www.newtekone.com Newtek Business Services Corp. NASDAQ: NEWT Update on Pending Acquisition of the National Bank of New York City March 2, 2022 Investor Relations Jayne Cavuoto Director of Investor Relations jcavuoto@newtekone.com (212) 273-8179 Barry Sloane Newtek President, Chairman & CEO (212) 356-9550 bsloane@newtekone.com

www.newtekone.com Note Regarding Forward-Looking Statements 1 The matters discussed in this Presentation, as well as in future oral and written statements by management of Newtek Business Services Corp., that are forward-looking statements, including statements regarding our ability to close the pending Acquisition, obtain required regulatory approvals for the pending Acquisition and obtain shareholder approval to withdraw our election as a BDC, as well as projections, estimates and assumptions concerning the pending Acquisition, are based on current management expectations that involve substantial risks and uncertainties which could cause actual results to differ materially from the results expressed in, or implied by, these forward- looking statements. Forward-looking statements relate to future events or our future financial performance. We generally identify forward-looking statements by terminology such as “may,” “will,” “should,” “would,” “allows,” “outlook,” “seeks,” “desires,” “expects,” “plans,” “anticipates,” “could,” “intends,” “target,” “projects,” “contemplates,” “believes,” “estimates,” “predicts,” “potential” or “continue” or the negative of these terms or other similar expressions. Important assumptions include our ability to originate new investments, achieve certain margins and levels of profitability, the availability of additional capital, and the ability to maintain certain debt to asset ratios. In light of these and other uncertainties, the inclusion of a projection or forward-looking statement in this Presentation should not be regarded as a representation by us that our plans or objectives will be achieved. The forward-looking statements contained in this Presentation include statements as to: the pending Acquisition and the benefits thereof, our future operating results; our business prospects and the prospects of our portfolio companies; the impact of investments that we expect to make; the ability to maintain key personnel and hire new personnel; our ability to expand our product offering; our ability and that of our portfolio companies to achieve their objectives; our expected financings and investments; our regulatory structure and tax status; our ability to operate as a BDC and a RIC; the adequacy of our cash resources and working capital; the timing of cash flows, if any, from the operations of our portfolio companies; the timing, form and amount of any dividend distributions; the impact of fluctuations in interest rates on our business; the valuation of any investments in portfolio companies, particularly those having no liquid trading market; and our ability to recover unrealized losses. The following discussion should be read in conjunction with the section entitled “Risk Factors,” and our consolidated financial statements and related notes and other financial information appearing in our quarterly and annual reports filed with the U.S. Securities and Exchange Commission (“SEC”). We may not actually achieve the plans, intentions or expectations disclosed in forward-looking statements, and you should not place undue reliance on forward looking statements. Actual results or events could differ materially from the plans, intentions and expectations disclosed in forward-looking statements. We do not assume any obligations to update any forward-looking statement, whether as a result of new information, future events or otherwise, except as required by law. In addition to factors previously disclosed in our reports filed with the SEC and those identified elsewhere in this Presentation, the following factors, among others, could cause actual results to differ materially from forward-looking statements or historical performance: our ability to obtain regulatory approvals (and the timing of such approvals) and meet other closing conditions to the Acquisition; modification or termination of certain businesses to comply with regulatory requirements; delay in closing the Acquisition; the occurrence of any event, change or other circumstance that could give rise to the right of one or both parties to terminate the Acquisition; the risk that any announcements relating to the proposed Acquisition could have adverse effects on the market price of our common stock; difficulties and delays in integrating the NBNYC business; diversion of management’s attention from ongoing business operations and opportunities; our ability to operate as a bank holding company and the increase in regulatory burden and compliance costs; the attractiveness of our banking products to our existing customer base and our ability to cross-sell; any change in our dividend payout due to no longer operating as a BDC and RIC. These are representative of the factors that could affect the outcome of the forward-looking statements. In addition, such statements could be affected by general industry and market conditions and growth rates, general economic and political conditions, either nationally or in the states in which Newtek or NBNYC does business, including interest rate fluctuations, changes and trends in the securities markets and other factors. Important risk factors could cause actual future results and other future events to differ materially from those currently estimated by management, including, but not limited to: the timing to consummate the proposed Acquisition; the risk that a condition to closing of the proposed Acquisition may not be satisfied; the risk that regulatory approvals that may be required for the proposed Acquisition, including but not limited to, the federal banking regulators and the SBA, is delayed, is not obtained or is obtained subject to conditions that are not anticipated or desirable; Newtek’s ability to achieve the synergies and value creation contemplated by the proposed Acquisition; inability to obtain shareholder approval to withdraw our election to be a BDC; our status as a RIC; the diversion of management time on Acquisition-related issues; unanticipated increases in costs; and changes in Newtek’s future cash requirements, capital requirements, results of operations, financial condition and/or cash flows.

www.newtekone.com 2 Special Note Regarding Projected Financial Information Projected financial information contained herein illustrates the potential effect of Newtek’s acquisition of NBNYC on our financial position and results of operations based upon management’s current assessment of Newtek’s and NBNYC’s respective historical financial positions and results of operations. Projected financial information for the combined businesses of Newtek and NBNYC is based on management’s current estimates, assumptions and projections and has not been prepared in conformance with the applicable accounting requirements of Regulation S-X relating to pro forma financial information, and the required pro forma adjustments have not been applied and are not reflected therein. None of this information should be considered in isolation from, or as a substitute for, the historical financial statements of Newtek and NBNYC. Projected financial information is unaudited and presented for illustrative purposes only and does not necessarily indicate the results of operations or the combined financial position that may result from Newtek’s Acquisition of NBNYC. All projected financial information is subject to change based upon, among other things, regulatory approvals of Newtek’s current business plan and other assumptions in connection with the pending acquisition of NBNYC. Newtek and its directors, executive officers and certain other members of management may be deemed to be participants in the solicitation of proxies from the stockholders of Newtek in connection with the proposal to withdraw its election to be treated as a business development company (the “Proposal”). Information about the directors and executive officers of Newtek is set forth in its proxy statement for its 2021 annual meeting of stockholders, which was filed with the SEC on March 13, 2021. Information regarding the Proposal and the persons who may, under the rules of the SEC, be considered participants in the solicitation of Newtek’s stockholders in connection with the Proposal, will be contained in the Proxy Statement when such document becomes available. STOCKHOLDERS SHOULD READ THE PROXY STATEMENT WHEN SUCH DOCUMENT BECOMES AVAILABLE. The Proxy Statement may be obtained free of charge from the sources indicated above.

