amortize. | | |

Credit Statistics:

| | | | |

Weighted Average U/W Net Cash Flow DSCR(1): | | | 2.49x | |

Weighted Average U/W Net Operating Income Debt Yield Ratio(1): | | | 14.8% | |

Weighted Average Cut-off Date Loan-to-Value Ratio(1): | | | 61.0% | |

Weighted Average Balloon or ARD Loan-to-Value Ratio(1): | | | 52.1% | |

% of Mortgage Loans with Additional Subordinate Debt(2): | | | 8.3% | |

% of Mortgage Loans with Single Tenants(3): | | | 12.2% | |

| | | | |

(1) | | With respect to the Augusta Mall and Carolina Place mortgage loans, loan-to-value ratio, debt service coverage ratio, debt yield and cut-off date balance per unit of measure calculations include the relatedpari passu companion loan (unless otherwise stated) in total debt. The information for each mortgaged property that relates to a mortgage loan that is cross-collateralized with other mortgage loans is based upon the principal balance of that mortgage loan, except that the applicable loan-to-value ratio, debt service coverage ratio, debt yield or cut-off date balance per unit of measure for each such mortgaged property is based upon the ratio, yield or balance (as applicable) for the aggregate indebtedness evidenced by all loans in the group. On an individual basis, without regard to the cross-collateralization feature, any mortgaged property securing a mortgage loan that is part of a cross-collateralized group of mortgage loans may have a higher loan-to-value ratio, lower debt service coverage ratio and/or lower debt yield than is presented herein. The DSCR and Debt Yield information for each residential cooperative mortgage loan is calculated using underwritten net cash flow for the related residential cooperative property which is the projected net cash flow reflected in the most recent appraisal obtained by or otherwise in the possession of the related mortgage loan seller as of the cut-off date, and the loan-to value ratio information for each residential cooperative mortgage loan is based upon the appraised value of the residential cooperative property determined as if such residential cooperative property is operated as a residential cooperative. See Annex A to the Free Writing Prospectus. Debt service coverage ratio, debt yield and loan-to-value ratio information takes no account of subordinate debt (whether or not secured by the mortgaged property), if any, that is allowed under the terms of any mortgage loan. | | |

| | |

(2) | | Eighteen (18) of the mortgage loans, each of which are secured by residential cooperative properties, currently have in place subordinate secured lines of credit to the related mortgage borrowers that permit future advances (such loans, collectively, the “Subordinate Coop LOCs”). The percentage figure expressed as “% of Mortgage loans with Additional Subordinate Debt” is determined as a percentage of cut-off date principal balance and does not take into account future subordinate debt (whether or not secured by the mortgaged property), if any, that may be permitted under the terms of any mortgage loan or the Pooling and Servicing Agreement. See “Description of the Mortgage Pool—Subordinate and/or Other Financing” and “—Additional Debt Financing for Mortgage Loans Secured by Residential Cooperatives” in the Free Writing Prospectus. | | |

| | |

(3) | | Excludes mortgage loans that are secured by multiple single-tenant properties with different tenants at such properties. | | |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

5

| | |

| WFRBS Commercial Mortgage Trust 2013-C15 | | Issue Characteristics |

Loan Structural Features:

Amortization: Based on the Cut-off Date Pool Balance, 87.4% of the mortgage pool (81 mortgage loans) has scheduled amortization, as follows:

47.8% (69 mortgage loans) requires amortization during the entire loan term

39.5% (12 mortgage loans) provides for an interest-only period followed by an amortization period

Interest-Only: Based on the Cut-off Date Pool Balance, 12.6% of the mortgage pool (5 mortgage loans) provides for interest-only payments during the entire loan term. The Weighted Average Cut-off Date Loan-to-Value Ratio and Weighted Average U/W Net Cash Flow DSCR for those mortgage loans is 57.0% and 5.49x, respectively.

Hard Lockboxes: Based on the Cut-off Date Pool Balance, 59.3% of the mortgage pool (23 mortgage loans) has hard lockboxes in place.

Reserves: The mortgage loans require amounts to be escrowed monthly as follows (excluding any mortgage loans with springing provisions):

| | | | |

| | | | | |

Real Estate Taxes: | | 50.4% of the pool | |

Insurance Premiums: | | 22.0% of the pool | |

Capital Replacements: | | 47.0% of the pool | |

TI/LC: | | 26.7% of the pool(1) | |

| | | | |

(1) | | The percentage of Cut-off Date Balance for loans with TI/LC reserves is based on the aggregate principal balance allocable to office, retail and mixed use properties. | | |

Call Protection/Defeasance: Based on the Cut-off Date Pool Balance, the mortgage pool has the following call protection and defeasance features:

66.5% of the mortgage pool (52 mortgage loans) features a lockout period, then defeasance only until an open period

13.9% of the mortgage pool (6 mortgage loans) features a lockout period, then the greater of a prepayment premium or yield maintenance until an open period

9.4% of the mortgage pool (24 mortgage loans) features no lockout period, but requires the greater of a prepayment premium or yield maintenance for a period, then a prepayment premium until an open period

9.0% of the mortgage pool (3 mortgage loans) features a lockout period, then the greater of a prepayment premium or yield maintenance, then defeasance or the greater of a prepayment premium or yield maintenance until an open period

1.3% of the mortgage pool (1 mortgage loan) features a lockout period, then defeasance or the greater of a prepayment premium or yield maintenance until an open period

Please refer to Annex A to the Free Writing Prospectus for further description of individual loan call protection.

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

6

| | |

| WFRBS Commercial Mortgage Trust 2013-C15 | | Issue Characteristics |

| III. | Issue Characteristics |

| | | | | | |

| | | | Securities Offered: | | $972,777,000 approximate monthly pay, multi-class, commercial mortgage REMIC pass-through certificates consisting of eight classes (Classes A-1, A-2, A-3, A-4, A-SB, A-S, B, C, PEX and X-A), which are offered pursuant to a registration statement filed with the SEC. |

| | | |

| | | | Mortgage Loan Sellers: | | The Royal Bank of Scotland (“RBS”); Wells Fargo Bank, National Association (“WFB”); NCB, FSB; Liberty Island Group I LLC (“LIG I”); C-III Commercial Mortgage LLC (“CIIICM”) and Basis Real Estate Capital II, LLC (“Basis”) |

| | | |

| | | | Co-lead Bookrunning Managers: | | RBS Securities Inc. and Wells Fargo Securities, LLC |

| | | |

| | | | Co-Manager: | | Deutsche Bank Securities Inc. |

| | | |

| | | | Rating Agencies: | | Fitch, Inc., Kroll Bond Rating Agency, Inc. and Moody’s Investors Service, Inc. |

| | | |

| | | | Master Servicers: | | Wells Fargo Bank, National Association and NCB, FSB |

| | | |

| | | | Special Servicers: | | CWCapital Asset Management LLC and NCB, FSB |

| | | |

| | | | Certificate Administrator: | | Wells Fargo Bank, National Association |

| | | |

| | | | Trustee: | | U.S. Bank National Association |

| | | |

| | | | Trust Advisor: | | Trimont Real Estate Advisors, Inc. |

| | | |

| | | | Cut-off Date: | | The Cut-off Date with respect to each mortgage loan is the due date for the monthly debt service payment that is due in August 2013 (or, in the case of any mortgage loan that has its first due date in September 2013, the date that would have been its due date in August 2013 under the terms of that mortgage loan if a monthly debt service payment were scheduled to be due in that month). |

| | | |

| | | | Expected Closing Date: | | On or about August 20, 2013. |

| | | |

| | | | Determination Dates: | | The eleventh day of each month (or if that day is not a business day, the next succeeding business day), commencing in September 2013. |

| | | |

| | | | Distribution Dates: | | The fourth business day following the Determination Date in each month, commencing in September 2013. |

| | | |

| | | | Rated Final Distribution Date: | | The Distribution Date in August 2046. |

| | | |

| | | | Interest Accrual Period: | | With respect to any Distribution Date, the calendar month preceding the month in which such Distribution Date occurs. |

| | | |

| | | | Day Count: | | The Offered Certificates will accrue interest on a 30/360 basis. |

| | | |

| | | | Minimum Denominations: | | $10,000 for each Class of Offered Certificates (other than the X-A) and $1,000,000 for the X-A Certificates. Investments may also be made in any whole dollar denomination in excess of the applicable minimum denomination. |

| | | |

| | | | Clean-up Call: | | 1% |

| | | |

| | | | Delivery: | | DTC, Euroclear and Clearstream Banking |

| | | |

| | | | ERISA/SMMEA Status: | | Each Class of Offered Certificates is expected to be eligible for exemptive relief under ERISA. No Class of Offered Certificates will be SMMEA eligible. |

| | | |

| | | | Risk Factors: | | THE CERTIFICATES INVOLVE CERTAIN RISKS AND MAY NOT BE SUITABLE FOR ALL INVESTORS. SEE THE “RISK FACTORS” SECTION OF THE FREE WRITING PROSPECTUS. |

| | | |

| | | | Bond Analytics Information: | | The Certificate Administrator will be authorized to make distribution date settlements, CREFC reports and certain supplemental reports (other than confidential information) available to certain financial modeling and data provision services, including Bloomberg Financial Markets L.P., Trepp LLC, Intex Solutions, Inc., Markit Group Limited, Interactive Data Corp. and BlackRock Financial Management Inc. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

7

| | |

| WFRBS Commercial Mortgage Trust 2013-C15 | | Characteristics of the Mortgage Pool |

| IV. | Characteristics of the Mortgage Pool(1) |

| A. | Ten Largest Mortgage Loans |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Mortgage Loan

