Exhibit 99.2 December 2018 Baylor Charles A. Sammons Cancer Center Dallas, TX SUPPLEMENTAL OPERATING & FINANCIAL INFORMATION FOURTH QUARTER 2018 PHYSICIANS REALTY TRUST NYSE: DOC Strictly Pediatrics Specialty Center Austin, TX

TABLE OF CONTENTS COMPANY OVERVIEW ABOUT PHYSICIANS REALTY TRUST 4 FOURTH QUARTER HIGHLIGHTS 6 FINANCIAL HIGHLIGHTS 7 FINANCIAL INFORMATION RECONCILIATION OF NON-GAAP MEASURES: FUNDS FROM OPERATIONS (FFO), NORMALIZED FUNDS FROM OPERATIONS (NORMALIZED FFO), AND NORMALIZED FUNDS AVAILABLE FOR DISTRIBUTION (NORMALIZED FAD) 8 RECONCILIATION OF NON-GAAP MEASURES: NET OPERATING INCOME AND ADJUSTED EBITDAre 9 MARKET CAPITALIZATION AND DEBT SUMMARY 10 FINANCIAL STATISTICS AND COVENANT PERFORMANCE 11 SAME-STORE PORTFOLIO PERFORMANCE AND TENANT OCCUPANCY 12 INVESTMENT ACTIVITY AND ASSETS SLATED FOR DISPOSITION 13 PORTFOLIO GEOGRAPHIC DISTRIBUTION 14 PORTFOLIO DIVERSIFICATION 15 LEASING RELATIONSHIPS AND EXPIRATION SCHEDULE 16 CONSOLIDATED BALANCE SHEETS 17 CONSOLIDATED STATEMENTS OF INCOME 18 REPORTING DEFINITIONS 19 2

FORWARD-LOOKING STATEMENTS Certain statements made in this supplemental information package constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 (set forth in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”)). In particular, statements pertaining to our capital resources, portfolio performance and results of operations contain forward-looking statements. Likewise, our pro forma financial statements and our statements regarding anticipated market conditions are forward-looking statements. You can identify forward-looking statements by the use of forward-looking terminology such as "believes,” “expects,” “may,” “will,” “should,” “seeks,” “approximately,” “intends,” “plans,” "outlook," "continue," "projects," “pro forma,” “estimates” or “anticipates” or the negative of these words and phrases or similar words or phrases which are predictions of or indicate future events or trends and which do not relate solely to historical matters. You can also identify forward-looking statements by discussions of strategy, plans, expectations or intentions. Forward-looking statements reflect the views of our management regarding current expectations and projections about future events and are based on currently available information. These forward-looking statements are not guarantees of future performance and involve numerous risks and uncertainties and you should not rely on them as predictions of future events. Forward-looking statements depend on assumptions, data or methods which may be incorrect or imprecise and we may not be able to realize them. While forward-looking statements reflect our good faith beliefs, they are not guarantees of future performance. We disclaim any obligation to publicly update or revise any forward-looking statement to reflect changes in underlying assumptions or factors, of new information, data or methods, future events or other changes after the date of this supplemental information package, except as required by applicable law. You should not place undue reliance on any forward-looking statements that are based on information currently available to us or the third parties making the forward-looking statements. For a discussion of factors that could impact our future results, performance or transactions, see Part I, Item 1A (Risk Factors) of our Annual Report on Form 10- K for the fiscal year ended December 31, 2018. NON-GAAP FINANCIAL MEASURES This presentation includes Adjusted EBITDAre, EBITDAR, Net Operating Income (or NOI), Cash NOI, Funds From Operations (or FFO), Normalized FFO, and Normalized Funds Available For Distribution (or FAD), which are non-GAAP financial measures. For purposes of the Securities and Exchange Commission’s (“SEC”) Regulation G, a non-GAAP financial measure is a numerical measure of a company’s historical or future financial performance, financial position or cash flows that excludes amounts, or is subject to adjustments that have the effect of excluding amounts, that are included in the most directly comparable financial measure calculated and presented in accordance with GAAP in the statement of operations, balance sheet or statement of cash flows (or equivalent statements) of the company, or includes amounts, or is subject to adjustments that have the effect of including amounts, that are excluded from the most directly comparable financial measure so calculated and presented. As used in this presentation, GAAP refers to generally accepted accounting principles in the United States of America. Our use of the non- GAAP financial measure terms herein may not be comparable to that of other real estate investment trusts. Pursuant to the requirements of Regulation G, we have provided reconciliations of the non-GAAP financial measures to the most directly comparable GAAP financial measures. ADDITIONAL INFORMATION The information in this supplemental information package should be read in conjunction with the Company’s Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, earnings press release dated February 27, 2019 and other information filed with, or furnished to, the SEC. You can access the Company’s reports and amendments to those reports filed or furnished to the SEC pursuant to Section 13(a) or 15(d) of the Exchange Act in the “Investor Relations” section on the Company’s website (www.docreit.com) under the tab “SEC Filings” as soon as reasonably practicable after they are filed with, or furnished to, the SEC. The information on or connected to the Company’s website is not, and shall not be deemed to be, a part of, or incorporated into this supplemental information package. You also can review these SEC filings and other information by accessing the SEC’s website at http://www.sec.gov. 3

ABOUT PHYSICIANS REALTY TRUST Physicians Realty Trust (NYSE:DOC) (the “Trust,” the “Company,” “DOC,” “we,” “our” and “us”) is a self-managed healthcare real estate company organized in 2013 to acquire, selectively develop, own, and manage healthcare properties that are leased to physicians, hospitals, and healthcare delivery systems. We invest in real estate that is integral to providing high quality healthcare services. Our properties typically are on a campus with a hospital or other healthcare facilities or strategically located and affiliated with a hospital or other healthcare facilities. Our management team has significant public healthcare REIT experience and long established relationships with physicians, hospitals, and healthcare delivery system decision makers that we believe will provide quality investment opportunities to generate attractive risk-adjusted returns to our shareholders. We are a Maryland real estate investment trust and elected to be taxed as a REIT for U.S. federal income tax purposes. We conduct our business through an UPREIT structure in which our properties are owned by Physicians Realty L.P., a Delaware limited partnership (the “operating partnership”), directly or through limited partnerships, limited liability companies, or other subsidiaries. We are the sole general partner of the operating partnership and, as of December 31, 2018, owned approximately 97.2% of the partnership interests in the operating partnership (“OP Units”). COMPANY SNAPSHOT As of December 31, 2018 Gross real estate investments (thousands) $ 4,367,500 Total healthcare properties (1) 252 % Leased (1) 95.7% Total portfolio gross leasable area (sq. ft.) (1) 13,624,598 % of GLA on-campus / affiliated (1) 90% Average remaining lease term for all buildings (years) (1) 7.9 Cash and cash equivalents (thousands) $ 19,161 Total debt to firm value 33.8% Weighted average interest rate per annum on consolidated debt 3.8% Equity market cap (thousands) $ 2,924,129 Quarterly dividend $ 0.23 Quarter end stock price $ 16.03 Dividend yield 5.74% Common shares outstanding 182,416,007 OP Units outstanding and not owned by DOC 5,182,784 Total firm value (thousands) $ 4,580,618 (1) Excludes the Company's corporate office building. 4

ABOUT PHYSICIANS REALTY TRUST (CONTINUED) BOARD OF TRUSTEES Tommy G. Thompson John T. Thomas Chairman Chief Executive Officer President Stanton D. Anderson Mark A. Baumgartner Albert C. Black Compensation Committee Chair Audit Committee Chair Nominating and Corporate Governance Committee Chair William A. Ebinger, M.D. Pamela J. Kessler Richard A. Weiss Trustee Trustee Finance and Investment Committee Chair MANAGEMENT TEAM John T. Thomas Chief Executive Officer President Jeffrey N. Theiler D. Deeni Taylor John W. Lucey Executive Vice President Executive Vice President Senior Vice President Chief Financial Officer Chief Investment Officer Chief Accounting and Administrative Officer Bradley D. Page Daniel M. Klein Mark D. Theine Senior Vice President Senior Vice President Senior Vice President General Counsel Deputy Chief Investment Officer Asset & Investment Management LOCATION AND CONTACT INFORMATION Corporate Headquarters Independent Registered Corporate and REIT Tax Counsel 309 N. Water Street, Suite 500 Public Accounting Firm Baker & McKenzie LLP Milwaukee, WI 53202 Ernst & Young Richard Lipton, Partner (414) 367-5600 Chicago, IL 60606 Chicago, IL 60601 (312) 879-2000 (312) 861-8000 COVERING ANALYSTS J. Kim - BMO Capital Markets Corp. J. Sadler - Keybanc Capital Markets Inc. M. Gorman - BTIG V. Malhotra - Morgan Stanley D. Bernstein - Capital One Securities J. Hughes - Raymond James Financial Inc. S. Manaker - Compass Point M. Carroll - RBC Capital Markets LLC C. Kucera - FBR Capital D. Babin - Robert W. Baird & Co. T. Okusanya - Jefferies LLC C. Vanacore - Stifel P. Martin - JMP Securities E. Fleming - SunTrust Robinson Humphrey The equity analysts listed above are those analysts that have published research material on the Company and are listed as covering the Company. Please note that any opinions, estimates, or forecasts regarding the Company's performance made by the analysts listed above do not represent the opinions, estimates, or forecasts of the Company or its management. The Company does not by its reference above imply its endorsement of or concurrence with any information, conclusions or recommendations made by any of such analysts. Interested persons may obtain copies of analysts' reports on their own, as we do not distribute these reports. Several of these firms may, from time to time, own our stock and/or hold other long or short positions on our stock, and may provide compensated services to us. 5

