UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-22895

Capitol Series Trust

(Exact name of registrant as specified in charter)

Ultimus Fund Solutions, LLC

225 Pictoria Drive, Suite 450

Cincinnati, OH 45246

(Address of principal executive offices) (Zip code)

Zachary P. Richmond

Ultimus Fund Solutions, LLC

225 Pictoria Drive, Suite 450

Cincinnati, OH 45246

(Name and address of agent for service)

| Registrant’s telephone number, including area code: | 513-587-3400 | |

| Date of fiscal year end: | August 31 | |

| | | |

| Date of reporting period: | August 31, 2020 | |

Item 1. Reports to Stockholders.

HEDEKER STRATEGIC APPRECIATION FUND

Institutional Shares – SAFFX

Annual Report

August 31, 2020

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund’s shareholder reports like this one will no longer be sent by mail, unless you specifically request paper copies of the reports from the Fund or from your financial intermediary such as a broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically by contacting the Fund at (800) 657-4450 or, if you own these shares through a financial intermediary, you may contact your financial intermediary.

You may elect to receive all future reports in paper free of charge. You can inform the Fund that you wish to continue receiving paper copies of your shareholder reports by contacting the Fund at (800) 657-4450. If you own shares through a financial intermediary, you may contact your financial intermediary or follow instructions included with this document to elect to continue to receive paper copies of your shareholder reports. Your election to receive reports in paper will apply to all funds held with the fund complex or at your financial intermediary.

Hedeker Wealth LLC

One Overlook Point, Suite 610

Lincolnshire, Illinois 60069

(800) 657-4450

Shareholder Letter (Unaudited) | August 31, 2020 |

Overview

Fiscal year 2020 was a uniquely difficult period to navigate through the markets. From the ongoing fight against Covid-19 to the renewed fervor for social justice reform, as well as the run-up to the 2020 Presidential election, this year was tumultuous. Gone are the days of only having to worry about the trade wars with China and the fallout from Brexit. Instead, yesteryear’s issues have been supplanted with concerns over a sustained economic recovery amidst record spikes in unemployment and jobless claims due to the pandemic. Despite all of the calamity, the overall market results have been encouraging. For the period of September 1, 2019 to August 31, 2020, the Hedeker Strategic Appreciation Fund (the “Fund”) returned 5.49% (net of fees). During the same period, the Fund’s benchmark, the Bloomberg Barclays U.S. Intermediate Government/Credit Index was up 5.95%.

Fiscal Year 2020

The three inputs that make up convertible securities valuations experienced a great deal of variance during fiscal year 2020. Volatility, as measured by the VIX (Chicago Board Options Exchange Volatility Index), ranged from 11.54 to as high as 82.69, its highest level since the index was created in 1990. Credit spreads, as measured by the Markit CDX High Yield Index, ranged from 275 bps to 871 bps, a fairly sizable spread. Interest rates also experienced a pronounced move, with the 10-year U.S. Treasury going from 1.94% in November 2019 to 0.50% in August 2020, the lowest level it has ever seen. Needless to say, convertible securities valuations fluctuated throughout the year. However, more important than valuations was the move in equity prices. While equity prices do not directly impact the theoretical valuation of a convertible bond, they do affect the actual price and movement of convertibles. During fiscal year 2020, the S&P 500® Index sold off nearly 34% from peak-to-trough, followed by a 58% recovery through August 31, 2020. Comparatively, the Fund sold off 22.4% from peak-to-trough, followed by a 28% recovery. Moves of such magnitude, in both directions in such a short time frame, are incredibly uncommon for equities and convertibles.

In response to these extraordinary circumstances, the Fed expanded its balance sheet to record levels in an effort to keep financial markets liquid and functioning. The Treasury Department did its part by helping to push through Congress the CARES Act stimulus package to deal with the economic fallout from the pandemic. Thus far, these actions have been exceedingly effective in supporting the economy, but it remains to be seen if further action will be necessary. The Fed remains committed to future accommodative policy, but the Treasury and Congress have yet to pass additional economic stimulus. Ultimately, the slowing and elimination of Covid-19 stands as the most important factor in a sustained economic recovery.

Historically, the Fund has invested in low delta convertible bonds in an effort to provide downside protection. However, the Adviser has determined that, in order to better participate in equity upside while targeting less downside participation, the Fund will increase its allocation to balanced, higher delta convertible securities. The change in portfolio construction will be subtle, but it will provide a greater probability of success in capturing the positive asymmetric profile of convertibles. Furthermore, a portfolio of balanced convertibles will generally provide higher current yields than equities and greater upside potential to bonds.

Conclusion

The events of 2020 have given us an opportunity to reflect on the best ways to achieve our goals. While the Fund’s final performance for fiscal year 2020 resulted in similar performance to its benchmark, the path there was a bumpy one. By refocusing the portfolio from low delta convertibles to higher delta, balanced convertibles, the Fund can achieve more consistent returns over time.

1

Ryan Casaquite

Portfolio Manager

Investors should carefully consider the investment objectives, risks, and charges and expenses of the fund before investing. The prospectus contains this and other information about the fund, and it should be read carefully before investing. Investors may obtain a copy of the prospectus by calling 800-657-4450.

Investing involves risk, including loss of principal. There is no guarantee that this, or any, investment strategy will be successful. A majority of the Fund’s assets will be invested in convertible securities that have credit ratings that are below investment grade or not rated. These “junk bonds” are considered speculative investments. Fixed income investments are affected by a number of risks, including fluctuation in interest rates, credit risk, and prepayment risk. In general, as prevailing interest rates rise, fixed income securities prices will fall. Some fixed income securities give the issuer the option to call, or redeem, the bonds before their maturity date. If an issuer “calls” its bonds during a time of declining interest rates, the Fund may have to invest the proceeds in an investment offering a lower yield. Convertible securities may be illiquid and difficult to value and may be subject to greater credit risk than other securities. Many of the convertible securities in which the Fund invests are issued by small or medium sized companies located in foreign and emerging markets. Investments in international markets present special risks including currency fluctuation, the potential for diplomatic and political instability, regulatory and liquidity risks, foreign taxation and differences in auditing and other financial standards. Risks of foreign investing are generally intensified for investments in emerging markets. Small and mid-cap investing involves greater risk not associated with investing in more established companies, such as greater price volatility, business risk, less liquidity and increased competitive threat.

Past performance does not guarantee future performance.

The Bloomberg Barclays Intermediate U.S. Government/Credit Index is a broad-based flagship benchmark that measures the non-securitized component of the Bloomberg Barclays U.S. Aggregate Index. The S&P 500® Index is a market capitalization weighted index that is widely used as a barometer of U.S. stock market performance. The Chicago Board Options Exchange Volatility Index (“the VIX”) reflects a market estimate of future volatility, based on the weighted average of the implied volatilities for a wide range of strikes. The Markit CDX High Yield Index is composed of 100 non-investment grade entities, distributed among 2 sub-indices: B, BB. You cannot invest directly in an index.

The Hedeker Strategic Appreciation Fund is distributed by Ultimus Fund Distributors, LLC.

2

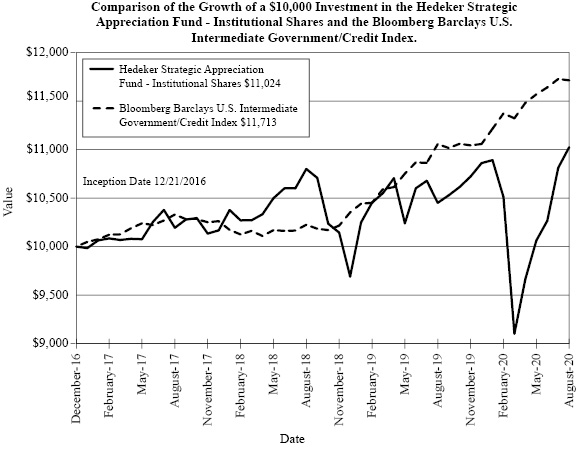

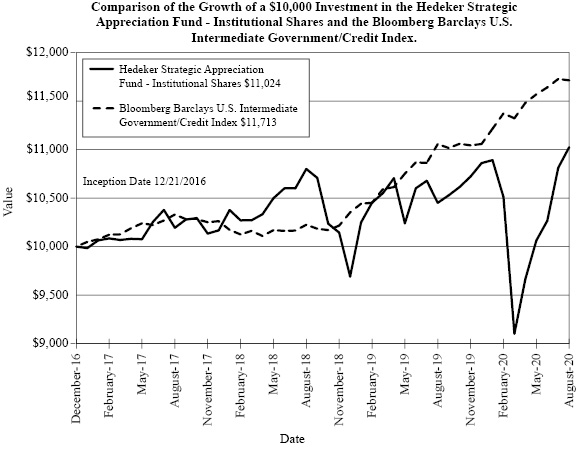

Investment Results (Unaudited)

Average Annual Total Returns(a) as of August 31, 2020

| One Year | Since

Inception

(12/21/2016) | Expense Ratio(c) |

Hedeker Strategic Appreciation Fund | | | |

Institutional Shares | 5.49% | 2.68% | 1.42% |

Bloomberg Barclays U.S. Intermediate Government/Credit Index(b) | 5.95% | 4.37% | |

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect deduction of taxes that a shareholder would pay on the Hedeker Strategic Appreciation Fund (the “Fund”) distributions or the redemption of Fund shares. Current performance of the Fund may be lower or higher than the performance quoted. The Fund’s investment objectives, risks, charges and expenses must be considered carefully before investing. Performance data current to the most recent month end may be obtained by calling (800) 657-4450.