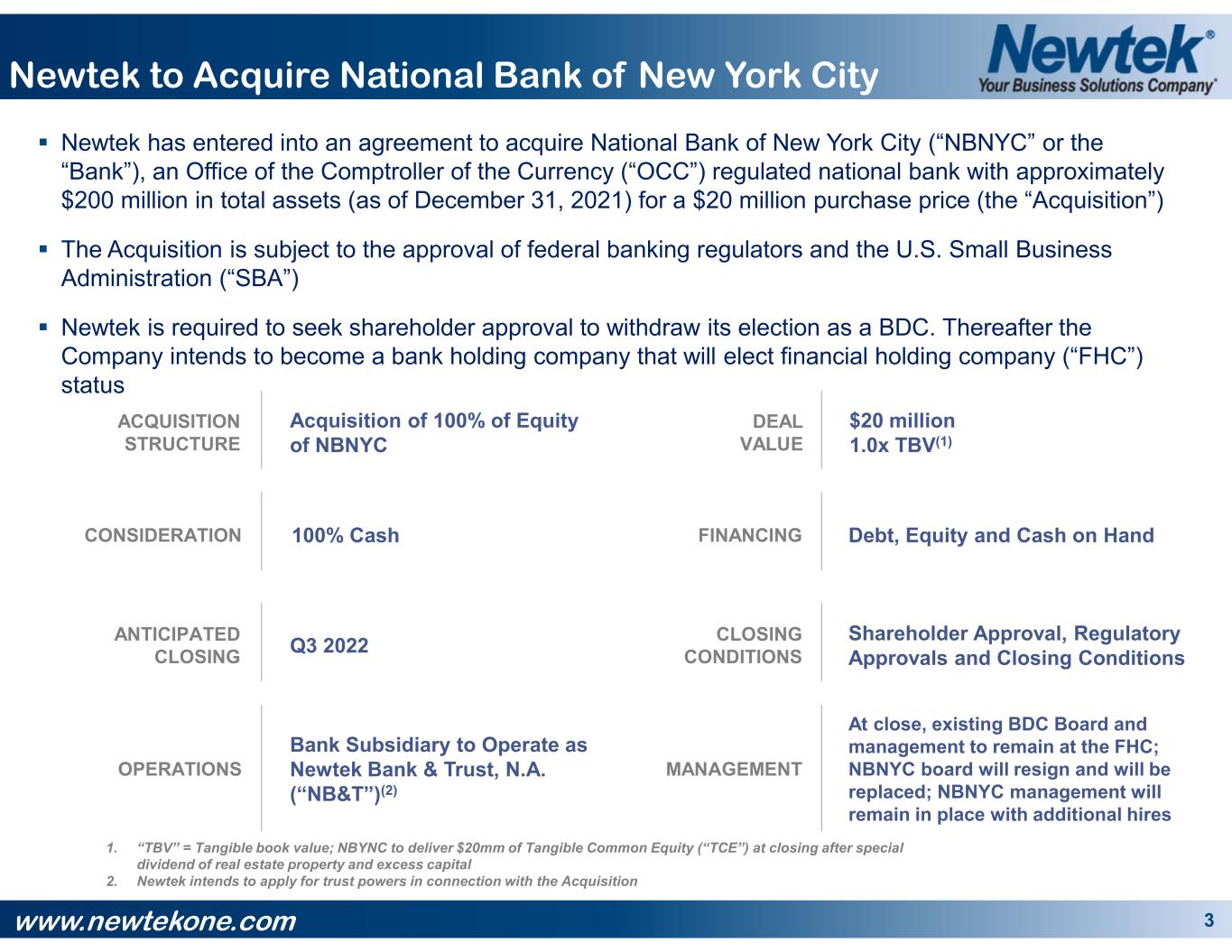

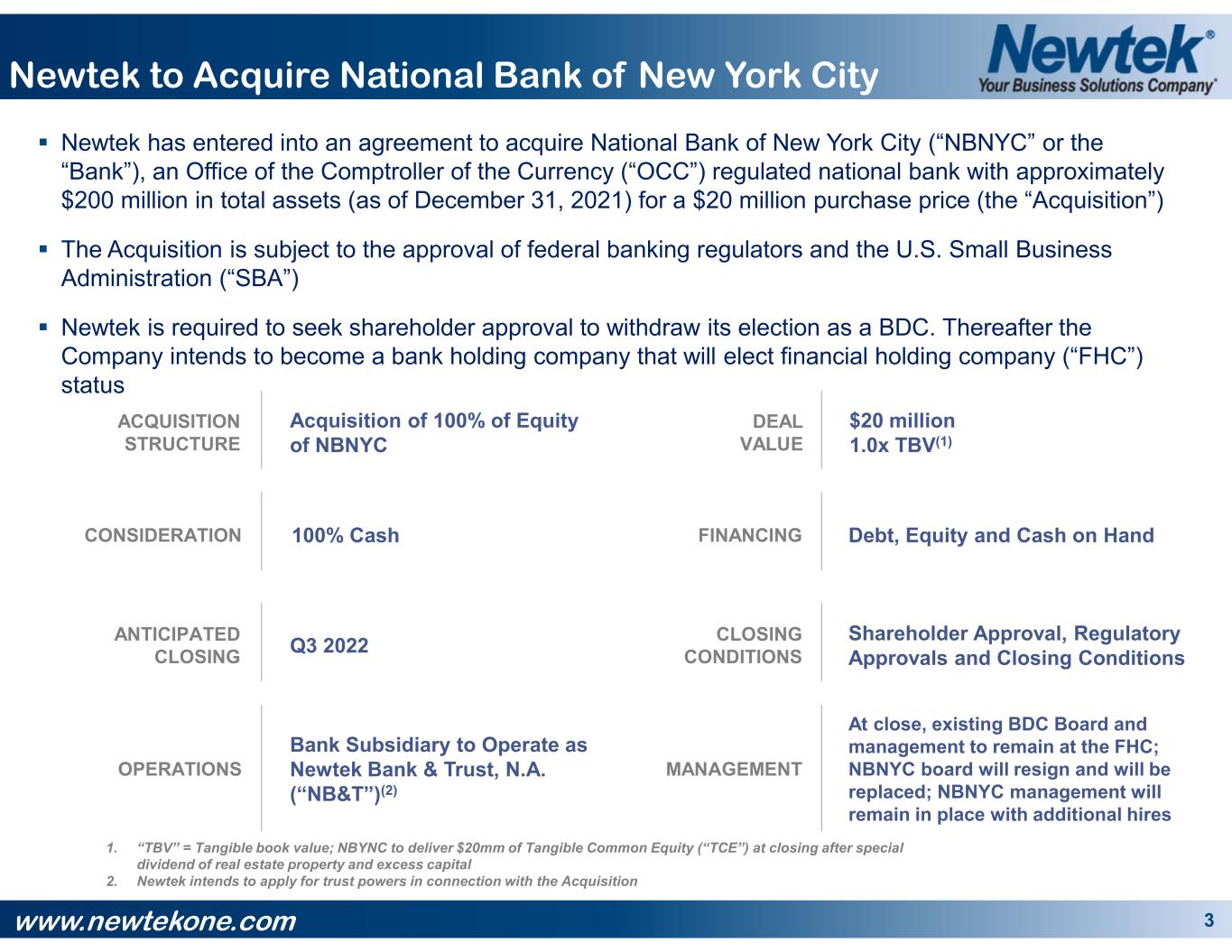

www.newtekone.com Newtek to Acquire National Bank of New York City 3 1. “TBV” = Tangible book value; NBYNC to deliver $20mm of Tangible Common Equity (“TCE”) at closing after special dividend of real estate property and excess capital 2. Newtek intends to apply for trust powers in connection with the Acquisition ACQUISITION STRUCTURE Acquisition of 100% of Equity of NBNYC DEAL VALUE $20 million 1.0x TBV(1) CONSIDERATION 100% Cash FINANCING Debt, Equity and Cash on Hand ANTICIPATED CLOSING Q3 2022 CLOSING CONDITIONS Shareholder Approval, Regulatory Approvals and Closing Conditions OPERATIONS Bank Subsidiary to Operate as Newtek Bank & Trust, N.A. (“NB&T”)(2) MANAGEMENT At close, existing BDC Board and management to remain at the FHC; NBNYC board will resign and will be replaced; NBNYC management will remain in place with additional hires Newtek has entered into an agreement to acquire National Bank of New York City (“NBNYC” or the “Bank”), an Office of the Comptroller of the Currency (“OCC”) regulated national bank with approximately $200 million in total assets (as of December 31, 2021) for a $20 million purchase price (the “Acquisition”) The Acquisition is subject to the approval of