Seller | | Mortgage Loan Name | | City | | State | | Number of

Mortgage Loans /

Mortgaged

Properties | | Mortgage Loan

Cut-off Date

Balance ($) | | | % of Cut-off

Date

Pool

Balance

(%) | | | Property

Type | | Number of

SF or

Rooms | | Cut-off Date

Balance

Per Unit of

Measure ($) | | Cut-off Date

LTV Ratio

(%) | | | Balloon or

ARD LTV

Ratio (%) | | | U/W NCF

DSCR (x) | | | U/W NOI

Debt Yield

(%) | |

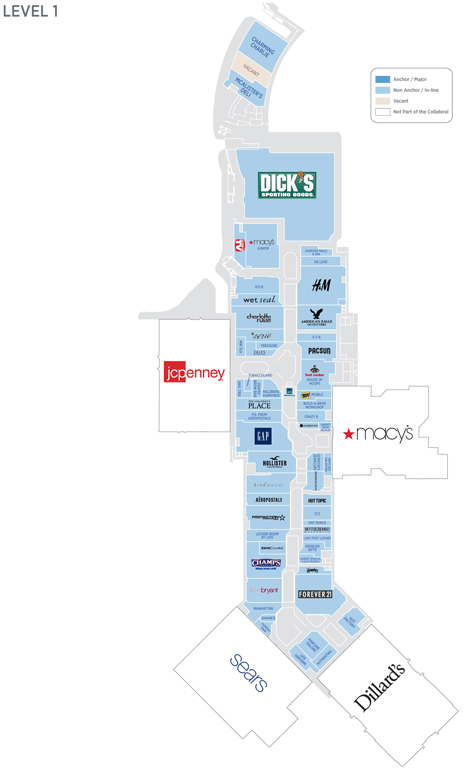

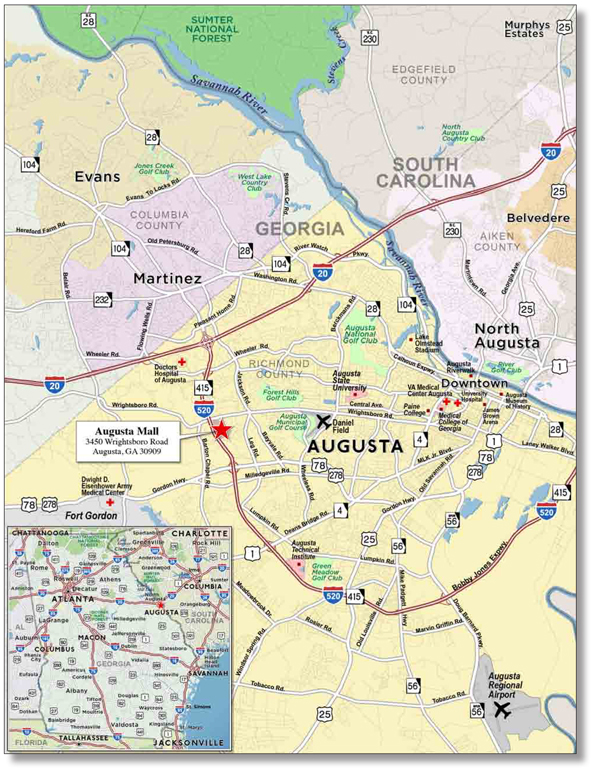

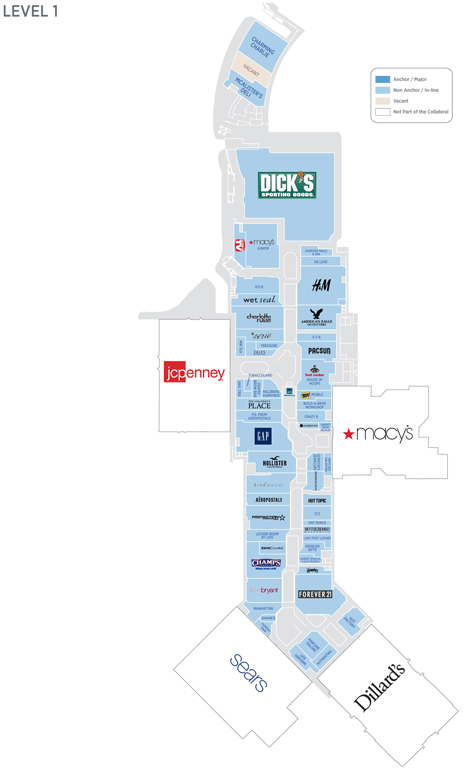

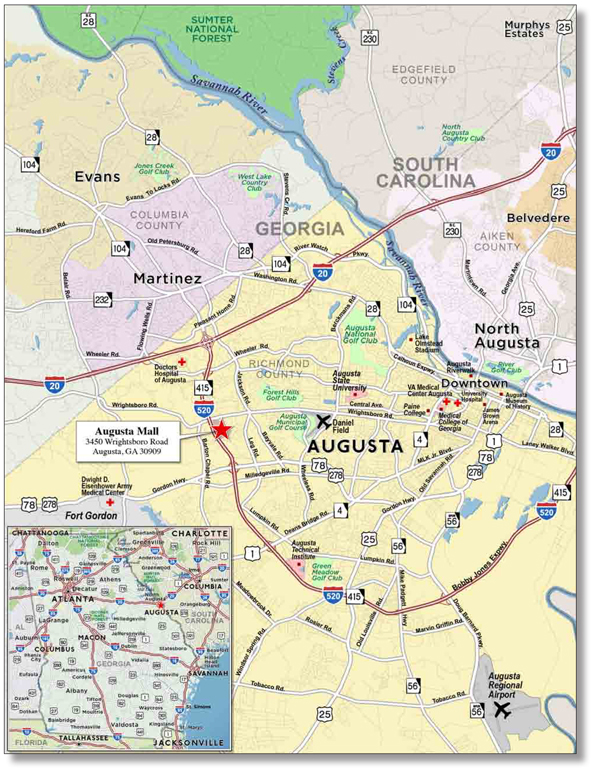

WFB | | Augusta Mall | | Augusta | | GA | | 1 / 1 | | | $110,000,000 | | | | 9.9% | | | Retail | | 500,222 | | $340 | | | 68.0% | | | | 68.0% | | | | 2.25x | | | | 10.4% | |

RBS | | Molina Office Portfolio | | Various | | Various | | 1 / 2 | | | 103,770,000 | | | | 9.4 | | | Office | | 621,446 | | 167 | | | 65.4 | | | | 59.7 | | | | 1.77 | | | | 11.2 | |

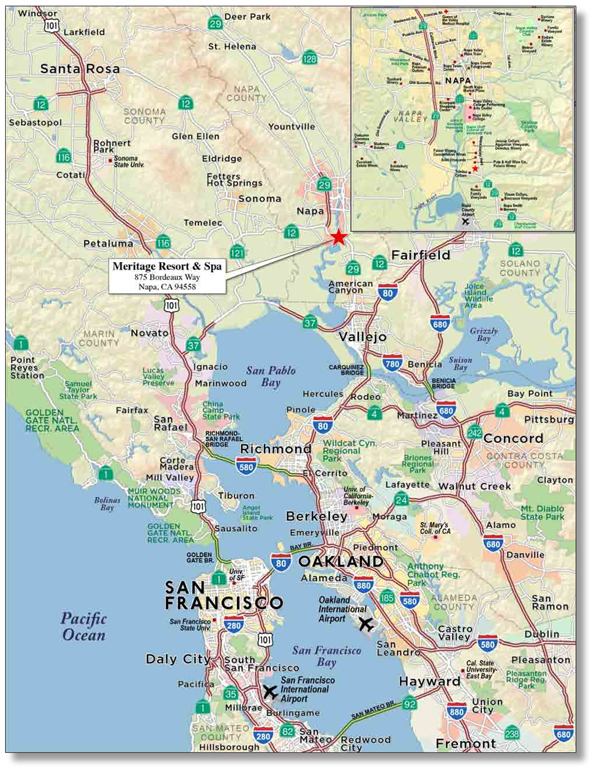

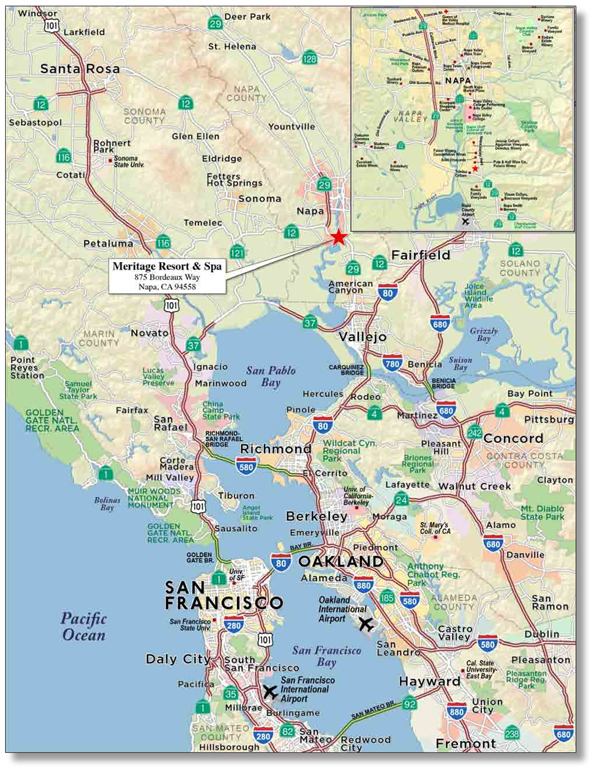

RBS | | Meritage Resort & Spa | | Napa | | CA | | 1 / 1 | | | 92,000,000 | | | | 8.3 | | | Hospitality | | 319 | | 288,401 | | | 62.7 | | | | 51.8 | | | | 1.60 | | | | 11.9 | |

