UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22865

Forethought Variable Insurance Trust

(Exact name of registrant as specified in charter)

10 West Market Street, Suite 2300

Indianapolis, Indiana 46204

(Address of principal executive offices) (Zip code)

The Corporation Trust Company

1209 Orange Street Wilmington, DE 19801

(Name and address of agent for service)

Registrant's telephone number, including area code: 877-355-1820

Date of fiscal year end: December 31

Date of reporting period: June 30, 2021

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

Semi-Annual Report

June 30, 2021

Global Atlantic Portfolios

Global Atlantic American Funds® Managed Risk Portfolio

Global Atlantic Balanced Managed Risk Portfolio

Global Atlantic BlackRock Selects Managed Risk Portfolio

Global Atlantic Franklin Dividend and Income Managed Risk Portfolio

Global Atlantic Goldman Sachs Dynamic Trends Allocation Portfolio1

Global Atlantic Growth Managed Risk Portfolio

Global Atlantic Moderate Growth Managed Risk Portfolio

Global Atlantic PIMCO Tactical Allocation Portfolio2

Global Atlantic Select Advisor Managed Risk Portfolio

Global Atlantic Wellington Research Managed Risk Portfolio

Class II shares

Each a separate series of the Forethought Variable Insurance Trust

Distributed by Global Atlantic Distributors, LLC

Member FINRA

1 Effective after the close of business on August 20, 2021, Global Atlantic Goldman Sachs Dynamic Trends Allocation Portfolio was reorganized into Global Atlantic Balanced Managed Risk Portfolio.

2 Effective after the close of business on August 20, 2021, Global Atlantic PIMCO Tactical Allocation Portfolio was reorganized into Global Atlantic Wellington Research Managed Risk Portfolio.

Dear Shareholders/Contract Owners:

Unlike the first half of 2020, which saw one of the most volatile periods in financial markets history, the six months ending June 30, 2021 (the "Period") were relatively calm. That said, the impact of the COVID-19 pandemic continues to be felt, as new variants develop, vaccine availability increases, and economic data remains inconsistent as the global economy slowly reopens. Following the March 2020 correction, volatility, as measured by the VIX, slowly declined and settled into the 20-25 range, compared to recent years where periods of benign volatility would be measured in the 10-15 range. This somewhat elevated level of volatility persisted through the first quarter of 2021. Furthermore, a pattern developed whereby brief spikes in volatility off this elevated base of 20-25 and generally only lasting a few days, would occur every few months as COVID-19 developments, economic data, and the U.S. election raised market fears. From June 2020 through May 2021, there were 11 such spikes, with the markets in each case moving rather quickly past its concerns.

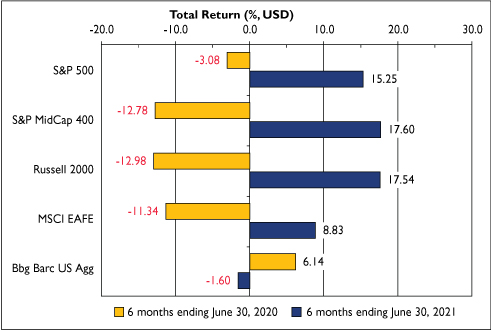

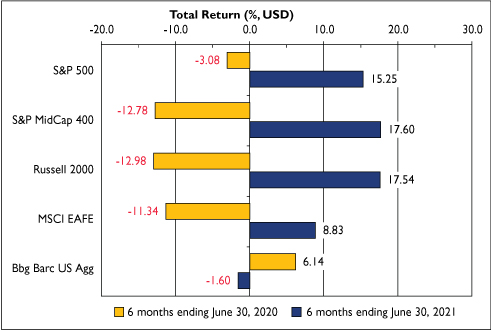

The record recovery that occurred in 2020 continued into 2021 despite an environment of persistently high volatility highlighted by periodic spikes. Major domestic equity indices were up approximately 15-20% during the Period, led by the S&P Midcap 400 and Russell 2000 indices which were up 17.60% and 17.54%, respectively. The S&P 500 also posted strong performance, up 15.25% during the Period. This compares to meaningfully negative returns during the same period a year ago, particularly as it relates to the S&P Midcap 400 and Russell 2000 indices, as shown in the chart below. International large capitalization equities, as measured by the MSCI EAFE Index, were up 8.83% during the Period, compared to down -11.34% during the same period a year ago.

Fixed income markets, in contrast to equity markets, generally were negative during the Period as U.S. Treasury yields rose sharply. The U.S. 10-year Treasury yield began the year at 0.92%, peaked at 1.76% in March, before ending the Period at 1.47%. The U.S. 30-year Treasury yield started 2021 at 1.64%, climbed to 2.45% in March, before slowly declining to 2.09% at the end of the Period. While spreads on investment grade bonds tightened throughout the Period, this was not enough to offset the meaningful rise in U.S. government bond yields, as illustrated by the -1.60% return on the Bbg Barc US Agg in the chart above.

As the U.S. economy continues to open, economic data is expected to be directionally positive but potentially inconsistent given the emergence of the Delta COVID-19 variant and differing degrees of vaccination rates throughout the country. Furthermore, concerns regarding inflation and rising interest rates, while more muted as of the end of the Period than earlier this year, remain a general concern going forward. Globally the outlook is more uncertain given the relatively lower level of vaccine availability in some countries (for example, Brazil and India) combined with the rapid spread of the Delta COVID-19 variant. As a result, there are concerns that the economic recovery globally could slow until these issues improve.

Given the hardships endured over the past 18 months, we hope this shareholder letter finds you healthy and wish you all the best for the remainder of 2021 and beyond.

Thank you for investing in the Global Atlantic Portfolios.

Sincerely, | |

| |

| |

Eric D. Todd, CFA | | Cameron Jeffreys, CFA | |

President | | Senior Vice President | |

Global Atlantic Investment Advisors, LLC | | Global Atlantic Investment Advisors, LLC | |

1

Portfolio | | Benchmark | |

Global Atlantic American Funds® Managed Risk Portfolio | | S&P Global Managed Risk LargeMidCap Index – Moderate Conservative | |

Global Atlantic Balanced Managed Risk Portfolio | | S&P Global Managed Risk LargeMidCap Index – Conservative | |

Global Atlantic BlackRock Selects Managed Risk Portfolio | | S&P Global Managed Risk LargeMidCap Index – Moderate Conservative | |

Global Atlantic Franklin Dividend and Income Managed Risk Portfolio | | S&P 500 Managed Risk Index – Moderate | |

Global Atlantic Goldman Sachs Dynamic Trends Allocation Portfolio1 | | S&P Global Managed Risk LargeMidCap Index – Conservative | |

Global Atlantic Growth Managed Risk Portfolio | | S&P Global Managed Risk LargeMidCap Index – Moderate Aggressive | |

Global Atlantic Moderate Growth Managed Risk Portfolio | | S&P Global Managed Risk LargeMidCap Index – Moderate Conservative | |

Global Atlantic PIMCO Tactical Allocation Portfolio2 | | S&P Global Managed Risk LargeMidCap Index – Moderate | |

Global Atlantic Select Advisor Managed Risk Portfolio | | S&P Global Managed Risk LargeMidCap Index – Moderate | |

Global Atlantic Wellington Research Managed Risk Portfolio | | S&P 500 Managed Risk Index – Moderate Conservative | |

The indices shown are for informational purposes only and are not reflective of any investment. As it is not possible to invest directly in the indices, the data shown does not reflect or compare features of an actual investment, such as its objectives, costs and expenses, liquidity, safety, guarantees or insurance, fluctuation of principal or return, or tax features. Past performance is no guarantee of future results.

This report contains the current opinions of Global Atlantic Investment Advisors, LLC and/or sub-advisers at the time of its publication and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. Such opinions are subject to change without notice and securities described herein may no longer be included in, or may at any time be removed from, a Portfolio's portfolio. This report is distributed for informational purposes only. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed.

Index Definitions:

S&P Global Managed Risk LargeMidCap Index – Conservative. An index that is designed to simulate a dynamic protective portfolio that allocates between the underlying equity index and cash based on realized volatilities of the underlying equity and bond indices, while maintaining a fixed allocation of 50% to the underlying bond index.

S&P Global Managed Risk LargeMidCap Index – Moderate Conservative. An index that is designed to simulate a dynamic protective portfolio that allocates between the underlying equity index and cash based on realized volatilities of the underlying equity and bond indices, while maintaining a fixed allocation of 40% to the underlying bond index.

S&P Global Managed Risk LargeMidCap Index – Moderate. An index that is designed to simulate a dynamic protective portfolio that allocates between the underlying equity index and cash based on realized volatilities of the underlying equity and bond indices, while maintaining a fixed allocation of 30% to the underlying bond index.

S&P Global Managed Risk LargeMidCap Index – Moderate Aggressive. An index that is designed to simulate a dynamic protective portfolio that allocates between the underlying equity index and cash based on realized volatilities of the underlying equity and bond indices, while maintaining a fixed allocation of 20% to the underlying bond index.

S&P 500 Managed Risk Index – Moderate Conservative. An index that is designed to simulate a dynamic protective portfolio that allocates between the underlying equity index and cash based on realized volatilities of the underlying equity and bond indices, while maintaining a fixed allocation of 40% to the underlying bond index.

S&P 500 Managed Risk Index – Moderate. An index that is designed to simulate a dynamic protective portfolio that allocates between the underlying equity index and cash based on realized volatilities of the underlying equity and bond indices, while maintaining a fixed allocation of 30% to the underlying bond index.

1 Effective after the close of business on August 20, 2021, Global Atlantic Goldman Sachs Dynamic Trends Allocation Portfolio was reorganized into Global Atlantic Balanced Managed Risk Portfolio.

2 Effective after the close of business on August 20, 2021, Global Atlantic PIMCO Tactical Allocation Portfolio was reorganized into Global Atlantic Wellington Research Managed Risk Portfolio.

2

Bloomberg Barclays US Aggregate Bond Index ("Bbg Barc US Agg"). An index weighted according to market capitalization and includes, among other categories, Treasury securities, mortgage backed securities, government agency bonds and corporate bonds. To be included in the index, bonds must be rated investment grade by Moody's and Standard & Poor's. Effective August 24, 2021, "Barclays" will be removed from the index's name.

CBOE Volatility Index ("VIX"). An index that reflects a market estimate of future volatility, based on the weighted average of the implied volatilities for a wide range of strikes.

MSCI EAFE Index ("MSCI EAFE"). An index created by Morgan Stanley Capital International (MSCI) that serves as a benchmark of the performance in major developed international equity markets as represented by 21 major MSCI indexes from Europe, Australasia and the Far East.

Russell 2000 Index ("Russell 2000"). An index measuring the performance of approximately 2,000 small-cap companies in the Russell 3000 Index, which is made up of 3,000 of the biggest U.S. stocks. The Russell 2000 serves as a benchmark for small-cap stocks in the United States.

S&P MidCap 400 Index ("S&P MidCap 400"). A capitalization-weighted index which measures the performance of the mid-range sector of the U.S. stock market.

S&P 500 Index ("S&P 500"). A market capitalization weighted price index composed of 500 widely held U.S. common stocks. Frequently used as a measure of U.S. stock market performance.