federal banking regulators and the U.S. Small Business Administration (“SBA”) Newtek is required to seek shareholder approval to withdraw its election as a BDC. Thereafter the Company intends to become a bank holding company that will elect financial holding company (“FHC”) status

www.newtekone.com 4 Anticipate A Well-Capitalized Institution “CET1” = Common Equity Tier 1 Note: For illustrative purposes, assumes closing date of June 30, 2022 and regulatory approvals of Newtek’s current business plan and assumptions; earnings presented on a core basis (excluding impact fair value adjustments); earnings is projected and illustrative and there can be no assurance of the actual results of the BHC and NB&T; see also Special Note Regarding Projected Financial Information on p. 2. Illustrative Bank Subsidiary and Consolidated Capital Summary at Closing Newtek Holding Company Level - Consolidated NB&T Bank Subsidiary TOTAL ASSETS ~$1.2 billion TCE RATIO ~20.9% TIER 1 LEVERAGE RATIO ~19.5% CET1 RATIO ~24.6% TOTAL CAPITAL RATIO ~24.6% TOTAL ASSETS ~$242 million TCE RATIO ~32.0% TIER1 LEVERAGE RATIO ~32.0% CET1 RATIO ~42.3% TOTAL CAPITAL RATIO ~42.3% ( )$241mm $1,157mm ( )$226mm $1,165mm ( )$226mm $917mm ( )$226mm $917mm ( )$77mm $240mm ( )$77mm $240mm ( )$77mm $182mm ( )$77mm $182mm

