UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22865

Forethought Variable Insurance Trust

(Exact name of registrant as specified in charter)

10 West Market Street, Suite 2300

Indianapolis, Indiana 46204

(Address of principal executive offices) (Zip code)

The Corporation Trust Company

1209 Orange Street Wilmington, DE 19801

(Name and address of agent for service)

Registrant's telephone number, including area code: 877-355-1820

Date of fiscal year end: December 31

Date of reporting period: June 30, 2022

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

| (a) | Include a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Act (17 CFR 270.30e-1). |

Semi-Annual Report

June 30, 2022

Global Atlantic Portfolios

Global Atlantic BlackRock Allocation Portfolio

Global Atlantic BlackRock Disciplined Core Portfolio

Global Atlantic BlackRock Disciplined Growth Portfolio

Global Atlantic BlackRock Disciplined International Core Portfolio

Global Atlantic BlackRock Disciplined Mid Cap Growth Portfolio

Global Atlantic BlackRock Disciplined Value Portfolio

Global Atlantic BlackRock High Yield Portfolio

Global Atlantic Goldman Sachs Core Fixed Income Portfolio

Class I and Class II shares*

Each a separate series of the Forethought Variable Insurance Trust

Distributed by Global Atlantic Distributors, LLC

Member FINRA

* As of June 30, 2022, each Portfolio offered Class I and Class II, except the Global Atlantic Goldman Sachs Core Fixed Income Portfolio (which only offered Class I shares).

Dear Shareholders/Contract Owners:

Similar to the first half of 2020, which saw one of the most volatile periods in financial markets history, the six months ending June 30, 2022 (the "Period") were volatile as well, albeit for different reasons. The 2020 period marked the start of the COVID-19 pandemic (the "Pandemic"), whereas the Period was driven primarily by concerns over inflation, interest rates, the Russian invasion of Ukraine, and to a lesser extent, the lingering Pandemic. From an inflation perspective, global prices are increasing at the fastest rate seen in decades, particularly in food and energy. The two main drivers of this are, one, the Russia/Ukraine conflict, where Russia is one of the largest energy suppliers, while Ukraine is one of the world's largest producers and exporters of wheat, and two, supply chain disruptions. The latter has been exacerbated by sporadic resurgences of COVID-19, particularly in China where entire cities have been shut down for weeks.

Given the significant and swift rise in inflation, central banks are changing their years long accommodative and stimulative policies, forced to raise interest rates quickly in an attempt to lower inflation. In the U.S., the Federal Reserve (the "Fed") raised the interest rates by 25 basis points in March, another 50 basis points in May, a further 75 basis points in June, and indicated that several more increases were likely over the remainder of 2022. With these central bank moves, government bond yields have risen substantially as illustrated by the U.S. 10-year Treasury, which has doubled during the Period from 1.51% at the end of 2021 to 3.02% as of June 30, 2022, a level not seen since 2011. In conjunction with the rise in interest rates, economic growth expectations have come down, with U.S. GDP now estimated to be 1.5%-2.0% for the year versus prior estimates of 2.5%-3.0%.

These aforementioned factors have led to increased volatility in the financial markets. While spikes in volatility, as measured by the CBOE Volatility Index ("VIX"), have occurred persistently over the past 2 years, more recent increases have lasted longer. Furthermore, the normalized range to which the VIX subsequently declines following these spikes has also risen to 20-25, up from 15-20 in recent years.

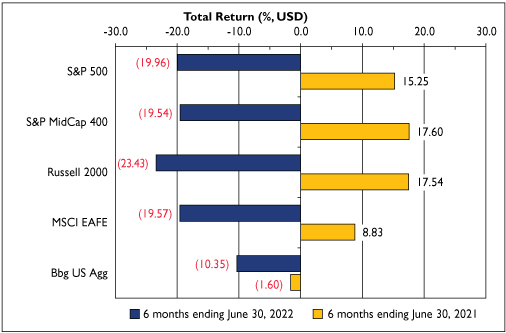

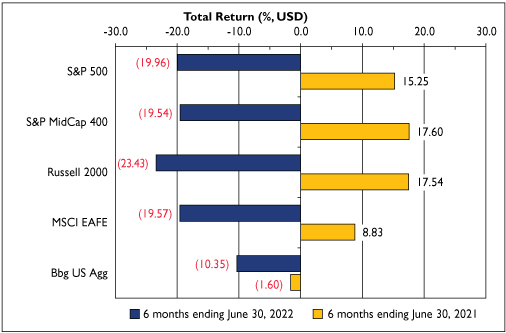

As shown in the chart, the 6-month periods ending June 30, 2022 and June 30, 2021 stand in stark contrast to one another. Whereas markets were very strong during the 2021 period, concerns over inflation, interest rates, the Ukraine/Russia conflict and as a result, the possibility of a recession, weighed heavily in the first half of 2022 with many global equity indices in or near a bear market, which is defined as down 20%. Not only have equity markets struggled, but the rapid rise in interest rates has led to negative returns across much of fixed income, as evidenced by the Bbg US Agg, which was down 10.35% during the Period.

We expect inflation, interest rates, the Ukraine/Russia conflict and economic growth to be the primary concerns for the remainder of 2022 and likely into 2023. In addition, while the Pandemic has eased somewhat with the greater adoption of vaccines globally, COVID-19 has not been eliminated and may continue to pose a risk as new variants emerge.

Given the hardships endured in recent years, we hope this shareholder letter finds you healthy and wish you all the best for the remainder of 2022 and beyond.

Thank you for investing in the Global Atlantic Portfolios.

Sincerely, | |

| |

| |

Eric D. Todd, CFA | | Cameron Jeffreys, CFA | |

President | | Senior Vice President | |

Global Atlantic Investment Advisors, LLC | | Global Atlantic Investment Advisors, LLC | |

1

Portfolio | | Benchmark | |

Global Atlantic BlackRock Allocation Portfolio | | S&P Target Risk® Growth Index | |

Global Atlantic BlackRock Disciplined Core Portfolio | | S&P 500® Index | |

Global Atlantic BlackRock Disciplined Growth Portfolio | | Russell 1000® Growth Index | |

Global Atlantic BlackRock Disciplined International Core Portfolio | | MSCI ACWI ex-USA Index | |

Global Atlantic BlackRock Disciplined Mid Cap Growth Portfolio | | Russell Midcap® Growth Index | |

Global Atlantic BlackRock Disciplined Value Portfolio | | Russell 1000® Value Index | |

Global Atlantic BlackRock High Yield Portfolio | | ICE BofA BB-B U.S. High Yield Constrained Index | |

Global Atlantic Goldman Sachs Core Fixed Income Portfolio | | Bloomberg U.S. Aggregate Bond Index | |

The indices shown are for informational purposes only and are not reflective of any investment. As it is not possible to invest directly in the indices, the data shown does not reflect or compare features of an actual investment, such as its objectives, costs and expenses, liquidity, safety, guarantees or insurance, fluctuation of principal or return, or tax features. Past performance is no guarantee of future results.

This report contains the current opinions of Global Atlantic Investment Advisors, LLC and/or sub-advisers at the time of its publication and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. Such opinions are subject to change without notice and securities described herein may no longer be included in, or may at any time be removed from, a Portfolio's portfolio. This report is distributed for informational purposes only. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed.

Index Definitions:

Bloomberg U.S. Aggregate Bond Index ("Bbg US Agg"). An index weighted according to market capitalization and includes, among other categories, Treasury securities, mortgage-backed securities, government agency bonds and corporate bonds. To be included in the index, bonds must be rated investment grade by Moody's and S&P Global Ratings ("S&P").

CBOE Volatility Index ("VIX"). An index that reflects a market estimate of future volatility, based on the weighted average of the implied volatilities for a wide range of strikes.

ICE BofA BB-B U.S. High Yield Constrained Index. An index that contains all securities in the ICE BofA U.S. High Yield Index rated BB1 through B3, based on an average of Moody's, S&P, and Fitch, but caps issuer exposure at 2%. Index constituents are capitalization-weighted, based on their current amount outstanding, provided the total allocation to an individual issuer does not exceed 2%.

MSCI ACWI ex-USA Index. A free float-adjusted market capitalization index designed to measure the combined equity market performance of developed and emerging market countries, excluding the United States.

MSCI EAFE Total Return Index ("MSCI EAFE"). An index created by Morgan Stanley Capital International (MSCI) that serves as a benchmark of the performance in major developed international equity markets as represented by 21 major MSCI indexes from Europe, Australasia and the Far East.

Russell 1000® Growth Index. An unmanaged index of common stock prices that measures the performance of those Russell 1000® Index companies with higher price-to-book ratios and higher forecasted growth values.

Russell 1000® Value Index. An index that measures the performance of large- and mid-capitalization value sectors of the U.S. equity market. It is a subset of the Russell 1000® Index, which measures the performance of the large-capitalization sector of the U.S. equity market.

Russell 2000® Index ("Russell 2000"). An index measuring the performance of approximately 2,000 small-cap companies in the Russell 3000 Index, which is made up of 3,000 of the biggest U.S. stocks. The Russell 2000 serves as a benchmark for small-cap stocks in the United States.

2

Russell Midcap® Growth Index. An unmanaged index that consists of the bottom 800 securities of the Russell 1000® Index with greater-than-average growth orientation as ranked by total market capitalization. Securities in this index generally have higher price-to-book and price-to-earnings ratios, lower dividend yields and higher forecasted growth values.

S&P 500 Index ("S&P 500"). A market capitalization weighted price index composed of 500 widely held U.S. common stocks. Frequently used as a measure of U.S. stock market performance.

S&P MidCap 400 Total Return Index ("S&P MidCap 400"). A capitalization-weighted index which measures the performance of the mid-range sector of the U.S. stock market.

S&P Target Risk® Growth Index. An index that increases exposure to equities, while also providing limited fixed income exposure to diversify risk.

3

| | | | | Page | |

• | | Global Atlantic Portfolio Performance | | | 5 | | |

• | | Global Atlantic Portfolio of Investments | | | | | |

| | | Global Atlantic BlackRock Allocation Portfolio | | | 7 | | |

| | | Global Atlantic BlackRock Disciplined Core Portfolio | | | 8 | | |

| | | Global Atlantic BlackRock Disciplined Growth Portfolio | | | 13 | | |

| | | Global Atlantic BlackRock Disciplined International Core Portfolio | | | 17 | | |

| | | Global Atlantic BlackRock Disciplined Mid Cap Growth Portfolio | | | 29 | | |

| | | Global Atlantic BlackRock Disciplined Value Portfolio | | | 35 | | |

| | | Global Atlantic BlackRock High Yield Portfolio | | | 41 | | |

| | | Global Atlantic Goldman Sachs Core Fixed Income Portfolio | | | 50 | | |

• | | Financial Statements: | | | | | |

| | | Statements of Assets and Liabilities | | | 60 | | |

| | | Statements of Operations | | | 62 | | |

| | | Statements of Changes in Net Assets | | | 64 | | |

| | | Financial Highlights | | | 68 | | |

• | | Notes to Financial Statements | | | 83 | | |

• | | Expense Examples | | | 106 | | |

• | | Privacy Notice | | | 108 | | |

• | | Proxy Voting Policy | | Back Cover | |

• | | Portfolio Holdings | | Back Cover | |

4

The Portfolio's performance figures for the periods ended June 30, 2022 as compared to its benchmarks:

| | | | | | | Annualized | | Operating

Expense** | |

| | | Inception

Date* | | Six Months

Ended

6/30/22 | | One Year

Ended

6/30/22 | | Three Years

Ended

6/30/22 | | Since

Inception

6/30/22 | | Gross

Ratios | | Net

Ratios | |

Global Atlantic BlackRock Allocation Portfolio | |

Class I | | 11/01/17 | | | (14.12 | )% | | | (10.84 | )% | | | 5.39 | % | | | 5.45 | % | | | 0.49 | % | | | 0.49 | % | |