FOURTH QUARTER 2018 HIGHLIGHTS OPERATING HIGHLIGHTS • Fourth quarter 2018 total revenue of $105.3 million, up 8% over the prior year period • Fourth quarter 2018 rental revenue of $77.3 million, up 6% over the prior year period • Generated quarterly net income per share of $0.06 on a fully diluted basis • Generated quarterly normalized funds from operations (Normalized FFO) of $0.27 per share on a fully diluted basis • Declared quarterly dividend of $0.23 per share for the fourth quarter • 95.7% of portfolio square footage leased as of December 31, 2018 COMPANY ANNOUNCEMENTS • December 21, 2018: Announced that our Board of Trustees authorized and declared a cash distribution of $0.23 per common share and OP Unit for the quarterly period ended December 31, 2018. The distribution was paid on January 18, 2019 to common shareholders and OP Unit holders of record as of the close of business on January 4, 2019. Lee's Hill Medical Plaza HMG Medical Plaza Fredericksburg, VA Kingsport, TN Springwoods MOB Northside Medical Midtown MOB Sping, TX Atlanta, GA 6

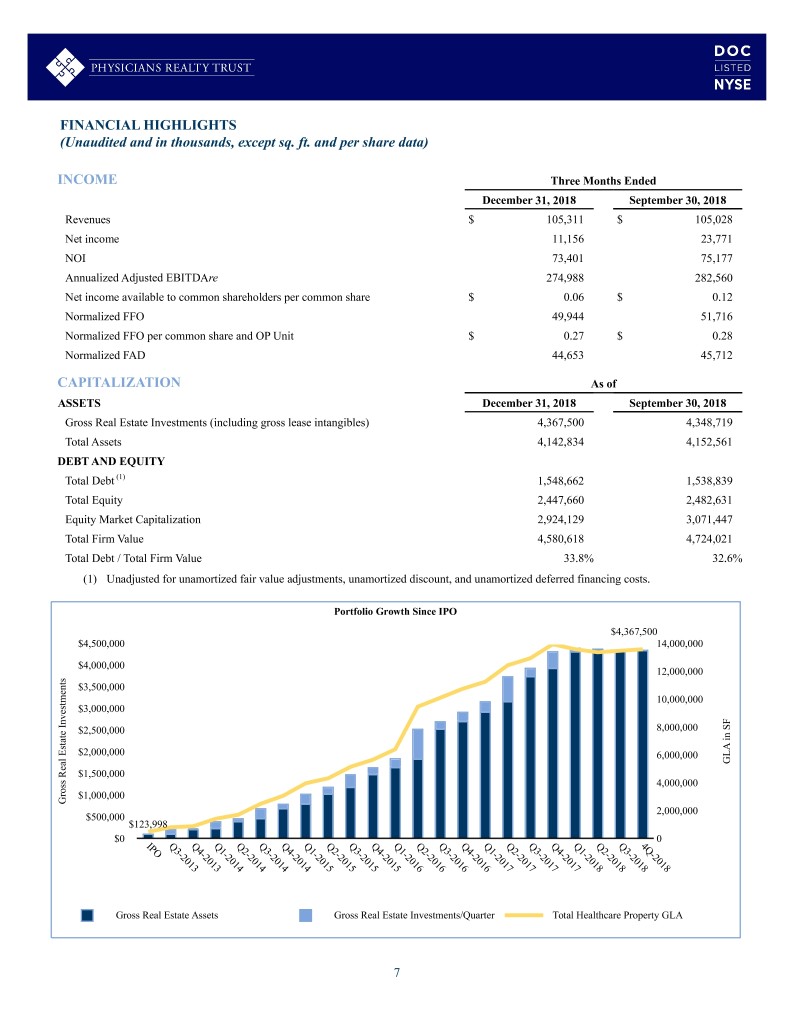

FINANCIAL HIGHLIGHTS (Unaudited and in thousands, except sq. ft. and per share data) INCOME Three Months Ended December 31, 2018 September 30, 2018 Revenues $ 105,311 $ 105,028 Net income 11,156 23,771 NOI 73,401 75,177 Annualized Adjusted EBITDAre 274,988 282,560 Net income available to common shareholders per common share $ 0.06 $ 0.12 Normalized FFO 49,944 51,716 Normalized FFO per common share and OP Unit $ 0.27 $ 0.28 Normalized FAD 44,653 45,712 CAPITALIZATION As of ASSETS December 31, 2018 September 30, 2018 Gross Real Estate Investments (including gross lease intangibles) 4,367,500 4,348,719 Total Assets 4,142,834 4,152,561 DEBT AND EQUITY Total Debt (1) 1,548,662 1,538,839 Total Equity 2,447,660 2,482,631 Equity Market Capitalization 2,924,129 3,071,447 Total Firm Value 4,580,618 4,724,021 Total Debt / Total Firm Value 33.8% 32.6% (1) Unadjusted for unamortized fair value adjustments, unamortized discount, and unamortized deferred financing costs. Portfolio Growth Since IPO $4,367,500 $4,500,000 14,000,000 $4,000,000 12,000,000 s t n $3,500,000 e m 10,000,000 t s $3,000,000 e v F n I 8,000,000 S e $2,500,000 n t i a t s A E $2,000,000 6,000,000 L l G a e R $1,500,000 s s 4,000,000 o r $1,000,000 G 2,000,000 $500,000 $123,998 $0 0 IP Q Q Q Q Q Q Q Q Q Q Q Q Q Q Q Q Q Q Q Q Q 4Q O 3- 4- 1- 2- 3- 4- 1- 2- 3- 4- 1- 2- 3- 4- 1- 2- 3- 4- 1- 2- 3- - 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 13 13 14 14 14 14 15 15 15 15 16 16 16 16 17 17 17 17 18 18 18 18 Gross Real Estate Assets Gross Real Estate Investments/Quarter Total Healthcare Property GLA 7

