Filed Pursuant To Rule 433

Registration No. 333-275079

April 16, 2024

2024 Grayscale Securities, LLC. For investment professionals use only.

The Grayscale Bitcoin Book 2024 Grayscale Securities, LLC For Investment Professional Use Only

"Foreword

In early 2014, I joined Grayscale Investments with a fundamental belief that Bitcoin and blockchain technology could change the world. At the time, we had begun offering Bitcoin exposure to investors through Grayscale Bitcoin Trust. The idea of investing in an intangible digitally-native non-sovereign form of money was not only novel, but nearly unheard of

by most investors. As we set out on a journey to democratize access to investing in this nascent asset class, we prioritized education, guiding investors through the foundational elements of Bitcoin, blockchain, and crypto more broadly.

A decade later, Grayscale Investments has emerged as the world’s largest crypto asset manager1, and our conviction has not wavered. We have proudly served as a leading partner and resource to investors, financial advisors, analysts, and all who are interested in exploring investments in crypto.

Whether you’re already familiar with Bitcoin, or just kicking-off your exploration of Bitcoin and the crypto asset class, Grayscale would be honored to support your learning. To start, we’ve created this Bitcoin Book – a three part culmination of topics we believe are most important in building your knowledge of Bitcoin (both the asset and the network), as well as Bitcoin investing.

I hope you enjoy the following chapters, and appreciate your interest in learning more about Bitcoin. Please do not hesitate to reach out to the Grayscale team with any questions or to discuss further at info@grayscale.com.

To learning – together,

Michael Sonnenshein

CEO, Grayscale Investments"

"1 With assets under management of $37bn as of January 11, 2024."

"| 1"

"Chapter 1: What is Bitcoin?"

"Chapter 1: What is Bitcoin? | 3 "

"Bitcoin is the world’s first digital asset that allows you to send money anywhere, at any time of the day, without a centralized intermediary. Before the invention of Bitcoin, money could not be sent directly over the internet like an email. This was even true for services such as PayPal and Venmo, which may seem entirely digital, but actually rely on the infrastructure of banks such as JP Morgan and Bank of America to verify and record transactions.

Unlike these centralized services, Bitcoin is decentralized and only has to rely on the Bitcoin network itself to verify and record transactions. Bitcoin is able to do this by combining concepts from computer science and cryptography to solve a historical problem: how can two people send money over the internet without having to trust a third party — whether that be the other person, a bank, or an intermediary.

Bitcoin was born out of the aftermath of the 2008 financial crisis — a time of deep mistrust in financial institutions — when an anonymous person or group of persons known as Satoshi Nakamoto released a whitepaper called “Bitcoin: A Peer-to-Peer Electronic Cash System”. The whitepaper called for the creation of a decentralized form of money whose code was native to the internet.

What are some of the unique features of Bitcoin that make it money?

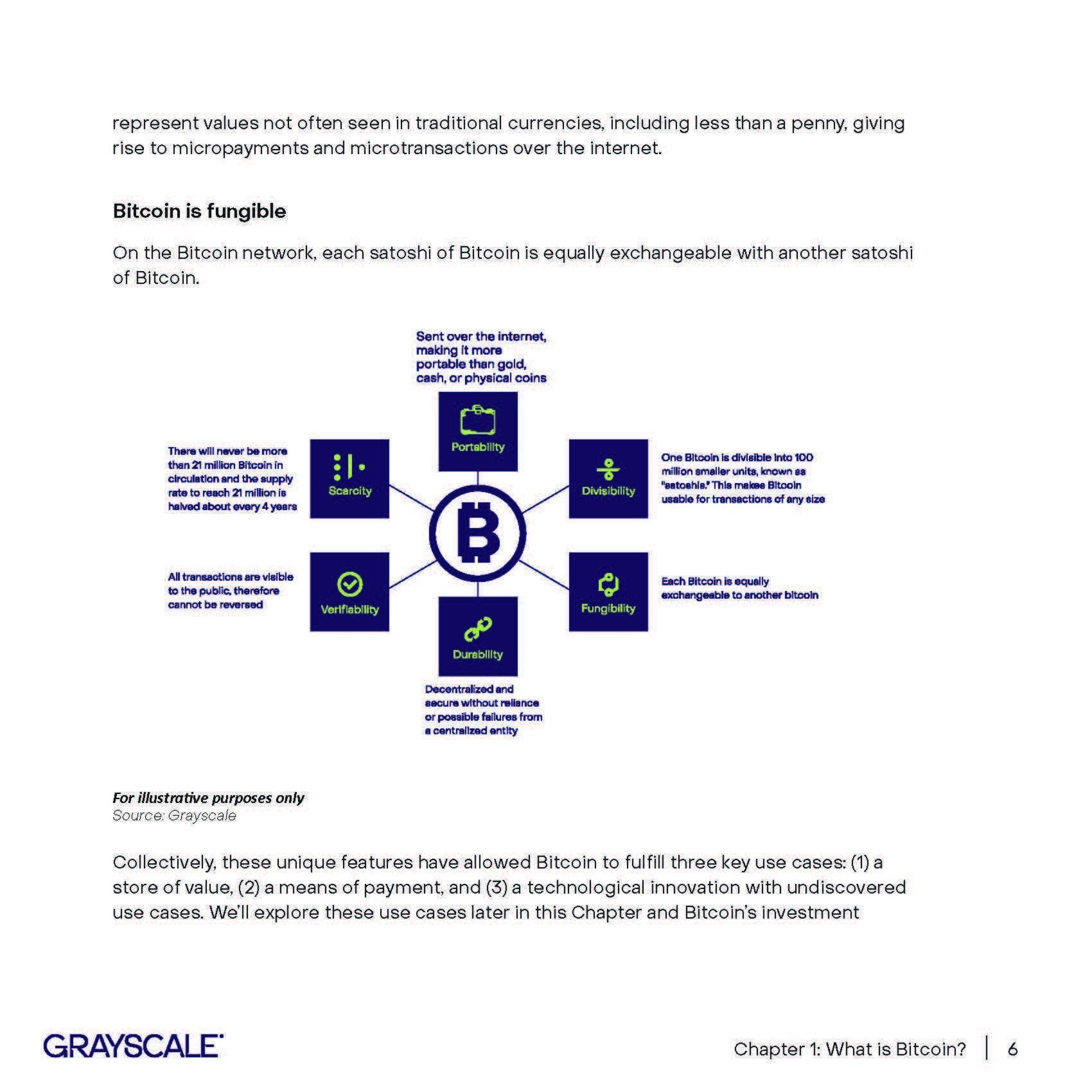

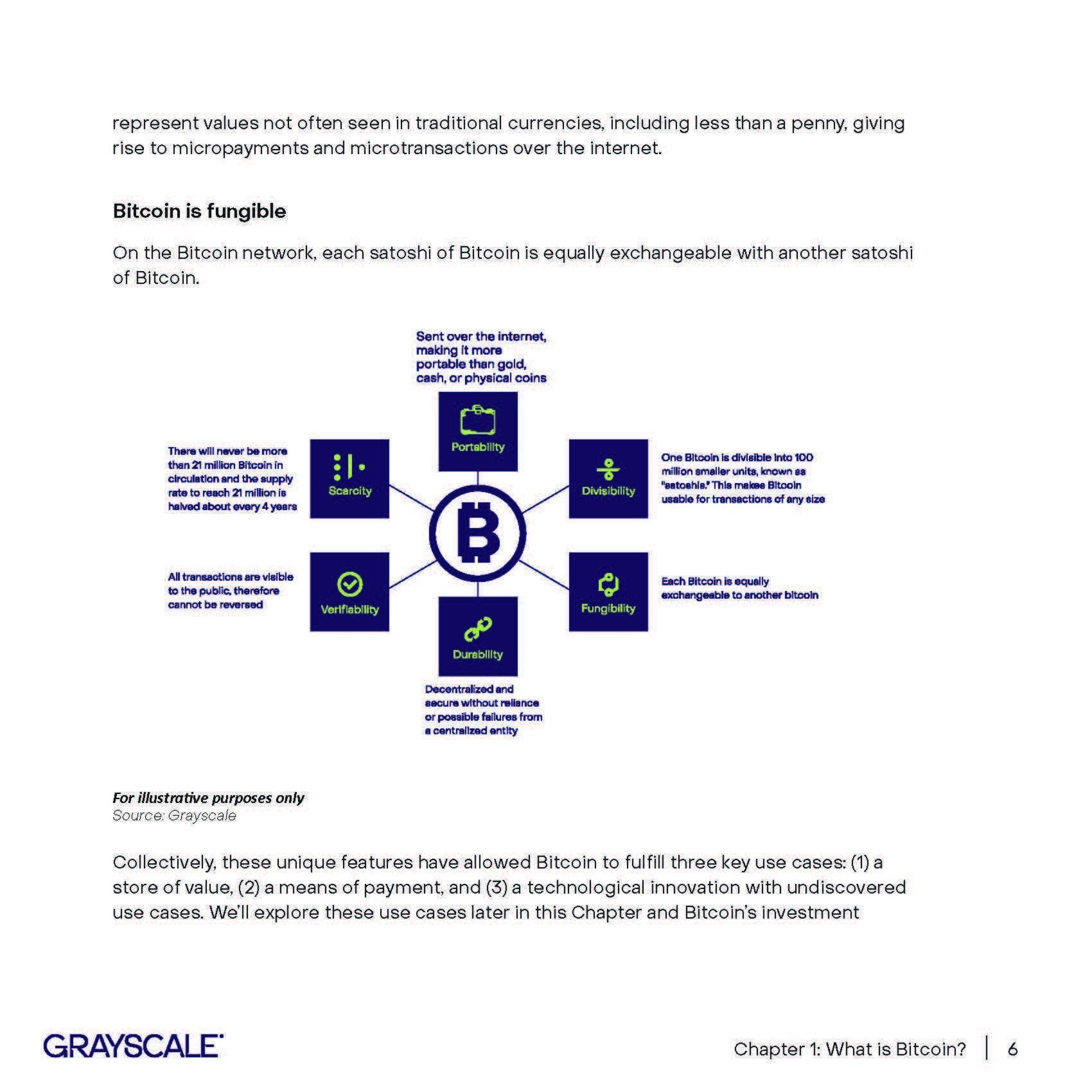

To better understand Bitcoin and how it can be used as money, it is helpful to understand its properties. When thinking about other forms of money or value—whether cash or precious metals such as gold—we often focus on scarcity, divisibility, portability, fungibility, durability, and verifiability. The same can be done for Bitcoin.

Bitcoin is portable

Because it can travel over the internet, Bitcoin is highly portable, especially when compared to physical assets such as cash, coins, or gold."

"Chapter 1: What is Bitcoin? | 4"

itcoin is durable The Bitcoin network is decentralized and secured by computers all over the world, rather than by a single centralized entity like a bank or government. This minimizes the possibility of a single point of failure. Furthermore, because Bitcoin operates based on code, rather than trusted intermediaries, it is less prone to the ill will or mistakes of humans. Bitcoin is verifiable Anyone with an internet connection can see a full history of all confirmed Bitcoin transactions, dating back to its inception. After a transaction has been verified, it is economically infeasible to reverse it, making it practically permanent. Bitcoin is scarce The Bitcoin network will never allow more than 21 million Bitcoin to exist and the supply curve within the code is predetermined, public, and final. Originally, 50 Bitcoin were issued approximately every 10 minutes. This distribution rate halves about every four years. Since 2008, there have been four halvings, and now 3.125 Bitcoin are issued approximately every 10 minutes. The next halving will occur sometime in 2028 and the 21 million Bitcoin limit is expected to be reached in the year 2140. Therefore, unlike traditional currencies such as the U.S. dollar, Bitcoin cannot be arbitrarily inflated, depreciated, or counterfeited. Bitcoin is divisible Bitcoin can be divided into increments as small as .00000001 Bitcoin, a fraction known as a “Satoshi” or “Sat” for short. This means anyone can buy, sell, or transfer a fraction of a Bitcoin and use it to buy and sell goods and services no matter how small or large. Bitcoin can even Chapter 1: What is Bitcoin?