Class II | | 11/01/17 | | | (14.17 | )% | | | (11.00 | )% | | | 5.13 | % | | | 5.20 | % | | | 0.74 | % | | | 0.74 | % | |

S&P Target Risk® Growth Index (Total Return)1 | | | | | (15.78 | )% | | | (12.83 | )% | | | 3.73 | % | | | 4.06 | % | | | | | |

Global Atlantic BlackRock Disciplined Core Portfolio | |

Class I | | 11/01/17 | | | (20.29 | )% | | | (11.11 | )% | | | 10.28 | % | | | 10.14 | % | | | 0.49 | % | | | 0.49 | % | |

Class II | | 11/01/17 | | | (20.39 | )% | | | (11.29 | )% | | | 10.00 | % | | | 9.85 | % | | | 0.74 | % | | | 0.74 | % | |

S&P 500® Index (Total Return)2 | | | | | (19.96 | )% | | | (10.62 | )% | | | 10.60 | % | | | 10.55 | % | | | | | |

Global Atlantic BlackRock Disciplined Growth Portfolio | |

Class I | | 08/20/21 | | | (28.35 | )% | | | N/A | | | | N/A | | | | (21.82 | )% | | | 0.51 | % | | | 0.48 | % | |

Class II | | 11/01/17 | | | (28.43 | )% | | | (19.41 | )% | | | 10.59 | % | | | 11.18 | % | | | 0.76 | % | | | 0.73 | % | |

Russell 1000® Growth Index (Total Return)3 | | | | | (28.07 | )% | | | (18.77 | )% | | | 12.58 | % | | | 13.09 | % | | | | | |

Global Atlantic BlackRock Disciplined International Core Portfolio | |

Class I | | 11/01/17 | | | (17.84 | )% | | | (18.83 | )% | | | 1.39 | % | | | 0.69 | % | | | 0.87 | % | | | 0.79 | % | |

Class II | | 11/01/17 | | | (17.95 | )% | | | (19.05 | )% | | | 1.11 | % | | | 0.43 | % | | | 1.12 | % | | | 1.04 | % | |

MSCI ACWI ex-USA Index4 | | | | | (18.42 | )% | | | (19.42 | )% | | | 1.35 | % | | | 0.87 | % | | | | | |

Global Atlantic BlackRock Disciplined Mid Cap Growth Portfolio | |

Class I | | 11/01/17 | | | (31.11 | )% | | | (29.71 | )% | | | 4.35 | % | | | 7.99 | % | | | 0.65 | % | | | 0.65 | % | |

Class II | | 11/01/17 | | | (31.21 | )% | | | (29.91 | )% | | | 4.06 | % | | | 7.72 | % | | | 0.90 | % | | | 0.90 | % | |

Russell Midcap® Growth Index (Total Return)5 | | | | | (31.00 | )% | | | (29.57 | )% | | | 4.25 | % | | | 7.79 | % | | | | | |

Global Atlantic BlackRock Disciplined Value Portfolio | |

Class I | | 11/01/17 | | | (13.66 | )% | | | (6.93 | )% | | | 7.00 | % | | | 6.99 | % | | | 0.55 | % | | | 0.55 | % | |

Class II | | 11/01/17 | | | (13.86 | )% | | | (7.23 | )% | | | 6.72 | % | | | 6.74 | % | | | 0.80 | % | | | 0.80 | % | |

Russell 1000® Value Index (Total Return)6 | | | | | (12.86 | )% | | | (6.82 | )% | | | 6.87 | % | | | 6.77 | % | | | | | |

Global Atlantic BlackRock High Yield Portfolio | |

Class I | | 11/01/17 | | | (13.42 | )% | | | (12.12 | )% | | | (0.30 | )% | | | 0.85 | % | | | 0.61 | % | | | 0.61 | % | |

Class II | | 11/01/17 | | | (13.52 | )% | | | (12.36 | )% | | | (0.54 | )% | | | 0.61 | % | | | 0.86 | % | | | 0.86 | % | |

ICE BofA BB-B U.S. High Yield Constrained Index7 | | | | | (13.64 | )% | | | (12.20 | )% | | | 0.04 | % | | | 1.69 | % | | | | | |

Global Atlantic Goldman Sachs Core Fixed Income Portfolio | |

Class I | | 11/01/17 | | | (11.22 | )% | | | (11.30 | )% | | | (0.80 | )% | | | 0.75 | % | | | 0.46 | % | | | 0.46 | % | |

Bloomberg U.S. Aggregate Bond Index8 | | | | | (10.35 | )% | | | (10.29 | )% | | | (0.93 | )% | | | 0.75 | % | | | | | |

The performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Total returns would have been lower absent fee waivers by the Adviser. Performance figures for periods greater than one year are annualized. The returns shown do not reflect the deduction of taxes that a shareholder may pay on Portfolio distributions or on the redemption of Portfolio shares, as well as other charges and expenses of the insurance contract or separate account.

* Commencement of operations is November 6, 2017, except for Class I shares of the Global Atlantic BlackRock Disciplined Growth Portfolio, which commenced operations on August 20, 2021.

** The estimated operating expense ratios for Class I and Class II shares, as disclosed in the most recent prospectus dated May 1, 2022. Ratios include Acquired Fund Fees and Expenses indirectly incurred by the Portfolio, if applicable. Gross operating expense ratio reflects the ratio of expenses absent waivers and/or reimbursements by the Adviser. The operating expense ratios presented here may differ from the expense ratios disclosed in the Financial Highlights table in this report.

1 The S&P Target Risk® Growth Index provides increased exposure to equities, while also providing limited fixed income exposure to diversify risk. It is not possible to invest directly in an index.

2 The S&P 500® Index is a market capitalization weighted price index composed of 500 widely held U.S. common stocks. It is frequently used as a measure of U.S. stock market performance. It is not possible to invest directly in an index.

5

Performance Summary (Continued)

3 The Russell 1000® Growth Index is an unmanaged index of common stock prices that measures the performance of those Russell 1000® Index companies with higher price-to-book ratios and higher forecasted growth values. It is not possible to invest directly in an index.

4 The MSCI ACWI ex-USA Index is a free float-adjusted market capitalization index designed to measure the combined equity market performance of developed and emerging market countries, excluding the United States. It is not possible to invest directly in an index.

5 The Russell Midcap® Growth Index is an unmanaged index that consists of the bottom 800 securities of the Russell 1000® Index with greater-than-average growth orientation as ranked by total market capitalization. Securities in this index generally have higher price-to-book and price-to-earnings ratios, lower dividend yields and higher forecasted growth values. It is not possible to invest directly in an index.

6 The Russell 1000® Value Index measures the performance of large- and mid-capitalization value sectors of the U.S. equity market. It is a subset of the Russell 1000® Index, which measures the performance of the large-capitalization sector of the U.S. equity market. It is not possible to invest directly in an index.

7 The ICE BofA BB-B US High Yield Constrained Index contains all securities in the ICE BofA U.S. High Yield Index rated BB1 through B3, based on an average of Moody's, S&P, and Fitch, but caps issuer exposure at 2%. Index constituents are capitalization-weighted, based on their current amount outstanding, provided the total allocation to an individual issuer does not exceed 2%. It is not possible to invest directly in an index.

8 The Bloomberg U.S. Aggregate Bond Index represents an unmanaged diversified portfolio of fixed income securities, including U.S. Treasuries, investment-grade corporate bonds, and mortgage-backed and asset-backed securities. It is not possible to invest directly in an index.

6

Global Atlantic BlackRock Allocation Portfolio

Portfolio of Investments (Unaudited)

June 30, 2022

| | | Shares/

Principal | | Fair

Value | |

EXCHANGE TRADED FUNDS - 99.0% | |

DEBT FUNDS - 38.6% | |

iShares 10-20 Year Treasury Bond ETF | | | 9,901 | | | $ | 1,189,605 | | |

iShares 1-5 Year Investment Grade

Corporate Bond ETF | | | 32,287 | | | | 1,632,108 | | |

iShares Core Total USD Bond Market ETF | | | 237,804 | | | | 11,133,983 | | |

iShares Fallen Angels USD Bond ETF | | | 64,848 | | | | 1,596,558 | | |

iShares TIPS Bond ETF | | | 29,679 | | | | 3,380,735 | | |

iShares U.S. Treasury Bond ETF | | | 215,136 | | | | 5,141,751 | | |

TOTAL DEBT FUNDS | | | | | 24,074,740 | | |

EQUITY FUNDS - 60.4% | |

iShares Core High Dividend ETF | | | 15,137 | | | | 1,520,209 | | |

iShares Core S&P 500 ETF | | | 35,542 | | | | 13,475,749 | | |

iShares ESG Aware MSCI USA ETF | | | 103,532 | | | | 8,686,335 | | |

iShares MSCI EAFE Growth ETF | | | 27,424 | | | | 2,207,358 | | |

iShares MSCI EAFE Value ETF | | | 105,323 | | | | 4,571,018 | | |

iShares MSCI Emerging Markets Min

Vol Factor ETF | | | 46,191 | | | | 2,560,367 | | |

iShares MSCI USA Min Vol Factor ETF | | | 14,185 | | | | 995,929 | | |

iShares S&P Small-Cap 600 Value ETF | | | 13,593 | | | | 1,210,185 | | |

| | | Shares/

Principal | | Fair

Value | |

EQUITY FUNDS - 60.4% (Continued) | |

iShares U.S. Energy ETF | | | 45,928 | | | $ | 1,750,775 | | |

iShares U.S. Infrastructure ETF | | | 17,778 | | | | 605,163 | | |

TOTAL EQUITY FUNDS | | | | | 37,583,088 | | |

TOTAL EXCHANGE

TRADED FUNDS (Cost - $61,069,878) | | | | | 61,657,828 | | |

SHORT-TERM INVESTMENTS - 1.0% | |

MONEY MARKET FUNDS - 1.0% | |

Fidelity Investments Money Market Fund -

Government Portfolio,

Institutional Class, 1.21% (a)

(Cost - $614,287) | | | 614,287 | | | | 614,287 | | |

TOTAL INVESTMENTS - 100.0%

(Cost - $61,684,165) | | | | $ | 62,272,115 | | |

OTHER ASSETS LESS

LIABILITIES - NET (0.0)%† | | | | | (29,944) | | |

TOTAL NET ASSETS - 100.0% | | | | $ | 62,242,171 | | |

† Represents less than 0.05%.

(a) The rate shown is the annualized seven-day yield at period end.

TIPS - Treasury Inflation Protected Security

Holdings by Asset Class | | % of Net Assets | |

Exchange Traded Funds | | | 99.0 | % | |

Short-Term Investments | | | 1.0 | % | |

Other Assets less Liabilities - Net | | | 0.0 | % | |

| | | | 100.0 | % | |

See accompanying notes to financial statements.