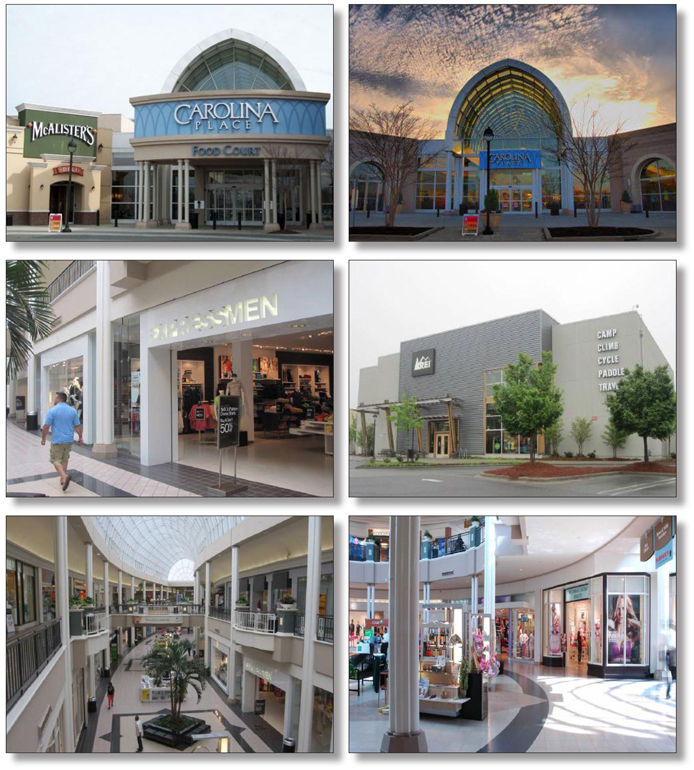

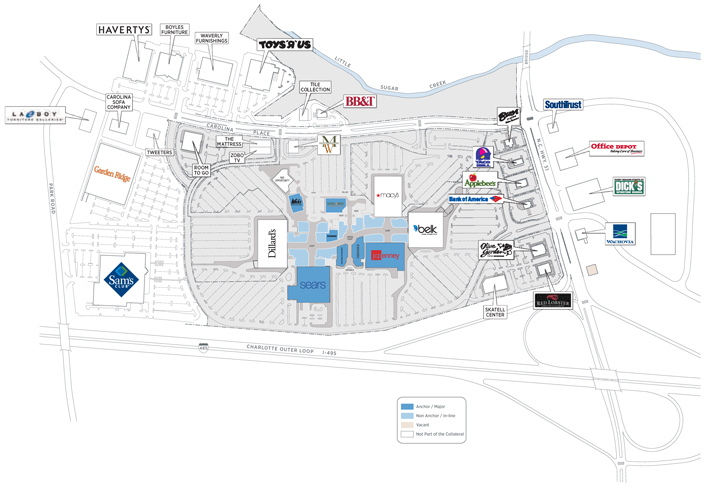

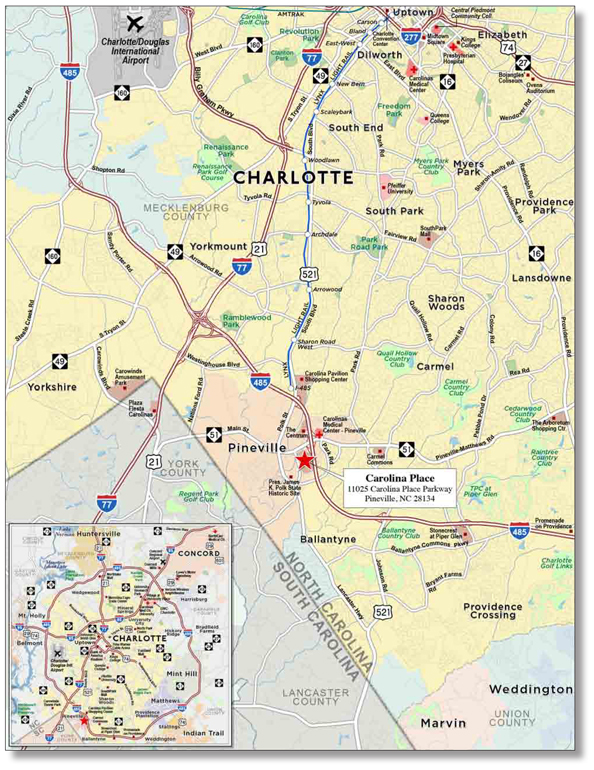

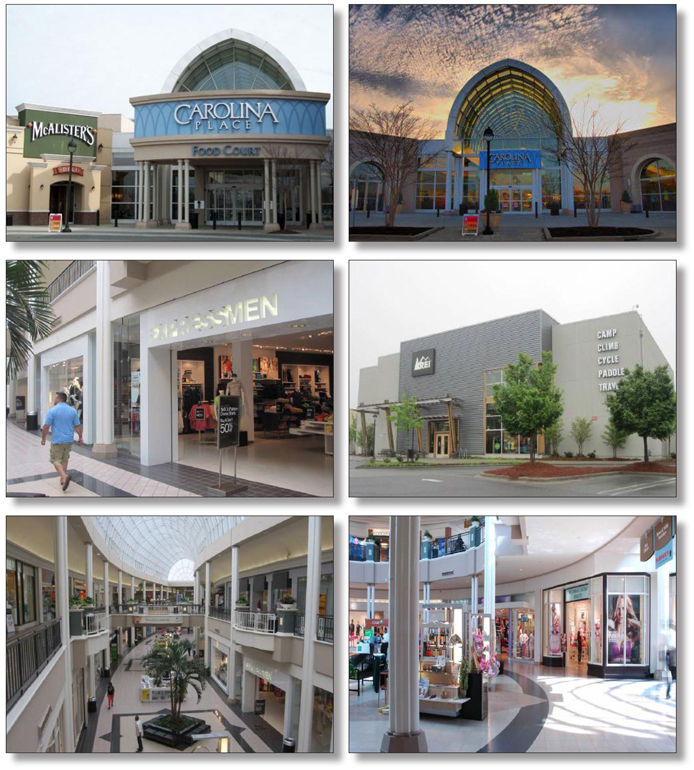

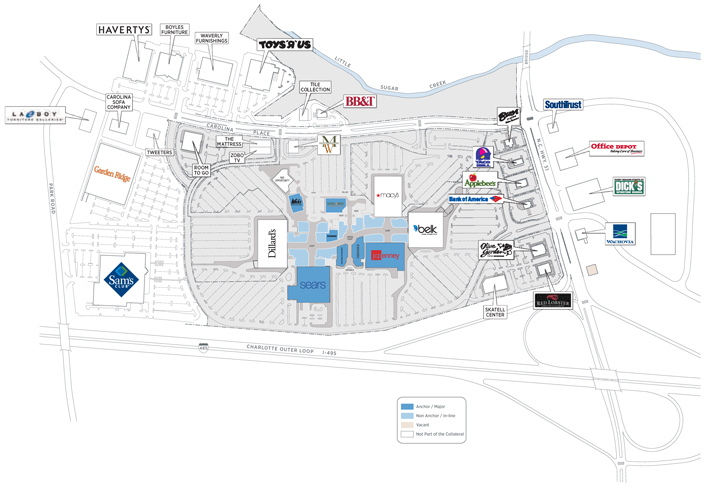

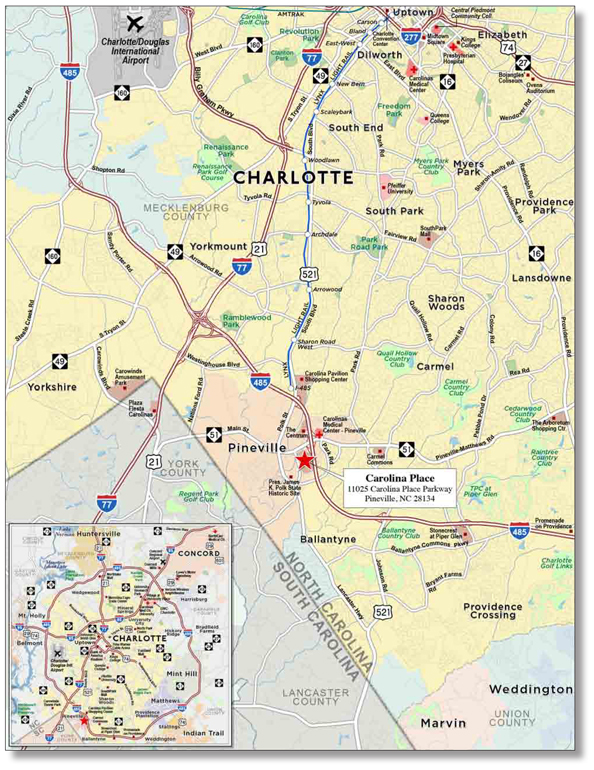

RBS | | Carolina Place | | Pineville | | NC | | 1 / 1 | | | 85,000,000 | | | | 7.7 | | | Retail | | 647,511 | | 270 | | | 66.5 | | | | 57.3 | | | | 1.71 | | | | 10.1 | |

RBS | | Kitsap Mall | | Silverdale | | WA | | 1 / 1 | | | 77,300,000 | | | | 7.0 | | | Retail | | 533,480 | | 145 | | | 69.6 | | | | 64.9 | | | | 1.70 | | | | 10.7 | |

WFB | | SecurCare Self Storage | | Various | | Various | | 1 / 24 | | | 41,104,000 | | | | 3.7 | | | Self Storage | | 1,040,619 | | 40 | | | 73.4 | | | | 58.7 | | | | 1.44 | | | | 10.2 | |

| | Portfolio | | | | | | | | | | | | |

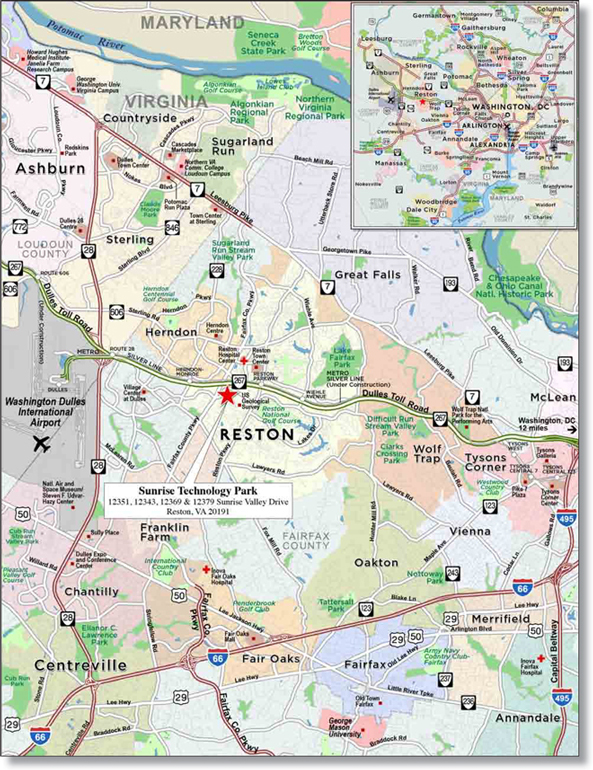

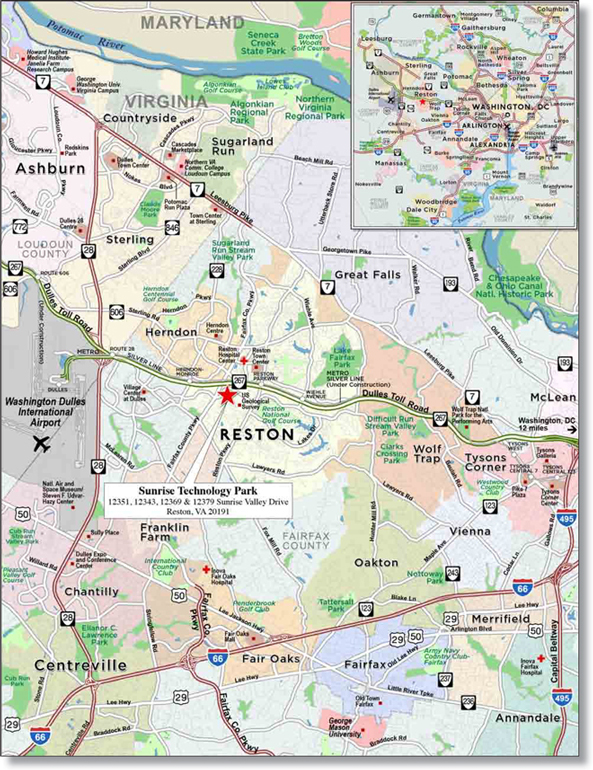

RBS | | Sunrise Technology Park | | Reston | | VA | | 1 / 1 | | | 40,430,000 | | | | 3.7 | | | Office | | 315,579 | | 128 | | | 65.0 | | | | 54.3 | | | | 1.83 | | | | 11.3 | |