(a) | Return figures reflect any change in price per share and assume the reinvestment of all distributions. |

(b) | The Bloomberg Barclays U.S. Intermediate Government/Credit Index (“Index”) is a broad-based flagship benchmark that measures the non-securitized component of the Bloomberg Barclays U.S. Aggregate Index. It includes investment grade, U.S. dollar-denominated, fixed-rate Treasuries, government-related and corporate securities. The returns of the Index do not reflect the deduction of fees and expenses, whereas the Fund returns are shown net of fees. An individual cannot invest directly in an index. |

(c) | The expense ratio is from the Fund’s prospectus dated December 30, 2019. Hedeker Wealth LLC, the Fund’s investment adviser (the “Adviser”), has contractually agreed, until December 31, 2020, to waive its management fee and/or reimburse expenses so that total annual operating expenses (excluding (i) interest; (ii) taxes; (iii) brokerage fees and commissions; (iv) other extraordinary expenses not incurred in the ordinary course of the Fund’s business; (v) dividend expenses on short sales; and (vi) indirect expenses such as acquired fund fees and expenses) do not exceed 1.75% of the Fund’s average daily net assets. (“Expense Limitation Agreement”). The Adviser is not expected to extend the Expense Limitation Agreement past December 31, 2020. During any fiscal year that the Investment Advisory Agreement between the Adviser and Capitol Series Trust (the “Trust”) is in effect, the Adviser may recoup the sum of all fees previously waived or expenses reimbursed, less any reimbursement previously paid, provided that the Adviser is only permitted to recoup fees or expenses within 36 months from the date the fee waiver or expense reimbursement first occurred and provided further that such recoupment can be achieved within the Expense Limitation Agreement currently in effect and the Expense Limitation Agreement in place when the waiver/reimbursement occurred. The Expense Limitation may not be terminated by the Adviser prior to its expiration date, but the Board of Trustees (the “Board”) may terminate such agreement at any time. The Institutional Shares expense ratio does not correlate to the corresponding ratio of expenses to average net assets included in the financial highlights section of this report, which reflects the operating expenses of the Fund, but does not include acquired fund fees and expenses. Additional information pertaining to the Fund’s expense ratios as of August 31, 2020, can be found in the financial highlights. |

The Fund’s investment objectives, strategies, risks, charges and expenses must be considered carefully before investing. The prospectus contains this and other important information about the Fund and may be obtained by calling (800) 657-4450. Please read it carefully before investing.

The Fund is distributed by Ultimus Fund Distributors, LLC, member FINRA/SIPC.

3

Investment Results (Unaudited) (continued)

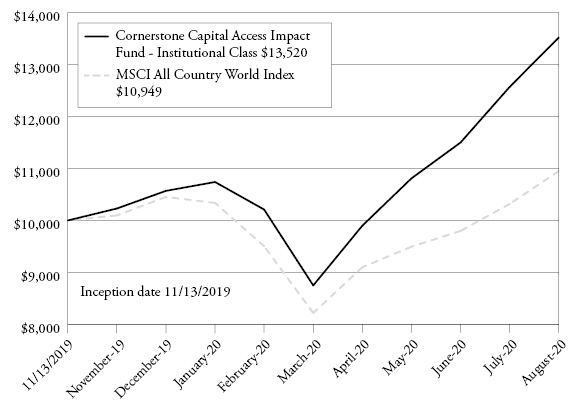

The chart above assumes an initial investment of $10,000 made on December 21, 2016 (commencement of operations) and held through August 31, 2020. THE FUND’S RETURNS REPRESENT PAST PERFORMANCE AND DO NOT GUARANTEE FUTURE RESULTS. The returns shown do not reflect deduction of taxes that a shareholder would pay on the Fund’s distributions or the redemption of the Fund’s shares. Investment returns and principal values will fluctuate so that your shares, when redeemed, may be worth more or less than their original purchase price.

Current performance may be lower or higher than the performance data quoted. For more information on the Fund, and to obtain performance data current to the most recent month-end, or to request a prospectus, please call (800) 657-4450. You should carefully consider the investment objectives, potential risks, management fees, and charges and expenses of the Fund before investing. The Fund’s prospectus contains this and other information about the Fund, and should be read carefully before investing.

The Fund is distributed by Ultimus Fund Distributors, LLC, Member FINRA/SIPC.

4

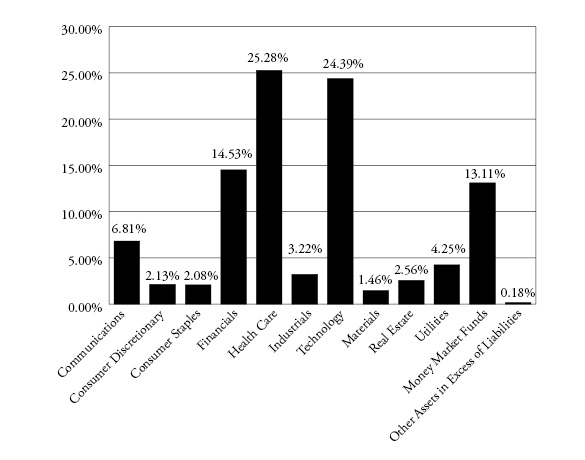

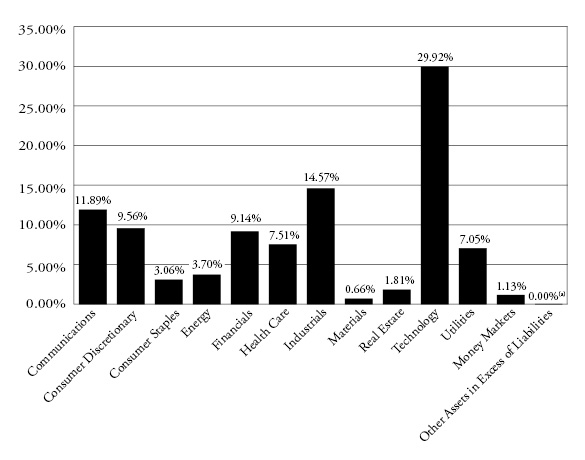

Portfolio Illustration (Unaudited)

August 31, 2020 |

|

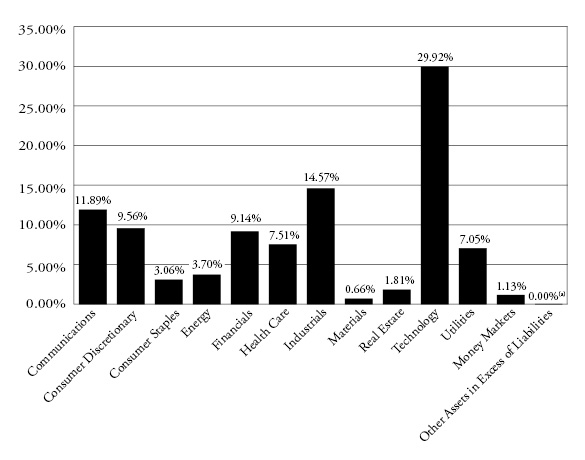

The following chart gives a visual breakdown of the Fund’s holdings as a percentage of net assets.

Availability of Portfolio Schedule (Unaudited)

The Fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission (“SEC”) for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT. The Fund’s Form N-PORT reports are available on the SEC’s website at http://www.sec.gov.

5

Hedeker Strategic Appreciation Fund

Schedule of Investments

August 31, 2020

| | | Principal

Amount | | | Fair

Value | |

| CONVERTIBLE CORPORATE BONDS — 74.89% | | | | | | |

| | | | | | | |

| Communications — 6.81% | | | | | | |

| Liberty Interactive LLC, 4.00%, 11/15/2029 | | $ | 1,350,000 | | | $ | 999,000 | |

| Liberty Media Corp., 2.25%, 9/30/2046 | | | 2,000,000 | | | | 960,415 | |

| Liberty Media Corp. - Liberty Formula One, 1.00%, 1/30/2023 | | | 1,000,000 | | | | 1,230,112 | |

| Twitter, Inc., 1.00%, 9/15/2021 | | | 500,000 | | | | 498,754 | |

| Twitter, Inc., 0.25%, 6/15/2024 | | | 500,000 | | | | 540,099 | |

| | | | | | | | 4,228,380 | |

| Consumer Discretionary — 2.13% | | | | | | | | |

Carriage Services, Inc., 2.75%, 3/15/2021(a) | | | 300,000 | | | | 350,250 | |

| Quotient Technology, Inc., 1.75%, 12/1/2022 | | | 1,000,000 | | | | 972,830 | |

| | | | | | | | 1,323,080 | |

| Consumer Staples — 2.08% | | | | | | | | |

| Herbalife Nutrition Ltd., 2.63%, 3/15/2024 | | | 1,250,000 | | | | 1,294,648 | |