7

Global Atlantic BlackRock Disciplined Core Portfolio

Portfolio of Investments (Unaudited)

June 30, 2022

| | | Shares/

Principal | | Fair

Value | |

COMMON STOCKS - 98.5% | |

AEROSPACE & DEFENSE - 2.9% | |

Boeing Co. (The)* | | | 7,745 | | | $ | 1,058,897 | | |

Curtiss-Wright Corp. | | | 4,673 | | | | 617,116 | | |

General Dynamics Corp. | | | 30,544 | | | | 6,757,860 | | |

HEICO Corp. | | | 5,773 | | | | 756,956 | | |

HEICO Corp., Class A | | | 7,506 | | | | 790,982 | | |

Lockheed Martin Corp. | | | 10,305 | | | | 4,430,738 | | |

Northrop Grumman Corp. | | | 2,542 | | | | 1,216,525 | | |

| | | | | | 15,629,074 | | |

AIR FREIGHT & LOGISTICS - 0.8% | |

Expeditors International of Washington, Inc. | | | 2,887 | | | | 281,367 | | |

FedEx Corp. | | | 3,381 | | | | 766,506 | | |

United Parcel Service, Inc., Class B | | | 17,131 | | | | 3,127,093 | | |

| | | | | | 4,174,966 | | |

AIRLINES - 0.1% | |

Delta Air Lines, Inc.* | | | 15,298 | | | | 443,183 | | |

AUTOMOBILES - 2.0% | |

General Motors Co.* | | | 49,518 | | | | 1,572,692 | | |

Tesla, Inc.* | | | 13,722 | | | | 9,240,669 | | |

| | | | | | 10,813,361 | | |

BANKS - 4.4% | |

Bank of America Corp. | | | 214,601 | | | | 6,680,529 | | |

Bank of Nova Scotia (The) | | | 6,506 | | | | 385,220 | | |

Citigroup, Inc. | | | 47,515 | | | | 2,185,215 | | |

Huntington Bancshares, Inc. | | | 10,851 | | | | 130,537 | | |

JPMorgan Chase & Co. | | | 69,403 | | | | 7,815,472 | | |

Pinnacle Financial Partners, Inc. | | | 2,164 | | | | 156,479 | | |

PNC Financial Services Group, Inc. (The) | | | 7,662 | | | | 1,208,834 | | |

Regions Financial Corp. | | | 60,533 | | | | 1,134,994 | | |

US Bancorp | | | 27,188 | | | | 1,251,192 | | |

Wells Fargo & Co. | | | 61,259 | | | | 2,399,515 | | |

| | | | | | 23,347,987 | | |

BEVERAGES - 2.2% | |

Brown-Forman Corp., Class B | | | 49,207 | | | | 3,452,363 | | |

Coca-Cola Co. (The) | | | 42,681 | | | | 2,685,062 | | |

PepsiCo, Inc. | | | 32,225 | | | | 5,370,618 | | |

| | | | | | 11,508,043 | | |

BIOTECHNOLOGY - 1.6% | |

AbbVie, Inc. | | | 21,760 | | | | 3,332,761 | | |

Amgen, Inc. | | | 12,824 | | | | 3,120,079 | | |

Biogen, Inc.* | | | 4,514 | | | | 920,585 | | |

Exelixis, Inc.* | | | 4,122 | | | | 85,820 | | |

Gilead Sciences, Inc. | | | 6,222 | | | | 384,582 | | |

Regeneron Pharmaceuticals, Inc.* | | | 939 | | | | 555,071 | | |

Vertex Pharmaceuticals, Inc.* | | | 1,259 | | | | 354,774 | | |

| | | | | | 8,753,672 | | |

| | | Shares/

Principal | | Fair

Value | |

BUILDING PRODUCTS - 0.5% | |

Builders FirstSource, Inc.* | | | 3,789 | | | $ | 203,469 | | |

Masco Corp. | | | 38,396 | | | | 1,942,838 | | |

Owens Corning | | | 9,819 | | | | 729,650 | | |

| | | | | | 2,875,957 | | |

CAPITAL MARKETS - 1.4% | |

Bank of New York Mellon Corp. (The) | | | 50,526 | | | | 2,107,440 | | |

Charles Schwab Corp. (The) | | | 30,822 | | | | 1,947,334 | | |

CME Group, Inc. | | | 3,819 | | | | 781,749 | | |

Goldman Sachs Group, Inc. (The) | | | 4,057 | | | | 1,205,010 | | |

Intercontinental Exchange, Inc. | | | 9,252 | | | | 870,058 | | |

State Street Corp. | | | 5,803 | | | | 357,755 | | |

Stifel Financial Corp. | | | 3,741 | | | | 209,571 | | |

| | | | | | 7,478,917 | | |

CHEMICALS - 1.9% | |

Corteva, Inc. | | | 6,619 | | | | 358,353 | | |

Ecolab, Inc. | | | 20,395 | | | | 3,135,935 | | |

FMC Corp. | | | 6,169 | | | | 660,145 | | |

Huntsman Corp. | | | 4,438 | | | | 125,817 | | |

Linde PLC | | | 16,470 | | | | 4,735,619 | | |

LyondellBasell Industries NV, Class A | | | 3,528 | | | | 308,559 | | |

Mosaic Co. (The) | | | 7,047 | | | | 332,830 | | |

PPG Industries, Inc. | | | 3,312 | | | | 378,694 | | |

| | | | | | 10,035,952 | | |

COMMERCIAL SERVICES & SUPPLIES - 0.1% | |

Tetra Tech, Inc. | | | 2,890 | | | | 394,629 | | |

Waste Connections, Inc. | | | 934 | | | | 115,779 | | |

| | | | | | 510,408 | | |

COMMUNICATIONS EQUIPMENT - 0.3% | |

Ciena Corp.* | | | 8,551 | | | | 390,781 | | |

Juniper Networks, Inc. | | | 47,417 | | | | 1,351,384 | | |

| | | | | | 1,742,165 | | |

CONSUMER FINANCE - 1.1% | |

Ally Financial, Inc. | | | 7,172 | | | | 240,334 | | |

American Express Co. | | | 24,118 | | | | 3,343,237 | | |

Capital One Financial Corp. | | | 12,918 | | | | 1,345,926 | | |

Discover Financial Services | | | 6,557 | | | | 620,161 | | |

Synchrony Financial | | | 14,695 | | | | 405,876 | | |

| | | | | | 5,955,534 | | |

DIVERSIFIED FINANCIAL SERVICES - 2.0% | |

Berkshire Hathaway, Inc., Class B* | | | 28,153 | | | | 7,686,332 | | |

Voya Financial, Inc. | | | 48,994 | | | | 2,916,613 | | |

| | | | | | 10,602,945 | | |

DIVERSIFIED TELECOMMUNICATION - 0.5% | |

AT&T, Inc. | | | 33,316 | | | | 698,303 | | |

BCE, Inc. | | | 33,004 | | | | 1,623,137 | | |

Iridium Communications, Inc.* | | | 1,677 | | | | 62,988 | | |

TELUS Corp. | | | 10,145 | | | | 226,031 | | |

| | | | | | 2,610,459 | | |

See accompanying notes to financial statements.

8

Global Atlantic BlackRock Disciplined Core Portfolio

Portfolio of Investments (Unaudited) (Continued)

June 30, 2022

| | | Shares/

Principal | | Fair

Value | |

ELECTRIC UTILITIES - 0.9% | |

Entergy Corp. | | | 6,100 | | | $ | 687,104 | | |

NextEra Energy, Inc. | | | 34,277 | | | | 2,655,096 | | |

NRG Energy, Inc. | | | 40,605 | | | | 1,549,893 | | |

| | | | | | 4,892,093 | | |

ELECTRICAL EQUIPMENT - 0.5% | |

AMETEK, Inc. | | | 9,056 | | | | 995,164 | | |

Eaton Corp. PLC | | | 15,353 | | | | 1,934,324 | | |

| | | | | | 2,929,488 | | |

ELECTRONIC EQUIPMENT, INSTRUMENTS & COMPONENTS - 0.3% | |

Avnet, Inc. | | | 9,141 | | | | 391,966 | | |

Flex Ltd.* | | | 17,884 | | | | 258,782 | | |

TE Connectivity Ltd. | | | 10,303 | | | | 1,165,784 | | |

| | | | | | 1,816,532 | | |

ENERGY EQUIPMENT & SERVICES - 0.5% | |

Halliburton Co. | | | 42,205 | | | | 1,323,549 | | |

Schlumberger NV | | | 38,355 | | | | 1,371,575 | | |

| | | | | | 2,695,124 | | |

ENTERTAINMENT - 0.6% | |

Activision Blizzard, Inc. | | | 3,923 | | | | 305,445 | | |

Electronic Arts, Inc. | | | 5,909 | | | | 718,830 | | |

Walt Disney Co. (The)* | | | 21,743 | | | | 2,052,539 | | |

Warner Bros Discovery, Inc.* | | �� | 20,985 | | | | 281,619 | | |

| | | | | | 3,358,433 | | |

EQUITY REAL ESTATE INVESTMENT - 2.5% | |

American Tower Corp. | | | 4,939 | | | | 1,262,359 | | |

Crown Castle International Corp. | | | 15,116 | | | | 2,545,232 | | |

Equinix, Inc. | | | 2,254 | | | | 1,480,923 | | |

Equity Residential | | | 11,330 | | | | 818,253 | | |

Essex Property Trust, Inc. | | | 1,152 | | | | 301,259 | | |

Extra Space Storage, Inc. | | | 3,567 | | | | 606,818 | | |

Lamar Advertising Co., Class A | | | 675 | | | | 59,380 | | |

Mid-America Apartment Communities, Inc. | | | 11,927 | | | | 2,083,289 | | |

Prologis, Inc. | | | 25,104 | | | | 2,953,486 | | |

SBA Communications Corp. | | | 3,759 | | | | 1,203,068 | | |

Simon Property Group, Inc. | | | 2,997 | | | | 284,475 | | |

| | | | | | 13,598,542 | | |

FOOD & STAPLES RETAILING - 1.0% | |

Costco Wholesale Corp. | | | 11,273 | | | | 5,402,923 | | |

Kroger Co. (The) | | | 2,860 | | | | 135,364 | | |

| | | | | | 5,538,287 | | |

FOOD PRODUCTS - 1.3% | |

Archer-Daniels-Midland Co. | | | 5,417 | | | | 420,359 | | |

Bunge Ltd. | | | 5,236 | | | | 474,853 | | |

Hershey Co. (The) | | | 6,491 | | | | 1,396,603 | | |

J M Smucker Co. (The) | | | 974 | | | | 124,682 | | |

| | | Shares/

Principal | | Fair

Value | |

FOOD PRODUCTS - 1.3% (Continued) | |

McCormick & Co., Inc. | | | 8,814 | | | $ | 733,765 | | |

Mondelez International, Inc., Class A | | | 38,554 | | | | 2,393,818 | | |

Tyson Foods, Inc., Class A | | | 13,526 | | | | 1,164,048 | | |

| | | | | | 6,708,128 | | |

GAS UTILITIES - 0.0%† | |

Atmos Energy Corp. | | | 576 | | | | 64,570 | | |

HEALTH CARE EQUIPMENT & SUPPLIES - 2.2% | |

Abbott Laboratories | | | 32,199 | | | | 3,498,421 | | |

Align Technology, Inc.* | | | 3,108 | | | | 735,570 | | |

Boston Scientific Corp.* | | | 87,870 | | | | 3,274,915 | | |

Edwards Lifesciences Corp.* | | | 7,781 | | | | 739,895 | | |

Enovis Corp.* | | | 1,966 | | | | 108,130 | | |

Hologic, Inc.* | | | 989 | | | | 68,538 | | |

IDEXX Laboratories, Inc.* | | | 2,193 | | | | 769,151 | | |

Medtronic PLC | | | 27,904 | | | | 2,504,384 | | |

| | | | | | 11,699,004 | | |

HEALTH CARE PROVIDERS & SERVICES - 4.3% | |

AmerisourceBergen Corp. | | | 12,411 | | | | 1,755,908 | | |

Cigna Corp. | | | 22,147 | | | | 5,836,178 | | |

CVS Health Corp. | | | 16,968 | | | | 1,572,255 | | |

Elevance Health, Inc. | | | 8,940 | | | | 4,314,265 | | |

McKesson Corp. | | | 4,334 | | | | 1,413,794 | | |

Molina Healthcare, Inc.* | | | 2,429 | | | | 679,173 | | |

UnitedHealth Group, Inc. | | | 14,927 | | | | 7,666,955 | | |

| | | | | | 23,238,528 | | |

HOTELS, RESTAURANTS & LEISURE - 1.1% | |

Chipotle Mexican Grill, Inc.* | | | 161 | | | | 210,469 | | |

Choice Hotels International, Inc. | | | 7,200 | | | | 803,736 | | |

Expedia Group, Inc.* | | | 1,213 | | | | 115,029 | | |

McDonald's Corp. | | | 6,578 | | | | 1,623,977 | | |

Texas Roadhouse, Inc. | | | 1,648 | | | | 120,633 | | |

Travel + Leisure Co. | | | 65,490 | | | | 2,542,322 | | |

Yum! Brands, Inc. | | | 5,211 | | | | 591,500 | | |

| | | | | | 6,007,666 | | |

HOUSEHOLD DURABLES - 0.4% | |

Lennar Corp., Class A | | | 1,897 | | | | 133,871 | | |

Whirlpool Corp. | | | 12,433 | | | | 1,925,499 | | |

| | | | | | 2,059,370 | | |

HOUSEHOLD PRODUCTS - 2.2% | |

Colgate-Palmolive Co. | | | 40,941 | | | | 3,281,012 | | |

Procter & Gamble Co. (The) | | | 59,611 | | | | 8,571,465 | | |

| | | | | | 11,852,477 | | |

INDEPENDENT POWER AND RENEWABLE ELECTRICITY PRODUCERS - 0.1% | |

Vistra Corp. | | | 13,867 | | | | 316,861 | | |

INDUSTRIAL CONGLOMERATES - 0.0%† | |

General Electric Co. | | | 3,524 | | | | 224,373 | | |

See accompanying notes to financial statements.