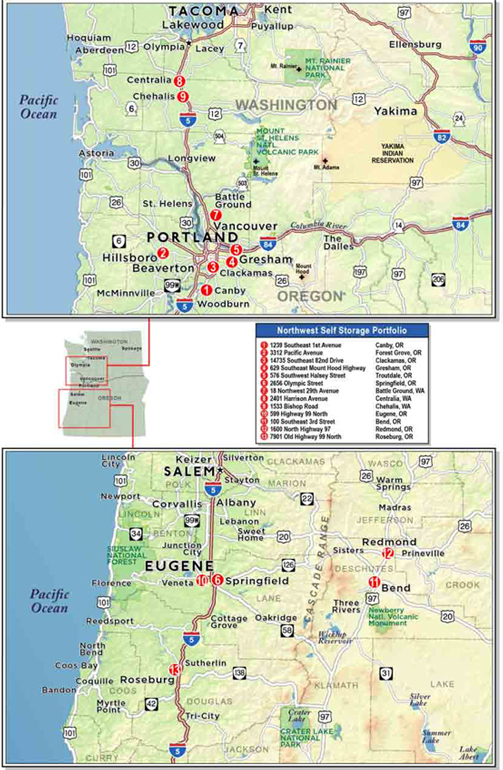

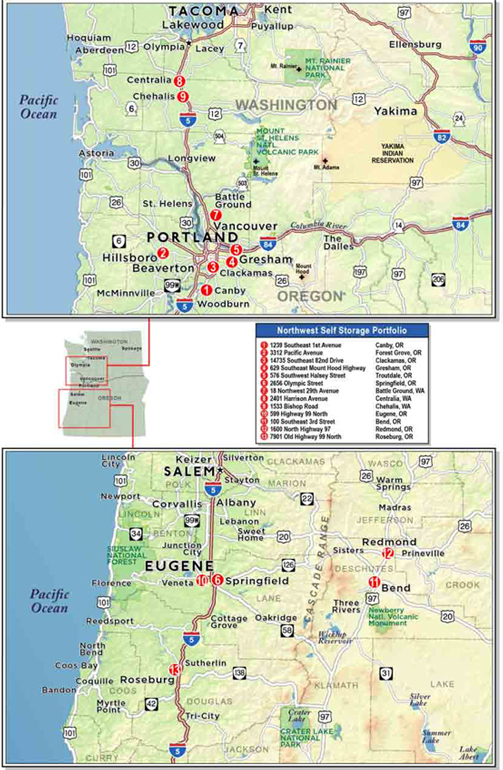

WFB | | Northwest Self Storage | | Various | | Various | | 1 / 13 | | | 27,084,000 | | | | 2.4 | | | Self Storage | | 563,685 | | 48 | | | 73.4 | | | | 58.8 | | | | 1.41 | | | | 9.8 | |

| | Portfolio | | | | | | | | | | | | |

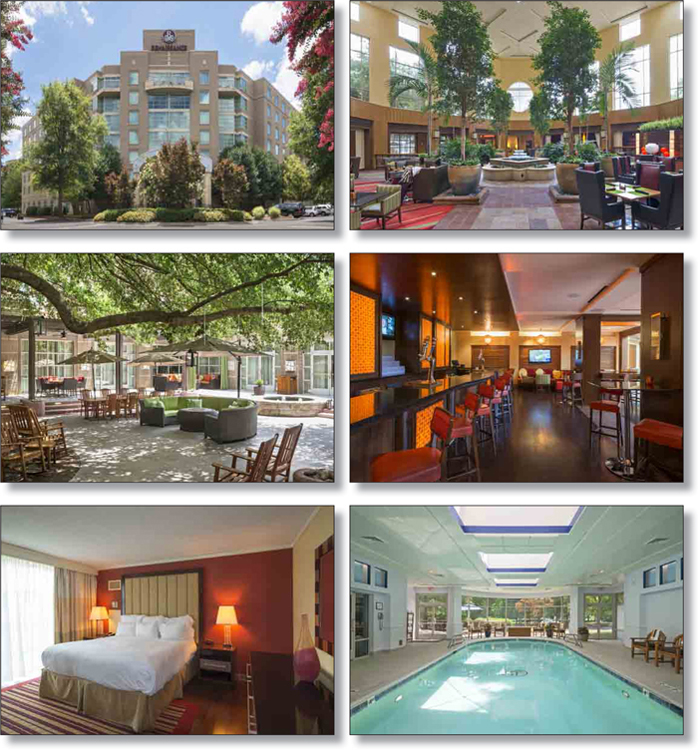

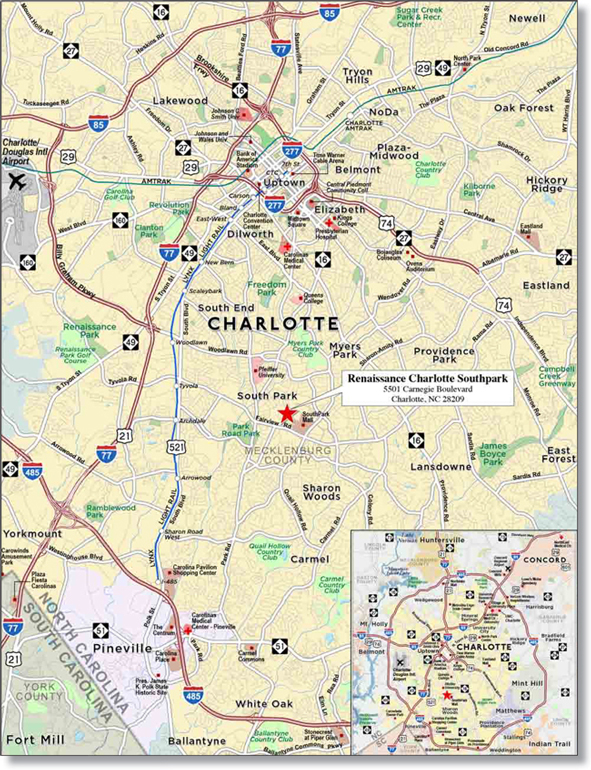

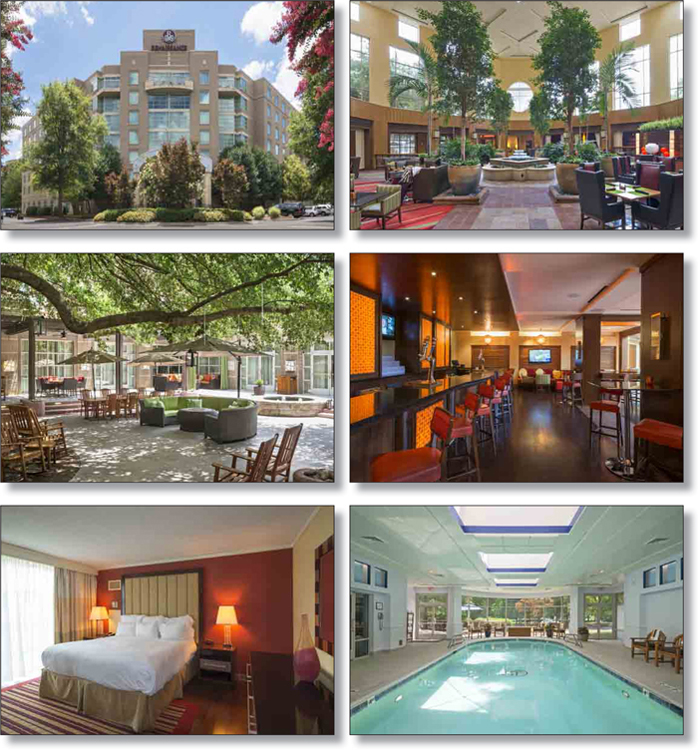

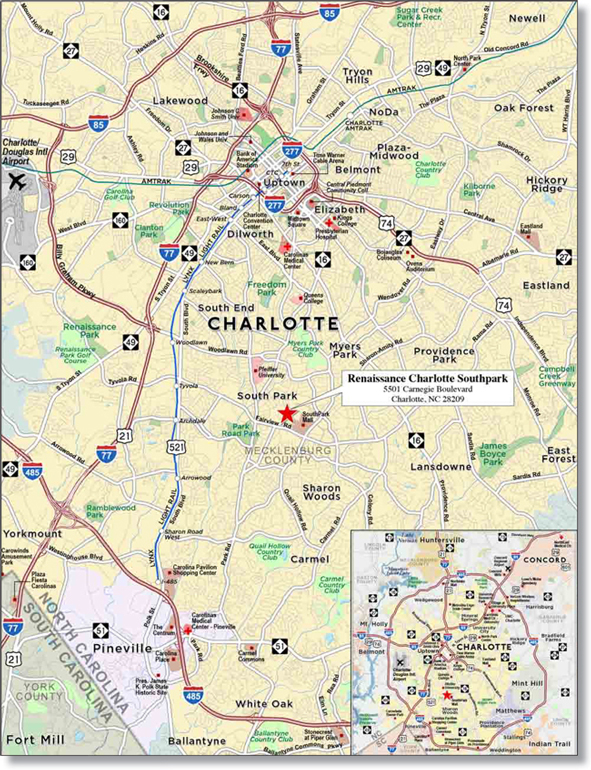

WFB | | Renaissance Charlotte | | Charlotte | | NC | | 1 / 1 | | | 23,975,328 | | | | 2.2 | | | Hospitality | | 264 | | 90,816 | | | 62.1 | | | | 51.4 | | | | 1.67 | | | | 13.7 | |

| | Southpark | | | | | | | | | | | | |

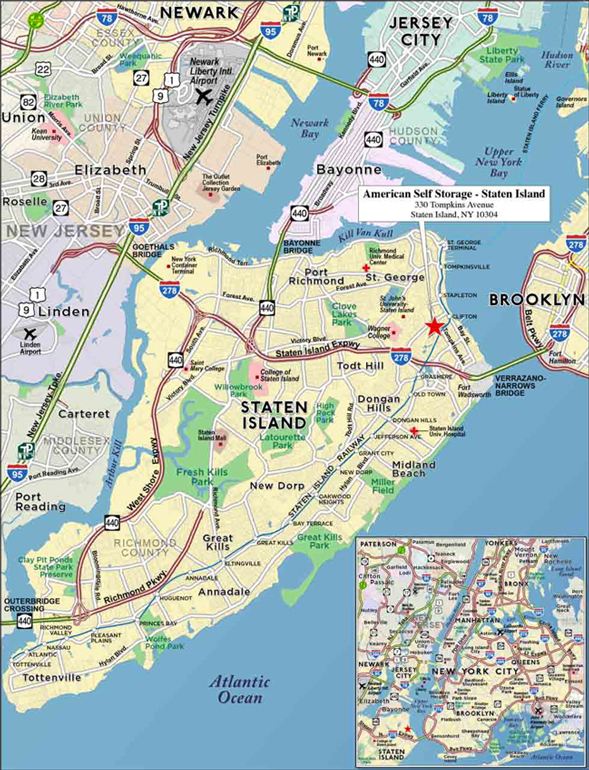

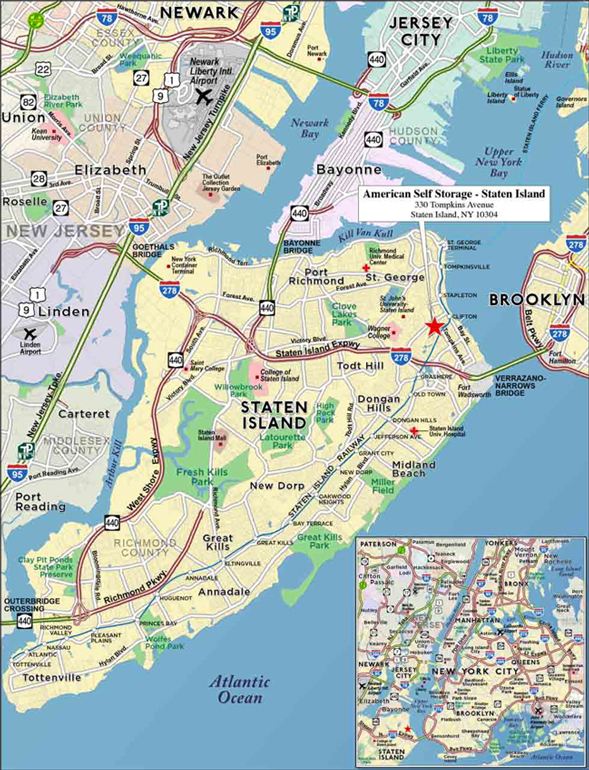

RBS | | American Self Storage | | Staten Island | | NY | | 1 / 1 | | | 20,948,223 | | | | 1.9 | | | Self Storage | | 165,103 | | 127 | | | 65.5 | | | | 53.2 | | | | 1.34 | | | | 8.6 | |

