UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-22895

Capitol Series Trust

(Exact name of registrant as specified in charter)

Ultimus Fund Solutions, LLC

225 Pictoria Drive, Suite 450

Cincinnati, OH 45246

(Address of principal executive offices) (Zip code)

Zachary P. Richmond

Ultimus Fund Solutions, LLC

225 Pictoria Drive, Suite 450

Cincinnati, OH 45246

(Name and address of agent for service)

Registrant’s telephone number, including area code: 513-587-3400

Date of fiscal year end: September 30

Date of reporting period: September 30, 2020

Item 1. Reports to Stockholders.

Fuller & Thaler Behavioral Small-Cap Equity Fund

Fuller & Thaler Behavioral Small-Cap Growth Fund

Fuller & Thaler Behavioral Mid-Cap Value Fund

Fuller & Thaler Behavioral Unconstrained Equity Fund

Fuller & Thaler Behavioral Small-Mid Core Equity Fund

Fuller & Thaler Behavioral Micro-Cap Equity Fund

Annual Report

September 30, 2020

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund’s shareholder reports like this one will no longer be sent by mail, unless you specifically request paper copies of the reports from the Fund or from your financial intermediary such as a broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically by contacting the Fund at (888) 912-4562 or, if you own these shares through a financial intermediary, you may contact your financial intermediary.

You may elect to receive all future reports in paper free of charge. You can inform the Fund that you wish to continue receiving paper copies of your shareholder reports by contacting the Fund at (888) 912-4562. If you own shares through a financial intermediary, you may contact your financial intermediary or follow instructions included with this document to elect to continue to receive paper copies of your shareholder reports. Your election to receive reports in paper will apply to all funds held with the fund complex or at your financial intermediary.

411 Borel Avenue, Suite 300

San Mateo, CA 94402

(888) 912-4562

Fuller & Thaler Funds

Shareholder Letter (Unaudited)

September 30, 2020

Dear Shareholders:

As you may know, Fuller & Thaler’s investment process is based on decades of research into behavioral finance. Our very own Dr. Richard Thaler won the 2017 Nobel Prize® in Economics for his research on behavioral finance. Behavioral finance is the study of how investors actually behave, as opposed to how they should behave, when making investment decisions. Professional investors are human, and like all humans, they make mistakes. Investors make mistakes because they have emotions, use imperfect rules-of thumb, and have priorities beyond risk and return. We look for those mistakes. We predict when other investors – the “market” – have likely made a behavioral mistake, and in turn, have created a buying opportunity.

There are two kinds of mistakes that produce buying opportunities: over-reaction and under reaction. Other investors may over-react to bad news and losses (e.g., panic). Or investors may underreact to good news (e.g., not pay attention). At the individual stock level, we search for events that suggest this type of investor misbehavior. If these behaviors are present, we then analyze fundamentals. In summary, if an investor mistake is likely and the company has solid fundamentals – we buy the stock.

Our value strategies buy when others have likely over-reacted to bad news. Our growth strategies buy when others have likely under-reacted to good news. Our blend strategies combine both insights. We sell the stocks when we believe the over-reaction or under-reaction has gone away.

Our Funds deliver similar risk characteristics to their benchmarks. We believe our behavioral insights provide us with an opportunity to outperform.

Our behavioral process delivers returns primarily through stock selection. In general, we aim to deliver portfolios with similar sector composition and risk characteristics to that of each benchmark, but we will deviate when stock-specific opportunities arise.

For the 12-month period ended September 30, 2020, our Funds performed as follows:

The Institutional Shares of the Fuller & Thaler Behavioral Small-Cap Equity Fund returned -2.11% for the year. The Fund underperformed its U.S. small-cap equity benchmark, the Russell 2000® Index (0.39%) by 2.50% over that period. The strongest performing stocks in the Fund during the period were Horizon Therapeutics PLC, BMC Stock Holdings, Inc., and Deckers Outdoor Corp.; while the weakest performers were MasTec, Inc., J2 Global, Inc., and Fulton Financial Corp. Our focus on downside risk means we tend to outperform during a crisis like Q1 and underperform during a junk/risk rally like Q2 and Q3. In Q3 and Q2, stocks with high levels of debt, high levels of disagreement, and negative earnings significantly outperformed the rest of the market; because we tend to avoid these stocks, we under-performed. In terms of sector allocation, our underweight to Healthcare hurt, while our underweight to Energy helped. In terms of stock selection, we had relatively weak stock selection among the Health Care and Technology sectors, but strong stock selection among Industrials.

The Institutional Shares of the Fuller & Thaler Behavioral Small-Cap Growth Fund returned 29.37% for the year. The Fund outperformed its U.S. small-cap growth benchmark, the Russell 2000® Growth Index (15.71%) by 13.66% over that period. The strongest performing stocks in the Fund during the period were Fastly, Inc., Livongo Health, Inc., and Sarepta Therapeutics, Inc.; while the weakest

1

Fuller & Thaler Funds

Shareholder Letter (Unaudited) (continued)

September 30, 2020

performers were Meritage Homes Corp., Denny’s Corp., and OneMain Holdings, Inc. Stock selection was the largest contributor to returns for the fiscal year with strong selection in the Technology, Health Care, and Consumer Discretionary sectors.

The Institutional Shares of the Fuller & Thaler Behavioral Mid-Cap Value Fund returned -10.51% for the year. The Fund underperformed its U.S. mid-cap value benchmark, the Russell Mid-Cap® Value Index (-7.30%) by 3.21% over that period. The strongest performing stocks in the Fund during the period were Dollar General Corp., Berry Global Group, Inc., and Kansas City Southern; while the weakest performers were First Horizon National Corp., Continental Resources, Inc., and Colony Capital, Inc. In terms of sector allocation, the Fund’s overweight to the Materials sector and underweights to the Real Estate and Energy sectors were the largest contributors to performance. The Fund’s underweight to the Health Care and Communication Services sectors, and overweight to the Financials sector were the largest detractors from performance. The Fund’s overweight to the Banks industry group, which is supported by our behavioral process, was a significant detractor from performance. During the 12-month period ended September 30, 2020, the S&P® Regional Banks Index returned -29.97% and the KBW Bank Index returned -24.25% while the Russell Mid-Cap® Value Index returned -7.30%.

The Institutional Shares of the Fuller & Thaler Behavioral Unconstrained Equity Fund returned 7.09% for the year. The Fund underperformed its U.S. all-cap benchmark, the Russell 3000® Index (15.00%) by 7.91% over that period. The primary driver of underperformance was the Fund’s low exposure to “mega-cap” stocks (those with market capitalizations above $200 billion), which performed strongly relative to other stocks during the period. While this has been a headwind for the strategy returns in the most recent period, we do believe that the companies the strategy is invested in will prove to be superior long-term investments. The strongest performing stocks in the Fund during the period were Generac Holdings, Inc., Tiffany & Co., and eBay, Inc. The weakest performers were Southwest Airlines Co., Cooper-Standard Holdings, Inc., and Allison Transmission Holdings, Inc.

The Institutional Shares of Fuller & Thaler Behavioral Small-Mid Core Equity Fund returned 0.63% for the year. The Fund underperformed its U.S. small-mid cap benchmark, the Russell 2500® Index (2.22%) by 1.59% over that period. A primary driver of underperformance was the Fund’s lack of exposure to a group of technology and health care stocks in the Russell 2500 universe that shared certain characteristics: negative or very low profitability, unusually high valuations, and operating in businesses receiving much positive news coverage during the period, e.g. coronavirus-related treatments and cloud computing. Although such stocks outperformed significantly during the period, our investment methodology’s emphasis on positive free cash flow and profitability deters us from investing in them. Lack of exposure to these stocks can constitute an investment headwind in periods such as the past year, but we believe that over a multi-year time horizon, stocks meeting our investment criteria will prove to be superior longer-term investments. The strongest performing stocks in the Fund during the period were Generac Holdings, Inc., Entegris, Inc., and Synnex Corp. The weakest performers were Cooper-Standard Holdings, Inc., Store Capital Corp., and American Assets Trust, Inc.

2

Fuller & Thaler Funds

Shareholder Letter (Unaudited) (continued)

September 30, 2020

The Institutional Shares of Fuller & Thaler Behavioral Micro-Cap Equity Fund returned -13.88% for the year. The Fund underperformed its U.S. micro-cap benchmark, the Russell MicroCap Index (4.44%) by 18.32% over that period. The strongest performing stocks in the Fund during the period were Matador Resources Co., Owens & Minor, Inc., and Cardlytics, Inc.; while the weakest performers were Exantas Capital Corp., Intrepid Potash, Inc., and NN, Inc. Stock selection in the materials, consumer discretionary and healthcare sectors were the largest contributors to poor performance. The Micro-Cap Fund is greatly impacted by stock selection and sector allocations due to the idiosyncratic characteristics of the asset class. In addition, asset flows in the small cap equity market can have large, disproportional effects on the less liquid micro-cap asset class.

Looking forward, we see many opportunities. We believe that our unique, behaviorally driven investment process will continue to identify these opportunities and allow our Funds to outperform both our peers and our benchmark.

Finally, we thank you for your investments in our Funds.

Nobel Prize® is a trademark of the Nobel Foundation.

3

Investment Results (Unaudited)

Average Annual Total Returns* as of September 30, 2020

| | One Year | Three Year | Five Year | Since

Inception

(9/8/11) | Since

Inception

(12/19/18) |

Fuller & Thaler Behavioral Small-Cap Equity Fund | | |

R6 Shares | -2.02% | 1.16% | 9.07% | 12.41% | |

Institutional Shares | -2.11% | 1.06% | 8.92% | 12.27% | |

Investor Shares | -2.40% | 0.81% | 8.69% | 12.05% | |

A Shares | | | | | |

Without Load | -2.31% | | | | 8.98% |

With Load | -7.93% | | | | 5.41% |

C Shares | | | | | |

Without Load | -2.95% | | | | 8.28% |

With Load | -2.95% | | | | 8.28% |

Russell 2000® Index(a) | 0.39% | 1.77% | 8.00% | 10.46% | 7.99% |

| | R6 Shares | Institutional

Shares | Investor

Shares | A Shares | C Shares |

Expense Ratios(b) | 0.72% | 0.82% | 1.10% | 1.01% | 1.72% |

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fuller & Thaler Behavioral Small-Cap Equity Fund (the “Small-Cap Equity Fund”) distributions or the redemption of Small-Cap Equity Fund shares. Current performance of the Small-Cap Equity Fund may be lower or higher than the performance quoted. The Small-Cap Equity Fund’s investment objectives, risks, charges and expenses must be considered carefully before investing. Performance data current to the most recent month end may be obtained by calling (888) 912-4562.

* Return figures reflect any change in price per share and assume the reinvestment of all distributions. The Small-Cap Equity Fund’s returns reflect any fee waivers during the applicable periods. If such fee waivers had not occurred, the quoted performance would have been lower. Prior to October 26, 2015, the performance reflected represents that of a series of Allianz Funds Multi-Strategy Trust for which Fuller & Thaler Asset Management, Inc. (the “Adviser”) served as the sole sub-adviser (“the Predecessor Fund”) (see Note 1).

(a) The Russell 2000® Index (“Russell 2000”) is a widely recognized unmanaged index of equity securities and is representative of a broader domestic equity market and range of securities than is found in the Small-Cap Equity Fund’s portfolio. The Russell 2000 measures the performance of the small-cap segment of the U.S. equity universe and is a subset of the Russell 3000® Index. Individuals cannot invest directly in an index; however, an individual can invest in exchange traded funds or other investment vehicles that attempt to track the performance of a benchmark index.