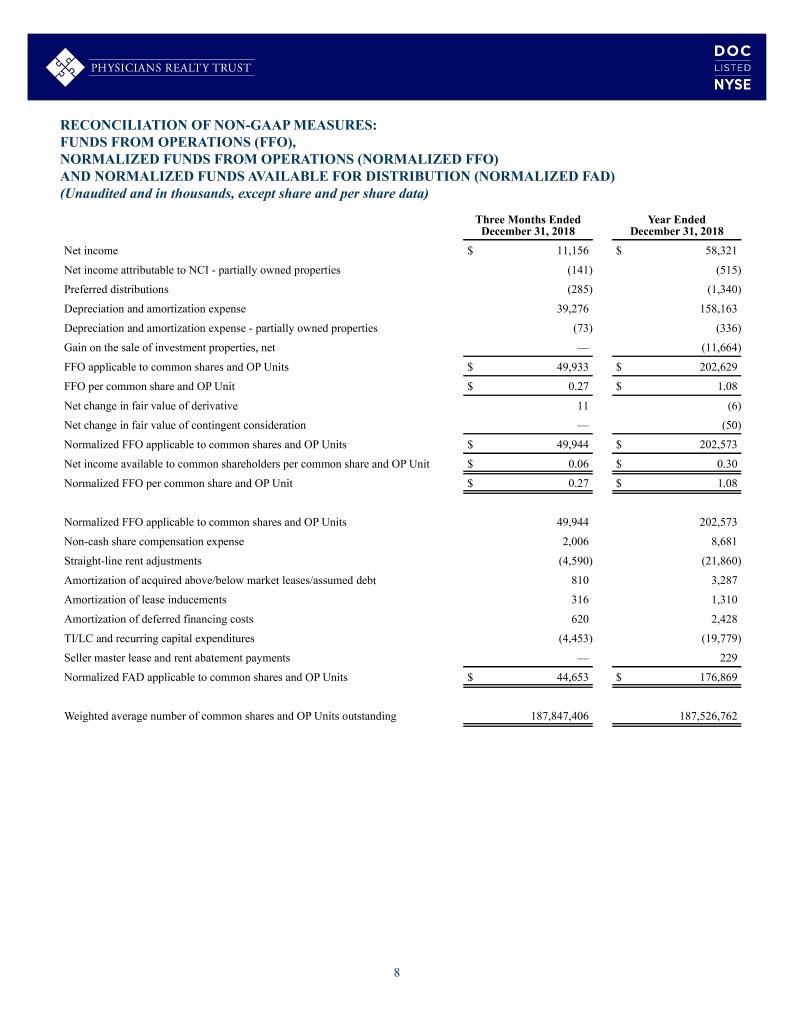

RECONCILIATION OF NON-GAAP MEASURES: FUNDS FROM OPERATIONS (FFO), NORMALIZED FUNDS FROM OPERATIONS (NORMALIZED FFO) AND NORMALIZED FUNDS AVAILABLE FOR DISTRIBUTION (NORMALIZED FAD) (Unaudited and in thousands, except share and per share data) Three Months Ended Year Ended December 31, 2018 December 31, 2018 Net income $ 11,156 $ 58,321 Net income attributable to NCI - partially owned properties (141) (515) Preferred distributions (285) (1,340) Depreciation and amortization expense 39,276 158,163 Depreciation and amortization expense - partially owned properties (73) (336) Gain on the sale of investment properties, net — (11,664) FFO applicable to common shares and OP Units $ 49,933 $ 202,629 FFO per common share and OP Unit $ 0.27 $ 1.08 Net change in fair value of derivative 11 (6) Net change in fair value of contingent consideration — (50) Normalized FFO applicable to common shares and OP Units $ 49,944 $ 202,573 Net income available to common shareholders per common share and OP Unit $ 0.06 $ 0.30 Normalized FFO per common share and OP Unit $ 0.27 $ 1.08 Normalized FFO applicable to common shares and OP Units 49,944 202,573 Non-cash share compensation expense 2,006 8,681 Straight-line rent adjustments (4,590) (21,860) Amortization of acquired above/below market leases/assumed debt 810 3,287 Amortization of lease inducements 316 1,310 Amortization of deferred financing costs 620 2,428 TI/LC and recurring capital expenditures (4,453) (19,779) Seller master lease and rent abatement payments — 229 Normalized FAD applicable to common shares and OP Units $ 44,653 $ 176,869 Weighted average number of common shares and OP Units outstanding 187,847,406 187,526,762 8

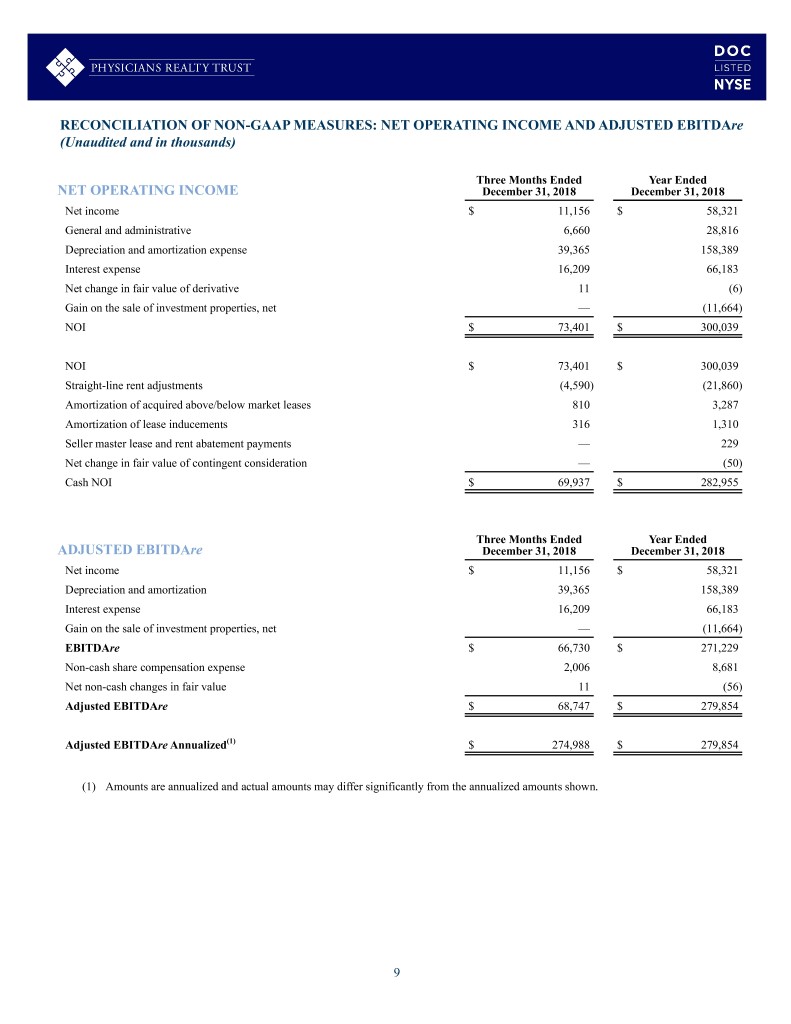

RECONCILIATION OF NON-GAAP MEASURES: NET OPERATING INCOME AND ADJUSTED EBITDAre (Unaudited and in thousands) Three Months Ended Year Ended NET OPERATING INCOME December 31, 2018 December 31, 2018 Net income $ 11,156 $ 58,321 General and administrative 6,660 28,816 Depreciation and amortization expense 39,365 158,389 Interest expense 16,209 66,183 Net change in fair value of derivative 11 (6) Gain on the sale of investment properties, net — (11,664) NOI $ 73,401 $ 300,039 NOI $ 73,401 $ 300,039 Straight-line rent adjustments (4,590) (21,860) Amortization of acquired above/below market leases 810 3,287 Amortization of lease inducements 316 1,310 Seller master lease and rent abatement payments — 229 Net change in fair value of contingent consideration — (50) Cash NOI $ 69,937 $ 282,955 Three Months Ended Year Ended ADJUSTED EBITDAre December 31, 2018 December 31, 2018 Net income $ 11,156 $ 58,321 Depreciation and amortization 39,365 158,389 Interest expense 16,209 66,183 Gain on the sale of investment properties, net — (11,664) EBITDAre $ 66,730 $ 271,229 Non-cash share compensation expense 2,006 8,681 Net non-cash changes in fair value 11 (56) Adjusted EBITDAre $ 68,747 $ 279,854 Adjusted EBITDAre Annualized(1) $ 274,988 $ 279,854 (1) Amounts are annualized and actual amounts may differ significantly from the annualized amounts shown. 9

