UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22906

Virtus Alternative Solutions Trust

(Exact name of registrant as specified in charter)

101 Munson Street

Greenfield, MA 01301

(Address of principal executive offices) (Zip code)

Jennifer Fromm, Esq.

Vice President, Chief Legal Officer, Counsel and Secretary for Registrant

One Financial Plaza

Hartford, CT 06103-4506

(Name and address of agent for service)

Registrant’s telephone number, including area code: (800)-243-1574

Date of fiscal year end: October 31

Date of reporting period: October 31, 2023

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

| | (a) | The Report to Shareholders is attached herewith. |

ANNUAL REPORT

VIRTUS ALTERNATIVE SOLUTIONS TRUST

| Virtus Duff & Phelps Select MLP and Energy Fund |

| Virtus KAR Long/Short Equity Fund |

Not FDIC Insured • No Bank Guarantee • May Lose Value

Table of Contents

| 1 |

| 2 |

| 4 |

| Fund | Fund

Summary | Schedule

of

Investments |

| 15 | 15 |

| 17 | 17 |

| 19 |

| 21 |

| 22 |

| 23 |

| 25 |

| 33 |

| 34 |

| 35 |

| 36 |

Proxy Voting Procedures and Voting Record (Form N-PX)

The subadvisers vote proxies, if any, relating to portfolio securities in accordance with procedures that have been approved by the Board of Trustees of the Trust (“Trustees”, or the “Board”). You may obtain a description of these procedures, along with information regarding how the Funds voted proxies during the most recent 12-month period ended June 30, free of charge, by calling toll-free 1-800-243-1574. This information is also available through the Securities and Exchange Commission’s (the “SEC”) website at https://www.sec.gov.

PORTFOLIO HOLDINGS INFORMATION

The Trust files a complete schedule of portfolio holdings for each Fund with the SEC for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT-P. Form N-PORT-P is available on the SEC’s website at https://www.sec.gov.

This report is not authorized for distribution to prospective investors in the Funds presented in this book unless preceded or accompanied by an effective prospectus which includes information concerning the sales charge, each Fund’s record and other pertinent information.

To my fellow shareholders of Virtus Funds:

I am pleased to present this annual report, which reviews the performance of your Fund for the 12 months ended October 31, 2023.

After a challenging 2022, markets started to show strength in 2023. Inflation began to slow while the U.S. economy demonstrated continued resilience. The efforts of the Federal Reserve (Fed) and other central banks to manage inflation appeared more likely to generate an economic “soft landing.” A brief banking crisis in March of 2023 was quickly resolved without impacting economic growth, and investors were optimistic about the possibilities for artificial intelligence (AI). As the fiscal year came to a close, however, concerns that interest rates might remain higher for longer began to weigh on markets, causing the rally to slow.

The returns of domestic equity indexes were mixed for the 12 months ended October 31, 2023. U.S. large-capitalization stocks were up 10.14%, as measured by the S&P 500® Index, while small-cap stocks were down 8.56%, as measured by the Russell 2000® Index. International equities performed well, with developed markets, as measured by the MSCI EAFE® Index (net), returning 14.40%, while emerging markets, as measured by the MSCI Emerging Markets Index (net), returned 10.80%.

In fixed income markets, the yield on the 10-year Treasury rose to 4.88% on October 31, 2023, from 4.10% on October 31, 2022. The broader U.S. fixed income market, as represented by the Bloomberg U.S. Aggregate Bond Index, returned 0.36% for the 12-month period, while non-investment grade bonds, as measured by the Bloomberg U.S. Corporate High Yield Bond Index, were up 6.23%.

Thank you for entrusting the Virtus Funds with your assets. Please call our customer service team at 800-243-1574 if you have questions about your account or require assistance. We appreciate your business and remain committed to your long-term financial success.

Sincerely,

George R. Aylward

President and Trustee, Virtus Alternative Solutions Trust

December 2023

Refer to the Fund Summary section for your Fund’s performance. Performance data quoted represents past results. Past performance is no guarantee of future results, and current performance may be higher or lower than the performance shown above. Investing involves risk, including the risk of loss of principal invested.

VIRTUS ALTERNATIVE SOLUTIONS TRUST

DISCLOSURE OF FUND EXPENSES (Unaudited)

FOR THE SIX-MONTH PERIOD OF May 1, 2023 TO October 31, 2023

We believe it is important for you to understand the impact of costs on your investment. All mutual funds have operating expenses. As a shareholder of a Virtus Alternative Solutions Trust Fund (each, a “Fund”), you may incur two types of costs: (1) transaction costs, including sales charges on purchases of Class A shares and contingent deferred sales charges on Class C shares; and (2) ongoing costs, including investment advisory fees, distribution and service fees, and other expenses. Class I shares and Class R6 shares are sold without sales charges and do not incur distribution and service fees. Class R6 shares also do not incur shareholder servicing fees. For further information regarding applicable sales charges, see Note 1 in the Notes to Financial Statements. These examples are intended to help you understand your ongoing costs (in dollars) of investing in a Fund and to compare these costs with the ongoing costs of investing in other mutual funds. These examples are based on an investment of $1,000 invested at the beginning of the period and held for the entire six-month period. The Annualized Expense Ratios may be different from the expense ratios in the Financial Highlights which are for the fiscal year ended October 31, 2023.

Please note that the expenses shown in the accompanying tables are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges or contingent deferred sales charges. Therefore, the accompanying tables are useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher. The calculations assume no shares were bought or sold during the period. Your actual costs may have been higher or lower, depending on the amount of your investment and the timing of any purchases or redemptions.

Actual Expenses

The table below provides information about actual account values and actual expenses. You may use the information below, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the table under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

| | | Beginning

Account Value

May 1, 2023 | | Ending

Account Value

October 31, 2023 | | Annualized

Expense

Ratio | | Expenses

Paid

During

Period** |

Duff & Phelps Select MLP and Energy Fund

| | | | | | | | |

| | Class A | $ 1,000.00 | | $ 1,070.90 | | 1.49 % | | $ 7.78 |

| | Class C | 1,000.00 | | 1,066.00 | | 2.24 | | 11.66 |

| | Class I | 1,000.00 | | 1,072.50 | | 1.24 | | 6.48 |

KAR Long/Short Equity Fund*

| | | | | | | | |

| | Class A | 1,000.00 | | 978.80 | | 2.16 | | 10.77 |

| | Class C | 1,000.00 | | 975.50 | | 2.92 | | 14.54 |

| | Class I | 1,000.00 | | 980.30 | | 1.93 | | 9.63 |

| | Class R6 | 1,000.00 | | 980.30 | | 1.85 | | 9.23 |

| * | Annualized expense ratios include dividend and interest expense on securities sold short. |

| ** | Expenses are equal to the relevant Fund’s annualized expense ratio, which is net of waived fees and reimbursed expenses, if applicable, multiplied by the average account value over the period, multiplied by the number of days (184) expenses were accrued in the most recent fiscal half-year, then divided by 365 to reflect the one-half year period. |

For Funds which may invest in other funds, the annualized expense ratios noted above do not reflect fees and expenses associated with any underlying funds. If such fees and expenses had been included, the expenses would have been higher.

You can find more information about a Fund’s expenses in the Financial Statements section that follows. For additional information on operating expenses and other shareholder costs, refer to that Fund’s prospectus.

Hypothetical Example for Comparison Purposes

The table below provides information about hypothetical account values and hypothetical expenses based on a Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not your Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your Fund and other funds. To do so, compare these 5% hypothetical examples with the 5% hypothetical examples that appear in the shareholder reports of other mutual funds.

| | | Beginning

Account Value

May 1, 2023 | | Ending

Account Value

October 31, 2023 | | Annualized

Expense

Ratio | | Expenses

Paid

During

Period** |

Duff & Phelps Select MLP and Energy Fund

| | | | | | | | |

| | Class A | $ 1,000.00 | | $ 1,017.69 | | 1.49 % | | $ 7.58 |

| | Class C | 1,000.00 | | 1,013.91 | | 2.24 | | 11.37 |

| | Class I | 1,000.00 | | 1,018.95 | | 1.24 | | 6.31 |

VIRTUS ALTERNATIVE SOLUTIONS TRUST

DISCLOSURE OF FUND EXPENSES (Unaudited) (Continued)

FOR THE SIX-MONTH PERIOD OF May 1, 2023 TO October 31, 2023

| | | Beginning

Account Value

May 1, 2023 | | Ending

Account Value

October 31, 2023 | | Annualized

Expense

Ratio | | Expenses

Paid

During

Period** |

KAR Long/Short Equity Fund*

| | | | | | | | |

| | Class A | $1,000.00 | | $1,014.32 | | 2.16% | | $10.97 |

| | Class C | 1,000.00 | | 1,010.49 | | 2.92 | | 14.80 |

| | Class I | 1,000.00 | | 1,015.48 | | 1.93 | | 9.80 |

| | Class R6 | 1,000.00 | | 1,015.88 | | 1.85 | | 9.40 |

| * | Annualized expense ratios include dividend and interest expense on securities sold short. |

| ** | Expenses are equal to the relevant Fund’s annualized expense ratio, which is net of waived fees and reimbursed expenses, if applicable, multiplied by the average account value over the period, multiplied by the number of days (184) expenses were accrued in the most recent fiscal half-year, then divided by 365 to reflect the one-half year period. |

For Funds which may invest in other funds, the annualized expense ratios noted above do not reflect fees and expenses associated with any underlying funds. If such fees and expenses had been included, the expenses would have been higher.