9

Global Atlantic BlackRock Disciplined Core Portfolio

Portfolio of Investments (Unaudited) (Continued)

June 30, 2022

| | | Shares/

Principal | | Fair

Value | |

INSURANCE - 2.4% | |

Allstate Corp. (The) | | | 9,031 | | | $ | 1,144,499 | | |

Aon PLC, Class A | | | 227 | | | | 61,218 | | |

Hartford Financial Services Group, Inc. (The) | | | 4,763 | | | | 311,643 | | |

Marsh & McLennan Cos., Inc. | | | 16,116 | | | | 2,502,009 | | |

MetLife, Inc. | | | 79,908 | | | | 5,017,423 | | |

Travelers Cos., Inc. (The) | | | 21,086 | | | | 3,566,275 | | |

| | | | | | 12,603,067 | | |

INTERACTIVE MEDIA & SERVICES - 5.3% | |

Alphabet, Inc., Class A* | | | 5,582 | | | | 12,164,630 | | |

Alphabet, Inc., Class C* | | | 4,565 | | | | 9,985,709 | | |

Meta Platforms, Inc., Class A* | | | 38,661 | | | | 6,234,086 | | |

| | | | | | 28,384,425 | | |

INTERNET & DIRECT MARKETING RETAIL - 2.7% | |

Amazon.com, Inc.* | | | 135,347 | | | | 14,375,205 | | |

eBay, Inc. | | | 5,618 | | | | 234,102 | | |

MercadoLibre, Inc.* | | | 71 | | | | 45,218 | | |

| | | | | | 14,654,525 | | |

IT SERVICES - 3.7% | |

Accenture PLC, Class A | | | 3,356 | | | | 931,793 | | |

Automatic Data Processing, Inc. | | | 7,566 | | | | 1,589,163 | | |

Cognizant Technology Solutions Corp.,

Class A | | | 23,354 | | | | 1,576,161 | | |

Fidelity National Information Services, Inc. | | | 13,780 | | | | 1,263,213 | | |

Gartner, Inc.* | | | 1,432 | | | | 346,300 | | |

Global Payments, Inc. | | | 9,228 | | | | 1,020,986 | | |

GoDaddy, Inc., Class A* | | | 2,066 | | | | 143,711 | | |

Mastercard, Inc., Class A | | | 11,297 | | | | 3,563,978 | | |

Paychex, Inc. | | | 2,418 | | | | 275,338 | | |

PayPal Holdings, Inc.* | | | 24,083 | | | | 1,681,957 | | |

Visa, Inc., Class A | | | 36,924 | | | | 7,269,966 | | |

| | | | | | 19,662,566 | | |

LIFE SCIENCES TOOLS & SERVICES - 2.4% | |

Agilent Technologies, Inc. | | | 23,665 | | | | 2,810,692 | | |

Bruker Corp. | | | 1,951 | | | | 122,445 | | |

Charles River Laboratories International,

Inc.* | | | 563 | | | | 120,465 | | |

Danaher Corp. | | | 13,674 | | | | 3,466,632 | | |

Mettler-Toledo International, Inc.* | | | 754 | | | | 866,173 | | |

Syneos Health, Inc.* | | | 19,924 | | | | 1,428,152 | | |

Thermo Fisher Scientific, Inc. | | | 7,067 | | | | 3,839,360 | | |

| | | | | | 12,653,919 | | |

MACHINERY - 1.9% | |

Caterpillar, Inc. | | | 7,644 | | | | 1,366,441 | | |

Cummins, Inc. | | | 9,398 | | | | 1,818,795 | | |

Deere & Co. | | | 4,058 | | | | 1,215,249 | | |

Illinois Tool Works, Inc. | | | 18,415 | | | | 3,356,134 | | |

Otis Worldwide Corp. | | | 6,484 | | | | 458,224 | | |

PACCAR, Inc. | | | 12,320 | | | | 1,014,429 | | |

Snap-on, Inc. | | | 1,056 | | | | 208,064 | | |

| | | Shares/

Principal | | Fair

Value | |

MACHINERY - 1.9% (Continued) | |

Stanley Black & Decker, Inc. | | | 5,787 | | | $ | 606,825 | | |

Timken Co. (The) | | | 988 | | | | 52,413 | | |

| | | | | | 10,096,574 | | |

MEDIA - 1.3% | |

Altice USA, Inc., Class A* | | | 22,012 | | | | 203,611 | | |

Charter Communications, Inc., Class A* | | | 1,568 | | | | 734,655 | | |

Comcast Corp., Class A | | | 79,325 | | | | 3,112,713 | | |

Fox Corp., Class A | | | 88,375 | | | | 2,842,140 | | |

Fox Corp., Class B | | | 2,791 | | | | 82,893 | | |

Paramount Global, Class B | | | 2,026 | | | | 50,001 | | |

| | | | | | 7,026,013 | | |

METALS & MINING - 0.2% | |

Freeport-McMoRan, Inc. | | | 28,409 | | | | 831,247 | | |

MULTILINE RETAIL - 0.8% | |

Dollar General Corp. | | | 6,128 | | | | 1,504,057 | | |

Target Corp. | | | 18,614 | | | | 2,628,855 | | |

| | | | | | 4,132,912 | | |

MULTI-UTILITIES - 1.8% | |

Ameren Corp. | | | 5,246 | | | | 474,029 | | |

Black Hills Corp. | | | 16,305 | | | | 1,186,515 | | |

CMS Energy Corp. | | | 45,961 | | | | 3,102,367 | | |

Dominion Energy, Inc. | | | 5,558 | | | | 443,584 | | |

DTE Energy Co. | | | 35,069 | | | | 4,444,996 | | |

| | | | | | 9,651,491 | | |

OIL, GAS & CONSUMABLE FUELS - 3.7% | |

APA Corp. | | | 10,255 | | | | 357,899 | | |

Chevron Corp. | | | 27,860 | | | | 4,033,571 | | |

Devon Energy Corp. | | | 12,264 | | | | 675,869 | | |

Diamondback Energy, Inc. | | | 2,938 | | | | 355,939 | | |

EOG Resources, Inc. | | | 26,958 | | | | 2,977,242 | | |

Exxon Mobil Corp. | | | 92,182 | | | | 7,894,466 | | |

Marathon Oil Corp. | | | 54,280 | | | | 1,220,214 | | |

Murphy Oil Corp. | | | 1,878 | | | | 56,697 | | |

Occidental Petroleum Corp. | | | 11,765 | | | | 692,723 | | |

Ovintiv, Inc. | | | 3,661 | | | | 161,780 | | |

Phillips 66 | | | 6,835 | | | | 560,402 | | |

Targa Resources Corp. | | | 1,096 | | | | 65,398 | | |

Valero Energy Corp. | | | 6,812 | | | | 723,979 | | |

| | | | | | 19,776,179 | | |

PHARMACEUTICALS - 5.4% | |

Bristol-Myers Squibb Co. | | | 22,065 | | | | 1,699,005 | | |

Eli Lilly and Co. | | | 13,310 | | | | 4,315,501 | | |

GSK PLC, ADR | | | 1,521 | | | | 66,209 | | |

Johnson & Johnson | | | 52,905 | | | | 9,391,167 | | |

Merck & Co., Inc. | | | 51,764 | | | | 4,719,324 | | |

Perrigo Co. PLC | | | 11,832 | | | | 480,024 | | |

Pfizer, Inc. | | | 94,176 | | | | 4,937,648 | | |

See accompanying notes to financial statements.

10

Global Atlantic BlackRock Disciplined Core Portfolio

Portfolio of Investments (Unaudited) (Continued)