3

| | | | | Page | |

• | | Global Atlantic Portfolio Performance | | | 5 | | |

• | | Global Atlantic Portfolio of Investments | | | | | |

| | | | | Global Atlantic American Funds® Managed Risk Portfolio | | | 7 | | |

| | | Global Atlantic Balanced Managed Risk Portfolio | | | 8 | | |

| | | Global Atlantic BlackRock Selects Managed Risk Portfolio | | | 9 | | |

| | | Global Atlantic Franklin Dividend and Income Managed Risk Portfolio | | | 10 | | |

| | | Global Atlantic Goldman Sachs Dynamic Trends Allocation Portfolio | | | 22 | | |

| | | Global Atlantic Growth Managed Risk Portfolio | | | 23 | | |

| | | Global Atlantic Moderate Growth Managed Risk Portfolio | | | 24 | | |

| | | Global Atlantic PIMCO Tactical Allocation Portfolio | | | 25 | | |

| | | Global Atlantic Select Advisor Managed Risk Portfolio | | | 31 | | |

| | | Global Atlantic Wellington Research Managed Risk Portfolio | | | 32 | | |

• | | Financial Statements: | | | |

| | | Statements of Assets and Liabilities | | | 43 | | |

| | | Statements of Operations | | | 46 | | |

| | | Statements of Changes in Net Assets | | | 49 | | |

| | | Financial Highlights | | | 54 | | |

• | | Notes to Financial Statements | | | 64 | | |

• | | Expense Examples | | | 88 | | |

• | | Privacy Notice | | | 92 | | |

• | | Proxy Voting Policy | | Back Cover | |

• | | Portfolio Holdings | | Back Cover | |

4

The Portfolio's performance figures for the periods ended June 30, 2021 as compared to its benchmarks:

| | | | | | | Annualized | | Operating

Expenses* | |

| | | Inception

Date | | Six Months

Ended

6/30/21 | | One Year

Ended

6/30/21 | | Three Years

Ended

6/30/21 | | Five Years

Ended

6/30/21 | | Since

Inception

6/30/21 | | Gross

Ratios | | Net

Ratios | |

Global Atlantic American Funds® Managed Risk Portfolio^ | |

Class II | | 10/31/13 | | | 6.81 | % | | | 20.52 | % | | | 9.14 | % | | | 9.00 | % | | | 7.08 | % | | | 1.67 | % | | | 1.27 | % | |

S&P Global Managed Risk

LargeMidCap Index - Moderate

Conservative1 | | | | | 6.73 | % | | | 18.20 | % | | | 8.81 | % | | | 8.69 | % | | | 6.36 | % | | | | | |

Global Atlantic Balanced Managed Risk Portfolio^ | |

Class II | | 10/31/13 | | | 5.42 | % | | | 15.97 | % | | | 7.73 | % | | | 6.91 | % | | | 5.73 | % | | | 1.03 | % | | | 1.03 | % | |

S&P Global Managed Risk

LargeMidCap Index -

Conservative2 | | | | | 5.35 | % | | | 15.14 | % | | | 8.15 | % | | | 7.72 | % | | | 5.92 | % | | | | | |

Global Atlantic BlackRock Selects Managed Risk Portfolio^^ | |

Class II | | 10/31/13 | | | 6.64 | % | | | 20.01 | % | | | 8.53 | % | | | 7.80 | % | | | 4.53 | % | | | 1.17 | % | | | 1.17 | % | |

S&P Global Managed Risk

LargeMidCap Index - Moderate

Conservative1 | | | | | 6.73 | % | | | 18.20 | % | | | 8.81 | % | | | 8.69 | % | | | 6.36 | % | | | | | |

Global Atlantic Franklin Dividend and Income Managed Risk Portfolio^^^ | |

Class II | | 4/30/14 | | | 7.51 | % | | | 21.54 | % | | | 10.04 | % | | | 9.23 | % | | | 7.00 | % | | | 1.23 | % | | | 1.20 | % | |

S&P 500 Managed Risk Index -

Moderate3 | | | | | | | 8.97 | % | | | 19.02 | % | | | 10.59 | % | | | 10.47 | % | | | 8.61 | % | | | | | | | | | |

Global Atlantic Goldman Sachs Dynamic Trends Allocation Portfolio^^^^ | |

Class II | | 4/30/15 | | | 5.85 | % | | | 15.28 | % | | | 8.44 | % | | | 6.54 | % | | | 4.84 | % | | | 1.29 | % | | | 1.23 | % | |

S&P Global Managed Risk

LargeMidCap Index -

Conservative2 | | | | | | | 5.35 | % | | | 15.14 | % | | | 8.15 | % | | | 7.72 | % | | | 5.76 | % | | | | | | | | | |

Global Atlantic Growth Managed Risk Portfolio^ | |

Class II | | 4/30/14 | | | 8.86 | % | | | 22.13 | % | | | 8.56 | % | | | 8.93 | % | | | 5.93 | % | | | 1.01 | % | | | 0.98 | % | |

S&P Global Managed Risk

LargeMidCap Index - Moderate

Agressive4 | | | | | 9.54 | % | | | 24.28 | % | | | 10.03 | % | | | 10.53 | % | | | 6.99 | % | | | | | |

Global Atlantic Moderate Growth Managed Risk Portfolio^ | |

Class II | | 4/30/14 | | | 7.21 | % | | | 19.19 | % | | | 8.26 | % | | | 8.01 | % | | | 6.12 | % | | | 1.01 | % | | | 1.01 | % | |

S&P Global Managed Risk

LargeMidCap Index - Moderate

Conservative1 | | | | | 6.73 | % | | | 18.20 | % | | | 8.81 | % | | | 8.69 | % | | | 6.23 | % | | | | | |

Global Atlantic PIMCO Tactical Allocation Portfolio^^^^ | |

Class II | | 4/30/15 | | | 4.59 | % | | | 12.78 | % | | | 8.55 | % | | | 7.86 | % | | | 5.93 | % | | | 1.42 | % | | | 1.20 | % | |

S&P Global Managed Risk

LargeMidCap Index -

Moderate5 | | | | | 8.13 | % | | | 21.12 | % | | | 9.42 | % | | | 9.60 | % | | | 6.52 | % | | | | | |

Global Atlantic Select Advisor Managed Risk Portfolio^ | |

Class II | | 10/31/13 | | | 8.67 | % | | | 22.32 | % | | | 9.17 | % | | | 9.05 | % | | | 7.03 | % | | | 1.83 | % | | | 1.21 | % | |

S&P Global Managed Risk

LargeMidCap Index -

Moderate5 | | | | | 8.13 | % | | | 21.12 | % | | | 9.42 | % | | | 9.60 | % | | | 6.74 | % | | | | | |

5

Performance Summary (Continued)

| | | | | | | Annualized | | Operating

Expenses* | |

| | | Inception

Date | | Six Months

Ended

6/30/21 | | One Year

Ended

6/30/21 | | Three Years

Ended

6/30/21 | | Five Years

Ended

6/30/21 | | Since

Inception

6/30/21 | | Gross

Ratios | | Net

Ratios | |

Global Atlantic Wellington Research Managed Risk Portfolio^^^^ | |

Class II | | 10/31/13 | | | 6.89 | % | | | 20.28 | % | | | 10.41 | % | | | 9.59 | % | | | 8.15 | % | | | 1.23 | % | | | 1.22 | % | |

S&P 500 Managed Risk Index -

Moderate Conservative6 | | | | | | | 7.57 | % | | | 16.61 | % | | | 10.01 | % | | | 9.54 | % | | | 8.31 | % | | | | | | | | | |

^ The performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Total returns would have been lower absent fee waivers by the Adviser. Performance figures for periods greater than one year are annualized. The returns shown do not reflect the deduction of taxes that a shareholder may pay on Portfolio distributions or on the redemption of Portfolio shares, as well as other charges and expenses of the insurance contract or separate account. Prior to October 1, 2016, the Capital Appreciation and Income Component of the Portfolio was managed by the Adviser without the use of a sub-adviser. The performance prior to that date is attributable to the Adviser's asset allocation decisions.

^^ The performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Total returns would have been lower absent fee waivers by the Adviser. Performance figures for periods greater than one year are annualized. The returns shown do not reflect the deduction of taxes that a shareholder may pay on Portfolio distributions or on the redemption of Portfolio shares, as well as other charges and expenses of the insurance contract or separate account. Prior to May 1, 2019, the Capital Appreciation and Income Component of the Portfolio was managed pursuant to a different investment strategy by the Adviser without the use of a sub-adviser. The performance prior to that date is attributable to the Adviser and the prior investment strategy.

^^^ The performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Total returns would have been lower absent fee waivers by the Adviser. Performance figures for periods greater than one year are annualized. The returns shown do not reflect the deduction of taxes that a shareholder may pay on Portfolio distributions or on the redemption of Portfolio shares, as well as other charges and expenses of the insurance contract or separate account. Prior to October 1, 2016, the Fixed Income Component of the Portfolio was managed by the Adviser without the use of a sub-adviser.

^^^^ The performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that your shares,when redeemed, may be worth more or less than their original cost. Total returns would have been lower absent fee waivers by the Adviser. Performance figures for periods greater than one year are annualized. The returns shown do not reflect the deduction of taxes that a shareholder may pay on Portfolio distributions or on the redemption of Portfolio shares, as well as other charges and expenses of the insurance contract or separate account.

* The estimated operating expense ratios for Class II shares, as disclosed in the most recent prospectus dated May 1, 2021. Ratios include Acquired Fund Fees and Expenses indirectly incurred by the Portfolio, if applicable. Gross operating expense ratio reflects the ratio of expenses absent waivers and/or reimbursements by the Adviser. The operating expense ratios presented here may differ from the expense ratios disclosed in the Financial Highlights table in this report.

1 S&P Global Managed Risk LargeMidCap Index - Moderate Conservative. An index that is designed to simulate a dynamic protective portfolio that allocates between the underlying equity index and cash based on realized volatilities of the underlying equity and bond indices, while maintaining a fixed allocation of 40% to the underlying bond index.

2 S&P Global Managed Risk LargeMidCap Index - Conservative. An index that is designed to simulate a dynamic protective portfolio that allocates between the underlying equity index and cash based on realized volatilities of the underlying equity and bond indices, while maintaining a fixed allocation of 50% to the underlying bond index.

3 S&P 500 Managed Risk Index - Moderate. An index that is designed to simulate a dynamic protective portfolio that allocates between the underlying equity index and cash based on realized volatilities of the underlying equity and bond indices, while maintaining a fixed allocation of 30% to the underlying bond index.

4 S&P Global Managed Risk LargeMidCap Index - Moderate Aggressive. An index that is designed to simulate a dynamic protective portfolio that allocates between the underlying equity index and cash based on realized volatilities of the underlying equity and bond indices, while maintaining a fixed allocation of 20% to the underlying bond index.

5 S&P Global Managed Risk LargeMidCap Index - Moderate. An index that is designed to simulate a dynamic protective portfolio that allocates between the underlying equity index and cash based on realized volatilities of the underlying equity and bond indices, while maintaining a fixed allocation of 30% to the underlying bond index.

6 S&P 500 Managed Risk Index - Moderate Conservative. An index that is designed to simulate a dynamic protective portfolio that allocates between the underlying equity index and cash based on realized volatilities of the underlying equity and bond indices, while maintaining a fixed allocation of 40% to the underlying bond index.

