As filed with the Securities and Exchange Commission on March 8, 2021

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-23227

SYNTAX ETF TRUST

(Exact Name of Registrant as Specified in Charter)

One Liberty Plaza, 46th Floor

New York, NY 10006

(Address of Principal Executive Offices) (Zip Code)

Registrant’s Telephone Number, including Area Code: (212) 880-0200

Carly Arison, One Liberty Plaza, 46th Floor New York, NY 10006

(Name and Address of Agent for Service)

Copies to:

Kathleen H. Moriarty

Counsel to the Trust

Chapman & Cutler LLP

1270 Avenue of the Americas, 30th Floor

New York, New York 10020

Date of fiscal year end: December 31

Date of reporting period: December 31, 2020

| Item 1: | Report(s) to Shareholders. |

The Annual Report is attached.

ANNUAL REPORT

Syntax Stratified LargeCap ETF

Syntax Stratified MidCap ETF

Syntax Stratified SmallCap ETF

December 31, 2020

Beginning on January 1, 2021, as permitted by regulations adopted by the U.S. Securities and Exchange Commission, paper copies of a Fund’s annual and semi-annual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from the Fund (or from your financial intermediary, such as a broker-dealer or bank). Instead, the reports will be made available on the Fund’s website (www.syntaxadvisors.com), and you will be notified by mail each time a report is posted, and provided with a website link to access the report. If you already elected to receive reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications by contacting your financial intermediary.

You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. Your election to receive reports in paper will apply to all funds held in your account.

Syntax ETF Trust

Annual Report

December 31, 2020

Table of Contents

This report is not authorized for distribution to prospective investors in the Fund unless preceded or accompanied by an effective prospectus.

Dear Shareholder,

Enclosed is the report for the Syntax ETF Trust for the period ending December 31, 2020, together with Management's Discussion and Analysis for the Syntax Stratified LargeCap ETF, the Syntax Stratified MidCap ETF, and the Syntax Stratified SmallCap ETF. Also included is information about their respective indices - the Syntax Stratified LargeCap Index, the Syntax Stratified MidCap Index, and the Syntax Stratified SmallCap Index.

Syntax’s goal is to offer investors investment products that track Stratified Weight versions of major market indices. Our thesis is stratifying these indices provides diversification across business risks1. Accordingly, we are pleased to report that during 2020 we launched two new Stratified ETFs: The Syntax Stratified MidCap ETF (NYSE Arca Ticker: SMDY) began trading on January 16, 2020, and the Syntax Stratified SmallCap ETF (NYSE Arca Ticker: SSLY) began trading on May 28, 2020.

The first quarter of 2020 saw widespread selloffs in the domestic equity markets as the coronavirus (Covid-19) pandemic and resulting lockdowns sent shockwaves through the global economy. Investor fear and panic selling characterized the market’s mood. In the second quarter, despite the spread of the virus, investors returned to the equity markets, and we saw a broad-based recovery which included an unprecedented stimulus package enacted by Congress and the President. Late in the year, positive news regarding successful trials of several COVID-19 vaccines encouraged investors to shift towards riskier assets, leading to an equity market rally despite surging case numbers. 2020 ended much as it began, with volatility and uncertainty remaining as the U.S. Presidential election, civil unrest, and division left investors uncertain about the future.

Based on our analysis of market movements during the past year, we see the current market environment as one potentially favorable to investors using the Syntax Stratified Weight approach. Our research shows that the hardest hit sectors during a sell-off have generally been the best performers during the subsequent recovery. This is encouraging as the core of our Stratified Weight strategy is to spread exposure across business risk groups, instead of concentrating in the largest companies or most represented sectors and industries. In doing so, we believe our strategy will provide a more stable return by allowing investors to partake in the full economic opportunity of the reversal across sectors. Conversely, cap-weighted strategies fail to capture this reversal since they do not rebalance their weights, which leads to oversized positions in sectors with the lowest upside potential.

Although we are hopeful that 2021 brings less volatile economic and social conditions, we believe it prudent to note that the economic risks associated with the pandemic may continue. However, we are cautiously optimistic that the observed economic recovery will continue. We remain confident that the Stratified Weight approach is well positioned to benefit from continued expansion since it seeks to capture a fuller range of market opportunities by diversifying across business risks and avoiding concentrations in any one sector or industry.

We appreciate your investment in and support of The Syntax ETF Trust and look forward to serving your investment needs in the future.

1 Business risks are risks related to the nature of a company's business: what it does, who its customers are, what supplies it utilizes, and other such attributes.

Syntax Stratified LargeCap ETF (SSPY)

Manager’s Note

As an index fund, the Syntax Stratified LargeCap ETF (the “Fund”) seeks to track the returns (before fees and expenses) of its underlying index – the Syntax Stratified LargeCap Index (the “Index”). The Index reweights the constituents of the widely tracked S&P 500® to address the related business risk concentrations that occur in capitalization-weighted indices. Its goal is to deliver an unbiased return that is representative of all the business opportunities in the market, not just the largest ones.

When compared to capitalization-weighted and equal weighted strategies, the Stratified approach may provide the following potential advantages:

- Reduce the negative impact of a significant correction in an overweight sector.

- Increase the chance of participating in all sectors during a market rally.

- Capture a fuller range of market opportunities.

In accordance with its guidelines and procedures, Syntax, LLC (“Syntax” or the “Index Provider”) has contracted with S&P Opco, LLC (a subsidiary of S&P Dow Jones Indices LLC) to calculate and maintain the Index, which is a Stratified WeightTM version of the S&P 500 Index. Unlike the S&P 500 Index, which employs a market capitalization weighted methodology, the Index utilizes a patented investment technology to diversify the same constituents and use the same rebalancing schedule as the S&P 500, the primary difference is the weighting scheme applied. The Fund generally invests in all of the securities comprising the Index in proportion to their weightings in the Index.

For the year ending December 31, 2020, on a market price basis, the Fund returned 12.22%. On a net asset value (“NAV”) basis, the Fund returned 12.18%. During the same time period, the Index returned 12.38%. During the year, the Fund fully replicated the components of the Index; therefore, the Fund’s performance, on a NAV basis, differed from the return of the Index primarily due to fees and operating expenses that the Fund incurred during the period.

During this same time period, the S&P 500 Index returned 18.40% and the S&P 500 Equal Weight Index returned 12.83%. The S&P 500 is an unmanaged index weighted by market capitalization based on the average performance of approximately 505 equity securities. The S&P Equal Weight 500 is an unmanaged index and is the equal-weight

version of the S&P 500 Index. It includes the same companies as the S&P 500 Index, but each company is allocated an equal fixed weight of the index at each quarterly rebalance.

Both the S&P 500 Index and the S&P 500 Equal Weight Index were selected as performance comparators for their recognition in the marketplace. Their performance comparison is a useful measure for investors as a broad representation of the U.S. equity market using two different weighting methodologies: capitalization weighting and equal weighting. Both indices also use the same underlying universe as the Index. The performance of the Fund differed from the S&P 500 Index and the S&P 500 Equal Weight Index in part because the Fund employs a Stratified Weight methodology.

Syntax Stratified LargeCap ETF (SSPY)

Manager’s Note

| Top 10 Holdings and Portfolio Weights | |

Kroger Co.

| 0.77% |

Costco Wholesale Corp.

| 0.77% |

Walmart, Inc.

| 0.75% |

Sysco Corp.

| 0.75% |

Autodesk, Inc.

| 0.74% |

ANSYS, Inc.

| 0.74% |

Exxon Mobil Corp.

| 0.72% |

Adobe, Inc.

| 0.71% |

Microsoft Corp.

| 0.71% |

Chevron Corp.

| 0.70% |

| As of December 31, 2020. Holdings subject to change | |

| Sector Breakdown | |

Information Tools

| 12.82% |

Financials

| 12.75% |

Consumer Products Services

| 12.55% |

Healthcare

| 12.50% |

Information

| 12.49% |

Food

| 12.35% |

Industrials

| 12.27% |

Energy

| 12.03% |

Other Assets in Excess of Liabilities

| 0.24% |

| As of December 31, 2020. (% of the Fund’s Net Assets) |

Due to rounding, numbers presented may not add up precisely to the totals provided and percentages may not precisely reflect the absolute figures.

Syntax Stratified LargeCap ETF (SSPY)

Manager’s Note

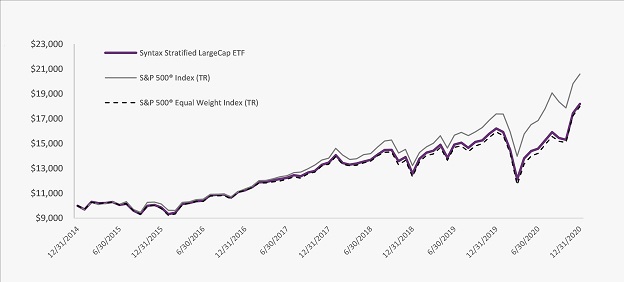

Performance: Growth of $10,000

Performance Return (%) As of December 31, 2020

| | Cumulative | Annualized | Calendar Year |

| | YTD | 4Q20 | 1Y | 3Y | 5Y | Since Fund

Inception | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 |

SSPY NAV (%)

| 12.18 | 17.77 | 12.18 | 10.56 | 13.04 | 10.49 | -1.44 | 14.11 | 19.73 | -6.57 | 28.93 | 12.18 |

SSPY Market Price (%)

| 12.22 | 17.60 | 12.22 | -- | -- | -- | -- | -- | -- | -- | 28.90 | 12.22 |

Syntax Stratified LargeCap Index (TR)

| 12.38 | 17.91 | 12.38 | 10.79 | -- | -- | -- | -- | 20.12 | -6.43 | 29.33 | 12.38 |

S&P 500 Index (TR)

| 18.40 | 12.15 | 18.40 | 14.18 | 15.22 | 12.79 | 1.38 | 11.96 | 21.83 | -4.38 | 31.49 | 18.40 |

S&P 500 Equal Weight Index (TR)

| 12.83 | 18.46 | 12.83 | 10.44 | 12.95 | 10.27 | -2.20 | 14.80 | 18.90 | -7.64 | 29.24 | 12.83 |

Past performance is no guarantee of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. The Growth of $10,000 chart represents a hypothetical investment based upon the historical performance of the Fund. It includes the reinvestment of dividends and capital gains at net asset value: actual returns may differ. Performance reflects contractual reimbursements in effect until May 1, 2021. In the absence of such reimbursements, performance would be reduced. The gross and net expense ratios of the Fund are 0.45% and 0.30%, respectively. Indexes are unmanaged and do not incur fees, expenses, and other costs. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than that shown here. Please see important disclosures relating to Portability of Performance on page 11. A privately offered fund managed by Syntax Advisors, LLC was reorganized into the Syntax Stratified Largecap ETF (“the Fund”) as of January 2, 2019 upon commencement of the ETF operations. For periods prior to the commencement of ETF operations, the Fund’s performance is that of the private fund. The Fund’s NAV price as of January 2, 2019 was used in calculating market price performance for January 2 and January 3, prior to the fund first trading on the New York Stock Exchange on January 4, 2019.

