UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-22895

Capitol Series Trust

(Exact name of registrant as specified in charter)

Ultimus Fund Solutions, LLC

225 Pictoria Drive, Suite 450

Cincinnati, OH 45246

(Address of principal executive offices) (Zip code)

Zachary P. Richmond

Ultimus Fund Solutions, LLC

225 Pictoria Drive, Suite 450

Cincinnati, OH 45246

(Name and address of agent for service)

| Registrant’s telephone number, including area code: | 513-587-3400 | |

| Date of fiscal year end: | September 30 | |

| Date of reporting period: | March 31, 2020 | |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

Fuller & Thaler Behavioral Small-Cap Equity Fund

Fuller & Thaler Behavioral Small-Cap Growth Fund

Fuller & Thaler Behavioral Mid-Cap Value Fund

Fuller & Thaler Behavioral Unconstrained Equity Fund

Fuller & Thaler Behavioral Small-Mid Core Equity Fund

Fuller & Thaler Behavioral Micro-Cap Equity Fund

Semi-Annual Report

March 31, 2020

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund’s shareholder reports like this one will no longer be sent by mail, unless you specifically request paper copies of the reports from the Fund or from your financial intermediary such as a broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically by contacting the Fund at (888) 912-4562 or, if you own these shares through a financial intermediary, you may contact your financial intermediary.

You may elect to receive all future reports in paper free of charge. You can inform the Fund that you wish to continue receiving paper copies of your shareholder reports by contacting the Fund at (888) 912-4562. If you own shares through a financial intermediary, you may contact your financial intermediary or follow instructions included with this document to elect to continue to receive paper copies of your shareholder reports. Your election to receive reports in paper will apply to all funds held with the fund complex or at your financial intermediary.

411 Borel Avenue, Suite 300

San Mateo, CA 94402

(888) 912-4562

Fuller & Thaler Funds

Shareholder Letter (Unaudited)

March 31, 2020

Dear Shareholders:

Fuller & Thaler’s investment process is based on decades of research into behavioral finance. Our very own Dr. Richard Thaler won the 2017 Nobel Prize® in Economics for his research on behavioral finance. Behavioral finance is the study of how investors actually behave, as opposed to how they should behave, when making investment decisions. Professional investors are human, and like all humans, they make mistakes. Investors make mistakes because they have emotions, use imperfect rules-of thumb, and have priorities beyond risk and return. We look for those mistakes. We predict when other investors – the “market” – have likely made a behavioral mistake, and in turn, have created a buying opportunity.

There are two kinds of mistakes that produce buying opportunities: over-reaction and under reaction. Other investors may over-react to bad news and losses (e.g., panic). Or investors may underreact to good news (e.g., not pay attention). At the individual stock level, we search for events that suggest this type of investor misbehavior. If these behaviors are present, we then analyze fundamentals. In summary, if an investor mistake is likely and the company has solid fundamentals – we buy the stock.

Our value strategies buy when others have likely over-reacted to bad news. Our growth strategies buy when others have likely under-reacted to good news. Our blend strategies combine both insights.

Our Funds deliver similar risk characteristics to their benchmarks. We believe our behavioral insights provide us with an opportunity to outperform.

Our behavioral process delivers returns primarily through stock selection. In general, we aim to deliver portfolios with similar sector composition and risk characteristics to that of each benchmark, but we will deviate when stock-specific opportunities arise.

During this ongoing COVID-19 pandemic, we’d like to briefly mention how we are responding, as a firm and as investors.

As a firm, we have been able to operate remotely with little disruption thanks to our prior business continuity planning. Our office is in San Mateo, California in the San Francisco Bay Area —earthquake country—and we prepared long ago to be able to work remotely if necessary. Our entire office has been working from home since March 9th. With widespread high-speed internet, video-conferencing, and other tools, there has been no disruption to our investment process.

As investors, we believe the ongoing volatility in the market related to the COVID-19 pandemic has demonstrated the power of our approach, which invests based on psychological principles, not formulas. Other investors initially under-reacted to the coronavirus, and then by selling stocks indiscriminately, over-reacted in many stocks. Our investment process is designed to capitalize on these investor mistakes. One key event that indicates investors may have over-reacted to bad news is insider buying—when management of a company buys shares of their own stock. Like us, insiders are long-term investors. We have seen the highest level of insider buying in the history of our firm.

1

Fuller & Thaler Funds

Shareholder Letter (Unaudited) (continued)

March 31, 2020

Looking forward, we believe that while the next few quarters are uncertain, the long-term opportunities for the stocks we own are very good.

We believe that our unique, behaviorally driven investment process will continue to identify these opportunities and allow our Funds to outperform both our peers and our benchmarks.

We thank you for your investments in our Funds.

Nobel Prize® is a trademark of the Nobel Foundation.

2

Investment Results (Unaudited)

Average Annual Total Returns* as of March 31, 2020

| | Six

Months | One Year | Three Year | Five Year | Since

Inception

(9/8/11) | Since

Inception

(12/19/18) |

Fuller & Thaler Behavioral Small-Cap Equity Fund | | | |

R6 Shares | -19.47% | -15.30% | -2.14% | 3.54% | 10.62% | |

Institutional Shares | -19.50% | -15.40% | -2.24% | 3.39% | 10.48% | |

Investor Shares | -19.65% | -15.67% | -2.48% | 3.18% | 10.26% | |

A Shares | | | | | | |

Without Load | -19.50% | -15.48% | | | | -3.11% |

With Load | -24.13% | -20.36% | | | | -7.49% |

C Shares | | | | | | |

Without Load | -19.86% | -16.09% | | | | -3.82% |

With Load | -20.66% | -16.09% | | | | -3.82% |

Russell 2000® Index(a) | -23.72% | -23.99% | -4.64% | -0.25% | 7.59% | -10.21% |

| | R6 Shares | Institutional

Shares | Investor

Shares | A Shares | C Shares |

Expense Ratios(b) | 0.72% | 0.82% | 1.10% | 1.01% | 1.72% |

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fuller & Thaler Behavioral Small-Cap Equity Fund (the “Small-Cap Equity Fund”) distributions or the redemption of Small-Cap Equity Fund shares. Current performance of the Small-Cap Equity Fund may be lower or higher than the performance quoted. The Small-Cap Equity Fund’s investment objectives, risks, charges and expenses must be considered carefully before investing. Performance data current to the most recent month end may be obtained by calling (888) 912-4562.

* Return figures reflect any change in price per share and assume the reinvestment of all distributions. The Small-Cap Equity Fund’s returns reflect any fee waivers during the applicable periods. If such fee waivers had not occurred, the quoted performance would have been lower. Total returns for periods less than 1 year are not annualized. Prior to October 26, 2015, the performance reflected represents that of a series of Allianz Funds Multi-Strategy Trust for which Fuller & Thaler Asset Management, Inc. (the “Adviser”) served as the sole sub-adviser (“the Predecessor Fund”) (see Note 1).

(a) The Russell 2000® Index (“Russell 2000”) is a widely recognized unmanaged index of equity securities and is representative of a broader domestic equity market and range of securities than is found in the Small-Cap Equity Fund’s portfolio. The Russell 2000 measures the performance of the small cap segment of the U.S. equity universe. The Russell 2000 is a subset of the Russell 3000® Index and represents approximately 10% of total market capitalization of that index. Individuals cannot invest directly in an index; however, an individual can invest in exchange traded funds or other investment vehicles that attempt to track the performance of a benchmark index.

(b) The expense ratios are from the Small-Cap Equity Fund’s most recent prospectus dated January 28, 2020. The Adviser has contractually agreed to waive its management fee and/or reimburse Small-Cap Equity Fund expenses so that total annual operating expenses do not exceed 1.30%, 1.80%, 1.25%, 0.99% and 0.80% for A Shares, C Shares, Investor Shares, Institutional Shares and R6 Shares, respectively, of the average daily net assets for each class through January 31, 2021. The expense limitation does not apply to (i) interest (other than custodial overdraft fees and expenses associated with the Small-Cap Equity Fund’s participation in an alternative liquidity program), (ii) taxes, (iii) brokerage fees and commissions, (iv) other extraordinary expenses not incurred in the ordinary course of the Small-Cap Equity Fund’s business, (v) dividend expense on short sales and (vi) indirect expenses such as

3

Investment Results (Unaudited) (continued)

acquired fund fees and expenses incurred by the Small-Cap Equity Fund in any fiscal year. During any fiscal year that the Investment Advisory Agreement between the Adviser and Capitol Series Trust (the “Trust”) is in effect, the Adviser may recoup the sum of all fees previously waived or expenses reimbursed, less any reimbursement previously paid, provided that the Adviser is only permitted to recoup fees or expenses within 36 months from the date the fee waiver or expense reimbursement occurred and provided further that such recoupment can be achieved within the Expense Limitation Agreement currently in effect and the Expense Limitation Agreement in place when the waiver/reimbursement occurred. The Expense Limitation Agreement may not be terminated by the Adviser prior to its expiration date, but the Board of Trustees of the Trust (the “Board”) may terminate such agreement at any time. The Expense Limitation Agreement shall terminate automatically upon the termination of the Advisory Agreement. Additional information pertaining to the Small-Cap Equity Fund’s expense ratios as of March 31, 2020 can be found in the financial highlights.

The Small-Cap Equity Fund’s investment objectives, strategies, risks, charges and expenses must be considered carefully before investing. The Small-Cap Equity Fund’s prospectus contains this and other important information about the Small-Cap Equity Fund and may be obtained by calling (888) 912-4562. Please read it carefully before investing.

The Small-Cap Equity Fund is distributed by Ultimus Fund Distributors, LLC, member FINRA/SIPC.

4

Investment Results (Unaudited) (continued)

Average Annual Total Returns* as of March 31, 2020

| | Six

Months | One Year | Since

Inception

(12/21/17) | Since

Inception

(12/19/18) |

Fuller & Thaler Behavioral Small-Cap Growth Fund | | | | |

R6 Shares | -16.38% | -18.99% | -4.13% | |

Institutional Shares | -16.41% | -19.10% | -4.23% | |

Investor Shares | -16.53% | -19.29% | -4.46% | |

A Shares | | | | |

Without Load | -16.54% | -19.34% | | -6.32% |

With Load | -21.34% | -23.97% | | -10.57% |

C Shares | | | | |

Without Load | -16.78% | -19.77% | | -6.81% |

With Load | -17.62% | -19.77% | | -6.81% |

Russell 2000® Growth Index(a) | -17.31% | -18.58% | -6.38% | -3.27% |

| | Expense Ratios(b) |

| | R6 Shares | Institutional

Shares | Investor

Shares | A Shares | C Shares |

Gross | 2.19% | 2.25% | 2.57% | 2.15% | 2.87% |

With Applicable Waivers | 0.90% | 0.99% | 1.25% | 1.30% | 1.80% |

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fuller & Thaler Behavioral Small-Cap Growth Fund (the “Small-Cap Growth Fund”) distributions or the redemption of Small-Cap Growth Fund shares. Current performance of the Small-Cap Growth Fund may be lower or higher than the performance quoted. The Small-Cap Growth Fund’s investment objectives, risks, charges and expenses must be considered carefully before investing. Performance data current to the most recent month end may be obtained by calling (888) 912-4562.