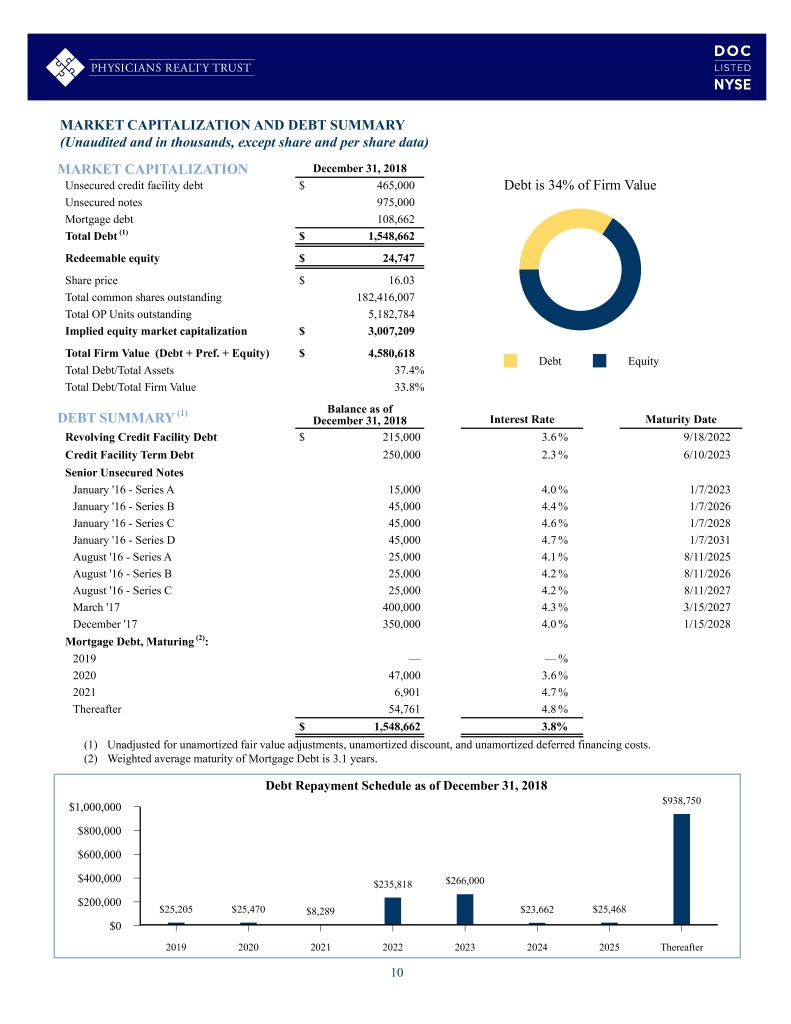

MARKET CAPITALIZATION AND DEBT SUMMARY (Unaudited and in thousands, except share and per share data) MARKET CAPITALIZATION December 31, 2018 Unsecured credit facility debt $ 465,000 Debt is 34% of Firm Value Unsecured notes 975,000 Mortgage debt 108,662 Total Debt (1) $ 1,548,662 Redeemable equity $ 24,747 Share price $ 16.03 Total common shares outstanding 182,416,007 Total OP Units outstanding 5,182,784 Implied equity market capitalization $ 3,007,209 Total Firm Value (Debt + Pref. + Equity) $ 4,580,618 Debt Equity Total Debt/Total Assets 37.4% Total Debt/Total Firm Value 33.8% (1) Balance as of DEBT SUMMARY December 31, 2018 Interest Rate Maturity Date Revolving Credit Facility Debt $ 215,000 3.6 % 9/18/2022 Credit Facility Term Debt 250,000 2.3 % 6/10/2023 Senior Unsecured Notes January '16 - Series A 15,000 4.0 % 1/7/2023 January '16 - Series B 45,000 4.4 % 1/7/2026 January '16 - Series C 45,000 4.6 % 1/7/2028 January '16 - Series D 45,000 4.7 % 1/7/2031 August '16 - Series A 25,000 4.1 % 8/11/2025 August '16 - Series B 25,000 4.2 % 8/11/2026 August '16 - Series C 25,000 4.2 % 8/11/2027 March '17 400,000 4.3 % 3/15/2027 December '17 350,000 4.0 % 1/15/2028 Mortgage Debt, Maturing (2): 2019 — — % 2020 47,000 3.6 % 2021 6,901 4.7 % Thereafter 54,761 4.8 % $ 1,548,662 3.8% (1) Unadjusted for unamortized fair value adjustments, unamortized discount, and unamortized deferred financing costs. (2) Weighted average maturity of Mortgage Debt is 3.1 years. Debt Repayment Schedule as of December 31, 2018 $938,750 $1,000,000 $800,000 $600,000 $400,000 $235,818 $266,000 $200,000 $25,205 $25,470 $8,289 $23,662 $25,468 $0 2019 2020 2021 2022 2023 2024 2025 Thereafter 10

FINANCIAL STATISTICS AND COVENANT PERFORMANCE (Unaudited and in thousands, except share and per share data) Quarter Ended December 31, 2018 Annualized dividend rate (1) $ 0.92 Price per share (2) $ 16.03 Annualized Dividend Yield 5.74% Total debt (3) $ 1,548,662 Net debt (less cash) 1,529,501 Adjusted EBITDAre (annualized)* 274,988 Net Debt / Adjusted EBITDAre Ratio 5.56x Adjusted EBITDAre (annualized)* $ 274,988 Cash interest expense (annualized)* 62,420 Interest Coverage Ratio 4.41x Total interest $ 16,209 Capitalized interest 93 Secured debt principal amortization 277 Total fixed charges $ 16,579 Adjusted EBITDAre 68,747 Adjusted EBITDAre Fixed Charge Coverage Ratio 4.15x Implied equity market cap $ 3,007,209 Redeemable equity 24,747 Total debt (3) 1,548,662 Total Firm Value 4,580,618 Total debt (3) $ 1,548,662 Total assets 4,142,834 Total Debt / Total Assets 37.4% Total Debt / Total Firm Value 33.8% Weighted average common shares 182,361,904 Weighted average unvested restricted common shares and share units 303,087 Weighted average OP Units not owned by DOC 5,182,415 Weighted Average Common Shares and OP Units - Diluted 187,847,406 COVENANT PERFORMANCE Required December 31, 2018 Total Leverage Ratio ≤ 60.0% 35.6% Total Secured Leverage Ratio ≤ 40.0% 2.5% Maintenance of Unencumbered Assets ≥ 1.5x 2.9x Consolidated Debt Service (Trailing Four Quarters) ≥ 1.5x 4.1x (1) Annualized rate based on $0.23 quarterly dividend for the quarter ending December 31, 2018. Actual dividend amounts will be determined by the Trust's board of trustees based on a variety of factors. (2) Closing common share price of $16.03 as of December 31, 2018. (3) Unadjusted for unamortized fair value adjustments, unamortized discount, and unamortized deferred financing costs. * Amounts are annualized and actual amounts may differ significantly from the annualized amounts shown. 11

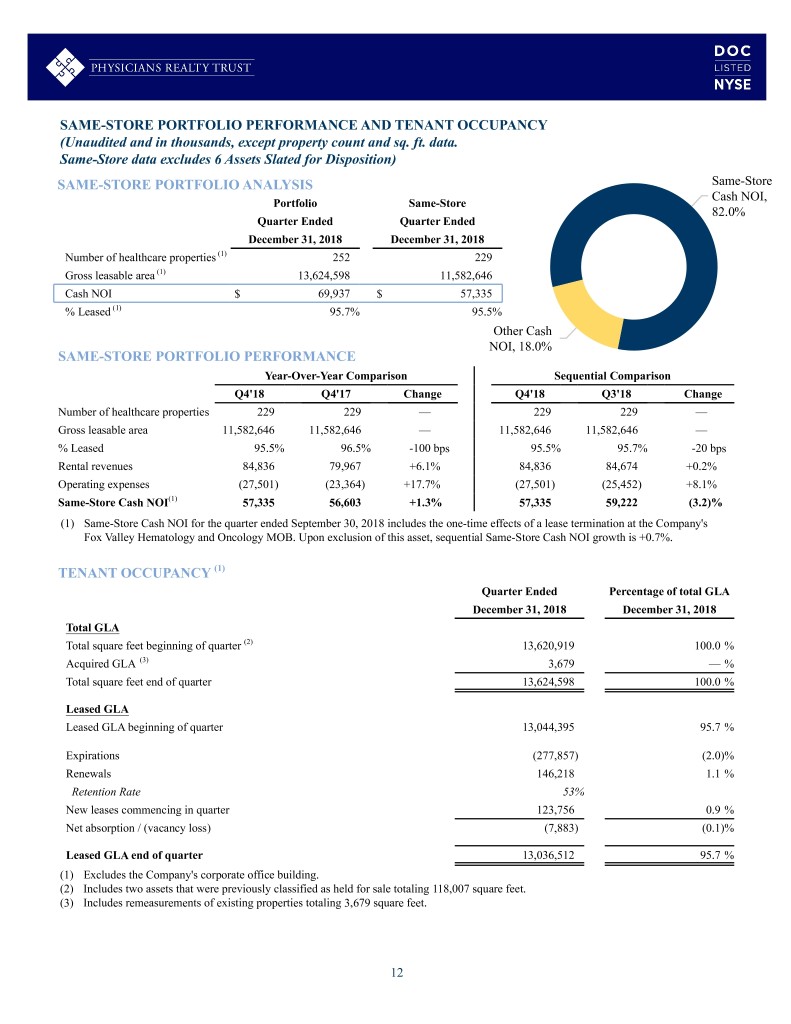

SAME-STORE PORTFOLIO PERFORMANCE AND TENANT OCCUPANCY (Unaudited and in thousands, except property count and sq. ft. data. Same-Store data excludes 6 Assets Slated for Disposition) SAME-STORE PORTFOLIO ANALYSIS Same-Store Cash NOI, Portfolio Same-Store 82.0% Quarter Ended Quarter Ended December 31, 2018 December 31, 2018 Number of healthcare properties (1) 252 229 Gross leasable area (1) 13,624,598 11,582,646 Cash NOI $ 69,937 $ 57,335 % Leased (1) 95.7% 95.5% Other Cash NOI, 18.0% SAME-STORE PORTFOLIO PERFORMANCE Year-Over-Year Comparison Sequential Comparison Q4'18 Q4'17 Change Q4'18 Q3'18 Change Number of healthcare properties 229 229 — 229 229 — Gross leasable area 11,582,646 11,582,646 — 11,582,646 11,582,646 — % Leased 95.5% 96.5% -100 bps 95.5% 95.7% -20 bps Rental revenues 84,836 79,967 +6.1% 84,836 84,674 +0.2% Operating expenses (27,501) (23,364) +17.7% (27,501) (25,452) +8.1% Same-Store Cash NOI(1) 57,335 56,603 +1.3% 57,335 59,222 (3.2)% (1) Same-Store Cash NOI for the quarter ended September 30, 2018 includes the one-time effects of a lease termination at the Company's Fox Valley Hematology and Oncology MOB. Upon exclusion of this asset, sequential Same-Store Cash NOI growth is +0.7%. TENANT OCCUPANCY (1) Quarter Ended Percentage of total GLA December 31, 2018 December 31, 2018 Total GLA Total square feet beginning of quarter (2) 13,620,919 100.0 % Acquired GLA (3) 3,679 — % Total square feet end of quarter 13,624,598 100.0 % Leased GLA Leased GLA beginning of quarter 13,044,395 95.7 % Expirations (277,857) (2.0)% Renewals 146,218 1.1 % Retention Rate 53% New leases commencing in quarter 123,756 0.9 % Net absorption / (vacancy loss) (7,883) (0.1)% Leased GLA end of quarter 13,036,512 95.7 % (1) Excludes the Company's corporate office building. (2) Includes two assets that were previously classified as held for sale totaling 118,007 square feet. (3) Includes remeasurements of existing properties totaling 3,679 square feet. 12