Syntax Stratified MidCap ETF (SMDY)

Manager’s Note

As an index fund, the Syntax Stratified MidCap ETF (the “Fund”) seeks to track the returns (before fees and expenses) of its underlying index – the Syntax Stratified MidCap Index (the “Index”). The Index reweights the constituents of the widely tracked S&P 400® to address the related business risk concentrations that occur in capitalization-weighted indices. Its goal is to deliver an unbiased return that is representative of all the business opportunities in the market, not just the largest ones.

When compared to capitalization-weighted and equal weighted strategies, the Stratified approach may provide the following potential advantages:

- Reduce the negative impact of a significant correction in an overweight sector.

- Increase the chance of participating in all sectors during a market rally.

- Capture a fuller range of market opportunities.

In accordance with its guidelines and procedures, Syntax, LLC (“Syntax” or the “Index Provider”) has contracted with S&P Opco, LLC (a subsidiary of S&P Dow Jones Indices LLC) to calculate and maintain the Index, which is a Stratified WeightTM version of the S&P 400 Index. Unlike the S&P 400 Index, which employs a market capitalization weighted methodology, the Index utilizes a patented investment technology to diversify the same constituents and use the same rebalancing schedule as the S&P 400, the primary difference is the weighting scheme applied. The Fund generally invests in all of the securities comprising the Index in proportion to their weightings in the Index.

Since inception on the close of January 16, 2020 through year-end December 31, 2020, on a net asset value (“NAV”) basis, the Fund returned 17.22%. During the same time period, the Index returned 17.79%. During the year, the Fund fully replicated the components of the Index; therefore, the Fund’s performance, on a NAV basis, differed from the return of the Index primarily due to fees and operating expenses that the Fund incurred during the period.

During this same time period, the S&P 400 Index returned 13.66% and the S&P 400 Equal Weight Index returned 15.77%. The S&P 400 is an unmanaged index weighted by market capitalization based on the average performance of approximately 400 equity securities. The S&P Equal Weight 400 is an unmanaged index and is the equal-weight

version of the S&P 400 Index. It includes the same companies as the S&P 400 Index, but each company is allocated an equal fixed weight of the index at each quarterly rebalance.

Both the S&P 400 Index and the S&P 400 Equal Weight Index were selected as performance comparators for their recognition in the marketplace. Their performance comparison is a useful measure for investors as a broad representation of the U.S. equity market using two different weighting methodologies: capitalization weighting and equal weighting. Both indices also use the same underlying universe as the Index. The performance of the Fund differed from the S&P 400 Index and the S&P 400 Equal Weight Index in part because the Fund seeks to track its Index that employs a Stratified Weight methodology.

Syntax Stratified MidCap ETF (SMDY)

Manager’s Note

| Top 10 Holdings and Portfolio Weights | |

Ciena Corp.

| 1.28% |

Lumentum Holdings, Inc.

| 1.27% |

Coherent, Inc.

| 0.86% |

Yelp, Inc.

| 0.86% |

National Instruments Corp.

| 0.85% |

Sabre Corp.

| 0.84% |

Grubhub, Inc.

| 0.82% |

PTC, Inc.

| 0.81% |

CMC Materials, Inc.

| 0.81% |

MKS Instruments, Inc.

| 0.79% |

| As of December 31, 2020. Holdings subject to change | |

| Sector Breakdown | |

Industrials

| 15.95% |

Healthcare

| 14.56% |

Financials

| 14.07% |

Information Tools

| 14.01% |

Information

| 13.83% |

Consumer Products Services

| 13.75% |

Food

| 6.95% |

Energy

| 6.62% |

Other Assets in Excess of Liabilities

| 0.26% |

| As of December 31, 2020. (% of the Fund’s Net Assets) |

Due to rounding, numbers presented may not add up precisely to the totals provided and percentages may not precisely reflect the absolute figures.

Syntax Stratified MidCap ETF (SMDY)

Manager’s Note

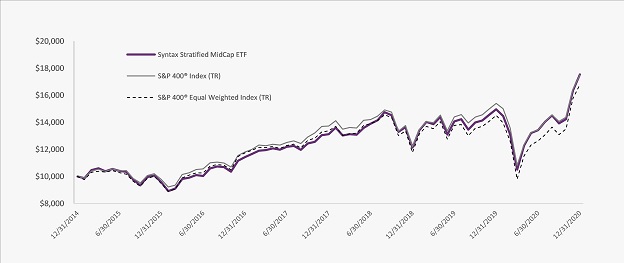

Performance: Growth of $10,000

Performance Return (%) As of December 31, 2020

| | Cumulative | Annualized | Calendar Year |

| | YTD | 4Q20 | 1Y | 3Y | 5Y | Since Fund

Inception | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 |

SMDY NAV (%)

| 17.22 | 26.00 | 17.22 | 10.15 | 12.85 | 9.82 | -4.12 | 19.25 | 14.82 | -7.58 | 23.35 | 17.22 |

SMDY Market Price (%)

| -- | 26.16 | -- | -- | -- | -- | -- | -- | -- | -- | -- | -- |

Syntax Stratified MidCap ETF (TR)

| 17.79 | 26.20 | 17.79 | 10.56 | -- | -- | -- | -- | 15.13 | -7.33 | 23.81 | 17.79 |

S&P 400 Index (TR)

| 13.66 | 24.37 | 13.66 | 8.45 | 12.35 | 9.79 | -2.18 | 20.74 | 16.24 | -11.08 | 26.20 | 13.66 |

S&P 400 Equal Weight Index (TR)

| 15.77 | 28.34 | 15.77 | 7.92 | 12.15 | 9.04 | -5.24 | 23.95 | 13.87 | -11.94 | 23.29 | 15.77 |

Past performance is no guarantee of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. The Growth of $10,000 chart represents a hypothetical investment based upon the historical performance of the Fund. It includes the reinvestment of dividends and capital gains at net asset value: actual returns may differ. Performance reflects contractual reimbursements in effect until May 1, 2021. In the absence of such reimbursements, performance would be reduced. The gross and net expense ratios of the Fund are 0.45% and 0.30%, respectively. Indexes are unmanaged and do not incur fees, expenses, and other costs. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than that shown here. Please see important disclosures relating to Portability of Performance on page 11. A privately offered fund managed by Syntax Advisors, LLC was reorganized into the Syntax Stratified Midcap ETF (“the Fund”) as of January 16, 2020 upon commencement of the ETF operations. For periods prior to the commencement of ETF operations, the Fund’s performance is that of the private fund.

Syntax Stratified SmallCap ETF (SSLY)

Manager’s Note

As an index fund, the Syntax Stratified SmallCap ETF (the “Fund”) seeks to track the returns (before fees and expenses) of its underlying index – the Syntax Stratified SmallCap Index (the “Index”). The Index reweights the constituents of the widely tracked S&P 600® to address the related business risk concentrations that occur in capitalization-weighted indices. Its goal is to deliver an unbiased return that is representative of all the business opportunities in the market, not just the largest ones.

When compared to capitalization-weighted and equal weighted strategies, the Stratified approach may provide the following potential advantages:

- Reduce the negative impact of a significant correction in an overweight sector.

- Increase the chance of participating in all sectors during a market rally.

- Capture a fuller range of market opportunities.

In accordance with its guidelines and procedures, Syntax, LLC (“Syntax” or the “Index Provider”) has contracted with S&P Opco, LLC (a subsidiary of S&P Dow Jones Indices LLC) to calculate and maintain the Index, which is a Stratified WeightTM version of the S&P 600 Index. Unlike the S&P 600 Index, which employs a market capitalization weighted methodology, the Index utilizes a patented investment technology to diversify the same constituents and use the same rebalancing schedule as the S&P 600, the primary difference is the weighting scheme applied. The Fund generally invests in all of the securities comprising the Index in proportion to their weightings in the Index.

Since inception on the close of May 28, 2020 through year-end December 31, 2020, on a market price basis, the Fund returned 45.10%. On a net asset value (“NAV”) basis, the Fund returned 44.82%. During the same time period, the Index returned 45.77%. The Fund’s performance, on a NAV basis, differed from the return of the Index due to differences in the securities that were used to seed the Fund, as well as fees and operating expenses.

During this same time period, the S&P 600 Index returned 39.11% and the S&P 600 Equal Weight Index returned 45.85%. The S&P 600 is an unmanaged index weighted by market capitalization based on the average performance of approximately 601 equity securities. The S&P Equal Weight 600 is an unmanaged index and is the equal-weight version of the S&P 600 Index. It includes the same

companies as the S&P 600 Index, but each company is allocated an equal fixed weight of the index at each quarterly rebalance.

Both the S&P 600 Index and the S&P 600 Equal Weight Index were selected as performance comparators for their recognition in the marketplace. Their performance comparison is a useful measure for investors as a broad representation of the U.S. equity market using two different weighting methodologies: capitalization weighting and equal weighting. Both indices also use the same underlying universe as the Index. The performance of the Fund differed from the S&P 600 Index and the S&P 600 Equal Weight Index in part because the Fund seeks to track its Index that employs a Stratified Weight methodology.

