UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22865

Forethought Variable Insurance Trust

(Exact name of registrant as specified in charter)

10 West Market Street, Suite 2300

Indianapolis, Indiana 46204

(Address of principal executive offices) (Zip code)

The Corporation Trust Company

1209 Orange Street Wilmington, DE 19801

(Name and address of agent for service)

Registrant's telephone number, including area code: 877-355-1820

Date of fiscal year end: December 31

Date of reporting period: June 30, 2023

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

| (a) | Include a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Act (17 CFR 270.30e-1). |

Semi-Annual Report

June 30, 2023

Global Atlantic Portfolios

Global Atlantic BlackRock Allocation Portfolio

Global Atlantic BlackRock Disciplined Core Portfolio

Global Atlantic BlackRock Disciplined Growth Portfolio

Global Atlantic BlackRock Disciplined International Core Portfolio

Global Atlantic BlackRock Disciplined Mid Cap Growth Portfolio

Global Atlantic BlackRock Disciplined Value Portfolio

Global Atlantic BlackRock High Yield Portfolio

Global Atlantic Goldman Sachs Core Fixed Income Portfolio

Class I and Class II shares*

Each a separate series of the Forethought Variable Insurance Trust

Distributed by Global Atlantic Distributors, LLC

Member FINRA

* As of June 30, 2023, each Portfolio offered Class I and Class II, except the Global Atlantic Goldman Sachs Core Fixed Income Portfolio (which only offered Class I shares).

Dear Shareholders/Contract Owners:

After raising interest rates on seven occasions in 2022 by a total of 425 basis points, the U.S. Federal Reserve (the "Fed") implemented just three increases totaling 75 bps in the first half of 2023, as economic data generally softened. That said, employment remains strong and inflation, while cooling somewhat of late as a result of the aggressive tightening from global central banks, was stubbornly high early in the period. In March, the surprise failures of Silicon Valley Bank and Signature Bank, and the acquisition of troubled Credit Suisse Group AG by UBS, followed in May by the failure of First Republic Bank, generated concerns of another global financial crisis. This was largely averted due to the rapid response from regulators and the banking industry, so much so that central banks continued to raise interest rates during this time. More recently, the Fed paused from raising interest rates in June, but it is expected that additional hikes will be needed this year.

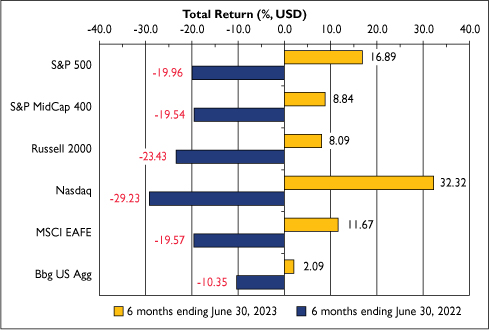

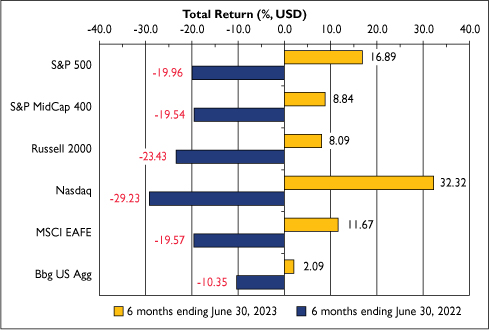

Despite periods of heightened volatility driven by uncertainty surrounding global growth and the path of interest rate hikes, equity and fixed income indices generally posted positive returns during the first half of 2023. This strong performance stands in stark contrast to the same period a year ago (see chart) when several indices were in bear market territory, a period when global central banks began to aggressively tighten monetary policy. The speed and severity with which interest rates have increased over the past year suggests that it's likely we are closer to the end of the rate hiking cycle rather than the beginning. Against this backdrop of relatively greater clarity on the path forward, equity indices, particularly the U.S. technology-focused Nasdaq and the S&P 500, were very strong during the 6 months ending June 30, 2023 (the "Period"). Although the U.S. small and midcap-oriented Russell 2000 and S&P MidCap 400 lagged, both indices posted strong returns during the Period, as did international large cap equities, represented by the MSCI EAFE.

While the pace and severity of the Fed's increases declined, interest rate volatility remained high during the Period, as market expectations regarding future increases changed frequently. This was exacerbated by the aforementioned bank failures, which caused historic swings in yields, particularly shorter-term yields. Medium to longer terms yields, while also somewhat volatile, were roughly flat at June 30, 2023 compared to year end 2022. At the same time, the relatively greater economic clarity resulted in general spread tightening, meaning many fixed income indices posted positive returns for the 6-month period.

In our view, the key question yet to be answered and the primary source of market volatility is whether or not the fight to lower inflation will lead to an economic recession. Monetary policy typically takes several months or quarters to affect the economy, and while economic data is softening in places, it remains strong in others, particularly employment and inflation. Not to be forgotten, the Ukraine/Russia conflict has entered its second year, with seemingly no sign of resolution on the horizon. Consequently, a meaningful degree of uncertainty remains.

Thank you for investing in the Global Atlantic Portfolios.

Sincerely, | |

| |

| |

Eric D. Todd, CFA | | Cameron Jeffreys, CFA | |

President | | Senior Vice President | |

Global Atlantic Investment Advisors, LLC | | Global Atlantic Investment Advisors, LLC | |

1

Portfolio | | Benchmark | |

Global Atlantic BlackRock Allocation Portfolio | | S&P Target Risk® Growth Index | |

Global Atlantic BlackRock Disciplined Core Portfolio | | S&P 500® Index | |

Global Atlantic BlackRock Disciplined Growth Portfolio | | Russell 1000® Growth Index | |

Global Atlantic BlackRock Disciplined International Core Portfolio | | MSCI ACWI ex-USA Index | |

Global Atlantic BlackRock Disciplined Mid Cap Growth Portfolio | | Russell Midcap® Growth Index | |

Global Atlantic BlackRock Disciplined Value Portfolio | | Russell 1000® Value Index | |

Global Atlantic BlackRock High Yield Portfolio | | ICE BofA BB-B U.S. High Yield Constrained Index | |

Global Atlantic Goldman Sachs Core Fixed Income Portfolio | | Bloomberg U.S. Aggregate Bond Index | |

The indices shown are for informational purposes only and are not reflective of any investment. As it is not possible to invest directly in the indices, the data shown does not reflect or compare features of an actual investment, such as its objectives, costs and expenses, liquidity, safety, guarantees or insurance, fluctuation of principal or return, or tax features. Past performance is no guarantee of future results.

This report contains the current opinions of Global Atlantic Investment Advisors, LLC and/or sub-advisers at the time of its publication and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. Such opinions are subject to change without notice and securities described herein may no longer be included in, or may at any time be removed from, a Portfolio's portfolio. This report is distributed for informational purposes only. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed.

Index Definitions:

Bloomberg U.S. Aggregate Bond Index ("Bbg US Agg"). An index weighted according to market capitalization and includes, among other categories, Treasury securities, mortgage-backed securities, government agency bonds and corporate bonds. To be included in the index, bonds must be rated investment grade by Moody's and S&P Global Ratings.

ICE BofA BB-B U.S. High Yield Constrained Index. An index that contains all securities in the ICE BofA U.S. High Yield Index rated BB1 through B3, based on an average of Moody's, S&P, and Fitch, but caps issuer exposure at 2%. Index constituents are capitalization-weighted, based on their current amount outstanding, provided the total allocation to an individual issuer does not exceed 2%.

MSCI ACWI ex-USA Index. A free float-adjusted market capitalization index designed to measure the combined equity market performance of developed and emerging market countries, excluding the United States.

MSCI EAFE Total Return Index ("MSCI EAFE"). An index created by Morgan Stanley Capital International (MSCI) that serves as a benchmark of the performance in major developed international equity markets as represented by 21 major MSCI indexes from Europe, Australasia and the Far East.

Nasdaq Composite ("Nasdaq"). A broad-based market capitalization-weighted index of over 3,700 stocks listed on the Nasdaq Stock Exchange. As a broad index that is heavily weighted toward the technology sector, the Nasdaq serves as a benchmark for technology stocks in the United States.

Russell 1000® Growth Index. An unmanaged index of common stock prices that measures the performance of those Russell 1000® Index companies with higher price-to-book ratios and higher forecasted growth values.

Russell 1000® Value Index. An index that measures the performance of large- and mid-capitalization value sectors of the U.S. equity market. It is a subset of the Russell 1000® Index, which measures the performance of the large-capitalization sector of the U.S. equity market.

Russell 2000® Index ("Russell 2000"). An index measuring the performance of approximately 2,000 small-cap companies in the Russell 3000 Index, which is made up of 3,000 of the biggest U.S. stocks. The Russell 2000 serves as a benchmark for small-cap stocks in the United States.

2

Russell Midcap® Growth Index. An unmanaged index that consists of the bottom 800 securities of the Russell 1000® Index with greater-than-average growth orientation as ranked by total market capitalization. Securities in this index generally have higher price-to-book and price-to-earnings ratios, lower dividend yields and higher forecasted growth values.

S&P 500 Index ("S&P 500"). A market capitalization weighted price index composed of 500 widely held U.S. common stocks. Frequently used as a measure of U.S. stock market performance.

S&P MidCap 400 Total Return Index ("S&P MidCap 400"). A capitalization-weighted index which measures the performance of the mid-range sector of the U.S. stock market.

S&P Target Risk® Growth Index. An index that increases exposure to equities, while also providing limited fixed income exposure to diversify risk.

5897890.1

3

| | | | | Page | |

• | | Global Atlantic Portfolio Performance | | | 5 | | |

• | | Global Atlantic Portfolio of Investments | | | | | |

| | | Global Atlantic BlackRock Allocation Portfolio | | | 7 | | |

| | | Global Atlantic BlackRock Disciplined Core Portfolio | | | 8 | | |

| | | Global Atlantic BlackRock Disciplined Growth Portfolio | | | 12 | | |

| | | Global Atlantic BlackRock Disciplined International Core Portfolio | | | 15 | | |

| | | Global Atlantic BlackRock Disciplined Mid Cap Growth Portfolio | | | 26 | | |

| | | Global Atlantic BlackRock Disciplined Value Portfolio | | | 31 | | |

| | | Global Atlantic BlackRock High Yield Portfolio | | | 36 | | |

| | | Global Atlantic Goldman Sachs Core Fixed Income Portfolio | | | 43 | | |

• | | Financial Statements: | | | | | |

| | | Statements of Assets and Liabilities | | | 53 | | |

| | | Statements of Operations | | | 55 | | |

| | | Statements of Changes in Net Assets | | | 57 | | |

| | | Financial Highlights | | | 61 | | |

• | | Notes to Financial Statements | | | 76 | | |

• | | Expense Examples | | | 98 | | |

• | | Privacy Notice | | | 100 | | |

• | | Proxy Voting Policy | | Back Cover | |

• | | Portfolio Holdings | | Back Cover | |

4

The Portfolio's performance figures for the periods ended June 30, 2023 as compared to its benchmarks:

| | | | | | | Annualized | | Operating

Expenses** | |

| | | Inception

Date* | | Six Months

Ended

6/30/23 | | One Year

Ended

6/30/23 | | Three Years

Ended

6/30/23 | | Five Years

Ended

6/30/23 | | Since

Inception

6/30/23 | | Gross

Ratios | | Net

Ratios | |

Global Atlantic BlackRock Allocation Portfolio | |

Class I | | 11/01/17 | | | 9.20 | % | | | 10.10 | % | | | 6.63 | % | | | 6.74 | % | | | 6.26 | % | | | 0.47 | % | | | 0.47 | % | |

Class II | | 11/01/17 | | | 9.02 | % | | | 9.77 | % | | | 6.37 | % | | | 6.45 | % | | | 5.99 | % | | | 0.72 | % | | | 0.72 | % | |