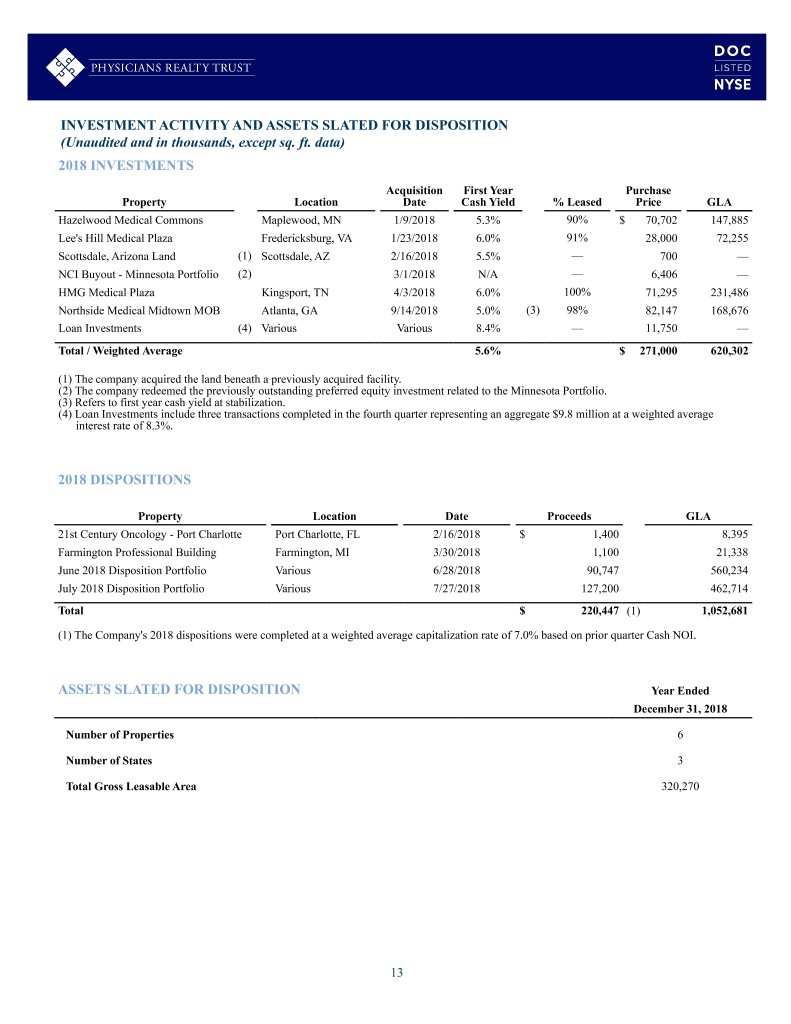

INVESTMENT ACTIVITY AND ASSETS SLATED FOR DISPOSITION (Unaudited and in thousands, except sq. ft. data) 2018 INVESTMENTS Acquisition First Year Purchase Property Location Date Cash Yield % Leased Price GLA Hazelwood Medical Commons Maplewood, MN 1/9/2018 5.3% 90% $ 70,702 147,885 Lee's Hill Medical Plaza Fredericksburg, VA 1/23/2018 6.0% 91% 28,000 72,255 Scottsdale, Arizona Land (1) Scottsdale, AZ 2/16/2018 5.5% — 700 — NCI Buyout - Minnesota Portfolio (2) 3/1/2018 N/A — 6,406 — HMG Medical Plaza Kingsport, TN 4/3/2018 6.0% 100% 71,295 231,486 Northside Medical Midtown MOB Atlanta, GA 9/14/2018 5.0% (3) 98% 82,147 168,676 Loan Investments (4) Various Various 8.4% — 11,750 — Total / Weighted Average 5.6% $ 271,000 620,302 (1) The company acquired the land beneath a previously acquired facility. (2) The company redeemed the previously outstanding preferred equity investment related to the Minnesota Portfolio. (3) Refers to first year cash yield at stabilization. (4) Loan Investments include three transactions completed in the fourth quarter representing an aggregate $9.8 million at a weighted average interest rate of 8.3%. 2018 DISPOSITIONS Property Location Date Proceeds GLA 21st Century Oncology - Port Charlotte Port Charlotte, FL 2/16/2018 $ 1,400 8,395 Farmington Professional Building Farmington, MI 3/30/2018 1,100 21,338 June 2018 Disposition Portfolio Various 6/28/2018 90,747 560,234 July 2018 Disposition Portfolio Various 7/27/2018 127,200 462,714 Total $ 220,447 (1) 1,052,681 (1) The Company's 2018 dispositions were completed at a weighted average capitalization rate of 7.0% based on prior quarter Cash NOI. ASSETS SLATED FOR DISPOSITION Year Ended December 31, 2018 Number of Properties 6 Number of States 3 Total Gross Leasable Area 320,270 13

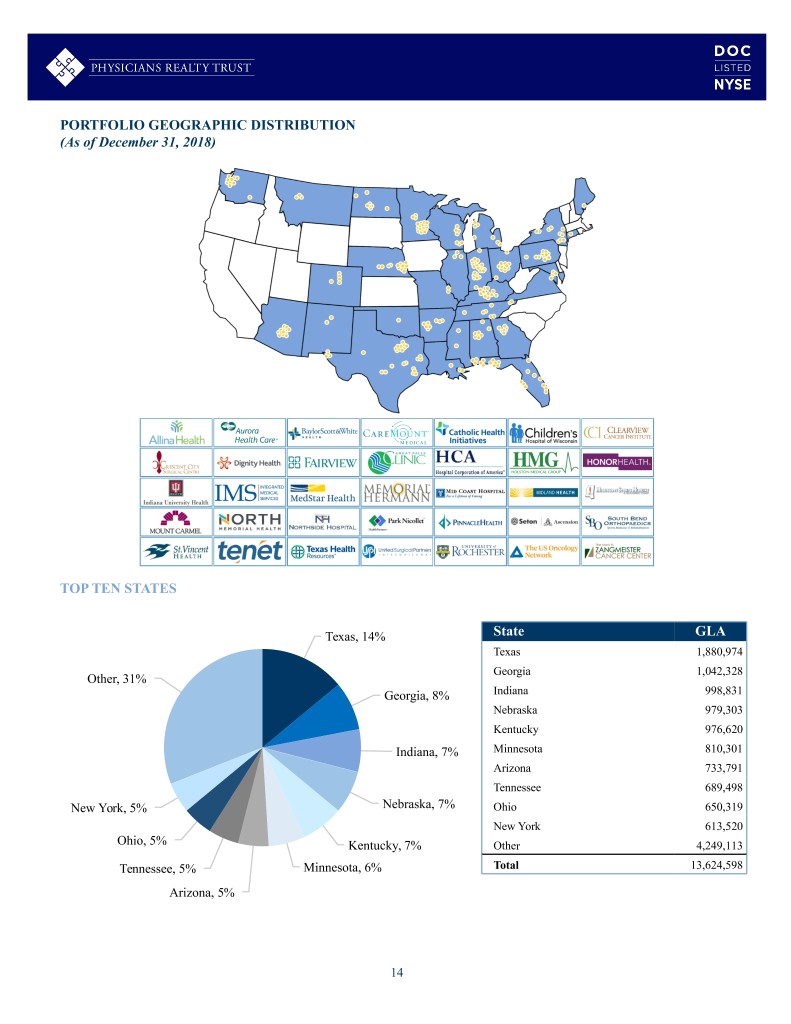

PORTFOLIO GEOGRAPHIC DISTRIBUTION (As of December 31, 2018) TOP TEN STATES Texas, 14% State GLA Texas 1,880,974 Georgia 1,042,328 Other, 31% Georgia, 8% Indiana 998,831 Nebraska 979,303 Kentucky 976,620 Indiana, 7% Minnesota 810,301 Arizona 733,791 Tennessee 689,498 New York, 5% Nebraska, 7% Ohio 650,319 New York 613,520 Ohio, 5% Kentucky, 7% Other 4,249,113 Tennessee, 5% Minnesota, 6% Total 13,624,598 Arizona, 5% 14

