Filed Pursuant To Rule 433

Registration No. 333-275079

April 18, 2024

The Grayscale Bitcoin Primer

Bitcoin investing begins here Grayscale

Understanding Bitcoin

Bitcoin is the world’s largest digital asset that allows you to send money anywhere, at any time of the

day, without a centralized intermediary. Before the introduction of Bitcoin, money could not be sent

directly over the internet like an email. This was even true for services such as PayPal and Venmo,

which may seem entirely digital, but actually rely on the infrastructure of banks such as JP Morgan

and Bank of America to verify and record transactions.

Unlike these centralized services, Bitcoin is decentralized and only has to rely on the Bitcoin network

itself to verify and record transactions. Bitcoin is able to do this by combining concepts from

computer science and cryptography to solve a historical problem: how can two people send money

over the internet without having to trust a third party — whether that be the other person, a bank, or

an intermediary?

Bitcoin was born out of the aftermath of the 2008 financial crisis — a time of deep mistrust in

financial institutions — when an anonymous person or group of persons known as Satoshi Nakamoto

released a whitepaper called “Bitcoin: A Peer-to-Peer Electronic Cash System”. The whitepaper

called for the creation of a decentralized form of money whose code was native to the internet.

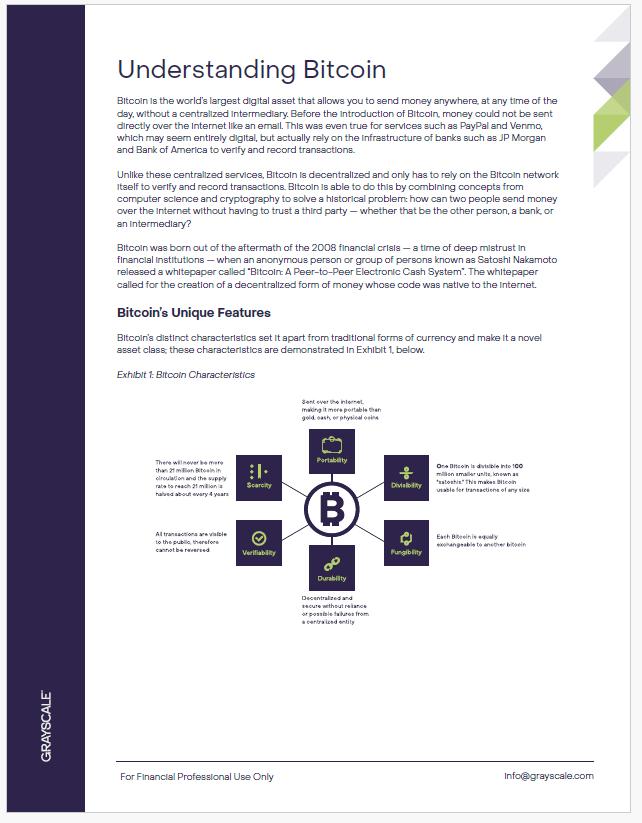

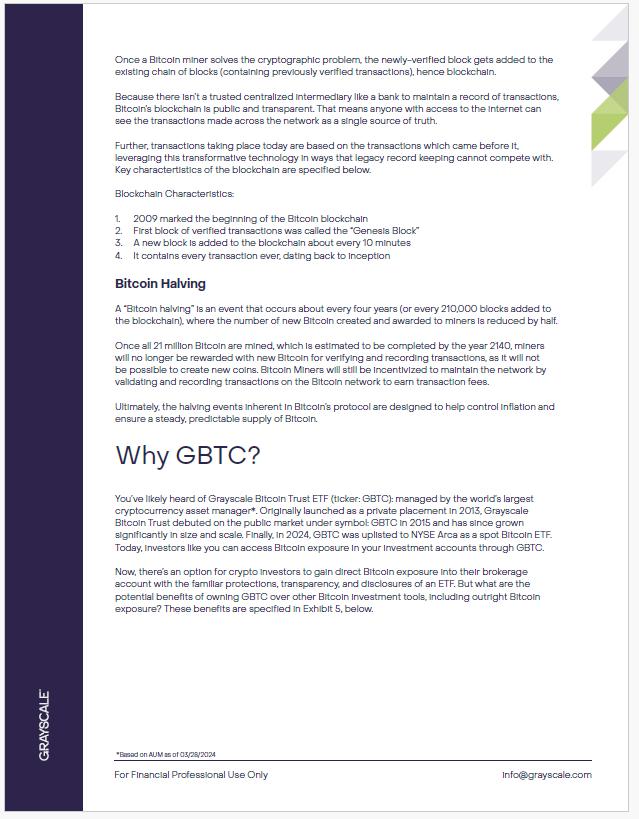

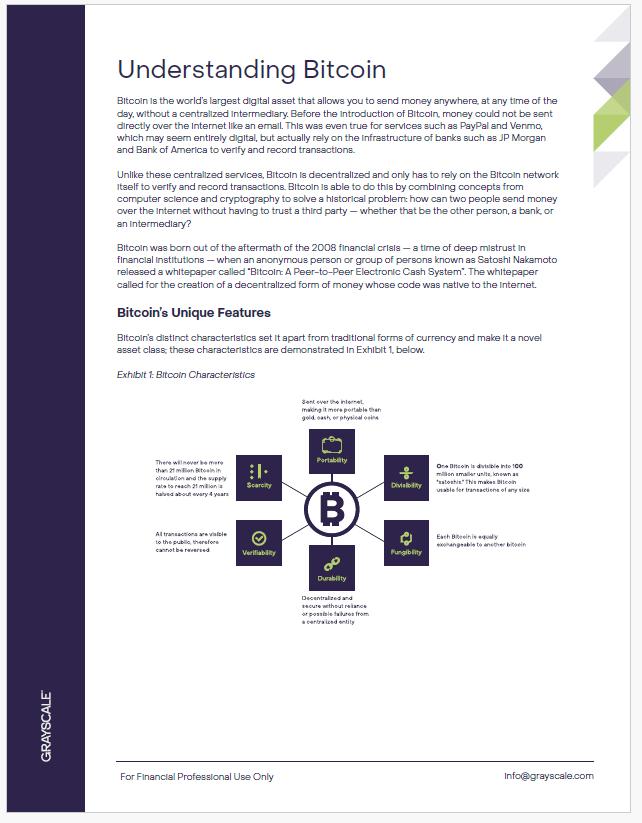

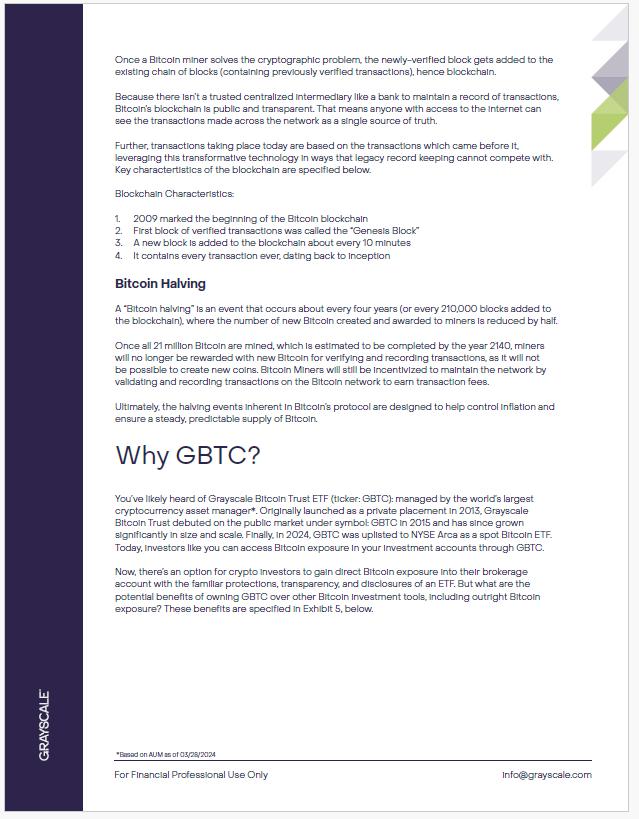

Bitcoin’s Unique Features

Bitcoin’s distinct characteristics set it apart from traditional forms of currency and make it a novel

asset class; these characteristics are demonstrated in Exhibit 1, below.

Exhibit 1: Bitcoin Characteristics

info@grayscale.com

B

Scarcity

Verifiability

Divisibility

Portability

Fungibility

Durability

Sent over the internet,

making it more portable than

gold, cash, or physical coins

One Bitcoin is divisible into 100

million smaller units, known as

"satoshis." This makes Bitcoin

usable for transactions of any size

Each Bitcoin is equally

exchangeable to another bitcoin

Decentralized and

secure without reliance

or possible failures from

a centralized entity

All transactions are visible

to the public, therefore

cannot be reversed

There will never be more

than 21 million Bitcoin in

circulation and the supply

rate to reach 21 million is

halved about every 4 years

For Financial Professional Use Only

Use Cases of Bitcoin

These characteristics allow Bitcoin to fulfill three key use cases: (1) a store of value, (2) a means of

payment, and (3) a technological innovation with undiscovered use cases.

• Store of Value - Bitcoin is often referred to as “digital gold” due to its scarcity and durability.