S&P Target Risk® Growth

Index (Total Return)1 | | | | | | | 9.19 | % | | | 9.85 | % | | | 5.72 | % | | | 5.45 | % | | | 5.06 | % | | | | | | | | | |

Global Atlantic BlackRock Disciplined Core Portfolio | |

Class I | | 11/01/17 | | | 16.48 | % | | | 18.53 | % | | | 13.93 | % | | | 11.68 | % | | | 11.57 | % | | | 0.50 | % | | | 0.50 | % | |

Class II | | 11/01/17 | | | 16.42 | % | | | 18.27 | % | | | 13.66 | % | | | 11.42 | % | | | 11.29 | % | | | 0.75 | % | | | 0.75 | % | |

S&P 500® Index

(Total Return)2 | | | | | | | 16.89 | % | | | 19.59 | % | | | 14.60 | % | | | 12.31 | % | | | 12.09 | % | | | | | | | | | |

Global Atlantic BlackRock Disciplined Growth Portfolio | |

Class I | | 08/20/21 | | | 27.70 | % | | | 25.20 | % | | | NA | | | | NA | | | | (1.14 | )% | | | 0.49 | % | | | 0.49 | % | |

Class II | | 11/01/17 | | | 27.53 | % | | | 24.90 | % | | | 12.11 | % | | | 13.10 | % | | | 13.49 | % | | | 0.74 | % | | | 0.74 | % | |

Russell 1000® Growth

Index (Total Return)3 | | | | | | | 29.02 | % | | | 27.11 | % | | | 13.73 | % | | | 15.14 | % | | | 15.45 | % | | | | | | | | | |

Global Atlantic BlackRock Disciplined International Core Portfolio | |

Class I | | 11/01/17 | | | 10.13 | % | | | 13.62 | % | | | 8.18 | % | | | 3.54 | % | | | 2.86 | % | | | 0.87 | % | | | 0.85 | % | |

Class II | | 11/01/17 | | | 10.03 | % | | | 13.40 | % | | | 7.92 | % | | | 3.27 | % | | | 2.61 | % | | | 1.12 | % | | | 1.10 | % | |

MSCI ACWI ex-USA Index4 | | | | | | | 9.47 | % | | | 12.72 | % | | | 7.22 | % | | | 3.52 | % | | | 2.87 | % | | | | | | | | | |

Global Atlantic BlackRock Disciplined Mid Cap Growth Portfolio | |

Class I | | 11/01/17 | | | 14.71 | % | | | 22.48 | % | | | 7.71 | % | | | 9.68 | % | | | 10.42 | % | | | 0.66 | % | | | 0.66 | % | |

Class II | | 11/01/17 | | | 14.54 | % | | | 22.27 | % | | | 7.46 | % | | | 9.41 | % | | | 10.16 | % | | | 0.91 | % | | | 0.91 | % | |

Russell Midcap® Growth

Index (Total Return)5 | | | | | | | 15.94 | % | | | 23.13 | % | | | 7.63 | % | | | 9.71 | % | | | 10.35 | % | | | | | | | | | |

Global Atlantic BlackRock Disciplined Value Portfolio | |

Class I | | 11/01/17 | | | 5.76 | % | | | 12.24 | % | | | 14.32 | % | | | 8.30 | % | | | 7.90 | % | | | 0.57 | % | | | 0.57 | % | |

Class II | | 11/01/17 | | | 5.54 | % | | | 11.96 | % | | | 14.04 | % | | | 8.01 | % | | | 7.64 | % | | | 0.82 | % | | | 0.82 | % | |

Russell 1000® Value

Index (Total Return)6 | | | | | | | 5.12 | % | | | 11.54 | % | | | 14.30 | % | | | 8.11 | % | | | 7.60 | % | | | | | | | | | |

Global Atlantic BlackRock High Yield Portfolio | |

Class I | | 11/01/17 | | | 4.78 | % | | | 9.36 | % | | | 2.66 | % | | | 3.03 | % | | | 2.30 | % | | | 0.62 | % | | | 0.62 | % | |

Class II | | 11/01/17 | | | 4.55 | % | | | 9.00 | % | | | 2.39 | % | | | 2.75 | % | | | 2.04 | % | | | 0.87 | % | | | 0.87 | % | |

ICE BofA BB-B U.S. High

Yield Constrained Index7 | | | | | | | 4.86 | % | | | 8.57 | % | | | 2.64 | % | | | 3.38 | % | | | 2.87 | % | | | | | | | | | |

Global Atlantic Goldman Sachs Core Fixed Income Portfolio | |

Class I | | 11/01/17 | | | 2.13 | % | | | (0.89 | )% | | | (4.07 | )% | | | 0.88 | % | | | 0.46 | % | | | 0.48 | % | | | 0.48 | % | |

Bloomberg U.S. Aggregate

Bond Index8 | | | | | | | 2.09 | % | | | (0.94 | )% | | | (3.96 | )% | | | 0.77 | % | | | 0.45 | % | | | | | | | | | |

The performance data quoted is historical. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Total returns would have been lower absent fee waivers by the Adviser. Performance figures for periods greater than one year are annualized. The returns shown do not reflect the deduction of taxes that a shareholder may pay on Portfolio distributions or on the redemption of Portfolio shares, as well as other charges and expenses of the insurance contract or separate account.

* Commencement of operations is November 6, 2017, except for Class I shares of the Global Atlantic BlackRock Disciplined Growth Portfolio, which commenced operations on August 20, 2021.

5

Performance Summary (Continued)

** The estimated operating expense ratios for Class I and Class II shares, as disclosed in the most recent prospectus dated May 1, 2023. Ratios include Acquired Fund Fees and Expenses indirectly incurred by the Portfolio, if applicable. Gross operating expense ratio reflects the ratio of expenses absent waivers and/or reimbursements by the Adviser. The operating expense ratios presented here may differ from the expense ratios disclosed in the Financial Highlights table in this report.

1 The S&P Target Risk® Growth Index provides increased exposure to equities, while also providing limited fixed income exposure to diversify risk. It is not possible to invest directly in an index.

2 The S&P 500® Index is a market capitalization weighted price index composed of 500 widely held U.S. common stocks. It is frequently used as a measure of U.S. stock market performance. It is not possible to invest directly in an index.

3 The Russell 1000® Growth Index is an unmanaged index of common stock prices that measures the performance of those Russell 1000® Index companies with higher price-to-book ratios and higher forecasted growth values. It is not possible to invest directly in an index.

4 The MSCI ACWI ex-USA Index is a free float-adjusted market capitalization index designed to measure the combined equity market performance of developed and emerging market countries, excluding the United States. It is not possible to invest directly in an index.

5 The Russell Midcap® Growth Index is an unmanaged index that consists of the bottom 800 securities of the Russell 1000® Index with greater-than-average growth orientation as ranked by total market capitalization. Securities in this index generally have higher price-to- book and price-to-earnings ratios, lower dividend yields and higher forecasted growth values. It is not possible to invest directly in an index.

6 The Russell 1000® Value Index measures the performance of large- and mid-capitalization value sectors of the U.S. equity market. It is a subset of the Russell 1000® Index, which measures the performance of the large-capitalization sector of the U.S. equity market. It is not possible to invest directly in an index.

7 The ICE BofA BB-B US High Yield Constrained Index contains all securities in the ICE BofA U.S. High Yield Index rated BB1 through B3, based on an average of Moody's, S&P, and Fitch, but caps issuer exposure at 2%. Index constituents are capitalization-weighted, based on their current amount outstanding, provided the total allocation to an individual issuer does not exceed 2%. It is not possible to invest directly in an index.

8 The Bloomberg U.S. Aggregate Bond Index represents an unmanaged diversified portfolio of fixed income securities, including U.S. Treasuries, investment-grade corporate bonds, and mortgage-backed and asset-backed securities. It is not possible to invest directly in an index.

6

Global Atlantic BlackRock Allocation Portfolio

Portfolio of Investments (Unaudited)

June 30, 2023

| | | Shares/

Principal | | Fair

Value | |

EXCHANGE TRADED FUNDS - 98.9% | |

DEBT FUNDS - 37.4% | |

iShares 10-20 Year Treasury Bond ETF | | | 10,284 | | | $ | 1,139,159 | | |

iShares Core Total USD Bond Market ETF | | | 252,877 | | | | 11,498,317 | | |

iShares Fallen Angels USD Bond ETF | | | 24,978 | | | | 633,692 | | |

iShares JP Morgan USD Emerging

Markets Bond ETF | | | 7,441 | | | | 643,944 | | |

iShares MBS ETF | | | 42,865 | | | | 3,997,804 | | |

iShares U.S. Treasury Bond ETF | | | 174,567 | | | | 3,997,584 | | |

TOTAL DEBT FUNDS | | | | | 21,910,500 | | |

EQUITY FUNDS - 61.5% | |

iShares Core MSCI Emerging Markets ETF | | | 21,913 | | | | 1,080,092 | | |

iShares Core S&P 500 ETF | | | 33,130 | | | | 14,766,372 | | |

iShares ESG Aware MSCI EM ETF | | | 48,965 | | | | 1,548,763 | | |

iShares ESG Aware MSCI USA ETF | | | 20,003 | | | | 1,949,492 | | |

iShares MSCI EAFE Growth ETF | | | 46,319 | | | | 4,419,296 | | |

iShares MSCI EAFE Value ETF | | | 62,335 | | | | 3,050,675 | | |

iShares MSCI USA Min Vol Factor ETF | | | 18,644 | | | | 1,385,808 | | |

iShares MSCI USA Quality Factor ETF | | | 36,049 | | | | 4,861,929 | | |

| | | Shares/

Principal | | Fair

Value | |

EQUITY FUNDS - 61.5% (Continued) | |

iShares U.S. Infrastructure ETF | | | 15,416 | | | $ | 602,457 | | |

iShares U.S. Technology ETF | | | 21,265 | | | | 2,315,121 | | |

TOTAL EQUITY FUNDS | | | | | 35,980,005 | | |

TOTAL EXCHANGE TRADED FUNDS

(Cost - $52,500,427) | | | | | 57,890,505 | | |

SHORT-TERM INVESTMENTS - 0.8% | |

MONEY MARKET FUNDS - 0.8% | |

Fidelity Investments Money Market Fund -

Government Portfolio,

Institutional Class, 4.99% (a)

(Cost - $453,260) | | | 453,260 | | | | 453,260 | | |

TOTAL INVESTMENTS - 99.7%

(Cost - $52,953,687) | | | | $ | 58,343,765 | | |

OTHER ASSETS LESS LIABILITIES - NET 0.3% | | | | | 149,164 | | |

TOTAL NET ASSETS - 100.0% | | | | $ | 58,492,929 | | |

(a) The rate shown is the annualized seven-day yield at period end.

Holdings by Asset Class | | % of Net Assets | |

Exchange Traded Funds | | | 98.9 | % | |

Short-Term Investments | | | 0.8 | % | |

Other Assets Less Liabilities - Net | | | 0.3 | % | |

| | | | 100.0 | % | |

See accompanying notes to financial statements.