"represent values not often seen in traditional currencies, including less than a penny, giving rise to micropayments and microtransactions over the internet. Bitcoin is fungible On the Bitcoin network, each satoshi of Bitcoin is equally exchangeable with another satoshi of Bitcoin." Portability Divisibility Fungibility Durability Verifiability Scarcity Sent over the internet, making it more portable than gold, cash, or physical coins One Bitcoin is divisible into 100 million smaller units, known as "satoshis." This makes Bitcoin usable for transactions of any size Decentralized and secure without reliance or possible failures from All transactions are visible to the public, therefore cannot be reversed There will never be more than 21 million Bitcoin in circulation and the supply rate to reach 21 million is halved about every 4 years "For illustrative purposes only Source: Grayscale Collectively, these unique features have allowed Bitcoin to fulfill three key use cases: (1) a store of value, (2) a means of payment, and (3) a technological innovation with undiscovered use cases. We’ll explore these use cases later in this Chapter and Bitcoin’s investment"

"Chapter 1: What is Bitcoin? | 6"

theses more in Chapter 2.

Now that we’ve discussed what Bitcoin is, its features, and how it can be used, we can

explore how Bitcoin works.

How does Bitcoin’s Network work?

Bitcoin Wallet

Similar to the physical world, a Bitcoin transaction starts with a wallet, only it’s a digital

wallet. Bitcoin’s digital wallet operates in a system analogous to email. In this system, each

user is given a unique public key, which can be thought of as their “email address”, and

an associated private key, which can be thought of as their “email password”. Like email

addresses, people need to know your public key so they can know who to send Bitcoin to or

receive Bitcoin from. And like your email password, it’s important that only you or someone

you trust knows your private key. However unlike email, where a user can choose their

username and password, Bitcoin relies on cryptography to maintain its security, the same

type of cryptography used by the internet. This means you cannot choose your public key

or private key, which is cryptographically derived from your public key. Instead, the Bitcoin

network gives them to you. Here is an example2 of a Bitcoin public key and private key:

Public Key:

02b4632d08485ff1df2db55b9dafd23347d1c47a457072a1e87be26896549a8737

Private Key:

E9873D79C6D87DC0FB6A5778633389F4453213303DA61F20BD67FC233AA33262

While this is likely incomprehensible to a human, it has meaning to the Bitcoin network. And

2 Example keys are provided for illustrative purposes only. They do not represent actual public or private keys

and are not associated with any wallet.

"just like email passwords, where length and randomness lead to more security, private keys are so complex that it is impossible, based on the current state of modern computing, to reverse engineer them from the public key. But this also means it’s extremely important to not lose your private key. If you lose your private key, you will no longer be able to access your Bitcoin. Thankfully, Bitcoin custody has come a long way since its inception, and there are now safer and more secure methods for individuals and institutions to manage their private keys.

Once you’ve set up your wallet, you can start transacting. The first Bitcoin transactions began between a small group of developers in 2009, but the first “real-world” transaction didn’t happen until May 22, 2010 — a day now celebrated as “Bitcoin Pizza Day”.3 In 2010, an early Bitcoiner named Laszlo Hanyecz famously paid 10,000 Bitcoin for two pizzas. In

a traditional credit card transaction, various intermediaries including banks or credit card companies would ensure that the buyer has the funds to purchase the goods (in this case, pizzas), and would subsequently note when the seller takes possession of the funds. But Laszlo’s transaction was entirely completed using the Bitcoin network, without the need for an intermediary to approve and document the transaction.

We previously mentioned that Bitcoin allows people like Laszlo to send money over the internet without a centralized intermediary because it combines computer science and cryptography. Now it’s time to dive deeper into those concepts:

Bitcoin Miners

Behind the scenes of Laszlo’s transaction, a decentralized network of computers — operated by individuals or companies called “Bitcoin miners”— compete with one another to be the first one to verify and record transactions on the Bitcoin network. More specifically, they are working to solve cryptographic puzzles or math problems that simply consist of trying different number inputs in a function to achieve a desired output. Miners, therefore, compete based on their computational resources (i.e., how powerful their computers are"

"3 George, Benedict. ""What Is Bitcoin Pizza Day?"" CoinDesk. 22 May 2023."

"Chapter 1: What is Bitcoin? | 8"

compete based on their computational resources (i.e., how powerful their computers are and how quickly they can crunch through numbers) and electricity (i.e., how inexpensively they can source power to operate their computers). Miners have an economic incentive to solve the problem because they are rewarded with newly-issued Bitcoin generated by the network as well as transaction fees paid by users like Laszlo in his pizza transaction. At this point it is natural to question what may seem to be a wasteful process of using computational resources and electricity to solve meaningless math problems. But, this process of mining actually serves a critical function of the Bitcoin network because it creates cost. If there is no cost, then a bad actor may be incentivized to not follow the rules of properly verifying and recording transactions (the same service that we entrust to banks and governments in the physical world). The cost disincentivizes this bad behavior. In the same vein, the reward of newly-issued Bitcoin and transaction fees for the miner that first solves the problem incentivizes them to engage in good behavior by properly verifying and recording transactions. For this reason, if you see value in the ability to transfer money over the internet through the Bitcoin network, then it is worth spending computational resources and electricity on that. The number of parties involved in verifying these transactions—the amount of computational power on the network—is significant and helps to ensure its security. On the Bitcoin network, incentives are key. And because Bitcoin relies on code rather than trusted intermediaries, it’s important that rules are followed. In computer science, one way to accomplish this is through a consensus mechanism.

"Proof-of-Work Consensus Mechanism

A consensus mechanism is simply a way for a group of individuals and entities to reach agreement about something based on a set of rules. On the Bitcoin network, some of the basic rules include: you cannot send more Bitcoin than you hold in your public key, you cannot send the same Bitcoin in more than one transaction (i.e., double-spend), a new set of transactions cannot be recorded until a miner solves the math problem, the problem should take approximately ten minutes to solve based on the amount of computational resources powering the network, and only when consensus is reached are the newest set of transactions recorded.

There are many different consensus mechanisms in computer science. Bitcoin uses one called “Proof-of-Work (PoW)” because of its reliance on the work of solving math problems through computational resources and electricity. The participants that reach consensus are called “nodes.” There are two main types of nodes:"

"Chapter 1: What is Bitcoin? | 10"