(b) The expense ratios are from the Small-Cap Equity Fund’s most recent prospectus dated January 28, 2020. The Adviser has contractually agreed to waive its management fee and/or reimburse Small-Cap Equity Fund expenses so that total annual operating expenses do not exceed 1.30%, 1.80%, 1.25%, 0.99% and 0.80% for A Shares, C Shares, Investor Shares, Institutional Shares and R6 Shares, respectively, of the average daily net assets for each class through January 31, 2021. The expense limitation does not apply to (i) interest (other than custodial overdraft fees and expenses associated with the Small-Cap Fund’s participation in an alternative liquidity program), (ii) taxes, (iii) brokerage fees and commissions, (iv) other extraordinary expenses not incurred in the ordinary course of the Small-Cap Equity Fund’s business, (v) dividend expense on short sales and (vi) indirect expenses such as acquired fund fees and expenses incurred by the Small-Cap Equity Fund in any fiscal year. During any fiscal year that the Investment

4

Investment Results (Unaudited) (continued)

Advisory Agreement between the Adviser and Capitol Series Trust (the “Trust”) is in effect, the Adviser may recoup the sum of all fees previously waived or expenses reimbursed, less any reimbursement previously paid, provided that the Adviser is only permitted to recoup fees or expenses within 36 months from the date the fee waiver or expense reimbursement occurred and provided further that such recoupment can be achieved within the Expense Limitation Agreement currently in effect and the Expense Limitation Agreement in place when the waiver/reimbursement occurred. The Expense Limitation Agreement may not be terminated by the Adviser prior to its expiration date, but the Board of Trustees of the Trust (the “Board”) may terminate such agreement at any time. The Expense Limitation Agreement shall terminate automatically upon the termination of the Advisory Agreement. Additional information pertaining to the Small-Cap Equity Fund’s expense ratios as of September 30, 2020 can be found in the financial highlights.

Comparison of the Growth of a $1,000,000 Investment in the Fuller & Thaler Behavioral Small-Cap Equity Fund - R6 Shares and the Russell 2000® Index.

The chart above assumes an initial investment of $1,000,000 made on September 8, 2011 (commencement of operations) and held through September 30, 2020. THE SMALL-CAP EQUITY FUND’S RETURNS REPRESENT PAST PERFORMANCE AND DO NOT GUARANTEE FUTURE RESULTS. The returns shown do not reflect deduction of taxes that a shareholder would pay on the Small-Cap Equity Fund’s distributions or the redemption of the Small-Cap Equity Fund’s shares. Investment returns and principal values will fluctuate so that your shares, when redeemed, may be worth more or less than their original purchase price.

Current performance may be lower or higher than the performance data quoted. For more information on the Small-Cap Equity Fund, and to obtain performance data current to the most recent month-end, or to request a prospectus, please call (888) 912-4562. You should carefully consider the investment objectives, potential risks, management fees, and charges and expenses of the Small-Cap Equity Fund before investing. The Small-Cap Equity Fund’s prospectus contains this and other information about the Small-Cap Equity Fund, and should be read carefully before investing.

Prior to October 26, 2015, the performance reflected represents that of a series of the Allianz Funds Multi-Strategy Trust for which the Adviser served as the sole sub-adviser (see Note 1). Visit www.fullerthalerfunds.com for more current performance information.

The Small-Cap Equity Fund is distributed by Ultimus Fund Distributors, LLC, Member FINRA/SIPC.

5

Investment Results (Unaudited) (continued)

Average Annual Total Returns* as of September 30, 2020

| | One Year | Since

Inception

(12/21/17) | Since

Inception

(12/19/18) |

Fuller & Thaler Behavioral Small-Cap Growth Fund | | | |

R6 Shares | 29.41% | 13.06% | |

Institutional Shares | 29.37% | 12.98% | |

Investor Shares | 28.98% | 12.69% | |

A Shares | | | |

Without Load | 28.90% | | 21.79% |

With Load | 21.48% | | 17.79% |

C Shares | | | |

Without Load | 28.31% | | 21.23% |

With Load | 28.31% | | 21.23% |

Russell 2000® Growth Index(a) | 15.71% | 6.94% | 17.91% |

| | Expense Ratios(b) |

| | R6 Shares | Institutional

Shares | Investor

Shares | A Shares | C Shares |

Gross | 2.19% | 2.25% | 2.57% | 2.15% | 2.87% |

With Applicable Waivers | 0.90% | 0.99% | 1.25% | 1.30% | 1.80% |

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fuller & Thaler Behavioral Small-Cap Growth Fund (the “Small-Cap Growth Fund”) distributions or the redemption of Small-Cap Growth Fund shares. Current performance of the Small-Cap Growth Fund may be lower or higher than the performance quoted. The Small-Cap Growth Fund’s investment objectives, risks, charges and expenses must be considered carefully before investing. Performance data current to the most recent month end may be obtained by calling (888) 912-4562.

* Return figures reflect any change in price per share and assume the reinvestment of all distributions. The Small-Cap Growth Fund’s returns reflect any fee waivers during the applicable periods. If such fee waivers had not occurred, the quoted performance would have been lower.

(a) The Russell 2000® Growth Index (“Russell 2000 Growth”) is a widely recognized unmanaged index of equity securities and is representative of a broader domestic equity market and range of securities than is found in the Small-Cap Growth Fund’s portfolio. Russell 2000 Growth measures the performance of those Russell 2000 companies with higher price/book ratios and higher forecasted growth values. Individuals cannot invest directly in an index; however, an individual can invest in exchange traded funds or other investment vehicles that attempt to track the performance of a benchmark index.

(b) The expense ratios are from the Small-Cap Growth Fund’s most recent prospectus dated January 28, 2020. The Adviser has contractually agreed to waive its management fee and/or reimburse Small-Cap Growth Fund expenses so that total annual operating expenses do not exceed 1.30%, 1.80% 1.25%, 0.99%, and 0.90% for A Shares, C Shares, Investor Shares, Institutional Shares and R6 Shares, respectively, of the average daily net assets for each class through January 31, 2021. The expense limitation does not apply to (i) interest (other than custodial overdraft fees and expenses associated with the Small-Cap Growth Fund’s participation in an alternative liquidity program), (ii) taxes, (iii) brokerage fees and commissions, (iv) other extraordinary expenses not incurred in the ordinary course of the Small-Cap Growth Fund’s business, (v) dividend expense on short sales and (vi) indirect expenses such as acquired fund fees and expenses incurred by the Small-Cap Growth Fund in any fiscal year. During any fiscal year that the

6

Investment Results (Unaudited) (continued)

Investment Advisory Agreement between the Adviser and the Trust is in effect, the Adviser may recoup the sum of all fees previously waived or expenses reimbursed, less any reimbursement previously paid, provided that the Adviser is only permitted to recoup fees or expenses within 36 months from the date the fee waiver or expense reimbursement occurred and provided further that such recoupment can be achieved within the Expense Limitation Agreement currently in effect and the Expense Limitation Agreement in place when the waiver/reimbursement occurred. The Expense Limitation Agreement may not be terminated by the Adviser prior to its expiration date, but the Board may terminate such agreement at any time. The Expense Limitation Agreement shall terminate automatically upon the termination of the Advisory Agreement. Additional information pertaining to the Small-Cap Growth Fund’s expense ratios as of September 30, 2020 can be found in the financial highlights.

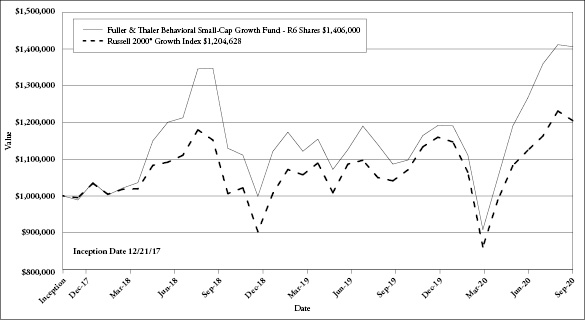

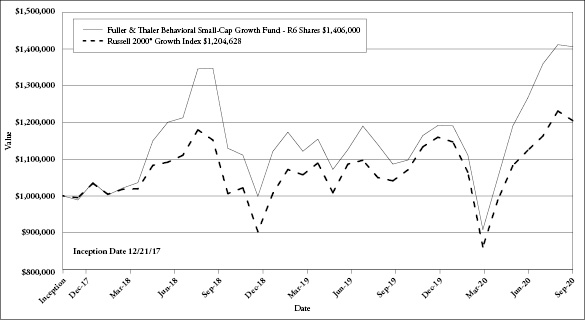

Comparison of the Growth of a $1,000,000 Investment in the Fuller & Thaler Behavioral Small-Cap Growth Fund - R6 Shares and the Russell 2000® Growth Index.

The chart above assumes an initial investment of $1,000,000 made on December 21, 2017 (commencement of operations) and held through September 30, 2020. THE SMALL-CAP GROWTH FUND’S RETURNS REPRESENT PAST PERFORMANCE AND DO NOT GUARANTEE FUTURE RESULTS. The returns shown do not reflect deduction of taxes that a shareholder would pay on the Small-Cap Growth Fund’s distributions or the redemption of the Small-Cap Growth Fund’s shares. Investment returns and principal values will fluctuate so that your shares, when redeemed, may be worth more or less than their original purchase price.

Current performance may be lower or higher than the performance data quoted. For more information on the Small-Cap Growth Fund, and to obtain performance data current to the most recent month-end, or to request a prospectus, please call (888) 912-4562. You should carefully consider the investment objectives, potential risks, management fees, and charges and expenses of the Small-Cap Growth Fund before investing. The Small-Cap Growth Fund’s prospectus contains this and other information about the Small-Cap Growth Fund, and should be read carefully before investing. Visit www.fullerthalerfunds.com for more current performance information.

The Small-Cap Growth Fund is distributed by Ultimus Fund Distributors, LLC, Member FINRA/SIPC.

7

Investment Results (Unaudited) (continued)

Average Annual Total Returns* as of September 30, 2020

| | One Year | Since

Inception

(12/21/17) |

Fuller & Thaler Behavioral Mid-Cap Value Fund | | |

R6 Shares | -10.42% | -1.12% |

Institutional Shares | -10.51% | -1.21% |

Investor Shares | -10.72% | -1.48% |

Russell Midcap® Value Index(a) | -7.30% | -0.93% |

| | Expense Ratios(b) |

| | R6 Shares | Institutional

Shares | Investor

Shares |

Gross | 1.72% | 1.81% | 2.10% |

With Applicable Waivers | 0.80% | 0.90% | 1.15% |

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fuller & Thaler Behavioral Mid-Cap Value Fund (the “Mid-Cap Value Fund”) distributions or the redemption of Mid-Cap Value Fund shares. Current performance of the Mid-Cap Value Fund may be lower or higher than the performance quoted. The Mid-Cap Value Fund’s investment objectives, risks, charges and expenses must be considered carefully before investing. Performance data current to the most recent month end may be obtained by calling (888) 912-4562.

* Return figures reflect any change in price per share and assume the reinvestment of all distributions. The Mid-Cap Value Fund’s returns reflect any fee waivers during the applicable periods. If such fee waivers had not occurred, the quoted performance would have been lower.

(a) The Russell Midcap® Value Index (“Russell Midcap Value”) is a widely recognized unmanaged index of equity securities and is representative of a broader domestic equity market and range of securities than is found in the Mid-Cap Value Fund’s portfolio. The Russell Midcap Value measures the performance of those Russell Midcap companies with lower price/book ratios and lower forecasted growth values. Individuals cannot invest directly in an index; however, an individual can invest in exchange traded funds or other investment vehicles that attempt to track the performance of a benchmark index.