| | - Staten Island | | | | | | | | | | | | |

Top Three Total/Weighted Average | | | | 3 / 4 | | | $305,770,000 | | | | 27.6% | | | | | | | | | | 65.5% | | | | 60.3% | | | | 1.89x | | | | 11.1% | |

Top Five Total/Weighted Average | | 5 / 6 | | | $468,070,000 | | | | 42.3% | | | | | | | | | | 66.4% | | | | 60.5% | | | | 1.83x | | | | 10.9% | |

Top Ten Total/Weighted Average | | 10 / 46 | | | $621,611,551 | | | | 56.2% | | | | | | | | | | 66.9% | | | | 59.3% | | | | 1.76x | | | | 10.8% | |

Non-Top Ten Total/Weighted Average | | 76 / 90 | | | $485,389,879 | | | | 43.8% | | | | | | | | | | 53.4% | | | | 42.9% | | | | 3.42x | | | | 19.8% | |

| | |

(1) | | With respect to the Augusta Mall and Carolina Place mortgage loans, Cut-off Date Balance per unit of measure, loan-to-value ratio, debt service coverage ratio and debt yield calculations include the relatedpari passu companion loan (unless otherwise stated) in total debt. |

| B. | Summary ofPari Passu Split Loan Structures |

| | | | | | | | | | | | | | |

Mortgage

Loan Name | | Mortgage

Loan

Seller | | Related Notes in

Loan Group

(Original Balance) | | | Holder of Note | | Whether Note is

Lead Servicing for

the Entire Loan

Combination | | Current Master Servicer

Under Related

Securitization PSA | | Current Special Servicer

Under Related

Securitization PSA |

Augusta Mall | | WFB | | | $110,000,000 | | | WFRBS 2013-C15 | | Yes | | Wells Fargo Bank, National Association | | CWCapital Asset Management LLC |

| | WFB | | | $60,000,000 | | | (1) | | No | | TBD | | TBD |

Carolina Place | | RBS | | | $90,000,000 | | | WFCM 2013-LC12 | | Yes | | Wells Fargo Bank, National Association | | Rialto Capital Advisors, LLC |

| | RBS | | | $85,000,000 | | | WFRBS 2013-C15 | | No | | Wells Fargo Bank, National Association | | CWCapital Asset Management LLC |

| | |

(1) | | The relatedpari passu companion loan is currently held by the mortgage loan seller for the mortgage loan included in the WFRBS 2013-C15 trust. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

8

| | |

| WFRBS Commercial Mortgage Trust 2013-C15 | | Characteristics of the Mortgage Pool |

| C. | Previous Securitization History(1) |

| | | | | | | | | | | | | | | | | | |

Loan

No. | | Mortgage

Loan Seller | | Mortgage Loan or Mortgaged Property Name | | City | | State | | Property Type | | Mortgage Loan

or Mortgaged

Property Cut-off

Date Balance ($) | | | % of Cut-off

Date Pool

Balance (%) | | Previous Securitization |

1 | | WFB | | Augusta Mall | | Augusta | | GA | | Retail | | | $110,000,000 | | | 9.9% | | JPMCC 2007-LDPX |

4 | | RBS | | Carolina Place | | Pineville | | NC | | Retail | | | 85,000,000 | | | 7.7 | | CGCMT 2005-C3 |

10 | | RBS | | American Self Storage - Staten Island | | Staten Island | | NY | | Self Storage | | | 20,948,223 | | | 1.9 | | MLCFC 2007-7 |

19 | | NCB, FSB | | 33 Greenwich Owners Corp. | | New York | | NY | | Multifamily | | | 11,990,567 | | | 1.1 | | MSC 2005-IQ10 |

21 | | WFB | | Vallejo Mobile Estates | | Vallejo | | CA | | Manufactured Housing Community | | | 11,187,241 | | | 1.0 | | WBCMT 2004-C14 |

28 | | WFB | | Whittier Gateway | | Whittier | | CA | | Retail | | | 9,200,000 | | | 0.8 | | BSCMS 2003-PWR2 |

29 | | CIIICM | | Oakwood MHC | | Bryan | | TX | | Manufactured Housing Community | | | 6,275,000 | | | 0.6 | | CSFB 2003-C5 |

30 | | CIIICM | | Bel Air MHC | | Bryan | | TX | | Manufactured Housing Community | | | 1,450,000 | | | 0.1 | | CSFB 2003-C5 |

31 | | CIIICM | | Country Village | | Bryan | | TX | | Manufactured Housing Community | | | 1,275,000 | | | 0.1 | | CSFB 2003-C5 |

38 | | WFB | | Halsted Village | | Farmington

Hills | | MI | | Retail | | | 8,000,000 | | | 0.7 | | JPMCC 2003-CB6 |

39 | | WFB | | Newburgh Plaza - MI | | Livonia | | MI | | Retail | | | 8,000,000 | | | 0.7 | | JPMCC 2003-LN1 |

42 | | NCB, FSB | | Fleetwood Court Apartments, Inc. | | Yonkers | | NY | | Multifamily | | | 7,479,103 | | | 0.7 | | CSFB 2004-C4 |

45 | | RBS | | Central Park Tower | | Bedford | | TX | | Office | | | 6,991,665 | | | 0.6 | | JPMCC 2004-CB8 |

49 | | CIIICM | | Brightwood Manor MHC | | Apopka | | FL | | Manufactured Housing Community | | | 4,692,602 | | | 0.4 | | GECMC 2003-C2 |

50 | | CIIICM | | Desoto Village MHC | | Arcadia | | FL | | Manufactured Housing Community | | | 1,397,796 | | | 0.1 | | GECMC 2003-C2 |

59 | | NCB, FSB | | West 73rdTenants Corp. | | New York | | NY | | Multifamily | | | 4,743,898 | | | 0.4 | | MSC 2003-IQ6 |

61 | | NCB, FSB | | The Beverly House, Inc. | | Kew Gardens | | NY | | Multifamily | | | 4,486,304 | | | 0.4 | | CSFB 2004-C4 |

62 | | NCB, FSB | | Broadpark Lodge Corp. | | White Plains | | NY | | Multifamily | | | 4,094,179 | | | 0.4 | | CSFB 2004-C4 |

63 | | NCB, FSB | | Coronet Owners, Inc. | | Woodside | | NY | | Multifamily | | | 3,743,975 | | | 0.3 | | MSC 2003-IQ6 |

65 | | NCB, FSB | | 400 East 17thStreet Corp. | | Brooklyn | | NY | | Multifamily | | | 3,595,131 | | | 0.3 | | CSFB 2004-C4 |

66 | | NCB, FSB | | 1120 Park Corporation | | New York | | NY | | Multifamily | | | 3,450,000 | | | 0.3 | | MSC 2004-IQ7 |

67 | | NCB, FSB | | Archer Cooperative, Inc. | | Bronx | | NY | | Multifamily | | | 2,997,759 | | | 0.3 | | CSFB 2004-C1 |

68.01 | | CIIICM | | El Valle del Sol MHC | | Mission | | TX | | Manufactured Housing Community | | | 2,544,062 | | | 0.2 | | CSFB 2003-C4 |

68.02 | | CIIICM | | Luna MHC | | McAllen | | TX | | Manufactured Housing Community | | | 451,191 | | | 0.0 | | CSFB 2003-C4 |

69 | | NCB, FSB | | Chelsea-Warren Corp. | | New York | | NY | | Multifamily | | | 2,990,817 | | | 0.3 | | CSFB 2003-C3 |

72 | | CIIICM | | Ashbury Ridge MHC | | Mooresville | | IN | | Manufactured Housing Community | | | 2,397,377 | | | 0.2 | | BACM 2003-2 |

73 | | CIIICM | | Alamo Self Storage | | Carson | | CA | | Self Storage | | | 2,172,595 | | | 0.2 | | MSC 2004-T13 |

74 | | NCB, FSB | | 130 East 75thStreet Owners Corp. | | New York | | NY | | Multifamily | | | 2,000,000 | | | 0.2 | | MSC 2004-IQ7 |

76 | | NCB, FSB | | Bainbridge House, Inc. | | Bronx | | NY | | Multifamily | | | 1,996,649 | | | 0.2 | | CSFB 2004-C4 |

79 | | NCB, FSB | | Gramgar, Inc. | | Bronxville | | NY | | Multifamily | | | 1,655,909 | | | 0.1 | | CSFB 2004-C4 |

81 | | NCB, FSB | | 17thStreet Artists Corp. | | New York | | NY | | Multifamily | | | 1,595,294 | | | 0.1 | | MSC 2006-IQ11 |

84 | | NCB, FSB | | Victory Apartments, Inc. | | Elmhurst | | NY | | Multifamily | | | 1,098,758 | | | 0.1 | | MSC 2003-IQ6 |

86 | | NCB, FSB | | Remsen Owners Corp. | | Brooklyn | | NY | | Multifamily | | | 1,046,882 | | | 0.1 | | MSC 2005-IQ10 |

Total | | | | | | | | | | | | | $340,947,978 | | | 30.8% | | |

| | |

(1) | | The table above represents the most recent securitization with respect to the mortgaged property securing the related mortgage loan, based on information provided by the related borrower or obtained through searches of a third-party database. While the above mortgage loans may have been securitized multiple times in prior transactions, mortgage loans are only listed in the above chart if the mortgage loan paid off a mortgage loan in another securitization. The information has not otherwise been confirmed by the mortgage loan sellers. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

9

| | |

| WFRBS Commercial Mortgage Trust 2013-C15 | | Characteristics of the Mortgage Pool |

| D. | Mortgage Loans with Scheduled Balloon Payments and Related Classes |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Class A-2(1) |

Loan

No. | | Mortgage

Loan

Seller | | Mortgage

Loan Name | | State | | Property

Type | | Mortgage

Loan Cut-off

Date

Balance ($) | | | % of

Cut-off

Date

Pool

Balance

(%) | | | Mortgage

Loan

Balance at

Maturity ($) | | | % of

Class A-2

Certificate

Principal

Balance

(%)(2) | | Units/SF

/Rooms | | Loan

per

Unit/

SF/

Room

($) | | U/W

NCF

DSCR

(x) | | | U/W

NOI

Debt

Yield

(%) | | | Cut-off

Date

LTV

Ratio

(%) | | | Balloon

LTV

Ratio

(%) | | | Rem.