| | | | | | | | | |

| Financials — 9.89% | | | | | | | | |

| Apollo Commercial Real Estate Finance, Inc., 5.38%, 10/15/2023 | | | 500,000 | | | | 433,656 | |

| Ares Capital Corp., 3.75%, 2/1/2022 | | | 1,000,000 | | | | 1,015,000 | |

| Ares Capital Corp., 4.63%, 3/1/2024 | | | 750,000 | | | | 774,375 | |

| New Mountain Finance Corp., 5.75%, 8/15/2023 | | | 1,000,000 | | | | 997,550 | |

| Prospect Capital Corp., 4.95%, 7/15/2022 | | | 1,000,000 | | | | 1,003,758 | |

| Prospect Capital Corp., 6.38%, 3/1/2025 | | | 1,000,000 | | | | 1,005,000 | |

| Redwood Trust, Inc., 4.75%, 8/15/2023 | | | 1,000,000 | | | | 914,722 | |

| | | | | | | | 6,144,061 | |

| Health Care — 25.28% | | | | | | | | |

| Collegium Pharmaceutical, Inc., 2.63%, 2/15/2026 | | | 250,000 | | | | 238,200 | |

| CONMED Corp., 2.63%, 2/1/2024 | | | 1,000,000 | | | | 1,172,997 | |

| Exact Sciences Corp., 0.38%, 3/15/2027 | | | 1,000,000 | | | | 1,001,875 | |

| Gossamer Bio, Inc., 5.00%, 6/1/2027 | | | 2,000,000 | | | | 2,200,962 | |

| Illumina, Inc., 0.00%, 8/15/2023 | | | 500,000 | | | | 560,000 | |

| Illumina, Inc., 0.50%, 6/15/2021 | | | 500,000 | | | | 722,188 | |

| Insmed, Inc., 1.75%, 1/15/2025 | | | 1,000,000 | | | | 1,013,942 | |

| Jazz Investments I Ltd., 1.88%, 8/15/2021 | | | 500,000 | | | | 504,063 | |

| Jazz Investments I Ltd., 1.50%, 8/15/2024 | | | 500,000 | | | | 497,825 | |

| Karyopharm Therapeutics, Inc., 3.00%, 10/15/2025 | | | 1,000,000 | | | | 1,205,485 | |

| NeoGenomics, Inc., 1.25%, 5/1/2025 | | | 1,500,000 | | | | 1,924,188 | |

| Pacira BioSciences, Inc., 2.38%, 4/1/2022 | | | 1,000,000 | | | | 1,169,418 | |

| Repligen Corp., 0.38%, 7/15/2024 | | | 1,000,000 | | | | 1,486,863 | |

| Retrophin, Inc., 2.50%, 9/15/2025 | | | 1,000,000 | | | | 884,172 | |

| Vocera Communiciations, Inc., 1.50%, 5/15/2023 | | | 1,000,000 | | | | 1,111,875 | |

| | | | | | | | 15,694,053 | |

| Industrials — 1.75% | | | | | | | | |

| Mesa Laboratories, Inc., 1.38%, 8/15/2025 | | | 1,000,000 | | | | 1,086,168 | |

6 | See accompanying notes which are an integral part of these financial statements. | |

Hedeker Strategic Appreciation Fund

Schedule of Investments (continued)

August 31, 2020

| | | Principal

Amount | | | Fair

Value | |

| CONVERTIBLE CORPORATE BONDS — (continued) | | | | | | |

| | | | | | | |

| Real Estate — 2.56% | | | | | | |

| Hannon Armstrong Sustainable Infrastructure, 4.13%, 9/1/2022 | | $ | 1,000,000 | | | $ | 1,592,500 | |

| | | | | | | | | |

| Technology — 24.39% | | | | | | | | |

| Akamai Technologies, Inc., 0.13%, 5/1/2025 | | | 1,500,000 | | | | 2,006,139 | |

| Altair Engineering, Inc., 0.25%, 6/1/2024 | | | 1,000,000 | | | | 1,111,835 | |

| Guidewire Software, Inc., 1.25%, 3/15/2025 | | | 1,000,000 | | | | 1,194,709 | |

| II-VI, Inc., 0.25%, 9/1/2022 | | | 1,250,000 | | | | 1,472,019 | |

| New Relic, Inc., 0.50%, 5/1/2023 | | | 1,000,000 | | | | 971,022 | |

| Nuance Communications, Inc., 1.00%, 12/15/2035 | | | 1,000,000 | | | | 1,344,350 | |

| Nutanix, Inc., 0.00%, 1/15/2023 | | | 1,000,000 | | | | 988,945 | |

| Palo Alto Networks, Inc., 0.75%, 7/1/2023 | | | 1,000,000 | | | | 1,163,290 | |

| Pure Storage, Inc., 0.13%, 4/15/2023 | | | 1,000,000 | | | | 968,924 | |

| Q2 Holdings, Inc., 0.75%, 6/1/2026 | | | 1,000,000 | | | | 1,277,585 | |

| Rapid7, Inc., 1.25%, 8/1/2023 | | | 1,000,000 | | | | 1,632,999 | |

| Verint Systems, Inc., 1.50%, 6/1/2021 | | | 1,000,000 | | | | 1,013,159 | |

| | | | | | | | 15,144,976 | |

| Total Convertible Corporate Bonds (Cost $43,526,581) | | | | | | | 46,507,866 | |

| | | Shares | | | | |

| CONVERTIBLE PREFERRED STOCKS — 11.82% | | | | | | | | |

| | | | | | | | | |

| Financials — 4.64% | | | | | | | | |

| Bank of America Corp., Series L, 7.25% | | | 1,000 | | | | 1,496,030 | |

| Wells Fargo & Co., Series L, 7.50% | | | 1,000 | | | | 1,380,500 | |

| | | | | | | | 2,876,530 | |

| Industrials — 1.47% | | | | | | | | |

| Fortive Corp., Series A, 5.00% | | | 1,000 | | | | 913,660 | |

| | | | | | | | | |

| Materials — 1.46% | | | | | | | | |

| International Flavors & Fragrances, Inc., 6.00% | | | 20,000 | | | | 908,000 | |

| | | | | | | | | |

| Utilities — 4.25% | | | | | | | | |

| NextEra Energy, Inc., 4.87% | | | 40,000 | | | | 2,192,000 | |

| Southern Co. (The), Series 2019, 6.75% | | | 10,000 | | | | 450,000 | |

| | | | | | | | 2,642,000 | |

| Total Convertible Preferred Stocks (Cost $7,203,923) | | | | | | | 7,340,190 | |

| | See accompanying notes which are an integral part of these financial statements. | 7 |

Hedeker Strategic Appreciation Fund

Schedule of Investments (continued)

August 31, 2020

| | Shares | | | Fair

Value | |

MONEY MARKET FUNDS — 13.11% | | | | | | | | |

| | | | | | | | | |

Fidelity Investments Money Market Government Portfolio, Institutional Class, 0.05%(b) | | | 8,143,574 | | | $ | 8,143,574 | |

Total Money Market Funds (Cost $8,143,574) | | | | | | | 8,143,574 | |

| | | | | | | | | |

Total Investments — 99.82% (Cost $58,874,078) | | | | | | | 61,991,630 | |

| | | | | | | | | |

Other Assets in Excess of Liabilities — 0.18% | | | | | | | 109,608 | |

| | | | | | | | | |

NET ASSETS — 100.00% | | | | | | $ | 62,101,238 | |

(a) | Illiquid security. The total fair value of these securities as of August 31, 2020 was $350,250, representing 0.56% of net assets. |

(b) | Rate disclosed is the seven day effective yield as of August 31, 2020. |

8 | See accompanying notes which are an integral part of these financial statements. | |

Hedeker Strategic Appreciation Fund

Statement of Assets and Liabilities

August 31, 2020

Assets |

Investments in securities at fair value (cost $58,874,078) | | $ | 61,991,630 | |

Receivable for fund shares sold | | | 1,810,344 | |

Dividends and interest receivable | | | 289,801 | |

Prepaid expenses | | | 2,983 | |

Total Assets | | | 64,094,758 | |

Liabilities |

Payable for fund shares redeemed | | | 1,905,417 | |

Payable to Adviser | | | 51,919 | |

Payable to auditors | | | 16,700 | |

Payable to Administrator | | | 9,828 | |

Other accrued expenses | | | 9,656 | |

Total Liabilities | | | 1,993,520 | |

Net Assets | | $ | 62,101,238 | |

Net Assets consist of: | | | | |

Paid-in capital | | | 63,117,830 | |

Accumulated deficit | | | (1,016,592 | ) |

Net Assets | | $ | 62,101,238 | |

Shares outstanding (unlimited number of shares authorized, no par value) | | | 2,498,045 | |

Net asset value, offering and redemption price per share | | $ | 24.86 | |

| | See accompanying notes which are an integral part of these financial statements. | 9 |