(b) The expense ratios are from the Mid-Cap Value Fund’s most recent prospectus dated January 28, 2020. The Adviser has contractually agreed to waive its management fee and/or reimburse Mid-Cap Value Fund expenses so that total annual operating expenses do not exceed 1.15%, 0.90%, and 0.80% for Investor Shares, Institutional Shares and R6 Shares, respectively, of the average daily net assets for each class through January 31, 2021. The expense limitation does not apply to (i) interest (other than custodial overdraft fees and expenses associated with the Mid-Cap Value Fund’s participation in an alternative liquidity program), (ii) taxes, (iii) brokerage fees and commissions, (iv) other extraordinary expenses not incurred in the ordinary course of the Mid-Cap Value Fund’s business, (v) dividend expense on short sales and (vi) indirect expenses such as acquired fund fees and expenses incurred by the Mid-Cap Value Fund in any fiscal year. During any fiscal year that the Investment Advisory Agreement between the Adviser and the Trust is in effect, the Adviser may recoup the sum of all fees previously waived or expenses reimbursed, less any reimbursement previously paid, provided that the Adviser is only permitted to recoup fees or expenses within 36 months from the date the fee waiver or expense reimbursement occurred and provided further that such recoupment can be achieved within the Expense Limitation Agreement currently in effect and the Expense Limitation Agreement in place when the waiver/reimbursement occurred. This Expense Limitation Agreement may not be terminated by the Adviser prior to its expiration date, but the Board may terminate such agreement at any time. The Expense

8

Investment Results (Unaudited) (continued)

Limitation Agreement shall terminate automatically upon the termination of the Advisory Agreement. Additional information pertaining to the Mid-Cap Value Fund’s expense ratios as of September 30, 2020 can be found in the financial highlights.

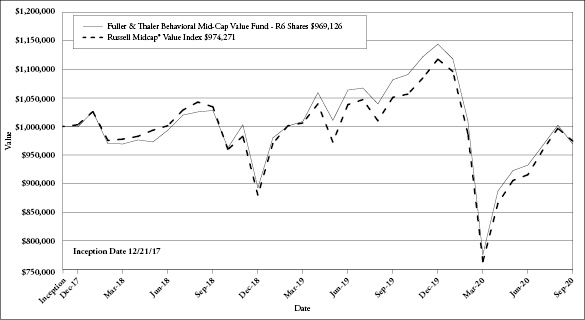

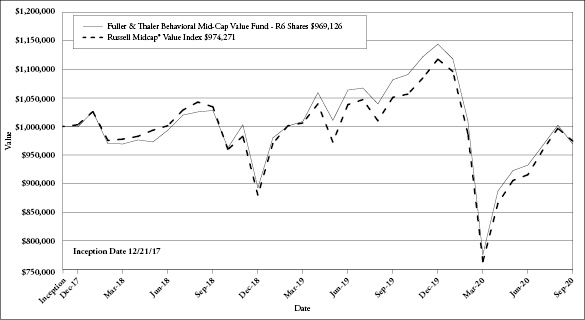

Comparison of the Growth of a $1,000,000 Investment in the Fuller & Thaler Behavioral Mid-Cap Value Fund - R6 Shares and the Russell Midcap® Value Index.

The chart above assumes an initial investment of $1,000,000 made on December 21, 2017 (commencement of operations) and held through September 30, 2020. THE MID-CAP VALUE FUND’S RETURNS REPRESENT PAST PERFORMANCE AND DO NOT GUARANTEE FUTURE RESULTS. The returns shown do not reflect deduction of taxes that a shareholder would pay on the Mid-Cap Value Fund’s distributions or the redemption of the Mid-Cap Value Fund’s shares. Investment returns and principal values will fluctuate so that your shares, when redeemed, may be worth more or less than their original purchase price.

Current performance may be lower or higher than the performance data quoted. For more information on the Mid-Cap Value Fund, and to obtain performance data current to the most recent month-end, or to request a prospectus, please call (888) 912-4562. You should carefully consider the investment objectives, potential risks, management fees, and charges and expenses of the Mid-Cap Value Fund before investing. The Mid-Cap Value Fund’s prospectus contains this and other information about the Mid-Cap Value Fund, and should be read carefully before investing. Visit www.fullerthalerfunds.com for more current performance information.

The Mid-Cap Value Fund is distributed by Ultimus Fund Distributors, LLC, Member FINRA/SIPC.

9

Investment Results (Unaudited) (continued)

Average Annual Total Returns* as of September 30, 2020

| | One Year | Since

Inception

(12/26/18) |

Fuller & Thaler Behavioral Unconstrained Equity Fund | | |

R6 Shares | 7.22% | 20.30% |

Institutional Shares | 7.09% | 20.16% |

Russell 3000® Index(a) | 15.00% | 21.23% |

| | Expense Ratios(b) |

| | R6 Shares | Institutional

Shares |

Gross | 4.33% | 4.39% |

With Applicable Waivers | 0.90% | 0.99% |

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fuller & Thaler Behavioral Unconstrained Equity Fund (the “Unconstrained Equity Fund”) distributions or the redemption of Unconstrained Equity Fund shares. Current performance of the Unconstrained Equity Fund may be lower or higher than the performance quoted. The Unconstrained Equity Fund’s investment objectives, risks, charges and expenses must be considered carefully before investing. Performance data current to the most recent month end may be obtained by calling (888) 912-4562.

* Return figures reflect any change in price per share and assume the reinvestment of all distributions. The Unconstrained Equity Fund’s returns reflect any fee waivers during the applicable periods. If such fee waivers had not occurred, the quoted performance would have been lower.

(a) The Russell 3000® Index (“Russell 3000”) measures the performance of the broad U.S. equity market. The Russell 3000 represents the 3000 largest U.S. publicly traded companies as measured by market capitalization. Individuals cannot invest directly in an index; however, an individual can invest in exchange traded funds or other investment vehicles that attempt to track the performance of a benchmark index.

(b) The expense ratios are from the Unconstrained Equity Fund’s most recent prospectus dated January 28, 2020. The Adviser has contractually agreed to waive its management fee and/or reimburse Unconstrained Equity Fund expenses so that total annual operating expenses do not exceed 0.99% and 0.90% for Institutional Shares and R6 Shares, respectively, of the average daily net assets for each class through January 31, 2021. The expense limitation does not apply to (i) interest (other than custodial overdraft fees and expenses associated with the Unconstrained Equity Fund’s participation in an alternative liquidity program), (ii) taxes, (iii) brokerage fees and commissions, (iv) other extraordinary expenses not incurred in the ordinary course of the Unconstrained Equity Fund’s business, (v) dividend expense on short sales and (vi) indirect expenses such as acquired fund fees and expenses incurred by the Unconstrained Equity Fund in any fiscal year. During any fiscal year that the Investment Advisory Agreement between the Adviser and the Trust is in effect, the Adviser may recoup the sum of all fees previously waived or expenses reimbursed, less any reimbursement previously paid, provided that the Adviser is only permitted to recoup fees or expenses within 36 months from the date the fee waiver or expense reimbursement occurred and provided further that such recoupment can be achieved within the Expense Limitation Agreement currently in effect and the Expense Limitation Agreement in place when the waiver/reimbursement occurred. This Expense Limitation Agreement may not be terminated by the Adviser prior to its expiration date, but the Board may terminate such agreement at any time. The Expense Limitation Agreement shall terminate automatically upon the termination of the Advisory Agreement. Additional information pertaining to the Unconstrained Equity Fund’s expense ratios as of September 30, 2020 can be found in the financial highlights.

10

Investment Results (Unaudited) (continued)

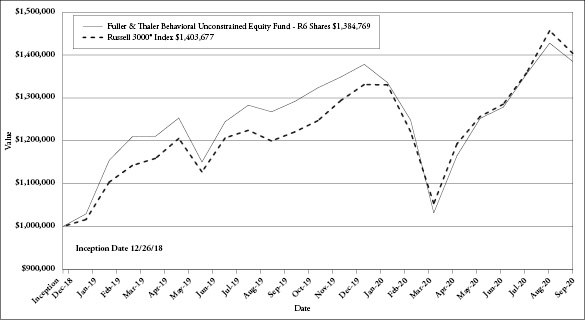

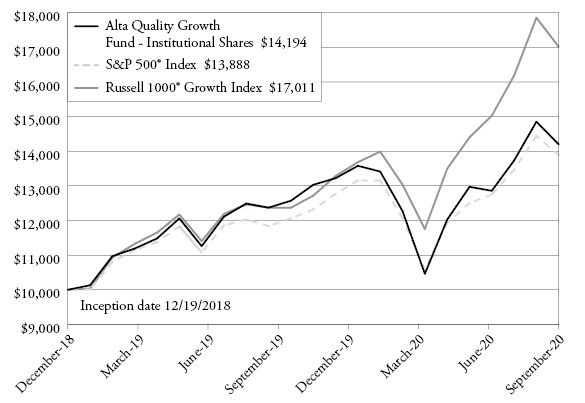

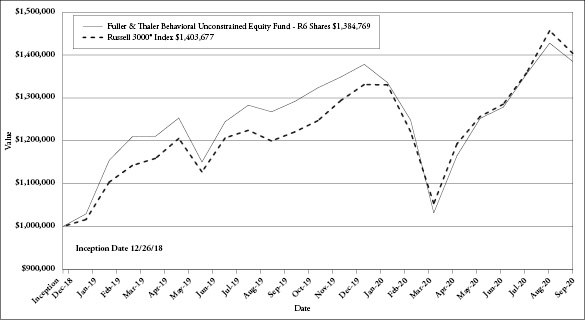

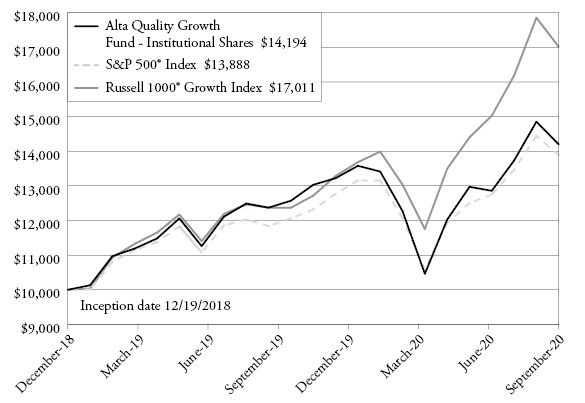

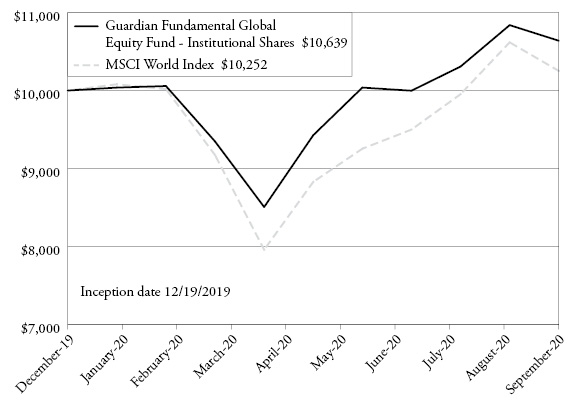

Comparison of the Growth of a $1,000,000 Investment in the Fuller & Thaler Behavioral Unconstrained Equity Fund - R6 Shares and the Russell 3000® Index.

The chart above assumes an initial investment of $1,000,000 made on December 26, 2018 (commencement of operations) and held through September 30, 2020. THE UNCONSTRAINED EQUITY FUND’S RETURNS REPRESENT PAST PERFORMANCE AND DO NOT GUARANTEE FUTURE RESULTS. The returns shown do not reflect deduction of taxes that a shareholder would pay on the Unconstrained Equity Fund’s distributions or the redemption of the Unconstrained Equity Fund’s shares. Investment returns and principal values will fluctuate so that your shares, when redeemed, may be worth more or less than their original purchase price.

Current performance may be lower or higher than the performance data quoted. For more information on the Unconstrained Equity Fund, and to obtain performance data current to the most recent month-end, or to request a prospectus, please call (888) 912-4562. You should carefully consider the investment objectives, potential risks, management fees, and charges and expenses of the Unconstrained Equity Fund before investing. The Unconstrained Equity Fund’s prospectus contains this and other information about the Unconstrained Equity Fund, and should be read carefully before investing. Visit www.fullerthalerfunds.com for more current performance information.

The Unconstrained Equity Fund is distributed by Ultimus Fund Distributors, LLC, Member FINRA/SIPC.

