UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| Investment Company Act file number: 811-22895 |

Capitol Series Trust

(Exact name of registrant as specified in charter)

Ultimus Fund Solutions, LLC

225 Pictoria Drive, Suite 450

Cincinnati, OH 45246

(Address of principal executive offices) (Zip code)

Zachary P. Richmond

Ultimus Fund Solutions, LLC

225 Pictoria Drive, Suite 450

Cincinnati, OH 45246

(Name and address of agent for service)

| Registrant’s telephone number, including area code: | 513-587-3400 |

| Date of fiscal year end: | April 30 |

| Date of reporting period: | April 30, 2023 |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

| |

| |

| |

| |

| |

| |

| |

| |

| Canterbury Portfolio Thermostat Fund |

| |

| |

| |

| |

| |

| Institutional Shares – CAPTX |

| |

| |

| |

| Annual Report |

| |

| April 30, 2023 |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| Canterbury Investment Management, LLC |

| 23 East Cedar Street |

| Zionsville, IN 46077 |

| (844) 838-2121 |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| Canterbury Portfolio Thermostat Fund |

| Management’s Discussion of Fund Performance |

| (Unaudited) |

| April 30, 2023 |

| |

To begin this year’s discussion of the Canterbury Portfolio Thermostat Fund’s (the “Fund”) performance, we want to first discuss the state of the global markets. The calendar year 2022 was unquestionably a bear market, characterized by the high volatility of many global indexes, and markets generally forming a pattern of lower lows and lower highs. Global indexes saw large declines, followed by sharp rallies, before experiencing another sharp decline. Take the S&P 500 as an example (chart shown below). The market index, with heavy exposure to technology-related stocks, looked like a volatile rollercoaster in 2022. The S&P 500 Index (the “S&P 500”) experienced several sharp declines and short-lived, snapback rallies. At its lowest point, the S&P 500 was down -25% off its January peak.

Source: Canterbury Investment Management. Chart created using Optuma Technical Analysis Software

Now, it is important to understand that prudent portfolio diversification would typically involve more than just owning a few market indexes. Most “conservative” investors, for instance, would hold some combination of both stocks and bonds. The goal or intention of doing so would be to reduce the balanced portfolio’s level of volatility. The issue is that bonds were, and continue to be, in a bear market just as stocks were in 2022. In other words, bonds contributed to a balanced portfolio’s high volatility rather than reducing it. Twenty-year treasuries saw peak-to-trough declines of -35%. Shorter duration bonds, such as 7-10 year treasuries, saw declines of nearly -20%. In summary, the conservative, “diversified” investor saw two of their major asset classes moving in the same direction, at the same time.

| Canterbury Portfolio Thermostat Fund |

| Management’s Discussion of Fund Performance |

| (Unaudited) (continued) |

| April 30, 2023 |

| |

If we examine the Fund’s performance in the window of last year, the Fund took the necessary steps to adapt to the new, volatile bear market. The Fund’s primary aim is to limit portfolio volatility and fluctuations to the realm of normal noise. We define normal fluctuation as any singular day that falls within -1.50% to +1.50%. Typically, days beyond +/-1.50% (which we refer to as “outlier” days) will occur roughly thirteen times per year for the S&P 500 in a normal, low risk environment. In the bear market last year, the S&P 500 experienced seventy-five outlier days. A conservative blend of stocks and bonds would have seen about thirty outlier days. The Fund only experienced ten.

With both stocks and bonds experiencing a volatile decline, how did the Fund manage to reduce its volatility? Through the Fund’s adaptive process and methodology, the Fund rotated away from the most volatile sectors (primarily technology) and into less risky sectors (such as energy last year). In addition, the Fund employed the use of “inverse” securities, which move in the opposite direction of their underlying index. Rather than having a portfolio of securities moving in the same direction, the Fund held a combination of securities with low correlation to each other. This allowed the portfolio to maintain low and consistent volatility, and limit declines. The Fund’s performance for 2022 was down -11.8%, about half of the decline of the S&P 500.

Now, let’s transition to the first few months of 2023. While most of the global and domestic indexes began this year in a bear market, things have started to calm down. Part of this is due to the resurgence of technology-stocks, which were some of the worst performers in 2023. While the technology sector dragged indexes like the S&P 500 down in 2022, it has carried most of the index’s performance in 2023. This has led to declining volatility, and as it stands right now, a beginning to a return to a lower risk market environment. As a result, the Fund has rotated some positions into technology-oriented sectors.

Not all market sectors have been created equal, however. Many market sectors and industries remain in a volatile market state. Take real estate, financials, and small caps stocks as an example. Each of these sectors or indices have remained volatile throughout the first few months of 2023. For diversification purposes, and a means of lowering portfolio volatility, the Fund maintains positions in inverse real estate and inverse Russell 2000 (small cap stocks). The Fund will benefit if these market segments continue to struggle.

Over the course of the fiscal year ended April 30, 2023, the Fund has continued to adapt its holdings to accommodate the shifting global markets. One thing we have noticed is that global market strength favors international equities over domestic ones. Right now, the Fund has a larger-than-normal exposure to international equities. International equities

| Canterbury Portfolio Thermostat Fund |

| Management’s Discussion of Fund Performance |

| (Unaudited) (continued) |

| April 30, 2023 |

| |

have generally benefited from a struggling US dollar. The Fund’s exposure to international regions is primarily in large European stocks.

We are going to end with this note. Investing is a lifelong endeavor and requires a systematic process. It is not something you can look at through the lens of a window of time, such as January to December or April to April. Markets are variable, continuous, and ever-changing. An investment portfolio is not meant to be judged against a fixed index like the S&P 500 or MSCI World Index. Those indexes were built to measure market capitalization, and as everyone was reminded of last year, will experience volatile bear markets. The Fund is designed as an adaptive, total portfolio process. Its process involves rotating and shifting to different asset classes that are reflective of today’s market environment. As the market goes through both bull and bear markets, the Fund aims to maintain consistent portfolio volatility and fluctuation- regardless of the external market environment.

| Investment Results (Unaudited) |

| |

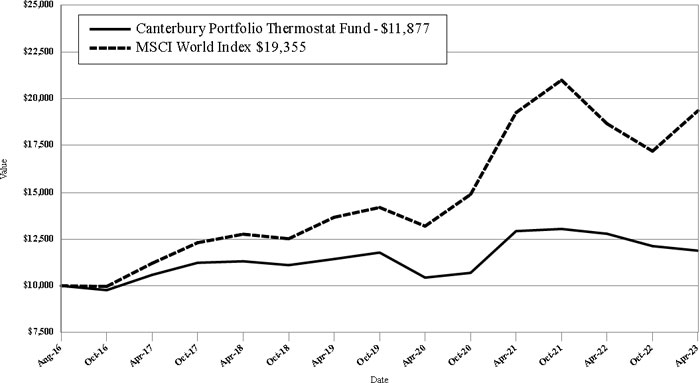

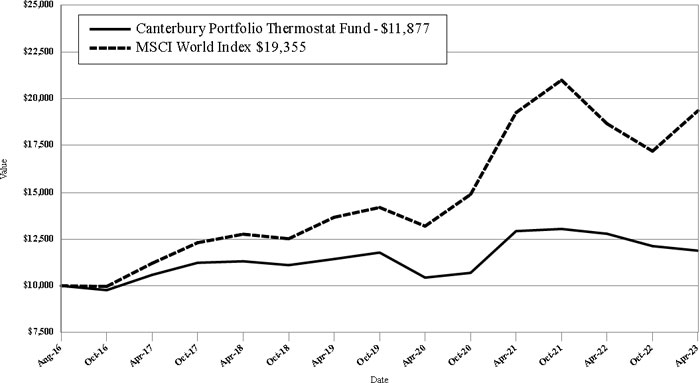

Average Annual Total Returns(a) as of April 30, 2023

| | | | | Since |

| | | | | Inception |

| | One Year | Three Year | Five Year | (8/2/16) |

| Canterbury Portfolio Thermostat Fund, Institutional Shares | (7.07)% | 4.40% | 0.98% | 2.58% |

| MSCI World Index(b) | 3.72% | 13.64% | 8.69% | 10.29% |

| | | | | |

| | | | Expense | |

| | | | Ratio(c) | |

| | | | Institutional | |

| | | | Shares | |

| | | | 2.40% | |

| | | | | |

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect deduction of taxes that a shareholder would pay on Canterbury Portfolio Thermostat Fund (the “Fund”) distributions or the redemption of Fund shares. Current performance of the Fund may be lower or higher than the performance quoted. The Fund’s investment objectives, risks, charges and expenses must be considered carefully before investing. Performance data current to the most recent month end may be obtained by calling (844) 838-2121.