Many investors view it as a hedge against inflation and currency devaluation, similar to how gold

has historically been used.

• Means of Payment - Bitcoin enables direct peer-to-peer transactions over the internet. It offers

a decentralized alternative to traditional payment systems, allowing users to transfer value

without intermediaries.

• Technological Innovation - The blockchain technology underpinning Bitcoin has potential

applications across various fields, from supply chain management to digital identity verification.

Today, Bitcoin serves primarily as a store of value and — though it has grown significantly over

the years — we believe its primary use case provides potential for upside in comparison to the

investment gold market. Going forward, continued developer innovation on the Bitcoin network

could lead to additional use cases as well as an increased relevance and growth in adoption of the

asset.

Investment Insights

Now that we understand Bitcoin’s purpose, let’s discuss its investment use cases.

Scarcity and

Value

The Bitcoin network caps the supply of Bitcoin at 21 million tokens. The supply curve

within the code is predetermined, public, and final. Therefore, unlike traditional

currencies such as the U.S. dollar, Bitcoin cannot be arbitrarily inflated, depreciated, or

counterfeited.

Decentralized

Nature

The Bitcoin network is decentralized and secured by computers all over the world,

rather than by a single centralized entity like a bank or government. This minimizes the

possibility of a single point of failure.

Technological

Innovation

Bitcoin can be thought of as a technological innovation with undiscovered use cases

that could emerge over its continued evolution and adoption.

Diversification Because Bitcoin has shown negative correlation1 with the value of the U.S. Dollar, it may

provide additional diversification benefits for investors exposed to Dollar depreciation.

Hedge Against

Inflation

Bitcoin has moved together with other inflation hedging assets in recent years.

Relative to gold or other commodities, Bitcoin may provide an inflation hedge that can

produce positive total returns.

Institutional

Adoption

Large financial institutions, tech companies, and governments around the world have

begun to embrace Bitcoin — adding it to their balance sheets, accepting Bitcoin as

payment, embracing Bitcoin as legal tender, and more2.

Given the above investment use cases, there may be several benefits to introducing Bitcoin into

one’s investment portfolio.

1 BTC/USD correlation of -0.34 between January 2020 and November 2023, based on monthly Bloomberg data include fees.

Fees could have an impact on investor returns if they were significantly different across assets (i.e. stocks, bonds, or Bitcoin).