11

Investment Results (Unaudited) (continued)

Average Annual Total Returns* as of September 30, 2020

| | One Year | Since

Inception

(12/26/18) |

Fuller & Thaler Behavioral Small-Mid Core Equity Fund | | |

Institutional Shares | 0.63% | 11.19% |

Russell 2500® Index(a) | 2.22% | 12.08% |

| | Expense

Ratios(b) |

| | Institutional

Shares |

Gross | 6.27% |

With Applicable Waivers | 0.95% |

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fuller & Thaler Behavioral Small-Mid Core Equity Fund (the “Small-Mid Core Equity Fund”) distributions or the redemption of Small-Mid Core Equity Fund shares. Current performance of the Small-Mid Core Equity Fund may be lower or higher than the performance quoted. The Small-Mid Core Equity Fund’s investment objectives, risks, charges and expenses must be considered carefully before investing. Performance data current to the most recent month end may be obtained by calling (888) 912-4562.

* Return figures reflect any change in price per share and assume the reinvestment of all distributions. The Small-Mid Core Equity Fund’s returns reflect any fee waivers during the applicable periods. If such fee waivers had not occurred, the quoted performance would have been lower.

(a) The Russell 2500® Index (“Russell 2500”) is a widely recognized unmanaged index of equity securities and is representative of a broader domestic equity market and range of securities than is found in the Small-Mid Core Equity Fund’s portfolio. The Russell 2500 measures the performance of those Russell 2500 companies with lower price/book ratios and lower forecasted growth values. Individuals cannot invest directly in an index; however, an individual can invest in exchange traded funds or other investment vehicles that attempt to track the performance of a benchmark index.

(b) The expense ratios are from the Small-Mid Core Equity Fund’s most recent prospectus dated January 28, 2020. The Adviser has contractually agreed to waive its management fee and/or reimburse Small-Mid Core Equity Fund expenses so that total annual operating expenses do not exceed 0.95% of the Small-Mid Core Equity Fund’s Institutional Shares average daily net assets through January 31, 2021. The expense limitation does not apply to (i) interest (other than custodial overdraft fees and expenses associated with the Small-Mid Core Equity Fund’s participation in an alternative liquidity program), (ii) taxes, (iii) brokerage fees and commissions, (iv) other extraordinary expenses not incurred in the ordinary course of the Small-Mid Core Equity Fund’s business, (v) dividend expense on short sales and (vi) indirect expenses such as acquired fund fees and expenses incurred by the Small-Mid Core Equity Fund in any fiscal year. During any fiscal year that the Investment Advisory Agreement between the Adviser and the Trust is in effect, the Adviser may recoup the sum of all fees previously waived or expenses reimbursed, less any reimbursement previously paid, provided that the Adviser is only permitted to recoup fees or expenses within 36 months from the date the fee waiver or expense reimbursement occurred and provided further that such recoupment can be achieved within the Expense Limitation Agreement currently in effect and the Expense Limitation Agreement in place when the waiver/reimbursement occurred. This Expense Limitation Agreement may not be terminated by the Adviser prior to its expiration date, but the Board may terminate such agreement at

12

Investment Results (Unaudited) (continued)

any time. The Expense Limitation Agreement shall terminate automatically upon the termination of the Advisory Agreement. Additional information pertaining to the Small-Mid Core Equity Fund’s expense ratios as of September 30, 2020 can be found in the financial highlights.

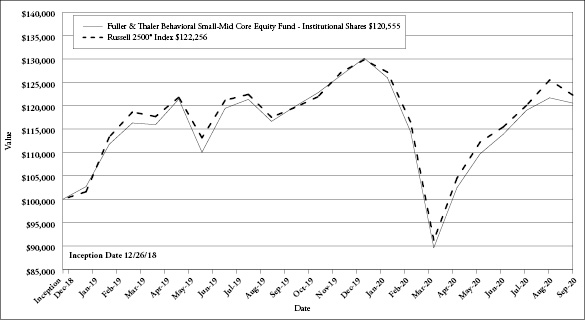

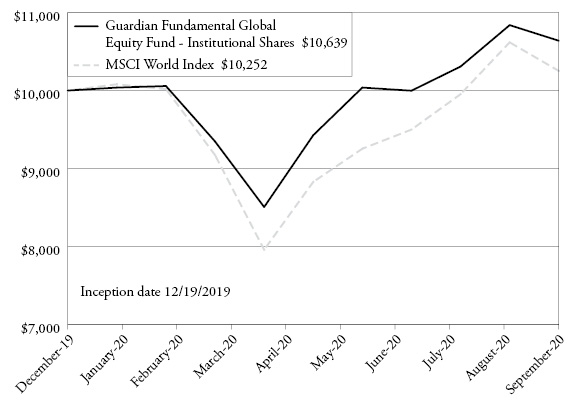

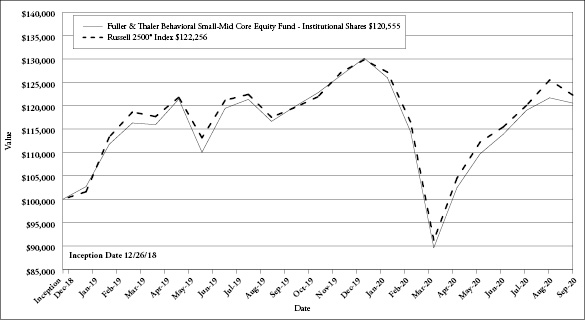

Comparison of the Growth of a $100,000 Investment in the Fuller & Thaler Behavioral Small-Mid Core Equity Fund - Institutional Shares and the Russell 2500® Index.

The chart above assumes an initial investment of $100,000 made on December 26, 2018 (commencement of operations) and held through September 30, 2020. THE SMALL-MID CORE EQUITY FUND’S RETURNS REPRESENT PAST PERFORMANCE AND DO NOT GUARANTEE FUTURE RESULTS. The returns shown do not reflect deduction of taxes that a shareholder would pay on the Small-Mid Core Equity Fund’s distributions or the redemption of the Small-Mid Core Equity Fund’s shares. Investment returns and principal values will fluctuate so that your shares, when redeemed, may be worth more or less than their original purchase price.

Current performance may be lower or higher than the performance data quoted. For more information on the Small-Mid Core Equity Fund, and to obtain performance data current to the most recent month-end, or to request a prospectus, please call (888) 912-4562. You should carefully consider the investment objectives, potential risks, management fees, and charges and expenses of the Small-Mid Core Equity Fund before investing. The Small-Mid Core Equity Fund’s prospectus contains this and other information about the Small-Mid Core Equity Fund, and should be read carefully before investing. Visit www.fullerthalerfunds.com for more current performance information.

The Small-Mid Core Equity Fund is distributed by Ultimus Fund Distributors, LLC, Member FINRA/SIPC.

13

Investment Results (Unaudited) (continued)

Average Annual Total Returns* as of September 30, 2020

| | One Year | Since

Inception

(12/28/18) |

Fuller & Thaler Behavioral Micro-Cap Equity Fund | | |

Institutional Shares | -13.88% | -3.79% |

Russell Microcap® Index(a) | 4.44% | 7.54% |

| | Expense

Ratios(b) |

| | Institutional

Shares |

Gross | 5.28% |

With Applicable Waivers | 1.75% |

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fuller & Thaler Behavioral Micro-Cap Equity Fund (the “Micro-Cap Equity Fund”) distributions or the redemption of Micro-Cap Equity Fund shares. Current performance of the Micro-Cap Equity Fund may be lower or higher than the performance quoted. The Micro-Cap Equity Fund’s investment objectives, risks, charges and expenses must be considered carefully before investing. Performance data current to the most recent month end may be obtained by calling (888) 912-4562.

* Return figures reflect any change in price per share and assume the reinvestment of all distributions. The Micro-Cap Equity Fund’s returns reflect any fee waivers during the applicable periods. If such fee waivers had not occurred, the quoted performance would have been lower.

(a) The Russell Microcap® Index (“Russell Microcap”) measures the performance of the microcap segment of the U.S. equity market. Russell Microcap stocks make up less than 3% of the U.S. equity market (by market cap) and consist of the smallest 1,000 securities in the small cap Russell 2000® Index, plus the next smallest eligible securities by market cap. Individuals cannot invest directly in an index; however, an individual can invest in exchange traded funds or other investment vehicles that attempt to track the performance of a benchmark index.

(b) The expense ratios are from the Micro-Cap Equity Fund’s most recent prospectus dated January 28, 2020. The Adviser has contractually agreed to waive its management fee and/or reimburse Micro-Cap Equity Fund expenses so that total annual operating expenses do not exceed 1.75% of the Micro-Cap Equity Fund’s Institutional Shares average daily net assets through January 31, 2021. The expense limitation does not apply to (i) interest (other than custodial overdraft fees and expenses associated with the Micro-Cap Equity Fund’s participation in an alternative liquidity program), (ii) taxes, (iii) brokerage fees and commissions, (iv) other extraordinary expenses not incurred in the ordinary course of the Micro-Cap Equity Fund’s business, (v) dividend expense on short sales and (vi) indirect expenses such as acquired fund fees and expenses incurred by the Micro-Cap Equity Fund in any fiscal year. During any fiscal year that the Investment Advisory Agreement between the Adviser and the Trust is in effect, the Adviser may recoup the sum of all fees previously waived or expenses reimbursed, less any reimbursement previously paid, provided that the Adviser is only permitted to recoup fees or expenses within 36 months from the date the fee waiver or expense reimbursement occurred and provided further that such recoupment can be achieved within the Expense Limitation Agreement currently in effect and the Expense Limitation Agreement in place when the waiver/reimbursement occurred. This Expense Limitation Agreement may not be terminated by the Adviser prior to its expiration date, but the Board may terminate such agreement at any time. The Expense Limitation Agreement shall terminate automatically upon the termination of the Advisory Agreement. Additional information pertaining to the Micro-Cap Equity Fund’s expense ratios as of September 30, 2020 can be found in the financial highlights.

14

Investment Results (Unaudited) (continued)

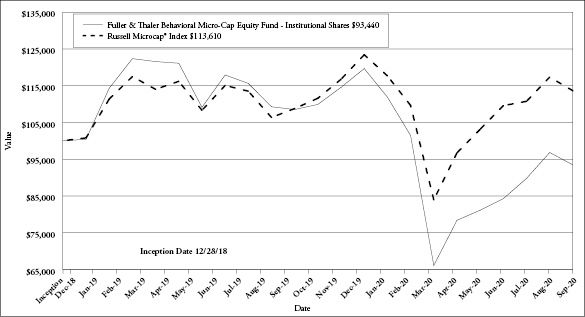

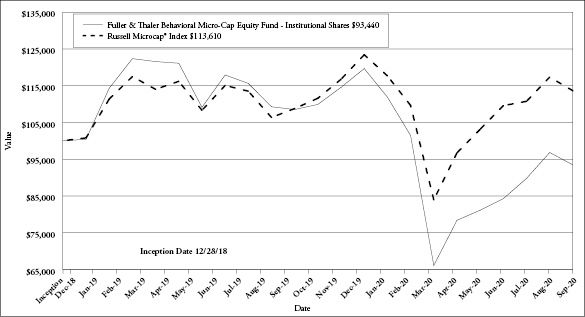

Comparison of the Growth of a $100,000 Investment in the Fuller & Thaler Behavioral Micro-Cap Equity Fund - Institutional Shares and the Russell Microcap® Index.

The chart above assumes an initial investment of $100,000 made on December 28, 2018 (commencement of operations) and held through September 30, 2020. THE MICRO-CAP EQUITY FUND’S RETURNS REPRESENT PAST PERFORMANCE AND DO NOT GUARANTEE FUTURE RESULTS. The returns shown do not reflect deduction of taxes that a shareholder would pay on the Micro-Cap Equity Fund’s distributions or the redemption of the Micro-Cap Equity Fund’s shares. Investment returns and principal values will fluctuate so that your shares, when redeemed, may be worth more or less than their original purchase price.

Current performance may be lower or higher than the performance data quoted. For more information on the Micro-Cap Equity Fund, and to obtain performance data current to the most recent month-end, or to request a prospectus, please call (888) 912-4562. You should carefully consider the investment objectives, potential risks, management fees, and charges and expenses of the Micro-Cap Equity Fund before investing. The Micro-Cap Equity Fund’s prospectus contains this and other information about the Micro-Cap Equity Fund, and should be read carefully before investing. Visit www.fullerthalerfunds.com for more current performance information.

