UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| Investment Company Act file number: 811-22895 |

| Capitol Series Trust |

| (Exact name of registrant as specified in charter) |

Ultimus Fund Solutions, LLC 225 Pictoria Drive, Suite 450 Cincinnati, OH 45246 |

| (Address of principal executive offices) (Zip code) |

Zachary P. Richmond Ultimus Fund Solutions, LLC 225 Pictoria Drive, Suite 450 Cincinnati, OH 45246 |

| (Name and address of agent for service) |

| Registrant’s telephone number, including area code: | 513-587-3400 | |

| Date of fiscal year end: | April 30 | |

| Date of reporting period: | October 31, 2020 | |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

Canterbury Portfolio Thermostat Fund

Institutional Shares – CAPTX

Semi-Annual Report

October 31, 2020

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund’s shareholder reports like this one will no longer be sent by mail, unless you specifically request paper copies of the reports from the Fund or from your financial intermediary such as a broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically by contacting the Fund at (844) 838-2121 or, if you own these shares through a financial intermediary, you may contact your financial intermediary.

You may elect to receive all future reports in paper free of charge. You can inform the Fund that you wish to continue receiving paper copies of your shareholder reports by contacting the Fund at (844) 838-2121. If you own shares through a financial intermediary, you may contact your financial intermediary or follow instructions included with this document to elect to continue to receive paper copies of your shareholder reports. Your election to receive reports in paper will apply to all funds held with the fund complex or at your financial intermediary.

Canterbury Investment Management, LLC

23 East Cedar Street

Zionsville, Indiana 46077

(844) 838-2121

Investment Results (Unaudited)

Average Annual Total Returns(a) as of October 31, 2020

| 6 Month | One Year | Since

Inception

(8/2/16) |

Canterbury Portfolio Thermostat Fund, Institutional Shares | 2.44% | -9.19% | 1.59% |

MSCI World Index (b) | 12.84% | 4.91% | 9.82% |

| Expense Ratio(c)

Institutional

Shares |

Total Annual Operating Expenses | 2.00% |

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect deduction of taxes that a shareholder would pay on Canterbury Portfolio Thermostat Fund (the “Fund”) distributions or the redemption of Fund shares. Current performance of the Fund may be lower or higher than the performance quoted. The Fund’s investment objectives, risks, charges and expenses must be considered carefully before investing. Performance data current to the most recent month end may be obtained by calling (844) 838-2121.

(a) | Return figures reflect any change in price per share and assume the reinvestment of all distributions. The Fund’s returns reflect any fee reductions during the applicable periods and exclude the redemption fee. If such fee reductions had not occurred, the quoted performance would have been lower. Total returns for periods less than one year are not annualized. |

(b) | The MSCI World Index is an unmanaged free float-adjusted market capitalization index that is designed to measure global developed market equity performance. Currently the MSCI World Index consists of the following 23 developed market country indices: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, the United Kingdom and the United States. The performance of the index is expressed in terms of U.S. dollars, and does not reflect the deduction of fees or taxes with a mutual fund. Individuals cannot invest directly in an index; however, an individual can invest in exchange traded funds or other investment vehicles that attempt to track the performance of a benchmark index. |

(c) | The expense ratio is from the Fund’s prospectus dated August 28, 2020. The Institutional Shares expense ratio does not correlate to the corresponding ratio of expenses to average net assets included in the financial highlights section of this report, which reflects the operating expenses of the Fund and does not include acquired fund fees and expenses. Additional information pertaining to the Fund’s expense ratios as of October 31, 2020, can be found in the financial highlights. |

The Fund’s investment objectives, strategies, risks, charges and expenses must be considered carefully before investing. The prospectus contains this and other important information about the Fund and may be obtained by calling the same number as above. Please read it carefully before investing.

The Fund is distributed by Ultimus Fund Distributors, LLC, member FINRA/SIPC.

1

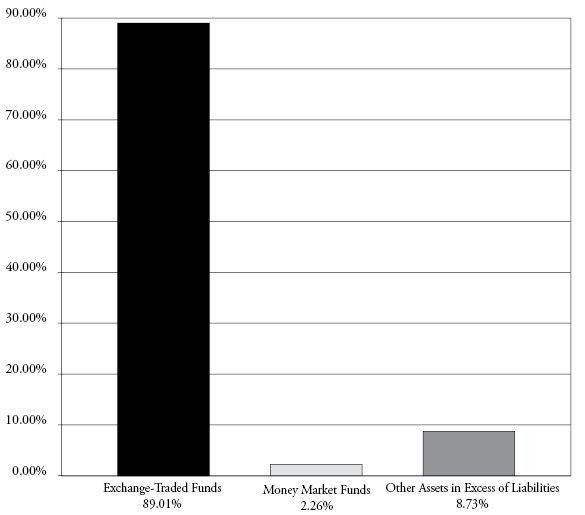

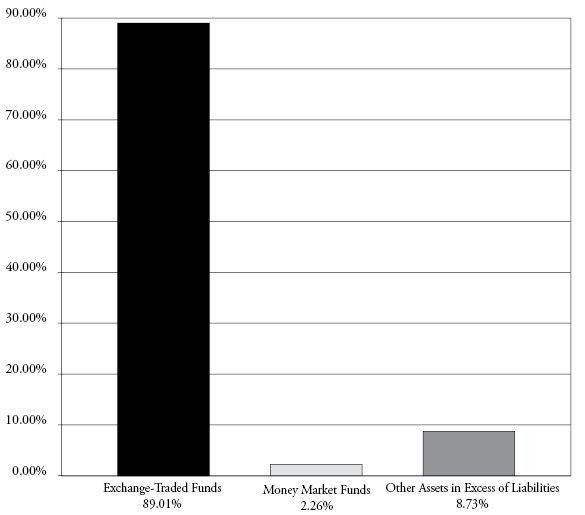

Portfolio Illustration (Unaudited)

October 31, 2020

The following chart gives a visual breakdown of the Fund’s holdings as a percentage of net assets.

Availability of Portfolio Schedule (Unaudited)

The Fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission (“SEC”) for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT. The Fund’s Form N-PORT reports are available on the SEC’s website at http://www.sec.gov.

2

Canterbury Portfolio Thermostat Fund

Schedule of Investments

October 31, 2020 (Unaudited)

| | Shares | | | Fair

Value | |

EXCHANGE-TRADED FUNDS — 89.01% | | | | | | | | |

Consumer Discretionary Select Sector SPDR Fund (The) | | | 14,255 | | | $ | 2,038,037 | |

Invesco QQQ Trust, Series 1 | | | 7,575 | | | | 2,040,554 | |

iShares MSCI South Korea ETF | | | 19,980 | | | | 1,296,702 | |

iShares U.S. Medical Devices ETF | | | 5,115 | | | | 1,525,088 | |

Materials Select Sector SPDR | | | 24,995 | | | | 1,579,184 | |

ProShares Short 20+ Year Treasury | | | 142,980 | | | | 2,271,952 | |

ProShares Short MSCI EAFE | | | 68,860 | | | | 1,697,654 | |

ProShares Short Real Estate | | | 119,550 | | | | 1,524,263 | |

SPDR® S&P 500® ETF Trust | | | 6,300 | | | | 2,057,202 | |

SPDR® S&P® Biotech ETF | | | 13,330 | | | | 1,503,224 | |

SPDR® S&P® Homebuilders ETF | | | 21,990 | | | | 1,143,040 | |

Total Exchange-Traded Funds (Cost $17,269,159) | | | | | | | 18,676,900 | |

| | | | | | | | | |

MONEY MARKET FUNDS — 2.26% | | | | | | | | |

Morgan Stanley Institutional Liquidity Government Portfolio - Institutional Class, 0.02%(a) | | | 473,822 | | | | 473,822 | |

Total Money Market Funds (Cost $473,822) | | | | | | | 473,822 | |

| | | | | | | | | |

Total Investments — 91.27% (Cost $17,742,981) | | | | | | | 19,150,722 | |

Other Assets in Excess of Liabilities — 8.73% | | | | | | | 1,831,008 | |

NET ASSETS — 100.00% | | | | | | $ | 20,981,730 | |

(a) | Rate disclosed is the seven day effective yield as of October 31, 2020. |

ETF - Exchange-Traded Fund

SPDR - Standard & Poor’s Depositary Receipt

| | See accompanying notes which are an integral part of these financial statements. | 3 |