| (a) | Return figures reflect any change in price per share and assume the reinvestment of all distributions. The Fund’s returns reflect any fee reductions during the applicable periods and exclude the redemption fee. If such fee reductions had not occurred, the quoted performance would have been lower. |

| (b) | The MSCI World Index is an unmanaged free float-adjusted market capitalization index that is designed to measure global developed market equity performance. Currently, the MSCI World Index consists of the following 23 developed market country indices: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, the United Kingdom and the United States. The performance of the index is expressed in terms of U.S. dollars, and does not reflect the deduction of fees or taxes with a mutual fund. Individuals cannot invest directly in an index; however, an individual can invest in exchange traded funds or other investment vehicles that attempt to track the performance of a benchmark index. |

| (c) | The expense ratio is from the Fund’s prospectus dated August 26, 2022. The Institutional Shares expense ratio does not correlate to the corresponding ratio of expenses to average net assets included in the financial highlights section of this report, which reflects the operating expenses of the Fund and does not include acquired fund fees and expenses. Additional information pertaining to the Fund’s expense ratios as of April 30, 2023, can be found in the financial highlights. |

Fund’s investment objectives, strategies, risks, charges and expenses must be considered carefully before investing. The prospectus contains this and other important information about the Fund and may be obtained by calling the same number as above. Please read it carefully before investing.

The Fund is distributed by Ultimus Fund Distributors, LLC, Member FINRA/SIPC.

| Investment Results (Unaudited) (continued) |

| |

Comparison of the Growth of a $10,000 Investment in the Canterbury Portfolio Thermostat Fund Institutional Shares and the MSCI World Index.

The chart above assumes an initial investment of $10,000 made on August 2, 2016 (commencement of operations) and held through April 30, 2023. THE FUND’S RETURN REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE FUTURE RESULTS. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment returns and principal values will fluctuate so that your shares, when redeemed, may be worth more or less than their original purchase price.

Current performance may be lower or higher than the performance data quoted. For more information on the Fund, and to obtain performance data current to the most recent month-end, or to request a prospectus, please call (844) 838-2121. You should carefully consider the investment objectives, potential risks, management fees, and charges and expenses of the Fund before investing. The Fund’s prospectus contains this and other information about the Fund, and should be read carefully before investing.

The Fund is distributed by Ultimus Fund Distributors, LLC, Member FINRA/SIPC.

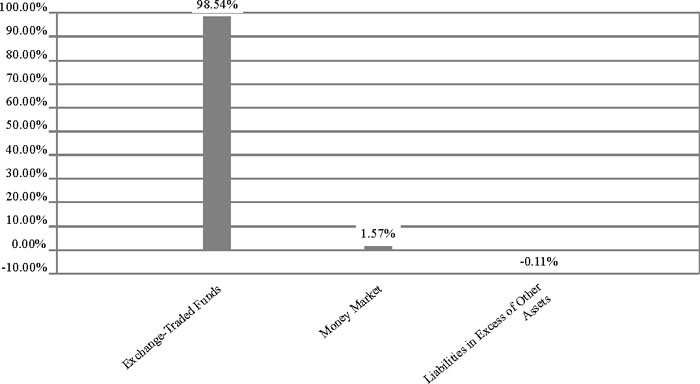

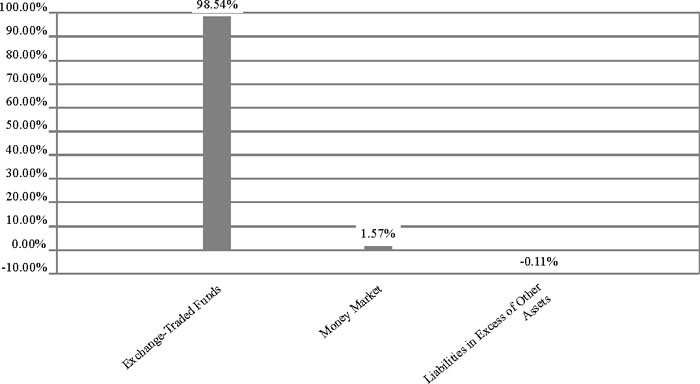

| Portfolio Illustration (Unaudited) |

| |

Canterbury Portfolio Thermostat Fund Holdings as of April 30, 2023*

| * | As a percentage of net assets. |

| AVAILABILITY OF PORTFOLIO SCHEDULE (Unaudited) |

| |

The Fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission (“SEC”) for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT. The Fund’s Form N-PORT reports are available on the SEC’s website at www.sec. gov and on the Fund’s website at www.canterburygroup.com/mutualfund.

| Canterbury Portfolio Thermostat Fund |

| Schedule of Investments |

| April 30, 2023 |

| EXCHANGE-TRADED FUNDS — 98.54% | | Shares | | | Fair Value | |

| | | | | | | |

| Communication Services Select Sector SPDR® Fund | | | 33,500 | | | $ | 2,006,650 | |

| Consumer Staples Select Sector SPDR® Fund | | | 25,400 | | | | 1,966,976 | |

| Industrial Select Sector SPDR® ETF | | | 19,540 | | | | 1,954,000 | |

| Invesco S&P Global Water ETF | | | 34,710 | | | | 1,724,740 | |

| iShares MSCI South Korea ETF | | | 26,535 | | | | 1,609,878 | |

| iShares U.S. Aerospace & Defense ETF | | | 13,150 | | | | 1,498,574 | |

| iShares U.S. Home Construction ETF | | | 25,735 | | | | 1,950,456 | |

| ProShares Short MSCI Emerging Markets | | | 102,395 | | | | 1,525,686 | |

| ProShares Short Real Estate | | | 87,480 | | | | 1,739,977 | |

| ProShares Short Russell 2000 | | | 63,800 | | | | 1,564,376 | |

| SPDR® Bloomberg Emerging Markets Local Bond ETF | | | 80,330 | | | | 1,697,373 | |

| SPDR® EURO STOXX 50 ETF | | | 76,600 | | | | 3,548,112 | |

| SPDR® Portfolio S&P 500® Value ETF | | | 48,910 | | | | 2,026,341 | |

| Technology Select Sector SPDR® Fund | | | 12,540 | | | | 1,891,408 | |

| | | | | | | | | |

| Total Exchange-Traded Funds (Cost $26,024,683) | | | | | | | 26,704,547 | |

| | | | | | | | | |

| MONEY MARKET FUNDS - 1.57% | | | | | | | | |

| Morgan Stanley Institutional Liquidity Government Portfolio, Class I, 4.76%(a) | | | 424,353 | | | | 424,353 | |

| Total Money Market Funds (Cost $424,353) | | | | | | | 424,353 | |

| Total Investments — 100.11% (Cost $26,449,036) | | | | | | | 27,128,900 | |

| Liabilities in Excess of Other Assets — (0.11)% | | | | | | | (30,689 | ) |

| NET ASSETS — 100.00% | | | | | | $ | 27,098,211 | |

| | | | | | | | | |

| (a) | - Rate Disclosed is the seven day effective yield as of April 30, 2023. |

| ETF | - Exchange-Traded Fund |

| SPDR | - Standard & Poor’s Depositary Receipt |

See accompanying notes which are an integral part of these financial statements.