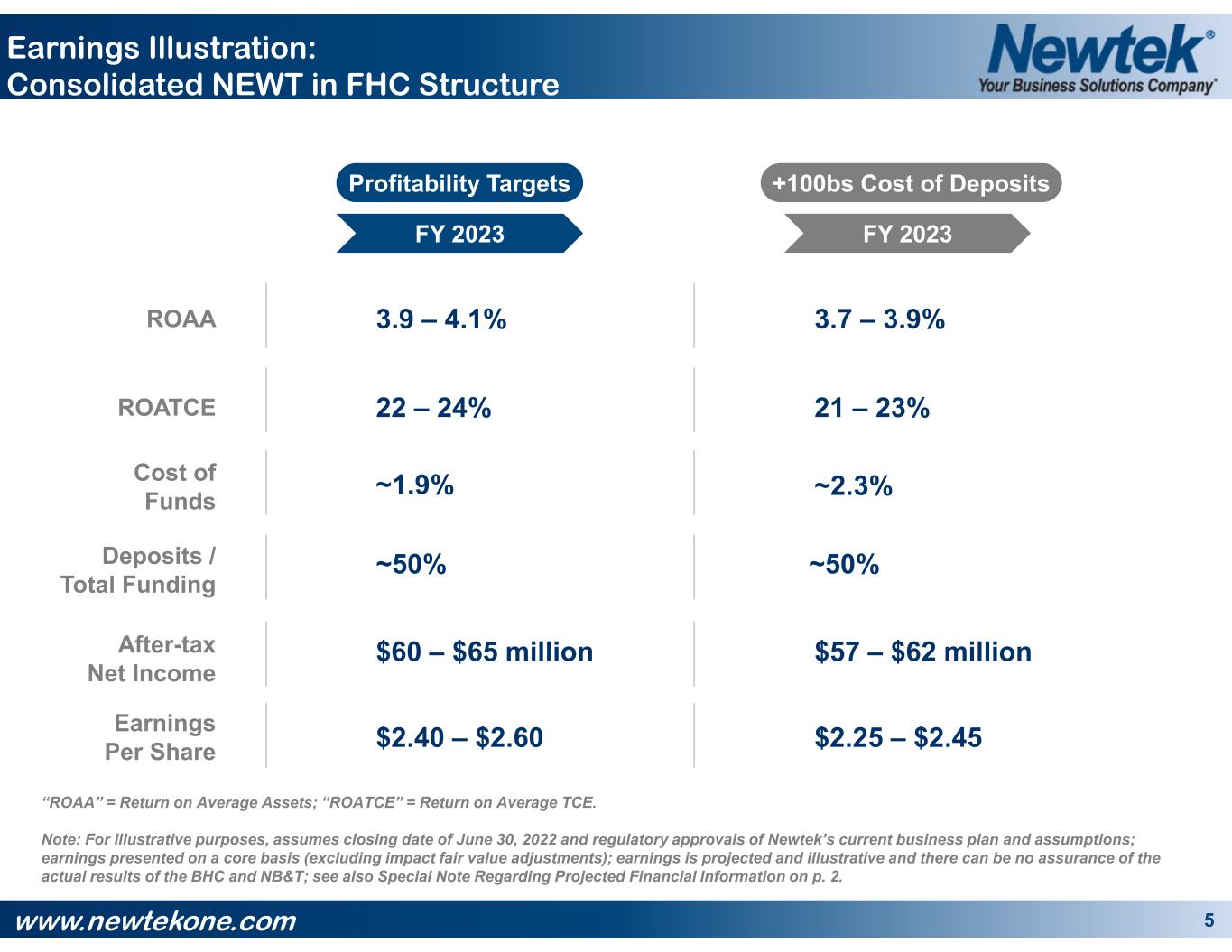

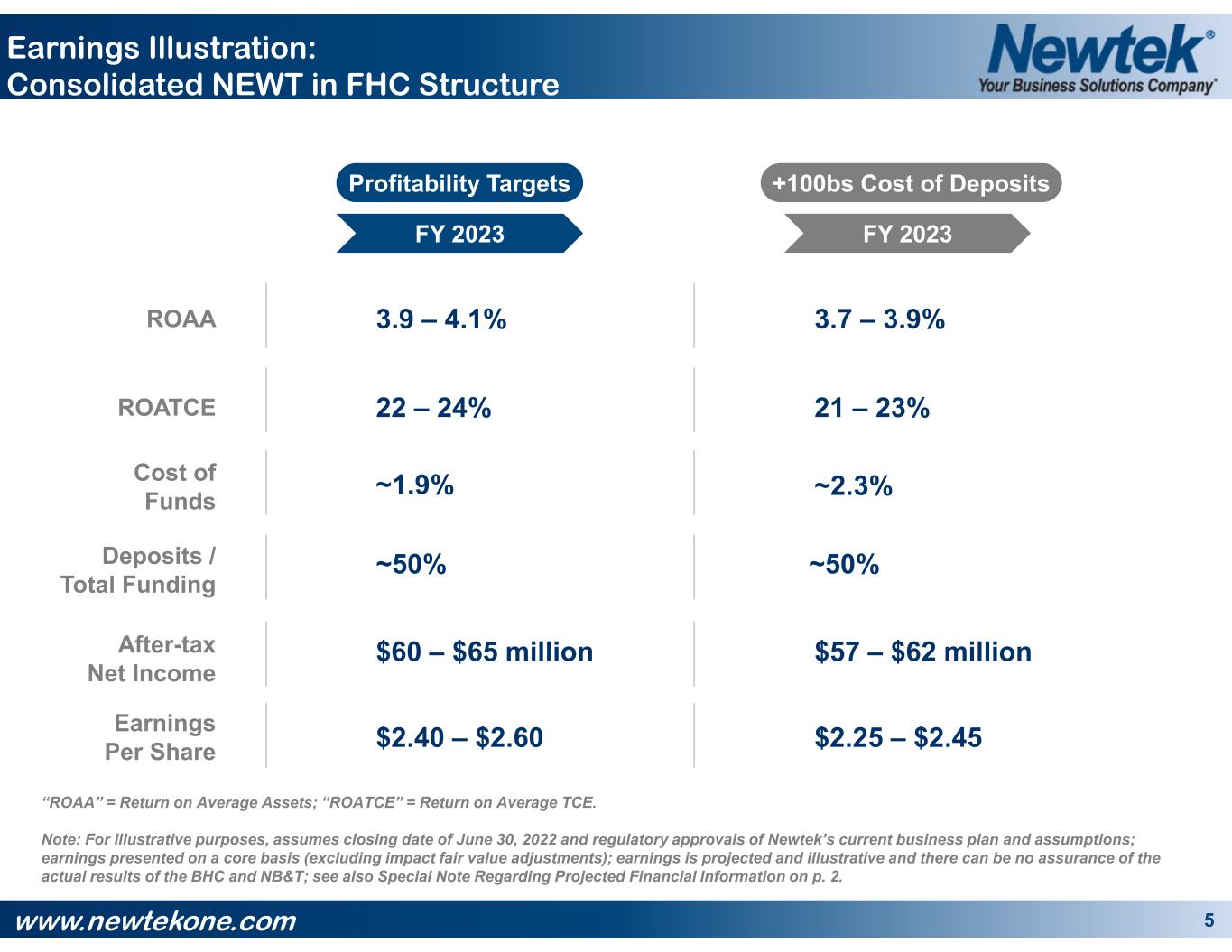

www.newtekone.com 5 ROAA ROATCE After-tax Net Income Earnings Per Share 3.7 – 3.9% FY 2023 21 – 23% $57 – $62 million $2.25 – $2.45 +100bs Cost of Deposits Cost of Funds ~2.3% Deposits / Total Funding ~50% 3.9 – 4.1% FY 2023 22 – 24% $60 – $65 million $2.40 – $2.60 Profitability Targets ~1.9% ~50% “ROAA” = Return on Average Assets; “ROATCE” = Return on Average TCE. Note: For illustrative purposes, assumes closing date of June 30, 2022 and regulatory approvals of Newtek’s current business plan and assumptions; earnings presented on a core basis (excluding impact fair value adjustments); earnings is projected and illustrative and there can be no assurance of the actual results of the BHC and NB&T; see also Special Note Regarding Projected Financial Information on p. 2. Earnings Illustration: Consolidated NEWT in FHC Structure