The Micro-Cap Equity Fund is distributed by Ultimus Fund Distributors, LLC, Member FINRA/SIPC.

15

Portfolio Illustration (Unaudited)

September 30, 2020

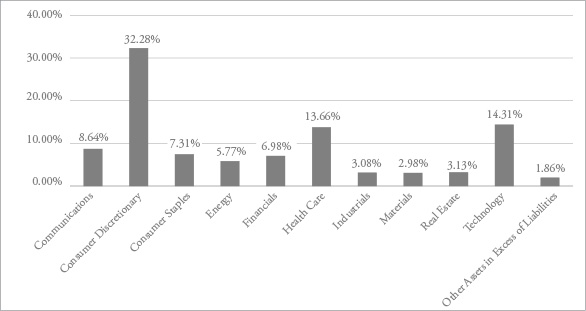

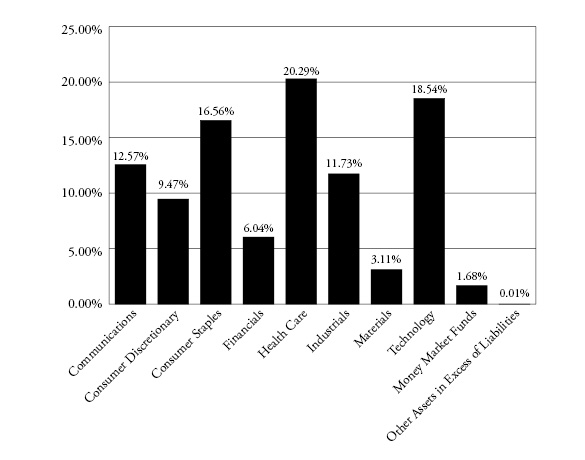

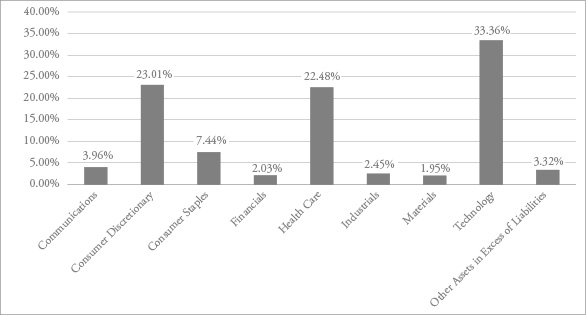

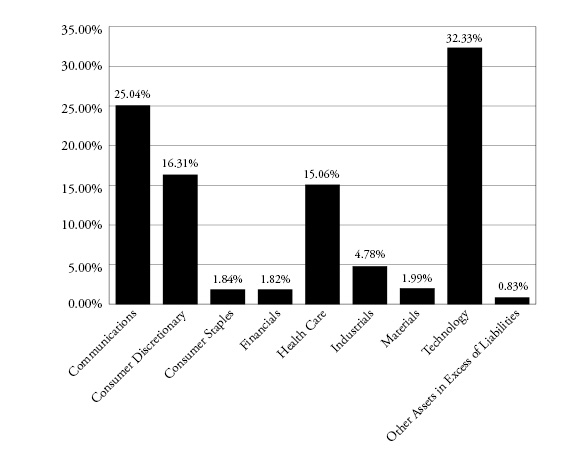

Fuller & Thaler Behavioral Small-Cap Equity Fund Sector Holdings as of September 30, 2020.*

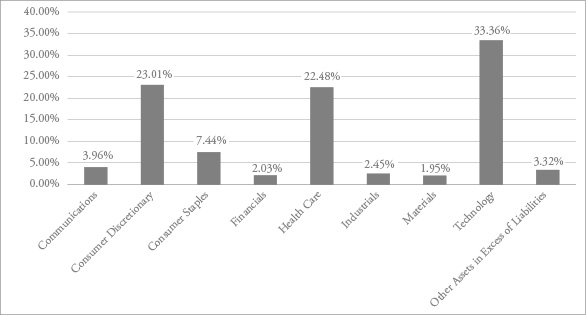

Fuller & Thaler Behavioral Small-Cap Growth Fund Sector Holdings as of September 30, 2020.*

* | As a percentage of net assets. |

16

Portfolio Illustration (Unaudited)

September 30, 2020

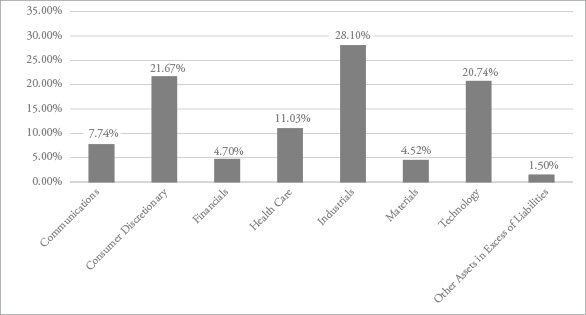

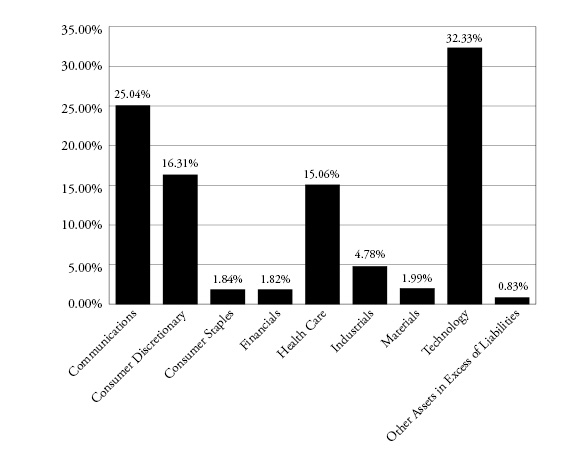

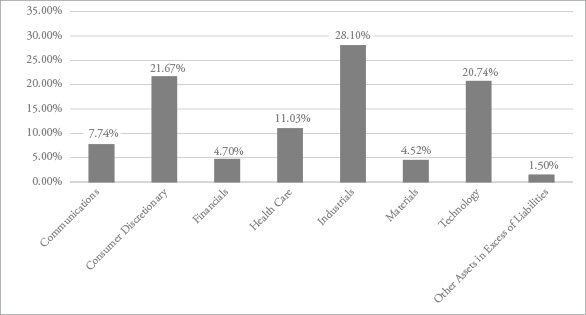

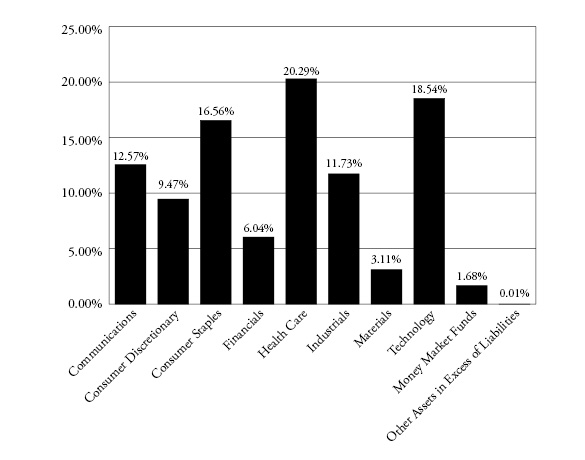

Fuller & Thaler Behavioral Mid-Cap Value Fund Sector Holdings as of September 30, 2020.*

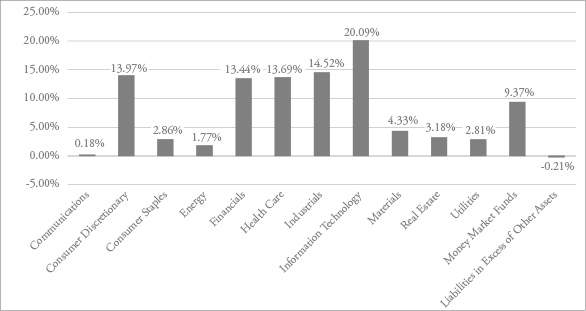

Fuller & Thaler Behavioral Unconstrained Equity Fund Sector Holdings as of September 30, 2020.*

* | As a percentage of net assets. |

17

Portfolio Illustration (Unaudited)

September 30, 2020

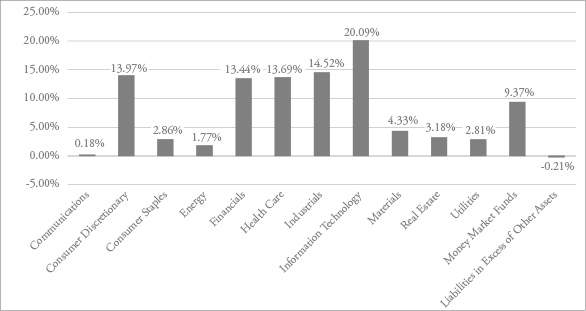

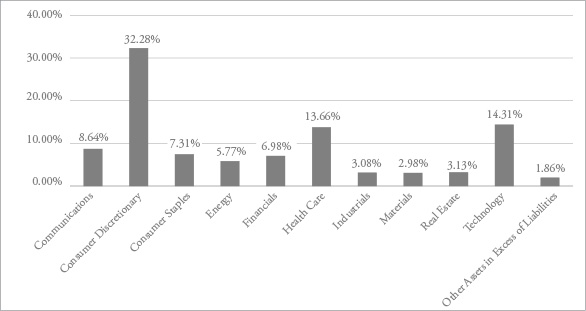

Fuller & Thaler Behavioral Small-Mid Core Equity Fund Sector Holdings as of September 30, 2020.*

Fuller & Thaler Behavioral Micro-Cap Equity Fund Sector Holdings as of September 30, 2020.*

* | As a percentage of net assets. |

Availability of Portfolio Schedules (Unaudited)

The Funds file their complete schedule of portfolio holdings with the Securities and Exchange Commission (“SEC”) for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT. The Funds’ Form N-PORT reports are available on the SEC’s website at http://www.sec.gov.