Canterbury Portfolio Thermostat Fund

Statement of Assets and Liabilities

October 31, 2020 (Unaudited)

Assets |

Investments in securities at fair value (cost $17,742,981) | | $ | 19,150,722 | |

Receivable for fund shares sold | | | 17,360 | |

Receivable for investments sold | | | 2,037,810 | |

Dividends receivable | | | 26 | |

Prepaid expenses | | | 17,013 | |

Total Assets | | | 21,222,931 | |

Liabilities |

Payable for fund shares redeemed | | | 200,685 | |

Payable to Adviser | | | 17,171 | |

Payable to Administrator | | | 7,301 | |

Payable to trustees | | | 737 | |

Other accrued expenses | | | 15,307 | |

Total Liabilities | | | 241,201 | |

Net Assets | | $ | 20,981,730 | |

Net Assets consist of: | | | | |

Paid-in capital | | | 22,340,440 | |

Accumulated deficit | | | (1,358,710 | ) |

Net Assets | | $ | 20,981,730 | |

Institutional Shares | | | | |

Shares outstanding (unlimited number of shares authorized, no par value) | | | 2,045,975 | |

Net asset value, offering and redemption price per share(a) | | $ | 10.26 | |

(a) | Subject to certain exceptions, a 2.00% redemption fee is imposed upon shares redeemed within 90 calendar days of their purchase. |

4 | See accompanying notes which are an integral part of these financial statements. | |

Canterbury Portfolio Thermostat Fund

Statement of Operations

For the six months ended October 31, 2020 (Unaudited)

Investment Income | | | | |

Dividend income | | $ | 97,968 | |

Total investment income | | | 97,968 | |

Expenses | | | | |

Adviser | | | 113,647 | |

Registration | | | 16,236 | |

Administration | | | 15,123 | |

Fund accounting | | | 13,863 | |

Legal | | | 10,775 | |

Transfer agent | | | 10,082 | |

Audit and tax preparation | | | 8,545 | |

Trustee | | | 7,534 | |

Printing | | | 6,115 | |

Compliance Services | | | 3,025 | |

Custodian | | | 2,521 | |

Insurance | | | 1,207 | |

Pricing | | | 237 | |

Miscellaneous | | | 13,141 | |

Total expenses | | | 222,051 | |

Fees contractually waived by Adviser | | | (37,002 | ) |

Net operating expenses | | | 185,049 | |

Net investment loss | | | (87,081 | ) |

Net Realized and Change in Unrealized Gain (Loss) on Investments |

Net realized loss on investment securities transactions | | | (660,497 | ) |

Net change in unrealized appreciation of investment securities | | | 1,472,736 | |

Net realized and change in unrealized gain on investments | | | 812,239 | |

Net increase in net assets resulting from operations | | $ | 725,158 | |

| | See accompanying notes which are an integral part of these financial statements. | 5 |

Canterbury Portfolio Thermostat Fund

Statements of Changes in Net Assets

| | | For the

Six Months Ended

October 31, 2020

(Unaudited) | | | For the

Year Ended

April 30, 2020 | |

Increase (Decrease) in Net Assets due to: | | | | | | | | |

Operations | | | | | | | | |

Net investment income (loss) | | $ | (87,081 | ) | | $ | 151,557 | |

Net realized loss on investment securities transactions | | | (660,497 | ) | | | (1,616,138 | ) |

Net change in unrealized appreciation (depreciation) of investment securities | | | 1,472,736 | | | | (1,402,039 | ) |

Net increase (decrease) in net assets resulting from operations | | | 725,158 | | | | (2,866,620 | ) |

Distributions to Shareholders – Institutional Shares | | | | | | | | |

From earnings | | | (10,860 | ) | | | (343,660 | ) |

From return of capital | | | — | | | | (33,986 | ) |

Total Distributions to Shareholders | | | (10,860 | ) | | | (377,646 | ) |

Capital Transactions - Institutional Shares | | | | | | | | |

Proceeds from shares sold | | | 2,357,229 | | | | 15,546,221 | |

Reinvestment of distributions | | | 10,860 | | | | 377,646 | |

Amount paid for shares redeemed | | | (9,411,096 | ) | | | (14,549,470 | ) |

Proceeds from redemption fees(a) | | | 7,117 | | | | 20,265 | |

Total Capital Transactions - Institutional Shares | | | (7,035,890 | ) | | | 1,394,662 | |

Total Decrease in Net Assets | | | (6,321,592 | ) | | | (1,849,604 | ) |

Net Assets | | | | | | | | |

Beginning of period | | $ | 27,303,322 | | | $ | 29,152,926 | |

End of period | | $ | 20,981,730 | | | $ | 27,303,322 | |

Share Transactions - Institutional Shares | | | | | | | | |

Shares sold | | | 228,821 | | | | 1,389,575 | |

Shares issued in reinvestment of distributions | | | 1,081 | | | | 33,573 | |

Shares redeemed | | | (908,337 | ) | | | (1,323,619 | ) |

Total Share Transactions- Institutional Shares | | | (678,435 | ) | | | 99,529 | |

(a) | Subject to certain exceptions, a 2.00% redemption fee is imposed upon shares redeemed within 90 calendar days of their purchase. |

6 | See accompanying notes which are an integral part of these financial statements. | |

Canterbury Portfolio Thermostat Fund - Institutional Shares

Financial Highlights

(For a share outstanding during each period)

| | | For the

Six Months

Ended

October 31,

2020

(Unaudited) | | | For the

Year Ended

April 30,

2020 | | | For the

Year Ended

April 30,

2019 | | | For the

Year Ended

April 30,

2018 | | | For the

Period Ended

April 30,

2017(a) | |

Selected Per Share Data | | | | | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | $ | 10.02 | | | $ | 11.11 | | | $ | 11.15 | | | $ | 10.54 | | | $ | 10.00 | |

| | | | | | | | | | | | | | | | | | | | | |

Income from investment operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss) | | | (0.05 | ) | | | 0.05 | | | | 0.03 | | | | 0.06 | | | | 0.04 | |

Net realized and unrealized gain (loss) on investments | | | 0.29 | | | | (1.01 | ) | | | 0.06 | | | | 0.65 | | | | 0.54 | |

Total from investment operations | | | 0.24 | | | | (0.96 | ) | | | 0.09 | | | | 0.71 | | | | 0.58 | |

| | | | | | | | | | | | | | | | | | | | | |

Less distributions to shareholders from: | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | — | (b) | | | (0.05 | ) | | | (0.03 | ) | | | (0.07 | ) | | | (0.04 | ) |

Net realized gains | | | — | | | | (0.08 | ) | | | (0.12 | ) | | | (0.04 | ) | | | — | |

Return of capital | | | — | | | | (0.01 | ) | | | — | | | | — | | | | — | |

Total from distributions | | | — | | | | (0.14 | ) | | | (0.15 | ) | | | (0.11 | ) | | | (0.04 | ) |

| | | | | | | | | | | | | | | | | | | | | |

Paid-in capital from redemption fees | | | — | (b) | | | 0.01 | | | | 0.02 | | | | 0.01 | | | | — | |

| | | | | | | | | | | | | | | | | | | | | |

Net asset value, end of period | | $ | 10.26 | | | $ | 10.02 | | | $ | 11.11 | | | $ | 11.15 | | | $ | 10.54 | |

| | | | | | | | | | | | | | | | | | | | | |

Total Return(c) | | | 2.44 | %(d) | | | (8.69 | )% | | | 1.07 | % | | | 6.85 | % | | | 5.86 | %(d) |

| | | | | | | | | | | | | | | | | | | | | |

Ratios and Supplemental Data: | | | | | | | | | | | | | | | | | | | | |

Net assets, end of period (000 omitted) | | $ | 20,982 | | | $ | 27,303 | | | $ | 29,153 | | | $ | 35,051 | | | $ | 14,784 | |

Ratio of expenses to average net assets before expense waiver | | | 1.75 | %(e) | | | 1.61 | % | | | 1.53 | % | | | 1.73 | % | | | 2.98 | %(e) |

Ratio of expenses to average net assets after expense waiver | | | 1.46 | %(e) | | | 1.30 | % | | | 1.30 | % | | | 1.30 | % | | | 1.30 | %(e) |