Hedeker Strategic Appreciation Fund

Statement of Operations

For the year ended August 31, 2020

Investment Income | | | | |

Dividend income | | $ | 479,091 | |

Interest income | | | 1,600,236 | |

Total investment income | | | 2,079,327 | |

Expenses | | | | |

Adviser | | | 608,670 | |

Administration | | | 61,014 | |

Fund accounting | | | 38,501 | |

Legal | | | 21,570 | |

Audit and tax preparation | | | 19,450 | |

Trustee | | | 14,297 | |

Transfer agent | | | 12,000 | |

Report printing | | | 10,387 | |

Line of credit | | | 10,355 | |

Pricing | | | 9,801 | |

Custodian | | | 6,757 | |

Compliance services | | | 6,000 | |

Registration | | | 4,878 | |

Interest expense | | | 396 | |

Miscellaneous | | | 27,024 | |

Net operating expenses | | | 851,100 | |

Net investment income | | | 1,228,227 | |

Net Realized and Change in Unrealized Gain (Loss) on Investments |

Net realized loss on investment securities transactions | | | (610,245 | ) |

Net change in unrealized appreciation of investment securities | | | 2,214,231 | |

Net realized and change in unrealized gain on investments | | | 1,603,986 | |

Net increase in net assets resulting from operations | | $ | 2,832,213 | |

10 | See accompanying notes which are an integral part of these financial statements. | |

Hedeker Strategic Appreciation Fund

Statements of Changes in Net Assets

| | | For the

Year Ended

August 31, 2020 | | | For the

Year Ended

August 31, 2019 | |

Increase (Decrease) in Net Assets due to: | | | | | | | | |

Operations | | | | | | | | |

Net investment income | | $ | 1,228,227 | | | $ | 539,076 | |

Net realized loss on investment securities transactions and foreign currency translations | | | (610,245 | ) | | | (1,552,732 | ) |

Net change in unrealized appreciation (depreciation) of investment securities and foreign currency translations | | | 2,214,231 | | | | (884,259 | ) |

Net increase (decrease) in net assets resulting from operations | | | 2,832,213 | | | | (1,897,915 | ) |

Distributions to Shareholders from Earnings: | | | | | | | | |

Institutional Shares | | | (2,031,689 | ) | | | (1,776,026 | ) |

Total distributions | | | (2,031,689 | ) | | | (1,776,026 | ) |

Capital Transactions - Institutional Shares | | | | | | | | |

Proceeds from shares sold | | | 9,916,880 | | | | 11,103,161 | |

Reinvestment of distributions | | | 2,031,689 | | | | 1,776,026 | |

Amount paid for shares redeemed | | | (10,375,726 | ) | | | (9,771,834 | ) |

Net increase in net assets resulting from capital transactions | | | 1,572,843 | | | | 3,107,353 | |

Total Increase (Decrease) in Net Assets | | | 2,373,367 | | | | (566,588 | ) |

Net Assets | | | | | | | | |

Beginning of year | | | 59,727,871 | | | | 60,294,459 | |

End of year | | $ | 62,101,238 | | | $ | 59,727,871 | |

Share Transactions - Institutional Shares | | | | | | | | |

Shares sold | | | 405,778 | | | | 454,058 | |

Shares issued in reinvestment of distributions | | | 86,552 | | | | 73,503 | |

Shares redeemed | | | (443,831 | ) | | | (399,557 | ) |

Net increase in shares | | | 48,499 | | | | 128,004 | |

| | See accompanying notes which are an integral part of these financial statements. | 11 |

Hedeker Strategic Appreciation Fund - Institutional Shares

Financial Highlights

(For a share outstanding during each period)

| | | For the

Year Ended

August 31,

2020 | | | For the

Year Ended

August 31,

2019 | | | For the

Year Ended

August 31,

2018 | | | For the

Period Ended

August 31,

2017(a) | |

Net asset value, beginning of period | | $ | 24.38 | | | $ | 25.97 | | | $ | 25.47 | | | $ | 25.00 | |

| | | | | | | | | | | | | | | | | |

Investment operations: | | | | | | | | | | | | | | | | |

Net investment income | | | 0.48 | | | | 0.23 | | | | 0.41 | | | | 0.07 | |

Net realized and unrealized gain (loss) on investments | | | 0.80 | | | | (1.08 | ) | | | 1.06 | | | | 0.41 | |

Total from investment operations | | | 1.28 | | | | (0.85 | ) | | | 1.47 | | | | 0.48 | |

| | | | | | | | | | | | | | | | | |

Distributions from: | | | | | | | | | | | | | | | | |

Net investment income | | | (0.80 | ) | | | (0.74 | ) | | | (0.66 | ) | | | (0.01 | ) |

Net realized gains | | | — | | | | — | | | | (0.31 | ) | | | — | |

Total from distributions | | | (0.80 | ) | | | (0.74 | ) | | | (0.97 | ) | | | (0.01 | ) |

| | | | | | | | | | | | | | | | | |

Net asset value, end of period | | $ | 24.86 | | | $ | 24.38 | | | $ | 25.97 | | | $ | 25.47 | |

| | | | | | | | | | | | | | | | | |

Total Return(b) | | | 5.49 | % | | | (3.23 | )% | | | 5.94 | % | | | 1.94 | %(c) |

| | | | | | | | | | | | | | | | | |

Ratios/Supplemental Data: | | | | | | | | | | | | | | | | |

Net assets, end of period (000 omitted) | | $ | 62,101 | | | $ | 59,728 | | | $ | 60,294 | | | $ | 50,621 | |

Ratio of net expenses to average net assets | | | 1.40 | % | | | 1.41 | % | | | 1.44 | % | | | 1.56 | %(d) |

Ratio of net investment income to average net assets | | | 2.02 | % | | | 0.90 | % | | | 1.55 | % | | | 0.49 | %(d) |

Portfolio turnover rate | | | 73 | % | | | 121 | % | | | 163 | % | | | 113 | %(c) |

| | | | | | | | | | | | | | | | | |

(a) | For the period December 21, 2016 (commencement of operations) to August 31, 2017. |

(b) | Total return in the above table represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of distributions. |

12 | See accompanying notes which are an integral part of these financial statements. | |

Hedeker Strategic Appreciation Fund

Notes to the Financial Statements

August 31, 2020

NOTE 1. ORGANIZATION

The Hedeker Strategic Appreciation Fund (the “Fund”) was organized as a non-diversified series of Capitol Series Trust (the “Trust”) on December 15, 2016. The Fund subsequently became and now operates as a diversified series of the Trust. The Trust is an open-end investment company established under the laws of Ohio by an Agreement and Declaration of Trust dated September 18, 2013 (the “Trust Agreement”). The Trust Agreement permits the Board of Trustees of the Trust (the “Board”) to issue an unlimited number of shares of beneficial interest of separate series without par value. The Fund is one of a series of funds currently authorized by the Board. The Fund’s investment adviser is Hedeker Wealth LLC (the “Adviser”). The investment objective of the Fund is to seek superior risk-adjusted returns over a market cycle.

The Fund currently offers one class of shares, Institutional Shares. The Fund commenced operations on December 21, 2016. Each share represents an equal proportionate interest in the assets and liabilities belonging to the Fund and is entitled to such dividends and distributions out of income belonging to the Fund as are declared by the Board.

NOTE 2. SIGNIFICANT ACCOUNTING POLICIES

The Fund is an investment company and follows accounting and reporting guidance under Financial Accounting Standards Board Accounting Standards Codification (“ASC”) Topic 946, “Financial Services-Investment Companies.” The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements. These policies are in conformity with generally accepted accounting principles in the United States of America (“GAAP”).

Estimates – The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

Foreign Currency Translation – The accounting records of the Fund are maintained in U.S. dollars. Foreign currency amounts are translated into U.S. dollars at the current rate of exchange each business day to determine the value of investments, and other assets and liabilities. Purchases and sales of foreign securities, and income and expenses, are translated at the prevailing rate of exchange on the respective date of these transactions. The Fund does not isolate that portion of the results of operations resulting from changes in foreign exchange rates on investments from fluctuation arising from changes in market prices of securities held. These fluctuations are included with the unrealized gain or loss from investments.

Federal Income Taxes – The Fund makes no provision for federal income or excise tax. The Fund has qualified and intends to qualify each year as a regulated investment company (“RIC”) under subchapter M of the Internal Revenue Code of 1986, as amended, by complying with the requirements applicable to RICs and by distributing substantially all of its taxable income. The Fund also intends to distribute sufficient net investment income and net realized capital gains, if any, so that it will not be subject to excise tax on undistributed income and gains. If the required amount of net investment income or gains is not distributed, the Fund could incur a tax expense.

13

Hedeker Strategic Appreciation Fund

Notes to the Financial Statements (continued)

August 31, 2020

The Fund may be subject to taxes imposed by countries in which it invests. Such taxes are generally based on income and/or capital gains earned or repatriated. Taxes are accrued and applied to net investment income, net realized gains and unrealized appreciation as such income and/or gains are earned.

The Fund recognizes tax benefits or expenses of uncertain tax positions only when the position is “more likely than not” to be sustained assuming examination by tax authorities. Management of the Fund has reviewed tax positions taken in tax years that remain subject to examination by all major tax jurisdictions, including federal (i.e., the previous three tax year ends and the interim tax period since then, as applicable) and has concluded that no provision for unrecognized tax benefits or expenses is required in these financial statements and does not expect this to change over the next twelve months. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the Statement of Operations. During the period, the Fund did not incur any interest or penalties.