2 Coinglass. “Bitcoin Treasuries.”

For Financial Professional Use Only info@grayscale.com

Low Correlation

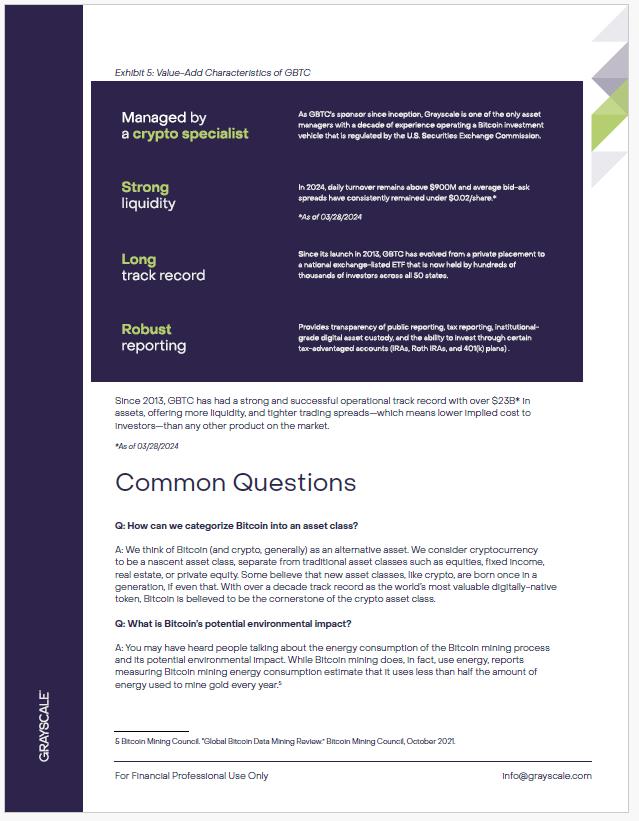

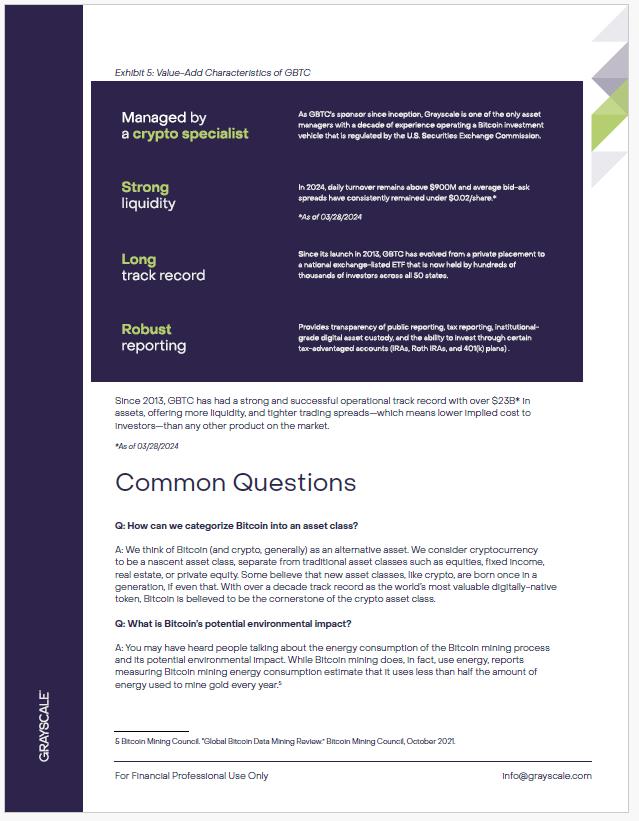

In Exhibit 2 below, we can see that over the last five years, Bitcoin has had a correlation with the S&P

500 well below comparable alternatives.

Exhibit 2: Five-year Risky Asset Correlations with S&P 500

We believe Bitcoin is a rare example of a high-return-potential asset with a low correlation to stocks.

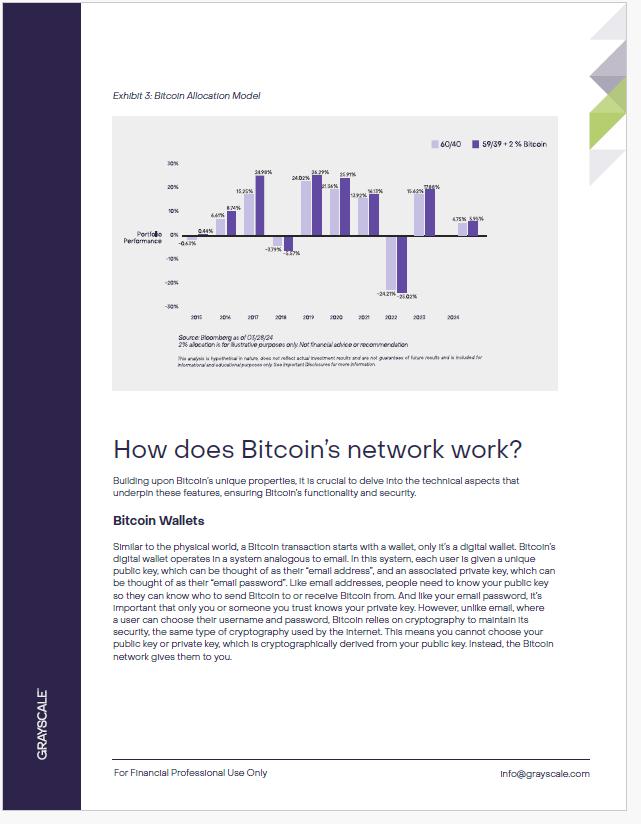

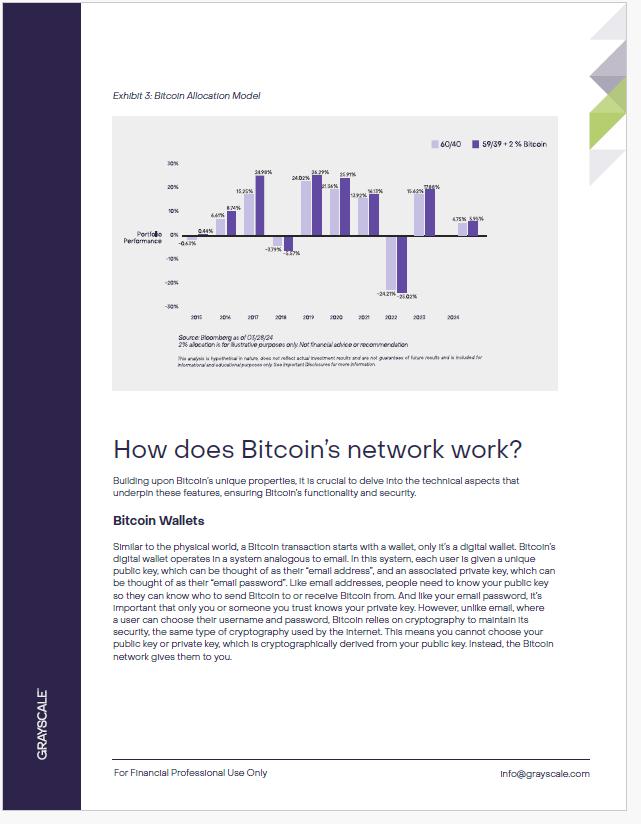

Portfolio Allocation

Appropriate Bitcoin allocation varies per individual investor needs, but a general guideline suggests

scaling up to 5% of investable assets, balancing enhanced returns with manageable volatility. For

conservative investors, a smaller allocation of 1-3% may be more suitable. This can be found in

Exhibit 3 below.

info@grayscale.com

Exhibit 3: Bitcoin Allocation Model

How does Bitcoin’s network work?

Building upon Bitcoin’s unique properties, it is crucial to delve into the technical aspects that

underpin these features, ensuring Bitcoin’s functionality and security.