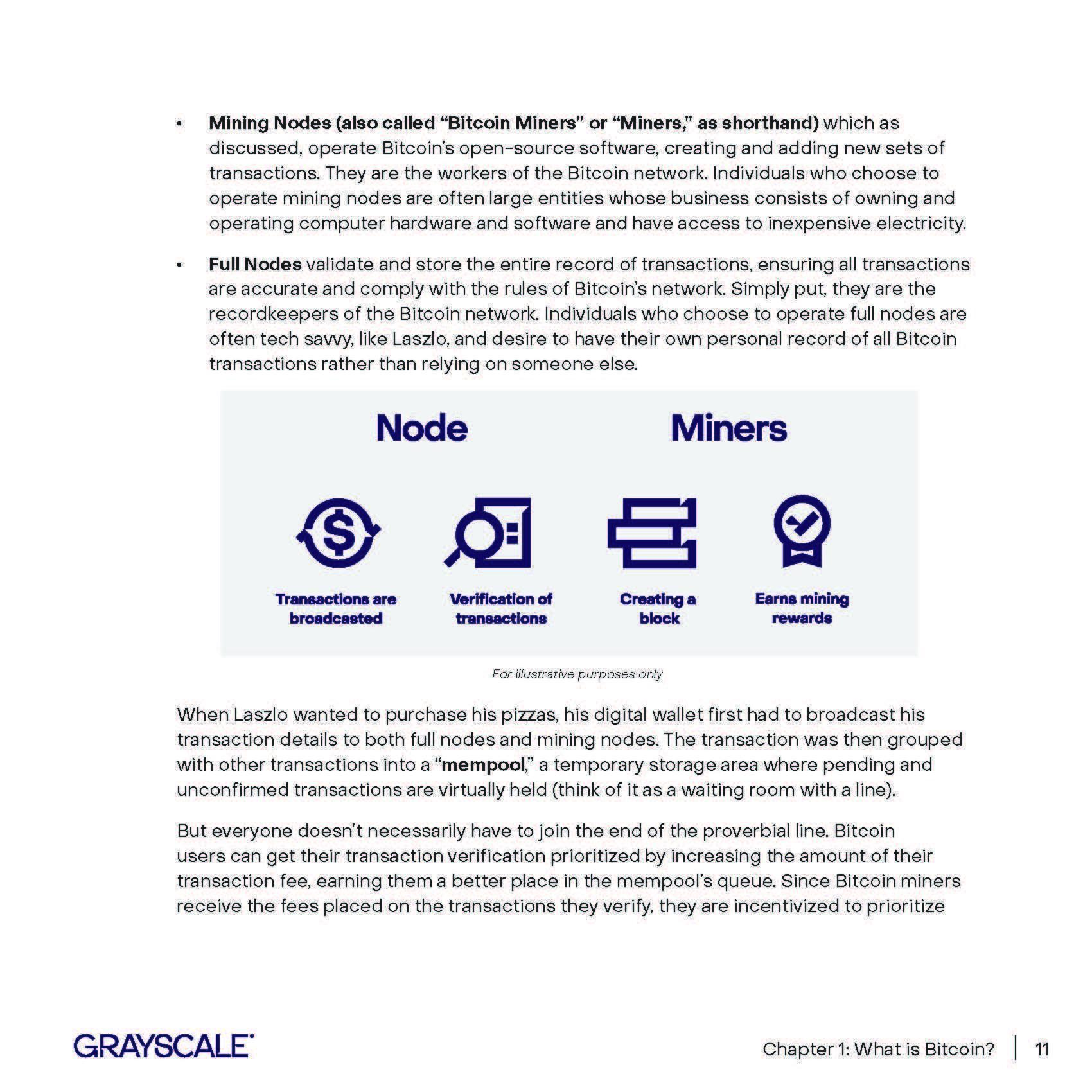

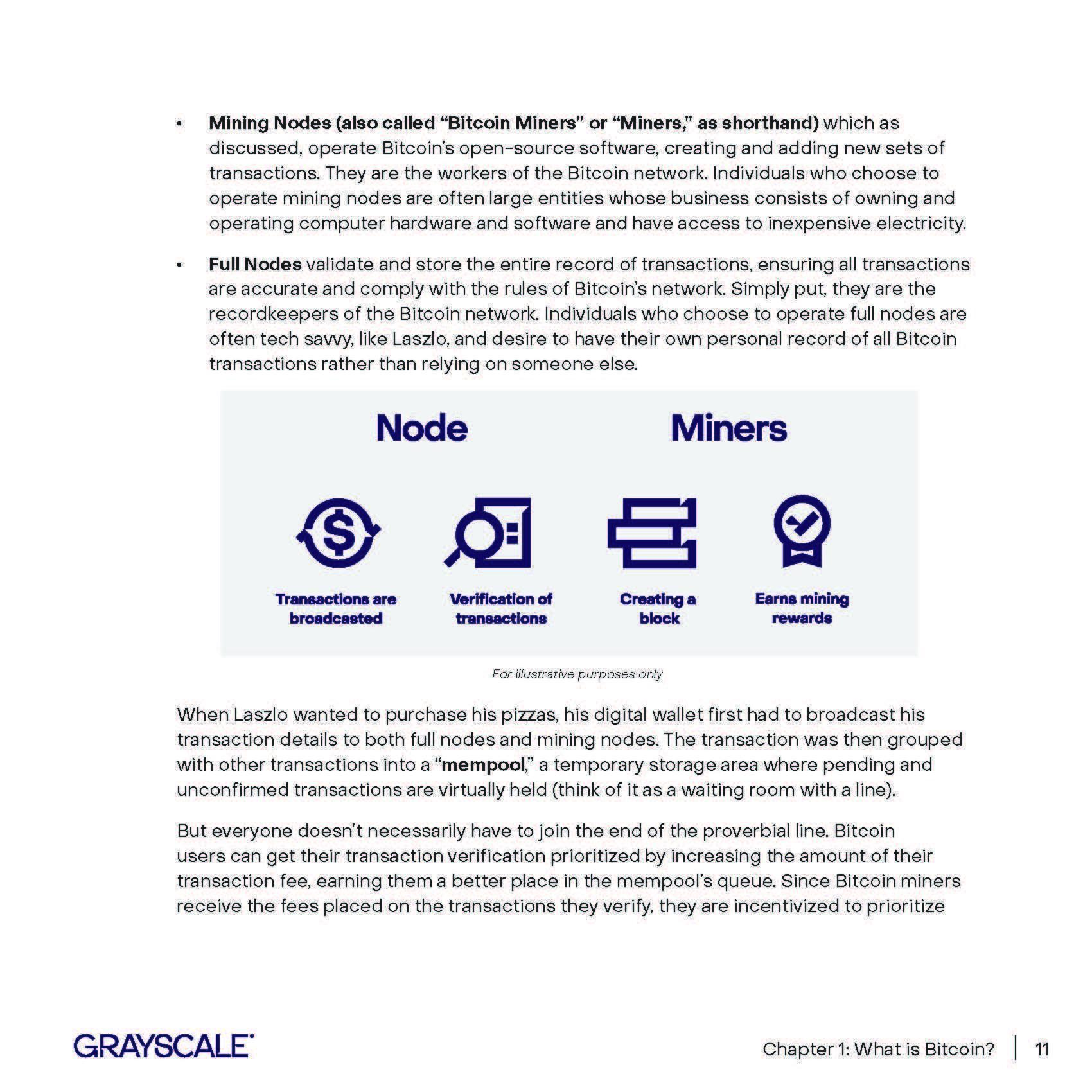

"• Mining Nodes (also called “Bitcoin Miners” or “Miners,” as shorthand) which as discussed, operate Bitcoin’s open-source software, creating and adding new sets of transactions. They are the workers of the Bitcoin network. Individuals who choose to operate mining nodes are often large entities whose business consists of owning and operating computer hardware and software and have access to inexpensive electricity.

• Full Nodes validate and store the entire record of transactions, ensuring all transactions are accurate and comply with the rules of Bitcoin’s network. Simply put, they are the recordkeepers of the Bitcoin network. Individuals who choose to operate full nodes are often tech savvy, like Laszlo, and desire to have their own personal record of all Bitcoin transactions rather than relying on someone else."

"For illustrative purposes only"

"When Laszlo wanted to purchase his pizzas, his digital wallet first had to broadcast his transaction details to both full nodes and mining nodes. The transaction was then grouped with other transactions into a “mempool,” a temporary storage area where pending and unconfirmed transactions are virtually held (think of it as a waiting room with a line).

But everyone doesn’t necessarily have to join the end of the proverbial line. Bitcoin users can get their transaction verification prioritized by increasing the amount of their

transaction fee, earning them a better place in the mempool’s queue. Since Bitcoin miners

receive the fees placed on the transactions they verify, they are incentivized to prioritize"

"Chapter 1: What is Bitcoin? | 11"

"the transactions that have the highest fees. If your transaction doesn’t make it into a set of verified transactions, that’s okay, it will simply remain in the mempool until it is included in a subsequent batch. If your transaction is selected, after a Bitcoin miner has solved the

cryptographic puzzle, it will be grouped with other transactions, added to the full record of Bitcoin transactions by the miner, and will be maintained by the full nodes for others to view.

On the Bitcoin network, the code is written in such a way to allow a set of transactions to be confirmed approximately every ten minutes, on average. To do that, the computational difficulty of the cryptographic puzzle will adjust once every two weeks depending on how quickly transactions were confirmed during that time period. If mining is happening too quickly, the puzzle will get harder. If it’s going too slowly, the puzzle will get easier.

Bitcoin Blockchain

Several times we’ve referenced Bitcoin transactions being verified and recorded, but where is this record actually held? This is where we introduce the next innovation of Bitcoin that you may have heard of, the blockchain. A blockchain is analogous to a digital accounting ledger used by banks. The name “blockchain” is derived from how transactions are verified and stored in the digital accounting ledger. A block is simply a data structure that contains a list of transactions Bitcoin network users would like verified. Once a Bitcoin miner solves the cryptographic problem, the newly-verified block gets added to the existing chain of blocks (containing previously verified transactions), hence blockchain.

Because there isn’t a trusted centralized intermediary like a bank to maintain a record of transactions, Bitcoin’s blockchain is public and transparent. That means anyone with access to the internet can see the transactions made across the network as a single source of truth. Notably, though, internet users will not know it was a specific user effecting a transaction

— for instance, Laszlo buying pizzas. Instead, they will see that long alphanumeric public key you saw earlier in this book. So, on the Bitcoin network, a viewer can only see the digital wallet letters and numbers, not the names associated with individual accounts. In this way, Bitcoin is pseudonymous, which is why it was originally described as an electronic cash

system."

"Chapter 1: What is Bitcoin? | 12"

"But where and when did the blockchain begin? In 2009, to mark the beginning of the blockchain, the first block of verified transactions was called the “Genesis Block”. Since then, a new block of transactions has been added to build upon the chain approximately once every ten minutes. That’s right, one of Bitcoin’s most transformative properties is that its blockchain contains every transaction ever, dating back to inception. Further, transactions taking place today are based on the transactions which came before it, leveraging this transformative technology in ways that legacy record keeping cannot compete with.

At this point, we’ve covered a lot of what you need to know to understand how a Bitcoin transaction works. In summary, a user who wants to send Bitcoin accesses their public key with their private key, and identifies the public key to which they want to send their Bitcoin. This transaction is broadcasted to the Bitcoin network, sitting in the mempool until miners group it together with other transactions. If a miner who has grouped the transaction is the first one to solve the math problem, then it will get verified by other miners and full nodes to confirm it follows the Bitcoin network’s rules. If it does, it will be added to the blockchain and the transaction is completed.

When speaking about Bitcoin, it is common to hear about the innovation of The Blockchain or Blockchain Technology. But it’s important to recognize that Bitcoin is able to work not because of one monolithic thing, but rather because of an elegant combination of things that collectively come together through computer science, cryptography, and incentive mechanisms. It is also common to lament our friend Laszlo. If you’re doing the math, his pizza purchase today would be worth hundreds of millions of dollars. But transactions

like Laszlo’s were critical in the early days of Bitcoin to prove that it could have real world purpose. And that is why instead of lamenting, we celebrate Bitcoin Pizza day.

What is a Bitcoin Halving?

We’re nearly at the end of this Chapter, but there’s another important concept about Bitcoin that you may have heard of that is worth mentioning."

"Chapter 1: What is Bitcoin? | 13"

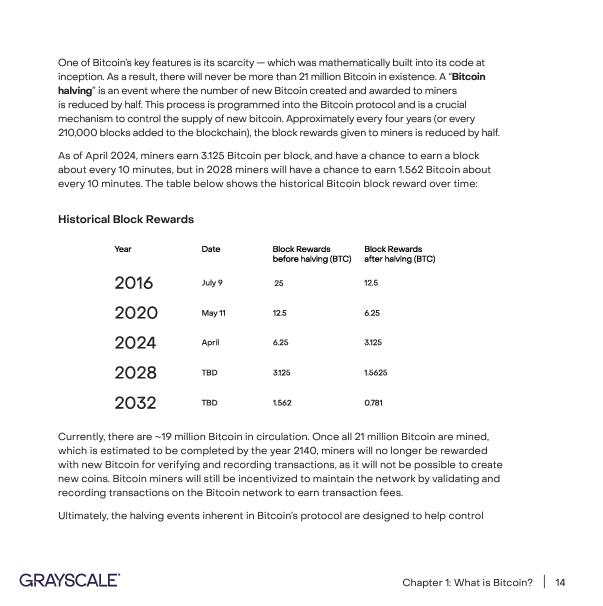

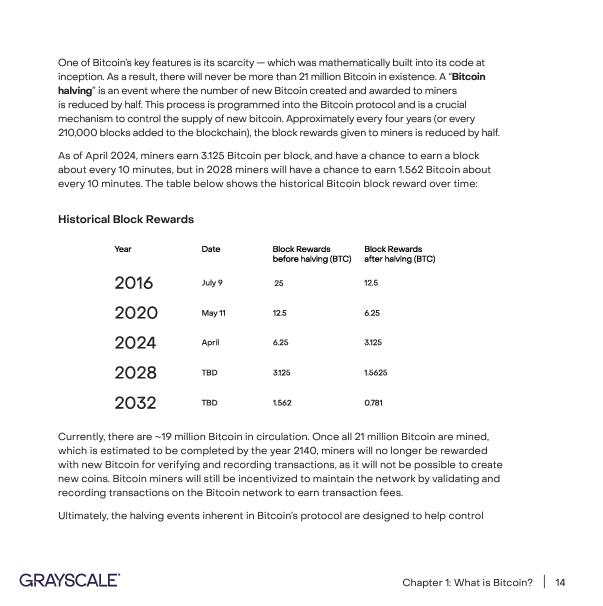

One of Bitcoin’s key features is its scarcity — which was mathematically built into its code at inception. As a result, there will never be more than 21 million Bitcoin in existence. A “Bitcoin halving” is an event where the number of new Bitcoin created and awarded to miners is reduced by half. This process is programmed into the Bitcoin protocol and is a crucial mechanism to control the supply of new bitcoin. Approximately every four years (or every 210,000 blocks added to the blockchain), the block rewards given to miners is reduced by half. As of April 2024, miners earn 3.125 Bitcoin per block, and have a chance to earn a block about every 10 minutes, but in 2028 miners will have a chance to earn 1.562 Bitcoin about every 10 minutes. The table below shows the historical Bitcoin block reward over time: Historical Block Rewards Currently, there are ~19 million Bitcoin in circulation. Once all 21 million Bitcoin are mined, which is estimated to be completed by the year 2140, miners will no longer be rewarded with new Bitcoin for verifying and recording transactions, as it will not be possible to create new coins. Bitcoin miners will still be incentivized to maintain the network by validating and recording transactions on the Bitcoin network to earn transaction fees. Ultimately, the halving events inherent in Bitcoin’s protocol are designed to help control

"inflation and ensure a steady, predictable supply of Bitcoin. This is in stark contrast to conventional fiat currencies, where central banks can modify the money supply

unpredictably. The combination of Bitcoin’s fixed total supply, unwavering and predictable supply schedule, and decreasing creation rate creates scarcity, which some theorize could drive its value upwards over time.

How has the use case of Bitcoin evolved over time?

As we mentioned, in January 2009, the inaugural block, dubbed the “Genesis Block,” was mined and Bitcoin’s network went live, marking the emergence of Bitcoin, blockchain technology, and Bitcoin mining. Bitcoin’s earliest users and adopters were originally “cypherpunks” who advocated for the widespread application of robust cryptography to safeguard people’s rights in order to help create an open and decentralized society. Soon after, programmers, tech enthusiasts, innovators, venture capitalists, and investors were drawn to Bitcoin’s unique genesis and potential.