* Return figures reflect any change in price per share and assume the reinvestment of all distributions. The Small-Cap Growth Fund’s returns reflect any fee waivers during the applicable periods. If such fee waivers had not occurred, the quoted performance would have been lower. Total returns for periods less than 1 year are not annualized.

(a) The Russell 2000® Growth Index (“Russell 2000 Growth”) is a widely recognized unmanaged index of equity securities and is representative of a broader domestic equity market and range of securities than is found in the Small-Cap Growth Fund’s portfolio. Russell 2000 Growth measures the performance of those Russell 2000 companies with higher price/book ratios and higher forecasted growth values. Individuals cannot invest directly in an index; however, an individual can invest in exchange traded funds or other investment vehicles that attempt to track the performance of a benchmark index.

(b) The expense ratios are from the Small-Cap Growth Fund’s most recent prospectus dated January 28, 2020. The Adviser has contractually agreed to waive its management fee and/or reimburse Small-Cap Growth Fund expenses so that total annual operating expenses do not exceed 1.30%, 1.80% 1.25%, 0.99%, and 0.90% for A Shares, C Shares, Investor Shares, Institutional Shares and R6 Shares, respectively, of the average daily net assets for each class through January 31, 2021. The expense limitation does not apply to (i) interest (other than custodial overdraft fees and expenses associated with the Small-Cap Growth Fund’s participation in an alternative liquidity program), (ii) taxes, (iii) brokerage fees and commissions, (iv) other extraordinary expenses not incurred in the ordinary course of the Small-Cap Growth Fund’s business, (v) dividend expense on short sales and (vi) indirect expenses such as acquired fund fees and expenses incurred by the Small-Cap Growth Fund in any fiscal year. During any fiscal year that the

5

Investment Results (Unaudited) (continued)

Investment Advisory Agreement between the Adviser and the Trust is in effect, the Adviser may recoup the sum of all fees previously waived or expenses reimbursed, less any reimbursement previously paid, provided that the Adviser is only permitted to recoup fees or expenses within 36 months from the date the fee waiver or expense reimbursement occurred and provided further that such recoupment can be achieved within the Expense Limitation Agreement currently in effect and the Expense Limitation Agreement in place when the waiver/reimbursement occurred. The Expense Limitation Agreement may not be terminated by the Adviser prior to its expiration date, but the Board may terminate such agreement at any time. The Expense Limitation Agreement shall terminate automatically upon the termination of the Advisory Agreement. Additional information pertaining to the Small-Cap Growth Fund’s expense ratios as of March 31, 2020 can be found in the financial highlights.

The Small-Cap Growth Fund’s investment objectives, strategies, risks, charges and expenses must be considered carefully before investing. The prospectus contains this and other important information about the Small-Cap Growth Fund and may be obtained by calling (888) 912-4562. Please read it carefully before investing.

The Small-Cap Growth Fund is distributed by Ultimus Fund Distributors, LLC, member FINRA/SIPC.

6

Investment Results (Unaudited) (continued)

Average Annual Total Returns* as of March 31, 2020

| | Six

Months | One Year | Since

Inception

(12/21/17) |

Fuller & Thaler Behavioral Mid-Cap Value Fund | | | |

R6 Shares | -28.29% | -23.10% | -10.56% |

Institutional Shares | -28.33% | -23.22% | -10.64% |

Investor Shares | -28.44% | -23.42% | -10.91% |

Russell Midcap® Value Index(a) | -27.37% | -24.13% | -11.20% |

| | Expense Ratios(b) |

| | R6 Shares | Institutional

Shares | Investor

Shares |

Gross | 1.72% | 1.81% | 2.10% |

With Applicable Waivers | 0.80% | 0.90% | 1.15% |

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fuller & Thaler Behavioral Mid-Cap Value Fund (the “Mid-Cap Value Fund”) distributions or the redemption of Mid-Cap Value Fund shares. Current performance of the Mid-Cap Value Fund may be lower or higher than the performance quoted. The Mid-Cap Value Fund’s investment objectives, risks, charges and expenses must be considered carefully before investing. Performance data current to the most recent month end may be obtained by calling (888) 912-4562.

* Return figures reflect any change in price per share and assume the reinvestment of all distributions. The Mid-Cap Value Fund’s returns reflect any fee waivers during the applicable periods. If such fee waivers had not occurred, the quoted performance would have been lower. Total returns for periods less than 1 year are not annualized.

(a) The Russell Midcap® Value Index (“Russell Midcap Value”) is a widely recognized unmanaged index of equity securities and is representative of a broader domestic equity market and range of securities than is found in the Mid-Cap Value Fund’s portfolio. The Russell Midcap Value measures the performance of those Russell Midcap companies with lower price/book ratios and lower forecasted growth values. Individuals cannot invest directly in an index; however, an individual can invest in exchange traded funds or other investment vehicles that attempt to track the performance of a benchmark index.

(b) The expense ratios are from the Mid-Cap Value Fund’s most recent prospectus dated January 28, 2020. The Adviser has contractually agreed to waive its management fee and/or reimburse Mid-Cap Value Fund expenses so that total annual operating expenses do not exceed 1.15%, 0.90%, and 0.80% for Investor Shares, Institutional Shares and R6 Shares, respectively, of the average daily net assets for each class through January 31, 2021. The expense limitation does not apply to (i) interest (other than custodial overdraft fees and expenses associated with the Mid-Cap Value Fund’s participation in an alternative liquidity program), (ii) taxes, (iii) brokerage fees and commissions, (iv) other extraordinary expenses not incurred in the ordinary course of the Mid-Cap Value Fund’s business, (v) dividend expense on short sales and (vi) indirect expenses such as acquired fund fees and expenses incurred by the Mid-Cap Value Fund in any fiscal year. During any fiscal year that the Investment Advisory Agreement between the Adviser and the Trust is in effect, the Adviser may recoup the sum of all fees previously waived or expenses reimbursed, less any reimbursement previously paid, provided that the Adviser is only permitted to recoup fees or expenses within 36 months from the date the fee waiver or expense reimbursement occurred and provided further that such recoupment can be achieved within the Expense Limitation Agreement currently in effect and the Expense Limitation Agreement in place when the waiver/reimbursement occurred. This Expense Limitation Agreement may not be terminated by the

7

Investment Results (Unaudited) (continued)

Adviser prior to its expiration date, but the Board may terminate such agreement at any time. The Expense Limitation Agreement shall terminate automatically upon the termination of the Advisory Agreement. Additional information pertaining to the Mid-Cap Value Fund’s expense ratios as of March 31, 2020 can be found in the financial highlights.

The Mid-Cap Value Fund’s investment objectives, strategies, risks, charges and expenses must be considered carefully before investing. The prospectus contains this and other important information about the Mid-Cap Value Fund and may be obtained by calling (888) 912-4562. Please read it carefully before investing.

The Mid-Cap Value Fund is distributed by Ultimus Fund Distributors, LLC, member FINRA/SIPC.

8

Investment Results (Unaudited) (continued)

Total Returns* as of March 31, 2020

| | Six

Months | One Year | Since

Inception

(12/26/18) |

Fuller & Thaler Behavioral Unconstrained Equity Fund | | | |

R6 Shares | -20.10% | -14.75% | 2.52% |

Institutional Shares | -20.16% | -14.85% | 2.40% |

Russell 3000® Index(a) | -13.70% | -9.13% | 4.21% |

| | Expense Ratios(b) |

| | R6 Shares | Institutional

Shares |

Gross | 4.33% | 4.39% |

With Applicable Waivers | 0.90% | 0.99% |

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fuller & Thaler Behavioral Unconstrained Equity Fund (the “Unconstrained Equity Fund”) distributions or the redemption of Unconstrained Equity Fund shares. Current performance of the Unconstrained Equity Fund may be lower or higher than the performance quoted. The Unconstrained Equity Fund’s investment objectives, risks, charges and expenses must be considered carefully before investing. Performance data current to the most recent month end may be obtained by calling (888) 912-4562.

* Return figures reflect any change in price per share and assume the reinvestment of all distributions. The Unconstrained Equity Fund’s returns reflect any fee waivers during the applicable periods. If such fee waivers had not occurred, the quoted performance would have been lower. Total returns for periods less than 1 year are not annualized.

(a) The Russell 3000® Index (“Russell 3000”) measures the performance of the broad U.S. equity market. The Russell 3000 represents the 3000 largest U.S. publicly traded companies as measured by market capitalization. Individuals cannot invest directly in an index; however, an individual can invest in exchange traded funds or other investment vehicles that attempt to track the performance of a benchmark index.

(b) The expense ratios are from the Unconstrained Equity Fund’s most recent prospectus dated January 28, 2020. The Adviser has contractually agreed to waive its management fee and/or reimburse Unconstrained Equity Fund expenses so that total annual operating expenses do not exceed 0.99% and 0.90% for Institutional Shares and R6 Shares, respectively, of the average daily net assets for each class through January 31, 2021. The expense limitation does not apply to (i) interest (other than custodial overdraft fees and expenses associated with the Unconstrained Equity Fund’s participation in an alternative liquidity program), (ii) taxes, (iii) brokerage fees and commissions, (iv) other extraordinary expenses not incurred in the ordinary course of the Unconstrained Equity Fund’s business, (v) dividend expense on short sales and (vi) indirect expenses such as acquired fund fees and expenses incurred by the Unconstrained Equity Fund in any fiscal year. During any fiscal year that the Investment Advisory Agreement between the Adviser and the Trust is in effect, the Adviser may recoup the sum of all fees previously waived or expenses reimbursed, less any reimbursement previously paid, provided that the Adviser is only permitted to recoup fees or expenses within 36 months from the date the fee waiver or expense reimbursement occurred and provided further that such recoupment can be achieved within the Expense Limitation Agreement currently in effect and the Expense Limitation Agreement in place when the waiver/reimbursement occurred. This Expense Limitation Agreement may not be terminated by the Adviser prior to its expiration date, but the Board may terminate such agreement at any time. The Expense Limitation Agreement shall terminate automatically upon the termination of the Advisory Agreement. Additional information pertaining to the Unconstrained Equity Fund’s expense ratios as of March 31, 2020 can be found in the financial highlights.

9

Investment Results (Unaudited) (continued)

The Unconstrained Equity Fund’s investment objectives, strategies, risks, charges and expenses must be considered carefully before investing. The prospectus contains this and other important information about the Unconstrained Equity Fund and may be obtained by calling (888) 912-4562. Please read it carefully before investing.

The Unconstrained Equity Fund is distributed by Ultimus Fund Distributors, LLC, member FINRA/SIPC.