Syntax Stratified SmallCap ETF (SSLY)

Manager’s Note

| Top 10 Holdings and Portfolio Weights | |

Liquidity Services, Inc.

| 0.63% |

Covetrus, Inc.

| 0.62% |

Inter Parfums, Inc.

| 0.62% |

PetMed Express, Inc.

| 0.62% |

Shutterstock, Inc.

| 0.61% |

California Water Service Group

| 0.60% |

American States Water Co.

| 0.59% |

Avista Corp.

| 0.59% |

Chesapeake Utilities Corp.

| 0.59% |

Cogent Communications Holdings, Inc.

| 0.59% |

| As of December 31, 2020. Holdings subject to change | |

| Sector Breakdown | |

Information Tools

| 14.77% |

Healthcare

| 14.55% |

Financials

| 14.40% |

Industrials

| 14.28% |

Consumer Products Services

| 14.13% |

Information

| 13.91% |

Food

| 7.11% |

Energy

| 6.66% |

Other Assets in Excess of Liabilities

| 0.19% |

| As of December 31, 2020. (% of the Fund’s Net Assets) |

Due to rounding, numbers presented may not add up precisely to the totals provided and percentages may not precisely reflect the absolute figures.

Syntax Stratified SmallCap ETF (SSLY)

Manager’s Note

Performance: Growth of $10,000

Performance Return (%) As of December 31, 2020

| | YTD | 4Q20 | 1Y | 3Y | 5Y | Since Fund

Inception |

SSLY NAV (%)

| 44.82 | 31.78 | -- | -- | -- | 44.82 |

SSLY Market Price (%)

| 45.10 | 32.03 | -- | -- | -- | 45.10 |

Syntax Stratified SmallCap ETF (TR)

| 45.77 | 31.96 | -- | -- | -- | 45.77 |

S&P 600 Index (TR)

| 39.11 | 31.31 | -- | -- | -- | 39.11 |

S&P 600 Equal Weight Index (TR)

| 45.85 | 35.11 | -- | -- | -- | 45.85 |

Past performance is no guarantee of future results. Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares. The Growth of $10,000 chart represents a hypothetical investment based upon the historical performance of the Fund. It includes the reinvestment of dividends and capital gains at net asset value: actual returns may differ. Performance reflects contractual reimbursements in effect until May 1, 2021. In the absence of such reimbursements, performance would be reduced. The gross and net expense ratios of the Fund are 0.45% and 0.30%, respectively. Indexes are unmanaged and do not incur fees, expenses, and other costs. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than that shown here. Please see important disclosures on below.Performance data current to the most recent month end is available by calling (866) 972-4492. The Fund is subject to certain risks, including but not limited to, equity securities risk, small-capitalization risk, index tracking risk, passive strategy/index risk, and market trading risk. Investing involves risk, including possible loss of principal.

Syntax Stratified SmallCap ETF (SSLY)

Manager’s Note

Shares are bought and sold at market price (not NAV) and are not individually redeemed from the Fund. Investors may purchase or sell individual shares on an exchange on which they are listed. Market returns are based upon the midpoint of the bid/ask spread at 4:00 p.m. Eastern time (when NAV is normally determined for most ETFs), and do not represent the returns you would receive if you traded shares at other times. Please see the prospectus for more details.

Portability of Performance: A privately offered fund managed by Syntax Advisors, LLC was reorganized into the Syntax Stratified LargeCap ETF (“the Fund”) as of January 2, 2019 upon commencement of the ETF operations. For periods prior to the commencement of ETF operations, the Fund’s performance is that of the private fund. The returns were calculated using the methodology the SEC requires of registered funds. However, since the private fund did not calculate its returns on a per share basis, its returns have been calculated on its total net asset value. While the performance of the private fund is net of all fees and expenses, the performance of the private fund has not been restated to reflect the management and fee waivers applicable to the Fund. The Fund may be subject to higher fees which would negatively impact performance. The private fund began operations on January 1, 2015 and, on January 2, 2019, was reorganized into the Fund. Prior to the reorganization, the private fund had investment objectives, policies and strategies that were, in all material respects, the same as those of the Fund, and was managed in a manner that, in all material respects, complied with the investment guidelines and restrictions of the Fund. However, as a registered investment company, the Fund is subject to certain restrictions under the Investment Company Act of 1940 (the “1940 Act”) and the Internal Revenue Code of 1986 (the “Internal Revenue Code”) which did not apply to the private fund. If the private fund had been subject to the provisions of the 1940 Act and the Internal Revenue Code, its performance could have been adversely affected. However, these restrictions are not expected to have a material effect on the Fund’s investment performance.

Portability of Performance: A privately offered fund managed by Syntax Advisors, LLC was reorganized into the Syntax Stratified MidCap ETF (“the Fund”) as of January 16, 2020 upon commencement of the ETF operations. For periods prior to the commencement of ETF operations, the Fund’s performance is that of the private fund. The returns were calculated using the methodology the SEC requires of registered funds. However, since the private fund did not calculate its returns on a per share basis, its returns have been calculated on its total net asset value. While the performance of the private fund is net of all fees and expenses, the performance of the private fund has not been restated to reflect the management and fee waivers applicable to the Fund. The Fund may be subject to higher fees which would negatively impact performance. The private fund began operations on January 1, 2015 and, on January 16, 2020, was reorganized into the Fund. Prior to the reorganization, the private fund had investment objectives, policies and strategies that were, in all material respects, the same as those of the Fund, and was managed in a manner that, in all material respects, complied with the investment guidelines and restrictions of the Fund. However, as a registered investment company, the Fund is subject to certain restrictions under the Investment Company Act of 1940 (the “1940 Act”) and the Internal Revenue Code of 1986 (the “Internal Revenue Code”) which did not apply to the private fund. If the private fund had been subject to the provisions of the 1940 Act and the Internal Revenue Code, its performance could have been adversely affected. However, these restrictions are not expected to have a material effect on the Fund’s investment performance.

The Syntax Stratified LargeCap Index, Syntax Stratified MidCap Index, and Syntax Stratified SmallCap Index™ (“the Indices”) are the property of Syntax, LLC, which has contracted with S&P Opco, LLC (a subsidiary of S&P Dow Jones Indices LLC) to calculate and maintain the Indices. The Indices are not sponsored by S&P Dow Jones Indices or its affiliates or its third-party licensors (collectively, “S&P Dow Jones Indices”). S&P Dow Jones Indices will not be liable for any errors or omissions in calculating the Index. “Calculated by S&P Dow Jones Indices” and the related stylized mark(s) are service marks of S&P Dow Jones Indices and have been licensed for use by Syntax, LLC, the parent company of Syntax Advisors, LLC. S&P® is a registered trademark of Standard & Poor’s Financial Services LLC (“SPFS”), and Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”).

The Syntax Stratified LargeCap Index, Syntax Stratified MidCap Index, and Syntax Stratified SmallCap Index™ are the property of Syntax, LLC, the Fund’s index provider. Syntax®, Stratified®, Stratified Indices®, Stratified Weight™, and FIS™ are trademarks or registered trademarks of Locus LP. Performance of an index is not illustrative of any particular investment. It is not possible to invest directly in an index.

This report is submitted for the general information of the shareholders of the Funds. It is not authorized for distribution to prospective investors unless preceded or accompanied by an effective prospectus, which includes information regarding the Funds’ risks, objectives, fees and expenses, experience of its management, and other information.

This report is only intended for the recipient it is addressed and delivered to by Syntax Advisors, LLC and may not be redistributed without prior written consent. The report is provided for informational purposes and is not intended to be, nor should it be construed or used as an offer to sell, or a solicitation of any offer to buy shares or limited partnership interests in any funds managed by Syntax Advisors, LLC. These securities shall not be offered or sold in any jurisdiction in which such offer, solicitation or sale would be unlawful until the requirements of the laws of such jurisdiction have been satisfied. If any offer is made, it shall be pursuant to the offering documents prepared by or on behalf of a specific fund which contains detailed information concerning the investment terms and the risks, fees and expenses associated with an investment in that fund. In the case of any inconsistency between the descriptions or terms in this document and the offering documents, the offering documents shall control.

Index performance does not represent actual fund or portfolio performance and such performance does not reflect the actual investment experience of any investor. An investor cannot invest directly in an index. In addition, the results actual investors might have achieved would have differed from those shown because of differences in the timing, amounts of their investments, and fees and expenses associated with an investment in a portfolio invested in accordance with an index. None of the Syntax Indices or the benchmark indices portrayed herein charge management fees or incur brokerage expenses, and no such fees or expenses were deducted from the performance shown; provided, however, that the returns of any investment portfolio invested in accordance with such indices would be net of such fees and expenses. Additionally, none of these indices lend securities, and no revenues from securities lending were added to the performance shown.

THESE MATERIALS DO NOT CONSTITUTE AN OFFER OR SOLICITATION TO BUY ANY SECURITIES OR TO PARTICIPATE IN ANY PARTICULAR TRADING STRATEGY.

Syntax Stratified LargeCap ETF

Schedule of Investments

December 31, 2020

| Security Description | Shares | Value |

| COMMON STOCK—99.8% | | |

3M Co.

| 350 | $61,177 |

A O Smith Corp.

| 950 | 52,079 |

Abbott Laboratories

| 1,333 | 145,950 |

AbbVie, Inc.

| 618 | 66,219 |

ABIOMED, Inc.(a)

| 84 | 27,233 |

Accenture PLC, Class A

| 193 | 50,414 |

Activision Blizzard, Inc.

| 1,705 | 158,309 |

Adobe, Inc.(a)

| 599 | 299,572 |

Advance Auto Parts, Inc.

| 406 | 63,949 |

Advanced Micro Devices, Inc.(a)

| 519 | 47,597 |

AES Corp.

| 10,116 | 237,726 |

Aflac, Inc.

| 1,589 | 70,663 |

Agilent Technologies, Inc.

| 601 | 71,212 |

Air Products and Chemicals, Inc.

| 75 | 20,492 |

Akamai Technologies, Inc.(a)

| 1,378 | 144,676 |

Alaska Air Group, Inc.

| 1,285 | 66,820 |

Albemarle Corp.

| 147 | 21,685 |

Alexandria Real Estate Equities, Inc., REIT

| 205 | 36,535 |

Alexion Pharmaceuticals, Inc.(a)

| 545 | 85,151 |

Align Technology, Inc.(a)

| 103 | 55,041 |

Allegion PLC

| 327 | 38,056 |

Alliant Energy Corp.

| 691 | 35,607 |

Allstate Corp.

| 685 | 75,302 |

Alphabet, Inc., Class A(a)

| 53 | 92,890 |

Alphabet, Inc., Class C(a)

| 53 | 92,850 |

Altria Group, Inc.

| 3,732 | 153,012 |

Amazon.com, Inc.(a)

| 22 | 71,652 |

Amcor PLC

| 3,116 | 36,675 |

Ameren Corp.