Ratio of net investment income (loss) to average net assets after expense waiver | | | (0.69 | )%(e) | | | 0.51 | % | | | 0.25 | % | | | 0.54 | % | | | 0.63 | %(e) |

Portfolio turnover rate | | | 45 | %(d) | | | 206 | % | | | 185 | % | | | 116 | % | | | 92 | %(d) |

(a) | For the period August 2, 2016 (commencement of operations) to April 30, 2017. |

(b) | Rounds to less than $0.005 per share. |

(c) | Total return in the above table represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of distributions. Excludes redemption fees. |

| | See accompanying notes which are an integral part of these financial statements. | 7 |

Canterbury Portfolio Thermostat Fund

Notes to the Financial Statements

October 31, 2020 (Unaudited)

NOTE 1. ORGANIZATION

The Canterbury Portfolio Thermostat Fund (the “Fund”) was organized as a diversified series of Capitol Series Trust (the “Trust”) on December 17, 2015. The Trust is an open-end investment company established under the laws of Ohio by an Agreement and Declaration of Trust dated September 18, 2013 (the “Trust Agreement”). The Trust Agreement permits the Board of Trustees of the Trust (the “Board”) to issue an unlimited number of shares of beneficial interest of separate series without par value. The Fund is one of a series of funds currently authorized by the Board. The Fund’s investment adviser is Canterbury Investment Management, LLC (the “Adviser”). The investment objective of the Fund is to seek long-term risk-adjusted growth. The Fund attempts to achieve its investment objective utilizing broadly diversified liquid securities traded on major exchanges, primarily exchange-traded funds (“ETFs”). The Fund’s portfolio is structured primarily as a “fund of funds.” The Fund will invest in any debt, equity, and alternative security deemed appropriate and necessary to improve the portfolio’s composition, exposure to which is obtained through the use of ETFs.

The Fund currently offers one class of shares, Institutional Shares. The Fund’s Investor Shares have been approved by the Board, but are not yet available for purchase and are not being offered at this time. The Fund’s Institutional Shares commenced operations on August 2, 2016. Each share represents an equal proportionate interest in the assets and liabilities belonging to the Fund and is entitled to such dividends and distributions out of income belonging to the Fund as are declared by the Board. Both share classes impose a 2.00% redemption fee on shares redeemed within 90 days of purchase.

NOTE 2. SIGNIFICANT ACCOUNTING POLICIES

The Fund is an investment company and follows accounting and reporting guidance under Financial Accounting Standards Board Accounting Standards Codification (“ASC”) Topic 946, “Financial Services-Investment Companies.” The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements. These policies are in conformity with generally accepted accounting principles in the United States of America (“GAAP”).

Estimates – The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

8

Canterbury Portfolio Thermostat Fund

Notes to the Financial Statements (continued)

October 31, 2020 (Unaudited)

Federal Income Taxes – The Fund makes no provision for federal income or excise tax. The Fund has qualified and intends to qualify each year as a regulated investment company (“RIC”) under subchapter M of the Internal Revenue Code of 1986, as amended, by complying with the requirements applicable to RICs and by distributing substantially all of its taxable income. The Fund also intends to distribute sufficient net investment income and net realized capital gains, if any, so that it will not be subject to excise tax on undistributed income and gains. If the required amount of net investment income or gains is not distributed, the Fund could incur a tax expense.

The Fund recognizes tax benefits or expenses of uncertain tax positions only when the position is “more likely than not” to be sustained assuming examination by tax authorities. Management of the Fund has reviewed tax positions taken in tax years that remain subject to examination by all major tax jurisdictions, including federal (i.e., the previous three tax year ends and the interim tax period since then, as applicable) and has concluded that no provision for unrecognized tax benefits or expenses is required in these financial statements and does not expect this to change over the next twelve months. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the Statement of Operations. During the period, the Fund did not incur any interest or penalties.

Expenses – Expenses incurred by the Trust that do not relate to a specific fund of the Trust are allocated to the individual funds based on each fund’s relative net assets or another appropriate basis (as determined by the Board).

Security Transactions and Related Income – Throughout the reporting period, security transactions are accounted for no later than one business day following the trade date. For financial reporting purposes, security transactions are accounted for on trade date on the last business day of the reporting period. The specific identification method is used for determining gains or losses for financial statements and income tax purposes. Dividend income is recorded on the ex-dividend date.

Dividends and Distributions - The Fund intends to distribute its net investment income and net realized long-term and short-term capital gains, if any, at least annually. Dividends and distributions to shareholders, which are determined in accordance with income tax regulations, are recorded on the ex-dividend date. The treatment for financial reporting purposes of distributions made to shareholders during the period from net investment income or net realized capital gains may differ from their ultimate treatment for federal income tax purposes. These differences are caused primarily by differences in the timing of the recognition of certain components of income, expense or realized capital gain for federal income tax purposes. Where such differences are permanent in nature, they are reclassified among the components of net assets based on their ultimate characterization for federal income tax purposes. Any such reclassifications will have no effect on net assets, results of operations or net asset value (“NAV”) per share of the Fund.

9

Canterbury Portfolio Thermostat Fund

Notes to the Financial Statements (continued)

October 31, 2020 (Unaudited)

NOTE 3. SECURITIES VALUATION AND FAIR VALUE MEASUREMENTS

Fair value is defined as the price that the Fund would receive upon selling an investment in a timely transaction to an independent buyer in the principal or most advantageous market of the investment. GAAP establishes a three-tier hierarchy to maximize the use of observable market data and minimize the use of unobservable inputs and to establish classification of fair value measurements for disclosure purposes.

Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk (the risk inherent in a particular valuation technique used to measure fair value including a pricing model and/or the risk inherent in the inputs to the valuation technique). Inputs may be observable or unobservable. Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability developed based on market data obtained and available from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability developed based on the best information available in the circumstances.

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below.

| | ● | Level 1 – unadjusted quoted prices in active markets for identical investments and/or registered investment companies where the value per share is determined and published and is the basis for current transactions for identical assets or liabilities at the valuation date |

| | ● | Level 2 – other significant observable inputs (including, but not limited to, quoted prices for an identical security in an inactive market, quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.) |

| | ● | Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining fair value of investments based on the best information available) |

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy which is reported is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

In computing the NAV of the Fund, fair value is based on market valuations with respect to portfolio securities for which market quotations are readily available. Pursuant to Board approved policies, the Fund relies on independent third-party pricing services to provide the current market value of securities. Those pricing services value equity securities, including exchange-traded funds, exchange-traded notes, closed-end funds and preferred stocks, traded on a securities exchange at the last reported sales price on the principal exchange. Equity securities quoted by NASDAQ are valued at

10

Canterbury Portfolio Thermostat Fund

Notes to the Financial Statements (continued)

October 31, 2020 (Unaudited)

the NASDAQ Official Closing Price. If there is no reported sale on the principal exchange, equity securities are valued at the mean between the most recent quoted bid and asked price. When using the market quotations or close prices provided by the pricing service and when the market is considered active, the security will be classified as a Level 1 security. Investments in open-end mutual funds, including money market mutual funds, are generally priced at the ending NAV provided by the pricing service of the funds and are generally categorized as Level 1 securities.

In the event that market quotations are not readily available, the Adviser determines that the market quotation or the price provided by the pricing service does not accurately reflect the current fair value, or certain restricted or illiquid securities are being valued, such securities are valued as determined in good faith by the Trust’s Valuation Committee, based on recommendations from a pricing committee comprised of certain officers of the Trust, certain employees of the Fund’s administrator, and representatives of the Adviser (together the “Pricing Review Committee”). These securities will be classified as Level 2 or 3 within the fair value hierarchy, depending on the inputs used.

In accordance with the Trust’s Portfolio Valuation Procedures, the Pricing Review Committee, in making its recommendations with the Adviser’s participation, is required to consider all appropriate factors relevant to the value of securities for which it has determined other pricing sources are not available or reliable as described above. No single standard exists for determining fair value, because fair value depends upon the circumstances of each individual case. As a general principle, the current fair value of an issue of securities being valued pursuant to the Trust’s Fair Value Guidelines would be the amount which the Fund might reasonably expect to receive for them upon their current sale. Methods which are in accordance with this principle may, for example, be based on (i) a multiple of earnings; (ii) a discount from market prices of a similar freely traded security (including a derivative security or a basket of securities traded on other markets, exchanges or among dealers); or (iii) yield to maturity with respect to debt issues, or a combination of these and other methods. Fair value pricing is permitted if, in accordance with the Trust’s Portfolio Valuation Procedures, the validity of market quotations appears to be questionable based on factors such as evidence of a thin market in the security based on a small number of quotations, a significant event occurs after the close of a market but before the Fund’s NAV calculation that may affect a security’s value, or other data calls into question the reliability of market quotations.