IO

Period

(mos.) | | Rem.

Term to

Maturity

(mos.) |

20 | | WFB | | Arizona Student Housing Portfolio | | AZ | | Multifamily | | | $11,400,000 | | | | 1.0% | | | | $10,776,342 | | | 22.4% | | 304 | | $37,500 | | | 1.43x | | | | 9.4% | | | | 72.3% | | | | 68.3% | | | 18 | | 60 |

23 | | WFB | | Gander Mountain Portfolio | | Various | | Retail | | | 10,327,370 | | | | 0.9 | | | | 9,445,349 | | | 19.6 | | 103,860 | | 99 | | | 2.00 | | | | 13.0 | | | | 54.4 | | | | 49.7 | | | 0 | | 59 |

27 | | WFB | | DoubleTree - Holland | | MI | | Hospitality | | | 9,500,000 | | | | 0.9 | | | | 8,836,897 | | | 18.4 | | 168 | | 56,548 | | | 2.28 | | | | 15.6 | | | | 51.9 | | | | 48.3 | | | 11 | | 59 |

37 | | WFB | | College Town - Tucson | | AZ | | Multifamily | | | 8,100,000 | | | | 0.7 | | | | 7,656,874 | | | 15.9 | | 228 | | 35,526 | | | 1.48 | | | | 10.0 | | | | 64.8 | | | | 61.3 | | | 18 | | 60 |

45 | | RBS | | Central Park Tower | | TX | | Office | | | 6,991,665 | | | | 0.6 | | | | 6,406,143 | | | 13.3 | | 103,572 | | 68 | | | 1.51 | | | | 11.0 | | | | 74.4 | | | | 68.2 | | | 0 | | 59 |

70 | | CIIICM | | Candlewood Suites | | FL | | Hospitality | | | 2,535,000 | | | | 0.2 | | | | 2,292,031 | | | 4.8 | | 80 | | 31,688 | | | 1.49 | | | | 13.4 | | | | 53.9 | | | | 48.8 | | | 0 | | 60 |

Total/Weighted Average | | | | | | | $48,854,035 | | | | 4.4% | | | | $45,413,635 | | | 94.3% | | | | | | | 1.74x | | | | 11.9% | | | | 62.7% | | | | 58.3% | | | 9 | | 59 |

| | |

(1) | | The table above presents the mortgage loans whose balloon payments would be applied to pay down the principal balance of the Class A-2 Certificates, assuming a 0% CPR and applying the “Structuring Assumptions” described in the Free Writing Prospectus, including the assumptions that (i) none of the mortgage loans in the pool experience prepayments, defaults or losses; (ii) there are no extensions of maturity dates of any mortgage loans in the pool; and (iii) each mortgage loan in the pool is paid in full on its stated maturity date. Each class of Certificates, including the Class A-2 Certificates, evidences undivided ownership interests in the entire pool of mortgage loans. |

(2) | | Reflects the percentage of the Mortgage Loan Balance at Maturity divided by the initial Class A-2 Certificate Principal Balance. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Class A-SB(1) |

Loan

No. | | Mortgage

Loan

Seller | | Mortgage

Loan Name | | State | | Property

Type | | Mortgage

Loan Cut-off

Date

Balance ($) | | | % of

Cut-off

Date

Pool

Balance

(%) | | | Mortgage

Loan

Balance at

Maturity ($) | | | % of

Class A-SB

Certificate

Principal

Balance

(%)(2) | | | SF/

Rooms | | Loan

per

SF/

Room

($) | | U/W NCF

DSCR (x) | | | U/W

NOI

Debt

Yield

(%) | | | Cut-off

Date

LTV

Ratio

(%) | | Balloon

LTV

Ratio

(%) | | Rem.

IO

Period

(mos.) | | Rem.

Term to

Maturity

(mos.) |

36 | | WFB | | Southpark Village | | NC | | Retail | | | $8,250,000 | | | | 0.7% | | | | $7,526,137 | | | | 7.2% | | | 33,652 | | $245 | | | 1.45x | | | | 9.3% | | | 74.3% | | 67.8% | | 23 | | 83 |

57 | | Basis | | Hawthorne Suites by Wyndham-College Station | | TX | | Hospitality | | | 4,950,000 | | | | 0.4 | | | | 4,157,594 | | | | 4.0 | | | 81 | | 61,111 | | | 1.69 | | | | 13.6 | | | 65.1 | | 54.7 | | 0 | | 84 |

Total/Weighted Average | | | | | | | $13,200,000 | | | | 1.2% | | | | $11,683,731 | | | | 11.1% | | | | | | | | 1.54x | | | | 10.9% | | | 70.9% | | 62.9% | | 14 | | 83 |

| | |

| (1) | | The table above presents the mortgage loans whose balloon payments would be applied to pay down the principal balance of the Class A-SB Certificates, assuming a 0% CPR and applying the “Structuring Assumptions” described in the Free Writing Prospectus, including the assumptions that (i) none of the mortgage loans in the pool experience prepayments, defaults or losses; (ii) there are no extensions of maturity dates of any mortgage loans in the pool; and (iii) each mortgage loan in the pool is paid in full on its stated maturity date. Each class of Certificates, including the Class A-SB Certificates, evidences undivided ownership interests in the entire pool of mortgage loans. |

(2) | | Reflects the percentage of the Mortgage Loan Balance at Maturity divided by the initial Class A-SB Certificate Principal Balance. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

10

| | |

| WFRBS Commercial Mortgage Trust 2013-C15 | | Characteristics of the Mortgage Pool |

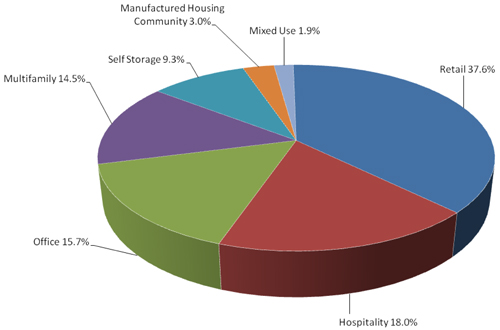

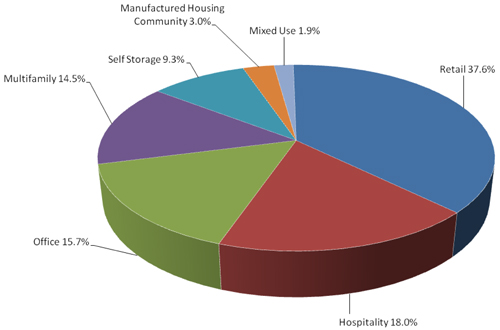

| E. | Property Type Distribution(1) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Property Type | | Number of

Mortgaged

Properties | | Aggregate Cut-

off Date Balance

($) | | | % of Cut-

off Date

Pool

Balance

(%) | | | Weighted

Average

Cut-off

Date LTV

Ratio (%) | | | Weighted

Average

Balloon or

ARD LTV

Ratio (%) | | | Weighted

Average

U/W NCF

DSCR (x) | | | Weighted

Average

U/W NOI

Debt

Yield (%) | | | Weighted

Average

U/W NCF

Debt

Yield (%) | | | Weighted

Average

Mortgage

Rate (%) | |

Retail | | 26 | | | $416,150,674 | | | | 37.6% | | | | 66.7% | | | | 58.9% | | | | 1.86x | | | | 11.2% | | | | 10.5% | | | | 4.376% | |

Regional Mall | | 3 | | | 272,300,000 | | | | 24.6 | | | | 68.0 | | | | 63.8 | | | | 1.93 | | | | 10.4 | | | | 9.9 | | | | 4.185 | |

Anchored | | 10 | | | 71,761,734 | | | | 6.5 | | | | 60.4 | | | | 43.7 | | | | 1.90 | | | | 14.8 | | | | 13.4 | | | | 4.797 | |

Single Tenant | | 8 | | | 34,201,651 | | | | 3.1 | | | | 64.3 | | | | 49.9 | | | | 1.59 | | | | 11.5 | | | | 10.6 | | | | 4.746 | |

Unanchored | | 3 | | | 25,187,290 | | | | 2.3 | | | | 71.4 | | | | 57.1 | | | | 1.48 | | | | 10.2 | | | | 9.4 | | | | 4.773 | |

Shadow Anchored(2) | | 2 | | | 12,700,000 | | | | 1.1 | | | | 71.8 | | | | 66.8 | | | | 1.63 | | | | 10.8 | | | | 9.7 | | | | 4.316 | |

Hospitality | | 11 | | | 198,933,810 | | | | 18.0 | | | | 61.1 | | | | 49.4 | | | | 1.67 | | | | 13.2 | | | | 11.3 | | | | 5.129 | |

Full Service | | 5 | | | 153,426,168 | | | | 13.9 | | | | 62.0 | | | | 51.3 | | | | 1.66 | | | | 12.8 | | | | 10.9 | | | | 5.087 | |

Limited Service | | 6 | | | 45,507,642 | | | | 4.1 | | | | 57.8 | | | | 43.0 | | | | 1.71 | | | | 14.4 | | | | 12.8 | | | | 5.270 | |

Office | | 8 | | | 173,398,436 | | | | 15.7 | | | | 65.3 | | | | 57.6 | | | | 1.74 | | | | 11.3 | | | | 10.4 | | | | 4.296 | |

Suburban | | 6 | | | 166,898,436 | | | | 15.1 | | | | 65.4 | | | | 57.9 | | | | 1.76 | | | | 11.3 | | | | 10.4 | | | | 4.247 | |

Medical | | 2 | | | 6,500,000 | | | | 0.6 | | | | 65.0 | | | | 49.5 | | | | 1.42 | | | | 11.6 | | | | 10.5 | | | | 5.540 | |

Multifamily | | 37 | | | 160,552,820 | | | | 14.5 | | | | 33.6 | | | | 28.3 | | | | 6.95 | | | | 34.3 | | | | 33.9 | | | | 4.190 | |