6

Global Atlantic American Funds® Managed Risk Portfolio

Portfolio of Investments (Unaudited)

June 30, 2021

| | | Shares/

Principal | | Fair

Value | |

VARIABLE INSURANCE TRUSTS - 95.6% | |

ASSET ALLOCATION FUND - 2.9% | |

American Funds Insurance Series -

New World Fund, Class 1 | | | 202,422 | | | $ | 6,809,487 | | |

TOTAL ASSET ALLOCATION FUND | | | | | 6,809,487 | | |

DEBT FUNDS - 33.4% | |

American Funds Insurance Series -

Bond Fund, Class 1 | | | 4,601,560 | | | | 52,043,643 | | |

American Funds Insurance Series -

Capital World Bond Fund, Class 1 | | | 551,613 | | | | 6,702,099 | | |

American Funds Insurance Series -

High-Income Bond Fund, Class 1 | | | 657,604 | | | | 6,819,356 | | |

American Funds Insurance Series -

U.S. Government/AAA-Rated

Securities Fund, Class 1 | | | 1,159,463 | | | | 13,588,911 | | |

TOTAL DEBT FUNDS | | | | | 79,154,009 | | |

EQUITY FUNDS - 59.3% | |

American Funds Insurance Series -

Blue Chip Income and

Growth Fund, Class 1 | | | 2,457,909 | | | | 40,457,181 | | |

American Funds Insurance Series -

Global Growth and

Income Fund, Class 1 | | | 1,382,162 | | | | 24,754,515 | | |

American Funds Insurance Series -

Global Small Capitalization Fund, Class 1 | | | 191,887 | | | | 6,794,703 | | |

| | | Shares/

Principal | | Fair

Value | |

EQUITY FUNDS - 59.3% (Continued) | |

American Funds Insurance Series -

Growth Fund, Class 1 | | | 216,017 | | | $ | 25,552,668 | | |

American Funds Insurance Series -

Growth-Income Fund, Class 1 | | | 546,025 | | | | 34,093,821 | | |

American Funds Insurance Series -

International Growth and

Income Fund, Class 1 | | | 439,938 | | | | 8,935,136 | | |

TOTAL EQUITY FUNDS | | | | | 140,588,024 | | |

TOTAL VARIABLE INSURANCE

TRUSTS (Cost - $177,611,059) | | | | | 226,551,520 | | |

SHORT-TERM INVESTMENTS - 4.5% | |

MONEY MARKET FUNDS - 4.5% | |

Dreyfus Government Cash

Management, 0.03% (a) | | | 10,650,582 | | | | 10,650,582 | | |

Fidelity Investments Money

Market Fund - Government Portfolio,

Institutional Class, 0.01% (a) | | | 100,246 | | | | 100,246 | | |

TOTAL SHORT-TERM

INVESTMENTS (Cost - $10,750,828) | | | | | 10,750,828 | | |

TOTAL INVESTMENTS - 100.1%

(Cost - $188,361,887) | | | | $ | 237,302,348 | | |

OTHER ASSETS LESS

LIABILITIES - NET (0.1)% | | | | | (212,842) | | |

TOTAL NET ASSETS - 100.0% | | | | $ | 237,089,506 | | |

(a) The rate shown is the annualized seven-day yield at period end.

Holdings by Asset Class | | % of Net Assets | |

Variable Insurance Trusts | | | 95.6 | % | |

Short-Term Investments | | | 4.5 | % | |

Other Assets less Liabilities - Net | | | (0.1 | )% | |

| | | 100.0 | % | |

See accompanying notes to financial statements.

7

Global Atlantic Balanced Managed Risk Portfolio

Portfolio of Investments (Unaudited)

June 30, 2021

| | | Shares/

Principal | | Fair

Value | |

EXCHANGE TRADED FUNDS - 95.1% | |

DEBT FUNDS - 43.5% | |

BlackRock Short Maturity Bond ETF | | | 31,120 | | | $ | 1,561,135 | | |

iShares 10+ Year Investment Grade

Corporate Bond ETF | | | 46,857 | | | | 3,289,361 | | |

iShares 1-3 Year Treasury Bond ETF | | | 9,056 | | | | 780,265 | | |

iShares 3-7 Year Treasury Bond ETF | | | 47,919 | | | | 6,254,867 | | |

iShares 5-10 Year Investment Grade

Corporate Bond ETF | | | 5,228 | | | | 316,398 | | |

iShares 7-10 Year Treasury Bond ETF | | | 8,536 | | | | 985,823 | | |

iShares Core Total USD Bond Market ETF | | | 108,502 | | | | 5,803,772 | | |

iShares Fallen Angels USD Bond ETF | | | 26,529 | | | | 794,809 | | |

iShares MBS ETF | | | 7,186 | | | | 777,741 | | |

iShares Trust iShares 1-5 Year Investment

Grade Corporate Bond ETF | | | 156,220 | | | | 8,562,418 | | |

iShares U.S. Treasury Bond ETF | | | 266,191 | | | | 7,080,680 | | |

TOTAL DEBT FUNDS | | | | | 36,207,269 | | |

EQUITY FUNDS - 51.6% | |

iShares Core MSCI EAFE ETF | | | 64,210 | | | | 4,806,761 | | |

iShares Core S&P 500 ETF | | | 32,979 | | | | 14,178,332 | | |

iShares Core S&P Mid-Cap ETF | | | 11,477 | | | | 3,084,214 | | |

iShares Core S&P Small-Cap ETF | | | 38,645 | | | | 4,366,112 | | |

iShares Global Financials ETF | | | 9,650 | | | | 748,937 | | |

iShares Global Tech ETF | | | 1,585 | | | | 534,969 | | |

iShares MSCI EAFE Growth ETF | | | 11,105 | | | | 1,191,344 | | |

iShares MSCI EAFE Value ETF | | | 50,840 | | | | 2,631,478 | | |

| | | Shares/

Principal | | Fair

Value | |

EQUITY FUNDS - 51.6% (Continued) | |

iShares MSCI USA Momentum Factor ETF | | | 4,449 | | | $ | 771,590 | | |

iShares MSCI USA Value Factor ETF | | | 15,860 | | | | 1,666,252 | | |

iShares Trust iShares ESG Aware MSCI

USA ETF | | | 62,613 | | | | 6,165,502 | | |

iShares U.S. Energy ETF | | | 54,242 | | | | 1,577,900 | | |

iShares, Inc. iShares ESG Aware MSCI EM ETF | | | 25,915 | | | | 1,170,062 | | |

TOTAL EQUITY FUNDS | | | | | 42,893,453 | | |

TOTAL EXCHANGE TRADED

FUNDS (Cost - $63,255,821) | | | | | 79,100,722 | | |

SHORT-TERM INVESTMENTS - 5.0% | |

MONEY MARKET FUNDS - 5.0% | |

Dreyfus Government Cash

Management, 0.03% (a) | | | 3,067,328 | | | | 3,067,328 | | |

Fidelity Investments Money Market Fund -

Government Portfolio,

Institutional Class, 0.01% (a) | | | 1,105,636 | | | | 1,105,636 | | |

TOTAL SHORT-TERM

INVESTMENTS (Cost - $4,172,964) | | | | | 4,172,964 | | |

TOTAL INVESTMENTS - 100.1%

(Cost - $67,428,785) | | | | $ | 83,273,686 | | |

OTHER ASSETS LESS

LIABILITIES - NET (0.1)% | | | | | (71,744) | | |

TOTAL NET ASSETS - 100.0% | | | | $ | 83,201,942 | | |

(a) The rate shown is the annualized seven-day yield at period end.

Holdings by Asset Class | | % of Net Assets | |

Exchange Traded Funds | | | 95.1 | % | |

Short-Term Investments | | | 5.0 | % | |

Other Assets less Liabilities - Net | | | (0.1 | )% | |

| | | 100.0 | % | |

See accompanying notes to financial statements.

8

Global Atlantic BlackRock Selects Managed Risk Portfolio

Portfolio of Investments (Unaudited)

June 30, 2021

| | | Shares/

Principal | | Fair

Value | |

EXCHANGE TRADED FUNDS - 73.6% | |

DEBT FUNDS - 25.2% | |

iShares 1-3 Year Treasury Bond ETF | | | 217,244 | | | $ | 18,717,743 | | |

iShares 20+ Year Treasury Bond ETF | | | 17,007 | | | | 2,454,961 | | |

iShares 7-10 Year Treasury Bond ETF | | | 51,316 | | | | 5,926,485 | | |

iShares iBoxx $ Investment Grade

Corporate Bond ETF | | | 17,845 | | | | 2,397,654 | | |

iShares iBoxx High Yield Corporate

Bond ETF | | | 80,788 | | | | 7,112,576 | | |

iShares JP Morgan USD Emerging

Markets Bond ETF | | | 31,496 | | | | 3,542,040 | | |

iShares Short Treasury Bond ETF | | | 190,858 | | | | 21,087,900 | | |

TOTAL DEBT FUNDS | | | | | 61,239,359 | | |

EQUITY FUNDS - 48.4% | |

iShares Core MSCI EAFE ETF | | | 181,656 | | | | 13,598,768 | | |

iShares Core MSCI Emerging Markets ETF | | | 68,836 | | | | 4,611,323 | | |

iShares Core S&P 500 ETF | | | 11,053 | | | | 4,751,906 | | |

iShares Core S&P Small-Cap ETF | | | 41,208 | | | | 4,655,680 | | |

iShares Core S&P U.S. Growth ETF | | | 461,562 | | | | 46,608,531 | | |

iShares Core S&P U.S. Value ETF | | | 285,989 | | | | 20,579,768 | | |

iShares Global Financials ETF | | | 28,744 | | | | 2,230,822 | | |

iShares MSCI Eurozone ETF | | | 365,461 | | | | 18,035,500 | | |

| | | Shares/

Principal | | Fair

Value | |

iShares U.S. Financial Services ETF | | | 12,299 | | | | 2,278,144 | | |

TOTAL EQUITY FUNDS | | | | | 117,350,442 | | |

TOTAL EXCHANGE TRADED

FUNDS (Cost - $149,699,674) | | | | | 178,589,801 | | |

VARIABLE INSURANCE TRUSTS - 22.2% | |

ASSET ALLOCATION FUND - 22.2% | |

BlackRock Global Allocation VI Fund,

Class I (Cost - $38,748,115) | | | 2,592,634 | | | $ | 53,874,925 | | |

SHORT-TERM INVESTMENTS - 4.3% | |

MONEY MARKET FUNDS - 4.3% | |

Dreyfus Government Cash

Management, 0.03% (a) | | | 8,944,651 | | | | 8,944,651 | | |

Fidelity Investments Money Market Fund -

Government Portfolio,

Institutional Class, 0.01% (a) | | | 1,452,706 | | | | 1,452,706 | | |

TOTAL SHORT-TERM

INVESTMENTS (Cost - $10,397,357) | | | | | 10,397,357 | | |

TOTAL INVESTMENTS - 100.1%

(Cost - $198,845,146) | | | | $ | 242,862,083 | | |

OTHER ASSETS LESS

LIABILITIES - NET (0.1)% | | | | | (206,819) | | |

TOTAL NET ASSETS - 100.0% | | | | $ | 242,655,264 | | |

(a) The rate shown is the annualized seven-day yield at period end.

Holdings by Asset Class | | % of Net Assets | |

Exchange Traded Funds | | | 73.6 | % | |

Variable Insurance Trusts | | | 22.2 | % | |

Short-Term Investments | | | 4.3 | % | |

Other Assets less Liabilities - Net | | | (0.1 | )% | |

| | | 100.0 | % | |

See accompanying notes to financial statements.