Canterbury Portfolio Thermostat Fund

Statement of Assets and Liabilities

April 30, 2023

| Assets | | | |

| Investments in securities at fair value (cost $26,449,036) | | $ | 27,128,900 | |

| Dividends receivable | | | 2,236 | |

| Prepaid expenses | | | 13,303 | |

| Total Assets | | | 27,144,439 | |

| Liabilities | | | | |

| Payable to Adviser | | | 19,960 | |

| Payable to Administrator | | | 7,151 | |

| Other accrued expenses | | | 19,117 | |

| Total Liabilities | | | 46,228 | |

| Net Assets | | $ | 27,098,211 | |

| Net Assets consist of: | | | | |

| Paid-in capital | | | 29,160,483 | |

| Accumulated deficit | | | (2,062,272 | ) |

| Net Assets | | $ | 27,098,211 | |

| Institutional Shares | | | | |

| Shares outstanding (unlimited number of shares authorized, no par value) | | | 2,693,557 | |

| Net asset value, offering and redemption price per share(a) | | $ | 10.06 | |

| (a) | Subject to certain exceptions, a 2.00% redemption fee is imposed upon shares redeemed within 60 calendar days of their purchase. |

See accompanying notes which are an integral part of these financial statements.

Canterbury Portfolio Thermostat Fund

Statement of Operations

For the year ended April 30, 2023

| Investment Income | | | | |

| Dividend income | | $ | 499,712 | |

| Total investment income | | | 499,712 | |

| | | | | |

| Expenses | | | | |

| Adviser | | | 248,905 | |

| Registration | | | 31,596 | |

| Administration | | | 30,975 | |

| Fund accounting | | | 28,393 | |

| Legal | | | 21,001 | |

| Transfer agent | | | 20,650 | |

| Audit and tax preparation | | | 16,285 | |

| Trustee | | | 15,452 | |

| Printing | | | 13,080 | |

| Compliance services | | | 5,999 | |

| Custodian | | | 5,001 | |

| Insurance | | | 3,648 | |

| Pricing | | | 325 | |

| Interest expense | | | 110 | |

| Miscellaneous | | | 26,591 | |

| Total expenses | | | 468,011 | |

| Net investment income | | | 31,701 | |

| | | | | |

| Net Realized and Change in Unrealized Gain (Loss) on Investments | | | | |

| Net realized loss on investment securities transactions | | | (2,317,965 | ) |

| Net change in unrealized appreciation of investment securities | | | 133,566 | |

| Net realized and change in unrealized loss on investments | | | (2,184,399 | ) |

| Net decrease in net assets resulting from operations | | $ | (2,152,698 | ) |

See accompanying notes which are an integral part of these financial statements.

Canterbury Portfolio Thermostat Fund

Statements of Changes in Net Assets

| | | For the Year Ended | | | For the Year Ended | |

| | | April 30, 2023 | | | April 30, 2022 | |

| Increase (Decrease) in Net Assets due to: | | | | | | | | |

| Operations | | | | | | | | |

| Net investment income (loss) | | $ | 31,701 | | | $ | (62,034 | ) |

| Net realized gain (loss) on investment securities transactions | | | (2,317,965 | ) | | | 432,607 | |

| Net change in unrealized appreciation (depreciation) of investment securities | | | 133,566 | | | | (697,306 | ) |

| Net decrease in net assets resulting from operations | | | (2,152,698 | ) | | | (326,733 | ) |

| | | | | | | | | |

| Distributions to Shareholders - Institutional Shares | | | | | | | | |

| From earnings | | | (60,425 | ) | | | (2,045,796 | ) |

| Total Distributions to Shareholders | | | (60,425 | ) | | | (2,045,796 | ) |

| | | | | | | | | |

| Capital Transactions - Institutional Shares | | | | | | | | |

| Proceeds from shares sold | | | 15,493,927 | | | | 11,221,271 | |

| Reinvestment of distributions | | | 60,425 | | | | 2,045,796 | |

| Amount paid for shares redeemed | | | (7,878,518 | ) | | | (6,934,354 | ) |

| Proceeds from redemption fees(a) | | | 80,701 | | | | 28,919 | |

| Total Capital Transactions - Institutional Shares | | | 7,756,535 | | | | 6,361,632 | |

| Total Increase in Net Assets | | | 5,543,412 | | | | 3,989,103 | |

| | | | | | | | | |

| Net Assets | | | | | | | | |

| Beginning of year | | $ | 21,554,799 | | | $ | 17,565,696 | |

| End of year | | $ | 27,098,211 | | | $ | 21,554,799 | |

| | | | | | | | | |

| Share Transactions - Institutional Shares | | | | | | | | |

| Shares sold | | | 1,461,262 | | | | 955,502 | |

| Shares issued in reinvestment of distributions | | | 6,091 | | | | 181,687 | |

| Shares redeemed | | | (760,483 | ) | | | (567,321 | ) |

| Total Share Transactions - Institutional Shares | | | 706,870 | | | | 569,868 | |

| (a) | Subject to certain exceptions, a 2.00% redemption fee is imposed upon shares redeemed within 60 calendar days of their purchase. |

See accompanying notes which are an integral part of these financial statements.

Canterbury Portfolio Thermostat Fund - Institutional Shares

Financial Highlights

(For a share outstanding during each year)

| | | For the Years Ended April 30, | |

| | 2023 | | | 2022 | | | 2021 | | | 2020 | | | 2019 | |

| Selected Per Share Data: | | | | | | | | | | | | | | | |

| Net asset value, beginning of year | | $ | 10.85 | | | $ | 12.40 | | | $ | 10.02 | | | $ | 11.11 | | | $ | 11.15 | |

| | | | | | | | | | | | | | | | | | | | | |

| Income from investment operations: | | | | | | | | | | | | | | | | | | | | |

| Net investment income (loss) | | | 0.01 | | | | (0.02 | ) | | | (0.12 | ) | | | 0.05 | | | | 0.03 | |

| Net realized and unrealized gain (loss) | | | (0.81 | ) | | | (0.08 | ) | | | 2.49 | | | | (1.01 | ) | | | 0.06 | |

| Total from investment operations | | | (0.80 | ) | | | (0.10 | ) | | | 2.37 | | | | (0.96 | ) | | | 0.09 | |

| | | | | | | | | | | | | | | | | | | | | |

| Less distributions to shareholders from: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | (0.02 | ) | | | — | | | | — | (a) | | | (0.05 | ) | | | (0.03 | ) |

| Net realized gains | | | — | | | | (1.47 | ) | | | — | | | | (0.08 | ) | | | (0.12 | ) |

| Return of capital | | | — | | | | — | | | | — | | | | (0.01 | ) | | | — | |

| Total from distributions | | | (0.02 | ) | | | (1.47 | ) | | | — | (a) | | | (0.14 | ) | | | (0.15 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Paid-in capital from redemption fees | | | 0.03 | | | | 0.02 | | | | 0.01 | | | | 0.01 | | | | 0.02 | |

| Net asset value, end of year | | $ | 10.06 | | | $ | 10.85 | | | $ | 12.40 | | | $ | 10.02 | | | $ | 11.11 | |

| | | | | | | | | | | | | | | | | | | | | |

| Total Return(b) | | | (7.07 | )% | | | (1.10 | )% | | | 23.80 | % | | | (8.69 | )% | | | 1.07 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Ratios and Supplemental Data: | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of year (000 omitted) | | $ | 27,098 | | | $ | 21,555 | | | $ | 17,566 | | | $ | 27,303 | | �� | $ | 29,153 | |

| Ratio of expenses to average net assets before expense waiver | | | 1.69 | % | | | 1.98 | % | | | 1.86 | % | | | 1.61 | % | | | 1.53 | % |

| Ratio of expenses to average net assets after expense waiver | | | 1.69 | % | | | 1.98 | % | | | 1.69 | % | | | 1.30 | % | | | 1.30 | % |

| Ratio of net investment income (loss) to average net assets after expense waiver | | | 0.11 | % | | | (0.32 | )% | | | (0.72 | )% | | | 0.51 | % | | | 0.25 | % |

| Portfolio turnover rate | | | 297 | % | | | 234 | % | | | 160 | % | | | 206 | % | | | 185 | % |

| (a) | Rounds to less than $0.005 per share. |

| (b) | Total return in the above table represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of distributions. Excludes redemption fees. |