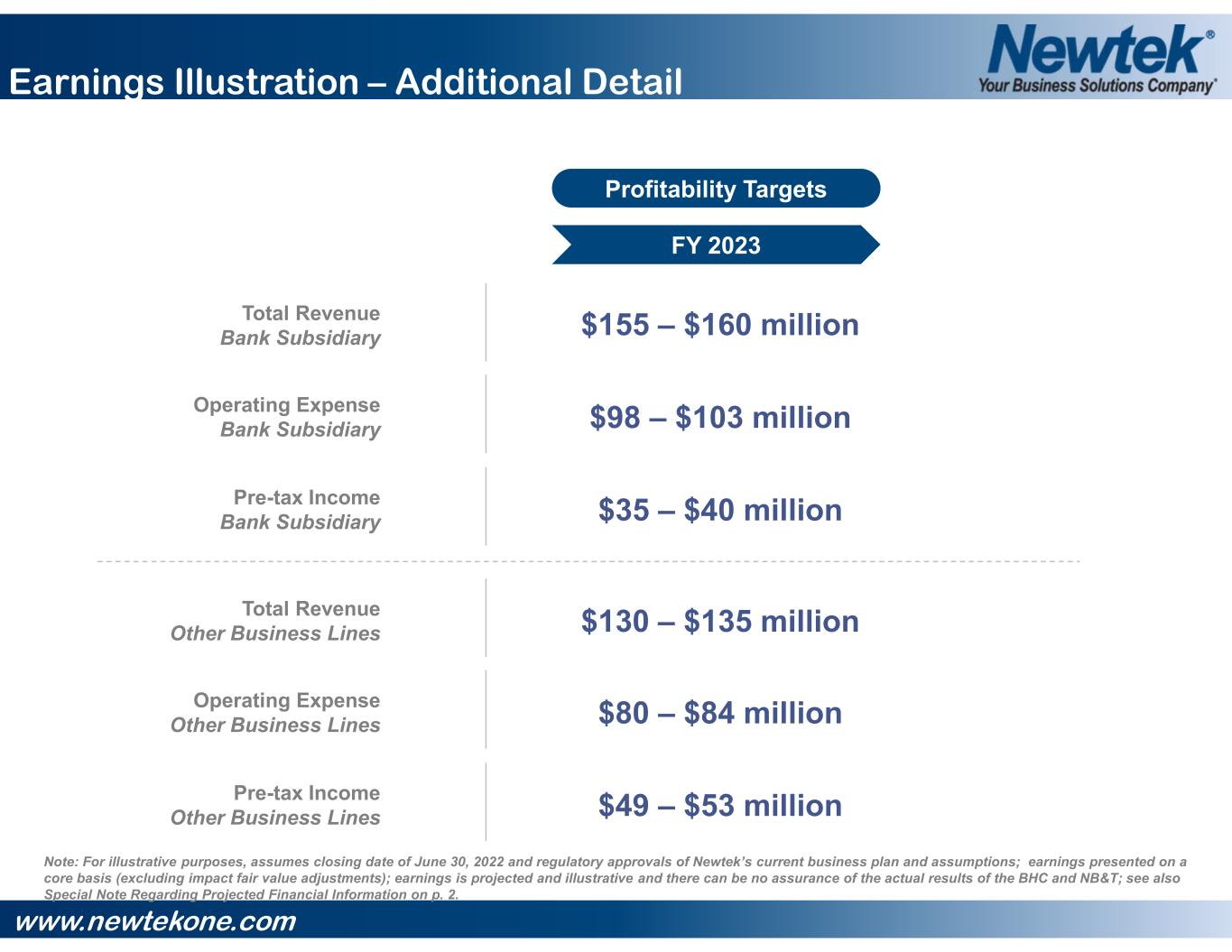

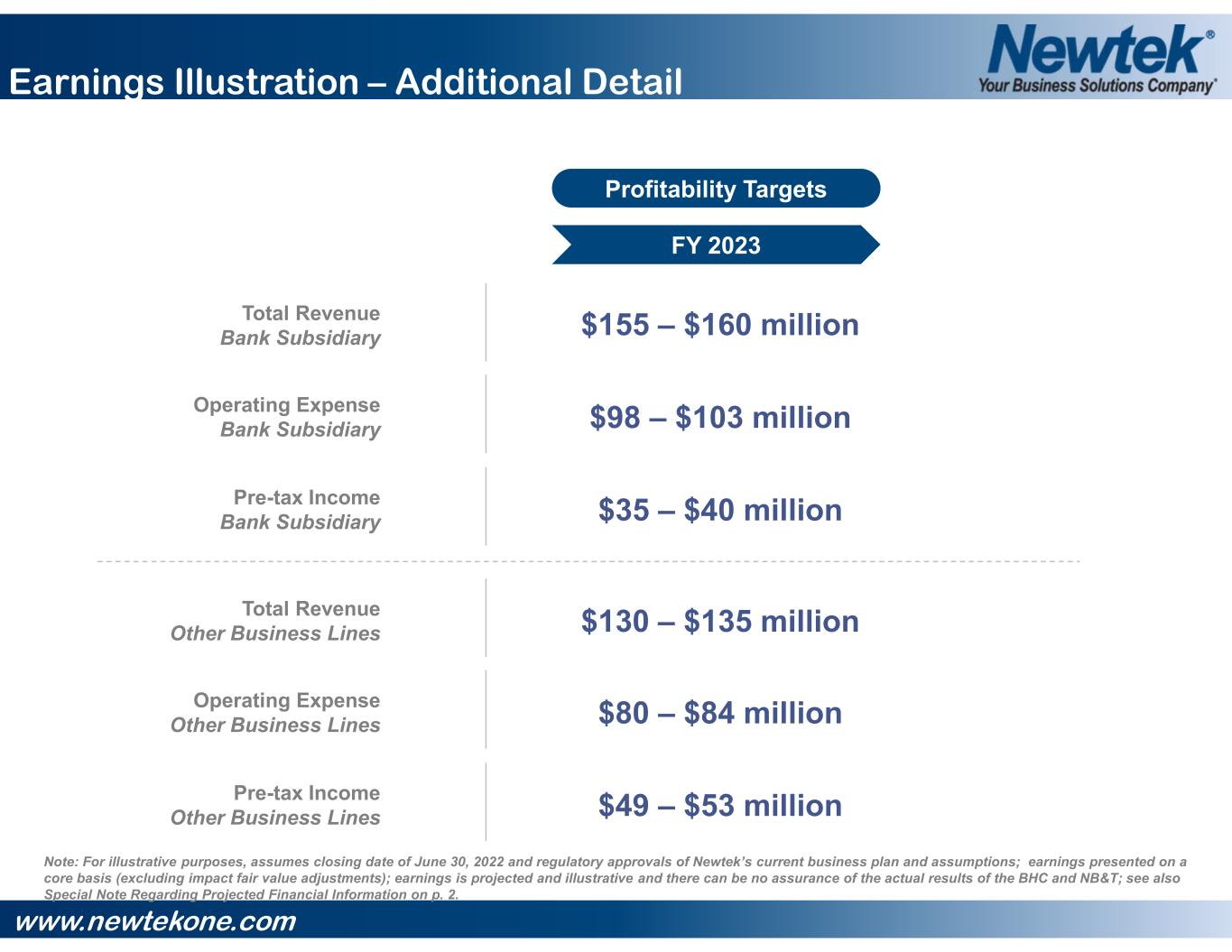

www.newtekone.com Earnings Illustration – Additional Detail Total Revenue Bank Subsidiary $155 – $160 million FY 2023 Profitability Targets Operating Expense Bank Subsidiary $98 – $103 million Pre-tax Income Bank Subsidiary $35 – $40 million Total Revenue Other Business Lines $130 – $135 million Operating Expense Other Business Lines $80 – $84 million Pre-tax Income Other Business Lines $49 – $53 million Note: For illustrative purposes, assumes closing date of June 30, 2022 and regulatory approvals of Newtek’s current business plan and assumptions; earnings presented on a core basis (excluding impact fair value adjustments); earnings is projected and illustrative and there can be no assurance of the actual results of the BHC and NB&T; see also Special Note Regarding Projected Financial Information on p. 2.