10

Investment Results (Unaudited) (continued)

Total Returns* as of March 31, 2020

| | Six

Months | One Year | Since

Inception

(12/26/18) |

Fuller & Thaler Behavioral Small-Mid Core Equity Fund | | | |

Institutional Shares | -25.18% | -22.69% | -8.31% |

Russell 2500® Index(a) | -23.72% | -22.47% | -7.03% |

| | Expense

Ratios(b) |

| | Institutional

Shares |

Gross | 6.27% |

With Applicable Waivers | 0.95% |

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fuller & Thaler Behavioral Small-Mid Core Equity Fund (the “Small-Mid Core Equity Fund”) distributions or the redemption of Small-Mid Core Equity Fund shares. Current performance of the Small-Mid Core Equity Fund may be lower or higher than the performance quoted. The Small-Mid Core Equity Fund’s investment objectives, risks, charges and expenses must be considered carefully before investing. Performance data current to the most recent month end may be obtained by calling (888) 912-4562.

* Return figures reflect any change in price per share and assume the reinvestment of all distributions. The Small-Mid Core Equity Fund’s returns reflect any fee waivers during the applicable periods. If such fee waivers had not occurred, the quoted performance would have been lower. Total returns for periods less than 1 year are not annualized.

(a) The Russell 2500® Index (“Russell 2500”) is a widely recognized unmanaged index of equity securities and is representative of a broader domestic equity market and range of securities than is found in the Small-Mid Core Equity Fund’s portfolio. The Russell 2500 measures the performance of those Russell 2500 companies with lower price/book ratios and lower forecasted growth values. Individuals cannot invest directly in an index; however, an individual can invest in exchange traded funds or other investment vehicles that attempt to track the performance of a benchmark index.

(b) The expense ratios are from the Small-Mid Core Equity Fund’s most recent prospectus dated January 28, 2020. The Adviser has contractually agreed to waive its management fee and/or reimburse Small-Mid Core Equity Fund expenses so that total annual operating expenses do not exceed 0.95% of the Small-Mid Core Equity Fund’s Institutional Shares average daily net assets through January 31, 2021. The expense limitation does not apply to (i) interest (other than custodial overdraft fees and expenses associated with the Small-Mid Core Equity Fund’s participation in an alternative liquidity program), (ii) taxes, (iii) brokerage fees and commissions, (iv) other extraordinary expenses not incurred in the ordinary course of the Small-Mid Core Equity Fund’s business, (v) dividend expense on short sales and (vi) indirect expenses such as acquired fund fees and expenses incurred by the Small-Mid Core Equity Fund in any fiscal year. During any fiscal year that the Investment Advisory Agreement between the Adviser and the Trust is in effect, the Adviser may recoup the sum of all fees previously waived or expenses reimbursed, less any reimbursement previously paid, provided that the Adviser is only permitted to recoup fees or expenses within 36 months from the date the fee waiver or expense reimbursement occurred and provided further that such recoupment can be achieved within the Expense Limitation Agreement currently in effect and the Expense Limitation Agreement in place when the waiver/reimbursement occurred. This Expense Limitation Agreement may not be terminated by the Adviser prior to its expiration date, but the Board may terminate such agreement at

11

Investment Results (Unaudited) (continued)

any time. The Expense Limitation Agreement shall terminate automatically upon the termination of the Advisory Agreement. Additional information pertaining to the Small-Mid Core Equity Fund’s expense ratios as of March 31, 2020 can be found in the financial highlights.

The Small-Mid Core Equity Fund’s investment objectives, strategies, risks, charges and expenses must be considered carefully before investing. The prospectus contains this and other important information about the Small-Mid Core Equity Fund and may be obtained by calling (888) 912-4562. Please read it carefully before investing.

The Small-Mid Core Equity Fund is distributed by Ultimus Fund Distributors, LLC, member FINRA/SIPC.

12

Investment Results (Unaudited) (continued)

Total Returns* as of March 31, 2020

| | Six

Months | One Year | Since

Inception

(12/28/18) |

Fuller & Thaler Behavioral Micro-Cap Equity Fund | | | |

Institutional Shares | -39.10% | -45.64% | -28.12% |

Russell Microcap® Index(a) | -22.85% | -26.37% | -13.02% |

| | Expense

Ratios(b) |

| | Institutional

Shares |

Gross | 5.28% |

With Applicable Waivers | 1.75% |

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fuller & Thaler Behavioral Micro-Cap Equity Fund (the “Micro-Cap Equity Fund”) distributions or the redemption of Micro-Cap Equity Fund shares. Current performance of the Micro-Cap Equity Fund may be lower or higher than the performance quoted. The Micro-Cap Equity Fund’s investment objectives, risks, charges and expenses must be considered carefully before investing. Performance data current to the most recent month end may be obtained by calling (888) 912-4562.

* Return figures reflect any change in price per share and assume the reinvestment of all distributions. The Micro-Cap Equity Fund’s returns reflect any fee waivers during the applicable periods. If such fee waivers had not occurred, the quoted performance would have been lower. Total returns for periods less than 1 year are not annualized.

(a) The Russell Microcap® Index (“Russell Microcap”) measures the performance of the microcap segment of the U.S. equity market. Russell Microcap stocks make up less than 3% of the U.S. equity market (by market cap) and consist of the smallest 1,000 securities in the small cap Russell 2000® Index, plus the next smallest eligible securities by market cap. Individuals cannot invest directly in an index; however, an individual can invest in exchange traded funds or other investment vehicles that attempt to track the performance of a benchmark index.

(b) The expense ratios are from the Micro-Cap Equity Fund’s most recent prospectus dated January 28, 2020. The Adviser has contractually agreed to waive its management fee and/or reimburse Micro-Cap Equity Fund expenses so that total annual operating expenses do not exceed 1.75% of the Micro-Cap Equity Fund’s Institutional Shares average daily net assets through January 31, 2021. The expense limitation does not apply to (i) interest (other than custodial overdraft fees and expenses associated with the Micro-Cap Equity Fund’s participation in an alternative liquidity program), (ii) taxes, (iii) brokerage fees and commissions, (iv) other extraordinary expenses not incurred in the ordinary course of the Micro-Cap Equity Fund’s business, (v) dividend expense on short sales and (vi) indirect expenses such as acquired fund fees and expenses incurred by the Micro-Cap Equity Fund in any fiscal year. During any fiscal year that the Investment Advisory Agreement between the Adviser and the Trust is in effect, the Adviser may recoup the sum of all fees previously waived or expenses reimbursed, less any reimbursement previously paid, provided that the Adviser is only permitted to recoup fees or expenses within 36 months from the date the fee waiver or expense reimbursement occurred and provided further that such recoupment can be achieved within the Expense Limitation Agreement currently in effect and the Expense Limitation Agreement in place when the waiver/reimbursement occurred. This Expense Limitation Agreement may not be terminated by the Adviser prior to its expiration date, but the Board may terminate such agreement at any time. The Expense Limitation Agreement shall terminate automatically upon the termination of the Advisory Agreement. Additional information pertaining to the Micro-Cap Equity Fund’s expense ratios as of March 31, 2020 can be found in the financial highlights.

13

Investment Results (Unaudited) (continued)

The Micro-Cap Equity Fund’s investment objectives, strategies, risks, charges and expenses must be considered carefully before investing. The prospectus contains this and other important information about the Micro-Cap Equity Fund and may be obtained by calling (888) 912-4562. Please read it carefully before investing.

The Micro-Cap Equity Fund is distributed by Unified Financial Securities, LLC, member FINRA/SIPC.

14

Portfolio Illustration (Unaudited)

March 31, 2020

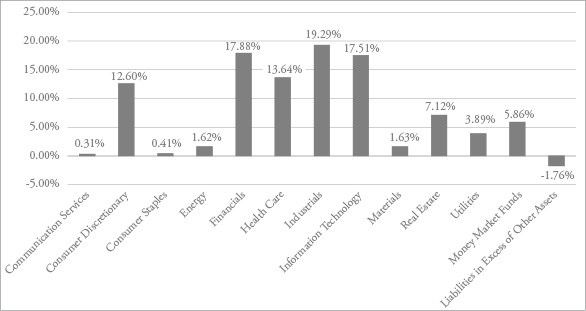

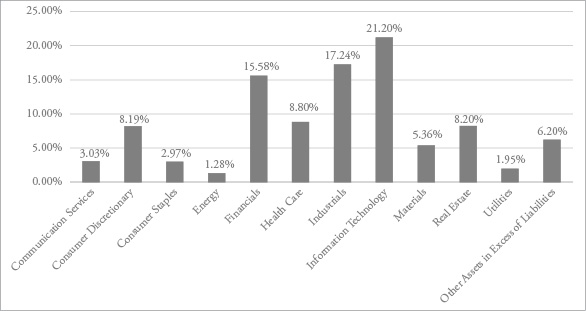

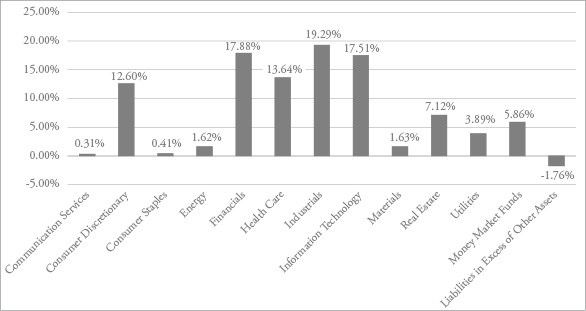

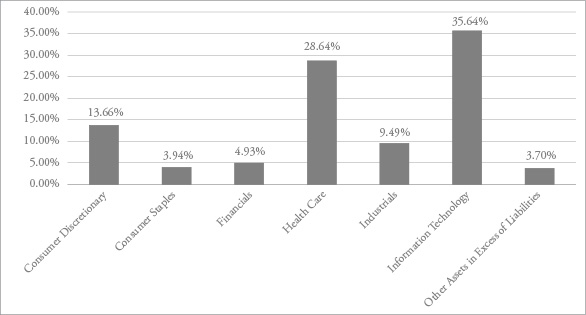

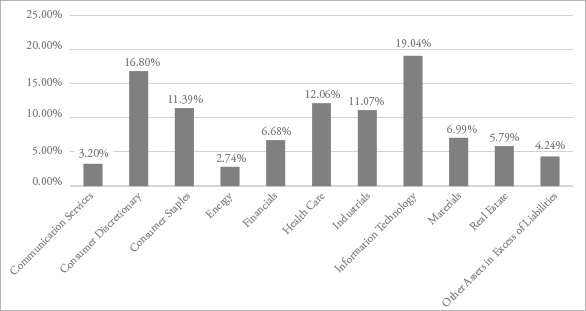

Fuller & Thaler Behavioral Small-Cap Equity Fund Sector Holdings as of March 31, 2020.*

Fuller & Thaler Behavioral Small-Cap Growth Fund Sector Holdings as of March 31, 2020.*

* | As a percentage of net assets. |

15

Portfolio Illustration (Unaudited)