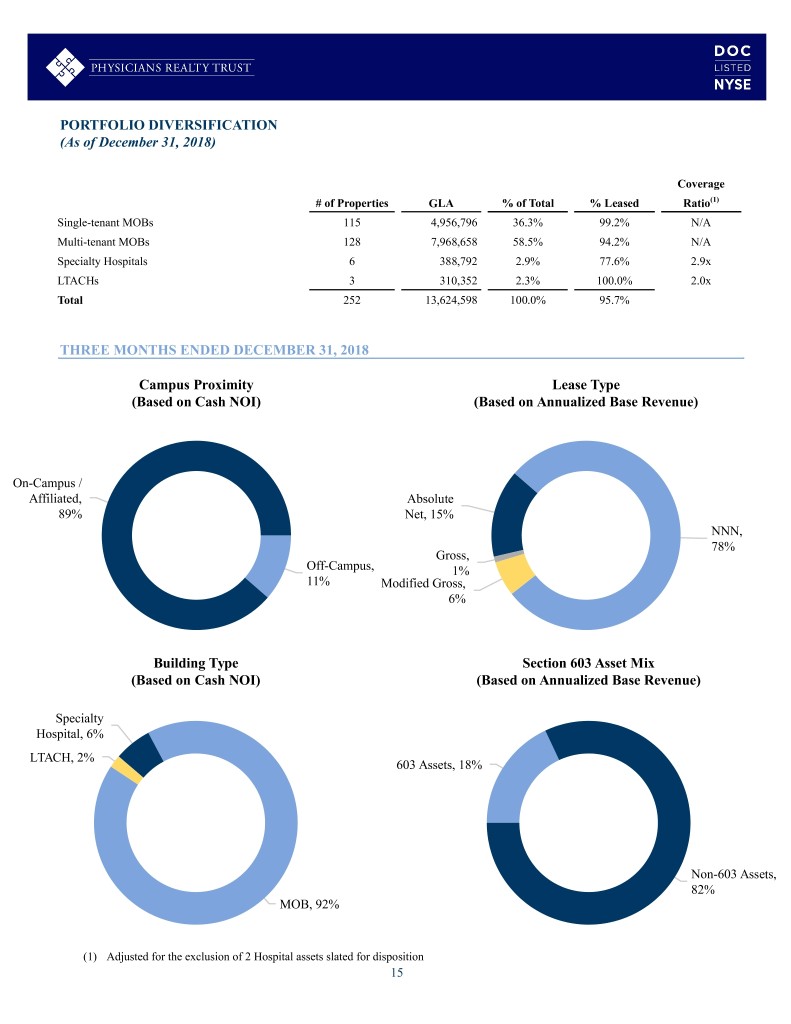

PORTFOLIO DIVERSIFICATION (As of December 31, 2018) Coverage # of Properties GLA % of Total % Leased Ratio(1) Single-tenant MOBs 115 4,956,796 36.3% 99.2% N/A Multi-tenant MOBs 128 7,968,658 58.5% 94.2% N/A Specialty Hospitals 6 388,792 2.9% 77.6% 2.9x LTACHs 3 310,352 2.3% 100.0% 2.0x Total 252 13,624,598 100.0% 95.7% THREE MONTHS ENDED DECEMBER 31, 2018 Campus Proximity Lease Type (Based on Cash NOI) (Based on Annualized Base Revenue) On-Campus / Affiliated, Absolute 89% Net, 15% NNN, 78% Gross, Off-Campus, 1% 11% Modified Gross, 6% Building Type Section 603 Asset Mix (Based on Cash NOI) (Based on Annualized Base Revenue) Specialty Hospital, 6% LTACH, 2% 603 Assets, 18% Non-603 Assets, 82% MOB, 92% (1) Adjusted for the exclusion of 2 Hospital assets slated for disposition 15

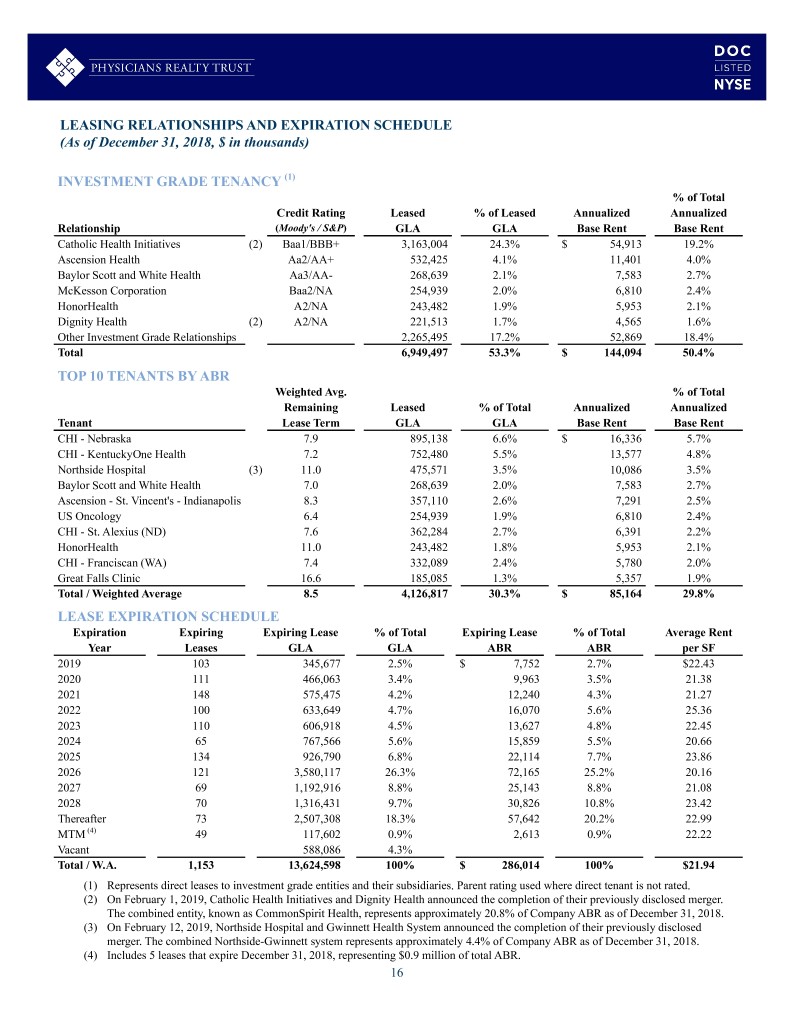

LEASING RELATIONSHIPS AND EXPIRATION SCHEDULE (As of December 31, 2018, $ in thousands) INVESTMENT GRADE TENANCY (1) % of Total Credit Rating Leased % of Leased Annualized Annualized Relationship (Moody's / S&P) GLA GLA Base Rent Base Rent Catholic Health Initiatives (2) Baa1/BBB+ 3,163,004 24.3% $ 54,913 19.2% Ascension Health Aa2/AA+ 532,425 4.1% 11,401 4.0% Baylor Scott and White Health Aa3/AA- 268,639 2.1% 7,583 2.7% McKesson Corporation Baa2/NA 254,939 2.0% 6,810 2.4% HonorHealth A2/NA 243,482 1.9% 5,953 2.1% Dignity Health (2) A2/NA 221,513 1.7% 4,565 1.6% Other Investment Grade Relationships 2,265,495 17.2% 52,869 18.4% Total 6,949,497 53.3% $ 144,094 50.4% TOP 10 TENANTS BY ABR Weighted Avg. % of Total Remaining Leased % of Total Annualized Annualized Tenant Lease Term GLA GLA Base Rent Base Rent CHI - Nebraska 7.9 895,138 6.6% $ 16,336 5.7% CHI - KentuckyOne Health 7.2 752,480 5.5% 13,577 4.8% Northside Hospital (3) 11.0 475,571 3.5% 10,086 3.5% Baylor Scott and White Health 7.0 268,639 2.0% 7,583 2.7% Ascension - St. Vincent's - Indianapolis 8.3 357,110 2.6% 7,291 2.5% US Oncology 6.4 254,939 1.9% 6,810 2.4% CHI - St. Alexius (ND) 7.6 362,284 2.7% 6,391 2.2% HonorHealth 11.0 243,482 1.8% 5,953 2.1% CHI - Franciscan (WA) 7.4 332,089 2.4% 5,780 2.0% Great Falls Clinic 16.6 185,085 1.3% 5,357 1.9% Total / Weighted Average 8.5 4,126,817 30.3% $ 85,164 29.8% LEASE EXPIRATION SCHEDULE Expiration Expiring Expiring Lease % of Total Expiring Lease % of Total Average Rent Year Leases GLA GLA ABR ABR per SF 2019 103 345,677 2.5% $ 7,752 2.7% $22.43 2020 111 466,063 3.4% 9,963 3.5% 21.38 2021 148 575,475 4.2% 12,240 4.3% 21.27 2022 100 633,649 4.7% 16,070 5.6% 25.36 2023 110 606,918 4.5% 13,627 4.8% 22.45 2024 65 767,566 5.6% 15,859 5.5% 20.66 2025 134 926,790 6.8% 22,114 7.7% 23.86 2026 121 3,580,117 26.3% 72,165 25.2% 20.16 2027 69 1,192,916 8.8% 25,143 8.8% 21.08 2028 70 1,316,431 9.7% 30,826 10.8% 23.42 Thereafter 73 2,507,308 18.3% 57,642 20.2% 22.99 MTM (4) 49 117,602 0.9% 2,613 0.9% 22.22 Vacant 588,086 4.3% Total / W.A. 1,153 13,624,598 100% $ 286,014 100% $21.94 (1) Represents direct leases to investment grade entities and their subsidiaries. Parent rating used where direct tenant is not rated. (2) On February 1, 2019, Catholic Health Initiatives and Dignity Health announced the completion of their previously disclosed merger. The combined entity, known as CommonSpirit Health, represents approximately 20.8% of Company ABR as of December 31, 2018. (3) On February 12, 2019, Northside Hospital and Gwinnett Health System announced the completion of their previously disclosed merger. The combined Northside-Gwinnett system represents approximately 4.4% of Company ABR as of December 31, 2018. (4) Includes 5 leases that expire December 31, 2018, representing $0.9 million of total ABR. 16