9

Global Atlantic Franklin Dividend and Income Managed Risk Portfolio

Portfolio of Investments (Unaudited)

June 30, 2021

| | | Shares/

Principal | | Fair

Value | |

COMMON STOCKS - 71.8% | |

AEROSPACE & DEFENSE - 2.6% | |

General Dynamics Corp. | | | 12,970 | | | $ | 2,441,732 | | |

Raytheon Technologies Corp. | | | 58,055 | | | | 4,952,672 | | |

| | | | | | 7,394,404 | | |

AIR FREIGHT & LOGISTICS - 1.6% | |

United Parcel Service, Inc., Class B | | | 21,075 | | | | 4,382,968 | | |

BANKS - 0.9% | |

JPMorgan Chase & Co. | | | 16,750 | | | | 2,605,295 | | |

BEVERAGES - 1.1% | |

PepsiCo, Inc. | | | 20,800 | | | | 3,081,936 | | |

BIOTECHNOLOGY - 0.7% | |

AbbVie, Inc. | | | 17,510 | | | | 1,972,326 | | |

BUILDING PRODUCTS - 1.4% | |

Johnson Controls International PLC | | | 54,975 | | | | 3,772,934 | | |

CAPITAL MARKETS - 0.8% | |

Nasdaq, Inc. | | | 13,290 | | | | 2,336,382 | | |

CHEMICALS - 7.3% | |

Air Products and Chemicals, Inc. | | | 19,900 | | | | 5,724,832 | | |

Albemarle Corp. | | | 26,645 | | | | 4,488,617 | | |

Ecolab, Inc. | | | 14,200 | | | | 2,924,774 | | |

Linde PLC | | | 22,850 | | | | 6,605,935 | | |

Sherwin-Williams Co. (The) | | | 2,600 | | | | 708,370 | | |

| | | | | | 20,452,528 | | |

COMMERCIAL SERVICES & SUPPLIES - 1.3% | |

Cintas Corp. | | | 9,540 | | | | 3,644,280 | | |

CONSUMER DISCRETIONARY SERVICES - 0.0%† | |

24 Hour Fitness Worldwide, Inc.* | | | 671 | | | | 1,342 | | |

ELECTRICAL EQUIPMENT - 0.4% | |

nVent Electric PLC | | | 38,670 | | | | 1,208,051 | | |

ENERGY EQUIPMENT & SERVICES - 0.0%† | |

Weatherford International PLC* | | | 1,897 | | | | 34,525 | | |

FOOD & STAPLES RETAILING - 1.0% | |

Walmart, Inc. | | | 19,900 | | | | 2,806,298 | | |

FOOD PRODUCTS - 0.9% | |

McCormick & Co., Inc. | | | 29,040 | | | | 2,564,813 | | |

HEALTH CARE EQUIPMENT & SUPPLIES - 9.9% | |

Abbott Laboratories | | | 35,875 | | | | 4,158,989 | | |

Becton Dickinson and Co. | | | 18,800 | | | | 4,571,972 | | |

Medtronic PLC | | | 43,500 | | | | 5,399,655 | | |

Stryker Corp. | | | 28,585 | | | | 7,424,382 | | |

West Pharmaceutical Services, Inc. | | | 17,000 | | | | 6,104,700 | | |

| | | | | | 27,659,698 | | |

| | | Shares/

Principal | | Fair

Value | |

HEALTH CARE PROVIDERS & SERVICES - 1.8% | |

CVS Health Corp. | | | 10,490 | | | $ | 875,286 | | |

UnitedHealth Group, Inc. | | | 10,700 | | | | 4,284,708 | | |

| | | | | | 5,159,994 | | |

HOTELS, RESTAURANTS & LEISURE - 1.2% | |

McDonald's Corp. | | | 15,020 | | | | 3,469,470 | | |

HOUSEHOLD PRODUCTS - 1.9% | |

Colgate-Palmolive Co. | | | 28,166 | | | | 2,291,304 | | |

Procter & Gamble Co. (The) | | | 22,800 | | | | 3,076,404 | | |

| | | | | | 5,367,708 | | |

INDUSTRIAL CONGLOMERATES - 6.0% | |

Carlisle Cos., Inc. | | | 8,880 | | | | 1,699,454 | | |

Honeywell International, Inc. | | | 24,060 | | | | 5,277,561 | | |

Roper Technologies, Inc. | | | 20,640 | | | | 9,704,928 | | |

| | | | | | 16,681,943 | | |

INSURANCE - 0.5% | |

Erie Indemnity Co., Class A | | | 7,500 | | | | 1,450,125 | | |

IT SERVICES - 4.6% | |

Accenture PLC, Class A | | | 27,000 | | | | 7,959,330 | | |

Visa, Inc., Class A | | | 21,520 | | | | 5,031,806 | | |

| | | | | | 12,991,136 | | |

MACHINERY - 2.5% | |

Donaldson Co., Inc. | | | 21,029 | | | | 1,335,973 | | |

Dover Corp. | | | 21,500 | | | | 3,237,900 | | |

Pentair PLC | | | 34,170 | | | | 2,306,133 | | |

| | | | | | 6,880,006 | | |

MULTILINE RETAIL - 2.1% | |

Target Corp. | | | 24,800 | | | | 5,995,152 | | |

OIL, GAS & CONSUMABLE FUELS - 1.5% | |

Chevron Corp. | | | 13,700 | | | | 1,434,938 | | |

EOG Resources, Inc. | | | 19,700 | | | | 1,643,768 | | |

Exxon Mobil Corp. | | | 17,200 | | | | 1,084,976 | | |

| | | | | | 4,163,682 | | |

PHARMACEUTICALS - 1.9% | |

Johnson & Johnson | | | 22,100 | | | | 3,640,754 | | |

Pfizer, Inc. | | | 39,000 | | | | 1,527,240 | | |

| | | | | | 5,167,994 | | |

ROAD & RAIL - 1.0% | |

Norfolk Southern Corp. | | | 10,500 | | | | 2,786,805 | | |

SEMICONDUCTORS & SEMICONDUCTOR

EQUIPMENT - 5.0% | |

Analog Devices, Inc. | | | 39,971 | | | | 6,881,407 | | |

Texas Instruments, Inc. | | | 37,200 | | | | 7,153,560 | | |

| | | | | | 14,034,967 | | |

See accompanying notes to financial statements.

10

Global Atlantic Franklin Dividend and Income Managed Risk Portfolio

Portfolio of Investments (Unaudited) (Continued)

June 30, 2021

| | | Shares/

Principal | | Fair

Value | |

SOFTWARE - 6.5% | |

Microsoft Corp. | | | 66,735 | | | $ | 18,078,512 | | |

SPECIALTY RETAIL - 2.9% | |

Lowe's Cos., Inc. | | | 22,200 | | | | 4,306,134 | | |

Ross Stores, Inc. | | | 30,200 | | | | 3,744,800 | | |

| | | | | | 8,050,934 | | |

TEXTILES, APPAREL & LUXURY GOODS - 1.8% | |

NIKE, Inc., Class B | | | 32,740 | | | | 5,058,003 | | |

TRADING COMPANIES & DISTRIBUTORS - 0.7% | |

WW Grainger, Inc. | | | 4,570 | | | | 2,001,660 | | |

TOTAL COMMON STOCKS

(Cost - $88,804,022) | | | | | 201,255,871 | | |

CORPORATE BONDS AND NOTES - 7.9% | |

AEROSPACE & DEFENSE - 0.2% | |

Lockheed Martin Corp., 4.70%, 5/15/46 | | $ | 300,000 | | | | 396,885 | | |

Northrop Grumman Corp., 5.25%, 5/1/50 | | | 100,000 | | | | 140,551 | | |

| | | | | | 537,436 | | |

AGRICULTURE - 0.1% | |

Altria Group, Inc., 3.40%, 5/6/30 | | | 250,000 | | | | 263,930 | | |

AIRLINES - 0.2% | |

American Airlines, Inc./AAdvantage

Loyalty IP Ltd., 5.75%, 4/20/29 (a) | | | 100,000 | | | | 107,959 | | |

Delta Air Lines, Inc. / SkyMiles

IP Ltd., 4.50%, 10/20/25 (a) | | | 200,000 | | | | 214,991 | | |

Hawaiian Brand Intellectual Property Ltd. /

HawaiianMiles Loyalty Ltd., 5.75%,

1/20/26 (a) | | | 150,000 | | | | 161,250 | | |

United Airlines 2020-1 Class B

Pass-Through Trust, 4.88%, 1/15/26 | | | 48,525 | | | | 51,436 | | |

United Airlines, Inc., 4.38%, 4/15/26 (a) | | | 100,000 | | | | 103,500 | | |

| | | | | | 639,136 | | |

AUTO PARTS & EQUIPMENT - 0.1% | |

Aptiv Corp., 4.15%, 3/15/24 | | | 200,000 | | | | 217,014 | | |

BANKS - 1.0% | |

Banco Santander SA, 2.75%, 12/3/30 | | | 200,000 | | | | 198,366 | | |

Bank of America Corp. | |

3.50%, 4/19/26 | | | 500,000 | | | | 550,369 | | |

2.59%, (SOFR + 2.15%), 4/29/31 (b) | | | 100,000 | | | | 103,208 | | |

Citigroup, Inc., 2.57%,

(SOFR + 2.11%), 6/3/31 (b) | | | 100,000 | | | | 102,913 | | |

HSBC Holdings PLC | |

2.85%, (SOFR + 2.39%), 6/4/31 (b) | | | 200,000 | | | | 207,783 | | |

2.36%, (SOFR + 1.95%), 8/18/31 (b) | | | 200,000 | | | | 200,358 | | |

JPMorgan Chase & Co., 4.49%,

(SOFR + 3.79%), 3/24/31 (b) | | | 400,000 | | | | 474,183 | | |

Morgan Stanley, 3.88%, 1/27/26 | | | 500,000 | | | | 559,035 | | |

| | | Shares/

Principal | | Fair

Value | |

BANKS - 1.0% (Continued) | |

Societe Generale SA, 1.79%, (US 1 Year

CMT T-Note + 1.00%), 6/9/27 (a),(b) | | $ | 200,000 | | | $ | 199,604 | | |

UniCredit SpA, 1.98%, (US 1 Year

CMT T-Note + 1.20%), 6/3/27 (a),(b) | | | 200,000 | | | | 199,341 | | |

| | | | | | 2,795,160 | | |

BEVERAGES - 0.1% | |

Anheuser-Busch Cos., LLC /

Anheuser-Busch InBev

Worldwide, Inc., 4.70%, 2/1/36 | | | 100,000 | | | | 122,912 | | |

BIOTECHNOLOGY - 0.0%† | |

Regeneron Pharmaceuticals,

Inc., 1.75%, 9/15/30 | | | 50,000 | | | | 47,430 | | |

CHEMICALS - 0.2% | |

Alpek SAB de CV, 3.25%, 2/25/31 (a) | | | 200,000 | | | | 201,502 | | |

Braskem Netherlands Finance

BV, 4.50%, 1/31/30 (a) | | | 200,000 | | | | 207,984 | | |

Westlake Chemical

Corp., 3.38%, 6/15/30 | | | 50,000 | | | | 53,866 | | |

Yara International ASA,

3.15%, 6/4/30 (a) | | | 100,000 | | | | 107,086 | | |

| | | | | | 570,438 | | |

COMMERCIAL SERVICES - 0.0%† | |

Nielsen Finance LLC / Nielsen Finance

Co., 4.75%, 7/15/31 (a) | | | 100,000 | | | | 100,250 | | |

COMPUTERS - 0.0%† | |

Presidio Holdings, Inc., 8.25%, 2/1/28 (a) | | | 100,000 | | | | 108,750 | | |

COSMETICS & PERSONAL CARE - 0.1% | |

Avon Products, Inc., 6.50%, 3/15/23 | | | 135,000 | | | | 145,176 | | |

Oriflame Investment Holding PLC,

5.13%, 5/4/26 (a) | | | 200,000 | | | | 205,060 | | |

| | | | | | 350,236 | | |

ELECTRIC - 1.2% | |

Calpine Corp., 5.13%, 3/15/28 (a) | | | 100,000 | | | | 101,875 | | |

Colbun SA, 3.15%, 3/6/30 (a) | | | 200,000 | | | | 203,750 | | |

Dominion Energy, Inc. | |

3.90%, 10/1/25 | | | 200,000 | | | | 221,231 | | |

3.38%, 4/1/30 | | | 100,000 | | | | 109,000 | | |

Duke Energy Carolinas LLC,

6.10%, 6/1/37 | | | 100,000 | | | | 139,524 | | |

Duke Energy Corp., 3.75%, 9/1/46 | | | 100,000 | | | | 106,884 | | |

EDP Finance BV | |

3.63%, 7/15/24 (a) | | | 200,000 | | | | 214,744 | | |

1.71%, 1/24/28 (a) | | | 200,000 | | | | 198,277 | | |

Electricite de France SA, 5.25%,

(USD 10 Year Swap + 3.71%),

7/29/69 (a),(b) | | | 400,000 | | | | 418,500 | | |

Enel Finance International NV,

3.50%, 4/6/28 (a) | | | 200,000 | | | | 219,160 | | |

See accompanying notes to financial statements.