Expenses – Expenses incurred by the Trust that do not relate to a specific fund of the Trust are allocated to the individual funds based on each fund’s relative net assets or another appropriate basis (as determined by the Board).

Security Transactions and Related Income – Throughout the reporting period, security transactions are accounted for no later than one business day following the trade date. For financial reporting purposes, security transactions are accounted for on trade date on the last business day of the reporting period. The specific identification method is used for determining gains or losses for financial statements and income tax purposes. Dividend income is recorded on the ex-dividend date. Interest income is recorded on an accrual basis and includes, where applicable, the amortization of premium or accretion of discount. Discounts and premiums on fixed income securities are accreted or amortized over the life of the respective securities using the effective interest method. Withholding taxes on foreign dividends, if any, have been recorded for in accordance with the Fund’s understanding of the applicable country’s tax rules and rates.

Dividends and Distributions – The Fund intends to distribute its net investment income and net realized long-term and short-term capital gains, if any, at least annually. Dividends and distributions to shareholders, which are determined in accordance with income tax regulations, are recorded on the ex-dividend date. The treatment for financial reporting purposes of distributions made to shareholders during the period from net investment income or net realized capital gains may differ from their ultimate treatment for federal income tax purposes. These differences are caused primarily by differences in the timing of the recognition of certain components of income, expense or realized capital gain for federal income tax purposes. Where such differences are permanent in nature, they are reclassified among the components of net assets based on their ultimate characterization for federal income tax purposes. Any such reclassifications will have no effect on net assets, results of operations or net asset value (“NAV”) per share of the Fund.

14

Hedeker Strategic Appreciation Fund

Notes to the Financial Statements (continued)

August 31, 2020

For the fiscal year ended August 31, 2020, the Fund made the following reclassifications to increase (decrease) the components of net assets:

| Paid-In Capital | Accumulated Earnings (Deficit) |

| $(517) | $517 |

Restricted and Illiquid Securities – Restricted securities are any securities which are subject to restriction on resale under federal securities law, including commercial paper issued in reliance on the exemption from registration afforded by Section 4(2) of Rule 144A under the Securities Act of 1933 (“1933 Act”) and loan participations. Illiquid securities are those that may not reasonably be expected to be sold or disposed of in current market conditions in seven calendar days or less without the conversion to cash significantly changing the market value of the investment. The Fund will not invest greater than 15% of its net assets in illiquid securities. As of August 31, 2020, the Fund held illiquid securities representing 0.56% of net assets.

NOTE 3. SECURITIES VALUATION AND FAIR VALUE MEASUREMENTS

Fair value is defined as the price that the Fund would receive upon selling an investment in a timely transaction to an independent buyer in the principal or most advantageous market of the investment. GAAP establishes a three-tier hierarchy to maximize the use of observable market data and minimize the use of unobservable inputs and to establish classification of fair value measurements for disclosure purposes.

Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk (the risk inherent in a particular valuation technique used to measure fair value including a pricing model and/or the risk inherent in the inputs to the valuation technique). Inputs may be observable or unobservable. Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability developed based on market data obtained and available from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability developed based on the best information available in the circumstances.

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below.

| | ● | Level 1 – unadjusted quoted prices in active markets for identical investments and/or registered investment companies where the value per share is determined and published and is the basis for current transactions for identical assets or liabilities at the valuation date |

| | ● | Level 2 – other significant observable inputs (including, but not limited to, quoted prices for an identical security in an inactive market, quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.) |

| | ● | Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining fair value of investments based on the best information available) |

15

Hedeker Strategic Appreciation Fund

Notes to the Financial Statements (continued)

August 31, 2020

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy which is reported, is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

In computing the NAV of the Fund, fair value is based on market valuations with respect to portfolio securities for which market quotations are readily available. Pursuant to Board approved policies, the Fund relies on independent third-party pricing services to provide the current market value of securities. Those pricing services value equity securities, including exchange-traded funds, exchange-traded notes, closed-end funds and preferred stocks, traded on a securities exchange at the last reported sales price on the principal exchange. Equity securities quoted by NASDAQ are valued at the NASDAQ Official Closing Price. If there is no reported sale on the principal exchange, equity securities are valued at the mean between the most recent quoted bid and asked price. When using the market quotations or close prices provided by the pricing service and when the market is considered active, the security will be classified as a Level 1 security. Investments in open-end mutual funds, including money market mutual funds, are generally priced at the ending NAV provided by the pricing service of the funds and are generally categorized as Level 1 securities. Debt securities are valued using evaluated prices furnished by a pricing vendor selected by the Board and are generally classified as Level 2 securities.

In the event that market quotations are not readily available, the Adviser determines that the market quotation or the price provided by the pricing service does not accurately reflect the current fair value, or certain restricted or illiquid securities are being valued, such securities are valued as determined in good faith by the Trust’s Valuation Committee, based on recommendations from a pricing committee comprised of certain officers of the Trust, certain employees of the Fund’s administrator, and representatives of the Adviser (together the “Pricing Review Committee”). These securities will be classified as Level 2 or 3 within the fair value hierarchy, depending on the inputs used.

In accordance with the Trust’s Portfolio Valuation Procedures, the Pricing Review Committee, in making its recommendations with the Adviser’s participation, is required to consider all appropriate factors relevant to the value of securities for which it has determined other pricing sources are not available or reliable as described above. No single standard exists for determining fair value, because fair value depends upon the circumstances of each individual case. As a general principle, the current fair value of an issue of securities being valued pursuant to the Trust’s Fair Value Guidelines would be the amount which the Fund might reasonably expect to receive for them upon their current sale. Methods which are in accordance with this principle may, for example, be based on (i) a multiple of earnings; (ii) a discount from market prices of a similar freely traded security (including a derivative security or a basket of securities traded on other markets, exchanges or among dealers); or (iii) yield to maturity with respect to debt issues, or a combination of these and other methods. Fair value pricing is permitted if, in accordance with the Trust’s Portfolio Valuation Procedures, the validity of market quotations appears to be questionable based on factors such as evidence of a thin market in the security based on a small number of quotations, a significant event occurs after the close of a market but before the Fund’s NAV calculation that may affect a security’s value, or other data calls into question the reliability of market quotations.

The following is a summary of the inputs used to value the Fund’s investments as of August 31, 2020:

16

Hedeker Strategic Appreciation Fund

Notes to the Financial Statements (continued)

August 31, 2020

| | | Valuation Inputs | | | | | |

Assets | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

Convertible Corporate Bonds(a) | | $ | — | | | $ | 46,507,866 | | | $ | — | | | $ | 46,507,866 | |

Convertible Preferred Stocks(a) | | | 5,844,160 | | | | 1,496,030 | | | | — | | | | 7,340,190 | |

Money Market Funds | | | 8,143,574 | | | | — | | | | — | | | | 8,143,574 | |

Total | | $ | 13,987,734 | | | $ | 48,003,896 | | | $ | — | | | $ | 61,991,630 | |

(a) | Refer to Schedule of Investments for sector classifications. |

The Fund did not hold any investments at the end of the reporting period for which significant unobservable inputs (Level 3) were used in determining fair value; therefore, no reconciliation of Level 3 securities is included for this reporting period. The Fund did not hold any derivative instruments during the reporting period.

NOTE 4. FEES AND OTHER TRANSACTIONS WITH AFFILIATES AND OTHER SERVICE PROVIDERS

Under the terms of the investment advisory agreement (the “Agreement”), the Adviser manages the Fund’s investments subject to approval of the Board. As compensation for its management services, the Fund is obligated to pay the Adviser a fee computed and accrued daily and paid monthly at an annual rate of 1.00% of the Fund’s average daily net assets. For the fiscal year ended August 31, 2020, the Adviser earned fees of $608,670 from the Fund. At August 31, 2020, the Fund owed the Adviser $51,919.

The Adviser has contractually agreed to waive its management fee and/or reimburse expenses so that total annual operating expenses (excluding (i) interest; (ii) taxes; (iii) brokerage fees and commissions; (iv) other extraordinary expenses not incurred in the ordinary course of the Fund’s business; (v) dividend expenses on short sales; and (vi) indirect expenses such as acquired fund fees and expenses) and expenses) do not exceed 1.75% of the Fund’s Institutional Shares average daily net assets through December 31, 2020 (“Expense Limitation”). The Adviser is not expected to extend the Expense Limitation Agreement past December 31, 2020. During any fiscal year that the Agreement between the Adviser and the Trust is in effect, the Adviser may recoup the sum of all fees previously waived or expenses reimbursed, less any reimbursement previously paid, provided that the Adviser is only permitted to recoup fees or expenses within 36 months from the date the fee waiver or expense reimbursement took effect and provided further that such recoupment can be achieved within the Expense Limitation currently in effect and the Expense Limitation in place when the waiver/reimbursement occurred. This Expense Limitation may not be terminated by the Adviser prior to its expiration date, but the Board may terminate such agreement at any time. The Expense Limitation terminates automatically upon the termination of the Agreement with the Adviser. For the fiscal year ended August 31, 2020, the Adviser did not waive any fees in the Fund.