See accompanying notes which are an integral part of these financial statements.

| Canterbury Portfolio Thermostat Fund |

| Notes to the Financial Statements |

| April 30, 2023 |

NOTE 1. ORGANIZATION

The Canterbury Portfolio Thermostat Fund (the “Fund”) is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as a diversified series of Capitol Series Trust (the “Trust”) on December 17, 2015. The Trust is an open-end investment company established under the laws of Ohio by an Agreement and Declaration of Trust dated September 18, 2013 (the “Trust Agreement”). The Trust Agreement permits the Board of Trustees of the Trust (the “Board”) to issue an unlimited number of shares of beneficial interest of separate series without par value. The Fund is one of a series of funds currently authorized by the Board. The Fund’s investment adviser is Canterbury Investment Management, LLC (the “Adviser”). The investment objective of the Fund is to seek long-term risk-adjusted growth. The Fund attempts to achieve its investment objective utilizing broadly diversified liquid securities traded on major exchanges, primarily exchange-traded funds (“ETFs”). The Fund’s portfolio is structured primarily as a “fund of funds”. The Fund will invest in any debt, equity, and alternative securities deemed appropriate and necessary to improve the portfolio’s composition, exposure to which is obtained through the use of ETFs.

The Fund currently offers one class of shares, Institutional Shares. The Fund’s Investor Shares have been approved by the Board, but are not yet available for purchase and are not being offered at this time. The Fund’s Institutional Shares commenced operations on August 2, 2016. Each share represents an equal proportionate interest in the assets and liabilities belonging to the Fund and is entitled to such dividends and distributions out of income belonging to the Fund as are declared by the Board. Both share classes impose a 2.00% redemption fee on shares redeemed within 60 days of purchase.

NOTE 2. SIGNIFICANT ACCOUNTING POLICIES

The Fund is an investment company and follows accounting and reporting guidance under Financial Accounting Standards Board Accounting Standards Codification (“ASC”) Topic 946, “Financial Services-Investment Companies”. The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements. These policies are in conformity with generally accepted accounting principles in the United States of America (“GAAP”).

Estimates

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and

| Canterbury Portfolio Thermostat Fund |

| Notes to the Financial Statements (continued) |

| April 30, 2023 |

the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

Federal Income Taxes – The Fund makes no provision for federal income or excise tax. The Fund has qualified and intends to qualify each year as a regulated investment company (“RIC”) under subchapter M of the Internal Revenue Code of 1986, as amended, by complying with the requirements applicable to RICs and by distributing substantially all of its taxable income. The Fund also intends to distribute sufficient net investment income and net realized capital gains, if any, so that it will not be subject to excise tax on undistributed income and gains. If the required amount of net investment income or gains is not distributed, the Fund could incur a tax expense.

The Fund may be subject to taxes imposed by countries in which it invests. Such taxes are generally based on income and/or capital gains earned or repatriated. Taxes are accrued and applied to net investment income, net realized gains and unrealized appreciation as such income and/or gains are earned.

The Fund recognizes tax benefits or expenses of uncertain tax positions only when the position is “more likely than not” to be sustained assuming examination by tax authorities. Management of the Fund has reviewed tax positions taken in tax years that remain subject to examination by all major tax jurisdictions, including federal (i.e., the previous three tax year ends and the interim tax period since then, as applicable) and has concluded that no provision for unrecognized tax benefits or expenses is required in these financial statements and does not expect this to change over the next twelve months. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the Statement of Operations. During the period, the Fund did not incur any interest or penalties.

Expenses – Expenses incurred by the Trust that do not relate to the Fund are allocated to the individual funds of the Trust based on each fund’s relative net assets or another appropriate basis (as determined by the Board).

Security Transactions and Related Income – Throughout the reporting period, security transactions are accounted for no later than one business day following the trade date. For financial reporting purposes, security transactions are accounted for on trade date on the last business day of the reporting period. The specific identification method is used for determining gains or losses for financial statements and income tax purposes. Dividend income is recorded on the ex-dividend date.

Dividends and Distributions – The Fund intends to distribute its net investment income and net realized long-term and short-term capital gains, if any, at least annually. Dividends

| Canterbury Portfolio Thermostat Fund |

| Notes to the Financial Statements (continued) |

| April 30, 2023 |

and distributions to shareholders, which are determined in accordance with income tax regulations, are recorded on the ex-dividend date. The treatment for financial reporting purposes of distributions made to shareholders during the period from net investment income or net realized capital gains may differ from their ultimate treatment for federal income tax purposes. These differences are caused primarily by differences in the timing of the recognition of certain components of income, expense or realized capital gain for federal income tax purposes. Where such differences are permanent in nature, they are reclassified among the components of net assets based on their ultimate characterization for federal income tax purposes. Any such reclassifications will have no effect on net assets, results of operations or net asset value (“NAV”) per share of the Fund.

For the fiscal year ended April 30, 2023, the Fund made the following reclassifications to increase (decrease) the components of net assets:

| | | | Accumulated Earnings | |

| Paid-In Capital | | | (Deficit) | |

| $ | (2,229 | ) | | $ | 2,229 | |

NOTE 3. SECURITIES VALUATION AND FAIR VALUE MEASUREMENTS

The Fund values its portfolio securities at fair value as of the close of regular trading on the New York Stock Exchange (“NYSE”) (normally 4:00 p.m. Eastern Time) on each business day the NYSE is open for business. Fair value is defined as the price that the Fund would receive upon selling an investment in a timely transaction to an independent buyer in the principal or most advantageous market of the investment. GAAP establishes a three-tier hierarchy to maximize the use of observable market data and minimize the use of unobservable inputs and to establish classification of fair value measurements for disclosure purposes.

Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk (the risk inherent in a particular valuation technique used to measure fair value including a pricing model and/or the risk inherent in the inputs to the valuation technique). Inputs may be observable or unobservable. Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability developed based on market data obtained and available from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability developed based on the best information available in the circumstances.

| Canterbury Portfolio Thermostat Fund |

| Notes to the Financial Statements (continued) |

| April 30, 2023 |

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below.

| ● | Level 1 – unadjusted quoted prices in active markets for identical investments and/or registered investment companies where the value per share is determined and published and is the basis for current transactions for identical assets or liabilities at the valuation date |

| ● | Level 2 – other significant observable inputs (including, but not limited to, quoted prices for an identical security in an inactive market, quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.) |

| ● | Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining fair value of investments based on the best information available) |

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy which is reported is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

In computing the NAV of the Fund, fair value is based on market valuations with respect to portfolio securities for which market quotations are readily available. Pursuant to Board approved policies, the Fund relies on independent third-party pricing services to provide the current market value of securities. Those pricing services value equity securities, including exchange-traded funds, exchange-traded notes, closed-end funds and preferred stocks, traded on a securities exchange at the last reported sales price on the principal exchange. Equity securities quoted by Nasdaq are valued at the Nasdaq Official Closing Price. If there is no reported sale on the principal exchange, equity securities are valued at the mean between the most recent quoted bid and asked price. When using market quotations or close prices provided by the pricing service and when the market is considered active, the security will be classified as a Level 1 security. Investments in open-end mutual funds, including money market mutual funds, are generally priced at the ending NAV provided by the pricing service of the funds and are generally categorized as Level 1 securities.