11

Global Atlantic Franklin Dividend and Income Managed Risk Portfolio

Portfolio of Investments (Unaudited) (Continued)

June 30, 2021

| | | Shares/

Principal | | Fair

Value | |

ELECTRIC - 1.2% (Continued) | |

Exelon Corp., 4.05%, 4/15/30 | | $ | 200,000 | | | $ | 228,013 | | |

InterGen NV, 7.00%, 6/30/23 (a) | | | 200,000 | | | | 198,500 | | |

Israel Electric Corp. Ltd.,

4.25%, 8/14/28 (a) | | | 200,000 | | | | 223,904 | | |

Leeward Renewable Energy

Operations LLC, 4.25%, 7/1/29 (a) | | | 100,000 | | | | 101,500 | | |

PacifiCorp, 6.10%, 8/1/36 | | | 100,000 | | | | 140,671 | | |

Southern Co. (The), 3.25%, 7/1/26 | | | 300,000 | | | | 325,379 | | |

Talen Energy Supply LLC,

7.25%, 5/15/27 (a) | | | 100,000 | | | | 93,306 | | |

Vistra Operations Co. LLC,

4.38%, 5/1/29 (a) | | | 100,000 | | | | 100,500 | | |

| | | | | | 3,344,718 | | |

ELECTRONICS - 0.1% | |

Flex Ltd., 4.88%, 5/12/30 | | | 200,000 | | | | 232,316 | | |

FLIR Systems, Inc., 2.50%, 8/1/30 | | | 50,000 | | | | 50,432 | | |

| | | | | | 282,748 | | |

FOOD - 0.3% | |

B&G Foods, Inc., 5.25%, 9/15/27 | | | 100,000 | | | | 104,154 | | |

Bimbo Bakeries USA, Inc., 4.00%,

5/17/51 (a) | | | 200,000 | | | | 214,927 | | |

Cencosud SA, 4.38%, 7/17/27 (a) | | | 200,000 | | | | 218,652 | | |

JBS Finance Luxembourg Sarl, 3.63%,

1/15/32 (a) | | | 200,000 | | | | 199,938 | | |

Kraft Heinz Foods Co., 3.88%, 5/15/27 | | | 100,000 | | | | 109,607 | | |

| | | | | | 847,278 | | |

FOREST PRODUCTS & PAPER - 0.1% | |

Suzano Austria GmbH, 3.13%, 1/15/32 | | | 200,000 | | | | 197,830 | | |

HEALTHCARE-PRODUCTS - 0.0%† | |

STERIS Irish FinCo UnLtd Co., 2.70%,

3/15/31 | | | 100,000 | | | | 101,965 | | |

HEALTHCARE-SERVICES - 0.3% | |

Anthem, Inc., 4.65%, 1/15/43 | | | 100,000 | | | | 124,677 | | |

Centene Corp., 3.00%, 10/15/30 | | | 100,000 | | | | 102,728 | | |

CHS/Community Health Systems,

Inc., 5.63%, 3/15/27 (a) | | | 100,000 | | | | 106,500 | | |

DaVita, Inc., 4.63%, 6/1/30 (a) | | | 100,000 | | | | 102,646 | | |

Kaiser Foundation Hospitals,

3.27%, 11/1/49 | | | 140,000 | | | | 152,907 | | |

Orlando Health Obligated Group,

3.78%, 10/1/28 | | | 35,000 | | | | 38,873 | | |

Quest Diagnostics, Inc., 2.80%, 6/30/31 | | | 245,000 | | | | 256,033 | | |

| | | | | | 884,364 | | |

HOME BUILDERS - 0.0%† | |

Ashton Woods USA LLC / Ashton

Woods Finance Co., 6.75%, 8/1/25 (a) | | | 100,000 | | | | 103,625 | | |

| | | Shares/

Principal | | Fair

Value | |

INSURANCE - 0.4% | |

Aflac, Inc., 3.60%, 4/1/30 | | $ | 100,000 | | | $ | 112,762 | | |

Arch Capital Group Ltd., 3.64%, 6/30/50 | | | 200,000 | | | | 215,318 | | |

Liberty Mutual Group, Inc.,

4.57%, 2/1/29 (a) | | | 300,000 | | | | 350,753 | | |

Metropolitan Life Global Funding I,

2.95%, 4/9/30 (a) | | | 150,000 | | | | 161,205 | | |

Radian Group, Inc., 4.88%, 3/15/27 | | | 200,000 | | | | 217,500 | | |

| | | | | | 1,057,538 | | |

INTERNET - 0.3% | |

Alibaba Group Holding Ltd., 4.40%,

12/6/57 | | | 200,000 | | | | 240,001 | | |

Netflix, Inc. | |

5.38%, 11/15/29 (a) | | | 100,000 | | | | 121,460 | | |

4.88%, 6/15/30 (a) | | | 100,000 | | | | 118,930 | | |

Tencent Holdings Ltd., 2.39%, 6/3/30 (a) | | | 200,000 | | | | 199,470 | | |

| | | | | | 679,861 | | |

LEISURE TIME - 0.1% | |

NCL Corp. Ltd., 5.88%, 3/15/26 (a) | | | 200,000 | | | | 209,500 | | |

TUI Cruises GmbH, 6.50%, 5/15/26 (a) | | EUR | 100,000 | | | | 123,092 | | |

| | | | | | 332,592 | | |

LODGING - 0.2% | |

Boyd Gaming Corp., 4.75%, 6/15/31 (a) | | | 100,000 | | | | 103,903 | | |

Genting New York LLC / GENNY

Capital, Inc., 3.30%, 2/15/26 (a) | | | 200,000 | | | | 201,973 | | |

Las Vegas Sands Corp., 3.90%, 8/8/29 | | | 100,000 | | | | 106,559 | | |

Studio City Finance Ltd., 5.00%,

1/15/29 (a) | | | 200,000 | | | | 201,804 | | |

| | | | | | 614,239 | | |

MACHINERY-CONSTRUCTION & MINING - 0.1% | |

Caterpillar, Inc. | |

2.60%, 4/9/30 | | | 50,000 | | | | 53,421 | | |

3.25%, 4/9/50 | | | 100,000 | | | | 110,632 | | |

| | | | | | 164,053 | | |

MACHINERY-DIVERSIFIED - 0.0%† | |

Westinghouse Air Brake Technologies

Corp., 3.20%, 6/15/25 | | | 50,000 | | | | 53,194 | | |

MEDIA - 0.2% | |

Charter Communications Operating

LLC / Charter Communications

Operating Capital, 2.80%, 4/1/31 | | | 200,000 | | | | 204,064 | | |

Comcast Corp., 3.15%, 2/15/28 | | | 200,000 | | | | 219,670 | | |

Diamond Sports Group LLC /

Diamond Sports Finance Co.,

5.38%, 8/15/26 (a) | | | 100,000 | | | | 64,870 | | |

Univision Communications, Inc.,

5.13%, 2/15/25 (a) | | | 100,000 | | | | 102,020 | | |

| | | | | | 590,624 | | |

See accompanying notes to financial statements.

12

Global Atlantic Franklin Dividend and Income Managed Risk Portfolio

Portfolio of Investments (Unaudited) (Continued)

June 30, 2021

| | | Shares/

Principal | | Fair

Value | |

MULTI-NATIONAL - 0.1% | |

Banque Ouest Africaine de

Developpement, 5.00%, 7/27/27 (a) | | $ | 200,000 | | | $ | 222,494 | | |

OIL & GAS - 0.4% | |

Aker BP ASA, 4.00%, 1/15/31 (a) | | | 200,000 | | | | 219,383 | | |

BP Capital Markets America, Inc.,

3.94%, 9/21/28 | | | 100,000 | | | | 114,099 | | |

Continental Resources, Inc./Ok,

5.75%, 1/15/31 (a) | | | 200,000 | | | | 239,560 | | |

Exxon Mobil Corp., 2.61%,

10/15/30 | | | 100,000 | | | | 105,514 | | |

Harvest Operations Corp.,

4.20%, 6/1/23 (a) | | | 100,000 | | | | 106,452 | | |

Occidental Petroleum Corp.,

6.13%, 1/1/31 | | | 100,000 | | | | 117,375 | | |

Petroleos Mexicanos, 6.63%, 6/15/35 | | | 80,000 | | | | 77,320 | | |

Sunoco LP / Sunoco Finance Corp.,

4.50%, 5/15/29 (a) | | | 100,000 | | | | 101,750 | | |

Total Capital International SA, 3.46%,

2/19/29 | | | 100,000 | | | | 111,417 | | |

| | | | | | 1,192,870 | | |

OIL & GAS SERVICES - 0.0%† | |

Baker Hughes a GE Co. LLC / Baker

Hughes Co.-Obligor, Inc., 4.49%, 5/1/30 | | | 50,000 | | | | 59,029 | | |

PACKAGING & CONTAINERS - 0.2% | |

Amcor Flexibles North America, Inc.,

2.63%, 6/19/30 | | | 50,000 | | | | 51,169 | | |

Mauser Packaging Solutions

Holding Co., 7.25%, 4/15/25 (a) | | | 100,000 | | | | 98,000 | | |

Plastipak Holdings, Inc., 6.25%, 10/15/25 (a) | | | 100,000 | | | | 102,250 | | |

Reynolds Group Issuer, Inc. / Reynolds

Group Issuer LLC / Reynolds

Group Issuer Lu, 4.00%, 10/15/27 (a) | | | 100,000 | | | | 99,307 | | |

WRKCo, Inc., 3.00%, 6/15/33 | | | 50,000 | | | | 52,412 | | |

| | | | | | 403,138 | | |

PHARMACEUTICALS - 0.3% | |

AbbVie, Inc. | |

2.95%, 11/21/26 | | | 100,000 | | | | 107,568 | | |

3.20%, 11/21/29 | | | 100,000 | | | | 108,710 | | |

4.55%, 3/15/35 | | | 100,000 | | | | 121,271 | | |

Bayer US Finance II LLC, 4.38%,

12/15/28 (a) | | | 100,000 | | | | 114,663 | | |

Cigna Corp., 4.38%, 10/15/28 | | | 150,000 | | | | 174,600 | | |

CVS Health Corp., 4.78%, 3/25/38 | | | 100,000 | | | | 122,837 | | |

Endo Luxembourg Finance Co.