Bitcoin Wallets

Similar to the physical world, a Bitcoin transaction starts with a wallet, only it’s a digital wallet. Bitcoin’s

digital wallet operates in a system analogous to email. In this system, each user is given a unique

public key, which can be thought of as their “email address”, and an associated private key, which can

be thought of as their “email password”. Like email addresses, people need to know your public key

so they can know who to send Bitcoin to or receive Bitcoin from. And like your email password, it’s

important that only you or someone you trust knows your private key. However, unlike email, where

a user can choose their username and password, Bitcoin relies on cryptography to maintain its

security, the same type of cryptography used by the internet. This means you cannot choose your

public key or private key, which is cryptographically derived from your public key. Instead, the Bitcoin

network gives them to you.

info@grayscale.com

This analysis is hypothetical in nature, does not reflect actual investment results and are not guarantees of future results and is included for

informational and educational purposes only. See Important Disclosures for more information.

-0.63%

0.44%

-3.79%

-5.57%

-24.21%

-25.02%

15.25%

24.98%

24.02%

26.29%

21.36%

25.91%

13.92%

16.13%

-30%

2015 2016 2017 2018 2019 2020 2021 2022 2023

-20%

-10%

0%

10%

20%

30%

6.61%

8.74%

Source: Bloomberg as of 03/28/24

2% allocation is for illustrative purposes only. Not financial advice or recommendation

2024

15.62%

17.88%

4.75%

5.95%

For Financial Professional Use Only

info@grayscale.com

Here is an example3 of a Bitcoin public key and private key:

The complexity of these keys means it’s extremely important not to lose private keys.

Luckily, Bitcoin custody has come a long way since its inception, and there are now safer and more

secure methods for individuals and institutions to manage their private keys.

The First Bitcoin Transaction

The first Bitcoin transactions took place on May 22, 2010 — a day now celebrated as “Bitcoin Pizza

Day”.4 In 2010, an early Bitcoiner named Laszlo Hanyecz famously paid 10,000 Bitcoin for two pizzas.

In a traditional credit card transaction, various intermediaries including banks or credit card

companies would ensure that the buyer has the funds to purchase the goods (in this case, pizzas),

and would subsequently note when the seller takes possession of the funds. But Laszlo’s transaction

was completed entirely using the Bitcoin network, without the need for an intermediary to approve

and document the transaction.

Bitcoin Miners

Behind the scenes of Laszlo’s transaction, a decentralized network of computers — operated by

individuals or companies called “Bitcoin miners”— compete with one another to be the first to solve

cryptographic puzzles or math problems by trying different number inputs in a function to achieve a

desired output.

Miners have an economic incentive to solve the problem because they are rewarded with newlyissued

Bitcoin generated by the network as well as transaction fees paid by users like Laszlo in his

pizza transaction. Miners, therefore, compete based on their computational resources (i.e., how

powerful their computers are and how quickly they can crunch through numbers) and electricity (i.e.,

how inexpensively they can source power to operate their computers).

On the Bitcoin network, incentives are key. And because Bitcoin relies on code rather than trusted

intermediaries, it’s important that rules are followed. In computer science, one way to accomplish

this is through a consensus mechanism.

Proof-of-Work Consensus Mechanism

A consensus mechanism is simply a way for a group of individuals and entities to reach agreement

about something based on a set of rules. On the Bitcoin network, some of the basic rules include:

1. You cannot send more Bitcoin than you hold in your public key.

2. You cannot send the same Bitcoin in more than one transaction (i.e., double-spend).

3. A new set of transactions cannot be recorded until a miner solves the math problem.

4. The problem should take approximately ten minutes to solve based on the computational

resources.

5. The problem can only be solved when consensus is reached are the newest set of transactions

recorded.

3 Example keys are provided for illustrative purposes only. They do not represent actual public or private keys and are not

associated with any wallet.