June 30, 2022

| | | Shares/

Principal | | Fair

Value | |

PHARMACEUTICALS - 5.4% (Continued) | |

Viatris, Inc. | | | 22,394 | | | $ | 234,465 | | |

Zoetis, Inc. | | | 17,906 | | | | 3,077,862 | | |

| | | | | | 28,921,205 | | |

PROFESSIONAL SERVICES - 0.3% | |

Booz Allen Hamilton Holding Corp. | | | 8,224 | | | | 743,121 | | |

KBR, Inc. | | | 1,295 | | | | 62,665 | | |

ManpowerGroup, Inc. | | | 670 | | | | 51,195 | | |

Robert Half International, Inc. | | | 6,217 | | | | 465,591 | | |

| | | | | | 1,322,572 | | |

REAL ESTATE MANAGEMENT & DEVELOPMENT - 0.1% | |

CBRE Group, Inc., Class A* | | | 10,247 | | | | 754,282 | | |

ROAD & RAIL - 1.0% | |

CSX Corp. | | | 61,575 | | | | 1,789,370 | | |

Landstar System, Inc. | | | 3,471 | | | | 504,753 | | |

Lyft, Inc., Class A* | | | 7,679 | | | | 101,977 | | |

Norfolk Southern Corp. | | | 3,032 | | | | 689,143 | | |

Old Dominion Freight Line, Inc. | | | 1,906 | | | | 488,470 | | |

Schneider National, Inc., Class B | | | 27,535 | | | | 616,233 | | |

Union Pacific Corp. | | | 4,836 | | | | 1,031,422 | | |

| | | | | | 5,221,368 | | |

SEMICONDUCTORS & SEMICONDUCTOR

EQUIPMENT - 5.9% | |

Advanced Micro Devices, Inc.* | | | 17,821 | | | | 1,362,744 | | |

Analog Devices, Inc. | | | 16,294 | | | | 2,380,390 | | |

Applied Materials, Inc. | | | 16,361 | | | | 1,488,524 | | |

| ASML Holding NV | | | 662 | | | | 315,033 | | |

Broadcom, Inc. | | | 4,845 | | | | 2,353,749 | | |

Cirrus Logic, Inc.* | | | 1,473 | | | | 106,851 | | |

CMC Materials, Inc. | | | 1 | | | | 175 | | |

Intel Corp. | | | 181,904 | | | | 6,805,029 | | |

KLA Corp. | | | 3,693 | | | | 1,178,362 | | |

Lam Research Corp. | | | 3,240 | | | | 1,380,726 | | |

MaxLinear, Inc.* | | | 3,413 | | | | 115,974 | | |

Micron Technology, Inc. | | | 8,320 | | | | 459,930 | | |

Monolithic Power Systems, Inc. | | | 1,330 | | | | 510,773 | | |

NVIDIA Corp. | | | 41,645 | | | | 6,312,966 | | |

NXP Semiconductors NV | | | 342 | | | | 50,626 | | |

QUALCOMM, Inc. | | | 24,730 | | | | 3,159,010 | | |

Semtech Corp.* | | | 1,017 | | | | 55,905 | | |

Silicon Laboratories, Inc.* | | | 9,711 | | | | 1,361,676 | | |

Teradyne, Inc. | | | 4,261 | | | | 381,573 | | |

Texas Instruments, Inc. | | | 11,561 | | | | 1,776,348 | | |

Tower Semiconductor Ltd.* | | | 1,708 | | | | 78,875 | | |

| | | | | | 31,635,239 | | |

SOFTWARE - 9.2% | |

Adobe, Inc.* | | | 8,090 | | | | 2,961,425 | | |

ANSYS, Inc.* | | | 493 | | | | 117,970 | | |

| | | Shares/

Principal | | Fair

Value | |

SOFTWARE - 9.2% (Continued) | |

Autodesk, Inc.* | | | 863 | | | $ | 148,402 | | |

Cadence Design Systems, Inc.* | | | 8,244 | | | | 1,236,847 | | |

Ceridian HCM Holding, Inc.* | | | 4,536 | | | | 213,555 | | |

Citrix Systems, Inc. | | | 2,061 | | | | 200,267 | | |

Fair Isaac Corp.* | | | 207 | | | | 82,986 | | |

Intuit, Inc. | | | 3,712 | | | | 1,430,753 | | |

Microsoft Corp. | | | 132,611 | | | | 34,058,483 | | |

Palo Alto Networks, Inc.* | | | 326 | | | | 161,025 | | |

Paycom Software, Inc.* | | | 1,237 | | | | 346,509 | | |

RingCentral, Inc., Class A* | | | 20,919 | | | | 1,093,227 | | |

Roper Technologies, Inc. | | | 1,569 | | | | 619,206 | | |

salesforce, Inc.* | | | 14,010 | | | | 2,312,210 | | |

ServiceNow, Inc.* | | | 7,200 | | | | 3,423,744 | | |

Workday, Inc., Class A* | | | 7,316 | | | | 1,021,167 | | |

| | | | | | 49,427,776 | | |

SPECIALTY RETAIL - 2.0% | |

Advance Auto Parts, Inc. | | | 1,962 | | | | 339,602 | | |

AutoNation, Inc.* | | | 2,909 | | | | 325,110 | | |

Best Buy Co., Inc. | | | 5,431 | | | | 354,047 | | |

Dick's Sporting Goods, Inc. | | | 2,043 | | | | 153,981 | | |

Foot Locker, Inc. | | | 3,725 | | | | 94,056 | | |

Home Depot, Inc. (The) | | | 18,572 | | | | 5,093,742 | | |

Lowe's Cos., Inc. | | | 16,519 | | | | 2,885,374 | | |

Penske Automotive Group, Inc. | | | 2,830 | | | | 296,273 | | |

TJX Cos., Inc. (The) | | | 15,646 | | | | 873,829 | | |

Tractor Supply Co. | | | 1,774 | | | | 343,890 | | |

| | | | | | 10,759,904 | | |

TECHNOLOGY HARDWARE, STORAGE &

PERIPHERALS - 7.4% | |

Apple, Inc. | | | 251,011 | | | | 34,318,224 | | |

Dell Technologies, Inc., Class C | | | 19,264 | | | | 890,190 | | |

Hewlett Packard Enterprise Co. | | | 122,186 | | | | 1,620,186 | | |

HP, Inc. | | | 59,644 | | | | 1,955,130 | | |

NetApp, Inc. | | | 9,844 | | | | 642,223 | | |

| | | | | | 39,425,953 | | |

TEXTILES, APPAREL & LUXURY GOODS - 0.3% | |

NIKE, Inc., Class B | | | 11,779 | | | | 1,203,814 | | |

Ralph Lauren Corp. | | | 6,472 | | | | 580,215 | | |

| | | | | | 1,784,029 | | |

TOBACCO - 0.7% | |

Altria Group, Inc. | | | 51,715 | | | | 2,160,136 | | |

Philip Morris International, Inc. | | | 18,421 | | | | 1,818,889 | | |

| | | | | | 3,979,025 | | |

TRADING COMPANIES & DISTRIBUTORS - 0.3% | |

SiteOne Landscape Supply, Inc.* | | | 6,142 | | | | 730,100 | | |

United Rentals, Inc.* | | | 2,853 | | | | 693,022 | | |

WW Grainger, Inc. | | | 175 | | | | 79,525 | | |

| | | | | | 1,502,647 | | |

See accompanying notes to financial statements.

11

Global Atlantic BlackRock Disciplined Core Portfolio

Portfolio of Investments (Unaudited) (Continued)

June 30, 2022

| | | Shares/

Principal | | Fair

Value | |

WIRELESS TELECOMMUNICATION SERVICES - 0.0%† | |

United States Cellular Corp.* | | | 4,168 | | | $ | 120,705 | | |

TOTAL COMMON STOCKS

(Cost - $469,141,349) | | | | | 527,809,722 | | |

SHORT-TERM INVESTMENTS - 1.4% | |

MONEY MARKET FUNDS - 1.4% | |

Fidelity Investments Money Market

Fund - Government Portfolio,

Institutional Class, 1.21% (a)

(Cost - $7,388,050) | | | 7,388,050 | | | | 7,388,050 | | |

TOTAL INVESTMENTS - 99.9%

(Cost - $476,529,399) | | | | $ | 535,197,772 | | |

OTHER ASSETS LESS LIABILITIES - NET 0.1% | | | | | 685,736 | | |

TOTAL NET ASSETS - 100.0% | | | | $ | 535,883,508 | | |

* Non-income producing security.

† Represents less than 0.05%.

(a) The rate shown is the annualized seven-day yield at period end.

ADR - American Depositary Receipt

PLC - Public Limited Company

Holdings by Asset Class | | % of Net Assets | |

Common Stocks | | | 98.5 | % | |

Short-Term Investments | | | 1.4 | % | |

Other Assets Less Liabilities - Net | | | 0.1 | % | |

| | | | 100.0 | % | |

FUTURES CONTRACTS | |

LONG FUTURES CONTRACTS | | Counterparty | | Number of

Contracts | | Expiration Date | | Notional Value | | Fair Value/

Unrealized

Appreciation

(Depreciation) | |

S&P 500 E-Mini Future | | Goldman Sachs & Co. | | | 46 | | | 9/16/2022 | | $ | 8,526,375 | | | $ | (177,534 | ) | |

See accompanying notes to financial statements.

12

Global Atlantic BlackRock Disciplined Growth Portfolio

Portfolio of Investments (Unaudited)

June 30, 2022

| | | Shares/

Principal | | Fair

Value | |

COMMON STOCKS - 97.7% | |

AEROSPACE & DEFENSE - 1.6% | |

Boeing Co. (The)* | | | 279 | | | $ | 38,145 | | |

General Dynamics Corp. | | | 2,977 | | | | 658,661 | | |

HEICO Corp. | | | 625 | | | | 81,950 | | |

HEICO Corp., Class A | | | 798 | | | | 84,093 | | |

Lockheed Martin Corp. | | | 1,075 | | | | 462,207 | | |

| | | | 1,325,056 | | |

AIR FREIGHT & LOGISTICS - 1.2% | |

Expeditors International of Washington, Inc. | | | 615 | | | | 59,938 | | |

FedEx Corp. | | | 200 | | | | 45,342 | | |

United Parcel Service, Inc., Class B | | | 4,903 | | | | 894,994 | | |

| | | | 1,000,274 | | |

AUTOMOBILES - 3.4% | |

Tesla, Inc.* | | | 4,210 | | | | 2,835,098 | | |

BANKS - 0.6% | |

Bank of America Corp. | | | 10,623 | | | | 330,694 | | |

JPMorgan Chase & Co. | | | 1,266 | | | | 142,564 | | |

| | | | 473,258 | | |

BEVERAGES - 2.2% | |

Brown-Forman Corp., Class B | | | 6,147 | | | | 431,273 | | |

Coca-Cola Co. (The) | | | 5,898 | | | | 371,043 | | |

PepsiCo, Inc. | | | 6,439 | | | | 1,073,124 | | |

| | | | 1,875,440 | | |

BIOTECHNOLOGY - 2.2% | |

AbbVie, Inc. | | | 6,958 | | | | 1,065,687 | | |

Amgen, Inc. | | | 2,286 | | | | 556,184 | | |

Biogen, Inc.* | | | 235 | | | | 47,926 | | |

Exelixis, Inc.* | | | 1,892 | | | | 39,391 | | |

Incyte Corp.* | | | 145 | | | | 11,016 | | |

Moderna, Inc.* | | | 176 | | | | 25,141 | | |

Novavax, Inc.* | | | 649 | | | | 33,378 | | |

Vertex Pharmaceuticals, Inc.* | | | 216 | | | | 60,867 | | |

| | | | 1,839,590 | | |

BUILDING PRODUCTS - 0.3% | |

Builders FirstSource, Inc.* | | | 745 | | | | 40,007 | | |

Masco Corp. | | | 2,860 | | | | 144,716 | | |

Owens Corning | | | 1,242 | | | | 92,293 | | |

| | | | 277,016 | | |

CAPITAL MARKETS - 0.8% | |

Bank of New York Mellon Corp. (The) | | | 912 | | | | 38,039 | | |

Blackstone, Inc. | | | 2,720 | | | | 248,146 | | |

Charles Schwab Corp. (The) | | | 2,052 | | | | 129,645 | | |

MarketAxess Holdings, Inc. | | | 44 | | | | 11,264 | | |

Moody's Corp. | | | 806 | | | | 219,208 | | |

State Street Corp. | | | 175 | | | | 10,789 | | |

Stifel Financial Corp. | | | 197 | | | | 11,036 | | |

| | | | 668,127 | | |

| | | Shares/

Principal | | Fair

Value | |

CHEMICALS - 1.1% | |

Ecolab, Inc. | | | 3,660 | | | $ | 562,762 | | |

Linde PLC | | | 935 | | | | 268,841 | | |

PPG Industries, Inc. | | | 413 | | | | 47,222 | | |

Sherwin-Williams Co. (The) | | | 86 | | | | 19,256 | | |

| | | | 898,081 | | |

COMMERCIAL SERVICES & SUPPLIES - 0.4% | |

Copart, Inc.* | | | 1,310 | | | | 142,345 | | |

Tetra Tech, Inc. | | | 1,308 | | | | 178,607 | | |

| | | | 320,952 | | |

COMMUNICATIONS EQUIPMENT - 0.1% | |

Ciena Corp.* | | | 1,961 | | | | 89,618 | | |

Juniper Networks, Inc. | | | 521 | | | | 14,848 | | |

| | | | 104,466 | | |

CONSUMER FINANCE - 0.9% | |

Ally Financial, Inc. | | | 766 | | | | 25,669 | | |

American Express Co. | | | 3,840 | | | | 532,301 | | |

Capital One Financial Corp. | | | 670 | | | | 69,807 | | |

Discover Financial Services | | | 1,365 | | | | 129,102 | | |

Synchrony Financial | | | 754 | | | | 20,825 | | |

| | | | 777,704 | | |

DIVERSIFIED FINANCIAL SERVICES - 0.4% | |

Voya Financial, Inc. | | | 5,497 | | | | 327,236 | | |

ELECTRIC UTILITIES - 0.1% | |

NRG Energy, Inc. | | | 1,493 | | | | 56,988 | | |

ELECTRICAL EQUIPMENT - 0.1% | |

Eaton Corp. PLC | | | 489 | | | | 61,609 | | |

Generac Holdings, Inc.* | | | 48 | | | | 10,108 | | |

| | | | 71,717 | | |

ELECTRONIC EQUIPMENT, INSTRUMENTS & COMPONENTS - 0.9% | |

Avnet, Inc. | | | 2,326 | | | | 99,739 | | |

CDW Corp. | | | 101 | | | | 15,914 | | |

Coherent, Inc.* | | | 796 | | | | 211,911 | | |

Flex Ltd.* | | | 4,190 | | | | 60,629 | | |

Jabil, Inc. | | | 178 | | | | 9,115 | | |

TE Connectivity Ltd. | | | 2,213 | | | | 250,401 | | |

Zebra Technologies Corp., Class A* | | | 270 | | | | 79,367 | | |

| | | | 727,076 | | |

ENERGY EQUIPMENT & SERVICES - 0.3% | |

Halliburton Co. | | | 4,749 | | | | 148,929 | | |

Schlumberger NV | | | 2,681 | | | | 95,872 | | |

| | | | 244,801 | | |

ENTERTAINMENT - 0.5% | |

Electronic Arts, Inc. | | | 640 | | | | 77,856 | | |

Live Nation Entertainment, Inc.* | | | 583 | | | | 48,144 | | |

ROBLOX Corp., Class A* | | | 2,288 | | | | 75,184 | | |

See accompanying notes to financial statements.