I Sarl / Endo US, Inc., 6.13%, 4/1/29 (a) | | | 100,000 | | | | 98,000 | | |

Prestige Brands, Inc., 3.75%, 4/1/31 (a) | | | 100,000 | | | | 96,413 | | |

| | | | | | 944,062 | | |

| | | Shares/

Principal | | Fair

Value | |

PIPELINES - 0.6% | |

Cheniere Energy, Inc.,

4.63%, 10/15/28 (a) | | $ | 100,000 | | | $ | 105,500 | | |

Crestwood Midstream Partners LP /

Crestwood Midstream Finance Corp.,

6.00%, 2/1/29 (a) | | | 100,000 | | | | 104,750 | | |

Enable Midstream Partners LP, 4.95%,

5/15/28 | | | 100,000 | | | | 114,585 | | |

Energy Transfer LP, 4.75%, 1/15/26 | | | 100,000 | | | | 112,597 | | |

Enterprise Products Operating LLC | |

3.13%, 7/31/29 | | | 100,000 | | | | 107,996 | | |

4.45%, 2/15/43 | | | 100,000 | | | | 118,365 | | |

MPLX LP, 4.88%, 6/1/25 | | | 100,000 | | | | 112,915 | | |

Rattler Midstream LP, 5.63%, 7/15/25 (a) | | | 100,000 | | | | 105,125 | | |

Sabine Pass Liquefaction LLC,

5.00%, 3/15/27 | | | 400,000 | | | | 462,103 | | |

TransCanada PipeLines Ltd. | |

4.25%, 5/15/28 | | | 100,000 | | | | 114,954 | | |

4.88%, 5/15/48 | | | 200,000 | | | | 252,949 | | |

Williams Cos., Inc. (The),

3.50%, 11/15/30 | | | 50,000 | | | | 54,630 | | |

| | | | | | 1,766,469 | | |

REITS - 0.1% | |

National Retail Properties, Inc.,

4.30%, 10/15/28 | | | 300,000 | | | | 339,932 | | |

RETAIL - 0.2% | |

Dollar Tree, Inc., 4.20%, 5/15/28 | | | 200,000 | | | | 228,333 | | |

Murphy Oil USA, Inc., 4.75%, 9/15/29 | | | 100,000 | | | | 105,000 | | |

Walmart, Inc., 3.55%, 6/26/25 | | | 100,000 | | | | 110,359 | | |

| | | | | | 443,692 | | |

SEMICONDUCTORS - 0.1% | |

SK Hynix, Inc., 2.38%, 1/19/31 (a) | | | 200,000 | | | | 194,969 | | |

SOFTWARE - 0.0%† | |

Fiserv, Inc., 2.65%, 6/1/30 | | | 100,000 | | | | 103,646 | | |

TELECOMMUNICATIONS - 0.3% | |

Altice France SA, 5.50%, 1/15/28 (a) | | | 200,000 | | | | 207,540 | | |

CommScope Technologies LLC,

5.00%, 3/15/27 (a) | | | 100,000 | | | | 102,375 | | |

T-Mobile USA, Inc. | |

3.88%, 4/15/30 | | | 300,000 | | | | 334,962 | | |

3.30%, 2/15/51 | | | 100,000 | | | | 99,835 | | |

| | | | | | 744,712 | | |

TEXTILES - 0.1% | |

Mohawk Industries, Inc., 3.63%, 5/15/30 | | | 200,000 | | | | 219,157 | | |

TRANSPORTATION - 0.1% | |

CSX Corp., 4.10%, 3/15/44 | | | 100,000 | | | | 117,532 | | |

FedEx Corp., 4.05%, 2/15/48 | | | 200,000 | | | | 229,731 | | |

| | | | | | 347,263 | | |

See accompanying notes to financial statements.

13

Global Atlantic Franklin Dividend and Income Managed Risk Portfolio

Portfolio of Investments (Unaudited) (Continued)

June 30, 2021

| | | Shares/

Principal | | Fair

Value | |

TRUCKING & LEASING - 0.1% | |

DAE Funding LLC, 1.55%, 8/1/24 (a) | | $ | 200,000 | | | $ | 199,594 | | |

TOTAL CORPORATE BONDS

AND NOTES (Cost - $20,955,429) | | | | | 22,188,348 | | |

U.S. TREASURY SECURITIES - 6.3% | |

U.S. Treasury Note | |

0.13%, 11/30/22 | | | 700,000 | | | | 699,535 | | |

0.13%, 1/15/24 | | | 600,000 | | | | 596,367 | | |

1.13%, 2/28/25 | | | 750,000 | | | | 763,887 | | |

0.25%, 6/30/25 | | | 900,000 | | | | 884,320 | | |

0.25%, 7/31/25 | | | 1,100,000 | | | | 1,079,590 | | |

0.25%, 8/31/25 | | | 500,000 | | | | 490,098 | | |

0.25%, 9/30/25 | | | 1,900,000 | | | | 1,860,590 | | |

0.38%, 11/30/25 | | | 2,065,000 | | | | 2,028,620 | | |

0.38%, 12/31/25 | | | 3,475,000 | | | | 3,410,522 | | |

0.75%, 5/31/26 | | | 300,000 | | | | 298,430 | | |

U.S. Treasury Bond | |

1.13%, 5/15/40 | | | 465,000 | | | | 401,825 | | |

1.13%, 8/15/40 | | | 895,000 | | | | 770,504 | | |

3.13%, 11/15/41 | | | 265,000 | | | | 316,095 | | |

2.50%, 5/15/46†† | | | 915,000 | | | | 991,881 | | |

2.25%, 8/15/46 | | | 485,000 | | | | 501,805 | | |

2.75%, 8/15/47 | | | 150,000 | | | | 170,684 | | |

2.75%, 11/15/47 | | | 265,000 | | | | 301,800 | | |

3.13%, 5/15/48 | | | 100,000 | | | | 122,012 | | |

3.00%, 8/15/48 | | | 330,000 | | | | 394,208 | | |

2.88%, 5/15/49 | | | 100,000 | | | | 117,156 | | |

2.25%, 8/15/49 | | | 100,000 | | | | 103,652 | | |

1.25%, 5/15/50 | | | 590,000 | | | | 482,072 | | |

2.38%, 5/15/51 | | | 170,000 | | | | 181,661 | | |

U.S. Treasury Inflation Indexed Bond,

3.63%, 4/15/28 | | | 544,873 | | | | 734,983 | | |

TOTAL U.S. TREASURY

SECURITIES (Cost - $17,508,738) | | | | | 17,702,297 | | |

ASSET BACKED AND COMMERCIAL BACKED

SECURITIES - 4.6% | |

Adagio CLO VIII DAC, 1.65%,

(3 Month EUR Libor + 1.65%),

4/15/32 (a),(b) | | EUR | 250,000 | | | | 296,753 | | |

AMMC CLO 21 Ltd., 2.28%,

(3 Month US Libor + 2.10%),

11/2/30 (a),(b) | | | 300,000 | | | | 298,703 | | |

AMMC CLO XI Ltd., 2.09%,

(3 Month US Libor + 1.90%),

4/30/31 (a),(b) | | | 400,000 | | | | 396,990 | | |

Antares CLO 2018-1 Ltd., 1.84%,

(3 Month US Libor + 1.65%),

4/20/31 (a),(b) | | | 250,000 | | | | 246,015 | | |

BlueMountain Fuji Eur CLO V DAC,

1.55%, (3 Month EUR Libor + 1.55%),

1/15/33 (a),(b) | | EUR | 250,000 | | | | 296,860 | | |

BRAVO Residential Funding Trust

2019-1, 3.50%, 3/25/58 (a) | | | 58,550 | | | | 59,449 | | |

| | | Shares/

Principal | | Fair

Value | |

ASSET BACKED AND COMMERCIAL BACKED

SECURITIES - 4.6% (Continued) | |

BRAVO Residential Funding Trust

2019-NQM2, 3.50%, 10/25/44 (a),(c) | | $ | 103,397 | | | $ | 107,725 | | |

Carlyle GMS Finance MM CLO

2015-1 LLC, 2.38%, (3 Month

US Libor + 2.20%), 10/15/31 (a),(b) | | | 250,000 | | | | 244,475 | | |

CARLYLE US CLO 2017-4 Ltd.,

2.98%, (3 Month US Libor + 2.80%),

1/15/30 (a),(b) | | | 200,000 | | | | 194,343 | | |

Cent CLO 21 Ltd., 3.38%,

(3 Month US Libor + 3.20%),

7/27/30 (a),(b) | | | 250,000 | | | | 246,901 | | |

| CF Hippolyta LLC | |

1.69%, 7/15/60 (a) | | | 95,438 | | | | 96,343 | | |

1.53%, 3/15/61 (a) | | | 100,000 | | | | 100,715 | | |

CIM Trust 2018-INV1, 4.00%,

8/25/48 (a),(c) | | | 50,436 | | | | 51,458 | | |

CIM Trust 2019-INV1, 4.00%,

2/25/49 (a),(c) | | | 47,759 | | | | 48,675 | | |

DBCG 2017-BBG Mortgage Trust,

0.77%, (1 Month US Libor + 0.70%),

6/15/34 (a),(b) | | | 160,000 | | | | 160,000 | | |

Eleven Madison Trust 2015-11MD

Mortgage Trust, 3.56%, 9/10/35 (a),(c) | | | 250,000 | | | | 272,760 | | |

Ellington CLO III Ltd., 1.84%,

(3 Month US Libor + 1.65%),

7/20/30 (a),(b) | | | 237,220 | | | | 234,626 | | |

Fannie Mae Connecticut Avenue Securities | |

5.34%, (1 Month US Libor + 5.25%),

10/25/23 (b) | | | 83,789 | | | | 87,608 | | |

4.49%, (1 Month US Libor + 4.40%),

1/25/24 (b) | | | 125,505 | | | | 128,784 | | |

2.69%, (1 Month US Libor + 2.60%),

5/25/24 (b) | | | 150,690 | | | | 151,574 | | |

2.69%, (1 Month US Libor + 2.60%),

5/25/24 (b) | | | 135,633 | | | | 136,921 | | |

2.99%, (1 Month US Libor + 2.90%),

7/25/24 (b) | | | 104,525 | | | | 106,378 | | |

3.09%, (1 Month US Libor + 3.00%),

7/25/24 (b) | | | 218,628 | | | | 220,281 | | |

4.99%, (1 Month US Libor + 4.90%),

11/25/24 (b) | | | 158,160 | | | | 163,208 | | |

4.09%, (1 Month US Libor + 4.00%),

5/25/25 (b) | | | 59,524 | | | | 60,830 | | |

4.09%, (1 Month US Libor + 4.00%),

5/25/25 (b) | | | 30,330 | | | | 30,572 | | |

5.09%, (1 Month US Libor + 5.00%),

7/25/25 (b) | | | 83,153 | | | | 85,372 | | |

5.09%, (1 Month US Libor + 5.00%),

7/25/25 (b) | | | 29,819 | | | | 30,089 | | |

6.09%, (1 Month US Libor + 6.00%),

9/25/28 (b) | | | 347,513 | | | | 366,953 | | |

4.34%, (1 Month US Libor + 4.25%),

1/25/29 (b) | | | 183,118 | | | | 191,265 | | |

4.54%, (1 Month US Libor + 4.45%),

1/25/29 (b) | | | 91,678 | | | | 95,837 | | |

See accompanying notes to financial statements.