March 31, 2020

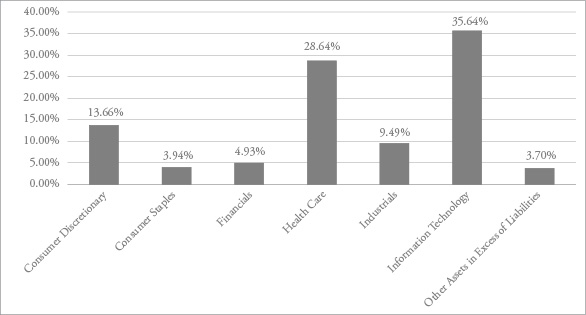

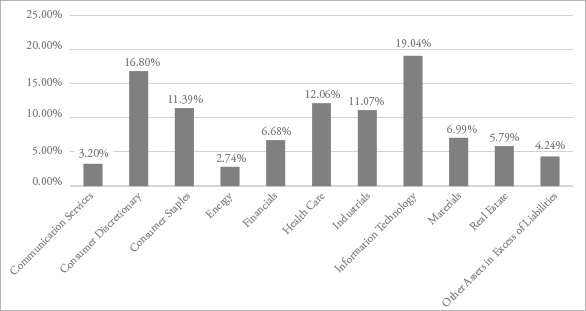

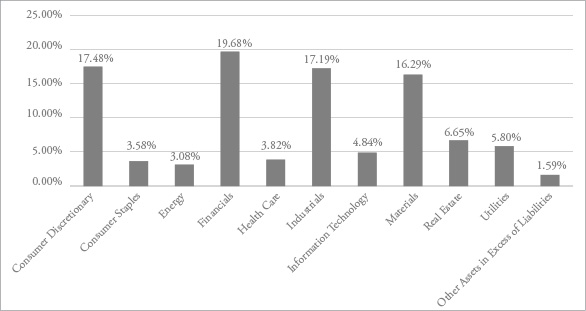

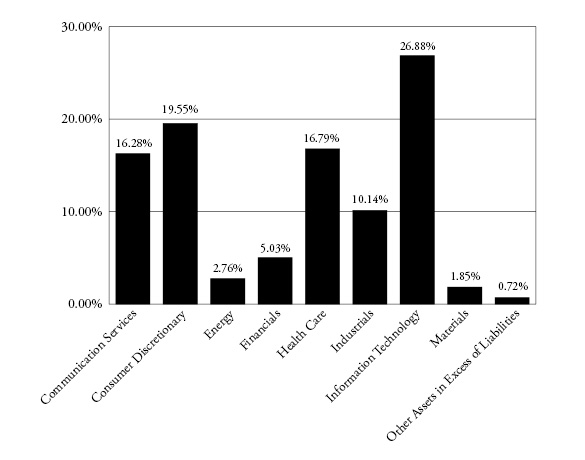

Fuller & Thaler Behavioral Mid-Cap Value Fund Sector Holdings as of March 31, 2020.*

Fuller & Thaler Behavioral Unconstrained Equity Fund Sector Holdings as of March 31, 2020.*

* | As a percentage of net assets. |

16

Portfolio Illustration (Unaudited)

March 31, 2020

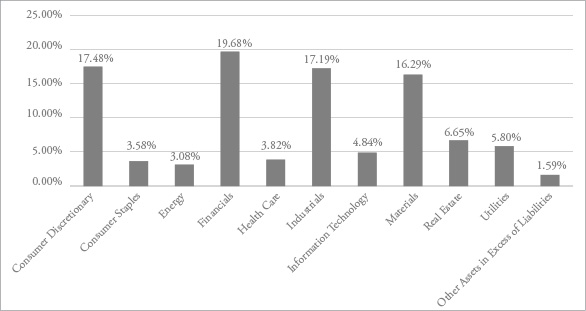

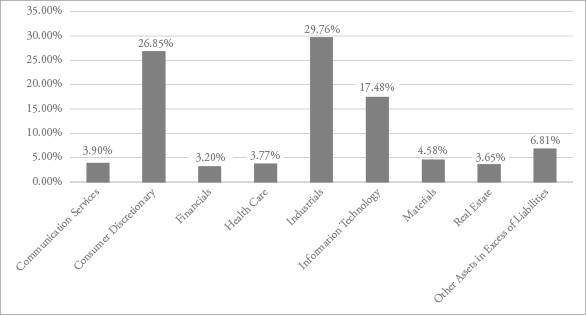

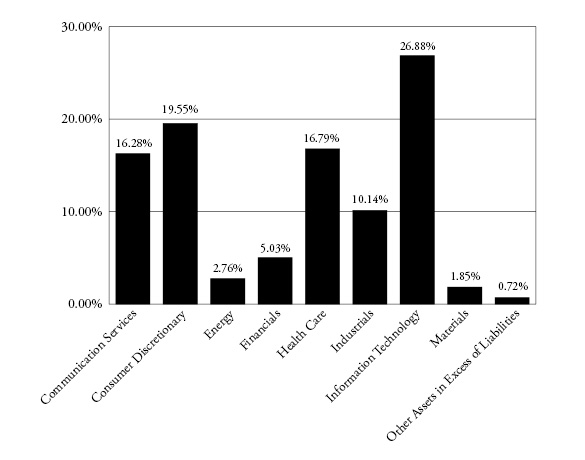

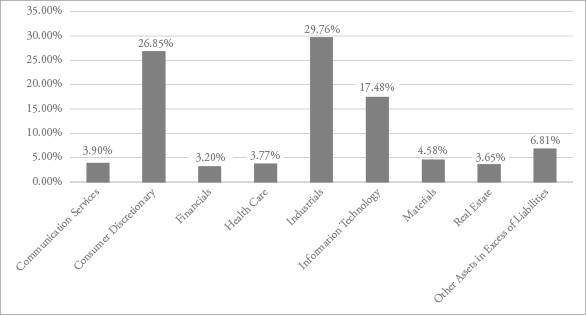

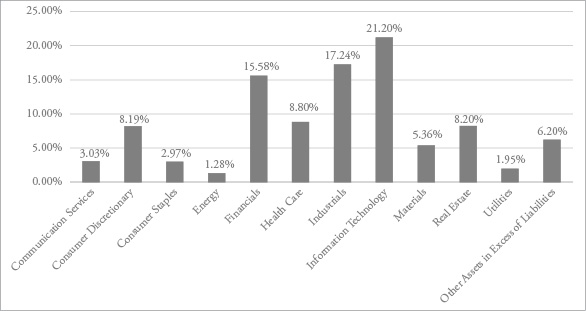

Fuller & Thaler Behavioral Small-Mid Core Equity Fund Sector Holdings as of March 31, 2020.*

Fuller & Thaler Behavioral Micro-Cap Equity Fund Sector Holdings as of March 31, 2020.*

* | As a percentage of net assets. |

Availability of Portfolio Schedules (Unaudited)

The Funds file their complete schedule of portfolio holdings with the Securities and Exchange Commission (“SEC”) for the first and third quarters of each fiscal year on Form N-Q, or as an exhibit to its reports on Form N-Q’s successor form, Form N-PORT, within sixty days after the end of the period. The Funds’ portfolio holdings are available on the SEC’s website at http://www.sec.gov.

17

Fuller & Thaler Behavioral Small-Cap Equity Fund

Schedule of Investments

March 31, 2020 (Unaudited)

| | Shares | | | Fair Value | |

COMMON STOCKS — 95.90% |

| |

Banks — 10.22% |

BancorpSouth Bank | | | 558,141 | | | $ | 10,560,028 | |

Bank of Hawaii Corporation | | | 335,780 | | | | 18,548,487 | |

F.N.B. Corporation | | | 4,114,144 | | | | 30,321,241 | |

Farmers National Banc Corporation | | | 99,290 | | | | 1,154,743 | |

Financial Institutions, Inc. | | | 160,041 | | | | 2,903,144 | |

First Citizens BancShares, Inc., Class A | | | 88,321 | | | | 29,399,411 | |

First Commonwealth Financial Corporation | | | 108,607 | | | | 992,668 | |

First Financial Corporation | | | 20,492 | | | | 690,990 | |

Fulton Financial Corporation | | | 3,077,243 | | | | 35,357,521 | |

Hancock Whitney Corporation | | | 944,189 | | | | 18,430,569 | |

Lakeland Bancorp, Inc. | | | 89,396 | | | | 966,371 | |

Lakeland Financial Corporation | | | 462,123 | | | | 16,983,020 | |

Peapack-Gladstone Financial Corporation | | | 141,161 | | | | 2,533,840 | |

TowneBank | | | 170,398 | | | | 3,082,500 | |

TriState Capital Holdings, Inc.(a) | | | 695,942 | | | | 6,729,759 | |

| | | | | | | | 178,654,292 | |

Building Products — 0.82% |

Cornerstone Building Brands, Inc.(a) | | | 329,498 | | | | 1,502,511 | |

Masonite International Corporation(a) | | | 184,712 | | | | 8,764,584 | |

Trex Company, Inc.(a) | | | 51,707 | | | | 4,143,799 | |

| | | | | | | | 14,410,894 | |

Capital Markets — 1.28% |

Blucora, Inc.(a) | | | 836,803 | | | | 10,083,476 | |

Federated Hermes, Inc., Class B | | | 296,051 | | | | 5,639,772 | |

Hamilton Lane, Inc., Class A | | | 120,395 | | | | 6,659,047 | |

| | | | | | | | 22,382,295 | |

Chemicals — 0.41% |

PolyOne Corporation | | | 380,070 | | | | 7,209,928 | |

| | | | | | | | | |

Commercial Services & Supplies — 0.95% |

Clean Harbors, Inc.(a) | | | 106,035 | | | $ | 5,443,837 | |

Deluxe Corporation | | | 295,900 | | | | 7,672,687 | |

SP Plus Corporation(a) | | | 165,251 | | | | 3,428,958 | |

| | | | | | | | 16,545,482 | |

Communications Equipment — 0.15% |

Comtech Telecommunications Corporation | | | 201,000 | | | | 2,671,290 | |

| | | | | | | | | |

Construction & Engineering — 7.09% |

Comfort Systems USA, Inc. | | | 792,239 | | | | 28,956,335 | |

EMCOR Group, Inc. | | | 473,460 | | | | 29,032,567 | |

MasTec, Inc.(a) | | | 1,658,437 | | | | 54,280,644 | |

Quanta Services, Inc. | | | 366,600 | | | | 11,632,218 | |

| | | | | | | | 123,901,764 | |

Distributors — 0.33% |

Core-Mark Holding Company, Inc. | | | 200,890 | | | | 5,739,427 | |

| | | | | | | | | |

Diversified Consumer Services — 1.65% |

K12, Inc.(a) | | | 1,525,096 | | | | 28,763,311 | |

| | | | | | | | | |

Electric Utilities — 1.86% |

Otter Tail Corporation | | | 129,219 | | | | 5,745,077 | |

Portland General Electric Company | | | 557,221 | | | | 26,713,175 | |

| | | | | | | | 32,458,252 | |

Electrical Equipment — 2.15% |

Generac Holdings, Inc.(a) | | | 403,342 | | | | 37,579,374 | |

| | | | | | | | | |

Electronic Equipment, Instruments & Components — 7.23% |

Avnet, Inc. | | | 243,323 | | | | 6,107,407 | |

Insight Enterprises, Inc.(a) | | | 69,826 | | | | 2,941,769 | |

Jabil, Inc. | | | 1,243,438 | | | | 30,563,706 | |

Sanmina Corporation(a) | | | 966,375 | | | | 26,362,710 | |

SYNNEX Corporation | | | 233,620 | | | | 17,077,622 | |

Tech Data Corporation(a) | | | 317,300 | | | | 41,518,705 | |

Vishay Precision Group, Inc.(a) | | | 92,638 | | | | 1,860,171 | |

| | | | | | | | 126,432,090 | |

Equity Real Estate Investment Trusts (REITs) — 6.82% |

Apple Hospitality REIT, Inc. | | | 2,462,336 | | | | 22,579,622 | |

City Office REIT, Inc. | | | 1,031,545 | | | | 7,458,070 | |

Columbia Property Trust, Inc. | | | 598,947 | | | | 7,486,838 | |

18 | See accompanying notes which are an integral part of these financial statements. | |