13

Global Atlantic BlackRock Disciplined Growth Portfolio

Portfolio of Investments (Unaudited) (Continued)

June 30, 2022

| | | Shares/

Principal | | Fair

Value | |

ENTERTAINMENT - 0.5% (Continued) | |

Spotify Technology SA* | | | 1,390 | | | $ | 130,424 | | |

Take-Two Interactive Software, Inc.* | | | 169 | | | | 20,707 | | |

Walt Disney Co. (The)* | | | 358 | | | | 33,795 | | |

| | | | 386,110 | | |

EQUITY REAL ESTATE INVESTMENT - 1.3% | |

American Tower Corp. | | | 1,422 | | | | 363,449 | | |

Crown Castle International Corp. | | | 2,448 | | | | 412,194 | | |

Equinix, Inc. | | | 287 | | | | 188,565 | | |

Prologis, Inc. | | | 799 | | | | 94,003 | | |

SBA Communications Corp. | | | 127 | | | | 40,646 | | |

| | | | 1,098,857 | | |

FOOD & STAPLES RETAILING - 1.7% | |

Costco Wholesale Corp. | | | 2,933 | | | | 1,405,728 | | |

FOOD PRODUCTS - 0.1% | |

Hershey Co. (The) | | | 274 | | | | 58,954 | | |

Mondelez International, Inc., Class A | | | 392 | | | | 24,339 | | |

| | | | 83,293 | | |

HEALTH CARE EQUIPMENT & SUPPLIES - 2.1% | |

Abbott Laboratories | | | 4,175 | | | | 453,614 | | |

Align Technology, Inc.* | | | 758 | | | | 179,396 | | |

Boston Scientific Corp.* | | | 8,658 | | | | 322,683 | | |

Dexcom, Inc.* | | | 1,060 | | | | 79,002 | | |

Edwards Lifesciences Corp.* | | | 2,635 | | | | 250,562 | | |

IDEXX Laboratories, Inc.* | | | 701 | | | | 245,862 | | |

Intuitive Surgical, Inc.* | | | 808 | | | | 162,174 | | |

Masimo Corp.* | | | 286 | | | | 37,371 | | |

| | | | 1,730,664 | | |

HEALTH CARE PROVIDERS & SERVICES - 3.3% | |

AmerisourceBergen Corp. | | | 752 | | | | 106,393 | | |

Cigna Corp. | | | 1,070 | | | | 281,966 | | |

Elevance Health, Inc. | | | 339 | | | | 163,595 | | |

HCA Healthcare, Inc. | | | 124 | | | | 20,839 | | |

McKesson Corp. | | | 466 | | | | 152,014 | | |

Molina Healthcare, Inc.* | | | 54 | | | | 15,099 | | |

UnitedHealth Group, Inc. | | | 3,916 | | | | 2,011,375 | | |

| | | | 2,751,281 | | |

HEALTH CARE TECHNOLOGY - 0.1% | |

Veeva Systems, Inc., Class A* | | | 268 | | | | 53,075 | | |

HOTELS, RESTAURANTS & LEISURE - 2.0% | |

Booking Holdings, Inc.* | | | 187 | | | | 327,061 | | |

Chipotle Mexican Grill, Inc.* | | | 140 | | | | 183,016 | | |

Choice Hotels International, Inc. | | | 1,303 | | | | 145,454 | | |

Expedia Group, Inc.* | | | 1,002 | | | | 95,020 | | |

Marriott International, Inc., Class A | | | 1,381 | | | | 187,830 | | |

McDonald's Corp. | | | 438 | | | | 108,133 | | |

Royal Caribbean Cruises Ltd.* | | | 558 | | | | 19,480 | | |

| | | Shares/

Principal | | Fair

Value | |

HOTELS, RESTAURANTS & LEISURE - 2.0% (Continued) | |

Starbucks Corp. | | | 499 | | | $ | 38,119 | | |

Texas Roadhouse, Inc. | | | 969 | | | | 70,931 | | |

Travel + Leisure Co. | | | 10,376 | | | | 402,796 | | |

Yum! Brands, Inc. | | | 989 | | | | 112,261 | | |

| | | | 1,690,101 | | |

HOUSEHOLD DURABLES - 0.0%† | |

Whirlpool Corp. | | | 271 | | | | 41,970 | | |

HOUSEHOLD PRODUCTS - 1.3% | |

Colgate-Palmolive Co. | | | 6,901 | | | | 553,046 | | |

Procter & Gamble Co. (The) | | | 4,026 | | | | 578,899 | | |

| | | | 1,131,945 | | |

INSURANCE - 0.2% | |

Aon PLC, Class A | | | 150 | | | | 40,452 | | |

MetLife, Inc. | | | 2,178 | | | | 136,757 | | |

Travelers Cos., Inc. (The) | | | 76 | | | | 12,854 | | |

| | | | 190,063 | | |

INTERACTIVE MEDIA & SERVICES - 5.7% | |

Alphabet, Inc., Class A* | | | 733 | | | | 1,597,398 | | |

Alphabet, Inc., Class C* | | | 1,107 | | | | 2,421,507 | | |

Match Group, Inc.* | | | 708 | | | | 49,341 | | |

Meta Platforms, Inc., Class A* | | | 4,269 | | | | 688,376 | | |

| | | | 4,756,622 | | |

INTERNET & DIRECT MARKETING RETAIL - 5.0% | |

Amazon.com, Inc.* | | | 36,222 | | | | 3,847,138 | | |

Coupang, Inc.* | | | 2,548 | | | | 32,487 | | |

eBay, Inc. | | | 5,409 | | | | 225,393 | | |

MercadoLibre, Inc.* | | | 179 | | | | 114,000 | | |

| | | | 4,219,018 | | |

IT SERVICES - 6.3% | |

Accenture PLC, Class A | | | 2,444 | | | | 678,577 | | |

Automatic Data Processing, Inc. | | | 1,981 | | | | 416,089 | | |

Cognizant Technology Solutions Corp., Class A | | | 2,613 | | | | 176,351 | | |

EPAM Systems, Inc.* | | | 246 | | | | 72,516 | | |

Gartner, Inc.* | | | 729 | | | | 176,294 | | |

GoDaddy, Inc., Class A* | | | 656 | | | | 45,631 | | |

Mastercard, Inc., Class A | | | 4,158 | | | | 1,311,766 | | |

Paychex, Inc. | | | 1,441 | | | | 164,087 | | |

PayPal Holdings, Inc.* | | | 3,853 | | | | 269,094 | | |

Visa, Inc., Class A | | | 10,201 | | | | 2,008,475 | | |

| | | | 5,318,880 | | |

LIFE SCIENCES TOOLS & SERVICES - 2.2% | |

Agilent Technologies, Inc. | | | 4,558 | | | | 541,354 | | |

Bruker Corp. | | | 2,290 | | | | 143,720 | | |

Charles River Laboratories International, Inc.* | | | 473 | | | | 101,208 | | |

Danaher Corp. | | | 1,067 | | | | 270,506 | | |

Illumina, Inc.* | | | 170 | | | | 31,341 | | |

See accompanying notes to financial statements.

14

Global Atlantic BlackRock Disciplined Growth Portfolio

Portfolio of Investments (Unaudited) (Continued)