The Trust retains Ultimus Fund Solutions, LLC (the “Administrator”) to provide the Fund with administration, compliance, fund accounting and transfer agent services, including all regulatory reporting. For the fiscal year ended August 31, 2020, the Administrator earned fees of $61,014 for

17

Hedeker Strategic Appreciation Fund

Notes to the Financial Statements (continued)

August 31, 2020

administration services, $6,000 for compliance services, $38,501 for fund accounting services, and $12,000 for transfer agent services. At August 31, 2020, the Fund owed the Administrator $9,828 for such services.

The Board supervises the business activities of the Trust. Each Trustee serves as a Trustee for the lifetime of the Trust or until the earlier of his or her retirement as a Trustee at age 78 (which may be extended for up to two years in an emeritus non-voting capacity at the pleasure and request of the Board), or until he/she dies, resigns, or is removed, whichever is sooner. “Independent Trustees,” meaning those Trustees who are not “interested persons” of the Trust, as defined in the Investment Company Act of 1940 (“1940 Act”), as amended, has received an annual retainer of $500 per Fund and $500 per Fund for each quarterly in-person Board meeting. Effective January 1, 2020, the annual retainer increased to $1,000 per Fund. In addition, each Independent Trustee may be compensated for preparation related to and participation in any special meetings of the Board and/or any Committee of the Board, with such compensation determined on a case-by-case basis based on the length and complexity of the meeting. The Trust also reimburses Trustees for out-of-pocket expense incurred in conjunction with attendance at Board meetings.

The officers and one trustee of the Trust are employees of the Administrator. Ultimus Fund Distributors, LLC (the “Distributor”) acts as the principal distributor of the Fund’s shares. The Distributor is a wholly-owned subsidiary of the Administrator.

NOTE 5. PURCHASES AND SALES OF SECURITIES

For the fiscal year ended August 31, 2020, purchases and sales of investment securities, other than short-term investments, were $40,333,014 and $38,877,376, respectively.

There were no purchases or sales of long-term U.S. government obligations during the fiscal year ended August 31, 2020.

NOTE 6. FEDERAL TAX INFORMATION

At August 31, 2020, the net unrealized appreciation (depreciation) and tax cost of investments for tax purposes was as follows:

Gross unrealized appreciation | | $ | 2,663,023 | |

Gross unrealized depreciation | | | (604,443 | ) |

Net unrealized appreciation/(depreciation) on investments | | $ | 2,058,580 | |

Tax cost of investments | | $ | 59,933,050 | |

The tax character of distributions paid for the fiscal years ended August 31, 2020 and August 31, 2019 were as follows:

| | | 2020 | | | 2019 | |

Distributions paid from: | | | | | | | | |

Ordinary income(a) | | $ | 2,031,689 | | | $ | 1,776,026 | |

Total distributions paid | | $ | 2,031,689 | | | $ | 1,776,026 | |

18

Hedeker Strategic Appreciation Fund

Notes to the Financial Statements (continued)

August 31, 2020

(a) | Short-term capital gain distributions are treated as ordinary income for tax purposes. |

At August 31, 2020, the components of accumulated earnings (deficit) on a tax basis were as follows:

Undistributed ordinary income | | $ | 632,839 | |

Accumulated capital and other losses | | | (3,708,011 | ) |

Unrealized appreciation on investments(a) | | | 2,058,580 | |

Total accumulated deficit | | $ | (1,016,592 | ) |

(a) | The difference between book basis and tax basis unrealized appreciation (depreciation) is primarily attributable to interest accruals on complex securities and deemed dividends from convertible bonds. |

As of August 31, 2020, the Fund had available for tax purposes unused capital loss carryforwards of $3,708,011 long-term capital losses with no expiration, which is available to offset against future taxable net capital gains. To the extent that these carryforwards are used to offset future gains, it is probable that the amount offset will not be distributed to shareholders.

NOTE 7. LINE OF CREDIT

During the prior fiscal year ended August 31, 2019, the Trust, on behalf of the Fund, entered into in a short-term credit agreement (“Line of Credit”) with Huntington National Bank (“Huntington”), expiring on March 15, 2020. Under the terms of the agreement, the Fund could borrow up to the lesser of 30% of the Fund’s daily market value or $10 million at an interest rate equal to the London Interbank Offered Rate (“LIBOR”) plus 137.50 basis points. Effective August 12, 2019, the Line of Credit was closed and any remaining fees related to the Line of Credit were expensed in the fiscal year ended August 31, 2020.

NOTE 8. SECTOR RISK

If the Fund has significant investments in the securities of issuers within a particular sector, any development affecting that sector will have a greater impact on the value of the net assets of the Fund than would be the case if the Fund did not have significant investments in that sector. In addition, this may increase the risk of loss in the Fund and increase the volatility of the Fund’s NAV per share. For instance, economic or market factors, regulatory changes or other developments may negatively impact all companies in a particular sector, and therefore the value of the Fund’s portfolio will be adversely affected. As of August 31, 2020, the Fund had 25.28% of the value of its net assets invested in stocks within the Health Care sector.

NOTE 9. COMMITMENTS AND CONTINGENCIES

The Trust indemnifies its officers and Trustees for certain liabilities that may arise from their performance of their duties to the Trust or the Fund. Additionally, in the normal course of business, the Trust enters into contracts that contain a variety of representations and warranties which provide general indemnifications. The Trust’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Trust that have not yet occurred.

19

Hedeker Strategic Appreciation Fund

Notes to the Financial Statements (continued)

August 31, 2020

NOTE 10. SUBSEQUENT EVENTS

Management of the Fund has evaluated the need for disclosures and/or adjustments resulting from subsequent events through the date at which these financial statements were issued. Based upon this evaluation, management has determined there were no items requiring adjustment of the financial statements or additional disclosure, other than the item below.

On October 22, 2020, the Board approved the liquidation of the Fund as being in the best interest of the Fund and its shareholders. It is anticipated that all outstanding shares of the Fund will be redeemed and will discontinue all operations on or about December 9, 2020. Shares of the Fund are no longer available for purchase as of the close of business on October 27, 2020.

NOTE 11. LIQUIDITY RISK MANAGEMENT PROGRAM (Unaudited)

The Fund has adopted and implemented a written liquidity risk management program (the “Program”) as required by Rule 22e-4 (the “Liquidity Rule”) under the 1940 Act. The Program is reasonably designed to assess and manage the Fund’s liquidity risk, taking into consideration, among other factors, the Fund’s investment strategy and the liquidity of its portfolio investments during normal and reasonably foreseeable stressed conditions; its short and long-term cash flow projections; and its cash holdings and access to other funding sources. The Board approved the appointment of the Liquidity Administrator Committee, comprising certain Trust officers and employees of the Adviser. The Liquidity Administrator Committee maintains Program oversight and reports to the Board on at least an annual basis regarding the Program’s operational effectiveness through a written report (the “Report”). The Program’s initial Report, which was presented to the Board for consideration at its meeting held on September 8, 2020, outlined the operation of the Program and the adequacy and effectiveness of the Program’s implementation. During the review period, the Fund did not experience unusual stress or disruption to its operations related to purchase and redemption activity. Also, during the review period the Fund held adequate levels of cash and highly liquid investments to meet shareholder redemption activities in accordance with applicable requirements. The Report concluded that the Program is reasonably designed to prevent violation of the Liquidity Rule and has been effectively implemented.

20

Report of Independent Registered Public Accounting Firm

To the Shareholders and the Board of Trustees of Hedeker Strategic Appreciation Fund

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities of Hedeker Strategic Appreciation Fund (the “Fund”) (one of the funds constituting Capitol Series Trust (the “Trust”)), including the schedule of investments, as of August 31, 2020, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, the financial highlights for each of the three years in the period then ended and the period from December 21, 2016 (commencement of operations) through August 31, 2017 and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund (one of the funds constituting Capitol Series Trust) at August 31, 2020, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended and its financial highlights for each of the three years in the period then ended and the period from December 21, 2016 (commencement of operations) through August 31, 2017, in conformity with U.S. generally accepted accounting principles.

Basis for Opinion

These financial statements are the responsibility of the Trust’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Trust in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Trust is not required to have, nor were we engaged to perform, an audit of Trust’s internal control over financial reporting. As part of our audits we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Trust’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of August 31, 2020, by correspondence with the custodian and brokers. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

We have served as the auditor of one or more Capitol Series Trust investment companies since 2017.

Cincinnati, Ohio

October 27, 2020

21

Summary of Fund Expenses (Unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction and (2) ongoing costs, including management fees and other Fund expenses. These examples are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from March 1, 2020 through August 31, 2020.