www.newtekone.com 7 8.6 9.1 22.3 KBW SMID-Cap Banks Fintech Enabled Banks Commercial Finance Companies Est. Year 1 FY 2023 12.7 18.0 15.2 KBW SMID-Cap Banks Fintech Enabled Banks Commercial Finance Companies 13.1 16.8 14.1 KBW SMID-Cap Banks Fintech Enabled Banks Commercial Finance Companies Est. Year 1 FY 2023 1.10 1.51 2.18 KBW SMID-Cap Banks Fintech Enabled Banks Commercial Finance Companies Est. Year 1 FY 2023 Est. ROAA (%) NEWT vs. Projected Peers (2022E) Est. ROATCE (%) NEWT vs. Projected Peers (2022E) TCE Ratio (%) NEWT vs. Projected Peers Price / 2022E EPS (X) Peer Levels Source: S&P Global Market Intelligence, Factset Market data as of 2/17/2022 1. Based on SMID-Cap Banks under KBW Research Coverage (defined by KBW Research) 2. Includes select Fintech-enabled banks with 10% estimated ’22 – ’23 EPS growth (AX, CCB, GDOT, INBK, LC, LOB, MVBF, SI, TBBK and TBK) 3. Includes select U.S. exchange traded Leasing, Commercial Finance, Market Place lenders 4. Est. Year 1 reflects first 12 months of NEWT operations presented on a core basis; earnings is projected and illustrative and there can be no assurance of the actual results of the BHC and Newtek Bank & Trust 5. Presented as ROAE due to lack of available ROATCE data 3.5-3.7% 3.9-4.1% 18-20% 22-24% ~18% ~16% (1) (2) (3) (1) (2) (3)(5) (1) (2) (3) (1) (2) (3) PF NEWT(4)PF NEWT(4) PF NEWT(4) Peer Benchmarking Illustration