Fuller & Thaler Behavioral Small-Cap Equity Fund

Schedule of Investments (continued)

March 31, 2020 (Unaudited)

| | Shares | | | Fair Value | |

COMMON STOCKS — (continued) |

| |

Equity Real Estate Investment Trusts (REITs) — (continued) |

CorEnergy Infrastructure Trust, Inc. | | | 158,690 | | | $ | 2,916,722 | |

Industrial Logistics Properties Trust | | | 440,421 | | | | 7,724,984 | |

Monmouth Real Estate Investment Corporation | | | 433,459 | | | | 5,223,181 | |

Office Properties Income Trust | | | 328,283 | | | | 8,945,712 | |

OUTFRONT Media, Inc. | | | 666,096 | | | | 8,978,974 | |

Piedmont Office Realty Trust, Inc., Class A | | | 890,937 | | | | 15,733,947 | |

Sunstone Hotel Investors, Inc. | | | 2,399,235 | | | | 20,897,337 | |

Xenia Hotels & Resorts, Inc. | | | 1,094,978 | | | | 11,278,273 | |

| | | | | | | | 119,223,660 | |

Food Products — 0.41% |

Simply Good Foods Company (The)(a) | | | 376,287 | | | | 7,247,288 | |

| | | | | | | | | |

Gas Utilities — 1.78% |

ONE Gas, Inc. | | | 186,783 | | | | 15,618,794 | |

Southwest Gas Holdings, Inc. | | | 223,603 | | | | 15,553,825 | |

| | | | | | | | 31,172,619 | |

Health Care Equipment & Supplies — 1.95% |

Integer Holdings Corporation(a) | | | 378,652 | | | | 23,802,065 | |

Integra LifeSciences Holdings Corp.(a) | | | 136,219 | | | | 6,084,903 | |

Lantheus Holdings, Inc.(a) | | | 326,411 | | | | 4,165,004 | |

| | | | | | | | 34,051,972 | |

Health Care Providers & Services — 3.38% |

Amedisys, Inc.(a) | | | 158,213 | | | | 29,038,414 | |

Chemed Corporation | | | 56,295 | | | | 24,386,994 | |

Select Medical Holdings Corporation(a) | | | 374,739 | | | | 5,621,085 | |

| | | | | | | | 59,046,493 | |

Hotels, Restaurants & Leisure — 0.30% |

Extended Stay America, Inc. | | | 559,929 | | | | 4,093,081 | |

Ruth’s Hospitality Group, Inc. | | | 172,852 | | | | 1,154,651 | |

| | | | | | | | 5,247,732 | |

Household Durables — 3.97% |

Helen of Troy Ltd.(a) | | | 423,291 | | | $ | 60,966,603 | |

TopBuild Corporation(a) | | | 116,421 | | | | 8,340,400 | |

| | | | | | | | 69,307,003 | |

Industrial Conglomerates — 0.17% |

Raven Industries, Inc. | | | 143,060 | | | | 3,037,164 | |

| | | | | | | | | |

Insurance — 5.38% |

James River Group Holdings Ltd. | | | 473,675 | | | | 17,165,982 | |

Kemper Corporation | | | 880,727 | | | | 65,499,667 | |

Primerica, Inc. | | | 128,508 | | | | 11,370,388 | |

| | | | | | | | 94,036,037 | |

Internet & Direct Marketing Retail — 0.65% |

Qurate Retail, Inc., Series A(a) | | | 1,853,800 | | | | 11,317,449 | |

| | | | | | | | | |

IT Services — 5.19% |

CoreLogic, Inc. | | | 93,400 | | | | 2,852,436 | |

CSG Systems International, Inc. | | | 983,515 | | | | 41,160,103 | |

EVERTEC, Inc. | | | 1,668,733 | | | | 37,930,301 | |

Perspecta, Inc. | | | 481,428 | | | | 8,781,247 | |

| | | | | | | | 90,724,087 | |

Leisure Products — 0.32% |

Johnson Outdoors, Inc., Class A | | | 89,154 | | | | 5,589,956 | |

| | | | | | | | | |

Life Sciences Tools & Services — 6.16% |

Bruker Corporation | | | 1,148,164 | | | | 41,173,161 | |

Medpace Holdings, Inc.(a) | | | 684,511 | | | | 50,229,418 | |

PRA Health Sciences, Inc.(a) | | | 196,107 | | | | 16,284,725 | |

| | | | | | | | 107,687,304 | |

Marine — 0.20% |

Costamare, Inc. | | | 782,924 | | | | 3,538,816 | |

| | | | | | | | | |

Media — 0.31% |

Sinclair Broadcast Group, Inc., Class A | | | 338,094 | | | | 5,436,552 | |

| | | | | | | | | |

Metals & Mining — 1.22% |

Commercial Metals Company | | | 938,435 | | | | 14,817,889 | |

Gold Resource Corporation | | | 725,007 | | | | 1,993,769 | |

Worthington Industries, Inc. | | | 172,900 | | | | 4,538,625 | |

| | | | | | | | 21,350,283 | |

| | See accompanying notes which are an integral part of these financial statements. | 19 |

Fuller & Thaler Behavioral Small-Cap Equity Fund

Schedule of Investments (continued)

March 31, 2020 (Unaudited)

| | Shares | | | Fair Value | |

COMMON STOCKS — (continued) |

| |

Mortgage Real Estate Investment Trusts (REITs) — 0.20% |

Apollo Commercial Real Estate Finance, Inc. | | | 307,100 | | | $ | 2,278,682 | |

Dynex Capital, Inc. | | | 122,400 | | | | 1,277,856 | |

| | | | | | | | 3,556,538 | |

Multi-Utilities — 0.25% |

Unitil Corporation | | | 84,231 | | | | 4,406,966 | |

| | | | | | | | | |

Oil, Gas & Consumable Fuels — 1.62% |

Brigham Minerals, Inc., Class A | | | 197,897 | | | | 1,636,608 | |

Cimarex Energy Company | | | 418,742 | | | | 7,047,428 | |

Delek US Holdings, Inc. | | | 974,446 | | | | 15,357,269 | |

W&T Offshore, Inc.(a) | | | 2,480,008 | | | | 4,216,014 | |

| | | | | | | | 28,257,319 | |

Pharmaceuticals — 2.15% |

Horizon Therapeutics plc(a) | | | 982,429 | | | | 29,099,547 | |

Supernus Pharmaceuticals, Inc.(a) | | | 471,058 | | | | 8,474,333 | |

| | | | | | | | 37,573,880 | |

Professional Services — 2.33% |

CRA International, Inc. | | | 52,527 | | | | 1,754,927 | |

FTI Consulting, Inc.(a) | | | 280,907 | | | | 33,644,231 | |

Kforce, Inc. | | | 206,068 | | | | 5,269,159 | |

| | | | | | | | 40,668,317 | |

Real Estate Management & Development — 0.30% |

Marcus & Millichap, Inc.(a) | | | 150,405 | | | | 4,075,975 | |

RMR Group, Inc. (The), Class A | | | 44,415 | | | | 1,197,873 | |

| | | | | | | | 5,273,848 | |

Road & Rail — 2.47% |

Landstar System, Inc. | | | 449,795 | | | | 43,117,349 | |

| | | | | | | | | |

Semiconductors & Semiconductor Equipment — 1.07% |

Amkor Technology, Inc.(a) | | | 2,174,787 | | | | 16,941,591 | |

DSP Group, Inc.(a) | | | 136,138 | | | | 1,824,249 | |

| | | | | | | | 18,765,840 | |

Software — 3.86% |

j2 Global, Inc.(a) | | | 701,260 | | | | 52,489,311 | |

Progress Software Corporation | | | 465,668 | | | | 14,901,376 | |

| | | | | | | | 67,390,687 | |

Specialty Retail — 2.62% |

Designer Brands, Inc., Class A | | | 994,254 | | | $ | 4,951,385 | |

MarineMax, Inc.(a) | | | 217,166 | | | | 2,262,870 | |

Murphy USA, Inc.(a) | | | 318,182 | | | | 26,841,834 | |

Rent-A-Center, Inc. | | | 562,689 | | | | 7,956,422 | |

Sleep Number Corporation(a) | | | 196,600 | | | | 3,766,856 | |

| | | | | | | | 45,779,367 | |

Textiles, Apparel & Luxury Goods — 2.78% |

Deckers Outdoor Corporation(a) | | | 362,400 | | | | 48,561,600 | |

| | | | | | | | | |

Thrifts & Mortgage Finance — 0.79% |

Federal Agricultural Mortgage Corporation, Class C | | | 95,368 | | | | 5,305,322 | |

Washington Federal, Inc. | | | 327,600 | | | | 8,504,496 | |

| | | | | | | | 13,809,818 | |

Trading Companies & Distributors — 3.11% |

Applied Industrial Technologies, Inc. | | | 391,897 | | | | 17,917,531 | |

BMC Stock Holdings, Inc.(a) | | | 1,465,547 | | | | 25,984,148 | |

WESCO International, Inc.(a) | | | 459,340 | | | | 10,495,919 | |

| | | | | | | | 54,397,598 | |

Total Common Stocks (Cost $1,919,635,272) | | | | | | | 1,676,321,941 | |

| | | | | | | | | |

MONEY MARKET FUNDS - 5.86% |

Fidelity Investments Money Market Government Portfolio, Institutional Class, 0.34%(b) | | | 102,435,145 | | | | 102,435,145 | |

| | | | | | | | | |

Total Money Market Funds (Cost $102,435,145) | | | | | | | 102,435,145 | |

Total Investments — 101.76% (Cost $2,022,070,417) | | | 1,778,757,086 | |

Liabilities in Excess of Other Assets — (1.76)% | | | | | | | (30,816,004 | ) |

NET ASSETS — 100.00% | | | | | | $ | 1,747,941,082 | |

(a) | Non-income producing security. |

(b) | Rate disclosed is the seven day effective yield as of March 31, 2020. |

20 | See accompanying notes which are an integral part of these financial statements. | |