11

Canterbury Portfolio Thermostat Fund

Notes to the Financial Statements (continued)

October 31, 2020 (Unaudited)

The following is a summary of the inputs used to value the Fund’s investments as of October 31, 2020:

| | | Valuation Inputs | |

Assets | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

Exchange-Traded Funds | | $ | 18,676,900 | | | $ | — | | | $ | — | | | $ | 18,676,900 | |

Money Market Funds | | | 473,822 | | | | — | | | | — | | | | 473,822 | |

Total | | $ | 19,150,722 | | | $ | — | | | $ | — | | | $ | 19,150,722 | |

The Fund did not hold any investments at the end of the reporting period for which significant unobservable inputs (Level 3) were used in determining fair value; therefore, no reconciliation of Level 3 securities is included for this reporting period.

NOTE 4. FEES AND OTHER TRANSACTIONS WITH AFFILIATES

Under the terms of the investment advisory agreement (the “Agreement”), the Adviser manages the Fund’s investments subject to approval of the Board. As compensation for its management services, the Fund is obligated to pay the Adviser a fee computed and accrued daily and paid monthly at an annual rate of 0.90% of the Fund’s average daily net assets. For the six months ended October 31, 2020, the Adviser earned fees of $113,647 from the Fund. At October 31, 2020, the Fund owed the Adviser $17,171.

Prior to September 1, 2020, the Adviser had contractually agreed to waive its management fee and/or reimburse expenses so that total annual operating expenses for the Fund (excluding (i) interest; (ii) taxes; (iii) brokerage fees and commissions; (iv) other extraordinary expenses not incurred in the ordinary course of the Fund’s business; (v) dividend expense on short sales; and (vi) indirect expenses such as acquired fund fees and expenses) did not exceed 1.30% of the average daily net assets of the Fund’s Institutional Shares through August 31, 2020 (the “Expense Limitation”). The Adviser decided not to renew the aforesaid Expense Limitation. As a result, the Adviser is not entitled to recoup any fees that were previously waived, or expenses that were previously reimbursed, pursuant to the previously effective Expense Limitation.

The Trust retains Ultimus Fund Solutions, LLC (the “Administrator”) to provide the Fund with administration, accounting, transfer agent and compliance services, including all regulatory reporting. For the six months ended October 31, 2020, the Administrator earned fees of $15,123 for administration services, $13,863 for fund accounting services, $3,025 for compliance services and $10,082 for transfer agent services. At October 31, 2020, the Fund owed the Administrator $7,301 for such services.

12

Canterbury Portfolio Thermostat Fund

Notes to the Financial Statements (continued)

October 31, 2020 (Unaudited)

The Board supervises the business activities of the Trust. Each Trustee serves as a Trustee for the lifetime of the Trust or until the earlier of his or her retirement as a Trustee at age 78 (which may be extended for up to two years in an emeritus non-voting capacity at the pleasure and request of the Board), or until he/she dies, resigns, or is removed, whichever is sooner. “Independent Trustees,” meaning those Trustees who are not “interested persons” of the Trust, as defined in the Investment Company Act of 1940 (“1940 Act”), as amended, has received an annual retainer of $1,000 per Fund and $500 per Fund for each quarterly in-person Board meeting. In addition, each Independent Trustee may be compensated for preparation related to and participation in any special meetings of the Board and/or any Committee of the Board, with such compensation determined on a case-by-case basis based on the length and complexity of the meeting. The Trust also reimburses Trustees for out-of-pocket expense incurred in conjunction with attendance at Board meetings.

The officers and one trustee of the Trust are employees of the Administrator. Ultimus Fund Distributors, LLC (the “Distributor”) acts as the principal distributor of the Fund’s shares. The Distributor is a wholly-owned subsidiary of the Administrator.

NOTE 5. PURCHASES AND SALES OF SECURITIES

For the six months ended October 31, 2020, purchases and sales of investment securities, other than short-term investments, were $10,674,487 and $18,961,759, respectively.

There were no purchases or sales of long-term U.S. government obligations during the six months ended October 31, 2020.

NOTE 6. FEDERAL TAX INFORMATION

At October 31, 2020, the net unrealized appreciation (depreciation) and tax cost of investments for tax purposes was as follows:

Gross unrealized appreciation | | $ | 1,985,774 | |

Gross unrealized depreciation | | | (578,033 | ) |

Net unrealized appreciation/(depreciation) on investments | | $ | 1,407,741 | |

Tax cost of investments | | $ | 17,742,981 | |

13

Canterbury Portfolio Thermostat Fund

Notes to the Financial Statements (continued)

October 31, 2020 (Unaudited)

The tax character of distributions paid for the fiscal year ended April 30, 2020, the Fund’s most recent fiscal year end, was as follows:

Distributions paid from: | | | | |

Ordinary income | | $ | 134,331 | |

Long-term capital gains | | | 209,329 | |

Tax return of capital | | | 33,986 | |

Total distributions paid | | $ | 377,646 | |

At April 30, 2020, the components of accumulated earnings (deficit) on a tax basis were as follows:

Accumulated capital and other losses | | $ | (2,008,013 | ) |

Unrealized depreciation on investments | | | (64,995 | ) |

Total accumulated deficit | | $ | (2,073,008 | ) |

Certain qualified losses incurred after October 31, and within the current taxable year, are deemed to arise on the first business day of the Fund’s following taxable year. For the tax year ended April 30, 2020, the Fund deferred post October qualified losses in the amount of $2,008,013.

NOTE 7. INVESTMENT IN OTHER INVESTMENT COMPANIES

The Fund may invest a significant portion of its assets in shares of one or more investment companies, including ETFs, open-end mutual funds and money market mutual funds. The Fund will incur additional indirect expenses (acquired fund fees and expenses) to the extent it invests in shares of other investment companies. As of October 31, 2020, the Fund had 89.01% of the value of its net assets invested in ETFs. The financial statements of these ETFs and open-end mutual funds can be found at www.sec.gov.

NOTE 8. COMMITMENTS AND CONTIGENCIES

The Trust indemnifies its officers and Trustees for certain liabilities that may arise from their performance of their duties to the Trust or the Fund. Additionally, in the normal course of business, the Trust enters into contracts that contain a variety of representations and warranties which provide general indemnifications. The Trust’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Trust that have not yet occurred.

14

Canterbury Portfolio Thermostat Fund

Notes to the Financial Statements (continued)

October 31, 2020 (Unaudited)

NOTE 9. SUBSEQUENT EVENTS

Management of the Fund has evaluated the need for disclosures and/or adjustments resulting from subsequent events through the date at which these financial statements were issued. Based upon this evaluation, management has determined there were no items requiring adjustment of the financial statements or additional disclosure.

NOTE 10. LIQUIDITY RISK MANAGEMENT PROGRAM (Unaudited)

The Fund has adopted and implemented a written liquidity risk management program (the “Program”) as required by Rule 22e-4 (the “Liquidity Rule”) under the 1940 Act. The Program is reasonably designed to assess and manage the Fund’s liquidity risk, taking into consideration, among other factors, the Fund’s investment strategy and the liquidity of its portfolio investments during normal and reasonably foreseeable stressed conditions; its short and long-term cash flow projections; and its cash holdings and access to other funding sources. The Board approved the appointment of the Liquidity Administrator Committee, comprising certain Trust officers and employees of the Adviser. The Liquidity Administrator Committee maintains Program oversight and reports to the Board on at least an annual basis regarding the Program’s operational effectiveness through a written report (the “Report”). The Report outlined the operation of the Program and the adequacy and effectiveness of the Program’s implementation and was presented to the Board for consideration at its meeting held on September 8, 2020. During the review period, the Fund did not experience unusual stress or disruption to its operations related to purchase and redemption activity. Also, during the review period the Fund held adequate levels of cash and highly liquid investments to meet shareholder redemption activities in accordance with applicable requirements. The Report concluded that the Program is reasonably designed to prevent violation of the Liquidity Rule and has been effectively implemented.