By the late 2010s, Bitcoin’s use case began to evolve as it gained wider recognition and acceptance. Notably, against the backdrop of several global economic crises, in countries like Venezuela and Zimbabwe, citizens began holding Bitcoin as an alternative way to mitigate against rampant inflation and to conduct cross-border transactions — surfacing Bitcoin’s use case as a decentralized “store of value” or “digital gold” that can be used as a peer-to-peer medium of exchange.

Today, Bitcoin is the most widely known digital asset, and it has continued to retain its core use case as a medium of exchange (e.g., peer-to-peer payments) and store of value. Large financial institutions, tech companies, and governments around the world have begun

to embrace Bitcoin — adding it to their balance sheets, accepting Bitcoin as payments, embracing Bitcoin as legal tender, and more5.

Deeper Dive: Bitcoin’s Purpose and Use Cases"

"5 “Bitcoin Treasuries."" Coinglass."

"Chapter 1: What is Bitcoin? | 15"

eeper Dive: Bitcoin’s Purpose and Use Cases While Bitcoin is more than a decade old and is owned by tens of millions of people5, there is still an ongoing evolution over how the Bitcoin network can and should be used. When it was first conceived, Bitcoin was intended as a peer-to-peer payments system.6 But, as the Bitcoin network has grown and developed over time, its purpose and use case has evolved, too. Due to its unique properties, Bitcoin has multiple potential use cases, including: 1. Store of Value 2. Means of Payment 3. Technological Innovation with Undiscovered Use Cases Below, you’ll find explanations for how Bitcoin’s intended and actual use has evolved over time. Use Case #1: Store of Value Though Bitcoin was originally intended as a peer-to-peer payments system, over time, Bitcoin has evolved to primarily be viewed as a store of value asset because of its scarcity, divisibility, portability, fungibility, durability, and verifiability. Bitcoin’s hard-capped supply at 21 million is a key differentiator compared to traditional currencies, which are largely controlled by central banks and by government entities that can create more supply (for example: additional U.S. dollars were printed with the COVID-19 stimulus package). Bitcoin’s scarcity has driven up the price of Bitcoin, and today many believe that Bitcoin is akin to “digital gold.”7 As such, over time, Bitcoin has begun to compete with gold as a scarce store of value asset. Like gold, Bitcoin can serve as a hedge against currency debasement.8 Although gold has 5 6 7 8 Bitcoin addresses with a balance greater than $10 was about 35M as of March 31, 2024. Source: Coin Metrics. Nakamoto, Satoshi. "Bitcoin: A Peer-to-Peer Electronic Cash System." 2008. Malwa, Shaurya. "Bitcoin’s Role as ‘Digital Gold’ Will Aid Further Demand, Traders Say." CoinDesk, 7 Nov. 2023. Macheel, Tanaya. "Bitcoin is a ‘critical hedge’ against currency debasement and return of inflation, Jefferies. says." CNBC, 5 Oct. 2023. Chapter 1: What is Bitcoin?

een around longer, Bitcoin is better than gold with respect to certain features of money that its holders may find attractive in comparison, especially portability: Bitcoin is available anywhere in the world, at any time, as long as holders have access to the internet and a bespoke private key. As of March 2024, Bitcoin’s market cap9 is relatively small compared to the physical gold market.10 Today, the investment gold market is about nine times larger than the market cap of Bitcoin. Some believe that Bitcoin may continue to take market share from gold, as it can be seen as a store of value asset that is more suited for our digitized age. 9 Bitcoin’s market cap is $1.4 trillion as of March 31, 2024. Source: Coinmarketcap. 10 Grayscale Research. “Bitcoin’s Purpose: Sizing the Addressable Markets.” Grayscale, 7 Sept. 2023. Chapter 1: What is Bitcoin? "Chapter 1: What is Bitcoin? | 17"

se Case #2: Means of Payment Today, Bitcoin is also used as a means of payment, though to a lesser degree than as a store of value. Still there remains opportunity for future growth of this use case. Today, the amount of transaction money globally, referred to by economists as “M1”, totals about $60 trillion.11 If Bitcoin were to grow significantly as a means of payment and capture even a small fraction of the M1 supply, it could have a meaningful impact on the token’s potential valuation. Within this use case, it’s important to remember that Bitcoin offers users the ability to send value anywhere in the world, at any time of day, representing any amount of value. This may appeal to users who regularly partake in global remittances as compared to the time, fees, or inefficiencies of the current financial system. Use Case #3: Technological Innovation with Undiscovered Use Cases Finally, Bitcoin can be thought of as a technological innovation with undiscovered use cases. New potential use cases for the network might emerge over the long term. As a public blockchain, Bitcoin allows for independent developers to build on its protocol. In the last few years, developers have created innovative new applications on the Bitcoin that open the network to new markets such as digital art, collectibles, and gaming. While these additional use cases are still nascent and unproven, Bitcoin could translate growing activity and developer interest into globally meaningful traction in these areas over the long-term. If so, the Bitcoin network could tap into additional markets such as the $67bn art market12, the $372bn collectibles market13, and the $227bn video game market14, among others. In the future, there are likely to be additional use cases for Bitcoin that we haven’t even yet considered. 11 12 13 14 Grayscale Research. "Bitcoin’s Purpose: Sizing the Addressable Markets." Grayscale, 7 Sept. 2023. McAndrew, Clare. “The Art Market 2023. A Report by Art Basel & UBS.” UBS and Art Basel. HSBC Private Banking. “Six of today’s most collectible luxury items.” HSBC, 19 Nov. 2021. PwC. “Perspectives from the Global Entertainment & Media Outlook 2023–2027.” PwC, 21 June 2023. Chapter 1: What is Bitcoin?

"Conclusion

By introducing a peer-to-peer and decentralized system for transferring value, Bitcoin has the potential to transform the financial ecosystem and foster a more transparent, inclusive and secure way for people to transact. Today, Bitcoin serves primarily as a store of value and

—though it has grown significantly over the years—we believe its primary use case provides potential for upside in comparison to the investment gold market. Going forward, continued developer innovation on the Bitcoin network could lead to additional use cases as well as an

increased relevance and growth in adoption of the asset."

"Chapter 1: What is Bitcoin? | 19"

"Chapter 1: What is Bitcoin? | 20"

"Chapter 2: The Investment Case for Bitcoin"

"Chapter 2: The Investment Case for Bitcoin | 21"

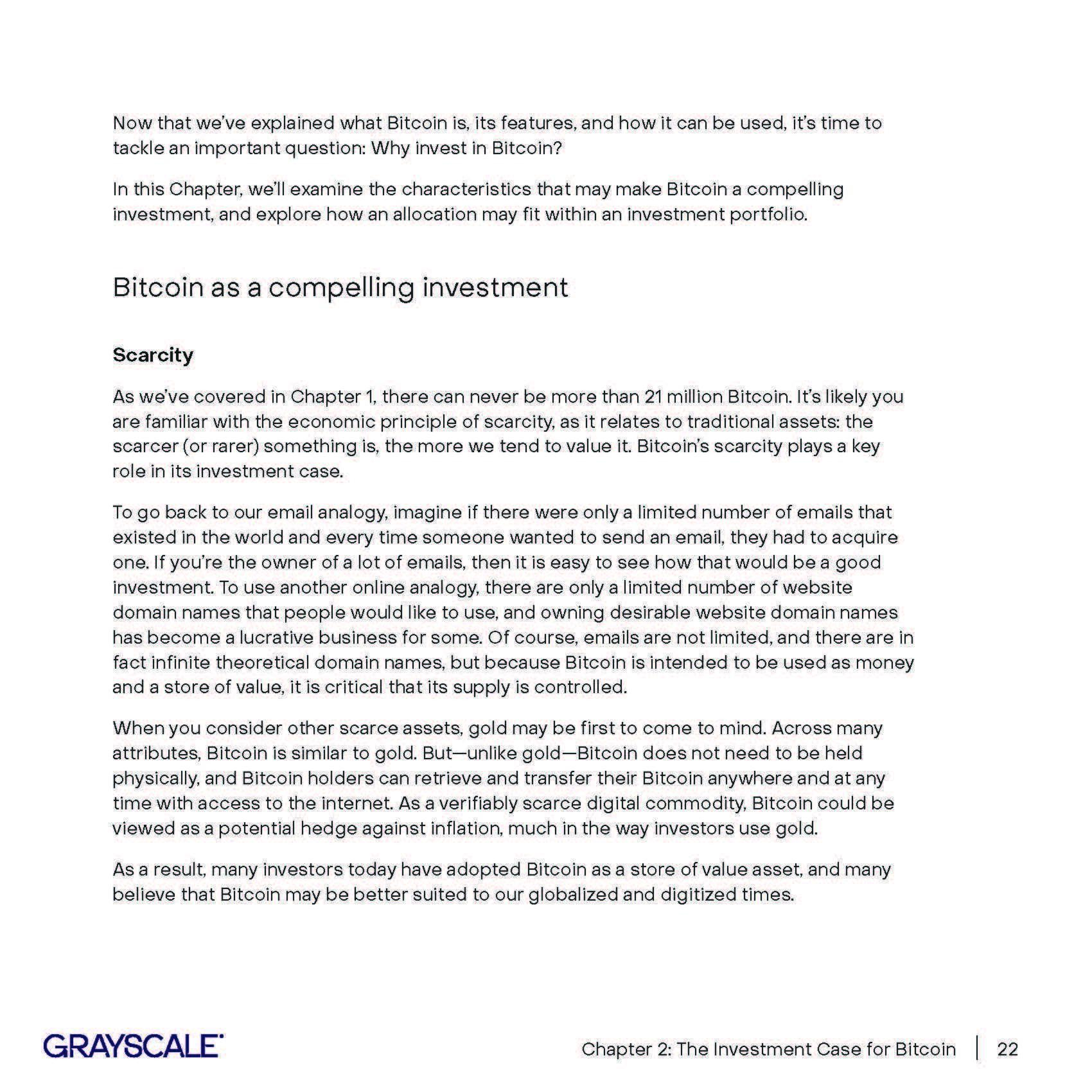

"Now that we’ve explained what Bitcoin is, its features, and how it can be used, it’s time to tackle an important question: Why invest in Bitcoin?

In this Chapter, we’ll examine the characteristics that may make Bitcoin a compelling investment, and explore how an allocation may fit within an investment portfolio.

Bitcoin as a compelling investment

Scarcity

As we’ve covered in Chapter 1, there can never be more than 21 million Bitcoin. It’s likely you are familiar with the economic principle of scarcity, as it relates to traditional assets: the scarcer (or rarer) something is, the more we tend to value it. Bitcoin’s scarcity plays a key role in its investment case.

To go back to our email analogy, imagine if there were only a limited number of emails that existed in the world and every time someone wanted to send an email, they had to acquire one. If you’re the owner of a lot of emails, then it is easy to see how that would be a good investment. To use another online analogy, there are only a limited number of website domain names that people would like to use, and owning desirable website domain names has become a lucrative business for some. Of course, emails are not limited, and there are in fact infinite theoretical domain names, but because Bitcoin is intended to be used as money and a store of value, it is critical that its supply is controlled.

When you consider other scarce assets, gold may be first to come to mind. Across many attributes, Bitcoin is similar to gold. But—unlike gold—Bitcoin does not need to be held physically, and Bitcoin holders can retrieve and transfer their Bitcoin anywhere and at any time with access to the internet. As a verifiably scarce digital commodity, Bitcoin could be viewed as a potential hedge against inflation, much in the way investors use gold.