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs. Therefore, the second line of the table below is useful in comparing ongoing costs only and will not help you determine the relative costs of owning different funds. In addition, if transaction costs were included, your costs would have been higher.

| | Beginning

Account

Value

March 1,

2020 | Ending

Account

Value

August 31,

2020 | Expenses

Paid

During

Period(a) | Annualized

Expense

Ratio |

Hedeker Strategic Appreciation Fund |

Institutional Shares | Actual | $ 1,000.00 | $ 1,048.90 | $ 7.11 | 1.38% |

| | | | | | |

| | Hypothetical(b) | $ 1,000.00 | $ 1,018.20 | $ 7.00 | 1.38% |

(a) | Expenses are equal to the Fund’s annualized expense ratios, multiplied by the average account value over the period, multiplied by 184/366 (to reflect the one-half year period). |

(b) | Hypothetical assumes a 5% return before expenses. |

22

Additional Federal Income Tax Information (Unaudited)

The Form 1099-DIV you receive in January 2021 will show the tax status of all distributions paid to your account in calendar year 2020. Shareholders are advised to consult their own tax adviser with respect to the tax consequences of their investment in the Fund. As required by the Internal Revenue Code and/or regulations, shareholders must be notified regarding the status of qualified dividend income for individuals and the dividends received deduction for corporations.

Qualified Dividend Income. The Fund designates approximately 13% or up to the maximum amount of such dividends allowable pursuant to the Internal Revenue Code, as qualified dividend income eligible for a reduced tax rate.

Qualified Business Income. The Fund designates approximately 0% of its ordinary income dividends, or up to the maximum amount of such dividends allowable pursuant to the Internal Revenue Code, as qualified business income.

Dividends Received Deduction. Corporate shareholders are generally entitled to take the dividends received deduction on the portion of the Fund’s dividend distribution that qualifies under tax law. For the Fund’s calendar year 2020 ordinary income dividends, 13% qualifies for the corporate dividends received deduction.

23

Trustees and Officers (Unaudited)

The Board supervises the business activities of the Trust and is responsible for protecting the interests of shareholders. The Chairman of the Board is Walter B. Grimm, who is an Independent Trustee of the Trust.

Each Trustee serves as a Trustee for the lifetime of the Trust or until the earlier of his or her retirement as a Trustee at age 78, death, resignation or removal. Officers are re-elected annually by the Board. The address of each Trustee and officer is 225 Pictoria Drive, Suite 450, Cincinnati, Ohio 45246.

As of the date of this report, the Trustees oversee the operations of 14 series.

Interested Trustee Background. The following table provides information regarding the Interested Trustee.

Name, (Age), Position with Trust,

Term of Position with Trust | Principal Occupation During Past 5 Years and Other Directorships |

Robert G. Dorsey* Birth Year: 1957

TRUSTEE

Began Serving: March 2017 | Principal Occupation(s): Vice Chairman of Ultimus Fund Solutions, LLC and its subsidiaries, except as otherwise noted for the FINRA-regulated broker-dealer entities (February 2019 to present); Interested Trustee of Ultimus Managers Trust (February 2012 to present). Previous Position(s): Managing Director and Co-Chief Executive Officer of Ultimus Fund Solutions, LLC (1999 to February 2019); President of Ultimus Fund Distributors, LLC (1999 to 2018); President of Ultimus Managers Trust (February 2012 to October 2013). |

* | Mr. Dorsey is considered an “interested person” of the Trust within the meaning of Section 2(a)(19) of the 1940 Act because of his relationship with the Trust’s administrator, transfer agent, and distributors. |

Independent Trustee Background. The following table provides information regarding the Independent Trustees.

Name, (Age), Position with Trust,

Term of Position with Trust | Principal Occupation During Past 5 Years

and Other Directorships |

John C. Davis Birth Year: 1952 TRUSTEE Began Serving: July 2018 | Previous Position(s): Retired Partner of PricewaterhouseCoopers LLP (1974-2010); Consultant, Board of Trustees of Ultimus Managers Trust (2016 to 2019) and Former Trustee of Ultimus Managers Trust (2012 to 2016). |

24

Trustees and Officers (Unaudited) (continued)

Name, (Age), Position with Trust,

Term of Position with Trust | Principal Occupation During Past 5 Years

and Other Directorships |

Walter B. Grimm Birth Year: 1945 TRUSTEE AND CHAIR Began Serving: November 2013 | Principal Occupations(s): President, Leigh Management Group, LLC (consulting firm) (October 2005 to present); and President, Leigh Investments, Inc. (1988 to present). |

Lori Kaiser Birth Year: 1963 TRUSTEE Began Serving: July 2018 | Principal Occupations(s): Founder and CEO, Kaiser Consulting since 1992. |

Janet Smith Meeks Birth Year: 1955 TRUSTEE Began Serving: July 2018 | Principal Occupations(s): Co-Founder and CEO, Healthcare Alignment Advisors, LLC (consulting company) since August 2015. Previous Position(s): President and Chief Operating Officer, Mount Carmel St. Ann’s Hospital (2006 to 2015). |

Mary M. Morrow Birth Year: 1958 TRUSTEE Began Serving: November 2013 | Principal Occupations(s): Chief Operating Officer, Dignity Health Managed Services Organization (October 2018 to present). Previous Position(s): Consultant (managed care services) (April 2018 to September 2018); Chief Operating Officer, Pennsylvania Health and Wellness (fully owned subsidiary of Centene Corporation) (November 2016 to April 2018); Vice President, Strategic Initiatives, Gateway Heath (January 2015 to November 2016); Consulting Practice Manager, DST Health Solutions (August 2010 to January 2015). |

25

Trustees and Officers (Unaudited) (continued)

Officers. The following table provides information regarding the Officers.

Name, (Age), Position with Trust,

Term of Position with Trust | Principal Occupation During Past 5 Years

and Other Directorships |

Matthew J. Miller Birth Year: 1976 PRESIDENT and CHIEF EXECUTIVE OFFICER Began Serving: September 2013 (as VP); September 2018 (as President) | Principal Occupation(s): Assistant Vice President, Relationship Management, Ultimus Fund Solutions, LLC (December 2015 to present); Vice President, Valued Advisers Trust (December 2011 to present). Previous Position(s): Vice President, Relationship Management, Huntington Asset Services, Inc. (n/k/a Ultimus Asset Services, LLC) (2008 to December 2015). |

Zachary P. Richmond Birth Year: 1980 TREASURER AND CHIEF FINANCIAL OFFICER Began Serving: August 2014 | Principal Occupation(s): Vice President, Director of Financial Administration for Ultimus Fund Solutions, LLC (February 2019 to present). Previous Position(s): Assistant Vice President, Associate Director of Financial Administration for Ultimus Fund Solutions, LLC (December 2015 to February 2019); Manager, Fund Administration, Huntington Asset Services, Inc. (January 2011 to December 2015). |

Martin R. Dean Birth Year: 1963 CHIEF COMPLIANCE OFFICER Began Serving: May 2019 | Principal Occupation(s): Senior Vice President, Head of Fund Compliance, Ultimus Fund Solutions, LLC (since January 2016), Chief Compliance Officer, First Western Funds Trust (since April 2016); Chief Compliance Officer, Cross Shore Discovery Fund (since June 2016);Chief Compliance Officer, FSI Low Beta Absolute Return Fund (since November 2016); Chief Compliance Officer, Peachtree Alternative Strategies Fund (since January 2017); and Chief Compliance Officer, Dupree Mutual Funds (since August 2017). Previous Position(s): Interim Chief Compliance Officer, Valued Advisers Trust (May 2019 to March 2020); Chief Compliance Officer, Fenimore Asset Management Trust (May 2019 to February 2020); and Senior Vice President and Compliance Group Manager, Huntington Asset Services, Inc. (July 2013 to December 2015). |

26

Trustees and Officers (Unaudited) (continued)

Name, (Age), Position with Trust,

Term of Position with Trust | Principal Occupation During Past 5 Years and Other Directorships |

Matthew J. Beck Birth Year: 1988 SECRETARY Began Serving: September 2018 | Principal Occupation(s): Senior Attorney, Ultimus Fund Solutions, LLC (since May 2018) and Secretary, Ultimus Managers Trust (since July 2018). Previous Position(s): Chief Compliance Officer, OBP Capital, LLC (May 2015 to May 2018); Secretary, Aspiration Funds (March 2015 to May 2018); Secretary, Starboard Investment Trust (September 2014 to May 2018); Secretary, Leeward Investment Trust (September 2014 to May 2018); Secretary, Hillman Capital Management Investment Trust (September 2014 to May 2018); Secretary, Spinnaker ETF Series (September 2014 to May 2018); Vice President and General Counsel, The Nottingham Company (July 2014 to May 2018). |

27

FACTS | WHAT DOES HEDEKER STRATEGIC APPRECIATION FUND (THE “FUND”) DO WITH YOUR PERSONAL INFORMATION? |

| | |

Why? | Financial companies choose how they share your personal information. Federal law gives consumers the right to limit some but not all sharing. Federal law also requires us to tell you how we collect, share, and protect your personal information. Please read this notice carefully to understand what we do. |

| | |

What? | The types of personal information we collect and share depend on the product or service you have with us. This information can include: ■ Social Security number ■ account balances and account transactions ■ transaction or loss history and purchase history ■ checking account information and wire transfer instructions When you are no longer our customer, we continue to share your information as described in this notice. |

| | |

How? | All financial companies need to share customers’ personal information to run their everyday business. In the section below, we list the reasons financial companies can share their customers’ personal information; the reasons the Fund chooses to share; and whether you can limit this sharing. |

| | |

Reasons we can share your personal information | Does the Fund share? |

For our everyday business purposes—

such as to process your transactions, maintain your account(s), respond to court orders and legal investigations, or report to credit bureaus | Yes |