15

Summary of Fund Expenses (Unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction and (2) ongoing costs, including management fees and other Fund expenses. These examples are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from May 1, 2020 through October 31, 2020.

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs. Therefore, the second line of the table below is useful in comparing ongoing costs only and will not help you determine the relative costs of owning different funds. In addition, if transaction costs were included, your costs would have been higher.

| | Beginning

Account

Value

May 1, 2020 | Ending

Account

Value

October 31, 2020 | Expenses

Paid

During

Period(a) | Annualized

Expense

Ratio |

Canterbury Portfolio Thermostat Fund |

Institutional Class | Actual | $1,000.00 | $1,024.40 | $7.46 | 1.46% |

| | | | | | |

| | Hypothetical(b) | $1,000.00 | $1,017.84 | $7.43 | 1.46% |

(a) | Expenses are equal to the Fund’s annualized expense ratios, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). |

(b) | Hypothetical assumes 5% annual return before expenses. |

16

FACTS | WHAT DOES CANTERBURY PORTFOLIO THERMOSTAT FUND (THE “FUND”) DO WITH YOUR PERSONAL INFORMATION? |

| | |

Why? | Financial companies choose how they share your personal information. Federal law gives consumers the right to limit some but not all sharing. Federal law also requires us to tell you how we collect, share, and protect your personal information. Please read this notice carefully to understand what we do. |

| | |

What? | The types of personal information we collect and share depend on the product or service you have with us. This information can include: ■ Social Security number ■ account balances and account transactions ■ transaction or loss history and purchase history ■ checking account information and wire transfer instructions When you are no longer our customer, we continue to share your information as described in this notice. |

| | |

How? | All financial companies need to share customers’ personal information to run their everyday business. In the section below, we list the reasons financial companies can share their customers’ personal information; the reasons the Fund chooses to share; and whether you can limit this sharing. |

| | |

Reasons we can share your personal information | Does the Fund share? |

For our everyday business purposes—

such as to process your transactions, maintain your account(s), respond to court orders and legal investigations, or report to credit bureaus | Yes |

For our marketing purposes—

to offer our products and services to you | No |

For joint marketing with other financial companies | No |

For our affiliates’ everyday business purposes— information about your transactions and experiences | No |

For our affiliates’ everyday business purposes— information about your creditworthiness | No |

For nonaffiliates to market to you | No |

| | |

Questions? | Call (844) 838-2121 |

17

Who we are |

Who is providing this notice? | Canterbury Portfolio Thermostat Fund

Ultimus Fund Distributors, LLC (Distributor)

Ultimus Fund Solutions, LLC (Administrator) |

What we do |

How does the Fund protect my personal information? | To protect your personal information from unauthorized access and use, we use security measures that comply with federal law. These measures include computer safeguards and secured files and buildings. Our service providers are held accountable for adhering to strict policies and procedures to prevent any misuse of your nonpublic personal information. |

How does the Fund collect my personal information? | We collect your personal information, for example, when you ■ open an account or deposit money ■ buy securities from us or sell securities to us ■ make deposits or withdrawals from your account ■ give us your account information ■ make a wire transfer ■ tell us who receives the money ■ tell us where to send the money ■ show your government-issued ID ■ show your driver’s license |

Why can’t I limit all sharing? | Federal law gives you the right to limit only ■ sharing for affiliates’ everyday business purposes — information about your creditworthiness ■ affiliates from using your information to market to you ■ sharing for nonaffiliates to market to you State laws and individual companies may give you additional rights to limit sharing. |

Definitions |

Affiliates | Companies related by common ownership or control. They can be financial and nonfinancial companies. ■ Canterbury Investment Management, LLC, the investment adviser to the Fund, could be deemed to be an affiliate. |

Nonaffiliates | Companies not related by common ownership or control. They can be financial and nonfinancial companies. ■ The Fund does not share your personal information with nonaffiliates so they can market to you. |

Joint marketing | A formal agreement between nonaffiliated financial companies that together market financial products or services to you. ■ The Fund doesn’t jointly market. |

18

This page is intentionally left blank.

This page is intentionally left blank.

This page is intentionally left blank.

PROXY VOTING

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities and information regarding how the Fund voted those proxies during the most recent twelve month period ended June 30, are available (1) without charge upon request by calling the Fund at (844) 838-2121 and (2) in Fund documents filed with the Securities and Exchange Commission (“SEC”) on the SEC’s website at www.sec.gov.

TRUSTEES

Walter B. Grimm, Chairman

John C. Davis

Robert G. Dorsey

Lori Kaiser

Janet Smith Meeks

Mary M. Morrow

OFFICERS

Matthew J. Miller, Chief Executive Officer and President

Zachary P. Richmond, Chief Financial Officer and Treasurer

Martin R. Dean, Chief Compliance Officer

Matthew J. Beck, Secretary

INVESTMENT ADVISER

Canterbury Investment Management, LLC

23 East Cedar Street

Zionsville, IN 46077

DISTRIBUTOR

Ultimus Fund Distributors, LLC

225 Pictoria Drive, Suite 450

Cincinnati, OH 45246

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Ernst & Young LLP

221 East 4th Street, Suite 2900

Cincinnati, OH 45202

LEGAL COUNSEL

Bernstein Shur

100 Middle Street, 6th Floor

Portland, ME 04104

CUSTODIAN

Huntington National Bank

41 South High Street

Columbus, OH 43215

ADMINISTRATOR, TRANSFER AGENT AND FUND ACCOUNTANT

Ultimus Fund Solutions, LLC

225 Pictoria Drive, Suite 450

Cincinnati, OH 45246

This report is intended only for the information of shareholders or those who have received the Fund’s prospectus which contains information about the Fund’s management fee and expenses. Please read the prospectus carefully before investing.

Distributed by Ultimus Fund Distributors, LLC

Member FINRA/SIPC

Guardian Dividend Growth Fund

Class I – DIVGX

Semi-Annual Report

October 31, 2020

Beginning on January 1, 2021, as permitted by regulations adopted by the U.S. Securities and Exchange Commission, paper copies of the Fund’s shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from the Fund or from your financial intermediary such as a broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically by contacting the Fund at (800) 968-2295 or, if you own any shares through a financial intermediary, by contacting your financial intermediary.

You may elect to receive all future reports in paper free of charge. You can inform the Fund that you wish to continue receiving paper copies of your shareholder reports by contacting the Fund at (800) 968-2295. If you own shares through a financial intermediary, you may contact your financial intermediary or follow instructions included with this document to elect to continue to receive paper copies of your shareholder reports. Your election to receive reports in paper will apply to all funds held with the fund complex or at your financial intermediary.

Guardian Capital LP

Commerce Court West

199 Bay Street, Suite 3100

P.O. Box 201

Toronto, Ontario M5L 1E8

Telephone: (800)-968-2295

Portfolio Managers’ Letter to Shareholders (Unaudited)

We hope everyone is healthy and safe during this unprecedented health crisis and shock to not only financial markets but also our everyday life.

At Guardian Capital, we continue to adapt our Business Continuity Plan as developments on the COVID-19 pandemic unfold, to ensure that we maintain our service capabilities without disruptions. Now working remotely and video conferencing have become the new routines within our homes. The transition has been seamless thanks to the hard work and preparedness of our operations team. Please feel free to reach out with any concerns – we are practicing social distancing while still very connected to our team members and clients.

In the six-month period ending October 31, 2020, global equity markets experienced a sharp rebound and held onto gains across most regions, despite ongoing economic growth uncertainty, and rising rates of infection in a second wave of the pandemic.

With unprecedented liquidity from central banks leading to a sharp recovery in equity markets from historic lows, the mandate lagged the benchmark MSCI World Index during the period, but continued to outperform its style benchmark MSCI World High Dividend Index. The largest underperformance came from the Communications and Consumer Discretionary sectors (in particular, not owning large benchmark constituents), while the REIT and Industrial sectors had a negative stock selection effect. The largest outperformance came from Consumer Staples where positions in Costco, Unilever and Procter and Gamble led to positive stock selection, and no exposure to Energy, and underweight to Financials, contributed to relative return.