Cooperative | | 24 | | | 104,081,895 | | | | 9.4 | | | | 14.7 | | | | 12.4 | | | | 9.86 | | | | 46.9 | | | | 46.9 | | | | 3.958 | |

Garden | | 10 | | | 36,970,925 | | | | 3.3 | | | | 68.2 | | | | 53.3 | | | | 1.66 | | | | 11.8 | | | | 10.6 | | | | 4.532 | |

Student Housing | | 3 | | | 19,500,000 | | | | 1.8 | | | | 69.2 | | | | 65.4 | | | | 1.45 | | | | 9.6 | | | | 9.1 | | | | 4.780 | |

Self Storage | | 42 | | | 103,414,615 | | | | 9.3 | | | | 70.6 | | | | 56.9 | | | | 1.43 | | | | 9.8 | | | | 9.4 | | | | 4.684 | |

Self Storage | | 42 | | | 103,414,615 | | | | 9.3 | | | | 70.6 | | | | 56.9 | | | | 1.43 | | | | 9.8 | | | | 9.4 | | | | 4.684 | |

Manufactured Housing Community | | 10 | | | 33,670,270 | | | | 3.0 | | | | 67.4 | | | | 54.2 | | | | 1.52 | | | | 10.5 | | | | 10.3 | | | | 5.082 | |

Manufactured Housing Community | | 10 | | | 33,670,270 | | | | 3.0 | | | | 67.4 | | | | 54.2 | | | | 1.52 | | | | 10.5 | | | | 10.3 | | | | 5.082 | |

Mixed Use | | 2 | | | 20,880,806 | | | | 1.9 | | | | 61.9 | | | | 54.2 | | | | 1.49 | | | | 9.7 | | | | 9.1 | | | | 4.569 | |

Office/Retail | | 2 | | | 20,880,806 | | | | 1.9 | | | | 61.9 | | | | 54.2 | | | | 1.49 | | | | 9.7 | | | | 9.1 | | | | 4.569 | |

Total/Weighted Average | | 136 | | | $1,107,001,430 | | | | 100.0% | | | | 61.0% | | | | 52.1% | | | | 2.49x | | | | 14.8% | | | | 13.9% | | | | 4.526% | |

| | |

(1) | | Because this table presents information relating to the mortgaged properties and not the mortgage loans, (a) the information for mortgage loans secured by more than one mortgaged property (other than through cross-collateralization with other mortgage loans) is based on allocated amounts (allocating the mortgage loan principal balance to each of those properties according to the relative appraised values of the mortgaged properties or the allocated loan amounts or property-specific release prices set forth in the related mortgage loan documents or such other allocation as the related mortgage loan seller deemed appropriate), and (b) the information for each mortgaged property that relates to a mortgage loan that is cross-collateralized with other mortgage loans is based upon the principal balance of that mortgage loan, except that the applicable loan-to-value ratio, debt service coverage ratio or debt yield for each such mortgaged property is based upon the ratio or yield (as applicable) for the aggregate indebtedness evidenced by all loans in the group. On an individual basis, without regard to the cross-collateralization feature, any mortgaged property securing a mortgage loan that is part of a cross-collateralized group of mortgage loans may have a higher loan-to-value ratio, lower debt service coverage ratio and/or lower debt yield than is presented herein. For mortgaged properties securing residential cooperative mortgage loans, the debt service coverage ratio or debt yield for each such mortgaged property are calculated using underwritten net cash flow for the related residential cooperative property which is the projected net cash flow reflected in the most recent appraisal obtained by or otherwise in the possession of the related mortgage loan seller as of the cut-off date, and the loan-to-value ratio is calculated based upon the appraised value of the residential cooperative property determined as if such residential cooperative property is operated as a residential cooperative. Debt service coverage ratio, debt yield and loan-to-value ratio information takes no account of subordinate debt (whether or not secured by the mortgaged property), if any, that is allowed under the terms of any mortgage loan. With respect to the Augusta Mall and Carolina Place mortgage loans, loan-to-value ratio, debt service coverage ratio and debt yield calculations include the relatedpari passu companion loan (unless otherwise stated) in total debt. |

(2) | | A mortgaged property is classified as shadow anchored if it is located in close proximity to an anchored retail property. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

11

| | |

| WFRBS Commercial Mortgage Trust 2013-C15 | | Characteristics of the Mortgage Pool |

| F. | Geographic Distribution(1)(2) |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Location(3) | | Number of

Mortgaged

Properties | | Aggregate Cut-off

Date Balance ($) | | | % of

Cut-off

Date

Pool

Balance | | | Weighted

Average Cut-off

Date LTV Ratio

(%) | | | Weighted

Average

Balloon or

ARD LTV

Ratio (%) | | Weighted

Average

U/W NCF

DSCR (x) | | Weighted

Average

U/W NOI

Debt Yield

(%) | | Weighted

Average

U/W NCF

Debt

Yield (%) | | Weighted

Average

Mortgage

Rate (%) | |

California | | 8 | | | $232,217,837 | | | | 21.0% | | | | 63.4% | | | 54.5% | | 1.65x | | 11.4% | | 10.4% | | | 4.770% | |

Northern | | 3 | | | 117,237,241 | | | | 10.6 | | | | 62.8 | | | 51.3 | | 1.59 | | 11.8 | | 10.5 | | | 5.098 | |

Southern | | 5 | | | 114,980,595 | | | | 10.4 | | | | 64.0 | | | 57.7 | | 1.71 | | 10.9 | | 10.3 | | | 4.437 | |

New York | | 27 | | | 137,756,539 | | | | 12.4 | | | | 27.3 | | | 22.6 | | 7.79 | | 37.7 | | 37.5 | | | 4.156 | |

North Carolina | | 6 | | | 126,193,328 | | | | 11.4 | | | | 66.7 | | | 57.0 | | 1.67 | | 10.7 | | 9.8 | | | 4.170 | |

Georgia | | 5 | | | 119,021,040 | | | | 10.8 | | | | 67.6 | | | 66.9 | | 2.21 | | 10.5 | | 10.0 | | | 4.369 | |

Washington | | 6 | | | 95,765,000 | | | | 8.7 | | | | 70.1 | | | 64.8 | | 1.67 | | 10.7 | | 10.0 | | | 4.336 | |

Ohio | | 7 | | | 56,845,786 | | | | 5.1 | | | | 67.1 | | | 56.5 | | 1.66 | | 12.3 | | 10.3 | | | 4.638 | |

Texas | | 21 | | | 55,515,674 | | | | 5.0 | | | | 69.3 | | | 57.0 | | 1.54 | | 11.5 | | 10.3 | | | 4.948 | |

Other States(4) | | 56 | | | 283,686,227 | | | | 25.6 | | | | 64.1 | | | 50.0 | | 1.71 | | 12.5 | | 11.4 | | | 4.688 | |

Total/Weighted Average | | 136 | | | $1,107,001,430 | | | | 100.0% | | | | 61.0% | | | 52.1% | | 2.49x | | 14.8% | | 13.9% | | | 4.526% | |

| (1) | The Mortgaged Properties are located in 26 states. |

| (2) | Because this table presents information relating to the mortgaged properties and not the mortgage loans, (a) the information for mortgage loans secured by more than one mortgaged property (other than through cross-collateralization with other mortgage loans) is based on allocated amounts (allocating the mortgage loan principal balance to each of those properties according to the relative appraised values of the mortgaged properties or the allocated loan amounts or property-specific release prices set forth in the related mortgage loan documents or such other allocation as the related mortgage loan seller deemed appropriate), and (b) the information for each mortgaged property that relates to a mortgage loan that is cross-collateralized with other mortgage loans is based upon the principal balance of that mortgage loan, except that the applicable loan-to-value ratio, debt service coverage ratio or debt yield for each such mortgaged property is based upon the ratio or yield (as applicable) for the aggregate indebtedness evidenced by all loans in the group. On an individual basis, without regard to the cross-collateralization feature, any mortgaged property securing a mortgage loan that is part of a cross-collateralized group of mortgage loans may have a higher loan-to-value ratio, lower debt service coverage ratio and/or lower debt yield than is presented herein. For mortgaged properties securing residential cooperative mortgage loans, the debt service coverage ratio or debt yield for each such mortgaged property are calculated using underwritten net cash flow for the related residential cooperative property which is the projected net cash flow reflected in the most recent appraisal obtained by or otherwise in the possession of the related mortgage loan seller as of the cut-off date, and the loan-to-value ratio is calculated based upon the appraised value of the residential cooperative property determined as if such residential cooperative property is operated as a residential cooperative. Debt service coverage ratio, debt yield and loan-to-value ratio information takes no account of subordinate debt (whether or not secured by the mortgaged property), if any, that is allowed under the terms of any mortgage loan. With respect to the Augusta Mall and Carolina Place mortgage loans, loan-to-value ratio, debt service coverage ratio, debt yield and cut-off date balance per unit of measure calculations include the relatedpari passu companion loan (unless otherwise stated) in total debt. |

| (3) | For purposes of determining whether a mortgaged property is in Northern California or Southern California, Northern California includes areas with zip codes above 93600 and Southern California includes areas with zip codes of 93600 and below. |

| (4) | Includes 19 other states. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

12

| | |

| WFRBS Commercial Mortgage Trust 2013-C15 | | Characteristics of the Mortgage Pool |