You can find more information about a Fund’s expenses in the Financial Statements section that follows. For additional information on operating expenses and other shareholder costs, refer to that Fund’s prospectus.

VIRTUS ALTERNATIVE SOLUTIONS TRUST

KEY INVESTMENT TERMS (Unaudited)

October 31, 2023

American Depositary Receipt (“ADR”)

Represents shares of foreign companies traded in U.S. dollars on U.S. exchanges that are held by a U.S. bank or a trust. Foreign companies use ADRs in order to make it easier for Americans to buy their shares.

Alerian Midstream Energy Index

The Alerian Midstream Energy Index is a capped, float-adjusted, market capitalization-weighted index. The index is a broad-based composite of North American energy infrastructure companies that earn the majority of their cash flow from midstream activities involving energy commodities. The index is unmanaged and it is not available for direct investment.

Bloomberg U.S. Aggregate Bond Index

The Bloomberg U.S. Aggregate Bond Index measures the U.S. investment grade, fixed rate bond market. The index is calculated on a total return basis. The index is unmanaged, its returns do not reflect any fees, expenses, or sales charges, and it is not available for direct investment.

Bloomberg U.S. Corporate High Yield Bond Index

The Bloomberg U.S. Corporate High Yield Bond Index measures the U.S. dollar-denominated, high yield, fixed-rate corporate bond market. The index is calculated on a total return basis. The index is unmanaged, its returns do not reflect any fees, expenses, or sales charges, and it is not available for direct investment.

Exchange–Traded Fund (“ETF”)

An open-end fund that is traded on a stock exchange. Most ETFs have a portfolio of stocks or bonds that track a specific market index.

Federal Reserve (the “Fed”)

The Fed is the central bank of the U.S., responsible for controlling money supply, interest rates, and credit with the goal of keeping the U.S. economy and currency stable. Governed by a seven-member board, the system includes 12 regional Federal Reserve Banks, 25 Branches, and all national and state banks that are part of the system.

Master Limited Partnerships (“MLPs”)

Investment which combines the tax benefits of a limited partnership with the liquidity of publicly traded securities. To be classified as an MLP, a partnership must derive most of its cash flows from real estate, natural resources and commodities.

MSCI EAFE® Index (net)

The MSCI EAFE® (Europe, Australasia, Far East) Index (net) is a free float-adjusted, market capitalization-weighted index that measures developed foreign market equity performance, excluding the U.S. and Canada. The index is calculated on a total return basis with net dividends reinvested. The index is unmanaged, its returns do not reflect any fees, expenses, or sales charges, and it is not available for direct investment.

MSCI Emerging Markets Index (net)

The MSCI Emerging Markets Index (net) is a free float-adjusted, market capitalization-weighted index designed to measure equity market performance in the global emerging markets. The index is calculated on a total return basis with net dividends reinvested. The index is unmanaged, its returns do not reflect any fees, expenses, or sales charges, and it is not available for direct investment.

Public Limited Company (“PLC”)

A Public Limited Company (PLC) is the legal designation of a limited liability company that has offered shares to the general public and has limited liability.

Organization of the Petroleum Exporting Countries (“OPEC”)

OPEC coordinates and unifies the petroleum policies of its Member Countries and ensures the stabilization of oil markets in order to secure an efficient, economic and regular supply of petroleum to consumers, a steady income to producers and a fair return on capital for those investing in the petroleum industry.

Real Estate Investment Trust (“REIT”)

A publicly traded company that owns, develops and operates income-producing real estate such as apartments, office buildings, hotels, shopping centers and other commercial properties.

Russell 2000® Index

The Russell 2000® Index is a market capitalization-weighted index of the 2,000 smallest companies in the Russell Universe, which comprises the 3,000 largest U.S. companies. The index is calculated on a total return basis with dividends reinvested. The index is unmanaged, its returns do not reflect any fees, expenses, or sales charges, and is not available for direct investment.

Russell 3000® Index

The Russell 3000® Index is a market capitalization-weighted index that measures the performance of the 3,000 largest U.S. companies. The index is calculated on a total return basis with dividends reinvested. The index is unmanaged, its returns do not reflect any fees, expenses, or sales charges, and it is not available for direct investment.

VIRTUS ALTERNATIVE SOLUTIONS TRUST

KEY INVESTMENT TERMS (Unaudited) (Continued) October 31, 2023

S&P 500® Energy Sector Index

The S&P 500® Energy Sector Index comprises those companies included in the S&P 500 that are classified as members of the GICS®energy sector.

S&P 500® Index

The S&P 500® Index is a free-float market capitalization-weighted index of 500 of the largest U.S. companies. The index is calculated on a total return basis with dividends reinvested. The index is unmanaged, its returns do not reflect any fees, expenses, or sales charges, and it is not available for direct investment.

| | Ticker Symbols: |

| | Class A: VLPAX |

| | Class C: VLPCX |

| | Class I: VLPIX |

Duff & Phelps Select MLP and Energy Fund

Fund Summary (Unaudited)

Portfolio Manager Commentary by

Duff & Phelps Investment Management Co.

| ■ | The Fund is non-diversified and has an investment objective of total return with a secondary objective of income. There is no guarantee that the Fund will meet its objective. |

| ■ | For the fiscal year ended October 31, 2023, the Fund’s Class A shares at NAV returned 2.16%, Class C shares at NAV returned 1.36%, and Class I shares at NAV returned 2.36%. For the same period, the Alerian Midstream Energy Index, which serves as both the Fund’s broad-based and style-specific benchmark appropriate for comparison, returned 4.20%. |

All performance figures assume reinvestment of distributions and exclude the effect of sales charges. Performance data quoted represents past results. Past performance is no guarantee of future results, and current performance may be higher or lower than the performance shown above. Investment return and principal value will fluctuate so your shares, when redeemed, may be worth more or less than their original cost. Please visit Virtus.com for performance data current to the most recent month-end.

How did the markets perform during the Fund’s fiscal year ended October 31, 2023?

After two consecutive years of meteoric rises, the energy sector came back down to earth during the fiscal year ended October 31, 2023. The S&P 500® Energy Sector Index fell 2.11% over the fiscal period, trailing the 10.12% rise of the S&P 500® Index. As is often the case during periods of energy underperformance versus the market, the relatively defensive midstream energy subsector outpaced the broader energy sector but still fell short of the return of the S&P 500® Index, with the Alerian Midstream Energy Index up 4.20% over the fiscal period.

The interest rate environment illustrated how the energy sector tends to perform relative to the broader market. During the period, investors favored value-oriented sectors like energy when expectations for inflation and interest rates were rising. Conversely, energy fell out of favor when investors believed inflationary pressures were abating, or that interest rates had peaked. This dynamic was a headwind for the sector’s relative performance for

most of the fiscal year, given investors’ growing conviction that both inflation and rates had peaked.

As always, commodity prices were an important driver of energy sector performance. Natural gas prices plunged in the first half of the fiscal year due to one of the warmest winters on record in the Northern Hemisphere, combined with resilient production in the U.S. and strong liquefied natural gas (LNG) imports into Europe. This resulted in healthy inventory levels in both regions, including record higher levels in Europe toward the end of the heating season. Although there was some recovery in the latter part of the fiscal year, U.S. and European prices fell 44% and 47%, respectively, through the entire period, and this weighed on the performance of stocks that are tied to both domestic gas and LNG.

Crude oil prices were also volatile, reaching nearly $100 per barrel in November 2022 before starting a sharp correction to around $73 per barrel in March of 2023. Global banking failures and rising inventories due to seasonally lower demand ignited recessionary fears in the spring. In an effort to support prices, the OPEC coalition in April announced deep cuts in output. Additionally, the U.S. program of releasing crude oil from the Strategic Petroleum Reserve had been exhausted. Combined, these two developments started the process of tightening supply and demand conditions in the global market. Crude oil prices moved higher in the summer of 2023, peaking around $97 per barrel before a modest pullback to around $87 per barrel to end the fiscal period.

Natural gas liquids (NGL) prices were weak overall, most notably propane, which traded down 24% during the fiscal year. This was largely due to a combination of resilient supply and weakening downstream demand. With the pandemic in the rearview mirror, consumer purchasing habits pivoted from hard goods to travel and entertainment, which reduced petrochemical demand for NGL feedstock. Additionally, propane’s use as a heating fuel was limited given the mild winter.

There were a few other key themes during the fiscal year. China’s economic reopening did not go as planned, punctuated by slow industrial growth, a property sector crisis, high youth unemployment, and growing geopolitical tensions. However, domestic mobility data demonstrated a nice recovery, as the populace was eager to travel after having movement restricted for an extended period

of time. Given the energy intensity of travel, this was broadly supportive for crude oil and refined products.

War, unfortunately, remained topical. Although the Ukraine-Russia conflict remained unresolved, the world began to adapt to new realities from an energy perspective. Europe, which was most affected by the conflict, reduced natural gas consumption and increased its imports of LNG exponentially to replace lost Russian supplies. Similarly, Europe leaned more heavily on imports from other nations to offset lost Russian refined product supplies. In early October, a new global conflict emerged between Israel and Hamas. The energy ramifications of this new war were uncertain at the end of the fiscal period, but it has the potential to disrupt both supplies from and transportation of critical energy products through the Middle East.