7

Global Atlantic BlackRock Disciplined Core Portfolio

Portfolio of Investments (Unaudited)

June 30, 2023

| | | Shares/

Principal | | Fair

Value | |

COMMON STOCKS - 98.4% | |

AEROSPACE & DEFENSE - 1.1% | |

Axon Enterprise, Inc.* | | | 83 | | | $ | 16,195 | | |

General Dynamics Corp. | | | 7,588 | | | | 1,632,558 | | |

Lockheed Martin Corp. | | | 9,454 | | | | 4,352,433 | | |

Textron, Inc. | | | 6,886 | | | | 465,700 | | |

| | | | | | 6,466,886 | | |

AUTOMOBILES - 2.1% | |

General Motors Co. | | | 79,823 | | | | 3,077,975 | | |

Tesla, Inc.* | | | 34,585 | | | | 9,053,315 | | |

| | | | | | 12,131,290 | | |

BANKS - 1.8% | |

Bank of America Corp. | | | 164,275 | | | | 4,713,050 | | |

Citigroup, Inc. | | | 57,300 | | | | 2,638,092 | | |

JPMorgan Chase & Co. | | | 21,370 | | | | 3,108,053 | | |

| | | | | | 10,459,195 | | |

BEVERAGES - 2.1% | |

Coca-Cola Co. (The) | | | 38,798 | | | | 2,336,416 | | |

PepsiCo, Inc. | | | 53,946 | | | | 9,991,878 | | |

| | | | | | 12,328,294 | | |

BIOTECHNOLOGY - 2.9% | |

AbbVie, Inc. | | | 27,184 | | | | 3,662,500 | | |

Amgen, Inc. | | | 24,687 | | | | 5,481,008 | | |

Exelixis, Inc.* | | | 8,719 | | | | 166,620 | | |

Gilead Sciences, Inc. | | | 26,025 | | | | 2,005,747 | | |

Incyte Corp.* | | | 48,229 | | | | 3,002,255 | | |

Neurocrine Biosciences, Inc.* | | | 5,161 | | | | 486,682 | | |

Regeneron Pharmaceuticals, Inc.* | | | 2,857 | | | | 2,052,869 | | |

Zai Lab Ltd., ADR* | | | 1,952 | | | | 54,129 | | |

| | | | | | 16,911,810 | | |

BROADLINE RETAIL - 4.2% | |

Amazon.com, Inc.* | | | 160,364 | | | | 20,905,051 | | |

eBay, Inc. | | | 67,191 | | | | 3,002,766 | | |

Etsy, Inc.* | | | 2,572 | | | | 217,617 | | |

Vipshop Holdings Ltd., ADR* | | | 5,796 | | | | 95,634 | | |

| | | | | | 24,221,068 | | |

BUILDING PRODUCTS - 0.9% | |

A O Smith Corp. | | | 9,672 | | | | 703,928 | | |

Allegion PLC | | | 20,979 | | | | 2,517,899 | | |

Johnson Controls International PLC | | | 2,862 | | | | 195,017 | | |

Trane Technologies PLC | | | 9,585 | | | | 1,833,227 | | |

| | | | | | 5,250,071 | | |

CAPITAL MARKETS - 1.7% | |

Bank of New York Mellon Corp. (The) | | | 25,202 | | | | 1,121,993 | | |

Intercontinental Exchange, Inc. | | | 14,352 | | | | 1,622,924 | | |

Moody's Corp. | | | 4,230 | | | | 1,470,856 | | |

| | | Shares/

Principal | | Fair

Value | |

CAPITAL MARKETS - 1.7% (Continued) | |

Nasdaq, Inc. | | | 52,641 | | | $ | 2,624,154 | | |

S&P Global, Inc. | | | 7,781 | | | | 3,119,325 | | |

| | | | | | 9,959,252 | | |

CHEMICALS - 1.5% | |

Ecolab, Inc. | | | 34,249 | | | | 6,393,946 | | |

LyondellBasell Industries NV, Class A | | | 20,063 | | | | 1,842,385 | | |

Westlake Corp. | | | 2,104 | | | | 251,365 | | |

| | | | | | 8,487,696 | | |

COMMERCIAL SERVICES & SUPPLIES - 0.7% | |

Cintas Corp. | | | 7,806 | | | | 3,880,206 | | |

COMMUNICATIONS EQUIPMENT - 0.1% | |

Juniper Networks, Inc. | | | 17,651 | | | | 553,006 | | |

CONSTRUCTION & ENGINEERING - 0.8% | |

AECOM | | | 47,522 | | | | 4,024,638 | | |

EMCOR Group, Inc. | | | 2,334 | | | | 431,277 | | |

| | | | | | 4,455,915 | | |

CONSTRUCTION MATERIALS - 0.1% | |

Vulcan Materials Co. | | | 1,559 | | | | 351,461 | | |

CONSUMER FINANCE - 0.7% | |

American Express Co. | | | 20,048 | | | | 3,492,361 | | |

Synchrony Financial | | | 6,740 | | | | 228,621 | | |

| | | | | | 3,720,982 | | |

CONSUMER STAPLES DISTRIBUTION & RETAIL - 1.9% | |

Kroger Co. (The) | | | 10,496 | | | | 493,312 | | |

Target Corp. | | | 7,049 | | | | 929,763 | | |

Walmart, Inc. | | | 60,767 | | | | 9,551,357 | | |

| | | | | | 10,974,432 | | |

ELECTRIC UTILITIES - 1.0% | |

IDACORP, Inc. | | | 1,654 | | | | 169,701 | | |

PPL Corp. | | | 208,670 | | | | 5,521,408 | | |

| | | | | | 5,691,109 | | |

ELECTRICAL EQUIPMENT - 0.4% | |

AMETEK, Inc. | | | 4,222 | | | | 683,458 | | |

Eaton Corp. PLC | | | 7,993 | | | | 1,607,392 | | |

| | | | | | 2,290,850 | | |

ELECTRONIC EQUIPMENT, INSTRUMENTS & COMPONENTS - 0.2% | |

Flex Ltd.* | | | 34,025 | | | | 940,451 | | |

ENTERTAINMENT - 0.6% | |

Activision Blizzard, Inc.* | | | 3,997 | | | | 336,947 | | |

Bilibili, Inc., ADR* | | | 20,007 | | | | 302,106 | | |

Electronic Arts, Inc. | | | 5,868 | | | | 761,080 | | |

iQIYI, Inc., ADR* | | | 39,212 | | | | 209,392 | | |

NetEase, Inc., ADR | | | 1,121 | | | | 108,389 | | |

See accompanying notes to financial statements.

8

Global Atlantic BlackRock Disciplined Core Portfolio

Portfolio of Investments (Unaudited) (Continued)

June 30, 2023

| | | Shares/

Principal | | Fair

Value | |

ENTERTAINMENT - 0.6% (Continued) | |

Netflix, Inc.* | | | 2,942 | | | $ | 1,295,922 | | |

Warner Bros Discovery, Inc.* | | | 21,364 | | | | 267,904 | | |

| | | | | | 3,281,740 | | |

FINANCIAL SERVICES - 4.5% | |

Berkshire Hathaway, Inc., Class B* | | | 13,076 | | | | 4,458,916 | | |

Block, Inc.* | | | 4,204 | | | | 279,860 | | |

Mastercard, Inc., Class A | | | 22,185 | | | | 8,725,360 | | |

PayPal Holdings, Inc.* | | | 35,993 | | | | 2,401,813 | | |

Visa, Inc., Class A | | | 41,849 | | | | 9,938,301 | | |

| | | | | | 25,804,250 | | |

FOOD PRODUCTS - 1.1% | |

General Mills, Inc. | | | 748 | | | | 57,372 | | |

Hershey Co. (The) | | | 25,772 | | | | 6,435,268 | | |

J M Smucker Co. (The) | | | 445 | | | | 65,713 | | |

| | | | | | 6,558,353 | | |

GROUND TRANSPORTATION - 0.1% | |

Norfolk Southern Corp. | | | 3,340 | | | | 757,378 | | |

HEALTH CARE EQUIPMENT & SUPPLIES - 2.8% | |

Abbott Laboratories | | | 31,397 | | | | 3,422,901 | | |

Boston Scientific Corp.* | | | 137,038 | | | | 7,412,385 | | |

Edwards Lifesciences Corp.* | | | 2,491 | | | | 234,976 | | |

Hologic, Inc.* | | | 625 | | | | 50,606 | | |

IDEXX Laboratories, Inc.* | | | 2,046 | | | | 1,027,563 | | |

ResMed, Inc. | | | 2,508 | | | | 547,998 | | |

Stryker Corp. | | | 11,944 | | | | 3,643,995 | | |

| | | | | | 16,340,424 | | |

HEALTH CARE PROVIDERS & SERVICES - 3.7% | |

Cigna Corp. (The) | | | 7,881 | | | | 2,211,408 | | |

CVS Health Corp. | | | 84,221 | | | | 5,822,198 | | |

Elevance Health, Inc. | | | 12,858 | | | | 5,712,681 | | |

UnitedHealth Group, Inc. | | | 15,812 | | | | 7,599,880 | | |

| | | | | | 21,346,167 | | |

HOTELS, RESTAURANTS & LEISURE - 1.3% | |

Boyd Gaming Corp. | | | 16,656 | | | | 1,155,427 | | |

Darden Restaurants, Inc. | | | 2,537 | | | | 423,882 | | |

McDonald's Corp. | | | 7,219 | | | | 2,154,222 | | |

Melco Resorts & Entertainment Ltd., ADR* | | | 11,041 | | | | 134,811 | | |

Starbucks Corp. | | | 13,638 | | | | 1,350,980 | | |

Travel + Leisure Co. | | | 42,527 | | | | 1,715,539 | | |

Trip.com Group Ltd., ADR* | | | 4,599 | | | | 160,965 | | |

Yum! Brands, Inc. | | | 2,706 | | | | 374,916 | | |

| | | | | | 7,470,742 | | |

HOUSEHOLD DURABLES - 0.6% | |

Lennar Corp., Class A | | | 5,843 | | | | 732,186 | | |

PulteGroup, Inc. | | | 7,450 | | | | 578,716 | | |

Taylor Morrison Home Corp.* | | | 7,662 | | | | 373,676 | | |

| | | Shares/

Principal | | Fair

Value | |

HOUSEHOLD DURABLES - 0.6% (Continued) | |

Toll Brothers, Inc. | | | 16,095 | | | $ | 1,272,632 | | |

TopBuild Corp.* | | | 1,776 | | | | 472,451 | | |

| | | | | | 3,429,661 | | |

HOUSEHOLD PRODUCTS - 2.1% | |

Kimberly-Clark Corp. | | | 31,193 | | | | 4,306,505 | | |

Procter & Gamble Co. (The) | | | 51,601 | | | | 7,829,936 | | |

| | | | | | 12,136,441 | | |

INDEPENDENT POWER AND RENEWABLE ELECTRICITY PRODUCERS - 0.1% | |

AES Corp. (The) | | | 13,042 | | | | 270,361 | | |

INDUSTRIAL CONGLOMERATES - 1.0% | |

Honeywell International, Inc. | | | 26,798 | | | | 5,560,585 | | |

INDUSTRIAL REITS - 0.1% | |

Prologis, Inc. | | | 5,614 | | | | 688,445 | | |

INSURANCE - 2.6% | |

Allstate Corp. (The) | | | 11,429 | | | | 1,246,218 | | |

Arch Capital Group Ltd.* | | | 9,179 | | | | 687,048 | | |

Everest Re Group Ltd. | | | 1,230 | | | | 420,488 | | |

Marsh & McLennan Cos., Inc. | | | 28,840 | | | | 5,424,227 | | |

MetLife, Inc. | | | 105,219 | | | | 5,948,030 | | |

Travelers Cos., Inc. (The) | | | 8,476 | | | | 1,471,942 | | |

| | | | | | 15,197,953 | | |

INTERACTIVE MEDIA & SERVICES - 6.4% | |

Alphabet, Inc., Class A* | | | 129,269 | | | | 15,473,499 | | |

Alphabet, Inc., Class C* | | | 78,103 | | | | 9,448,120 | | |

Baidu, Inc., ADR* | | | 8,442 | | | | 1,155,794 | | |

Meta Platforms, Inc., Class A* | | | 38,131 | | | | 10,942,835 | | |

| | | | | | 37,020,248 | | |

IT SERVICES - 0.0%† | |

Okta, Inc.* | | | 3,222 | | | | 223,446 | | |

LIFE SCIENCES TOOLS & SERVICES - 1.7% | |

Agilent Technologies, Inc. | | | 30,120 | | | | 3,621,930 | | |

Danaher Corp. | | | 18,591 | | | | 4,461,840 | | |

Thermo Fisher Scientific, Inc. | | | 2,967 | | | | 1,548,032 | | |

| | | | | | 9,631,802 | | |

MACHINERY - 3.1% | |

Caterpillar, Inc. | | | 2,797 | | | | 688,202 | | |

Cummins, Inc. | | | 6,654 | | | | 1,631,295 | | |

Deere & Co. | | | 9,480 | | | | 3,841,201 | | |

Graco, Inc. | | | 1,378 | | | | 118,990 | | |

Illinois Tool Works, Inc. | | | 22,443 | | | | 5,614,341 | | |

Oshkosh Corp. | | | 980 | | | | 84,858 | | |

Snap-on, Inc. | | | 10,171 | | | | 2,931,181 | | |

Xylem, Inc. | | | 23,942 | | | | 2,696,348 | | |

| | | | | | 17,606,416 | | |

See accompanying notes to financial statements.