Fuller & Thaler Behavioral Small-Cap Growth Fund

Schedule of Investments

March 31, 2020 (Unaudited)

| | Shares | | | Fair Value | |

COMMON STOCKS — 96.30% |

| | | | | | | | | |

Airlines — 1.18% |

Allegiant Travel Company | | | 1,810 | | | $ | 148,058 | |

| | | | | | | | | |

Auto Components — 0.96% |

Adient plc(a) | | | 13,300 | | | | 120,631 | |

| | | | | | | | | |

Biotechnology — 5.88% |

Halozyme Therapeutics, Inc.(a) | | | 16,200 | | | | 291,438 | |

Sarepta Therapeutics, Inc.(a) | | | 4,575 | | | | 447,527 | |

| | | | | | | | 738,965 | |

Building Products — 2.26% |

Trex Company, Inc.(a) | | | 3,550 | | | | 284,497 | |

| | | | | | | | | |

Consumer Finance — 1.22% |

OneMain Holdings, Inc. | | | 8,025 | | | | 153,438 | |

| | | | | | | | | |

Diversified Consumer Services — 1.84% |

Chegg, Inc.(a) | | | 6,475 | | | | 231,676 | |

| | | | | | | | | |

Entertainment — 2.77% |

Zynga, Inc., Class A(a) | | | 50,790 | | | | 347,912 | |

| | | | | | | | | |

Food & Staples Retailing — 2.13% |

Grocery Outlet Holding Corporation(a) | | | 7,800 | | | | 267,852 | |

| | | | | | | | | |

Food Products — 1.81% |

Darling Ingredients, Inc.(a) | | | 11,900 | | | | 228,123 | |

| | | | | | | | | |

Health Care Equipment & Supplies — 9.39% |

Integer Holdings Corporation(a) | | | 4,245 | | | | 266,841 | |

Merit Medical Systems, Inc.(a) | | | 8,900 | | | | 278,125 | |

Nevro Corporation(a) | | | 2,940 | | | | 293,941 | |

Tandem Diabetes Care, Inc.(a) | | | 5,325 | | | | 342,664 | |

| | | | | | | | 1,181,571 | |

Health Care Providers & Services — 10.53% |

Amedisys, Inc.(a) | | | 3,220 | | | | 590,998 | |

Guardant Health, Inc.(a) | | | 3,970 | | | | 276,312 | |

HealthEquity, Inc.(a) | | | 5,325 | | | | 269,392 | |

Select Medical Holdings Corporation(a) | | | 12,500 | | | | 187,500 | |

| | | | | | | | 1,324,202 | |

Hotels, Restaurants & Leisure — 2.64% |

Churchill Downs, Inc. | | | 3,230 | | | $ | 332,529 | |

| | | | | | | | | |

Household Durables — 5.16% |

Helen of Troy Ltd.(a) | | | 2,150 | | | | 309,664 | |

Meritage Homes Corporation(a) | | | 5,180 | | | | 189,121 | |

Tempur Sealy International, Inc.(a) | | | 3,400 | | | | 148,614 | |

| | | | | | | | 647,399 | |

Insurance — 3.71% |

eHealth, Inc.(a) | | | 3,315 | | | | 466,818 | |

| | | | | | | | | |

Internet & Direct Marketing Retail — 2.38% |

Stamps.com, Inc.(a) | | | 2,300 | | | | 299,184 | |

| | | | | | | | | |

IT Services — 2.31% |

ManTech International Corporation, Class A | | | 4,000 | | | | 290,680 | |

| | | | | | | | | |

Life Sciences Tools & Services — 2.84% |

Repligen Corporation(a) | | | 3,700 | | | | 357,198 | |

| | | | | | | | | |

Machinery — 1.29% |

Evoqua Water Technologies Corporation(a) | | | 14,500 | | | | 162,545 | |

| | | | | | | | | |

Professional Services — 4.75% |

FTI Consulting, Inc.(a) | | | 4,990 | | | | 597,652 | |

| | | | | | | | | |

Semiconductors & Semiconductor Equipment — 12.49% |

Cirrus Logic, Inc.(a) | | | 5,785 | | | | 379,670 | |

Ichor Holdings Ltd.(a) | | | 8,800 | | | | 168,608 | |

Lattice Semiconductor Corporation(a) | | | 17,690 | | | | 315,236 | |

MACOM Technology Solutions Holdings, Inc.(a) | | | 19,655 | | | | 372,069 | |

Synaptics, Inc.(a) | | | 5,790 | | | | 335,067 | |

| | | | | | | | 1,570,650 | |

| | See accompanying notes which are an integral part of these financial statements. | 21 |

Fuller & Thaler Behavioral Small-Cap Growth Fund

Schedule of Investments (continued)

March 31, 2020 (Unaudited)

| | Shares | | | Fair Value | |

COMMON STOCKS — (continued) |

| |

Software — 15.70% |

Box, Inc., Class A(a) | | | 18,855 | | | $ | 264,724 | |

Cloudera, Inc.(a) | | | 33,375 | | | | 262,661 | |

Five9, Inc.(a) | | | 5,600 | | | | 428,175 | |

Mimecast Ltd.(a) | | | 6,385 | | | | 225,391 | |

Ping Identity Holding Corporation(a) | | | 15,870 | | | | 317,717 | |

Trade Desk, Inc. (The), Class A(a) | | | 1,155 | | | | 222,915 | |

Varonis Systems, Inc.(a) | | | 3,968 | | | | 252,643 | |

| | | | | | | | 1,974,226 | |

Specialty Retail — 1.64% |

National Vision Holdings, Inc.(a) | | | 10,640 | | | | 206,629 | |

| | | | | | | | | |

Textiles, Apparel & Luxury Goods — 1.42% |

Crocs, Inc.(a) | | | 10,525 | | | | 178,820 | |

| | | | | | | | | |

Total Common Stocks/Investments — 96.30% (Cost $13,271,952) | | | | | | | 12,111,255 | |

Other Assets in Excess of Liabilities — 3.70% | | | | | | | 465,380 | |

NET ASSETS — 100.00% | | | | | | $ | 12,576,635 | |

(a) | Non-income producing security. |

22 | See accompanying notes which are an integral part of these financial statements. | |

Fuller & Thaler Behavioral Mid-Cap Value Fund

Schedule of Investments

March 31, 2020 (Unaudited)

| | Shares | | | Fair Value | |

COMMON STOCKS — 98.41% |

| | | | | | | | | |

Aerospace & Defense — 2.01% |

Arconic, Inc. | | | 17,550 | | | $ | 281,853 | |

| | | | | | | | | |

Banks — 12.38% |

CIT Group, Inc. | | | 8,050 | | | | 138,943 | |

Commerce Bancshares, Inc. | | | 4,744 | | | | 238,860 | |

East West Bancorp, Inc. | | | 11,325 | | | | 291,506 | |

First Horizon National Corporation | | | 38,440 | | | | 309,826 | |

KeyCorp | | | 22,740 | | | | 235,814 | |

M&T Bank Corporation | | | 2,360 | | | | 244,095 | |

TCF Financial Corporation | | | 12,402 | | | | 281,029 | |

| | | | | | | | 1,740,073 | |

Building Products — 1.50% |

Johnson Controls International plc | | | 7,800 | | | | 210,288 | |

| | | | | | | | | |

Chemicals — 3.78% |

Celanese Corporation | | | 2,975 | | | | 218,335 | |

Sherwin-Williams Company (The) | | | 410 | | | | 188,403 | |

W.R. Grace & Company | | | 3,500 | | | | 124,600 | |

| | | | | | | | 531,338 | |

Commercial Services & Supplies — 1.87% |

Republic Services, Inc. | | | 3,500 | | | | 262,710 | |

| | | | | | | | | |

Communications Equipment — 1.19% |

CommScope Holding Company, Inc.(a) | | | 18,345 | | | | 167,123 | |

| | | | | | | | | |

Consumer Finance — 1.77% |

Synchrony Financial | | | 15,425 | | | | 248,188 | |

| | | | | | | | | |

Containers & Packaging — 12.51% |

Berry Global Group, Inc.(a) | | | 15,275 | | | | 514,920 | |

Crown Holdings, Inc.(a) | | | 7,930 | | | | 460,257 | |

Graphic Packaging Holding Company | | | 42,555 | | | | 519,172 | |

WestRock Company | | | 9,350 | | | | 264,231 | |

| | | | | | | | 1,758,580 | |

Electric Utilities — 4.63% |

Alliant Energy Corporation | | | 5,500 | | | $ | 265,595 | |

Edison International | | | 3,050 | | | | 167,110 | |

Pinnacle West Capital Corporation | | | 2,875 | | | | 217,896 | |

| | | | | | | | 650,601 | |

Electrical Equipment — 1.28% |

AMETEK, Inc. | | | 2,500 | | | | 180,050 | |

| | | | | | | | | |

Energy Equipment & Services — 0.60% |

Patterson-UTI Energy, Inc. | | | 36,080 | | | | 84,788 | |

| | | | | | | | | |

Entertainment — 1.28% |

Live Nation Entertainment, Inc.(a) | | | 3,950 | | | | 179,567 | |

| | | | | | | | | |

Equity Real Estate Investment Trusts (REITs) — 6.65% |

Brixmor Property Group, Inc. | | | 17,350 | | | | 164,825 | |

Colony Capital, Inc., Class A | | | 40,800 | | | | 71,400 | |

Public Storage | | | 2,050 | | | | 407,150 | |

Retail Properties of America, Inc., Class A | | | 13,650 | | | | 70,571 | |

W.P. Carey, Inc. | | | 3,800 | | | | 220,704 | |

| | | | | | | | 934,650 | |

Food Products — 3.58% |

Ingredion, Inc. | | | 2,985 | | | | 225,368 | |

J.M. Smucker Company (The) | | | 2,500 | | | | 277,500 | |

| | | | | | | | 502,868 | |

Health Care Providers & Services — 3.82% |

Centene Corporation(a) | | | 3,000 | | | | 178,230 | |

Henry Schein, Inc.(a) | | | 3,350 | | | | 169,242 | |

Laboratory Corporation of America Holdings(a) | | | 1,500 | | | | 189,585 | |

| | | | | | | | 537,057 | |

Hotels, Restaurants & Leisure — 1.54% |

Aramark | | | 10,840 | | | | 216,475 | |

| | | | | | | | | |

Household Durables — 4.05% |

Mohawk Industries, Inc.(a) | | | 2,020 | | | | 154,005 | |

Newell Brands, Inc. | | | 17,881 | | | | 237,459 | |

Whirlpool Corporation | | | 2,080 | | | | 178,464 | |

| | | | | | | | 569,928 | |

| | See accompanying notes which are an integral part of these financial statements. | 23 |

Fuller & Thaler Behavioral Mid-Cap Value Fund

Schedule of Investments (continued)