Finally, consolidation in the energy sector picked up steam during the 12-month period. In the midstream sector, two bellwether companies combined when Oneok acquired crosstown peer Magellan Midstream. Phillips 66 completed its acquisition of DCP Midstream, and Energy Transfer announced plans to acquire Crestwood. There were numerous smaller corporate and asset-level transactions as well. This midstream consolidation activity mirrored what was happening in the rest of the sector, which included megadeals such as Exxon acquiring Pioneer and Chevron acquiring Hess.

What factors affected the Fund’s performance during its fiscal year?

The Fund underperformed its benchmark Alerian Midstream Energy Index for the 12 months ended October 31, 2023. The Fund suffered on a relative basis from a handful of smaller holdings that were punished by the market for failing to meet earnings growth expectations. This negative stock performance was amplified in the higher interest rate environment of the fiscal year, in which smaller and more growth-oriented stocks fell out of favor with investors. As a partial offset, the Fund benefitted from strategic underweights versus several of the benchmark’s large defensive constituents, which were not positioned to benefit from many of the structural tailwinds being experienced by the energy infrastructure sector.

The three largest individual contributors to Fund performance on an absolute basis were Targa Resources, Plains GP Holdings, and Magellan

For information regarding the indexes and certain investment terms, see the Key Investment Terms starting on page 4.

Duff & Phelps Select MLP and Energy Fund (Continued)

Midstream. These companies benefitted from competitively positioned assets that allowed them to generate solid growth and sustainably high levels of free cash flow generation. They were sector leaders in returning cash to shareholders through higher dividend payouts and share repurchases. In addition, Magellan was ultimately acquired by Oneok at a substantial premium to its stock price.

The three largest individual detractors from Fund performance on an absolute basis were Enviva, New Fortress Energy, and Chart Industries. Each of these companies experienced strategic and operational missteps that weighed on performance. Enviva buckled under the pressure of performance issues at its plants and management changes that undermined investor confidence in the company’s overall strategy. New Fortress experienced delays in commissioning its initial floating LNG project. Chart surprised the market with a large acquisition that increased debt levels and was not fully financed at the time of the announcement.

The preceding information is the opinion of portfolio management only through the end of the period stated on the cover. Any such opinions are subject to change at any time based upon market or other conditions and should not be relied upon as investment advice. Past performance is no guarantee of future results, and there is no guarantee that market forecasts will be realized.

Equity Securities: The market price of equity securities may be adversely affected by financial market, industry, or issuer-specific events. Focus on a particular style or on small, medium, or large-sized companies may enhance that risk.

Energy Industry Concentration: The Fund’s investments are concentrated in the energy industry which presents greater risks than if the Fund was broadly diversified over numerous sectors of the economy.

Master Limited Partnerships: Investments in MLPs may be adversely impacted by interest rates, tax law changes, regulation, or factors affecting underlying assets.

Foreign Investing: Investing in foreign securities subjects the Fund to additional risks such as increased volatility; currency fluctuations; less liquidity; less publicly available information about the foreign investment; and political, regulatory, economic, and market risk.

Non-Diversified: The Fund is not diversified and may be more susceptible to factors negatively impacting its holdings to the extent the Fund invests more of its assets in the securities of fewer issuers than would a diversified fund.

Market Volatility: The value of the securities in the Fund may go up or down in response to the prospects of individual companies and/or general

economic conditions. Local, regional or global events such as war or military conflict, terrorism, pandemic, or recession could impact the Fund, including hampering the ability of the Fund’s manager(s) to invest its assets as intended.

Prospectus: For additional information on risks, please see the Fund’s prospectus.

Asset Allocation

The following table presents asset allocation within certain sectors as a percentage of total investments as of October 31, 2023.

| Common Stocks & MLP Interests | | 100% |

| Diversified | 42% | |

| Liquefied Natural Gas | 12 | |

| Gathering/Processing | 12 | |

| Downstream/Other | 10 | |

| Petroleum Transportation & Storage | 9 | |

| Electric, LDC & Power | 8 | |

| Natural Gas Pipelines | 7 | |

| Total | | 100% |

For information regarding the indexes and certain investment terms, see the Key Investment Terms starting on page 4.

Duff & Phelps Select MLP and Energy Fund (Continued)

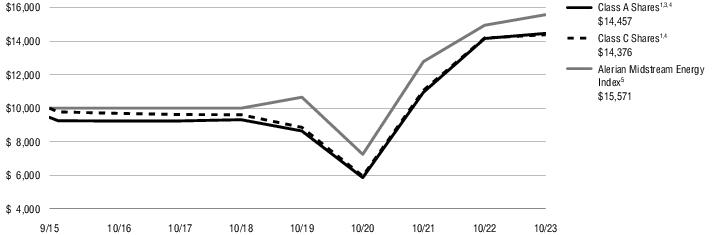

Average Annual Total Returns1 for periods ended 10/31/23

| | | 1 Year | 5 Years | Since

inception | Inception

date |

| Class A shares at NAV2 | | 2.16 % | 9.19 % | 5.36 % | 9/9/15 |

| Class A shares at POP3,4 | | -3.46 | 7.96 | 4.63 | 9/9/15 |

| Class C shares at NAV2 and with CDSC4 | | 1.36 | 8.39 | 4.56 | 9/9/15 |

| Class I shares at NAV2 | | 2.36 | 9.46 | 5.60 | 9/9/15 |

| Alerian Midstream Energy Index | | 4.20 | 9.26 | — | — |

| Fund Expense Ratios5: A Shares: Gross 1.58%, Net 1.40%; C Shares: Gross 2.29%, Net 2.15%; I Shares: Gross 1.34%, Net 1.15%. |

| All returns represent past performance which is no guarantee of future results. Current performance may be higher or lower than the performance shown. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The above table and graph below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares. Please visit Virtus.com for performance data current to the most recent month-end. |

Growth of $10,000 for periods ended 10/31

This chart assumes an initial investment of $10,000 made on September 9, 2015 (inception date of the Fund), for Class A shares and Class C shares including any applicable sales charges or fees. The performance of the other share class may be greater or less than that shown based on differences in inception dates, fees, and sales charges. Performance assumes reinvestment of dividends and capital gain distributions.

For information regarding the indexes and certain investment terms, see the Key Investment Terms starting on page 4.

Duff & Phelps Select MLP and Energy Fund (Continued)

Growth of $100,000 for periods ended 10/31

This chart assumes an initial investment of $100,000 made on September 9, 2015 (inception date of the Fund), for Class I shares. The performance of the other share class may be greater or less than that shown based on differences in inception dates, fees, and sales charges. Performance assumes reinvestment of dividends and capital gain distributions.

| 1 | Total returns are historical and include changes in share price and the reinvestment of both dividends and capital gain distributions. |

| 2 | “NAV” (Net Asset Value) total returns do not include the effect of any sales charge. |

| 3 | “POP” (Public Offering Price) total returns include the effect of the maximum front-end 5.50% sales charge. |

| 4 | “CDSC” (contingent deferred sales charge) is applied to redemptions of certain classes of shares that do not have a sales charge applied at the time of purchase. CDSC for certain redemptions of Class A shares made within 18 months of a finder’s fee being paid and all Class C shares are 1% within the first year and 0% thereafter. |

| 5 | The expense ratios of the Fund are set forth according to the prospectus for the Fund effective February 28, 2023, as supplemented and revised, and may differ from the expense ratios disclosed in the Financial Highlights tables in this report. See the Financial Highlights for more current expense ratios. Net Expense: Expenses reduced by a contractual expense limitation in effect through February 28, 2024. Gross Expense: Does not reflect the effect of the expense limitation. Expense ratios include fees and expenses associated with any underlying funds. |

The indexes are unmanaged and not available for direct investment; therefore, their performance does not reflect the expenses associated with active management of an actual portfolio.

For information regarding the indexes and certain investment terms, see the Key Investment Terms starting on page 4.

| | Ticker Symbols: |

| | Class A : VLSAX |

| | Class C: VLSCX |

| | Class I: VLSIX |

| | Class R6: VLSRX |

KAR Long/Short Equity Fund

Fund Summary (Unaudited)

Portfolio Manager Commentary by

Kayne Anderson Rudnick Investment Management, LLC

| ■ | The Fund is non-diversified and has an investment objective of seeking long-term capital appreciation. There is no guarantee that the Fund will meet its objective. |

| ■ | For the fiscal year October 31, 2023, the Fund’s Class A shares at NAV returned 3.50%†, Class C shares at NAV returned 2.73%, Class I shares at NAV returned 3.72%, and Class R6 shares at NAV returned 3.78%. For the same period, the Russell 3000® Index which serves as both the Fund’s broad-based and style-specific index appropriate for comparison, returned 8.38%. |

† See footnote 3 on page 13

All performance figures assume reinvestment of distributions and exclude the effect of sales charges. Performance data quoted represents past results. Past performance is no guarantee of future results, and current performance may be higher or lower than the performance shown above. Investment return and principal value will fluctuate so your shares, when redeemed, may be worth more or less than their original cost. Please visit Virtus.com for performance data current to the most recent month-end.

How did the markets perform during the Fund’s fiscal year ended October 31, 2023?