In the event that market quotations are not readily available or are considered unreliable due to market or other events, securities are valued in good faith by the Adviser as “valuation designee” under the oversight of the Board. The Adviser has adopted written policies and procedures for valuing securities and other assets in circumstances where market quotes are not readily available. In the event that market quotes are not readily available, and the security or asset cannot be valued pursuant to one of the valuation methods, the value of the security or asset will be determined in good faith by the Adviser pursuant to its policies and procedures. On a quarterly basis, the Adviser’s fair valuation determinations will be reviewed by the Board. Under these policies, the securities will be classified as Level 2 or 3 within the fair value hierarchy, depending on the inputs used.

| Canterbury Portfolio Thermostat Fund |

| Notes to the Financial Statements (continued) |

| April 30, 2023 |

In accordance with the Trust’s Portfolio Valuation Procedures, the Pricing Review Committee, in making its recommendations with the Adviser’s participation, is required to consider all appropriate factors relevant to the value of securities for which it has determined other pricing sources are not available or reliable as described above. No single standard exists for determining fair value, because fair value depends upon the circumstances of each individual case. As a general principle, the current fair value of an issue of securities being valued pursuant to the Trust’s Fair Value Guidelines would be the amount which the Fund might reasonably expect to receive for them upon their current sale. Methods which are in accordance with this principle may, for example, be based on (i) a multiple of earnings; (ii) a discount from market prices of a similar freely traded security (including a derivative security or a basket of securities traded on other markets, exchanges or among dealers); or (iii) yield to maturity with respect to debt issues, or a combination of these and other methods. Fair value pricing is permitted if, in accordance with the Trust’s Portfolio Valuation Procedures, the validity of market quotations appears to be questionable based on factors such as evidence of a thin market in the security based on a small number of quotations, a significant event occurs after the close of a market but before the Fund’s NAV calculation that may affect a security’s value, or other data calls into question the reliability of market quotations.

The following is a summary of the inputs used to value the Fund’s investments as of April 30, 2023:

| | | Valuation Inputs | | | | |

| Assets | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Exchange-Traded Funds | | $ | 26,704,547 | | | $ | — | | | $ | — | | | $ | 26,704,547 | |

| Money Market Funds | | | 424,353 | | | | — | | | | — | | | | 424,353 | |

| Total | | $ | 27,128,900 | | | $ | — | | | $ | — | | | $ | 27,128,900 | |

The Fund did not hold any investments at the end of the reporting period for which significant unobservable inputs (Level 3) were used in determining fair value; therefore, no reconciliation of Level 3 securities is included for this reporting period.

NOTE 4. FEES AND OTHER TRANSACTIONS WITH AFFILIATES AND OTHER SERVICE PROVIDERS

Under the terms of the investment advisory agreement (the “Agreement”), the Adviser manages the Fund’s investments subject to approval of the Board. As compensation for its management services, the Fund is obligated to pay the Adviser a fee computed and accrued daily and paid monthly at an annual rate of 0.90% of the Fund’s average daily net assets. For the fiscal year ended April 30, 2023, the Adviser earned fees of $248,905 from the Fund. At April 30, 2023, the Fund owed the Adviser $19,960.

| Canterbury Portfolio Thermostat Fund |

| Notes to the Financial Statements (continued) |

| April 30, 2023 |

The Trust retains Ultimus Fund Solutions, LLC (the “Administrator”) to provide the Fund with administration, accounting, transfer agent and compliance services, including all regulatory reporting. Prior to September 14, 2022, the Administrator provided compliance services to the Funds. Effective September 14, 2022, Northern Lights Compliance Services, LLC (“NLCS”), an affiliate of the Administrator, provides a Chief Compliance Officer to the Trust, as well as related compliance services, pursuant to a consulting agreement between NLCS and the Trust.

The Board supervises the business activities of the Trust. Each Trustee serves as a Trustee for the lifetime of the Trust or until the earlier of his or her required retirement as a Trustee at age 78 (which may be extended for up to two years in an emeritus non-voting capacity at the pleasure and request of the Board), or until he/she dies, resigns, or is removed, whichever is sooner. “Independent Trustees”, meaning those Trustees who are not “interested persons” of the Trust, as defined in the 1940 Act, as amended, have each received an annual retainer of $1,500 per Fund and $500 per Fund for each quarterly Board meeting. In addition, each Independent Trustee may be compensated for preparation related to and participation in any special meetings of the Board and/or any Committee of the Board, with such compensation determined on a case-by-case basis based on the length and complexity of the meeting. The Trust also reimburses Trustees for out-of-pocket expense incurred in conjunction with attendance at Board meetings.

The officers and one trustee of the Trust are employees of the Administrator. Ultimus Fund Distributors, LLC (the “Distributor”) acts as the principal distributor of the Fund’s shares. The Distributor is a wholly-owned subsidiary of the Administrator.

NOTE 5. PURCHASES AND SALES OF SECURITIES

For the fiscal year ended April 30, 2023, purchases and sales of investment securities, other than short-term investments, were $85,360,934 and $76,880,312, respectively.

There were no purchases or sales of long-term U.S. government obligations during the fiscal year ended April 30, 2023.

NOTE 6. FEDERAL TAX INFORMATION

At April 30, 2023, the net unrealized appreciation (depreciation) and tax cost of investments for tax purposes was as follows:

| Gross unrealized appreciation | | $ | 1,104,374 | |

| Gross unrealized depreciation | | | (424,510 | ) |

| Net unrealized appreciation/(depreciation) on investments | | | 679,864 | |

| Tax cost of investments | | $ | 26,449,036 | |

| Canterbury Portfolio Thermostat Fund |

| Notes to the Financial Statements (continued) |

| April 30, 2023 |

The tax character of distributions paid for the fiscal years ended April 30, 2023 and April 30, 2022 were as follows:

| | | 2023 | | | 2022 | |

| Distributions paid from: | | | | | | | | |

| Ordinary income | | $ | 60,425 | | | $ | 696,626 | |

| Long-term capital gains | | | — | | | | 1,349,170 | |

| Total distributions paid | | $ | 60,425 | | | $ | 2,045,796 | |

At April 30, 2023, the Fund’s most recent fiscal year end, the components of accumulated earnings (deficit) on a tax basis were as follows:

| Accumulated capital and other losses | | $ | (2,742,136 | ) |

| Unrealized appreciation on investments | | | 679,864 | |

| Total accumulated deficits | | $ | (2,062,272 | ) |

Under current tax law, net investment losses after December 31 and capital losses realized after October 31 of the Fund’s fiscal year may be deferred and treated as occurring on the first business day of the following fiscal year for tax purposes. The Fund had Qualified Late Year Ordinary Losses of $30,146.

NOTE 7. INVESTMENT IN OTHER INVESTMENT COMPANIES

The Fund may invest a significant portion of its assets in shares of one or more investment companies, including ETFs, open-end mutual funds and money market mutual funds. The Fund will incur additional indirect expenses (acquired fund fees and expenses) to the extent it invests in shares of other investment companies. As of April 30, 2023, the Fund had 98.54% of the value of its net assets invested in ETFs. The financial statements of these ETFs can be found at www.sec.gov.

NOTE 8. COMMITMENTS AND CONTINGENCIES

The Trust indemnifies its officers and Trustees for certain liabilities that may arise from their performance of their duties to the Trust or the Fund. Additionally, in the normal course of business, the Trust enters into contracts that contain a variety of representations and warranties which provide general indemnifications. The Trust’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Trust that have not yet occurred.

| Canterbury Portfolio Thermostat Fund |

| Notes to the Financial Statements (continued) |

| April 30, 2023 |

NOTE 9. SUBSEQUENT EVENTS

Management of the Fund has evaluated the need for disclosures and/or adjustments resulting from subsequent events through the date at which these financial statements were issued. Based upon this evaluation, management has determined there were no items requiring adjustment of the financial statements or additional disclosure.

| Report of Independent Registered Public Accounting Firm |

To the Shareholders and the Board of Trustees of Canterbury Portfolio Thermostat Fund

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities of Canterbury Portfolio Thermostat Fund (the “Fund”) (one of the funds constituting Capitol Series Trust (the “Trust”)), including the schedule of investments, as of April 30, 2023, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, the financial highlights for each of the five years in the period then ended and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund (one of the funds constituting Capitol Series Trust) at April 30, 2023, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended and its financial highlights for each of the five years in the period then ended, in conformity with U.S. generally accepted accounting principles.

Basis for Opinion

These financial statements are the responsibility of the Trust’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Trust in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Trust is not required to have, nor were we engaged to perform, an audit of Trust’s internal control over financial reporting. As part of our audits, we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Trust’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of April 30, 2023, by correspondence with the custodian. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

We have served as the auditor of one or more Capitol Series Trust investment companies since 2017.