| 461 | 35,986 |

American Airlines Group, Inc.

| 3,768 | 59,421 |

American Electric Power Co., Inc.

| 1,293 | 107,668 |

American Express Co.

| 158 | 19,104 |

American International Group, Inc.

| 2,757 | 104,380 |

American Tower Corp., REIT

| 110 | 24,691 |

American Water Works Co., Inc.

| 963 | 147,792 |

Ameriprise Financial, Inc.

| 211 | 41,004 |

AmerisourceBergen Corp.

| 1,091 | 106,656 |

AMETEK, Inc.

| 302 | 36,524 |

Amgen, Inc.

| 288 | 66,217 |

Amphenol Corp., Class A

| 611 | 79,900 |

Analog Devices, Inc.

| 1,009 | 149,060 |

ANSYS, Inc.(a)

| 852 | 309,958 |

Anthem, Inc.

| 364 | 116,877 |

Aon PLC, Class A

| 94 | 19,859 |

Apache Corp.

| 1,480 | 21,001 |

Apple, Inc.

| 1,163 | 154,318 |

Applied Materials, Inc.

| 807 | 69,644 |

Aptiv PLC

| 1,313 | 171,071 |

Archer-Daniels-Midland Co.

| 4,293 | 216,410 |

Arista Networks, Inc.(a)

| 388 | 112,741 |

Arthur J Gallagher & Co.

| 159 | 19,670 |

| Security Description | Shares | Value |

Assurant, Inc.

| 537 | $73,150 |

AT&T, Inc.

| 3,453 | 99,308 |

Atmos Energy Corp.

| 1,441 | 137,515 |

Autodesk, Inc.(a)

| 1,022 | 312,057 |

Automatic Data Processing, Inc.

| 364 | 64,137 |

AutoZone, Inc.(a)

| 54 | 64,014 |

AvalonBay Communities, Inc., REIT

| 377 | 60,482 |

Avery Dennison Corp.

| 180 | 27,920 |

Baker Hughes Co.

| 4,720 | 98,412 |

Ball Corp.

| 385 | 35,874 |

Bank of America Corp.

| 1,872 | 56,740 |

Bank of New York Mellon Corp.

| 1,180 | 50,079 |

Baxter International, Inc.

| 269 | 21,585 |

Becton Dickinson and Co.

| 87 | 21,769 |

Berkshire Hathaway, Inc., Class B(a)

| 947 | 219,581 |

Best Buy Co., Inc.

| 1,065 | 106,276 |

Biogen, Inc.(a)

| 274 | 67,092 |

Bio-Rad Laboratories, Inc., Class A(a)

| 93 | 54,213 |

BlackRock, Inc.

| 61 | 44,014 |

Boeing Co.

| 312 | 66,787 |

Booking Holdings, Inc.(a)

| 48 | 106,909 |

BorgWarner, Inc.

| 4,391 | 169,668 |

Boston Properties, Inc., REIT

| 359 | 33,936 |

Boston Scientific Corp.(a)

| 1,593 | 57,268 |

Bristol-Myers Squibb Co.

| 1,085 | 67,303 |

Broadcom, Inc.

| 234 | 102,457 |

Broadridge Financial Solutions, Inc.

| 320 | 49,024 |

Brown-Forman Corp., Class B

| 1,402 | 111,361 |

Cabot Oil & Gas Corp.

| 6,291 | 102,417 |

Cadence Design Systems, Inc.(a)

| 1,205 | 164,398 |

Campbell Soup Co.

| 1,941 | 93,847 |

Capital One Financial Corp.

| 1,546 | 152,822 |

Cardinal Health, Inc.

| 1,972 | 105,620 |

CarMax, Inc.(a)

| 684 | 64,611 |

Carnival Corp.

| 1,674 | 36,259 |

Carrier Global Corp.

| 960 | 36,211 |

Catalent, Inc.(a)

| 1,499 | 156,001 |

Caterpillar, Inc.

| 396 | 72,080 |

Cboe Global Markets, Inc.

| 221 | 20,580 |

CBRE Group, Inc., Class A(a)

| 288 | 18,063 |

CDW Corp.

| 349 | 45,995 |

Celanese Corp.

| 216 | 28,067 |

Centene Corp.(a)

| 1,881 | 112,916 |

CenterPoint Energy, Inc.

| 4,922 | 106,512 |

CenturyLink, Inc.

| 13,986 | 136,363 |

Cerner Corp.

| 638 | 50,070 |

CF Industries Holdings, Inc.

| 906 | 35,071 |

CH Robinson Worldwide, Inc.

| 381 | 35,764 |

Charles Schwab Corp.

| 2,166 | 114,885 |

Charter Communications, Inc., Class A(a)

| 219 | 144,879 |

Chevron Corp.

| 3,474 | 293,379 |

Chipotle Mexican Grill, Inc.(a)

| 166 | 230,194 |

See accompanying notes to financial statements.

Syntax Stratified LargeCap ETF

Schedule of Investments (continued)

December 31, 2020

| Security Description | Shares | Value |

Chubb Ltd.

| 556 | $85,580 |

Church & Dwight Co., Inc.

| 2,493 | 217,464 |

Cigna Corp.

| 545 | 113,458 |

Cincinnati Financial Corp.

| 1,065 | 93,049 |

Cintas Corp.

| 229 | 80,942 |

Cisco Systems, Inc.

| 2,414 | 108,026 |

Citigroup, Inc.

| 907 | 55,926 |

Citizens Financial Group, Inc.

| 671 | 23,995 |

Citrix Systems, Inc.

| 487 | 63,359 |

Clorox Co.

| 1,062 | 214,439 |

CME Group, Inc.

| 108 | 19,661 |

CMS Energy Corp.

| 601 | 36,667 |

Coca-Cola Co.

| 3,007 | 164,904 |

Cognizant Technology Solutions Corp., Class A

| 605 | 49,580 |

Colgate-Palmolive Co.

| 2,528 | 216,169 |

Comcast Corp., Class A

| 2,801 | 146,772 |

Comerica, Inc.

| 1,624 | 90,717 |

Conagra Brands, Inc.

| 2,594 | 94,058 |

Concho Resources, Inc.

| 374 | 21,823 |

ConocoPhillips

| 546 | 21,835 |

Consolidated Edison, Inc.

| 1,462 | 105,659 |

Constellation Brands, Inc., Class A

| 522 | 114,344 |

Cooper Companies, Inc.

| 160 | 58,131 |

Copart, Inc.(a)

| 810 | 103,073 |

Corning, Inc.

| 2,250 | 81,000 |

Corteva, Inc.

| 928 | 35,932 |

Costco Wholesale Corp.

| 854 | 321,770 |

Crown Castle International Corp., REIT

| 151 | 24,038 |

CSX Corp.

| 295 | 26,771 |

Cummins, Inc.

| 161 | 36,563 |

CVS Health Corp.

| 3,987 | 272,312 |

Danaher Corp.

| 237 | 52,647 |

Darden Restaurants, Inc.

| 1,899 | 226,209 |

DaVita, Inc.(a)

| 437 | 51,304 |

Deere & Co.

| 278 | 74,796 |

Delta Air Lines, Inc.

| 1,537 | 61,803 |

DENTSPLY SIRONA, Inc.

| 406 | 21,258 |

Devon Energy Corp.

| 6,621 | 104,678 |

DexCom, Inc.(a)

| 153 | 56,567 |

Diamondback Energy, Inc.

| 474 | 22,942 |

Digital Realty Trust, Inc., REIT

| 1,093 | 152,484 |

Discover Financial Services

| 1,710 | 154,806 |

Discovery, Inc., Class A(a)

| 1,477 | 44,443 |

Discovery, Inc., Class C(a)

| 1,679 | 43,973 |

DISH Network Corp., Class A(a)

| 2,972 | 96,114 |

Dollar General Corp.

| 343 | 72,133 |

Dollar Tree, Inc.(a)

| 667 | 72,063 |

Dominion Energy, Inc.

| 1,430 | 107,536 |

Domino's Pizza, Inc.

| 559 | 214,354 |

Dover Corp.

| 503 | 63,504 |

Dow, Inc.

| 530 | 29,415 |

| Security Description | Shares | Value |

DR Horton, Inc.

| 1,530 | $105,448 |

DTE Energy Co.

| 853 | 103,563 |

Duke Energy Corp.

| 390 | 35,708 |

Duke Realty Corp., REIT

| 620 | 24,781 |

DuPont de Nemours, Inc.

| 305 | 21,689 |

DXC Technology Co.

| 1,986 | 51,140 |

Eastman Chemical Co.

| 201 | 20,156 |

Eaton Corp. PLC

| 694 | 83,377 |

eBay, Inc.

| 1,291 | 64,873 |

Ecolab, Inc.

| 93 | 20,121 |

Edison International

| 1,703 | 106,982 |

Edwards Lifesciences Corp.(a)

| 636 | 58,022 |

Electronic Arts, Inc.

| 1,053 | 151,211 |

Eli Lilly and Co.

| 413 | 69,731 |

Emerson Electric Co.

| 160 | 12,859 |

Entergy Corp.

| 1,040 | 103,834 |

EOG Resources, Inc.

| 446 | 22,242 |

Equifax, Inc.

| 154 | 29,697 |

Equinix, Inc., REIT

| 205 | 146,407 |

Equity Residential, REIT

| 1,038 | 61,533 |

Essex Property Trust, Inc., REIT

| 250 | 59,355 |

Estee Lauder Companies, Inc., Class A

| 873 | 232,384 |

Etsy, Inc.(a)

| 372 | 66,183 |

Everest Re Group Ltd.

| 370 | 86,613 |

Evergy, Inc.

| 647 | 35,915 |

Eversource Energy

| 414 | 35,815 |

Exelon Corp.

| 5,196 | 219,375 |

Expedia Group, Inc.

| 772 | 102,213 |

Expeditors International of Washington, Inc.

| 395 | 37,568 |

Extra Space Storage, Inc., REIT

| 553 | 64,071 |

Exxon Mobil Corp.

| 7,331 | 302,184 |

F5 Networks, Inc.(a)

| 621 | 109,259 |

Facebook, Inc., Class A(a)

| 697 | 190,393 |

Fastenal Co.

| 933 | 45,558 |

Federal Realty Investment Trust, REIT

| 317 | 26,983 |

FedEx Corp.

| 122 | 31,674 |

Fidelity National Information Services, Inc.

| 162 | 22,917 |

Fifth Third Bancorp

| 871 | 24,013 |

First Republic Bank

| 659 | 96,827 |

FirstEnergy Corp.

| 3,521 | 107,778 |

Fiserv, Inc.(a)

| 206 | 23,455 |

FleetCor Technologies, Inc.(a)

| 70 | 19,098 |

FLIR Systems, Inc.

| 3,834 | 168,044 |

Flowserve Corp.

| 1,731 | 63,787 |

FMC Corp.

| 305 | 35,054 |

Ford Motor Co.

| 11,859 | 104,241 |

Fortinet, Inc.(a)

| 495 | 73,522 |

Fortive Corp.

| 194 | 13,739 |

Fortune Brands Home & Security, Inc.

| 641 | 54,947 |

Fox Corp., Class A

| 1,462 | 42,573 |

Fox Corp., Class B(a)

| 1,491 | 43,060 |

Franklin Resources, Inc.

| 1,673 | 41,808 |

See accompanying notes to financial statements.