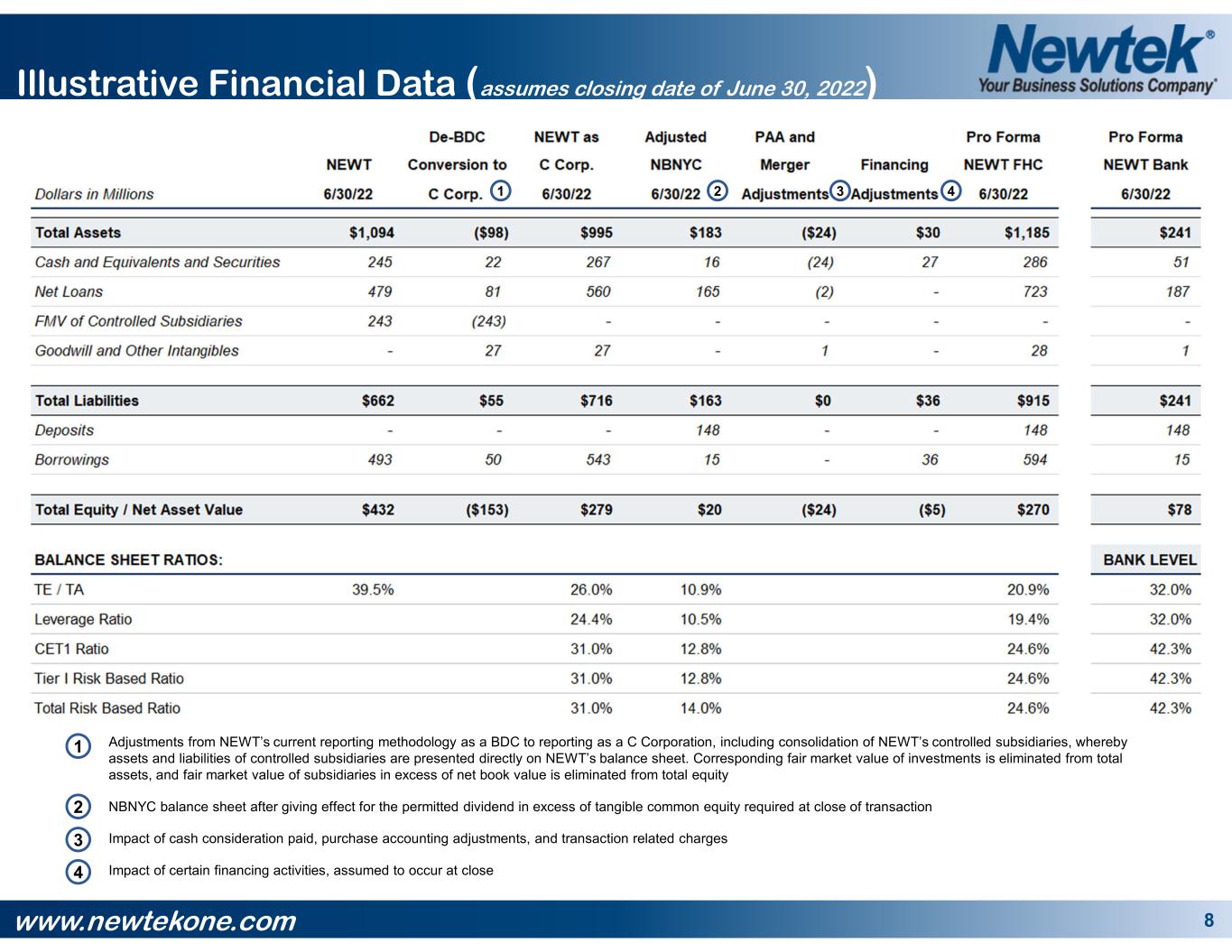

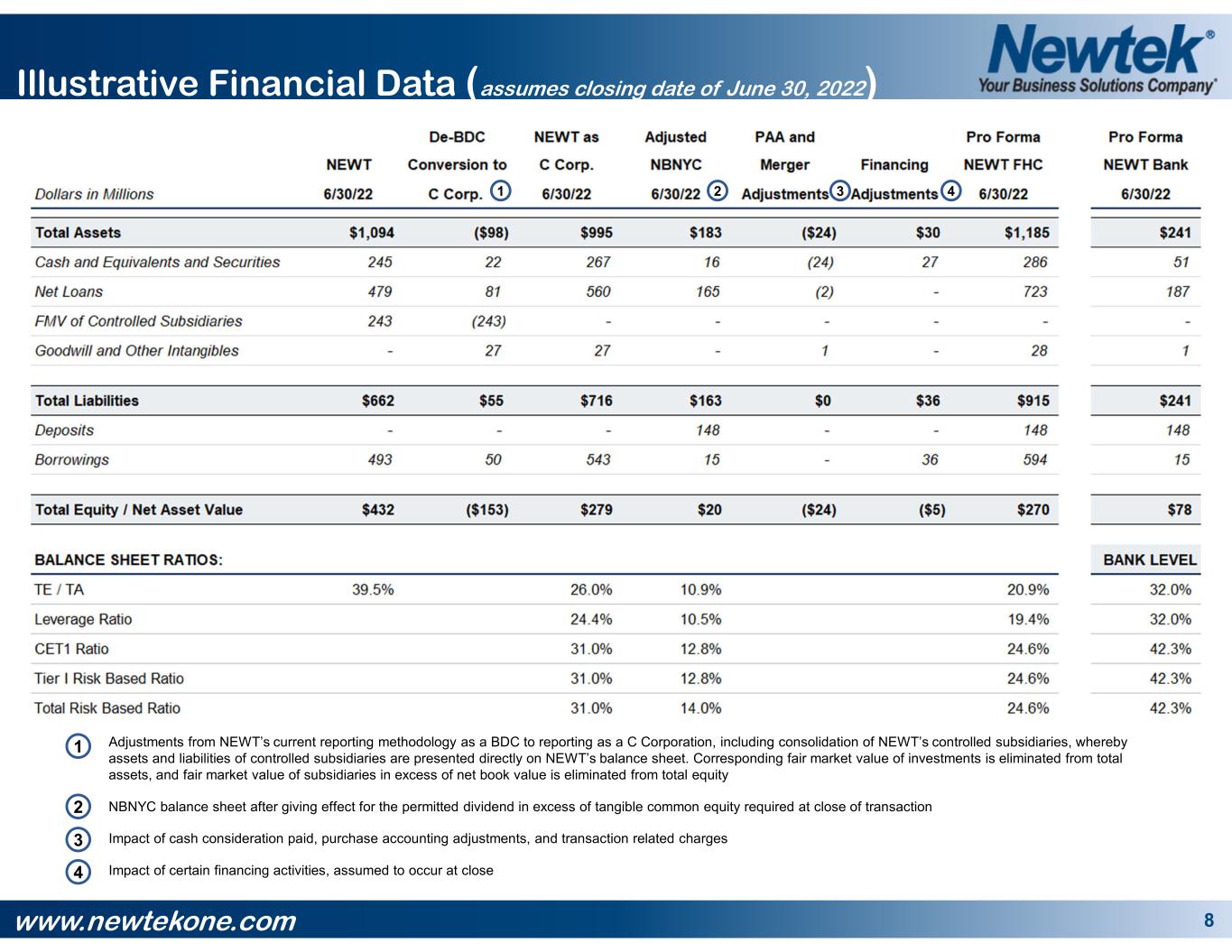

www.newtekone.com Illustrative Financial Data (assumes closing date of June 30, 2022) 1 2 3 4 Adjustments from NEWT’s current reporting methodology as a BDC to reporting as a C Corporation, including consolidation of NEWT’s controlled subsidiaries, whereby assets and liabilities of controlled subsidiaries are presented directly on NEWT’s balance sheet. Corresponding fair market value of investments is eliminated from total assets, and fair market value of subsidiaries in excess of net book value is eliminated from total equity NBNYC balance sheet after giving effect for the permitted dividend in excess of tangible common equity required at close of transaction Impact of cash consideration paid, purchase accounting adjustments, and transaction related charges Impact of certain financing activities, assumed to occur at close 1 2 3 4 8

www.newtekone.com Sample of Existing Newtek & Portfolio Company Talent Pool with Banking Experience 9 Nicolas Young – Chief Risk Officer, Newtek Business Services Corp (Proposed President of the Bank) – 20+ years of banking experience – IBERIABANK – Executive Vice President, Chief Credit Officer – Banco Sabadell Group – Executive Vice President, Chief Credit Officer Albert Spada – President, Newtek Business Credit – 36 years of banking experience – Santander Bank – Managing Director, Head of Asset Based Finance Division – RBS Citizens Business Capital – Senior Vice President, National Sales Leader – CIT – Executive Vice President, Chief Sales Officer – GE Capital, The Bank of New York Commercial Corporation, Goldman, Sachs & Co. Brian Lawn – Senior Vice President, Credit & PPP Loan Forgiveness, Small Business Lending – 30 years of banking experience – Peoples United Bank – Senior Vice President, NYCRE Portfolio Management Regional Manager – BNB Bank – Vice President, SBA Portfolio Underwriting Manager – Community National Bank – Vice President, Commercial Lending – Capital One Bank, Sovereign Bank, Banco Santander, Independence Community Bank, The Bank of New York Michael Ogus – Senior Vice President, Credit Committee Member, Newtek Small Business Finance – 39 years of banking experience – BNB Bank fka Bridgehampton National Bank – Director, Small Business Administration Lending – Astoria Federal Savings & Loan Association – Assistant Director, Small Business Lending – Chemical Bank/The Chase Manhattan Bank, IBJ Schroder Bank & Trust Company, Lincoln Savings Bank