9

Global Atlantic BlackRock Disciplined Core Portfolio

Portfolio of Investments (Unaudited) (Continued)

June 30, 2023

| | | Shares/

Principal | | Fair

Value | |

MEDIA - 1.1% | |

Comcast Corp., Class A | | | 75,463 | | | $ | 3,135,488 | | |

Fox Corp., Class A | | | 88,828 | | | | 3,020,152 | | |

Fox Corp., Class B | | | 2,791 | | | | 89,005 | | |

| | | | | | 6,244,645 | | |

METALS & MINING - 0.1% | |

ArcelorMittal SA | | | 14,987 | | | | 409,745 | | |

MULTI-UTILITIES - 0.5% | |

DTE Energy Co. | | | 26,808 | | | | 2,949,416 | | |

OFFICE REITS - 0.0%† | |

Alexandria Real Estate Equities, Inc. | | | 1,219 | | | | 138,344 | | |

OIL, GAS & CONSUMABLE FUELS - 3.1% | |

| BP PLC, ADR | | | 22,518 | | | | 794,660 | | |

Cheniere Energy, Inc. | | | 3,001 | | | | 457,232 | | |

Chevron Corp. | | | 45,850 | | | | 7,214,497 | | |

ConocoPhillips | | | 34,532 | | | | 3,577,861 | | |

EOG Resources, Inc. | | | 9,531 | | | | 1,090,728 | | |

Exxon Mobil Corp. | | | 21,304 | | | | 2,284,854 | | |

Marathon Petroleum Corp. | | | 2,365 | | | | 275,759 | | |

Phillips 66 | | | 8,164 | | | | 778,682 | | |

Targa Resources Corp. | | | 2,488 | | | | 189,337 | | |

Valero Energy Corp. | | | 11,187 | | | | 1,312,235 | | |

Williams Cos., Inc. (The) | | | 3,398 | | | | 110,877 | | |

| | | | | | 18,086,722 | | |

PHARMACEUTICALS - 2.9% | |

Bristol-Myers Squibb Co. | | | 108,238 | | | | 6,921,820 | | |

Eli Lilly and Co. | | | 8,498 | | | | 3,985,392 | | |

Johnson & Johnson | | | 24,857 | | | | 4,114,331 | | |

Pfizer, Inc. | | | 46,847 | | | | 1,718,348 | | |

| | | | | | 16,739,891 | | |

PROFESSIONAL SERVICES - 0.1% | |

Insperity, Inc. | | | 5,619 | | | | 668,436 | | |

REAL ESTATE MANAGEMENT & DEVELOPMENT - 0.1% | |

KE Holdings, Inc., ADR* | | | 19,445 | | | | 288,758 | | |

RESIDENTIAL REITS - 0.5% | |

Equity Residential | | | 37,763 | | | | 2,491,225 | | |

Invitation Homes, Inc. | | | 10,120 | | | | 348,128 | | |

| | | | | | 2,839,353 | | |

RETAIL REITS - 0.5% | |

Brixmor Property Group, Inc. | | | 2,836 | | | | 62,392 | | |

Kimco Realty Corp. | | | 2,814 | | | | 55,492 | | |

Simon Property Group, Inc. | | | 25,056 | | | | 2,893,467 | | |

| | | | | | 3,011,351 | | |

| | | Shares/

Principal | | Fair

Value | |

SEMICONDUCTORS & SEMICONDUCTOR EQUIPMENT - 7.6% | |

Analog Devices, Inc. | | | 2,682 | | | $ | 522,481 | | |

Applied Materials, Inc. | | | 54,134 | | | | 7,824,528 | | |

Broadcom, Inc. | | | 989 | | | | 857,888 | | |

Intel Corp. | | | 127,744 | | | | 4,271,759 | | |

Lam Research Corp. | | | 1,546 | | | | 993,862 | | |

Lattice Semiconductor Corp.* | | | 3,731 | | | | 358,437 | | |

MaxLinear, Inc.* | | | 5,263 | | | | 166,100 | | |

Microchip Technology, Inc. | | | 10,364 | | | | 928,511 | | |

Micron Technology, Inc. | | | 25,002 | | | | 1,577,876 | | |

NVIDIA Corp. | | | 49,274 | | | | 20,843,888 | | |

NXP Semiconductors NV | | | 10,912 | | | | 2,233,468 | | |

QUALCOMM, Inc. | | | 19,115 | | | | 2,275,450 | | |

Synaptics, Inc.* | | | 685 | | | | 58,485 | | |

Texas Instruments, Inc. | | | 3,653 | | | | 657,613 | | |

| | | | | | 43,570,346 | | |

SOFTWARE - 11.6% | |

Adobe, Inc.* | | | 7,974 | | | | 3,899,206 | | |

Autodesk, Inc.* | | | 7,019 | | | | 1,436,158 | | |

Cadence Design Systems, Inc.* | | | 3,932 | | | | 922,133 | | |

Dropbox, Inc., Class A* | | | 70,828 | | | | 1,888,983 | | |

Fortinet, Inc.* | | | 23,610 | | | | 1,784,680 | | |

Intuit, Inc. | | | 3,228 | | | | 1,479,037 | | |

Manhattan Associates, Inc.* | | | 15,182 | | | | 3,034,578 | | |

Microsoft Corp. | | | 131,682 | | | | 44,842,988 | | |

Oracle Corp. | | | 2,360 | | | | 281,052 | | |

Palo Alto Networks, Inc.* | | | 1,630 | | | | 416,481 | | |

Salesforce, Inc.* | | | 15,935 | | | | 3,366,428 | | |

ServiceNow, Inc.* | | | 1,947 | | | | 1,094,156 | | |

Splunk, Inc.* | | | 3,427 | | | | 363,570 | | |

Synopsys, Inc.* | | | 2,789 | | | | 1,214,359 | | |

Teradata Corp.* | | | 8,483 | | | | 453,077 | | |

| | | | | | 66,476,886 | | |

SPECIALIZED REITS - 0.8% | |

American Tower Corp. | | | 4,310 | | | | 835,881 | | |

Equinix, Inc. | | | 408 | | | | 319,848 | | |

SBA Communications Corp. | | | 11,515 | | | | 2,668,716 | | |

VICI Properties, Inc. | | | 24,030 | | | | 755,263 | | |

| | | | | | 4,579,708 | | |

SPECIALTY RETAIL - 2.7% | |

AutoNation, Inc.* | | | 3,641 | | | | 599,345 | | |

Best Buy Co., Inc. | | | 9,306 | | | | 762,627 | | |

Dick's Sporting Goods, Inc. | | | 2,775 | | | | 366,827 | | |

Five Below, Inc.* | | | 9,980 | | | | 1,961,469 | | |

Home Depot, Inc. (The) | | | 17,196 | | | | 5,341,765 | | |

Lowe's Cos., Inc. | | | 2,536 | | | | 572,375 | | |

Penske Automotive Group, Inc. | | | 4,855 | | | | 808,989 | | |

TJX Cos., Inc. (The) | | | 61,955 | | | | 5,253,165 | | |

| | | | | | 15,666,562 | | |

See accompanying notes to financial statements.

10

Global Atlantic BlackRock Disciplined Core Portfolio

Portfolio of Investments (Unaudited) (Continued)

June 30, 2023

| | | Shares/

Principal | | Fair

Value | |

TECHNOLOGY HARDWARE, STORAGE & PERIPHERALS - 9.4% | |

Apple, Inc. | | | 243,649 | | | $ | 47,260,597 | | |

Dell Technologies, Inc., Class C | | | 11,767 | | | | 636,712 | | |

Hewlett Packard Enterprise Co. | | | 264,535 | | | | 4,444,188 | | |

HP, Inc. | | | 53,324 | | | | 1,637,580 | | |

| | | | | | 53,979,077 | | |

TEXTILES, APPAREL & LUXURY GOODS - 0.5% | |

Crocs, Inc.* | | | 1,646 | | | | 185,076 | | |

Lululemon Athletica, Inc.* | | | 3,794 | | | | 1,436,029 | | |

NIKE, Inc., Class B | | | 12,751 | | | | 1,407,328 | | |

| | | | | | 3,028,433 | | |

TRADING COMPANIES & DISTRIBUTORS - 0.9% | |

WW Grainger, Inc. | | | 6,274 | | | | 4,947,614 | | |

TOTAL COMMON STOCKS

(Cost - $423,960,691) | | | | | 566,023,673 | | |

| | | Shares/

Principal | | Fair

Value | |

SHORT-TERM INVESTMENTS - 1.5% | |

MONEY MARKET FUNDS - 1.5% | |

Fidelity Investments Money Market

Fund - Government Portfolio,

Institutional Class, 4.98% (a)

(Cost - $8,412,651) | | | 8,412,651 | | | $ | 8,412,651 | | |

TOTAL INVESTMENTS - 99.9%

(Cost - $432,373,342) | | | | $ | 574,436,324 | | |

OTHER ASSETS LESS LIABILITIES - NET 0.1% | | | | | 313,231 | | |

TOTAL NET ASSETS - 100.0% | | | | $ | 574,749,555 | | |

* Non-income producing security.

† Represents less than 0.05%.

(a) The rate shown is the annualized seven-day yield at period end.

ADR - American Depositary Receipt

PLC - Public Limited Company

Holdings by Asset Class | | % of Net Assets | |

Common Stocks | | | 98.4 | % | |

Short-Term Investments | | | 1.5 | % | |

Other Assets Less Liabilities - Net | | | 0.1 | % | |

| | | | 100.0 | % | |

FUTURES CONTRACTS | |

LONG FUTURES CONTRACTS | | Counterparty | | Number of

Contracts | | Expiration Date | | Notional Value | | Fair Value/

Unrealized

Appreciation

(Depreciation) | |

S&P 500 E-Mini Future | | Goldman Sachs & Co. | | | 41 | | | 9/15/2023 | | $ | 9,200,913 | | | $ | 251,555 | | |

See accompanying notes to financial statements.