4 George, Benedict. “What Is Bitcoin Pizza Day?” CoinDesk. Updated May 22, 2023.

Public Key: 02b4632d08485ff1df2db55b9dafd23347d1c47a457072a1e87be26896549a8737

Private Key: E9873D79C6D87DC0FB6A5778633389F4453213303DA61F20BD67FC233AA33262

For Financial Professional Use Only

info@grayscale.com

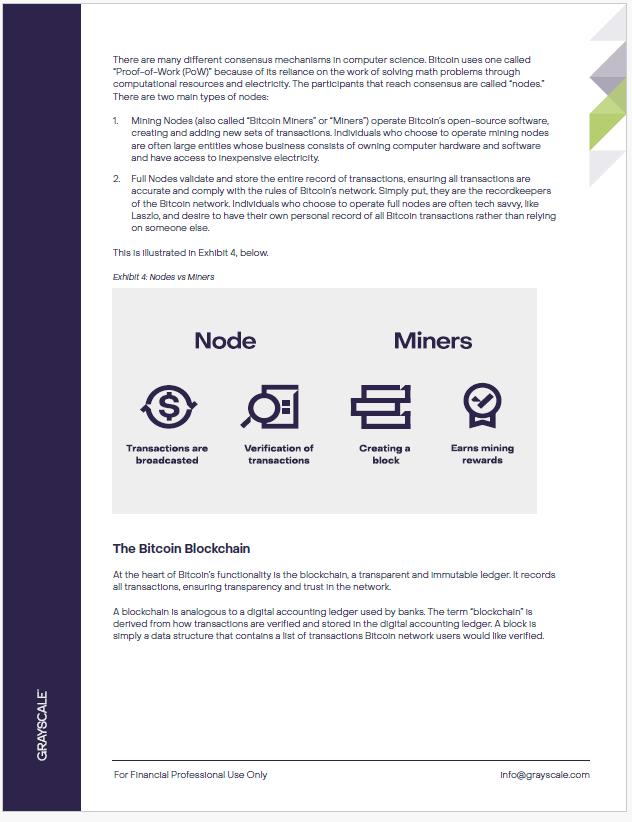

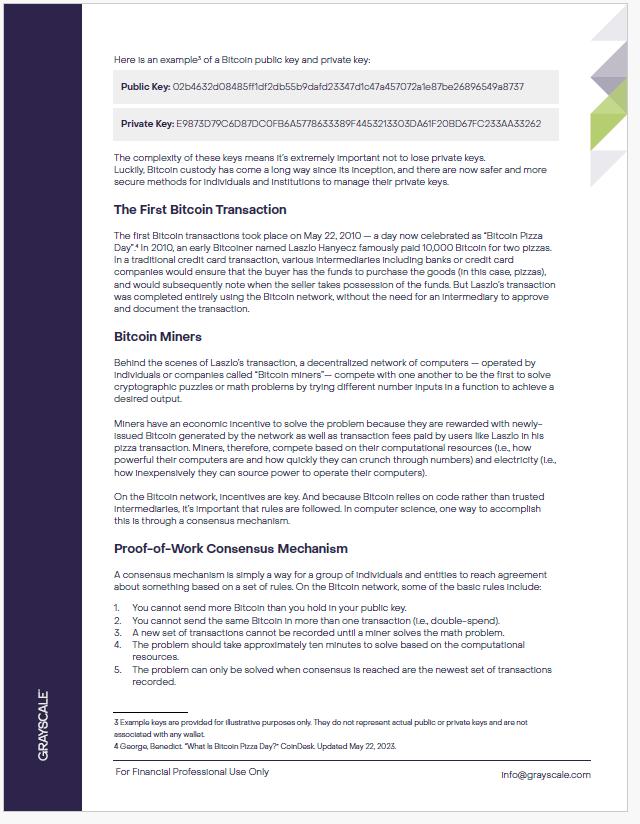

There are many different consensus mechanisms in computer science. Bitcoin uses one called

“Proof-of-Work (PoW)” because of its reliance on the work of solving math problems through

computational resources and electricity. The participants that reach consensus are called “nodes.”

There are two main types of nodes:

1. Mining Nodes (also called “Bitcoin Miners” or “Miners”) operate Bitcoin’s open-source software,

creating and adding new sets of transactions. Individuals who choose to operate mining nodes

are often large entities whose business consists of owning computer hardware and software

and have access to inexpensive electricity.

2. Full Nodes validate and store the entire record of transactions, ensuring all transactions are

accurate and comply with the rules of Bitcoin’s network. Simply put, they are the recordkeepers

of the Bitcoin network. Individuals who choose to operate full nodes are often tech savvy, like

Laszlo, and desire to have their own personal record of all Bitcoin transactions rather than relying

on someone else.

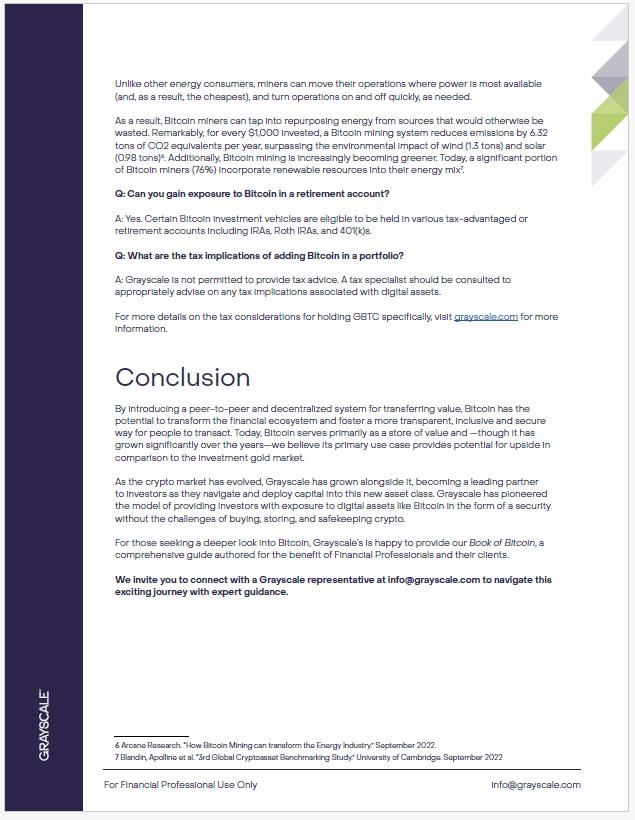

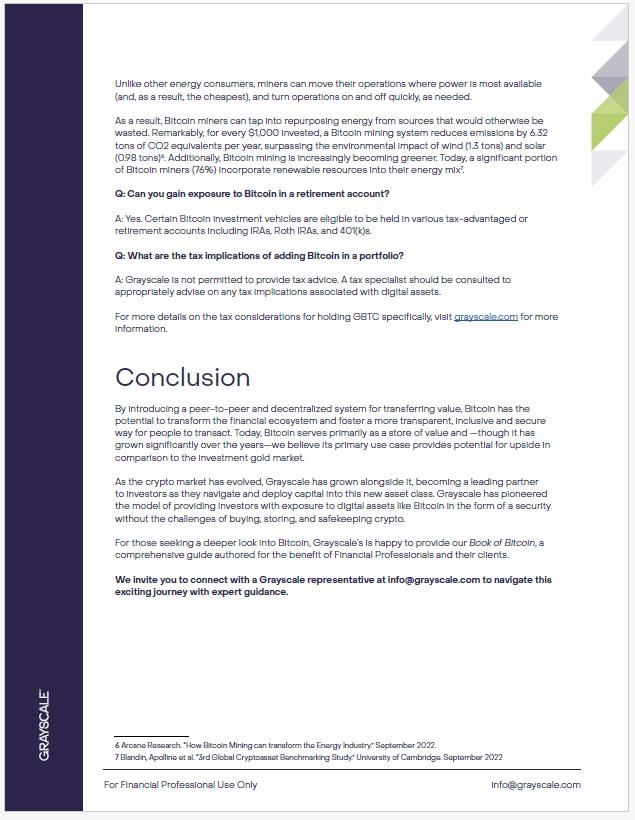

This is illustrated in Exhibit 4, below.

Exhibit 4: Nodes vs Miners

The Bitcoin Blockchain

At the heart of Bitcoin’s functionality is the blockchain, a transparent and immutable ledger. It records

all transactions, ensuring transparency and trust in the network.

A blockchain is analogous to a digital accounting ledger used by banks. The term “blockchain” is

derived from how transactions are verified and stored in the digital accounting ledger. A block is

simply a data structure that contains a list of transactions Bitcoin network users would like verified.

$

Transactions are

broadcasted

Verification of

transactions

Creating a

b�oc�

Earns mining

rewards

Node Miners

For Financial Professional Use Only

info@grayscale.com

Once a Bitcoin miner solves the cryptographic problem, the newly-verified block gets added to the

existing chain of blocks (containing previously verified transactions), hence blockchain.