For our marketing purposes—

to offer our products and services to you | No |

For joint marketing with other financial companies | No |

For our affiliates’ everyday business purposes—

information about your transactions and experiences | No |

For our affiliates’ everyday business purposes—

information about your creditworthiness | No |

For nonaffiliates to market to you | No |

| | |

Questions? | Call (800) 657-4450 |

28

Who we are |

Who is providing this notice? | Hedeker Strategic Appreciation Fund

Ultimus Fund Distributors, LLC (Distributor)

Ultimus Fund Solutions, LLC (Administrator) |

What we do |

How does the Fund protect my personal information? | To protect your personal information from unauthorized access and use, we use security measures that comply with federal law. These measures include computer safeguards and secured files and buildings. Our service providers are held accountable for adhering to strict policies and procedures to prevent any misuse of your nonpublic personal information. |

How does the Fund collect my personal information? | We collect your personal information, for example, when you ■ open an account or deposit money ■ buy securities from us or sell securities to us ■ make deposits or withdrawals from your account or provide account information ■ give us your account information ■ make a wire transfer ■ tell us who receives the money ■ tell us where to send the money ■ show your government-issued ID ■ show your driver’s license |

Why can’t I limit all sharing? | Federal law gives you the right to limit only ■ sharing for affiliates’ everyday business purposes — information about your creditworthiness ■ affiliates from using your information to market to you ■ sharing for nonaffiliates to market to you State laws and individual companies may give you additional rights to limit sharing. |

Definitions |

Affiliates | Companies related by common ownership or control. They can be financial and nonfinancial companies. ■ Hedeker Wealth LLC, the investment adviser to the Fund, could be deemed to be an affiliate. |

Nonaffiliates | Companies not related by common ownership or control. They can be financial and nonfinancial companies. ■ The Fund does not share your personal information with nonaffiliates so they can market to you |

Joint marketing | A formal agreement between nonaffiliated financial companies that together market financial products or services to you. ■ The Fund doesn’t jointly market. |

29

OTHER INFORMATION

The Fund’s Statement of Additional Information (“SAI”) includes additional information about the trustees and is available without charge, upon request. You may call toll-free at (800) 657-4450 to request a copy of the SAI or to make shareholder inquiries.

PROXY VOTING

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities and information regarding how the Fund voted those proxies during the most recent twelve month period ended June 30, are available (1) without charge upon request by calling the Fund at (800) 657-4450 and (2) in Fund documents filed with the Securities and Exchange Commission (“SEC”) on the SEC’s website at www.sec.gov.

TRUSTEES Walter B. Grimm, Chairman John C. Davis Robert G. Dorsey Lori Kaiser Janet Smith Meeks Mary M. Morrow OFFICERS Matthew J. Miller, Chief Executive Officer and President Zachary P. Richmond, Chief Financial Officer and Treasurer Martin R. Dean, Chief Compliance Officer Matthew J. Beck, Secretary INVESTMENT ADVISER Hedeker Wealth LLC One Overlook Point, Suite 610 Lincolnshire, IL 60069 DISTRIBUTOR Ultimus Fund Distributors, LLC 225 Pictoria Drive, Suite 450 Cincinnati, OH 45246 | INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM Ernst & Young LLP 221 East 4th Street, Suite 2900 Cincinnati, OH 45202 LEGAL COUNSEL Bernstein Shur 100 Middle Street, 6th Floor Portland, ME 04104 CUSTODIAN Huntington National Bank 41 South High Street Columbus, OH 43215 ADMINISTRATOR, TRANSFER AGENT AND FUND ACCOUNTANT Ultimus Fund Solutions, LLC 225 Pictoria Drive, Suite 450 Cincinnati, OH 45246 |

This report is intended only for the information of shareholders or those who have received the Fund’s prospectus which contains information about the Fund’s management fee and expenses. Please read the prospectus carefully before investing.

Distributed by Ultimus Fund Distributors, LLC

Member FINRA/SIPC

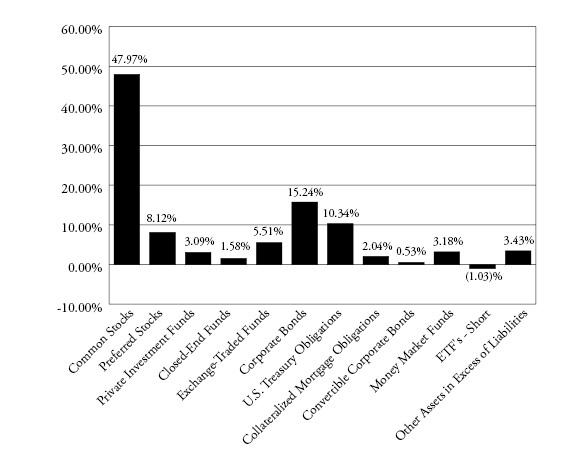

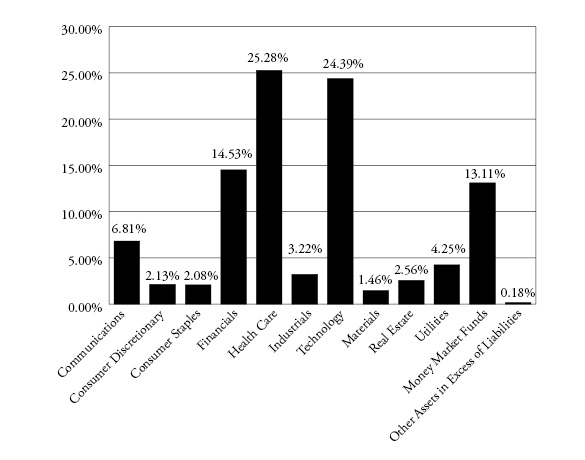

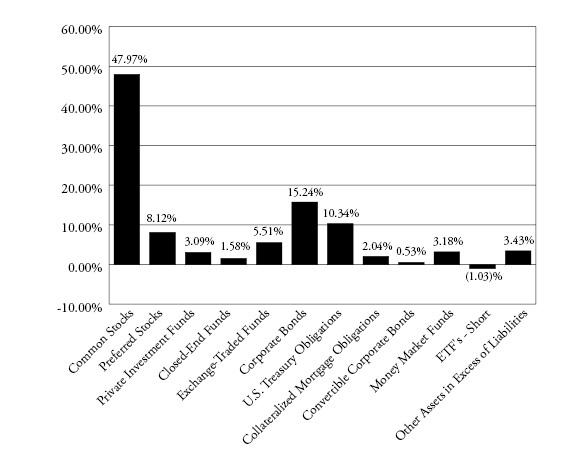

Preserver Alternative Opportunities Fund

Institutional Shares – PAOIX

Annual Report

August 31, 2020

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund’s shareholder reports like this one will no longer be sent by mail, unless you specifically request paper copies of the reports from the Fund or from your financial intermediary such as a broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically by contacting the Fund at (844) 838-2119 or, if you own these shares through a financial intermediary, you may contact your financial intermediary.

You may elect to receive all future reports in paper free of charge. You can inform the Fund that you wish to continue receiving paper copies of your shareholder reports by contacting the Fund at (844) 838-2119. If you own shares through a financial intermediary, you may contact your financial intermediary or follow instructions included with this document to elect to continue to receive paper copies of your shareholder reports. Your election to receive reports in paper will apply to all funds held with the fund complex or at your financial intermediary

Preserver Partners, LLC

425 Madison Avenue

Memphis, Tennessee 38103

(844) 838-2119 or (901) 755-4737

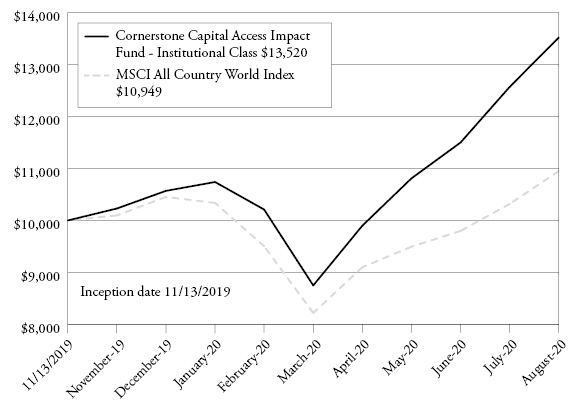

Dear Fellow Shareholders,

We are pleased to present the Annual Report for the Preserver Alternative Opportunities Fund (“Fund” or “PAOIX”). For the period September 1, 2019 through August 31, 2020, the Fund returned 11.46%. These returns outperformed the Fund’s primary benchmark, the Wilshire Liquid Alternative Index, which returned 1.25% during same period. For the three months ended August 31, 2020, PAOIX returned 9.44%. These returns exceeded Wilshire Liquid Alternative Index return of 4.04% for the three months ended August 31, 2020.