Markets underperformed in 2022, driven largely by expectations of higher inflation and global central bank tightening in response to elevated inflation. Late in 2022, markets began to see some relief in terms of inflation expectations, which led to a rally in equities that started in early 2023. However, the rally slowed during the late third quarter and early fourth quarter of 2023 on the realization that the Fed might have to hold interest rates higher for longer. Toward the end of the 12-month period, stocks flirted with a correction from their July 2023 highs.

For the fiscal year ended October 31, 2023, the S&P 500® Index returned 10.14%, while small-capitalization stocks, as represented by the Russell 2000® Index, declined 8.56%. The Russell 3000® Index returned a positive 8.38%.

What factors affected the Fund’s performance during its fiscal year?

The Fund delivered positive performance but underperformed its benchmark, the Russell 3000® Index, for the fiscal year ended October 31, 2023. The Fund’s net exposure during the period was 71.33% (97.62% long and 26.29% short). Net exposure is the difference between a fund’s short positions and long positions, expressed as a percentage. For example, if 80% of a fund is long and 20% is short, the fund’s net exposure is 60%.

In the Fund’s long portfolio, poor stock selection and an underweight in information technology, as well as an overweight in financials, detracted from performance. Positive stock selection in industrials and consumer staples contributed to performance. In the Fund’s short portfolio, stock selection in financials and industrials detracted from performance. Stock selection in information technology and stock selection and an allocation in real estate contributed positively to performance.

The biggest contributors to performance during the period were long positions in Primerica, Lennox International, Old Dominion Freight Line, Alphabet, and The Trade Desk.

The biggest detractors from performance during the period were long positions in Silk Road Medical, TransUnion, Jack Henry & Associates, Bank of Hawaii, and Aspen Technology.

The preceding information is the opinion of portfolio management only through the end of the period stated on the cover. Any such opinions are subject to change at any time based upon market or other conditions and should not be relied upon as investment advice. Past performance is no guarantee of future results, and there is no guarantee that market forecasts will be realized.

Equity Securities: The market price of equity securities may be adversely affected by financial market, industry, or issuer-specific events. Focus on a particular style or on small, medium, or large-sized companies may enhance that risk.

Sector Focused Investing: Events negatively affecting a particular industry or market sector in which the portfolio focuses its investments may cause the value of the portfolio to decrease.

Short Sales: The portfolio may engage in short sales, and may incur a loss if the price of a borrowed security increases before the date on which the portfolio replaces the security.

Counterparties: There is risk that a party upon whom the portfolio relies to complete a transaction will default.

Foreign Investing: Investing in foreign securities subjects the portfolio to additional risks such as increased volatility; currency fluctuations; less liquidity; less publicly available information about the foreign investment; and political, regulatory, economic, and market risk.

Non-Diversified: The portfolio is not diversified and may be more susceptible to factors negatively impacting its holdings to the extent the portfolio invests more of its assets in the securities of fewer issuers than would a diversified portfolio.

Market Volatility: The value of the securities in the portfolio may go up or down in response to the prospects of individual companies and/or general economic conditions. Local, regional, or global events such as war or military conflict, terrorism, pandemic, or recession could impact the portfolio, including hampering the ability of the portfolio’s manager(s) to invest its assets as intended.

Prospectus: For additional information on risks, please see the Fund’s prospectus.

For information regarding the indexes and certain investment terms, see the Key Investment Terms starting on page 4.

KAR Long/Short Equity Fund (Continued)

Asset Allocation

The following table presents asset allocation within certain sectors as a percentage of total investments as of October 31, 2023.

| Common Stocks | | 134% |

| Financials | 44% | |

| Information Technology | 27 | |

| Industrials | 18 | |

| Consumer Staples | 12 | |

| Consumer Discretionary | 11 | |

| Communication Services | 10 | |

| Health Care | 9 | |

| All other Common Stocks | 3 | |

| Securities Lending Collateral | | 2 |

| Securities Sold Short | | (36) |

| Industrials | (12) | |

| Consumer Discretionary | (11) | |

| Information Technology | (5) | |

| Real Estate | (3) | |

| Consumer Staples | (3) | |

| Financials | (2) | |

| Total | | 100% |

For information regarding the indexes and certain investment terms, see the Key Investment Terms starting on page 4.

KAR Long/Short Equity Fund (Continued)

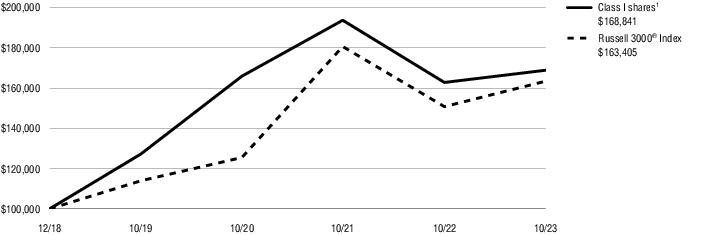

Average Annual Total Returns1 for periods ended 10/31/23

| | | 1 Year | Since

inception | Inception

date |

| Class A shares at NAV2 | | 3.50 %3 | 10.98 % | 12/6/18 |

| Class A shares at POP4,5 | | -2.19 | 9.71 | 12/6/18 |

| Class C shares at NAV2 and with CDSC5 | | 2.73 | 10.17 | 12/6/18 |

| Class I shares at NAV2 | | 3.72 | 11.27 | 12/6/18 |

| Class R6 shares at NAV2 | | 3.78 | 11.34 | 12/6/18 |

| Russell 3000® Index | | 8.38 | 10.53 6 | — |

| Fund Expense Ratios7: A Shares: Gross 2.29%, Net 2.17%; C Shares: Gross 2.95%, Net 2.92%; I Shares: Gross 2.02%, Net 1.92%, R6 Shares: Gross 1.88%, Net 1.85%. |

| All returns represent past performance which is no guarantee of future results. Current performance may be higher or lower than the performance shown. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The above table and graph below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of shares. Please visit Virtus.com for performance data current to the most recent month-end. |

Growth of $10,000 for periods ended 10/31

This chart assumes an initial investment of $10,000 made on December 6, 2018 (inception date of the Fund), for Class A shares and Class C shares including any applicable sales charges or fees. The performance of the other share class may be greater or less than that shown based on differences in inception dates, fees, and sales charges. Performance assumes reinvestment of dividends and capital gain distributions.

For information regarding the indexes and certain investment terms, see the Key Investment Terms starting on page 4.

KAR Long/Short Equity Fund (Continued)

Growth of $100,000 for periods ended 10/31

This chart assumes an initial investment of $100,000 made on December 6, 2018 (inception date of the Fund), for Class I shares. The performance of the other share class may be greater or less than that shown based on differences in inception dates, fees, and sales charges. Performance assumes reinvestment of dividends and capital gain distributions.

Growth of $2,500,000 for periods ended 10/31

This chart assumes an initial investment of $2,500,000 made on December 6, 2018 (inception date of the Fund), for Class R6 shares. The performance of the other share class may be greater or less than that shown based on differences in inception dates, fees, and sales charges. Performance assumes reinvestment of dividends and capital gain distributions.

| 1 | Total returns are historical and include changes in share price and the reinvestment of both dividends and capital gain distributions. |

| 2 | “NAV” (Net Asset Value) total returns do not include the effect of any sales charge. |

| 3 | Total Return for the report period presented in the table differs from the return in the Financial Highlights. The total return presented in the above table is calculated based on the NAV at which shareholder transactions were processed. The total return presented in the Financial Highlights section of the report is calculated in the same manner, but also takes into account certain adjustments that are necessary under generally accepted accounting principles required in the annual report and semiannual report. |

| 4 | “POP” (Public Offering Price) total returns include the effect of the maximum front-end 5.50% sales charge. |

| 5 | “CDSC” (contingent deferred sales charge) is applied to redemptions of certain classes of shares that do not have a sales charge applied at the time of purchase. CDSC for certain redemptions of Class A shares made within 18 months of a finder’s fee being paid and all Class C shares are 1% within the first year and 0% thereafter. |

| 6 | The since inception index return is from the Fund’s inception date. |

| 7 | The expense ratios of the Fund are set forth according to the prospectus for the Fund effective February 28, 2023, as supplemented and revised, and may differ from the expense ratios disclosed in the Financial Highlights tables in this report. See the Financial Highlights for more current expense ratios. Net Expense: Expenses reduced by a contractual expense limitation in effect through February 28, 2024. Gross Expense: Does not reflect the effect of the expense limitation. Expense ratios include fees and expenses associated with any underlying funds. |

For information regarding the indexes and certain investment terms, see the Key Investment Terms starting on page 4.

KAR Long/Short Equity Fund (Continued)

The index is unmanaged and not available for direct investment; therefore, its performance does not reflect the expenses associated with active management of an actual portfolio.

For information regarding the indexes and certain investment terms, see the Key Investment Terms starting on page 4.

Duff & Phelps Select MLP and Energy Fund

SCHEDULE OF INVESTMENTS October 31, 2023

($ reported in thousands)

| | Shares | | Value |

| Common Stocks & MLP Interests—96.6% |

| Diversified—40.4% | | |

| Energy Transfer LP | 124,165 | | $ 1,633 |

| Enterprise Products Partners LP | 61,642 | | 1,605 |

| Keyera Corp. | 31,314 | | 728 |

| Kinder Morgan, Inc. | 36,500 | | 591 |

| MPLX LP | 51,266 | | 1,848 |

| ONEOK, Inc. | 25,381 | | 1,655 |

| Pembina Pipeline Corp. | 32,971 | | 1,015 |

| Targa Resources Corp. | 38,505 | | 3,219 |

| | | | 12,294 |

| | | | |

| |

| Downstream/Other—10.1% | | |

| Chart Industries, Inc.(1) | 4,782 | | 556 |

| Kodiak Gas Services, Inc.(1) | 24,000 | | 413 |

| Koninklijke Vopak NV | 14,500 | | 488 |

| Marathon Petroleum Corp. | 6,105 | | 923 |

| Valero Energy Corp. | 5,545 | | 704 |

| | | | 3,084 |

| | | | |

| |

| Electric, LDC & Power—7.7% | | |

| AES Corp. (The) | 23,000 | | 343 |

| CenterPoint Energy, Inc. | 30,000 | | 806 |

| Sempra | 16,902 | | 1,184 |

| | | | 2,333 |

| | | | |

| |

| Gathering/Processing—11.1% | | |

| DT Midstream, Inc. | 20,603 | | 1,112 |

| EnLink Midstream LLC | 98,000 | | 1,204 |

| Equitrans Midstream Corp. | 82,655 | | 733 |

Western Midstream Partners

LP | 13,000 | | 349 |

| | | | 3,398 |

| | | | |

| |

| Liquefied Natural Gas—11.5% | | |

| Cheniere Energy, Inc. | 21,002 | | 3,495 |

| | Shares | | Value |

| | | | |

| Natural Gas Pipelines—7.1% | | |

| TC Energy Corp. | 20,000 | | $ 689 |

| Williams Cos., Inc. (The) | 43,326 | | 1,491 |

| | | | 2,180 |

| | | | |

| |

Petroleum Transportation &

Storage—8.7% | | |

| Enbridge, Inc. | 24,080 | | 771 |

| Genesis Energy LP | 37,000 | | 410 |

| Plains GP Holdings LP Class A | 93,103 | | 1,460 |

| | | | 2,641 |

| | | | |

| |

Total Common Stocks & MLP Interests

(Identified Cost $24,112) | | 29,425 |

| | | | |

| |

| | | | |

| |

Total Long-Term Investments—96.6%

(Identified Cost $24,112) | | 29,425 |

| | | | |

| |

| | | | |

| |

| Short-Term Investment—0.1% |

| Money Market Mutual Fund—0.1% |

| Dreyfus Government Cash Management Fund - Institutional Shares (seven-day effective yield 5.234%)(2) | 35,099 | | 35 |

Total Short-Term Investment

(Identified Cost $35) | | 35 |

| | | | |

| |

| | | | |

| |

TOTAL INVESTMENTS—96.7%

(Identified Cost $24,147) | | $29,460 |

| Other assets and liabilities, net—3.3% | | 993 |

| NET ASSETS—100.0% | | $30,453 |

| Abbreviations: |

| LLC | Limited Liability Company |

| LP | Limited Partnership |

| MLP | Master Limited Partnership |

| Footnote Legend: |

| (1) | Non-income producing. |

| (2) | Shares of this fund are publicly offered, and its prospectus and annual report are publicly available. |

| Country Weightings (Unaudited)† |

| United States | 87% |

| Canada | 11 |

| Netherlands | 2 |

| Total | 100% |

| † % of total investments as of October 31, 2023. |

| Ownership Structure (Unaudited)†,†† |

| Major Midstream Companies | 41% |

| Midstream MLP | 20 |

| MLP Affiliates & Other | 19 |

| Other MLP | 12 |

| Pure Play General Partner | 5 |

| Embedded General Partner | 3 |

| Total | 100% |

| † % of total investments as of October 31, 2023. |

†† Midstream MLPs are publicly traded limited partnerships and limited liability companies that are treated as partnerships for federal income tax purposes and operate and own assets used in transporting, storing, gathering, processing, treating, or marketing of natural gas, natural gas liquids, crude oil, and refined products.

Embedded General Partners are general partners of MLPs structured as C-corporations for federal income tax purposes with ownership in other assets beyond sole economic interests in an MLP.

Major Midstream Companies are entities that own and operate assets used in transporting, storing, gathering, processing, treating, or marketing of natural gas liquids, crude oil and refined products and structured as C-corporations for federal income tax purposes.

MLP Affiliates & Other consist of LLCs, Yieldcos and Limited Partnerships structured as corporations for tax purposes. LLCs are limited liability companies which hold investments in limited partner interests and may issue distributions in the form of additional shares, also known as paid-in-kind (PIK) distributions. Yieldcos are entities structured similar to an MLP but without possession of assets that would qualify for pass-through tax treatment and thus are not treated as partnerships for federal income tax purposes. Other also includes c-corporations that hold significant midstream or downstream assets.

Pure-Play General Partners are general partners of MLPs structured as C-corporations for federal income tax purposes with either direct economic incentive distribution rights to an underlying MLP or direct ownership in an affiliated general partner entity.

Other MLPs are publicly traded limited partnerships and limited liability companies that are treated as partnerships for federal income tax purposes and can include any MLP that is not Midstream.

For information regarding the abbreviations, see the Key Investment Terms starting on page 4.

See Notes to Financial Statements

Duff & Phelps Select MLP and Energy Fund

SCHEDULE OF INVESTMENTS (Continued)

October 31, 2023

($ reported in thousands)

The following table summarizes the value of the Fund’s investments as of October 31, 2023, based on the inputs used to value them (See Security Valuation Note 2A in the Notes to Financial Statements):

| | Total

Value at

October 31, 2023 | | Level 1

Quoted Prices |

| Assets: | | | |

| Equity Securities: | | | |

| Common Stocks & MLP Interests | $29,425 | | $29,425 |

| Money Market Mutual Fund | 35 | | 35 |

| Total Investments | $29,460 | | $29,460 |

There were no securities valued using significant observable inputs (Level 2) or significant unobservable inputs (Level 3) at October 31, 2023.

There were no transfers into or out of Level 3 related to securities held at October 31, 2023.

See Notes to Financial Statements

KAR Long/Short Equity Fund

SCHEDULE OF INVESTMENTS October 31, 2023

($ reported in thousands)

| | Shares | | Value |

| Common Stocks—97.7% |

| Communication Services—7.6% | | |

| Alphabet, Inc. Class C(1) | 23,309 | | $ 2,920 |

| Trade Desk, Inc. (The) Class A(1) | 34,620 | | 2,457 |

| | | | 5,377 |

| | | | |

| |

| Consumer Discretionary—8.2% | | |

| Home Depot, Inc. (The)(2) | 9,651 | | 2,748 |

| Pool Corp.(2) | 9,722 | | 3,070 |

| | | | 5,818 |

| | | | |

| |

| Consumer Staples—8.6% | | |

| Lamb Weston Holdings, Inc. | 36,976 | | 3,320 |

| Monster Beverage Corp.(1) | 53,277 | | 2,723 |

| | | | 6,043 |

| | | | |

| |

| Financials—32.1% | | |

| Bank of Hawaii Corp.(3) | 21,031 | | 1,039 |

| Berkley (W.R.) Corp. | 30,116 | | 2,030 |

| EVERTEC, Inc. | 62,771 | | 1,995 |

| Jack Henry & Associates, Inc.(2) | 14,595 | | 2,058 |

| LPL Financial Holdings, Inc. | 12,453 | | 2,796 |

| Moody’s Corp. | 9,830 | | 3,028 |

| Primerica, Inc. | 22,871 | | 4,372 |

| Ryan Specialty Holdings, Inc. Class A(1) | 64,589 | | 2,790 |

| Visa, Inc. Class A(2) | 11,069 | | 2,602 |

| | | | 22,710 |

| | | | |

| |

| Health Care—6.9% | | |

| Cooper Cos., Inc. (The) | 8,417 | | 2,624 |

| Zoetis, Inc. Class A(2) | 14,343 | | 2,252 |

| | | | 4,876 |

| | | | |

| |

| Industrials—12.9% | | |

| Lennox International, Inc. | 6,272 | | 2,324 |

| Old Dominion Freight Line, Inc. | 5,874 | | 2,212 |

| TransUnion | 46,150 | | 2,025 |

| Verisk Analytics, Inc. Class A(2) | 11,404 | | 2,593 |

| | | | 9,154 |

| | | | |

| |

| Information Technology—19.3% | | |

| Aspen Technology, Inc.(1) | 13,333 | | 2,370 |

| CDW Corp. | 11,209 | | 2,246 |

| Clearwater Analytics Holdings, Inc. Class A (1) | 171,786 | | 3,106 |

| | Shares | | Value |

| | | | |

| Information Technology—continued | | |

| Intuit, Inc. | 5,179 | | $ 2,563 |

| nCino, Inc.(1) | 120,102 | | 3,375 |

| | | | 13,660 |

| | | | |

| |

| Real Estate—2.1% | | |

| Lamar Advertising Co. Class A | 18,124 | | 1,491 |

Total Common Stocks

(Identified Cost $53,319) | | 69,129 |

| | | | |

| |

| | | | |

| |

Total Long-Term Investments—97.7%

(Identified Cost $53,319) | | 69,129 |

| | | | |

| |

| | | | |

| |

TOTAL INVESTMENTS, BEFORE SECURITIES SOLD SHORT—97.7%

(Identified Cost $53,319) | | 69,129 |

| | | | |

| |

| | | | |

| |

| Securities Sold Short(4)—(26.3)% |

| Consumer Discretionary—(7.8)% | | |

| Boot Barn Holdings, Inc.(5) | (21,085) | | (1,465) |

| H&R Block, Inc. | (52,736) | | (2,165) |

| ODP Corp. (The)(5) | (41,379) | | (1,859) |

| | | | (5,489) |

| | | | |

| |

| Consumer Staples—(2.4)% | | |

| Central Garden & Pet Co. Class A(5) | (43,531) | | (1,728) |

| Financials—(1.2)% | | |

| BRP Group, Inc. Class A(5) | (40,569) | | (849) |

| Industrials—(8.9)% | | |

| ACCO Brands Corp. | (208,852) | | (1,057) |

| Allison Transmission Holdings, Inc. | (26,926) | | (1,357) |

| ArcBest Corp. | (11,781) | | (1,283) |

| Deluxe Corp. | (76,871) | | (1,311) |

| Werner Enterprises, Inc. | (34,393) | | (1,249) |

| | | | (6,257) |

| | | | |

| |

| Information Technology—(3.5)% | | |

| Adeia, Inc. | (103,263) | | (870) |

| Consensus Cloud Solutions, Inc.(5) | (32,000) | | (691) |

| Xperi, Inc.(5) | (110,566) | | (939) |

| | | | (2,500) |

| | | | |

| |

| | Shares | | Value |

| | | | |

| Real Estate—(2.5)% | | |

| Compass, Inc. Class A(5) | (319,253) | | $ (632) |

| Retail Opportunity Investments Corp. | (98,974) | | (1,162) |

| | | | (1,794) |

| | | | |

| |

Total Securities Sold Short

(Proceeds $(21,920)) | | (18,617) |

| | | | |

| |

| | | | |

| |

| Securities Lending Collateral—1.5% |

| Dreyfus Government Cash Management Fund - Institutional Shares (seven-day effective yield 5.234%)(6)(7) | 1,038,651 | | 1,039 |

Total Securities Lending Collateral

(Identified Cost $1,039) | | 1,039 |

| | | | |

| |

| | | | |

| |

TOTAL INVESTMENTS, NET OF SECURITIES SOLD SHORT—72.9%

(Identified Cost $32,438) | | $ 51,551 |

| Other assets and liabilities, net—27.1% | | 19,191 |

| NET ASSETS—100.0% | | $ 70,742 |

| Footnote Legend: |

| (1) | Non-income producing. |

| (2) | All or portion segregated as collateral for securities sold short. The value of securities segregated as collateral is $13,234. |

| (3) | All or a portion of security is on loan. |

| (4) | The Fund is contractually responsible to the lender for any dividends payable and interest accrued on securities while those securities are in a short position. These dividends and interest are recorded as an expense of the Fund. |

| (5) | No dividend expense on security sold short. |

| (6) | Shares of this fund are publicly offered, and its prospectus and annual report are publicly available. |

| (7) | Represents security purchased with cash collateral received for securities on loan. |

See Notes to Financial Statements

KAR Long/Short Equity Fund

SCHEDULE OF INVESTMENTS (Continued)

October 31, 2023

($ reported in thousands)

The following table summarizes the value of the Fund’s investments as of October 31, 2023, based on the inputs used to value them (See Security Valuation Note 2A in the Notes to Financial Statements):

| | Total

Value at

October 31, 2023 | | Level 1

Quoted Prices |

| Assets: | | | |

| Equity Securities: | | | |

| Common Stocks | $ 69,129 | | $ 69,129 |

| Securities Lending Collateral | 1,039 | | 1,039 |

| Total Assets | 70,168 | | 70,168 |

| Liabilities: | | | |

| Securities Sold Short: | | | |

| Common Stocks | (18,617) | | (18,617) |

| Total Liabilities | (18,617) | | (18,617) |

| Total Investments, Net of Securities Sold Short | $ 51,551 | | $ 51,551 |

There were no securities valued using significant observable inputs (Level 2) or significant unobservable inputs (Level 3) at October 31, 2023.

There were no transfers into or out of Level 3 related to securities held at October 31, 2023.

See Notes to Financial Statements

VIRTUS ALTERNATIVE SOLUTIONS TRUST

STATEMENTS OF ASSETS AND LIABILITIES October 31, 2023

(Reported in thousands except shares and per share amounts)

| | Duff & Phelps

Select MLP

and Energy

Fund | | KAR Long/Short Equity Fund |

| Assets | | | |

Investment in securities at value(1)(2)

| $ 29,460 | | $70,168 |

Cash

| 902 | | 1,079 |

Due from broker

| — | | 19,214 |

| Receivables | | | |

Fund shares sold

| 1 | | 42 |

Dividends and interest

| 178 | | 13 |

Tax reclaims

| 2 | | — |

Securities lending income

| — | | — (a) |

Tax receivable

| 4 | | — |

Prepaid Trustees’ retainer

| 1 | | 1 |

Prepaid expenses

| 18 | | 89 |

Other assets

| 3 | | 8 |

Total assets

| 30,569 | | 90,614 |

| Liabilities | | | |

Securities sold short at value(3)

| — | | 18,617 |

| Payables | | | |

Fund shares repurchased

| 6 | | 73 |

Collateral on securities loaned

| — | | 1,039 |

Investment advisory fees

| 39 | | 79 |

Distribution and service fees

| 2 | | — (a) |

Administration and accounting fees

| 3 | | 7 |

Transfer agent and sub-transfer agent fees and expenses

| 8 | | 23 |

Professional fees

| 33 | | 26 |

Trustee deferred compensation plan

| 3 | | 8 |

Interest expense and/or commitment fees

| — (a) | | — (a) |

Other accrued expenses

| 22 | | — |

Total liabilities

| 116 | | 19,872 |

Net Assets

| $ 30,453 | | $70,742 |

| Net Assets Consist of: | | | |

Capital paid in on shares of beneficial interest

| $116,629 | | $53,908 |

Accumulated earnings (loss)

| (86,176) | | 16,834 |

Net Assets

| $ 30,453 | | $70,742 |

| | | | |

See Notes to Financial Statements

VIRTUS ALTERNATIVE SOLUTIONS TRUST

STATEMENTS OF ASSETS AND LIABILITIES (Continued)

October 31, 2023

(Reported in thousands except shares and per share amounts)

| | Duff & Phelps

Select MLP

and Energy

Fund | | KAR Long/Short Equity Fund |

| Net Assets: | | | |

Class A

| $ 8,600 | | $ 1,077 |

Class C

| $ 527 | | $ 144 |

Class I

| $ 21,326 | | $ 68,898 |

Class R6

| $ — | | $ 623 |

| Shares Outstanding (unlimited number of shares authorized, no par value): | | | |

Class A

| 740,989 | | 68,579 |

Class C

| 45,853 | | 9,507 |

Class I

| 1,863,005 | | 4,331,463 |

Class R6

| — | | 39,033 |

| Net Asset Value and Redemption Price Per Share:* | | | |

Class A

| $ 11.61 | | $ 15.70 |

Class C

| $ 11.49 | | $ 15.12 |

Class I

| $ 11.45 | | $ 15.91 |

Class R6

| $ — | | $ 15.96 |

| Maximum Offering Price Per Share (NAV/(1-5.50%)): | | | |

Class A

| $ 12.29 | | $ 16.61 |

Maximum Sales Charge - Class A

| 5.50% | | 5.50% |

(1) Investment in securities at cost

| $ 24,147 | | $ 54,358 |

(2) Market value of securities on loan

| $ — | | $ 1,018 |

(3) Securities sold short proceeds

| $ — | | $ 21,920 |

| (a) | Amount is less than $500 (not in thousands). |

| * | Net Asset Value and Redemption Price Per Share are calculated using unrounded net assets. |

See Notes to Financial Statements

VIRTUS ALTERNATIVE SOLUTIONS TRUST

STATEMENTS OF OPERATIONS YEAR ENDED October 31, 2023

($ reported in thousands)

| | Duff & Phelps

Select MLP

and Energy

Fund | | KAR Long/Short Equity Fund |

| Investment Income | | | |

Dividends

| $ 1,674 | | $1,052 |

Less: return of capital distributions

| (1,040) | | — |

Interest

| — | | 1,000 |

Securities lending, net of fees

| — | | 2 |

Foreign taxes withheld

| (27) | | — |

Total investment income

| 607 | | 2,054 |

| Expenses | | | |

Investment advisory fees

| 279 | | 1,191 |

Distribution and service fees, Class A

| 21 | | 3 |

Distribution and service fees, Class C

| 7 | | 2 |

Administration and accounting fees

| 19 | | 104 |

Transfer agent fees and expenses

| 18 | | 41 |

Sub-transfer agent fees and expenses, Class A

| 6 | | 3 |

Sub-transfer agent fees and expenses, Class C

| 1 | | — (1) |

Sub-transfer agent fees and expenses, Class I

| 22 | | 132 |

Custodian fees

| — (1) | | — (1) |

Printing fees and expenses

| 17 | | 22 |

Professional fees

| 36 | | 29 |

Interest expense and/or commitment fees

| — (1) | | 11 |

Registration fees

| 49 | | 34 |

Trustees’ fees and expenses

| 3 | | 8 |

Miscellaneous expenses

| 11 | | 12 |

Total expenses

| 489 | | 1,592 |

Dividend and interest expense on securities sold short

| — | | 341 |

Total expenses, including dividend and interest expense on securities sold short

| 489 | | 1,933 |

Less net expenses reimbursed and/or waived by investment adviser(2)

| (91) | | (107) |

Less low balance account fees

| — (1) | | — |

Net expenses

| 398 | | 1,826 |

Net investment income (loss)

| 209 | | 228 |

| Net Realized and Unrealized Gain (Loss) on Investments | | | |

| Net realized gain (loss) from: | | | |

Investments

| 1,783 | | 2,622 |

Securities sold short

| — | | (340) |

Foreign currency transactions

| (1) | | — |

| Net change in unrealized appreciation (depreciation) on: | | | |

Investments

| (1,566) | | 3,087 |

Securities sold short

| — | | (619) |

Foreign currency transactions

| — (1) | | — |

Net realized and unrealized gain (loss) on investments

| 216 | | 4,750 |

Net increase (decrease) in net assets resulting from operations

| $ 425 | | $4,978 |

| (1) | Amount is less than $500 (not in thousands). |

| (2) | See Note 3D in Notes to Financial Statements. |

See Notes to Financial Statements

VIRTUS ALTERNATIVE SOLUTIONS TRUST

STATEMENTS OF CHANGES IN NET ASSETS

($ reported in thousands)

| | Duff & Phelps Select MLP and Energy Fund | | KAR Long/Short Equity Fund |

| | Year Ended

October 31,

2023 | | Year Ended

October 31,

2022 | | Year Ended

October 31,

2023 | | Year Ended

October 31,

2022 |

| Increase (Decrease) in Net Assets Resulting from Operations | | | | | | | |

Net investment income (loss)

| $ 209 | | $ 228 | | $ 228 | | $ (1,075) |

Net realized gain (loss)

| 1,782 | | 2,701 | | 2,282 | | (188) |

Net change in unrealized appreciation (depreciation)

| (1,566) | | 4,122 | | 2,468 | | (24,679) |

Increase (decrease) in net assets resulting from operations

| 425 | | 7,051 | | 4,978 | | (25,942) |

| Dividends and Distributions to Shareholders | | | | | | | |

| Net Investment Income and Net Realized Gains: | | | | | | | |

Class A

| (217) | | — | | (45) | | (23) |

Class C

| (10) | | — | | (9) | | (2) |

Class I

| (571) | | — | | (4,293) | | (564) |

Class R6

| — | | — | | (23) | | (1) |

| Return of Capital: | | | | | | | |

Class A

| (67) | | (264) | | — | | — |

Class C

| (3) | | (15) | | — | | — |

Class I

| (175) | | (732) | | — | | — |

Total dividends and distributions to shareholders

| (1,043) | | (1,011) | | (4,370) | | (590) |

| Change in Net Assets from Capital Transactions (See Note 5): | | | | | | | |

Class A

| 194 | | 5,824 | | (107) | | (3,447) |

Class C

| (209) | | 325 | | (219) | | (12) |

Class I

| (3,903) | | (2,092) | | (31,990) | | (28,075) |

Class R6

| — | | — | | 106 | | 229 |

Increase (decrease) in net assets from capital transactions

| (3,918) | | 4,057 | | (32,210) | | (31,305) |

Net increase (decrease) in net assets

| (4,536) | | 10,097 | | (31,602) | | (57,837) |

| Net Assets | | | | | | | |

Beginning of period

| 34,989 | | 24,892 | | 102,344 | | 160,181 |

End of Period

| $ 30,453 | | $ 34,989 | | $ 70,742 | | $ 102,344 |

See Notes to Financial Statements

VIRTUS ALTERNATIVE SOLUTIONS TRUST

FINANCIAL HIGHLIGHTS

SELECTED PER SHARE DATA AND RATIOS FOR A SHARE OUTSTANDING

THROUGHOUT EACH PERIOD

| | | Net Asset Value,

Beginning of Period | Net Investment Income (Loss)(1) | Net Realized and

Unrealized Gain (Loss) | Total from Investment Operations | Dividends from

Net Investment Income | Return of Capital | Distributions from

Net Realized Gains | Total Distributions | Change in Net Asset Value | Net Asset Value, End of Period | Total Return(2)(3) | Net Assets, End of Period

(in thousands) | Ratio of Net Expenses to

Average Net Assets (including dividend

and interest expense on securities sold short)(4)(5) | Ratio of Gross Expenses

to Average Net Assets(4)(5) | Ratio of Net Investment Income (Loss)

to Average Net Assets(4) | Portfolio Turnover Rate(2) |

| | | | | | | | | | | | | | | | | | |

| Duff & Phelps Select MLP and Energy Fund | | | | | | | | | | | | | | | | | |

| Class A | | | | | | | | | | | | | | | | | |

| 11/1/22 to 10/31/23 | | $11.75 | 0.06 | 0.18 | 0.24 | (0.29) | (0.09) | — | (0.38) | (0.14) | $11.61 | 2.16 % | $ 8,600 | 1.44 % (6) | 1.73 % | 0.52 % | 44 % |

| 11/1/21 to 10/31/22 | | 9.37 | 0.04 | 2.69 | 2.73 | — | (0.35) | — | (0.35) | 2.38 | 11.75 | 29.24 | 8,668 | 1.42 (6) | 1.60 | 0.34 | 43 |

| 11/1/20 to 10/31/21 | | 5.19 | (0.01) | 4.49 | 4.48 | (0.08) | (0.22) | — | (0.30) | 4.18 | 9.37 | 86.75 | 2,117 | 1.40 | 2.02 | (0.14) | 49 |

| 11/1/19 to 10/31/20 | | 8.09 | 0.06 | (2.65) | (2.59) | — | (0.31) | — | (0.31) | (2.90) | 5.19 | (32.15) | 317 | 1.40 | 3.11 | 0.95 | 41 |

| 11/1/18 to 10/31/19 | | 9.26 | 0.14 | (0.82) | (0.68) | (0.12) | (0.37) | — | (0.49) | (1.17) | 8.09 | (7.22) | 447 | 1.40 | 2.59 | 1.56 | 82 |

| Class C | | | | | | | | | | | | | | | | | |

| 11/1/22 to 10/31/23 | | $11.59 | (0.02) | 0.17 | 0.15 | (0.19) | (0.06) | — | (0.25) | (0.10) | $11.49 | 1.36 % | $ 527 | 2.19 % (6) | 2.50 % | (0.22) % | 44 % |

| 11/1/21 to 10/31/22 | | 9.25 | (0.02) | 2.62 | 2.60 | — | (0.26) | — | (0.26) | 2.34 | 11.59 | 28.17 | 743 | 2.16 (6) | 2.32 | (0.16) | 43 |

| 11/1/20 to 10/31/21 | | 5.12 | (0.07) | 4.45 | 4.38 | (0.07) | (0.18) | — | (0.25) | 4.13 | 9.25 | 85.81 | 297 | 2.15 | 2.77 | (0.83) | 49 |

| 11/1/19 to 10/31/20 | | 8.01 | 0.02 | (2.64) | (2.62) | — | (0.27) | — | (0.27) | (2.89) | 5.12 | (32.76) | 79 | 2.15 | 3.85 | 0.28 | 41 |

| 11/1/18 to 10/31/19 | | 9.20 | (0.03) | (0.70) | (0.73) | (0.09) | (0.37) | — | (0.46) | (1.19) | 8.01 | (7.84) | 126 | 2.16 | 3.36 | (0.32) | 82 |

| Class I | | | | | | | | | | | | | | | | | |

| 11/1/22 to 10/31/23 | | $11.59 | 0.09 | 0.17 | 0.26 | (0.31) | (0.09) | — | (0.40) | (0.14) | $11.45 | 2.36 % | $ 21,326 | 1.19 % (6) | 1.49 % | 0.76 % | 44 % |

| 11/1/21 to 10/31/22 | | 9.22 | 0.09 | 2.62 | 2.71 | — | (0.34) | — | (0.34) | 2.37 | 11.59 | 29.48 | 25,578 | 1.17 (6) | 1.36 | 0.90 | 43 |

| 11/1/20 to 10/31/21 | | 5.10 | 0.02 | 4.42 | 4.44 | (0.08) | (0.24) | — | (0.32) | 4.12 | 9.22 | 87.52 | 22,478 | 1.15 | 1.78 | 0.28 | 49 |

| 11/1/19 to 10/31/20 | | 7.99 | 0.08 | (2.63) | (2.55) | — | (0.34) | — | (0.34) | (2.89) | 5.10 | (32.03) | 4,364 | 1.15 | 2.79 | 1.30 | 41 |

| 11/1/18 to 10/31/19 | | 9.25 | 0.05 | (0.70) | (0.65) | (0.24) | (0.37) | — | (0.61) | (1.26) | 7.99 | (6.98) | 4,255 | 1.16 | 2.31 | 0.62 | 82 |

| | | | | | | | | | | | | | | | | | |

| KAR Long/Short Equity Fund | | | | | | | | | | | | | | | | | |

| Class A | | | | | | | | | | | | | | | | | |

| 11/1/22 to 10/31/23 | | $15.87 | — (7) | 0.52 | 0.52 | — | — | (0.69) | (0.69) | (0.17) | $15.70 | 3.44 % | $ 1,077 | 2.15 % (8) | 2.40 % | — % | 13 % |

| 11/1/21 to 10/31/22 | | 18.99 | (0.20) | (2.85) | (3.05) | — | — | (0.07) | (0.07) | (3.12) | 15.87 | (16.18) | 1,202 | 2.19 (6)(8) | 2.31 | (1.16) | 26 |

| 11/1/20 to 10/31/21 | | 16.44 | (0.29) | 2.98 | 2.69 | — | — | (0.14) | (0.14) | 2.55 | 18.99 | 16.47 | 5,578 | 2.23 (8) | 2.31 | (1.59) | 19 |

| 11/1/19 to 10/31/20 | | 12.69 | (0.20) | 4.00 | 3.80 | — | — | (0.05) | (0.05) | 3.75 | 16.44 | 30.01 | 1,210 | 2.32 (8) | 2.51 | (1.34) | 33 |

| 12/6/18 (9) to 10/31/19 | | 10.00 | (0.11) | 2.80 | 2.69 | — | — | — | — | 2.69 | 12.69 | 26.90 | 134 | 2.40 (8) | 4.26 | (1.03) | 56 |

| Class C | | | | | | | | | | | | | | | | | |

| 11/1/22 to 10/31/23 | | $15.41 | (0.12) | 0.52 | 0.40 | — | — | (0.69) | (0.69) | (0.29) | $15.12 | 2.73 % | $ 144 | 2.90 % (8) | 2.98 % | (0.77) % | 13 % |

| 11/1/21 to 10/31/22 | | 18.59 | (0.30) | (2.81) | (3.11) | — | — | (0.07) | (0.07) | (3.18) | 15.41 | (16.80) | 367 | 2.93 (6)(8) | 2.96 | (1.82) | 26 |

| 11/1/20 to 10/31/21 | | 16.21 | (0.40) | 2.92 | 2.52 | — | — | (0.14) | (0.14) | 2.38 | 18.59 | 15.65 | 456 | 3.00 (8) | 3.01 | (2.29) | 19 |

| 11/1/19 to 10/31/20 | | 12.61 | (0.28) | 3.93 | 3.65 | — | — | (0.05) | (0.05) | 3.60 | 16.21 | 29.01 | 504 | 3.09 (8) | 3.28 | (2.02) | 33 |

| 12/6/18 (9) to 10/31/19 | | 10.00 | (0.18) | 2.79 | 2.61 | — | — | — | — | 2.61 | 12.61 | 26.10 | 138 | 3.15 (8) | 5.02 | (1.78) | 56 |

| Class I | | | | | | | | | | | | | | | | | |

| 11/1/22 to 10/31/23 | | $16.03 | 0.04 | 0.53 | 0.57 | — | — | (0.69) | (0.69) | (0.12) | $15.91 | 3.72 % | $ 68,898 | 1.91 % (8) | 2.02 % | 0.24 % | 13 % |

| 11/1/21 to 10/31/22 | | 19.14 | (0.14) | (2.90) | (3.04) | — | — | (0.07) | (0.07) | (3.11) | 16.03 | (15.95) | 100,256 | 1.94 (6)(8) | 2.04 | (0.83) | 26 |

| 11/1/20 to 10/31/21 | | 16.53 | (0.24) | 2.99 | 2.75 | — | — | (0.14) | (0.14) | 2.61 | 19.14 | 16.75 | 153,771 | 1.98 (8) | 2.07 | (1.31) | 19 |

| 11/1/19 to 10/31/20 | | 12.72 | (0.15) | 4.01 | 3.86 | — | — | (0.05) | (0.05) | 3.81 | 16.53 | 30.41 | 109,819 | 2.07 (8) | 2.30 | (1.05) | 33 |

| 12/6/18 (9) to 10/31/19 | | 10.00 | (0.10) | 2.82 | 2.72 | — | — | — | — | 2.72 | 12.72 | 27.20 | 17,813 | 2.04 (8) | 3.99 | (0.94) | 56 |

| Class R6 | | | | | | | | | | | | | | | | | |

| 11/1/22 to 10/31/23 | | $16.07 | 0.05 | 0.53 | 0.58 | — | — | (0.69) | (0.69) | (0.11) | $15.96 | 3.78 % | $ 623 | 1.83 % (8) | 1.88 % | 0.32 % | 13 % |

| 11/1/21 to 10/31/22 | | 19.17 | (0.12) | (2.91) | (3.03) | — | — | (0.07) | (0.07) | (3.10) | 16.07 | (15.87) | 519 | 1.85 (6)(8) | 1.88 | (0.72) | 26 |

| 11/1/20 to 10/31/21 | | 16.54 | (0.24) | 3.01 | 2.77 | — | — | (0.14) | (0.14) | 2.63 | 19.17 | 16.86 | 376 | 1.90 (8) | 1.92 | (1.30) | 19 |

| 11/1/19 to 10/31/20 | | 12.73 | (0.13) | 3.99 | 3.86 | — | — | (0.05) | (0.05) | 3.81 | 16.54 | 30.39 | 132 | 2.07 (8) | 2.24 | (0.95) | 33 |

| 12/6/18 (9) to 10/31/19 | | 10.00 | (0.07) | 2.80 | 2.73 | — | — | — | — | 2.73 | 12.73 | 27.30 | 3,437 | 2.08 (8) | 4.00 | (0.71) | 56 |

| Footnote Legend: |

| (1) | Calculated using average shares outstanding. |

| (2) | Not annualized for periods less than one year. |

See Notes to Financial Statements

VIRTUS ALTERNATIVE SOLUTIONS TRUST

FINANCIAL HIGHLIGHTS (Continued)

SELECTED PER SHARE DATA AND RATIOS FOR A SHARE OUTSTANDING

THROUGHOUT EACH PERIOD

| (3) | Sales charges, where applicable, are not reflected in the total return calculation. |

| (4) | Annualized for periods less than one year. |

| (5) | The Funds will also indirectly bear their prorated share of expenses of any underlying funds in which they invest. Such expenses are not included in the calculation of this ratio. |

| (6) | Net expense ratio includes extraordinary proxy expenses. |

| (7) | Amount is less than $0.005 per share. |

| (8) | The ratio of net expenses to average net assets excluding dividend and interest expense on securities sold short for the KAR Long/Short Equity Fund for Class A are 1.69%, 1.81%, 1.80%, 1.80% and 1.80%, for Class C is 2.45%, 2.56%, 2.55%, 2.55% and 2.55%, for Class I is 1.45%, 1.56%, 1.55%, 1.55% and 1.55% and for Class R6 is 1.37%, 1.50%, 1.48%, 1.48% and 1.48% for the years ended October 31, 2023, October 31, 2022, October 31, 2021, October 31, 2020 and the period ended October 31, 2019, respectively. |

| (9) | Inception date. |

See Notes to Financial Statements

VIRTUS ALTERNATIVE SOLUTIONS TRUST NOTES TO FINANCIAL STATEMENTS October 31, 2023

Note 1. Organization

Virtus Alternative Solutions Trust (the “Trust”) is organized as a Delaware statutory trust and is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company.

As of the date of this report, the Trust is comprised of four funds of which two (each a “Fund” or collectively, the “Funds”), are reported in this annual report. Each Fund has a distinct investment objective and all of the Funds are non-diversified. Each Fund’s investment objective is outlined in its respective Fund Summary page. There is no guarantee that a Fund will achieve its objective(s).

Both of the Funds offer Class A shares, Class C shares and Class I shares. The KAR Long/Short Equity Fund also offers Class R6 shares.

Class A shares of the Funds are sold with a front-end sales charge of up to 5.50% with some exceptions. Generally, Class A shares are not subject to any charges by the Funds when redeemed; however, a 1% contingent deferred sales charge (“CDSC”) may be imposed on certain redemptions made within a certain period following purchases on which a finder’s fee has been paid. The period for which such CDSC applies for the Funds is 18 months. The CDSC period begins on the last day of the month preceding the month in which the purchase was made.

Class C shares are generally sold with a 1% CDSC, applicable if redeemed within one year of purchase. Class C shares and any reinvested dividends and other distributions paid on such shares, will be automatically converted to Class A shares of the same Fund following a required holding period, which as of March 1, 2021, was eight years. Effective January 1, 2019 to February 28, 2021, with certain exceptions, Class C shares and any reinvested dividends and other distributions paid on such shares, were automatically converted to Class A shares of the same Fund ten years after the purchase date. If an investor intends to purchase greater than $999,999 of Class C shares, and the purchase would qualify for Class A shares with no load, then the purchase will automatically be made into a purchase of Class A shares, thus reducing expenses. Class I shares and Class R6 shares are sold without a front-end sales charge or CDSC.

Class I Shares are offered primarily to clients of financial intermediaries that (i) charge such clients an ongoing fee for advisory, investment, consulting, or similar services; or (ii) have entered into an agreement with the funds’ distributor to offer Class I Shares through a no-load network or platform. Such clients may include pension and profit sharing plans, other employee benefit trusts, endowments, foundations and corporations. Class I Shares are also offered to private and institutional clients of, or referred by, the adviser, a subadviser or their affiliates, and to Trustees of the funds and trustees/directors of affiliated open- and closed-end funds, and directors, officers and employees of Virtus and its affiliates. If you are eligible to purchase and do purchase Class I Shares, you will pay no sales charge at any time. There are no distribution and service fees applicable to Class I Shares.