Turnover was relatively low for the Guardian Dividend Growth Fund (the “Fund”) during the period but we continued to reduce risk and exit holdings that have higher cash flow variability and cyclical sensitivity. We reduced our exposure in some of the defensive sectors, and increased our weight in Information Technology and Industrials, increasing holdings with strong long-term dividend and earnings growth profiles. The Fund continues to benefit from secular trends in the post-COVID digitized world, and the IT sector, for example, shows a strong one-year dividend growth rate, and a low overall probability of dividend cut, as forecasted using our proprietary AI algorithms, as well as strong forecasted EPS growth coming from this sector.

With the uncertainty from US elections now passed and the second wave of COVID in the background, markets may experience renewed volatility in the near-term, but there are also continued signs of growth in many areas. We are now seeing US and foreign growth rates start to moderate as reflected in many Purchasing Managers Indexes (PMIs) around the world stabilizing, albeit at healthy levels.

We will remain focused on high-quality companies with robust growth prospects and secure stream of cash flows that will continue to sustain dividend growth, and that will remain, as always, our long-term investment approach. Using our algorithms for forecasting the probability of dividend cuts enables us to decrease the risk of the Fund by owning companies with future dividend growth and lower probabilities of dividend cuts. We

1

Portfolio Managers’ Letter to Shareholders (Unaudited) (continued)

will continue to focus on high-quality companies with strong fundamentals, visible cash flows and sustainable and growing earnings and dividends. The Fund has provided strong downside protection during past crises, while remaining well-positioned for potential upside.

We thank you for your trust and partnership as part of your investment strategy, and look forward to deepening our relationship with shareholders. We will remain committed to managing the Fund combining a quantitative, systematic approach with a fundamental discipline and portfolio management oversight to consistently grow shareholder value.

2

Investment Results (Unaudited)

Average Annual Total Returns(a) as of October 31, 2020

| | Six Months | One Year | Since Inception

05/01/2019 |

Guardian Dividend Growth Fund | | | |

Class I | 8.95% | 1.85% | 5.95% |

MSCI World Index(b) | 12.57% | 4.36% | 5.58% |

| | Expense Ratios(c) |

| | Class I |

Gross | 1.95% |

With Applicable Waivers | 0.96% |

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect deduction of taxes that a shareholder would pay on Guardian Dividend Growth Fund (the “Fund”) distributions or the redemption of Fund shares. Current performance of the Fund may be lower or higher than the performance quoted. The Fund’s investment objectives, risks, charges and expenses must be considered carefully before investing. Performance data current to the most recent month end may be obtained by calling (800) 968-2295.

(a) Return figures reflect any change in price per share and assume the reinvestment of all distributions. The Fund’s returns reflect any fee reductions during the applicable periods. If such fee reductions had not occurred, the quoted performance would have been lower. Total returns for less than one year are not annualized.

(b) The MSCI World Index is an unmanaged free float-adjusted market capitalization index that is designed to measure global developed market equity performance. Currently the MSCI World Index consists of the following 23 developed market country indices: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, the United Kingdom and the United States. The performance of the index is expressed in terms of U.S. dollars, and does not reflect the deduction of fees and expenses, whereas the Fund’s returns are shown net of fees. Individuals cannot invest directly in an index; however, an individual can invest in exchange traded funds or other investment vehicles that attempt to track the performance of a benchmark index.

(c) The expense ratio is from the Fund’s prospectus dated August 28, 2020. Guardian Capital LP, the Fund’s adviser (the “Adviser”), has contractually agreed to waive its management fee and/or reimburse expenses so that total annual operating expenses for the Fund (excluding (i) interest; (ii) taxes; (iii) brokerage fees and commissions; (iv) other extraordinary expenses not incurred in the ordinary course of the Fund’s business; (v) dividend expense on short sales; and (vi) indirect expenses such as acquired fund fees and expenses) do not exceed 0.95% of the Fund’s average daily net assets through August 31, 2021 (the “Expense Limitation”). During any fiscal year that the Investment Advisory Agreement between the Adviser and the Capitol Series Trust (the “Trust”) is in effect, the Adviser may recoup the sum of all fees previously waived or expenses reimbursed, less any reimbursement previously paid, provided that the Adviser is only permitted to recoup fees or expenses within 36 months from the date the fee waiver or expense reimbursement first occurred and provided further that such recoupment can be achieved within the Expense Limitation Agreement currently in effect and the Expense Limitation Agreement in place when the waiver/reimbursement occurred. This Expense Limitation Agreement may be terminated by the Board of Trustees (the “Board”) at any time. The Class I Shares expense ratio does not correlate to the corresponding ratio of expenses to average net assets included in the financial highlights section of this report, which reflects the operating expenses of the Fund, but does not include acquired fund fees and expenses. Additional information pertaining to the Fund’s expense ratios as of October 31, 2020, can be found in the financial highlights.

The Fund’s investment objectives, strategies, risks, charges and expenses must be considered carefully before investing. The prospectus contains this and other important information about the Fund and may be obtained by calling (800) 968-2295. Please read it carefully before investing.

The Fund is distributed by Ultimus Fund Distributors, LLC, member FINRA/SIPC.

3

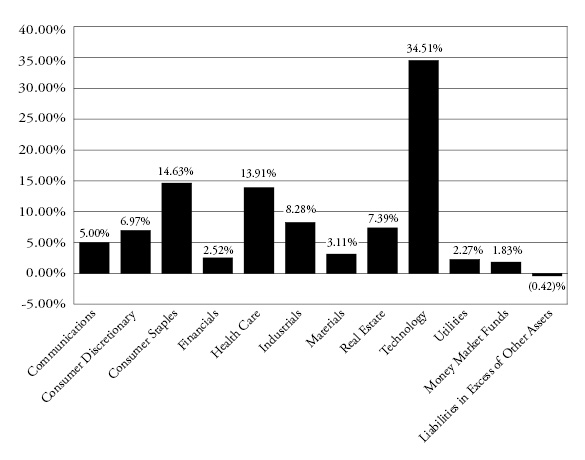

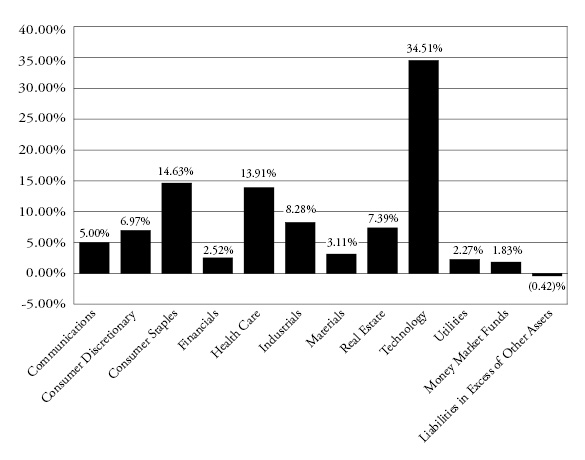

Portfolio Illustration (Unaudited)

October 31 2020

The following chart gives a visual breakdown of the Fund’s holdings as a percentage of net assets.

Availability of Portfolio Schedule (Unaudited)

The Fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission (“SEC”) for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT, within sixty days after the end of the period. The Fund’s portfolio holdings are available on the SEC’s website at http://www.sec.gov.