Because there isn’t a trusted centralized intermediary like a bank to maintain a record of transactions,

Bitcoin’s blockchain is public and transparent. That means anyone with access to the internet can

see the transactions made across the network as a single source of truth.

Further, transactions taking place today are based on the transactions which came before it,

leveraging this transformative technology in ways that legacy record keeping cannot compete with.

Key charactertistics of the blockchain are specified below.

Blockchain Characteristics:

1. 2009 marked the beginning of the Bitcoin blockchain

2. First block of verified transactions was called the “Genesis Block”

3. A new block is added to the blockchain about every 10 minutes

4. It contains every transaction ever, dating back to inception

Bitcoin Halving

A “Bitcoin halving” is an event that occurs about every four years (or every 210,000 blocks added to

the blockchain), where the number of new Bitcoin created and awarded to miners is reduced by half.

Once all 21 million Bitcoin are mined, which is estimated to be completed by the year 2140, miners

will no longer be rewarded with new Bitcoin for verifying and recording transactions, as it will not

be possible to create new coins. Bitcoin Miners will still be incentivized to maintain the network by

validating and recording transactions on the Bitcoin network to earn transaction fees.

Ultimately, the halving events inherent in Bitcoin’s protocol are designed to help control inflation and

ensure a steady, predictable supply of Bitcoin.

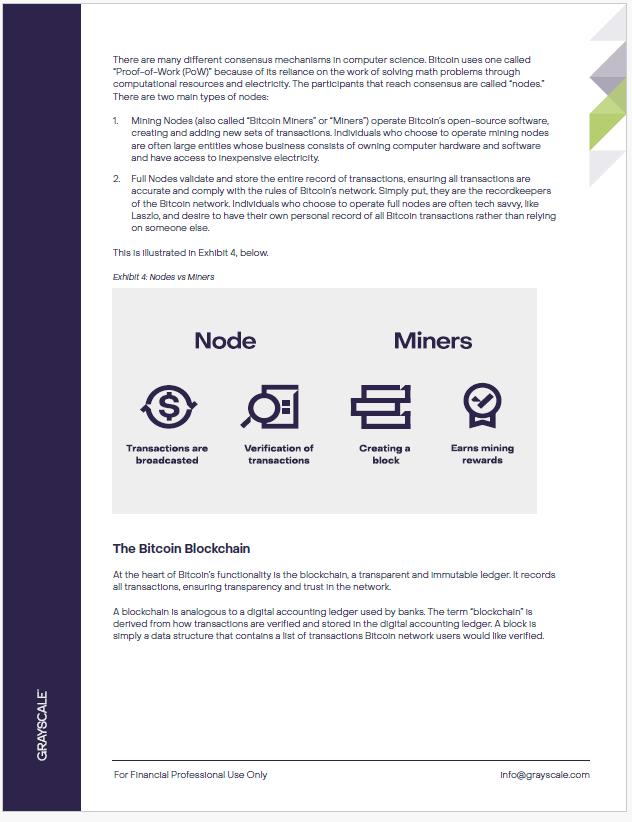

Why GBTC?

You’ve likely heard of Grayscale Bitcoin Trust ETF (ticker: GBTC): managed by the world’s largest

cryptocurrency asset manager*. Originally launched as a private placement in 2013, Grayscale

Bitcoin Trust debuted on the public market under symbol: GBTC in 2015 and has since grown

significantly in size and scale. Finally, in 2024, GBTC was uplisted to NYSE Arca as a spot Bitcoin ETF.

Today, investors like you can access Bitcoin exposure in your investment accounts through GBTC.

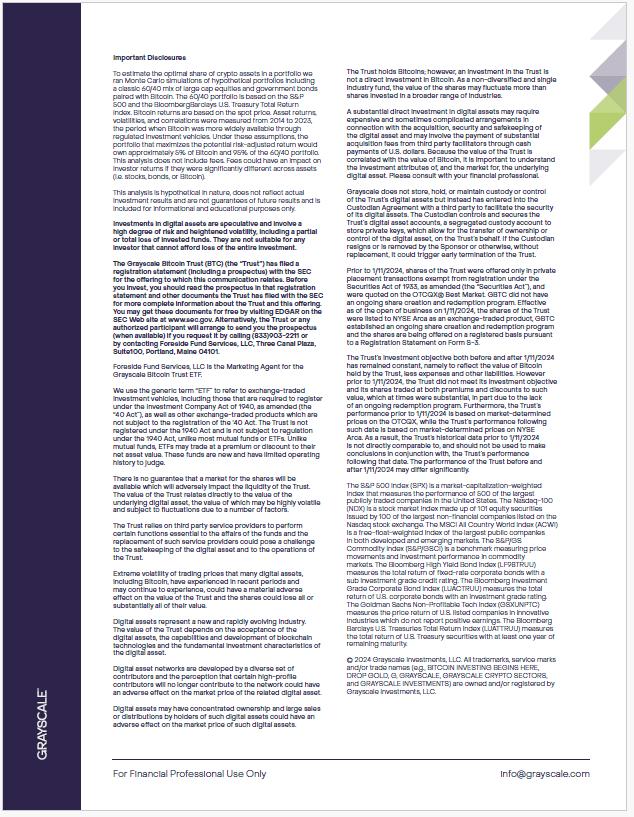

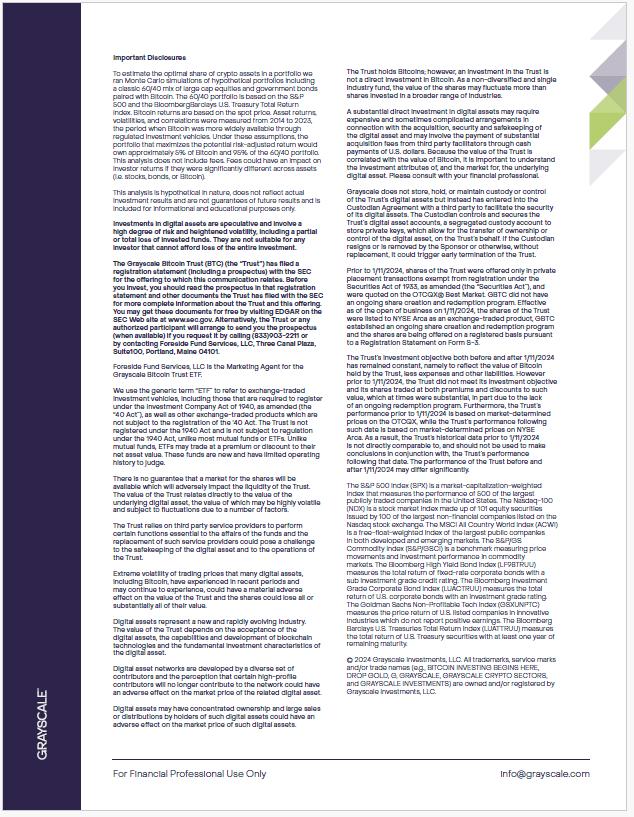

Now, there’s an option for crypto investors to gain direct Bitcoin exposure into their brokerage

account with the familiar protections, transparency, and disclosures of an ETF. But what are the

potential benefits of owning GBTC over other Bitcoin investment tools, including outright Bitcoin

exposure? These benefits are specified in Exhibit 5, below.