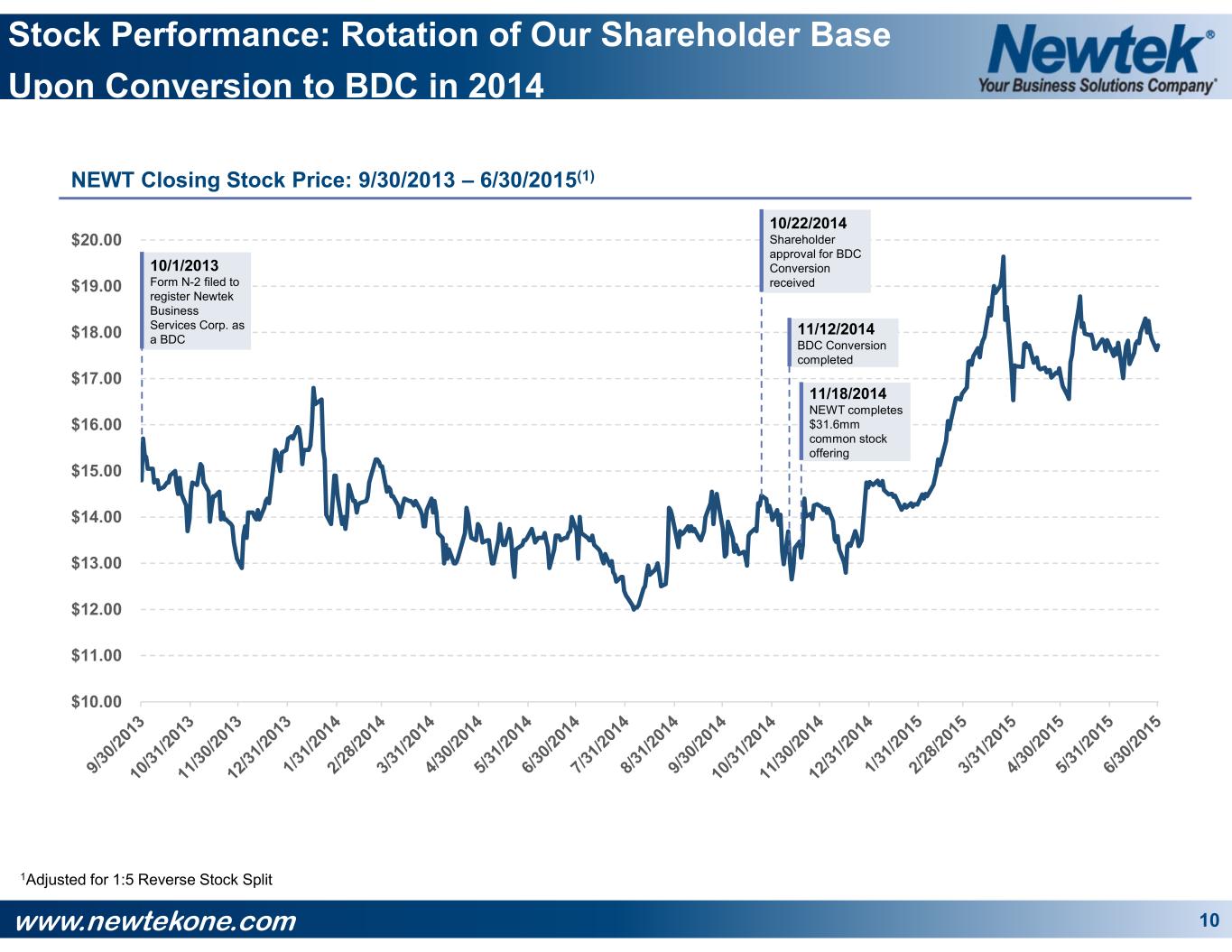

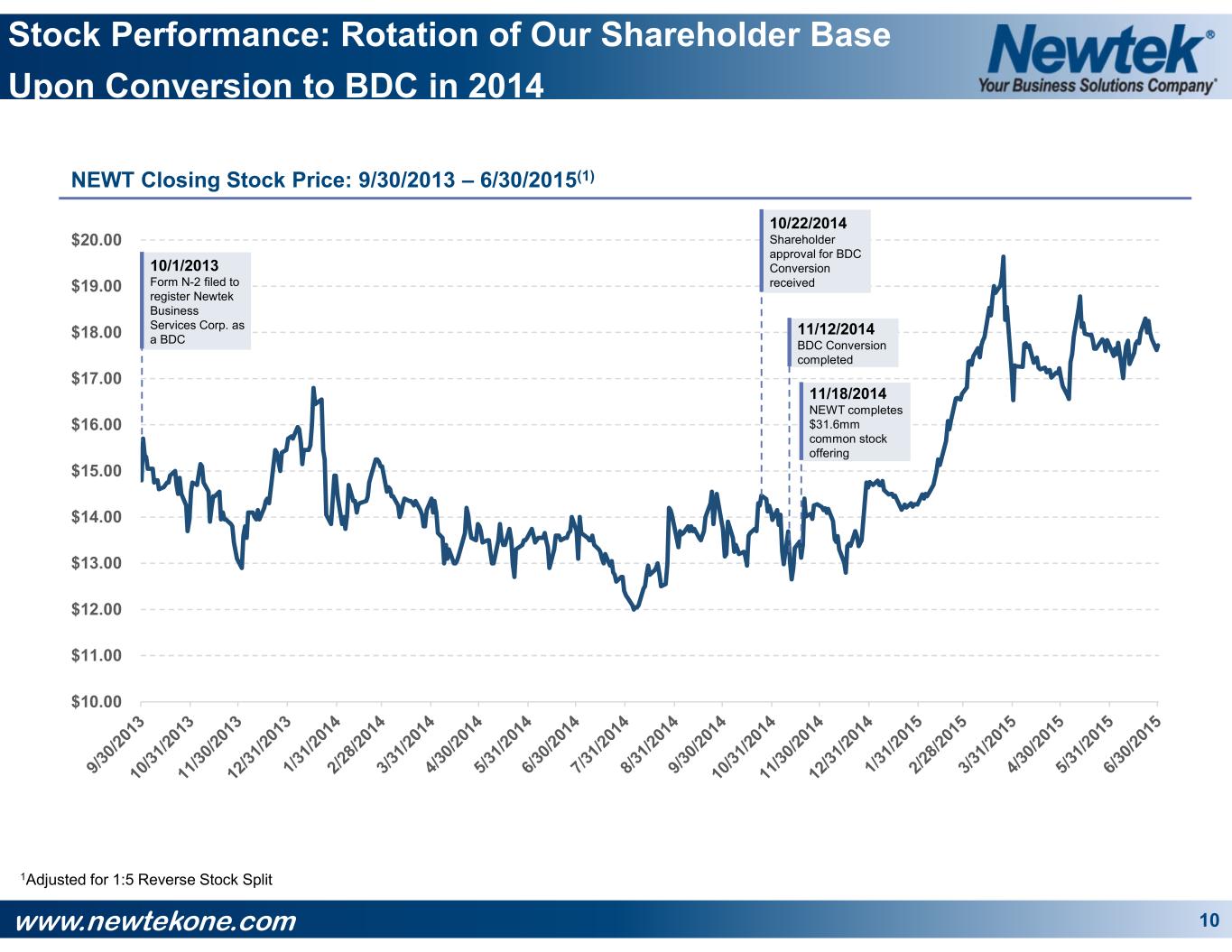

www.newtekone.com NEWT Closing Stock Price: 9/30/2013 – 6/30/2015(1) Stock Performance: Rotation of Our Shareholder Base Upon Conversion to BDC in 2014 1Adjusted for 1:5 Reverse Stock Split 10 $10.00 $11.00 $12.00 $13.00 $14.00 $15.00 $16.00 $17.00 $18.00 $19.00 $20.00 10/1/2013 Form N-2 filed to register Newtek Business Services Corp. as a BDC 10/22/2014 Shareholder approval for BDC Conversion received 11/12/2014 BDC Conversion completed 11/18/2014 NEWT completes $31.6mm common stock offering

www.newtekone.com NewtekOne Dashboard 11 TM

www.newtekone.com Investment Summary We believe a diversified business model can provide multiple streams of revenue We believe that we have a proven track record; Established in 1998; publically traded since September 2000 Newtek has consistently outperformed the Russell 2000 and the S&P 500 for over a decade Over 19-year lending history through multiple lending cycles; great depth and breadth of experience Newtek believes a BHC structure will be in the best long-term interests of the Company and all of its stakeholders We believe that management’s interests are aligned with shareholders; management and Board combined own approximately 5.0% of outstanding shares The Company believes by changing its corporate structure it can broaden and enhance its access to finance its growth that will be beneficial and accretive to its shareholders Newtek believes this transformative change can enhance its relationship with its channel partners and the underserved business community in the U.S. Newtek believes that by adding all of its solutions to its NewtekOne Dashboard™ can enhance its ability to cross sell all of its business and financial solutions with unprecedented ease Newtek expects to continue to pay dividends to its shareholders under its new structure 12