As a result, many investors today have adopted Bitcoin as a store of value asset, and many believe that Bitcoin may be better suited to our globalized and digitized times."

"Chapter 2: The Investment Case for Bitcoin | 22"

"Exposure to Emergent Technology and Associated Network Effects

Another compelling characteristic of Bitcoin is that it potentially offers investors exposure to an emerging technology.

You may recall from our discussion in Chapter 1, that blockchains are a type of network technology — like social media platforms or the telephone. Blockchains are unique, however, in that they have native tokens, like Bitcoin, which may increase in value due to network effects.

Networks are not like other goods: one of their special features is that their value generally increases with the number of network participants. Think of Facebook. If you were the only user on the Facebook network, then you have no one to engage with. But as more users join Facebook, it becomes more valuable to you and to them. For this reason, assets tied to network technologies — like social media stocks — can experience significant growth once network usage reaches critical mass (think Facebook pre-IPO). As Bitcoin adoption potentially reaches a much larger set of users, this could have nonlinear implications for its valuation due to network effects.

For example, Exhibit 1 (below) illustrates the growth of the Bitcoin network since its inception, highlighting the increase in wallet addresses and the number of transactions on the network. This exponential rise reflects not just growing interest but also greater adoption of Bitcoin as a digital currency. Mirroring this growth, between September 30, 2013, and June 30, 2017 — a period between two bull runs in Bitcoin’s history—the number of active Bitcoin addresses increased tenfold, indicating a surge in participation of the network."

"Chapter 2: The Investment Case for Bitcoin | 23"

xhibit 1: Bitcoin Wallet Addresses and Transaction Count15 Similarly, the early growth phase of Facebook witnessed a comparable exponential increase. Between September 30, 2008, and June 30, 2012 (first quarter since their IPO), Facebook’s monthly average users worldwide also increased tenfold.16 This parallel in growth trajectories between Bitcoin and Facebook is noteworthy. Just as the expanding number of Bitcoin wallet addresses during this period indicates a wider acceptance and use of cryptocurrency, the escalating user base of Facebook during its initial years demonstrated the increasing value of its social network. Both entities, despite operating in fundamentally different domains—exhibit network effect-driven growth. This is characterized by each additional user adding value to the network, thereby attracting more participants, fueling a cycle of continued growth. 15 16 Source: Glassnode, data as of April 10, 2024. For illustrative purposes only. “Number of monthly active Facebook users worldwide as of 3rd quarter 2023.” Statista, Oct. 2023. Chapter 2: The Investment Case for Bitcoin

"Diversification

Although Bitcoin is part of a nascent asset class and should be considered a risk asset, it is not highly correlated with other risk assets. This means that, historically, the price of Bitcoin has not moved together with other risk assets. Understanding which investments tend to move up or down at the same time helps enable investors to more effectively manage risks by creating portfolios with diverse return streams. This means spreading your investments across different types of assets, like stocks and bonds—and now—Bitcoin.

Below, in Exhibit 2, we can see that over the last five years Bitcoin has had a correlation with the S&P 500 well below comparable alternatives. You’ve likely considered that the value of an asset depends not only on its own return characteristics, but also on its correlation with other assets: because they can be combined to create more efficient portfolios. We believe Bitcoin is a rare example of a high-return-potential asset with a low correlation to stocks."

"Exhibit 2: Five-year Risky Asset Correlations with S&P 500"

"Chapter 2: The Investment Case for Bitcoin | 25"

itcoin in Portfolios Bitcoin introduced the world to a digitally-native non-sovereign form of money, and has established itself as a major global asset, owned by tens of millions of people.17 In fact, in its short history, Bitcoin has produced high investment returns, and has outperformed all other major asset classes over the last three, five, and ten years.18 Bitcoin’s high returns reflect its potential addressable market, as well as rising demand for digital gold. Naturally, we believe that it deserves a place in certain investor portfolios. Investors, however, should take into account their own investment preferences, such as risk tolerance and duration, and needs among liquidity and income. We believe an investment in Bitcoin is most appropriate for an intermediate or longer term investment horizon. Where does Bitcoin fit in a portfolio? When we consider how to create room in a portfolio for Bitcoin, we can think of it as an asset that can potentially substitute for other strategies offering return enhancement, diversification, or both. Gold and other commodities. Commodity investments historically have not produced attractive total returns relative to stocks and bonds over time. However, they can outperform traditional assets under certain conditions, including periods of inflation. Many investors hold allocations in these assets to provide portfolio diversification for those circumstances. In fact, Bitcoin has moved together with other inflation hedging assets in recent years. Relative to gold or other commodities, Bitcoin may provide a potential inflation hedge that can produce positive total returns. We believe many investors may want to consider substituting gold and/or commodity allocations with Bitcoin (possibly at a smaller allocation, reflecting Bitcoin’s volatility). Small cap equities and international stocks. Bitcoin can potentially replace ancillary equity allocations. For many investors, large cap domestic equities, often indexed to the S&P 500, 17 18 Coin Metrics data, as of March 31, 2024. Bloomberg, Preqin, Hedge Fund Research, Grayscale Investments; as of March 31, 2024. Chapter 2: The Investment Case for Bitcoin

"account for the lion’s share of portfolio risk. At the same time, many investors hold additional public equities seeking improved returns and/or correlation benefits, including small cap stocks and international equities. We believe Bitcoin can take share from these traditional allocations for risk-tolerant investors, as it may offer higher returns to either small caps or international stocks, and lower correlations to the S&P 500.

Technology stocks. Bitcoin introduced the world to blockchain technology, which we believe could transform many sectors, including the future of digital commerce. Investing in Bitcoin can provide exposure to this innovative technology. In a portfolio context, it could possibly replace technology investments, including public equities related to sectors spanning tech, biotech, cybersecurity, or artificial intelligence. As we start to see more tech companies—like Microstrategy, Tesla and Block (formerly known as Square, now Block Inc.)— add Bitcoin to their balance sheets, the similarity of exposures between technology stocks and Bitcoin may continue to increase.

As we think about how Bitcoin might fit into investor portfolios, we believe that macro trends may continue to provide tailwinds to Bitcoin. As we face higher and more volatile inflation, declining trust in centralized institutions, and structural threats to the dominant role of the U.S. dollar, investors may be more curious about appropriately sized allocations of Bitcoin in their portfolios.

How much Bitcoin should is appropriate for a portfolio?

When we consider Bitcoin’s risk and return profile, we believe an appropriate allocation could be scaled up over time to 5% of investable assets. Said differently, if you add Bitcoin to a portfolio otherwise holding a 60/40 mix of stocks and bonds, it would hypothetically achieve an improved return without adding too much volatility when Bitcoin makes up about 5% of the portfolio.

Of course, 5% isn’t the right amount for all investors, since portfolio construction needs to take into account each investor’s individual needs. For investors who are more risk averse, they might consider adding 1-3%. This would naturally result in lower expected returns, but could also reduce the portfolio’s volatility."

"Chapter 2: The Investment Case for Bitcoin | 27"

"Additionally, we consider Bitcoin to be a long-term investment which may not be right for investors who need capital in the near or intermediate term (3-5 years, for instance). For example, you may be saving up to buy a home or pay tuition. It’s also important to remember that Bitcoin doesn’t pay dividends or coupon payments, so it isn’t right for investors who rely on a fixed income.

At the same time, a 5% allocation to Bitcoin could be about the right amount for a variety of investor types. For example, if you are a younger investor with a long-term investment horizon and little need for income, a meaningful allocation to Bitcoin might enhance the returns of your portfolio.

Similarly, ex-U.S. investors with assets in the U.S. market (for example, a European investor that owns U.S. stocks) may want to consider a larger position in Bitcoin. Because Bitcoin has shown negative correlation20 with the value of the U.S. Dollar, it may provide additional diversification benefits for investors exposed to Dollar depreciation.

As always, you should reevaluate the share of any portfolio allocated to Bitcoin if returns, volatility, and/or correlations with other assets change over time, or if there are changes in your personal circumstances or risk tolerance.

To estimate the optimal share of crypto assets in a portfolio we ran Monte Carlo simulations of hypothetical portfolios including a classic 60/40 mix of large cap equities and government bonds paired with Bitcoin. The 60/40 portfolio is based on the S&P 500 and the Bloomberg- Barclays U.S. Treasury Total Return Index. Bitcoin returns are based on the spot price. Asset returns, volatilities, and correlations were measured from 2014 to 2023, the period when Bitcoin was more widely available through regulated investment vehicles. Under these assumptions, the portfolio that maximizes the potential risk-adjusted return would own approximately 5% of Bitcoin and 95% of the 60/40 portfolio. This analysis does not include fees. Fees could have an impact on investor returns if they were significantly different across assets (i.e. stocks, bonds, or Bitcoin).

This analysis is hypothetical in nature, does not reflect actual investment results and are not guarantees of future results and is included for informational and educational purposes only."

"20 BTC/USD correlation of -0.34 between January 2020 and November 2023, based on monthly Bloomberg data."

"Chapter 2: The Investment Case for Bitcoin | 28"

"Chapter 2: The Investment Case for Bitcoin | 29"

"Chapter 3: Common Questions | 30"

"Chapter 3: Common Questions"

"Chapter 3: Common Questions | 31"

"Q: What is a blockchain?

As you may recall from Chapter 1, a blockchain is analogous to a digital accounting ledger used by banks. The name “blockchain” is derived from how transactions are verified and stored in the digital accounting ledger. A block is simply a data structure that contains a list of transactions Bitcoin network users would like verified. Once a Bitcoin miner solves

the cryptographic problem, the new block gets added to the existing chain of transactions, hence blockchain. To expand a bit further on the details:

• Each block is made up of data consisting of (1) a unique digital marker or digital fingerprint known as a “hash”, (2) groups of recent valid transactions, and (3) the “hash” of the previous block.

• Each block contains a set of transactions linked in chronological order, which forms a chain (the blockchain). A key feature of blockchain technology is that once a block is added to the chain, it becomes nearly impossible to retroactively change it. This

concept is known as immutability and it ensures the security and integrity of the data. Anyone with access to a blockchain has an identical copy of the entire chain, which prevents censorship and removes the risk of a single actor altering the chain.

For a more detailed explanation of how a blockchain functions, please refer back to Chapter 1.

Q: What are some use cases of blockchain technology?

Blockchain technology’s versatility and reliability make it a promising solution for a wide array of industries. Since it is transparent and has an inalterable record of accurate, real-time

information, blockchain technology has already started to transform industries and applications.

For example, the healthcare sector experiences persistent challenges of interoperability and privacy issues that hinder efficient data sharing between different healthcare systems. Blockchain technology offers a potential solution for cross-party electronic record sharing. By employing a shared distributed ledger across providers, blockchain technology seeks to enable efficient data exchanges while ensuring privacy over sensitive information.21 One"

"21 “Henderson, James. ""UPS joins alliance to create blockchain standards for logistics."" Supply Chain Digital, 17 May 2020."

"Chapter 3: Common Questions | 32"

"example of this is MedRec, a blockchain-based system for managing medical information created by MIT researchers.

Q: What is an open (or public) blockchain?

Public blockchains are open to anyone with an internet connection; no permissions or approvals from centralized authorities are required for access. Because of the lack of permissions required, you may have heard open blockchains referred to as “permissionless,” making open blockchain networks more inclusive by providing access to anyone globally.

Bitcoin, for example, operates on a public blockchain that is fully permissionless, transparent, and public—promoting accountability. These features are designed to enable peer-to-peer transactions while maintaining privacy and transaction security.

One exciting use case for public blockchains is to increase financial inclusion in the developing world by providing people who are currently underserved by the financial system—also often called “unbanked” or “underbanked”—with the ability to effect transactions. Individuals may be unbanked due to bureaucratic and social hurdles, a lack of personal identification, or inability to physically access a bank location.