18

Fuller & Thaler Behavioral Small-Cap Equity Fund

Schedule of Investments

September 30, 2020

| | Shares | | | Fair Value | |

COMMON STOCKS — 90.82% |

| | | | | | | | | |

Apparel & Textile Products — 2.33% |

Deckers Outdoor Corp.(a) | | | 300,888 | | | $ | 66,198,369 | |

| | | | | | | | | |

Asset Management — 1.08% |

Blucora, Inc.(a) | | | 542,619 | | | | 5,111,471 | |

Federated Hermes, Inc., Class B | | | 1,192,468 | | | | 25,649,987 | |

| | | | | | | | 30,761,458 | |

Banking — 6.29% |

BancorpSouth Bank | | | 791,346 | | | | 15,336,285 | |

Bank of Hawaii Corp. | | | 652,380 | | | | 32,958,239 | |

F.N.B. Corporation | | | 4,573,005 | | | | 31,004,974 | |

Farmers National Banc Corp. | | | 110,390 | | | | 1,205,459 | |

Financial Institutions, Inc. | | | 160,041 | | | | 2,464,631 | |

First Citizens BancShares, Inc., Class A | | | 94,721 | | | | 30,195,160 | |

First Commonwealth Financial Corp. | | | 270,607 | | | | 2,094,498 | |

First Financial Corp. | | | 102,689 | | | | 3,224,435 | |

Fulton Financial Corp. | | | 2,306,015 | | | | 21,515,120 | |

Lakeland Bancorp, Inc. | | | 130,396 | | | | 1,297,440 | |

Lakeland Financial Corp. | | | 276,545 | | | | 11,393,654 | |

Peapack-Gladstone Financial Corp. | | | 118,861 | | | | 1,800,744 | |

TowneBank | | | 170,398 | | | | 2,794,527 | |

TriState Capital Holdings, Inc.(a) | | | 802,242 | | | | 10,621,684 | |

Washington Federal, Inc. | | | 523,500 | | | | 10,920,210 | |

| | | | | | | | 178,827,060 | |

Biotech & Pharmaceuticals — 1.94% |

Amphastar Pharmaceuticals, Inc.(a) | | | 767,678 | | | | 14,393,963 | |

Emergent BioSolutions, Inc.(a) | | | 180,778 | | | | 18,679,791 | |

Horizon Therapeutics PLC(a) | | | 37,829 | | | | 2,938,557 | |

Supernus Pharmaceuticals, Inc.(a) | | | 919,768 | | | | 19,167,964 | |

| | | | | | | | 55,180,275 | |

Chemicals — 1.14% |

Avient Corp. | | | 425,670 | | | | 11,263,228 | |

Stepan Co. | | | 67,642 | | | | 7,372,978 | |

Valvoline, Inc. | | | 725,000 | | | | 13,804,000 | |

| | | | | | | | 32,440,206 | |

Commercial Support Services — 2.37% |

Clean Harbors, Inc.(a) | | | 66,852 | | | $ | 3,745,718 | |

CRA International, Inc. | | | 55,031 | | | | 2,062,012 | |

Deluxe Corp. | | | 647,360 | | | | 16,656,573 | |

FTI Consulting, Inc.(a) | | | 157,244 | | | | 16,663,146 | |

H&R Block, Inc. | | | 1,362,400 | | | | 22,193,495 | |

Kforce, Inc. | | | 129,133 | | | | 4,154,209 | |

SP Plus Corp.(a) | | | 107,551 | | | | 1,930,540 | |

| | | | | | | | 67,405,693 | |

Construction Materials — 1.50% |

MDU Resources Group, Inc. | | | 1,899,259 | | | | 42,733,328 | |

| | | | | | | | | |

Consumer Services — 4.25% |

Adtalem Global Education, Inc.(a) | | | 706,892 | | | | 17,347,130 | |

K12, Inc.(a) | | | 636,996 | | | | 16,778,475 | |

Perdoceo Education Corp.(a) | | | 2,644,765 | | | | 32,371,924 | |

Rent-A-Center, Inc. | | | 1,827,128 | | | | 54,612,855 | |

| | | | | | | | 121,110,384 | |

Electric Utilities — 1.47% |

Otter Tail Corp. | | | 322,312 | | | | 11,658,025 | |

Portland General Electric Co. | | | 850,821 | | | | 30,204,146 | |

| | | | | | | | 41,862,171 | |

Electrical Equipment — 0.09% |

Generac Holdings, Inc.(a) | | | 13,878 | | | | 2,687,336 | |

| | | | | | | | | |

Engineering & Construction — 8.11% |

Comfort Systems USA, Inc. | | | 851,024 | | | | 43,836,246 | |

EMCOR Group, Inc. | | | 1,206,317 | | | | 81,679,725 | |

MasTec, Inc.(a) | | | 1,548,237 | | | | 65,335,601 | |

Primoris Services Corp. | | | 612,937 | | | | 11,057,383 | |

Quanta Services, Inc. | | | 307,200 | | | | 16,238,592 | |

TopBuild Corp.(a) | | | 72,921 | | | | 12,446,885 | |

| | | | | | | | 230,594,432 | |

Food — 0.29% |

Simply Good Foods Co.(The)(a) | | | 376,287 | | | | 8,297,128 | |

| | | | | | | | | |

Gas & Water Utilities — 1.35% |

ONE Gas, Inc. | | | 259,383 | | | | 17,900,021 | |

Southwest Gas Corp. | | | 322,503 | | | | 20,349,939 | |

| | | | | | | | 38,249,960 | |

| | See accompanying notes which are an integral part of these financial statements. | 19 |

Fuller & Thaler Behavioral Small-Cap Equity Fund

Schedule of Investments (continued)

September 30, 2020

| | Shares | | | Fair Value | |

COMMON STOCKS — (continued) |

| |

Health Care Facilities & Services — 7.38% |

Amedisys, Inc.(a) | | | 156,613 | | | $ | 37,028,012 | |

Chemed Corp. | | | 24,295 | | | | 11,670,103 | |

Medpace Holdings, Inc.(a) | | | 765,211 | | | | 85,512,329 | |

PRA Health Sciences, Inc.(a) | | | 422,007 | | | | 42,808,390 | |

Select Medical Holdings Corp.(a) | | | 1,244,125 | | | | 25,902,683 | |

Syneos Health, Inc.(a) | | | 128,777 | | | | 6,845,785 | |

| | | | | | | | 209,767,302 | |

Home Construction — 2.08% |

Masonite International Corp.(a) | | | 315,762 | | | | 31,070,981 | |

Meritage Homes Corp.(a) | | | 255,500 | | | | 28,204,645 | |

| | | | | | | | 59,275,626 | |

Household Products — 1.57% |

Helen of Troy Ltd.(a) | | | 230,763 | | | | 44,657,256 | |

| | | | | | | | | |

Industrial Intermediate Products — 0.09% |

Raven Industries, Inc. | | | 117,060 | | | | 2,519,131 | |

| | | | | | | | | |

Industrial Support Services — 1.67% |

Applied Industrial Technologies, Inc. | | | 465,321 | | | | 25,639,187 | |

WESCO International, Inc.(a) | | | 497,694 | | | | 21,908,490 | |

| | | | | | | | 47,547,677 | |

Insurance — 5.48% |

Hanover Insurance Group, Inc. | | | 431,728 | | | | 40,228,415 | |

James River Group Holdings Ltd. | | | 186,815 | | | | 8,318,872 | |

Kemper Corp. | | | 1,301,535 | | | | 86,981,584 | |

Primerica, Inc. | | | 179,308 | | | | 20,286,907 | |

| | | | | | | | 155,815,778 | |

Leisure Facilities & Services — 0.92% |

Extended Stay America, Inc. | | | 2,182,280 | | | | 26,078,246 | |

| | | | | | | | | |

Leisure Products — 0.17% |

Johnson Outdoors, Inc., Class A | | | 57,697 | | | | 4,724,807 | |

| | | | | | | | | |

Medical Equipment & Devices — 4.38% |

Bruker Corp. | | | 1,570,379 | | | $ | 62,422,565 | |

Integer Holdings Corp.(a) | | | 524,916 | | | | 30,975,293 | |

Integra LifeSciences Holdings Corp.(a) | | | 72,219 | | | | 3,410,181 | |

Lantheus Holdings, Inc.(a) | | | 708,877 | | | | 8,981,472 | |

Meridian Bioscience, Inc.(a) | | | 1,104,400 | | | | 18,752,712 | |

| | | | | | | | 124,542,223 | |

Metals & Mining — 0.05% |

Gold Resource Corp. | | | 378,747 | | | | 1,291,527 | |

| | | | | | | | | |

Oil & Gas Producers — 1.77% |

Cimarex Energy Co. | | | 142,342 | | | | 3,463,181 | |

Murphy USA, Inc.(a) | | | 365,182 | | | | 46,841,895 | |

| | | | | | | | 50,305,076 | |

Publishing & Broadcasting — 0.18% |

Sinclair Broadcast Group, Inc., Class A | | | 263,994 | | | | 5,076,605 | |

| | | | | | | | | |

Real Estate — 2.98% |

Apple Hospitality, Inc. | | | 745,140 | | | | 7,160,795 | |

City Office, Inc. | | | 2,062,399 | | | | 15,509,241 | |

Columbia Property Trust, Inc. | | | 1,175,492 | | | | 12,824,618 | |

Industrial Logistics Properties Trust | | | 572,376 | | | | 12,517,863 | |

Monmouth Real Estate Investment Corp. | | | 227,867 | | | | 3,155,958 | |

Office Properties Income Trust | | | 469,109 | | | | 9,719,938 | |

OUTFRONT Media, Inc. | | | 175,194 | | | | 2,549,073 | |

Piedmont Office Realty Trust, Inc., Class A | | | 1,131,237 | | | | 15,350,886 | |

Sunstone Hotel Investors, Inc. | | | 733,137 | | | | 5,821,108 | |

| | | | | | | | 84,609,480 | |

Real Estate Services — 0.20% |

Marcus & Millichap, Inc.(a) | | | 150,405 | | | | 4,139,146 | |

RMR Group, Inc. (The), Class A | | | 60,515 | | | | 1,662,347 | |

| | | | | | | | 5,801,493 | |

20 | See accompanying notes which are an integral part of these financial statements. | |

Fuller & Thaler Behavioral Small-Cap Equity Fund

Schedule of Investments (continued)

September 30, 2020

| | Shares | | | Fair Value | |

COMMON STOCKS — (continued) |

| |

Retail - Discretionary — 4.20% |

BMC Stock Holdings, Inc.(a) | | | 2,071,553 | | | $ | 88,724,615 | |

MarineMax, Inc.(a) | | | 167,496 | | | | 4,299,622 | |

Qurate Retail, Inc., Series A | | | 226,721 | | | | 1,627,857 | |

Sleep Number Corp.(a) | | | 507,016 | | | | 24,798,153 | |

| | | | | | | | 119,450,247 | |

Semiconductors — 2.40% |

Amkor Technology, Inc.(a) | | | 5,417,992 | | | | 60,681,510 | |

FormFactor, Inc.(a) | | | 306,144 | | | | 7,632,170 | |

| | | | | | | | 68,313,680 | |

Software — 3.71% |

j2 Global, Inc.(a) | | | 1,114,021 | | | | 77,112,534 | |

Progress Software Corp. | | | 776,372 | | | | 28,477,325 | |

| | | | | | | | 105,589,859 | |

Specialty Finance — 0.58% |

Federal Agricultural Mortgage Corp., Class C | | | 35,652 | | | | 2,269,606 | |

Stewart Information Services Corp. | | | 326,819 | | | | 14,291,795 | |

| | | | | | | | 16,561,401 | |

Steel — 1.64% |

Commercial Metals Co. | | | 1,925,350 | | | | 38,468,493 | |

Worthington Industries, Inc. | | | 200,374 | | | | 8,171,252 | |

| | | | | | | | 46,639,745 | |

Technology Hardware — 8.95% |

Avnet, Inc. | | | 760,122 | | | | 19,641,552 | |

Jabil, Inc. | | | 2,700,538 | | | | 92,520,431 | |

NETGEAR, Inc.(a) | | | 424,946 | | | | 13,096,836 | |

Sanmina Corp.(a) | | | 1,750,651 | | | | 47,355,110 | |

SYNNEX Corp. | | | 559,220 | | | | 78,324,353 | |

Vishay Precision Group, Inc.(a) | | | 153,257 | | | | 3,880,467 | |

| | | | | | | | 254,818,749 | |

Technology Services — 5.02% |

CoreLogic, Inc. | | | 56,800 | | | | 3,843,656 | |

CSG Systems International, Inc. | | | 1,100,204 | | | | 45,053,354 | |

EVERTEC, Inc. | | | 1,754,233 | | | | 60,889,426 | |

Technology Services — (continued) |

Insight Enterprises, Inc.(a) | | | 69,826 | | | $ | 3,950,755 | |

Perspecta, Inc. | | | 872,928 | | | | 16,978,450 | |

Science Applications International Corp. | | | 152,037 | | | | 11,922,742 | |

| | | | | | | | 142,638,383 | |

Transportation & Logistics — 2.19% |

Costamare, Inc. | | | 782,924 | | | | 4,752,349 | |

Hub Group, Inc., Class A(a) | | | 182,700 | | | | 9,170,627 | |

Landstar System, Inc. | | | 384,775 | | | | 48,285,414 | |

| | | | | | | | 62,208,390 | |

Wholesale - Consumer Staples — 1.00% |

Core-Mark Holding Co., Inc. | | | 978,578 | | | | 28,310,262 | |

| | | | | | | | | |

Total Common Stocks (Cost $2,464,612,703) | | | | | | | 2,582,890,743 | |

| | | | | | | | | |

PREFERRED STOCKS — 0.02% |

Retail - Discretionary — 0.02% |

Qurate Retail, Inc., 8.00% | | | 6,802 | | | | 669,961 | |

| | | | | | | | | |

Total Preferred Stocks (Cost $395,726) | | | | | | | 669,961 | |

| | | | | | | | | |

MONEY MARKET FUNDS — 9.37% |

Fidelity Investments Money Market Government Portfolio, Institutional Class, 0.03%(b) | | | 266,343,352 | | | | 266,343,352 | |

| | | | | | | | | |

Total Money Market Funds (Cost $266,343,352) | | | | | | | 266,343,352 | |

Total Investments — 100.21% (Cost $2,731,351,781) | | | 2,849,904,056 | |

Liabilities in Excess of Other Assets — (0.21)% | | | | | | | (6,071,941 | ) |

NET ASSETS — 100.00% | | $ | 2,843,832,115 | |

(a) | Non-income producing security. |

(b) | Rate disclosed is the seven day effective yield as of September 30, 2020. |

| | See accompanying notes which are an integral part of these financial statements. | 21 |