Syntax Stratified LargeCap ETF

Schedule of Investments (continued)

December 31, 2020

| Security Description | Shares | Value |

Freeport-McMoRan, Inc.

| 5,795 | $150,786 |

Gap, Inc.

| 4,104 | 82,860 |

Garmin Ltd.

| 1,197 | 143,233 |

Gartner, Inc.(a)

| 309 | 49,499 |

General Dynamics Corp.

| 473 | 70,392 |

General Electric Co.

| 5,477 | 59,152 |

General Mills, Inc.

| 1,545 | 90,846 |

General Motors Co.

| 2,550 | 106,182 |

Genuine Parts Co.

| 471 | 47,303 |

Gilead Sciences, Inc.

| 1,082 | 63,037 |

Global Payments, Inc.

| 101 | 21,757 |

Globe Life, Inc.

| 761 | 72,265 |

Goldman Sachs Group, Inc.

| 447 | 117,878 |

Halliburton Co.

| 3,598 | 68,002 |

Hanesbrands, Inc.

| 6,137 | 89,477 |

Hartford Financial Services Group, Inc.

| 2,317 | 113,487 |

Hasbro, Inc.

| 901 | 84,280 |

HCA Healthcare, Inc.

| 606 | 99,663 |

Healthpeak Properties, Inc., REIT

| 3,243 | 98,036 |

Henry Schein, Inc.(a)

| 1,529 | 102,229 |

Hershey Co.

| 540 | 82,258 |

Hess Corp.

| 420 | 22,172 |

Hewlett Packard Enterprise Co.

| 8,923 | 105,738 |

Hilton Worldwide Holdings, Inc.

| 455 | 50,623 |

HollyFrontier Corp.

| 5,838 | 150,912 |

Hologic, Inc.(a)

| 721 | 52,510 |

Home Depot, Inc.

| 404 | 107,310 |

Honeywell International, Inc.

| 285 | 60,620 |

Hormel Foods Corp.

| 4,530 | 211,143 |

Host Hotels & Resorts, Inc., REIT

| 3,276 | 47,928 |

Howmet Aerospace, Inc.

| 1,348 | 38,472 |

HP, Inc.

| 9,258 | 227,654 |

Humana, Inc.

| 291 | 119,389 |

Huntington Bancshares, Inc.

| 1,838 | 23,214 |

Huntington Ingalls Industries, Inc.

| 401 | 68,362 |

IDEX Corp.

| 331 | 65,935 |

IDEXX Laboratories, Inc.(a)

| 118 | 58,985 |

IHS Markit Ltd.

| 531 | 47,700 |

Illinois Tool Works, Inc.

| 300 | 61,164 |

Illumina, Inc.(a)

| 210 | 77,700 |

Incyte Corp.(a)

| 810 | 70,454 |

Ingersoll Rand, Inc.(a)

| 1,446 | 65,880 |

Intel Corp.

| 956 | 47,628 |

Intercontinental Exchange, Inc.

| 173 | 19,945 |

International Business Machines Corp.

| 382 | 48,086 |

International Flavors & Fragrances, Inc.

| 184 | 20,027 |

International Paper Co.

| 550 | 27,346 |

Interpublic Group of Companies, Inc.

| 1,986 | 46,711 |

Intuit, Inc.

| 173 | 65,714 |

Intuitive Surgical, Inc.(a)

| 27 | 22,089 |

Invesco Ltd.

| 2,282 | 39,775 |

IPG Photonics Corp.(a)

| 66 | 14,770 |

| Security Description | Shares | Value |

IQVIA Holdings, Inc.(a)

| 424 | $75,968 |

Iron Mountain, Inc., REIT

| 785 | 23,142 |

J M Smucker Co.

| 795 | 91,902 |

Jack Henry & Associates, Inc.

| 153 | 24,784 |

Jacobs Engineering Group, Inc.

| 1,477 | 160,934 |

JB Hunt Transport Services, Inc.

| 255 | 34,846 |

Johnson & Johnson

| 935 | 147,150 |

Johnson Controls International PLC

| 1,344 | 62,617 |

JPMorgan Chase & Co.

| 449 | 57,054 |

Juniper Networks, Inc.

| 4,882 | 109,894 |

Kansas City Southern

| 136 | 27,762 |

Kellogg Co.

| 1,292 | 80,401 |

KeyCorp

| 1,500 | 24,615 |

Keysight Technologies, Inc.(a)

| 283 | 37,381 |

Kimberly-Clark Corp.

| 1,573 | 212,088 |

Kimco Realty Corp., REIT

| 1,933 | 29,014 |

Kinder Morgan, Inc.

| 9,675 | 132,257 |

KLA Corp.

| 276 | 71,459 |

Kraft Heinz Co.

| 2,693 | 93,339 |

Kroger Co.

| 10,239 | 325,191 |

L Brands, Inc.

| 2,160 | 80,330 |

L3Harris Technologies, Inc.

| 846 | 159,911 |

Laboratory Corp. of America Holdings(a)

| 234 | 47,631 |

Lam Research Corp.

| 144 | 68,007 |

Lamb Weston Holdings, Inc.

| 1,188 | 93,543 |

Las Vegas Sands Corp.

| 839 | 50,004 |

Leggett & Platt, Inc.

| 1,298 | 57,501 |

Leidos Holdings, Inc.

| 453 | 47,619 |

Lennar Corp., Class A

| 1,472 | 112,211 |

Lincoln National Corp.

| 1,388 | 69,830 |

Linde PLC(a)

| 80 | 21,081 |

Live Nation Entertainment, Inc.(a)

| 504 | 37,034 |

LKQ Corp.(a)

| 1,748 | 61,600 |

Lockheed Martin Corp.

| 195 | 69,221 |

Loews Corp.

| 4,899 | 220,553 |

Lowe's Companies, Inc.

| 676 | 108,505 |

LyondellBasell Industries N.V., Class A

| 323 | 29,606 |

M&T Bank Corp.

| 187 | 23,805 |

Marathon Oil Corp.

| 3,369 | 22,471 |

Marathon Petroleum Corp.

| 3,740 | 154,686 |

MarketAxess Holdings, Inc.

| 36 | 20,540 |

Marriott International, Inc., Class A

| 372 | 49,074 |

Marsh & McLennan Companies, Inc.

| 166 | 19,422 |

Martin Marietta Materials, Inc.

| 265 | 75,252 |

Masco Corp.

| 986 | 54,161 |

Mastercard, Inc., Class A

| 60 | 21,416 |

Maxim Integrated Products, Inc.

| 1,694 | 150,173 |

McCormick & Co., Inc.

| 982 | 93,879 |

McDonald's Corp.

| 1,031 | 221,232 |

McKesson Corp.

| 613 | 106,613 |

Medtronic PLC

| 190 | 22,257 |

Merck & Co., Inc.

| 792 | 64,786 |

See accompanying notes to financial statements.

Syntax Stratified LargeCap ETF

Schedule of Investments (continued)

December 31, 2020

| Security Description | Shares | Value |

MetLife, Inc.

| 1,512 | $70,988 |

Mettler-Toledo International, Inc.(a)

| 13 | 14,816 |

MGM Resorts International

| 1,576 | 49,660 |

Microchip Technology, Inc.

| 338 | 46,681 |

Micron Technology, Inc.(a)

| 674 | 50,671 |

Microsoft Corp.

| 1,338 | 297,598 |

Mid-America Apartment Communities, Inc., REIT

| 503 | 63,725 |

Mohawk Industries, Inc.(a)

| 395 | 55,675 |

Molson Coors Beverage Co., Class B

| 2,261 | 102,175 |

Mondelez International, Inc., Class A

| 1,399 | 81,800 |

Monster Beverage Corp.(a)

| 1,825 | 168,776 |

Moody's Corp.

| 103 | 29,895 |

Morgan Stanley

| 1,691 | 115,884 |

Mosaic Co.

| 1,606 | 36,954 |

Motorola Solutions, Inc.

| 846 | 143,871 |

MSCI, Inc.

| 67 | 29,918 |

Nasdaq, Inc.

| 151 | 20,044 |

NetApp, Inc.

| 1,729 | 114,529 |

Netflix, Inc.(a)

| 191 | 103,279 |

Newell Brands, Inc.

| 3,915 | 83,115 |

Newmont Corp.

| 2,421 | 144,994 |

News Corp., Class A

| 2,382 | 42,805 |

News Corp., Class B

| 2,396 | 42,577 |

NextEra Energy, Inc.

| 1,449 | 111,790 |

Nielsen Holdings PLC

| 2,490 | 51,966 |

NIKE, Inc., Class B

| 624 | 88,277 |

NiSource, Inc.

| 6,230 | 142,916 |

Norfolk Southern Corp.

| 115 | 27,325 |

Northern Trust Corp.

| 453 | 42,192 |

Northrop Grumman Corp.

| 239 | 72,828 |

NortonLifeLock, Inc.

| 3,234 | 67,203 |

Norwegian Cruise Line Holdings Ltd.(a)

| 1,347 | 34,254 |

NOV, Inc.

| 7,467 | 102,522 |

NRG Energy, Inc.

| 6,445 | 242,010 |

Nucor Corp.

| 2,520 | 134,039 |

NVIDIA Corp.

| 92 | 48,042 |

NVR, Inc.(a)

| 29 | 118,316 |

Occidental Petroleum Corp.

| 1,140 | 19,733 |

Old Dominion Freight Line, Inc.