14

Global Atlantic Franklin Dividend and Income Managed Risk Portfolio

Portfolio of Investments (Unaudited) (Continued)

June 30, 2021

| | | Shares/

Principal | | Fair

Value | |

ASSET BACKED AND COMMERCIAL BACKED

SECURITIES - 4.6% (Continued) | |

3.74%, (1 Month US Libor + 3.65%),

9/25/29 (b) | | $ | 184,212 | | | $ | 191,230 | | |

FirstKey Homes 2020-SFR2 Trust,

1.27%, 10/19/37 (a) | | | 149,669 | | | | 148,743 | | |

Freddie Mac Structured Agency

Credit Risk Debt Notes | |

4.09%, (1 Month US Libor + 4.00%),

8/25/24 (b) | | | 153,385 | | | | 156,642 | | |

3.99%, (1 Month US Libor + 3.90%),

12/25/27 (b) | | | 166,973 | | | | 169,654 | | |

4.79%, (1 Month US Libor + 4.70%),

4/25/28 (b) | | | 215,137 | | | | 222,625 | | |

5.64%, (1 Month US Libor + 5.55%),

7/25/28 (b) | | | 505,844 | | | | 531,198 | | |

4.74%, (1 Month US Libor + 4.65%),

10/25/28 (b) | | | 341,416 | | | | 356,784 | | |

5.24%, (1 Month US Libor + 5.15%),

11/25/28 (b) | | | 210,754 | | | | 220,861 | | |

3.64%, (1 Month US Libor + 3.55%),

8/25/29 (b) | | | 418,227 | | | | 432,776 | | |

2.44%, (1 Month US Libor + 2.35%),

4/25/30 (b) | | | 179,311 | | | | 183,158 | | |

Halcyon Loan Advisors Funding

2018-1 Ltd., 1.99%, (3 Month US

Libor + 1.80%), 7/21/31 (a),(b) | | | 170,000 | | | | 170,000 | | |

Holland Park CLO DAC, 0.92%,

(3 Month EUR Libor + 0.92%),

11/14/32 (a),(b) | | EUR | 500,000 | | | | 593,467 | | |

Invitation Homes 2017-SFR2

Trust, 0.93%, (1 Month US

Libor + 0.85%), 12/17/36 (a),(b) | | | 142,784 | | | | 142,734 | | |

LCM XXV Ltd., 2.49%,

(3 Month US Libor + 2.30%),

7/20/30 (a),(b) | | | 440,000 | | | | 437,754 | | |

Madison Park Euro Funding VIII DAC | |

0.95%, (3 Month EUR Libor + 0.95%),

4/15/32 (a),(b) | | EUR | 600,000 | | | | 712,467 | | |

1.70%, (3 Month EUR Libor + 1.70%),

4/15/32 (a),(b) | | EUR | 250,000 | | | | 296,816 | | |

Madison Park Funding XXII Ltd., 2.18%,

(3 Month US Libor + 2.00%),

1/15/33 (a),(b) | | | 250,000 | | | | 250,069 | | |

Mill City Mortgage Loan Trust

2016-1, 2.50%, 4/25/57 (a),(c) | | | 42,826 | | | | 42,826 | | |

Mill City Mortgage Loan Trust

2018-4, 3.50%, 4/25/66 (a),(c) | | | 156,356 | | | | 162,296 | | |

Neuberger Berman Loan Advisers

CLO 27 Ltd., 1.28%, (3 Month US

Libor + 1.10%), 1/15/30 (a),(b) | | | 649,000 | | | | 646,158 | | |

Octagon Investment Partners 33 Ltd.,

2.94%, (3 Month US Libor + 2.75%),

1/20/31 (a),(b) | | | 100,000 | | | | 99,108 | | |

Octagon Investment Partners 35 Ltd.,

1.29%, (3 Month US Libor + 1.10%),

1/20/31 (a),(b) | | | 500,000 | | | | 496,930 | | |

| | | Shares/

Principal | | Fair

Value | |

ASSET BACKED AND COMMERCIAL BACKED

SECURITIES - 4.6% (Continued) | |

Provident Funding Mortgage Trust

2019-1, 3.00%, 12/25/49 (a),(c) | | $ | 41,073 | | | $ | 41,372 | | |

Provident Funding Mortgage Trust

2020-1, 3.00%, 2/25/50 (a),(c) | | | 23,114 | | | | 23,083 | | |

Strata CLO I Ltd., 2.38%, (3 Month

US Libor + 2.20%), 1/15/31 (a),(b) | | | 200,000 | | | | 198,645 | | |

TICP CLO VI Ltd., 1.30%, (3 Month

US Libor + 1.12%), 1/15/34 (a),(b) | | | 300,000 | | | | 299,660 | | |

Towd Point Mortgage Trust 2017-1,

2.75%, 10/25/56 (a),(c) | | | 63,185 | | | | 64,077 | | |

Towd Point Mortgage Trust 2017-2,

2.75%, 4/25/57 (a),(c) | | | 85,162 | | | | 86,155 | | |

Towd Point Mortgage Trust 2017-3,

2.75%, 7/25/57 (a),(c) | | | 64,071 | | | | 65,040 | | |

Voya CLO 2014-1 Ltd., 2.99%,

(3 Month US Libor + 2.80%),

4/18/31 (a),(b) | | | 200,000 | | | | 189,625 | | |

TOTAL ASSET BACKED AND

COMMERCIAL BACKED

SECURITIES (Cost - $12,796,915) | | | | | 12,840,416 | | |

AGENCY MORTGAGE BACKED SECURITIES - 3.5% | |

FEDERAL NATIONAL MORTGAGE ASSOCIATION - 3.5% | |

Fannie Mae Pool, 3.00%, 11/1/48 | | | 734,653 | | | | 771,597 | | |

Federal National Mortgage Association | |

2.00%, 7/1/36 (d) | | | 1,950,000 | | | | 2,011,852 | | |

2.50%, 7/1/51 (d) | | | 4,790,000 | | | | 4,956,153 | | |

Ginnie Mae II Pool | |

2.00%, 6/20/51 | | | 988,000 | | | | 1,008,037 | | |

2.50%, 6/20/51 | | | 924,350 | | | | 958,046 | | |

| | | | | | 9,705,685 | | |

TOTAL AGENCY MORTGAGE

BACKED SECURITIES

(Cost - $9,645,448) | | | | | 9,705,685 | | |

EXCHANGE TRADED FUNDS - 1.1% | |

DEBT FUNDS - 1.1% | |

Invesco Senior Loan ETF

(Cost - $3,031,630) | | | 136,000 | | | | 3,012,400 | | |

SOVEREIGN DEBTS - 0.9% | |

Banque Centrale de Tunisie International

Bond, 5.75%, 1/30/25 (a) | | | 200,000 | | | | 186,120 | | |

Colombia Government International

Bond, 5.00%, 6/15/45 | | | 200,000 | | | | 212,582 | | |

Dominican Republic International

Bond, 8.90%, 2/15/23 (a) | | DOP | 8,000,000 | | | | 147,195 | | |

Indonesia Government International

Bond, 4.35%, 1/8/27 (a) | | | 200,000 | | | | 226,332 | | |

Iraq International Bond, 5.80%,

1/15/28 (a) | | | 218,750 | | | | 211,595 | | |

Mexico Government International

Bond, 4.50%, 4/22/29 | | | 200,000 | | | | 226,192 | | |

Panama Government International

Bond, 3.75%, 4/17/26 (a) | | | 70,000 | | | | 75,453 | | |

See accompanying notes to financial statements.

15

Global Atlantic Franklin Dividend and Income Managed Risk Portfolio

Portfolio of Investments (Unaudited) (Continued)