Fuller & Thaler Behavioral Small-Cap Growth Fund

Schedule of Investments

September 30, 2020

| | Shares | | | Fair Value | |

COMMON STOCKS — 96.68% |

| | | | | | | | | |

Apparel & Textile Products — 6.41% |

Crocs, Inc.(a) | | | 30,300 | | | $ | 1,294,719 | |

Hanesbrands, Inc. | | | 74,225 | | | | 1,169,044 | |

Kontoor Brands, Inc. | | | 54,000 | | | | 1,306,799 | |

| | | | | | | | 3,770,562 | |

Asset Management — 2.03% |

Kennedy-Wilson Holdings, Inc. | | | 82,309 | | | | 1,195,127 | |

| | | | | | | | | |

Biotech & Pharmaceuticals — 6.19% |

Guardant Health, Inc.(a) | | | 11,445 | | | | 1,279,322 | |

Halozyme Therapeutics, Inc.(a) | | | 45,925 | | | | 1,206,909 | |

Sarepta Therapeutics, Inc.(a) | | | 8,200 | | | | 1,151,526 | |

| | | | | | | | 3,637,757 | |

Consumer Services — 3.60% |

Aaron’s, Inc. | | | 20,350 | | | | 1,152,828 | |

Chegg, Inc.(a) | | | 13,475 | | | | 962,654 | |

| | | | | | | | 2,115,482 | |

E-Commerce Discretionary — 1.84% |

Etsy, Inc.(a) | | | 8,880 | | | | 1,080,074 | |

| | | | | | | | | |

Entertainment Content — 1.66% |

Zynga, Inc., Class A(a) | | | 107,215 | | | | 977,801 | |

| | | | | | | | | |

Food — 2.08% |

Darling Ingredients, Inc.(a) | | | 34,075 | | | | 1,227,722 | |

| | | | | | | | | |

Forestry, Paper & Wood Products — 1.94% |

Trex Co., Inc.(a) | | | 15,900 | | | | 1,138,440 | |

| | | | | | | | | |

Health Care Facilities & Services — 2.00% |

Amedisys, Inc.(a) | | | 4,970 | | | | 1,175,057 | |

| | | | | | | | | |

Household Products — 1.78% |

Helen of Troy Ltd.(a) | | | 5,400 | | | | 1,045,008 | |

| | | | | | | | | |

Internet Media & Services — 2.30% |

Stamps.com, Inc.(a) | | | 5,600 | | | | 1,349,320 | |

| | | | | | | | | |

Leisure Facilities & Services — 5.07% |

Jack in the Box, Inc. | | | 13,275 | | | $ | 1,052,840 | |

Penn National Gaming, Inc.(a) | | | 26,475 | | | | 1,924,733 | |

| | | | | | | | 2,977,573 | |

Leisure Products — 3.07% |

Axon Enterprise, Inc.(a) | | | 10,765 | | | | 976,386 | |

Fox Factory Holding Corp.(a) | | | 11,125 | | | | 826,921 | |

| | | | | | | | 1,803,307 | |

Life Sciences Tools & Services — 2.00% |

Repligen Corp.(a) | | | 7,950 | | | | 1,172,943 | |

| | | | | | | | | |

Medical Equipment & Devices — 12.29% |

Cardiovascular Systems, Inc.(a) | | | 28,700 | | | | 1,129,345 | |

Globus Medical, Inc., Class A(a) | | | 20,745 | | | | 1,027,292 | |

Merit Medical Systems, Inc.(a) | | | 25,600 | | | | 1,113,600 | |

Natera, Inc.(a) | | | 21,015 | | | | 1,518,124 | |

Nevro Corp.(a) | | | 8,490 | | | | 1,182,657 | |

Tandem Diabetes Care, Inc.(a) | | | 11,050 | | | | 1,254,175 | |

| | | | | | | | 7,225,193 | |

Retail - Consumer Staples — 2.07% |

Big Lots, Inc. | | | 27,275 | | | | 1,216,465 | |

| | | | | | | | | |

Retail - Discretionary — 3.02% |

RH(a) | | | 2,955 | | | | 1,130,642 | |

Urban Outfitters, Inc.(a) | | | 30,900 | | | | 643,029 | |

| | | | | | | | 1,773,671 | |

Semiconductors — 4.90% |

Inphi Corp.(a) | | | 8,660 | | | | 972,085 | |

MACOM Technology Solutions Holdings, Inc.(a) | | | 29,580 | | | | 1,006,016 | |

Rambus, Inc.(a) | | | 65,905 | | | | 902,239 | |

| | | | | | | | 2,880,340 | |

22 | See accompanying notes which are an integral part of these financial statements. | |

Fuller & Thaler Behavioral Small-Cap Growth Fund

Schedule of Investments (continued)

September 30, 2020

| | Shares | | | Fair Value | |

COMMON STOCKS — (continued) |

| |

Software — 21.77% |

Avaya Holdings Corp.(a) | | | 56,525 | | | $ | 859,180 | |

Bandwidth, Inc., Class A(a) | | | 7,400 | | | | 1,291,818 | |

Box, Inc., Class A(a) | | | 54,405 | | | | 944,471 | |

Calix, Inc.(a) | | | 44,755 | | | | 795,744 | |

Evolent Health, Inc., Class A(a) | | | 96,625 | | | | 1,199,116 | |

FireEye, Inc.(a) | | | 70,175 | | | | 866,310 | |

Five9, Inc.(a) | | | 9,425 | | | | 1,222,234 | |

j2 Global, Inc.(a) | | | 16,700 | | | | 1,155,974 | |

LivePerson, Inc.(a) | | | 20,750 | | | | 1,078,793 | |

Model N,Inc.(a) | | | 22,117 | | | | 780,288 | |

Sailpoint Technologies Holdings, Inc.(a) | | | 36,375 | | | | 1,439,358 | |

Tenable Holdings, Inc.(a) | | | 30,575 | | | | 1,154,206 | |

| | | | | | | | 12,787,492 | |

Technology Hardware — 4.47% |

Digital Turbine, Inc.(a) | | | 52,661 | | | | 1,724,121 | |

NETGEAR, Inc.(a) | | | 29,350 | | | | 904,567 | |

| | | | | | | | 2,628,688 | |

Technology Services — 2.23% |

Green Dot Corp., Class A(a) | | | 25,850 | | | | 1,308,269 | |

| | | | | | | | | |

Transportation Equipment — 2.45% |

Navistar International Corp.(a) | | | 33,000 | | | | 1,436,820 | |

| | | | | | | | | |

Wholesale - Consumer Staples — 1.51% |

Grocery Outlet Holding Corp.(a) | | | 22,500 | | | | 884,700 | |

| | | | | | | | | |

Total Common Stocks/Investments — 96.68% (Cost $46,384,036) | | | | | | | 56,807,811 | |

Other Assets in Excess of Liabilities — 3.32% | | | | | | | 1,953,132 | |

NET ASSETS — 100.00% | | | | | | $ | 58,760,943 | |

(a) | Non-income producing security. |

| | See accompanying notes which are an integral part of these financial statements. | 23 |

Fuller & Thaler Behavioral Mid-Cap Value Fund

Schedule of Investments

September 30, 2020

| | Shares | | | Fair Value | |

COMMON STOCKS — 99.74% |

| | | | | | | | | |

Aerospace & Defense — 1.81% |

Howmet Aerospace, Inc.(a) | | | 38,140 | | | $ | 637,701 | |

| | | | | | | | | |

Banking — 13.99% |

CIT Group, Inc. | | | 16,310 | | | | 288,850 | |

Commerce Bancshares, Inc. | | | 9,744 | | | | 548,490 | |

East West Bancorp, Inc. | | | 23,460 | | | | 768,080 | |

First Horizon National Corp. | | | 79,440 | | | | 749,119 | |

KeyCorp | | | 73,465 | | | | 876,438 | |

M&T Bank Corp. | | | 4,730 | | | | 435,586 | |

TCF Financial Corp. | | | 25,252 | | | | 589,887 | |

Wells Fargo & Co. | | | 28,355 | | | | 666,626 | |

| | | | | | | | 4,923,076 | |

Chemicals — 5.31% |

Celanese Corp. | | | 6,060 | | | | 651,146 | |

Sherwin-Williams Co. (The) | | | 840 | | | | 585,262 | |

WR Grace & Co. | | | 15,650 | | | | 630,539 | |

| | | | | | | | 1,866,947 | |

Commercial Support Services — 6.59% |

Aramark | | | 38,285 | | | | 1,012,638 | |

Brink’s Co. (The) | | | 15,535 | | | | 638,333 | |

Republic Services, Inc. | | | 7,185 | | | | 670,720 | |

| | | | | | | | 2,321,691 | |

Containers & Packaging — 10.88% |

Berry Plastics Group, Inc.(a) | | | 21,595 | | | | 1,043,471 | |

Crown Holdings, Inc.(a) | | | 11,170 | | | | 858,526 | |

Graphic Packaging Holding Co. | | | 65,805 | | | | 927,192 | |

WestRock Co. | | | 28,835 | | | | 1,001,728 | |

| | | | | | | | 3,830,917 | |

Electric Utilities — 4.34% |

Alliant Energy Corp. | | | 8,275 | | | | 427,404 | |

CMS Energy Corp. | | | 5,725 | | | | 351,572 | |

Edison International | | | 6,160 | | | | 313,174 | |

Pinnacle West Capital Corp. | | | 5,860 | | | | 436,863 | |

| | | | | | | | 1,529,013 | |

Electrical Equipment — 4.37% |

AMETEK, Inc. | | | 5,120 | | | | 508,928 | |

Johnson Controls International PLC | | | 15,875 | | | | 648,493 | |

Roper Technologies, Inc. | | | 960 | | | | 379,306 | |

| | | | | | | | 1,536,727 | |

Food — 2.10% |

Ingredion, Inc. | | | 6,045 | | | $ | 457,486 | |

J.M. Smucker Co. (The) | | | 2,435 | | | | 281,291 | |

| | | | | | | | 738,777 | |

Health Care Facilities & Services — 3.84% |

Centene Corp.(a) | | | 6,040 | | | | 352,313 | |

Henry Schein, Inc.(a) | | | 6,810 | | | | 400,292 | |

Laboratory Corp. of America Holdings(a) | | | 3,180 | | | | 598,699 | |

| | | | | | | | 1,351,304 | |

Home & Office Products — 2.92% |

Newell Brands, Inc. | | | 36,286 | | | | 622,668 | |

Whirlpool Corp. | | | 2,205 | | | | 405,477 | |

| | | | | | | | 1,028,145 | |

Home Construction — 1.11% |

Mohawk Industries, Inc.(a) | | | 4,005 | | | | 390,848 | |

| | | | | | | | | |

Industrial Support Services — 2.58% |

AMERCO | | | 1,140 | | | | 405,817 | |

HD Supply Holdings, Inc.(a) | | | 12,180 | | | | 502,303 | |

| | | | | | | | 908,120 | |

Insurance — 4.47% |

Assured Guaranty Ltd. | | | 9,725 | | | | 208,893 | |

Everest Re Group Ltd. | | | 2,645 | | | | 522,494 | |

Globe Life, Inc. | | | 4,670 | | | | 373,133 | |

Markel Corp.(a) | | | 480 | | | | 467,376 | |

| | | | | | | | 1,571,896 | |

Leisure Facilities & Services — 1.23% |

Live Nation Entertainment, Inc.(a) | | | 8,020 | | | | 432,118 | |

| | | | | | | | | |

Machinery — 2.32% |

Donaldson Co., Inc. | | | 8,700 | | | | 403,854 | |

Snap-on, Inc. | | | 2,800 | | | | 411,964 | |

| | | | | | | | 815,818 | |

Metals & Mining — 0.37% |

Arconic Corp.(a) | | | 6,867 | | | | 130,816 | |

| | | | | | | | | |

Oil & Gas Producers — 2.59% |

Cheniere Energy, Inc.(a) | | | 8,250 | | | | 381,727 | |

Continental Resources, Inc. | | | 20,045 | | | | 246,153 | |

Pioneer Natural Resources Co. | | | 3,290 | | | | 282,907 | |

| | | | | | | | 910,787 | |

24 | See accompanying notes which are an integral part of these financial statements. | |