For Financial Professional Use Only

*Based on AUM as of 03/28/2024

For Financial Professional Use Only info@grayscale.com

Exhibit 5: Value-Add Characteristics of GBTC

Since 2013, GBTC has had a strong and successful operational track record with over $23B* in

assets, offering more liquidity, and tighter trading spreads—which means lower implied cost to

investors—than any other product on the market.

*As of 03/28/2024

Common Questions

Q: How can we categorize Bitcoin into an asset class?

A: We think of Bitcoin (and crypto, generally) as an alternative asset. We consider cryptocurrency

to be a nascent asset class, separate from traditional asset classes such as equities, fixed income,

real estate, or private equity. Some believe that new asset classes, like crypto, are born once in a

generation, if even that. With over a decade track record as the world’s most valuable digitally-native

token, Bitcoin is believed to be the cornerstone of the crypto asset class.

Q: What is Bitcoin’s potential environmental impact?

A: You may have heard people talking about the energy consumption of the Bitcoin mining process

and its potential environmental impact. While Bitcoin mining does, in fact, use energy, reports

measuring Bitcoin mining energy consumption estimate that it uses less than half the amount of

energy used to mine gold every year.5

5 Bitcoin Mining Council. “Global Bitcoin Data Mining Review.” Bitcoin Mining Council, October 2021.

Managed by

a crypto specialist

As GBTC's sponsor since inception, Grayscale is one of the only asset

managers with a decade of experience operating a Bitcoin investment

vehicle that is regulated by the U.S. Securities Exchange Commission.

Strong

liquidity

In 2024, daily turnover remains above $900M and average bid-ask

spreads have consistently remained under $0.02/share.*

*As of 03/28/2024

Long

track record

Since its launch in 2013, GBTC has evolved from a private placement to

a national exchange-listed ET8 that is now held by hundreds of

thousands of investors across all �0 states.

Robust

reporting

Provides transparency of public reporting, tax reporting, institutionalgrade

digital asset custody, and the ability to invest through certain

tax-advantaged accounts sIWAs, Woth IWAs, and 401skS plansSk.

Unlike other energy consumers, miners can move their operations where power is most available

(and, as a result, the cheapest), and turn operations on and off quickly, as needed.

As a result, Bitcoin miners can tap into repurposing energy from sources that would otherwise be

wasted. Remarkably, for every $1,000 invested, a Bitcoin mining system reduces emissions by 6.32

tons of CO2 equivalents per year, surpassing the environmental impact of wind (1.3 tons) and solar

(0.98 tons)6. Additionally, Bitcoin mining is increasingly becoming greener. Today, a significant portion

of Bitcoin miners (76%) incorporate renewable resources into their energy mix7.

Q: Can you gain exposure to Bitcoin in a retirement account?

A: Yes. Certain Bitcoin investment vehicles are eligible to be held in various tax-advantaged or

retirement accounts including IRAs, Roth IRAs, and 401(k)s.

Q: What are the tax implications of adding Bitcoin in a portfolio?

A: Grayscale is not permitted to provide tax advice. A tax specialist should be consulted to

appropriately advise on any tax implications associated with digital assets.

For more details on the tax considerations for holding GBTC specifically, visit grayscale.com for more

information.

Conclusion

By introducing a peer-to-peer and decentralized system for transferring value, Bitcoin has the

potential to transform the financial ecosystem and foster a more transparent, inclusive and secure

way for people to transact. Today, Bitcoin serves primarily as a store of value and —though it has

grown significantly over the years—we believe its primary use case provides potential for upside in

comparison to the investment gold market.

As the crypto market has evolved, Grayscale has grown alongside it, becoming a leading partner

to investors as they navigate and deploy capital into this new asset class. Grayscale has pioneered

the model of providing investors with exposure to digital assets like Bitcoin in the form of a security

without the challenges of buying, storing, and safekeeping crypto.

For those seeking a deeper look into Bitcoin, Grayscale’s is happy to provide our Book of Bitcoin, a

comprehensive guide authored for the benefit of Financial Professionals and their clients.

We invite you to connect with a Grayscale representative at info@grayscale.com to navigate this

exciting journey with expert guidance.

6 Arcane Research. “How Bitcoin Mining can transform the Energy Industry.” September 2022.

7 Blandin, Apolline et al. “3rd Global Cryptoasset Benchmarking Study.” University of Cambridge. September 2022

For Financial Professional Use Only info@grayscale.com

For Financial Professional Use Only info@grayscale.com

Important Disclosures

To estimate the optimal share of crypto assets in a portfolio we

ran Monte Carlo simulations of hypothetical portfolios including

a classic 60/40 mix of large cap equities and government bonds

paired with Bitcoin. The 60/40 portfolio is based on the S&P

500 and the BloombergBarclays U.S. Treasury Total Return

Index. Bitcoin returns are based on the spot price. Asset returns,

volatilities, and correlations were measured from 2014 to 2023,

the period when Bitcoin was more widely available through

regulated investment vehicles. Under these assumptions, the

portfolio that maximizes the potential risk-adjusted return would

own approximately 5% of Bitcoin and 95% of the 60/40 portfolio.

This analysis does not include fees. Fees could have an impact on

investor returns if they were significantly different across assets

(i.e. stocks, bonds, or Bitcoin).

This analysis is hypothetical in nature, does not reflect actual

investment results and are not guarantees of future results and is

included for informational and educational purposes only.

Investments in digital assets are speculative and involve a

high degree of risk and heightened volatility, including a partial

or total loss of invested funds. They are not suitable for any

investor that cannot afford loss of the entire investment.

The Grayscale Bitcoin Trust (BTC) (the “Trust”) has filed a

registration statement (including a prospectus) with the SEC

for the offering to which this communication relates. Before

you invest, you should read the prospectus in that registration

statement and other documents the Trust has filed with the SEC

for more complete information about the Trust and this offering.