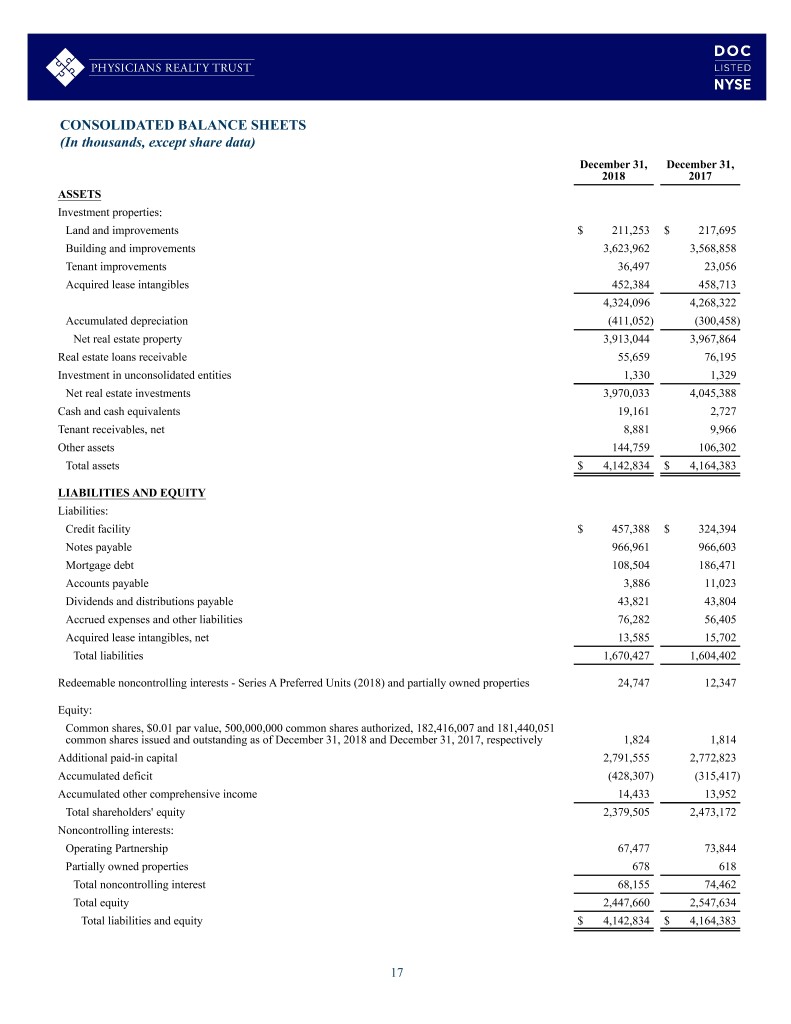

CONSOLIDATED BALANCE SHEETS (In thousands, except share data) December 31, December 31, 2018 2017 ASSETS Investment properties: Land and improvements $ 211,253 $ 217,695 Building and improvements 3,623,962 3,568,858 Tenant improvements 36,497 23,056 Acquired lease intangibles 452,384 458,713 4,324,096 4,268,322 Accumulated depreciation (411,052) (300,458) Net real estate property 3,913,044 3,967,864 Real estate loans receivable 55,659 76,195 Investment in unconsolidated entities 1,330 1,329 Net real estate investments 3,970,033 4,045,388 Cash and cash equivalents 19,161 2,727 Tenant receivables, net 8,881 9,966 Other assets 144,759 106,302 Total assets $ 4,142,834 $ 4,164,383 LIABILITIES AND EQUITY Liabilities: Credit facility $ 457,388 $ 324,394 Notes payable 966,961 966,603 Mortgage debt 108,504 186,471 Accounts payable 3,886 11,023 Dividends and distributions payable 43,821 43,804 Accrued expenses and other liabilities 76,282 56,405 Acquired lease intangibles, net 13,585 15,702 Total liabilities 1,670,427 1,604,402 Redeemable noncontrolling interests - Series A Preferred Units (2018) and partially owned properties 24,747 12,347 Equity: Common shares, $0.01 par value, 500,000,000 common shares authorized, 182,416,007 and 181,440,051 common shares issued and outstanding as of December 31, 2018 and December 31, 2017, respectively 1,824 1,814 Additional paid-in capital 2,791,555 2,772,823 Accumulated deficit (428,307) (315,417) Accumulated other comprehensive income 14,433 13,952 Total shareholders' equity 2,379,505 2,473,172 Noncontrolling interests: Operating Partnership 67,477 73,844 Partially owned properties 678 618 Total noncontrolling interest 68,155 74,462 Total equity 2,447,660 2,547,634 Total liabilities and equity $ 4,142,834 $ 4,164,383 17

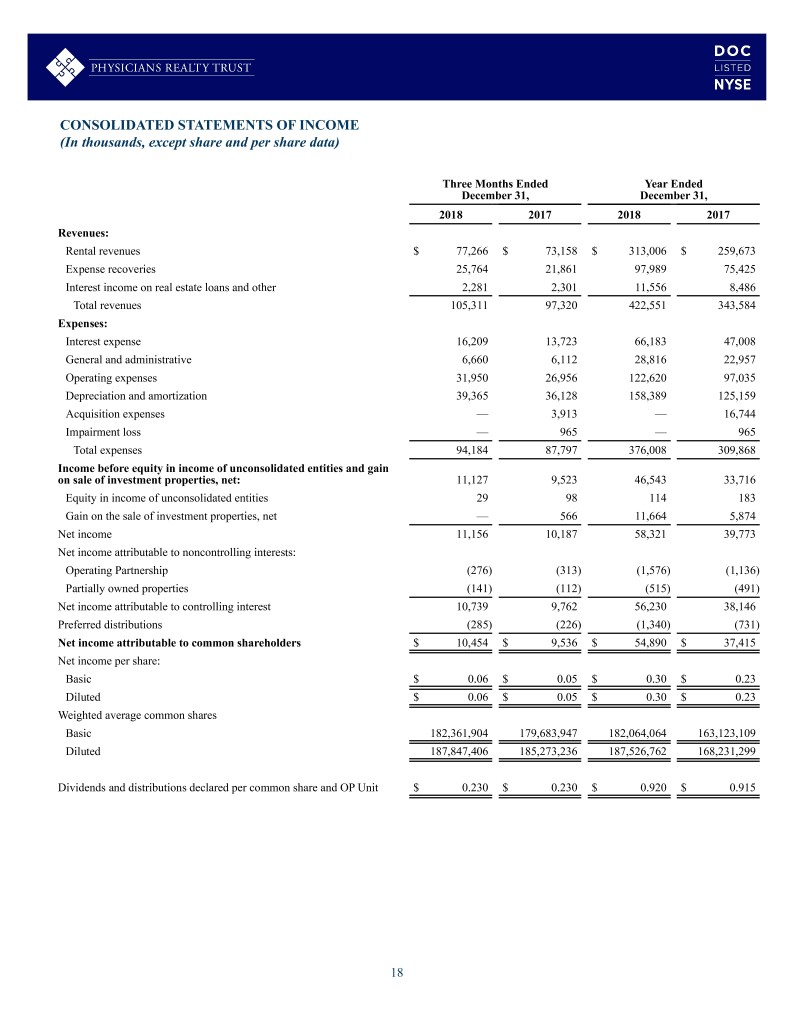

CONSOLIDATED STATEMENTS OF INCOME (In thousands, except share and per share data) Three Months Ended Year Ended December 31, December 31, 2018 2017 2018 2017 Revenues: Rental revenues $ 77,266 $ 73,158 $ 313,006 $ 259,673 Expense recoveries 25,764 21,861 97,989 75,425 Interest income on real estate loans and other 2,281 2,301 11,556 8,486 Total revenues 105,311 97,320 422,551 343,584 Expenses: Interest expense 16,209 13,723 66,183 47,008 General and administrative 6,660 6,112 28,816 22,957 Operating expenses 31,950 26,956 122,620 97,035 Depreciation and amortization 39,365 36,128 158,389 125,159 Acquisition expenses — 3,913 — 16,744 Impairment loss — 965 — 965 Total expenses 94,184 87,797 376,008 309,868 Income before equity in income of unconsolidated entities and gain on sale of investment properties, net: 11,127 9,523 46,543 33,716 Equity in income of unconsolidated entities 29 98 114 183 Gain on the sale of investment properties, net — 566 11,664 5,874 Net income 11,156 10,187 58,321 39,773 Net income attributable to noncontrolling interests: Operating Partnership (276) (313) (1,576) (1,136) Partially owned properties (141) (112) (515) (491) Net income attributable to controlling interest 10,739 9,762 56,230 38,146 Preferred distributions (285) (226) (1,340) (731) Net income attributable to common shareholders $ 10,454 $ 9,536 $ 54,890 $ 37,415 Net income per share: Basic $ 0.06 $ 0.05 $ 0.30 $ 0.23 Diluted $ 0.06 $ 0.05 $ 0.30 $ 0.23 Weighted average common shares Basic 182,361,904 179,683,947 182,064,064 163,123,109 Diluted 187,847,406 185,273,236 187,526,762 168,231,299 Dividends and distributions declared per common share and OP Unit $ 0.230 $ 0.230 $ 0.920 $ 0.915 18