A public blockchain allows anyone with an internet connection to participate in the global digital financial system. By allowing them to store their money and conduct transactions, it may help to improve the lives of individuals and accelerate broader economic development. In fact, even simple feature cell phones (non-smart phones) allow individuals to send and receive Bitcoin via SMS or text message.

Q: What is a closed (or permissioned) blockchain?

You may have also heard of companies building their own blockchain solutions, like JPMorgan, for example.

These are examples of closed blockchains. A closed (also referred to as an “enterprise”, “private”, “permissioned”, or “federated”) blockchain is restricted to a specific group of individuals who need to be given access— a stark contrast to public or permissionless blockchains (like the Bitcoin blockchain), which are open to everyone."

"Chapter 3: Common Questions | 33"

blockchains are typically developed and used by corporations, organizations, or centralized entities, where data privacy is paramount. While private blockchains may sacrifice decentralization and transparency, we believe they can be a valuable tool for industries or businesses that could benefit from tamperproof data. For example, IBM has created private blockchains for global shipping giants, like Walmart and Maersk, to more precisely track sensitive cargo shipments and deliveries around the world. More specifically, temperature-sensitive vaccines were distributed more efficiently around the globe during the COVID-19 pandemic because of innovations in blockchain technology. Other use cases for private blockchains are supply chain management, identity verification, voting systems, record keeping, and more. Other industries, such as the healthcare sector, use private blockchains for securely storing and sharing patient records, while maintaining data integrity. A private blockchain would allow medical providers, for example, to share data about a patient, without revealing sensitive information to the public. You can think of a closed blockchain as an implementation of technology that allows companies to improve their operations, rather than an investable asset like public blockchains, which offer native tokens (like Bitcoin) that you can own to invest in the network. Q: How can we categorize Bitcoin into an asset class? We think of Bitcoin (and crypto, generally) as an alternative asset. We consider cryptocurrency to be a nascent asset class, separate from traditional asset classes such as equities, fixed income, real estate, or private equity. Some believe that new asset classes, like crypto, are born once in a generation, if even that. With over a decade track record as the world’s most valuable digitally-native token, Bitcoin is believed to be the cornerstone of the crypto asset class. Q: What are the tax implications of adding Bitcoin in a portfolio? Grayscale is not permitted to provide tax advice. The U.S. Internal Revenue Service has Chapter 3: Common Questions

ublished this language on their website21 (as of November 30, 2023)22: “For federal tax purposes, digital assets are treated as property. General tax principles applicable to property transactions apply to transactions using digital assets. You may be required to report your digital asset activity on your tax return. Transactions involving a digital asset are generally required to be reported on a tax return. Taxable income, gain or loss may result from transactions including, but not limited to sale of a digital asset for fiat, exchange of a digital asset for property, goods, or services, exchange or trade of one digital asset for another digital asset, receipt of a digital asset as payment for goods or services, receipt of a new digital asset as a result of a hard fork, receipt of a new digital asset as a result of mining or staking activities, receipt of a digital asset as a result of an airdrop, or any other disposition of a financial interest in a digital asset.” A tax specialist should be consulted to appropriately advise on any tax implications associated with digital assets. Q: Can you gain exposure to Bitcoin in a retirement account? Yes. Certain Bitcoin investment vehicles are eligible to be held in various tax-advantaged or retirement accounts including IRAs and Roth IRAs. Q: At my wealth management firm, Bitcoin is not allowed in client portfolios. Are there alternatives? Over the past ~15 years of Bitcoin’s history, some wealth management firms have experienced operational, legal, and compliance challenges associated with providing clients access to Bitcoin. Policies related to Bitcoin are changing. Every year, more wealth management firms, brokerage firms, and custodians complete due diligence on regulated Bitcon investment 21 "Digital Assets." Internal Revenue Service. 22 "Digital Assets." Internal Revenue Service. Chapter 3: Common Questions

ehicles and approve them for investment on their platforms. These investment vehicles have included products like Trusts (Grayscale Bitcoin Trust) and Bitcoin Futures ETFs. With the introduction of spot Bitcoin ETFs—a preferred method of Bitcoin exposure at many wealth management firms—the rate of adoption is likely to increase given the door to exposure is now opening for many investors. Q: How can I learn more about Bitcoin to assist my clients? Grayscale is here to help. Educational materials (like this book!) have proliferated over the past 15 years, and most are available to you for free. Whether you prefer to learn about Bitcoin by reading news, listening to podcasts, watching webinars, or attending conferences, you will find a wide array of resources at your fingertips. If you need a place to start, feel free to check out the research and resources available on the Grayscale website (www.grayscale.com). Q: If my client already has Bitcoin exposure and wants to increase their crypto allocation, what else is there? If you recall our discussion of diversification in Chapter 2, this likely won’t come as a surprise. As investors embrace the opportunity to invest in different asset classes, it’s often likely that they want to diversify their exposure within a specific asset class (like cryptocurrency) as well. There are a lot of options: beyond Bitcoin, crypto spans thousands of digitally-native assets. Grayscale Crypto Sectors, delineates a comprehensive framework that structures Grayscale’s specialized view of the crypto landscape into five distinct sectors: Currencies, Smart Contract Platforms, Financials, Consumer and Culture, and Utilities and Services. You may be interested in learning more about how we think of the broader crypto investment landscape by visiting our Crypto Sectors website: www.grayscale.com/crypto-products/ grayscale-crypto-sectors. Chapter 3: Common Questions |

: Is Bitcoin too volatile and risky of an asset to be useful as an investment? While Bitcoin is part of a nascent asset class, Bitcoin may be less volatile than some large technology stocks. For example, as of March 28, 2024, Bitcoin’s 360 day volatility stood at 36.5%, below the Goldman Sachs Non-Profitable Tech Index (42%), and index of unprofitable public tech companies23. Bitcoin has established itself as a major global asset, owned by tens of millions of people. In fact, in its short history, Bitcoin has produced high investment returns, and has outperformed all other major asset classes over the last three, five, and ten years24. Bitcoin’s high returns reflect its potential addressable market, as well as rising demand for digital gold. Investors, however, should take into account their own investment preferences, such as risk tolerance and duration, and needs among liquidity and income. We believe an investment in Bitcoin is most appropriate for an intermediate or longer term investment horizon. Q: Is Bitcoin used as a means of illicit activity? You may have heard that Bitcoin is widely used by criminals because transactions are anonymous. The opposite is, in fact, true. Because transactions are processed and recorded on the Bitcoin blockchain, Bitcoin transactions are some of the most transparent and traceable transactions in the world. Bitcoin’s transparency enables individuals, firms, and government agencies to easily audit the blockchain to monitor activity. This is in contrast to cash-based transactions, which can facilitate illicit activity and aren’t traceable. According to blockchain data firm Chainalysis, illicit transactions represented a mere 0.34% of transaction volume in crypto in 2023.25 Bitcoin is held by tens of millions26 of individuals around the world as well as respected corporations like Tesla, Block (formerly Square), and Microstrategy. The vast majority of activity 23 Bloomberg, data as of 03/28/2024. The Non-Profitable Tech Index includes Pinterest, Teledoc, Snapchat, Peleton and many others. 24 Bloomberg, Preqin, Hedge Fund Research, Grayscale Investments; data as of November 30, 2023. 25 Chainalysis Team.”The 2024 Crypto Crime Report”, February 2024.. 26 Bitcoin addresses with a balance greater than $10 was about 35M as of March 31, 2024. Source: Coin Metrics. Chapter 3: Common Questions

"Q: Is Bitcoin purely speculative? Or does it have fundamental value as an asset or usage as a network?

elated to Bitcoin involves law abiding individuals and organizations. In the instances where this isn’t the case, Bitcoin’s transparency enables governments to trace activity of bad actors. Q: Is Bitcoin purely speculative? Or does it have fundamental value as an asset or usage as a network? Some people argue that Bitcoin has no fundamental value because it is not physical. But, many things in our world that are intangible, such as the internet, have tremendous value and utility. Additionally, Bitcoin, the asset, powers the Bitcoin network. If Bitcoin was purely speculative and had no fundamental value, we would see little usage of the Bitcoin network and little correlation between network activity and Bitcoin’s price. Investors would also be unlikely to use Bitcoin as a reliable hedge against macroeconomic events as some have historically done. But this isn’t the case. During 2023, the Bitcoin network averaged nearly one million daily active addresses and processed ~150 million transactions.27 These numbers demonstrate that Bitcoin is widely used as a network technology on a global level. Bitcoin’s value is also largely tied to its network usage. Blockchain networks including Bitcoin have shown a positive correlation between network usage and market cap.28 This is similar to other social media platforms that benefit from network effects like Facebook, Twitter, and Reddit. This means that the more users a network has, the more robust these platforms have become. Finally, if Bitcoin didn’t have any fundamental value, it wouldn’t have a reliable use-case beyond speculation. To the contrary, however, according to the global investment bank Jefferies, Bitcoin serves as a critical hedge against currency debasement29 around the world. This is similar to the function of gold. Although gold has been around longer, Bitcoin has certain features that its holders may find attractive in comparison, especially portability: 27 Coin Metrics, Grayscale Research. 28 Grayscale Research. “Bigger is Better: Blockchains as Network Technologies.” Grayscale, 11 Oct. 2023. 29 Macheel, Tanaya. "Bitcoin is a ‘critical hedge’ against currency debasement and return of inflation, Jefferies says." CNBC, 5 Oct. 2023. Chapter 3: Common Questions

itcoin is available anywhere in the world, at any time, as long as holders have access to the internet and a bespoke private key. Q: How is the Bitcoin network regulated? While it’s true that Bitcoin operates on a global decentralized network, that doesn’t mean it is unregulated. In fact, you have probably read about the steps various governments have taken to regulate and tax Bitcoin transactions. For example, Bitcoin is considered30 a “convertible virtual currency” by the Financial Crimes Enforcement Network (FinCEN) that can cause those who are considered to facilitate Bitcoin transmissions to be subject to rules of money services businesses. Bitcoin has even become a relevant topic in political primaries ahead of the 2024 U.S. Presidential Election.31 As of November 2023, candidates on both sides of the aisle support Bitcoin, with some saying Bitcoin is a “major innovation engine” and others claiming that Bitcoin is a “decentralized alternative to the dollar.” Internationally, other regulatory bodies are implementing rules applicable to Bitcoin. The European Union has adopted the Markets in Crypto Assets Regulation (MiCA)32 that applies to crypto-asset service providers, including those that deal in Bitcoin. MiCA attempts to bring uniformity to the registration and anti-money laundering requirements for crypto asset service providers across Europe. Elsewhere, Hong Kong has implemented a licensing and regulatory path33 for digital asset exchanges, including those that facilitate the trading of Bitcoin. The fact that crypto legislation is still being developed both in the United States and around the world reflects the nascency of this evolving asset class. Increasing support from major political party candidates demonstrates its growing adoption and integration into legislation 30 “Application of FinCEN’s Regulations to Certain Business Models Involving Convertible Virtual Currencies.” FinCEN,9 May 2019. 31 Grayscale Research. “Bitcoin, Crypto, and the 2024 Presidential Election.” Grayscale, 7 Aug. 2023. 32 “Markets in Crypto-Assets Regulation (MiCA).” European Securities and Markets Authorities. 33 “Virtual asset trading platform operators.” Securities and Futures Commission. Chapter 3: Common Questions

nd the broader public. Q: What is Bitcoin’s potential environmental impact? You may have heard people talking about the energy consumption of the Bitcoin mining process and its potential environmental impact. While Bitcoin mining does, in fact, use energy, these discussions often overlook several critical factors or have meaningful inaccuracies. Reports measuring Bitcoin mining energy consumption estimate that it uses about 60% of the amount of energy used to mine gold every year (although estimates differ).34 Additionally, Bitcoin mining consumes less energy per year than computer games and Christmas lights (see chart to the right). Bitcoin mining is also notably unique. Unlike other energy consumers, Bitcoin mining is priceresponsive, interruptible, and portable. Said differently, this means that miners can move their operations where power is most available (and, as a result, the cheapest), and turn operations on and off quickly, as needed. Consider this in comparison to the power required to keep homes warm and well-lit, or to keep the critical operations of a factory running. As a result, Bitcoin miners can tap into repurposing energy from sources that would otherwise be wasted. Bitcoin also possesses a number of advantages in regards to environmental impact. Remarkably, for every $1,000 invested, a Bitcoin mining system reduces emissions by 6.32 tons of CO2 equivalents per year, surpassing the environmental impact of wind (1.3 tons) and solar (0.98 tons).35 Additionally, Bitcoin mining is increasingly becoming greener. Today, a significant portion of Bitcoin miners (76%) incorporate renewable resources into their energy mix.36 34 “Global Bitcoin Data Mining Review.” Bitcoin Mining Council, August 2023. 35 “How Bitcoin Mining can transform the Energy Industry.” Arcane Research, Sept. 2022. 36 Blandin, Apolline et al. “3rd Global Cryptoasset Benchmarking Study.” University of Cambridge, Sept. 2022. Chapter 3: Common Questions