| G. | Characteristics of the Mortgage Pool(1) |

| | | | | | | | |

| CUT-OFF DATE BALANCE |

Range of Cut-off Date

Balances ($) | | Number of

Mortgage

Loans | | Aggregate Cut-

off Date Balance

($) | | | % of Cut-off

Date Pool

Balance |

1,046,882 – 2,000,000 | | 16 | | | $24,771,362 | | | 2.2% |

2,000,001 – 3,000,000 | | 7 | | | 18,585,230 | | | 1.7 |

3,000,001 – 4,000,000 | | 4 | | | 14,384,621 | | | 1.3 |

4,000,001 – 5,000,000 | | 8 | | | 37,428,105 | | | 3.4 |

5,000,001 – 6,000,000 | | 5 | | | 27,020,264 | | | 2.4 |

6,000,001 – 7,000,000 | | 6 | | | 39,328,359 | | | 3.6 |

7,000,001 – 8,000,000 | | 6 | | | 46,261,292 | | | 4.2 |

8,000,001 – 9,000,000 | | 6 | | | 50,295,959 | | | 4.5 |

9,000,001 – 10,000,000 | | 4 | | | 38,611,431 | | | 3.5 |

10,000,001 –15,000,000 | | 11 | | | 133,097,469 | | | 12.0 |

15,000,001 – 20,000,000 | | 3 | | | 55,605,786 | | | 5.0 |

20,000,001 – 30,000,000 | | 3 | | | 72,007,551 | | | 6.5 |

30,000,001 – 50,000,000 | | 2 | | | 81,534,000 | | | 7.4 |

50,000,001 – 90,000,000 | | 2 | | | 162,300,000 | | | 14.7 |

90,000,001 – 110,000,000 | | 3 | | | 305,770,000 | | | 27.6 |

Total: | | 86 | | | $1,107,001,430 | | | 100.0% |

Average: | | $12,872,110 | | | | | | |

UNDERWRITTEN NOI DEBT SERVICE COVERAGE RATIO |

Range of U/W NOI

DSCRs (x) | | Number of

Mortgage

Loans | | Aggregate Cut-

off Date Balance

($) | | | % of Cut-off

Date Pool

Balance |

1.40 – 1.50 | | 8 | | | $90,685,612 | | | 8.2% |

1.51 – 1.60 | | 19 | | | 143,809,711 | | | 13.0 |

1.61 – 1.70 | | 4 | | | 34,897,734 | | | 3.2 |

1.71 – 1.80 | | 6 | | | 175,200,581 | | | 15.8 |

1.81 – 1.90 | | 9 | | | 274,244,462 | | | 24.8 |

1.91 – 2.00 | | 4 | | | 29,145,230 | | | 2.6 |

2.01 – 2.25 | | 5 | | | 93,459,455 | | | 8.4 |

2.26 – 2.50 | | 4 | | | 138,455,851 | | | 12.5 |

2.51 – 3.00 | | 2 | | | 17,500,000 | | | 1.6 |

3.01 – 3.50 | | 2 | | | 12,486,304 | | | 1.1 |

3.51 – 88.02 | | 23 | | | 97,116,489 | | | 8.8 |

Total: | | 86 | | | $1,107,001,430 | | | 100.0% |

Weighted Average: | | 2.63x | | | | | | |

UNDERWRITTEN NCF DEBT SERVICE COVERAGE RATIO |

Range of U/W NCF

DSCRs (x) | | Number of

Mortgage

Loans | | Aggregate Cut- off Date Balance

($) | | | % of Cut-off

Date Pool

Balance |

1.29 – 1.30 | | 1 | | | $5,040,000 | | | 0.5% |

1.31 – 1.40 | | 6 | | | 56,765,997 | | | 5.1 |

1.41 – 1.50 | | 22 | | | 182,197,911 | | | 16.5 |

1.51 – 1.60 | | 7 | | | 140,415,570 | | | 12.7 |

1.61 – 1.70 | | 10 | | | 182,893,571 | | | 16.5 |

1.71 – 1.80 | | 7 | | | 236,103,862 | | | 21.3 |

1.81 – 1.90 | | 2 | | | 45,680,000 | | | 4.1 |

1.91 – 2.00 | | 1 | | | 10,327,370 | | | 0.9 |

2.01 – 2.25 | | 2 | | | 112,995,253 | | | 10.2 |

2.26 – 2.50 | | 3 | | | 24,979,103 | | | 2.3 |

2.51 – 3.50 | | 2 | | | 12,486,304 | | | 1.1 |

3.51 – 88.02 | | 23 | | | 97,116,489 | | | 8.8 |

Total: | | 86 | | | $1,107,001,430 | | | 100.0% |

Weighted Average: | | 2.49x | | | | | | |

| | | | | | | | |

| LOAN PURPOSE |

| Loan Purpose | | Number of

Mortgage

Loans | | Aggregate Cut-

off Date Balance

($) | | | % of Cut-off

Date Pool

Balance |

Refinance | | 70 | | | $801,344,284 | | | 72.4% |

Acquisition | | 15 | | | 287,532,856 | | | 26.0 |

Various | | 1 | | | 18,124,290 | | | 1.6 |

Total: | | 86 | | | $1,107,001,430 | | | 100.0% |

MORTGAGE RATE |

Range of Mortgage

Rates (%) | | Number of

Mortgage

Loans | | Aggregate Cut-

off Date Balance

($) | | | % of Cut-off

Date Pool

Balance |

3.330 – 3.750 | | 10 | | | $71,828,053 | | | 6.5% |

3.751 – 4.000 | | 10 | | | 121,753,624 | | | 11.0 |

4.001 – 4.250 | | 6 | | | 46,572,863 | | | 4.2 |

4.251 – 4.500 | | 12 | | | 364,161,149 | | | 32.9 |

4.501 – 4.750 | | 12 | | | 174,225,801 | | | 15.7 |

4.751 – 5.000 | | 11 | | | 64,776,956 | | | 5.9 |

5.001 – 5.250 | | 11 | | | 197,904,324 | | | 17.9 |

5.251 – 5.500 | | 4 | | | 23,911,085 | | | 2.2 |

5.501 – 5.750 | | 8 | | | 37,332,575 | | | 3.4 |

5.751 – 6.000 | | 2 | | | 4,535,000 | | | 0.4 |

Total: | | 86 | | | $1,107,001,430 | | | 100.0% |

Weighted Average: | | 4.526% | | | | | | |

UNDERWRITTEN NOI DEBT YIELD |

Range of U/W NOI

Debt Yields (%) | | Number of

Mortgage

Loans | | Aggregate Cut-

off Date Balance

($) | | | % of Cut-off

Date Pool

Balance |

8.6 – 8.9 | | 2 | | | $32,135,465 | | | 2.9% |

9.0 – 9.9 | | 11 | | | 94,671,344 | | | 8.6 |

10.0 – 10.9 | | 19 | | | 409,888,066 | | | 37.0 |

11.0 – 11.9 | | 11 | | | 295,004,042 | | | 26.6 |

12.0 – 12.9 | | 3 | | | 24,456,771 | | | 2.2 |

13.0 – 13.9 | | 9 | | | 89,027,741 | | | 8.0 |

14.0 – 14.9 | | 1 | | | 8,488,459 | | | 0.8 |

15.0 – 15.9 | | 2 | | | 27,481,496 | | | 2.5 |

16.0 – 16.9 | | 1 | | | 2,995,253 | | | 0.3 |

17.0 – 17.9 | | 2 | | | 9,486,304 | | | 0.9 |

18.0 – 19.9 | | 1 | | | 5,250,000 | | | 0.5 |

20.0 – 324.9 | | 24 | | | 108,116,489 | | | 9.8 |

Total: | | 86 | | | $1,107,001,430 | | | 100.0% |

Weighted Average: | | 14.8% | | | | | | |

UNDERWRITTEN NCF DEBT YIELD |

Range of U/W NCF

Debt Yields (%) | | Number of

Mortgage

Loans | | Aggregate Cut-

off Date Balance

($) | | | % of Cut-off

Date Pool

Balance |

8.2 – 8.9 | | 5 | | | $53,732,965 | | | 4.9% |

9.0 – 9.9 | | 22 | | | 403,551,737 | | | 36.5 |

10.0 – 10.9 | | 16 | | | 377,733,837 | | | 34.1 |

11.0 – 11.9 | | 8 | | | 89,339,913 | | | 8.1 |

12.0 – 12.9 | | 3 | | | 29,327,370 | | | 2.6 |

13.0 – 13.9 | | 4 | | | 27,467,562 | | | 2.5 |

14.0 – 19.9 | | 4 | | | 17,731,557 | | | 1.6 |

20.0 – 324.9 | | 24 | | | 108,116,489 | | | 9.8 |

Total: | | 86 | | | $1,107,001,430 | | | 100.0% |

Weighted Average: | | 13.9% | | | | | | |

| | |

(1) | | Information regarding mortgage loans that are cross-collateralized with other mortgage loans is based upon the individual loan balances, except that the applicable loan-to value ratio, debt service coverage ratio or debt yield for each such mortgage loan is based upon the ratio or yield (as applicable) for the aggregate indebtedness evidenced by all loans in the group. On an individual basis, without regard to the cross-collateralization feature, any mortgage loan that is part of a cross-collateralized group of mortgage loans may have a higher loan-to-value ratio, lower debt service coverage ratio and/or lower debt yield than is presented herein. For mortgaged properties securing residential cooperative mortgage loans, the debt service coverage ratio or debt yield for each such mortgaged property are calculated using underwritten net cash flow for the related residential cooperative property which is the projected net cash flow reflected in the most recent appraisal obtained by or otherwise in the possession of the related mortgage loan seller as of the cut-off date, and the loan-to-value ratio is calculated based upon the appraised value of the residential cooperative property determined as if such residential cooperative property is operated as a residential cooperative. Debt service coverage ratio, debt yield and loan-to-value ratio information takes no account of subordinate debt (whether or not secured by the mortgaged property), if any, that is allowed under the terms of any mortgage loan. With respect to the Augusta Mall and Carolina Place mortgage loans, loan-to-value ratio, debt service coverage ratio and debt yield calculations include the relatedpari passu companion loan (unless otherwise stated) in total debt. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

13

| | |

| WFRBS Commercial Mortgage Trust 2013-C15 | | Characteristics of the Mortgage Pool |

ORIGINAL TERM TO MATURITY OR ARD

| | | | | | | | | | |

Range of Original Terms to

Maturity or ARD (months) | | Number of

Mortgage Loans | | | Aggregate Cut-off Date Balance ($) | | | % of Cut-off Date Pool Balance |

60 | | | 6 | | | | $48,854,035 | | | 4.4% |

61 - 84 | | | 2 | | | | 13,200,000 | | | 1.2 |

85 - 120 | | | 76 | | | | 1,028,947,395 | | | 92.9 |

121 - 180 | | | 2 | | | | 16,000,000 | | | 1.4 |

Total: | | | 86 | | | | $1,107,001,430 | | | 100.0% |

Weighted Average: | | | 118 months | | | | | | | |

|

| REMAINING TERM TO MATURITY OR ARD |

Range of Remaining Terms

to Maturity or ARD (months) | | Number of

Mortgage Loans | | | Aggregate Cut-off Date Balance ($) | | | % of Cut-off Date Pool Balance |

59 - 60 | | | 6 | | | | $48,854,035 | | | 4.4% |

61 - 84 | | | 2 | | | | 13,200,000 | | | 1.2 |

85 - 120 | | | 76 | | | | 1,028,947,395 | | | 92.9 |

121 - 180 | | | 2 | | | | 16,000,000 | | | 1.4 |

Total: | | | 86 | | | | $1,107,001,430 | | | 100.0% |

Weighted Average: | | | 117 months | | | | | | | |

|

| ORIGINAL AMORTIZATION TERM(1) |

Range of Original

Amortization Terms (months) | | Number of

Mortgage Loans | | | Aggregate Cut-off Date Balance ($) | | | % of Cut-off Date Pool Balance |

Non-Amortizing | | | 5 | | | | $139,950,000 | | | 12.6% |

180 | | | 3 | | | | 21,250,000 | | | 1.9 |

181 - 240 | | | 2 | | | | 18,692,088 | | | 1.7 |

241 - 300 | | | 16 | | | | 162,077,393 | | | 14.6 |

301 - 360 | | | 53 | | | | 734,054,084 | | | 66.3 |

361 - 480 | | | 7 | | | | 30,977,864 | | | 2.8 |

Total: | | | 86 | | | | $1,107,001,430 | | | 100.0% |

Weighted Average(2): | | | 347 months | | | | | | | |