11

Global Atlantic BlackRock Disciplined Growth Portfolio

Portfolio of Investments (Unaudited)

June 30, 2023

| | | Shares/

Principal | | Fair

Value | |

COMMON STOCKS - 98.0% | |

AEROSPACE & DEFENSE - 0.8% | |

Lockheed Martin Corp. | | | 1,517 | | | $ | 698,397 | | |

AUTOMOBILES - 3.0% | |

Tesla, Inc.* | | | 10,255 | | | | 2,684,451 | | |

BEVERAGES - 1.2% | |

PepsiCo, Inc. | | | 5,927 | | | | 1,097,799 | | |

BIOTECHNOLOGY - 3.4% | |

AbbVie, Inc. | | | 4,172 | | | | 562,093 | | |

Amgen, Inc. | | | 4,110 | | | | 912,502 | | |

Exelixis, Inc.* | | | 906 | | | | 17,314 | | |

Gilead Sciences, Inc. | | | 1,066 | | | | 82,157 | | |

Horizon Therapeutics PLC* | | | 804 | | | | 82,691 | | |

Incyte Corp.* | | | 11,086 | | | | 690,103 | | |

Neurocrine Biosciences, Inc.* | | | 2,126 | | | | 200,482 | | |

Regeneron Pharmaceuticals, Inc.* | | | 403 | | | | 289,572 | | |

Seagen, Inc.* | | | 454 | | | | 87,377 | | |

Ultragenyx Pharmaceutical, Inc.* | | | 3,070 | | | | 141,619 | | |

| | | | 3,065,910 | | |

BROADLINE RETAIL - 6.0% | |

Amazon.com, Inc.* | | | 33,380 | | | | 4,351,417 | | |

eBay, Inc. | | | 14,174 | | | | 633,436 | | |

Etsy, Inc.* | | | 974 | | | | 82,410 | | |

MercadoLibre, Inc.* | | | 225 | | | | 266,535 | | |

| | | | 5,333,798 | | |

BUILDING PRODUCTS - 0.6% | |

Allegion PLC | | | 2,631 | | | | 315,773 | | |

Builders FirstSource, Inc.* | | | 204 | | | | 27,744 | | |

Trane Technologies PLC | | | 1,102 | | | | 210,768 | | |

| | | | 554,285 | | |

CAPITAL MARKETS - 0.5% | |

Moody's Corp. | | | 631 | | | | 219,411 | | |

Nasdaq, Inc. | | | 4,670 | | | | 232,800 | | |

| | | | 452,211 | | |

CHEMICALS - 0.7% | |

Ecolab, Inc. | | | 3,469 | | | | 647,628 | | |

COMMERCIAL SERVICES & SUPPLIES - 0.9% | |

Cintas Corp. | | | 1,688 | | | | 839,071 | | |

COMMUNICATIONS EQUIPMENT - 0.1% | |

Arista Networks, Inc.* | | | 260 | | | | 42,136 | | |

CONSTRUCTION & ENGINEERING - 0.1% | |

AECOM | | | 1,187 | | | | 100,527 | | |

CONSUMER FINANCE - 0.2% | |

American Express Co. | | | 1,117 | | | | 194,582 | | |

| | | Shares/

Principal | | Fair

Value | |

CONSUMER STAPLES DISTRIBUTION & RETAIL - 1.2% | |

Target Corp. | | | 1,157 | | | $ | 152,608 | | |

Walmart, Inc. | | | 5,850 | | | | 919,503 | | |

| | | | 1,072,111 | | |

ELECTRICAL EQUIPMENT - 0.2% | |

AMETEK, Inc. | | | 957 | | | | 154,919 | | |

ELECTRONIC EQUIPMENT, INSTRUMENTS & COMPONENTS - 0.2% | |

Flex Ltd.* | | | 7,166 | | | | 198,068 | | |

ENTERTAINMENT - 1.1% | |

Electronic Arts, Inc. | | | 326 | | | | 42,282 | | |

Netflix, Inc.* | | | 1,190 | | | | 524,183 | | |

ROBLOX Corp., Class A* | | | 3,985 | | | | 160,596 | | |

Spotify Technology SA* | | | 1,828 | | | | 293,485 | | |

| | | | 1,020,546 | | |

FINANCIAL SERVICES - 4.8% | |

Block, Inc.* | | | 4,213 | | | | 280,459 | | |

Mastercard, Inc., Class A | | | 4,511 | | | | 1,774,176 | | |

PayPal Holdings, Inc.* | | | 3,411 | | | | 227,616 | | |

Visa, Inc., Class A | | | 8,293 | | | | 1,969,422 | | |

| | | | 4,251,673 | | |

FOOD PRODUCTS - 0.9% | |

Hershey Co. (The) | | | 3,302 | | | | 824,509 | | |

GROUND TRANSPORTATION - 0.2% | |

Lyft, Inc., Class A* | | | 3,704 | | | | 35,522 | | |

Uber Technologies, Inc.* | | | 4,008 | | | | 173,025 | | |

| | | | 208,547 | | |

HEALTH CARE EQUIPMENT & SUPPLIES - 2.3% | |

Abbott Laboratories | | | 1,070 | | | | 116,651 | | |

Boston Scientific Corp.* | | | 17,669 | | | | 955,716 | | |

Edwards Lifesciences Corp.* | | | 445 | | | | 41,977 | | |

IDEXX Laboratories, Inc.* | | | 613 | | | | 307,867 | | |

Intuitive Surgical, Inc.* | | | 109 | | | | 37,272 | | |

Stryker Corp. | | | 1,823 | | | | 556,179 | | |

| | | | 2,015,662 | | |

HEALTH CARE PROVIDERS & SERVICES - 2.9% | |

CVS Health Corp. | | | 5,932 | | | | 410,079 | | |

Elevance Health, Inc. | | | 1,553 | | | | 689,982 | | |

UnitedHealth Group, Inc. | | | 3,198 | | | | 1,537,087 | | |

| | | | 2,637,148 | | |

HEALTH CARE TECHNOLOGY - 0.1% | |

Teladoc Health, Inc.* | | | 4,569 | | | | 115,687 | | |

HOTELS, RESTAURANTS & LEISURE - 1.7% | |

Airbnb, Inc., Class A* | | | 814 | | | | 104,322 | | |

Booking Holdings, Inc.* | | | 60 | | | | 162,020 | | |

See accompanying notes to financial statements.

12

Global Atlantic BlackRock Disciplined Growth Portfolio

Portfolio of Investments (Unaudited) (Continued)

June 30, 2023

| | | Shares/

Principal | | Fair

Value | |

HOTELS, RESTAURANTS & LEISURE - 1.7% (Continued) | |

Boyd Gaming Corp. | | | 4,457 | | | $ | 309,182 | | |

Caesars Entertainment, Inc.* | | | 2,826 | | | | 144,041 | | |

Domino's Pizza, Inc. | | | 380 | | | | 128,056 | | |

DoorDash, Inc., Class A* | | | 287 | | | | 21,932 | | |

DraftKings, Inc., Class A* | | | 879 | | | | 23,355 | | |

MGM Resorts International | | | 564 | | | | 24,771 | | |

Starbucks Corp. | | | 3,829 | | | | 379,301 | | |

Travel + Leisure Co. | | | 2,886 | | | | 116,421 | | |

Wingstop, Inc. | | | 360 | | | | 72,058 | | |

Yum! Brands, Inc. | | | 483 | | | | 66,920 | | |

| | | | 1,552,379 | | |

HOUSEHOLD DURABLES - 0.3% | |

Lennar Corp., Class A | | | 422 | | | | 52,881 | | |

Taylor Morrison Home Corp.* | | | 759 | | | | 37,016 | | |

Toll Brothers, Inc. | | | 434 | | | | 34,316 | | |

TopBuild Corp.* | | | 486 | | | | 129,286 | | |

| | | | 253,499 | | |

HOUSEHOLD PRODUCTS - 1.0% | |

Kimberly-Clark Corp. | | | 825 | | | | 113,900 | | |

Procter & Gamble Co. (The) | | | 5,279 | | | | 801,035 | | |

| | | | 914,935 | | |

INDUSTRIAL CONGLOMERATES - 0.6% | |

Honeywell International, Inc. | | | 2,709 | | | | 562,118 | | |

INSURANCE - 0.5% | |

Marsh & McLennan Cos., Inc. | | | 588 | | | | 110,591 | | |

MetLife, Inc. | | | 4,371 | | | | 247,093 | | |

Travelers Cos., Inc. (The) | | | 313 | | | | 54,355 | | |

| | | | 412,039 | | |

INTERACTIVE MEDIA & SERVICES - 9.0% | |

Alphabet, Inc., Class A* | | | 15,408 | | | | 1,844,338 | | |

Alphabet, Inc., Class C* | | | 20,915 | | | | 2,530,087 | | |

Meta Platforms, Inc., Class A* | | | 11,019 | | | | 3,162,233 | | |

Pinterest, Inc., Class A* | | | 4,973 | | | | 135,962 | | |

Snap, Inc., Class A* | | | 31,398 | | | | 371,752 | | |

| | | | 8,044,372 | | |

IT SERVICES - 0.4% | |

Okta, Inc.* | | | 485 | | | | 33,635 | | |

VeriSign, Inc.* | | | 1,116 | | | | 252,182 | | |

Wix.com Ltd.* | | | 828 | | | | 64,783 | | |

| | | | 350,600 | | |

LIFE SCIENCES TOOLS & SERVICES - 1.0% | |

Agilent Technologies, Inc. | | | 6,831 | | | | 821,428 | | |

Danaher Corp. | | | 150 | | | | 36,000 | | |

| | | | 857,428 | | |

| | | Shares/

Principal | | Fair

Value | |

MACHINERY - 1.2% | |

Caterpillar, Inc. | | | 314 | | | $ | 77,260 | | |

Cummins, Inc. | | | 1,355 | | | | 332,192 | | |

Deere & Co. | | | 140 | | | | 56,727 | | |

Illinois Tool Works, Inc. | | | 1,758 | | | | 439,781 | | |

Otis Worldwide Corp. | | | 359 | | | | 31,954 | | |

Xylem, Inc. | | | 1,544 | | | | 173,885 | | |

| | | | 1,111,799 | | |

MEDIA - 0.2% | |

Fox Corp., Class A | | | 5,300 | | | | 180,200 | | |

PHARMACEUTICALS - 1.9% | |

Bristol-Myers Squibb Co. | | | 7,045 | | | | 450,528 | | |

Eli Lilly and Co. | | | 2,689 | | | | 1,261,087 | | |

| | | | 1,711,615 | | |

PROFESSIONAL SERVICES - 0.3% | |

ExlService Holdings, Inc.* | | | 182 | | | | 27,493 | | |

Insperity, Inc. | | | 1,937 | | | | 230,426 | | |

| | | | 257,919 | | |

REAL ESTATE MANAGEMENT & DEVELOPMENT - 0.1% | |

Zillow Group, Inc., Class A* | | | 49 | | | | 2,411 | | |

Zillow Group, Inc., Class C* | | | 1,495 | | | | 75,139 | | |

| | | | 77,550 | | |

RETAIL REITS - 0.1% | |

Simon Property Group, Inc. | | | 413 | | | | 47,693 | | |

SEMICONDUCTORS & SEMICONDUCTOR EQUIPMENT - 9.3% | |

Advanced Micro Devices, Inc.* | | | 946 | | | | 107,759 | | |

Applied Materials, Inc. | | | 9,383 | | | | 1,356,219 | | |

Broadcom, Inc. | | | 643 | | | | 557,757 | | |

Intel Corp. | | | 9,728 | | | | 325,304 | | |

KLA Corp. | | | 59 | | | | 28,616 | | |

Lam Research Corp. | | | 589 | | | | 378,645 | | |

Lattice Semiconductor Corp.* | | | 1,622 | | | | 155,826 | | |

MaxLinear, Inc.* | | | 2,063 | | | | 65,108 | | |

Microchip Technology, Inc. | | | 1,187 | | | | 106,343 | | |

Micron Technology, Inc. | | | 2,775 | | | | 175,130 | | |

NVIDIA Corp. | | | 10,297 | | | | 4,355,837 | | |

NXP Semiconductors NV | | | 1,568 | | | | 320,938 | | |

QUALCOMM, Inc. | | | 3,539 | | | | 421,283 | | |

| | | | 8,354,765 | | |

SOFTWARE - 19.5% | |

Adobe, Inc.* | | | 2,459 | | | | 1,202,426 | | |

Autodesk, Inc.* | | | 2,621 | | | | 536,283 | | |

Box, Inc., Class A* | | | 792 | | | | 23,269 | | |

Cadence Design Systems, Inc.* | | | 1,946 | | | | 456,376 | | |

Crowdstrike Holdings, Inc., Class A* | | | 1,394 | | | | 204,737 | | |

DocuSign, Inc.* | | | 2,838 | | | | 144,994 | | |

See accompanying notes to financial statements.

13

Global Atlantic BlackRock Disciplined Growth Portfolio

Portfolio of Investments (Unaudited) (Continued)

June 30, 2023

| | | Shares/

Principal | | Fair

Value | |

SOFTWARE - 19.5% (Continued) | |

Dropbox, Inc., Class A* | | | 16,557 | | | $ | 441,575 | | |

Fortinet, Inc.* | | | 7,502 | | | | 567,076 | | |

Intuit, Inc. | | | 822 | | | | 376,632 | | |

Manhattan Associates, Inc.* | | | 3,517 | | | | 702,978 | | |

Microsoft Corp. | | | 30,480 | | | | 10,379,659 | | |

Palo Alto Networks, Inc.* | | | 811 | | | | 207,219 | | |

RingCentral, Inc., Class A* | | | 1,371 | | | | 44,873 | | |

Salesforce, Inc.* | | | 3,091 | | | | 653,005 | | |

ServiceNow, Inc.* | | | 1,028 | | | | 577,705 | | |

Splunk, Inc.* | | | 2,042 | | | | 216,636 | | |

Synopsys, Inc.* | | | 988 | | | | 430,185 | | |

Teradata Corp.* | | | 4,693 | | | | 250,653 | | |

VMware, Inc., Class A* | | | 418 | | | | 60,062 | | |

| | | | 17,476,343 | | |

SPECIALIZED REITS - 0.3% | |

SBA Communications Corp. | | | 1,109 | | | | 257,022 | | |

SPECIALTY RETAIL - 2.9% | |

AutoNation, Inc.* | | | 2,009 | | | | 330,701 | | |

Chewy, Inc., Class A* | | | 2,726 | | | | 107,595 | | |

Five Below, Inc.* | | | 1,559 | | | | 306,406 | | |

Home Depot, Inc. (The) | | | 2,011 | | | | 624,697 | | |

Lowe's Cos., Inc. | | | 768 | | | | 173,338 | | |

O'Reilly Automotive, Inc.* | | | 174 | | | | 166,222 | | |

Penske Automotive Group, Inc. | | | 98 | | | | 16,330 | | |

TJX Cos., Inc. (The) | | | 9,251 | | | | 784,392 | | |

Wayfair, Inc., Class A* | | | 978 | | | | 63,580 | | |

| | | | 2,573,261 | | |

| | | Shares/

Principal | | Fair

Value | |

TECHNOLOGY HARDWARE, STORAGE & PERIPHERALS - 14.0% | |

Apple, Inc. | | | 60,822 | | | $ | 11,797,643 | | |

Dell Technologies, Inc., Class C | | | 4,617 | | | | 249,826 | | |

Hewlett Packard Enterprise Co. | | | 22,628 | | | | 380,151 | | |

HP, Inc. | | | 3,086 | | | | 94,771 | | |

| | | | 12,522,391 | | |

TEXTILES, APPAREL & LUXURY GOODS - 1.2% | |

Crocs, Inc.* | | | 892 | | | | 100,296 | | |

Lululemon Athletica, Inc.* | | | 1,848 | | | | 699,468 | | |

NIKE, Inc., Class B | | | 2,343 | | | | 258,597 | | |

| | | | 1,058,361 | | |

TRADING COMPANIES & DISTRIBUTORS - 1.1% | |

WW Grainger, Inc. | | | 1,298 | | | | 1,023,590 | | |

TOTAL COMMON STOCKS

(Cost - $58,228,382) | | | | | 87,809,544 | | |

SHORT-TERM INVESTMENTS - 2.1% | |

MONEY MARKET FUNDS - 2.1% | |

Fidelity Investments Money Market

Fund - Government Portfolio,

Institutional Class, 4.99% (a)

(Cost - $1,876,227) | | | 1,876,227 | | | | 1,876,227 | | |

TOTAL INVESTMENTS - 100.1%

(Cost - $60,104,609) | | | | $ | 89,685,771 | | |

OTHER ASSETS LESS

LIABILITIES - NET (0.1)% | | | | | (68,098) | | |

TOTAL NET ASSETS - 100.0% | | | | $ | 89,617,673 | | |

* Non-income producing security.

(a) The rate shown is the annualized seven-day yield at period end.

PLC - Public Limited Company

Holdings by Asset Class | | % of Net Assets | |

Common Stocks | | | 98.0 | % | |

Short-Term Investments | | | 2.1 | % | |

Other Assets Less Liabilities - Net | | | (0.1 | )% | |

| | | | 100.0 | % | |

FUTURES CONTRACTS | |

LONG FUTURES CONTRACTS | | Counterparty | | Number of

Contracts | | Expiration Date | | Notional Value | | Fair Value/

Unrealized

Appreciation

(Depreciation) | |

NASDAQ 100 E-Mini Future | | Goldman Sachs & Co. | | | 6 | | | 9/15/2023 | | $ | 1,840,440 | | | $ | 66,298 | | |

See accompanying notes to financial statements.

14

Global Atlantic BlackRock Disciplined International Core Portfolio

Portfolio of Investments (Unaudited)

June 30, 2023

| | | Shares/

Principal | | Fair

Value | |

COMMON STOCKS - 87.2% | |

AEROSPACE & DEFENSE - 1.2% | |

Airbus SE | | | 2,324 | | | $ | 335,597 | | |

BAE Systems PLC | | | 5,478 | | | | 64,560 | | |

Dassault Aviation SA | | | 523 | | | | 104,647 | | |

Elbit Systems Ltd. | | | 89 | | | | 18,515 | | |

Embraer SA* | | | 9,191 | | | | 35,343 | | |

Kongsberg Gruppen ASA | | | 1,489 | | | | 67,851 | | |

Leonardo SpA | | | 2,317 | | | | 26,277 | | |

Rolls-Royce Holdings PLC* | | | 54,158 | | | | 104,004 | | |

Saab AB, Class B | | | 2,913 | | | | 157,283 | | |

Safran SA | | | 3,065 | | | | 479,718 | | |

Thales SA | | | 1,674 | | | | 250,573 | | |

| | | | | | | | 1,644,368 | | |

AIR FREIGHT & LOGISTICS - 0.5% | |

CJ Logistics Corp. | | | 69 | | | | 4,001 | | |

Deutsche Post AG | | | 4,761 | | | | 232,339 | | |

DSV A/S | | | 1,085 | | | | 227,815 | | |

JD Logistics, Inc*,(a) | | | 4,000 | | | | 6,237 | | |

NIPPON EXPRESS HOLDINGS, Inc. | | | 2,100 | | | | 117,746 | | |

SF Holding Co. Ltd., Class A | | | 2,600 | | | | 16,139 | | |

SG Holdings Co. Ltd. | | | 2,300 | | | | 32,582 | | |

ZTO Express Cayman, Inc., ADR | | | 4,120 | | | | 103,330 | | |

| | | | | | | | 740,189 | | |

AUTOMOBILE COMPONENTS - 0.3% | |

Denso Corp. | | | 300 | | | | 20,019 | | |

HL Mando Co. Ltd. | | | 497 | | | | 20,330 | | |

Hyundai Mobis Co. Ltd. | | | 743 | | | | 131,103 | | |

Pirelli & C SpA*,(a) | | | 26,219 | | | | 129,409 | | |

Valeo | | | 1,969 | | | | 42,169 | | |

| | | | | | | | 343,030 | | |

AUTOMOBILES - 3.3% | |

Bayerische Motoren Werke AG | | | 4,591 | | | | 563,588 | | |

BYD Co. Ltd., Class A | | | 9,626 | | | | 342,248 | | |

BYD Co. Ltd., Class H | | | 10,500 | | | | 334,967 | | |

Ferrari NV | | | 661 | | | | 215,985 | | |

Geely Automobile Holdings Ltd. | | | 73,000 | | | | 89,054 | | |

Great Wall Motor Co. Ltd., Class H | | | 55,000 | | | | 62,954 | | |

Honda Motor Co. Ltd. | | | 15,900 | | | | 477,544 | | |

Kia Corp. | | | 907 | | | | 60,919 | | |

Li Auto, Inc., Class A* | | | 4,000 | | | | 69,163 | | |

Mercedes-Benz Group AG | | | 14,469 | | | | 1,162,931 | | |

NIO, Inc., ADR* | | | 5,867 | | | | 56,851 | | |

NIO, Inc., Class A* | | | 1,700 | | | | 16,454 | | |

Renault SA | | | 962 | | | | 40,491 | | |

Subaru Corp. | | | 4,500 | | | | 84,156 | | |

Suzuki Motor Corp. | | | 3,400 | | | | 122,347 | | |

Toyota Motor Corp. | | | 52,200 | | | | 833,734 | | |

Volkswagen AG | | | 163 | | | | 27,191 | | |

XPeng, Inc., Class A* | | | 1,200 | | | | 7,656 | | |

| | | | | | | | 4,568,233 | | |

| | | Shares/

Principal | | Fair

Value | |

BANKS - 9.5% | |

ABN AMRO Bank NV, CVA (a) | | | 2,674 | | | $ | 41,514 | | |

Absa Group Ltd. | | | 8,658 | | | | 76,954 | | |

Agricultural Bank of China Ltd., Class H | | | 47,000 | | | | 18,472 | | |

ANZ Group Holdings Ltd. | | | 13,121 | | | | 207,083 | | |

Banco Bilbao Vizcaya Argentaria SA | | | 44,448 | | | | 341,001 | | |

Banco Bradesco SA | | | 14,933 | | | | 45,412 | | |

Banco do Brasil SA | | | 4,536 | | | | 46,545 | | |

Banco Santander Brasil SA | | | 9,764 | | | | 62,179 | | |

Banco Santander SA | | | 140,670 | | | | 519,499 | | |

Bank Central Asia TBK PT | | | 656,000 | | | | 400,360 | | |

Bank Hapoalim BM | | | 19,802 | | | | 162,111 | | |

Bank Mandiri Persero TBK PT | | | 230,600 | | | | 79,981 | | |

Bank Negara Indonesia Persero Tbk PT | | | 43,900 | | | | 26,792 | | |

Bank of China Ltd., Class H | | | 229,000 | | | | 91,757 | | |

Bank of Nova Scotia (The) | | | 12,215 | | | | 611,835 | | |

Bank of Queensland Ltd. | | | 2,806 | | | | 10,254 | | |

Bank Rakyat Indonesia Persero TBK PT | | | 438,800 | | | | 158,779 | | |

Bankinter SA | | | 7,501 | | | | 46,074 | | |

Barclays PLC | | | 92,358 | | | | 180,098 | | |

BAWAG Group AG*,(a) | | | 427 | | | | 19,668 | | |

BNP Paribas SA | | | 5,896 | | | | 371,286 | | |

BOC Hong Kong Holdings Ltd. | | | 57,500 | | | | 175,730 | | |

CaixaBank SA | | | 36,118 | | | | 149,226 | | |

Canadian Imperial Bank of Commerce | | | 9,936 | | | | 424,697 | | |

Capitec Bank Holdings Ltd. | | | 595 | | | | 49,380 | | |

China CITIC Bank Corp. Ltd., Class H | | | 119,000 | | | | 55,881 | | |

China Construction Bank Corp., | |

Class H* | | | 581,000 | | | | 375,886 | | |

China Merchants Bank Co. Ltd., Class A | | | 36,800 | | | | 165,964 | | |

China Merchants Bank Co. Ltd., Class H | | | 41,500 | | | | 188,526 | | |

CIMB Group Holdings BHD | | | 53,200 | | | | 57,674 | | |

Commonwealth Bank of Australia | | | 4,990 | | | | 333,056 | | |

Credit Agricole SA | | | 2,597 | | | | 30,804 | | |

DNB Bank ASA | | | 5,302 | | | | 99,324 | | |

Erste Group Bank AG | | | 1,446 | | | | 50,625 | | |

Grupo Financiero Banorte SAB de CV,

Class O | | | 33,407 | | | | 274,299 | | |

Hana Financial Group, Inc. | | | 697 | | | | 20,736 | | |

Hong Leong Bank BHD | | | 4,200 | | | | 17,061 | | |

HSBC Holdings PLC | | | 83,895 | | | | 663,105 | | |

Industrial & Commercial Bank of China Ltd.,

Class H | | | 355,000 | | | | 189,355 | | |

Industrial Bank Co., Ltd., Class A | | | 15,600 | | | | 33,609 | | |

ING Groep NV | | | 31,081 | | | | 418,374 | | |

Intesa Sanpaolo SpA | | | 92,181 | | | | 241,367 | | |

Israel Discount Bank Ltd., Class A | | | 9,794 | | | | 48,562 | | |

Japan Post Bank Co. Ltd. | | | 8,400 | | | | 65,324 | | |

Jyske Bank A/S* | | | 209 | | | | 15,875 | | |

KakaoBank Corp. | | | 1,396 | | | | 25,162 | | |

KB Financial Group, Inc. | | | 1,199 | | | | 43,450 | | |

Lloyds Banking Group PLC | | | 501,088 | | | | 277,694 | | |

See accompanying notes to financial statements.

15

Global Atlantic BlackRock Disciplined International Core Portfolio

Portfolio of Investments (Unaudited) (Continued)

June 30, 2023

| | | Shares/

Principal | | Fair

Value | |

BANKS - 9.5% (Continued) | |

Malayan Banking BHD | | | 108,000 | | | $ | 199,687 | | |

Mediobanca Banca di Credito Finanziario SpA | | | 21,724 | | | | 259,762 | | |

Mitsubishi UFJ Financial Group, Inc. | | | 95,000 | | | | 700,003 | | |

Mizrahi Tefahot Bank Ltd. | | | 1,969 | | | | 65,422 | | |

Mizuho Financial Group, Inc. | | | 13,500 | | | | 205,393 | | |

National Australia Bank Ltd. | | | 10,890 | | | | 191,154 | | |

Nedbank Group Ltd. | | | 2,444 | | | | 29,572 | | |

Nordea Bank Abp | | | 1,395 | | | | 15,149 | | |

OTP Bank Nyrt | | | 4,889 | | | | 173,459 | | |

Ping An Bank Co., Ltd., Class A | | | 84,500 | | | | 130,634 | | |

Postal Savings Bank of China Co. Ltd.,

Class H (a) | | | 40,000 | | | | 24,603 | | |

Public Bank BHD | | | 211,900 | | | | 174,786 | | |

Raiffeisen Bank International AG* | | | 3,994 | | | | 63,270 | | |

Resona Holdings, Inc. | | | 22,300 | | | | 106,505 | | |

RHB Bank BHD | | | 99,400 | | | | 115,638 | | |

Royal Bank of Canada | | | 9,379 | | | | 896,755 | | |

Shinhan Financial Group Co. Ltd. | | | 2,179 | | | | 56,226 | | |

Societe Generale SA | | | 9,544 | | | | 247,818 | | |

Standard Bank Group Ltd. | | | 19,329 | | | | 181,664 | | |

Standard Chartered PLC | | | 12,625 | | | | 109,627 | | |

Sumitomo Mitsui Financial Group, Inc. | | | 7,600 | | | | 323,855 | | |

Sumitomo Mitsui Trust Holdings, Inc. | | | 1,700 | | | | 60,138 | | |

Swedbank AB, Class A | | | 1,170 | | | | 19,698 | | |

TMBThanachart Bank PCL, NVDR | | | 488,400 | | | | 21,352 | | |

Toronto-Dominion Bank (The) | | | 207 | | | | 12,845 | | |

UniCredit SpA | | | 10,071 | | | | 233,648 | | |

United Overseas Bank Ltd. | | | 6,600 | | | | 136,550 | | |

Westpac Banking Corp. | | | 24,447 | | | | 347,269 | | |

| | | | | | | | 13,110,882 | | |

BEVERAGES - 2.0% | |

Ambev SA | | | 65,559 | | | | 209,561 | | |

Anheuser-Busch InBev SA | | | 7,922 | | | | 447,962 | | |

Arca Continental SAB de CV | | | 12,214 | | | | 125,113 | | |

Budweiser Brewing Co. APAC Ltd. (a) | | | 5,700 | | | | 14,693 | | |

China Resources Beer Holdings Co. Ltd. | | | 4,000 | | | | 26,338 | | |

Coca-Cola Femsa SAB de CV | | | 6,091 | | | | 50,765 | | |

Davide Campari-Milano NV | | | 3,723 | | | | 51,544 | | |

Diageo PLC | | | 19,581 | | | | 841,179 | | |

Fomento Economico Mexicano SAB de CV | | | 13,849 | | | | 152,948 | | |

Jiangsu Yanghe Brewery Joint-Stock Co. Ltd.,

Class A | | | 1,000 | | | | 18,082 | | |

Kirin Holdings Co. Ltd. | | | 1,100 | | | | 15,994 | | |

Kweichow Moutai Co. Ltd., Class A | | | 400 | | | | 93,116 | | |

Luzhou Laojiao Co. Ltd., Class A | | | 500 | | | | 14,425 | | |

Pernod Ricard SA | | | 1,771 | | | | 391,069 | | |

Remy Cointreau SA | | | 309 | | | | 49,540 | | |

Shanxi Xinghuacun Fen Wine Factory Co.

Ltd., Class A | | | 2,990 | | | | 76,178 | | |

| | | Shares/

Principal | | Fair

Value | |

BEVERAGES - 2.0% (Continued) | |

Suntory Beverage & Food Ltd. | | | 3,100 | | | $ | 111,787 | | |

Treasury Wine Estates Ltd. | | | 4,522 | | | | 33,803 | | |

Wuliangye Yibin Co. Ltd., Class A | | | 700 | | | | 15,762 | | |

| | | | | | | | 2,739,859 | | |

BIOTECHNOLOGY - 0.7% | |

3SBio, Inc.*,(a) | | | 7,500 | | | | 7,532 | | |

Akeso, Inc.*,(a) | | | 3,000 | | | | 13,533 | | |

Argenx SE* | | | 162 | | | | 62,814 | | |

BeiGene Ltd.* | | | 1,600 | | | | 21,928 | | |

Bloomage Biotechnology Corp. Ltd., Class A | | | 2,119 | | | | 26,009 | | |

Celltrion, Inc. | | | 758 | | | | 87,958 | | |

CSL Ltd. | | | 2,335 | | | | 431,130 | | |

Galapagos NV* | | | 376 | | | | 15,330 | | |

Genmab A/S* | | | 552 | | | | 208,673 | | |

Grifols SA* | | | 770 | | | | 9,862 | | |

Innovent Biologics, Inc.*,(a) | | | 7,000 | | | | 26,440 | | |

SK Bioscience Co. Ltd.* | | | 79 | | | | 4,766 | | |

Swedish Orphan Biovitrum AB* | | | 1,605 | | | | 31,264 | | |

Zai Lab Ltd., ADR* | | | 403 | | | | 11,175 | | |

| | | | | | | | 958,414 | | |

BROADLINE RETAIL - 1.4% | |

Alibaba Group Holding Ltd.* | | | 90,600 | | | | 938,764 | | |

Dollarama, Inc. | | | 1,004 | | | | 68,074 | | |

J Front Retailing Co. Ltd. | | | 1,600 | | | | 15,260 | | |

JD.com, Inc., Class A | | | 14,800 | | | | 250,047 | | |

Naspers Ltd., Class N | | | 1,190 | | | | 214,110 | | |

PDD Holdings, Inc., ADR* | | | 803 | | | | 55,519 | | |

Prosus NV* | | | 3,611 | | | | 264,387 | | |

Rakuten Group, Inc. | | | 10,200 | | | | 35,215 | | |

Vipshop Holdings Ltd., ADR* | | | 3,955 | | | | 65,258 | | |

Woolworths Holdings Ltd./South Africa | | | 22,801 | | | | 86,117 | | |

| | | | | | | | 1,992,751 | | |

BUILDING PRODUCTS - 0.3% | |

Assa Abloy AB, Class B | | | 12,883 | | | | 308,916 | | |

Belimo Holding AG | | | 32 | | | | 15,960 | | |

Cie de Saint-Gobain | | | 658 | | | | 40,007 | | |

Kingspan Group PLC | | | 1,598 | | | | 106,174 | | |

| | | | | | | | 471,057 | | |

CAPITAL MARKETS - 1.1% | |

Amundi SA (a) | | | 1,875 | | | | 110,566 | | |

B3 SA - Brasil Bolsa Balcao | | | 55,849 | | | | 169,145 | | |

Brookfield Corp., Class A | | | 3,262 | | | | 109,945 | | |

China International Capital Corp. Ltd.,

Class H*,(a) | | | 20,000 | | | | 35,066 | | |

Deutsche Bank AG | | | 16,812 | | | | 176,412 | | |

EQT AB | | | 954 | | | | 18,318 | | |

Hong Kong Exchanges & Clearing Ltd. | | | 2,400 | | | | 90,407 | | |

IG Group Holdings PLC | | | 5,344 | | | | 45,996 | | |

See accompanying notes to financial statements.

16

Global Atlantic BlackRock Disciplined International Core Portfolio

Portfolio of Investments (Unaudited) (Continued)

June 30, 2023

| | | Shares/

Principal | | Fair

Value | |

CAPITAL MARKETS - 1.1% (Continued) | |

IGM Financial, Inc. | | | 862 | | | $ | 26,272 | | |

London Stock Exchange Group PLC | | | 564 | | | | 59,988 | | |

Macquarie Group Ltd. | | | 5,668 | | | | 670,143 | | |

Nomura Holdings, Inc. | | | 6,000 | | | | 22,716 | | |

Reinet Investments SCA | | | 690 | | | | 15,229 | | |

SBI Holdings, Inc. | | | 1,000 | | | | 19,154 | | |

| | | | | | | | 1,569,357 | | |

CHEMICALS - 2.4% | |

Air Liquide SA | | | 2,918 | | | | 522,737 | | |

Arkema SA | | | 351 | | | | 33,048 | | |

Asahi Kasei Corp. | | | 7,500 | | | | 50,438 | | |

BASF SE | | | 4,185 | | | | 203,043 | | |

Covestro AG*,(a) | | | 2,405 | | | | 124,843 | | |

Croda International PLC | | | 734 | | | | 52,500 | | |

Dongyue Group Ltd. | | | 6,000 | | | | 4,487 | | |

DSM-Firmenich AG* | | | 110 | | | | 11,835 | | |

Evonik Industries AG | | | 9,463 | | | | 179,950 | | |

Ganfeng Lithium Group Co Ltd, Class H*,(a) | | | 5,600 | | | | 36,516 | | |

Givaudan SA | | | 72 | | | | 238,618 | | |

Hyosung Advanced Materials Corp. | | | 30 | | | | 10,485 | | |

Johnson Matthey PLC | | | 1,862 | | | | 41,332 | | |

LG Chem Ltd. | | | 393 | | | | 198,938 | | |

Mitsubishi Chemical Group Corp. | | | 21,300 | | | | 127,209 | | |

Mitsubishi Gas Chemical Co., Inc. | | | 11,900 | | | | 172,117 | | |

Nippon Paint Holdings Co. Ltd. | | | 2,200 | | | | 18,007 | | |

Nitto Denko Corp. | | | 1,800 | | | | 132,383 | | |

Novozymes A/S, Class B | | | 4,989 | | | | 232,386 | | |

Shanghai Putailai New Energy Technology

Co. Ltd., Class A | | | 8,120 | | | | 42,724 | | |

Sika AG | | | 510 | | | | 145,763 | | |

Solvay SA | | | 2,647 | | | | 295,430 | | |

Sumitomo Chemical Co. Ltd. | | | 122,300 | | | | 369,350 | | |

Tosoh Corp. | | | 1,600 | | | | 18,808 | | |

Wacker Chemie AG | | | 126 | | | | 17,286 | | |

Weihai Guangwei Composites Co. Ltd.,

Class A | | | 2,880 | | | | 12,231 | | |

Zangge Mining Co., Ltd., Class A | | | 9,800 | | | | 30,449 | | |

| | | | | | | | 3,322,913 | | |

COMMERCIAL SERVICES & SUPPLIES - 0.0%† | |

Brambles Ltd. | | | 4,699 | | | | 45,073 | | |

COMMUNICATIONS EQUIPMENT - 0.0%† | |

ZTE Corp., Class A | | | 4,300 | | | | 26,958 | | |

CONSTRUCTION & ENGINEERING - 0.4% | |

Ferrovial SE | | | 844 | | | | 26,676 | | |

JGC Holdings Corp. | | | 1,600 | | | | 20,645 | | |

Kajima Corp. | | | 5,700 | | | | 85,578 | | |

Obayashi Corp. | | | 2,900 | | | | 24,960 | | |

| | | Shares/

Principal | | Fair

Value | |

CONSTRUCTION & ENGINEERING - 0.4% (Continued) | |

Stantec, Inc. | | | 1,638 | | | $ | 107,063 | | |

Vinci SA | | | 1,035 | | | | 120,123 | | |

Worley Ltd. | | | 11,540 | | | | 121,292 | | |

| | | | | | | | 506,337 | | |

CONSTRUCTION MATERIALS - 0.2% | |

Cemex SAB de CV* | | | 113,453 | | | | 80,043 | | |

Holcim AG* | | | 1,881 | | | | 126,571 | | |

James Hardie Industries PLC* | | | 2,268 | | | | 60,010 | | |

| | | | | | | | 266,624 | | |

CONSUMER FINANCE - 0.1% | |

JMT Network Services PCL, NVDR | | | 11,800 | | | | 12,481 | | |

Marui Group Co. Ltd. | | | 2,800 | | | | 48,586 | | |

Muangthai Capital PCL, NVDR | | | 8,800 | | | | 9,742 | | |

| | | | | | | | 70,809 | | |

CONSUMER STAPLES DISTRIBUTION & RETAIL - 1.4% | |

Aeon Co., Ltd. | | | 3,300 | | | | 67,171 | | |

Alimentation Couche-Tard, Inc. | | | 5,297 | | | | 271,925 | | |

Carrefour SA | | | 3,275 | | | | 62,010 | | |

Clicks Group Ltd. | | | 2,219 | | | | 30,692 | | |

Cosmos Pharmaceutical Corp. | | | 300 | | | | 30,242 | | |

Empire Co. Ltd., Class A | | | 5,873 | | | | 167,014 | | |

JD Health International, Inc.*,(a) | | | 1,550 | | | | 9,781 | | |

Jeronimo Martins SGPS SA | | | 721 | | | | 19,854 | | |

Koninklijke Ahold Delhaize NV | | | 840 | | | | 28,648 | | |

Lawson, Inc. | | | 9,600 | | | | 424,224 | | |

Raia Drogasil SA | | | 5,338 | | | | 32,676 | | |

Sendas Distribuidora SA | | | 11,898 | | | | 33,987 | | |

Seven & i Holdings Co. Ltd. | | | 2,000 | | | | 85,862 | | |

Tesco PLC | | | 125,232 | | | | 395,487 | | |

Tsuruha Holdings, Inc. | | | 2,200 | | | | 162,943 | | |

Wal-Mart de Mexico SAB de CV | | | 21,019 | | | | 83,203 | | |

| | | | | | 1,905,719 | | |

CONTAINERS & PACKAGING - 0.0%† | |

Smurfit Kappa Group PLC | | | 767 | | | | 25,547 | | |

DIVERSIFIED CONSUMER SERVICES - 0.0%† | |

Cogna Educacao SA* | | | 29,080 | | | | 19,592 | | |

New Oriental Education & Technology

Group, Inc.* | | | 3,200 | | | | 12,556 | | |

YDUQS Participacoes SA* | | | 6,220 | | | | 25,453 | | |

| | | | | | | | 57,601 | | |

DIVERSIFIED REITS - 0.1% | |

Charter Hall Group | | | 1,883 | | | | 13,424 | | |

GPT Group (The) | | | 14,419 | | | | 39,736 | | |

Mirvac Group | | | 22,830 | | | | 34,345 | | |

| | | | | | | | 87,505 | | |

See accompanying notes to financial statements.

17

Global Atlantic BlackRock Disciplined International Core Portfolio

Portfolio of Investments (Unaudited) (Continued)

June 30, 2023

| | | Shares/

Principal | | Fair

Value | |

DIVERSIFIED TELECOMMUNICATION SERVICES - 1.1% | |

BT Group PLC | | | 93,421 | | | $ | 145,316 | | |

China Tower Corp. Ltd., Class H (a) | | | 112,000 | | | | 12,434 | | |

Deutsche Telekom AG | | | 22,125 | | | | 482,188 | | |

Koninklijke KPN NV | | | 4,811 | | | | 17,158 | | |

KT Corp. | | | 2,015 | | | | 45,571 | | |

Nippon Telegraph & Telephone Corp. | | | 290,000 | | | | 342,097 | | |

Orange SA | | | 3,579 | | | | 41,788 | | |

Proximus SADP | | | 5,410 | | | | 40,277 | | |

Singapore Telecommunications Ltd. | | | 73,700 | | | | 136,144 | | |

Telecom Italia SpA/Milano (Common share)* | | | 55,635 | | | | 15,648 | | |

Telefonica SA | | | 22,338 | | | | 90,562 | | |

Telekom Malaysia BHD | | | 38,800 | | | | 40,816 | | |

Telenor ASA | | | 3,662 | | | | 37,189 | | |

Telstra Group Ltd. | | | 18,678 | | | | 53,462 | | |

| | | | | | | | 1,500,650 | | |

ELECTRIC UTILITIES - 1.1% | |

Acciona SA | | | 1,443 | | | | 244,648 | | |

CLP Holdings Ltd. | | | 3,500 | | | | 27,199 | | |

| CPFL Energia SA | | | 16,341 | | | | 115,986 | | |

EDP - Energias de Portugal SA | | | 41,123 | | | | 200,817 | | |

Enel SpA | | | 41,534 | | | | 279,494 | | |

Energisa SA | | | 4,781 | | | | 49,951 | | |

Iberdrola SA | | | 13,020 | | | | 169,748 | | |

Light SA* | | | 4,100 | | | | 8,091 | | |

SSE PLC | | | 12,342 | | | | 288,871 | | |

Tenaga Nasional BHD | | | 101,000 | | | | 195,833 | | |

| | | | | | | | 1,580,638 | | |

ELECTRICAL EQUIPMENT - 2.2% | |

ABB Ltd. | | | 26,332 | | | | 1,035,444 | | |

Contemporary Amperex Technology

Co. Ltd., Class A | | | 8,203 | | | | 258,363 | | |

Eve Energy Co. Ltd., Class A | | | 1,300 | | | | 10,827 | | |

Legrand SA | | | 296 | | | | 29,323 | | |

Mitsubishi Electric Corp. | | | 6,700 | | | | 93,963 | | |

Nidec Corp. | | | 5,300 | | | | 287,671 | | |

Schneider Electric SE | | | 4,777 | | | | 867,541 | | |

Siemens Energy AG* | | | 4,113 | | | | 72,604 | | |

Signify NV (a) | | | 3,987 | | | | 111,660 | | |

Sunwoda Electronic Co. Ltd., Class A | | | 18,400 | | | | 41,339 | | |

Suzhou Maxwell Technologies Co., Ltd.,

Class A | | | 960 | | | | 22,385 | | |

Vestas Wind Systems A/S* | | | 2,155 | | | | 57,297 | | |

WEG SA | | | 21,229 | | | | 166,435 | | |

Xinjiang Goldwind Science & Technology

Co. Ltd., Class H* | | | 6,200 | | | | 4,248 | | |

| | | | | | | | 3,059,100 | | |

ELECTRONIC EQUIPMENT, INSTRUMENTS & COMPONENTS - 0.9% | |

AAC Technologies Holdings, Inc. | | | 3,500 | | | | 8,236 | | |

Avary Holding Shenzhen Co. Ltd., Class A | | | 4,900 | | | | 16,385 | | |

| | | Shares/

Principal | | Fair

Value | |

ELECTRONIC EQUIPMENT, INSTRUMENTS & COMPONENTS - 0.9% (Continued) | |

BOE Technology Group Co. Ltd., Class A | | | 345,200 | | | $ | 194,364 | | |

Delta Electronics Thailand PCL, NVDR | | | 23,000 | | | | 59,681 | | |

Halma PLC | | | 1,002 | | | | 29,007 | | |

Hana Microelectronics PCL, NVDR | | | 8,400 | | | | 11,194 | | |

Keyence Corp. | | | 100 | | | | 46,944 | | |

LG Innotek Co. Ltd. | | | 177 | | | | 41,575 | | |

Luxshare Precision Industry Co. Ltd., Class A | | | 2,700 | | | | 12,061 | | |

Murata Manufacturing Co. Ltd. | | | 500 | | | | 28,491 | | |

Omron Corp. | | | 4,900 | | | | 297,251 | | |

Samsung Electro-Mechanics Co. Ltd. | | | 893 | | | | 97,931 | | |

Samsung SDI Co. Ltd. | | | 378 | | | | 191,919 | | |

Shimadzu Corp. | | | 3,000 | | | | 91,909 | | |

Spectris PLC | | | 636 | | | | 29,068 | | |

Sunny Optical Technology Group Co. Ltd. | | | 5,400 | | | | 53,851 | | |

TDK Corp. | | | 2,200 | | | | 84,737 | | |

| | | | | | | | 1,294,604 | | |

ENERGY EQUIPMENT & SERVICES - 0.0%† | |

Dialog Group BHD | | | 15,700 | | | | 6,929 | | |

ENTERTAINMENT - 0.4% | |

Bilibili, Inc., Class Z* | | | 660 | | | | 9,829 | | |

Krafton, Inc.* | | | 54 | | | | 7,983 | | |

NCSoft Corp. | | | 161 | | | | 36,045 | | |

NetEase, Inc. | | | 17,060 | | | | 332,205 | | |

Netmarble Corp.*,(a) | | | 287 | | | | 10,695 | | |

Nexon Co. Ltd. | | | 1,200 | | | | 22,807 | | |

Nintendo Co. Ltd. | | | 1,300 | | | | 58,841 | | |

Sea Ltd., ADR* | | | 462 | | | | 26,814 | | |

Tencent Music Entertainment Group, ADR* | | | 3,441 | | | | 25,395 | | |

Ubisoft Entertainment SA* | | | 2,677 | | | | 75,585 | | |

| | | | | | | | 606,199 | | |

FINANCIAL SERVICES - 1.3% | |

Adyen NV*,(a) | | | 89 | | | | 153,979 | | |

Banca Mediolanum SpA | | | 10,539 | | | | 95,227 | | |

Cielo SA | | | 53,228 | | | | 50,425 | | |

FirstRand Ltd. | | | 37,438 | | | | 135,751 | | |

Groupe Bruxelles Lambert NV | | | 2,248 | | | | 176,977 | | |

Industrivarden AB, Class A | | | 3,472 | | | | 96,047 | | |

Industrivarden AB, Class C | | | 11,145 | | | | 306,657 | | |

Investor AB, Class A | | | 2,067 | | | | 41,278 | | |

Investor AB, Class B | | | 13,973 | | | | 278,973 | | |

L E Lundbergforetagen AB, Class B | | | 1,692 | | | | 71,870 | | |

Mitsubishi HC Capital, Inc. | | | 26,500 | | | | 156,670 | | |

ORIX Corp. | | | 8,000 | | | | 144,602 | | |

Wendel SE | | | 227 | | | | 23,280 | | |

| | | | | | | | 1,731,736 | | |

FOOD PRODUCTS - 2.4% | |

Chocoladefabriken Lindt & Spruengli AG | | | 21 | | | | 263,835 | | |

Dali Foods Group Co. Ltd. (a) | | | 66,000 | | | | 29,477 | | |

See accompanying notes to financial statements.

18

Global Atlantic BlackRock Disciplined International Core Portfolio

Portfolio of Investments (Unaudited) (Continued)

June 30, 2023

| | | Shares/

Principal | | Fair

Value | |

FOOD PRODUCTS - 2.4% (Continued) | |