By increasing renewable energy demand, Bitcoin mining can help incentivize energy companies to integrate renewable sources into the grid, making them more accessible and cost-effective for all consumers. Going forward, Bitcoin mining can not only adapt to energy challenges but also spur innovation and move the energy sector towards a more renewable, sustainable future. Sources: Bitcoin Mining Council. For illustrative purposes only. Data as of August, 2023. Annualized values are used for Bitcoin mining energy and electricity use. Q: Does Bitcoin get hacked? Since its inception in 2009, Bitcoin has never been hacked. Bitcoin’s underlying blockchain technology is known for its robust security, with a global decentralized network of tens of thousands of nodes that collectively validate transactions and maintain the security of the blockchain.

n fact, Bitcoin’s perfect record of security contrasts sharply with the record of traditional finance which has suffered a variety of hacks and data breaches in the past decade— including Equifax (exposed personal credit information of 147mm customers in 201737), JP Morgan (exposed personal data for 76mm households38) and Capital One (exposed personal data for 98mm U.S. households39). Any “hack” that you may have read about in regards to crypto or Bitcoin may have referred to services being provided that leverage or offer Bitcoin, but was not referring to the Bitcoin blockchain itself. An apt analogy might be hearing about an unfortunate robbery of a local bank branch with millions of dollars stolen from depositors. Would you then believe that the U.S. dollar got hacked? Of course not. The event simply highlights a security vulnerability at that particular bank branch, rather than suggest a flaw in the U.S. dollar itself. The same is true for Bitcoin, when services being offered are exploited as opposed to Bitcoin itself. Q: What does the advancement of quantum computing mean for Bitcoin? Bitcoin relies on cryptography for its security, specifically Elliptic Curve Cryptography (ECC) algorithms, the same cryptography used by the internet to remain secure. Quantum computers have the potential to crack ECC algorithms, which could allow attackers to forge transactions that don’t comply with Bitcoin protocol rules or steal bitcoin (since they would be able to reverse engineer private keys). Quantum computers can also compute a lot faster than traditional computers, so if a miner were to use one to compete with other miners using traditional computers, they could become dominant, thus undermining the Bitcoin network. While the Bitcoin network adjusts about every two weeks to account for the additional computational resources of miners, it may not be able to do this fast enough in light of quantum computers. However, current quantum computers are nowhere near this powerful. Some experts predict that we could see quantum computers capable of affecting the Bitcoin network 37 "Equifax Data Breach Settlement." The Federal Trade Commission, Dec. 2022. 38 Silver-Greenberg, Jessica, Matthew Goldstein, and Nicole Perlroth. "JPMorgan Chase Hacking Affects 76 Million Households." The New York Times, 2 Oct. 2014. 39 “Capital One Data Breach Class Action Settlement.” Capital One Settlement. Chapter 3: Common Questions