REPORTING DEFINITIONS Adjusted Earnings Before Interest Taxes, Depreciation and Amortization for Real Estate (Adjusted EBITDAre): We define Adjusted EBITDAre for DOC as EBITDAre, computed in accordance with standards established by the National Association of Real Estate Investment Trusts (“NAREIT”), plus acquisition-related expenses, non-cash compensation, and other non-reoccurring items. We consider Adjusted EBITDAre an important measure because it provides additional information to allow management, investors, and our current and potential creditors to evaluate and compare our core operating results and our ability to service debt. Annualized Base Rent (ABR): Annualized base rent is calculated by multiplying reported base rent for December 2018 by 12 (but excluding the impact of concessions and straight-line rent). Assets Slated for Disposition: Properties that are included in discontinued operations, designated as held for sale, or for which there is an active intent to sell or reposition such properties. Where indicated, such assets are excluded from property counts, concentration statistics, and performance metrics for all periods presented. Results from these assets are included in the Company’s GAAP financial results and reconciliations. Cash Net Operating Income (NOI): Cash NOI is a non-GAAP financial measure which excludes from NOI straight-line rent adjustments, amortization of acquired below and above market leases and other non-cash and normalizing items. Other non-cash and normalizing items include items such as the amortization of lease inducements, and payment received from a seller master lease. DOC believes that Cash NOI provides an accurate measure of the operating performance of its operating assets because it excludes certain items that are not associated with management of the properties. Additionally, DOC believes that Cash NOI is a widely accepted measure of comparative operating performance in the real estate community. However, DOC’s use of the term Cash NOI may not be comparable to that of other real estate companies as such other companies may have different methodologies for computing this amount. Coverage Ratio: Reflects the ratio of full-year EBITDAR to rent of indicated properties. Coverage ratios are calculated one quarter in arrears, beginning the first full quarter after acquisition, for all properties the company has owned for fifteen months. Management fee is standardized to 4% of revenues for LTACHs. Earnings Before Interest Taxes, Depreciation, Amortization and Rent (EBITDAR): We define EBITDAR for DOC as net (loss) income computed in accordance with GAAP plus depreciation, amortization, interest expense and net change in the fair value of derivative financial instruments, net (loss) included from discontinued operations, stock based compensation, acquisition-related expenses and lease expense. We consider EBITDAR an important measure because it provides additional information to allow management, investors, and our current and potential creditors to evaluate and compare our tenants ability to fund their rent obligations. Earnings Before Interest Taxes, Depreciation and Amortization for Real Estate (EBITDAre): In 2017, NAREIT issued a white paper defining EBITDA for real estate as net income or loss computed in accordance with GAAP plus interest expense, income tax expense, depreciation and amortization expense, impairment, gains or losses from the sale of real estate; and the proportionate share of joint venture depreciation, amortization and other adjustments. We adopted the use of EBITDAre in the first quarter of 2018. Funds From Operations (FFO): Funds from operations, or FFO, is a widely recognized measure of REIT performance. We believe that information regarding FFO is helpful to shareholders and potential investors because it facilitates an understanding of the operating performance of our properties without giving effect to real estate depreciation and amortization, which assumes that the value of real estate assets diminishes ratably over time. We calculate FFO in accordance with standards established by NAREIT. NAREIT defines FFO as net income or loss (computed in accordance with GAAP) before noncontrolling interests of holders of OP units, excluding preferred distributions, gains (or losses) on sales of depreciable operating property, impairment write-downs on depreciable assets, plus real estate related depreciation and amortization (excluding amortization of deferred financing costs). Our FFO computation may not be comparable to FFO reported by other REITs that do not compute FFO in accordance with NAREIT definition or that interpret the NAREIT definition differently than we do. The GAAP measure that we believe to be most directly comparable to FFO, net income, includes depreciation and amortization expenses, gains or losses on property sales, impairments and noncontrolling interests. In computing FFO, we eliminate these items because, in our view, they are not indicative of the results from the operations of our properties. To facilitate a clear understanding of our historical operating results, FFO should be examined in conjunction with net income (determined in accordance with GAAP) as presented in our financial statements. FFO does not represent cash generated from operating activities in accordance with GAAP, should not be considered to be an alternative to net income or loss (determined in accordance with GAAP) as a measure of our liquidity and is not indicative of funds available for our cash needs, including our ability to make cash distributions to shareholders. Gross Leasable Area (GLA): Gross leasable area (in square feet). Gross Real Estate Investments: Based on acquisition price (and includes lease intangibles). Health System: We define an entity to be a health system if each of the following criteria are met: 1) the entity provides inpatient or outpatient services in the primary course of business; 2) services are provided at more than one campus or site of care; and 3) if the entity only provides outpatient services, they must employ a minimum of 50 physicians. Health System-Affiliated: Properties are considered affiliated with a health system if one or more of the following conditions are met: 1) the land parcel is contained within the physical boundaries of a hospital campus; 2) the land parcel is located adjacent to the campus; 3) the building is physically connected to the hospital regardless of the land ownership structure; 4) a ground lease is maintained with a health system entity; 5) a master lease is maintained with a health system entity; 6) significant square footage is leased to a health system entity; 7) the property includes an ambulatory surgery center with a hospital ownership interest; or 8) a significant square footage is leased to a physician group that is either employed, directly or indirectly by a health system, or has a significant clinical and financial affiliation with the health system. Hospitals: Hospitals refer to specialty surgical hospitals. These hospitals provide a wide range of inpatient and outpatient services, including but not limited to, surgery and clinical laboratories. LTACHs: Long-term acute care hospitals (LTACH) provide inpatient services for patients with complex medical conditions who require more sensitive care, monitoring or emergency support than that available in most skilled nursing facilities. 19

REPORTING DEFINITIONS (continued) Medical Office Building (MOB): Medical office buildings are office and clinic facilities, often located near hospitals or on hospital campuses, specifically constructed and designed for use by physicians and other health care personnel to provide services to their patients. They may also include ambulatory surgery centers that are used for general or specialty surgical procedures not requiring an overnight stay in a hospital. Medical office buildings may contain sole and group physician practices and may provide laboratory and other patient services. Net Operating Income (NOI): NOI is a non-GAAP financial measure that is defined as net income or loss, computed in accordance with GAAP, generated from DOC’s total portfolio of properties before general and administrative expenses, acquisition-related expenses, depreciation and amortization expense, REIT expenses, interest expense and net change in the fair value of derivative financial instruments, and gains or loss on the sale of discontinued properties. DOC believes that NOI provides an accurate measure of operating performance of its operating assets because NOI excludes certain items that are not associated with management of the properties. Additionally, DOC’s use of the term NOI may not be comparable to that of other real estate companies as they may have different methodologies for computing this amount. Normalized Funds Available for Distribution (Normalized FAD): DOC defines Normalized FAD, a non-GAAP measure, which excludes from Normalized FFO non-cash share compensation expense, straight-line rent adjustments, amortization of acquired above or below market leases and assumed debt, amortization of deferred financing costs, amortization of lease inducements, and recurring capital expenditures related to tenant improvements and leasing commissions, and includes cash payments from seller master leases and rent abatement payments. Other REITs or real estate companies may use different methodologies for calculating Normalized FAD, and accordingly, our computation may not be comparable to those reported by other REITs. Although the Company’s computation of Normalized FAD may not be comparable to that of other REITs, the Company believes Normalized FAD provides a meaningful supplemental measure of its performance due to its frequency of use by analysts, investors, and other interested parties in the evaluation of our performance as a REIT. Normalized FAD should not be considered as an alternative to net income or loss attributable to controlling interest (computed in accordance with GAAP) or as an indicator of the Company’s financial performance. Normalized FAD should be reviewed in connection with other GAAP measurements. Normalized Funds From Operations (Normalized FFO): Changes in the accounting and reporting rules under GAAP have prompted a significant increase in the amount of non-operating items included in FFO, as defined. Therefore, DOC uses Normalized FFO, which excludes from FFO net change in fair value of derivative financial instruments, acquisition expenses, acceleration of deferred financing costs, write off contingent consideration and other normalizing items. However, our use of the term Normalized FFO may not be comparable to that of other real estate companies as they may have different methodologies for computing this amount. Normalized FFO should not be considered as an alternative to net income or loss (computed in accordance with GAAP), as an indicator of our financial performance or of cash flow from operating activities (computed in accordance with GAAP), or as an indicator of our liquidity, nor is it indicative of funds available to fund our cash needs, including its ability to make distributions. Normalized FFO should be reviewed in connection with other GAAP measurements. Occupancy: Occupancy represents the percentage of total gross leasable area that is leased, including month-to-month leases, leases in holdover status, and leases that are signed but not yet commenced, as of the date reported. Off-Campus: A building portfolio that is not located on or adjacent to key hospital based-campuses. On-Campus / Affiliated: On-campus refers to a property that is located on or within a quarter mile to a health system. Affiliated refers to a property that is not on the campus of a health system, but is affiliated with a health system. Same-Store Portfolio: The same-store portfolio consists of medical properties held by the Company for the entire preceding year and not currently slated for disposition. Section 603 Assets: For the purposes of this Supplemental Information, "603 Asset" is defined to be our estimate of Annualized Base Revenue (ABR) as a percentage of all our ABR, derived from leases to hospitals for hospital outpatient department space located in an off-campus medical office building at least 250 yards from the hospital's main campus inpatient location, and that was billing Medicare for outpatient department services provided in that off-campus location as of November 2, 2015. ABR that is "not-603" for the purposes of this Supplemental Information could and would include ABR from space leased to a hospital outpatient department services provided in leased space within the 250 yard requirement for on-campus locations or in buildings that are more than 250 yards from the hospital service provider's main campus, but the hospital did not start billing for that service in the location until after November 2, 2015. 20