June 30, 2022

| | | Shares/

Principal | | Fair

Value | |

LIFE SCIENCES TOOLS & SERVICES - 2.2% (Continued) | |

Mettler-Toledo International, Inc.* | | | 267 | | | $ | 306,722 | | |

Syneos Health, Inc.* | | | 2,588 | | | | 185,508 | | |

Thermo Fisher Scientific, Inc. | | | 353 | | | | 191,778 | | |

Waters Corp.* | | | 28 | | | | 9,267 | | |

West Pharmaceutical Services, Inc. | | | 203 | | | | 61,381 | | |

| | | | 1,842,785 | | |

MACHINERY - 1.5% | |

Caterpillar, Inc. | | | 1,955 | | | | 349,476 | | |

Deere & Co. | | | 1,354 | | | | 405,482 | | |

Illinois Tool Works, Inc. | | | 2,538 | | | | 462,551 | | |

PACCAR, Inc. | | | 417 | | | | 34,336 | | |

Stanley Black & Decker, Inc. | | | 397 | | | | 41,629 | | |

| | | | 1,293,474 | | |

MEDIA - 0.8% | |

Altice USA, Inc., Class A* | | | 4,199 | | | | 38,841 | | |

Charter Communications, Inc., Class A* | | | 676 | | | | 316,726 | | |

Comcast Corp., Class A | | | 875 | | | | 34,335 | | |

Fox Corp., Class A | | | 8,517 | | | | 273,907 | | |

| | | | 663,809 | | |

METALS & MINING - 0.0%† | |

Freeport-McMoRan, Inc. | | | 1,527 | | | | 44,680 | | |

MULTILINE RETAIL - 0.6% | |

Dollar General Corp. | | | 832 | | | | 204,206 | | |

Target Corp. | | | 1,903 | | | | 268,761 | | |

| | | | 472,967 | | |

OIL, GAS & CONSUMABLE FUELS - 1.0% | |

Devon Energy Corp. | | | 3,045 | | | | 167,810 | | |

EOG Resources, Inc. | | | 4,536 | | | | 500,956 | | |

Exxon Mobil Corp. | | | 178 | | | | 15,244 | | |

Marathon Oil Corp. | | | 1,873 | | | | 42,105 | | |

Occidental Petroleum Corp. | | | 1,208 | | | | 71,127 | | |

Ovintiv, Inc. | | | 730 | | | | 32,259 | | |

| | | | 829,501 | | |

PERSONAL PRODUCTS - 0.4% | |

Estee Lauder Cos., Inc. (The), Class A | | | 1,217 | | | | 309,933 | | |

PHARMACEUTICALS - 3.2% | |

Bristol-Myers Squibb Co. | | | 675 | | | | 51,975 | | |

Eli Lilly and Co. | | | 3,751 | | | | 1,216,187 | | |

Johnson & Johnson | | | 583 | | | | 103,488 | | |

Merck & Co., Inc. | | | 6,832 | | | | 622,873 | | |

Zoetis, Inc. | | | 3,993 | | | | 686,357 | | |

| | | | 2,680,880 | | |

PROFESSIONAL SERVICES - 0.1% | |

Booz Allen Hamilton Holding Corp. | | | 565 | | | | 51,054 | | |

Robert Half International, Inc. | | | 253 | | | | 18,947 | | |

| | | | 70,001 | | |

| | | Shares/

Principal | | Fair

Value | |

REAL ESTATE MANAGEMENT & DEVELOPMENT - 0.1% | |

CBRE Group, Inc., Class A* | | | 665 | | | $ | 48,951 | | |

Zillow Group, Inc., Class A* | | | 200 | | | | 6,362 | | |

| | | | 55,313 | | |

ROAD & RAIL - 0.9% | |

CSX Corp. | | | 2,031 | | | | 59,021 | | |

JB Hunt Transport Services, Inc. | | | 272 | | | | 42,832 | | |

Lyft, Inc., Class A* | | | 2,574 | | | | 34,182 | | |

Old Dominion Freight Line, Inc. | | | 965 | | | | 247,310 | | |

Uber Technologies, Inc.* | | | 5,139 | | | | 105,144 | | |

Union Pacific Corp. | | | 1,193 | | | | 254,443 | | |

XPO Logistics, Inc.* | | | 867 | | | | 41,755 | | |

| | | | 784,687 | | |

SEMICONDUCTORS & SEMICONDUCTOR EQUIPMENT - 8.2% | |

Advanced Micro Devices, Inc.* | | | 5,448 | | | | 416,571 | | |

Analog Devices, Inc. | | | 1,209 | | | | 176,623 | | |

Applied Materials, Inc. | | | 5,885 | | | | 535,417 | | |

Broadcom, Inc. | | | 1,780 | | | | 864,742 | | |

Enphase Energy, Inc.* | | | 291 | | | | 56,815 | | |

Intel Corp. | | | 11,031 | | | | 412,670 | | |

KLA Corp. | | | 1,651 | | | | 526,801 | | |

Lam Research Corp. | | | 659 | | | | 280,833 | | |

Lattice Semiconductor Corp.* | | | 934 | | | | 45,299 | | |

MaxLinear, Inc.* | | | 923 | | | | 31,363 | | |

Micron Technology, Inc. | | | 843 | | | | 46,601 | | |

Monolithic Power Systems, Inc. | | | 419 | | | | 160,913 | | |

NVIDIA Corp. | | | 12,424 | | | | 1,883,354 | | |

NXP Semiconductors NV | | | 378 | | | | 55,955 | | |

QUALCOMM, Inc. | | | 6,959 | | | | 888,943 | | |

Semtech Corp.* | | | 773 | | | | 42,492 | | |

Silicon Laboratories, Inc.* | | | 1,016 | | | | 142,463 | | |

Teradyne, Inc. | | | 1,267 | | | | 113,460 | | |

Texas Instruments, Inc. | | | 1,115 | | | | 171,320 | | |

| | | | 6,852,635 | | |

SOFTWARE - 17.2% | |

Adobe, Inc.* | | | 2,821 | | | | 1,032,655 | | |

ANSYS, Inc.* | | | 446 | | | | 106,723 | | |

Atlassian Corp. PLC, Class A* | | | 471 | | | | 88,265 | | |

Autodesk, Inc.* | | | 1,694 | | | | 291,300 | | |

Box, Inc., Class A* | | | 456 | | | | 11,464 | | |

Cadence Design Systems, Inc.* | | | 3,086 | | | | 462,993 | | |

Ceridian HCM Holding, Inc.* | | | 2,231 | | | | 105,035 | | |

Crowdstrike Holdings, Inc., Class A* | | | 960 | | | | 161,818 | | |

Datadog, Inc., Class A* | | | 519 | | | | 49,430 | | |

DocuSign, Inc.* | | | 785 | | | | 45,043 | | |

Dynatrace, Inc.* | | | 322 | | | | 12,700 | | |

Fair Isaac Corp.* | | | 105 | | | | 42,095 | | |

Fortinet, Inc.* | | | 4,425 | | | | 250,367 | | |

HubSpot, Inc.* | | | 516 | | | | 155,135 | | |

See accompanying notes to financial statements.

15

Global Atlantic BlackRock Disciplined Growth Portfolio

Portfolio of Investments (Unaudited) (Continued)

June 30, 2022

| | | Shares/

Principal | | Fair

Value | |

SOFTWARE - 17.2% (Continued) | |

Intuit, Inc. | | | 1,667 | | | $ | 642,528 | | |

Manhattan Associates, Inc.* | | | 1,020 | | | | 116,892 | | |

Microsoft Corp. | | | 31,768 | | | | 8,158,975 | | |

Oracle Corp. | | | 2,496 | | | | 174,396 | | |

Palo Alto Networks, Inc.* | | | 771 | | | | 380,828 | | |

Paycom Software, Inc.* | | | 739 | | | | 207,009 | | |

PTC, Inc.* | | | 164 | | | | 17,440 | | |

RingCentral, Inc., Class A* | | | 1,562 | | | | 81,630 | | |

Roper Technologies, Inc. | | | 56 | | | | 22,100 | | |

salesforce, Inc.* | | | 1,096 | | | | 180,884 | | |

ServiceNow, Inc.* | | | 1,919 | | | | 912,523 | | |

Splunk, Inc.* | | | 881 | | | | 77,933 | | |

Synopsys, Inc.* | | | 320 | | | | 97,184 | | |

Trade Desk, Inc. (The), Class A* | | | 662 | | | | 27,731 | | |

VMware, Inc., Class A | | | 532 | | | | 60,637 | | |

Workday, Inc., Class A* | | | 2,289 | | | | 319,499 | | |

Zendesk, Inc.* | | | 562 | | | | 41,627 | | |

Zscaler, Inc.* | | | 456 | | | | 68,177 | | |

| | | | 14,403,016 | | |

SPECIALTY RETAIL - 3.1% | |

AutoNation, Inc.* | | | 191 | | | | 21,346 | | |

Best Buy Co., Inc. | | | 393 | | | | 25,620 | | |

Dick's Sporting Goods, Inc. | | | 407 | | | | 30,676 | | |

Home Depot, Inc. (The) | | | 5,141 | | | | 1,410,022 | | |

Lowe's Cos., Inc. | | | 3,577 | | | | 624,795 | | |

TJX Cos., Inc. (The) | | | 5,304 | | | | 296,228 | | |

Tractor Supply Co. | | | 370 | | | | 71,724 | | |

Ulta Beauty, Inc.* | | | 147 | | | | 56,665 | | |

Williams-Sonoma, Inc. | | | 387 | | | | 42,938 | | |

| | | | 2,580,014 | | |

TECHNOLOGY HARDWARE, STORAGE & PERIPHERALS - 10.8% | |

Apple, Inc. | | | 59,383 | | | | 8,118,844 | | |

Dell Technologies, Inc., Class C | | | 4,576 | | | | 211,457 | | |

Hewlett Packard Enterprise Co. | | | 7,508 | | | | 99,556 | | |

HP, Inc. | | | 11,003 | | | | 360,678 | | |

| | | Shares/

Principal | | Fair

Value | |

TECHNOLOGY HARDWARE, STORAGE & PERIPHERALS - 10.8% (Continued) | |

NetApp, Inc. | | | 2,506 | | | $ | 163,491 | | |

Pure Storage, Inc., Class A* | | | 2,777 | | | | 71,397 | | |

| | | | 9,025,423 | | |

TEXTILES, APPAREL & LUXURY GOODS - 0.8% | |

Lululemon Athletica, Inc.* | | | 350 | | | | 95,414 | | |

NIKE, Inc., Class B | | | 4,886 | | | | 499,349 | | |

Ralph Lauren Corp. | | | 638 | | | | 57,197 | | |

Under Armour, Inc., Class A* | | | 828 | | | | 6,897 | | |

| | | | 658,857 | | |

TOBACCO - 0.3% | |

Altria Group, Inc. | | | 5,525 | | | | 230,779 | | |

TRADING COMPANIES & DISTRIBUTORS - 0.3% | |

SiteOne Landscape Supply, Inc.* | | | 1,505 | | | | 178,899 | | |

United Rentals, Inc.* | | | 290 | | | | 70,444 | | |

WW Grainger, Inc. | | | 33 | | | | 14,996 | | |

| | | | 264,339 | | |

TOTAL COMMON STOCKS

(Cost - $69,950,650) | | | | | 81,743,580 | | |

SHORT-TERM INVESTMENTS - 1.9% | |

MONEY MARKET FUNDS - 1.9% | |

Fidelity Investments Money Market

Fund - Government Portfolio,

Institutional Class, 1.21% (a)

(Cost - $1,569,544) | | | 1,569,544 | | | | 1,569,544 | | |

TOTAL INVESTMENTS - 99.6%

(Cost - $71,520,194) | | | | $ | 83,313,124 | | |

OTHER ASSETS LESS

LIABILITIES - NET 0.4% | | | | | 319,431 | | |

TOTAL NET ASSETS - 100.0% | | | | $ | 83,632,555 | | |

* Non-income producing security.

† Represents less than 0.05%.

(a) The rate shown is the annualized seven-day yield at period end.

PLC - Public Limited Company

Holdings by Asset Class | | % of Net Assets | |

Common Stocks | | | 97.7 | % | |

Short-Term Investments | | | 1.9 | % | |

Other Assets Less Liabilities - Net | | | 0.4 | % | |

| | | | 100.0 | % | |

FUTURES CONTRACTS | |

LONG FUTURES CONTRACTS | | Counterparty | | Number of

Contracts | | Expiration Date | | Notional Value | | Fair Value/

Unrealized

Appreciation

(Depreciation) | |

NASDAQ 100 E-Mini Future | | Goldman Sachs & Co. | | | 7 | | | 9/16/2022 | | $ | 1,614,130 | | | $ | (36,382 | ) | |

See accompanying notes to financial statements.

16

Global Atlantic BlackRock Disciplined International Core Portfolio

Portfolio of Investments (Unaudited)