Cincinnati, Ohio

June 22, 2023

| Liquidity Risk Management Program (Unaudited) |

The Trust has adopted and implemented a written liquidity risk management program (the “Program”) as required by Rule 22e-4 (the “Liquidity Rule”) under the 1940 Act. The Program applies to each individual series of the Trust. The Program is reasonably designed to assess and manage the Fund’s liquidity risk, taking into consideration, among other factors, the Fund’s investment strategy and the liquidity of its portfolio investments during normal and reasonably foreseeable stressed conditions; its short and long-term cash flow projections; and its cash holdings and access to other funding sources. The Board approved the appointment of the Liquidity Administrator Committee, comprising certain Trust officers and employees of the Adviser. The Liquidity Administrator Committee maintains Program oversight and reports to the Board on at least an annual basis regarding the Program’s operational effectiveness through a written report (the “Report”). The Report outlined the operation of the Program and the adequacy and effectiveness of the Program’s implementation and was presented to the Board for consideration at its meeting held on December 7 and 8, 2022. During the review period, the Fund did not experience unusual stress or disruption to its operations related to purchase and redemption activity. Also, during the review period the Fund held adequate levels of cash and highly liquid investments to meet shareholder redemption activities in accordance with applicable requirements. The Report concluded that the Program is reasonably designed to prevent violation of the Liquidity Rule and has been effectively implemented.

| Summary of Fund Expenses (Unaudited) |

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs and (2) ongoing costs, including management fees, distribution (12b-1) fees and other Fund expenses. These examples are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other funds. The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from November 1, 2022 through April 30, 2023.

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs. Therefore, the second line of the table below is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if transaction costs were included, your costs would have been higher.

| | | | | Beginning | | | Ending | | | | | | |

| | | | | Account | | | Account | | | Expenses | | | |

| | | | | Value | | | Value | | | Paid | | | Annualized |

| | | | | November 1, | | | April 30, | | | During | | | Expense |

| | | | | 2022 | | | 2023 | | | Period(a) | | | Ratio |

| Canterbury Portfolio Thermostat Fund | | | | | | | | | | | | | | |

| Institutional Class | | Actual | | $ | 1,000.00 | | | $ | 979.80 | | | $ | 8.24 | | | 1.68% |

| | | Hypothetical(b) | | $ | 1,000.00 | | | $ | 1,016.47 | | | $ | 8.39 | | | 1.68% |

| (a) | Expenses are equal to the Fund’s annualized expense ratios, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). |

| (b) | Hypothetical assumes 5% annual return before expenses. |

| Additional Federal Income Tax Information (Unaudited) |

The Form 1099-DIV you receive in January 2024 will show the tax status of all distributions paid to your account in calendar year 2023. Shareholders are advised to consult their own tax adviser with respect to the tax consequences of their investment in the Fund. As required by the Internal Revenue Code and/or regulations, shareholders must be notified regarding the status of qualified dividend income for individuals and the dividends received deduction for corporations.

Qualified Dividend Income. The Fund designates approximately 100% or up to the maximum amount of such dividends allowable pursuant to the Internal Revenue Code, as qualified dividend income eligible for a reduced tax rate.

Qualified Business Income. The Fund designates approximately 0% of its ordinary income dividends, or up to the maximum amount of such dividends allowable pursuant to the Internal Revenue Code, as qualified business income.

Dividends Received Deduction. Corporate shareholders are generally entitled to take the dividends received deduction on the portion of the Fund’s dividend distribution that qualifies under tax law. For the Fund’s calendar year 2023 ordinary income dividends, 100% qualifies for the corporate dividends received deduction.

| Trustees and Officers (Unaudited) |

The Board supervises the business activities of the Trust and is responsible for protecting the interests of shareholders. The Chairman of the Board is Walter B. Grimm, who is an Independent Trustee of the Trust.

Officers are re-elected annually by the Board. The address of each Trustee and officer is 225 Pictoria Drive, Suite 450, Cincinnati, Ohio 45246.

As of the date of this report, the Trustees oversee the operations of 14 series.

Independent Trustee Background. The following table provides information regarding the Independent Trustees.

Name, (Age), Position with Trust, Term of

Position with Trust | | Principal Occupation During

Past 5 Years and Other Directorships |

Walter B. Grimm

Birth Year: 1945

TRUSTEE AND CHAIR

Began Serving: November 2013 | | Principal Occupation(s): President, Leigh Management Group, LLC (consulting firm) (October 2005 to present); and President, Leigh Investments, Inc. (1988 to present) Board member, Boys & Girls Club of Coachella (2018 to present). |

Lori Kaiser

Birth Year: 1963

TRUSTEE

Began Serving: July 2018 | | Principal Occupation(s): Founder and CEO, Kaiser Consulting since 1992. |

Janet Smith Meeks

Birth Year: 1955

TRUSTEE

Began Serving: July 2018 | | Principal Occupation(s): Co-Founder and CEO, Healthcare Alignment Advisors, LLC (consulting company) since August 2015. Previous Position(s): President and Chief Operating Officer, Mount Carmel St. Ann’s Hospital (2006 to 2015). |

Mary Madick

Birth Year: 1958

TRUSTEE

Began Serving: November 2013 | | Principal Occupation(s): President, US Health Holdings (2020 to present). Previous Position(s): President (2019 to 2020) and Chief Operating Officer (2018 to 2019), Dignity Health Managed Services Organization; Chief Operating Officer, Pennsylvania Health and Wellness (fully owned subsidiary of Centene Corporation) (2016 to 2018); Vice President, Gateway Heath (2015 to 2016). |

| Trustees and Officers (Unaudited) (continued) |

Interested Trustee Background. The following table provides information regarding the Interested Trustee.

Name, (Age), Position with Trust, Term of

Position with Trust | | Principal Occupation During

Past 5 Years and Other Directorships |

David James*

Birth Year: 1970

TRUSTEE

Began Serving: March 2021 | | Principal Occupation(s):Executive Vice President and Chief Legal and Risk Officer of Ultimus Fund Solutions, LLC (2018 to present). Previous Position(s): Managing Director and Senior Managing Counsel, State Street Bank and Trust Company (2009 to 2018). |

| * | Mr. James is considered an “interested person” of the Trust within the meaning of Section 2(a) (19) of the 1940 Act because of his relationship with the Trust’s administrator, transfer agent, and distributors. |

Officers. The following table provides information regarding the Officers.

Name, (Age), Position with Trust, Term of

Position with Trust | | Principal Occupation During

Past 5 Years and Other Directorships |

Matthew J. Miller

Birth Year: 1976

PRESIDENT and CHIEF EXECUTIVE OFFICER

Began Serving: September 2013 (as VP); September 2018 (as President) | | Principal Occupation(s): Assistant Vice President, Relationship Management, Ultimus Fund Solutions, LLC (December 2015 to present). Previous Position(s): Vice President, Relationship Management, Huntington Asset Services, Inc. (n/k/a Ultimus Asset Services, LLC) (2008 to December 2015). |

Zachary P. Richmond

Birth Year: 1980

TREASURER AND CHIEF FINANCIAL

OFFICER

Began Serving: August 2014 | | Principal Occupation(s): Vice President, Director of Financial Administration for Ultimus Fund Solutions, LLC (February 2019 to present). Previous Position(s): Assistant Vice President, Associate Director of Financial Administration for Ultimus Fund Solutions, LLC (December 2015 to February 2019). |

Martin R. Dean

Birth Year: 1963

CHIEF COMPLIANCE OFFICER

Began Serving: May 2019 | | Principal Occupation(s): President, Northern Lights Compliance Services (2023 to present); Senior Vice President, Head of Fund Compliance, Ultimus Fund Solutions, LLC (January 2016 to January 2023). |

Paul F. Leone

Birth Year: 1963

SECRETARY

Began Serving: June 2021 | | Principal Occupation(s): Vice President and Senior Counsel, Ultimus Fund Solutions, LLC (2020 to present). Previous Position(s): Managing Director, Leone Law Office, P.C. (2019 to 2020); and served in the roles of Senior Counsel - Distribution and Senior Counsel - Compliance, Empower Retirement/Great-West Life & Annuity Ins. Co. (2015 to 2019). |

| Trustees and Officers (Unaudited) (continued) |

Stephen Preston

Birth Year: 1966

ANTI-MONEY LAUNDERING OFFICER

Began Serving: December 2016 | | Principal Occupation(s): Chief Compliance Officer, Ultimus Fund Distributors, LLC (June 2011 to present). Previous Position(s): Chief Compliance Officer, Ultimus Fund Solutions, LLC (June 2011 to August 2019). |

| Investment Advisory Agreement Approval (Unaudited) |

At a quarterly meeting of the Board of Trustees of Capitol Series Trust (“Trust”) held on December 7 and 8, 2022, the Trust’s Board of Trustees (“Board”), including all of the Trustees who are not “interested persons” of the Trust (“Independent Trustees”) as that term is defined in Section 2(a)(19) of the Investment Company Act of 1940, as amended (the “1940 Act”), considered and approved the renewal of the Investment Advisory Agreement (“Investment Advisory Agreement”) for an additional one-year period between the Trust and Canterbury Investment Management, LLC (“Canterbury”) with respect to the Canterbury Portfolio Thermostat Fund (the “Canterbury Fund” or the “Fund”), a series of the Trust.