You may get these documents for free by visiting EDGAR on the

SEC Web site at www.sec.gov. Alternatively, the Trust or any

authorized participant will arrange to send you the prospectus

(when available) if you request it by calling (833)903-2211 or

by contacting Foreside Fund Services, LLC, Three Canal Plaza,

Suite100, Portland, Maine 04101.

Foreside Fund Services, LLC is the Marketing Agent for the

Grayscale Bitcoin Trust ETF.

We use the generic term “ETF” to refer to exchange-traded

investment vehicles, including those that are required to register

under the Investment Company Act of 1940, as amended (the

“40 Act”), as well as other exchange-traded products which are

not subject to the registration of the ‘40 Act. The Trust is not

registered under the 1940 Act and is not subject to regulation

under the 1940 Act, unlike most mutual funds or ETFs. Unlike

mutual funds, ETFs may trade at a premium or discount to their

net asset value. These funds are new and have limited operating

history to judge.

There is no guarantee that a market for the shares will be

available which will adversely impact the liquidity of the Trust.

The value of the Trust relates directly to the value of the

underlying digital asset, the value of which may be highly volatile

and subject to fluctuations due to a number of factors.

The Trust relies on third party service providers to perform

certain functions essential to the affairs of the funds and the

replacement of such service providers could pose a challenge

to the safekeeping of the digital asset and to the operations of

the Trust.

Extreme volatility of trading prices that many digital assets,

including Bitcoin, have experienced in recent periods and

may continue to experience, could have a material adverse

effect on the value of the Trust and the shares could lose all or

substantially all of their value.

Digital assets represent a new and rapidly evolving industry.

The value of the Trust depends on the acceptance of the

digital assets, the capabilities and development of blockchain

technologies and the fundamental investment characteristics of

the digital asset.

Digital asset networks are developed by a diverse set of

contributors and the perception that certain high-profile

contributors will no longer contribute to the network could have

an adverse effect on the market price of the related digital asset.

Digital assets may have concentrated ownership and large sales

or distributions by holders of such digital assets could have an

adverse effect on the market price of such digital assets.

The Trust holds Bitcoins; however, an investment in the Trust is

not a direct investment in Bitcoin. As a non-diversified and single

industry fund, the value of the shares may fluctuate more than

shares invested in a broader range of industries.

A substantial direct investment in digital assets may require

expensive and sometimes complicated arrangements in

connection with the acquisition, security and safekeeping of

the digital asset and may involve the payment of substantial

acquisition fees from third party facilitators through cash

payments of U.S. dollars. Because the value of the Trust is

correlated with the value of Bitcoin, it is important to understand

the investment attributes of, and the market for, the underlying

digital asset. Please consult with your financial professional.

Grayscale does not store, hold, or maintain custody or control

of the Trust’s digital assets but instead has entered into the

Custodian Agreement with a third party to facilitate the security

of its digital assets. The Custodian controls and secures the

Trust’s digital asset accounts, a segregated custody account to

store private keys, which allow for the transfer of ownership or

control of the digital asset, on the Trust’s behalf. If the Custodian

resigns or is removed by the Sponsor or otherwise, without

replacement, it could trigger early termination of the Trust.

Prior to 1/11/2024, shares of the Trust were offered only in private

placement transactions exempt from registration under the

Securities Act of 1933, as amended (the “Securities Act”), and

were quoted on the OTCQX® Best Market. GBTC did not have

an ongoing share creation and redemption program. Effective

as of the open of business on 1/11/2024, the shares of the Trust

were listed to NYSE Arca as an exchange-traded product, GBTC

established an ongoing share creation and redemption program

and the shares are being offered on a registered basis pursuant

to a Registration Statement on Form S-3.

The Trust’s investment objective both before and after 1/11/2024

has remained constant, namely to reflect the value of Bitcoin

held by the Trust, less expenses and other liabilities. However

prior to 1/11/2024, the Trust did not meet its investment objective

and its shares traded at both premiums and discounts to such

value, which at times were substantial, in part due to the lack

of an ongoing redemption program. Furthermore, the Trust’s

performance prior to 1/11/2024 is based on market-determined

prices on the OTCQX, while the Trust’s performance following

such date is based on market-determined prices on NYSE

Arca. As a result, the Trust’s historical data prior to 1/11/2024

is not directly comparable to, and should not be used to make

conclusions in conjunction with, the Trust’s performance

following that date. The performance of the Trust before and

after 1/11/2024 may differ significantly.

The S&P 500 Index (SPX) is a market-capitalization-weighted

index that measures the performance of 500 of the largest

publicly traded companies in the United States. The Nasdaq-100

(NDX) is a stock market index made up of 101 equity securities

issued by 100 of the largest non-financial companies listed on the

Nasdaq stock exchange. The MSCI All Country World Index (ACWI)

is a free-float-weighted index of the largest public companies

in both developed and emerging markets. The S&P/GS

Commodity Index (S&P/GSCI) is a benchmark measuring price

movements and investment performance in commodity

markets. The Bloomberg High Yield Bond Index (LF98TRUU)

measures the total return of fixed-rate corporate bonds with a

sub investment grade credit rating. The Bloomberg Investment

Grade Corporate Bond Index (LUACTRUU) measures the total

return of U.S. corporate bonds with an investment grade rating.

The Goldman Sachs Non-Profitable Tech Index (GSXUNPTC)

measures the price return of U.S. listed companies in innovative

industries which do not report positive earnings. The Bloomberg

Barclays U.S. Treasuries Total Return Index (LUATTRUU) measures

the total return of U.S. Treasury securities with at least one year of

remaining maturity.

© 2024 Grayscale Investments, LLC. All trademarks, service marks

and/or trade names (e.g., BITCOIN INVESTING BEGINS HERE,

DROP GOLD, G, GRAYSCALE, GRAYSCALE CRYPTO SECTORS,

and GRAYSCALE INVESTMENTS) are owned and/or registered by

Grayscale Investments, LLC.

Grayscale Bitcoin Trust (BTC) (the “Trust”) has filed a registration statement (including a prospectus) with the SEC for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the Trust has filed with the SEC for more complete information about the Trust and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the Trust or any authorized participant will arrange to send you the prospectus (when available) if you request it by calling (833) 903 - 2211 or by contacting Foreside Fund Services, LLC, Three Canal Plaza, Suite 100, Portland, Maine 04101.