June 30, 2021

| | | Shares/

Principal | | Fair

Value | |

SOVEREIGN DEBTS - 0.9% (Continued) | |

Peruvian Government International

Bond, 2.78%, 1/23/31 | | $ | 200,000 | | | $ | 203,594 | | |

Republic of Belarus International

Bond, 7.63%, 6/29/27 (a) | | | 200,000 | | | | 194,432 | | |

Republic of South Africa Government

International Bond, 5.88%, 6/22/30 | | | 200,000 | | | | 228,164 | | |

Russian Foreign Bond - Eurobond,

4.88%, 9/16/23 (a) | | | 200,000 | | | | 217,250 | | |

Turkey Government International Bond,

5.25%, 3/13/30 | | | 200,000 | | | | 189,609 | | |

Ukraine Government International Bond,

7.38%, 9/25/32 (a) | | | 200,000 | | | | 210,186 | | |

Uruguay Government International Bond,

3.70%, 6/26/37 | | UYU | 5,898,730 | | | | 151,687 | | |

TOTAL SOVEREIGN DEBTS

(Cost - $2,703,809) | | | | | 2,680,391 | | |

MUNICIPAL BONDS - 0.7% | |

California Health Facilities

Financing Authority | |

2.93%, 6/1/32 | | | 45,000 | | | | 48,200 | | |

2.98%, 6/1/33 | | | 40,000 | | | | 42,745 | | |

3.03%, 6/1/34 | | | 30,000 | | | | 32,029 | | |

City of Austin TX Electric Utility Revenue,

6.26%, 11/15/32 | | | 160,000 | | | | 200,690 | | |

Commonwealth Financing Authority,

2.99%, 6/1/42 | | | 325,000 | | | | 333,736 | | |

County of Broward FL Airport System

Revenue, 3.48%, 10/1/43 | | | 50,000 | | | | 52,245 | | |

Foothill-Eastern Transportation Corridor

Agency, 4.09%, 1/15/49 | | | 135,000 | | | | 142,915 | | |

Gilroy Unified School District,

3.36%, 8/1/47 | | | 100,000 | | | | 103,196 | | |

Greenville City School District, 3.54%,

1/1/51 | | | 110,000 | | | | 112,667 | | |

Massachusetts School Building Authority,

3.40%, 10/15/40 | | | 85,000 | | | | 91,309 | | |

Metropolitan Transportation Authority,

4.00%, 11/15/45 | | | 95,000 | | | | 110,895 | | |

New York State Dormitory Authority,

3.14%, 7/1/43 | | | 45,000 | | | | 46,526 | | |

Salt Lake City Corp., 3.10%, 4/1/38 | | | 40,000 | | | | 42,165 | | |

San Jose Redevelopment Agency

Successor Agency, 3.23%, 8/1/27 | | | 90,000 | | | | 99,452 | | |

State of Illinois, 5.10%, 6/1/33 | | | 120,000 | | | | 141,101 | | |

State of New Jersey, 3.00%, 6/1/32 | | | 110,000 | | | | 124,933 | | |

Texas State University System | |

2.94%, 3/15/33 | | | 35,000 | | | | 37,211 | | |

3.29%, 3/15/40 | | | 30,000 | | | | 31,203 | | |

University of Pittsburgh-of the

Commonwealth System of Higher

Education, 3.01%, 9/15/41 | | | 80,000 | | | | 83,835 | | |

Utah Transit Authority, 3.44%, 12/15/42 | | | 60,000 | | | | 63,228 | | |

TOTAL MUNICIPAL BONDS

(Cost - $1,845,339) | | | | | 1,940,281 | | |

| | | Shares/

Principal | | Fair

Value | |

TERM LOANS - 0.7% | |

24 Hour Fitness Worldwide, Inc.,

1.19%, (3 Months US Libor + 1.00%),

12/29/25 (b) | | $ | 30,127 | | | $ | 26,393 | | |

Adient US LLC, 3.60%, (1 Months US

Libor + 3.50%), 4/10/28 (b) | | | 30,000 | | | | 29,991 | | |

ADMI Corp. | |

3.75%, (1 Months US Libor + 3.25%),

12/23/27 (b) | | | 4,086 | | | | 4,037 | | |

4.25%, (1 Months US Libor + 3.75%),

12/23/27 (b) | | | 3,847 | | | | 3,840 | | |

Alliant Holdings Intermediate LLC | |

3.35%, (1 Months US Libor + 3.25%),

5/9/25 (b) | | | 38,413 | | | | 37,976 | | |

0.00%, 11/5/27 (e) | | | 1,386 | | | | 1,387 | | |

Amentum Government Services

Holdings LLC, 5.50%, (3 Months US

Libor + 4.75%), 1/29/27 (b) | | | 9,975 | | | | 10,047 | | |

American Airlines, Inc., 5.50%, (3 Months

US Libor + 4.75%), 4/20/28 (b) | | | 6,131 | | | | 6,387 | | |

American Trailer World Corp., 0.00%,

3/3/28 (e) | | | 5,400 | | | | 5,390 | | |

AqGen Ascensus, Inc., 0.00%, 5/22/28 (e) | | | 9,079 | | | | 9,051 | | |

Arches Buyer, Inc., 3.75%, (1 Months US

Libor + 3.25%), 12/6/27 (b) | | | 6,454 | | | | 6,433 | | |

AssuredPartners, Inc. | |

0.00%, 2/12/27 (e) | | | 2,551 | | | | 2,553 | | |

3.60%, (1 Months US Libor + 3.50%),

2/12/27 (b) | | | 29,599 | | | | 29,431 | | |

Astoria Energy LLC, 4.50%, (3 Months US

Libor + 3.50%), 12/10/27 (b) | | | 1,245 | | | | 1,242 | | |

Asurion LLC | |

3.10%, (1 Months US Libor + 3.00%),

11/3/23 (b) | | | 16,617 | | | | 16,524 | | |

3.34%, (1 Months US Libor + 3.25%),

12/23/26 (b) | | | 9,139 | | | | 9,030 | | |

3.35%, (1 Months US Libor + 3.25%),

7/31/27 (b) | | | 8,442 | | | | 8,343 | | |

5.35%, (1 Months US Libor + 5.25%),

1/31/28 (b) | | | 354 | | | | 357 | | |

athenahealth, Inc., 4.41%, (3 Months US

Libor + 4.25%), 2/11/26 (b) | | | 23,116 | | | | 23,166 | | |

Atlas Purchaser, Inc., 6.00%, (3 Months

US Libor + 5.25%), 5/6/28 (b) | | | 12,212 | | | | 11,968 | | |

Aveanna Healthcare LLC. | |

0.00%, 7/15/28 (e) | | | 1,145 | | | | 1,145 | | |

4.25%, (3 Months US Libor + 3.75%),

7/15/28 (b) | | | 4,922 | | | | 4,924 | | |

Avis Budget Car Rental LLC, 2.36%,

(1 Months US Libor + 2.25%), 8/6/27 (b) | | | 85,076 | | | | 83,269 | | |

Banijay Entertainment SAS, 3.84%,

(1 Months US Libor + 3.75%), 3/1/25 (b) | | | 18,824 | | | | 18,745 | | |

Barracuda Networks, Inc., 3.90%,

(3 Months US Libor + 3.75%), 2/12/25 (b) | | | 6,466 | | | | 6,479 | | |

Bausch Health Companies, Inc., 3.10%,

(1 Months US Libor + 3.00%), 6/2/25 (b) | | | 35,486 | | | | 35,322 | | |

See accompanying notes to financial statements.

16

Global Atlantic Franklin Dividend and Income Managed Risk Portfolio

Portfolio of Investments (Unaudited) (Continued)

June 30, 2021

| | | Shares/

Principal | | Fair

Value | |

TERM LOANS - 0.7% (Continued) | |

Blackboard, Inc., 7.00%, (3 Months US

Libor + 6.00%), 6/30/24 (b) | | $ | 23,829 | | | $ | 23,888 | | |

BWay Holding Co., 3.35%, (3 Months US

Libor + 3.25%), 4/3/24 (b) | | | 29,640 | | | | 28,904 | | |

Caesars Resort Collection LLC, 2.85%,

(1 Months US Libor + 2.75%),

12/23/24 (b) | | | 29,089 | | | | 28,824 | | |

CCI Buyer, Inc., 4.75%, (3 Months US

Libor + 4.00%), 12/17/27 (b) | | | 1,302 | | | | 1,303 | | |

Cengage Learning, Inc. | |

5.25%, (3 Months US Libor + 4.25%),

6/7/23 (b) | | | 9,922 | | | | 9,927 | | |

0.00%, 6/29/26 (e) | | | 9,948 | | | | 9,954 | | |

Charter Next Generation, Inc., 0.00%,

12/1/27 (e) | | | 1,761 | | | | 1,763 | | |

Citadel Securities LP, 2.60%, (3 Months

US Libor + 2.50%), 2/2/28 (b) | | | 9,975 | | | | 9,865 | | |

City Brewing Co., LLC, 4.25%, (3 Months

US Libor + 3.50%), 4/5/28 (b) | | | 7,407 | | | | 7,435 | | |

Clarios Global LP, 3.35%, (1 Months US

Libor + 3.25%), 4/30/26 (b) | | | 18,219 | | | | 18,036 | | |

Clear Channel Outdoor Holdings, Inc.,

3.69%, (3 Months US Libor + 3.50%),

8/21/26 (b) | | | 9,899 | | | | 9,656 | | |

CNT Holdings I Corp., 4.50%, (1 Months

US Libor + 3.75%), 11/8/27 (b) | | | 1,793 | | | | 1,793 | | |

Commscope, Inc., 3.35%, (1 Months

US Libor + 3.25%), 4/6/26 (b) | | | 29,549 | | | | 29,380 | | |

Conair Holdings LLC, 4.25%, (3 Months

US Libor + 3.75%), 5/17/28 (b) | | | 10,000 | | | | 10,020 | | |

Coty, Inc., 2.33%, (1 Months US Libor +

2.25%), 4/7/25 (b) | | | 95,428 | | | | 91,738 | | |

CPC Acquisition Corp., 4.50%,

(3 Months US Libor + 3.75%),

12/29/27 (b) | | | 13,203 | | | | 13,166 | | |

CSC Holdings LLC, 2.32%, (1 Months

US Libor + 2.25%), 7/17/25 (b) | | | 36,465 | | | | 35,918 | | |

Cushman & Wakefield U.S. Borrower,

LLC., 2.85%, (3 Months US Libor + 2.75%),

8/21/25 (b) | | | 9,950 | | | | 9,852 | | |

Cyanco Intermediate 2 Corp., 3.59%,

(1 Months US Libor + 3.50%), 3/16/25 (b) | | | 12,595 | | | | 12,440 | | |

DCert Buyer, Inc., 4.10%, (1 Months US

Libor + 4.00%), 10/16/26 (b) | | | 19,750 | | | | 19,758 | | |

Delta Air Lines, Inc., 4.75%, (3 Months

US Libor + 3.75%), 10/20/27 (b) | | | 5,518 | | | | 5,826 | | |

Dun & Bradstreet Corp. (The), 3.35%,

(1 Months US Libor + 3.25%), 2/6/26 (b) | | | 963 | | | | 958 | | |

Dynasty Acquisition Co., Inc. | |

3.65%, (3 Months US Libor + 3.50%),

4/6/26 (b) | | | 80,141 | | | | 78,003 | | |

3.65%, (3 Months US Libor + 3.50%),

4/6/26 (b) | | | 43,113 | | | | 41,963 | | |

Edelman Financial Center, 4.50%,

(1 Months US Libor + 3.75%), 4/7/28 (b) | | | 20,000 | | | | 20,014 | | |

| | | Shares/

Principal | | Fair

Value | |

TERM LOANS - 0.7% (Continued) | |

eResearch Technology, Inc., 5.50%,

(1 Months US Libor + 4.50%), 2/4/27 (b) | | $ | 2,168 | | | $ | 2,177 | | |

Evergreen AcqCo 1 LP, 6.50%,

(3 Months US Libor + 5.75%), 4/21/28 (b) | | | 6,123 | | | | 6,172 | | |

First Brands Group, LLC, 6.00%,

(3 Months US Libor + 5.00%), 3/30/27 (b) | | | 19,698 | | | | 19,903 | | |

First Eagle Holdings, Inc., 2.65%,

(3 Months US Libor + 2.50%), 2/1/27 (b) | | | 15,675 | | | | 15,450 | | |

Global Tel Link Corp., 4.35%,

(1 Months US Libor + 4.25%), 11/29/25 (b) | | | 38,815 | | | | 35,576 | | |

Gray Television, Inc., 2.59%, (1 Months

US Libor + 2.50%), 1/2/26 (b) | | | 35,504 | | | | 35,314 | | |

Great Outdoors Group, LLC, 5.00%,

(3 Months US Libor + 4.25%), 3/6/28 (b) | | | 24,546 | | | | 24,608 | | |

Greeneden US Holdings II LLC, 4.75%,

(1 Months US Libor + 4.00%), 12/1/27 (b) | | | 9,654 | | | | 9,671 | | |

Harbor Freight Tools USA, Inc., 3.75%,

(1 Months US Libor + 3.25%), 10/19/27 (b) | | | 12,737 | | | | 12,728 | | |

Heartland Dental LLC, 4.07%, (1 Months

US Libor + 4.00%), 4/30/25 (b) | | | 2,812 | | | | 2,805 | | |

Hercules Achievement, Inc., 4.50%,

(1 Months US Libor + 3.50%), 12/16/24 (b) | | | 85,346 | | | | 83,283 | | |

Highline AfterMarket Acquisition LLC,

5.25%, (3 Months US Libor + 4.50%),

11/9/27 (b) | | | 6,905 | | | | 6,919 | | |

Hilton Grand Vacations Borrower LLC,

0.00%, 5/22/28 (e) | | | 18,000 | | | | 18,006 | | |

Hyland Software, Inc., 4.25%,

(1 Months US Libor + 3.50%), 7/1/24 (b) | | | 7,405 | | | | 7,411 | | |

Icon Luxembourg Sarl., 3.00%,

(3 Months US Libor + 2.50%), 6/16/28 (b) | | | 5,017 | | | | 5,024 | | |

Idera, Inc., 4.50%, (1 Months US Libor +

3.75%), 3/2/28 (b) | | | 10,430 | | | | 10,424 | | |

IGT Holding IV AB, 4.25%, (3 Months

US Libor + 3.75%), 3/31/28 (b) | | | 16,442 | | | | 16,483 | | |

Illuminate Sub Co., 4.00%, (1 Months

US Libor + 3.50%), 6/30/28 (b) | | | 1,990 | | | | 1,987 | | |

Ineos US Petrochem, LLC, 3.25%,

(3 Months US Libor + 2.75%), 1/29/26 (b) | | | 7,530 | | | | 7,504 | | |

IRB Holding Corp., 4.25%, (3 Months

US Libor + 3.25%), 12/15/27 (b) | | | 6,589 | | | | 6,585 | | |

Ivanti Software, Inc., 5.75%, (3 Months

US Libor + 4.75%), 12/1/27 (b) | | | 9,975 | | | | 9,976 | | |

Jane Street Group, LLC, 2.85%,

(1 Months US Libor + 2.75%), 1/26/28 (b) | | | 8,597 | | | | 8,551 | | |

Jazz Financing Lux Sarl, 4.00%,

(1 Months US Libor + 3.50%), 5/5/28 (b) | | | 3,827 | | | | 3,837 | | |

JBS USA LUX SA, 2.10%, (1 Months

US Libor + 2.00%), 5/1/26 (b) | | | 36,654 | | | | 36,520 | | |

Jeffries Finance LLC, 3.13%, (1 Months

US Libor + 3.00%), 6/3/26 (b) | | | 7,954 | | | | 7,912 | | |

Kenan Advantage Group, Inc. (The),

4.50%, (1 Months US Libor + 3.75%),

3/24/26 (b) | | | 52,266 | | | | 52,282 | | |

See accompanying notes to financial statements.

17

Global Atlantic Franklin Dividend and Income Managed Risk Portfolio

Portfolio of Investments (Unaudited) (Continued)

June 30, 2021

| | | Shares/

Principal | | Fair

Value | |

TERM LOANS - 0.7% (Continued) | |

Kuehg Corp., 4.75%, (3 Months

US Libor + 3.75%), 2/21/25 (b) | | $ | 40,000 | | | $ | 39,329 | | |

Logmein, Inc., 4.83%, (1 Months

US Libor + 4.75%), 8/31/27 (b) | | | 32,702 | | | | 32,641 | | |

Lummus Technology Holdings,

LLC, 3.60%, (1 Months US Libor +

3.50%), 6/30/27 (b) | | | 3,579 | | | | 3,555 | | |

Madison IAQ LLC, 0.00%, 6/16/28 (e) | | | 4,406 | | | | 4,406 | | |

Magenta Buyer LLC, 5.75%,