June 30, 2022

| | | Shares/

Principal | | Fair

Value | |

COMMON STOCKS - 87.2% | |

AEROSPACE & DEFENSE - 0.7% | |

Airbus SE | | | 350 | | | $ | 33,828 | | |

BAE Systems PLC | | | 5,478 | | | | 55,231 | | |

Embraer SA* | | | 9,191 | | | | 20,159 | | |

Kongsberg Gruppen ASA | | | 441 | | | | 15,757 | | |

Leonardo SpA | | | 3,628 | | | | 36,708 | | |

MTU Aero Engines AG | | | 74 | | | | 13,438 | | |

Rheinmetall AG | | | 285 | | | | 65,639 | | |

Rolls-Royce Holdings PLC* | | | 54,158 | | | | 54,558 | | |

Saab AB, Class B | | | 4,666 | | | | 192,425 | | |

Safran SA | | | 1,990 | | | | 195,999 | | |

Thales SA | | | 1,674 | | | | 204,847 | | |

| | | | | | | | 888,589 | | |

AIR FREIGHT & LOGISTICS - 0.3% | |

Deutsche Post AG | | | 2,789 | | | | 104,209 | | |

DSV A/S | | | 782 | | | | 108,967 | | |

JD Logistics, Inc.*,(a) | | | 4,000 | | | | 8,727 | | |

Mainfreight Ltd. | | | 267 | | | | 11,604 | | |

PostNL NV | | | 10,987 | | | | 33,253 | | |

SG Holdings Co. Ltd. | | | 1,000 | | | | 16,849 | | |

ZTO Express Cayman, Inc., ADR | | | 4,120 | | | | 113,094 | | |

| | | | | | | | 396,703 | | |

AIRLINES - 0.1% | |

Air China Ltd., Class H* | | | 20,000 | | | | 17,383 | | |

CAPITAL A BHD* | | | 89,900 | | | | 12,442 | | |

China Eastern Airlines Corp. Ltd.,

Class A* | | | 18,600 | | | | 15,254 | | |

International Consolidated Airlines

Group SA* | | | 36,066 | | | | 47,138 | | |

Jin Air Co. Ltd.* | | | 1,154 | | | | 12,265 | | |

Korean Air Lines Co. Ltd.* | | | 1,051 | | | | 20,398 | | |

| | | | | | | | 124,880 | | |

AUTO COMPONENTS - 0.3% | |

Hyundai Mobis Co. Ltd. | | | 743 | | | | 113,876 | | |

Koito Manufacturing Co. Ltd. | | | 1,000 | | | | 31,688 | | |

Mando Corp. | | | 497 | | | | 18,201 | | |

NGK Spark Plug Co. Ltd. | | | 3,800 | | | | 68,893 | | |

NOK Corp. | | | 1,500 | | | | 12,189 | | |

Pirelli & C SpA (a) | | | 26,219 | | | | 106,244 | | |

Valeo | | | 1,969 | | | | 37,928 | | |

| | | | | | | | 389,019 | | |

AUTOMOBILES - 2.5% | |

BAIC Motor Corp. Ltd., Class H*,(a) | | | 40,500 | | | | 13,471 | | |

Bayerische Motoren Werke AG | | | 5,464 | | | | 419,628 | | |

BYD Co. Ltd., Class A | | | 6,626 | | | | 330,088 | | |

BYD Co. Ltd., Class H | | | 7,500 | | | | 300,117 | | |

Ferrari NV | | | 628 | | | | 115,026 | | |

Geely Automobile Holdings Ltd. | | | 41,000 | | | | 93,213 | | |

| | | Shares/

Principal | | Fair

Value | |

AUTOMOBILES - 2.5% (Continued) | |

Great Wall Motor Co. Ltd., Class A | | | 3,300 | | | $ | 18,259 | | |

Great Wall Motor Co. Ltd., Class H | | | 29,000 | | | | 59,649 | | |

Honda Motor Co. Ltd. | | | 12,500 | | | | 302,989 | | |

Hyundai Motor Co. | | | 228 | | | | 31,696 | | |

Kia Corp. | | | 907 | | | | 53,998 | | |

Li Auto, Inc., ADR* | | | 2,860 | | | | 109,567 | | |

Mercedes-Benz Group AG | | | 8,431 | | | | 486,720 | | |

NIO, Inc., ADR* | | | 5,867 | | | | 127,431 | | |

Nissan Motor Co. Ltd. | | | 20,600 | | | | 80,092 | | |

Renault SA* | | | 2,222 | | | | 55,264 | | |

Stellantis NV | | | 9,234 | | | | 113,836 | | |

Subaru Corp. | | | 5,900 | | | | 104,728 | | |

Suzuki Motor Corp. | | | 1,600 | | | | 50,218 | | |

Toyota Motor Corp. | | | 29,000 | | | | 448,272 | | |

Volkswagen AG | | | 76 | | | | 13,817 | | |

XPeng, Inc., ADR* | | | 1,776 | | | | 56,370 | | |

XPeng, Inc., Class A* | | | 1,200 | | | | 19,330 | | |

| | | | | | | | 3,403,779 | | |

BANKS - 9.7% | |

ABN AMRO Bank NV, CVA (a) | | | 1,727 | | | | 19,346 | | |

Absa Group Ltd. | | | 8,658 | | | | 81,705 | | |

Agricultural Bank of China Ltd., Class H* | | | 47,000 | | | | 17,729 | | |

Aozora Bank Ltd. | | | 1,100 | | | | 21,351 | | |

Australia & New Zealand Banking

Group Ltd. | | | 14,450 | | | | 218,902 | | |

Banco Bilbao Vizcaya Argentaria SA | | | 57,043 | | | | 258,252 | | |

Banco Bradesco SA | | | 14,933 | | | | 40,977 | | |

Banco de Sabadell SA | | | 3,124 | | | | 2,484 | | |

Banco do Brasil SA | | | 4,536 | | | | 28,919 | | |

Banco Santander Brasil SA | | | 9,764 | | | | 53,698 | | |

Banco Santander SA | | | 148,811 | | | | 418,184 | | |

Bangkok Bank PCL, NVDR | | | 5,100 | | | | 19,185 | | |

Bank Central Asia TBK PT | | | 656,000 | | | | 319,248 | | |

Bank Hapoalim BM | | | 33,144 | | | | 275,967 | | |

Bank Mandiri Persero TBK PT | | | 115,300 | | | | 61,336 | | |

Bank Negara Indonesia Persero Tbk PT | | | 43,900 | | | | 23,132 | | |

Bank of China Ltd., Class H* | | | 229,000 | | | | 91,344 | | |

Bank of Ningbo Co. Ltd., Class A | | | 6,550 | | | | 35,038 | | |

Bank of Nova Scotia (The) | | | 13,954 | | | | 824,075 | | |

Bank Rakyat Indonesia Persero TBK PT | | | 438,800 | | | | 122,237 | | |

Bankinter SA | | | 9,199 | | | | 57,241 | | |

Banque Cantonale Vaudoise | | | 804 | | | | 62,902 | | |

Barclays PLC | | | 12,426 | | | | 23,107 | | |

BAWAG Group AG*,(a) | | | 3,279 | | | | 137,670 | | |

BNP Paribas SA | | | 7,320 | | | | 347,164 | | |

BOC Hong Kong Holdings Ltd. | | | 57,500 | | | | 227,158 | | |

| BPER Banca | | | 47,344 | | | | 77,585 | | |

Capitec Bank Holdings Ltd. | | | 595 | | | | 71,990 | | |

China CITIC Bank Corp. Ltd., Class H | | | 179,000 | | | | 80,068 | | |

China Construction Bank Corp., Class H | | | 581,000 | | | | 390,199 | | |

See accompanying notes to financial statements.

17

Global Atlantic BlackRock Disciplined International Core Portfolio

Portfolio of Investments (Unaudited) (Continued)

June 30, 2022

| | | Shares/

Principal | | Fair

Value | |

BANKS - 9.7% (Continued) | |

China Merchants Bank Co. Ltd., Class A | | | 13,400 | | | $ | 84,472 | | |

China Merchants Bank Co. Ltd., Class H | | | 36,500 | | | | 244,203 | | |

CIMB Group Holdings BHD | | | 53,200 | | | | 59,869 | | |

Commerzbank AG* | | | 19,657 | | | | 137,400 | | |

Commonwealth Bank of Australia | | | 10,316 | | | | 641,137 | | |

Credit Agricole SA | | | 17,278 | | | | 157,711 | | |

DBS Group Holdings Ltd. | | | 6,500 | | | | 138,622 | | |

DNB Bank ASA | | | 21,241 | | | | 379,574 | | |

Erste Group Bank AG | | | 4,273 | | | | 108,106 | | |

FinecoBank Banca Fineco SpA | | | 1,273 | | | | 15,198 | | |

Grupo Financiero Banorte SAB de CV,

Class O | | | 33,407 | | | | 186,112 | | |

Hana Financial Group, Inc. | | | 697 | | | | 21,124 | | |

Hong Leong Bank BHD | | | 4,200 | | | | 19,497 | | |

HSBC Holdings PLC | | | 87,136 | | | | 566,784 | | |

Industrial & Commercial Bank of China

Ltd., Class H* | | | 355,000 | | | | 210,821 | | |

ING Groep NV | | | 25,948 | | | | 255,838 | | |

Intesa Sanpaolo SpA | | | 139,779 | | | | 260,115 | | |

Israel Discount Bank Ltd., Class A | | | 35,633 | | | | 184,771 | | |

Japan Post Bank Co. Ltd. | | | 14,600 | | | | 113,378 | | |

Jyske Bank A/S* | | | 339 | | | | 16,513 | | |

KB Financial Group, Inc. | | | 616 | | | | 22,844 | | |

KBC Group NV | | | 3,472 | | | | 194,340 | | |

Lloyds Banking Group PLC | | | 547,300 | | | | 281,221 | | |

Malayan Banking BHD | | | 155,300 | | | | 302,672 | | |

Mediobanca Banca di Credito Finanziario

SpA | | | 25,889 | | | | 223,508 | | |

Mizrahi Tefahot Bank Ltd. | | | 2,427 | | | | 80,042 | | |

Mizuho Financial Group, Inc. | | | 20,200 | | | | 229,426 | | |

National Australia Bank Ltd. | | | 9,848 | | | | 185,485 | | |

Nedbank Group Ltd. | | | 2,444 | | | | 30,920 | | |

Nordea Bank Abp | | | 46,861 | | | | 411,567 | | |

OTP Bank Nyrt | | | 4,889 | | | | 108,487 | | |

Oversea-Chinese Banking Corp. Ltd. | | | 20,500 | | | | 167,777 | | |

Ping An Bank Co. Ltd., Class A* | | | 19,300 | | | | 43,188 | | |

Postal Savings Bank of China Co. Ltd.,

Class H (a) | | | 40,000 | | | | 31,758 | | |

Public Bank BHD | | | 211,900 | | | | 210,097 | | |

Raiffeisen Bank International AG | | | 885 | | | | 9,567 | | |

RHB Bank BHD | | | 99,400 | | | | 129,226 | | |

Royal Bank of Canada | | | 4,226 | | | | 408,333 | | |

Shinhan Financial Group Co. Ltd. | | | 2,179 | | | | 62,178 | | |

Societe Generale SA | | | 10,269 | | | | 224,269 | | |

Standard Bank Group Ltd. | | | 19,329 | | | | 183,078 | | |

Standard Chartered PLC | | | 12,625 | | | | 94,846 | | |

Sumitomo Mitsui Financial Group, Inc. | | | 23,000 | | | | 682,610 | | |

TMBThanachart Bank PCL, NVDR | | | 488,400 | | | | 16,991 | | |

Toronto-Dominion Bank (The) | | | 2,915 | | | | 190,748 | | |

UniCredit SpA | | | 15,779 | | | | 149,538 | | |

United Overseas Bank Ltd. | | | 7,500 | | | | 141,464 | | |

Westpac Banking Corp. | | | 11,262 | | | | 151,014 | | |

| | | | | | | | 13,176,632 | | |

| | | Shares/

Principal | | Fair

Value | |

BEVERAGES - 2.3% | |

Ambev SA | | | 65,559 | | | $ | 167,738 | | |

Anheuser-Busch InBev SA | | | 8,008 | | | | 429,984 | | |

Arca Continental SAB de CV | | | 20,605 | | | | 135,452 | | |

Budweiser Brewing Co. APAC Ltd. (a) | | | 5,700 | | | | 17,070 | | |

Carlsberg A/S, Class B | | | 606 | | | | 77,013 | | |

China Resources Beer Holdings Co. Ltd. | | | 4,000 | | | | 29,820 | | |

Coca-Cola Femsa SAB de CV | | | 6,091 | | | | 33,652 | | |

Davide Campari-Milano NV | | | 4,817 | | | | 50,536 | | |

Diageo PLC | | | 20,560 | | | | 881,534 | | |

Fomento Economico Mexicano SAB de CV | | | 18,619 | | | | 125,257 | | |

Heineken NV | | | 1,553 | | | | 141,252 | | |

Jiangsu Yanghe Brewery Joint-Stock Co.,

Ltd., Class A | | | 1,000 | | | | 27,359 | | |

JiuGui Liquor Co. Ltd., Class A | | | 600 | | | | 16,654 | | |

Kweichow Moutai Co. Ltd., Class A | | | 400 | | | | 122,194 | | |

Luzhou Laojiao Co., Ltd., Class A | | | 900 | | | | 33,145 | | |

Pernod Ricard SA | | | 1,771 | | | | 324,567 | | |

Remy Cointreau SA | | | 546 | | | | 95,155 | | |

Shanxi Xinghuacun Fen Wine Factory Co.

Ltd., Class A | | | 990 | | | | 48,034 | | |

Suntory Beverage & Food Ltd. | | | 4,200 | | | | 158,596 | | |

Treasury Wine Estates Ltd. | | | 13,874 | | | | 108,284 | | |

Wuliangye Yibin Co. Ltd., Class A | | | 2,400 | | | | 72,395 | | |

| | | | | | | | 3,095,691 | | |

BIOTECHNOLOGY - 0.8% | |

3SBio, Inc. (a) | | | 7,500 | | | | 5,964 | | |

Argenx SE* | | | 95 | | | | 35,506 | | |

BeiGene Ltd., ADR* | | | 449 | | | | 72,671 | | |

Beijing Wantai Biological Pharmacy

Enterprise Co. Ltd., Class A | | | 1,740 | | | | 40,366 | | |

Celltrion, Inc. | | | 729 | | | | 100,221 | | |

CSL Ltd. | | | 2,604 | | | | 481,790 | | |

Galapagos NV* | | | 971 | | | | 53,842 | | |