4

Guardian Dividend Growth Fund

Schedule of Investments (Unaudited)

October 31, 2020

| | Shares | | | Fair Value | |

COMMON STOCKS — 98.59% | | | | | | | | |

| | | | | | | | | |

Communications — 5.00% | | | | | | | | |

BCE, Inc. | | | 6,603 | | | $ | 265,363 | |

Telus Corp. | | | 14,292 | | | | 244,381 | |

Verizon Communications, Inc. | | | 5,332 | | | | 303,871 | |

| | | | | | | | 813,615 | |

Consumer Discretionary — 6.97% | | | | | | | | |

Home Depot, Inc. (The) | | | 1,502 | | | | 400,598 | |

LVMH Moet Hennessy Louis Vuitton SA - ADR | | | 1,749 | | | | 164,633 | |

McDonald’s Corp. | | | 2,672 | | | | 569,136 | |

| | | | | | | | 1,134,367 | |

Consumer Staples — 14.63% | | | | | | | | |

Costco Wholesale Corp. | | | 1,581 | | | | 565,397 | |

Kimberly-Clark Corp. | | | 2,319 | | | | 307,476 | |

Nestle S.A. - ADR | | | 5,939 | | | | 666,772 | |

Procter & Gamble Co. (The) | | | 2,584 | | | | 354,266 | |

Unilever N.V. - ADR | | | 8,610 | | | | 486,982 | |

| | | | | | | | 2,380,893 | |

Financials — 2.52% | | | | | | | | |

Royal Bank of Canada | | | 5,861 | | | | 409,847 | |

| | | | | | | | | |

Health Care — 13.91% | | | | | | | | |

AstraZeneca plc - ADR | | | 8,878 | | | | 445,320 | |

Johnson & Johnson | | | 2,505 | | | | 343,461 | |

Lonza Group AG - ADR | | | 3,422 | | | | 206,723 | |

Medtronic plc | | | 2,360 | | | | 237,345 | |

Novartis AG - ADR | | | 3,387 | | | | 264,457 | |

Novo Nordisk A/S - ADR | | | 2,486 | | | | 158,831 | |

Roche Holding AG - ADR | | | 7,797 | | | | 311,802 | |

Sanofi - ADR | | | 6,496 | | | | 294,269 | |

| | | | | | | | 2,262,208 | |

Industrials — 8.28% | | | | | | | | |

Lockheed Martin Corp. | | | 874 | | | | 306,014 | |

Republic Services, Inc. | | | 4,113 | | | | 362,643 | |

Schneider Electric SE - ADR | | | 13,574 | | | | 330,798 | |

Waste Management, Inc. | | | 3,224 | | | | 347,902 | |

| | | | | | | | 1,347,357 | |

Materials — 3.11% | | | | | | | | |

Air Products & Chemicals, Inc. | | | 1,834 | | | | 506,624 | |

| | | | | | | | | |

| | See accompanying notes which are an integral part of these financial statements. | 5 |

Guardian Dividend Growth Fund

Schedule of Investments (Unaudited) (continued)

October 31, 2020

| | Shares | | | Fair Value | |

COMMON STOCKS — (continued) | | | | | | | | |

| | | | | | | | | |

Real Estate — 7.39% | | | | | | | | |

Crown Castle International Corp. | | | 934 | | | $ | 145,891 | |

Digital Realty Trust, Inc. | | | 3,454 | | | | 498,412 | |

Medical Properties Trust, Inc. | | | 31,279 | | | | 557,392 | |

| | | | | | | | 1,201,695 | |

Technology — 34.51% | | | | | | | | |

Accenture PLC, Class A | | | 3,782 | | | | 820,354 | |

Apple, Inc. | | | 7,245 | | | | 788,691 | |

Booz Allen Hamilton Holding Corp. | | | 4,072 | | | | 319,652 | |

Broadcom, Inc. | | | 1,819 | | | | 635,977 | |

CDW Corp. | | | 2,695 | | | | 330,407 | |

IHS Markit Ltd. | | | 3,294 | | | | 266,386 | |

Lam Research Corp. | | | 1,017 | | | | 347,895 | |

MarketAxess Holdings, Inc. | | | 361 | | | | 194,525 | |

Mastercard, Inc., Class A | | | 2,433 | | | | 702,261 | |

Microsoft Corp. | | | 3,779 | | | | 765,134 | |

Wolters Kluwer NV - ADR | | | 5,502 | | | | 445,497 | |

| | | | | | | | 5,616,779 | |

Utilities — 2.27% | | | | | | | | |

American Water Works Co., Inc. | | | 2,451 | | | | 368,900 | |

| | | | | | | | | |

Total Common Stocks (Cost $14,122,729) | | | | | | | 16,042,285 | |

| | | | | | | | | |

| | | | | | | | | |

MONEY MARKET FUNDS — 1.83% | | | | | | | | |

Morgan Stanley Institutional Liquidity Fund, Institutional Class, 0.01%(a) | | | 297,835 | | | | 297,835 | |

Total Money Market Funds (Cost $297,835) | | | | | | | 297,835 | |

| | | | | | | | | |

Total Investments — 100.42% (Cost $14,420,564) | | | | | | | 16,340,120 | |

| | | | | | | | | |

Liabilities in Excess of Other Assets — (0.42)% | | | | | | | (68,861 | ) |

| | | | | | | | | |

NET ASSETS — 100.00% | | | | | | $ | 16,271,259 | |

(a) | Rate disclosed is the seven day effective yield as of October 31, 2020. |

ADR - American Depositary Receipt.

6 | See accompanying notes which are an integral part of these financial statements. | |

Guardian Dividend Growth Fund

Statement of Assets and Liabilities (Unaudited)

October 31, 2020

Assets |

Investments in securities at fair value (cost $14,420,564) | | $ | 16,340,120 | |

Receivable for investments sold | | | 260,468 | |

Dividends receivable | | | 21,401 | |

Receivable from Adviser | | | 129 | |

Prepaid expenses | | | 9,006 | |

Total Assets | | | 16,631,124 | |

Liabilities | | | | |

Payable for investments purchased | | | 330,844 | |

Payable to Administrator | | | 4,083 | |

Payable to auditors | | | 12,314 | |

Other accrued expenses | | | 12,624 | |

Total Liabilities | | | 359,865 | |

Net Assets | | $ | 16,271,259 | |

Net Assets consist of: | | | | |

Paid-in capital | | $ | 15,257,517 | |

Accumulated earnings | | | 1,013,742 | |

Net Assets | | $ | 16,271,259 | |

Shares outstanding (unlimited number of shares authorized, no par value) | | | 1,525,146 | |

Net asset value, offering and redemption price per share | | $ | 10.67 | |

| | See accompanying notes which are an integral part of these financial statements. | 7 |

Guardian Dividend Growth Fund

Statement of Operations (Unaudited)

For the six months ended October 31, 2020

Investment Income | | | | |

Dividend income (net of foreign taxes withheld of $14,867) | | $ | 178,605 | |

Total investment income | | | 178,605 | |

Expenses | | | | |

Adviser | | | 61,610 | |

Administration | | | 23,720 | |

Audit and tax preparation | | | 10,614 | |

Legal | | | 8,982 | |

Compliance services | | | 7,057 | |

Trustee | | | 6,994 | |

Transfer agent | | | 6,049 | |

Custodian | | | 3,615 | |

Report printing | | | 2,629 | |

Registration | | | 817 | |

Pricing | | | 109 | |

Miscellaneous | | | 13,656 | |

Total expenses | | | 145,852 | |

Fees contractually waived and expenses reimbursed by Adviser | | | (67,566 | ) |

Net operating expenses | | | 78,286 | |

Net investment income | | | 100,319 | |

Net Realized and Change in Unrealized Gain (Loss) on Investments | | | | |

Net realized loss on investment securities transactions | | | (107,385 | ) |

Net realized gain on foreign currency translations | | | 256 | |

Net change in unrealized appreciation of investment securities and foreign currency translations | | | 1,347,420 | |

Net realized and change in unrealized gain on investments | | | 1,240,291 | |

Net increase in net assets resulting from operations | | $ | 1,340,610 | |

8 | See accompanying notes which are an integral part of these financial statements. | |

Guardian Dividend Growth Fund

Statements of Changes in Net Assets

| | For the

Six Months Ended

October 31, 2020

(Unaudited) | | | For the

Period Ended

April 30, 2020(a) | |

Increase (Decrease) in Net Assets due to: | | | | | | | | |

Operations | | | | | | | | |

Net investment income | | $ | 100,319 | | | $ | 258,249 | |

Net realized loss on investment securities transactions and foreign currency translations | | | (107,129 | ) | | | (818,371 | ) |

Net change in unrealized appreciation of investment securities and foreign currency translations | | | 1,347,420 | | | | 572,079 | |

Net increase in net assets resulting from operations | | | 1,340,610 | | | | 11,957 | |

Distributions to Shareholders from Earnings: | | | | | | | | |

Class I | | | (93,042 | ) | | | (245,783 | ) |

Total distributions | | | (93,042 | ) | | | (245,783 | ) |

Capital Transactions - Class I | | | | | | | | |

Proceeds from shares sold | | | — | | | | 15,000,010 | |

Reinvestment of distributions | | | 70,712 | | | | 186,795 | |

Net increase in net assets resulting from capital transactions | | | 70,712 | | | | 15,186,805 | |