March 31, 2020 (Unaudited)

| | Shares | | | Fair Value | |

COMMON STOCKS — (continued) |

| |

Industrial Conglomerates — 1.01% |

Roper Technologies, Inc. | | | 455 | | | $ | 141,874 | |

| | | | | | | | | |

Insurance — 5.53% |

Assured Guaranty Ltd. | | | 4,750 | | | | 122,503 | |

Everest Re Group Ltd. | | | 1,315 | | | | 253,032 | |

Globe Life, Inc. | | | 2,300 | | | | 165,531 | |

Markel Corporation(a) | | | 255 | | | | 236,612 | |

| | | | | | | | 777,678 | |

IT Services — 1.78% |

Amdocs Ltd. | | | 4,550 | | | | 250,113 | |

| | | | | | | | | |

Machinery — 2.22% |

Donaldson Company, Inc. | | | 4,300 | | | | 166,109 | |

Snap-on, Inc. | | | 1,340 | | | | 145,819 | |

| | | | | | | | 311,928 | |

Multi-Line Retail — 5.82% |

Dollar General Corporation | | | 2,925 | | | | 441,704 | |

Dollar Tree, Inc.(a) | | | 5,125 | | | | 376,534 | |

| | | | | | | | 818,238 | |

Multi-Utilities — 1.17% |

CMS Energy Corporation | | | 2,800 | | | | 164,500 | |

| | | | | | | | | |

Oil, Gas & Consumable Fuels — 2.48% |

Cheniere Energy, Inc.(a) | | | 4,050 | | | | 135,675 | |

Continental Resources, Inc. | | | 9,900 | | | | 75,636 | |

Occidental Petroleum Corporation | | | 1,747 | | | | 20,230 | |

Pioneer Natural Resources Company | | | 1,660 | | | | 116,449 | |

| | | | | | | | 347,990 | |

Professional Services — 2.49% |

Nielsen Holdings plc | | | 6,850 | | | $ | 85,899 | |

Verisk Analytics, Inc. | | | 1,900 | | | | 264,822 | |

| | | | | | | | 350,721 | |

Road & Rail — 3.60% |

AMERCO | | | 600 | | | | 174,330 | |

Kansas City Southern | | | 2,615 | | | | 332,575 | |

| | | | | | | | 506,905 | |

Software — 1.32% |

Verint Systems, Inc.(a) | | | 4,300 | | | | 184,900 | |

| | | | | | | | | |

Specialty Retail — 4.79% |

Advance Auto Parts, Inc. | | | 1,100 | | | | 102,652 | |

CarMax, Inc.(a) | | | 5,210 | | | | 280,454 | |

O’Reilly Automotive, Inc.(a) | | | 965 | | | | 290,514 | |

| | | | | | | | 673,620 | |

Technology Hardware, Storage & Peripherals — 0.55% |

NCR Corporation(a) | | | 4,400 | | | | 77,880 | |

| | | | | | | | | |

Trading Companies & Distributors — 1.21% |

HD Supply Holdings, Inc.(a) | | | 6,000 | | | | 170,580 | |

| | | | | | | | | |

Total Common Stocks/Investments — 98.41% (Cost $18,430,423) | | | | | | | 13,833,064 | |

Other Assets in Excess of Liabilities — 1.59% | | | | | | | 224,143 | |

NET ASSETS — 100.00% | | | | | | $ | 14,057,207 | |

(a) | Non-income producing security. |

24 | See accompanying notes which are an integral part of these financial statements. | |

Fuller & Thaler Behavioral Unconstrained Equity Fund

Schedule of Investments

March 31, 2020 (Unaudited)

| | Shares | | | Fair Value | |

COMMON STOCKS — 93.19% |

| | | | | | | | | |

Airlines — 4.27% |

Southwest Airlines Company | | | 43,495 | | | $ | 1,548,857 | |

| | | | | | | | | |

Auto Components — 1.55% |

Cooper-Standard Holdings, Inc.(a) | | | 54,845 | | | | 563,258 | |

| | | | | | | | | |

Chemicals — 4.58% |

Ecolab, Inc. | | | 10,675 | | | | 1,663,485 | |

| | | | | | | | | |

Commercial Services & Supplies — 5.02% |

Cintas Corporation | | | 10,530 | | | | 1,824,007 | |

| | | | | | | | | |

Consumer Finance — 3.20% |

Synchrony Financial | | | 72,185 | | | | 1,161,457 | |

| | | | | | | | | |

Electrical Equipment — 6.66% |

Generac Holdings, Inc.(a) | | | 25,955 | | | | 2,418,227 | |

| | | | | | | | | |

Electronic Equipment, Instruments & Components — 4.05% |

Zebra Technologies Corporation, Class A(a) | | | 8,010 | | | | 1,470,636 | |

| | | | | | | | | |

Equity Real Estate Investment Trusts (REITs) — 3.65% |

Gaming and Leisure Properties, Inc. | | | 47,870 | | | | 1,326,478 | |

| | | | | | | | | |

Hotels, Restaurants & Leisure — 6.18% |

Yum China Holdings, Inc. | | | 52,655 | | | | 2,244,683 | |

| | | | | | | | | |

Internet & Direct Marketing Retail — 10.37% |

Booking Holdings, Inc.(a) | | | 1,170 | | | | 1,574,024 | |

eBay, Inc. | | | 72,885 | | | | 2,190,924 | |

| | | | | | | | 3,764,948 | |

IT Services — 4.75% |

VeriSign, Inc.(a) | | | 9,580 | | | $ | 1,725,262 | |

| | | | | | | | | |

Life Sciences Tools & Services — 3.77% |

Waters Corporation(a) | | | 7,520 | | | | 1,369,016 | |

| | | | | | | | | |

Machinery — 8.74% |

Allison Transmission Holdings, Inc. | | | 42,470 | | | | 1,384,947 | |

Parker-Hannifin Corporation | | | 13,795 | | | | 1,789,624 | |

| | | | | | | | 3,174,571 | |

Media — 3.90% |

Liberty Media Corporation - Liberty SiriusXM, Class C(a) | | | 44,815 | | | | 1,417,050 | |

| | | | | | | | | |

Road & Rail — 5.07% |

Union Pacific Corporation | | | 13,065 | | | | 1,842,688 | |

| | | | | | | | | |

Semiconductors & Semiconductor Equipment — 8.68% |

Cabot Microelectronics Corporation | | | 14,850 | | | | 1,694,979 | |

Lam Research Corporation | | | 6,070 | | | | 1,456,800 | |

| | | | | | | | 3,151,779 | |

Specialty Retail — 8.75% |

O’Reilly Automotive, Inc.(a) | | | 4,490 | | | | 1,351,715 | |

Ross Stores, Inc. | | | 20,975 | | | | 1,824,195 | |

| | | | | | | | 3,175,910 | |

Total Common Stocks/ Investments — 93.19% (Cost $41,181,500) | | | | | | | 33,842,312 | |

Other Assets in Excess of Liabilities — 6.81% | | | | | | | 2,471,273 | |

NET ASSETS — 100.00% | | | | | | $ | 36,313,585 | |

(a) | Non-income producing security. |

| | See accompanying notes which are an integral part of these financial statements. | 25 |

Fuller & Thaler Behavioral Small-Mid Core Equity Fund

Schedule of Investments

March 31, 2020 (Unaudited)

| | Shares | | | Fair Value | |

COMMON STOCKS — 93.80% |

| | | | | | | | | |

Airlines — 2.21% |

Alaska Air Group, Inc. | | | 720 | | | $ | 20,498 | |

JetBlue Airways Corporation(a) | | | 2,590 | | | | 23,181 | |

| | | | | | | | 43,679 | |

Auto Components — 0.93% |

Cooper-Standard Holdings, Inc.(a) | | | 1,785 | | | | 18,332 | |

| | | | | | | | | |

Banks — 9.49% |

East West Bancorp, Inc. | | | 1,250 | | | | 32,175 | |

First Citizens BancShares, Inc., Class A | | | 115 | | | | 38,280 | |

Live Oak Bancshares, Inc. | | | 3,765 | | | | 46,951 | |

PacWest Bancorp | | | 1,470 | | | | 26,342 | |

Western Alliance Bancorporation | | | 1,425 | | | | 43,619 | |

| | | | | | | | 187,367 | |

Biotechnology — 1.98% |

Exelixis, Inc.(a) | | | 2,265 | | | | 39,003 | |

| | | | | | | | | |

Chemicals — 3.90% |

Huntsman Corporation | | | 2,950 | | | | 42,569 | |

NewMarket Corporation | | | 90 | | | | 34,458 | |

| | | | | | | | 77,027 | |

Diversified Financial Services — 2.58% |

Voya Financial, Inc. | | | 1,255 | | | | 50,890 | |

| | | | | | | | | |

Electrical Equipment — 4.15% |

Generac Holdings, Inc.(a) | | | 880 | | | | 81,990 | |

| | | | | | | | | |

Electronic Equipment, Instruments & Components — 2.69% |

Keysight Technologies, Inc.(a) | | | 195 | | | | 16,318 | |

Zebra Technologies Corporation, Class A(a) | | | 200 | | | | 36,720 | |

| | | | | | | | 53,038 | |

Entertainment — 1.87% |

SciPlay Corporation(a) | | | 3,880 | | | | 36,957 | |

| | | | | | | | | |

Equity Real Estate Investment Trusts (REITs) — 8.20% |

American Assets Trust, Inc. | | | 1,175 | | | $ | 29,375 | |

Gaming and Leisure Properties, Inc. | | | 2,425 | | | | 67,197 | |

Site Centers Corporation | | | 2,620 | | | | 13,650 | |

STORE Capital Corporation | | | 2,845 | | | | 51,551 | |

| | | | | | | | 161,773 | |

Food Products — 2.97% |

Lancaster Colony Corporation | | | 405 | | | | 58,579 | |

| | | | | | | | | |

Gas Utilities — 1.95% |

UGI Corporation | | | 1,440 | | | | 38,405 | |

| | | | | | | | | |

Health Care Equipment & Supplies — 2.11% |

DENTSPLY SIRONA, Inc. | | | 1,075 | | | | 41,742 | |

| | | | | | | | | |

Health Care Providers & Services — 2.36% |

Universal Health Services, Inc., Class B | | | 470 | | | | 46,568 | |

| | | | | | | | | |

Hotels, Restaurants & Leisure — 3.59% |

Ruth’s Hospitality Group, Inc. | | | 3,910 | | | | 26,119 | |

Yum China Holdings, Inc. | | | 1,050 | | | | 44,761 | |

| | | | | | | | 70,880 | |

Household Durables — 1.24% |

Mohawk Industries, Inc.(a) | | | 320 | | | | 24,397 | |

| | | | | | | | | |

Insurance — 3.50% |

Brown & Brown, Inc. | | | 1,910 | | | | 69,180 | |

| | | | | | | | | |

IT Services — 3.20% |

Leidos Holdings, Inc. | | | 690 | | | | 63,238 | |

| | | | | | | | | |

Life Sciences Tools & Services — 2.35% |

Waters Corporation(a) | | | 255 | | | | 46,423 | |

| | | | | | | | | |

Machinery — 6.93% |

Allison Transmission Holdings, Inc. | | | 970 | | | | 31,632 | |

Altra Industrial Motion Corporation | | | 1,850 | | | | 32,357 | |

Hillenbrand, Inc. | | | 1,685 | | | | 32,200 | |

Oshkosh Corporation | | | 630 | | | | 40,527 | |

| | | | | | | | 136,716 | |

26 | See accompanying notes which are an integral part of these financial statements. | |