Prior to the meeting, the Trustees received and considered information from Canterbury and the Trust’s administrator designed to provide the Trustees with the information necessary to evaluate the terms of the proposed renewal of the Investment Advisory Agreement between the Trust and Canterbury, including, but not limited to: Canterbury’s responses to counsel’s initial due diligence letter requesting information relevant to the approval of the Investment Advisory Agreement, Canterbury’s responses to counsel’s supplemental requests for additional information, and peer group comparative expense and performance data provided by Broadridge (collectively, the “Support Materials”). The Trustees noted the completeness of the Support Materials that Canterbury provided, and reviewed such Support Materials at various times with Canterbury, Trust management, and counsel to the Independent Trustees. The Trustees also noted the discussions that had taken place with representatives of Canterbury, and considered additional information that Canterbury had provided regarding its services to the Canterbury Fund, including but not limited to: information regarding Canterbury’s investment philosophy and investment strategy; Canterbury’s development of innovations in investor tools; the firm’s investment in internal resources to support and promote the Canterbury Fund; the firm’s compliance culture; compensation of portfolio managers; trading practices; liability insurance; Canterbury’s financial statements; Canterbury’s profitability with respect to the Canterbury Fund; Canterbury’s marketing and distribution plans for the Fund; and other benefits that Canterbury derives from its relationship with the Fund. This information, together with information provided to and reviewed by the Board concerning Canterbury and the Canterbury Fund since the Fund’s inception, formed the primary, but not exclusive, basis for the Board’s determinations.

Before voting to approve the renewal of the Investment Advisory Agreement, the Trustees reviewed the terms of Investment Advisory Agreement, as well as the Support Materials, with Trust management and with counsel to the Independent Trustees. The Trustees also received, reviewed and discussed a memorandum from such counsel delineating each Trustee’s duty of care and duty of loyalty obligations and application of the fiduciary duty standards of Section 36(b) of the 1940 Act, all of which govern their consideration of the renewal of the Investment Advisory Agreement. In addition, the memorandum described the various factors that the U.S. Securities and Exchange Commission (“SEC”) and U.S. Courts over the years have suggested are appropriate for trustee consideration in the advisory agreement approval and renewal process, including the factors outlined in Gartenberg v. Merrill Lynch Asset Management Inc., 694 F.2d 923, 928 (2d Cir. 1982); cert. denied sub. nom. and Andre v. Merrill Lynch Ready Assets Trust, Inc., 461 U.S. 906 (1983).

In determining whether to approve the renewal of the Investment Advisory Agreement, the Trustees considered all factors they believed relevant with respect to the Canterbury Fund, including the following: (1) the nature, extent, and quality of the services to be provided by Canterbury; (2) the

| Investment Advisory Agreement Approval (Unaudited) (continued) |

cost of the services to be provided and the profits to be realized by Canterbury from services rendered to the Trust and the Fund; (3) comparative fee and expense data for the Canterbury Fund and other investment companies with similar investment objectives; (4) the extent to which economies of scale would be realized as the Canterbury Fund grows and whether the proposed advisory fee for the Fund reflects these economies of scale for the Fund’s benefit; and (5) other financial benefits to Canterbury resulting from services to be rendered to the Canterbury Fund. In their deliberations, the Trustees did not identify any particular information that was all-important or controlling.

After having received and reviewed the Support Materials, as well as investment performance, compliance, operating, and distribution reports of the Canterbury Fund on a quarterly basis since the Fund’s inception, and having noted Canterbury’s presentation and the additional discussions with representatives of Canterbury that had occurred at various times, the Trustees determined that they had all of the information they deemed reasonably necessary to make an informed decision concerning the approval of the renewal of the Investment Advisory Agreement. The Trustees discussed the facts and factors relevant to the approval of the Investment Advisory Agreement, which incorporated and reflected their knowledge of Canterbury’s services provided to the Canterbury Fund. Based upon the Support Materials, Canterbury’s presentation and discussions with representatives of Canterbury, and performance, compliance, fee and expense and distribution information received on a quarterly basis since the Fund’s inception, the Board concluded that the overall arrangements between the Trust and Canterbury as set forth in the Investment Advisory Agreement are fair and reasonable in light of the services that Canterbury performs, the investment advisory fees that the Canterbury Fund pays, and such other matters as the Trustees considered relevant in the exercise of their reasonable business judgment. The material factors and conclusions that formed the basis of the Trustees’ determination to approve the continuation of the Investment Advisory Agreement are summarized below.

Nature, Extent and Quality of Services Provided. The Trustees considered the scope of services that Canterbury provides under the Canterbury Investment Advisory Agreement, noting that such services include but are not limited to the following: (1) investing the Canterbury Fund’s assets consistent with the Fund’s investment objective and investment policies; (2) determining the portfolio securities to be purchased, sold or otherwise disposed of and the timing of such transactions; (3) voting all proxies with respect to the Fund’s portfolio securities; (4) maintaining the required books and records for transactions that Canterbury effects on behalf of the Fund; (5) selecting broker-dealers to execute orders on behalf of the Canterbury Fund; (6) performing compliance services on behalf of the Canterbury Fund; and (7) engaging in marketing activities. The Trustees noted no changes to the services that Canterbury provides to the Canterbury Fund under the terms of the Investment Advisory Agreement. The Trustees considered Canterbury’s capitalization and its assets under management. The Trustees further considered the investment philosophy and investment industry experience of the portfolio managers, and noted the proprietary software and research algorithm developed by Canterbury and utilized to manage the Fund’s portfolio in accordance with its investment strategy. The Trustees also noted the Canterbury Fund’s performance compared to its benchmark index, the MSCI World NR USD, including the fact that the Fund had outperformed its benchmark index for the one-year period and underperformed its benchmark index for the three-year, five-year, and since inception periods ended September 30, 2022. The Trustees also considered the Canterbury Fund’s performance compared to the Tactical Allocation Morningstar category and the custom Broadridge peer group, which was a subset of the Morningstar category with filters applied for actively managed, unaffiliated fund-of-funds and net assets. The Trustees noted that

| Investment Advisory Agreement Approval (Unaudited) (continued) |

the performance of the Fund exceeded the performance of the Morningstar category median for the one-year period, but trailed the performance for the three-year, five-year and since inceptions periods ended September 30, 2022. With respect to the custom peer group, the Trustees noted that the Canterbury Fund’s performance exceeded the peer group median for the one-year and five-year periods, but trailed the performance of the peer group median for the three-year and since inception periods ended September 30, 2022. The Board further noted its discussions with representatives of Canterbury regarding management of the Canterbury Fund’s adaptive portfolio strategy, performance of the Canterbury Fund and historical success in limiting drawdowns during normal favorable market corrections. Based upon the foregoing, the Trustees concluded that they are satisfied with the nature, extent and quality of services that Canterbury provides to the Canterbury Fund under the Investment Advisory Agreement.