Fuller & Thaler Behavioral Mid-Cap Value Fund

Schedule of Investments (continued)

September 30, 2020

| | Shares | | | Fair Value | |

COMMON STOCKS — (continued) |

| |

Oil & Gas Services & Equipment — 0.59% |

Patterson-UTI Energy, Inc. | | | 73,405 | | | $ | 209,204 | |

| | | | | | | | | |

Real Estate — 6.68% |

Brixmor Property Group, Inc. | | | 51,900 | | | | 606,711 | |

Public Storage | | | 2,065 | | | | 459,917 | |

Retail Properties of America, Inc., Class A | | | 27,775 | | | | 161,373 | |

Simon Property Group, Inc. | | | 9,660 | | | | 624,808 | |

WP Carey, Inc. | | | 7,650 | | | | 498,474 | |

| | | | | | | | 2,351,283 | |

Retail - Consumer Staples — 3.45% |

Dollar General Corp. | | | 2,655 | | | | 556,541 | |

Dollar Tree, Inc.(a) | | | 7,190 | | | | 656,735 | |

| | | | | | | | 1,213,276 | |

Retail - Discretionary — 5.57% |

Advance Auto Parts, Inc. | | | 2,215 | | | | 340,003 | |

CarMax, Inc.(a) | | | 7,320 | | | | 672,781 | |

O’Reilly Automotive, Inc.(a) | | | 2,055 | | | | 947,519 | |

| | | | | | | | 1,960,303 | |

Software — 1.19% |

Verint Systems, Inc.(a) | | | 8,700 | | | | 419,166 | |

| | | | | | | | | |

Specialty Finance — 2.32% |

Synchrony Financial | | | 31,185 | | | $ | 816,111 | |

| | | | | | | | | |

Technology Hardware — 2.21% |

CommScope Holding Co., Inc.(a) | | | 37,345 | | | | 336,105 | |

NCR Corp.(a) | | | 19,875 | | | | 440,033 | |

| | | | | | | | 776,138 | |

Technology Services — 4.14% |

Amdocs Ltd. | | | 9,340 | | | | 536,209 | |

Nielsen Holdings PLC | | | 13,850 | | | | 196,393 | |

Verisk Analytics, Inc. | | | 3,900 | | | | 722,709 | |

| | | | | | | | 1,455,311 | |

Transportation & Logistics — 2.77% |

Kansas City Southern | | | 5,385 | | | | 973,770 | |

| | | | | | | | | |

Total Common Stocks/Investments — 99.74% (Cost $36,097,008) | | | | | | | 35,099,263 | |

Other Assets in Excess of Liabilities — 0.26% | | | | | | | 92,917 | |

NET ASSETS — 100.00% | | | | | | $ | 35,192,180 | |

(a) | Non-income producing security. |

| | See accompanying notes which are an integral part of these financial statements. | 25 |

Fuller & Thaler Behavioral Unconstrained Equity Fund

Schedule of Investments

September 30, 2020

| | Shares | | | Fair Value | |

COMMON STOCKS — 98.50% |

| | | | | | | | | |

Automotive — 1.44% |

Cooper-Standard Holding, Inc.(a) | | | 55,765 | | | $ | 736,656 | |

| | | | | | | | | |

Biotech & Pharmaceuticals — 7.58% |

Amgen, Inc. | | | 7,465 | | | | 1,897,304 | |

Exelixis, Inc.(a) | | | 80,880 | | | | 1,977,516 | |

| | | | | | | | 3,874,820 | |

Chemicals — 4.52% |

Ecolab, Inc. | | | 11,576 | | | | 2,313,348 | |

| | | | | | | | | |

Commercial Support Services — 6.97% |

Cintas Corp. | | | 10,710 | | | | 3,564,609 | |

| | | | | | | | | |

E-Commerce Discretionary — 6.43% |

eBay, Inc. | | | 63,135 | | | | 3,289,334 | |

| | | | | | | | | |

Electrical Equipment — 8.47% |

Generac Holdings, Inc.(a) | | | 22,375 | | | | 4,332,696 | |

| | | | | | | | | |

Internet Media & Services — 3.75% |

VeriSign, Inc.(a) | | | 9,360 | | | | 1,917,396 | |

| | | | | | | | | |

Leisure Facilities & Services — 5.40% |

Yum China Holdings, Inc. | | | 52,105 | | | | 2,758,960 | |

| | | | | | | | | |

Machinery — 4.03% |

Parker-Hannifin Corp. | | | 10,180 | | | | 2,059,821 | |

| | | | | | | | | |

Medical Equipment & Devices — 3.45% |

Waters Corp.(a) | | | 9,025 | | | | 1,766,012 | |

| | | | | | | | | |

Publishing & Broadcasting — 3.99% |

Liberty Media Corp.-Liberty Sirius XM, Class C(a) | | | 61,666 | | | | 2,039,911 | |

| | | | | | | | | |

Retail - Discretionary — 8.40% |

O’Reilly Automotive, Inc.(a) | | | 4,570 | | | $ | 2,107,136 | |

Ross Stores, Inc. | | | 23,435 | | | | 2,186,953 | |

| | | | | | | | 4,294,089 | |

Semiconductors — 12.51% |

Cabot Microelectronics Corp. | | | 15,100 | | | | 2,156,431 | |

Lam Research Corp. | | | 7,330 | | | | 2,431,727 | |

Teradyne, Inc. | | | 22,730 | | | | 1,806,126 | |

| | | | | | | | 6,394,284 | |

Software — 4.21% |

Fortinet, Inc.(a) | | | 18,280 | | | | 2,153,567 | |

| | | | | | | | | |

Specialty Finance — 4.70% |

Synchrony Financial | | | 91,840 | | | | 2,403,453 | |

| | | | | | | | | |

Technology Hardware — 4.02% |

Zebra Technologies Corp., Class A(a) | | | 8,150 | | | | 2,057,549 | |

| | | | | | | | | |

Transportation & Logistics — 5.11% |

Union Pacific Corp. | | | 13,285 | | | | 2,615,418 | |

| | | | | | | | | |

Transportation Equipment — 3.52% |

Allison Transmission Holdings, Inc. | | | 51,170 | | | | 1,798,114 | |

| | | | | | | | | |

Total Common Stocks/Investments — 98.50% (Cost $44,736,178) | | | | | | | 50,370,037 | |

Other Assets in Excess of Liabilities — 1.50% | | | | | | | 765,098 | |

NET ASSETS — 100.00% | | | | | | $ | 51,135,135 | |

(a) | Non-income producing security. |

26 | See accompanying notes which are an integral part of these financial statements. | |

Fuller & Thaler Behavioral Small-Mid Core Equity Fund

Schedule of Investments

September 30, 2020

| | Shares | | | Fair Value | |

COMMON STOCKS — 98.02% |

| | | | | | | | | |

Apparel & Textile Products — 2.11% |

Carter’s, Inc. | | | 530 | | | $ | 45,888 | |

PVH Corp. | | | 330 | | | | 19,681 | |

| | | | | | | | 65,569 | |

Automotive — 0.87% |

Cooper-Standard Holding, Inc.(a) | | | 2,035 | | | | 26,882 | |

| | | | | | | | | |

Banking — 7.15% |

First Citizens BancShares, Inc., Class A | | | 105 | | | | 33,472 | |

Live Oak Bancshares, Inc. | | | 3,165 | | | | 80,168 | |

PacWest BanCorp | | | 1,670 | | | | 28,524 | |

Sterling Bancorp | | | 4,010 | | | | 42,185 | |

Western Alliance Bancorp | | | 1,175 | | | | 37,154 | |

| | | | | | | | 221,503 | |

Biotech & Pharmaceuticals — 2.44% |

Exelixis, Inc.(a) | | | 3,095 | | | | 75,673 | |

| | | | | | | | | |

Cable & Satellite — 0.67% |

Liberty Latin America Ltd., Class C(a) | | | 2,535 | | | | 20,635 | |

| | | | | | | | | |

Chemicals — 4.67% |

Huntsman Corp. | | | 3,360 | | | | 74,625 | |

NewMarket Corp. | | | 100 | | | | 34,232 | |

Orion Engineered Carbons SA(a) | | | 2,890 | | | | 36,154 | |

| | | | | | | | 145,011 | |

Electrical Equipment — 6.88% |

Advanced Energy Industries, Inc.(a) | | | 825 | | | | 51,926 | |

Generac Holdings, Inc.(a) | | | 835 | | | | 161,689 | |

| | | | | | | | 213,615 | |

Entertainment Content — 2.31% |

Sciplay Corp.(a) | | | 4,420 | | | | 71,692 | |

| | | | | | | | | |

Food — 2.68% |

Lancaster Colony Corp. | | | 465 | | | | 83,142 | |

| | | | | | | | | |

Gas & Water Utilities — 1.54% |

UGI Corp. | | | 1,450 | | | | 47,821 | |

| | | | | | | | | |

Health Care Facilities & Services — 1.97% |

Universal Health Services, Inc., Class B | | | 570 | | | $ | 61,001 | |

| | | | | | | | | |

Industrial Support Services — 1.26% |

HD Supply Holdings, Inc.(a) | | | 945 | | | | 38,972 | |

| | | | | | | | | |

Institutional Financial Services — 1.74% |

Evercore Partners, Inc., Class A | | | 825 | | | | 54,005 | |

| | | | | | | | | |

Insurance — 5.58% |

Brown & Brown, Inc. | | | 1,000 | | | | 45,270 | |

Mercury General Corp. | | | 1,005 | | | | 41,577 | |

Old Republic International Corp. | | | 2,400 | | | | 35,376 | |

Voya Financial, Inc. | | | 1,065 | | | | 51,045 | |

| | | | | | | | 173,268 | |

Leisure Facilities & Services — 5.89% |

Carnival Corp. | | | 2,580 | | | | 39,164 | |

Darden Restaurants, Inc. | | | 460 | | | | 46,340 | |

Ruth’s Hospitality Group, Inc. | | | 3,040 | | | | 33,622 | |

Yum China Holdings, Inc. | | | 1,200 | | | | 63,541 | |

| | | | | | | | 182,667 | |

Machinery — 5.68% |

Altra Industrial Motion Corp. | | | 2,110 | | | | 78,007 | |

Hillenbrand, Inc. | | | 1,915 | | | | 54,309 | |

Oshkosh Corp. | | | 600 | | | | 44,100 | |

| | | | | | | | 176,416 | |

Medical Equipment & Devices — 7.93% |

Dentsply Sirona, Inc. | | | 1,325 | | | | 57,942 | |

Meridian Bioscience, Inc.(a) | | | 2,560 | | | | 43,469 | |

Quidel Corp.(a) | | | 370 | | | | 81,171 | |

Waters Corp.(a) | | | 325 | | | | 63,596 | |

| | | | | | | | 246,178 | |

Oil & Gas Producers — 1.15% |

WPX Energy, Inc.(a) | | | 7,250 | | | | 35,525 | |

| | | | | | | | | |

| | See accompanying notes which are an integral part of these financial statements. | 27 |

Fuller & Thaler Behavioral Small-Mid Core Equity Fund