Fuller & Thaler Behavioral Small-Mid Core Equity Fund

Schedule of Investments (continued)

March 31, 2020 (Unaudited)

| | Shares | | | Fair Value | |

COMMON STOCKS — (continued) |

| |

Media — 1.16% |

Liberty Latin America Ltd., Class C(a) | | | 2,225 | | | $ | 22,829 | |

| | | | | | | | | |

Metals & Mining — 1.46% |

Steel Dynamics, Inc. | | | 1,280 | | | | 28,851 | |

| | | | | | | | | |

Oil, Gas & Consumable Fuels — 1.28% |

WPX Energy, Inc.(a) | | | 8,260 | | | | 25,193 | |

| | | | | | | | | |

Road & Rail — 2.48% |

Kansas City Southern | | | 385 | | | | 48,964 | |

| | | | | | | | | |

Semiconductors & Semiconductor Equipment — 11.30% |

Advanced Energy Industries, Inc.(a) | | | 725 | | | | 35,155 | |

Cabot Microelectronics Corporation | | | 645 | | | | 73,620 | |

Entegris, Inc. | | | 1,240 | | | | 55,515 | |

Power Integrations, Inc. | | | 665 | | | | 58,739 | |

| | | | | | | | 223,029 | |

Software — 2.41% |

Aspen Technology, Inc.(a) | | | 500 | | | $ | 47,535 | |

| | | | | | | | | |

Technology Hardware, Storage & Peripherals — 1.60% |

Xerox Holdings Corporation | | | 1,665 | | | | 31,535 | |

| | | | | | | | | |

Textiles, Apparel & Luxury Goods — 2.44% |

Carter’s, Inc. | | | 560 | | | | 36,809 | |

PVH Corporation | | | 300 | | | | 11,292 | |

| | | | | | | | 48,101 | |

Trading Companies & Distributors — 1.47% |

HD Supply Holdings, Inc.(a) | | | 1,020 | | | | 28,999 | |

| | | | | | | | | |

Total Common Stocks/Investments — 93.80% (Cost $2,359,502) | | | | | | | 1,851,220 | |

Other Assets in Excess of Liabilities — 6.20% | | | | | | | 122,454 | |

NET ASSETS — 100.00% | | | | | | $ | 1,973,674 | |

(a) | Non-income producing security. |

| | See accompanying notes which are an integral part of these financial statements. | 27 |

Fuller & Thaler Behavioral Micro-Cap Equity Fund

Schedule of Investments

March 31, 2020 (Unaudited)

| | Shares | | | Fair Value | |

COMMON STOCKS — 95.76% |

| | | | | | | | | |

Aerospace & Defense — 1.30% |

Ducommun, Inc.(a) | | | 1,293 | | | $ | 32,131 | |

| | | | | | | | | |

Biotechnology — 3.84% |

PDL BioPharma, Inc.(a) | | | 33,610 | | | | 94,780 | |

| | | | | | | | | |

Building Products — 2.00% |

Cornerstone Building Brands, Inc.(a) | | | 10,816 | | | | 49,320 | |

| | | | | | | | | |

Capital Markets — 4.63% |

B. Riley Financial, Inc.(a) | | | 3,951 | | | | 72,777 | |

WisdomTree Investments, Inc. | | | 17,800 | | | | 41,474 | |

| | | | | | | | 114,251 | |

Chemicals — 2.71% |

Flotek Industries, Inc.(a) | | | 21,213 | | | | 18,880 | |

Intrepid Potash, Inc.(a) | | | 29,599 | | | | 23,679 | |

LSB Industries, Inc.(a) | | | 11,584 | | | | 24,326 | |

| | | | | | | | 66,885 | |

Construction & Engineering — 1.68% |

HC2 Holdings, Inc.(a) | | | 26,750 | | | | 41,463 | |

| | | | | | | | | |

Consumer Finance — 1.20% |

Regional Management Corporation(a) | | | 2,166 | | | | 29,588 | |

| | | | | | | | | |

Diversified Consumer Services — 2.55% |

Carriage Services, Inc. | | | 3,897 | | | | 62,937 | |

| | | | | | | | | |

Electronic Equipment, Instruments & Components — 1.50% |

Arlo Technologies, Inc.(a) | | | 15,301 | | | | 37,181 | |

| | | | | | | | | |

Equity Real Estate Investment Trusts (REITs) — 5.79% |

CatchMark Timber Trust, Inc., Class A | | | 6,935 | | | | 50,071 | |

Hersha Hospitality Trust, Class A | | | 4,519 | | | | 16,178 | |

Investors Real Estate Trust | | | 1,397 | | | | 76,835 | |

| | | | | | | | 143,084 | |

Food & Staples Retailing — 2.86% |

Natural Grocers by Vitamin Cottage, Inc. | | | 8,312 | | | | 70,735 | |

| | | | | | | | | |

Food Products — 6.41% |

Freshpet, Inc.(a) | | | 1,287 | | | $ | 82,201 | |

Landec Corporation(a) | | | 5,448 | | | | 47,343 | |

Limoneira Company(a) | | | 2,190 | | | | 28,689 | |

| | | | | | | | 158,233 | |

Health Care Equipment & Supplies — 6.14% |

Antares Pharma, Inc.(a) | | | 16,034 | | | | 37,840 | |

AxoGen, Inc.(a) | | | 4,036 | | | | 41,974 | |

Cutera, Inc.(a) | | | 1,732 | | | | 22,620 | |

Invacare Corporation | | | 6,615 | | | | 49,150 | |

| | | | | | | | 151,584 | |

Health Care Providers & Services — 2.09% |

Cross Country Healthcare, Inc.(a) | | | 7,648 | | | | 51,548 | |

| | | | | | | | | |

Hotels, Restaurants & Leisure — 4.76% |

Del Taco Restaurants, Inc.(a) | | | 6,062 | | | | 20,793 | |

Drive Shack, Inc.(a) | | | 14,777 | | | | 22,461 | |

Lindblad Expeditions Holdings, Inc.(a) | | | 3,477 | | | | 14,499 | |

Potbelly Corporation(a) | | | 14,239 | | | | 43,998 | |

Red Robin Gourmet Burgers, Inc.(a) | | | 1,856 | | | | 15,813 | |

| | | | | | | | 117,564 | |

Household Durables — 2.08% |

Universal Electronics, Inc.(a) | | | 1,337 | | | | 51,301 | |

| | | | | | | | | |

Interactive Media & Services — 1.26% |

Cars.com, Inc.(a) | | | 7,244 | | | | 31,149 | |

| | | | | | | | | |

Internet Software & Services — 1.49% |

Liquidity Services, Inc.(a) | | | 9,506 | | | | 36,883 | |

| | | | | | | | | |

IT Services — 4.46% |

Limelight Networks, Inc.(a) | | | 19,317 | | | | 110,107 | |

| | | | | | | | | |

Machinery — 3.42% |

Manitowoc Company, Inc. (The)(a) | | | 3,352 | | | | 28,492 | |

NN, Inc.(a) | | | 7,144 | | | | 12,359 | |

Spartan Motors, Inc. | | | 3,373 | | | | 43,545 | |

| | | | | | | | 84,396 | |

28 | See accompanying notes which are an integral part of these financial statements. | |

Fuller & Thaler Behavioral Micro-Cap Equity Fund

Schedule of Investments (continued)

March 31, 2020 (Unaudited)

| | Shares | | | Fair Value | |

COMMON STOCKS — (continued) |

| |

Media — 5.82% |

comScore, Inc.(a) | | | 15,461 | | | $ | 43,600 | |

Entravision Communications Corporation, Class A | | | 25,828 | | | | 52,431 | |

WideOpenWest, Inc.(a) | | | 10,028 | | | | 47,733 | |

| | | | | | | | 143,764 | |

Mortgage Real Estate Investment Trusts (REITs) — 0.85% |

Exantas Capital Corporation | | | 7,618 | | | | 21,026 | |

| | | | | | | | | |

Multi-Line Retail — 0.22% |

Tuesday Morning Corporation(a) | | | 9,608 | | | | 5,532 | |

| | | | | | | | | |

Oil, Gas & Consumable Fuels — 2.74% |

Matador Resources Company(a) | | | 13,300 | | | | 32,984 | |

W&T Offshore, Inc.(a) | | | 20,454 | | | | 34,772 | |

| | | | | | | | 67,756 | |

Paper & Forest Products — 4.28% |

Verso Corporation, Class A(a) | | | 9,379 | | | | 105,795 | |

| | | | | | | | | |

Personal Products — 2.12% |

e.l.f. Beauty, Inc.(a) | | | 5,329 | | | | 52,437 | |

| | | | | | | | | |

Professional Services — 1.11% |

Acacia Research Corporation(a) | | | 12,321 | | | | 27,353 | |

| | | | | | | | | |

Software — 7.15% |

A10 Networks, Inc.(a) | | | 9,070 | | | $ | 56,325 | |

RealNetworks, Inc.(a) | | | 12,961 | | | | 9,462 | |

Rubicon Project, Inc. (The)(a) | | | 13,984 | | | | 77,612 | |

Smith Micro Software, Inc.(a) | | | 7,883 | | | | 33,187 | |

| | | | | | | | 176,586 | |

Specialty Retail — 5.07% |

Barnes & Noble Education, Inc.(a) | | | 13,505 | | | | 18,367 | |

Boot Barn Holdings, Inc.(a) | | | 3,019 | | | | 39,035 | |

Chico’s FAS, Inc. | | | 15,810 | | | | 20,395 | |

Express, Inc.(a) | | | 11,495 | | | | 17,128 | |

MarineMax, Inc.(a) | | | 2,904 | | | | 30,260 | |

| | | | | | | | 125,185 | |

Technology Hardware, Storage & Peripherals — 2.67% |

Diebold Nixdorf, Inc.(a) | | | 8,826 | | | | 31,068 | |

Immersion Corporation(a) | | | 6,486 | | | | 34,764 | |

| | | | | | | | 65,832 | |

Trading Companies & Distributors — 1.56% |

CAI International, Inc.(a) | | | 2,734 | | | | 38,659 | |

| | | | | | | | | |

Total Common Stocks/Investments — 95.76% (Cost $3,404,742) | | | | | | | 2,365,045 | |

Other Assets in Excess of Liabilities — 4.24% | | | | | | | 104,844 | |

NET ASSETS — 100.00% | | | | | | $ | 2,469,889 | |

(a) | Non-income producing security. |

The industries shown on the schedules of investments are based on the Global Industry Classification Standard, orGICS® (“GICS”). The GICS was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor’s Financial Services LLC (“S&P”). GICS is a service mark of MSCI, Inc. and S&P and has been licensed for use by Ultimus Fund Solutions, LLC.

| | See accompanying notes which are an integral part of these financial statements. | 29 |

Fuller & Thaler Funds

Statements of Assets and Liabilities

March 31, 2020 (Unaudited)

| | | Fuller & Thaler

Behavioral

Small-Cap

Equity Fund | | | Fuller & Thaler

Behavioral

Small-Cap