Cost of Advisory Services and Profitability. The Trustees considered the annual management fee that the Canterbury Fund pays to Canterbury under the Investment Advisory Agreement, as well as Canterbury’s profitability from the services that it renders to the Fund, noting the said services were roughly break even during the last fiscal year and were projected to be breakeven in the current fiscal year. The Trustees noted that, while a Rule 12b-1 Distribution Plan had been approved on behalf of the Investor Shares of the Canterbury Fund, Investor Shares were not currently offered for purchase. The Trustees also considered Canterbury’s commitment with respect to the Canterbury Fund and the growth of assets in the Fund over time.

Comparative Fee and Expense Data. The Trustees noted that the Canterbury Fund’s management fee was equal to the Morningstar category median and higher than the Morningstar category average, and the Canterbury Fund’s management fee was lower than both the median and average for the Broadridge custom peer group. The Trustees then noted that the Canterbury Fund’s gross and net total expense ratios were above the median and average gross and net total expense ratios reported for the same Morningstar category. With regard to the custom Broadridge peer group, the Trustees noted that the Canterbury Fund’s gross and net total expense ratio was higher than the average and the median gross and net total expense ratios reported for the peer group. They further considered the fees paid by Canterbury’s separately managed accounts and sub-advisory relationships to other accounts with similar investment objectives and strategies to that of the Fund, noting the differences in the services provided to these accounts compared to the services provided to the Canterbury Fund. In particular, they noted that Canterbury has additional responsibilities with respect to the Canterbury Fund, including compliance, reporting and operational responsibilities. While recognizing that it is difficult to compare advisory fees because the scope of advisory services provided may vary from one investment adviser to another, or from one investment product to another, the Trustees concluded that Canterbury’s advisory fee continues to be reasonable.

Economies of Scale. The Trustees considered whether the Canterbury Fund may benefit from any economies of scale, but did not find that any material economies exist at this time. The Trustees also noted Canterbury’s view that due to the Canterbury Fund’s low net asset total and the profit Canterbury derives from the Fund, fee breakpoints are not necessary or appropriate at this time.

Other Benefits. The Trustees noted that Canterbury does not utilize soft dollar arrangements with respect to portfolio transactions and does not use affiliated brokers to execute the Canterbury Fund’s portfolio transactions. The Trustees noted that Canterbury had confirmed that there were no economic or other benefits to the Adviser associated with the selection or use of any particular ETF providers

| Investment Advisory Agreement Approval (Unaudited) (continued) |

for the Fund’s portfolio. The Trustees concluded that all things considered, Canterbury does not receive material additional financial benefits from services rendered to the Canterbury Fund.

Other Considerations. The Trustees also considered potential conflicts for Canterbury with respect to relationships forged with ETF providers. The Trustees noted that both they and Counsel have discussed with representatives of Canterbury their duty of loyalty relative to the selection of ETF providers and the conflicts that could develop relative to any relationship that Canterbury may form with a specific ETF provider. Based on the assurances and representations from Canterbury, the Trustees concluded that no conflict of interest currently exists that could adversely impact the Canterbury Fund.

| FACTS | WHAT DOES CANTERBURY PORTFOLIO THERMOSTAT FUND (THE “FUND”) DO WITH YOUR PERSONAL INFORMATION? |

| | |

| Why? | Financial companies choose how they share your personal information. Federal law gives consumers the right to limit some but not all sharing. Federal law also requires us to tell you how we collect, share, and protect your personal information. Please read this notice carefully to understand what we do. |

| | |

| What? | The types of personal information we collect and share depend on the product or service you have with us. This information can include: ■ Social Security number ■ account balances and account transactions ■ transaction or loss history and purchase history ■ checking account information and wire transfer instructions When you are no longer our customer, we continue to share your information as described in this notice. |

| | |

| How? | All financial companies need to share customers’ personal information to run their everyday business. In the section below, we list the reasons financial companies can share their customers’ personal information; the reasons the Funds choose to share; and whether you can limit this sharing. |

| Reasons we can share your personal information | Does the Fund share? |

For our everyday business purposes—

such as to process your transactions, maintain your account(s), respond to court orders and legal investigations, or report to credit bureaus | Yes |

For our marketing purposes—

to offer our products and services to you | No |

| For joint marketing with other financial companies | No |

For our affiliates’ everyday business purposes—

information about your transactions and experiences | No |

For our affiliates’ everyday business purposes—

information about your creditworthiness | No |

| For nonaffiliates to market to you | No |

| Questions? | Call (844) 838-2121 |

| Who we are | |

| Who is providing this notice? | Canterbury Portfolio Thermostat Fund |

| | Ultimus Fund Distributors, LLC (Distributor) |

| | Ultimus Fund Solutions, LLC (Administrator) |

| What we do | |

| How does the Fund protect my personal information? | To protect your personal information from unauthorized access and use, we use security measures that comply with federal law. These measures include computer safeguards and secured files and buildings. Our service providers are held accountable for adhering to strict policies and procedures to prevent any misuse of your nonpublic personal information. |

| How does the Fund collect my personal information? | We collect your personal information, for example, when you ■ open an account or deposit money ■ buy securities from us or sell securities to us ■ make deposits or withdrawals from your account ■ give us your account information ■ make a wire transfer ■ tell us who receives the money ■ tell us where to send the money ■ show your government-issued ID ■ show your driver’s license |

| Why can’t I limit all sharing? | Federal law gives you the right to limit only ■ sharing for affiliates’ everyday business purposes — information about your creditworthiness ■ affiliates from using your information to market to you ■ sharing for nonaffiliates to market to you State laws and individual companies may give you additional rights to limit sharing. |

| Definitions | |

| Affiliates | Companies related by common ownership or control. They can be financial and nonfinancial companies. ■ Canterbury Investment Management, LLC., the investment adviser to the Fund, could be deemed to be an affiliate. |

| Nonaffiliates | Companies not related by common ownership or control. They can be financial and nonfinancial companies. ■ The Fund does not share your personal information with nonaffiliates so they can market to you. |

| Joint marketing | A formal agreement between nonaffiliated financial companies that together market financial products or services to you. ■ The Fund does not jointly market. |

Proxy Voting

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities and information regarding how the Fund voted those proxies during the most recent twelve month period ended June 30, are available (1) without charge upon request by calling the Fund at (844) 838-2121 and (2) in Fund documents filed with the SEC on the SEC’s website at www.sec.gov.

TRUSTEES

Walter B. Grimm, Chairman

David James

Lori Kaiser

Janet Smith Meeks

Mary Madick | INDEPENDENT REGISTERED PUBLIC

ACCOUNTING FIRM

Ernst & Young LLP

221 East 4th Street, Suite 2900

Cincinnati, OH 45202 |

| | |

OFFICERS

Matthew J. Miller, Chief Executive Officer and President

Zachary P. Richmond, Chief Financial Officer and Treasurer

Martin R. Dean, Chief Compliance Officer

Paul F. Leone, Secretary | LEGAL COUNSEL

Practus, LLP

11300 Tomahawk Creek Parkway, Suite 310

Leawood, KS 66211 |

| | |

INVESTMENT ADVISER

Canterbury Investment Management, LLC

23 East Cedar Street

Zionsville, IN 46077 | CUSTODIAN

Huntington National Bank

41 South High Street

Columbus, OH 43215 |

| | |

DISTRIBUTOR

Ultimus Fund Distributors, LLC

225 Pictoria Drive, Suite 450

Cincinnati, OH 45246 | ADMINISTRATOR, TRANSFER

AGENT AND FUND ACCOUNTANT

Ultimus Fund Solutions, LLC

225 Pictoria Drive, Suite 450

Cincinnati, OH 45246 |

| | |

This report is intended only for the information of shareholders or those who have received the Fund’s prospectus which contains information about the Fund’s management fee and expenses. Please read the prospectus carefully before investing.

Distributed by Ultimus Fund Distributors, LLC, Member FINRA/SIPC

Canterbury-AR-23

(b) Not applicable.

Item 2. Code of Ethics.

As of the end of the period covered by this report, the registrant has adopted a code of ethics that applies to the registrant's principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions,