UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22894

INVESTMENT MANAGERS SERIES TRUST II

(Exact name of registrant as specified in charter)

235 W. Galena Street

Milwaukee, WI 53212

(Address of principal executive offices) (Zip code)

Diane J. Drake

Mutual Fund Administration, LLC

2220 E. Route 66, Suite 226

Glendora, CA 91740

(Name and address of agent for service)

(626) 385-5777

Registrant’s telephone number, including area code

Date of fiscal year end: March 31

Date of reporting period: September 30, 2024

Item 1. Report to Stockholders.

(a) The registrant’s semi-annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “Investment Company Act”), is as follows:

AXS

Astoria Real Assets ETF

PPI

SEMI-ANNUAL SHAREHOLDER REPORT | September 30, 2024

This semi-annual shareholder report contains important information about the AXS Astoria Real Assets ETF (“Fund”) for the period of April 1, 2024 to September 30, 2024. You can find additional information about the Fund at www.axsinvestments.com/ppi/#literature. You can also request this information by contacting us at (833) 297-2587.

This report describes changes to the Fund that occurred during the reporting period.

Fund Expenses

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

Astoria Real Assets ETF

(PPI) | $35 | 0.71%1 |

Key Fund Statistics

The following table outlines key fund statistics that you should pay attention to.

| Fund net assets | $66,192,858 |

| Total number of portfolio holdings | 53 |

| Portfolio turnover rate as of the end of the reporting period | 81% |

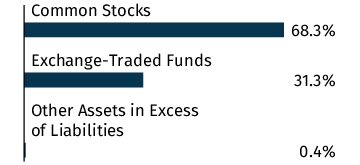

Graphical Representation of Holdings

The tables below show the investment makeup of the Fund, representing percentage of the total net asset of the Fund. The Top Ten Holdings exclude short-term holdings, if any.

| SPDR Gold MiniShares Trust | 5.8% |

| Schwab U.S. TIPS ETF | 5.2% |

| iShares 0-5 Year TIPS Bond ETF | 4.7% |

| Vanguard Short-Term Inflation-Protected Securities ETF | 4.2% |

| BondBloxx Bloomberg Six Month Target Duration U.S. Treasury ETF | 4.0% |

| Caterpillar, Inc. | 3.9% |

| United Rentals, Inc. | 3.7% |

| Exxon Mobil Corp. | 2.9% |

| abrdn Physical Precious Metals Basket Shares ETF | 2.8% |

| VanEck Gold Miners ETF | 2.6% |

Material Fund Changes

On October 15, 2024, the Fund changed its name from AXS Astoria Inflation Sensitive ETF to AXS Astoria Real Assets ETF. Effective October 15, 2024, the Fund changed its investment strategy and objective to seek to identify real asset-related investments that it believes are positioned to benefit from a sustained inflationary environment, such as companies the overall profits of which are expected to increase with rising consumer, producer, and raw material prices (“real asset-related companies”). Prior to October 15, 2024, the Fund’s investment strategy and objective was to seek long-term capital appreciation in inflation-adjusted terms.

This is a summary of certain changes to the Fund since April 1, 2024. For more complete information, you may review the Fund's prospectus, which is dated July 31, 2024, as amended August 13, 2024 at https://www.axsinvestments.com/ppi/#literature.

Changes in and Disagreements with Accountants

There were no changes in or disagreements with the Fund's accountants during the reporting period.

Availability of Additional Information

You can find additional information about the Fund such as the prospectus, financial information, fund holdings and proxy voting information at www.axsinvestments.com/ppi/#literature. You can also request this information by contacting us at (833) 297-2587.

Householding

In order to reduce expenses, we will deliver a single copy of prospectuses, proxies, financial reports and other communication to shareholders with the same residential address, provided they have the same last name, or we reasonably believe them to be members of the same family. Unless we are notified otherwise, we will continue to send recipients only one copy of these materials for as long as they remain a shareholder of the Fund. If you would like to receive individual mailings, please call (833) 297-2587 and we will begin sending you separate copies of these materials within 30 days after receiving your request.

AXS

Change Finance

ESG ETF

CHGX

SEMI-ANNUAL SHAREHOLDER REPORT | September 30, 2024

This semi-annual shareholder report contains important information about the AXS Change Finance ESG ETF (“Fund”) for the period of April 1, 2024 to September 30, 2024. You can find additional information about the Fund at www.axsinvestments.com/chgx/#fundliterature. You can also request this information by contacting us at (833) 297-2587.

Fund Expenses

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

Change Finance ESG ETF

(CHGX) | $25 | 0.49%1 |

Key Fund Statistics

The following table outlines key fund statistics that you should pay attention to.

| Fund net assets | $132,804,156 |

| Total number of portfolio holdings | 100 |

| Portfolio turnover rate as of the end of the reporting period | 21% |

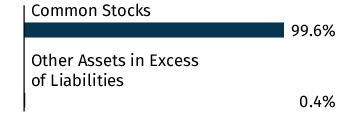

Graphical Representation of Holdings

The tables below show the investment makeup of the Fund, representing percentage of the total net asset of the Fund. The Top Ten Holdings exclude short-term holdings, if any.

| Oracle Corp. | 1.2% |

| Fair Isaac Corp. | 1.1% |

| Carrier Global Corp. | 1.1% |

| Advanced Micro Devices, Inc. | 1.1% |

| Caterpillar, Inc. | 1.1% |

| International Business Machines Corp. | 1.1% |

| PulteGroup, Inc. | 1.1% |

| Arista Networks, Inc. | 1.1% |

| Salesforce, Inc. | 1.1% |

| Deere & Co. | 1.1% |

Changes in and Disagreements with Accountants

There were no changes in or disagreements with the Fund's accountants during the reporting period.

Availability of Additional Information

You can find additional information about the Fund such as the prospectus, financial information, fund holdings and proxy voting information at www.axsinvestments.com/chgx/#fundliterature. You can also request this information by contacting us at (833) 297-2587.

Householding

In order to reduce expenses, we will deliver a single copy of prospectuses, proxies, financial reports and other communication to shareholders with the same residential address, provided they have the same last name, or we reasonably believe them to be members of the same family. Unless we are notified otherwise, we will continue to send recipients only one copy of these materials for as long as they remain a shareholder of the Fund. If you would like to receive individual mailings, please call (833) 297-2587 and we will begin sending you separate copies of these materials within 30 days after receiving your request.

AXS

Esoterica NextG Economy ETF

WUGI

SEMI-ANNUAL SHAREHOLDER REPORT | September 30, 2024

This semi-annual shareholder report contains important information about the AXS Esoterica NextG Economy ETF (“Fund”) for the period of April 1, 2024 to September 30, 2024. You can find additional information about the Fund at www.axsinvestments.com/wugi/#fundliterature. You can also request this information by contacting us at (833) 297-2587.

Fund Expenses

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

Esoterica NextG Economy ETF

(WUGI) | $40 | 0.75%1 |

Key Fund Statistics

The following table outlines key fund statistics that you should pay attention to.

| Fund net assets | $31,883,951 |

| Total number of portfolio holdings | 31 |

| Portfolio turnover rate as of the end of the reporting period | 44% |

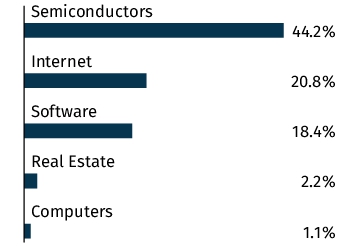

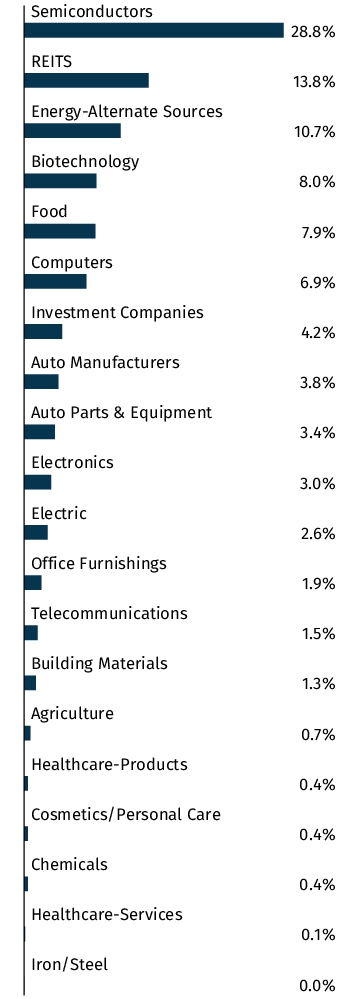

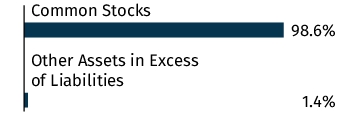

Graphical Representation of Holdings

The tables below show the investment makeup of the Fund, representing percentage of the total net asset of the Fund. The Top Ten Holdings and Industry Allocation exclude short-term holdings, if any. The Industry Allocation chart represents Common Stocks of the Fund.

| NVIDIA Corp. | 22.5% |

| Meta Platforms, Inc. - Class A | 8.1% |

| Broadcom, Inc. | 7.2% |

| Amazon.com, Inc. | 6.7% |

| ASML Holding N.V. | 4.4% |

| Taiwan Semiconductor Manufacturing Co., Ltd. - ADR | 4.2% |

| Microsoft Corp. | 4.2% |

| Synopsys, Inc. | 3.6% |

| Xtrackers Harvest CSI 300 China A-Shares ETF | 3.3% |

| KraneShares CSI China Internet ETF | 3.2% |

Changes in and Disagreements with Accountants

There were no changes in or disagreements with the Fund's accountants during the reporting period.

Availability of Additional Information

You can find additional information about the Fund such as the prospectus, financial information, fund holdings and proxy voting information at www.axsinvestments.com/kno/#fundliterature. You can also request this information by contacting us at (833) 297-2587.

Householding

In order to reduce expenses, we will deliver a single copy of prospectuses, proxies, financial reports and other communication to shareholders with the same residential address, provided they have the same last name, or we reasonably believe them to be members of the same family. Unless we are notified otherwise, we will continue to send recipients only one copy of these materials for as long as they remain a shareholder of the Fund. If you would like to receive individual mailings, please call (833) 297-2587 and we will begin sending you separate copies of these materials within 30 days after receiving your request.

SEMI-ANNUAL SHAREHOLDER REPORT | September 30, 2024

This semi-annual shareholder report contains important information about the AXS Green Alpha ETF (“Fund”) for the period of April 1, 2024 to September 30, 2024. You can find additional information about the Fund at www.axsinvestments.com/nxte/#fundliterature. You can also request this information by contacting us at (833) 297-2587.

Fund Expenses

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

Green Alpha ETF

(NXTE) | $51 | 1.00%1 |

Key Fund Statistics

The following table outlines key fund statistics that you should pay attention to.

| Fund net assets | $50,734,069 |

| Total number of portfolio holdings | 60 |

| Portfolio turnover rate as of the end of the reporting period | 2% |

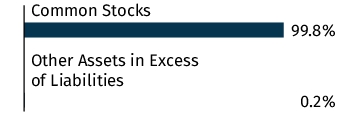

Graphical Representation of Holdings

The tables below show the investment makeup of the Fund, representing percentage of the total net asset of the Fund. The Top Ten Holdings and Industry Allocation exclude short-term holdings, if any. The Industry Allocation chart represents Common Stocks of the Fund.

| Taiwan Semiconductor Manufacturing Co., Ltd. - ADR | 7.9% |

| International Business Machines Corp. | 5.2% |

| Applied Materials, Inc. | 5.1% |

| Sprouts Farmers Market, Inc. | 4.4% |

| ASML Holding N.V. | 4.4% |

| Vestas Wind Systems A/S | 3.9% |

| Lam Research Corp. | 3.8% |

| QUALCOMM, Inc. | 3.7% |

| First Solar, Inc. | 3.5% |

| CRISPR Therapeutics A.G. | 3.4% |

Changes in and Disagreements with Accountants

There were no changes in or disagreements with the Fund's accountants during the reporting period.

Availability of Additional Information

You can find additional information about the Fund such as the prospectus, financial information, fund holdings and proxy voting information at www.axsinvestments.com/nxte/#fundliterature. You can also request this information by contacting us at (833) 297-2587.

Householding

In order to reduce expenses, we will deliver a single copy of prospectuses, proxies, financial reports and other communication to shareholders with the same residential address, provided they have the same last name, or we reasonably believe them to be members of the same family. Unless we are notified otherwise, we will continue to send recipients only one copy of these materials for as long as they remain a shareholder of the Fund. If you would like to receive individual mailings, please call (833) 297-2587 and we will begin sending you separate copies of these materials within 30 days after receiving your request.

AXS

Knowledge Leaders ETF

KNO

SEMI-ANNUAL SHAREHOLDER REPORT | September 30, 2024

This semi-annual shareholder report contains important information about the Knowledge Leaders ETF (“Fund”) for the period of May 1, 2024 to September 30, 2024. You can find additional information about the Fund at www.axsinvestments.com/kno/#fundliterature. You can also request this information by contacting us at (833) 297-2587.

This report describes changes to the Fund that occurred during the reporting period.

Fund Expenses

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage

of a $10,000 investment |

Knowledge Leaders ETF

(KNO) | $38 | 0.85%1 |

Key Fund Statistics

The following table outlines key fund statistics that you should pay attention to.

| Fund net assets | $135,560,824 |

| Total number of portfolio holdings | 101 |

| Portfolio turnover rate as of the end of the reporting period | 39% |

Graphical Representation of Holdings

The tables below show the investment makeup of the Fund, representing percentage of the total net asset of the Fund. The Top Ten Holdings exclude short-term holdings, if any.

| Sanwa Holdings Corp. | 1.7% |

| Kao Corp. | 1.7% |

| Atlas Copco A.B. - A Shares | 1.7% |

| Aristocrat Leisure Ltd. | 1.6% |

| NS Solutions Corp. | 1.6% |

| Volvo A.B. - B Shares | 1.4% |

| Trane Technologies PLC | 1.4% |

| Cie Generale des Etablissements Michelin SCA | 1.4% |

| SAP S.E. | 1.4% |

| Garmin Ltd. | 1.3% |

Material Fund Changes

Effective as of close of business on July 19, 2024, the Knowledge Leaders Developed World ETF was reorganized into the AXS Knowledge Leaders ETF.

This is a summary of certain changes to the Fund since May 1, 2024. For more complete information, you may review the Fund's prospectus, which is dated July 31, 2024, as amended August 13, 2024 at https://www.axsinvestments.com/kno/#fundliterature.

Changes in and Disagreements with Accountants

There were no changes in or disagreements with the Fund's accountants during the reporting period.

Availability of Additional Information

You can find additional information about the Fund such as the prospectus, financial information, fund holdings and proxy voting information at www.axsinvestments.com/kno/#fundliterature. You can also request this information by contacting us at (833) 297-2587.

Householding

In order to reduce expenses, we will deliver a single copy of prospectuses, proxies, financial reports and other communication to shareholders with the same residential address, provided they have the same last name, or we reasonably believe them to be members of the same family. Unless we are notified otherwise, we will continue to send recipients only one copy of these materials for as long as they remain a shareholder of the Fund. If you would like to receive individual mailings, please call (833) 297-2587 and we will begin sending you separate copies of these materials within 30 days after receiving your request.

(b) Not applicable.

Item 2. Code of Ethics.

Not applicable.

Item 3. Audit Committee Financial Expert.

Not applicable.

Item 4. Principal Accountant Fees and Services.

Not applicable.

Item 5. Audit Committee of Listed Registrants.

Not applicable.

Item 6. Investments.

| (a) | Schedule of Investments is included as part of the report to shareholders filed under Item 7 of this Form. |

Item 7. Financial Statements and Financial Highlights for Open-End Management Investment Companies.

AXS Astoria Real Assets ETF

(formerly, AXS Astoria Inflation Sensitive ETF)

(PPI)

AXS Change Finance ESG ETF

(CHGX)

AXS Green Alpha ETF

(NXTE)

AXS Esoterica NextG Economy ETF

(WUGI)

AXS Knowledge Leaders ETF

(KNO)

SEMI-ANNUAL FINANCIALS AND OTHER INFORMATION

SEPTEMBER 30, 2024

AXS ETFs

Eash a series of Investment Managers Series Trust II

Table of Contents

This report and the financial statements contained herein are provided for the general information of the shareholders of the AXS ETFs (the “ETFs”). This report is not authorized for distribution to prospective investors in the ETFs unless preceded or accompanied by an effective shareholder report and prospectus.

www.axsinvestments.com

Item 7. Financial Statements and Financial Highlights for Open-End Management Investment Companies.

AXS Astoria Real Assets ETF

SCHEDULE OF INVESTMENTS

As of September 30, 2024 (Unaudited)

Number of

Shares | | | | | Value | |

| | | | | | | |

| | | | | COMMON STOCKS — 68.3% | | | | |

| | | | | AEROSPACE/DEFENSE — 3.1% | | | | |

| | 1,235 | | | Rheinmetall A.G. | | $ | 670,416 | |

| | 190,685 | | | Rolls-Royce Holdings PLC* | | | 1,348,447 | |

| | | | | | | | 2,018,863 | |

| | | | | AIRLINES — 2.6% | | | | |

| | 33,305 | | | Delta Air Lines, Inc. | | | 1,691,561 | |

| | | | | | | | | |

| | | | | BUILDING MATERIALS — 5.7% | | | | |

| | 7,460 | | | Builders FirstSource, Inc.* | | | 1,446,196 | |

| | 18,170 | | | CRH PLC1 | | | 1,685,086 | |

| | 6,354 | | | Holcim A.G. | | | 621,879 | |

| | | | | | | | 3,753,161 | |

| | | | | CHEMICALS — 6.2% | | | | |

| | 4,278 | | | Air Liquide S.A. | | | 827,223 | |

| | 5,522 | | | Celanese Corp. | | | 750,771 | |

| | 8,681 | | | CF Industries Holdings, Inc. | | | 744,830 | |

| | 11,551 | | | LyondellBasell Industries N.V. - Class A1 | | | 1,107,741 | |

| | 5,711 | | | RPM International, Inc. | | | 691,031 | |

| | | | | | | | 4,121,596 | |

| | | | | COMMERCIAL SERVICES — 3.7% | | | | |

| | 2,986 | | | United Rentals, Inc. | | | 2,417,854 | |

| | | | | | | | | |

| | | | | DISTRIBUTION/WHOLESALE — 2.8% | | | | |

| | 68,300 | | | Mitsubishi Corp. | | | 1,409,786 | |

| | 25,500 | | | Toyota Tsusho Corp. | | | 460,832 | |

| | | | | | | | 1,870,618 | |

| | | | | ENGINEERING & CONSTRUCTION — 1.4% | | | | |

| | 2,165 | | | EMCOR Group, Inc. | | | 932,097 | |

| | | | | | | | | |

| | | | | IRON/STEEL — 4.0% | | | | |

| | 33,124 | | | Fortescue Ltd. | | | 475,222 | |

| | 8,104 | | | Nucor Corp. | | | 1,218,355 | |

| | 7,495 | | | Steel Dynamics, Inc. | | | 944,970 | |

| | | | | | | | 2,638,547 | |

| | | | | MACHINERY-CONSTRUCTION & MINING — 5.5% | | | | |

| | 6,663 | | | Caterpillar, Inc. | | | 2,606,032 | |

| | 70,600 | | | Mitsubishi Heavy Industries Ltd. | | | 1,045,131 | |

| | | | | | | | 3,651,163 | |

| | | | | MACHINERY-DIVERSIFIED — 0.9% | | | | |

| | 42,600 | | | Kubota Corp. | | | 604,870 | |

AXS Astoria Real Assets ETF

SCHEDULE OF INVESTMENTS - Continued

As of September 30, 2024 (Unaudited)

| Number | | | | | | |

| of Shares | | | | | Value | |

| | | | | COMMON STOCKS (Continued) | | | | |

| | | | | METAL FABRICATE/HARDWARE — 0.9% | | | | |

| | 3,618 | | | Advanced Drainage Systems, Inc. | | $ | 568,605 | |

| | | | | | | | | |

| | | | | MINING — 2.5% | | | | |

| | 9,128 | | | Cameco Corp. | | | 436,552 | |

| | 218,644 | | | Pilbara Minerals Ltd.* | | | 496,008 | |

| | 9,879 | | | Rio Tinto PLC | | | 702,181 | |

| | | | | | | | 1,634,741 | |

| | | | | MISCELLANEOUS MANUFACTURING — 3.2% | | | | |

| | 3,287 | | | Carlisle Cos., Inc. | | | 1,478,328 | |

| | 7,423 | | | Textron, Inc. | | | 657,530 | |

| | | | | | | | 2,135,858 | |

| | | | | OIL & GAS — 21.4% | | | | |

| | 31,122 | | | Canadian Natural Resources Ltd. | | | 1,034,597 | |

| | 34,208 | | | Cenovus Energy, Inc. | | | 572,771 | |

| | 14,417 | | | ConocoPhillips | | | 1,517,822 | |

| | 15,557 | | | Devon Energy Corp. | | | 608,590 | |

| | 4,945 | | | Diamondback Energy, Inc. | | | 852,518 | |

| | 127,500 | | | ENEOS Holdings, Inc. | | | 694,101 | |

| | 11,490 | | | EOG Resources, Inc. | | | 1,412,466 | |

| | 16,294 | | | Exxon Mobil Corp. | | | 1,909,983 | |

| | 23,380 | | | Marathon Oil Corp. | | | 622,609 | |

| | 6,704 | | | Marathon Petroleum Corp. | | | 1,092,149 | |

| | 13,905 | | | Ovintiv, Inc. | | | 532,700 | |

| | 40,255 | | | Repsol S.A. | | | 532,155 | |

| | 35,507 | | | Shell PLC | | | 1,154,962 | |

| | 24,826 | | | Suncor Energy, Inc. | | | 917,365 | |

| | 42,230 | | | Woodside Energy Group Ltd. | | | 738,286 | |

| | | | | | | | 14,193,074 | |

| | | | | PACKAGING & CONTAINERS — 1.0% | | | | |

| | 23,139 | | | Graphic Packaging Holding Co. | | | 684,683 | |

| | | | | | | | | |

| | | | | SEMICONDUCTORS — 3.4% | | | | |

| | 2,900 | | | Disco Corp. | | | 760,074 | |

| | 8,600 | | | Tokyo Electron Ltd. | | | 1,520,512 | |

| | | | | | | | 2,280,586 | |

| | | | | TOTAL COMMON STOCKS | | | | |

| | | | | (Cost $41,735,951) | | | 45,197,877 | |

| | | | | EXCHANGE-TRADED FUNDS — 31.3% | | | | |

| | 16,691 | | | abrdn Physical Precious Metals Basket Shares ETF* | | | 1,890,924 | |

| | 51,996 | | | BondBloxx Bloomberg Six Month Target Duration U.S. Treasury ETF | | | 2,622,678 | |

| | 30,544 | | | iShares 0-5 Year TIPS Bond ETF | | | 3,094,718 | |

AXS Astoria Real Assets ETF

SCHEDULE OF INVESTMENTS - Continued

As of September 30, 2024 (Unaudited)

| Number | | | | | | |

| of Shares | | | | | Value | |

| | | | EXCHANGE-TRADED FUNDS (Continued) | | | |

| | 64,574 | | | Schwab U.S. TIPS ETF | | $ | 3,463,104 | |

| | 73,277 | | | SPDR Gold MiniShares Trust* | | | 3,819,930 | |

| | 26,200 | | | U.S. Treasury 3 Month Bill ETF | | | 1,311,048 | |

| | 43,759 | | | VanEck Gold Miners ETF | | | 1,742,483 | |

| | 56,375 | | | Vanguard Short-Term Inflation-Protected Securities ETF | | | 2,779,851 | |

| | | | | TOTAL EXCHANGE-TRADED FUNDS | | | | |

| | | | | (Cost $19,199,479) | | | 20,724,736 | |

| | | | | | | | | |

| | | | | TOTAL INVESTMENTS — 99.6% | | | | |

| | | | | (Cost $60,935,430) | | | 65,922,613 | |

| | | | | | | | | |

| | | | | Other Assets in Excess of Liabilities — 0.4% | | | 270,245 | |

| | | | | TOTAL NET ASSETS — 100.0% | | $ | 66,192,858 | |

PLC – Public Limited Company

ETF – Exchange-Traded Fund

| * | Non-income producing security. |

| 1 | Foreign security denominated in U.S. Dollars. |

See accompanying Notes to Financial Statements.

AXS Change Finance ESG ETF

SCHEDULE OF INVESTMENTS

As of September 30, 2024 (Unaudited)

Number

of Shares | | | | | Value | |

| | | | COMMON STOCKS — 99.6% | | | |

| | | | APPAREL — 2.0% | | | |

| | 8,165 | | | Deckers Outdoor Corp.* | | $ | 1,301,909 | |

| | 15,671 | | | NIKE, Inc. - Class B | | | 1,385,317 | |

| | | | | | | | 2,687,226 | |

| | | | | BANKS — 2.0% | | | | |

| | 19,141 | | | Bank of New York Mellon Corp. | | | 1,375,472 | |

| | 14,991 | | | State Street Corp. | | | 1,326,254 | |

| | | | | | | | 2,701,726 | |

| | | | | BIOTECHNOLOGY — 1.0% | | | | |

| | 3,911 | | | Amgen, Inc. | | | 1,260,163 | |

| | | | | | | | | |

| | | | | BUILDING MATERIALS — 1.1% | | | | |

| | 17,941 | | | Carrier Global Corp. | | | 1,444,071 | |

| | | | | | | | | |

| | | | | CHEMICALS — 1.0% | | | | |

| | 5,157 | | | Ecolab, Inc. | | | 1,316,737 | |

| | | | | | | | | |

| | | | | COMMERCIAL SERVICES — 6.9% | | | | |

| | 4,733 | | | Automatic Data Processing, Inc. | | | 1,309,763 | |

| | 19,760 | | | Block, Inc.* | | | 1,326,489 | |

| | 4,251 | | | Equifax, Inc. | | | 1,249,199 | |

| | 2,677 | | | Moody’s Corp. | | | 1,270,477 | |

| | 18,028 | | | PayPal Holdings, Inc.* | | | 1,406,725 | |

| | 2,544 | | | S&P Global, Inc. | | | 1,314,281 | |

| | 4,787 | | | Verisk Analytics, Inc. | | | 1,282,725 | |

| | | | | | | | 9,159,659 | |

| | | | | COMPUTERS — 8.0% | | | | |

| | 3,819 | | | Accenture PLC - Class A1 | | | 1,349,940 | |

| | 5,702 | | | Apple, Inc. | | | 1,328,566 | |

| | 16,790 | | | Cognizant Technology Solutions Corp. - Class A | | | 1,295,852 | |

| | 4,708 | | | Crowdstrike Holdings, Inc. - Class A* | | | 1,320,453 | |

| | 17,022 | | | Fortinet, Inc.* | | | 1,320,056 | |

| | 2,654 | | | Gartner, Inc.* | | | 1,344,941 | |

| | 36,090 | | | HP, Inc. | | | 1,294,548 | |

| | 6,460 | | | International Business Machines Corp. | | | 1,428,177 | |

| | | | | | | | 10,682,533 | |

| | | | | DISTRIBUTION/WHOLESALE — 2.0% | | | | |

| | 24,656 | | | Copart, Inc.* | | | 1,291,974 | |

| | 1,327 | | | W.W. Grainger, Inc. | | | 1,378,501 | |

| | | | | | | | 2,670,475 | |

AXS Change Finance ESG ETF

SCHEDULE OF INVESTMENTS - Continued

As of September 30, 2024 (Unaudited)

Number

of Shares | | | | | Value | |

| | | | COMMON STOCKS (Continued) | | | |

| | | | DIVERSIFIED FINANCIAL SERVICES — 8.0% | | | |

| | 5,049 | | | American Express Co. | | $ | 1,369,289 | |

| | 2,906 | | | Ameriprise Financial, Inc. | | | 1,365,268 | |

| | 20,056 | | | Charles Schwab Corp. | | | 1,299,829 | |

| | 6,053 | | | CME Group, Inc. | | | 1,335,594 | |

| | 8,083 | | | Intercontinental Exchange, Inc. | | | 1,298,453 | |

| | 2,702 | | | Mastercard, Inc. - Class A | | | 1,334,248 | |

| | 18,114 | | | Nasdaq, Inc. | | | 1,322,503 | |

| | 4,725 | | | Visa, Inc. - Class A | | | 1,299,139 | |

| | | | | | | | 10,624,323 | |

| | | | | ELECTRIC — 1.0% | | | | |

| | 17,520 | | | Ormat Technologies, Inc. | | | 1,347,989 | |

| | | | | | | | | |

| | | | | FOOD — 2.0% | | | | |

| | 18,062 | | | General Mills, Inc. | | | 1,333,878 | |

| | 16,747 | | | Sysco Corp. | | | 1,307,271 | |

| | | | | | | | 2,641,149 | |

| | | | | HEALTHCARE-PRODUCTS — 5.0% | | | | |

| | 11,528 | | | Abbott Laboratories | | | 1,314,307 | |

| | 9,136 | | | Agilent Technologies, Inc. | | | 1,356,514 | |

| | 14,741 | | | Medtronic PLC1 | | | 1,327,132 | |

| | 3,623 | | | Stryker Corp. | | | 1,308,845 | |

| | 2,123 | | | Thermo Fisher Scientific, Inc. | | | 1,313,224 | |

| | | | | | | | 6,620,022 | |

| | | | | HEALTHCARE-SERVICES — 1.9% | | | | |

| | 3,301 | | | HCA Healthcare, Inc. | | | 1,341,626 | |

| | 5,191 | | | IQVIA Holdings, Inc.* | | | 1,230,111 | |

| | | | | | | | 2,571,737 | |

| | | | | HOME BUILDERS — 2.1% | | | | |

| | 7,172 | | | Lennar Corp. - Class A | | | 1,344,607 | |

| | 9,919 | | | PulteGroup, Inc. | | | 1,423,674 | |

| | | | | | | | 2,768,281 | |

| | | | | HOUSEHOLD PRODUCTS/WARES — 1.0% | | | | |

| | 12,816 | | | Church & Dwight Co., Inc. | | | 1,342,091 | |

| | | | | | | | | |

| | | | | INSURANCE — 2.9% | | | | |

| | 3,800 | | | Aon PLC - Class A1 | | | 1,314,762 | |

| | 5,740 | | | Marsh & McLennan Cos., Inc. | | | 1,280,537 | |

| | 5,178 | | | Progressive Corp. | | | 1,313,969 | |

| | | | | | | | 3,909,268 | |

AXS Change Finance ESG ETF

SCHEDULE OF INVESTMENTS - Continued

As of September 30, 2024 (Unaudited)

Number

of Shares | | | | | Value | |

| | | | COMMON STOCKS (Continued) | | | |

| | | | INTERNET — 3.9% | | | |

| | 7,991 | | | Alphabet, Inc. - Class A | | $ | 1,325,307 | |

| | 7,907 | | | Alphabet, Inc. - Class C | | | 1,321,971 | |

| | 1,862 | | | Netflix, Inc.* | | | 1,320,661 | |

| | 3,600 | | | Palo Alto Networks, Inc.* | | | 1,230,480 | |

| | | | | | | | 5,198,419 | |

| | | | | IRON/STEEL — 1.0% | | | | |

| | 10,925 | | | Steel Dynamics, Inc. | | | 1,377,424 | |

| | | | | | | | | |

| | | | | MACHINERY-CONSTRUCTION & MINING — 1.1% | | | | |

| | 3,668 | | | Caterpillar, Inc. | | | 1,434,628 | |

| | | | | | | | | |

| | | | | MACHINERY-DIVERSIFIED — 1.1% | | | | |

| | 3,386 | | | Deere & Co. | | | 1,413,079 | |

| | | | | | | | | |

| | | | | MEDIA — 2.1% | | | | |

| | 32,998 | | | Comcast Corp. - Class A | | | 1,378,326 | |

| | 14,447 | | | Walt Disney Co. | | | 1,389,657 | |

| | | | | | | | 2,767,983 | |

| | | | | PHARMACEUTICALS — 6.6% | | | | |

| | 6,652 | | | AbbVie, Inc. | | | 1,313,637 | |

| | 5,450 | | | Cencora, Inc. | | | 1,226,686 | |

| | 1,361 | | | Eli Lilly & Co. | | | 1,205,764 | |

| | 7,873 | | | Johnson & Johnson | | | 1,275,898 | |

| | 2,327 | | | McKesson Corp. | | | 1,150,515 | |

| | 11,023 | | | Merck & Co., Inc. | | | 1,251,772 | |

| | 45,009 | | | Pfizer, Inc. | | | 1,302,561 | |

| | | | | | | | 8,726,833 | |

| | | | | REITS — 2.0% | | | | |

| | 10,216 | | | Prologis, Inc. | | | 1,290,077 | |

| | 7,803 | | | Simon Property Group, Inc. | | | 1,318,863 | |

| | | | | | | | 2,608,940 | |

| | | | | RETAIL — 3.9% | | | | |

| | 411 | | | AutoZone, Inc.* | | | 1,294,666 | |

| | 1,156 | | | O’Reilly Automotive, Inc.* | | | 1,331,250 | |

| | 8,670 | | | Ross Stores, Inc. | | | 1,304,922 | |

| | 11,135 | | | TJX Cos., Inc. | | | 1,308,808 | |

| | | | | | | | 5,239,646 | |

| | | | | SEMICONDUCTORS — 12.8% | | | | |

| | 8,789 | | | Advanced Micro Devices, Inc.* | | | 1,442,099 | |

| | 5,560 | | | Analog Devices, Inc. | | | 1,279,745 | |

AXS Change Finance ESG ETF

SCHEDULE OF INVESTMENTS - Continued

As of September 30, 2024 (Unaudited)

Number

of Shares | | | | | Value | |

| | | | COMMON STOCKS (Continued) | | | |

| | | | SEMICONDUCTORS (Continued) | | | |

| | 8,020 | | | Broadcom, Inc. | | $ | 1,383,450 | |

| | 59,242 | | | Intel Corp. | | | 1,389,817 | |

| | 1,594 | | | KLA Corp. | | | 1,234,410 | |

| | 17,127 | | | Marvell Technology, Inc. | | | 1,235,199 | |

| | 15,892 | | | Microchip Technology, Inc. | | | 1,275,969 | |

| | 13,566 | | | Micron Technology, Inc. | | | 1,406,930 | |

| | 1,397 | | | Monolithic Power Systems, Inc. | | | 1,291,527 | |

| | 10,939 | | | NVIDIA Corp. | | | 1,328,432 | |

| | 16,768 | | | ON Semiconductor Corp.* | | | 1,217,525 | |

| | 7,448 | | | QUALCOMM, Inc. | | | 1,266,532 | |

| | 6,092 | | | Texas Instruments, Inc. | | | 1,258,424 | |

| | | | | | | | 17,010,059 | |

| | | | | SOFTWARE — 14.1% | | | | |

| | 2,273 | | | Adobe, Inc.* | | | 1,176,914 | |

| | 5,054 | | | Autodesk, Inc.* | | | 1,392,276 | |

| | 4,855 | | | Cadence Design Systems, Inc.* | | | 1,315,851 | |

| | 8,601 | | | Electronic Arts, Inc. | | | 1,233,727 | |

| | 754 | | | Fair Isaac Corp.* | | | 1,465,414 | |

| | 15,837 | | | Fidelity National Information Services, Inc. | | | 1,326,349 | |

| | 2,072 | | | Intuit, Inc. | | | 1,286,712 | |

| | 2,249 | | | MSCI, Inc. | | | 1,311,009 | |

| | 9,242 | | | Oracle Corp. | | | 1,574,837 | |

| | 2,356 | | | Roper Technologies, Inc. | | | 1,310,973 | |

| | 5,163 | | | Salesforce, Inc. | | | 1,413,165 | |

| | 1,528 | | | ServiceNow, Inc.* | | | 1,366,628 | |

| | 2,512 | | | Synopsys, Inc.* | | | 1,272,052 | |

| | 4,962 | | | Workday, Inc. - Class A* | | | 1,212,762 | |

| | | | | | | | 18,658,669 | |

| | | | | TELECOMMUNICATIONS — 2.1% | | | | |

| | 3,696 | | | Arista Networks, Inc.* | | | 1,418,599 | |

| | 25,836 | | | Cisco Systems, Inc. | | | 1,374,992 | |

| | | | | | | | 2,793,591 | |

AXS Change Finance ESG ETF

SCHEDULE OF INVESTMENTS - Continued

As of September 30, 2024 (Unaudited)

Number of Shares | | | | | Value | |

| | | | COMMON STOCKS (Continued) | | | |

| | | | WATER — 1.0% | | | |

| | 9,124 | | | American Water Works Co., Inc. | | $ | 1,334,294 | |

| | | | | TOTAL COMMON STOCKS | | | | |

| | | | | (Cost $107,363,832) | | | 132,311,015 | |

| | | | | | | | | |

| | | | | TOTAL INVESTMENTS — 99.6% | | | | |

| | | | | (Cost $107,363,832) | | | 132,311,015 | |

| | | | | | | | | |

| | | | | Other Assets in Excess of Liabilities — 0.4% | | | 493,141 | |

| | | | | TOTAL NET ASSETS — 100.0% | | $ | 132,804,156 | |

PLC – Public Limited Company

| * | Non-income producing security. |

| 1 | Foreign security denominated in U.S. Dollars. |

See accompanying Notes to Financial Statements.

AXS Green Alpha ETF

SCHEDULE OF INVESTMENTS

As of September 30, 2024 (Unaudited)

| Number | | | | | | |

| of Shares | | | | | Value | |

| | | | COMMON STOCKS — 99.8% | | | |

| | | | AGRICULTURE — 0.7% | | | |

| | 9,933 | | | Vital Farms, Inc.* | | $ | 348,350 | |

| | | | | | | | | |

| | | | | AUTO MANUFACTURERS — 3.8% | | | | |

| | 32,251 | | | Rivian Automotive, Inc. - Class A* | | | 361,856 | |

| | 4,472 | | | Tesla, Inc.* | | | 1,170,009 | |

| | 32,860 | | | XPeng, Inc. - ADR*,1 | | | 400,235 | |

| | | | | | | | 1,932,100 | |

| | | | | AUTO PARTS & EQUIPMENT — 3.4% | | | | |

| | 38,928 | | | Contemporary Amperex Technology Co., Ltd. - Class A | | | 1,401,067 | |

| | 59,964 | | | QuantumScape Corp.* | | | 344,793 | |

| | | | | | | | 1,745,860 | |

| | | | | BIOTECHNOLOGY — 8.0% | | | | |

| | 20,212 | | | Arcturus Therapeutics Holdings, Inc.* | | | 469,121 | |

| | 3,825 | | | BioNTech S.E. - ADR*,1 | | | 454,295 | |

| | 91,083 | | | Caribou Biosciences, Inc.* | | | 178,523 | |

| | 36,698 | | | CRISPR Therapeutics A.G.*,1 | | | 1,724,072 | |

| | 78,890 | | | Editas Medicine, Inc.* | | | 269,015 | |

| | 8,156 | | | Moderna, Inc.* | | | 545,065 | |

| | 24,970 | | | Prime Medicine, Inc.* | | | 96,634 | |

| | 23,279 | | | Recursion Pharmaceuticals, Inc. - Class A* | | | 153,409 | |

| | 29,174 | | | Verve Therapeutics, Inc.* | | | 141,202 | |

| | | | | | | | 4,031,336 | |

| | | | | BUILDING MATERIALS — 1.3% | | | | |

| | 9,921 | | | Trex Co., Inc.* | | | 660,540 | |

| | | | | | | | | |

| | | | | CHEMICALS — 0.4% | | | | |

| | 9,507 | | | Daqo New Energy Corp. - ADR*,1 | | | 193,658 | |

| | | | | | | | | |

| | | | | COMPUTERS — 6.9% | | | | |

| | 847 | | | Crowdstrike Holdings, Inc. - Class A* | | | 237,558 | |

| | 12,002 | | | International Business Machines Corp. | | | 2,653,402 | |

| | 14,923 | | | Rapid7, Inc.* | | | 595,279 | |

| | | | | | | | 3,486,239 | |

| | | | | COSMETICS/PERSONAL CARE — 0.4% | | | | |

| | 58,196 | | | Honest Co., Inc.* | | | 207,760 | |

| | | | | | | | | |

| | | | | ELECTRIC — 2.6% | | | | |

| | 40,052 | | | Brookfield Renewable Corp. - Class A1 | | | 1,308,098 | |

| | | | | | | | | |

| | | | | ELECTRONICS — 3.0% | | | | |

| | 20,263 | | | ABB Ltd. - ADR1 | | | 1,173,633 | |

AXS Green Alpha ETF

SCHEDULE OF INVESTMENTS - Continued

As of September 30, 2024 (Unaudited)

| Number | | | | | | |

| of Shares | | | | | Value | |

| | | | COMMON STOCKS (Continued) | | | |

| | | | ELECTRONICS (Continued) | | | |

| | 3,106 | | | Advanced Energy Industries, Inc. | | $ | 326,876 | |

| | | | | | | | 1,500,509 | |

| | | | | ENERGY-ALTERNATE SOURCES — 10.7% | | | | |

| | 15,955 | | | Canadian Solar, Inc.*,1 | | | 267,406 | |

| | 3,809 | | | Enphase Energy, Inc.* | | | 430,493 | |

| | 7,028 | | | First Solar, Inc.* | | | 1,753,064 | |

| | 149,415 | | | Freyr Battery, Inc.* | | | 144,947 | |

| | 21,005 | | | JinkoSolar Holding Co., Ltd. - ADR1 | | | 563,354 | |

| | 1,962 | | | SolarEdge Technologies, Inc.* | | | 44,949 | |

| | 3,543 | | | Sunrun, Inc.* | | | 63,987 | |

| | 39,685 | | | TPI Composites, Inc.* | | | 180,567 | |

| | 90,323 | | | Vestas Wind Systems A/S* | | | 1,999,290 | |

| | | | | | | | 5,448,057 | |

| | | | | FOOD — 7.9% | | | | |

| | 5,491 | | | Danone S.A. | | | 400,419 | |

| | 45,081 | | | Natural Grocers by Vitamin Cottage, Inc. | | | 1,338,455 | |

| | 20,386 | | | Sprouts Farmers Market, Inc.* | | | 2,250,818 | |

| | | | | | | | 3,989,692 | |

| | | | | HEALTHCARE-PRODUCTS — 0.4% | | | | |

| | 132,042 | | | Pacific Biosciences of California, Inc.* | | | 224,471 | |

| | | | | | | | | |

| | | | | HEALTHCARE-SERVICES — 0.1% | | | | |

| | 5,133 | | | Ginkgo Bioworks Holdings, Inc.* | | | 41,834 | |

| | | | | | | | | |

| | | | | INVESTMENT COMPANIES — 4.2% | | | | |

| | 38,964 | | | HA Sustainable Infrastructure Capital, Inc. | | | 1,343,089 | |

| | 74,771 | | | Horizon Technology Finance Corp. | | | 796,311 | |

| | | | | | | | 2,139,400 | |

| | | | | IRON/STEEL — 0.0% | | | | |

| | 304 | | | Commercial Metals Co. | | | 16,708 | |

| | | | | | | | | |

| | | | | OFFICE FURNISHINGS — 1.9% | | | | |

| | 27,973 | | | Interface, Inc. | | | 530,648 | |

| | 32,327 | | | Steelcase, Inc. - Class A | | | 436,091 | |

| | | | | | | | 966,739 | |

| | | | | REITS — 13.8% | | | | |

| | 6,616 | | | Alexandria Real Estate Equities, Inc. | | | 785,650 | |

| | 6,026 | | | BXP, Inc. | | | 484,852 | |

| | 8,754 | | | Digital Realty Trust, Inc. | | | 1,416,660 | |

| | 1,248 | | | Equinix, Inc. | | | 1,107,762 | |

AXS Green Alpha ETF

SCHEDULE OF INVESTMENTS - Continued

As of September 30, 2024 (Unaudited)

| Number | | | | | | |

| of Shares | | | | | Value | |

| | | | COMMON STOCKS (Continued) | | | |

| | | | REITS (Continued) | | | |

| | 91,656 | | | Hudson Pacific Properties, Inc. | | $ | 438,116 | |

| | 13,543 | | | Kilroy Realty Corp. | | | 524,114 | |

| | 19,174 | | | SL Green Realty Corp. | | | 1,334,702 | |

| | 22,623 | | | Vornado Realty Trust | | | 891,346 | |

| | | | | | | | 6,983,202 | |

| | | | | SEMICONDUCTORS — 28.8% | | | | |

| | 2,639 | | | Analog Devices, Inc. | | | 607,418 | |

| | 12,758 | | | Applied Materials, Inc. | | | 2,577,754 | |

| | 2,656 | | | ASML Holding N.V.1 | | | 2,213,112 | |

| | 37,687 | | | Infineon Technologies A.G. | | | 1,323,226 | |

| | 2,361 | | | Lam Research Corp.* | | | 1,926,765 | |

| | 11,097 | | | QUALCOMM, Inc. | | | 1,887,045 | |

| | 23,258 | | | Taiwan Semiconductor Manufacturing Co., Ltd. - ADR1 | | | 4,039,217 | |

| | 5,552 | | | Wolfspeed, Inc.* | | | 53,854 | |

| | | | | | | | 14,628,391 | |

| | | | | TELECOMMUNICATIONS — 1.5% | | | | |

| | 32,695 | | | SK Telecom Co., Ltd. - ADR1 | | | 777,160 | |

| | | | | TOTAL COMMON STOCKS | | | | |

| | | | | (Cost $44,637,532) | | | 50,630,104 | |

| | | | | | | | | |

| | | | | TOTAL INVESTMENTS — 99.8% | | | | |

| | | | | (Cost $44,637,532) | | | 50,630,104 | |

| | | | | | | | | |

| | | | | Other Assets in Excess of Liabilities — 0.2% | | | 103,965 | |

| | | | | TOTAL NET ASSETS — 100.0% | | $ | 50,734,069 | |

ADR – American Depository Receipt

| * | Non-income producing security. |

| 1 | Foreign security denominated in U.S. Dollars. |

See accompanying Notes to Financial Statements.

AXS Esoterica NextG Economy ETF

SCHEDULE OF INVESTMENTS

As of September 30, 2024 (Unaudited)

| Number | | | | | | |

| of Shares | | | | | Value | |

| | | | COMMON STOCKS — 86.7% | | | |

| | | | COMPUTERS — 1.1% | | | |

| | 2,194 | | | Zscaler, Inc.* | | $ | 375,042 | |

| | | | | | | | | |

| | | | | INTERNET — 20.8% | | | | |

| | 2,871 | | | Alphabet, Inc. - Class C | | | 480,002 | |

| | 11,402 | | | Amazon.com, Inc.* | | | 2,124,535 | |

| | 369 | | | JD.com, Inc. - Class A | | | 7,938 | |

| | 37,443 | | | Meituan - Class B*,1 | | | 829,121 | |

| | 4,534 | | | Meta Platforms, Inc. - Class A | | | 2,595,443 | |

| | 3,018 | | | Sea Ltd. - ADR* | | | 284,537 | |

| | 5,304 | | | Tencent Holdings Ltd. | | | 303,593 | |

| | | | | | | | 6,625,169 | |

| | | | | REAL ESTATE — 2.2% | | | | |

| | 35,216 | | | KE Holdings, Inc. - ADR | | | 701,151 | |

| | | | | | | | | |

| | | | | SEMICONDUCTORS — 44.2% | | | | |

| | 4,209 | | | Advanced Micro Devices, Inc.* | | | 690,613 | |

| | 1,670 | | | ASML Holding N.V. | | | 1,391,527 | |

| | 13,403 | | | Broadcom, Inc. | | | 2,312,017 | |

| | 8,275 | | | MACOM Technology Solutions Holdings, Inc.* | | | 920,677 | |

| | 2,414 | | | Micron Technology, Inc. | | | 250,356 | |

| | 59,146 | | | NVIDIA Corp. | | | 7,182,690 | |

| | 7,779 | | | Taiwan Semiconductor Manufacturing Co., Ltd. - ADR | | | 1,350,979 | |

| | | | | | | | 14,098,859 | |

| | | | | SOFTWARE — 18.4% | | | | |

| | 7,203 | | | Cloudflare, Inc. - Class A* | | | 582,651 | |

| | 1,255 | | | Datadog, Inc. - Class A* | | | 144,400 | |

| | 42,707 | | | Gaotu Techedu, Inc. - ADR* | | | 167,412 | |

| | 764 | | | HubSpot, Inc.* | | | 406,142 | |

| | 3,122 | | | Microsoft Corp. | | | 1,343,397 | |

| | 2,184 | | | MongoDB, Inc.* | | | 590,444 | |

| | 1,843 | | | Oracle Corp. | | | 314,047 | |

| | 365 | | | ServiceNow, Inc.* | | | 326,452 | |

| | 5,510 | | | Snowflake, Inc. - Class A* | | | 632,879 | |

| | 2,253 | | | Synopsys, Inc.* | | | 1,140,897 | |

| | 1,375 | | | Take-Two Interactive Software, Inc.* | | | 211,351 | |

| | | | | | | | 5,860,072 | |

| | | | | TOTAL COMMON STOCKS | | | | |

| | | | | (Cost $22,611,832) | | | 27,660,293 | |

| | | | | | | | | |

| | | | | EXCHANGE-TRADED FUNDS — 11.6% | | | | |

| | 26,297 | | | Direxion Daily FTSE China Bull 3X Shares | | | 971,148 | |

| | 6,653 | | | iShares 20+ Year Treasury Bond ETF | | | 652,659 | |

| | 30,006 | | | KraneShares CSI China Internet ETF | | | 1,020,804 | |

AXS Esoterica NextG Economy ETF

SCHEDULE OF INVESTMENTS - Continued

As of September 30, 2024 (Unaudited)

| Number | | | | | | |

| of Shares | | | | | Value | |

| | | | EXCHANGE-TRADED FUNDS (Continued) | | | |

| | 36,494 | | | Xtrackers Harvest CSI 300 China A-Shares ETF | | $ | 1,043,364 | |

| | | | | TOTAL EXCHANGE-TRADED FUNDS | | | | |

| | | | | (Cost $3,569,696) | | | 3,687,975 | |

| | | | | | | | | |

| | | | | TOTAL INVESTMENTS — 98.3% | | | | |

| | | | | (Cost $26,181,528) | | | 31,348,268 | |

| | | | | | | | | |

| | | | | Other Assets in Excess of Liabilities — 1.7% | | | 535,683 | |

| | | | | TOTAL NET ASSETS — 100.0% | | $ | 31,883,951 | |

ADR – American Depository Receipt

ETF – Exchange-Traded Fund

| * | Non-income producing security. |

| 1 | Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities are restricted and may be resold in transactions exempt from registration normally to qualified institutional buyers. The total value of these securities is $829,121, which represents 2.60% of Net Assets. |

See accompanying Notes to Financial Statements.

AXS Knowledge Leaders ETF

SCHEDULE OF INVESTMENTS

As of September 30, 2024 (Unaudited)

Number of

Shares | | | | | Value | |

| | | | COMMON STOCKS — 98.6% | | | |

| | | | AUSTRALIA — 1.6% | | | |

| | 52,649 | | | Aristocrat Leisure Ltd. | | $ | 2,140,379 | |

| | | | | | | | | |

| | | | | BELGIUM — 0.8% | | | | |

| | 4,928 | | | D'ieteren Group | | | 1,044,430 | |

| | | | | | | | | |

| | | | | CANADA — 3.8% | | | | |

| | 14,848 | | | Descartes Systems Group, Inc.* | | | 1,529,588 | |

| | 9,020 | | | FirstService Corp. | | | 1,649,900 | |

| | 12,070 | | | RB Global, Inc. | | | 972,515 | |

| | 10,066 | | | Suncor Energy, Inc.1 | | | 371,957 | |

| | 17,932 | | | Suncor Energy, Inc. | | | 662,049 | |

| | | | | | | | 5,186,009 | |

| | | | | FRANCE — 2.3% | | | | |

| | 45,325 | | | Cie Generale des Etablissements Michelin SCA | | | 1,844,328 | |

| | 31,995 | | | Dassault Systemes S.E. | | | 1,272,277 | |

| | | | | | | | 3,116,605 | |

| | | | | GERMANY — 8.2% | | | | |

| | 3,517 | | | adidas A.G. | | | 933,793 | |

| | 11,307 | | | Beiersdorf A.G. | | | 1,705,482 | |

| | 27,033 | | | Fresenius S.E. & Co. KGaA* | | | 1,032,725 | |

| | 14,772 | | | Heidelberg Materials A.G. | | | 1,609,062 | |

| | 39,137 | | | Infineon Technologies A.G. | | | 1,374,137 | |

| | 16,651 | | | Knorr-Bremse A.G. | | | 1,483,880 | |

| | 6,507 | | | Merck KGaA | | | 1,147,418 | |

| | 8,079 | | | SAP S.E. | | | 1,842,986 | |

| | | | | | | | 11,129,483 | |

| | | | | IRELAND — 2.7% | | | | |

| | 34,054 | | | Experian PLC | | | 1,795,615 | |

| | 4,878 | | | Trane Technologies PLC | | | 1,896,225 | |

| | | | | | | | 3,691,840 | |

| | | | | ISRAEL — 1.0% | | | | |

| | 36,600 | | | Sapiens International Corp. N.V. | | | 1,364,082 | |

| | | | | | | | | |

| | | | | ITALY — 2.2% | | | | |

| | 15,128 | | | Interpump Group S.p.A. | | | 707,085 | |

| | 13,819 | | | Moncler S.p.A. | | | 879,402 | |

| | 18,781 | | | Prysmian S.p.A. | | | 1,366,627 | |

| | | | | | | | 2,953,114 | |

| | | | | JAPAN — 34.6% | | | | |

| | 49,100 | | | ABC-Mart, Inc. | | | 1,046,945 | |

AXS Knowledge Leaders ETF

SCHEDULE OF INVESTMENTS - Continued

As of September 30, 2024 (Unaudited)

Number of

Shares | | | | | Value | |

| | | | COMMON STOCKS (Continued) | | | |

| | | | JAPAN (Continued) | | | |

| | 34,900 | | | BIPROGY, Inc. | | $ | 1,185,780 | |

| | 32,600 | | | Chugai Pharmaceutical Co., Ltd. | | | 1,579,860 | |

| | 66,000 | | | Denso Corp. | | | 980,726 | |

| | 20,400 | | | Fuji Electric Co., Ltd. | | | 1,229,362 | |

| | 64,000 | | | FUJIFILM Holdings Corp. | | | 1,650,112 | |

| | 5,600 | | | Hikari Tsushin, Inc. | | | 1,247,707 | |

| | 11,000 | | | Hirose Electric Co., Ltd. | | | 1,400,378 | |

| | 83,800 | | | J Front Retailing Co., Ltd. | | | 906,017 | |

| | 16,200 | | | Jeol Ltd. | | | 629,585 | |

| | 50,900 | | | Kansai Paint Co., Ltd. | | | 908,115 | |

| | 45,900 | | | Kao Corp. | | | 2,281,202 | |

| | 14,600 | | | Konami Group Corp. | | | 1,484,599 | |

| | 14,000 | | | Kose Corp. | | | 908,669 | |

| | 37,000 | | | Makita Corp. | | | 1,252,216 | |

| | 53,800 | | | MISUMI Group, Inc. | | | 974,147 | |

| | 210,800 | | | Mitsubishi Chemical Group Corp. | | | 1,354,195 | |

| | 49,900 | | | Mitsui Chemicals, Inc. | | | 1,327,387 | |

| | 45,100 | | | Miura Co., Ltd. | | | 1,107,321 | |

| | 33,400 | | | MonotaRO Co., Ltd. | | | 559,819 | |

| | 54,400 | | | NIDEC Corp. | | | 1,143,221 | |

| | 31,932 | | | Nifco, Inc. | | | 811,694 | |

| | 8,900 | | | Nitori Holdings Co., Ltd. | | | 1,356,093 | |

| | 39,400 | | | Nomura Research Institute Ltd. | | | 1,459,871 | |

| | 81,800 | | | NS Solutions Corp. | | | 2,135,927 | |

| | 26,600 | | | Recruit Holdings Co., Ltd. | | | 1,618,799 | |

| | 36,300 | | | Ryohin Keikaku Co., Ltd. | | | 668,444 | |

| | 89,200 | | | Sanwa Holdings Corp. | | | 2,354,097 | |

| | 16,800 | | | SCREEN Holdings Co., Ltd. | | | 1,171,326 | |

| | 55,100 | | | Sega Sammy Holdings, Inc. | | | 1,101,692 | |

| | 4,500 | | | Shimano, Inc. | | | 854,761 | |

| | 89,600 | | | Suzuki Motor Corp. | | | 997,539 | |

| | 106,000 | | | Takashimaya Co., Ltd. | | | 847,022 | |

| | 50,700 | | | Tokyo Ohka Kogyo Co., Ltd. | | | 1,236,663 | |

| | 46,100 | | | TOPPAN Holdings, Inc. | | | 1,367,788 | |

| | 168,900 | | | Yamaha Corp. | | | 1,456,503 | |

| | 128,500 | | | Yamaha Motor Co., Ltd. | | | 1,149,888 | |

| | 45,400 | | | Yokogawa Electric Corp. | | | 1,160,074 | |

| | | | | | | | 46,905,544 | |

| | | | | NETHERLANDS — 1.0% | | | | |

| | 41,086 | | | Koninklijke Philips N.V.* | | | 1,349,026 | |

| | | | | | | | | |

| | | | | NORWAY — 1.3% | | | | |

| | 187,945 | | | Orkla A.S.A. | | | 1,774,589 | |

AXS Knowledge Leaders ETF

SCHEDULE OF INVESTMENTS - Continued

As of September 30, 2024 (Unaudited)

Number of

Shares | | | | | Value | |

| | | | COMMON STOCKS (Continued) SWEDEN — 6.0% | | | |

| | 116,524 | | | Atlas Copco A.B. - A Shares | | $ | 2,258,266 | |

| | 68,229 | | | H & M Hennes & Mauritz A.B. - B Shares | | | 1,163,109 | |

| | 248,358 | | | Husqvarna A.B. - B Shares | | | 1,739,579 | |

| | 139,134 | | | Telefonaktiebolaget LM Ericsson - B Shares | | | 1,053,051 | |

| | 71,833 | | | Volvo A.B. - B Shares | | | 1,900,599 | |

| | | | | | | | 8,114,604 | |

| | | | | SWITZERLAND — 4.5% | | | | |

| | 16,484 | | | Alcon A.G. | | | 1,647,716 | |

| | 1,894 | | | EMS-Chemie Holding A.G. | | | 1,594,144 | |

| | 10,296 | | | Garmin Ltd. | | | 1,812,405 | |

| | 1,570 | | | Lonza Group A.G. | | | 994,988 | |

| | | | | | | | 6,049,253 | |

| | | | | UNITED KINGDOM — 6.2% | | | | |

| | 15,282 | | | Anglo American PLC | | | 497,909 | |

| | 35,846 | | | British American Tobacco PLC | | | 1,309,754 | |

| | 341,694 | | | ConvaTec Group PLC | | | 1,040,412 | |

| | 81,164 | | | GSK PLC | | | 1,651,003 | |

| | 108,524 | | | Howden Joinery Group PLC | | | 1,320,308 | |

| | 546,629 | | | JD Sports Fashion PLC | | | 1,129,527 | |

| | 348,399 | | | Kingfisher PLC | | | 1,504,786 | |

| | | | | | | | 8,453,699 | |

| | | | | UNITED STATES — 22.4% | | | | |

| | 11,178 | | | Agilent Technologies, Inc. | | | 1,659,710 | |

| | 8,086 | | | Alphabet, Inc. - Class A | | | 1,341,063 | |

| | 6,760 | | | Amazon.com, Inc.* | | | 1,259,591 | |

| | 7,764 | | | Analog Devices, Inc. | | | 1,787,040 | |

| | 6,185 | | | Biogen, Inc.* | | | 1,198,900 | |

| | 20,187 | | | Boston Scientific Corp.* | | | 1,691,671 | |

| | 14,185 | | | Carrier Global Corp. | | | 1,141,751 | |

| | 51,607 | | | Cohu, Inc.* | | | 1,326,300 | |

| | 6,896 | | | Constellation Brands, Inc. - Class A | | | 1,777,030 | |

| | 5,373 | | | Danaher Corp. | | | 1,493,802 | |

| | 5,547 | | | Datadog, Inc. - Class A* | | | 638,238 | |

| | 6,702 | | | Ecolab, Inc. | | | 1,711,222 | |

| | 9,912 | | | Genuine Parts Co. | | | 1,384,508 | |

| | 3,181 | | | Hubbell, Inc. | | | 1,362,581 | |

| | 37,101 | | | Keurig Dr Pepper, Inc. | | | 1,390,546 | |

| | 2,001 | | | KLA Corp. | | | 1,549,594 | |

| | 21,484 | | | McCormick & Co., Inc. | | | 1,768,133 | |

| | 11,424 | | | NetApp, Inc. | | | 1,410,978 | |

| | 51,616 | | | Pfizer, Inc. | | | 1,493,767 | |

| | 4,834 | | | STERIS PLC | | | 1,172,438 | |

AXS Knowledge Leaders ETF

SCHEDULE OF INVESTMENTS - Continued

As of September 30, 2024 (Unaudited)

Number of

Shares | | | | | Value | |

| | | | | COMMON STOCKS (Continued) | | | | |

| | | | | UNITED STATES (Continued) | | | | |

| | 2,527 | | | Thermo Fisher Scientific, Inc. | | $ | 1,563,126 | |

| | 2,049 | | | Veralto Corp. | | | 229,201 | |

| | | | | | | | 30,351,190 | |

| | | | | TOTAL COMMON STOCKS | | | | |

| | | | | (Cost $107,661,719) | | | 133,623,847 | |

| | | | | | | | | |

| | | | TOTAL INVESTMENTS — 98.6% | | | |

| | | | | (Cost $107,661,719) | | | 133,623,847 | |

| | | | | | | | | |

| | | | | Other Assets in Excess of Liabilities — 1.4% | | | 1,936,977 | |

| | | | | TOTAL NET ASSETS — 100.0% | | $ | 135,560,824 | |

PLC – Public Limited Company

*Non-income producing security.

1Denoted investment is a Canadian security traded on the U.S. Stock Exchange.

See accompanying Notes to Financial Statements.

AXS Funds

STATEMENTS OF ASSETS AND LIABILITIES

As of September 30, 2024 (Unaudited)

| | | AXS

Astoria Real Assets ETF | | | AXS

Change Finance

ESG ETF | |

| Assets: | | | | | | |

| Investments, at value (cost $60,935,430 and $107,363,832, respectively) | | $ | 65,922,613 | | | $ | 132,311,015 | |

| Foreign currency, at value (cost $24,770 and $0, respectively) | | | 24,723 | | | | - | |

| Cash | | | - | | | | 473,665 | |

| Receivables: | | | | | | | | |

| Dividends and interest | | | 116,870 | | | | 61,260 | |

| Reclaims receivable | | | 180,107 | | | | 3,095 | |

| Prepaid expenses | | | - | | | | - | |

| Other receivable | | | 3,100 | | | | - | |

| Total assets | | | 66,247,413 | | | | 132,849,035 | |

| | | | | | | | | |

| Liabilities: | | | | | | | | |

| Foreign currency due to custodian, at value (proceeds $0 and $0, respectively) | | | - | | | | - | |

| Payables: | | | | | | | | |

| Advisory fees | | | 32,605 | | | | 44,879 | |

| Fund administration fees | | | - | | | | - | |

| Transfer agent fees and expenses | | | - | | | | - | |

| Custody fees | | | - | | | | - | |

| Due to custodian | | | 21,950 | | | | - | |

| Fund accounting fees | | | - | | | | - | |

| Auditing fees | | | - | | | | - | |

| Chief Compliance Officer fees | | | - | | | | - | |

| Legal fees | | | - | | | | - | |

| Trustees’ fees and expenses | | | - | | | | - | |

| Trustees’ deferred compensation (Note 3) | | | - | | | | - | |

| Shareholder reporting fees | | | - | | | | - | |

| Accrued other expenses | | | - | | | | - | |

| Total liabilities | | | 54,555 | | | | 44,879 | |

| Commitments and contingencies (Note 3) | | | | | | | | |

| Net Assets | | $ | 66,192,858 | | | $ | 132,804,156 | |

| | | | | | | | | |

| Components of Net Assets: | | | | | | | | |

| Paid-in capital (par value of $0.01 per share with an unlimited number of shares authorized) | | $ | 69,762,713 | | | $ | 126,325,026 | |

| Total distributable earnings (accumulated deficit) | | | (3,569,855 | ) | | | 6,479,130 | |

| Net Assets | | $ | 66,192,858 | | | $ | 132,804,156 | |

| | | | | | | | | |

| Shares of beneficial interest issued and outstanding | | | 4,265,349 | | | | 3,450,000 | |

| Net asset value per share | | $ | 15.52 | | | $ | 38.49 | |

See accompanying Notes to Financial Statements.

AXS Funds

STATEMENTS OF ASSETS AND LIABILITIES - Continued

As of September 30, 2024 (Unaudited)

| | | AXS

Green Alpha ETF | | | AXS

Esoterica NextG Economy

ETF | |

| Assets: | | | | | | |

| Investments, at value (cost $44,637,532 and $26,181,528, respectively) | | $ | 50,630,104 | | | $ | 31,348,268 | |

| Foreign currency, at value (cost $19 and $0, respectively) | | | 20 | | | | - | |

| Cash | | | 58,106 | | | | 595,651 | |

| Receivables: | | | | | | | | |

| Dividends and interest | | | 55,246 | | | | 6,044 | |

| Reclaims receivable | | | 25,418 | | | | - | |

| Prepaid expenses | | | - | | | | 6 | |

| Other receivable | | | - | | | | - | |

| Total assets | | | 50,768,894 | | | | 31,949,969 | |

| | | | | | | | | |

| Liabilities: | | | | | | | | |

| Foreign currency due to custodian, at value (proceeds $166 and $324, respectively) | | | 172 | | | | 324 | |

| Payables: | | | | | | | | |

| Advisory fees | | | 34,653 | | | | 2,293 | |

| Fund administration fees | | | - | | | | 9,948 | |

| Transfer agent fees and expenses | | | - | | | | 2,844 | |

| Custody fees | | | - | | | | 4,259 | |

| Due to custodian | | | - | | | | - | |

| Fund accounting fees | | | - | | | | 10,216 | |

| Auditing fees | | | - | | | | 8,523 | |

| Chief Compliance Officer fees | | | - | | | | 5,664 | |

| Legal fees | | | - | | | | 4,812 | |

| Trustees’ fees and expenses | | | - | | | | 1,031 | |

| Trustees’ deferred compensation (Note 3) | | | - | | | | 3,652 | |

| Shareholder reporting fees | | | - | | | | 4,995 | |

| Accrued other expenses | | | - | | | | 7,457 | |

| Total liabilities | | | 34,825 | | | | 66,018 | |

| Commitments and contingencies (Note 3) | | | | | | | | |

| Net Assets | | $ | 50,734,069 | | | $ | 31,883,951 | |

| Components of Net Assets: | | | | | | | | |

| Paid-in capital (par value of $0.01 per share with an unlimited number of shares authorized) | | $ | 46,333,591 | | | $ | 27,119,552 | |

| Total distributable earnings (accumulated deficit) | | | 4,400,478 | | | | 4,764,399 | |

| Net Assets | | $ | 50,734,069 | | | $ | 31,883,951 | |

| | | | | | | | | |

| Shares of beneficial interest issued and outstanding | | | 1,500,000 | | | | 450,754 | |

| Net asset value per share | | $ | 33.82 | | | $ | 70.73 | |

See accompanying Notes to Financial Statements.

AXS Funds

STATEMENTS OF ASSETS AND LIABILITIES - Continued

As of September 30, 2024 (Unaudited)

| | | AXS

Knowledge Leaders ETF | |

| Assets: | | | |

| Investments, at value (cost $107,661,719) | | $ | 133,623,847 | |

| Cash | | | 1,109,608 | |

| Receivables: | | | | |

| Dividends and interest | | | 533,270 | |

| Reclaims receivable | | | 404,225 | |

| Total assets | | | 135,670,950 | |

| | | | | |

| Liabilities: | | | | |

| Foreign currency due to custodian, at value (proceeds $38,858) | | | 38,858 | |

| Payables: | | | | |

| Advisory fees | | | 71,268 | |

| Total liabilities | | | 110,126 | |

| Commitments and contingencies (Note 3) | | | | |

| Net Assets | | $ | 135,560,824 | |

| | | | | |

| Components of Net Assets: | | | | |

| Paid-in capital (par value of $0.01 per share with an unlimited number of shares authorized) | | $ | 112,261,316 | |

| Total distributable earnings (accumulated deficit) | | | 23,299,508 | |

| Net Assets | | $ | 135,560,824 | |

| | | | | |

| Shares of beneficial interest issued and outstanding | | | 2,800,001 | |

| Net asset value per share | | $ | 48.41 | |

See accompanying Notes to Financial Statements.

AXS Funds

STATEMENTS OF OPERATIONS

For the Six Months/Period Ended September 30, 2024 (Unaudited)

| | | AXS

Astoria Real Assets ETF | | | AXS

Change Finance

ESG ETF | |

| Investment Income: | | | | | | |

| Dividends (net of foreign withholding taxes of $35,770 and $0, respectively) | | $ | 832,110 | | | $ | 776,281 | |

| Interest | | | 15,184 | | | | 9,654 | |

| Total investment income | | | 847,294 | | | | 785,935 | |

| | | | | | | | | |

| Expenses: | | | | | | | | |

| Advisory fees | | | 242,357 | | | | 306,187 | |

| Fund administration fees | | | - | | | | - | |

| Transfer agent fees and expenses | | | - | | | | - | |

| Custody fees | | | - | | | | - | |

| Interest expense | | | 4,139 | | | | 23 | |

| Fund accounting fees | | | - | | | | - | |

| Shareholder reporting fees | | | - | | | | - | |

| Legal fees | | | - | | | | - | |

| Auditing fees | | | - | | | | - | |

| Trustees’ fees and expenses | | | - | | | | - | |

| Insurance fees | | | - | | | | - | |

| Chief Compliance Officer fees | | | - | | | | - | |

| Miscellaneous | | | - | | | | - | |

| Total expenses | | | 246,496 | | | | 306,210 | |

| Advisory fees (waived) recovered | | | - | | | | - | |

| Net expenses | | | 246,496 | | | | 306,210 | |

| Net investment income (loss) | | | 600,798 | | | | 479,725 | |

| | | | | | | | | |

| Realized and Unrealized Gain (Loss) on: | | | | | | | | |

| Net realized gain (loss) on: | | | | | | | | |

| Investments | | | 1,989,316 | | | | (2,949,451 | ) |

| Investments in-kind | | | 4,028,452 | | | | 6,206,597 | |

| Foreign currency transactions | | | (31,007 | ) | | | - | |

| Net realized gain (loss) | | | 5,986,761 | | | | 3,257,146 | |

| Net change in unrealized appreciation/depreciation on: | | | | | | | | |

| Investments | | | (6,322,287 | ) | | | 2,497,956 | |

| Foreign currency translations | | | 2,512 | | | | - | |

| Net change in unrealized appreciation/depreciation | | | (6,319,775 | ) | | | 2,497,956 | |

| Net realized and unrealized gain (loss) | | | (333,014 | ) | | | 5,755,102 | |

| | | | | | | | | |

| Net Increase (Decrease) in Net Assets from Operations | | $ | 267,784 | | | $ | 6,234,827 | |

See accompanying Notes to Financial Statements.

AXS Funds

STATEMENTS OF OPERATIONS - Continued

For the Six Months/Period Ended September 30, 2024 (Unaudited)

| | | AXS

Green Alpha ETF | | | AXS

Esoterica NextG Economy

ETF | |

| Investment Income: | | | | | | |

| Dividends (net of foreign withholding taxes of $23,838 and $3,131, respectively) | | $ | 376,651 | | | $ | 68,476 | |

| Interest | | | 3,783 | | | | 69,735 | |

| Total investment income | | | 380,434 | | | | 138,211 | |

| Expenses: | | | | | | | | |

| Advisory fees | | | 259,670 | | | | 114,273 | |

| Fund administration fees | | | - | | | | 22,582 | |

| Transfer agent fees and expenses | | | - | | | | 1,597 | |

| Custody fees | | | - | | | | 9,922 | |

| Interest expense | | | 17 | | | | 10 | |

| Fund accounting fees | | | - | | | | 20,659 | |

| Shareholder reporting fees | | | - | | | | 6,016 | |

| Legal fees | | | - | | | | 3,655 | |

| Auditing fees | | | - | | | | 8,523 | |

| Trustees’ fees and expenses | | | - | | | | 2,717 | |

| Insurance fees | | | - | | | | 502 | |

| Chief Compliance Officer fees | | | - | | | | 12,191 | |

| Miscellaneous | | | - | | | | 5,013 | |

| Total expenses | | | 259,687 | | | | 207,660 | |

| Advisory fees (waived) recovered | | | - | | | | (93,291 | ) |

| Net expenses | | | 259,687 | | | | 114,369 | |

| Net investment income (loss) | | | 120,747 | | | | 23,842 | |

| | | | | | | | | |

| Realized and Unrealized Gain (Loss) on: | | | | | | | | |

| Net realized gain (loss) on: | | | | | | | | |

| Investments | | | 548,748 | | | | 2,424,553 | |

| Investments in-kind | | | 1,117,093 | | | | 1,418,871 | |

| Foreign currency transactions | | | 391 | | | | (370 | ) |

| Net realized gain (loss) | | | 1,666,232 | | | | 3,843,054 | |

| Net change in unrealized appreciation/depreciation on: | | | | | | | | |

| Investments | | | (226,619 | ) | | | (292,592 | ) |

| Foreign currency translations | | | 249 | | | | - | |

| Net change in unrealized appreciation/depreciation | | | (226,370 | ) | | | (292,592 | ) |

| Net realized and unrealized gain (loss) | | | 1,439,862 | | | | 3,550,462 | |

| | | | | | | | | |

| Net Increase (Decrease) in Net Assets from Operations | | $ | 1,560,609 | | | $ | 3,574,304 | |

See accompanying Notes to Financial Statements.

AXS Funds

STATEMENTS OF OPERATIONS - Continued

For the Six Months/Period Ended September 30, 2024 (Unaudited)

| | | AXS

Knowledge Leaders ETF*,** | |

| Investment Income: | | | |

| Dividends (net of foreign withholding taxes of $102,553) | | $ | 931,505 | |

| Interest | | | 91,964 | |

| Total investment income | | | 1,023,469 | |

| | | | | |

| Expenses: | | | | |

| | | | | |

| Advisory fees | | | 410,028 | |

| Interest expense | | | 54,423 | |

| Total expenses | | | 464,451 | |

| Net investment income (loss) | | | 559,018 | |

| | | | | |

| Realized and Unrealized Gain (Loss) on: | | | | |

| Net realized gain (loss) on: | | | | |

| Investments | | | 3,864,775 | |

| Investments in-kind | | | 2,813,239 | |

| Foreign currency transactions | | | (163,665 | ) |

| Net realized gain (loss) | | | 6,514,349 | |

| Net change in unrealized appreciation/depreciation on: | | | | |

| Investments | | | 7,886,311 | |

| Foreign currency translations | | | 52,510 | |

| Net change in unrealized appreciation/depreciation | | | 7,938,821 | |

| Net realized and unrealized gain (loss) | | | 14,453,170 | |

| | | | | |

| Net Increase (Decrease) in Net Assets from Operations | | $ | 15,012,188 | |

| * | Fiscal year end changed to March 31, effective August 1, 2024. |

| ** | AXS Knowledge Leaders ETF commenced investment operations on July 22, 2024. Prior to that date, the AXS Knowledge Leaders ETF acquired the assets and assumed the liabilites of the Knowledge Leaders Developed World ETF (the “Knowledge Leaders ETF Predecessor Fund”), a series of Investment Mangers Series Trust, in a tax-free reorganization as set out in the Agreement and Plan of Reorganization. |

See accompanying Notes to Financial Statements.

AXS Astoria Real Assets ETF

STATEMENTS OF CHANGES IN NET ASSETS

| | | For the

Six Months

Ended

September 30,

2024 (Unaudited) | | | For the

Year Ended

March 31, 2024 | |

| Increase (Decrease) in Net Assets from: | | | | | | |

| Operations: | | | | | | |

| Net investment income (loss) | | $ | 600,798 | | | $ | 1,229,613 | |

| Net realized gain (loss) on investments, investments in kind and foreign currency transactions | | | 5,986,761 | | | | 2,111,732 | |

| Net change in unrealized appreciation/depreciation on investments and foreign currency translations | | | (6,319,775 | ) | | | 11,575,626 | |

| Net increase (decrease) in net assets resulting from operations | | | 267,784 | | | | 14,916,971 | |

| | | | | | | | | |

| Distributions to Shareholders: | | | | | | | | |

| Total distributions to shareholders | | | (585,020 | ) | | | (1,371,385 | ) |

| | | | | | | | | |

| Capital Transactions: | | | | | | | | |

| Net proceeds from shares sold | | | 32,097,153 | | | | 21,959,728 | |

| Cost of shares redeemed | | | (28,141,397 | ) | | | (41,939,051 | ) |

| Net increase (decrease) in net assets from capital transactions | | | 3,955,756 | | | | (19,979,323 | ) |

| | | | | | | | | |

| Total increase (decrease) in net assets | | | 3,638,520 | | | | (6,433,737 | ) |

| | | | | | | | | |

| Net Assets: | | | | | | | | |

| Beginning of period | | | 62,554,338 | | | | 68,988,075 | |

| End of period | | $ | 66,192,858 | | | $ | 62,554,338 | |

| | | | | | | | | |

| Capital Share Transactions:* | | | | | | | | |

| Shares sold | | | 1,820,349 | | | | 1,650,000 | |

| Shares redeemed | | | (1,495,000 | ) | | | (3,210,000 | ) |

| Net increase (decrease) in capital share transactions | | | 325,349 | | | | (1,560,000 | ) |

| * | The Fund had a 2-1 forward stock split after the close of business April 29, 2024, which is retroactively adjusted as of March 31, 2024. See Note 1 in the accompanying Notes to Financial Statements. |

See accompanying Notes to Financial Statements.

AXS Change Finance ESG ETF

STATEMENTS OF CHANGES IN NET ASSETS

| | | For the

Six Months

Ended

September 30,

2024 (Unaudited) | | | For the

Year Ended

March 31, 2024 | |

Increase (Decrease) in Net Assets from:

Operations: | | | | | | |

| Net investment income (loss) | | $ | 479,725 | | | $ | 1,190,996 | |

| Net realized gain (loss) on investments and investments in kind | | | 3,257,146 | | | | 8,172,295 | |

| Net change in unrealized appreciation/depreciation on investments | | | 2,497,956 | | | | 21,898,534 | |

| Net increase (decrease) in net assets resulting from operations | | | 6,234,827 | | | | 31,261,825 | |

| | | | | | | | | |

| Distributions to Shareholders: | | | | | | | | |

| Total distributions to shareholders | | | - | | | | (1,243,419 | ) |

| | | | | | | | | |

| Capital Transactions: | | | | | | | | |

| Net proceeds from shares sold | | | 27,599,652 | | | | 39,198,032 | |

| Cost of shares redeemed | | | (28,428,425 | ) | | | (58,775,350 | ) |

| Net increase (decrease) in net assets from capital transactions | | | (828,773 | ) | | | (19,577,318 | ) |

| | | | | | | | | |

| Total increase (decrease) in net assets | | | 5,406,054 | | | | 10,441,088 | |

| | | | | | | | | |

| Net Assets: | | | | | | | | |

| Beginning of period | | | 127,398,102 | | | | 116,957,014 | |

| End of period | | $ | 132,804,156 | | | $ | 127,398,102 | |

| | | | | | | | | |

| Capital Share Transactions: | | | | | | | | |

| Shares sold | | | 750,000 | | | | 1,225,000 | |

| Shares redeemed | | | (775,000 | ) | | | (1,800,000 | ) |

| Net increase (decrease) in capital share transactions | | | (25,000 | ) | | | (575,000 | ) |

See accompanying Notes to Financial Statements.

AXS Green Alpha ETF

STATEMENTS OF CHANGES IN NET ASSETS

| | | For the

Six Months

Ended

September 30,

2024

(Unaudited) | | | For the Year Ended

March 31,

2024 | |

| Increase (Decrease) in Net Assets from: | | | | | | |

| Operations: | | | | | | |

| Net investment income (loss) | | $ | 120,747 | | | $ | 426,993 | |

| Net realized gain (loss) on investments, investments in kind and foreign currency transactions | | | 1,666,232 | | | | 1,612,656 | |

| Net change in unrealized appreciation/depreciation on investments and foreign currency translations | | | (226,370 | ) | | | 2,444,841 | |

| Net increase (decrease) in net assets resulting from operations | | | 1,560,609 | | | | 4,484,490 | |

| | | | | | | | | |

| Distributions to Shareholders: | | | | | | | | |

| Total distributions to shareholders | | | (258,373 | ) | | | (618,637 | ) |

| | | | | | | | | |

| Capital Transactions: | | | | | | | | |

| Net proceeds from shares sold | | | - | | | | 15,208,289 | |

| Cost of shares redeemed | | | (7,640,230 | ) | | | (31,937,045 | ) |

| Net increase (decrease) in net assets from capital transactions | | | (7,640,230 | ) | | | (16,728,756 | ) |

| | | | | | | | | |

| Total increase (decrease) in net assets | | | (6,337,994 | ) | | | (12,862,903 | ) |

| | | | | | | | | |

| Net Assets: | | | | | | | | |

| Beginning of period | | | 57,072,063 | | | | 69,934,966 | |

| End of period | | $ | 50,734,069 | | | $ | 57,072,063 | |

| Capital Share Transactions: | | | | | | | | |

| Shares sold | | | - | | | | 490,000 | |

| Shares redeemed | | | (230,000 | ) | | | (950,000 | ) |

| Net increase (decrease) in capital share transactions | | | (230,000 | ) | | | (460,000 | ) |

See accompanying Notes to Financial Statements.

AXS Esoterica NextG Economy ETF

STATEMENTS OF CHANGES IN NET ASSETS

| | | For the

Six Months

Ended

September 30,

2024

(Unaudited) | | | For the

Year Ended

March 31,

2024 | �� |

Increase (Decrease) in Net Assets from:

Operations: | | | | | | |

| Net investment income (loss) | | $ | 23,842 | | | $ | (44,765 | ) |

| Net realized gain (loss) on investments, investments in kind and foreign currency transactions | | | 3,843,054 | | | | 1,379,825 | |

| Net change in unrealized appreciation/depreciation on investments and foreign currency translations | | | (292,592 | ) | | | 8,844,066 | |

| Net increase (decrease) in net assets resulting from operations | | | 3,574,304 | | | | 10,179,126 | |

| | | | | | | | | |

| Capital Transactions: | | | | | | | | |

| Net proceeds from shares sold | | | 1,755,290 | | | | 7,899,129 | |

| Cost of shares redeemed | | | (4,478,425 | ) | | | (6,872,963 | ) |

| Transactions fees (Note 2c) | | | 77 | | | | 247 | |

| Net increase (decrease) in net assets from capital transactions | | | (2,723,058 | ) | | | 1,026,413 | |

| | | | | | | | | |

| Total increase (decrease) in net assets | | | 851,246 | | | | 11,205,539 | |

| | | | | | | | | |

| Net Assets: | | | | | | | | |

| Beginning of period | | | 31,032,705 | | | | 19,827,166 | |

| End of period | | $ | 31,883,951 | | | $ | 31,032,705 | |

| | | | | | | | | |

| Capital Share Transactions: | | | | | | | | |

| Shares sold | | | 25,000 | | | | 150,000 | |

| Shares redeemed | | | (75,000 | ) | | | (150,000 | ) |

| Net increase (decrease) in capital share transactions | | | (50,000 | ) | | | - | |

See accompanying Notes to Financial Statements.

AXS Knowledge Leaders ETF ^

STATEMENTS OF CHANGES IN NET ASSETS

| | | For the

Period

Ended

September 30,

2024*

(Unaudited) | | | For the

Year Ended

April 30,

2024 | | | For the

Year Ended

April 30,

2023 | |

| Increase (Decrease) in Net Assets from: | | | | | | | | | | | | |

| Operations: | | | | | | | | | | | | |

| Net investment income (loss) | | $ | 559,018 | | | $ | 1,446,426 | | | $ | 1,519,589 | |

| Net realized gain (loss) on investments, investments in kind and foreign currency transactions | | | 6,514,349 | | | | 17,344,985 | | | | (11,177,516 | ) |

| Net change in unrealized appreciation/depreciation on investments and foreign currency translations | | | 7,938,821 | | | | (6,530,039 | ) | | | 12,835,811 | |

| Net increase (decrease) in net assets resulting from operations | | | 15,012,188 | | | | 12,261,372 | | | | 3,177,884 | |

| | | | | | | | | | | | | |

| Distributions to Shareholders: | | | | | | | | | | | | |

| Total distributions to shareholders | | | - | | | | (1,732,994 | ) | | | (2,229,007 | ) |

| | | | | | | | | | | | | |

| Capital Transactions: | | | | | | | | | | | | |

| Net proceeds from shares sold | | | 2,324,000 | | | | - | | | | 1,861,275 | |

| Cost of shares redeemed | | | (13,482,135 | ) | | | (5,932,885 | ) | | | (33,601,565 | ) |

| Net increase (decrease) in net assets from capital transactions | | | (11,158,135 | ) | | | (5,932,885 | ) | | | (31,740,290 | ) |

| Total increase (decrease) in net assets | | | 3,854,053 | | | | 4,595,493 | | | | (30,791,413 | ) |

| | | | | | | | | | | | | |

| Net Assets: | | | | | | | | | | | | |

| Beginning of period | | | 131,706,771 | | | | 127,111,278 | | | | 157,902,691 | |

| End of period | | $ | 135,560,824 | | | $ | 131,706,771 | | | $ | 127,111,278 | |

| Capital Share Transactions: | | | | | | | | | | | | |

| Shares sold | | | 50,000 | | | | - | | | | 50,000 | |

| Shares redeemed | | | (300,000 | ) | | | (150,000 | ) | | | 900,000 | |

| Net increase (decrease) in capital share transactions | | | (250,000 | ) | | | (150,000 | ) | | | (850,000 | ) |

| ^ | AXS Knowledge Leaders ETF commenced investment operations on July 22, 2024. Prior to that date, the AXS Knowledge Leaders ETF acquired the assets and assumed the liabilites of the Knowledge Leaders Developed World ETF (the “Knowledge Leaders ETF Predecessor Fund”), a series of Investment Mangers Series Trust, in a tax-free reorganization as set out in the Agreement and Plan of Reorganization. |

| * | Fiscal year end changed to March 31, effective August 1, 2024. |

See accompanying Notes to Financial Statements.

AXS Astoria Real Assets ETF

FINANCIAL HIGHLIGHTS*

Per share operating performance.

For a capital share outstanding throughout each period.

| | | For the | | | | | | | | | | |

| | | Six Months | | | | | | | | | | |

| | | Ended | | | For the | | | For the | | | For the | |

| | | September 30, | | | Year Ended | | | Year Ended | | | Period Ended | |

| | | 2024 | | | March 31, | | | March 31, | | | March 31, | |

| | | (Unaudited) | | | 2024 | | | 2023 | | | 2022* | |

| Net asset value, beginning of period | | $ | 15.88 | | | $ | 12.55 | | | $ | 14.25 | | | $ | 12.50 | |

| Income from Investment Operations: | | | | | | | | | | | | | | | | |

| Net investment income (loss)1 | | | 0.14 | | | | 0.27 | | | | 0.45 | | | | 0.09 | |

| Net realized and unrealized gain (loss) | | | (0.38 | ) | | | 3.37 | | | | (1.72 | ) | | | 1.66 | |

| Total from investment operations | | | (0.24 | ) | | | 3.64 | | | | (1.27 | ) | | | 1.75 | |

| | | | | | | | | | | | | | | | | |

| Less Distributions: | | | | | | | | | | | | | | | | |

| From net investment income | | | (0.12 | ) | | | (0.31 | ) | | | (0.43 | ) | | | - | |

| Total distributions | | | (0.12 | ) | | | (0.31 | ) | | | (0.43 | ) | | | - | |

| Net asset value, end of period | | $ | 15.52 | | | $ | 15.88 | | | $ | 12.55 | | | $ | 14.25 | |

| | | | | | | | | | | | | | | | | |