| 179 | 34,937 |

Omnicom Group, Inc.

| 737 | 45,967 |

ONEOK, Inc.

| 3,434 | 131,797 |

Oracle Corp.

| 1,048 | 67,795 |

O'Reilly Automotive, Inc.(a)

| 144 | 65,170 |

Otis Worldwide Corp.

| 558 | 37,693 |

PACCAR, Inc.

| 835 | 72,044 |

Packaging Corp. of America

| 195 | 26,892 |

Parker-Hannifin Corp.

| 130 | 35,413 |

Paychex, Inc.

| 688 | 64,108 |

Paycom Software, Inc.(a)

| 150 | 67,838 |

PayPal Holdings, Inc.(a)

| 112 | 26,230 |

Pentair PLC

| 1,247 | 66,203 |

| Security Description | Shares | Value |

People's United Financial, Inc.

| 6,566 | $84,898 |

PepsiCo, Inc.

| 555 | 82,307 |

PerkinElmer, Inc.

| 486 | 69,741 |

Perrigo Co. PLC

| 4,477 | 200,211 |

Pfizer, Inc.

| 1,600 | 58,896 |

Philip Morris International, Inc.

| 1,888 | 156,308 |

Phillips 66

| 2,307 | 161,352 |

Pinnacle West Capital Corp.

| 445 | 35,578 |

Pioneer Natural Resources Co.

| 205 | 23,347 |

PNC Financial Services Group, Inc.

| 164 | 24,436 |

Pool Corp.

| 136 | 50,660 |

PPG Industries, Inc.

| 199 | 28,700 |

PPL Corp.

| 1,270 | 35,814 |

Principal Financial Group, Inc.

| 836 | 41,474 |

Procter & Gamble Co.

| 1,568 | 218,172 |

Progressive Corp.

| 753 | 74,457 |

Prologis, Inc., REIT

| 243 | 24,217 |

Prudential Financial, Inc.

| 906 | 70,731 |

Public Service Enterprise Group, Inc.

| 1,892 | 110,304 |

Public Storage, REIT

| 278 | 64,199 |

PulteGroup, Inc.

| 2,525 | 108,878 |

PVH Corp.

| 906 | 85,064 |

Qorvo, Inc.(a)

| 624 | 103,752 |

QUALCOMM, Inc.

| 657 | 100,087 |

Quanta Services, Inc.

| 2,225 | 160,244 |

Quest Diagnostics, Inc.

| 392 | 46,715 |

Ralph Lauren Corp.

| 844 | 87,557 |

Raymond James Financial, Inc.

| 1,157 | 110,690 |

Raytheon Technologies Corp.

| 840 | 60,068 |

Realty Income Corp., REIT

| 470 | 29,220 |

Regency Centers Corp., REIT

| 608 | 27,719 |

Regeneron Pharmaceuticals, Inc.(a)

| 138 | 66,669 |

Regions Financial Corp.

| 1,528 | 24,631 |

Republic Services, Inc.

| 846 | 81,470 |

ResMed, Inc.

| 262 | 55,691 |

Robert Half International, Inc.

| 739 | 46,173 |

Rockwell Automation, Inc.

| 56 | 14,045 |

Rollins, Inc.

| 2,185 | 85,368 |

Roper Technologies, Inc.

| 32 | 13,795 |

Ross Stores, Inc.

| 1,893 | 232,479 |

Royal Caribbean Cruises Ltd.

| 468 | 34,955 |

S&P Global, Inc.

| 90 | 29,586 |

salesforce.com, Inc.(a)

| 286 | 63,644 |

SBA Communications Corp., REIT

| 87 | 24,545 |

Schlumberger N.V.

| 3,112 | 67,935 |

Seagate Technology PLC

| 1,652 | 102,688 |

Sealed Air Corp.

| 797 | 36,495 |

Sempra Energy

| 278 | 35,420 |

ServiceNow, Inc.(a)

| 119 | 65,501 |

Sherwin-Williams Co.

| 38 | 27,927 |

Simon Property Group, Inc., REIT

| 327 | 27,887 |

Skyworks Solutions, Inc.

| 1,025 | 156,702 |

See accompanying notes to financial statements.

Syntax Stratified LargeCap ETF

Schedule of Investments (continued)

December 31, 2020

| Security Description | Shares | Value |

SL Green Realty Corp., REIT

| 600 | $35,748 |

Snap-on, Inc.

| 444 | 75,986 |

Southern Co.

| 588 | 36,121 |

Southwest Airlines Co.

| 1,399 | 65,207 |

Stanley Black & Decker, Inc.

| 457 | 81,602 |

Starbucks Corp.

| 2,076 | 222,090 |

State Street Corp.

| 653 | 47,525 |

STERIS PLC

| 117 | 22,176 |

Stryker Corp.

| 231 | 56,604 |

SVB Financial Group(a)

| 243 | 94,243 |

Synchrony Financial

| 4,421 | 153,453 |

Synopsys, Inc.(a)

| 604 | 156,581 |

Sysco Corp.

| 4,230 | 314,120 |

T Rowe Price Group, Inc.

| 268 | 40,573 |

Take-Two Interactive Software, Inc.(a)

| 749 | 155,635 |

Tapestry, Inc.

| 2,919 | 90,723 |

Target Corp.

| 415 | 73,260 |

TE Connectivity Ltd.

| 678 | 82,085 |

TechnipFMC PLC

| 7,375 | 69,325 |

Teledyne Technologies, Inc.(a)

| 36 | 14,111 |

Teleflex, Inc.

| 57 | 23,459 |

Teradyne, Inc.

| 620 | 74,332 |

Tesla, Inc.(a)

| 175 | 123,492 |

Texas Instruments, Inc.

| 889 | 145,912 |

Textron, Inc.

| 1,499 | 72,447 |

Thermo Fisher Scientific, Inc.

| 152 | 70,799 |

Tiffany & Co.

| 653 | 85,837 |

TJX Companies, Inc.

| 3,236 | 220,986 |

T-Mobile US, Inc.(a)

| 816 | 110,038 |

Tractor Supply Co.

| 331 | 46,532 |

Trane Technologies PLC

| 254 | 36,871 |

TransDigm Group, Inc.(a)

| 57 | 35,274 |

Travelers Companies, Inc.

| 635 | 89,135 |

Truist Financial Corp.

| 504 | 24,157 |

Twitter, Inc.(a)

| 3,698 | 200,247 |

Tyler Technologies, Inc.(a)

| 143 | 62,422 |

Tyson Foods, Inc., Class A

| 3,091 | 199,184 |

UDR, Inc., REIT

| 1,606 | 61,719 |

Ulta Beauty, Inc.(a)

| 403 | 115,725 |

Under Armour, Inc., Class A(a)

| 2,493 | 42,805 |

Under Armour, Inc., Class C(a)

| 2,835 | 42,185 |

Union Pacific Corp.

| 130 | 27,069 |

United Airlines Holdings, Inc.(a)

| 1,329 | 57,479 |

United Parcel Service, Inc., Class B

| 210 | 35,364 |

United Rentals, Inc.(a)

| 190 | 44,063 |

UnitedHealth Group, Inc.

| 338 | 118,530 |

Universal Health Services, Inc., Class B

| 717 | 98,588 |

Unum Group

| 3,065 | 70,311 |

US Bancorp

| 517 | 24,087 |

Valero Energy Corp.

| 2,719 | 153,814 |

Varian Medical Systems, Inc.(a)

| 125 | 21,876 |

| Security Description | Shares | Value |

Ventas, Inc., REIT

| 1,938 | $95,040 |

VeriSign, Inc.(a)

| 678 | 146,719 |

Verisk Analytics, Inc.

| 148 | 30,723 |

Verizon Communications, Inc.

| 1,772 | 104,105 |

Vertex Pharmaceuticals, Inc.(a)

| 292 | 69,011 |

VF Corp.

| 987 | 84,300 |

ViacomCBS, Inc., Class B

| 2,402 | 89,499 |

Viatris, Inc.(a)

| 12,340 | 231,252 |

Visa, Inc., Class A

| 93 | 20,342 |

Vontier Corp.(a)

| 428 | 14,295 |

Vornado Realty Trust, REIT

| 919 | 34,315 |

Vulcan Materials Co.

| 515 | 76,380 |

W R Berkley Corp.

| 1,320 | 87,674 |

Walgreens Boots Alliance, Inc.

| 6,870 | 273,976 |

Walmart, Inc.

| 2,184 | 314,824 |

Walt Disney Co.(a)

| 487 | 88,235 |

Waste Management, Inc.

| 696 | 82,079 |

Waters Corp.(a)

| 298 | 73,731 |

WEC Energy Group, Inc.

| 386 | 35,524 |

Wells Fargo & Co.

| 1,837 | 55,441 |

Welltower, Inc., REIT

| 739 | 47,754 |

West Pharmaceutical Services, Inc.

| 83 | 23,515 |

Western Digital Corp.

| 2,095 | 116,042 |

Western Union Co.

| 2,866 | 62,880 |

Westinghouse Air Brake Technologies Corp.

| 478 | 34,990 |

Westrock Co.

| 616 | 26,814 |

Weyerhaeuser Co., REIT

| 2,229 | 74,738 |

Whirlpool Corp.

| 292 | 52,703 |

Williams Companies, Inc.

| 6,507 | 130,465 |

Willis Towers Watson PLC

| 92 | 19,383 |

WW Grainger, Inc.

| 111 | 45,326 |

Wynn Resorts Ltd.

| 430 | 48,517 |

Xcel Energy, Inc.

| 551 | 36,735 |

Xerox Holdings Corp.

| 9,400 | 217,986 |

Xilinx, Inc.

| 330 | 46,784 |

Xylem, Inc.

| 654 | 66,571 |

Yum! Brands, Inc.

| 2,017 | 218,966 |

Zebra Technologies Corp., Class A(a)

| 95 | 36,511 |

Zimmer Biomet Holdings, Inc.

| 377 | 58,092 |

Zions Bancorp NA

| 2,055 | 89,269 |

Zoetis, Inc.

| 410 | 67,855 |

INVESTMENTS IN

COMMON STOCK—99.8%

(Cost $33,789,937)

| | 41,890,187 |

OTHER ASSETS IN EXCESS OF LIABILITIES—0.2%

| | 98,878 |

NET ASSETS—100.0%

| | $41,989,065 |

| (a) | Non-income producing security. |

| PLC=Public Limited Company |

| REIT=Real Estate Investment Trust |

See accompanying notes to financial statements.

Syntax Stratified LargeCap ETF

Schedule of Investments (continued)

December 31, 2020

INDUSTRY BREAKDOWN

AS OF December 31, 2020*

| INDUSTRY | PERCENTAGE OF

NET ASSETS |

Business Software for Specific Uses

| 3.5% |

Electric Competitive

| 3.2 |

Restaurants

| 3.2 |

Branded Pharmaceuticals

| 3.1 |

Processed Foods

| 3.1 |

Food Distributors

| 3.0 |

Downstream

| 2.9 |

Consumer Insurance

| 2.2 |

Content Providers

| 2.2 |

End User Hardware

| 2.1 |

Operators and Developers

| 2.1 |

Commercial Insurance

| 2.1 |

Commercial Hardware

| 2.1 |

Rental

| 2.1 |

Electric Regulated

| 2.0 |

Telecommunication Networks

| 2.0 |

Upstream Energy

| 1.9 |

Non Real Estate Banking

| 1.8 |

Home Office and Consumer Equipment Manufacture

| 1.6 |

Mechanical Components

| 1.6 |

Capital Markets

| 1.6 |

Auto Products

| 1.6 |

Home Office and Consumer Equipment Retail

| 1.6 |

Information and Electrical Components

| 1.6 |

Specialty Services

| 1.6 |

Diversified Household and Personal Products

| 1.6 |

Distribution Services

| 1.5 |

Alcohol and Tobacco

| 1.5 |

Transportation Services

| 1.5 |

Primary Foods

| 1.5 |

Online Distribution Networks

| 1.5 |

Semiconductor Services and Equipment

| 1.4 |

Analog and Mixed Signal Integrated Circuits

| 1.4 |

Digital Integrated Circuits

| 1.4 |

Internet Services

| 1.4 |

Transaction Services

| 1.4 |

Management and IT Services

| 1.4 |

Healthcare Providers and Facilities

| 1.4 |

Healthcare Insurance

| 1.4 |

Search and Social Networks

| 1.4 |

Drugstores

| 1.3 |

Investment Services

| 1.3 |

| INDUSTRY | PERCENTAGE OF

NET ASSETS |

Transport Aerospace and Defense Equipment

| 1.2% |

Medical Devices

| 1.1 |

Medical Research Services and Equipment

| 1.1 |

Apparel Retailers

| 1.1 |

Diversified Drugs and Devices

| 1.1 |

Personal Products

| 1.1 |

Other Natural Resources

| 1.1 |

Accessories and Footwear

| 1.0 |

Chemicals

| 1.0 |

Metals

| 1.0 |

Midstream and Gas

| 1.0 |

Branded Apparel

| 1.0 |

Hospital Equipment

| 1.0 |

Healthcare Products Distribution

| 1.0 |

Midstream

| 0.9 |

Industrial Conglomerates

| 0.9 |

Production Equipment

| 0.8 |

Operating Systems and Middleware

| 0.7 |

Brokers and Dealers

| 0.5 |

Consumer Paper Products

| 0.5 |

Real Estate Banking

| 0.4 |

Business Software for Specific Industries

| 0.2 |

Other Assets in Excess of Liabilities

| 0.2 |

| Total | 100.0% |

* The Fund’s industry breakdown is expressed as a percentage of net assets and may change over time.

See accompanying notes to financial statements.

Syntax Stratified MidCap ETF

Schedule of Investments (continued)

December 31, 2020

| Security Description | Shares | Value |

| COMMON STOCK—99.7% | | |

Acadia Healthcare Co., Inc.(a)

| 282 | $14,173 |

ACI Worldwide, Inc.(a)

| 448 | 17,217 |

Acuity Brands, Inc.

| 52 | 6,297 |

Adient PLC(a)

| 83 | 2,886 |

Adtalem Global Education, Inc.(a)

| 155 | 5,262 |

AECOM(a)

| 101 | 5,028 |

Affiliated Managers Group, Inc.

| 75 | 7,627 |

AGCO Corp.

| 108 | 11,134 |

Alleghany Corp.

| 15 | 9,055 |

ALLETE, Inc.

| 143 | 8,857 |

Alliance Data Systems Corp.

| 90 | 6,669 |

Amedisys, Inc.(a)

| 50 | 14,666 |

American Campus Communities, Inc.

| 229 | 9,794 |

American Eagle Outfitters, Inc.

| 675 | 13,547 |

American Financial Group, Inc.

| 75 | 6,572 |

Antero Midstream Corp.

| 1,172 | 9,036 |

Apartment Income REIT Corp.(a)

| 240 | 9,218 |

AptarGroup, Inc.

| 25 | 3,422 |

Arrow Electronics, Inc.(a)

| 34 | 3,308 |

Arrowhead Pharmaceuticals, Inc.(a)

| 238 | 18,262 |

ASGN, Inc.(a)

| 81 | 6,766 |

Ashland Global Holdings, Inc.

| 42 | 3,326 |

Associated Banc-Corp

| 109 | 1,858 |

AutoNation, Inc.(a)

| 149 | 10,399 |

Avanos Medical, Inc.(a)

| 54 | 2,478 |

Avient Corp.

| 86 | 3,464 |

Avis Budget Group, Inc.(a)

| 253 | 9,437 |

Avnet, Inc.

| 104 | 3,651 |

Axon Enterprise, Inc.(a)

| 82 | 10,047 |

BancorpSouth Bank

| 66 | 1,811 |

Bank of Hawaii Corp.

| 99 | 7,585 |

Bank OZK

| 60 | 1,876 |

Belden, Inc.

| 87 | 3,645 |

Bio-Techne Corp.

| 30 | 9,526 |

BJ's Wholesale Club Holdings, Inc.(a)

| 351 | 13,085 |

Black Hills Corp.

| 127 | 7,804 |

Blackbaud, Inc.

| 105 | 6,044 |

Boston Beer Co., Inc., Class A(a)

| 14 | 13,920 |

Boyd Gaming Corp.

| 82 | 3,519 |

Brighthouse Financial, Inc.(a)

| 393 | 14,229 |

Brink's Co.

| 105 | 7,560 |

Brixmor Property Group, Inc.

| 81 | 1,341 |

Brown & Brown, Inc.

| 193 | 9,150 |

Brunswick Corp.

| 100 | 7,624 |

Builders FirstSource, Inc.(a)

| 168 | 6,856 |

Cable One, Inc.

| 12 | 26,733 |

Cabot Corp.

| 67 | 3,007 |

CACI International, Inc., Class A(a)

| 29 | 7,231 |

Caesars Entertainment, Inc.(a)

| 49 | 3,639 |

Camden Property Trust

| 101 | 10,092 |

Cantel Medical Corp.

| 59 | 4,653 |

| Security Description | Shares | Value |

Carlisle Companies, Inc.

| 21 | $3,280 |

Carter's, Inc.

| 146 | 13,734 |

Casey's General Stores, Inc.

| 55 | 9,824 |

Cathay General Bancorp

| 57 | 1,835 |

CDK Global, Inc.

| 345 | 17,881 |

Ceridian HCM Holding, Inc.(a)

| 59 | 6,287 |

ChampionX Corp.(a)

| 1,071 | 16,386 |

Charles River Laboratories International, Inc.(a)

| 38 | 9,495 |

Chemed Corp.

| 27 | 14,380 |

Chemours Co.

| 108 | 2,677 |

Choice Hotels International, Inc.

| 23 | 2,455 |

Churchill Downs, Inc.

| 17 | 3,311 |

Ciena Corp.(a)

| 829 | 43,813 |

Cimarex Energy Co.

| 149 | 5,589 |

Cinemark Holdings, Inc.

| 808 | 14,067 |

Cirrus Logic, Inc.(a)

| 167 | 13,727 |

CIT Group, Inc.

| 67 | 2,405 |

Clean Harbors, Inc.(a)

| 104 | 7,914 |

CMC Materials, Inc.

| 182 | 27,537 |

CNO Financial Group, Inc.

| 574 | 12,760 |

CNX Resources Corp.(a)

| 551 | 5,951 |

Cognex Corp.

| 131 | 10,517 |

Coherent, Inc.(a)

| 196 | 29,404 |

Colfax Corp.(a)

| 214 | 8,183 |

Columbia Sportswear Co.

| 160 | 13,981 |

Commerce Bancshares, Inc.

| 103 | 6,767 |

Commercial Metals Co.

| 330 | 6,778 |

CommVault Systems, Inc.(a)

| 114 | 6,312 |

Compass Minerals International, Inc.

| 108 | 6,666 |

Concentrix Corp.(a)

| 65 | 6,416 |

CoreLogic, Inc.

| 57 | 4,407 |

CoreSite Realty Corp.

| 149 | 18,667 |

Corporate Office Properties Trust

| 63 | 1,643 |

Coty, Inc., Class A

| 2,867 | 20,126 |

Cousins Properties, Inc.

| 48 | 1,608 |

Cracker Barrel Old Country Store, Inc.

| 99 | 13,060 |

Crane Co.

| 85 | 6,601 |

Cree, Inc.(a)

| 41 | 4,342 |

Cullen/Frost Bankers, Inc.

| 32 | 2,791 |

Curtiss-Wright Corp.

| 35 | 4,072 |

CyrusOne, Inc.

| 264 | 19,312 |

Dana, Inc.

| 157 | 3,065 |

Darling Ingredients, Inc.(a)

| 137 | 7,902 |

Deckers Outdoor Corp.(a)

| 43 | 12,332 |

Dick's Sporting Goods, Inc.

| 185 | 10,399 |

Domtar Corp.

| 107 | 3,387 |

Donaldson Co., Inc.

| 119 | 6,650 |

Douglas Emmett, Inc.

| 51 | 1,488 |

Dycom Industries, Inc.(a)

| 63 | 4,758 |

Eagle Materials, Inc.

| 65 | 6,588 |

East West Bancorp, Inc.

| 40 | 2,028 |

See accompanying notes to financial statements.

Syntax Stratified MidCap ETF

Schedule of Investments (continued)

December 31, 2020

| Security Description | Shares | Value |

EastGroup Properties, Inc.

| 27 | $3,728 |

Eaton Vance Corp.

| 118 | 8,016 |

Edgewell Personal Care Co.

| 543 | 18,777 |

EMCOR Group, Inc.

| 54 | 4,939 |

Emergent BioSolutions, Inc.(a)

| 211 | 18,906 |

Encompass Health Corp.

| 156 | 12,900 |

Energizer Holdings, Inc.

| 464 | 19,572 |

EnerSys

| 72 | 5,980 |

Enphase Energy, Inc.(a)

| 40 | 7,019 |

EPR Properties

| 39 | 1,268 |

EQT Corp.

| 426 | 5,414 |

Equitrans Midstream Corp.

| 1,128 | 9,069 |

Essent Group Ltd.

| 183 | 7,906 |

Essential Utilities, Inc.

| 154 | 7,283 |

Evercore, Inc., Class A

| 67 | 7,346 |

Exelixis, Inc.(a)

| 886 | 17,782 |

FactSet Research Systems, Inc.

| 21 | 6,982 |

Fair Isaac Corp.(a)

| 34 | 17,375 |

Federated Hermes, Inc.

| 254 | 7,338 |

First American Financial Corp.

| 83 | 4,285 |

First Financial Bankshares, Inc.

| 53 | 1,917 |

First Horizon Corp.

| 513 | 6,546 |

First Industrial Realty Trust, Inc.

| 79 | 3,328 |

First Solar, Inc.(a)

| 44 | 4,352 |

FirstCash, Inc.

| 92 | 6,444 |

Five Below, Inc.(a)

| 58 | 10,149 |

Flowers Foods, Inc.

| 657 | 14,868 |

Fluor Corp.

| 294 | 4,695 |

FNB Corp.

| 191 | 1,815 |

Foot Locker, Inc.

| 311 | 12,577 |

Fox Factory Holding Corp.(a)

| 31 | 3,277 |

FTI Consulting, Inc.(a)

| 58 | 6,480 |

Fulton Financial Corp.

| 134 | 1,704 |

GATX Corp.

| 60 | 4,991 |

Generac Holdings, Inc.(a)

| 18 | 4,093 |

Gentex Corp.

| 223 | 7,566 |

Genworth Financial, Inc., Class A(a)

| 3,047 | 11,518 |

Glacier Bancorp, Inc.

| 41 | 1,886 |

Globus Medical, Inc., Class A(a)

| 293 | 19,109 |

Goodyear Tire & Rubber Co.

| 285 | 3,109 |

Graco, Inc.

| 95 | 6,873 |

Graham Holdings Co., Class B

| 11 | 5,867 |

Grand Canyon Education, Inc.(a)

| 53 | 4,935 |

Greif, Inc., Class A

| 44 | 2,063 |

Grocery Outlet Holding Corp.(a)

| 345 | 13,541 |

Grubhub, Inc.(a)

| 378 | 28,074 |

H&R Block, Inc.

| 474 | 7,518 |

Haemonetics Corp.(a)

| 39 | 4,631 |

Hain Celestial Group, Inc.(a)

| 261 | 10,479 |

Halozyme Therapeutics, Inc.(a)

| 429 | 18,323 |

Hancock Whitney Corp.

| 86 | 2,926 |

Hanover Insurance Group, Inc.

| 57 | 6,664 |

| Security Description | Shares | Value |

Harley-Davidson, Inc.

| 193 | $7,083 |

Hawaiian Electric Industries, Inc.

| 227 | 8,034 |

Healthcare Realty Trust, Inc.

| 667 | 19,743 |

Healthcare Services Group, Inc.

| 304 | 8,542 |

HealthEquity, Inc.(a)

| 70 | 4,880 |

Helen of Troy Ltd.(a)

| 93 | 20,664 |

Herman Miller, Inc.

| 156 | 5,273 |

Hexcel Corp.

| 65 | 3,152 |

Highwoods Properties, Inc.

| 44 | 1,744 |

Hill-Rom Holdings, Inc.

| 46 | 4,507 |

HNI Corp.

| 159 | 5,479 |

Home BancShares, Inc.

| 94 | 1,831 |

Hubbell, Inc.

| 23 | 3,606 |

Hudson Pacific Properties, Inc.

| 63 | 1,513 |

IAA, Inc.(a)

| 161 | 10,462 |

ICU Medical, Inc.(a)

| 16 | 3,432 |

IDACORP, Inc.

| 89 | 8,547 |

II-VI, Inc.(a)

| 54 | 4,102 |

Ingevity Corp.(a)

| 38 | 2,878 |

Ingredion, Inc.

| 92 | 7,238 |

Insperity, Inc.

| 51 | 4,152 |

Integra LifeSciences Holdings Corp.(a)

| 45 | 2,921 |

Interactive Brokers Group, Inc., Class A

| 239 | 14,560 |

InterDigital, Inc.

| 215 | 13,046 |

International Bancshares Corp.

| 48 | 1,797 |

ITT, Inc.

| 52 | 4,005 |

J2 Global, Inc.(a)

| 175 | 17,096 |

Jabil, Inc.

| 501 | 21,308 |

Jack in the Box, Inc.

| 149 | 13,827 |

Janus Henderson Group PLC

| 229 | 7,445 |

Jazz Pharmaceuticals PLC(a)

| 119 | 19,641 |

JBG SMITH Properties

| 51 | 1,595 |

Jefferies Financial Group, Inc.

| 280 | 6,888 |

JetBlue Airways Corp.(a)

| 665 | 9,669 |

John Wiley & Sons, Inc., Class A

| 225 | 10,273 |

Jones Lang LaSalle, Inc.

| 58 | 8,605 |

KAR Auction Services, Inc.

| 526 | 9,789 |

KB Home

| 292 | 9,788 |

KBR, Inc.

| 176 | 5,444 |

Kemper Corp.

| 170 | 13,061 |

Kennametal, Inc.

| 206 | 7,465 |

Kilroy Realty Corp.

| 25 | 1,435 |

Kinsale Capital Group, Inc.

| 7 | 1,401 |

Kirby Corp.(a)

| 179 | 9,278 |

Knight-Swift Transportation Holdings, Inc.

| 180 | 7,528 |

Kohl's Corp.

| 343 | 13,957 |

Lamar Advertising Co., Class A

| 17 | 1,415 |

Lancaster Colony Corp.

| 85 | 15,617 |

Landstar System, Inc.

| 51 | 6,868 |

Lear Corp.

| 17 | 2,704 |

LendingTree, Inc.(a)

| 30 | 8,214 |

Lennox International, Inc.

| 23 | 6,301 |

See accompanying notes to financial statements.

Syntax Stratified MidCap ETF

Schedule of Investments (continued)

December 31, 2020

| Security Description | Shares | Value |

LHC Group, Inc.(a)

| 66 | $14,079 |

Life Storage, Inc.

| 85 | 10,148 |

Ligand Pharmaceuticals, Inc.(a)

| 190 | 18,895 |

Lincoln Electric Holdings, Inc.

| 65 | 7,556 |

Lithia Motors, Inc., Class A

| 34 | 9,951 |

Littelfuse, Inc.

| 23 | 5,857 |

LivaNova PLC(a)

| 291 | 19,267 |

LiveRamp Holdings, Inc.(a)

| 82 | 6,002 |

Louisiana-Pacific Corp.

| 85 | 3,159 |

Lumentum Holdings, Inc.(a)

| 457 | 43,324 |

Macerich Co.

| 113 | 1,206 |

Manhattan Associates, Inc.(a)

| 58 | 6,100 |

ManpowerGroup, Inc.

| 75 | 6,763 |

Marriott Vacations Worldwide Corp.

| 33 | 4,528 |

Masimo Corp.(a)

| 51 | 13,687 |

MasTec, Inc.(a)

| 75 | 5,114 |

Mattel, Inc.(a)

| 372 | 6,491 |

MAXIMUS, Inc.

| 61 | 4,465 |

MDU Resources Group, Inc.

| 268 | 7,059 |

Medical Properties Trust, Inc.

| 953 | 20,766 |

Medpace Holdings, Inc.(a)

| 62 | 8,630 |

Mercury General Corp.

| 282 | 14,723 |

Mercury Systems, Inc.(a)

| 46 | 4,051 |

MGIC Investment Corp.

| 655 | 8,220 |

Middleby Corp.(a)

| 58 | 7,477 |

Minerals Technologies, Inc.

| 46 | 2,858 |

MKS Instruments, Inc.

| 180 | 27,081 |

Molina Healthcare, Inc.(a)

| 64 | 13,612 |

Monolithic Power Systems, Inc.

| 41 | 15,015 |

MSA Safety, Inc.

| 63 | 9,412 |

MSC Industrial Direct Co., Inc., Class A

| 37 | 3,122 |

Murphy Oil Corp.

| 439 | 5,312 |

Murphy USA, Inc.

| 78 | 10,208 |

National Fuel Gas Co.

| 170 | 6,992 |

National Instruments Corp.

| 660 | 29,000 |

National Retail Properties, Inc.

| 34 | 1,391 |

Navient Corp.

| 694 | 6,815 |

NCR Corp.(a)

| 587 | 22,054 |

Nektar Therapeutics(a)

| 1,049 | 17,833 |

Neogen Corp.(a)

| 34 | 2,696 |

NetScout Systems, Inc.(a)

| 762 | 20,894 |

New Jersey Resources Corp.

| 223 | 7,928 |

New York Community Bancorp, Inc.

| 178 | 1,878 |

New York Times Co., Class A

| 195 | 10,095 |

NewMarket Corp.

| 6 | 2,390 |

Nordson Corp.

| 39 | 7,837 |

Nordstrom, Inc.

| 429 | 13,389 |

NorthWestern Corp.

| 153 | 8,921 |

Nu Skin Enterprises, Inc., Class A

| 382 | 20,869 |

NuVasive, Inc.(a)

| 386 | 21,743 |

nVent Electric PLC

| 252 | 5,869 |

OGE Energy Corp.

| 262 | 8,347 |

| Security Description | Shares | Value |

O-I Glass, Inc.

| 187 | $2,225 |

Old Republic International Corp.

| 351 | 6,918 |

Olin Corp.

| 139 | 3,414 |

Ollie's Bargain Outlet Holdings, Inc.(a)

| 127 | 10,385 |

Omega Healthcare Investors, Inc.

| 352 | 12,785 |

ONE Gas, Inc.

| 95 | 7,293 |

Oshkosh Corp.

| 77 | 6,627 |

Owens Corning

| 42 | 3,182 |

PacWest Bancorp