Total Increase in Net Assets | | | 1,318,280 | | | | 14,952,979 | |

Net Assets | | | | | | | | |

Beginning of period | | | 14,952,979 | | | | — | |

End of period | | $ | 16,271,259 | | | $ | 14,952,979 | |

Share Transactions - Class I | | | | | | | | |

Shares sold | | | — | | | | 1,500,001 | |

Shares issued in reinvestment of distributions | | | 6,654 | | | | 18,491 | |

Net increase in shares | | | 6,654 | | | | 1,518,492 | |

(a) | For the period May 1, 2019 (commencement of operations) to April 30, 2020. |

| | See accompanying notes which are an integral part of these financial statements. | 9 |

Guardian Dividend Growth Fund – Class I

Financial Highlights

(For a share outstanding during each period)

| | | For the

Six Months Ended

October 31, 2020

(Unaudited) | | | For the

Period Ended

April 30, 2020(a) | |

Net asset value, beginning of period | | $ | 9.85 | | | $ | 10.00 | |

Investment operations: | | | | | | | | |

Net investment income | | | 0.06 | | | | 0.17 | |

Net realized and unrealized gain (loss) on investments | | | 0.82 | | | | (0.16 | ) |

Total from investment operations | | | 0.88 | | | | 0.01 | |

Distributions from: | | | | | | | | |

Net investment income | | | (0.06 | ) | | | (0.16 | ) |

Total from distributions | | | (0.06 | ) | | | (0.16 | ) |

Net asset value, end of period | | $ | 10.67 | | | $ | 9.85 | |

Total Return(b) | | | 8.95 | %(c) | | | 0.10 | %(c) |

| | | | | | | | | |

Ratios/Supplemental Data: | | | | | | | | |

Net assets, end of period (000 omitted) | | $ | 16,271 | | | $ | 14,953 | |

Ratio of net expenses to average net assets | | | 0.95 | %(d) | | | 0.95 | %(d) |

Ratio of expenses to average net assets before waiver and reimbursement | | | 1.77 | %(d) | | | 1.94 | %(d) |

Ratio of net investment income to average net assets | | | 1.22 | %(d) | | | 1.64 | %(d) |

Portfolio turnover rate | | | 17 | %(c) | | | 29 | %(c) |

(a) | For the period May 1, 2019 (commencement of operations) to April 30, 2020. |

(b) | Total return represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of distributions. |

10 | See accompanying notes which are an integral part of these financial statements. | |

Guardian Dividend Growth Fund

Notes to the Financial Statements (Unaudited)

October 31, 2020

NOTE 1. ORGANIZATION

The Guardian Dividend Growth Fund (the “Fund”) was organized as a diversified series of Capitol Series Trust (the “Trust”) on April 15, 2019. The Trust is an open-end investment company established under the laws of Ohio by an Agreement and Declaration of Trust dated September 18, 2013 (the “Trust Agreement”). The Trust Agreement permits the Board of Trustees of the Trust (the “Board”) to issue an unlimited number of shares of beneficial interest of separate series without par value. The Fund is one of a series of funds currently authorized by the Board. The Fund’s investment adviser is Guardian Capital LP (the “Adviser”). The investment objective of the Fund is to seek long-term capital appreciation and current income.

The Fund currently offers one class of shares, Class I. Each share represents an equal proportionate interest in the assets and liabilities belonging to the Fund and is entitled to such dividends and distributions out of income belonging to the Fund as are declared by the Board.

NOTE 2. SIGNIFICANT ACCOUNTING POLICIES

The Fund is an investment company and follows accounting and reporting guidance under Financial Accounting Standards Board Accounting Standards Codification (“ASC”) Topic 946, “Financial Services-Investment Companies.” The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements. These policies are in conformity with generally accepted accounting principles in the United States of America (“GAAP”).

Estimates – The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

Foreign Currency Translation – The accounting records of the Fund are maintained in U.S. dollars. Foreign currency amounts are translated into U.S. dollars at the current rate of exchange each business day to determine the value of investments, and other assets and liabilities. Purchases and sales of foreign securities, and income and expenses, are translated at the prevailing rate of exchange on the respective date of these transactions. The Fund does not isolate that portion of the results of operations resulting from changes in foreign exchange rates on investments from fluctuation arising from changes in market prices of securities held. These fluctuations are included with the unrealized gain or loss from investments.

11

Guardian Dividend Growth Fund

Notes to the Financial Statements (Unaudited) (continued)

October 31, 2020

Federal Income Taxes – The Fund makes no provision for federal income or excise tax. The Fund has qualified and intends to qualify each year as a regulated investment company (“RIC”) under subchapter M of the Internal Revenue Code of 1986, as amended, by complying with the requirements applicable to RICs and by distributing substantially all of its taxable income. The Fund also intends to distribute sufficient net investment income and net realized capital gains, if any, so that it will not be subject to excise tax on undistributed income and gains. If the required amount of net investment income or gains is not distributed, the Fund could incur a tax expense.

The Fund may be subject to taxes imposed by countries in which it invests. Such taxes are generally based on income and/or capital gains earned or repatriated. Taxes are accrued and applied to net investment income, net realized gains and unrealized appreciation as such income and/or gains are earned.

The Fund recognizes tax benefits or expenses of uncertain tax positions only when the position is “more likely than not” to be sustained assuming examination by tax authorities. Management of the Fund has reviewed tax positions taken in tax years that remain subject to examination by all major tax jurisdictions, including federal (i.e., the previous three tax year ends and the interim tax period since then, as applicable) and has concluded that no provision for unrecognized tax benefits or expenses is required in these financial statements and does not expect this to change over the next twelve months. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the Statement of Operations. During the period, the Fund did not incur any interest or penalties.

Expenses – Expenses incurred by the Trust that do not relate to a specific fund of the Trust are allocated to the individual funds based on each fund’s relative net assets or another appropriate basis (as determined by the Board).

Security Transactions and Related Income – Throughout the reporting period, security transactions are accounted for no later than one business day following the trade date. For financial reporting purposes, security transactions are accounted for on trade date on the last business day of the reporting period. The specific identification method is used for determining gains or losses for financial statements and income tax purposes. Dividend income is recorded on the ex-dividend date and interest income is recorded on an accrual basis and includes, where applicable, the amortization of premium or accretion of discount. Dividend income from real estate investment trusts (REITs) and distributions from limited partnerships are recognized on the ex-date and included in dividend income. The calendar year-end classification of distributions received from REITs during the fiscal year, which may include return of capital, are reported subsequent to year end; accordingly, the Fund estimates the character of REIT distributions based on the most recent information available. Income or loss from limited partnerships is reclassified among the components

12

Guardian Dividend Growth Fund

Notes to the Financial Statements (Unaudited) (continued)

October 31, 2020

of net assets upon receipt of K-1’s. Discounts and premiums on fixed income securities are accreted or amortized over the life of the respective securities using the effective interest method.

Dividends and Distributions – The Fund intends to distribute substantially all of its net investment income, if any, at least quarterly. The Fund intends to distribute its net realized long-term and short-term capital gains, if any, annually. Distributions to shareholders, which are determined in accordance with income tax regulations, are recorded on the ex-dividend date. The treatment for financial reporting purposes of distributions made to shareholders during the year from net investment income or net realized capital gains may differ from their ultimate treatment for federal income tax purposes. These differences are caused primarily by differences in the timing of the recognition of certain components of income, expense or realized capital gain for federal income tax purposes. Where such differences are permanent in nature, they are reclassified in the components of the net assets based on their ultimate characterization for federal income tax purposes. Any such reclassifications will have no effect on net assets, results of operations or net asset value (“NAV”) per share of the Fund.

NOTE 3. SECURITIES VALUATION AND FAIR VALUE MEASUREMENTS

Fair value is defined as the price that the Fund would receive upon selling an investment in a timely transaction to an independent buyer in the principal or most advantageous market of the investment. GAAP establishes a three-tier hierarchy to maximize the use of observable market data and minimize the use of unobservable inputs and to establish classification of fair value measurements for disclosure purposes.

Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk (the risk inherent in a particular valuation technique used to measure fair value including a pricing model and/or the risk inherent in the inputs to the valuation technique). Inputs may be observable or unobservable. Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability developed based on market data obtained and available from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability developed based on the best information available in the circumstances.