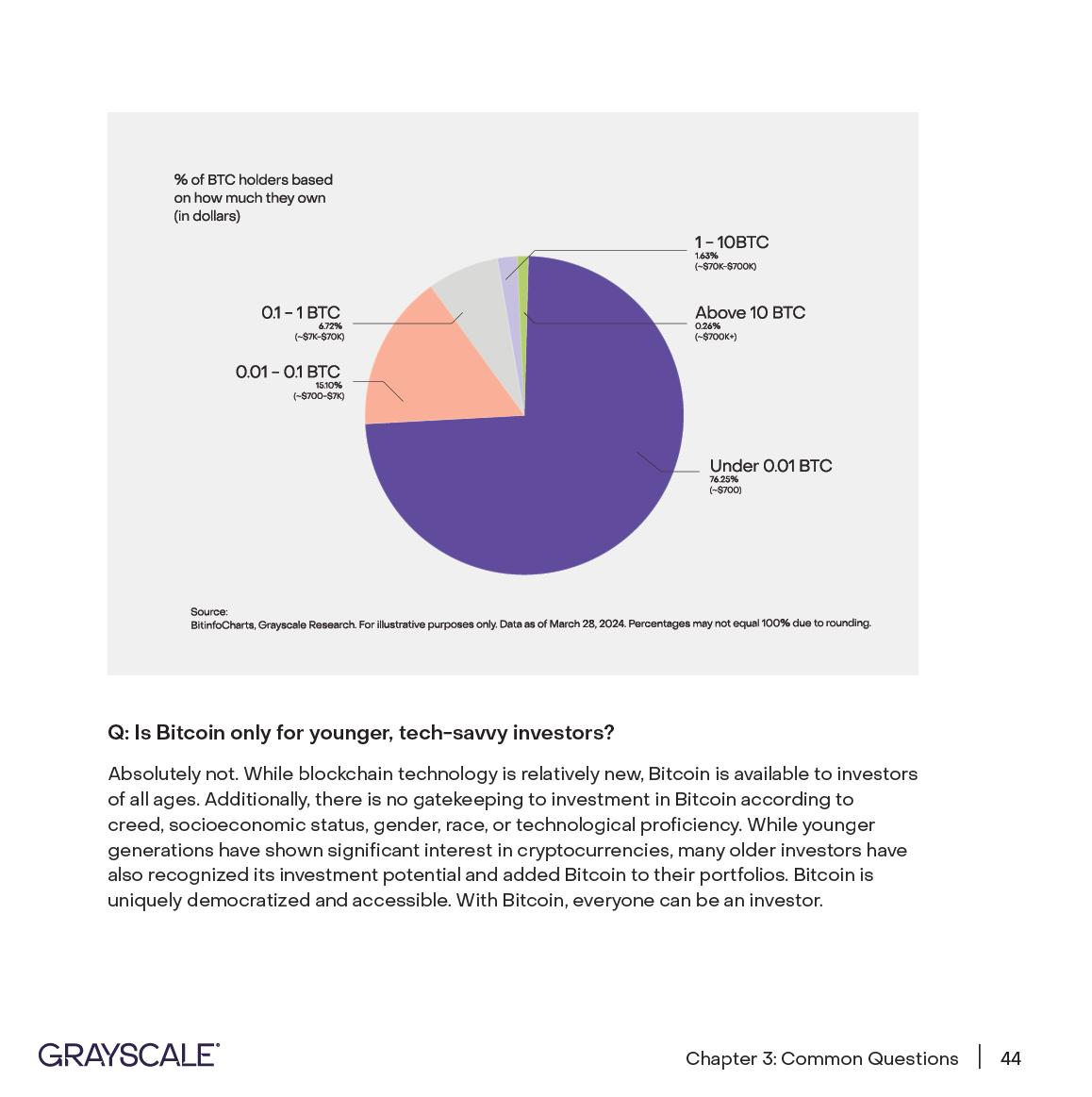

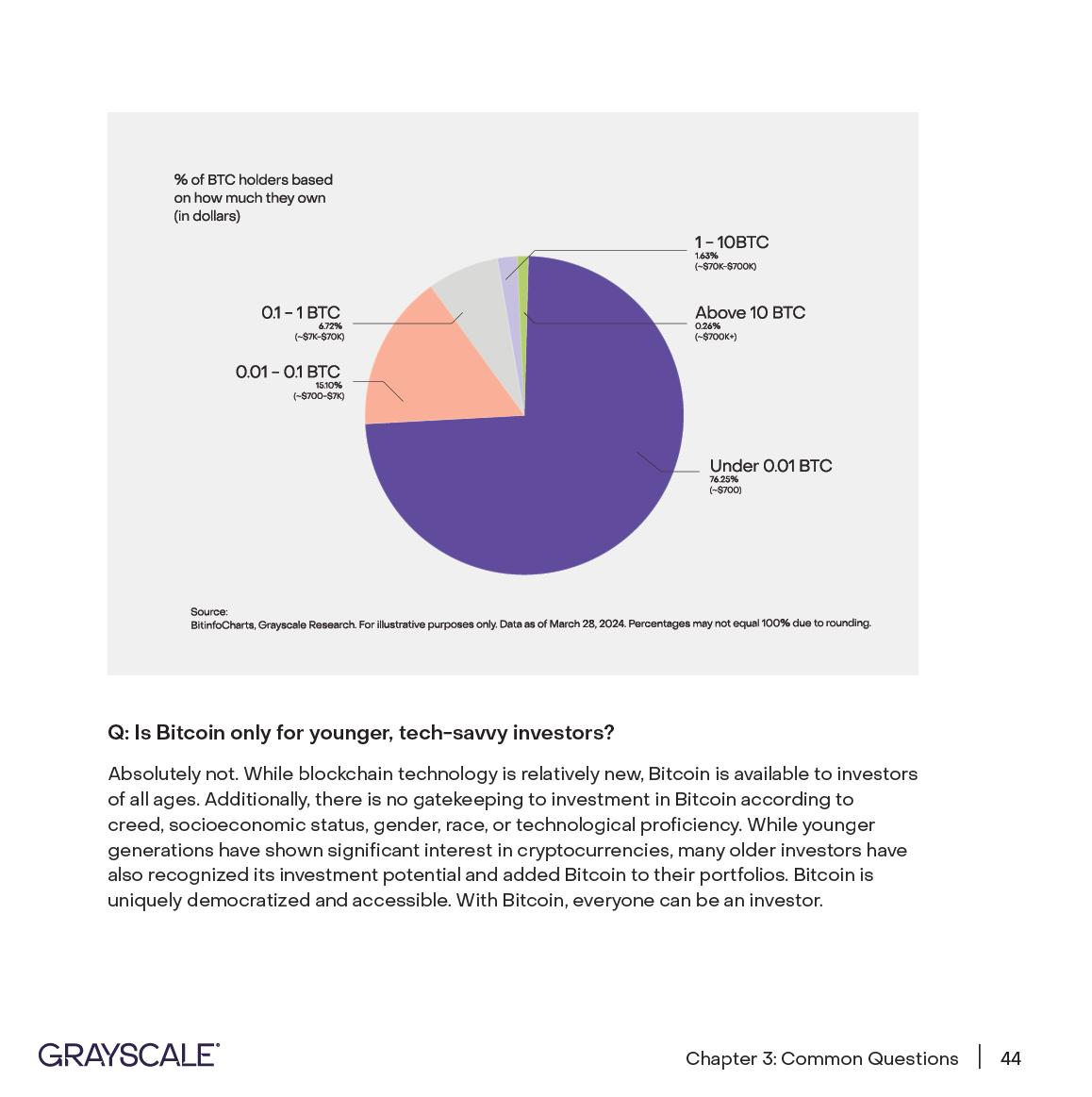

ithin the next 10-20 years, but this is uncertain. Nonetheless, the Bitcoin community is aware of the threat and is actively researching and developing solutions, including new algorithms that are resistant to quantum attacks. Q: Does Bitcoin only benefit a small number of Bitcoin owners with a large holding? In comparison to certain assets or asset classes, Bitcoin is uniquely democratized and accessible—like an early stage venture capital investment that is available to everyone. By comparison, only accredited investors are legally allowed to own certain asset classes that have historically provided some of the highest returns, including Private Equity and stocks in pre-IPO companies. Often, individuals must exceed certain net worth or income levels in order to gain access to these assets. This excludes the majority of the investment community. In contrast, access to invest in Bitcoin is not gated. Because of this, we often think of an investment in Bitcoin as democratized access to an early-stage technology or venture capital investment—available to anyone with internet access, anywhere, in any amount. Moreover, when we examine the data, Bitcoin is held by tens of millions of individuals around the world.40 According to Coin Metrics, 58% of Bitcoin holders own less than $100 worth of Bitcoin and 99% percent of holders own less than $100K worth of Bitcoin as of March 2024.41 An increase in Bitcoin’s price is accretive to everyone who owns Bitcoin. This includes holders in countries like Argentina that may use Bitcoin as a safe haven asset against upwards of 100% annual currency inflation as well as investors around the world who own Bitcoin as part of a diversified portfolio. Coin Metrics, as of March 31, 2024. 40 Bitcoin addresses with a balance greater than $10 was about 35M as of March 31, 2024. Source: Coin Metrics. 41 Chapter 3: Common Question

% of BTC holders based on how much they own (in dollars)

"Q: Is Bitcoin only for younger, tech-savvy investors?

Absolutely not. While blockchain technology is relatively new, Bitcoin is available to investors of all ages. Additionally, there is no gatekeeping to investment in Bitcoin according to

creed, socioeconomic status, gender, race, or technological proficiency. While younger generations have shown significant interest in cryptocurrencies, many older investors have also recognized its investment potential and added Bitcoin to their portfolios. Bitcoin is

uniquely democratized and accessible. With Bitcoin, everyone can be an investor."

"Chapter 3: Common Questions | 44"

: Is it too late to invest in Bitcoin? Is it already too expensive? If the high price tag on one Bitcoin gives you sticker shock, you aren’t alone. However, you don’t have to buy an entire Bitcoin. In fact, a Bitcoin is divisible into units much smaller than a penny; there are 100 million units within each Bitcoin (this is why Bitcoin is shown to eight decimal places). Because there is no minimum investment for Bitcoin, it is available to everyone. Today, many investors navigate access to Bitcoin through two primary channels. First, investors will often purchase shares of a Bitcoin ETF such as Grayscale Bitcoin Trust or other instruments, allowing their core Bitcoin exposure to side along their other investments. Second, some investors will also choose to purchase some Bitcoin directly, either through an exchange or order book. Often, investors will experiment with this Bitcoin, pairing their public and private keys to facilitate transactions and see them hit the Bitcoin blockchain. Q: Is Bitcoin the most popular because it was the first? Will its dominance decrease with the development of more cryptocurrencies? Bitcoin emerged over a decade ago, launching in 2009. It has the largest market cap in all of crypto at over $1.4T as of March 31, 2024.42 Like any innovation or emerging technology, Bitcoin has faced skepticism and criticism. Despite this, Bitcoin has shown resilience, and has grown in adoption around the world. This is likely for a number of different factors: 1. When investors consider the staying power of a new technology, they often evoke the Lindy effect. This concept suggests that the longer a technology or idea endures, the longer its future life expectancy. As the first cryptocurrency, Bitcoin has already withstood over a decade of challenges, bolstering its credibility. This Lindy effect underscores the notion that Bitcoin is not only the first mover but also likely to persist going forward as the most prominent crypto asset. 2. Network effects:

Bitcoin has more active users than any other cryptocurrency.43 Bitcoin 42 Coin Metrics, data as of March 31, 2024 43 Grayscale Research, Token Terminal, Coin Metrics; data as of March 31, 2024. Chapter 3: Common Questions

s also the most liquid and most highly traded asset in crypto. More liquidity and trading volume leads to better trading spreads and historically lower volatility. As a result, we believe Bitcoin has a significant advantage over other assets in capturing new investors in this space. 3. Bitcoin is also the most secure and decentralized network since it has more nodes than any other network.44 As a result, Bitcoin is arguably the most trusted decentralized form of money in crypto. In a world of ever-evolving assets, Bitcoin’s resilience—bolstered by the Lindy effect, network effects and security, and supply dynamics sets a compelling precedent. As it has continued to withstand challenges and skepticism over the past ~15 years, one thing becomes increasingly clear: Bitcoin isn’t just the first mover. It is also well positioned to grow as a network and defend its place as the primary asset in the crypto industry. 44 “Why Don't Altcoins Threaten Bitcoin?” River Financial. Chapter 3: Common Questions |

"Chapter 3: Common Questions | 47"

"Chapter 3: Common Questions | 48"

"Chapter 4: Why GBTC?"

"Chapter 4: Why GBTC? | 49"

ou’ve likely heard of Grayscale Bitcoin Trust (ticker: GBTC): a spot Bitcoin ETF managed by the world’s largest crypto asset manager. 45 Originally launched as a private placement in 2013, Grayscale Bitcoin Trust debuted on the public market under symbol: GBTC in 2015 and has since grown significantly in size and scale. Finally, in 2024, GBTC was uplisted to NYSE Arca as a spot Bitcoin ETF. Today, investors like you can access Bitcoin exposure in your investment accounts through GBTC. While crypto may be new to you, it’s likely you have invested in ETFs before. This familiar structure has been leveraged to allow investors to invest in a wide range of assets— including stocks, bonds and commodities. Now, there’s an option for crypto as well, allowing investors to add Bitcoin exposure into their brokerage account with the familiar protections, transparency, and disclosures of an ETF. It’s also no secret that buying Bitcoin can be tricky. From having to open a digital wallet, buy tokens on an exchange, determine how to custody Bitcoin, investors face numerous frictions associated with the ownership of cryptocurrencies (frictions generally absent when transacting in traditional asset classes). Grayscale’s goal is to solve this problem by enabling investors to obtain Bitcoin exposure by simply investing in GBTC through their brokerage account just like other stocks and ETFs. But what are the potential benefits of owning GBTC over other Bitcoin investment tools, including outright Bitcoin exposure? GBTC, like some other Bitcoin ETFs and listed derivatives, is able to provide traditional financial statements, tax reporting, institutionalgrade digital asset custody, and the ability to invest through certain tax-advantaged accounts (IRAs, Roth IRAs, and 401(k)s). Until the recent availability of spot Bitcoin ETFs, the only available options with these features introduced extra costs and other sources of tracking error associated with derivatives. Sponsored by the world’s largest crypto asset manager,47 GBTC offers investors exposure to Bitcoin without the challenges of buying, storing, and safekeeping it themselves. 45 By assets under management as of March 28, 2024. Chapter 4: Why GBTC?

hy should I buy GBTC at a higher expense ratio than other products? While GBTC may not be the lowest fee product in the market, other factors are often considered to be more important. Investors should consider liquidity, brand recognition and reputation, track record, and firm familiarity with crypto and other risk disclosures before making an investment decision. After all, Bitcoin is a complex asset that many incumbent ETF issuers had little to no experience with prior to 2023. GBTC, on the other hand, was created more than 10 years ago and has since been managed by Grayscale. Since 2013, GBTC has had a strong and successful operational track record, including becoming the first SEC-reporting Bitcoin product in January 2020. Grayscale has a long history of upholding strict compliance standards and working closely with regulators and auditors to provide greater transparency and visibility. Most importantly, GBTC came to market with over over $28B46 in assets, offering more liquidity, and tighter trading spreads—which means lower implied cost to investors—than any other product on the market. Today, GBTC is held by hundreds of thousands of investors and benefits from the brand heritage associated with world’s largest cryptocurrency asset manager. We use the generic term “ETF” to refer to exchange-traded investment vehicles, including those that are required to register under the Investment Company Act of 1940, as amended (the “40 Act”), as well as other exchange-traded products which are not subject to the registration of the ‘40 Act. The Trust is not registered under the 1940 Act and is not subject to regulation under the 1940 Act, unlike most mutual funds or ETFs. Unlike mutual funds, ETFs may trade at a premium or discount to their net asset value. These funds are new and have limited operating history to judge. 46 On January 11th, 2024. Chapter 4: Why GBTC?

Important Information

Investments in digital assets are speculative and involve a high degree of risk and heightened

volatility, including a partial or total loss of invested funds. They are not suitable for any investor that

cannot afford loss of the entire investment.

The Grayscale Bitcoin Trust (BTC) (the “Trust”) has filed a registration statement (including a

prospectus) with the SEC for the offering to which this communication relates. Before you invest,

you should read the prospectus in that registration statement and other documents the Trust has

filed with the SEC for more complete information about the Trust and this offering. You may get

these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the

Trust or any authorized participant will arrange to send you the prospectus (when available) if you

request it by calling (833)903-2211 or by contacting Foreside Fund Services, LLC, Three Canal Plaza,

Suite100, Portland, Maine 04101.

Foreside Fund Services, LLC is the Marketing Agent for the Grayscale Bitcoin Trust ETF.

There is no guarantee that a market for the shares will be available which will adversely impact the

liquidity of the Trust. The value of the Trust relates directly to the value of the underlying digital asset,

the value of which may be highly volatile and subject to fluctuations due to a number of factors.

The Trust relies on third party service providers to perform certain functions essential to the affairs of

the funds and the replacement of such service providers could pose a challenge to the safekeeping

of the digital asset and to the operations of the Trust.

Extreme volatility of trading prices that many digital assets, including Bitcoin, have experienced in

recent periods and may continue to experience, could have a material adverse effect on the value of

the Trust and the shares could lose all or substantially all of their value.

Digital assets represent a new and rapidly evolving industry. The value of the Trust depends on the

acceptance of the digital assets, the capabilities and development of blockchain technologies and the

fundamental investment characteristics of the digital asset.

Digital asset networks are developed by a diverse set of contributors and the perception that certain

high-profile contributors will no longer contribute to the network could have an adverse effect on the

market price of the related digital asset.

Digital assets may have concentrated ownership and large sales or distributions by holders of such

digital assets could have an adverse effect on the market price of such digital assets.

The Trust holds Bitcoins; however, an investment in the Trust is not a direct investment in Bitcoin. As

a non-diversified and single industry fund, the value of the shares may fluctuate more than shares

invested in a broader range of industries..

A substantial direct investment in digital assets may require expensive and sometimes complicated

arrangements in connection with the acquisition, security and safekeeping of the digital asset and

may involve the payment of substantial acquisition fees from third party facilitators through cash

payments of U.S. dollars. Because the value of the Trust is correlated with the value of Bitcoin, it is

important to understand the investment attributes of, and the market for,the underlying digital asset.

Please consult with your financial professional.

Grayscale does not store, hold, or maintain custody or control of the Trust’s digital assets but instead

has entered into the Custodian Agreement with a third party to facilitate the security of its digital

assets. The Custodian controls and secures the Trust’s digital asset accounts, a segregated custody

account to store private keys, which allow for the transfer of ownership or control of the digital asset,

on the Trust’s behalf. If the Custodian resigns or is removed by the Sponsor or otherwise, without

replacement, it could trigger early termination of the Trust.